Financial Data Anomaly Discovery Using Behavioral Change Indicators

Abstract

:1. Introduction

2. Related Work

3. Financial Data Analysis Using Behavioral Change Indicators

- Financial key performance indicators (KPIs) analyze the enterprise’s performance (business process) using raw financial accounting data.

- Behavioral change indicators (BCIs) are useful for analyzing financial accounting indicators, evaluating financial KPIs’ time series characteristics, and conducting research with the aim of anomaly detection.

3.1. Financial Data Behavioral Change Indicators (BCI)

- BCI-R (t, t*)—the change in the KPI rating in financial period t compared to the same KPI rating in financial period t*;

- BCI-AR—the occurrence of an unusual or rare KPI value (global anomaly) in some period (t, t*);

- BCI-ARC—the unusual or rare co-occurrence of two KPI values (local anomaly) in some period (t, t*).

- Absolute change indicators (BCI-A);

- Relative change indicators (ratio indicators BCI-RE); and

- Delta change indicators (D-BCI).

- BCI-A1: the absolute change ∆X(t, t′) in KPI in the financial period t compared to the change in the previous period t′:∆X(t, t′) = X(t) − X(t′)

- BCI-A2: the absolute change ∆XA(t, (t′, t″)) in KPI in the financial period t compared to the moving average of the KPI over the periods (t′, t″):∆XA(t, (t′, t″)) = X(t) − average(X(t′, t″))

- BCI-RO: the robustness coefficient ∆XRO (t, XN) is the difference between the KPI value in period t and the normative (reference) value XN.∆XRO (t, XN) = X(t) − XN

- BCI-RE1: the relative change ∆XRE (t, t′) KPI is the ratio of the difference in the KPI of the financial period t to the value of the KPI of the previous period t′ (as a percentage):∆XRE(t, t′) = 100 × (X(t) − X(t′))/X(t′)

- BCI-RE2: the relative change ∆XREA(t, av(t′, t″)) in KPI in the financial period t is the ratio of the change in the KPI to the KPI’s average value over given periods (t′, t″) (in percentage terms):∆XREA(t, (t′, t″)) = 100 × (X(t) − X(t′))/average(X(t′, t″))

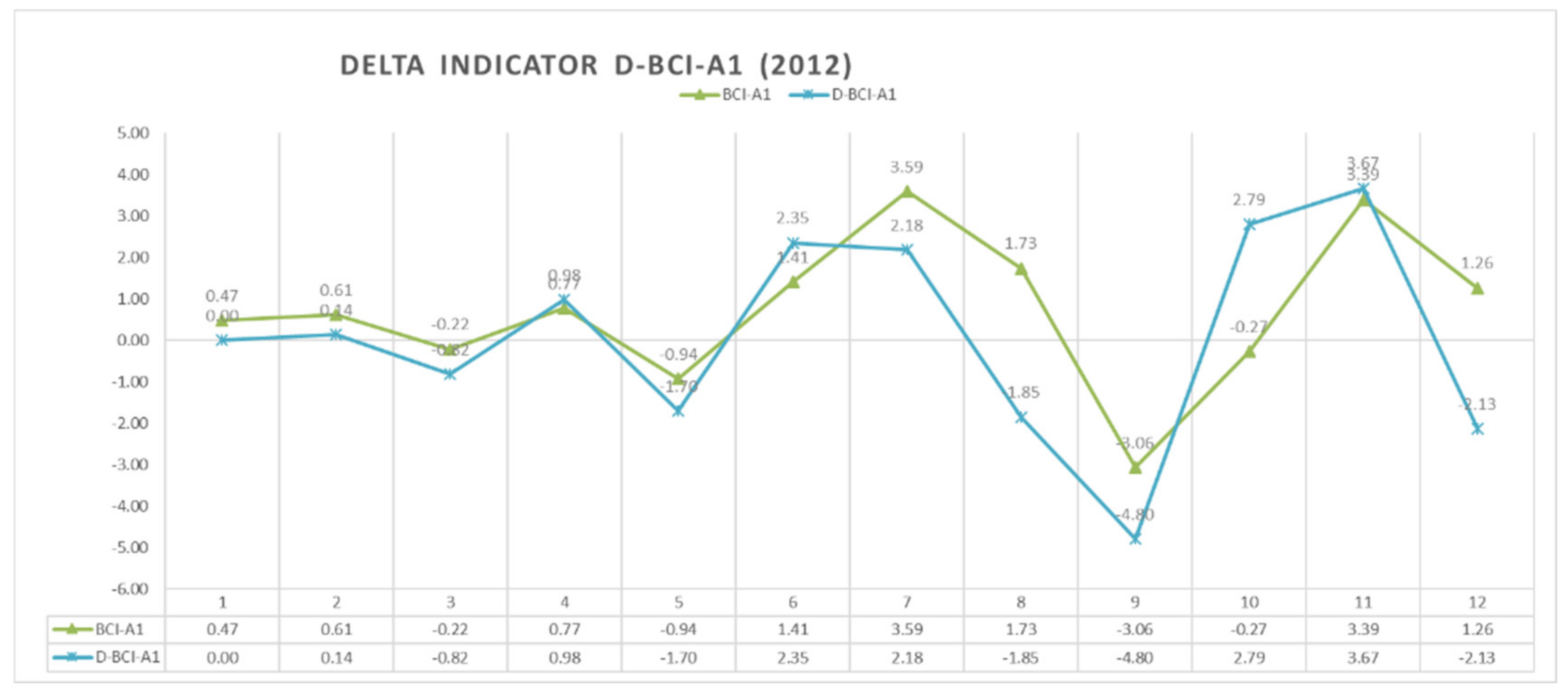

- Delta change D(∆XA(t, t′)) expresses a difference in BCI-A1 value ∆XA(t, t′) in financial period t compared to the BCI-A1 value ∆XA(t′, t″) in the previous period t′:D(∆XA(t, t′)) = ∆XA(t, t′) − ∆XA(t′, t″)

- Delta change D(∆XRE(t, t′)) expresses a difference in BCI-RE value (∆XRE(t, t′) in financial period t compared to the BCI-RE value (∆XRE(t′, t″) in the previous period t′:D(∆XRE(t, t′)) = ∆XRE(t, t′) − ∆XRE(t′, t″)

- D-BCI-RO: delta change D(∆XRO(t, XN)) expresses a difference in the robustness coefficient ∆XRO(t, XN) in period t compared to the robustness coefficient ∆XRO(t′, XN) in period t′:D(∆XREA(t, t′)) = ∆XRO(t, XN) − ∆XRO(t′, XN)

- D-BCI-RE: delta of relative change D(∆XREA(t, t′)) expresses the ratio of the change ∆XRE(t, t′) in BCI-RE during period t compared to the change ∆XRE(t′, t″) in BCI-RE during the previous period t′:D(∆XREA(t, t′)) = ∆XA(t, t′) − ∆XA(t′, t″)

- D-BCI-A1: the delta change D(∆XA(t, t′)) expresses a difference in the absolute change ∆XA(t, t′) in BCI-A1 during financial period t compared to the change ∆XA(t′, t″) in BCI-A1 during the previous period t′:D(∆XA(t, t′)) = ∆XA(t, t′) − ∆XA(t′, t″)

- D-BCI-A2: delta change D(∆XA(t, (t′, t″))) expresses a difference in the absolute change ∆XA(t, (t′, t″)) in BCI-A2 during financial period t compared to the change ∆XA(t, (t′, t″)) in BCI-A2 (moving average) during the previous period t′:where:D(∆XA(t, (t′, t″))) = ∆XA(t, (t′, t″)) − ∆XA(t′, (t″, t*))∆XA(t, (t′, t″)) = X(t) − average(X(t′, t″))∆XA(t′, (t″, t*)) = X(t′) − average(X(t″, t*))

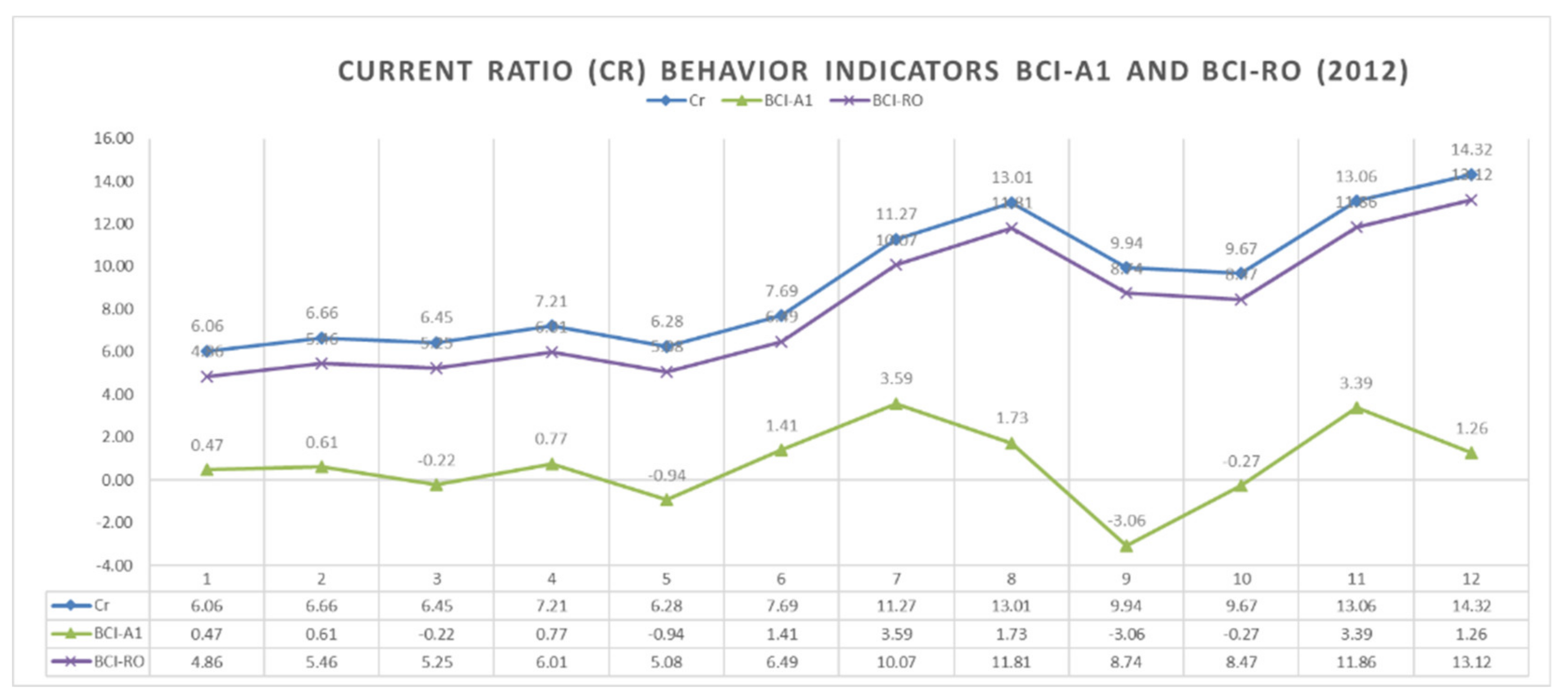

3.2. Example of BCI Calculation and Visualization

- Financial KPI type: liquidity ratios

- KPI = current ratio (Cr)

- Cr = current assets (CA)/current liabilities (CL)

- Current ratio safe zone threshold Cr > 1.2

- Absolute change BCI-A1 shows an absolute KPI change over a certain financial period

- Absolute change ∆X(t, t*) in KPI = Cr in the financial period t compared to the value in the previous period t*:∆X(t, t*) = X(t) − X(t*)

- Robustness coefficient (BCI-RO)

- BCI-RO measures the distance of the KPI = Cr from the reference value (Cr-norm = 1.2)

- BCI-RO = Cr/Cr-norm, where Cr-norm = 1.2

- Relative behavioral change indicator (BCI-RE1)

- BCI-RE1 is the ratio of the change in the KPI = Cr in the financial period t compared to the previous period’s t* value (in percentage terms):∆XRE (t, t*) = 100 × (X(t) − X(t*))/X(t*)

4. Thresholds of KPIs and BCIs

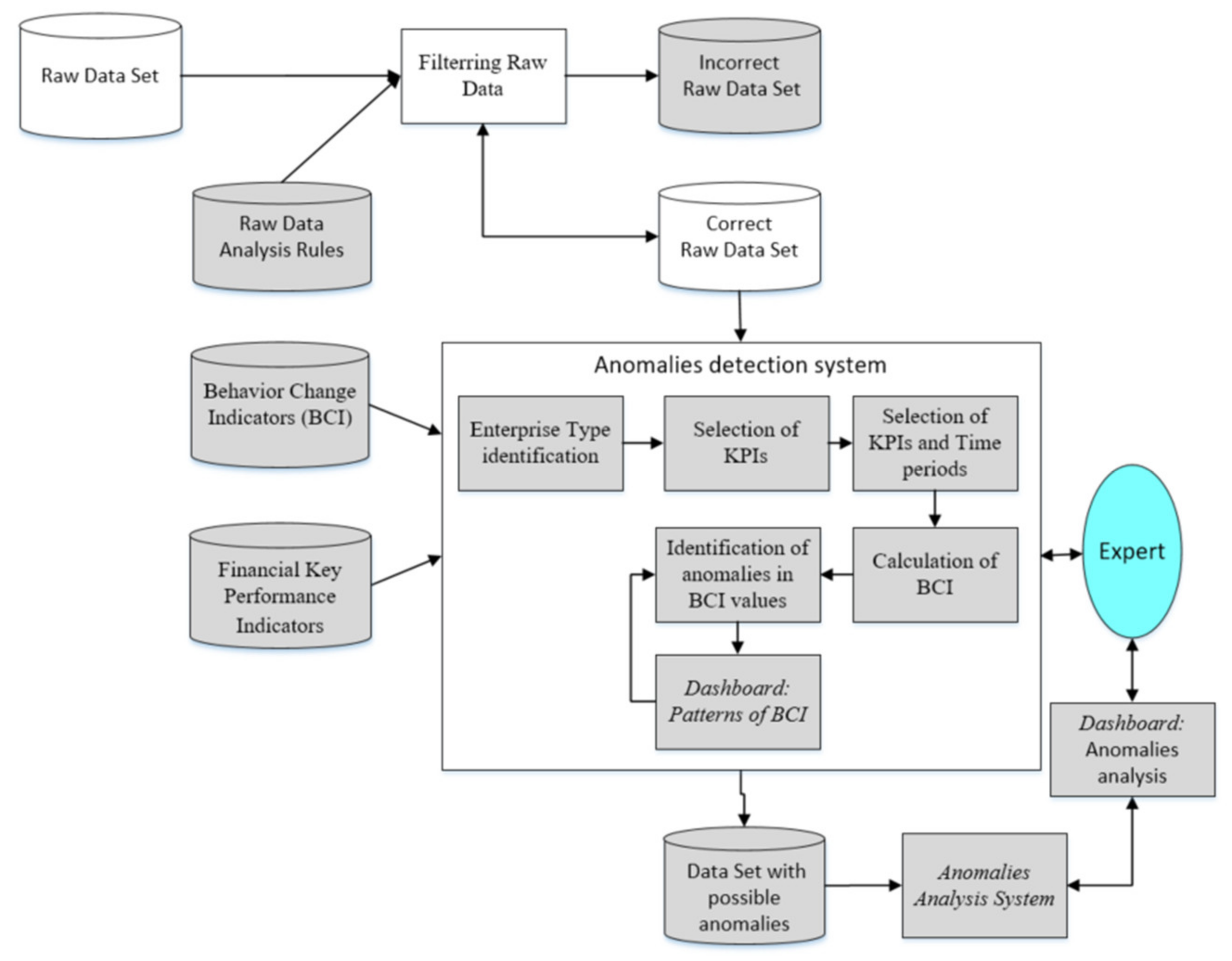

5. Financial Data Set Anomaly Detection

- Discovery of a normalized model (company-specific)

- ◦

- To detect anomalous journal entries, we first must define “normality” in relation to accounting attribute types and indicator types.

- Identification of deviations of attribute values

- ◦

- Anomalies exhibit unusual or rare individual attribute values. Such anomalies usually relate to skewed attributes, e.g., rarely used ledgers, journals, or unique posting times. Traditionally, “red-flag” tests performed by auditors during an annual audit are designed to capture this type of anomaly.

- Unusual or rare combinations of attribute values:

- ◦

- Journal entries that exhibit an unusual or rare combination of attribute values while their attribute values occur fairly frequently: e.g., unique accounting records.

- ▪

- Irregular combinations of general ledger accounts, and

- ▪

- user accounts used by several accounting departments.

- List of actual periods.

- Financial data preprocessing is performed using the Camunda Modeler: filtering out the incorrect raw data set using predefined rules. At this stage, a subject-specific raw data analysis is performed in order to identify the correct data set (incorrect datasets are stored separately).

- The basic steps involved in detecting data with possible anomalies are as follows:

- The user interface allows the auditor to select KPIs and BCIs according to their needs and specific subjects to obtain results as expected and to specify the most important KPIs (there will be about 40 of them).

- The expert chooses the type of company from the list and links it to the specific KPIs. KPI models (coefficients and thresholds) can be modified as needed.

- The expert selects the company (e.g., ID-xxx), the required data set (e.g., DB_9999-99), and the required periods from the list. The system calculates the values of the selected KPIs and the relevant BCIs.

- The Camunda Business Rules engine evaluates the BCI values according to the specified thresholds, compiles the estimates (e.g., green, yellow, red), and provides the results to the storage “data set with possible anomalies”.

- BCI thresholds can be determined and adjusted according to the needs of the analyst using the Camunda Modeler interactive user interface.

- The analyst performs an analysis of the data for possible anomalies through an interactive user interface (a Tableau dashboard).

6. Advantages of Using BCIs in Financial Data Analysis

- BCI-A shows the change in the value of a particular KPI over some time (t) compared to the value of that KPI in another period, such as the previous period (t − 1) or the average or normative value of a KPI.

- BCI-RE shows a relative change in KPI in the financial period t—the ratio to the previous period t* or the average value over previous periods (t′, t″).

- Delta BCI (D-BCI) shows the absolute or relative BCI change compared to a certain defined period.

7. Conclusions

Author Contributions

Funding

Informed Consent Statement

Conflicts of Interest

References

- Bhatti, M.I.; Awan, H.M.; Razaq, Z. The key performance indicators (KPIs) and their impact on overall organizational performance. Qual. Quant. 2013, 48, 3127–3143. [Google Scholar] [CrossRef]

- What Is a Key Performance Indicator (KPI)? Guide & Examples. Available online: https://www.qlik.com/us/kpi (accessed on 15 October 2021).

- Bititci, U.S.; Turner, U.; Begemann, C. Dynamics of performance measurement systems. Int. J. Oper. Prod. Manag. 2000, 20, 692–704. [Google Scholar] [CrossRef]

- Gosselin, M. An empirical study of performance measurement in manufacturing firms. Int. J. Prod. Perform. Manag. 2005, 54, 419–437. [Google Scholar] [CrossRef]

- Durrah, O.; Rahman, A.A.A.; Jamil, S.A.; Ghafeer, N.A. Exploring the relationship between liquidity ratios and indicators of financial performance: An analytical study on industrial food companies listed in Amman Bursa. Int. J. Econ. Financ. Issues 2016, 6, 435–441. [Google Scholar]

- Neely, A.; Gregory, M.; Platts, K. Performance measurement system design: A literature review and research agenda. Int. J. Oper. Prod. Manag. 2005, 25, 1228–1263. [Google Scholar] [CrossRef]

- Parmenter, D. Key Performance Indicators: Developing, Implementing, and Using Winning KPIs; Wiley: Hoboken, NJ, USA, 2009; Available online: https://onlinelibrary.wiley.com/doi/pdf/10.1002/9781119019855.fmatter (accessed on 14 September 2021).

- Striteska, M.; Marketa, S. Review and comparison of performance measurement systems. J. Organ. Manag. Stud. 2012, 2012, 1. [Google Scholar] [CrossRef] [Green Version]

- Heckl, D.; Moormann, J. Process Performance Management. In Handbook on Business Process Management; Springer: Berlin/Heidelberg, Germany, 2010; Volume 2, pp. 115–135. [Google Scholar] [CrossRef]

- Badri, M.A.; Davis, D.; Davis, D. A study of measuring the critical factors of quality management. Int. J. Qual. Reliab. Manag. 1994, 12, 36–53. Available online: https://www.researchgate.net/publication/238495215_A_study_of_measuring_the_critical_factors_of_quality_management (accessed on 12 August 2021). [CrossRef]

- Tangen, S. An overview of frequently used performance measures. Work Study 2003, 52, 347–354. [Google Scholar] [CrossRef] [Green Version]

- Leong, G.K.; Snyder, D.L.; Ward, P.T. Research in the process and content of manufacturing strategy. Omega 1990, 18, 109–122. [Google Scholar] [CrossRef]

- Qamar, A.; Hall, M.A.; Chicksand, D.; Collinson, S. Quality and flexibility performance trade-offs between lean and agile manufacturing firms in the automotive industry. Prod. Plan. Control 2020, 31, 723–738. [Google Scholar] [CrossRef]

- Flin, R.; Mearns, K.; Oconnor, P.; Bryden, R. Measuring safety climate: Identifying the common features. Saf. Sci. 2000, 34, 177–192. [Google Scholar] [CrossRef]

- Mearns, K.; Whitaker, S.M.; Flin, R. Safety climate, safety management practice and safety performance in offshore environments. Saf. Sci. 2003, 41, 641–680. [Google Scholar] [CrossRef]

- Sadler-Smith, E.; Spicer, D.P.; Chaston, I. Learning orientations and growth in smaller organizations. Long Range Plan. 2001, 34, 139–158. [Google Scholar] [CrossRef]

- Kihn, L.-A.; Comparing, P.M. Approaches in Accounting Research. Finn. J. Bus. Econ. 2005, 2, 143–184. [Google Scholar]

- Cai, J.; Liu, X.; Xiao, Z.; Liu, J. Improving supply chain performance management: A systematic approach to analyzing iterative KPI accomplishment. Decis. Support Syst. 2009, 46, 512–521. [Google Scholar] [CrossRef]

- Tomas, K.; Anna, S.; Maria, M. Financial Health Prediction of Company’s Business Partners Based on Selected Quantitative and Qualitative Indicators. J. Econ. Bus. Manag. 2017, 5, 3. [Google Scholar] [CrossRef]

- Schreyer, M.; Timur, S.; Damian, B.; Andreas, R. Dengel and Bernd Reimer. Detection of Anomalies in Large Scale Accounting Data using Deep Autoencoder Networks. arXiv 2017, arXiv:abs/1709.05254. [Google Scholar]

- Punjanit, L.; Dennis, B.; Colleen, M. Good Practice Study on Principles for Indicator Development, Selection, and Use in Climate Change Adaptation Monitoring and Evaluation. June 2015. Available online: https://www.researchgate.net/publication/297234569_Good_Practice_Study_on_Principles_for_Indicator_Development_Selection_and_Use_in_Climate_Change_Adaptation_Monitoring_and_Evaluation (accessed on 25 September 2021).

- McKee, N.; Manoncourt, E.; Yoon, C.S.; Carnegie, R. Behaviour and Beyond: An Evaluation Perspective. In Approaches to Development Communication; Servaes, J., Ed.; UNESCO: Paris, Frence, 2002. [Google Scholar]

- Mulholland, B. Ratio Analysis of Financial KPI in the Higher Education Sector: A Case Study; Paperback: 14 pages; Independently Published: Traverse City, MI, USA, 2021; ISBN 9798774872572. (In English) [Google Scholar]

- Villanueva, P.S. Learning to ADAPT: Monitoring and Evaluation Approaches in Climate Change Adaptation and Disaster Risk Reduction—Challenges, Gaps and Ways Forward; SCR Discussion Paper 9; Institute of Development Studies: Brighton, UK, 2011. [Google Scholar]

- World Bank, Operation Policy Department. Performance Monitoring Indicators: A Handbook for Task Managers. Available online: https://www.measureevaluation.org/resources/training/capacity-building-resources/basic-me-concepts-portuguese/indicators.pdf (accessed on 16 May 2020).

- Francesco, L.A. Guide to Building a Financial Transaction Anomaly Detector. 9 July 2021. Available online: https://unit8.com/resources/a-guide-to-building-a-financial-transaction-anomaly-detector/ (accessed on 25 September 2021).

- Monroe, M.C.; Agrawal, S.; Jakes, P.J.; Kruger, L.E.; Nelson, K.C.; Sturtevant, V. Identifying Indicators of Behavior Change: Insights from Wildfire Education Programs. J. Environ. Educ. 2013, 44, 180–194. [Google Scholar] [CrossRef]

- Ann Elizabeth Flanagan and Jeffery Clark Tanner A Framework for Evaluating Behavior Change in International Development Operations IEG Working Paper 2016/No. 2. Available online: https://ieg.worldbankgroup.org/sites/default/files/Data/reports/behavior-change-wp.pdf (accessed on 12 November 2021).

- Climate Change Indicators Dashboard. IMF Climate Change Dashboard. Financial and Risk Indicators. Available online: https://climatedata.imf.org/pages/fi-indicators (accessed on 12 December 2021).

- Lopata, A.; Butleris, R.; Gudas, S.; Rudžionis, V.; Rudžionienė, K.; Žioba, L.; Veitaitė, I.; Dilijonas, D.; Grišius, E.; Zwitserloot, M. Financial Data Preprocessing Issues. In Proceedings of the 27th International Conference, Information and Software Technologies ICIST 2021, Kaunas, Lithuania, 14–16 October 2021; pp. 60–71. Available online: https://link.springer.com/chapter/10.1007/978-3-030-88304-1_5 (accessed on 21 September 2021).

- Auffarth, B. Machine Learning for Time-Series with Python: Forecast, Predict, and Detect Anomalies with State-of-the-Art Machine Learning Methods; Paperback: 370 pages; Packt Publishing: Birmingham, UK, 2021; ISBN 9781801819626. (In English) [Google Scholar]

| Behavioral Change Indicators (BCI) | Notation | Description |

|---|---|---|

| 1. BCI-A: Absolute change in KPI over a given financial period | BCI-A is the difference in KPI value over some financial accounting period, i.e., financial year, month, etc. | |

| 1.1 BCI-A1: Absolute change in KPI in the financial period t | ∆X (t, t′) | BCI-A1 is the difference between the value of KPI in period t and given previous period t′. |

| 1.2. BCI-A2: Absolute change in KPI in the financial period t compared to the moving average of the KPIs over the financial periods (t′, t″) | ∆XA (t, (t′, t″)) | BCI-A2 is the difference between the KPI value in period t and the moving average of the KPI over the periods (t′, t″) |

| 2. BCI-RO: Robustness coefficient, an indicator of stability | ∆XRO (t, XN) | BCI-RO is the difference between the KPI value in period t and the normative (reference) value XN. |

| 3. Relative behavioral change indicator BCI-RE | ||

| 3.1. BCI-RE1: Relative change in KPI in the financial period t (the ratio to the previous period t*) | ∆XRE (t, t*) | BCI-RE1 is the ratio of the change in the KPI to the previous period’s KPI value (in percentage terms) |

| 3.2. BCI-RE2: Relative change in KPI in financial period t (the ratio to the average value over previous periods (t′, t″) | ∆XREA (t, (t′, t″)) | BCI-RE2 is the ratio of the change in the KPI to the previous periods (t′, t″) KPIs average value (in percentage terms) |

| 4. Delta BCI (D-BCI) shows the absolute or relative BCI change over a defined period. | Definition: Delta BCI means the change in BCI compared to a certain defined period. | |

| 4.1. D-BCI-A shows an absolute change in BCI XA (t, t*) in financial period t compared to the change in BCI-A in the previous period t* | D(∆XA (t, t*)) | A set of D-BCI-A shows a trend of change in BCI-A over some time (over a set of periods) |

| 4.2. D-BCI-RE is the ratio of the change in BCI-RE in period t compared to the change in BCI-RE in previous period t* | A set of D-BCI-RE shows a trend of change in BCI-RE over a given period (in percentage terms) | |

| 4.3. D-BCI-RO shows the change in the robustness coefficient BCI-RO in some periods (t, t*) (trend of BCI-RO change) | A set of D-BCI-RO shows a trend of change in BCI-RO over some time (over a set of periods) |

| Financial Year | Financial Period | Cr | BCI-RE1 | BCI-A1 | BCI-RO | D-BCI-A1 |

|---|---|---|---|---|---|---|

| 2012 | 1 | 6.06 | 0.00 | 0.47 | 4.86 | 0.00 |

| 2012 | 2 | 6.66 | 10.02 | 0.61 | 5.46 | 0.14 |

| 2012 | 3 | 6.45 | −3.23 | −0.22 | 5.25 | −0.82 |

| 2012 | 4 | 7.21 | 11.87 | 0.77 | 6.01 | 0.98 |

| 2012 | 5 | 6.28 | −12.98 | −0.94 | 5.08 | −1.70 |

| 2012 | 6 | 7.69 | 22.48 | 1.41 | 6.49 | 2.35 |

| 2012 | 7 | 11.27 | 46.67 | 3.59 | 10.07 | 2.18 |

| 2012 | 8 | 13.01 | 15.38 | 1.73 | 11.81 | −1.85 |

| 2012 | 9 | 9.94 | −23.55 | −3.06 | 8.74 | −4.80 |

| 2012 | 10 | 9.67 | −2.76 | −0.27 | 8.47 | 2.79 |

| 2012 | 11 | 13.06 | 35.09 | 3.39 | 11.86 | 3.67 |

| 2012 | 12 | 14.32 | 9.64 | 1.26 | 13.12 | −2.13 |

| Financial KPI | Formula | Normative Threshold |

|---|---|---|

| Current ratio (Cr) | Cr = current assets/current liabilities | Cr > 1.0 (1.2) |

| Acid test (Quick) ratio (Ar) | Ar = current assets (inventory)/current liabilities | Ar > 1.0 |

| (Cash ratio) (CA) | CA = cash/current liabilities | 0.1 < CA < 0.2 |

| Working capital to total assets (NWC) | NWC= working capital/total assets | 1.5 < NWC < 2 |

| Debt ratio (Dr) | Dr = debt/total assets | 0.5 < Dr < 0.7 |

| Debt to equity ratio (De) | De = debt/equity | De < 2.0 |

| Bankruptcy indicator Altman Z SCORE (Z) | Z = 0.717(X1) + 0.847(X2) + 3.107(X3) + 0.420(X4) + 0.998(X5) (1) where X1 = working capital/total assets, X2 = retained earnings/total assets, X3 = earnings before interest and taxes/total assets, X4 = book value of equity/book value of total liabilities, X5 = net sales/total assets | Z: (0–1.8)—distress zone; (1.8–3.0)—gray zone; (3.0–4.0)—safe zone. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lopata, A.; Gudas, S.; Butleris, R.; Rudžionis, V.; Žioba, L.; Veitaitė, I.; Dilijonas, D.; Grišius, E.; Zwitserloot, M. Financial Data Anomaly Discovery Using Behavioral Change Indicators. Electronics 2022, 11, 1598. https://doi.org/10.3390/electronics11101598

Lopata A, Gudas S, Butleris R, Rudžionis V, Žioba L, Veitaitė I, Dilijonas D, Grišius E, Zwitserloot M. Financial Data Anomaly Discovery Using Behavioral Change Indicators. Electronics. 2022; 11(10):1598. https://doi.org/10.3390/electronics11101598

Chicago/Turabian StyleLopata, Audrius, Saulius Gudas, Rimantas Butleris, Vytautas Rudžionis, Liutauras Žioba, Ilona Veitaitė, Darius Dilijonas, Evaldas Grišius, and Maarten Zwitserloot. 2022. "Financial Data Anomaly Discovery Using Behavioral Change Indicators" Electronics 11, no. 10: 1598. https://doi.org/10.3390/electronics11101598

APA StyleLopata, A., Gudas, S., Butleris, R., Rudžionis, V., Žioba, L., Veitaitė, I., Dilijonas, D., Grišius, E., & Zwitserloot, M. (2022). Financial Data Anomaly Discovery Using Behavioral Change Indicators. Electronics, 11(10), 1598. https://doi.org/10.3390/electronics11101598