Abstract

For the European Union in the field of raw material policy, it is primarily important to ensure reliable, seamless, and unrestricted access to raw materials in all EU countries. An important aspect in assessing the European Union’s raw material policy is a detailed analysis of selected significant raw materials. This paper focuses on raw material policy within the European Union (EU). Specifically, it examines five types of raw materials: critical raw materials, metal ores, non-metallic minerals, fossil energy materials, and biomass. The research is oriented to analyzing the materials from the perspectives of consumption, mining, export, and import. The objective is to assess the European Union’s (EU) raw material policy by employing specific tools and statistical methodologies to analyze individual data. We aimed to assess the European Union (EU) raw material policy using selected statistical methods such as regression and correlation analysis, multivariate analysis, and pairwise correlation to reveal and describe the relationships between variables. Based on the examination of import and export data, it is evident that imports are on the rise while exports are declining. This trend underscores the EU’s continued reliance on raw materials sourced from other global regions. The results show that domestic production and consumption are sufficient; on the other hand, the EU remains dependent on imports of critical raw materials. The results are useful for the development of future EU raw material policy.

1. Introduction

It is difficult to define how big the geological reserves of mineral raw materials actually are; only a fraction of the existing geological raw material potential is known. Raw materials are an essential part of our lives. Without them, life would change in a very short time. Raw materials are available all over the world, but their occurrences are very unevenly distributed. Usually, mining provides the need for mineral raw materials. After mining and processing, raw materials are added to products that we use in our daily lives [1].

A shortage of relevant data on raw materials presents an obstacle to effective evaluation and management in this very important area. Therefore, the goal of the paper is to analyze raw material policy in the EU by using chosen tools to limit the main tendencies of EU raw material policy and, in this way, to contribute to the increasing availability of data for the creation of raw material policy. The contribution in the first chapter deals with research of the present literature, where authors conducted research in the area of raw material policy. The next chapter of the paper deals with methodology and methods of the research, together with the individual used statistical methods. The Results chapter evaluates results of the analyzed raw materials in the area of consumption, mining, importing, and exporting of raw materials and offers a review of the raw material policy in the EU.

Raw materials form the basis of Europe’s economy to ensure jobs and competitiveness, and they are essential for maintaining and improving the quality of life. There are a number of countries with established raw material policymaking [2], but although all raw materials are important, some of them are of more concern in comparison with others [3]. Due to energy transition and digitalization, the demand for raw materials is increasing drastically. At the same time, the raw materials markets are particularly tense due to the war in Ukraine, and supply shortages are possible [4]. The European Union, which started out as the European Coal and Steel Community in 1958, put the raw materials issues back at the center of the public and industry’s attention at the end of the first decade of the 21st century. This action, backed up by different policies at the regional, national, and EU level, is necessary due to the major changes in supply [5].

Companies, economies, and technologies are vulnerable to the supply chain of raw materials. Therefore, Helbig et al. (2016) estimated the raw material economic importance or its significance for supply disruptions for strategic goals [6]. Similar importance is underlined by Tale and Noori-Darvan (2014) [7]. Also, Gao et al. (2022) addressed the raw material from the view of inventory management problem with orientation to the carbon emission limitation, which presents nowadays an important task of the business [8]. Disruption in raw material supply can cause vulnerability of a national economy, technology, or company system [9].

The facilitation of dialogues, the provision of information relevant to the mineral raw materials sector, the monitoring and support of mineral raw materials policymaking, and the identification of industry trends are made by the International Raw Materials Observatory, which reinforces its capacity to identify synergies and bridges between mineral stakeholders [10]. One of the main activities is the evaluation of potential future scenarios for 2050 to frame raw material policy development [11]. The other task is to incorporate innovation into the raw material policy creation. Innovation policy, as well as innovative activities, is very different in the central, peripheral, in the old industrial regions, and new raw-material regions [12]. Therefore, a technological innovation capability is one of the decisive factors of economic development and competitiveness improvement of regions with raw-material specialization [13]. Increased costs in mining are taking place around the world. This dictates the urgent need for the development and use of new technologies. As a result, raw-material branches abroad serve in practice as “drivers” of socio-economic development [14].

Raw material policy has to provide effective use of the domestic raw material base, and therefore, it should be carried out from a systematic view [15]. However, there are differences in raw material policy according to individual regions and countries. A necessary condition for the creation of a raw material policy of the region or country is the knowledge of the raw material base and the raw material needs of the given region [16]. For example, in the case of China, the China Raw Materials dispute recently arbitrated by the WTO opposed China as the defendant to the US, the EU, and Mexico as the claimants on the somewhat unusual issue of export restrictions on natural resources. For the claimants, Chinese export restrictions on various raw materials, of which the country is a major producer, create shortages in foreign markets, increasing the prices of these goods. China defends export limitations by presenting them as a natural resource conserving policy [17].

In Czech Republic, the implications stemming from these points, such as the very high dependency of the Czech production system on metal ores from abroad and the Czech economic, environmental, and sustainability policies so far and present unresolved issues which will have to be dealt with [18]. Here lies the necessity to deal with raw material policy.

The EU’s position deteriorated particularly in the African minerals markets over the past years for the benefit of China’s demand for commodities. The EU’s Raw Material Initiative (RMI) could therefore present an answer to China’s activities in the national and international commodity markets. The EU, by contrast, promotes an economically liberal access to raw materials based on a level playing field according to market principles as well as transparency and good governance [19]. Importantly, this includes the active use of EU trade policy, in particular the inclusion of rules in bilateral and multilateral agreements to achieve access to raw materials [20].

The present worldwide geopolitical situations influence the raw material policy as well. Wisniewski (2023) suggested that the past dependencies on Russian energy raw materials have not been similar across the EU countries and have been associated with the economic size of the EU member states and their proximity to or remoteness from Russia [21]. In this regard, economic size and distance from Russia may be significant determinants of certain dissimilarities.

According to Ouedraogo and Kilolo (2024), Africa can play a pivotal role in facilitating the global transition away from fossil fuels [22]. This also requires a renewed global raw material diplomacy in which Africa manages the geopolitics of critical minerals, identifying strategic global alliances to unleash economic potential, create local content in the mining sector, develop domestic productive capacity, and foster sustainable development.

Sustainability of raw materials is crucial for the EU’s sustainable development. In this area, Di Noi et al. (2020) investigated whether the social life can support responsible sourcing of raw materials, found there are considerable social risks in raw material use, such as corruption, fair salary, health and safety, etc. [23]. The creation of raw material policy should regard sustainable development, together with clean industries, recycling targets [24]. Many existing EU policies are relatively more coherent with green and digital transitions [25]. On the other hand, Hofmann et al. (2018) introduced the topic of materials criticality for a Special Issue of sustainable materials, showing that the criticality of raw materials is not so interesting [26]. The ambition of this paper is to fill this gap.

2. Methodology

The contribution aims to examine the raw material policy of the European Union through the chosen tools and to analyze the individual data that significantly influence the raw materials policy. An important aspect in assessing EU raw material policy is a detailed analysis of selected significant raw materials, which need to be analyzed from the perspective of imports and exports, mining, and consumption. In addition, of the statistical methods, we determined the possibilities of developing the direction of EU raw material policy.

Sources of the research presented information from the European Commission and various experts and studies [12]. The statistical analysis was conducted according to available data from the Eurostat database, which serves as the statistical office of the European Union. We also evaluated the data obtained regarding the raw material policy using the Excel program. Statistical analysis was performed in the JMP Pro17 program [27].

According to the results and conclusions from the comparison of the individual selected categories of the raw materials, we considered possibilities for future development. We used statistical methods, including regression modeling, pairwise correlation, and comparative analysis.

- Through regression analysis and a regression model, we defined the relationship between mining, consumption, imports, and exports of the analyzed raw materials. Regression analysis is used to be easily adapted to the area of mining [28].

- Pairwise correlation analysis of indexes: the method helped to evaluate linear dependence of all combinations of indicators according to the individual raw materials through measuring power and orientation of the relation between two indicators, defined by correlation coefficient r [29].where

Xi—variable X in time I;

—arithmetical average of variables X in a time series;

Yi—variable Y in time I;

—arithmetical average of variables Y in the time series;

n—the extent of the analyzed time series.

The coefficient of correlation measures the mutual linear dependence of two variables with values from the interval <−1,1>. If r = 1, there is positive linear dependence between variables. If r = −1 there is negative dependence. If r = 0, there is no dependence between X and Y. The correlation coefficient can also have other values, which can be classified as follows:

0 < |r| < 0.3 low level of dependence between variables;

0.3 ≤ |r| < 0.5 moderate level of dependence between variables;

0.5 ≤ |r| < 0.7 medium level of dependence between variables;

0.7 ≤ |r| < 1 strong level of dependence between variables.

- 3.

- Comparative analysis. To compare the extraction and consumption of selected raw materials, as well as the exports and imports of selected raw materials, we used comparative analysis as a way to look at two or more objects to see how they differ and what they have in common [30].

3. Results

Raw materials are currently a very popular and discussed topic in the European Union. This chapter consists of the results at two levels:

- Results of the comparison of mining and consumption of chosen raw materials;

- Results of multivariate and pairwise correlation of chosen raw materials.

3.1. Results of Comparison of Mining and Consumption of Chosen Raw Materials

The following graph (Figure 1) compares the extraction and consumption of individual types of mineral resources, starting with metallic ores, non-metallic minerals, fossil energy materials, and finally biomass.

Figure 1.

Comparison of mining and consumption of metal ores.

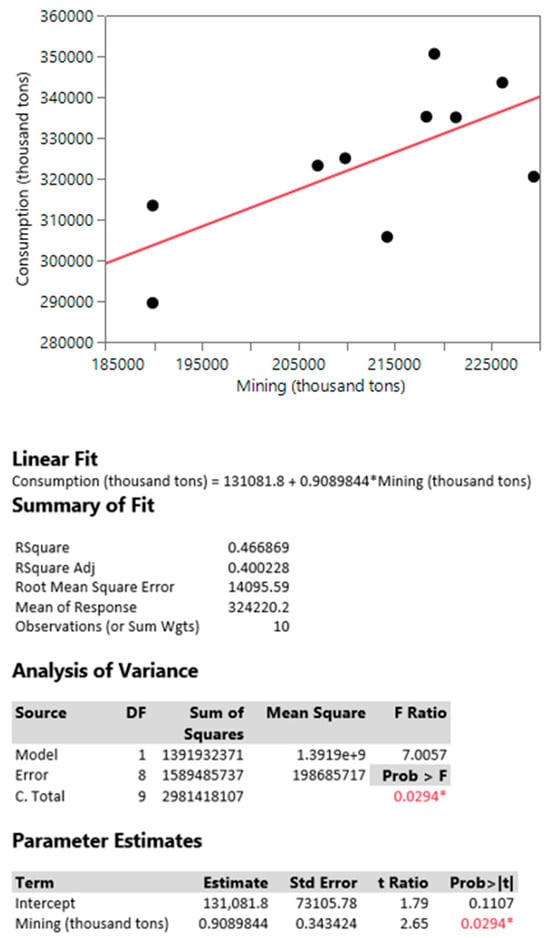

Figure 1 displays the results of comparing metal ore mining and consumption, along with the regression analysis line and model summary. In this case, the relationship between metal ore mining and consumption is positive and moderately strong, as evidenced by the probability value of 0.0294, which is greater than 0.0001.

The p-value is already at the significant level of importance, indicating that the relationships are not very strong. This means that as metal ore mining increases, so does its consumption. A strong relationship implies that when the value of one variable increases, the value of the other also increases. Based on the graph and regression analysis, we can predict that as metal ore mining grows, its consumption will also rise. This could potentially affect metal ore prices. Figure 1 also displays model fit statistics, including the coefficient of determination (R2), which measures the proportion of variability in metal ore consumption explained by the model. In this case, R2 = 0.466869, indicating that the model accounts for 46.69% of the variability in metal ore consumption. This suggests that other factors influencing consumption exist beyond what is included in this model.

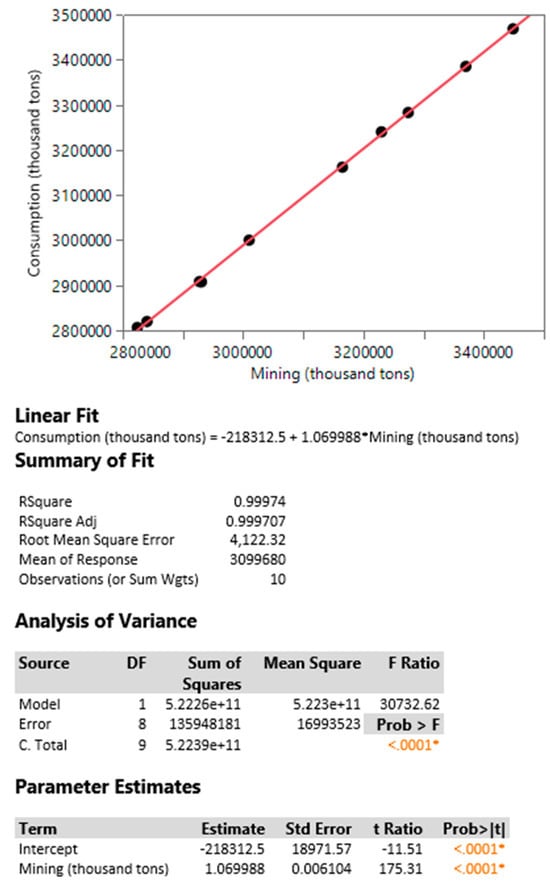

Figure 2 shows the results of the comparison between mining and consumption of non-metallic minerals. From the graph, we conclude that the relationship between mining and consumption of non-metallic minerals is positive and strong, which means that as mining increases, so does the consumption of non-metallic minerals. We can confirm this relationship because the significance level is <0.0001. A strong relationship means that there is a close association between two variables. Increased mining and consumption of non-metallic minerals could lead to resource depletion, and we may have to import from other sources in the future due to either insufficient quantity or quality of non-metallic minerals. The coefficient of determination, R2 = 0.99974, is a measure of how much of the variability in the consumption of non-metallic minerals is explained in the model. This model explains 99.97% of the variability in non-metallic mineral consumption.

Figure 2.

Comparison of mining and consumption of non-metallic minerals.

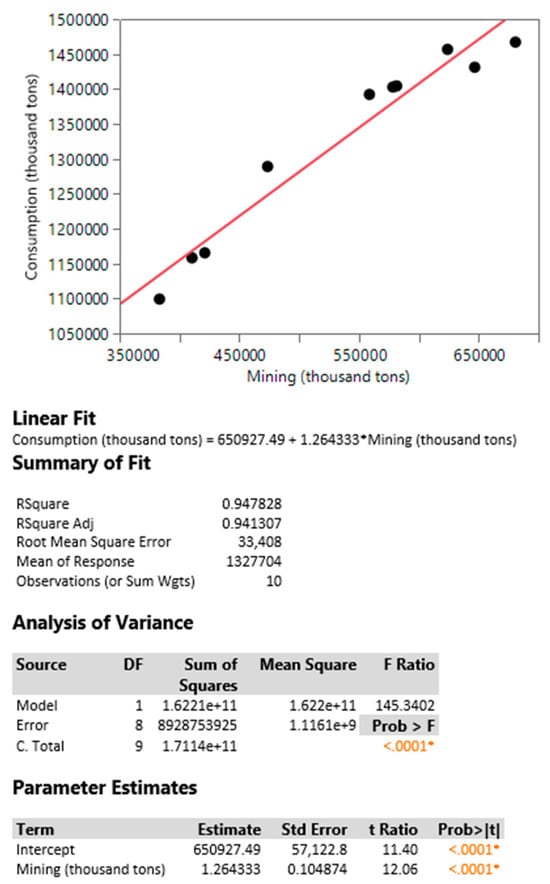

Figure 3 shows the results of the comparison of the extraction and consumption of fossil energy materials. The relationship between mining and the consumption of fossil energy materials is positive and strong, due to the probability value < 0.0001, so as mining increases, so does the consumption of fossil energy materials. The likelihood that a strong positive relationship between the extraction and consumption of fossil materials will be maintained in the future is high. The impact of a strong positive relationship between production and consumption will be negative in the future, as the EU tries to reduce increased greenhouse gas emissions and build awareness of climate change. The coefficient of determination is R2 = 0.947828, which means that 94.78% of changes in consumption are explained by changes in fossil fuel extraction.

Figure 3.

Comparison of mining and consumption of fossil energy materials.

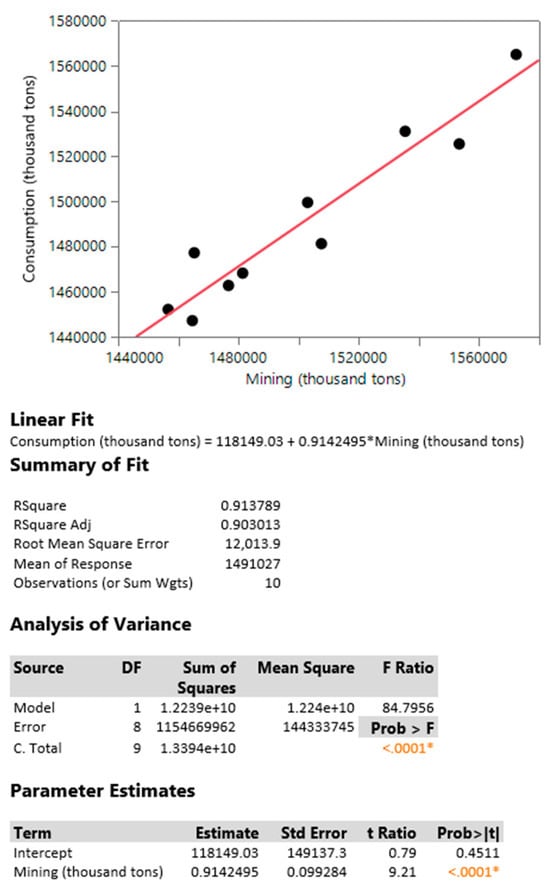

Figure 4 shows the results of the comparison of biomass extraction and consumption. The relationship between biomass extraction and consumption is positive and moderately strong, so as extraction increases, so does consumption. The coefficient of determination R2 is 0.913789, which indicates that the model explains 91.38% of the variability in biomass consumption. This means that we can confidently predict biomass consumption if we know its extraction. The significance level is <0.0001. The graph shows that there is a trend of increasing biomass consumption. This trend could continue in the future if biomass extraction increases. The more that is extracted at home, the more is consumed at home. It depends on various factors whether we will be self-sufficient or whether we will have to import biomass. This question remains open for the future.

Figure 4.

Comparison of mining and consumption of biomass.

3.2. Results of Multivariate and Pairwise Correlation of Chosen Raw Materials

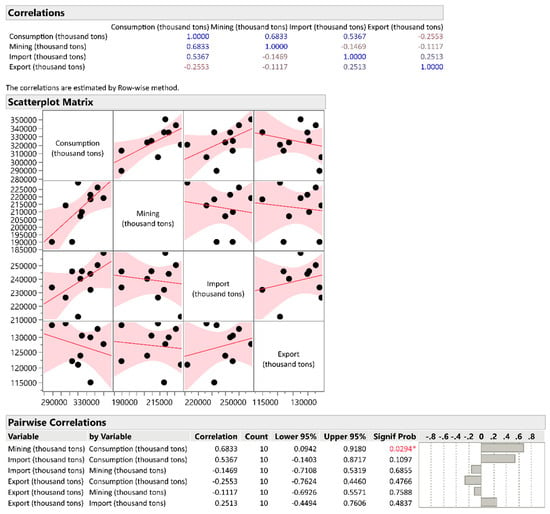

The next part illustrates the results of multivariate and pairwise correlation of individual types of mineral resources, starting with metallic ores, non-metallic minerals, fossil energy materials, and finally biomass. Figure 5 illustrates multivariate and pairwise correlations for metal ores.

Figure 5.

Multivariate and pairwise correlation of metal ores.

The multivariate and pairwise correlation tables and the graph in Figure 5 tell the relationship between mining, consumption, imports, and exports of metal ores in thousands of tons. Between consumption and mining of metal ores, there is a slight positive correlation, R2 = 0.6833, which is 68.33%. We are talking about a weak positive relationship here. Nevertheless, this means that as consumption increases, the extraction of metal ores also increases. The level of significance in this case is on the verge of 0.0294. If a country consumes more metal ores than it produces, it will have to import them. For other relationships between imports, exports, and mining, the probability values exceed <0.0001, so we do not consider these values.

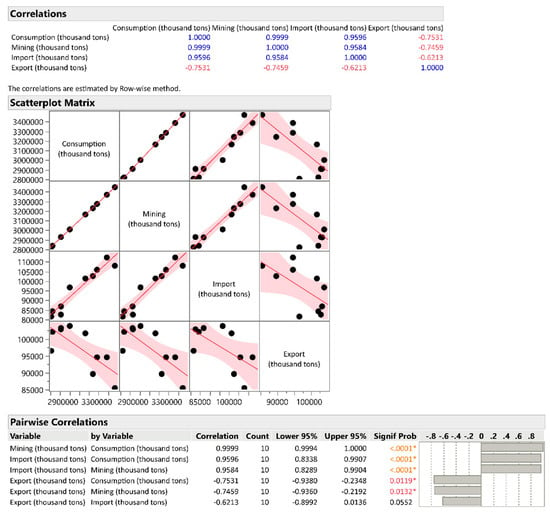

The multivariate and pairwise correlation table and graph in Figure 6 show the relationships between the variables—import, export, mining, and consumption of non-metallic minerals. There is a very strong positive relationship between consumption and mining, with a value of 0.999, indicating a very strong positive correlation of 99.9%. This means that as the consumption of non-metallic minerals increases, so does their extraction. There is also a strong relationship between mining and imports, with a value of 0.9584, which means a strong positive correlation of 95.84%, so as mining increases, so do imports. As total consumption increases, in that case, we see a dependency between extraction and imports. It is a control value of consumption and mining, since they are dependent, and consumption is very high; therefore, both mining and imports are growing. There is also a strong relationship between consumption and imports, with a correlation coefficient value of 0.9596, which means 95.96%, so as the consumption increases, so does the import of non-metallic minerals. The relationship between exports and consumption and exports and mining is at the borderline of significance, so these relationships are weak. The relationship between exports and imports exceeds the level of significance, and it is therefore not considered.

Figure 6.

Multivariate and pairwise correlation of non-metallic minerals.

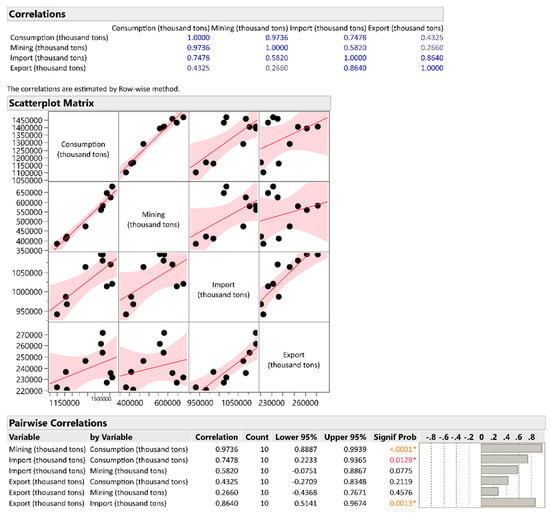

The multivariate correlation table, pairwise correlation, and graph in Figure 7 show the correlation between the variables—import, export, extraction, and consumption of fossil energy materials. Consumption and mining have a strong positive correlation relationship between them. The correlation coefficient is 0.9736, i.e., 97.36%. This indicates a strong positive correlation and a strong relationship between consumption and production. There is a moderately strong relationship between consumption and imports, as the probability exceeds 0.0001. The coefficient of determination is R2 = 0.7478. The relationships between imports and extraction, exports and consumption, and exports and extraction is not connected; they exceed the level of significance, so they are not relevant for evaluation. The relationship between exports and imports is strong and positive, with the coefficient of determination R2 = 0.9640, i.e., 86.40%. If the export grows, so does the import of fossil energy materials. The result is relevant, but it would be necessary to analyze the specific fossil imports and exports.

Figure 7.

Multivariate and pairwise correlation of fossil energetic materials.

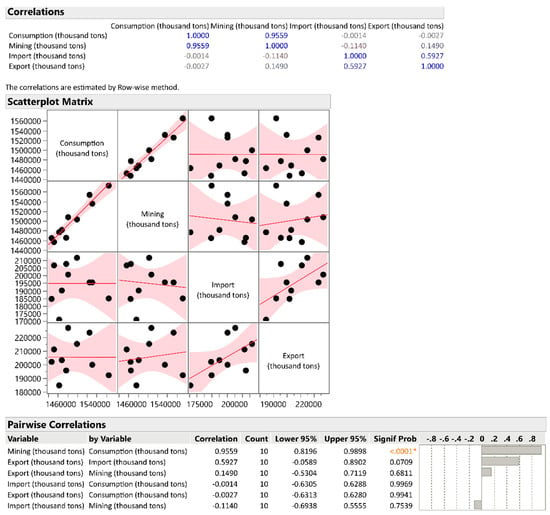

In Figure 8, we see a multivariate and pairwise correlation table and a graph showing the relationships between imports, exports, extraction, and consumption of biomass. From the graph, we can see that the mutual relationship between consumption and mining is positive. There is a strong positive correlation between biomass consumption and extraction, meaning that what we extract is what we consume. The value of the coefficient of determination R2 = 0.9559. This suggests that EU countries that consume more biomass tend to extract more. According to the pairwise correlation table, only the mining–consumption relationship is relevant to us, as the significance level is <0.0001. Other relationships exceed the <0.0005 significance level and are thus not statistically significant.

Figure 8.

Multivariate and pairwise correlation of biomass.

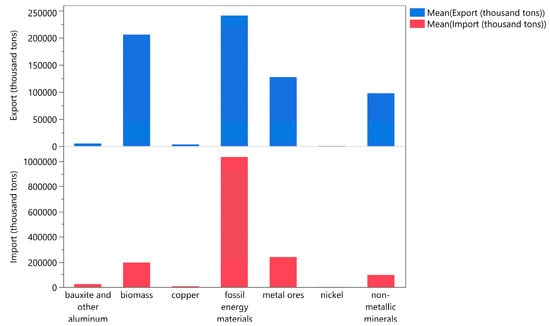

A comparison of the results of the import and export of raw materials is in Figure 9 of the comparative analysis. All categories of investigated raw materials were included in the comparison. Since there are insufficient data on critical raw materials, we have used all the available data that we have obtained. In the case of bauxite and other aluminum, the import is significantly higher than the export, which indicates the dependence of the EU on the import of this raw material. This trend will continue in the future, given the limited reserves of bauxite in the EU. The export of copper is insufficient, and the import is very important. In the future, the EU will continue to import copper. In addition, the import of nickel is significantly higher than the export, so in this case, the EU is also forced to import. In that case, the prediction for the future is the same as in the previous two raw materials, namely, the dependence on imports in the future.

Figure 9.

Comparative analysis of the export and import of raw materials.

Biomass imports and exports are comparable, indicating that the EU is relatively self-sufficient in this sector. It is likely that this trend will continue in the future, with increasing demand for biomass as an energy source.

Imports of fossil energy materials are significantly higher than an export, which indicates the EU’s dependence on energy imports. This trend is likely to continue in the short term, but in the long term, dependence on fossil fuels is expected to decrease due to the development of renewable energy sources.

The import of metal ores is lower than the export. This indicates that the EU is relatively self-sufficient in this sector. This trend is likely to continue in the future with increasing demand for metals in industrial sectors.

The import and export of non-metallic minerals are comparable. This suggests that the EU is relatively self-sufficient in this sector as well, a trend that is likely to continue in the future, with increasing demand for non-metals in industrial areas.

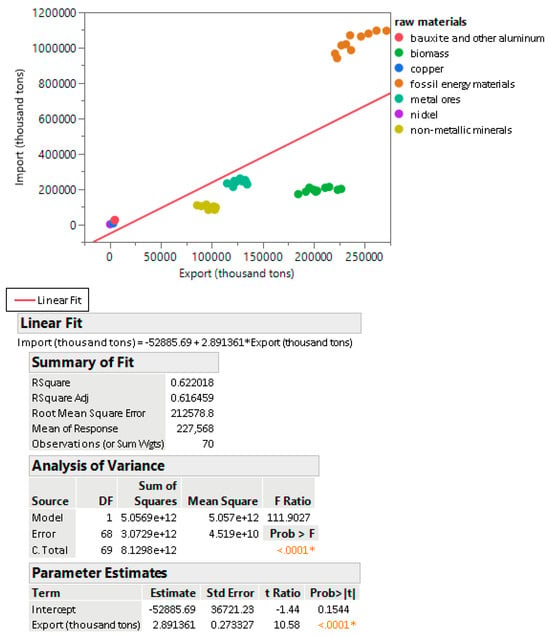

Figure 10 shows the regression analysis of all investigated raw materials. Of the critical raw materials, only some raw materials with available data were selected. The chart displays a scatter plot with a regression analysis line. From Figure 10, we can observe that there is a direct and strong relationship between the import and export for bauxite and other aluminum, biomass, fossil energy materials, and non-metallic minerals. This means that as the import of these raw materials increases, so does their export. For metal ores, copper and nickel, there is a direct but weaker relationship between imports and exports, meaning that as imports increase, so do their exports, but the increase in exports is not as strong as for other commodities. The coefficient of determination for this model is R2 = 0.622018. This means that 62.2% of the variability of the export of raw materials is explained by the variability of the import of raw materials. From the mentioned, we can judge that the data are relevant for evaluating the relationship between the import and export of raw materials.

Figure 10.

Regression analysis of the import and export of raw materials.

4. Discussion

This paper examined the multifaceted nature of the EU’s raw material policy. This policy included critical raw materials, metallic ores, non-metallic minerals, fossil energy materials, and biomass. The area of consumption and extraction, import and export, was investigated using various statistical analyses. Although the EU boasts a strong domestic raw material base, it faces dependence on imports.

From the findings, we can conclude the following statements:

Domestic production and consumption are sufficient or covered by moderate imports for non-metallic minerals and biomass materials. This support results from McLellan et al. (2012) [31], finding potential for increased use of biofuel (the same [32]).

In the case of fossil energy materials, there is a greater dependence on imports, but because the whole EU prefers a policy of reducing fossil energy materials from the point of view of ecology and CO2, the prospects are unclear. It is questionable whether the EU will continue in the direction of CO2 reduction, or whether it will start intensively preferring the circular economy, which is currently the subject of great interest. This results from the geopolitical supply risk [33]. This demands the introduction of the energy security index [34].

In the category of metal ores, imports currently exceed exports, because consumption is much higher than mining. We expect this trend to continue, and the consumption of metal ores will increase. The trend is connected with export restrictions [35], which many play a non-trivial role in international markets, affecting availability and prices of raw materials.

In the area of global business with raw materials, the EU presents 16% of worldwide imports and exports (https://policy.trade.ec.europa.eu/eu-trade-relationships-country-and-region/eu-position-world-trade_en). Due to the openness of the business agreements, the EU is an important player in the global business scene, presenting a region that is an excellent business partner. We know from the strategies for EU raw material policy that the goal is to ensure a fair and sustainable supply of raw materials from global markets, to ensure sustainable supplies within the EU and efficient use of resources and supply of secondary raw materials through recycling [36].

The task is therefore to consider business with recycled raw materials, especially exports from the EU; for example, Shopova et al. (2022) pointed to the increase in recycled materials exported from the EU, where Turkey is the biggest partner [37]. On the other hand, the biggest import partner is Brazil.

The geopolitical environment will have a significant impact on the future raw material policy. The European Union can expand the circle of its trading partners and strengthen its alliances with states that have rich natural resources. Since the EU’s current priority is the circular economy, it would be appropriate to focus on recycling and the use of recycled materials, and look for technologies that use the raw materials that Europe has. The results of the study would contribute to the state policy in the area of promoting critical raw materials.

The research is limited to the chosen raw materials, due to the data availability from the perspective of the chosen indicators. The research would demand extending to the systematic analysis of individual elements of the system relations with supplier–consumer, legislative, property, personal, economic, political, and other relations in the frame of the system, as well as relationships with its surroundings. In addition, the circular economy deals primarily with critical raw materials, which could be included individually in the analysis as well.

However, the results of the research are useful for raw-material policy determination in the future. European Union could in connection with future dependence on raw materials redefine some of its statements, since EU is still dependent on the import of critical materials [38,39], the question is if the dependence could be changed due to the technical, technological, and innovation development of the society.

Author Contributions

Conceptualization, L.D. and D.Š.; methodology, D.Š. and S.M.; software, M.T.; validation, L.D., B.K., and K.Č.; formal analysis, D.Š. and M.T.; investigation, D.Š. and L.D; resources, K.Č.; data curation, B.K. and S.M.; writing—original draft preparation, K.Č.; writing—review and editing, L.D. and K.Č.; visualization, M.T.; supervision, L.D.; project administration, K.Č.; funding acquisition, L.D. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Acknowledgments

The authors acknowledge support of the project solving VEGA 1/0328/25, KEGA 013TUKE-4/2023, and KEGA 075TUKE-4/2024.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Buijs, B.; Sievers, H.; Tercero, L.A. Limits to the critical raw materials approach. Waste Resour. Manag. 2012, 165, 201–207. [Google Scholar] [CrossRef]

- Bartekova, E.; Kemp, R. Critical raw material strategies in different world regions. In MERIT Working Papers United Nations University; Maastricht Economic and Social Research Institute on Innovation and Technology (MERIT): Maastricht, The Netherlands, 2016; p. 005. [Google Scholar]

- Blengini, A.; Nuss, P.; Dewulf, J.; Nita, V.; Peiró, T.L.; Vidal-Legaz, B.; Latunussa, C.; Mancini, L.; Blagoeva, D.; Pennington, D.; et al. EU methodology for critical raw materials assessment: Policy needs and proposed solutions for incremental improvements. Resour. Policy 2017, 53, 12–19. [Google Scholar] [CrossRef]

- Reisch, V. The race for raw materials: Contributions to the debate on the EU’s raw materials policy following the publication of the Fourth Critical Raw Materials List and the 2020 Action Plan. Ser. SWP J. Rev. 2022, 1, 1–8. [Google Scholar] [CrossRef]

- Šolar, S.V.; Demicheli, L.; Wall, P. Raw Materials Initiative: A Contribution to the European Minerals Policy Framework; Springer: Dordrecht, The Netherlands, 2012. [Google Scholar]

- Helbig, C.; Wietschel, L.; Thorenz, A.; Tuma, A. How to evaluate raw material vulnerability—An overview. Resour. Policy 2016, 48, 13–24. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Noori-Darvan, M. Pricing, manufacturing and inventory policies for raw material in a three-level supply chain. Int. J. Syst. Sci. 2014, 47, 919–931. [Google Scholar] [CrossRef]

- Gao, X.; Chen, S.; Tang, H.; Zhang, H. Study of optimal order policy for a multi-period multi-raw material inventory management problem under carbon emission constraint. Comput. Ind. Eng. 2022, 148, 106693. [Google Scholar] [CrossRef]

- Schrijvers, D.; Hool, A.; Blengini, G.A.; Wei-Qiang, C.; Dewulf, J.; Eggert, R.; van Ellen, L.; Gauss, R.; Goddin, J.; Habib, K.; et al. A review of methods and data to determine raw material criticality. Resour. Conserv. Recycl. 2020, 155, 104617. [Google Scholar] [CrossRef]

- Correia, V.; Falck, W.E. The INTRAW International Raw Materials Observatory. Miner. Econ. 2023, 36, 367–368. [Google Scholar] [CrossRef]

- Schimpf, S.; Sturm, F.; Correa, V.; Bodo, B.; Keane, C. The world of raw materials 2050: Scoping future dynamics in raw materials through scenarios. Resour. Environ. ERE 2017, 125, 6–13. [Google Scholar] [CrossRef]

- European Commission. CORDIS EU Research Results. Innovative Solutions for Sustainable Raw Materials Extraction. 2023. Available online: https://cordis.europa.eu/article/id/447091-innovative-solutions-for-sustainable-raw-materials-extraction (accessed on 25 March 2024).

- Teplicka, K.; Khouri, S.; Beer, M.; Rybarova, J. Evaluation of the Performance of Mining Processes after the Strategic Innovation for Sustainable Development. Processes 2021, 9, 1374. [Google Scholar] [CrossRef]

- Sevastyanova, A.E. Approach to justification of innovation policy for raw material regions. J. Sib. Fed. Univ. 2015, 8, 98–107. [Google Scholar]

- Simkova, Z.; Ocenasova, M.; Tudos, D.; Roth, B. The political frame of the European Union for mining of non-energetic raw materials. Acta Montan. Slovaca 2019, 24, 35–43. [Google Scholar]

- Bednarova, L.; Dzukova, J.; Grosos, R.; Gomory, M.; Petras, M. Legislative instruments and their use in the management of raw materials in the Slovak Republic. Acta Montan. Slovaca 2020, 25, 105–115. [Google Scholar] [CrossRef]

- Charlier, C.; Guillou, S. Distortion effects of export quota policy: An analysis of the China Raw materials dispute. China Econ. Rev. 2014, 31, 320–338. [Google Scholar] [CrossRef]

- Kovanda, J.; Weinzettle, J. The importance of raw material equivalents in economy-wide material flow accounting and its policy dimension. Environ. Sci. Policy 2013, 29, 71–80. [Google Scholar] [CrossRef]

- Meunier, S.; Nocilaidis, K. The Geopoliticization of European Trade and Investment Policy. J. Common Mark. Stud. 2019, 57, 103–113. [Google Scholar] [CrossRef]

- Tröster, B.; Küblböck, K.; Grumiller, J. EU’s and Chinese raw materials policies in Africa: Converging trends? Kurswechsel 2017, 3, 69–78. Available online: www.kurswechsel.at (accessed on 25 March 2024).

- Wisniewski, T.P. Investigating Divergent Energy Policy Fundamentals: Warfare Assessment of Past Dependence on Russian Energy Raw Materials in Europe. Energies 2023, 16, 2019. [Google Scholar] [CrossRef]

- Ouedraogo, N.S.; Kilolo, J.M.M. Africa’s critical minerals can power the global low-carbon transition. Prog. Energy 2024, 6, 033004. [Google Scholar] [CrossRef]

- Di Noi, C.; Ciroth, A.; Mancini, L. Can S-LCA methodology support responsible sourcing of raw materials in EU policy context? Int. J. Life Cycle Assess 2020, 25, 332–349. [Google Scholar] [CrossRef]

- Hool, A.; Helbig, C.; Wierink, G. Challenges and opportunities of the European Critical Raw Materials Act. Miner. Econ. 2023, 37, 661–668. [Google Scholar] [CrossRef]

- Gstohl, S.; Schnock, J. Towards a Coherent Trade-Environment Nexus? The EU’s Critical Raw Materials Policy. J. World Trade 2024, 58, 35–60. [Google Scholar] [CrossRef]

- Hofmann, M.; Hofmann, H.; Hageluken, C.; Hool, A. Critical raw materials: A perspective from the materials science community. Sustain. Mater. Technol. 2018, 17, e00074. [Google Scholar] [CrossRef]

- Jump Statistical Discovery. Available online: https://www.jmp.com/en_us/home.html (accessed on 1 January 2024).

- Nguyen, T.C.; Do, A.N.; Pham, V.V.; Gospodarikov, A. Multiple linear regression analysis model and artificial neural network model to calculate and estimate the blast induced area of the tunnel face. A case study Deo Ca tunnel. J. Min. Earth Sci. 2022, 63, 43–52. [Google Scholar] [CrossRef]

- Backhaus, K.; Erichson, B.; Gensler, S.; Weiber, R.; Weiber, T. Multivariate Analysis: An Application-Oriented Introduction; Springer Gabler: Wiesbaden, Germany, 2021. [Google Scholar]

- Kutner, M.H.; Nachstheim, C.J.; Neter, J. Applied Linear Statistical Models; McGraw-Hill/Irwin: Boston, MA, USA, 2005. [Google Scholar]

- McLellan, B.C.; Corder, G.D.; Giurco, D.P.; Ishihara, K.N. Renewable energy in the minerals industry: A review of global potential. J. Clean. Prod. 2012, 32, 32–44. [Google Scholar] [CrossRef]

- Malico, I.; Pereira, R.N.; Goncalves, A.C.; Sousa, A.M.O. Current status and future perspectives for energy production from solid biomass in the European industry. Renew. Sustain. Energy Rev. 2019, 112, 960–977. [Google Scholar] [CrossRef]

- Koyamparambath, A.; Santillán-Saldivar, J.; McLellan, B.; Sonnemann, G. Supply risk evolution of raw materials for batteries and fossil fuels for selected OECD countries (2000–2018). Resour. Policy 2022, 75, 102465. [Google Scholar] [CrossRef]

- Berdysheva, S.; Ikonnikova, S. The energy transition and shifts in fossil fuel use: The study of international energy trade and energy security Dynamics. Energies 2021, 14, 5396. [Google Scholar] [CrossRef]

- Kowalski, P.; Legendre, C. Raw Materials Critical for the Green Transition: Production, International Trade and Export Restrictions. OECD TRADE POLICY PAPER 2023, No. 269. Available online: https://www.oecd-ilibrary.org/docserver/c6bb598b-en.pdf?expires=1718003389&id=id&accname=guest&checksum=2A11DD864F77360681A1EBBD64A4A830 (accessed on 1 December 2024).

- European Union. Import, Export, and Trade in the European Union. 2023. Available online: https://european-union.europa.eu/live-work-study/import-and-export_sk (accessed on 25 March 2024).

- Shopova, M.; Petrova, M.; Todorov, L. Trade in Recyclable Raw Materials in EU: Structural Dynamics Study. In International Conference on Sustainable, Circular Management and Environmental Engineering; Springer Nature: Cham, Switzerland, 2022; pp. 43–64. [Google Scholar]

- CRM Alliance. What Are Critical Raw Materials? 2024. Available online: https://www.crmalliance.eu/critical-raw-materials (accessed on 1 January 2024).

- Asif, M.S.; Lau, H.; Nakandala, D.; Hurriyet, H. Paving the way to net-zero: Identifying environmental sustainability factors for business model innovation through carbon disclosure project data. Front. Sustain. Food Syst. 2023, 7, 1214490. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).