1. Introduction

Continuous improvement of everything is a core principle of the Lean philosophy in manufacturing companies. This guiding principle is the trigger in companies, which drives the digital transformation to ensure long-term success in the so-called factories of the future. Digitalization involves the utilization of different information and communications technology (ICT) enablers, as well as technological paradigms, summarized all together under the Industry 4.0 umbrella. Newcomers and enterprises who what to undergo the digital transformation should have a good overview of the different perspectives, challenges, and taxonomies that next-generation ICT [

1,

2] technologies and Industry 4.0 offers [

3] in order to be able to progress successfully. In this paper, we focus on digitalization of internal supply chain and workflow at GPV metal shop floor as a technological paradigm.

GPV’s mechanics manufacturing site is located in Tarm, Denmark, and produces metal housing products. These products are produced and assembled in-house, consisting of both internally and externally produced electronic components. The GPV Tarm manufacturing site handles bigger parts and produces more significant products than their electronic manufacturing counterparts in the GPV group. The significance of the site lies in the wide range of products being manufactured, in contrast to the electronic sites that produce several similar products with only small alterations. Therefore, it is necessary to trace large manufactured products to harmonize with the vision for the next generation digital manufacturing capabilities of the GPV group. The GPV Tarm site is not heavily automated and many processes, including the movement of the assets being produced, are handled manually. Furthermore, the different manufacturing steps for each product are being registered manually into the ERP system after every completed step. To monitor when different products are due, and when to start the production for a specific product, a routing card is created for each job batch. The cart is functioning as a task/job tracker for the particular product visualizing the included steps in the manufacturing process. The routing cards follow the assets throughout the production line, and the responsible department manager at each involved department ensures to follow the steps stated in the job cart. This provides the correct planning, which is crucial and essential for the concerned department, as well as the overall production. GPV departments are facing challenges between the individual manufacturing processes and the digital visualization of the production stages and Work in Progress (WIP) during the manufacturing cycle. These challenges arise from changes that occur in planning, resulting in batches being stored between processes awaiting to be handled. When batches are put on hold and are stored between processes, bottlenecks are created, which leads to a longer lead time for the products to arrive at the customers’ destination and adding waiting time, which is considered a waste factor, in the overall value added to the end products.

To be able to make better decisions regarding production planning, and to minimize unnecessary motion and waiting time, GPV is planning to improve the shop floor management by digitalization and better visualization of the WIP, the lead time, as well as real-time visualization of the asset units flow in the production. To do so, GPV is rolling out a digital tractability tool to trace their products in the production, contributing to smart manufacturing, using elements from Industry 4.0 and the Industrial Internet of Things (IIoT). Therefore, a case study is undertaken to investigate, how GPV can benefit from digital traceability technologies in manufacturing as a first step in moving towards a smart manufacturing transformation.

2. Digital Maturity Assessment of GPV

For introducing the idea of IIoT digitalization in production, the assessment of GPVs current digital maturity has been carried out, in collaboration with the Director of Digitalization, and the Director of Strategy and Business Development at GPV Group. The data collection is based on the interview outcome and supported by common internal knowledge both within the organization and the digitalization department. The assessment acts as a snapshot of the organization’s digital transformation at their current state and must, therefore, be adjusted if changes appear. The current activities in digitalization and the use of internal business applications support the answers in the assessment.

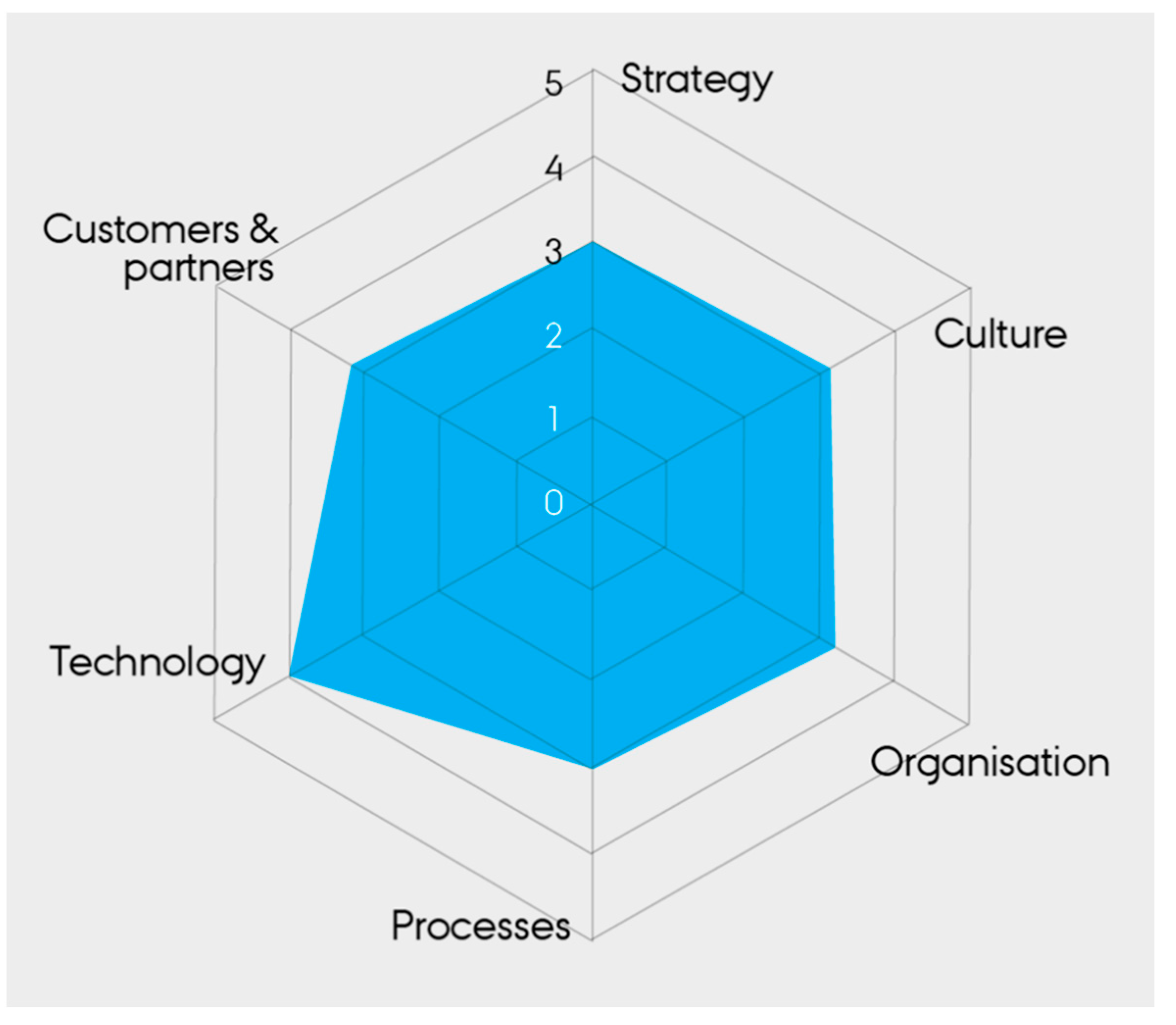

When conducting an assessment of the digital maturity of GPV, the Digital Maturity Assessment Tool (DMAT), which is developed by Aarhus University, has been applied (

https://dbd.au.dk/dmat/ (accessed on 1 June 2020). DMAT evaluated digital transformation in organizations on six theoretically derived dimensions (Strategy, Culture, Organization, Processes, Technology, and Customers and Partners). There are a plethora of digital business model innovation tools [

4,

5] and digital maturity evaluation tools [

6,

7] In this case we use our in house developed digital tools (DMAT, IoT value chain tool) which are tailored to suit the next generation of IoT/IIoT business models and innovation, required to accommodate the society needs appearing within the digitalization/AI era. The DMAT evaluation was carried out in a plenum, providing answers on the level of digital maturity on the different dimensions of the company. Below

Table 1 visualizes the score from 1–5 within the six dimensions including the description of the characteristics of each different dimension.

The assessment acts as a snapshot of the organization’s digital maturity at their current state. The current activities of GPV in digitalization and the use of internal business applications support the answers in the assessment (

Figure 1).

Briefly the average score from the DMAT assessment is 3.28 indicating that GPV can improve all dimensions to reach the maximum score of 5. Most important, GPV needs to improve the dimension of strategy, which scores in the low end. The technology dimension received a score of 4.00, which is higher than the average score in the metal manufacturing industry. This indicates, that have GPV worked with digital technologies in some contexts. Working with digital technology requires a clear digital strategy to guide investments, prioritization and integration of selected technologies. Using a systematic process to map the exiting state and draw the future strategy for digitalization using such innovation tools is proven at previous studies [

8] that it always leads to significantly higher total shareholder return (TSR) for developed services/products compared to those who do not use any business model innovation and evaluation tools.

3. AS-IS Mapping of the Production

In order to be able to select a technological solution for tracing assets in the manufacturing, a mapping of the AS-IS manufacturing process at GPV has been conducted. This mapping helps to identify the current situation and provides a match between a suitable tracing technology with GPV’s necessities, while also identifying bottlenecks and potential processes that can be optimized using digital traceability technology

To map the current process of manufacturing, interviews, as well as observations in the manufacturing facility, have been conducted. A random product has been selected for mapping the different processes representing a metal ‘housing’ product production. The manufacturing of the housing product includes 13 frequently used processes when it is produced and has been chosen to provide insight into the manufacturing of a product involving a broad spectrum of processes. These processes will be described step by step explaining the flow of products throughout the production.

The processes for manufacturing are described in a routing card (a job card) representing the route of the product including the specific processes, starting time, ending time, quantity, and operation number (the ID of the specific process). These routing cards are printed from GPV’s ERP system as physical papers and follow the batch of products through the processes of manufacturing. The routing card is provided with an ID and a barcode for every process, which needs to be manually typed or scanned, and registered in the ERP system by the employee handling the products in their respective department. The employee registers the process, when it begins, and once again when the process is finished. This allows the system to know when the batch is ready for the next process, which may occur in a different department. Between processes, the batch is manually moved from the previous process in a given department to the inventory waiting area for the next process to start. This waiting process can be categorized as non-value-adding to the final product. The amount of time that the batch is stored and awaits production varies from batch to batch, depending on the customer order and the overall WIP. Additionally, changes in the customer order can occur and prolong the agreed end date for the final products and thereby extending the overall lead time. The example of the random product has a production lead time (PLT) extending from 27-11-20xx to 09-01-20xx, indicating a PLT consisting of 43 days. This process is visualized in the internal routing card, explained by a project manager in the production. The routing card is described as follows:

CNC punching—Raw metal sheets are being delivered to the CNC punching machine, where it is punching out units from the sheet. As described above, the employee handling this process registers the process in the ERP system before the process begins. When the machine has finalized the production, and the right number of items have been produced, the employee registers that the process is completed, again in the ERP system, making this registration the only tool for tracking the product through the manufacturing process. This procedure for registration occurs in each of the 13 processes for producing these metal housing products and will therefore not be mentioned in the other steps. When the process is done, the metal items are placed on a pallet and transported by truck to the shopfloor buffer area (WIP inventory) waiting to be dispatched to the next process in the production line. The transportation and storage of the batch also occur at every step in the manufacturing process but will not be described further in the following steps.

Flatter—The flatter machine ensures to remove unevenness from the surface of the metal units.

Edge pressing—Bending of edges on the metal units.

Degreasing—The units are hung on hooks and go through a washer.

Pressure montage—Holes are pressed on the surface of the units by bolts.

Aluminum welding—Other handled material is welded with the metal units.

Grinding—Bumps and sharp edges are removed by grinding.

Drilling—If holes have not been pressed out entirely in the pressure montage phase, some holes are drilled out manually.

Dispatching/receiving from external coating—The units get shipped to an external surface treatment supplier and received again at the warehouse when the process is done. The time of this process depends on the quantity and the shipment.

Pressure montage—More holes are pressed on the surface of the units.

Covering—Before powder coating of the units, they are being covered to ensure that the coating is only applied at the right spots.

Powder coating—Powder coating of the units.

Internal transport—The units are internally transported to department 57, the montage process. Here the units get assembled, and in most cases, other units produced internally or externally are used in the assembling of the final product.

The 13 manufacturing procedures presented above helped gain insight into the processes included in the overall production routings, enabling the authors to assess the maturity barriers of implementing digital traceability technology. The aspect of asset tracking is core in Industry 4.0 as shown in reference architecture model Industry 4.0 (RAMI4.0) and vital for continues innovation and optimization in lean operations in the new digital era among different type of industries. Technologies such as RFID and the resent introduced Sigfox indeed exist in market but their adoption in industrial set ups is very low in reality. The innovation in this study lies with the examination and justification for use in the GPV shop floor, standard low-cost digital tracking technologies such as RFID, Sigfox, and IIoT technologies for solving the prominent problem of internal assets tracking and monitoring of product flow in large production lines. Such proposed solution which combines the traditional lean philosophy and IIoT technologies is new and considered innovative particularly in the traditionally conservative industries such as metal and construction, which they want to move in the next generation of digitalization.

4. Production Issues Identification

Throughout the walk-through of the manufacturing, some questionable procedures were observed and later discussed in the interview with a project manager from the production.

For example, after a process finishes the batches are not always transported to the next process immediately. This has to do with a lack of registration of the process in the ERP system when the process is completed. The manual registration in the ERP also takes time and causes delays. This can in some cases result in a longer waiting time between processes. Especially the processes involving the assembly of components and welding, the departments are depending on all necessary parts for assembling. If some batches are missing, the process cannot start and will result in possible downtime, which can be identified as a significant bottleneck in the manufacturing process and cause a lack of overview. Additionally, the department manager of the assembling department is not able to access the ERP system due to lack of real-time updated information and identify if the needed components for assembling are ready or some processes are still missing due to lack of routing card overview including registrations, the current position of the batch and the parts needed for next steps.

In some of the processes, numerous WIP is being stored at the buffer awaiting the process to begin, which are not adding value to the final product and results in the buffer being crowded.

The departments have to manually check the ERP system in order to see the priority of which work order is expected to be manufactured next. Only one department is using a screen to display the queue of work orders, showing the WIP concerning the department for bending and punching (see

Figure 2). This gives the manager of the department an overview of the work orders.

The digital lean board displaying the WIP and products awaiting to be processed has four different statuses and color codes for easy recognition in the display:

(Red) Backlog, waiting in progress—the products have arrived at the department, but are allocated to the backlog, meaning that the products are behind schedule and are therefore marked as an urgent job.

(Orange) Backlog, coming from another department—the products are soon arriving at the department, and are already behind schedule, and the job is therefore urgent when arriving.

(Blue) Coming from another process—the products soon arrive from the previous process and are following the schedule.

(Green) Waiting in the process—the products have arrived from the previous process and are ready to begin the process. The products follow the scheduled plan.

At a previous study of a similar case [

9] the use of IIoT tracking technologies like RFID/Sigfox in combination an ERP/MES system for automated recording helped to reduce the time for recording parts manually for blue color employees from 3 h/day to ~3 min/day and for white color employees to make a summary and assess the status from 30 min/day to ~5 min/day. The estimated yearly cost saving in terms of labor waste time was good enough to leverage the cost of investment for digitalization. At [

10] utilization of RFID and WiFi tracking technologies together with used to enchase the capabilities of a shop floor Digital Twin for implementing a Factory of Future smart logistic system for managing the production demonstrating that such implementation and digitalization strategy improved the overall factory score from 69% to 86%. In a detailed review [

11] of Industry 4.0 technologies for internal logistics in production factories IoT track and trace technologies such as RFID when combined with artificial intelligence (AI) for data analysis and AGVs for automating internal transportation is shown to be vital for ensuring secure production supply, cost optimization, and time efficiency. Similarly at [

12] use of RFID for real-time production planning and scheduling improved the WIP inventory and internal operations efficiency. The use of LoRa and Sigfox [

13,

14] IoT active tags to track and find tools, as well as time automatically the product batch movement between processing stations, has shown that it can reduce the waste time in internal logistics. Hence, the implementation of such an automated digital tracking systems at later stage could solve the issues at GPV production as show in previous similar cases.

5. Identification of Company Needs and Specifications for Next Generation Digital Traceability

To be able to formulate specifications and recommendations for GPV the actual needs of the possible digital traceability technology for the shop floor manufacturing had to be identified, which has been the research aim of this study. These needs are described as target specifications and are derived from interviews with employees at GPV. These targets describe the GPV’s customer needs, as explained in the literature of product development by 1 as a framework for gathering data from customers and interpreting them into needs in order to be able to establish target specifications. Thus, the specifications represent the required capabilities of technological solutions to solve the needs of GPV.

The target specifications are described and visualized in

Table 2 listing the needs and the ideal targets, which have been derived from an interpretation of the needs.

Here it is worth mentioning that only some of the target specifications were assigned a marginal target. This is because of the already broadened requirements represented by the ideal targets. Therefore, a marginal target would lead to a very narrow target not contributing enough to the desired needs from GPV.

6. Screening of Alternative Technologies “TO-BE” Used for Digitalized Production Mapping

In investigating the different technologies, a framework is being applied in order to identify the capabilities of the technology. The framework ensures that the technology is introduced and presented based on other cases’ applications, capabilities, advantages, and disadvantages.

Digital traceability technologies provide benefits in a manufacturing company by increasing traceability of assets moving around the production while providing more accuracy, security, enabling real-time controllability and labor cost reductions [

15].

Digital traceability is used in many different areas, but primarily utilized in logistics, supply chain management systems, and production for identification, tracing, and tracking [

16]. By adopting and correctly implementing digital traceability technologies in production lines, problem identification in the production process is made possible [

15].

Digital traceability technologies are one element working with IIoT. It is part of a connectivity ecosystem between machines and systems to acquire data from the production to analyze the data and optimize business and production processes. An IIoT environment consists of five layers contributing to the utilization of the acquired data. These layers cover (1) the acquisition of data through the manufacturing chain using devices to acquire data. This data is being processed by a (2) communication network leading the data into (3) computing management systems to (4) analyze the data in order to use it as (5) descriptive, diagnostic, predictive, or prescriptive data [

17].

Interoperability and connectivity between different manufacturing equipment, systems, and products are very important aspects regarding the ability to monitor and control operations in the production and supply chain. The technologies traditionally used for this purpose have their limitations, which will make it difficult in the future to develop the operations any further [

18].

This screening of technologies investigates the capabilities and use of two different digital traceability technologies and their interrelation between the layers of the architecture. The technologies that we focus on in this paper are (1) Radio Frequency Identification (RFID) and (2) a Low Power Wide Area Network technology (LPWAN) called Sigfox [

19,

20]. These technologies are chosen due to their ability to support the lack of data, and software to support online shop floor management.

6.1. RFID

Radio Frequency Identification (RFID) is an automatic object identification and data collection technology based on radio waves. The technology was developed shortly after the invention of radar technology before the second world war and was meant for other purposes [

18,

21] such as IFOF. In the 1970s and 1980s, the technology was commercialized as the development was transferred to public companies, and since then, new advancements have been introduced frequently.

The RFID technology consists of a radio frequency transmitter/receiver, where a wireless tag can transmit data in form of its identity to a tag reader. The technology usually includes an information management system for processing the received data [

18].

A typical architecture of an RFID information system constitutes a tag, which is attached to a component/product/batch for identification. The attachment of the tag can be done using various approaches depending on the surface of the part. For metallic parts, the tag can be attached using different variations of tags, e.g., smart RFID bolts that are being drilled into the part, small RFID tags that can be placed between bolts or between elements, or lastly as metal RFID labels that can easily be attached to any metal surface flat or rounded [

22]. The tag contains a unique code and/or other electronically stored information [

18]. Some tags can be read at a short distance, often a few meters, where others can be read at a distance of 100 m. These long-distance tags are often powered by a local power source like a battery, whereas the short distance tags often are powered by electromagnetic induction from a magnetic field [

22].

Tag readers are the devices that read the tags, receives data from the tag by emitting radio waves to the tag, which then responds by sending back the data [

18].

There are different types of tag readers. The most common tag readers are manual readers or gate readers. The difference between these types is typically, that a manual reader consists of handheld scanners and mobile terminals, while a gate reader can consist of a reader installed in a portal gate or is located nearby to a conveyor belt, registering the bypassing of the RFID tag. A single reader can read the data from multiple frequency-based tags [

23]. The reader typically is connected to the Information Management System, where information from the tag will be transferred to a database for processing the data.

The end-user has access to a database within the Information Management System, e.g., an ERP system. The systems have to be set up in the way necessary for transferring data and thereby makes it possible for the end-user to use the information for various purposes [

18].

For management of manufacturing and supply chain, [

18] states five different groups of RFID-based applications, for different purposes. These are the following:

- -

Warehouse inventory tracking and management

- -

Process monitoring, management, and control

- -

Tool management

- -

Supply chain management

- -

Life cycle management

In order to evaluate the RFID technology, some technical capabilities need to be addressed. These vary a lot depending on the specific tags, and the year of the investigated scientific papers. There are three different types of RFID tags: (1) Passive (2) Active and (3) Semi-Passive. In this report, only the passive RFID tags are being treated.

The passive RFID tag comes at a lower unit price than the two other types and has a unit price of less than 1

$ depending on the tag and supplier. A standard passive RFID tag often has an average price below 2 cents per unit [

24,

25]. The passive tag is powered by induction from electromagnetic waves emitted by the reader [

26], and therefore requires a form of a reader(s) in the manufacturing.

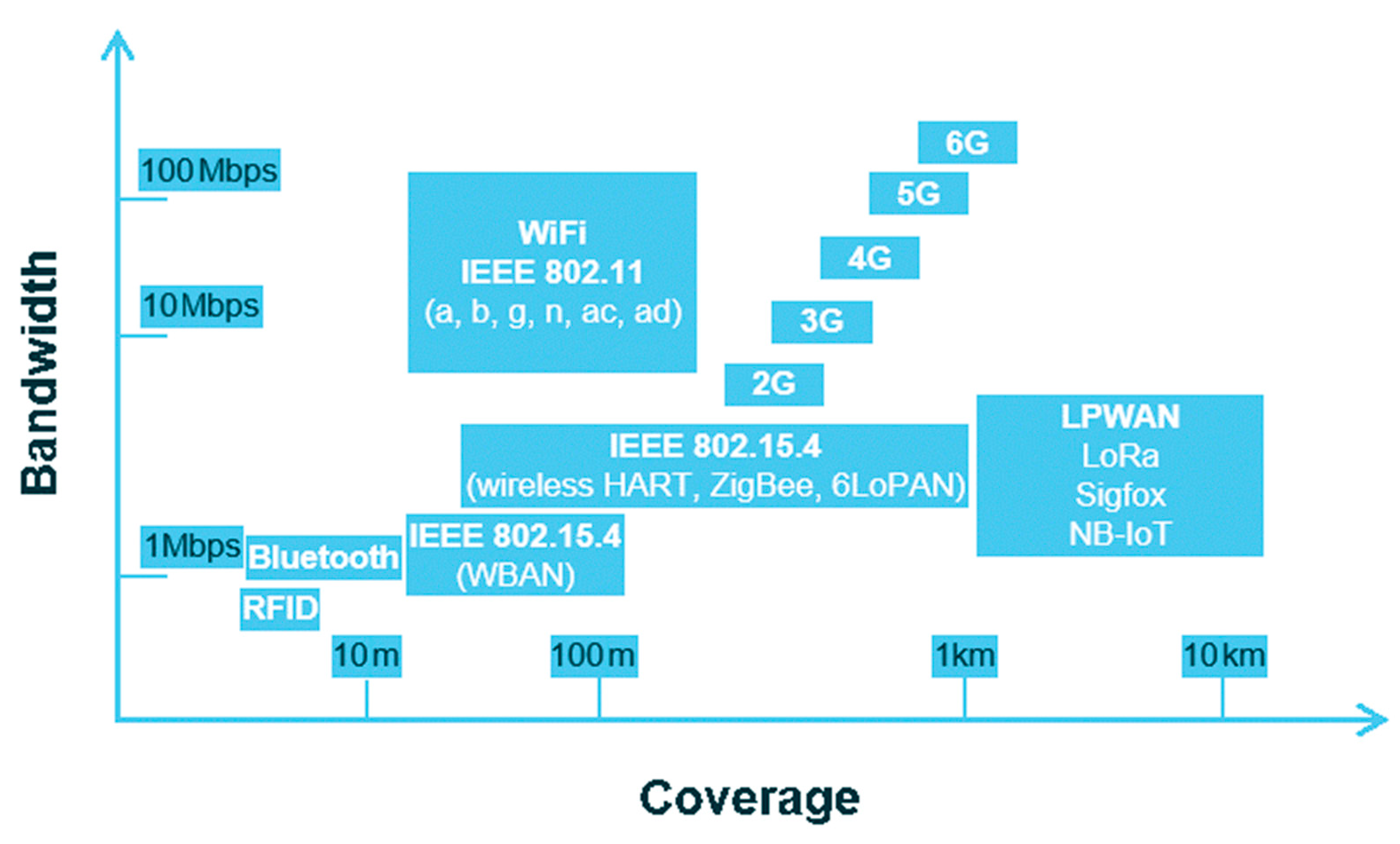

RFID and other conventional wireless technologies provide lower coverage and broadband than wired technologies or networks like 4G or Low Power Wide Area Networks (LPWAN), and should therefore also be taken into account when a company is choosing a traceability solution [

17].

6.2. LPWAN: SigFox

Sigfox is a low-power wide-area network (LPWAN), which like the RFID technology also operates using radio communication to acquire data. The network provides emerging technological solutions with wide coverage (see

Figure 3) and is also very energy sufficient [

17]. Besides Sigfox, which is just one type of LPWAN technology, LPWAN also consists of technologies like LoRa and Narrow Band IoT technology (NB-IoT). LPWAN technologies first emerged just before 2010, and Sigfox as one of the known emerging technologies was developed in 2010 [

27,

28].

According to [

29], “Sigfox uses a wide-reaching signal, which can easily pass through solid objects” and therefore “the signal from Sigfox can be used to easily cover large areas” [

29].

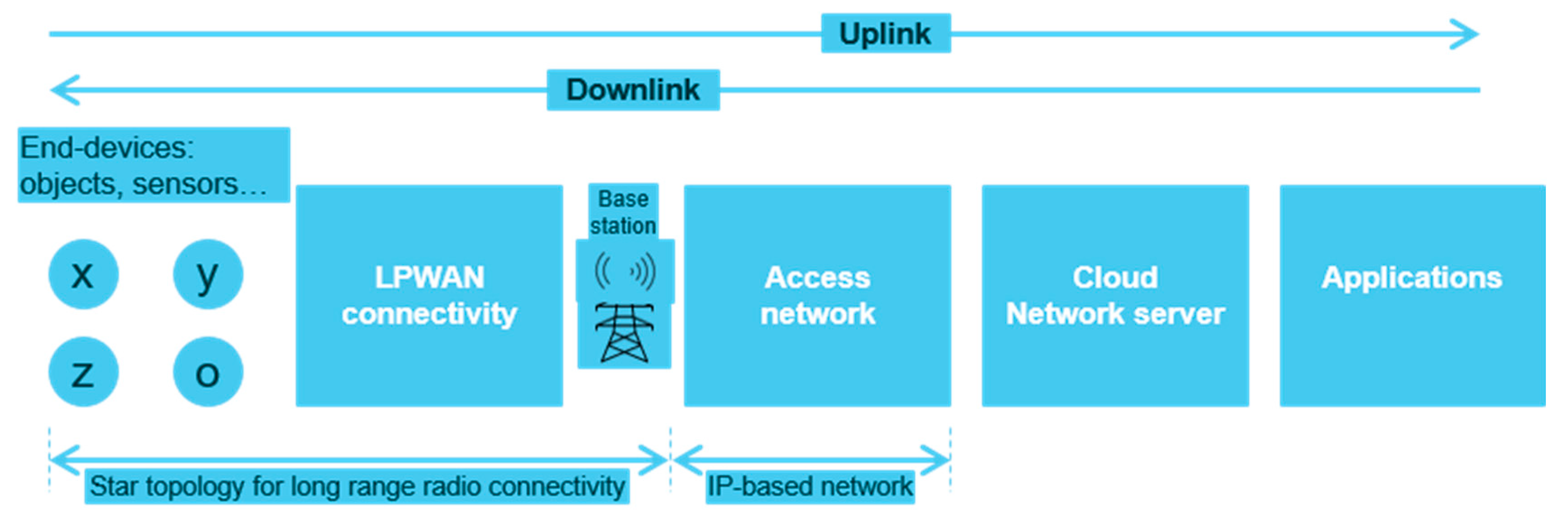

As stated, Sigfox also uses radio connectivity to acquire data from the manufacturing. In

Figure 4, it is shown, that the end device, which can be any object (e.g., a batch of products moving around the manufacturing line) is connected to the Sigfox network with data being transmitted uplink to the base stations (BS) using radio chipsets, which costs less than 2€ [

19]. Then, the base stations forward the data to a backup server, e.g., a network server, using an IP-based network, used by the company, which then forward the data to the application server used at the company, e.g., an ERP system [

27].

The Sigfox technology has a disadvantage in connecting a huge number of devices due to a high deployment cost, and as [

27] states, “when data are transmitted through multi hops towards a gateway, a subset of devices are more congested than others which reduce their batteries lifetime (i.e., excessive energy consumption) and thus limit the entire network lifetime”.

When transmitting data uplink, Sigfox is limited to transmit 140 messages per day with a maximum payload length of 12 bytes for each message. As Sigfox using narrow bandwidth, it is possible to tag a large number of devices to utilize the limited spectrums efficiently [

29], and it is therefore considered as a technology for scaling up the operation of traceability in a company.

The Sigfox technology can be suitable for tracking pallets in manufacturing. As the costs only concern the device costs and the battery lifetime, there are not many more requirements for the company, because of the ability to acquire their own network for guaranteed coverage at the manufacturing facilities [

27].

6.3. Comparison of RFID vs. SigFox for Application Suitability

These technologies show two different approaches for connecting devices in manufacturing to acquire data for usage in a system application. RFID represents a local solution with low costs elements, which requires manual or semi-manual reading of the tags at a relatively close distance. Sigfox represents a more expensive solution connected to base stations and operates in a cloud network server. The Sigfox technology can be used to transmit/receive data in a longer range than RFID, covering up to 13km. The Pros and Cons of RFID and SigFox are illustrated in

Table 3 below.

7. Conclusions

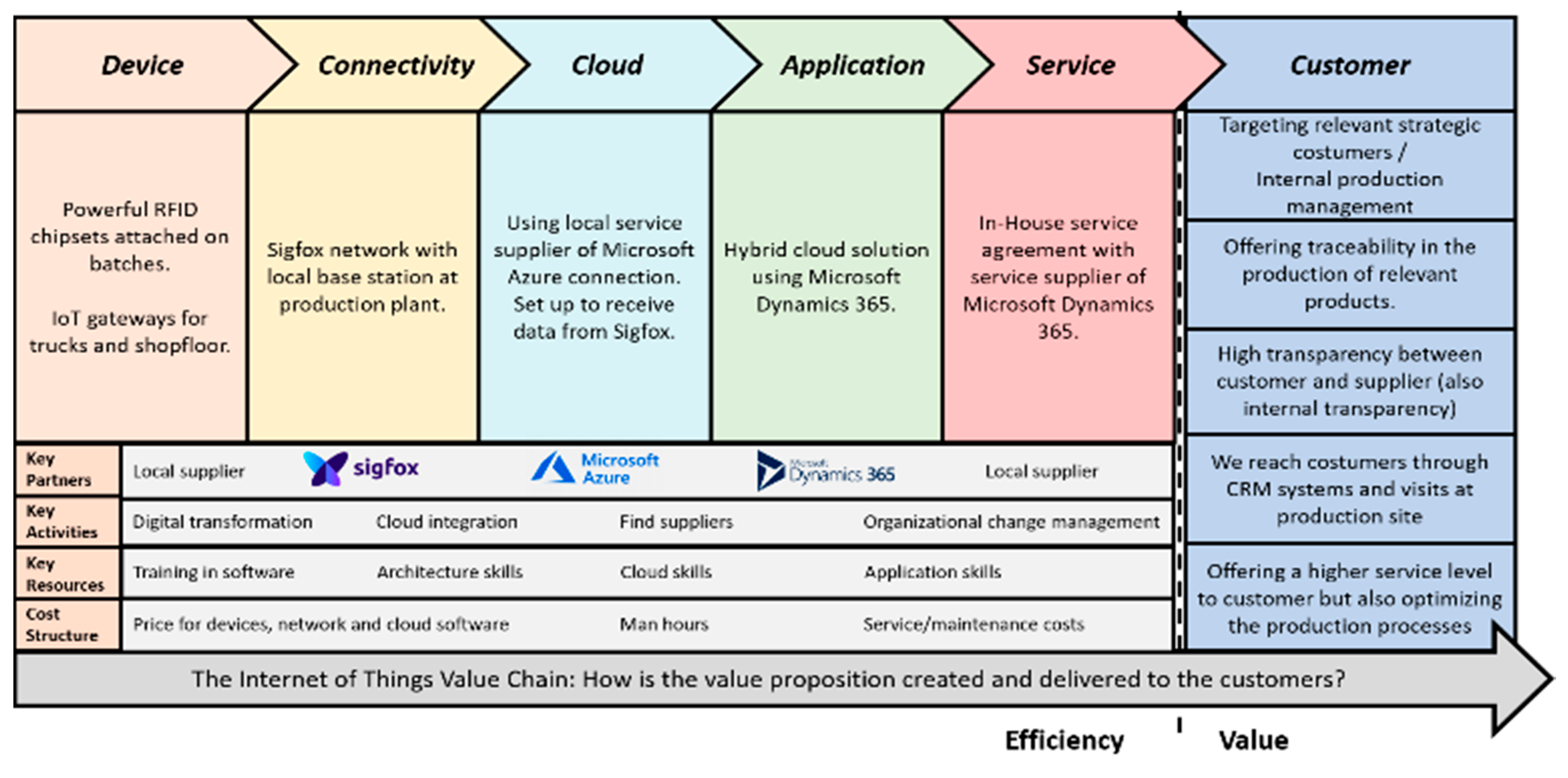

By an interpretative selection of the two technologies, RFID and LPWAN, the latter and specifically Sigfox, appear to be a more appropriate technology for matching the company needs.

In order to map the potential added value chain of IoT-based digitalization for product tractability in GPV shop floor, the IoT tool [

30] has been used as depicted in

Figure 5.

Integrating LPWAN technology for tracking WIP in shop floor, GPV is facing the beginning of a digital transition towards smart manufacturing using IoT compatible solutions. This establishes a foundation and a stepping-stone for GPV, where the benefits can become a motivation to investigate other business aspects of the connectivity of devices in the production site. For example, automation and Industry 4.0 system functions with dynamic search and discovery IoT devices technologies, where geo indexing of the sensing elements and geolocation queries can be performed in the data streams at the local setup such as the ones shown previously in [

31] and the EU IoTCrawler project (No. 779852). Such functions can make possible to search and track the real-time geo-position of monitored assets, while initiating alerts in ERP for assets with long-standing time in particular geolocation, enabling the mangers to become aware of the situation and take corrective actions. Such next-generation IIoT innovative elements can be the key turning point in the further digitalization road map for GPV.

Due to the digitalized traceability of products being a possibility in transmitting data from IoT-enabled devices to the applications of choice, GPV will be able to fulfill the company’s needs for tracing products throughout the production, as described in the target specifications in

Table 3. This enables possible optimization levers for the manufacturing of products. For example, GPV will be able to track specific movements, locations, up-time and down-time of WIP, which creates the basis of possible improvements of the asset utilization and thereby improving production execution and performance [

16]. Additionally, controlling process information based on data from tags/radio chips will be beneficial in reducing scrap and improving the performance of the different included manufacturing processes. Scrap in this case refers to the fundamentals of lean philosophy “Muda-value adding processes or actions, Mura-lack of stability and flow, Muri-the overburden” which can be found during the Gemba Walk, and should not be confused with regular waste. Furthermore, collecting historical data at each step of the processes can lead to surgical precision in product tracking and product genealogy [

16].

Factors like those mentioned above contribute to optimizing the lead time for specific products, and thereby cutting waste like unnecessary movement and waiting time. This is possible due to better visualization of the product flows and WIP. Thereby this creates a solid foundation for the management to make better decisions, for example regarding products being late for assembling processes.

Being able to track and trace the movement of batches, GPV becomes aware of the products with more transportation steps, but without added benefit. This can help to make accurate and improved logistic planning and schedules [

17,

32,

33].

Implementation of this traceability technology can enable transparency in the production, and develop competitive advantages for GVP in order to meet the customers’ demands, providing them with better insight into the manufacturing of their products and higher efficiency.

Implementing a digital traceability solution offers benefits to the understanding of manufacturing lead times and bottlenecks. In practice, there are many barriers to overcome. In particular, if the digital traceability solution should not be an isolated, standalone system or simple ERP system add-on, but if it is to contribute to the overall digital journey of GPV, specifically the facility in Tarm, Denmark. The introduction of digital traceability technology in GPV which combines the Lean philosophy with Industry 4.0 digital capabilities together with additional, technologies such as deep learning for the automatic analysis of big data as shown in previous studies [

34,

35] would benefit further the development of their digitalization agenda.

According to [

36] innovation beyond the core business have a lower success rate compared to smaller steps. The digital traceability solution is in our opinion a single step away from the core business of GPV’s existing activities by adding only a new technology to the process. Thus, it provides an ideal starting point for a more elaborate digital journey that promises a higher rate of success compared to solutions that might change too many dimensions simultaneously.

In the overall roadmap of GPV digital transformation, the step-by-step implementation approach for digitalization is important. GPV needs to pay significant attention to building the digitalization culture in the company by hosting educational seminars to enable a smoother transition for employees and with a minimum of disruptions in the daily working routines.

These changes are necessary for the success of the overall GPV digitalization journey and the implementation of incremental steps toward digital transformation such as the digital traceability technology in the mechanics manufacturing site located at Tarm, Denmark.