Abstract

For many years, the United Arab Emirates has been using its natural resource wealth to develop infrastructure and attain economic growth. Nevertheless, human capital theory stresses the importance of human capital to reach sustainability in the long-term. This study examines the impacts of natural resource rents and institutional quality on human capital by applying the cointegration and error correction model based on the autoregressive distributed lag (ARDL) approach. The study uses corruption and law and order as proxies for institutional quality. The results indicate that one percent increases in resource rents and corruption decrease the human capital by 0.16% and 0.14%, respectively, in the long-term. Moreover, in the short-term, the current corruption and lag of resource rents have significant negative impacts on human capital. However, law and order has a positive impact on human capital in both the short and long-term. Thus, this study suggests that there is an instant need to prioritize education to reach long-term sustainability.

1. Introduction

The economic history of resource-rich countries shows varied evidence of how natural resources affect economic growth. These resources are considered as either an engine of growth or an obstacle to growth [1]. These two pieces of evidence prove and disprove the resource curse theory, respectively, as this theory is based on the argument that natural resources harm growth [2]. However, economic theory proposes that natural resources improve the production potential, thus boosting economic growth [3].

The mere existence of natural resources does not prompt economic stagnation, yet it causes certain distortions, which then act as transmission mechanisms that, in turn, disturb economic growth. Thus, these transmission mechanisms affect growth directly, while natural resources merely exert indirect effects via the transmission mechanisms, such as declines in human capital and government mismanagement [4]. Besides, the traditional view under a policy perspective focuses on the monetary aspects of development: The growth rate and level of gross domestic product per capita (per capita GDP) [5]. However, the interest in non-monetary outcomes has increased rapidly [6,7,8,9,10] which supports the need for a better understanding of how natural resources affect human development. After observing these two areas in the literature, we proposed this study to investigate the impact of natural resources on human capital along with per capita GDP, corruption, and law and order as control variables in one of the major petroleum-exporting countries.

Human capital represents the skills and knowledge that individuals build, maintain, and practice [11,12], and it is a necessary element for rapid economic growth and development across the globe, because it improves the quality of living conditions by increasing the efficiency of workers, fostering democracy, creating good governance, and enhancing equality [13,14,15]. A number of studies have observed the effect of human capital on economic performance, and the majority have found that human capital positively affects economic performance [16,17,18,19,20].

There has been an upsurge of interest regarding the relationship between natural resources and human capital, and a negative link between resource abundance and economic growth to deteriorating human capital in resource-rich countries has been traced [1,8,9,10,21,22]. The principal argument that explains how rents from natural resources, as measured by income from oil, gas, and minerals, tend to deteriorate human capital is related to the false sense of security and overconfidence that natural resource rents deliver for both the government and the people. Consequently, this retards the incentive to invest in human capital and be locked in low skilled jobs, leading to low growth. According to [4], countries that consider natural resources as their most relevant asset are prone to neglect human capital development by allocating low attention and financial resources to it.

Despite these conclusions, the literature is deficient on how other important factors in a resource-rich economy could affect human capital, such as the institutional quality and per capita GDP. It is crucial to understand the complex dynamics of the resource curse from a different perspective, since natural resources should not be the only factor that ruins or enhances human capital in a resource-rich country. However, few studies have examined this scenario by looking at the direct and indirect links between natural resources and human development via institutional quality [23,24,25,26].

Based on this argument, our study questions whether institutional quality has any link to human capital as a clarification step to give a full picture of the relationships that may exist among the selected variables. It is observed that good institutional quality is essential to support human capital development [20], as an enhancement in human capital may not necessarily be linked to major improvements in growth if the country has weak institutional quality [27].

The present study constructs objectives based on different factors; since it has been agreed that human capital is essential for growth, the number of studies are limited in this field, and the resource curse has different “strains” according to national circumstances. So, the objective is to test whether there is evidence of the resource curse for human capital along with per capita GDP and institutional quality as control variables in one of the major petroleum exporting countries, the United Arab Emirates, which, to date, has not received attention in the literature.

To our knowledge, this is the first study to examine the short and long-term effects of natural resources on human capital in the United Arab Emirates (UAE). It is interesting for an international audience because an oil-rich country like the United Arab Emirates is a prime candidate for the undesirable effects of the resource curse and, as such, provides useful results for policymakers.

2. Data and Research Methodology

2.1. Data and Variables Description

This study takes the per capita GDP, resource rents, and institutional quality as independent variables and the human capital as a dependent variable. The descriptions and the rationale of choosing these variables are as follows:

Human capital (HC) is challenging to measure, but it is often regarded as the accumulation of education in a country [28]. Human capital theory explains how education is a significant source of human capital, which, in time, is an important component in the economic growth of any country [29]. The present study took the human capital index for the period of 1984–2014, based on the average number of schooling years and rate of return in terms of education from the Penn world table [30] version 9, as also used by [31].

The per capita GDP (PGDP) was used as an indicator, following several studies that considered PGDP as a proxy for the degree of development in a country [32,33,34,35]. There is a strong link between PGDP and human capital. High national income is used to allocate more resources to improve human capital and to support an institutional environment that encourages learning and schooling [36,37]. Data on PGDP from 1984–2014 were retrieved from the world development indicators (WDI) provided by the world bank (2017) for the period 1984–2014. PGDP is measured in US dollars and divided by the population of each country for the said period to get the per capita GDP; the population data were obtained from the world bank (2017). PGDP was also used by [38,39].

Natural resource rents (NRR) were detangled in this study. One point of view holds that resources are seen to discourage the society to invest on education and to obtain high skills because people can get jobs with less skills in resource-based sectors [4,40]. The other point of view is that resource-rich countries have the capacity to invest and spend more on education to increase human capital. To estimate this phenomenon, the present study used resource rents (RR) as independent variable to check the impact of non-renewable natural resources on human capital. The total natural resource rents (% of GDP) data from 1984–2014 were taken from the world development indicators (WDI) provided by the world bank (2017). The natural resource rents was defined as the total percentage of GDP associated with sales of natural resources (World Bank, 2017) in accordance with [4,22,41,42,43,44,45,46].

Institution Quality (IQ), in the form of corruption and weak law and order, hinders human capital development [47,48,49] This study used corruption (CRP) and law and order (LO) as proxies for institutional quality (IQ) following [34,50,51,52,53], and data from 1984–2014 were taken from the international country risk guide (ICRG) by the PRS Group [54]. The CRP variable assesses the level of corruption within a political system and includes financial corruption, e.g., demands for special payments and bribes in connection with import and export licenses, exchange controls, tax assessments, excessive patronage, nepotism, or secret party funding [34,55]. As stated by [51]. LO reflects “the degree to which the citizens of a country are willing to accept the established institutions to make and implement laws and adjudicate disputes”. In ICRG, “law and order” has a scale from 0–6 and corruption is measured as “control of corruption” on a scale from 0–6. The measure of corruption was inverted to represent “corruption” in this paper, which is a similar approach to that taken by [42]. The descriptive statistics are given in Table 1.

Table 1.

Descriptive statistics.

2.2. Theoretical Model

To determine whether resource rent growth is inclusive or exclusive, this study tested the impact of resource rents on human capital:

where HC is the human capital, RR is the resource rents, Crp is corruption, LO is law and order, and PGDP is the per capita GDP.

2.3. Empirical Model and Estimation Procedure

This section describes the empirical investigation of the impacts of resource rents and institutional quality on human capital. Thus, Equation (1) is written as follows:

where is constant, is the error term, and …, are parameters.

2.4. Autoregressive Distributed Lag Model

To derive the short- and long-term results, this study applied the autoregressive distributed lag model (ARDL). The general form of the ARDL model of Equation (2) is as follows:

where is the constant, and the terms , , and are the parameters used for short-term analysis, while , , , and are used for estimating long-term parameters. t is the time period and i is the lag length. The Wald restriction test is used to test the long-term relationship or cointegration between the dependent and the independent variables. The value of the F-test is taken by applying the coefficient diagnostic Wald restriction test on long-term variable parameters. The hypothesis for the cointegration test is

The F-test is based on the number of regressors in the model. If the F-stat value is greater than the value of the upper bound, then the null hypothesis will be rejected to conclude that there is cointegration and a long-term relationship exists between the dependent and independent variables. If the value of the F-stat is lower than the value of the lower bound, then the null hypothesis is not rejected, which shows that there is no cointegration means and no long-term relationship exists. Finally, if the F-stat is between the lower and upper bounds, the result is inconclusive.

The order of the lag length in the ARDL model was selected using Akaike’s information criteria (AIC). If the cointegration was statistically significant, then the values of the long-term parameters were found by normalizing the long-term equation and estimating the error correction model for the short-term analysis.

Under the assumption of steady-state conditions, the long-term equation is .

This means that

By applying the above assumption and dividing by , Equation (3) can be written in the long-term form as follows:

Now, by re-parameterizing,

Now , are the long-term parameters, and their values and signs determine the long-term relationships between the dependent variable and the independent variables in the model. For the short-term analysis, the error correction model was used.

2.5. Error Correction Model

When a long-term relationship exists between the variables, then there is an error correction representative model, so the following error correction model was run in the third step:

The coefficient of the determines the speed of adjustment towards equilibrium in case of any disturbance.

3. Results and Discussion

3.1. Unit Root Test

In this study, the level of stationarity and the order of cointegration were checked by applying the augmented Dickey Fuller tests. The results of the unit root test are given in Table 2. It was found that the null hypotheses of the unit root cannot be rejected for PGDP, human capital, law and order, and corruption at the level of stationarity, but these variables were shown to be stationary at first difference. However, the resource rents were shown to be stationary at level I (0).

Table 2.

Results of the augmented Dickey Fuller unit root test.

3.2. Autoregressive Distributed Lag (ARDL) and Bound Test

As the variables follow different orders of integration, ARDL is an appropriate econometric technique to follow. After the ARDL, we applied the cointegration bound test, as shown in Table 3. The results show that all values of F-statistics are higher than the 95 percent confidence interval, and the value for human capital is 33.62; therefore, the long-term relationship was confirmed. We then continued to the cointegration and error correction model results.

Table 3.

Cointegration bound test results.

3.3. Short-Term and Long-Term Results

The equation of human capital was estimated for human capital while controlling corruption, law and order, and per capita GDP, and the results are shown in Table 4. The stability of the model was proven by the error correction term (ECT), which depicts that 10 percent of error is corrected successfully each year.

Table 4.

Impacts of resource rents and institutional quality on human capital.

The results show that the one-year lag resource rent negatively affects the human capital in the short-term, and the same effects appear in the long-term between the resource rents and human capital. This indicates that a one percent increase in resource rents causes a decline in human capital by 0.16 percent in the long-term.

Moreover, current corruption has a negative and significant relationship with human capital in the short-term at the 90 percent confidence interval. Also, corruption has a significant negative effect on human capital in the long-term. This shows that a one percent increase in corruption causes a decline in human capital by 0.14 percent in the long-term and 0.001 percent in the short-term. However, law and order has positive and significant impacts on human capital in both the short- and long-term at a 95 percent confident interval. This reveals that a one percent increase in law and order causes enhancements in human capital by 0.02 percent and 0.27 percent in the short and long-term, respectively. In addition, the lag of per capita GDP shows a significant positive relationship with human capital, while it appears to be insignificant in the long-term.

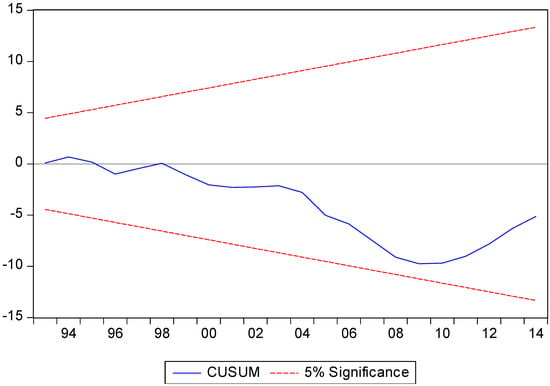

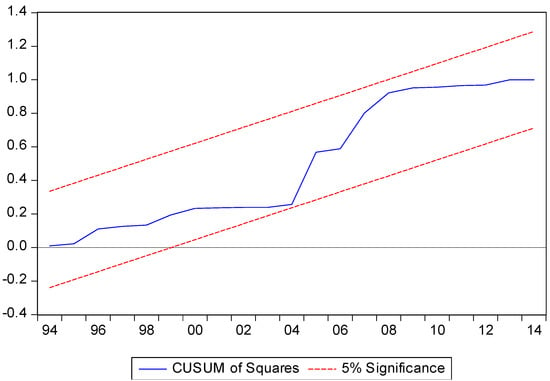

Further, the cumulative sum control chart (CUSUM) and CUSUM of squares tests were applied, and both tests indicated that the model is stable (see Appendix A, Figure A1 and Figure A2).

3.4. Discussion

Natural resources appear to crowd out human capital in the UAE. One possible reason for this is that the huge oil windfalls trigger a false sense of confidence [56] that pushes citizens to ignore their children’s education and causes the government to keep education as a low priority. The results confirm what is known as the social resource curse [1,26,40,57].

In the UAE, corruption is negatively correlated with human capital. In this case, the reason is likely because corruption reduces the funding for human capital, wasting good opportunities and influencing education outcomes. A negative relationship is shown in studies by [33,47,49].

Moreover, since “law and order” positively affects human capital, the results confirm the fact that better institutional quality increases the incentive to learn and raises the skills of the labor force. Similar results were found by [27].

The finding of PGDP and human capital was also realized by [37] The logic behind the positive relationship is that income describes the well-being of individuals, so income growth drives schooling by assigning more resources to education, increasing access to high levels of education and knowledge, and offering more opportunities and expenses for educated workers and education. However, the cause of the insignificancy in the long-term is likely because people are not prioritizing the education sector with the growing level of income in the long-term.

4. Conclusions

This paper investigated the nexus between natural resource rents, institutional quality, and human capital in the United Arab Emirates. The ARDL model and cointegration techniques were used to study the social aspects of the resource curse by taking human capital as the dependent variable.

Natural resource rents appear to crowd out education as a proxy for human capital in the short- and long-term in the UAE. This slows down the pace of the progress of economic development, as human capital is a key driver of growth in any country. This is mainly because natural resources appear to crowd out human capital due to the false sense of security that reduces the incentives of households to educate their children and pushes the government to keep education as a low priority. The results confirm the social resource curse [40,57]. Moreover, corruption deteriorates human capital, while law and order enhance human capital, confirming the fact that good institutional quality encourages learning and skill development.

On the other hand, the lag in income (PGDP) in the UAE contributes positively to human capital, as the higher the income is, the more schooling, knowledge, and experiences are attained. Notwithstanding, a high income is observed to play an insignificant role in enhancing human capital in the long-term.

Presently, natural resources are believed to be a blessing for UAE, since the huge windfalls from these natural resources boost investments, employment, as well as per capita GDP. Yet, deterioration in human capital could turn this blessing into a curse by slowing the pace of economic development. Accordingly, it is suggested that if the UAE desires to continue receiving the full benefits from this blessing, more attention and funding should target human capital through education.

Besides, authorities in the UAE should consider stimulating their economic performance by improving human capital, since higher levels of education can help to achieve efficient management of resources and can shift the comparative advantage from the natural resource sector to the manufacturing sector. The manufacturing sector accelerates what is known as “learning by doing” and demands higher skills and technology, hence guaranteeing diversification and sustainability.

In our study, it was observed that a higher institutional quality enhances education levels in case of the UAE in the short and long-term. Consequently, it is essential to ensure better law and order conditions and control corruption and the overall institutional environment to improve human capital.

All in all, it is believed that exporting natural resources can increase the financial revenue and reduce the budget constraints of government expenditure, even though these revenues are volatile and uncertain. Thus, this study suggests that the government should invest more in education, augment educational opportunities, and encourage the populace to receive education.

5. Limitations and Future Research

This study has potential limitations related to the time period used that have to be noted. The data duration was limited to 30 years, from 1984 to 2014, which represents the full extent of publicly available data. Although the data were adequate to show reliable results under the ARDL approach, more data would have been desirable.

There is scope for comparative studies between resource-rich countries that would allow the effects of natural resources to be explored within different countries, such as a comparison between resource-rich countries in the Gulf and technologically advanced resource-rich countries such as Norway, which have comparable diversification policies. The extension of this study and the application of the model to all Gulf Countries and other resource-rich countries would confirm the generalizability of the results, which is a fundamental element in any study.

Funding

This research has received no external funding.

Acknowledgments

I have to thank my supervisor Andrew Angus for his comments and support during this research.

Conflicts of Interest

The author declares no conflict of interest.

Appendix A. Impact of Resource Rents on Human Capital

Figure A1.

CUSUM stability test.

Figure A2.

CUSUM of squares stability test.

References

- Bravo-Ortega, C.; De Gregorio, J. The Relative Richness of the Poor? Natural Resources, Human Capital, and Economic Growth; World Bank: Washington, DC, USA, 2005. [Google Scholar]

- Sachs, J.D.; Warner, A.M. Natural Resources Abundance and Economic Growth; NBER Working Paper No. 5398; National Bureau for Economic Research: Cambridge, UK, 1995. [Google Scholar] [CrossRef]

- Frankel, J.A. The Natural Resource Curse: A Survey; NBER Working Paper No. 15836; the National Bureau of Economic Research: Cambridge, MA, USA, 2010. [Google Scholar]

- Gylfason, T.; Herbertsson, T.; Zoega, G. A mixed blessing: Natural resources and economic growth. Macroecon. Dyn. 1999, 3, 204–225. [Google Scholar] [CrossRef]

- Moradbeigi, M.; Law, S.H. The role of financial development in the oil-growth nexus. Resour. Policy 2017, 53, 164–172. [Google Scholar] [CrossRef]

- Kurtz, M.J.; Brooks, S.M. Conditioning the “Resource Curse”: Globalization, Human Capital, and Growth in Oil-Rich Nations. Comp. Political Stud. 2011, 44, 747–770. [Google Scholar] [CrossRef]

- Cockx, L.; Francken, N. Extending the concept of the resource curse: Natural resources and public spending on health. Ecol. Econ. 2014, 108, 136–149. [Google Scholar] [CrossRef]

- Shao, S.; Yang, L. Natural resource dependence, human capital accumulation, and economic growth: A combined explanation for the resource curse and the resource blessing. Energy Policy 2014, 74, 632–642. [Google Scholar] [CrossRef]

- Cockx, L.; Francken, N. Natural resources: A curse on education spending? Energy Policy 2016, 92, 394–408. [Google Scholar] [CrossRef]

- Faria, H.J.; Montesinos-Yufa, H.M.; Morales, D.R.; Navarro, C.E. Unbundling the roles of human capital and institutions in economic development. Eur. J. Political Econ. 2016, 45, 108–128. [Google Scholar] [CrossRef]

- Armstrong, M. A Handbook of Human Resource Management Practice, 10th ed.; Kogan Page Limited: London, UK, 2006. [Google Scholar]

- Romer, P.M. Endogenous Technological Change. J. Political Econ. 1990, 98, 71–102. [Google Scholar] [CrossRef]

- Barro, R.J. Determinants of Economic Growth: A Cross-Country Empirical Study. Foreign Aff. 1997, 76, 154. [Google Scholar]

- Aghion, P.; Caroli, È.; García-Peñalosa, C. Inequality and Economic Growth: The Perspective of the New Growth Theories. J. Econ. Lit. 1999, 37, 1615–1660. [Google Scholar] [CrossRef]

- Romer, P.M. Increasing Returns and Long-Run Growth. J. Political Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef]

- Krueger, A.B.; Lindahl, M. Education for Growth: Why and for Whom? J. Econ. Lit. 2001, 39, 1101–1136. [Google Scholar] [CrossRef]

- Temple, J. Growth Effects of Education and Social Capital in the OECD Countries. Hist. Soc. Res. 2001, 27, 5–46. [Google Scholar] [CrossRef]

- Sala-I-Martin, X.; Doppelhofer, G.; Miller, R.I. Determinants of Long-Term Growth: A Bayesian Averaging of Classical Estimates (BACE) Approach. Am. Econ. Rev. 2004, 94, 813–835. [Google Scholar] [CrossRef]

- Sianesi, B.; Van Reenen, J. The Returns to Education: Macroeconomics. J. Econ. Surv. 2003, 17, 157–200. [Google Scholar] [CrossRef]

- Hanushek, E.A.; Woessmann, L. The Role of Education Quality for Economic Growth; World Bank Policy Research Working Paper No. 4122; World Bank: Washington, DC, USA, 2007; Available online: https://ssrn.com/abstract=960379 (accessed on 11 February 2019).

- Birdsall, N.; Pinckney, T.; Sabot, R. Natural Resources, Human Capital, and Growth. In Resource Abundance and Economic Growth; Auty, R., Ed.; Oxford University Press: New York, NY, USA, 2001; pp. 57–75. [Google Scholar] [CrossRef]

- Blanco, L.; Grier, R. Natural resource dependence and the accumulation of physical and human capital in Latin America. Resour. Policy 2012, 37, 281–295. [Google Scholar] [CrossRef]

- Barro, R.J. Economic Growth in a Cross Section of Countries. Q. J. Econ. 1991, 106, 407. [Google Scholar] [CrossRef]

- Bulte, E.H.; Damania, R.; Deacon, R.T. Resource intensity, institutions, and development. World Dev. 2005, 33, 1029–1044. [Google Scholar] [CrossRef]

- Costantini, V.; Monni, S. Environment, human development and economic growth. Ecol. Econ. 2008, 64, 867–880. [Google Scholar] [CrossRef]

- Carmignani, F. Development outcomes, resource abundance, and the transmission through inequality. Resour. Energy Econ. 2013, 35, 412–428. [Google Scholar] [CrossRef]

- Faruq, H.A.; Taylor, A.C. Quality of Education, Economic Performance and Institutional Environment. Int. Adv. Econ. Res. 2011, 17, 224–235. [Google Scholar] [CrossRef]

- Sun, H.-P.; Sun, W.-F.; Geng, Y.; Kong, Y.-S. Natural resource dependence, public education investment, and human capital accumulation. Pet. Sci. 2018, 15, 657–665. [Google Scholar] [CrossRef] [PubMed]

- Acevedo, S. Measuring the Impact of Human Capital on the Economic Growth of South Korea. J. Korean Econ. 2008, 9, 113–139. [Google Scholar]

- Feenstra, R.C.; Inklaar, R.; Timmer, M.P. The Next Generation of the Penn World Table. Am. Econ. Rev. 2015, 105, 3150–3182. [Google Scholar] [CrossRef]

- Kim, D.-H.; Lin, S.-C. Human capital and natural resource dependence. Struct. Chang. Econ. Dyn. 2017, 40, 92–102. [Google Scholar] [CrossRef]

- Olayungbo, D.O.; Adediran, K.A. Effects of Oil Revenue and Institutional Quality on Economic Growth with an ARDL Approach. Energy Pol. Res. 2017, 4, 44–54. [Google Scholar] [CrossRef]

- Akpan, G.E.; Chuku, C. Natural Resources, Human Capital and Economic Development in Nigeria: Tracing the Linkages. J. Econ. Sustain. Dev. 2014, 5, 40–51. [Google Scholar]

- Busse, M.; Gröning, S. The resource curse revisited: Governance and natural resources. Public Choice. 2013, 154, 1–20. [Google Scholar] [CrossRef]

- Arezki, R.; Van Der Ploeg, F. Do Natural Resources Depress Income Per Capita? Rev. Dev. Econ. 2011, 15, 504–521. [Google Scholar] [CrossRef]

- Bils, M.; Klenow, P.J. Does Schooling Cause Growth? Am. Econ. Rev. 2000, 90, 1160–1183. [Google Scholar] [CrossRef]

- Brückner, M.; Gradstein, M. Income and Schooling; CEPR Discussion Paper; Centre for Economic Policy Research: London, UK, 2013. [Google Scholar]

- World Bank. World Development Indicators. 2017. Available online: www.data.worldbank.org (accessed on 20 December 2018).

- Carmignani, F.; Avom, D. The social development effects of primary commodity export dependence. Ecol. Econ. 2010, 70, 317–330. [Google Scholar] [CrossRef]

- Gylfason, T. Natural resources, education, and economic development. Eur. Econ. Rev. 2001, 45, 847–859. [Google Scholar] [CrossRef]

- Atkinson, G.; Hamilton, K. Savings, Growth and the Resource Curse Hypothesis. World Dev. 2003, 31, 1793–1807. [Google Scholar] [CrossRef]

- Okada, K.; Samreth, S. Corruption and natural resource rents: Evidence from quantile regression. Appl. Econ. Lett. 2017, 24, 1490–1493. [Google Scholar] [CrossRef]

- Elbadawi, I.A.; Soto, R. Resource rents, institutions, and violent civil conflicts. Def. Peace Econ. 2015, 26, 89–113. [Google Scholar] [CrossRef]

- Farhadi, M.; Islam, M.R.; Moslehi, S. Economic Freedom and Productivity Growth in Resource-rich Economies. World Dev. 2015, 72, 109–126. [Google Scholar] [CrossRef]

- Bhattacharyya, S.; Hodler, R. Do Natural Resource Revenues Hinder Financial Development? The Role of Political Institutions. World Dev. 2014, 57, 101–113. [Google Scholar] [CrossRef]

- Anthonsen, M.; Löfgren, Å.; Nilsson, K.; Westerlund, J. Effects of rent dependency on quality of government. Econ. Gov. 2012, 13, 145–168. [Google Scholar] [CrossRef]

- Azfar, O.; Gurgur, T. Does Corruption Affect Health and Education Outcomes in the Philippines? Econ. Gov. 2008, 9, 197–244. [Google Scholar] [CrossRef]

- Svensson, J. Eight Questions about Corruption. J. Econ. Perspect. 2005, 19, 19–42. [Google Scholar] [CrossRef]

- Chimezie, N.B.; Prince, O.N. Effects of Corruption on Educational System: A Focus on Private Secondary Schools in Nsukka Zone. Glob. J. Hum. Soc. Sci. A 2016, 16, 59–67. [Google Scholar]

- Herzfeld, T.; Weiss, C. Corruption and legal effectiveness: An empirical investigation. Eur. J. Political Econ. 2003, 19, 621–632. [Google Scholar] [CrossRef]

- Knack, S.; Keefer, P. Institutions and economic performance: Cross-country tests using alternative institutional measures. Econ. Political 1995, 7, 207–227. [Google Scholar] [CrossRef]

- Tebaldi, E.; Elmslie, B. Does institutional quality impact innovation? Evidence from cross-country patent grant data. Appl. Econ. 2013, 45, 887–900. [Google Scholar] [CrossRef]

- Boschini, A.D.; Pettersson, J.; Roine, J. The Resource Curse and its Potential Reversal. World Dev. 2013, 43, 19. [Google Scholar] [CrossRef]

- ICRG: International Country Risk Guide. 2018. Available online: https://epub.prsgroup.com/products/icrg (accessed on 23 December 2018).

- Aidt, T.; Dutta, J.; Sena, V. Governance regimes, corruption and growth: Theory and evidence. J. Comp. Econ. 2008, 36, 195–220. [Google Scholar] [CrossRef]

- Sachs, J.D.; Warner, A.M. The Curse of Natural Resources. Eur. Econ. Rev. 2001, 45, 827–838. [Google Scholar] [CrossRef]

- Behbudi, D.; Karami, A.; Mamipour, S. Natural resource abundance, human capital and economic growth in the petroleum exporting countries. J. Econ. Dev. 2010, 35, 81–102. [Google Scholar] [CrossRef]

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).