Abstract

In liberalized markets, consumers can choose their electricity suppliers or be part of an energy community. The problem with communities is that they may not have enough weight to trade in markets, which can be overcome by forming coalitions. Electricity is traded in spot markets or through bilateral contracts involving consumers and suppliers. This paper is devoted to bilateral contracting, modeled as a negotiation process involving an iterative exchange of offers and counter-offers. It focuses on coalitions of energy communities. Specifically, it presents team and single-agent negotiation models, where each consumer has strategies, tactics, and decision models. Coalition agents are equipped with intra-team strategies and decision protocols. It also describes a study of bilateral contracts involving a seller agent and a coalition of energy communities. By allying into a coalition, members of energy communities reduced their average costs for electricity by between 2% (large consumers) and 64% (small consumers) according to their consumption. Their levelized cost reduction was 19%. The results demonstrate the power of coalitions when negotiating bilateral contracts and the benefit of a low-consumption members alliance with larger players.

1. Introduction

The liberalization of the electric sector divided the traditional, vertical, monopolistic approach of having companies that produce, transport, distribute, and sell electricity into competition in wholesale and retail markets. It has separated the functions of generation and retail from the natural monopoly functions of transmission and distribution. This process has ensured the establishment of competitive wholesale and retail markets where producers offer their energy to demand-side players and retailers propose tariffs to end-use consumers [1,2,3]. Between wholesale and retail markets, centralized, derivatives, and bilateral markets coexist where large supply and demand players can trade electricity.

Centralized markets consist of marginal, auction-based day-ahead, intraday, and real-time markets, such as continuous pay-as-bid intraday markets [4]. Standard bilateral agreements are traded on derivatives markets, using the exchanges as intermediaries [5,6,7]. Private bilateral contracts are traded between the parties, which have the advantage of negotiating their terms and conditions. Derivatives and bilateral markets are used as risk hedging against spot price volatility and the market power of big players [6,7,8]. Furthermore, physical agreements on these markets are validated by the system operator. Players with settled agreements must comply with their programmed dispatches during real-time operation as balance responsible parties. In cases of deviations between supply and demand according to programmed dispatches, system operators activate balancing reserves traded in balancing markets to guarantee the power-system frequency stability [9]. Players that deviate from their programmed schedules may have to pay penalties according to the costs of balancing reserves [9,10,11,12].

Retailers participate in wholesale markets to feed their portfolios of consumers [13]. They rely on demand forecasts to trade on these markets, paying significant penalties when deviating from programmed dispatches [14]. Thus, retailers charge a high risk-premium when proposing tariffs to end-use consumers, making electricity retail prices substantially higher than wholesale prices [15]. The replacement of traditional, large-scale thermal generation with decentralized, renewable generation has increased the importance of managing distributed resources and reduced the use of the transmission grid [16,17,18].

The role of local citizen energy communities (CECs) has been incorporated into legislation in the European Union [19,20]. European regulations and guidelines are essential to enhance the active participation of new market players in markets and incentivize local governments to adopt them [21]. Some governments have incentivized the formation and active participation of CECs in markets by giving them discounts on grid access costs [17]. However, while communities may invest in self-consumption and other distributed resources, they may not have the dimensions or experience to participate in wholesale markets [4,22]. Furthermore, these communities may be composed of diverse local players for whom energy is not their business. Thus, they may not have the time or knowledge to negotiate around it. Different communities can trade energy on a local level but may need to ally or have a supplier as an intermediate to participate in wholesale markets [23]. Against this background, the presented work demonstrates an automated negotiation model including coalitions of energy communities and suppliers. It automatically trades local energy and negotiates the energy needs of communities. Therefore, the model can be used to negotiate the energy price between a coalition’s mediator and its members and between the mediator and opponents. Relevant work exists on power system alliances, considering their formation [24,25], team strategies [26,27], decisions [28], and negotiation models [29,30,31,32]. However, almost all agent-based systems are simulators and decision-support systems that do not provide models for automated negotiation (see [6,27,28,33,34,35] and the next section for a review of negotiation models and systems).

Considering the increasing complexity of power systems and their development toward more decentralized systems with smaller players, this paper describes ongoing work using the potential of agent-based technology to develop a simulator for automated bilateral contracting and resource management in citizen energy communities and other alliances (see [28] for a review of power system alliances). Software agents were developed in the JADE multi-agent platform, which was chosen for two main reasons [36]:

- It is an agent-oriented platform offering a framework for the development of multi-agent systems that can support different agent models;

- It is built on top of and fully integrated with the Java programming language, including all components of Java and offering specific extensions to implement agents’ behaviors.

Agents inherit from the “Agent” class and communicate by sending and receiving messages considering different interaction protocols. Consumer, prosumer, and supplier agents are equipped with decision-making strategies. Coalitions are equipped with team strategies and decision algorithms to ease the management of the complexity of power systems. Specifically, the purpose of this paper is threefold:

- To adopt and extend a model for bilateral trading of electricity between coalitions of consumers and sellers of electricity and, specifically, to develop interaction protocols and decision strategies for both coalitions and their members;

- To equip software agents with the negotiation model and strategies;

- To describe a study on forward bilateral contracts involving a seller agent and a coalition of citizen energy communities to verify the benefits of forming a coalition.

The remainder of this paper is structured as follows. Section 2 presents a literature review regarding negotiation and alliance models. Section 3 presents the automated bilateral negotiation model for individual agents. Section 4 presents the negotiation model for alliances of agents and performance parameters. Section 5 presents a study testing the negotiation models. Section 6 summarizes the main conclusions of the work.

2. Literature Review

The liberalization and decarbonization of the energy sector led to the establishment of new, decentralized, small market players. These players may not have the expertise and weight to participate in wholesale markets. To avoid the use of intermediaries, they may form alliances. Alliances of citizen energy communities are mainly composed of consumers and prosumers for whom energy is not their business. Against this background, modeling these players as software agents and equipping them with the required automated negotiation and learning models can be relevant for their efficient participation in competitive markets. Modeling energy market players and alliances as software agents has been the focus of the literature.

Marsa-Maestre et al. [34] presented a book with the main concepts of agent-based negotiation. They focused on single and intra-team negotiation models and strategies, considering the negotiation protocols and time constraints.

Klusch and Gerber [24] presented the concept of dynamic coalition formation, where agents dynamically ally and respond to events with the aim of achieving a common goal.

Pinto et al. [25] presented a model considering the formation and management of agent-based coalitions of producers in the electricity sector. They developed learning and predictive models enabling the adaptation of virtual power producers to diverse events.

Baarslag et al. [33] presented a survey about opponent models while negotiating bilateral contracts with the goal of enabling agents to learn from past negotiations. Furthermore, they indicated guidelines to select the best performance measures according to opponents’ negotiation models.

Sanchez-Anguix et al. [29] presented a negotiation model for alliances using a trusted mediator to achieve unanimous decisions. They tested the model in bilateral negotiations with opponents, concluding that, by reaching unanimous decisions, members increase their utilities. In [26], the authors studied the output of different intra-team strategies in the negotiation outcomes, concluding that the increasing number of members negatively affected their utilities. In [30], the authors tested a negotiation model to simulate efficient deals with low computational costs. They concluded that their model could improve similar heuristics and had similar results in cases of partial or perfect information, respectively. In [31], the authors presented and tested a model using bottom-up approaches for team negotiation to achieve Pareto-optimal deals.

Mansour et al. [35] presented a hybrid negotiation strategy for agents to define their offers and counter-offers. The model consists of preference-based and fuzzy-similarity methods used for quantitative and qualitative issues, respectively. The authors concluded that the hybrid strategy improved the negotiation output of agents when compared to other strategies.

Considering the previous work on the scope of communities, ref. [17] presented the regulatory framework of CECs, indicating their role in power systems and their potential members, benefits, and functions. Ref. [28] presented a review and model for the agent-based formation and management of power system alliances and their resources. Ref. [27] presented an agent-based model for CECs equipped with coalition formation and management models, decision protocols, and intra-team strategies. Ref. [23] presented the strategic bidding process for CECs, considering their active participation in wholesale markets without the need for intermediaries.

The literature review identified the economic benefits for consumers from being part of CECs. Concerning traditional consumers, CECs have more power while negotiating bilateral agreements with suppliers. Furthermore, alliances of CECs or their participation in local markets may provide the required weight for their active participation in wholesale markets without intermediaries. This work presents the interaction and decision protocols in an automated negotiation between alliances and opponents. It can be used as a decision-support model in energy alliances or automated negotiation, enabling small market players to form and manage teams and their decisions.

3. Automated Bilateral Negotiation Model

Autonomous agents have generated much excitement in recent years because of their promise as a new paradigm for designing and implementing complex software systems. Agent technology has been used to solve real-world problems related to industrial and commercial applications (e.g., [37]). The motivations for the increasing interest in agent research include the ability to solve problems that have multiple problem-solving entities and methods. Conceptually, a multi-agent approach in which autonomous agents are capable of flexible action to meet their design objectives is an ideal fit for the naturally distributed domain of a deregulated energy market.

The research community has paid significant attention to autonomous agents lately, and some prominent architectures have been proposed in the literature; notably, deliberative, reactive, and hybrid (combining the previous two) architectures [38]. The deliberative approach, employing a belief–desire–intention architecture for agents, is probably the most widely used in multi-agent systems and was adopted in this work. Beliefs use agents’ information about their environment to define their limits. Desires consider the goal-based behavior of agents in achieving their design goals. Intentions use plan templates of agents when negotiating their issues. With the increasing number of small, active, decentralized players in energy markets, automated negotiation may support the efficient market participation of these agents.

Negotiation is an important and pervasive form of social interaction. Traditional negotiation is conducted face-to-face and via mail or telephone, and it is often difficult to manage, prone to misunderstanding, and time-consuming. Automated negotiation promises a higher level of process efficiency, faster emergence, and higher-quality agreements [39].

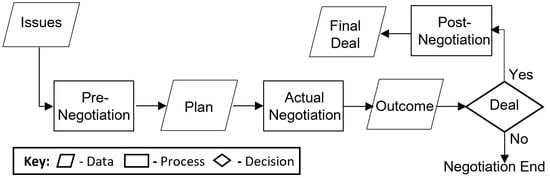

Figure 1 presents the automated negotiation model. Time matters in negotiation; i.e., negotiation, similarly to other forms of social interaction, often proceeds through several distinct phases or stages—notably, initiation (pre-negotiation), problem solving (actual negotiation), and resolution (post-negotiation) [40].

Figure 1.

A model for bilateral negotiation.

3.1. Pre-Negotiation

The initiation phase, also known as pre-negotiation, consists of the preparation and planning for negotiation and mainly involves the creation of a well-conceived plan specifying the activities that negotiators should attend to before actually starting to negotiate. In this phase, agents may define their: (i) agenda (i.e., the k issues under negotiation); (ii) initial and limit values for each issue; (iii) negotiation strategies, tactics, and plan templates; and (iv) proposals’ score (e.g., using utility functions). It is often considered the key to successful negotiation [41].

Negotiation tactics are functions that model concessions throughout the negotiation according to the selected negotiation strategy. Agents can use different negotiation strategies according to their preferences (see [42] for a review of negotiation strategies). In the energy-dependent concession making (EDCM) strategy, when negotiating time-of-use tariffs, they concede strategically in the periods they trade lower quantities of energy while conceding less in the other periods. In the low-priority concession making (LPCM) strategies, agents concede strategically on low-priority issues throughout the negotiation according to the weight, given to each k issue. In the starting reasonably and conceding moderately (SRCM), reasonably (SRCR), and slowly (SRCS) strategies, agents adopt a careful initial offer and make moderate, reasonable, and small concessions during negotiation, respectively. The quantity-dependent concession making (QDCM) strategy allows sellers to change their concession behavior according to the quantity of traded energy. It was developed based on a scale economy when sellers reduce aspirations for increasing quantities of traded energy [32].

Consider that a negotiating agent wants to negotiate a k issue with limit . According to the chosen concession tactic, , the concession factor, , of for is computed as follows:

The limit defined by each agent for each k issue consists of the least-acceptable value for achieving an agreement.

Negotiation strategies may consider conceding, stalemating, or accommodating strategies. These strategies are computationally tractable functions that model typical patterns of concessions, presuming that agents can compute concession strategies in a reasonable amount of time. For a given period, they specify the concession tactics to prepare counter-offers.

3.2. Actual Negotiation

The problem-solving phase, also known as actual negotiation, is when opponent parties try to achieve an agreement involving an iterative exchange of proposals and counter-proposals. Agents submit offers according to their agenda by using a set of strategies and tactics. In “good faith” negotiation, agents submit offers, which are accepted or returned with counter-offers. There is an unstated assumption that the parties will show their commitment to finding a solution by making concessions and not simply reject the offers of the others out of hand. To do so is often seen as “bad faith” bargaining [43]. Hopefully, through the give and take of negotiation, a point can be reached on which the parties will agree.

The literature identifies compromise, integrative, and Pareto-optimal agreements as the most used types of agreements [44]. In a compromise agreement, the parties set the middle ground of their initial offers. An integrative agreement considers a deal that reconciles the parties’ interests, providing a higher joint benefit or utility. A Pareto-optimal agreement is a solution that maximizes the social welfare considering both parties’ agendas defined in the pre-negotiation phase [45].

Negotiation may end with either agreement or no agreement. Failure to agree can occur in two ways: (i) either party decides to opt out unilaterally, or (ii) the two do not agree to any proposal. The resistance points or limits play a key role in reaching an agreement when the parties can unilaterally opt out of the negotiation—they define the worst agreement for a given party that is still better than opting out.

Each party scores proposals according to the following utility function [45]:

where:

- (i)

- is the weight given by for an issue ;

- (ii)

- is the (marginal) utility function of for ; i.e., the function that gives the score assigns to a value of an issue .

For each agent , we denote this agreement by . Hence, is the least-acceptable agreement for ; i.e., the worst (but still acceptable) agreement for . The set of all agreements that are preferred by to opting out is denoted by , being the set of decisions.

In this work, the behavior of each agent during negotiation is defined by the following plan template . For , this is a function with the following general form:

where:

- (i)

- for each issue , is a concession tactic (see Equation (1));

- (ii)

- is the offer of for period t of negotiation;

- (iii)

- ;

- (iv)

- is the utility of the least-acceptable agreement for ; i.e., the worst (but still acceptable) agreement for .

The plan template for agents has four steps and three possible decisions, . In the first step, agents prepare an offer using their negotiation strategies. Next, if the received proposals are better than their own or limit offers, they accept or reject the proposal, respectively. When agents reject proposals, they may opt out of the negotiation (quit) or send counter-proposals (compromise) in the last two steps. They opt out of the negotiation (quit) when the received proposals have worse utility than their least-acceptable agreements, .

3.3. Post-Negotiation

The resolution phase, also known as the post-negotiation process, is when opponent parties build commitment to implement the accepted agreement. It provides the basis of trust on which negotiators perform their part of the agreement. The degree of commitment to agreements may consider the incurring costs if negotiators fail to comply with their terms. These costs should be higher when keeping agreements to make parties regard the commitment as binding.

Agreements may finish according to their temporal clause [46]. Parties should discuss that clause, such as its terminal date. However, none can be binding forever. Hence, when negotiating long-term agreements, opponents should carefully analyze the incurred costs for not complying because of new alternatives and information, illegitimacy, unfairness, and surprises, which may incentivize them to rescind their contracts.

4. A Negotiation Model for Coalition Agents

Agents start forming a coalition when they have a common goal. Coalitions use team strategies to achieve mutually acceptable agreements. Members can leave and join coalitions until they sign the contract. The main issue when starting a promising coalition is that all members must have a common goal and similar objectives; then, depending on the coalition type, if none of the members or their companies have any legal relation (belong to the same owner), the formation phase can be started by a founder or a group of founders.

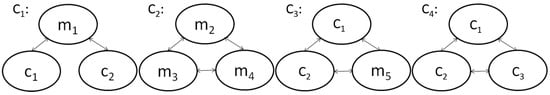

Figure 2 illustrates a summary of the different types of coalition formation. The first coalition () represents the aggregation-type coalition; e.g., where the owner of a company (agent ) with three different buildings aggregates the consumption of the two other buildings ( and ) with the main building (). The second coalition () represents the formation of a coalition of three members (, and ) of a specific sector where all members can negotiate. The third coalition () is a more complex type of coalition that results from the coalition of the two aforementioned coalitions ( and ) with another independent negotiation agent (). The fourth coalition () is composed of three other coalitions as members.

Figure 2.

Different types of coalition formation.

Increasing the complexity of the coalition also increases the ambiguity among the members, which gives extra importance to the interaction between them in the next phase of the model.

4.1. Interaction

The coalition selects a trusted mediator to communicate with opponents, transmitting their proposals and decisions to members (multi-party decision making) using a contract-net protocol [47]. The mediator negotiates with opponents on behalf of the coalition using an alternating-offers bilateral protocol [48]. This interaction protocol restricts the communication to the protocol initiation and the negotiation and decision of proposals. There is no interaction between members apart from this, so they cannot be influenced by or influence the others in this model; i.e., there is no persuasion between members during negotiation. However, other interaction protocols may consider the interaction between all members. Thus, the Shapley–Shubik index and other methods may consider persuasion in the decision-making processes of coalitions [49,50,51,52]. This involves evaluating the strength of agents to persuade or influence others to accept their proposals.

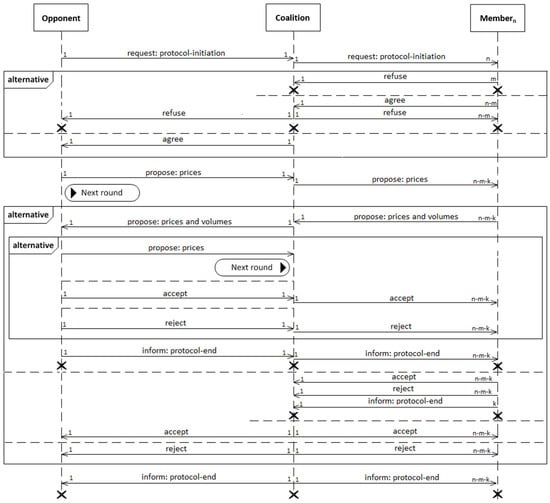

Figure 3 presents a interaction protocol that, depending on the type of coalition and the coalition strategy, can simplify the communication between the members and the trusted mediator of the coalition (i.e., all members start with the protocol initiation but, in the negotiation phase, can be restricted to a limited type of communication). Some members (dependent consumer agents) only receive the information regarding acceptance or rejection of a proposal, others (independent consumer agents) can vote for the acceptance of proposals, and the negotiation agents can interact in all processes according to the team strategy. All members except dependent consumer agents can leave the coalition before signing a contract with the seller agent.

Figure 3.

Multi-party negotiation protocol involving opponents, coalitions, and their members.

4.2. Negotiation and Decision

The negotiation and decision processes are interrelated. The mediator receives proposals from opponents and members. Thus, members can be requested to vote for the best proposal depending on the team’s strategy. According to Equation (5), they receive proposals and vote to accept (1) a proposal or not (0) by comparing its utility with all the other utilities; i.e., each member votes for the acceptance of the proposal that maximizes its utility.

The behavior of members during the negotiation and decision processes is highly dependent on the coalition strategy and, in addition to their individual model defined in Section 3, they also have the voting process.

4.2.1. Coalition Strategies

The selection of the coalition strategy is important in the negotiating and decision-making processes. Coalitions with homogeneous members should select strategies that invite all members to contribute to both processes. Coalitions with few or any experts should select one to be the mediator or an external entity, respectively. These experts should participate in the negotiation and all members should participate in the decision process. If some members do not have negotiation and decision skills, they should not participate in those processes. The selection of the strategy according to the coalition composition determines the level of satisfaction of its members with the final decision.

The coalition strategies used in this work were selected to cover the range of participation in coalition decisions: strategies that involve less participation in decision making (representative [27]); strategies that involve majority, unanimous, or board decisions (similarity-based and board voting [26,29]); and strategies that consider the member’s weight in the coalition (similarity distinction voting [27]).

Representative strategies consider that a representative mediator (RM) is selected to strategically negotiate with opponents, either considering the individual decision making (RM-IDM) of members or not. Simple voting strategies allow members of the coalition to submit proposals and vote on the best one considering a similarity (SSV), a majority (MSV), consensus (CSV), or unanimous (USV) rule, where the proposal with the most votes or at least 51%, 75%, or 100% of votes is accepted, respectively. In the last three strategies, the mediator eliminates proposals with fewer votes to achieve an agreement. Similarity-based unanimity Borda voting (SBV) indicates that members rank all proposals according to their preference. The best-ranked proposals receive a higher number of votes. The mediator selects the most voted proposal. The similarity distinction voting (SDV) strategy is similar to SSV. However, it provides all members with different numbers of votes according to their dimensions; then, the most voted proposal wins (see [27] for a detailed description of these strategies).

Considering that all members seek a common goal, a certain degree of cooperation and truthfulness among members is assumed. A scenario where members lie and play strategically is possible but unlikely in practical situations since they are cooperative. Team members delegate team decision making to a representative mediator , which, in this case, is the trusted mediator. This representative directly communicates with the opponent. The mediator selection can be formalized as follows:

The mediator is also in charge of applying the negotiation team strategies to decide which offer should be sent to the opponent and whether opponent offers should be accepted or not, considering the following voting system for each member of the coalition:

Considering that the representative does not know other members’ utility functions, it uses the team negotiation strategy to make decisions. The negotiation strategy employed by the mediator is agreed upon before starting the negotiation process. In accordance with the selected team negotiation strategy, there is an exchange of proposals between the members of the community until the number of positive (1) or negative (0) votes is enough for the mediator to accept the proposal or send the most voted proposal, , respectively. During this process, the proposals with fewer votes are removed until a final decision is achieved.

Next, the mediator agent, , adopts the team negotiation strategy on behalf of all members. It applies the selected strategy in a plan template of the coalition decision strategy with the following general form:

where:

- (i)

- For each issue , is the mediator’s concession tactic (see Equation (1));

- (ii)

- is the selected offer of for period t of negotiation;

- (iii)

- is the utility of the least-acceptable agreement for ; i.e., the worst (but still acceptable) agreement.

Depending on the selected team strategy, members may prepare a proposal and vote for the best one, but only the mediator can withdraw from the negotiation if the received proposal is unacceptable. Thus, while all members may decide on the acceptance of a proposal using a voting system, only the mediator may quit negotiating. However, if any member of the coalition considers the final proposal unacceptable, it can leave the coalition, as presented in the plan template in Equation (3).

The plan template for coalitions’ mediators has six steps and three possible decisions, . In the first step, mediators prepare proposals using their negotiation strategies and collect the offers of all agents. In the next two steps, mediators send all proposals to members, selecting the most voted proposal according to the intra-team strategies. If opponents have the most voted proposals, they are accepted. Otherwise, mediators continue to the last three steps of the plan. Then, mediators may opt out of the negotiation (quit) if the utilities of opponents’ proposals are worse than their least-acceptable agreements, . Otherwise, they reject proposals and offer their most voted proposal to opponents (compromise).

4.3. Auxiliary Parameters of Coalition Performance Evaluation

The preliminary results indicated that, by forming a citizen energy community, some members benefit from a tariff reduction, reducing their final costs and increasing their utility [27].

In this article, other parameters beyond the coalition and individual costs and utilities can be studied. The negotiation bargaining power, complexity, and knowledge are used to explain the advantages and disadvantages of belonging to coalitions.

The individual cost of electricity is the total cost that a member will have to pay in the coalition’s deal:

where is the price that has to pay for its requested electricity quantity at period k.

Coalition total costs are equal to the sum of the individual costs of each member:

where is the price that all members of the coalition have to pay for their quantities at period k.

The utility of an agent is and the average utility of the coalition is equal to:

Considering that each member can have a different weight in the coalition, , the coalition’s weighted utility is equal to:

where, in this article, the weight of the agent in the coalition is equal to the value obtained with Equation (11). and are the total energy quantities required by each agent and the entire coalition, respectively.

The social welfare of an agent, , is the value that refers to the agent’s benefit from the boundary prices at which agents are willing to trade and the traded prices, computed as follows:

where and are the constant values used for seller and buyer agents, respectively.

Related to the social welfare is the bargaining power. How strong the bargaining power of an agent is can determine how much higher its social welfare can potentially reach.

Definition 1

(bargaining power). Let be a member of the coalition . The bargaining power is the capacity of to influence its opponent to give in to its demands (i.e., make the opponent propose a better proposal that complies with its needs). The computational bargaining power, , is the BP computed considering perfect information, where 0 refers to an agent without bargaining power and 1 to an agent with full bargaining power. The BP can be computed considering different approaches; e.g., it is possible to compute it considering opponents’ initial and limit positions (i.e., the initial and limit prices). This way of calculating the BP can be considered as the BP from the point of view of the negotiation using perfect information, CBP, which is computed as follows:

where is the initial price that proposes to , is the agreed price, is the weight of , and is the limit price of for the period k.

This approach has some limitations because it can only be used in a simulation (in real-world negotiations, we do not know opponents’ boundaries), and it is not a good approach when our opponent does not use a conventional way of negotiation. If it is very optimistic, it can lead to an initial position that is too high, which can give the wrong idea that opponents will significantly concede to our demands.

When we send and receive the first proposal, we have the information on the initial position of both parties in the negotiation. With this information, we can verify how much each party will concede to the opponent’s demands and calculate the BP of each party. This approach is also limited by the negotiation style of each agent and by not having access to the boundary values of the opponent. Thus, it can be considered the BP from the point of view of each agent. One approach that avoids this limitation consists of the evaluation of the initial position of the opponent considering our boundary position. The limit position is a more reasonable value because it can consider past negotiations, the actual or future market values of the item, current negotiations and tariffs, etc. One more realistic way of computing the BP in real-world negotiation is as follows:

This approach is the most convenient in real-world negotiations because it overcomes some of the limitations of the previous approach. In a simulation, the formulation defined in Equation (13) seems the most appropriate because it gives a more reliable result concerning the BP of in the negotiation. However, if we do not have perfect information, the last approach should be used.

The negotiation complexity is computed by considering the time spent in the negotiation or the number of exchanged proposals.

Definition 2

(negotiation complexity). Let be the opponent and the coalition agent , respectively. It can be verified that the agreement is hard to achieve (complex agreement) when we are near the maximum number of exchanged proposals, , defined for this negotiation or near the negotiation deadline. Otherwise, it is simple to achieve (easy agreement) if they exchange a low number of proposals, .

The negotiation complexity, , is considered simple for values near 0 and complex for values near 1. For values equal to 1, there is an impasse or no agreement. Thus, one or both parties must give in to some demands to achieve an agreement. For a negotiation between agents and , the is equal to:

The computational complexity of the negotiation depends on the complexity of intra-team strategies.

Definition 3

(computational complexity of the negotiation). Let be the coalition agent and n the number of members comprising the coalition agents. The computational complexity of the negotiation is defined as the number of interactions needed to achieve an agreement in the coalition. It is used to evaluate algorithms [53,54]. This model uses it to evaluate the computational complexity of team strategies. For example, let represent the complexity of the strategy, which means that it is only necessary for one interaction to achieve an agreement. If , it means that n interactions are necessary to achieve an agreement, where n is the number of members in the coalition.

The negotiation knowledge of agents may increase with the extra information they acquire by being part of alliances.

Definition 4

(negotiation knowledge). Let be a member of the coalition . By entering into a coalition, the negotiation knowledge of the agent can increase because it can gain access to other members’ information, such as tariffs, market data, and negotiation strategies. Agents evaluate their tariffs, negotiation tactics, and strategies more carefully (adaptive learning), re-evaluating their tariffs by considering new information and possibly upgrading their negotiation level. As t is the instant of time when the agent enters into the coalition, the agent’s increase in negotiation knowledge (INK) can be proportional to the utility (score) transferred from the time moment before it enters into the coalition, , to the entrance moment, t:

The following section presents a study testing the automated negotiation model for alliances of energy communities.

5. Study on the Multy-Party Automated Negotiation of Electricity Bilateral Contracts

This study considered that the members of eight English public institutions formed three citizen energy communities and then joined and formed a coalition. The three communities already negotiated a new time-of-use tariff with the retailer in an initial study [27]. It was verified that all members of the first and second communities had positive and negative benefits, respectively. In the third community, one of the members had a negative benefit due to the choice of the mediator (see Table 1). The study concluded that it is critical to choose a good mediator when negotiating bilateral contracts for electricity.

Table 1.

Agents’ data.

Against this background, this study considered the automated negotiation of a bilateral contract between a retailer (seller agent) and a coalition of communities to obtain a mutual-benefit agreement for all parties. It used data from existing buildings in the United Kingdom (UK) obtained from the ecoDriver website (http://www.ecodriver.co.uk, accessed on 12 May 2023). The eight consumers studied here were:

- (i)

- : Department for Transport headquarters building, Great Minster House, London;

- (ii)

- : Ministry of Defense Main Building in Whitehall, London;

- (iii)

- : The UK Department for International Development, London;

- (iv)

- : St George’s College, Weybridge, London;

- (v)

- : St George’s Junior School, Weybridge, London;

- (vi)

- : Ludgrove Preparatory School, London;

- (vii)

- : Thames Ditton Infant School, London;

- (viii)

- : Ashley C of E Primary School, London.

Table 1 presents the data for these agents. The actual tariffs in Table 1 correspond to their real-world tariffs, which led to the previous goals and limits. The “Community tariff” reflects the negotiated tariff for each agent after joining the community. The community tariffs and being part of a coalition led agents to define their beliefs and desires about electricity prices, resulting in the “Initial Price” and “Limit” for members. They reflect an upgrade in the beliefs of all agents due to joining the coalition . All the other parameters were obtained through calculations (see Section 4.3).

As can be verified in Table 1, by forming a coalition that included all the studied agents and considering the interaction between them and the learning process resulting from their interaction, the agents updated their knowledge bases. Furthermore, they computed the utility of their contracts (“Actual Utility”), which was reduced due to their increase in knowledge (INK). Furthermore, their actual tariff bargaining power from their point of view changed because of their positive INK. As all members had a positive INK, it can be concluded that, by forming this coalition, all members started by increasing the quality of their information and updating their knowledge bases with relevant information. Members of the first community increased their social welfare, while the other members had negative or low SW values, except for the last agent, which significantly reduced its tariff. The sum of the SW among all consumers was somewhat higher than the SW of the supplier but balanced.

This study aimed to verify if joining a coalition with a good mediator could benefit all members while negotiating new tariffs. The formation process resulted in the alliance of all agents into a coalition. Considering the automated negotiation model presented in Section 3 and the alliances’ negotiation model shown in Section 4, the eight team-decision strategies presented in Section 4.2.1 for negotiation between the coalition and the seller agents were selected. Members can be active in the negotiation and decision processes depending on the type of agent and the chosen team strategy. The coalition selected the first consumer, , as the mediator. Table 2 and Table 3 present the main results of the automated negotiation from the point of view of the coalition and its members, respectively.

Table 2.

Results from the point of view of the coalition.

Table 3.

Results from the point of view of agents.

Analyzing the results in Table 2 obtained by using the different types of intra-team strategies studied in Section 4.2.1, it can be concluded that, from the point of view of the coalition, some strategies have the same results because the number of members is small (only eight members) and, in general, the members of the coalition increase their benefit, being SBV the best strategy. Indeed, as the mediator and the most powerful member are the same agent, the representative, and the SDV strategies have the same results, all the other strategies except for the SBV give lower benefits to the coalition, mainly because they increase the power of worse negotiators than .

Concerning the BP, it can be concluded that, while the members of the first community slightly increased it, the members of other communities significantly increased it, which resulted in a high increase in the benefit for these members by joining this coalition. Analyzing the results of each strategy, it is possible to verify that the SBV strategy usually brings a higher benefit to the coalition and increases its average utility. SBV evaluates all proposals without neglecting the worst proposals as the other strategies do. Further conclusions can be obtained by analyzing the individual benefit for each member.

The “Benefit (GBP)” parameter evaluates the members’ benefit from forming this coalition in terms of being only part of a community. The “Final benefit (%)” parameter evaluates their relative benefit concerning their initial tariff.

Analyzing Table 3, it can be concluded that agents from the first community have lower benefits, but the SBV strategy has improved results. The other members significantly increased their benefits in terms of their actual and community tariffs. This happened essentially because the members of the first community had more power and because had a better negotiation strategy when compared to all the other members. Concerning the SW, all members had positive and higher SWs compared to the community tariff. However, the SW of the seller decreased to values between GBP 45,110 in the CSV and USV strategies and GBP 13,543 in the SBV strategy. The SW of the coalition was thus substantially higher than that of the seller.

These results support the previous conclusions by proving that the agents that benefit more by joining a coalition are small consumers and bad negotiators. Interestingly, the SBV increased the benefit for the representative mediator, , concerning the representative strategies when it was the only one proposing tariffs on behalf of the coalition. This happened because the SBV ranks all proposals. Therefore, considering the numerous proposals, it is harder to rank the opponent proposal as the best proposal compared to the other strategies. Thus, SBV retards the negotiation, making the opponent concede more to achieve an agreement. Table 2 presents the “Negotiation complexity” parameter, which indicates SBV as the heaviest strategy to achieve an agreement. Table 4 compares the costs agents have for electricity according to the organization they belong to.

Table 4.

Agents’ costs and benefits (regarding single costs) in each type of agent-based organization.

Analyzing Table 4, it can be concluded that agents benefit from being part of a coalition, even considering the worst outputs (CSV and USV strategies). However, forming small communities with little negotiation expertise can prejudice their members, as verified from the negative benefits of three of the last five agents from and .

As a general conclusion, for coalitions where the members are different, they must carefully choose the mediator and the intra-team strategy. They should select their expert in negotiation (or the best negotiator among the members) or contract an external entity (if they do not have experienced negotiators) as the mediator. Even so, they should choose the SBV strategy to guarantee equality among all members. Although more complex, it is the recommended strategy because, on average, it brings greater utilities and benefits to members. However, this strategy may involve lengthy negotiations, leading some opponents to withdraw without agreement.

6. Conclusions

This article focused on coalition agents and their functions in liberalized electricity markets. It presented single- and coalition-agent models, considering their formation, interaction, negotiation, and decision processes. Furthermore, it presented a study to test several intra-team strategies and prove that the members of well-organized and structured coalitions have economic benefits.

An initial study simulated the formation of three different types of communities. The first was well-formed with a proper mediator, the second had no relevance to the seller, and the third had a mediator with little negotiation expertise. It was concluded that all members of the first community had positive benefits. However, in the second community, all members had negative benefits because their alliance did not impact the seller. In the third coalition, one of the members had a negative benefit due to the choice of a representative without negotiation expertise. Thus, it was concluded that formation of a relevant alliance and choosing a negotiation expert as the mediator are key to successful alliances.

In the presented study, all agents formed a coalition. They chose the mediator of the first community as the representative mediator, resulting in cost reductions for all. The most and less powerful members reduced their average costs for electricity by 5% and 64%, respectively. The levelized cost reduction of the coalition was 19%. Furthermore, choosing an expert as the mediator and a board voting strategy, the similarity-based unanimity Borda voting strategy, in all proposals for team decisions guaranteed a competitive negotiation with the opponent and a rigorous decision-making process among the members.

Future work will consider the impact of increasing competition where a coalition decides through concurrent negotiations of bilateral contracts with several sellers. Furthermore, the impact that alliances have on sellers in terms of risk management will be studied with more detail using a risk-return analysis.

Funding

This work received funding from the EU Horizon 2020 research and innovation program under the project TradeRES (grant agreement no. 864276).

Data Availability Statement

The consumption data for real-world consumers and the information about their tariffs can be found at http://www.ecodriver.co.uk. All data accessed on 12 May 2023.

Conflicts of Interest

The author declares no conflict of interest.

Abbreviations

| BP | bargaining power |

| CBP | computational bargaining power |

| CEC | citizen energy community |

| CSV | consensus simple voting |

| EDCM | energy-dependent concession making |

| LPCM | low-priority concession making |

| INK | increase in negotiation knowledge |

| MSV | majority simple voting |

| NC | negotiation complexity |

| QDCM | quantity-dependent concession making |

| RM | representative mediator |

| RM-IDM | RM with individual decision making |

| SBV | similarity-based unanimity Borda voting |

| DSV | similarity distinction voting |

| SRCM | starting reasonably and conceding moderately |

| SRCR | starting reasonably and conceding reasonably |

| SRCS | starting reasonably and conceding slowly |

| SSV | similarity simple voting |

| SW | social welfare |

| UK | United Kingdom |

| USV | unanimous simple voting |

| Indices | |

| agenda | |

| coalition agent | |

| CEC agent | |

| set of issues | |

| i | number of proposals |

| k | issue index |

| j | opponent index |

| m | number of lost members |

| N | number of members |

| n | member index |

| set of decisions | |

| t | period |

| number of periods | |

| Parameters | |

| cost | |

| mediator, opponent, and member agents | |

| b | agent type constant |

| customer | |

| concession function | |

| negotiator | |

| maximum number of proposals | |

| p | proposal |

| P | price |

| plan template | |

| q | quantity |

| decision | |

| least-acceptable agreement | |

| utility function | |

| issue’s weight | |

| marginal utility function | |

| voting decision | |

| agent’s weight | |

| issues | |

| concession tactic |

References

- Hunt, S.; Shuttleworth, G. Competition and Choice in Electricity; Wiley: Chichester, UK, 1996. [Google Scholar]

- Shahidehpour, M.; Yamin, H.; Li, Z. Market Operations in Electric Power Systems; Wiley: Chichester, UK, 2002. [Google Scholar]

- Kirschen, D.; Strbac, G. Fundamentals of Power System Economics; Wiley: Chichester, UK, 2018. [Google Scholar]

- Algarvio, H.; Lopes, F.; Couto, A.; Santana, J.; Estanqueiro, A. Effects of Regulating the European Internal Market on the integration of Variable Renewable Energy. WIREs Energy Environ. 2019, 8, e346. [Google Scholar] [CrossRef]

- Hull, J.C. Options Futures and Other Derivatives; Pearson Education India: Noida, India, 1997. [Google Scholar]

- Algarvio, H. Multi-step optimization of the purchasing options of power retailers to feed their portfolios of consumers. Int. J. Electr. Power Energy Syst. 2022, 142, 108260. [Google Scholar] [CrossRef]

- Algarvio, H. Risk-Sharing Contracts and risk management of bilateral contracting in electricity markets. Int. J. Electr. Power Energy Syst. 2023, 144, 108579. [Google Scholar] [CrossRef]

- Brigatto, A.; Fanzeres, B. A soft robust methodology to devise hedging strategies in renewable energy trading based on electricity options. Electr. Power Syst. Res. 2022, 207, 107852. [Google Scholar] [CrossRef]

- Algarvio, H.; Lopes, F.; Couto, A.; Estanqueiro, A. Participation of wind power producers in day-ahead and balancing markets: An overview and a simulation-based study. WIREs Energy Environ. 2019, 8, e343. [Google Scholar] [CrossRef]

- Strbac, G.; Papadaskalopoulos, D.; Chrysanthopoulos, N.; Estanqueiro, A.; Algarvio, H.; Lopes, F.; de Vries, L.; Morales-España, G.; Sijm, J.; Hernandez-Serna, R.; et al. Decarbonization of Electricity Systems in Europe: Market Design Challenges. IEEE Power Energy Mag. 2021, 19, 53–63. [Google Scholar] [CrossRef]

- Algarvio, H.; Lopes, F.; Couto, A.; Estanqueiro, A.; Santana, J. Variable Renewable Energy and Market Design: New Market Products and a Real-world Study. Energies 2019, 12, 4576. [Google Scholar] [CrossRef]

- Frade, P.; Pereira, J.; Santana, J.; Catalão, J. Wind balancing costs in a power system with high wind penetration–Evidence from Portugal. Energy Policy 2019, 132, 702–713. [Google Scholar] [CrossRef]

- Algarvio, H.; Lopes, F.; Sousa, J.; Lagarto, J. Multi-agent electricity markets: Retailer portfolio optimization using Markowitz theory. Electr. Power Syst. Res. 2017, 148, 282–294. [Google Scholar] [CrossRef]

- Wei, N.; Li, C.; Peng, X.; Zeng, F.; Lu, X. Conventional models and artificial intelligence-based models for energy consumption forecasting: A review. J. Pet. Sci. Eng. 2019, 181, 106187. [Google Scholar] [CrossRef]

- Algarvio, H.; Lopes, F. Agent-based Retail Competition and Portfolio Optimization in Liberalized Electricity Markets: A Study Involving Real-World Consumers. Int. J. Electr. Power Energy Syst. 2022, 137, 107687. [Google Scholar] [CrossRef]

- Gils, H.; Scholz, Y.; Pregger, T.; de Tena, D.; Heide, D. Integrated modelling of variable renewable energy-based power supply in Europe. Energy 2017, 123, 173–188. [Google Scholar] [CrossRef]

- Algarvio, H. The Role of Local Citizen Energy Communities in the Road to Carbon-Neutral Power Systems: Outcomes from a Case Study in Portugal. Smart Cities 2021, 4, 840–863. [Google Scholar] [CrossRef]

- Bohland, M.; Schwenen, S. Renewable support and strategic pricing in electricity markets. Int. J. Ind. Organ. 2022, 80, 102792. [Google Scholar] [CrossRef]

- European Commission. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee, the Committee of the Regions and the European Investment Bank: Clean Energy for All Europeans (COM/2016/0860 Final). Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52016DC0860 (accessed on 27 March 2022).

- European Commission, Regulation (EU) 2019/943 of the European Parliament and of the Council on the Internal Market for Electricity. 5 June 2019. Available online: http://data.europa.eu/eli/reg/2019/943/oj (accessed on 27 March 2022).

- Miguelez, C.; Baeza, V.; Parada, R.; Monzo, C. Guidelines for Renewal and Securitization of a Critical Infrastructure Based on IoT Networks. Smart Cities 2023, 6, 728–743. [Google Scholar] [CrossRef]

- Meeus, L.; Purchalaa, K.; Belmans, R. Development of the Internal Electricity Market in Europe. Electr. J. 2005, 18, 25–35. [Google Scholar] [CrossRef]

- Algarvio, H. Strategic Participation of Active Citizen Energy Communities in Spot Electricity Markets Using Hybrid Forecast Methodologies. Eng 2022, 4, 1–14. [Google Scholar] [CrossRef]

- Klusch, K.; Gerber, A. Dynamic Coalition Formation among Rational Agents. IEEE Intell. Syst. 2002, 17, 42–47. [Google Scholar] [CrossRef]

- Pinto, T.; Morais, H.; Oliveira, P.; Vale, Z.; Praça, I.; Ramos, C. A new approach for multi-agent coalition formation and management in the scope of electricity markets. Energy 2011, 36, 5004–5015. [Google Scholar] [CrossRef]

- Sanchez-Anguix, V.; Julián, V.; Botti, V.; García-Fornes, A. Studying the impact of negotiation environments on negotiation teams’ performance. Inf. Sci. 2013, 219, 17–40. [Google Scholar] [CrossRef]

- Algarvio, H. Agent-based model of citizen energy communities used to negotiate bilateral contracts in electricity markets. Smart Cities 2022, 5, 1039–1053. [Google Scholar] [CrossRef]

- Algarvio, H. Management of Local Citizen Energy Communities and Bilateral Contracting in Multi-Agent Electricity Markets. Smart Cities 2021, 4, 1437–1453. [Google Scholar] [CrossRef]

- Sánchez-Anguix, V.; Julián, V.; Botti, V.; García-Fornes, A. Reaching Unanimous Agreements within Agent-Based Negotiation Teams with Linear and Monotonic Utility Functions. IEEE Trans. Syst. Man Cybern. Part B Cybern. 2012, 42, 778–792. [Google Scholar] [CrossRef]

- Sánchez-Anguix, V.; Valero, S.; Julián, V.; Botti, V.; García-Fornes. Evolutionary-aided negotiation model for bilateral bargaining in Ambient Intelligence domains with complex utility functions. Inf. Sci. 2013, 222, 25–46. [Google Scholar] [CrossRef]

- Sánchez-Anguix, V.; Aydogan, R.; Baarslag, T.; Jonker, C. Bottom-up approaches to achieve Pareto optimal agreements in group decision making. Knowl. Inf. Syst. 2019, 61, 1019–1046. [Google Scholar] [CrossRef]

- Algarvio, H.; Lopes, F.; Santana, J. Multi-agent Retail Energy Markets: Contract Negotiation, Customer Coalitions and a Real-World Case Study. In Advances in Practical Applications of Scalable Multi-Agent Systems; Springer: Berlin/Heidelberg, Germany, 2016; pp. 13–23. [Google Scholar]

- Baarslag, T.; Hendrikx, M.J.; Hindriks, K.V.; Jonker, C.M. Learning about the opponent in automated bilateral negotiation: A comprehensive survey of opponent modeling techniques. Auton. Agents Multi-Agent Syst. 2016, 30, 849–898. [Google Scholar] [CrossRef]

- Marsa-Maestre, I.; Lopez-Carmona, M.A.; Ito, T.; Zhang, M.; Bai, Q.; Fujita, K. Novel Insights in Agent-Based Complex Automated Negotiation; Springer: Berlin/Heidelberg, Germany, 2014; p. 535. [Google Scholar]

- Mansour, K.; Al-Lahham, Y.; Tawil, S.; Kowalczyk, R.; Al-Qerem, A. An Effective Negotiation Strategy for Quantitative and Qualitative Issues in Multi-Agent Systems. Electronics 2022, 11, 2754. [Google Scholar] [CrossRef]

- Bellifemine, F.; Caire, G.; Greenwood, D. Developing Multi-Agent Systems with JADE; John Wiley & Sons: Chichester, UK, 2007. [Google Scholar]

- Pechoucek, M.; Marik, V. Industrial Deployment of Multi-agent Technologies: Review and Selected Case Studies. Auton. Agents Multi-Agent Syst. 2008, 17, 397–431. [Google Scholar] [CrossRef]

- Wooldridge, M. An Introduction to Multiagent Systems; Wiley: Chichester, UK, 2009. [Google Scholar]

- Bichler, M.; Kersten, G.; Strecker, S. Towards a Structured Design of Electronic Negotiations. Group Decis. Negot. 2003, 12, 311–335. [Google Scholar] [CrossRef]

- Lewicki, R.; Barry, B.; Saunders, D. Negotiation; McGraw Hill: New York, NY, USA, 2010. [Google Scholar]

- Thompson, L. The Mind and Heart of the Negotiator; Prentice-Hall: Englewood Cliffs, NJ, USA, 2005. [Google Scholar]

- Lopes, F.; Algarvio, H.; Coelho, H. Bilateral Contracting in Multi-agent Electricity Markets: Negotiation Strategies and a Case Study. In Proceedings of the International Conference on the European Energy Market (EEM-13), Stockholm, Sweden, 27–31 May 2013; IEEE Computer Society Press: Piscataway, NJ, USA, 2013; pp. 1–8. [Google Scholar]

- Raiffa, H.; Richardson, J.; Metcalfe, D. Negotiation Analysis; Harvard University Press: Cambridge, UK, 2002. [Google Scholar]

- Pruitt, D.; Kim, S. Social Conflict: Escalation, Stalemate, and Settlement; McGraw Hill: New York, NY, USA, 2004. [Google Scholar]

- Raiffa, H. The Art and Science of Negotiation; Harvard University Press: Cambridge, UK, 1982. [Google Scholar]

- Lax, D.; Sebenius, J. The Manager as Negotiator; Free Press: New York, NY, USA, 1986. [Google Scholar]

- Smith, R.G. The contract net protocol: High-level communication and control in a distributed problem solver. IEEE Trans. Comput. 1980, 12, 1104–1113. [Google Scholar] [CrossRef]

- Osborne, M.; Rubinstein, A. Bargaining and Markets; Academic Press: San Diego, CA, USA, 1990. [Google Scholar]

- Shapley, L.S.; Shubik, M. A method for evaluating the distribution of power in a committee system. Am. Political Sci. Rev. 1954, 48, 787–792. [Google Scholar] [CrossRef]

- Banzhaf, J. Weighted voting doesn’t work: A mathematical analysis. Rutgers Law Rev. 1965, 19, 317–343. [Google Scholar]

- Lucas, W.; Straffin, P. Political and Related Models; Springer: New York, NY, USA, 1983. [Google Scholar]

- Leech, D. An empirical comparison of the performance of classical power indices. Political Stud. 2022, 50, 122. [Google Scholar] [CrossRef]

- Cormen, T.; Leiserson, C.; Rivest, R.; Stein, C. Introduction to Algorithms, 3rd ed.; MIT Press: Cambridge, MA, USA, 2009. [Google Scholar]

- Sedgewick, R. Algorithms in Java, Parts 1–4, 3rd ed.; Addison-Wesley Professional: Boston, MA, USA, 2002. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).