Abstract

As a result of the gas market liberalization, new business models are emerging and one that brings positive effects to market players is purchasing group functioning. This paper adopts the approach of gas market review and provides a synthesis of its functioning in Poland. The review focuses first on the frameworks of the process of gas market liberalization. Next, the author presents gas market structure and lists and comments on its components. Then, the main characteristics of the market are discussed. The author presents a case study of the Metropolitan Gas Purchasing Group—the largest gas purchasing group in Poland with the volume reaching almost 225 GWh of purchased gas. As a result, the author highlights the effects of this coopetitive strategy which reached a value of PLN 3,000,000.

1. Introduction

The process of the liberalization of the natural gas market influences the behavior of market players. In Poland, a model based on the introduction of mandatory gas sales involving the exchange segment has been adopted. It has contributed to the greater involvement of stakeholders in gas trading on the Polish Power Exchange (TGE). TGE is a pioneer in the implementation of innovative solutions in the field of commodity trading and Poland’s only licensed commodity exchange to operate a regulated market. It operates under constant supervision of the Polish Financial Supervision Authority, which ensures reliability and security of transactions on the markets operated by the exchange, including electricity, natural gas, property rights, and CO2 emission allowances. As of 20 December 2012, within the functioning of Commodity Derivatives Market, TGE has been trading futures contracts with physical gas supplies. The Commodity Derivatives Market for gas (RTTg) accounts for the largest share of the market for this fuel product on the stock exchange. The product range includes weekly, monthly, quarterly, seasonal, and annual contracts. Trading contracts on RTTg is conducted in the continuous trading system and the auction system.

Changes taking place in the environment caused the evolution of the rules of the market game, which directly affected the shape of relationships between players. The supply of products in a globalized economy often requires multilateral joint interactions. Increasingly, organizations seek benefits including cooperation and competition [1], complementing their actions to achieve greater benefits [2] than acting on ones’ own. A response to the dynamics of the functioning of the market reflecting the current behavior of its players is a paradoxical combination of competition and cooperation called coopetition. The definition that has been adopted for consideration in the paper is the definition by Bengtsson and Kock saying that coopetition is the cooperation of competitors and the same cooperation and competition can take place in various fields of coopetitor activities [3].

The premise for the interest in the issues raised in this article has been emerging in the literature, the importance of coopetition and its impact on collective results as well as observations of the real behavior of public sector entities. Combining limited achievements empirical, identified research gaps, and implications postulated in coopetition literature [4], scientific exploration in this area confirms its relevance and validity, in particular, in the context of collective benefits that cooperation can bring competitors in the public administration. The identified research gap seems to be promising in conducting analyses as the collective results achieved by coopetitors within the public sector are scarcely presented in the coopetition literature so far. The article fulfills this gap by showing the measurable effects of coopetition in the public sector. Previous studies on coopetition were carried out at the level of a single company focusing on individual benefits [5] or collective results within the business sector. The researchers admit that coopetition is the best solution for the analyzed company [6], but they do not provide arguments for why public organizations should join this coopetitive interaction. Thus, an asymmetry of explanation arises. The benefits of public administration remain outside the scope of researchers’ interest. To solve the research problem, the author stated the following research question: 1. Is there coopetition in the public sector? and if so (1a) how can it be classified? and (1b) are there mutual benefits resulting from coopetition?

The article helps to fill the cognitive gap in terms of mutual benefits achieved by coopetitors within the public sector. Choosing a research field that allows one to identify the effects of coopetitive interactions was made in a non-accidental manner. The subject of consideration of this article is a gas purchasing group established in the GZM Metropolis (GZM), Poland, conditioned by the specificity of its functioning within a public sector. The author presents the project implemented by the GZM Metropolis in the light of gas market functioning in Poland. The main purpose of the article is to identify the measurable effects of coopetition within the Metropolitan Gas Purchasing Group. The article shows the benefits of coopetition focusing on the possibilities created from the cooperation of the cities. The main value of the article is the identification of coopetition in metropolitan structures, which allows one to fulfill the research gap.

2. Materials and Methods

The basic methodological approach presented in this article is descriptive and was based on the literature (mainly scientific articles), reports, and case studies. The methodology used in the paper is a study of the literature, gas market reports, and case study analysis of the project implemented by GZM Metropolis in the light of gas market functioning.

A literature study includes:

- presenting the definition of coopetition

- presenting the classification of coopetition

- identifying coopetition within the public sector—purchasing groups

Literature studies focus primarily on the attempt to present a definition of coopetition, presenting a possible classification of coopetition, as well as identifying coopetition within the public sector. The author put particular emphasis on an attempt to identify the benefits of coopetition in the public sector, however, as literature studies have shown, this issue remains a research gap. While there are examples of mutual benefits of coopetition in the business environment in the literature on the subject, they are not investigated, defined, nor presented in the public sector.

A descriptive analysis of the gas market in Poland includes:

- process of gas market liberalization

- identification of gas market structure

- gas market characteristics

Understanding the uniqueness of the applied case study can occur only knowing the history of the possibilities of using such and no other solution. Therefore, the author decided to present the process of gas market liberalization in Poland, which in turn resulted directly from EU directives. Although the directives are a way to achieve the competitive market, the path to (re)organize it and detailed solutions applied were developed at the level of a given EU country. The data that helped to illustrate the liberalization process and the current state come directly from the Polish Power Exchange.

A case study of the Metropolitan Gas Purchasing Group includes:

- introduction of GZM Metropolis

- introduction of Gas Purchasing Group

- effects of coopetition within the Gas Purchasing Group

The choice of case study was not accidental. On the one hand, literature studies have indicated a research gap in showing the mutual benefits of coopetition in public administration. Coopetition research focuses mostly on B2B or B2C relations and not necessarily by analyzing the public sector. On the other hand, the deduction of market players’ behavior in this sector in particular in the context of gas market liberalization and the possibility of switching suppliers have shown new behaviors in which players seek their benefits. The analyzed project itself is a novelty of reflection because GZM is a unique concept, the only one established under the Metropolis Act in Poland, which implements various projects bringing measurable benefits.

Data used in the analysis: invoices for all the Purchasing Group Members for one year (2018) to identify price levels resulting from signed contracts, signed annexes, or bidding processes. Additionally, the bidding documentation was analyzed together with the final offer for selling gas fuel. A comparative study of the pre-bid and after-bid results taking into account all the circumstances of the bid led to the final conclusions.

2.1. Literature Study

2.1.1. Coopetition

Generally speaking, coopetition is a business model in which the simultaneous occurrence of cooperation and competition is observed. The competing market players apply strategies in which there is a consensus of interests and a combination of efforts because the synergistic benefits of cooperation understood in this way are greater than in the case of operating on one’s own. Coopetition as the subject of research is defined as the consequence of intensification and development of the complexity of unstable and dynamic cooperative behaviors between competitors [2]. Coopetition is the transfer of game theory into the realities of business, creating a new strategic theory that denotes the ability to entering into paradoxical inter-organizational ties, enabling access to external resources, i.e., know-how, finance, or technology. In the game theory, coopetition is a positive-sum game which simply means it is a win-win solution. In this light, coopetition is a strategy of joint creation of value and competition in its division, in conditions of partial convergence of interests or goals and a variable structure of the game with a positive (non-zero) sum, the result of which is positive but variable because cooperative behavior is accompanied by confrontational attitude and it is difficult to determine ex-ante to what extent partners will profit from cooperation [7]. Coopetition is a two-sided and paradoxical relation that appears between cooperating companies in some part of their business, while at the same time these organizations can compete in another field to achieve better results, both individual and joint [8]. In other words, the more parties work together, the more benefits they can achieve. The strategic management literature gives some patterns typical of coopetition in everyday practical business relationships. This phenomenon can be classified in different ways depending on the adopted division criterion.

First, coopetition can be deliberate [1] and emerging [9]. The first pattern is characterized by a conscious, thoughtful, and purposeful search for benefits at both an individual and a common level, where the coordination of the activities of cooperating competitors is relatively clear, and often it is specified. Coopetition in this sense is an intended strategy, externally oriented, strongly focused on more entities involved than one organization. On the other hand, it may be a kind of behavior provoked by market changes. The emerging pattern refers to the sudden and dynamic growth of individual behavior seeking values within the relationships of cooperating partners, most often unplanned before starting cooperation.

Secondly, taking into account the direction of these relations, there can be distinguished horizontal and vertical [10] coopetition. Horizontal relations relate to the cooperation of direct competitors on the market in which they operate, while vertical coopetition occurs in the relations between the seller and the buyer and mainly concerns the level of negotiated prices. In a vertical relationship, it is quite easy to see the partners’ common interests and their interdependence within the supply chain. On the other hand, horizontal coopetition is to help achieve a strong position on the market and gain a permanent competitive advantage. In this situation, the coopetitor is a rival who seeks the favor of the same end recipient. Finally, bilateral coopetition can be distinguished—when two competitors cooperate and a network one—in the case of more than two competitors [11]. Both the network and bilateral perspective can be additionally divided into simple and complex. Simple bilateral coopetition stands for relationships between two companies determined in relation to one link within the value chain. In turn, complex bilateral coopetition concerns more than one link in the value chain. Similarly, simple network coopetition occurs within a group of companies pertaining to one link, while a complex network relationship engages activities in more links in the value creation chain.

Organizations cannot operate in isolation from the external environment [12], which is why it is so important for them to identify and consciously use all interactions with other market players. It can be seen that the benefits resulting from both competing and cooperation relationships [1] with which companies supplement their activities are increasingly sought after. Jointly created value is often the result of cooperation of many participants in the value chain [7] including competitors, moreover, it would be impossible to achieve by the parties involved alone.

2.1.2. Coopetition within Public Sector

Public sector management requires careful and professional management of the costs of purchasing various goods and services. Increasingly, public sector organizations cooperate when purchasing products and services [13,14]. They apply the business model of purchasing groups to provide greater value for money. In the literature, examples of such cooperation can be found such as the Italian approach to sustainable development in the food chain meaning the creation of new sustainable agri-food systems with an institutional element. Although there are many different concepts of sustainability, spontaneous consumer groups called solidarity purchasing groups have been developing in recent years [15]. In Italy, household groups work together to buy food and other goods directly from producers. The goal is to build a more sustainable economy by changing the way we buy food and other goods. In short, they are characterized not by a local economy, but by an ethical and fair economy, in which social and economic territorial relations tend to develop districts and networks.

Worth mentioning is also the example of coopetitive cooperation in joint tender procedures. Constantly growing competition means that cities in search of ways to strengthen their position decide to establish cooperation on the global meeting market. A similar solution was implemented in Europe by Barcelona and Vienna, which have become industry partners and have been working together effectively for over 20 years. In 2012, the convention bureau of Vienna and Barcelona intensified cooperation, modified its rules and created its model of coopetition [16]. Another example may be Polish local governments, which began to organize electricity and gas purchasing groups. The main task is to collect information on electricity and gas consumption and conduct a structured process of energy purchase, following the requirements of the Public Procurement Law.

3. Results and Discussion

3.1. Gas Market in Poland—Process of Liberalization

December 2012, the beginning of trade in natural gas on the commodity exchange in Poland was one of the first steps towards the full liberalization of the market. Another crucial step was the entry into force of the amendment of the Energy Law in September 2013. It introduced the so-called exchange obligation which stands for the obligation to sell fuels on commodity exchanges. In 2013 the obligation was at the level of 30%, in 2014 it was 40% and from 2015, 55%. The development of the gas exchange market which was happening in Poland in 2014 resembled the pace of development of the electricity market in the initial period. It is worth emphasizing that gas prices on the Polish exchange follow the developed European markets. Judging by past experience, one can expect a similar increase in the liquidity of the gas market as the one noted on the electricity market [17]. As regards the natural gas market, in 2010 the European Commission published the Energy Strategy of the European Union in the 2020 perspective. Its priorities included building an internal, infrastructure-integrated and competitive natural gas market, the foundation of which was ensuring relevant liquidity of trade in this raw material between particular countries. This result could have been achieved inter alia through the development of infrastructure, standardization of products offered by the Transmission System Operator and enabling trading on exchanges. Further steps primarily included gradual integration of regional markets followed by initiating trade between them.

One of the first initiatives to create a gas market in Poland was the launch of the gas release program (PUG). This action, initiated in November 2011 by the President of the Energy Regulatory Office, assumed that the leader on the Polish market, PGNiG group, would make available in an auction mechanism gas covering 70% of the market demand, i.e., about 10.5 billion m3. The auctions were to be carried out through the stock market segment, which was supposed to guarantee the transparency of the mechanism and as part of which a secondary gas market would be created in the next stage. PUG, strongly protested by market participants and industry associations, has not been implemented. At the same time, however, work was underway to implement mechanisms known and tested within the electricity market, which have been implemented since January 2013 as part of the Transmission Network Code (IRiESP). Creating the conditions for gas trade in the so-called “virtual gas trading point,” i.e., in isolation from the physical location of the receiving point on the network. This provision made it possible to conclude transactions without physical delivery, thus becoming a catalyst for further changes both in the adjustment segment of the stock market segment and in regulatory matters. The next step was the release of licensed energy enterprises from the obligation to submit tariffs for gaseous fuels for approval, in terms of their sale to energy enterprises purchasing them for resale, which was tantamount to the statement that the wholesale gas trading area meets the conditions of the competitive market.

Gas trading as a part of the stock exchange segment in Poland began on 20 December 2012 and was the first practical effect of work on launching the gas market. In 2013, as part of the Polish Power Exchange, the SPOT trading floor enabled trading through a continuous trading system and a forward transaction package, under which participants were able to trade monthly, quarterly and trade annual BASE contracts. The relatively low interest in contracting gas through the exchange was the reason for the amendment to the Energy Law, which resulted in the introduction of the so-called “exchange obligation” meaning the obligation for gas entering the transmission network of at least 30%, 40%, and 55% for 2013, 2014, and 2015, respectively. To meet the market needs and adjusting the offer in other member countries (e.g., TTF, Gaspool, NCG), in 2014 a seasonal product was additionally introduced and contract quotations were launched: weekend and weekly. Following the example of other European solutions, the current transaction segment has also evolved.

In June 2014, fixing was launched, and the Intraday hourly market was inaugurated in the second half of the year. It was a natural evolution of the stock market segment, consisting of the gradual introduction of further products in accordance with the demand reported by market players. Market mechanisms functioning in Poland due to the connection of systems with neighboring countries enable active participation and commercial involvement on foreign exchanges and hubs as well as cross-border profiles also in the field of contracting with physical delivery. Price spreads between markets, market liquidity and gas supply costs play a key role in these trading processes. Due to the large import and export possibilities, the developed and highly liberalized market and one of the largest stock exchanges in Europe—European Energy Exchange—the German gas market significantly affects the price level in Poland [18].

Bearing in mind the above process of gas market liberalization, it became possible to change the seller of blue fuel, which in turn led to a change in the gas market structure.

3.2. Gas Market in Poland—Structure

The structure of the natural gas sector in Poland includes entities conducting the following types of activities [19]: (1) transmission (TSO), (2) distribution (NOSD), (3) trading, (4) storage, and (5) exploration and extraction. The structure of the gas sector is highly monopolized. This is due to the dominance on the market of one capital group, which is PGNiG, which directly or through subsidiaries conducts all of the above-mentioned types of activity, covering 98% market of its business range. Therefore, gas prices are subject to tariffs and approval by the President of the Energy Regulatory Office [20].

3.2.1. Transmission

Gas-transmission in the Polish gas system is handled by Gaz-System S.A., which is also the Gas Transmission System Operator (TSO). The Polish gas transmission system includes transmission gas pipelines with a total length of over 9700 km, 14 compressor stations, 56 gas nodes, and 974 exit points. The supervision over the gas transmission system is exercised by the National Gas Disposal and Branch Gas Dispositions.

3.2.2. Distribution

Gas distribution in the Polish gas system is handled by Polska Spółka Gazownictwa Sp. z o.o.(PSG) from the PGNiG Group, which is also the National Gas Distribution System Operator. Polska Spółka Gazownictwa is the largest company of the PGNiG Group. It employs over 11 thousand employees, operates throughout Poland and distributes gas through over 180,000 km of gas pipelines. PSG is also the largest gas distribution system operator in Europe. The tasks of PSG include conducting network traffic, expansion, maintenance, and repairs of networks and devices, measuring the quality and quantity of gas transported.

3.2.3. Trading

This activity involves gas trading that is extracted from domestic deposits or imported. The largest gas sellers on the domestic market are companies from the PGNiG Group: PGNiG S.A., PGNiG Obrót Detaliczny Sp. z o.o. At the end of 2018, 197 entities had a concession for trading in gaseous fuels, compared to 200 at the end of 2017. However, 102 enterprises actively participated in trading in natural gas. Gas trading companies outside the PGNiG S.A. obtained 97.1 TWh of natural gas [20].

3.2.4. Storage

There are seven underground gas storage facilities in Poland, which are located in Brzeźnica, Husów, Mogilno, Strachocin, Swarzów, Wierzchowice and Kosaków, which belong to PGNiG S.A. To implement the legal obligation to unbundle the PGNiG S.A. storage system operator created a dedicated company—Gas Storage Poland Sp. z o.o., whose main subject of activity is performing the tasks of a storage system operator. The company provides storage capacity and capacity in a way that optimizes its use.

3.2.5. Exploration and Extraction

This activity consists of obtaining hydrocarbons from deposits and preparing them for sale. It covers the entire process of exploration and extraction of natural gas from deposits, ranging from geological analyzes, geophysical surveys, and drilling, to the development and exploitation of deposits. Part of the nitrogen-rich gas produced is further processed into high-methane gas at the PGNiG SA denitrification plants in Odolanów and Grodzisk Wielkopolski. As a result of cryogenic processing of nitrogen-rich gas, PGNiG, in addition to high-methane gas, acquires products such as liquefied natural gas LNG, liquid and helium gas, and liquid nitrogen. The capacity of two gas storage facilities at UGS Daszewo and UGS Bonikowo is used in this activity. PGNiG Upstream Norway AS, PGNiG Upstream North Africa B.V., Geofizyka Toruń Sp. z o.o. operate in the exploration and production area. Apart from PGNiG, such activities are also carried out by Petrobaltic S.A. having an exclusive license to explore for and exploit hydrocarbon deposits in the Polish maritime area covering approximately 30,000 km2, EuroGas Polska Sp. z o.o., FX Energy Poland Sp. z o.o., RWE Dea Polska Oil Sp. z o.o., CalEnergy Gas Polska Sp. z o.o., CalEnergy Gas Polska Sp. z o.o. and Energia Zachód Sp. z o.o.

Taking into account the wholesale market, purchases of gas from abroad in the amount of 163.5 TWh were supplemented with gas from domestic sources in the amount of 42.4 TWh. Total gas supplies from abroad in 2018 included import and intra-community acquisition. In 2018, imports from the East continued to be a significant part, carried out under a long-term contract concluded between PGNiG S.A. and Gazprom. In 2018, 557.1 TWh of high-methane gas and 8.3 TWh of nitrogen-rich gas flowed through the Polish transmission system. Most of the high-methane gas was transited via the Yamal pipeline [20].

3.3. Gas Market in Poland—Characteristics

As mentioned before, the sale and purchase of gaseous fuels on the Polish wholesale market takes place primarily on the commodity exchange operated by the Polish Power Exchange. Stock market participants are mainly gas trading companies and the largest end recipients, who can act independently after concluding an appropriate agreement with TGE, becoming exchange members, or through brokerage houses. Exchange trading takes place through the conclusion of sales contracts (transactions) between exchange members. The subject of trade on the gas commodity futures market (RTTg) is the supply of gas in the same quantity at all times of the delivery period following the instrument standard (weekly, monthly, quarterly, and annual). The subject of trading on the next day gas market (DAMg) is a gas supply in equal quantities at all times of the delivery day. It is a base instrument and one contract corresponds to the supply of 1 MWh of gas in each hour of the delivery day. Trading is carried out for one day preceding the delivery date, in the fixing and continuous trading system. Trading on the intraday market (RDBg) is conducted in the continuous trading system. In 2018, the President of the Energy Regulatory Office also monitored transactions concluded at a virtual point on the OTC (bilateral) market. As a result of the contracts concluded at this point on the OTC market, regardless of the date of the contract, 28.0 TWh of natural gas was delivered at an average price of PLN 95.04/MWh [17].

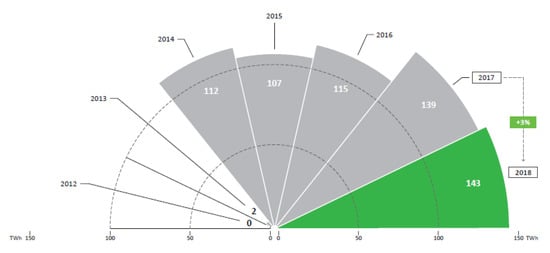

The natural gas market on the Polish Power Exchange is young compared to the electricity market. Turnover in 2012–2013 was minimal. Starting in 2014, the scale of trade exceeded 50% of domestic gas consumption. As with electricity, 2018 was a record year. Turnover at 143 TWh was higher than recorded in the record-breaking 2017 by 3% [21]. Natural gas trading volumes in the years 2012–2018 have been presented in the Figure 1.

Figure 1.

Natural gas trading on the Polish Power Exchange (TGE) 2012–2018 [17].

Active participation in market liberalization, constant expansion offers and trust have led to the formation in Poland, the largest natural gas trading platform in the region. Addressing the domestic market with a volume of 8.1 TWh, it can be stated that TGE is a trading platform for all domestic recipients. TGE offers on the spot market currently base and weekend products. TGE also offers products on the futures market base weekly, monthly, quarterly, seasonal, and annual with physical delivery as shown on the Figure 2.

Figure 2.

Gas products on the Polish Power Exchange [21].

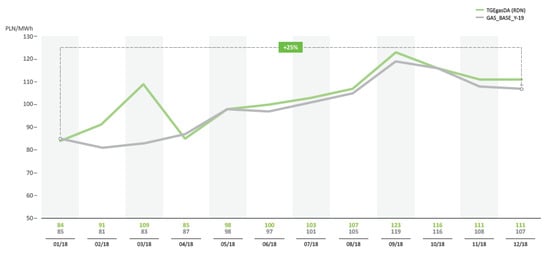

Natural gas prices, like electricity prices, increased in 2018, although the growth rate was more than twice lower. The average monthly price of the contract with delivery in 2019 was December 2018 25% higher than in January (Figure 3).

Figure 3.

Average monthly natural gas price on the spot market [21].

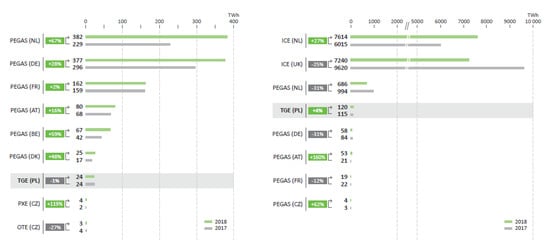

European natural gas markets have different characteristics. In Poland, it operates relatively the small spot market, with the majority of trading taking place on the futures market. Accordingly, the volume of natural gas trading on the futures market is higher than in the German or French markets. The highest turnover has traditionally been recorded in Dutch and British markets (Figure 4).

Figure 4.

Natural gas trading volume on selected exchange spot markets (left) and commodity derivatives (right) in Europe [21].

The analysis of the retail market for gaseous fuels was performed separately for high-methane, nitrogen-rich and LNG—based on annual monitoring of trading companies. The analysis showed that the total sales of high-methane and nitrogen-rich gaseous fuel to end-users in 2018 amounted to 206,161,845 MWh. Compared to 2017, gas consumption increased, mainly by industrial customers. Sales of gas to end users were dominated by entities from the PGNiG S.A. The share of these entities amounted to 82.08% and increased compared to the previous year by approximately 2%. The observed increase in the share of the PGNiG S.A. in the sale of gas to end users, persisting since 2017 resulted from a decrease in gas imports from abroad directly by large (industrial) end customers for own needs and purchase from the PGNiG S.A. This was mainly due to changes in legal regulations regarding the need to maintain mandatory reserves. The remaining 17.92% of gas sales to final customers were made by other trading companies selling to final customers in the country. The President of the Energy Regulatory Office also monitored the sale of liquefied gas (LNG) in 2018. LNG acquisition was 38,388,704 MWh, the majority of which was obtained through the LNG terminal in Świnoujście. Most of the acquired LNG gas was sold to end users after regasification and the introduction of the obtained high-methane gas into the gas network. The volume of LNG sales to end-users in the liquefied form amounted to approximately 423,887 MWh and was realized only by alternative sellers [21]. Currently, 197 entities have a concession for trading in gaseous fuel from which 102 enterprises actively participate in trading in natural gas.

The above-described change in the gas market towards its liberalization and the presented market characteristics show the direction of its development. This means, among others the ability to change the seller i.e., looking for the best alternative for end-users. This is understood by the Third-Party Access (TPA) right. The Internal Market in Electricity Directive envisages the third-party access right as a crucial element of the organization of access to the energy infrastructure system in Europe and as the main instrument for opening the Internal Energy Market to competition. Where the owner of a pipeline or electricity network is obliged to transport gas, crude, or electricity in a non-discriminatory way—i.e., for any third party at the same rate as all other users.

It is therefore worth looking at the other side of the market towards gas consumers who are seeking for the most effective buying strategies.

3.4. Metropolitan Gas Purchasing Group

It is worth analyzing the unique case of the gas purchasing group created by the GZM Metropolis (GZM).

3.4.1. GZM Metropolis

GZM was established on 1 July 2017 and began operating on 1 January 2018. The organization, by virtue of law prepared especially for the region, brings together 41 cities and municipalities inhabited by a total of nearly 2.3 million people [22]. The creation of the Metropolis is the result of many years of efforts of local government officials, who have often proved that they want to cooperate. They were aware that one, even the largest and richest, but functioning independently, city would not be as strong and would not have as much to offer as the synergy of the potential of more cities and municipalities. Coopetition, i.e., simultaneously occurring cooperation and competition between cities, has been officially formalized thanks to the Act [23] dedicated to the Metropolis. There are about 240,000 companies and enterprises in GZM that generate about 8% of the country’s GDP. The Metropolis lies on the route of main national and international routes, both road and rail. The Katowice-Pyrzowice International Airport operates in the north of the Metropolis. It is an economic center, being a shopping and service center with a significant share of production activity. It is also a center of concentration of specialist medical services, academic, cultural, religious, and sports functions. The GZM Metropolis lies at the intersection of two trans-European transport corridors, which creates opportunities for the development of innovative companies and new areas of the economy. The extensive road infrastructure and the presence of the Katowice International Airport in Pyrzowice enable access to many markets and positively affects the mobility of residents. There are twenty-eight universities in the metropolis. The dynamic development of the knowledge-based economy at GZM has solid foundations and support from valued educational and scientific centers, i.e., the Silesian University of Technology, WSB University, University of Economics, University of Silesia, Silesian Medical University, Academy of Fine Arts [22].

3.4.2. Gas Purchasing Group

Purchasing groups (PG) are strategic projects for GZM. First, they are characterized by the specifics of conducting the order process in accordance with applicable law for public administration, and secondly, the group’s volume is unmatched by the country’s scale—this is the largest gas purchasing group in Poland. Among their participants there are the municipalities of GZM, including City Halls, Municipal Companies, Housing Cooperatives, City Cleaning Plants, City Hospitals, Educational Institutions such as Schools, Kindergartens, Nurseries. Due to formal and legal conditions arising from the formal documents, for a purchasing group to be formally constituted, its members must sign an appropriate agreement containing the details of cooperation.

The largest in Poland, GZM gas purchasing group that was to buy almost a 225 GWh of gas for the years 2019–2020 was created by 25 municipalities servicing 517 organizational units (1.025 gas consumption points). The subject of the tender procedure was the purchase of gas in the period from 1 January 2020 to 31 December 2021 (with some units being purchased later due to existing contracts) in the amount of 222,184 MWh, and the estimated value of the contract was PLN 46 million (excluding VAT), including PLN 12.2 million—the cost of gas distribution. The estimated value of the contract was determined based on PGNiG’s basic price list applicable at the time the documentation was being prepared. This price was 13.386 gr/kWh net for the W-1 to W-4 tariff groups, 13.360 gr/kWh for the W-5 tariff group, and 13.006 gr/kWh for the W-6 tariff group.

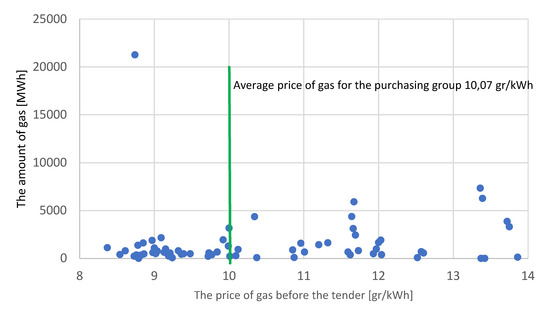

Analyses and obtained offer showed that the municipalities of the GZM will save over PLN 3 million. The costs obtained within the joint tender procedure are lower than the average prices before the tender announcement by around 11%, and from the supplier’s standard price list by around 33%. The average price per 1 kWh which the Metropolis received in its tender was 8.9 gr. In contrast, the average price before this procedure, which was paid by entities participating in the joint purchase, was by 11%. higher and amounted to 10.07 gr/kWh. Taking into account the PGNiG standard price list, then in this period, the average price was 13.3 gr/kWh. This means that the amount obtained by the purchasing group is about 33 percent lower. After the tender by GZM, it also turned out that one of the entities, which at the same time conducted individual proceedings regarding the purchase of gas, obtained a price of over PLN 0.10 for 1 kWh. It is 27% more expensive than the GZM offer.

Before the tender procedure, there was a various state of how to buy gas by the cities and other actors that formulated the Purchasing Group. Several municipalities had already conducted tenders for the purchase of gaseous fuel, including the largest one—Katowice. However, the overwhelming number of units bought fuel gas from PGNiG based on individual contracts, without exercising the TPA right. These agreements often included price annexes setting prices other than the PGNiG base price list. An overview of the price situation in pre-bid contracts is shown in Figure 5. It is also worth noting that a deep analysis of the invoices of all the Purchasing Group members was conducted for one year (2018). Because the gas price on the wholesale market increased in 2019 (compared to 2018) pre-bid prices were higher in those cases where price annexes were signed with PGNiG. Only a few entities had a better price than the one obtained in the tender, but taking into account the growing price trend on the gas wholesale market, the price achieved by the Purchasing Group was considered a success. The analysis of the effects obtained thanks to the joint tender for the purchase of gas indicates that the estimated savings obtained in the purchasing group are different for individual customers due to different prices pre-bidding. The largest savings occur with those contracting entities who had basic price list prices. For some cities, we can see that the price they obtained in the purchasing group tender did not change significantly with respect to the contracts they signed themselves. Nevertheless, we can say that they will also save relatively, because gas prices in 2019 increased compared to last year. Even obtaining prices at a similar level as a year or two ago should be considered a success, because it gives stability and a guarantee that the price will be maintained until 2021.

Figure 5.

The amount of gas and the purchase price of gas.

Before the tender, there was a very different state of how to buy gas. Several municipalities have already conducted tenders for the purchase of gas (including the largest one conducted by the City of Katowice). However, the overwhelming number of units bought gas from PGNiG based on individual contracts, without exercising the TPA right. These agreements often included price annexes setting prices other than the PGNiG base price list. The average unit price of gas for the facilities participating in the procedure determined from the data on invoices was 10.07 gr/kWh.

One bid was submitted in the tender procedure and the contractor who submitted the bid was PGNiG Obrót Detaliczny Sp. z o. o. Gross price of the offer reached PLN 38,310,906.22. The unit price of gas presented in the offer was 8.959 gr/kWh and is the same for all tariff groups in both years covered by the purchase. Differentiated for tariff groups occurs in subscription fees. In the period preceding the submission of the offer, gas fuel prices at the Polish Power Exchange were 8.190 gr/kWh for 2020 and 9.035 gr/kWh for 2021. Taking into account the need to add mandatory components to gas prices, the seller’s margin including subscription fees did not exceed 3%. It should be acknowledged that even though only one offer was received in the proceedings, the competitive gas market mechanisms worked for the tender.

The biggest advantage of the Purchasing Group was, firstly, the volume ordered and, secondly, the number of group members. The volume reaching almost 225 GWh excluded irrelevant players on the market, but the effect of the scale showed that only the largest player on the Polish gas market decided to make the final offer. However, it is worth noting that other players visible on the market were asking questions about the procedure, also the interest in the bidding procedure was visible. What is more, a large number of group members was a significant factor affecting a favorable offer due to the desire to acquire and keep such large groups of clients for 2 years. This is an undoubted advantage in terms of sales and customer service from the perspective of the bidder. The scale of the proceeding has eliminated small players, giving the opportunity the greatest ones. Finally, one offer in the tender procedure turned out to be very competitive to the prices bidding before the proceeding, despite the price increase on the gas market, which confirms the legitimacy of creating a purchasing group, which became possible thanks to gas market liberalization.

4. Conclusions

Due to the key synthesis of both theoretical and research results based on the behavior of the purchasing group members, it can be concluded that the implemented strategy directly falls under the definition of coopetition adopted for these considerations by Bengtsson and Kock [3]. The above, in turn, gives an affirmative answer to the research question regarding the identification of coopetition in public administration. What is more, the analysis allowed us to classify the identified coopetition, thus answering question 1a. In the discussed case, the Metropolitan Gas Purchasing Group presents coopetition:

- Horizontal (occurring between the cities—competitors on the market)

- Deliberate (aware and formalized)

- Network (more than two participants)

- Complex (more than one link in the value chain)

Answering the 1b research question led to achieving the main purpose of the article showing the measurable effects of coopetition within the Metropolitan Gas Purchasing Group which directly contributes to solving the research problem posed in the article. The development of the gas market, seen also in its other branches [24,25,26,27], allowed changing the seller and organizing a Purchasing Group. The bid unit price of gaseous fuel is lower than the average price before the tender by 11%, lower than the price contained in the PGNiG price list by 33%. In relation to the prices in individual units, the differences in prices range from +2.5% to −33%. Estimated savings obtained from the tender are different for individual awarding entities due to different prices prevailing before the tender which is also the confirmation for the coopetition definition applied for this analysis. The largest savings occur with those municipalities who had the basic price list prices. In the case of the City of Katowice, there are no savings, but the price remains almost unchanged (increase by 2.5%) for the next 2 years. The amount of savings compared to the average price before the tender is PLN 3.036 million. The amount of savings calculated in relation to the PGNiG OD standard price list is PLN 12.10 million.

The premise for interest in the issues raised in this article was emerging in the literature, the importance of coopetition and its impact on collective results as well as observations of the real behavior of public sector entities. Combining limited achievements empirical, identified research gaps and implications postulated in coopetition literature [4], scientific exploration in this area confirms its relevance and validity, in particular, in the context of collective benefits that cooperation can bring competitors in the public administration.

There are many benefits of coopetition presented and described in the literature. In the case discussed in the article, it is worth emphasizing the essence of rational use of resources and economies of scale while optimizing economic indicators. The scale effect is unique due to the number of participants in the presented project and its scope. There is no larger gas purchasing group in Poland. Therefore, there is economic and organizational justification for preparing and carrying out one procedure, which in turn allows reducing operating costs associated with the gas purchase process, compared to the situation where each entity wanted to act alone. The joint operation is the purchase of a total volume for the entire group, which in turn should ensure favorable prices. Additional benefits resulting from the functioning of this solution are: an information and organizational center for all group entities along with constant consultation and substantive support for coordinators from all group members, increasing energy awareness among the group members and connecting not only municipalities within the GZM but also other market players participating in the project.

Based on the literature review and presented case study, the goals of seeking benefits among coopetitors seem promising because they provide explanations for the rationale for simultaneous competitive and cooperative behavior, unilateral search for annuity and collective actions, as well as adaptive actions especially within the purchasing groups which are possible to create in the light of gas market functioning in Poland. Taking into account all the above mentioned, a systematic scrutiny of the literature sheds light on several gaps. A first general issue in coopetition research is a lack of presenting collective results within the public sector—this gap is fulfilled by the author with the analyzed case study. Secondly, further research should address the involvement issue—what are the real premises encouraging competitors to cooperate? Exogenous pressures, separation of collaborative and competitive activities, or organizational ambidexterity hold the promise of better explanations. This thread of research may shed additional light both on coopetition antecedents and on the coopetition process on its own. Thirdly, coopetition outcomes need to be brought into light—beyond innovation, market, and financial performance other variables such as growth, survival, or speed to market can be explored.

Funding

This research received no external funding.

Conflicts of Interest

The author declares no conflict of interest.

References

- Robert, F.; Marques, P.; Le Roy, F. Coopetition between SMEs: An empirical study of French professional football. Int. J. Entrep. Small Bus. 2009, 8, 23–43. [Google Scholar] [CrossRef]

- Brandenburger, A.M.; Nalebuff, B.J. Co-Opetition; Doubleday Currency: New York, NY, USA, 1996. [Google Scholar]

- Bengtsson, M.; Kock, S. Cooperation and competition in relationships between competitors in business networks. J. Bus. Ind. Mark. 1999, 14, 178–191. [Google Scholar] [CrossRef]

- Czakon, W.; Mucha-Kuś, K.; Rogalski, M. Coopetition Research Landscape—A Systematic Literature Review 1997–2010. J. Econ. Manag. 2014, 17, 121–150. [Google Scholar]

- Ritala, P.; Hurmelinna-Laukkanen, P. What’s in it For Me? Creating and Appropriating Value in Innovation-Related Coopetition. Technovation 2009, 29, 819–828. [Google Scholar] [CrossRef]

- Okura, M. Coopetitive Strategies of Japanese Insurance Firms—A Game Theory Approach. Int. Stud. Manag. Organ. 2007, 37, 53–69. [Google Scholar] [CrossRef]

- Czakon, W.; Mucha-Kuś, K.; Sołtysik, M. Coopetition strategy—What is it in for all? Int. Stud. Manag. Organ. 2016, 46, 80–93. [Google Scholar] [CrossRef]

- Mucha-Kuś, K. Strategia koopetycji. Innowacyjne połączenie konkurencji i współdziałania. Przegląd Organ. 2010, 2, 9–12. [Google Scholar]

- Mariani, M. Coopetition as an Emergent Strategy. Empirical Evidence from an Italian Consortium of Opera Houses. Int. Stud. Manag. Organ. 2007, 37, 97–126. [Google Scholar] [CrossRef]

- Tidström, A. Causes of Conflict in Intercompetitor Cooperation. J. Bus. Ind. Mark. 2009, 7, 506–518. [Google Scholar] [CrossRef]

- Dagnino, G.; Le Roy, F.; Yami, S.; Czakon, W. Strategie koopetycji–nowa forma dynamiki międzyorganizacyjnej. Przegląd Organ. 2007, 6, 3–7. [Google Scholar]

- Hakanson, H.; Snehota, I. No Business is an Island: The Network Concept of Business Strategy. Scand. J. Manag. 2006, 5, 187–200. [Google Scholar] [CrossRef]

- Meehan, J.; Ludbrook, M.N.; Mason, C.J. Collaborative public procurement: Institutional explanations of legitimised resistance. J. Purch. Supply Manag. 2016, 22, 160–170. [Google Scholar] [CrossRef]

- Patrucco, A.S.; Walker, H.; Luzzini, D.; Ronchi, S. Which shape fits best? Designing the organizational form of local government procurement. J. Purch. Supply Manag. 2018. [Google Scholar] [CrossRef]

- Fonte, M. Food consumption as social practice: Solidarity Purchasing Groups in Rome, Italy. J. Rural Stud. 2013, 32, 230–239. [Google Scholar] [CrossRef]

- Congress. Available online: https://www.acv.at/presse/Gastroenterology_Congress.pdf?5i85ar (accessed on 26 September 2019).

- Polish Power Exchange. Available online: https://tge.pl/dane-statystyczne (accessed on 28 September 2019).

- Sołtysik, M.; Mucha-Kuś, K. Strategie handlu gazem–analiza przypadków. Mater. Konf. VI Konferencji Nauk.-Tech. Energetyka Gazow. 2016, I, 67. [Google Scholar]

- CIRE. Available online: https://rynek-gazu.cire.pl/st,43,287,tr,32,0,0,0,0,0,struktura-rynku.html (accessed on 26 September 2019).

- Energy Regulatory Office. Available online: https://www.ure.gov.pl/ (accessed on 26 September 2019).

- Polish Power Exchange (TGE), Report. 2018. Available online: https://tge.pl/statistic-data (accessed on 17 December 2019).

- The Socio-Economic Potential of Metropolis GZM. PwC Advisory sp. z o.o. sp.k., Report. 2019. Available online: http://metropoliagzm.pl/wp-content/uploads/2019/02/GZM_raport.pdf (accessed on 17 December 2019).

- Ustawa z dnia 9 marca 2017 r. o związku metropolitalnym w województwie śląskim. Available online: http://prawo.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU20170000730 (accessed on 18 December 2019).

- Adamus, W.; Florkowski, W.J. The evolution of shale gas development and energy security in Poland: Presenting a hierarchical choice of priorities. Energy Res. Soc. Sci. 2016, 20, 168–178. [Google Scholar] [CrossRef]

- Johnson, C.; Boersma, T. Energy (in) security in Poland the case of shale gas. Energy Policy 2013, 53, 389–399. [Google Scholar] [CrossRef]

- Koltsaklis, N.E.; Dagoumas, A.S. State-of-the-art generation expansion planning: A review. Appl. Energy 2018, 230, 563–589. [Google Scholar] [CrossRef]

- Stygar, M.; Brylewski, T. Contemporary low-emissions hydrogen-based energy market in Poland: Issues and opportunities, part I. Int. J. Hydrog. Energy 2015, 40, 1–12. [Google Scholar] [CrossRef]

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).