Implications of Land-Grabbing on the Ecological Balance of Brazil

Abstract

1. Introduction

2. Materials and Methods

2.1. Land-Grabbing Data

2.2. Biocapacity

- -

- i represents the land type, i.e., cropland, pasture, fishing ground, forest, and built up.

- -

- YF is the Yield Factor, i.e., the land specific factor that reflects the relative productivity of national (N) and world average hectares of a given land use type (i). Each country (N), in each year, has a set of yield factors for each land use type (i);

- -

- EQF is the Equivalence Factor, i.e., the factor able to account for the relative productivity of world average hectares of different land use types (i). EQF is specific for land type (i) and not for country. So for each year, there is a unique set of equivalence factors.

3. Results and Discussion

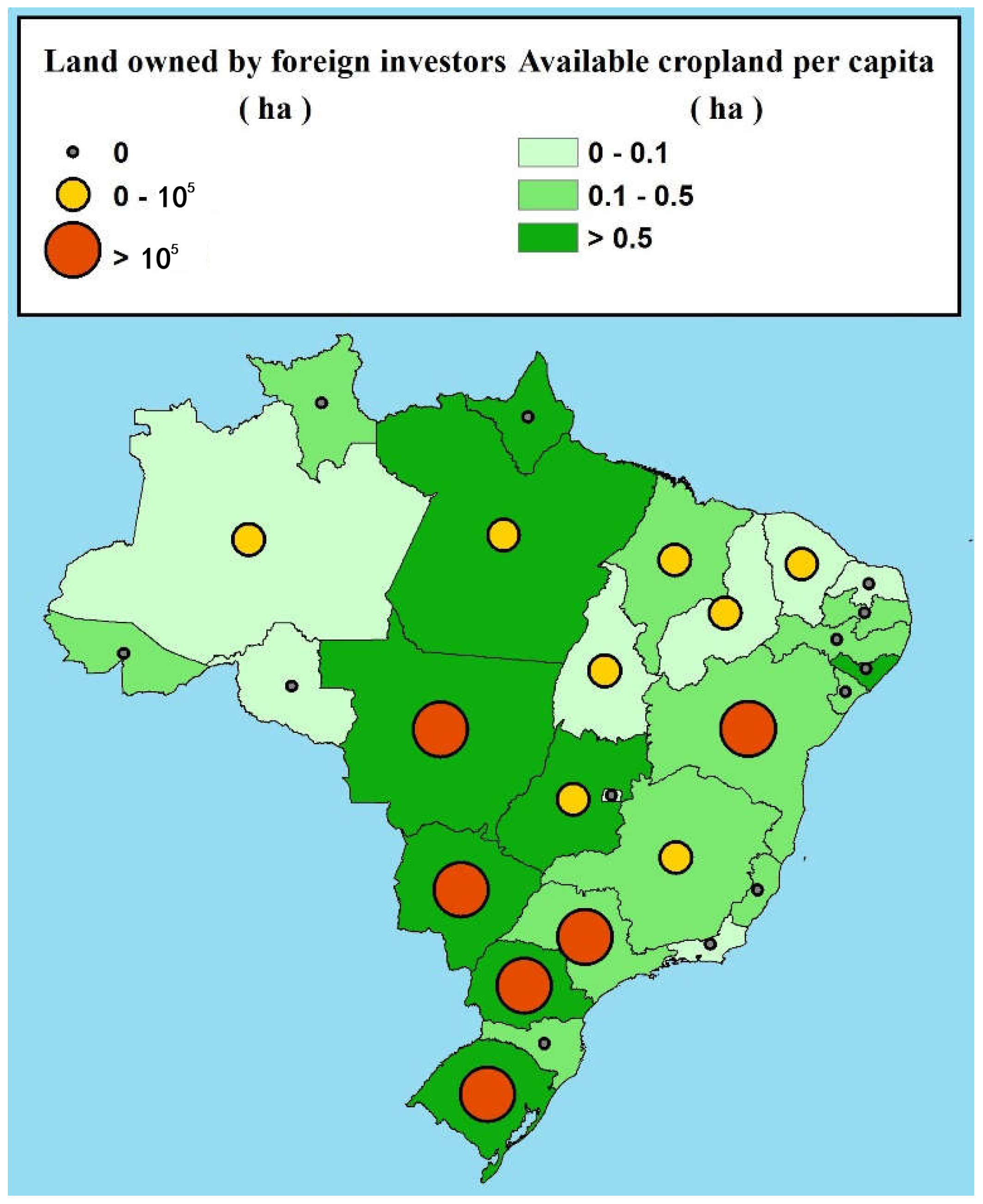

3.1. Land-Grabbing in Brazil

3.2. The Effect of Land-Grabbing on the Ecological Balance of Brazil

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Ripple, W.J.; Wolf, C.; Newsome, T.M.; Galetti, M.; Alamgir, M.; Crist, E.; Mahmoud, M.I.; Laurance, W.F. World scientists’ warning to humanity: A second notice. BioScience 2017, 67, 1026–1028. [Google Scholar] [CrossRef]

- Watts, J. Land Degradation Threatens Human Well-Being, Major Report Warns. Available online: https://www.theguardian.com/environment/2018/mar/26 (accessed on 1 May 2018).

- Nesme, T.; Roques, S.; Metson, G.S.; Bennett, E.M. The surprisingly small but increasing role of international agricultural trade on the European Union’s dependence on mineral phosphorus fertilizer. Environ. Res. Lett. 2016, 11, 025003. [Google Scholar] [CrossRef]

- Scherer, L.; Pfister, S. Global biodiversity loss by freshwater consumption and eutrophication from Swiss food consumption. Environ. Sci. Technol. 2016, 50, 7019–7028. [Google Scholar] [CrossRef] [PubMed]

- Dell’Angelo, J.; Rulli, M.C.; D’Odorico, P. The global water grabbing syndrome. Ecol. Econ. 2018, 143, 276–285. [Google Scholar] [CrossRef]

- Scheidel, A.; Sorman, A.H. Energy transitions and the global land rush: Ultimate drivers and persistent consequences. Glob. Environ. Chang. 2012, 22, 588–595. [Google Scholar] [CrossRef]

- Gabay, M.; Alam, M. Community forestry and its mitigation potential in the Anthropocene: The importance of land tenure governance and the threat of privatization. For. Policy Econ. 2017, 79, 26–35. [Google Scholar] [CrossRef]

- Rulli, M.C.; Saviori, A.; D’Odorico, P. Global land and water grabbing. Proc. Natl. Acad. Sci. USA 2013, 110, 892–897. [Google Scholar] [CrossRef] [PubMed]

- The Economist. Buying Farmland Abroad: Outsourcing’s Third Wave. Available online: http://www.economist.com/node/13692889 (accessed on 1 May 2018).

- International Land Coalition (ILC). Global Assembly 2011. Available online: www.landcoalition.org/about-us/aom2011/tiranadeclaration (accessed on 1 May 2018).

- Rulli, M.C.; D’Odorico, P. Food appropriation through large scale land acquisitions. Environ. Res. Lett. 2014, 9, 064030. [Google Scholar] [CrossRef]

- Vendergeten, E.; Azadi, H.; Teklemariam, G.D.; Nyssen, J.; Witlox, F.; Vanhaute, E. Agricultural outsourcing or land grabbing: A meta-analysis. Landsc. Ecol. 2016, 31, 1395–1417. [Google Scholar] [CrossRef]

- Margulis, M.E.; McKeon, N.; Borras, S.M., Jr. Land grabbing and global governance: Critical perspectives. Globalizations 2013, 10, 1–23. [Google Scholar] [CrossRef]

- Ambalam, K. Food sovereignty in the era of land grabbing: An African perspective. J. Sustain. Dev. 2014, 7, 121–132. [Google Scholar] [CrossRef]

- Hules, M.; Singh, S.J. India’s land grab deals in Ethiopia: Food security or global politics? Land Use Policy 2014, 60, 343–351. [Google Scholar] [CrossRef]

- Carmody, P. The New Scramble for Africa; Polity Press: Cambridge, UK, 2016. [Google Scholar]

- Weinzettel, J.; Hertwich, E.G.; Peters, G.P.; Steen-Olsen, K.; Galli, A. Affluence drives the global displacement of land use. Glob. Environ. Chang. 2013, 23, 433–438. [Google Scholar] [CrossRef]

- Coscieme, L.; Pulselli, F.M.; Niccolucci, V.; Patrizi, N.; Sutton, P.C. Accounting for “land-grabbing” from a biocapacity viewpoint. Sci. Total Environ. 2016, 539, 551–559. [Google Scholar] [CrossRef] [PubMed]

- Bucciferro, J.R. The economic geography of race in the New World: Brazil, 1500–2000. Econ. Hist. Rev. 2017, 70, 1103–1130. [Google Scholar] [CrossRef]

- Fontes, M.P.F.; Fontes, R.M.O.; Carneiro, P.A.S. Land suitability, water balance and agricultural technology as a geographic-technological index to support regional planning and economic studies. Land Use Policy 2009, 26, 589–598. [Google Scholar] [CrossRef]

- Davis, K.F.; Yu, K.; Rulli, M.C.; Pichdara, L.; D’Odorico, P. Accelerated deforestation driven by large-scale land acquisitions in Cambodia. Nat. Geosci. 2015, 8, 772–775. [Google Scholar] [CrossRef]

- Kennedy, C.M.; Lonsdorf, E.; Neel, M.C.; Williams, N.M.; Ricketts, T.H.; Winfree, R.; Bommarco, R.; Brittain, C.; Burley, A.L.; Cariveau, D.; et al. A global quantitative synthesis of local and landscape effects on wild bee pollinators in agroecosystems. Ecol. Lett. 2013, 16, 584–599. [Google Scholar] [CrossRef] [PubMed]

- Schuler, L.J.; Bugmann, H.; Snell, R.S. From monocultures to mixed-species forests: Is tree diversity key for providing ecosystem services at the landscape scale? Landsc. Ecol. 2017, 32, 1499–1516. [Google Scholar] [CrossRef]

- Rees, W.E. Ecological footprints and appropriated carrying capacity: What urban economics leaves out. Environ. Urban. 1992, 4, 121–130. [Google Scholar] [CrossRef]

- Wackernagel, M.; Rees, W.E. Our Ecological Footprint: Reducing Human Impact on the Earth, 1st ed.; New Society Publishers: Gabriola Island, BC, Canada, 1996. [Google Scholar]

- Mancini, M.S.; Galli, A.; Coscieme, L.; Niccolucci, V.; Lin, D.; Pulselli, F.M.; Bastianoni, S.; Marchettini, N. Exploring ecosystem services assessment through ecological footprint accounting. Ecosyst. Serv. 2018, 30, 228–235. [Google Scholar] [CrossRef]

- Monfreda, C.; Wackernagel, M.; Deumling, D. Establishing national natural capital accounts based on detailed ecological footprint and biological capacity assessments. Land Use Policy 2004, 21, 231–246. [Google Scholar] [CrossRef]

- Borucke, M.; Moore, D.; Cranston, G.; Gracey, K.; Katsunori, I.; Larson, J.; Lazarus, E.; Morales, J.C.M.; Wackernagel, M.; Galli, A. Accounting for demand and supply of the biosphere’s regenerative capacity: The National Footprint Accounts’ underlying methodology and framework. Ecol. Indic. 2013, 24, 518–533. [Google Scholar] [CrossRef]

- Bastianoni, S.; Niccolucci, V.; Neri, E.; Cranston, G.; Galli, A.; Wackernagel, M. Sustainable development: Ecological footprint as accounting tool. In Encyclopedia of Environmental Management; Taylor and Francis: New York, NY, USA, 2013; pp. 2467–2481. [Google Scholar]

- Wackernagel, M.; Rees, W.E. Perceptual and structural barriers to investing in natural capital: Economics from an ecological footprint perspective. Ecol. Econ. 1997, 20, 3–24. [Google Scholar] [CrossRef]

- Galli, A.; Kitzes, J.; Wermer, P.; Wackernagel, M.; Niccolucci, V.; Tiezzi, E. An exploration of the mathematics behind the ecological footprint. Int. J. Ecodyn. 2007, 2, 250–257. [Google Scholar] [CrossRef]

- Global Footprint Network (GFN). National Footprint Accounts, 2017th ed.; Global Footprint Network: Oakland, CA, USA, 2017; Available online: http://data.footprintnetwork.org (accessed on 1 May 2018).

- Niccolucci, V.; Tiezzi, E.; Pulselli, F.M.; Capineri, C. Biocapacity vs. ecological footprint of world regions: A geopolitical interpretation. Ecol. Indic. 2012, 16, 23–30. [Google Scholar] [CrossRef]

- Lin, D.; Hanscom, L.; Martindill, J.; Borucke, M.; Cohen, L.; Galli, A.; Lazarus, E.; Zokai, G.; Iha, K.; Eaton, D.; et al. Working Guidebook to the National Footprint Accounts, 2016th ed.; Global Footprint Network: Oakland, CA, USA, 2016. [Google Scholar]

- Fisher, J.A.; Patenaude, G.; Giri, K.; Lewis, K.; Meir, P.; Pinho, P.; Rounsevell, M.D.; Williams, M. Understanding the relationships between ecosystem services and poverty alleviation: A conceptual framework. Ecosyst. Serv. 2014, 7, 34–45. [Google Scholar] [CrossRef]

- De Schutter, O. How not to think of land-grabbing: Three critiques of large-scale investments in farmland. J. Peasant Stud. 2011, 38, 249–279. [Google Scholar] [CrossRef]

- Tscharntke, T.; Clough, T.; Wanger, T.C.; Jackson, L.; Motzke, I.; Perfecto, I.; Vandermeer, J.; Whitbread, A. Global food security, biodiversity conservation and the future of agricultural intensification. Biol. Conserv. 2012, 151, 53–59. [Google Scholar] [CrossRef]

- Börner, J.; Wunder, S.; Wertz-Kanounnikoff, S.; Tito, M.R.; Pereira, L.; Nascimento, N. Direct conservation payments in the Brazilian Amazon: Scope and equity implications. Ecol. Econ. 2010, 69, 1272–1282. [Google Scholar] [CrossRef]

| Foreign Investor’s Countries Owning Land in Brazil | Total Area Owned (km2) | Location of Foreign Land Owned by Brazil’s Investors | Total Area Owned (km2) | Location of Land-Grabbed Areas in the States of Brazil | Total Area Owned (km2) | % of Total State Area |

|---|---|---|---|---|---|---|

| Netherlands | 11,860 | Paraguay | 1613 | São Paulo | 15,909 | 6.41 |

| Argentina | 4987 | Uruguay | 1000 | Mato Grosso | 5571 | 0.62 |

| U.S.A. | 3972 | Angola | 390 | Bahia | 4461 | 0.79 |

| Finland | 2957 | Colombia | 130 | Mato Grosso do Sul | 1953 | 0.55 |

| Japan | 2636 | Sudan | 120 | Paraná | 1850 | 0.93 |

| Chile | 2083 | Peru | 115 | Rio Grande do Sul | 1608 | 0.57 |

| Australia | 2000 | Mozambique | 90 | Piauí | 574 | 0.23 |

| Canada | 1252 | Ghana | 87 | Minas Gerais | 562 | 0.10 |

| India | 780 | Nicaragua | 77 | Pará | 488 | 0.04 |

| U.K. | 700 | Maranhão | 424 | 0.13 | ||

| Portugal | 368 | Amazonas | 400 | 0.03 | ||

| China | 212 | Goiás | 221 | 0.07 | ||

| Qatar | 169 | Tocantins | 174 | 0.06 | ||

| Germany | 65 | Ceará | 12 | 0.01 | ||

| Hong Kong | 46 | |||||

| Bermuda | 46 | |||||

| Switzerland | 46 | |||||

| Cayman Islands | 12 | |||||

| France | 10 | |||||

| New Zealand | 8 | |||||

| TOTALS | 34,209 | 3622 | 34,209 |

| Foreign Investor’s Countries Owning Land in Brazil | Biocapacity (104 gha) | Location of Land-Grabbed Areas in the States of Brazil | Biocapacity (104 gha) | ||

|---|---|---|---|---|---|

| “Cropland to Cropland” | “Total Deforestation” | “Cropland to Cropland” | “Total Deforestation” | ||

| Netherlands | 313.52 | 322.67 | São Paulo | 420.55 | 432.82 |

| Argentina | 131.83 | 135.68 | Mato Grosso | 147.27 | 151.56 |

| U.S.A. | 105 | 108.07 | Bahia | 117.91 | 121.35 |

| Finland | 78.17 | 80.45 | Mato Grosso do Sul | 51.62 | 53.13 |

| Japan | 69.7 | 71.74 | Paraná | 48.9 | 50.33 |

| Chile | 55.06 | 56.67 | Rio Grande do Sul | 42.5 | 43.74 |

| Australia | 52.87 | 54.41 | Piauí | 15.18 | 15.63 |

| Canada | 33.09 | 34.06 | Minas Gerais | 14.87 | 15.31 |

| India | 20.62 | 21.22 | Pará | 12.9 | 13.27 |

| U.K. | 18.50 | 19.04 | Maranhão | 11.21 | 11.54 |

| Portugal | 9.73 | 10.01 | Amazonas | 10.57 | 10.88 |

| China | 5.6 | 5.76 | Goiás | 5.85 | 6.02 |

| Qatar | 4.47 | 4.6 | Tocantins | 4.6 | 4.73 |

| Germany | 1.72 | 1.77 | Ceará | 0.32 | 0.33 |

| Hong Kong | 1.21 | 1.24 | |||

| Bermuda | 1.21 | 1.24 | |||

| Switzerland | 1.21 | 1.24 | |||

| Cayman Islands | 0.32 | 0.33 | |||

| France | 0.26 | 0.27 | |||

| New Zealand | 0.21 | 0.22 | |||

| TOTALS | 904.32 | 930.7 | TOTALS | 904.32 | 930.7 |

| Location of Foreign Land Owned by Brazil’s Investors | Biocapacity (104 gha) | |

|---|---|---|

| “Cropland to Cropland” | “Total Deforestation” | |

| Paraguay | 76.04 | 36.56 |

| Uruguay | 33.23 | 23.23 |

| Angola | 5.32 | 0.88 |

| Colombia | 4.13 | 2.21 |

| Sudan | 0.99 | 0.68 |

| Peru | 2.16 | 1.3 |

| Mozambique | 0.82 | 0.35 |

| Ghana | 1.93 | 0.68 |

| Nicaragua | 1.05 | 1.09 |

| TOTALS | 125.71 | 67.03 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Coscieme, L.; Niccolucci, V.; Giannetti, B.F.; Pulselli, F.M.; Marchettini, N.; Sutton, P.C. Implications of Land-Grabbing on the Ecological Balance of Brazil. Resources 2018, 7, 44. https://doi.org/10.3390/resources7030044

Coscieme L, Niccolucci V, Giannetti BF, Pulselli FM, Marchettini N, Sutton PC. Implications of Land-Grabbing on the Ecological Balance of Brazil. Resources. 2018; 7(3):44. https://doi.org/10.3390/resources7030044

Chicago/Turabian StyleCoscieme, Luca, Valentina Niccolucci, Biagio F. Giannetti, Federico M. Pulselli, Nadia Marchettini, and Paul C. Sutton. 2018. "Implications of Land-Grabbing on the Ecological Balance of Brazil" Resources 7, no. 3: 44. https://doi.org/10.3390/resources7030044

APA StyleCoscieme, L., Niccolucci, V., Giannetti, B. F., Pulselli, F. M., Marchettini, N., & Sutton, P. C. (2018). Implications of Land-Grabbing on the Ecological Balance of Brazil. Resources, 7(3), 44. https://doi.org/10.3390/resources7030044