Fine-Grained Classification of Announcement News Events in the Chinese Stock Market

Abstract

:1. Introduction

2. Related Research

3. Proposed Method

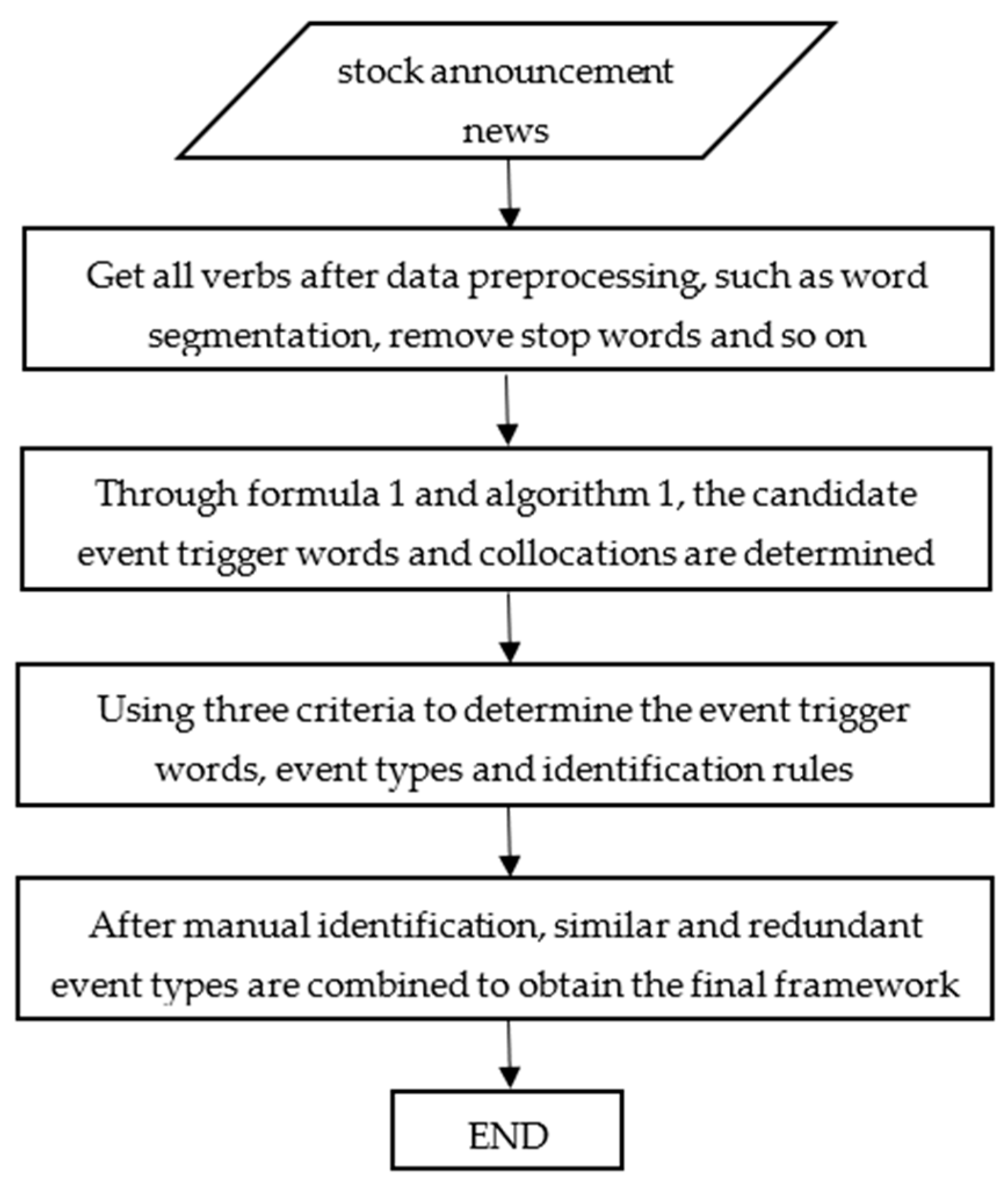

3.1. Extracting Event Trigger Words

| Algorithm 1: Extract Candidate Trigger Words and Collocations from Announcement News |

|

3.2. Three Classification Criteria

“Drug consistency evaluation” is a drug quality requirement in the 12th Five Year Plan for national drug safety, that is, the state requires that the imitated drugs should be consistent with the quality and efficacy of the original drugs. Specifically, it is required that the impurity spectrum is consistent, the stability is consistent, and the dissolution law in vivo and in vitro is consistent.

3.3. Event Types of Chinese Stock Announcement News

4. Experimental Verification

4.1. Data Description

4.2. Evaluation Results

- The average p value of “signing” is 0.796, which is far lower than the average since one of the legal professional evaluators believes that there is a semantic difference between the word “签署” and the word “签订”, although the two meanings are very similar.

- The average p value of the “profit” event is 0.743, which is much lower than the average since the specific information about the “profit” event is described in detail in the sample text. Announcements that do not describe the specific information of profit in detail shifted the focus of the evaluators.

- The average p value of “impairment” is 0.752, which is much lower than the average value. The reason is that the sample text describes the event of “asset impairment”. The evaluators exclude the remaining “goodwill impairment” and “accrued (excluding asset) impairment” from the type, so the p value is low.

- The average p value of “planning” is 0.759, which is much lower than the average since the example text contains the word “major event” in addition to the planning trigger word. The evaluators believe that “major events” play an important role in representing the planned events, so they marked the evaluation text without “major events” as different.

4.3. Comparison to Existing Results

5. Filtering of Event Types

5.1. Return Calculation Method

5.2. Investment Results

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Yi, Z. Research on Deep Learning Based Event-Driven Stock Prediction. Ph.D. Thesis, Harbin Institute of Technology, Harbin, China, 2019. [Google Scholar]

- Yang, H.; Chen, Y.; Liu, K.; Xiao, Y.; Zhao, J. DCFEE: A document-level Chinese financial event extraction system based on automatically labeled training data. In Proceedings of the ACL 2018, System Demonstrations, Melbourne, Australia, 15–20 July 2018; pp. 50–55. [Google Scholar]

- Linghao, W.U. Empirical Analysis of the Impact of Stock Events on Abnormal Volatility of Stock Prices. Master’s Thesis, Huazhong University of Science and Technology, Wuhan, China, 2019. [Google Scholar]

- Balali, A.; Asadpour, M.; Jafari, S.H. COfEE: A Comprehensive Ontology for Event Extraction from text. arXiv 2021, arXiv:2107.10326. [Google Scholar] [CrossRef]

- Guda, V.; Sanampudi, S.K. Rules based event extraction from natural language text. In Proceedings of the 2016 IEEE International Conference on Recent Trends in Electronics, Information & Communication Technology (RTEICT), Bangalore, India, 20–21 May 2016; pp. 9–13. [Google Scholar]

- Ritter, A.; Etzioni, O.; Clark, S. Open domain event extraction from twitter. In Proceedings of the 18th ACM SIGKDD International Conference on Knowledge Discovery and Data Mining, Beijing, China, 12–16 August 2012; pp. 1104–1112. [Google Scholar]

- Fung GP, C.; Yu, J.X.; Lam, W. Stock prediction: Integrating text mining approach using real-time news. In Proceedings of the 2003 IEEE International Conference on Computational Intelligence for Financial Engineering, Hong Kong, China, 20–23 March 2003; pp. 395–402. [Google Scholar]

- Wong, K.F.; Xia, Y.; Xu, R.; Wu, M.; Li, W. Pattern-based opinion mining for stock market trend prediction. Int. J. Comput. Processing Lang. 2008, 21, 347–361. [Google Scholar] [CrossRef]

- Du, M.; Pivovarova, L.; Yangarber, R. PULS: Natural language processing for business intelligence. In Proceedings of the 2016 Workshop on Human Language Technology, New York, NY, USA, 9–15 July 2016; pp. 1–8. [Google Scholar]

- Chen, C.; Ng, V. Joint modeling for Chinese event extraction with rich linguistic features. In Proceedings of the COLING 2012, Mumbai, India, 8–15 December 2012; pp. 529–544. [Google Scholar]

- Liu, L. Heterogeneous Information Based Financial Event Detection. Ph.D. Thesis, Harbin Institute of Technology, Harbin, China, 2010. [Google Scholar]

- Feldman, R.; Rosenfeld, B.; Bar-Haim, R.; Fresko, M. The stock sonar—sentiment analysis of stocks based on a hybrid approach. In Proceedings of the AAAI Conference on Artificial Intelligence, San Francisco, CA, USA, 7–11 August 2011; pp. 1642–1647. [Google Scholar]

- He, Y. Research on Ontology-Based Case Base Building and Reasoning for Theme Events in the Stock Markets. Master’s Thesis, Hefei University of Technology, Hefei, China, 2017. [Google Scholar]

- Wang, Y. Research on Financial Events Detection by Incorporating Text and Time-Series Data. Master’s Thesis, Harbin Institute of Technology, Harbin, China, 2015. [Google Scholar]

- Chen, H. Research and Application of Event Extraction Technology in Financial Field. Ph.D. Thesis, Beijing Institute of Technology, Beijing, China, 2017. [Google Scholar]

- Han, S.; Hao, X.; Huang, H. An event-extraction approach for business analysis from online Chinese news. Electron. Commer. Res. Appl. 2018, 28, 244–260. [Google Scholar] [CrossRef]

- Boudoukh, J.; Feldman, R.; Kogan, S.; Richardson, M. Information, trading, and volatility: Evidence from firm-specific news. Rev. Financ. Stud. 2019, 32, 992–1033. [Google Scholar] [CrossRef]

- Arendarenko, E.; Kakkonen, T. Ontology-based information and event extraction for business intelligence. In Proceedings of the 2012 International Conference on Artificial Intelligence: Methodology, Systems, and Applications, Varna, Bulgaria, 13–15 September 2012; pp. 89–102. [Google Scholar]

- Zhang, W. Research on key technologies of event-driven stock market prediction. Ph.D. Thesis, Harbin Institute of Technology, Harbin, China, 2018. [Google Scholar]

- Turchi, M.; Zavarella, V.; Tanev, H. Pattern learning for event extraction using monolingual statistical machine translation. In Proceedings of the International Conference Recent Advances in Natural Language Processing 2011, Hissar, Bulgaria, 10–16 September 2011; pp. 371–377. [Google Scholar]

- Zhou, X. Research on Financial Event Extraction Technology Based on Deep Learning. Ph.D. Thesis, University of Electronic Science and Technology of China, Chengdu, China, 2020. [Google Scholar]

- Wang, Y.; Luo, S.; Hu, Z.; Han, M. A Study of event elements extraction on Chinese bond news texts. In Proceedings of the 2018 IEEE International Conference on Progress in Informatics and Computing (PIC), Suzhou, China, 14–16 December 2018; pp. 420–424. [Google Scholar]

- Ding, P.; Zhuoqian, L.; Yuan, D. Textual information extraction model of financial reports. In Proceedings of the 2019 7th International Conference on Information Technology: IoT and Smart City, Shanghai, China, 20–23 December 2019; pp. 404–408. [Google Scholar]

- Wang, A. Study on the Impact of Change on Interest Rate on Real Estate Listed Companies Stock Price. Master’s thesis, Southwestern University of Finance and Economics, Chengdu, China, 2012. [Google Scholar]

- Jinmei Zhao Yu Shen Fengyun, W.U. Natural disasters, man-made disasters and stock prices: A study based on earthquakes and mass riots. J. Manag. Sci. China 2014, 17, 19–33. [Google Scholar]

- Yi, Z.; Lu, H.; Pan, B. The impact of Sino US trade war on China’s stock market—An analysis based on event study method. J. Manag. 2020, 33, 18–28. [Google Scholar]

- Li, T.; Qian, Z.; Deng, W.; Zhang, D.; Lu, H.; Wang, S. Forecasting crude oil prices based on variational mode decomposition and random sparse Bayesian learning. Appl. Soft Comput. 2021, 113, 108032. [Google Scholar] [CrossRef]

- Brandt, M.; Gao, L. Macro fundamentals or geopolitical events? A textual analysis of news events for crude oil. J. Empir. Financ. 2019, 51, 64–94. [Google Scholar] [CrossRef]

- Li, T.; Shi, J.; Deng, W.; Hu, Z. Pyramid particle swarm optimization with novel strategies of competition and cooperation. Appl. Soft Comput. 2022, 121, 108731. [Google Scholar] [CrossRef]

- Deng, W.; Shang, S.; Cai, X.; Zhao, H.; Zhou, Y.; Chen, H.; Deng, W. Quantum differential evolution with cooperative coevolution framework and hybrid mutation strategy for large scale optimization. Knowl.-Based Syst. 2021, 224, 107080. [Google Scholar] [CrossRef]

| Event Type: | “投产/Put into Production” |

|---|---|

| Event trigger word: | 投产/Put into production |

| Words matching list extracted by the algorithm | 期/Phase (0.33)-项目/Project (0.75)-建成/completed (0.23)-投产/put into operation |

| Event identification template: | […]投产/Put into production […] |

| Event example: | (SZ000952): The VB2 production line of the industrial park will be officially put into production, and the performance is expected to achieve restorative growth. |

| ID | Event Type | p | R | F |

|---|---|---|---|---|

| 1 | “垃圾焚烧”事件/garbage burn | 0.977 | 0.95 | 0.963 |

| 2 | “增资扩股”事件/Capital increase and share expansion | 0.903 | 0.920 | 0.912 |

| 3 | “业绩预告”事件/Performance forecast | 0.910 | 0.947 | 0.928 |

| 4 | “责令改正”事件/Order to correct | 0.936 | 1.000 | 0.967 |

| 5 | “权益分派”事件/Equity distribution | 1.000 | 0.952 | 0.975 |

| 6 | “股票解禁”事件/lifting the ban on stocks | 0.901 | 1.000 | 0.948 |

| 7 | “到期失效”事件/Expiration | 1.000 | 0.988 | 0.994 |

| 8 | “不确定性”事件/Uncertain | 0.957 | 0.989 | 0.972 |

| 9 | “届满”事件/Expiration | 0.879 | 0.944 | 0.911 |

| 10 | “可转换债券”事件/Convertible bond | 0.925 | 0.966 | 0.945 |

| 11 | “补助”事件/Subsidy | 0.935 | 0.974 | 0.955 |

| 12 | “犯罪”事件/Crime | 0.917 | 0.927 | 0.922 |

| 13 | “辞职”事件/Resignation | 0.962 | 0.989 | 0.975 |

| 14 | “一致性评价”事件/Consistency evaluation | 0.871 | 1.000 | 0.931 |

| 15 | “侦查”事件/Investigation incident | 1.000 | 0.933 | 0.966 |

| 16 | “违纪”事件/Violation of discipline | 0.897 | 0.977 | 0.935 |

| 17 | “行政处罚”事件/Administrative punishment | 0.946 | 0.891 | 0.918 |

| 18 | “拨付款”事件/Payment allocation | 0.879 | 1.000 | 0.935 |

| 19 | “投产”事件/Put into production | 0.871 | 0.989 | 0.926 |

| 20 | “拘留”事件/Detention | 1.000 | 1.000 | 1.000 |

| 21 | “盈利”事件/Profit | 0.743 | 0.909 | 0.818 |

| 22 | “预增”事件/Pre increase | 0.978 | 0.940 | 0.959 |

| 23 | “改制”事件/Restructuring | 1.000 | 1.000 | 1.000 |

| 24 | “减值”事件/Devaluation | 0.752 | 0.989 | 0.854 |

| 25 | “减持”事件/Reduction | 0.968 | 0.968 | 0.968 |

| 26 | “建成”事件/Completion | 0.853 | 1.000 | 0.921 |

| 27 | “清仓”事件/Clearance | 0.849 | 0.939 | 0.892 |

| 28 | “吞吐量”事件/Throughput | 1.000 | 1.000 | 1.000 |

| 29 | “预中标”事件/Pre bid winning | 1.000 | 1.000 | 1.000 |

| 30 | “转增股”事件/Conversion to share capital | 0.827 | 0.990 | 0.901 |

| 31 | “中标”事件/Winning the bid | 1.000 | 1.000 | 1.000 |

| 32 | “吸收合并”事件/Absorb merge | 0.957 | 0.937 | 0.947 |

| 33 | “扩建”事件/Expansion | 0.882 | 0.978 | 0.927 |

| 34 | “诉讼”事件/Litigation | 0.957 | 1.000 | 0.978 |

| 35 | “发起设立”事件/Initiate establishment | 0.875 | 0.893 | 0.884 |

| 36 | “投建”事件/Investment and construction | 0.978 | 0.989 | 0.984 |

| 37 | “罢免”事件/Recall | 0.967 | 1.000 | 0.983 |

| 38 | “药品临床”事件/Drug clinical | 0.817 | 1.000 | 0.899 |

| 39 | “筹划”事件/Planning | 0.759 | 0.908 | 0.827 |

| 40 | “并购”事件/Merger and acquisition | 0.925 | 0.976 | 0.950 |

| 41 | “转让”事件/Transfer | 0.829 | 0.823 | 0.826 |

| 42 | “净利”事件/Net profit | 1.000 | 0.979 | 0.989 |

| 43 | “补贴”事件/Subsidy | 0.913 | 1.000 | 0.955 |

| 44 | “收购”事件/Acquisition | 0.968 | 0.958 | 0.963 |

| 45 | “增持”事件/Overweight | 0.989 | 0.924 | 0.956 |

| 46 | “质押”事件/Pledge | 0.989 | 0.969 | 0.979 |

| 47 | “罚款”事件/Fine | 0.975 | 1.000 | 0.988 |

| 48 | “违法”事件/Illegal | 0.914 | 1.000 | 0.955 |

| 49 | “冻结”事件/Freeze | 1.000 | 1.000 | 1.000 |

| 50 | “签署签订”事件/Signing | 0.796 | 1.000 | 0.886 |

| 51 | “回购”事件/Repurchase | 0.978 | 0.989 | 0.984 |

| 52 | “出售”事件/Sale | 1.000 | 0.990 | 0.995 |

| 53 | “设立公司”事件/Establishment of company | 0.925 | 0.943 | 0.934 |

| 54 | “股票激励”事件/Stock incentive | 0.968 | 0.949 | 0.959 |

| Total | 0.927 | 0.969 | 0.946 |

| Source | Method | Event Type Framework |

|---|---|---|

| ACE event typology | full-manual | 1 type: Business 4 subtypes: Start-org, Merge-org, Declare bankruptcy and End-org |

| The Stock Sonar project [12] | semi-manual | 8 types: Legal, Analyst Recommendation, Financial, Stock Price Change, Deals, Mergers and Acquisitions, Partnerships, Product and Employment |

| BEECON [18] | semi-manual | 11 types: Analyst Event, Bankruptcy, Company Basic Information Change, Company Collaboration, Company Growth, Product Event, etc. 41 subtypes: reorganizations and changes in employment, company changing its stock listing, name or accounting procedures, debt financing, etc. |

| He [13] | semi-manual | 3 types: Financial Policy Events, Monetary Policy Events and Market Rule Adjustment multiple subtypes: tax rate adjustment, deposit and loan interest rate adjustment, national debt adjustment, etc. |

| Wang [14] | semi-manual | 2 types: Macro-Events, Individual Stock Event 6 subtypes: policy events, social emergencies, mergers and acquisitions, profitability, personnel changes and refinancing |

| Chen [15] | full-manual | 8 types: Major contracts, Raw Materials, Major Conferences, Company Financial Statements, Major Policies, Mergers and Acquisitions, Personnel Changes and Additional Allotments |

| Han et al. [16] | full-manual | 8 types: Product Transformation, Equity Change, Share Price Movement, Personnel Changes, Financial Status, etc. 16 subtypes: win bidding, shareholding increase, stock suspension, profit, debt, etc. |

| Zhang [19] | full-manual | 12 types: Major Events, Major Risks, Shareholding Changes, Capital Changes, Emergencies, Special Treatment, etc. 30 subtypes: enterprise cooperation, product release, senior management change, reorganization and merger, government support, etc. |

| Boudoukh et al. [17] | full-manual | 18 types: Business Trend, Deal, Employment, Financial, Mergers and Acquisitions, Earnings Factors, Ratings, Legal, Product, Investment, etc. |

| Wu [20] | semi-manual | 13 types: Issuance, Dividend, Event Prompt, Pledge, Performance Notice, Suspension and Resumption of Trading, Fund-Raising, etc. |

| Zhou [21] | full-manual | 4 types: Share Change, Debt, Market Transaction, Enterprise Change 34 subtypes: senior management change, performance change, product release, related party transactions, equity auction, debt overdue, etc. |

| Event Type | Selling Time t | Purchase Price: Opening Price | Purchase Price: Highest Price | Purchase Price: Closing Price | Sample Sizes | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Probability of Positive Return | Average Return | Variance | Probability of Positive Return | Average Return | Variance | Probability of Positive Return | Average Return | Variance | |||

| Capital increase and share expansion | 2 | 69.4% | 3.3% | 0.4% | 42.2% | 0.3% | 0.3% | 78.2% | 2.6% | 0.2% | 147 |

| 3 | 61.2% | 3.2% | 1.1% | 42.2% | 0.2% | 0.9% | 63.3% | 2.5% | 0.7% | 147 | |

| The experimental results show that the best investment scheme for such events is to buy at the closing price and sell on the second day. It has a probability of 78.2% and can obtain a positive return with an average of 2.6%. | |||||||||||

| Expiration | 2 | 77.1% | 3.1% | 0.1% | 62.9% | 0.7% | 0.1% | 91.4% | 2.5% | 0.1% | 35 |

| 3 | 91.4% | 3.4% | 0.1% | 77.1% | 1.0% | 0.1% | 91.4% | 2.8% | 0.1% | 35 | |

| The experimental results show that the best investment scheme for such events is to buy at the opening price and sell on the third day, with a probability of 91.4% and a positive return with an average of 3.4%; the second best investment scheme is to buy at the closing price and sell on the third day, with a probability of 91.4% and a positive return with an average of 2.8% or to sell on the second day with a probability of 91.4% and a positive return with an average of 2.5%. | |||||||||||

| Restructuring | 2 | 71.6% | 1.0% | 0.3% | 33.8% | −1.4% | 0.2% | 79.7% | 0.8% | 0.1% | 74 |

| 3 | 58.1% | −0.1% | 0.6% | 35.1% | −2.5% | 0.4% | 51.4% | −0.4% | 0.3% | 74 | |

| It can be seen from the experimental results that the positive average return of this kind of event sample is low. Therefore, such events have no investment value. | |||||||||||

| Throughput | 2 | 68.8% | 1.5% | 0.1% | 42.5% | 0.1% | 0.1% | 83.8% | 1.4% | 0.0% | 80 |

| 3 | 60.0% | 1.5% | 0.2% | 42.5% | 0.2% | 0.2% | 70.0% | 1.4% | 0.1% | 80 | |

| The experimental results show that the best investment scheme for such events is to buy at the closing price and sell on the second day, with a probability of 83.8% and a positive return with an average of 1.4%. | |||||||||||

| Conversion to share capital | 2 | 64.4% | 2.3% | 0.5% | 42.5% | 0.1% | 0.4% | 78.3% | 2.9% | 0.3% | 811 |

| 3 | 59.4% | 2.5% | 1.0% | 45.4% | 0.3% | 1.0% | 67.2% | 3.0% | 0.8% | 811 | |

| The experimental results show that the best investment scheme for such events is to buy at the closing price and sell on the second day. It has a probability of 78.3% and can obtain a positive return with an average of 2.9%. | |||||||||||

| Winning the bid | 2 | 66.7% | 1.5% | 0.2% | 36.3% | −0.5% | 0.1% | 79.6% | 1.5% | 0.1% | 1990 |

| 3 | 59.6% | 1.3% | 0.4% | 37.3% | −0.7% | 0.3% | 64.2% | 1.3% | 0.3% | 1990 | |

| The experimental results show that the best investment scheme for such events is to buy at the closing price and sell on the second day. It has a probability of 79.6% and can obtain a positive return with an average of 1.5%. | |||||||||||

| Subsidy | 2 | 73.8% | 2.3% | 0.2% | 42.1% | 0.2% | 0.1% | 82.2% | 1.9% | 0.1% | 107 |

| 3 | 67.3% | 2.3% | 0.3% | 40.2% | 0.2% | 0.2% | 70.1% | 2.0% | 0.2% | 107 | |

| The experimental results show that the best investment scheme for such events is to buy at the closing price and sell on the second day, with a probability of 82.2% and a positive return with an average of 1.9%. | |||||||||||

| Acquisition | 2 | 64.5% | 2.3% | 0.5% | 42.0% | 0.0% | 0.4% | 73.8% | 2.3% | 0.3% | 3555 |

| 3 | 58.6% | 2.3% | 1.1% | 42.0% | 0.0% | 1.0% | 60.0% | 2.3% | 0.9% | 3555 | |

| The experimental results show that the best investment scheme for such events is to buy at the closing price and sell on the second day, with a probability of 73.8% and a positive return with an average of 2.3%. | |||||||||||

| Overweight | 2 | 72.8% | 3.2% | 0.4% | 43.1% | 0.2% | 0.2% | 81.7% | 2.6% | 0.2% | 3268 |

| 3 | 66.7% | 3.3% | 0.7% | 43.5% | 0.3% | 0.5% | 67.1% | 2.7% | 0.5% | 3268 | |

| The experimental results show that the best investment scheme for such events is to buy at the closing price and sell on the second day, with a probability of 81.7% and a positive return with an average of 2.6%. | |||||||||||

| Illegal | 2 | 65.2% | 1.5% | 0.4% | 35.0% | −1.2% | 0.2% | 70.5% | 0.8% | 0.2% | 397 |

| 3 | 60.5% | 1.5% | 0.8% | 39.3% | −1.2% | 0.5% | 63.2% | 0.8% | 0.5% | 397 | |

| It can be seen from the experimental results that although the probability of obtaining a positive return is 70.5%, the average positive return is small. Therefore, on the whole, such events are not good for investment. | |||||||||||

| Signing | 2 | 65.7% | 2.1% | 0.3% | 39.2% | −0.2% | 0.2% | 77.4% | 2.1% | 0.1% | 1809 |

| 3 | 58.5% | 1.9% | 0.6% | 40.3% | −0.5% | 0.6% | 64.0% | 1.8% | 0.5% | 1809 | |

| The experimental results show that the best investment scheme for such events is to buy at the closing price and sell on the second day, with a probability of 77.4% and a positive return with an average of 2.1%. | |||||||||||

| Stock incentive | 2 | 72.1% | 2.9% | 0.3% | 40.4% | 0.0% | 0.2% | 81.9% | 2.3% | 0.1% | 408 |

| 3 | 66.4% | 2.8% | 0.7% | 42.9% | −0.2% | 0.5% | 67.4% | 2.1% | 0.5% | 408 | |

| The experimental results show that the best investment scheme for such events is to buy at the closing price and sell on the second day, with a probability of 81.9% and a positive return with an average of 2.3% or buy at the opening price and sell on the second day, with a probability of 72.1% and a positive return with an average of 2.9%. | |||||||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Miu, F.; Wang, P.; Xiong, Y.; Jia, H.; Liu, W. Fine-Grained Classification of Announcement News Events in the Chinese Stock Market. Electronics 2022, 11, 2058. https://doi.org/10.3390/electronics11132058

Miu F, Wang P, Xiong Y, Jia H, Liu W. Fine-Grained Classification of Announcement News Events in the Chinese Stock Market. Electronics. 2022; 11(13):2058. https://doi.org/10.3390/electronics11132058

Chicago/Turabian StyleMiu, Feng, Ping Wang, Yuning Xiong, Huading Jia, and Wei Liu. 2022. "Fine-Grained Classification of Announcement News Events in the Chinese Stock Market" Electronics 11, no. 13: 2058. https://doi.org/10.3390/electronics11132058

APA StyleMiu, F., Wang, P., Xiong, Y., Jia, H., & Liu, W. (2022). Fine-Grained Classification of Announcement News Events in the Chinese Stock Market. Electronics, 11(13), 2058. https://doi.org/10.3390/electronics11132058