Assessing Artificial Intelligence Technology Acceptance in Managerial Accounting

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Research Design

3.2. Methods

- —endogenous and exogenous latent variables’ vectors;

- —the matrix of regression coefficients relating the latent endogenous variables to each other;

- —the matrix of regression coefficients relating the endogenous variables to exogenous variables;

- —disturbance;

- —cases in the sample.

- Λy, Λx—matrices of factor loadings;

- ε, δ—vectors of uniqueness.

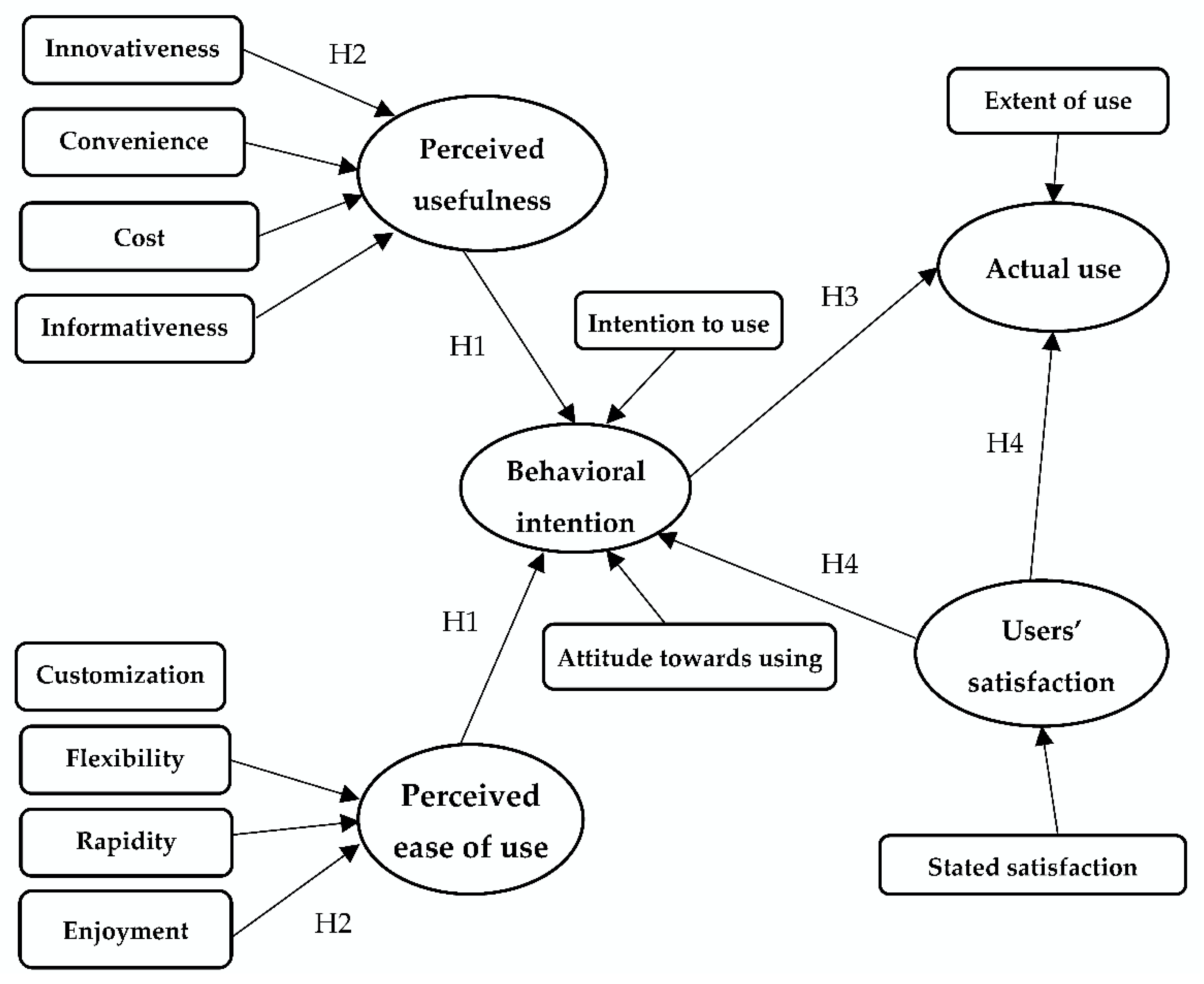

3.3. Hypotheses

3.4. Questionnaire

4. Results

5. Discussion

6. Conclusions

6.1. Empirical and Managerial Implications

6.2. Theoretical Implications

6.3. Limitations and Further Research

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Jasim, Y.A.; Raewf, M.B. Information Technology’s Impact on the Accounting System. Cihan Univ. J. Humanit. Soc. Sci. 2020, 4, 50–57. [Google Scholar] [CrossRef]

- Quattrone, P. Management accounting goes digital: Will the move make it wiser? Manag. Account. Res. 2016, 31, 118–122. [Google Scholar] [CrossRef] [Green Version]

- Richins, G.; Stapleton, A.; Stratopoulos, T.; Wong, C. Big Data Analytics: Opportunity or Threat for the Accounting Profession? J. Inf. Syst. 2017, 31, 63–79. [Google Scholar] [CrossRef]

- Moll, J.; Yigitbasioglu, O. The role of internet-related technologies in shaping the work of accountants: New directions for accounting research. Br. Account. Rev. 2019, 51, 100833. [Google Scholar] [CrossRef]

- Damerji, H.; Salimi, A. Mediating effect of use perceptions on technology readiness and adoption of artificial intelligence in accounting. Account. Educ. 2021, 30, 107–130. [Google Scholar] [CrossRef]

- Gonçalves, M.J.A.; da Silva, A.C.F.; Ferreira, C.G. The Future of Accounting: How Will Digital Transformation Impact the Sector? Informatics 2022, 9, 19. [Google Scholar] [CrossRef]

- Korhonen, T.; Selos, E.; Laine, T.; Suomala, P. Exploring the programmability of management accounting work for increasing automation: An interventionist case study. Account. Audit. Account. J. 2020, 34, 253–280. [Google Scholar] [CrossRef]

- Bromwicha, M.; Scapens, R.W. Management Accounting Research: 25 years on. Manag. Account. Res. 2016, 31, 1–9. [Google Scholar] [CrossRef]

- Piccarozzi, M.; Aquilani, B.; Gatti, C. Industry 4.0 in management studies: A systematic literature review. Sustainability 2018, 10, 3821. [Google Scholar] [CrossRef] [Green Version]

- Milian, E.Z.; Spinola, M.D.M.; De Carvalho, M.M. Fintech: A literature review and research agenda. Electron. Commer. Res. Appl. 2019, 34, 100833. [Google Scholar] [CrossRef]

- Arundel, A.; Bloch, C.; Ferguson, B. Advancing innovation in the public sector: Aligning innovation measurement with policy goals. Res. Policy 2019, 48, 789–798. [Google Scholar] [CrossRef]

- Rikhardsson, P.; Yigitbasioglu, O. Business intelligence & analytics in management accounting research: Status and future focus. Int. J. Account. Inf. Syst. 2018, 29, 37–58. [Google Scholar] [CrossRef] [Green Version]

- ACCA/IMA. Digital Darwinism: Thriving in the Face of Technology Change. Available online: https://www.accaglobal.com/in/en/technical-activities/technical-resources-search/2013/october/digital-darwinism.html (accessed on 28 March 2022).

- Chandi, N. Accounting trends of tomorrow: What You Need to Know. Forbes, 2018, 13A. Available online: https://www.forbes.com/sites/forbestechcouncil/2018/09/13/accounting-trends-of-tomorrow-what-you-need-to-know/?sh=34f5fb94283b (accessed on 28 March 2022).

- Ionescu, B.; Ionescu, I.; Bendovschi, A.; Tudoran, L. Traditional accounting vs. cloud accounting. In Proceedings of the 8th International Conference Accounting and Management Informational Systems, Bucharest, Romania, 12–13 June 2013; pp. 106–125. [Google Scholar]

- Christauskas, C.; Misevicience, R. Cloud computing-based accounting for small to medium-sized business. Inz. Ekon. Eng. Econ. 2012, 23, 14–21. [Google Scholar] [CrossRef]

- Phillips, B.A. How Cloud Computing Will Change Accounting Forever. 2012. Available online: https://docplayer.net/2537016-How-the-cloud-will-change-accounting-forever.html (accessed on 16 February 2022).

- Ahn, S.; Jung, H.R. A study on the role of public officials in local governmental accounting. Korean Gov. Account. Rev. 2018, 16, 67–91. [Google Scholar] [CrossRef]

- Bauguess, S. The role of big data, machine learning, and AI in assessing risks: A regulatory perspective. In Champagne Keynote Speech; Securities and Exchange Commission: New York, NY, USA, 2017. Available online: https://www.sec.gov/news/speech/bauguess-big-data-ai (accessed on 21 April 2022).

- Cho, J.S.; Ahn, S.; Jung, W. The impact of artificial intelligence on the audit market. Korean Account. J. 2018, 27, 289–330. [Google Scholar] [CrossRef]

- Belfo, F.P.; Trigo, A. Accounting Information Systems: Tradition and Future Directions. Procedía Technol. 2013, 9, 536–546. [Google Scholar] [CrossRef] [Green Version]

- Taipaleenmäki, J.; Ikäheimo, S. On the convergence of management accounting and financial accounting—The role of information technology in accounting change. Int. J. Account. Inf. Syst. 2013, 14, 321–348. [Google Scholar] [CrossRef]

- Arnold, V. The changing technological environment and the future of behavioral research in accounting. Account. Fínanc. 2018, 58, 315–339. [Google Scholar] [CrossRef]

- Dos Santos, B.L.; Suave, R.; Ferreira, M.M.; Altoé, S.M.L. Profissäo contábil em tempos de mudança: Implicaçôes do avanço tecnológico nas atividades em um escritorio de contabilidade. Rev. Contab. Control. 2020, 11, 113–133. [Google Scholar] [CrossRef]

- Schmitz, J.; Leoni, G. Accounting and Auditing at the Time of Blockchain Technology: A Research Agenda. Aust. Account. Rev. 2019, 29, 331–342. [Google Scholar] [CrossRef]

- George, K.; Patatoukas, P.N. The Blockchain Evolution and Revolution of Accounting. 2020. Available online: https://ssrn.com/abstract=3681654 (accessed on 7 April 2022).

- Secinaro, S.; Calandra, D.; Biancone, P. Blockchain, trust, and trust accounting: Can blockchain technology substitute trust created by intermediaries in trust accounting? A theoretical examination. Int. J. Manag. Pract. 2021, 14, 129–145. [Google Scholar] [CrossRef]

- Carlin, T. Blockchain and the Journey Beyond Double Entry. Aust. Account. Rev. 2019, 29, 305–311. [Google Scholar] [CrossRef]

- Marrone, M.; Hazelton, J. The disruptive and transformative potential of new technologies for accounting, accountants, and accountability: A review of current literature and call for further research. Med. Account. Res. 2019, 27, 677–694. [Google Scholar] [CrossRef]

- Kroon, N.; Alves, M.d.C.; Martins, I. The Impacts of Emerging Technologies on Accountants’ Role and Skills: Connecting to Open Innovation—A Systematic Literature Review. J. Open Innov. Technol. Mark. Complex. 2021, 7, 163. [Google Scholar] [CrossRef]

- International Federation of Accountants; Association of Accounting Technicians. An Illustrative Competency Framework for Accounting Technicians; International Federation of Accountants: New York, NY, USA; Association of Accounting Technicians: London, UK, 2019. [Google Scholar]

- Institute of Management Accounting. IMA Management Accounting Competency Framework; Institute of Management Accounting: Buffalo, NY, USA, 2019; pp. 1–48. [Google Scholar]

- Association of Chartered Certified Accountants. Future Ready: Accountancy Careers in the 2020s; Association of Chartered Certified Accountants: London, UK, 2020; pp. 1–72. [Google Scholar]

- Demirkan, S.; Demirkan, I.; McKee, A. Blockchain technology in the future of business cyber security and accounting. J. Manag. Anal. 2020, 7, 189–208. [Google Scholar] [CrossRef]

- Yoon, S. A Study on the Transformation of Accounting Based on New Technologies: Evidence from Korea. Sustainability 2020, 12, 8669. [Google Scholar] [CrossRef]

- Yùksel, F. Sustainability in Accounting Curriculum of Turkey Higher Education Institutions. Turk. Online J. Qual. Inq. 2020, 11, 393M16. [Google Scholar] [CrossRef]

- Berikol, B.Z.; Killi, M. The Effects of Digital Transformation Process on Accounting Profession and Accounting Education. In Ethics and Sustainability in Accounting and Finance; Çaliyurt, K.T., Ed.; Springer: Singapore, 2021; Volume II, pp. 219–231. [Google Scholar] [CrossRef]

- Stoica, O.C.; Ionescu-Feleagă, L. Digitalization in Accounting: A Structured Literature Review. In Proceedings of the 4th Inter-national Conference on Economics and Social Sciences: Resilience and Economic Intelligence through Digitalization and Big Data Analytics, Sciendo, Bucharest, Romania, 10–11 June 2021; pp. 453–464. [Google Scholar] [CrossRef]

- Howieson, B. Accounting practice in the new millennium: Is accounting education ready to meet the challenge? Br. Account. Rev. 2003, 35, 69–103. [Google Scholar] [CrossRef]

- Pan, G.; Seow, P.-S. Preparing accounting graduates for digital revolution: A critical review of information technology competencies and skills development. J. Educ. Bus. 2016, 91, 166–175. [Google Scholar] [CrossRef]

- Schmidt, P.J.; Riley, J.; Church, K.S. Investigating Accountants’ Resistance to Move beyond Excel and Adopt New Data Analytics Technology. Account. Horiz. 2020, 34, 165–180. [Google Scholar] [CrossRef]

- Fullana, O.; Ruiz, J. Accounting Information Systems in the Blockchain Era. 2020. Available online: https://ssrn.com/abstract=3517142 (accessed on 17 April 2022).

- Kokina, J.; Mancha, R.; Pachamanova, D. Blockchain: Emergent Industry Adoption and Implications for Accounting. J. Emerg. Technol. Account. 2017, 14, 91–100. [Google Scholar] [CrossRef]

- Yu, T.; Lin, Z.; Tang, Q. Blockchain: The Introduction and Its Application in Financial Accounting. J. Corp. Account. Financ. 2018, 29, 37–47. [Google Scholar] [CrossRef]

- Karajovic, M.; Kim, H.M.; Laskowski, M. Thinking Outside the Block: Projected Phases of Blockchain Integration in the Accounting Industry. Aust. Account. Rev. 2019, 29, 319–330. [Google Scholar] [CrossRef]

- Fuller, S.H.; Markelevich, A. Should accountants care about blockchain? J. Corp. Account. Financ. 2020, 31, 34–46. [Google Scholar] [CrossRef]

- Al-Htaybat, K.; Von Alberti-Alhtaybat, L. Big Data, and corporate reporting: Impacts and paradoxes. Account. Audit. Account. J. 2017, 30, 850–873. [Google Scholar] [CrossRef]

- Kokina, J.; Davenport, T.H. The Emergence of Artificial Intelligence: How Automation is Changing Auditing. J. Emerg. Technol. Account. 2017, 14, 115–122. [Google Scholar] [CrossRef]

- Marshall, T.E.; Lambert, S.L. Cloud-Based Intelligent Accounting Applications: Accounting Task Automation Using IBM Watson Cognitive Computing. J. Emerg. Technol. Account. 2018, 15, 199–215. [Google Scholar] [CrossRef]

- Lombardi, R.; Secundo, G. The digital transformation of corporate reporting—A systematic literature review and avenues for future research. Med. Account. Res. 2020, 29, 1179–1208. [Google Scholar] [CrossRef]

- Lamboglia, R.; Lavorato, D.; Scornavacca, E.; Za, S. Exploring the relationship between audit and technology. A bibliometric analysis. Med. Account. Res. 2020, 29, 1233–1260. [Google Scholar] [CrossRef]

- Wolf, T.; Kuttner, M.; Feldbauer-Durstmüller, B.; Mitter, C. What we know about management accountants’ changing identities and roles—A systematic literature review. J. Account. Organ. Chang. 2020, 16, 311–347. [Google Scholar] [CrossRef]

- Abad-Segura, E.; González-Zamar, M.-D. Research Analysis on Emerging Technologies in Corporate Accounting. Mathematics 2020, 8, 1589. [Google Scholar] [CrossRef]

- Burns, M.B.; Igou, A. “Alexa, Write an Audit Opinion”: Adopting Intelligent Virtual Assistants in Accounting Workplaces. J. Emerg. Technol. Account. 2019, 16, 81–92. [Google Scholar] [CrossRef]

- Zhang, C. Intelligent Process Automation in Audit. J. Emerg. Technol. Account. 2019, 16, 69–88. [Google Scholar] [CrossRef]

- Huang, F.; Vasarhelyi, M.A. Applying robotic process automation (RPA) in auditing: A framework. Int. J. Account. Inf. Syst. 2019, 35, 100433. [Google Scholar] [CrossRef]

- Permatasari, C.L.; Prajanti, S.D.W. Acceptance of Financial Accounting Information System at Schools: Technology Acceptance Model. J. Econ. Educ. 2018, 7, 109–120. [Google Scholar]

- Binberg, G.J.; Shields, J.F. Three Decades of Behavioral Accounting Research: A Search for Order. Behav. Res. Account. 1989, 1, 23–74. [Google Scholar] [CrossRef]

- Davis, F.D. A Technology Acceptance Model for Empirically Testing New End-User Information Systems: Theory and Results. Diss. Massachusetts Institute of Technology. Available online: https://dspace.mit.edu/bitstream/handle/1721.1/15192/14927137-MIT.pdf?sequence=2&isAllowed=y (accessed on 9 May 2022).

- Davis, F.D.; Bagozzi, R.P.; Warshaw, P.R. User Acceptance of Computer Technology: A Comparison of Two Theoretical Models. Manag. Sci. 1989, 35, 982–1003. [Google Scholar] [CrossRef] [Green Version]

- Venkatesh, V.; Davis, F.D. A Theoretical Extension of the Technology Acceptance Model: Four Longitudinal Field Studies. Manag. Sci. 2000, 46, 186–204. [Google Scholar] [CrossRef] [Green Version]

- Venkatesh, V.; Bala, H. Technology Acceptance Model 3 and a Research Agenda on Interventions. Decis. Sci. 2008, 39, 273–315. [Google Scholar] [CrossRef] [Green Version]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.A. Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 2nd ed.; Sage: Thousand Oaks, CA, USA, 2017. [Google Scholar]

- Liu, M.; Wu, K.; Xu, J.J. How Will Blockchain Technology Impact Auditing and Accounting: Permissionless versus Permissioned Blockchain. Curr. Issues Audit. 2019, 13, A19–A29. [Google Scholar] [CrossRef] [Green Version]

- Feung, J.L.C.; Thiruchelvam, I.V. A framework model for continuous auditing in financial statement audits using big data analytics. Int. J. Sci. Technol. Res. 2020, 9, 3416–3434. [Google Scholar]

- Marr, B. Data Strategy: How to Profit from a World of Big Data, Analytics and the Internet of Things; Kogan Page: London, UK, 2017. [Google Scholar]

- Agrawal, A.; Gans, J.; Goldfarb, A. Prediction Machines: The Simple Economics of Artificial Intelligence; Harvard Business Review Press: Brighton, MA, USA, 2018; ISBN 978-1-633695672. [Google Scholar]

- Davenport, T.; Guszcza, J.; Smith, T.; Stiller, B. Analytics and AI-Driven Enterprises Thrive in the Age of with- the Culture Catalyst. 2019. Available online: https://www2.deloitte.com/content/dam/Deloitte/ec/Documents/technology-media-telecommunications/DI_Becoming-an-Insight-Driven-organization(2).pdf (accessed on 9 May 2022).

- D’Angelo, G.; Palmieri, F. Knowledge elicitation based on genetic programming for non destructive testing of critical aerospace systems. Future Gener. Comput. Syst. 2020, 102, 633–642. [Google Scholar] [CrossRef]

- D’Angelo, G.; Palmieri, F. Network traffic classification using deep convolutional recurrent autoencoder neural networks for spatial-temporal features extraction. J. Netw. Comput. Appl. 2021, 173, 102890. [Google Scholar] [CrossRef]

| Variables | Items | Scales |

|---|---|---|

| Demographic variables | Gender | Male (1), Female (2) |

| Age | 18–30 years (1), 31–45 years (2), 46–65 years (3) | |

| PU | Innovativeness | 1 to 5 (1—non-important, 5—most important) |

| Convenience | ||

| Cost | ||

| Informativeness | ||

| PEU | Customization | |

| Flexibility | ||

| Rapidity | ||

| Enjoyment | ||

| Behavioral intention | Attitude toward using | 1 to 5 (1—very poor, 5—very good) |

| Intention to use | 1 to 5 (1—very small, 5—very tall) | |

| Actual use | Extent of use | 1 to 5 (1—minimal, 5—maximal extent) |

| Users’ satisfaction | Stated satisfaction | On a scale of 1 to 5 (1—very small, 5—very tall) |

| Min | Max | Mean | Std. Deviation | Skewness | Kurtosis | |

|---|---|---|---|---|---|---|

| Gender | 1 | 2 | 1.46 | 0.499 | 0.142 | −1.990 |

| Age | 1 | 3 | 2.04 | 0.752 | −0.066 | −1.225 |

| Innovativeness | 1 | 5 | 3.70 | 0.881 | −0.094 | −0.564 |

| Convenience | 2 | 5 | 3.95 | 0.850 | −0.461 | −0.428 |

| Cost | 1 | 5 | 3.99 | 0.863 | −0.608 | −0.003 |

| Informativeness | 2 | 5 | 3.87 | 0.838 | −0.372 | −0.423 |

| Customization | 1 | 5 | 3.81 | 0.941 | −0.526 | −0.388 |

| Flexibility | 2 | 5 | 4.03 | 0.957 | −0.608 | −0.676 |

| Rapidity | 2 | 5 | 3.82 | 0.993 | −0.388 | −0.912 |

| Enjoyment | 2 | 5 | 3.72 | 0.975 | −0.145 | −1.033 |

| Attitude toward using | 1 | 5 | 3.55 | 0.968 | −0.095 | −0.815 |

| Intention to use | 1 | 5 | 3.82 | 0.881 | −0.484 | −0.179 |

| Extent of use | 1 | 5 | 3.27 | 1.325 | −0.187 | −1.119 |

| Stated satisfaction | 1 | 5 | 3.86 | 0.949 | −0.428 | −0.594 |

| Cronbach’s Alpha | Composite Reliability | AVE | |

|---|---|---|---|

| Actual use | 1.000 | 1.000 | 1.000 |

| Behavioral intention | 0.797 | 0.907 | 0.830 |

| Easy to use | 0.872 | 0.912 | 0.723 |

| Usefulness | 0.821 | 0.882 | 0.651 |

| Users’ satisfaction | 1.000 | 1.000 | 1.000 |

| Actual Use | Behavioral Intention | Easy to Use | Usefulness | Users Satisfaction | |

|---|---|---|---|---|---|

| Actual use | 1.000 | ||||

| Behavioral intention | 0.872 | 0.911 | |||

| Easy to use | 0.880 | 0.852 | 0.850 | ||

| Usefulness | 0.779 | 0.758 | 0.656 | 0.807 | |

| Users’ satisfaction | 0.887 | 0.846 | 0.841 | 0.742 | 1.000 |

| Original Sample | T Statistics | p Values | F Square | |

|---|---|---|---|---|

| Behavioral intention -> Actual use (H3) | 0.428 | 11.230 | 0.000 | 0.325 |

| Easy to use -> Behavioral intention (H1) | 0.452 | 11.645 | 0.000 | 0.317 |

| Usefulness -> Behavioral intention (H1) | 0.257 | 8.182 | 0.000 | 0.157 |

| Users’ satisfaction -> Actual use (H4) | 0.525 | 13.822 | 0.000 | 0.489 |

| Users’ satisfaction -> Behavioral intention (H4) | 0.275 | 6.454 | 0.000 | 0.193 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vărzaru, A.A. Assessing Artificial Intelligence Technology Acceptance in Managerial Accounting. Electronics 2022, 11, 2256. https://doi.org/10.3390/electronics11142256

Vărzaru AA. Assessing Artificial Intelligence Technology Acceptance in Managerial Accounting. Electronics. 2022; 11(14):2256. https://doi.org/10.3390/electronics11142256

Chicago/Turabian StyleVărzaru, Anca Antoaneta. 2022. "Assessing Artificial Intelligence Technology Acceptance in Managerial Accounting" Electronics 11, no. 14: 2256. https://doi.org/10.3390/electronics11142256

APA StyleVărzaru, A. A. (2022). Assessing Artificial Intelligence Technology Acceptance in Managerial Accounting. Electronics, 11(14), 2256. https://doi.org/10.3390/electronics11142256