A Techno-Economic Analysis of Natural Gas Valuation in the Amazon Region to Increase the Liquefied Petroleum Gas (LPG) Production in Ecuador

Abstract

1. Introduction

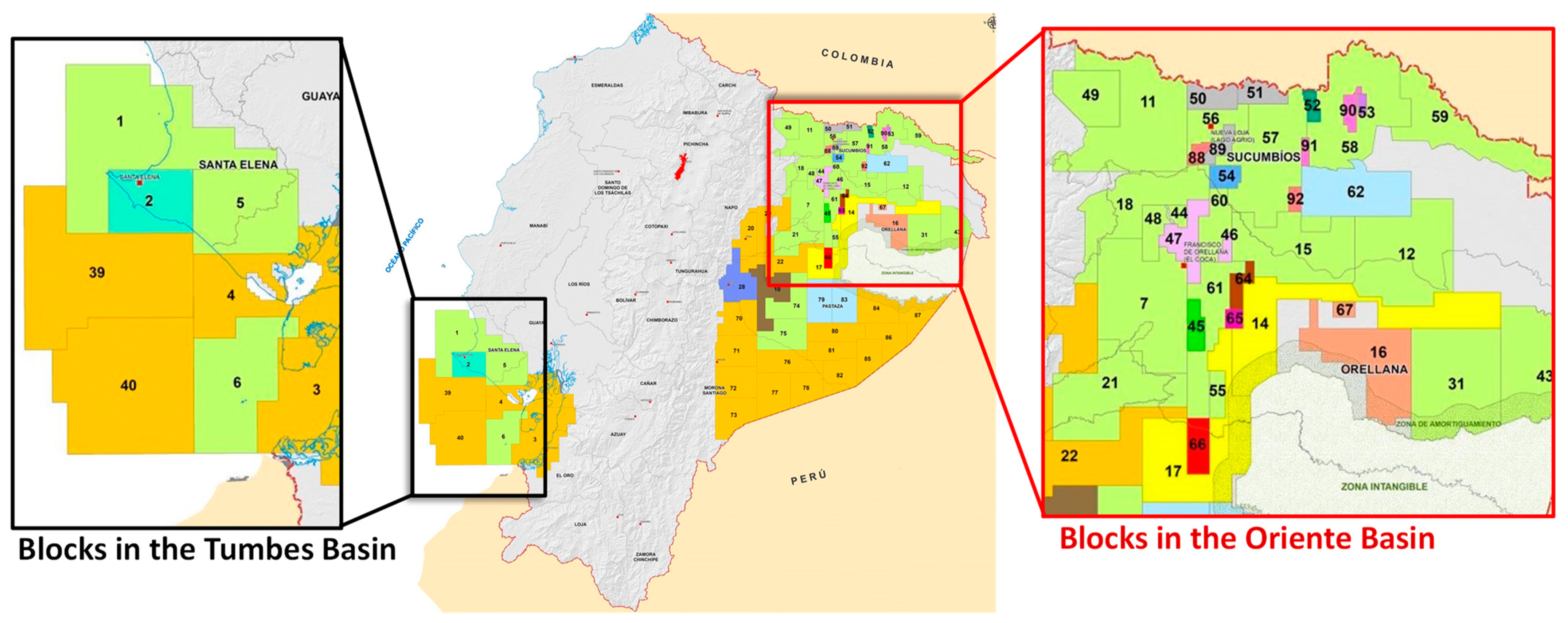

2. Natural Gas Industry in Ecuador: A Brief Review

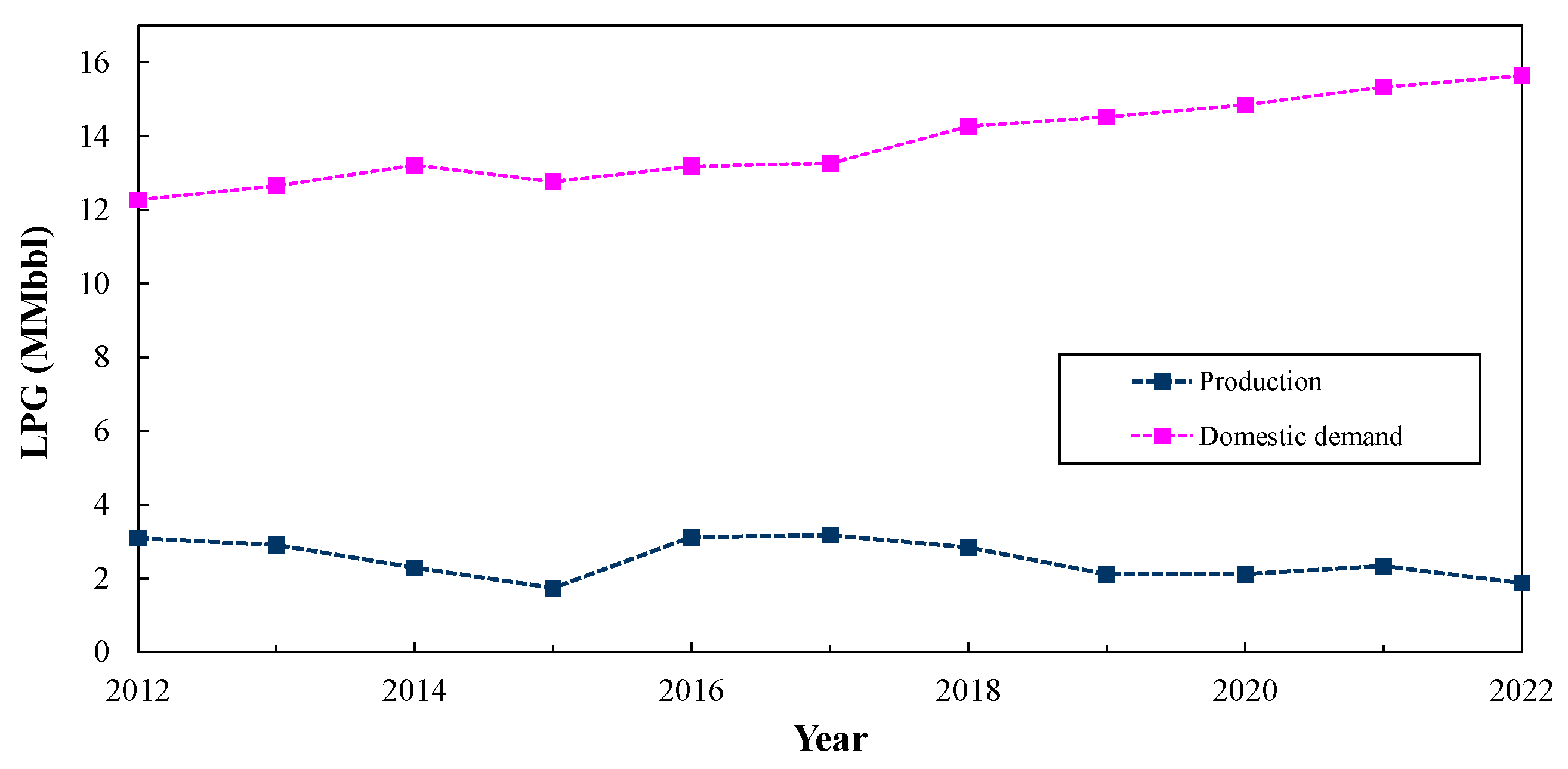

2.1. Liquefied Petroleum Gas Market

2.2. Shushufindi Gas Plant

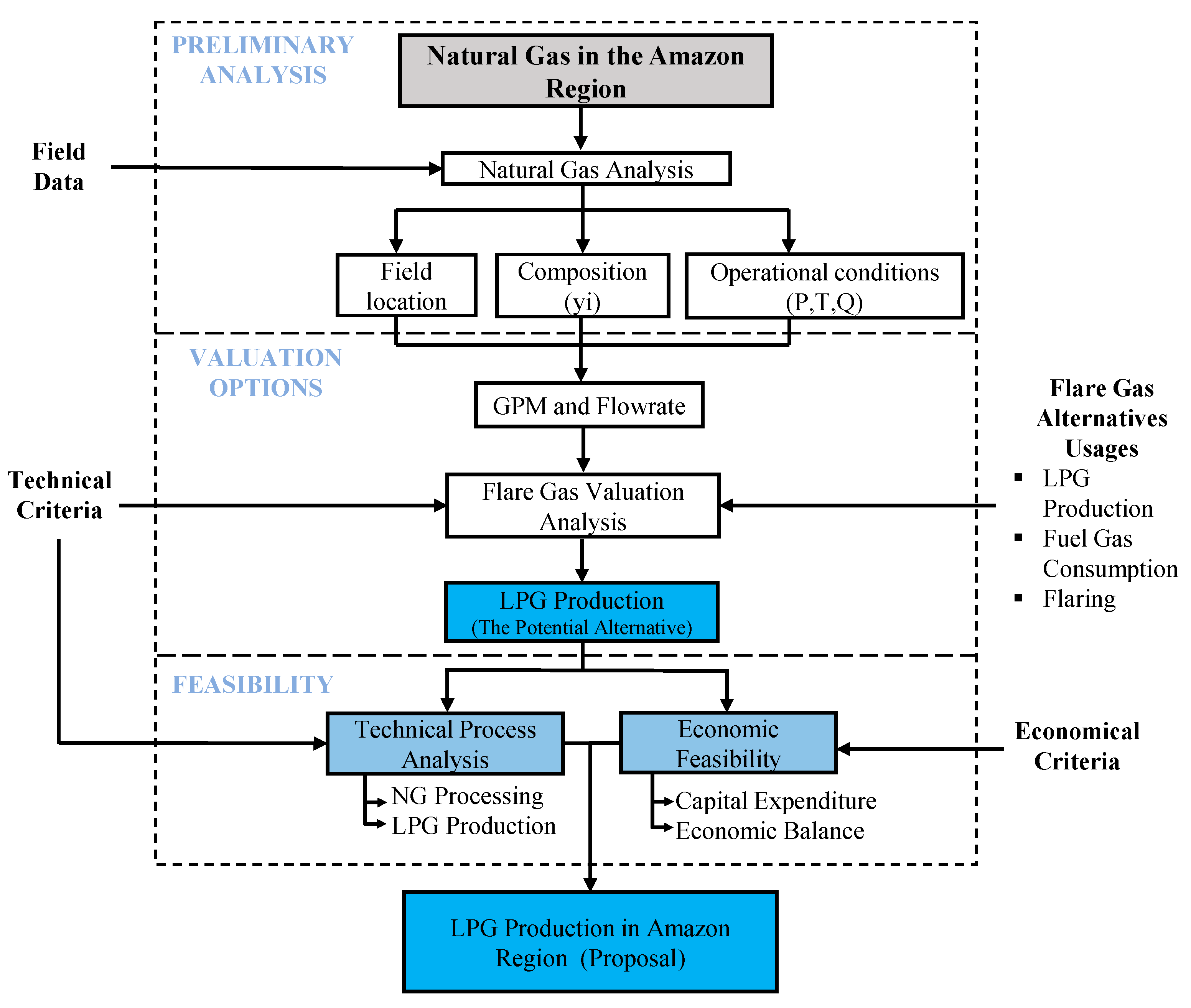

3. Methods

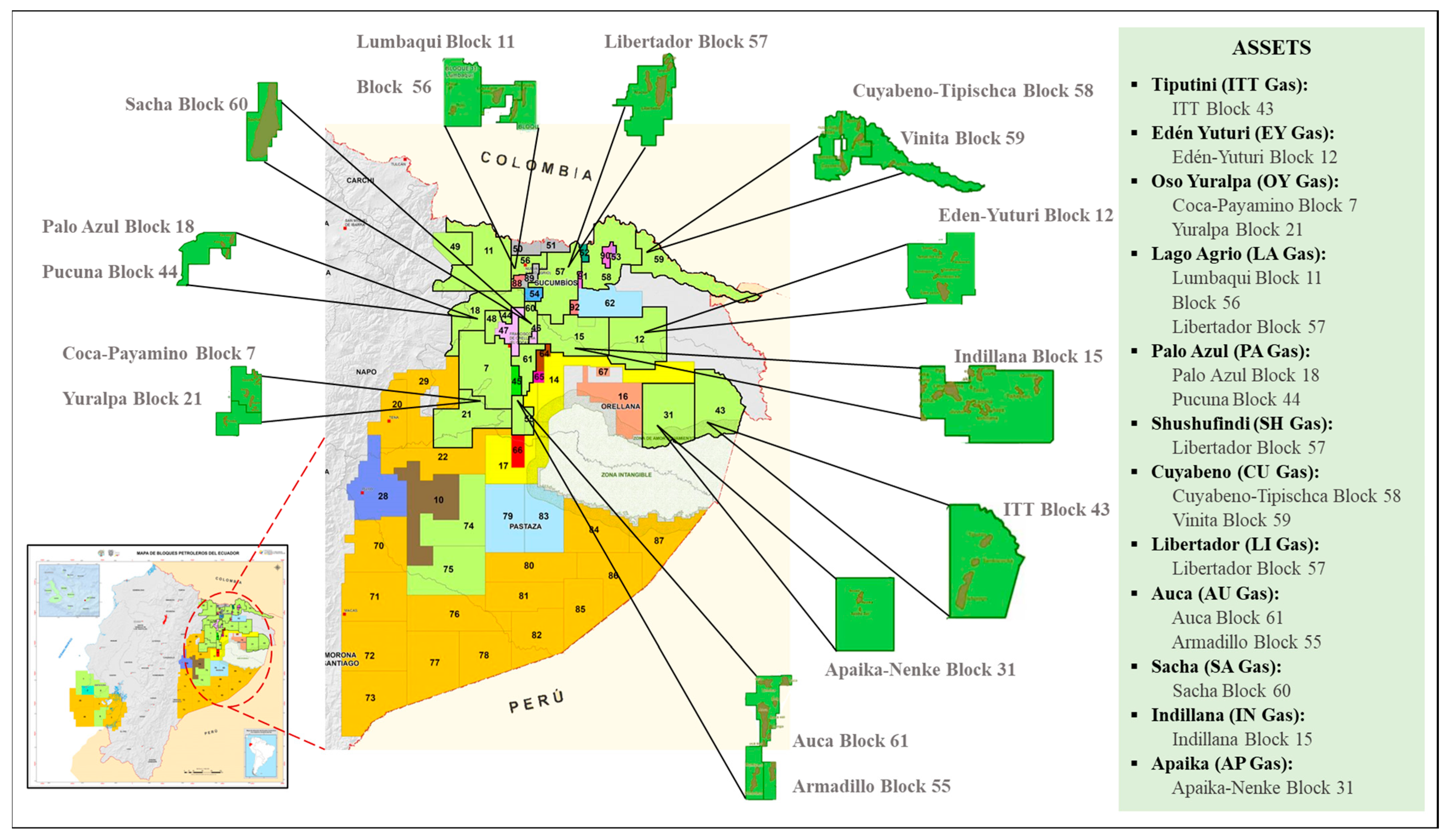

3.1. Preliminary Analysis of Natural Gas in the Amazon Region

3.2. Feasibility of Liquefied Natural Gas Production

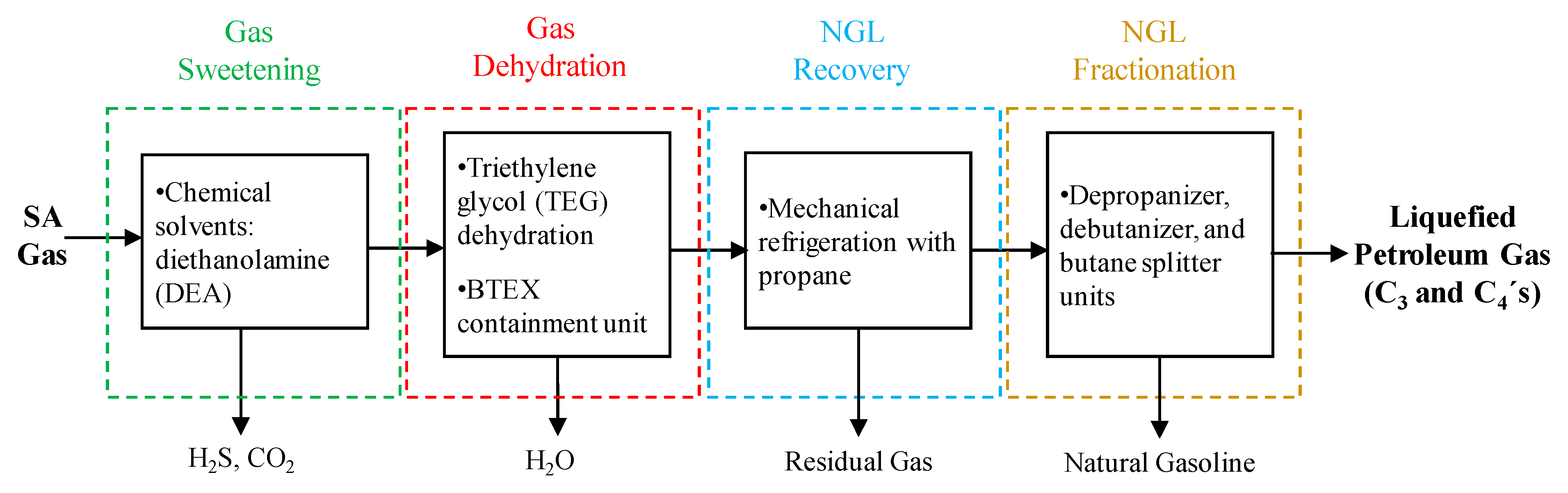

- Gas sweetening: In this section, the cost applied to remove the acid gases with diethanolamine (DEA) as a chemical solvent and an operating pressure from 585 to 785 psia. However, the cost excluded any gas dehydration after gas treatment.

- Gas dehydration: In this section, to remove the water, the cost applied for the new glycol dehydration facility, having BTEX (benzene, toluene, ethylbenzene, and xylene) containment equipment, and for an operating pressure from 585 to 785 psia. However, the cost excluded improvements to generate concentrations of lean glycol greater than 98.6 wt.%.

- Natural gas liquids recovery: In this section, to recover a single natural gas liquids (NGL) product stream, the cost applied for a straight refrigeration process, including limited storage, the use of ethylene-glycol injection for hydrate inhibition, and the cost of glycol regeneration. However, the cost excluded upstream compression and treating, liquid product fractionation, and any outlet-gas compression (pressure drop is small in this unit).

- Natural gas liquid fractionation: The most conventional fractionation process was considered for this section. Furthermore, due to the lack of public data on fractionation cost, the cost for this stage was calculated as 50% of the natural gas liquids recovery stage.

- Note that within the battery limit of the gas plant, the infrastructure costs for gas gathering and inlet compression were not considered.

4. Results and Discussion

4.1. Natural Gas Analysis in the Amazon Region

4.2. Associated Gas Valuation in the Amazon Region

4.3. Liquefied Petroleum Gas Production Feasibility

4.3.1. Technical Processing Study

- Gas sweetening: In the gas sweetening stage, the available technology (liquid-phase absorption) for removing acid gases included chemical, physical, and hybrid solvents. The use of each of them depended on different parameters, including the type and amount of acid gases, hydrocarbon composition, partial pressure in the feedstock, and others. The SA gas was characterized by a high quantity of natural gas liquids due to its GPM of 5.5. Physical solvents were not possible for this situation because, according to Gas Processors Suppliers Association (GPSA) [30], physical solvents tend to dissolve heavy hydrocarbons. Additionally, removing around 9.35 mole % of CO2 (and considering possible H2S removal simultaneously) required an intensive, not selective, acid gas removal. According to Kidnay et al. [29], the chemical solvents meet these requirements and partially remove COS and mercaptans. Chemical solvents also were favorable for low partial pressures of the acid gases. Therefore, a possible technology for this stage was chemical solvents, especially DEA, one of the most mature technologies of chemical solvents.

- Gas Dehydration: Due to amine usage (in water solution), the treated gas left the sweetening stage saturated with water. In the gas dehydration stage, it was necessary to remove this water content. The conventional technologies for water remotion included absorption and adsorption methods. For selecting each of them, several factors must be considered. This process was not focused on cryogenic liquids recovery, so adsorption methods such as molecular sieves were not considered. According to Kidnay et al. [29], molecular sieve dehydration requires high energy consumption in the regeneration step.

- Absorption methods such as glycol dehydration were more feasible to meet the specifications of this process. According to Mokhatab et al. [6], glycol dehydration is more economically expensive in capital investment and operating expenditure than molecular sieves technology. Also, it could meet the specification for NGL recovery as low as −40 °F. Therefore, a possible technology for the SA gas to remove water was glycol technology, especially the triethylene glycol (TEG) dehydration process. In addition, according to Myers, it was also required to include a BTEX containment unit [41]. This equipment avoided the absorption of BTEX hydrocarbons in the TEG process and their subsequent release to the atmosphere in the glycol regenerator.

- Natural gas liquids recovery: A chart by Kidnay et al. [29] showed the ethane and propane recovery level dependency as a function of the C3+ content in the feed stream and the separation temperature. It was noticeable that recovery levels increased with a higher gas richness. For a 5.5 GPM C3+ gas, a 90% propane recovery required −30 to −40 °F at 614.7 psia. Furthermore, there was also a chance of high ethane recovery from the SA gas through different refrigeration techniques arrangement and combination. It also could increase the propane and butane recovery to almost 100%. However, ethane recovery, which required separation temperatures lower than 40 °F (cryogenic temperatures), was not within the scope of this study, but it could be considered for future projects.

- For recovering NGL products, there were several refrigeration techniques, including valve expansion, mechanical refrigeration, and turboexpanders. Their use depended on different factors such as the desired products, the inlet conditions, the economic availability, and others. As this process was not focused on cryogenic recovery, which requires low temperatures for liquids condensation (−150 °F), turboexpanders were not considered because of their high operation cost [6]. Also, despite its simplicity in operation and low maintenance equipment, J-T units require high inlet pressures that the SA gas did not have. Therefore, in this case, a possible technology for NGL recovery was mechanical refrigeration (straight refrigeration), which could meet the current low inlet gas pressure conditions.

- Furthermore, according to GPSA [30], straight refrigeration is quite flexible because it can be used for modest liquid recovery, high propane recovery (−40 °F), and reasonable quantities of ethane recovery (in the case of rich gases). For this process, an ideal system was mechanical refrigeration with propane, an industry-matured technology. Additionally, according to Kidnay et al. [29], ethylene glycol injection was also necessary for hydrate inhibition in this section (when the water content was higher).

- Natural gas liquid fractionation: In the gas fractionation stage, conventional technology was considered for processing the raw NGL into individual products by fractionation. The NGL went through a four-column fractionation system. It included a de-ethanizer unit, a depropanizer unit, a debutanizer unit, and a butane splitter unit; which processes the gas from raw NGL into end products such as LPG and natural gasoline.

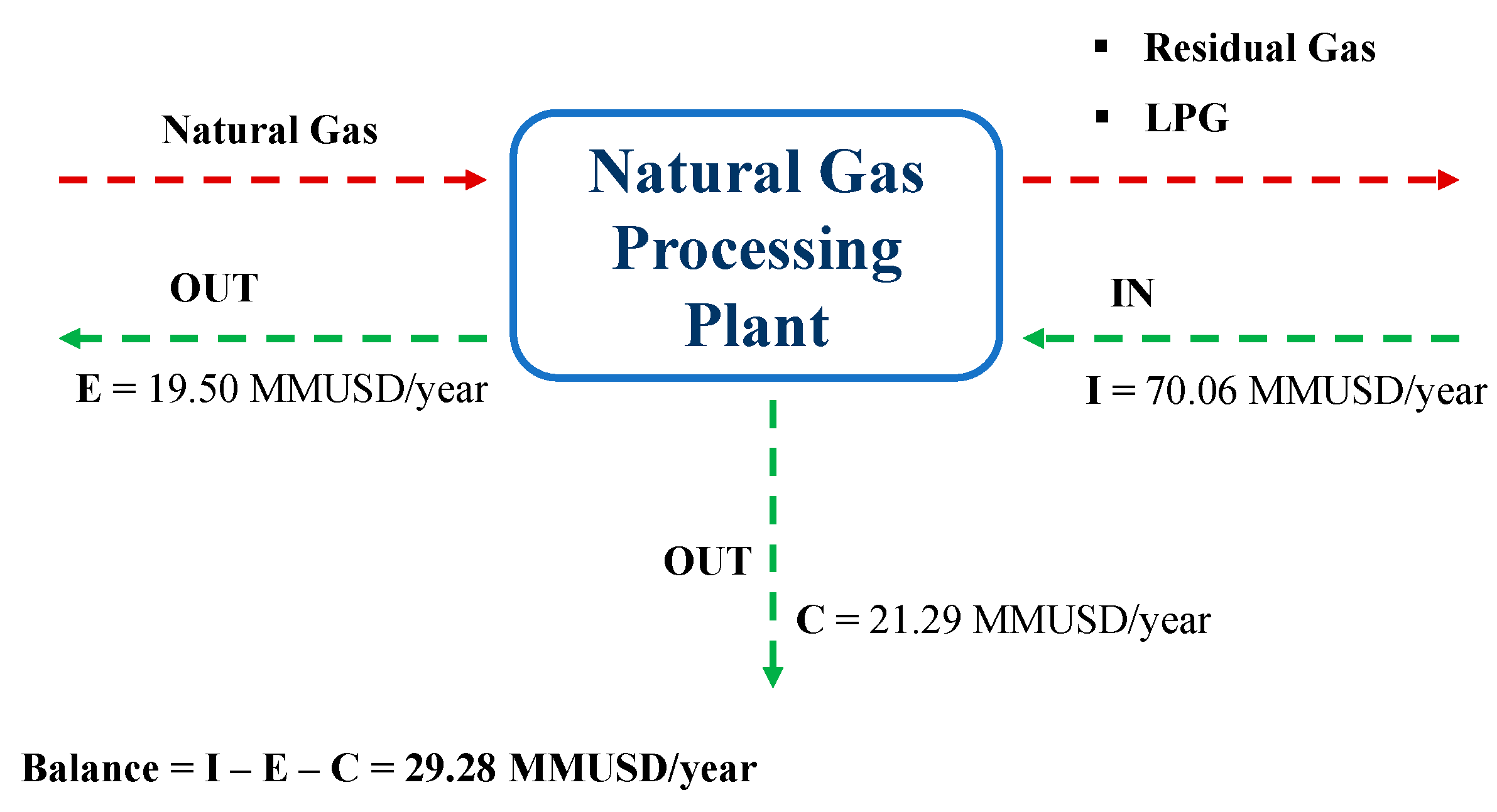

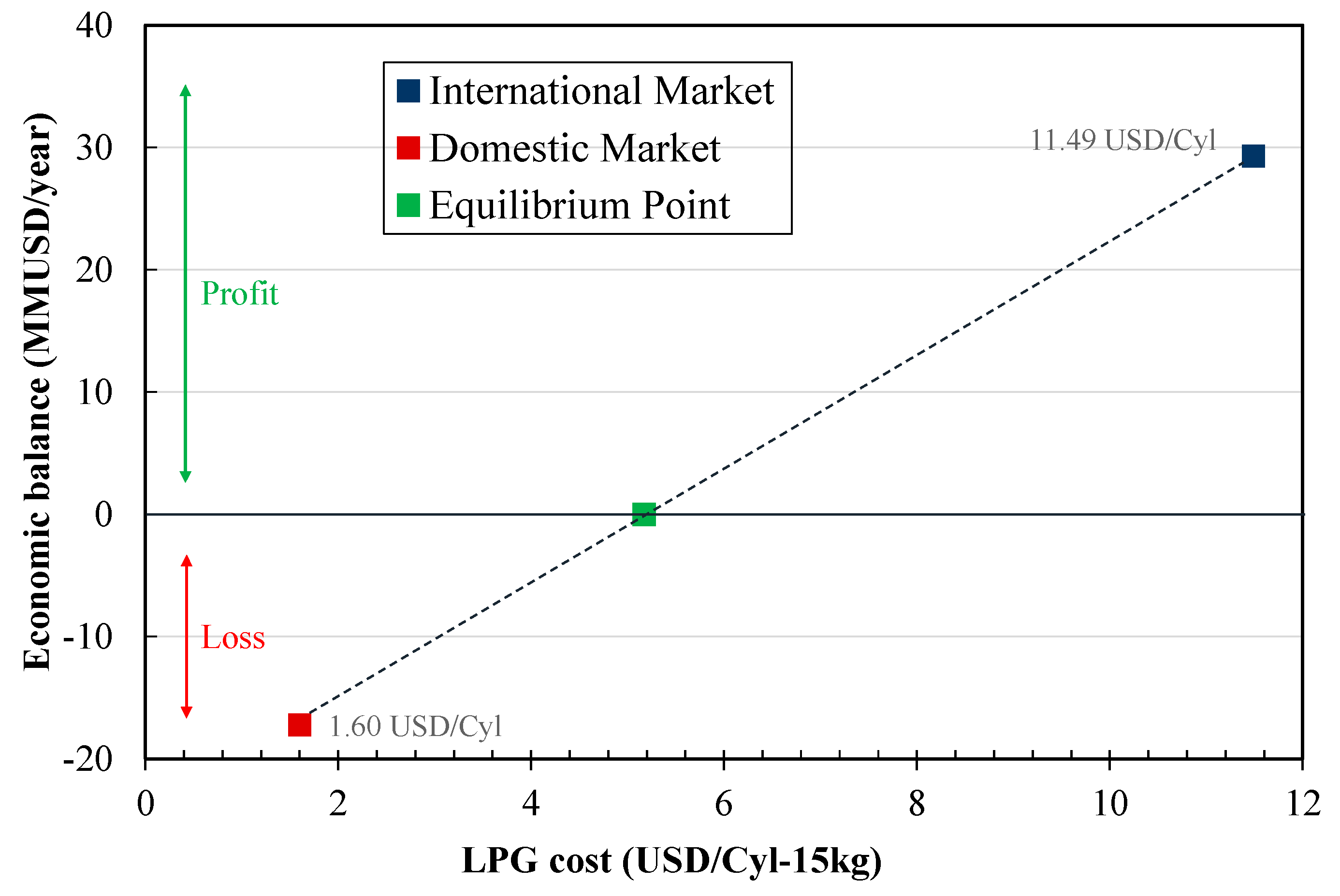

4.3.2. Economic Feasibility Study

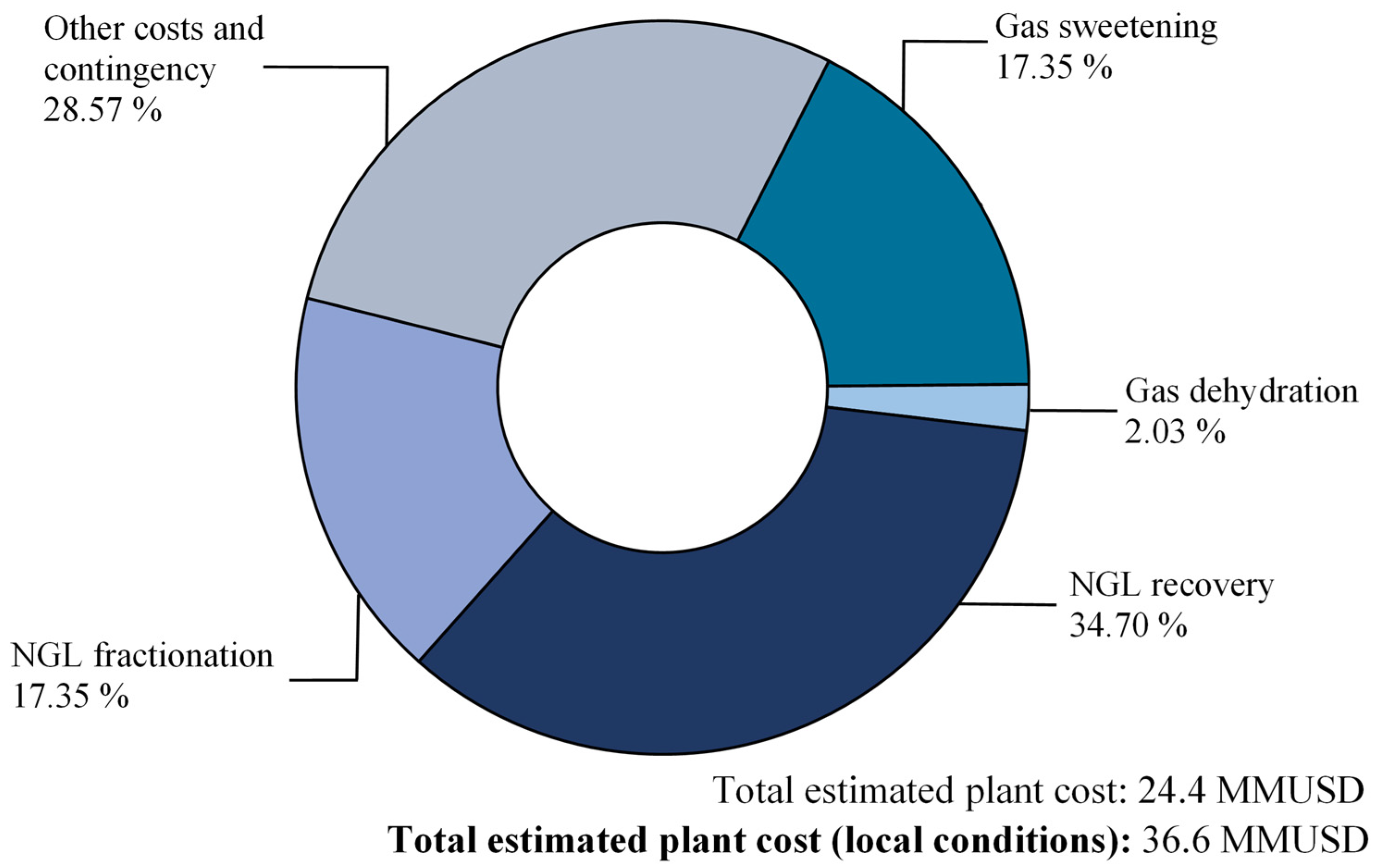

- Gas Sweetening: In the gas sweetening stage, the aim was to remove the acid gases from the SA gas stream. Hence, it was necessary to remove ~9.35% of acid gases. The acid gas volume to remove was directly related to their operating and capital cost. Large removal volume implied high capacities (absorber and regenerator) to manage the amine recirculation rates. Thus, it required higher costs. In this study, the estimated capital cost for SA gas sweetening, using DEA as a solvent, was ~4.23 MMUSD.

- Gas Dehydration: In the gas dehydration stage, the aim was to remove the water content from the SA gas stream. There is a water-saturated gas, so the dehydration capital and operation costs depend on the inlet flowrate. For the SA gas dehydration facility, it was necessary to have ~0.49 MMUSD as the capital cost using TEG technology.

- Natural gas liquids recovery: In natural gas liquids recovery, the aim was to condense the heavy hydrocarbons from the SA gas stream. The increase in the GPM (on a C3+ basis) impacted the recovery cost, mainly because of the more significant load of refrigeration required. Hence, for SA gas, with a GPM of 5.5, the capital cost for the NGL recovery facility was ~8.46 MMUSD.

- Natural gas liquid fractionation: In the natural gas liquids fractionation stage, the aim was to separate the NGL from SA gas into individuals. For this study, the estimated capital cost for NGL fractionation was ~4.23 MMUSD.

4.4. Final Remarks

5. Conclusions and Recommendations

- In the Amazon region, the associated gas produced had a high content of heavy hydrocarbons (GPM C2+ ≥ 3 gal/Mscf and GPM C3+ ≥ 3 gal/Mscf) and commercial characteristics. Therefore, there was an opportunity to take advantage of this gas by natural gas processing, increasing industrial revenues and reducing gas flaring.

- The processed gas from the Sacha field could produce 2548 bbl/day of LPG, constituting an increase of 30.9% of the current domestic LPG production. This associated gas valuation would represent a tremendous social impact by introducing ~14,600 LPG cylinders of 15 kg daily to the domestic market. It easily could represent the LPG supply of nearly 219,000 households per month in Ecuador. Inserting this amount of LPG into the domestic market would highly reduce the import dependency on this commodity.

- The technical analysis determined that the potential technology to process the associated gas from the Sacha field includes gas sweetening, dehydration, natural gas liquids recovery, and fractionation units.

- The economic study (class V) showed that the estimated capital expenditure (CAPEX) of the gas processing plant for the SA gas was 36.6 MMUSD, considering local conditions. The plant consisted of gas sweetening, dehydration, recovery, and fractionation stages.

- The economic balance study of the SA gas processing plant showed that the introduction of 2548 bbl/day of LPG would replace 49.37 MMUSD/year in LPG imports. The potential savings of producing this amount of LPG would give the Ecuadorian economy a 32.13 MMUSD/year profit.

- The study results showed that it is possible to value natural gas streams—through conventional conditioning and processing technologies—to produce LPG as an alternative to reduce gas flaring in Ecuador. It would make it possible to supply the internal market with this commodity, which has a high social impact, as it is used in homes as fuel for food preparation and hot water services, as well as in the local commercial sector dedicated to food services. Additionally, this study was raised to demonstrate that despite the LPG price being regulated in Ecuador, the development of an LPG production plant is viable. Modest capital investments would be required, financed with the money saved by reducing the import of LPG. The findings of this study can be used in similar engineering analyses worldwide that require the valuation of natural gas using conventional and mature technologies, emphasizing those countries where the government subsidizes LPG and other commodities.

- Finally, an economic study of the associated gas compression, gathering process, and related infrastructure is recommended to have a more accurate value of the CAPEX of the gas processing plant. In addition, it is required to estimate labor costs (workers’ wages and insurance) to have a better perspective of the economy of the gas processing plant. For future studies on this topic, conducting a deep analysis of the associated gas produced in the different wells of the Amazon region was recommended to select more flexible equipment with a minimum operating range to process the gas.

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| AU Gas | associated natural gas from the Auca field |

| BTEX | benzene, toluene, ethylbenzene, and xylene |

| BTU/ft3 | British thermal unit per cubic feet |

| C1 | methane |

| C2 | ethane |

| C3 | propane |

| C4’s | butanes (n-butane and i-butane) |

| C5+ | natural gasoline |

| CO2 | carbon dioxide |

| CAPEX | capital expenditure |

| CEPCI | chemical engineering plant cost index |

| Cyl | cylinder |

| Cyl-15kg | 15 kg cylinder |

| CU Gas | associated natural gas from the Cuyabeno field |

| bpd | barrels per day |

| DEA | diethanolamine |

| EY Gas | associated natural gas from the Edén Yuturi field |

| Gal | U.S. gallons |

| gpm | US gallons per minute |

| GPM | liquid hydrocarbon content expressed in gallons can be obtained for every 1000 cubic feet of natural gas at standard conditions |

| GPSA | gas processors suppliers association |

| H2S | hydrogen sulfide |

| IN Gas | associated natural gas from the Indillana field |

| ITT Gas | associated natural gas from the Tiputini field |

| LA Gas | associated natural gas from the Lago Agrio field |

| LI Gas | associated natural gas from the Libertador field |

| lb/MMscf | pound per million standard cubic feet |

| LPG | liquefied petroleum gas |

| LNG | liquefied natural gas |

| MMbbl | million barrels |

| MMbbl/year | million barrels per year |

| MMBTU | million British thermal unit |

| Mscf | thousand standard cubic feet |

| MMscf | million standard cubic feet |

| MMscfd | million standard cubic feet per day |

| MMUSD | million U.S. dollars |

| MMUSD/year | million U.S. dollars per year |

| NG | natural gas |

| NGL | natural gas liquids |

| N2 | nitrogen |

| OGE&EE | optimization of power generation and energy efficiency |

| OPEX | operational expenditure |

| OY Gas | associated natural gas from the Oso Yuralpa field |

| P | pressure (psia) |

| PA Gas | associated natural gas from the Palo Azul field |

| ppmv | parts per million by volume |

| Q | gas flowrate (MMscfd) |

| SA Gas | associated natural gas from the Sacha field |

| SH Gas | associated natural gas from the Shushufindi field |

| ShGP | Shushufindi gas plant |

| TCF | trillion cubic feet (1012 cubic feet) |

| TEG | triethylene glycol |

| Tm/d | metric tons per day |

| USD/MMBTU | US dollar per million British thermal unit |

| USD/Mscf | U.S. dollar per thousand standard cubic feet |

| USD/bbl | U.S. dollar per barrel |

| T | temperature (°F) |

Appendix A

| Cost Include | Cost Exclude |

|---|---|

|

|

References

- Bahadori, A. Natural Gas Processing Technology and Engineering Design, 2nd ed.; Elsevier: Oxford, UK, 2014. [Google Scholar] [CrossRef]

- Energy Institute. Statistical Review of World Energy, 72nd ed.; Energy Institute: London, UK, 2023; Available online: https://www.energyinst.org/statistical-review (accessed on 27 June 2023).

- ElBadawy, K.; Teamah, M.; Shehata, A.; Hanfy, A. Simulation of liquefied petroleum gas (LPG) production from natural gas using fractionation towers. Int. J. Adv. Sci. Technol. Res. 2018, 6, 148–153. [Google Scholar] [CrossRef]

- Hubbard, R. The role of gas processing in the natural-gas value chain. J. Pet. Technol. 2009, 61, 65–71. [Google Scholar] [CrossRef]

- Speight, J.G. Natural Gas: A Basic Handbook, 2nd ed.; Elsevier: Cambridge, UK, 2019; ISBN 9780128095706. [Google Scholar]

- Mokhatab, S.; Poe, W.; Mak, J. Handbook of Natural Gas Transmission and Processing: Principles and Practices, 3rd ed.; Gulf Professional Publishing: Oxford, UK, 2015. [Google Scholar] [CrossRef]

- The World Bank. Seven Countries Account for Two-Thirds of Global Gas Flaring. 2021. Available online: https://www.worldbank.org/en/news/press-release/2021/04/28/seven-countries-account-for-two-thirds-of-global-gas-flaring (accessed on 27 June 2023).

- Elvidge, C.; Zhizhin, M.; Baugh, K.; Hsu, F.-C.; Ghosh, T. Methods for global survey of natural gas flaring from visible infrared imaging radiometer suite data. Energies 2016, 9, 14. [Google Scholar] [CrossRef]

- The World Bank. Environmental, Health and Safety Guidelines for Onshore Oil and Gas Development, 1st ed.; World Bank Group: Washington, DC, USA, 2007; Available online: http://documents.worldbank.org/curated/en/130481486373751616/Environmental-health-and-safety-guidelines-for-onshore-oil-and-gas-development (accessed on 27 June 2023).

- The World Bank. Global Gas Flaring Tracker Report; World Bank Group: Washington, DC, USA, 2023; Available online: https://www.worldbank.org/en/topic/extractiveindustries/publication/2023-global-gas-flaring-tracker-report (accessed on 27 June 2023).

- The World Bank. Global Gas Flaring Reduction. A Public-Private Partnership. A Voluntary Standard for Global Gas Flaring and Venting Reduction; World Bank Group: Washington, DC, USA, 2004; Available online: https://documents1.worldbank.org/curated/en/342761468780614074/pdf/295550GGF0a0pu1ship10no10401public1.pdf (accessed on 27 June 2023).

- Ayala, D.; Padilla, W.; Ayala, S. Energy efficiency and secondary recovery: Two management options for a mature fields in Ecuador. In Proceedings of the SPE Canadian Energy Technology Conference and Exhibition, Calgary, AB, Canada, 10 March 2023. [Google Scholar]

- Carbon Limits AS. Reduction of Gas Flaring in Ecuador and Peru-Final Report; Carbon Limits AS: Oslo, Norway, 2017. [Google Scholar]

- Ministerio de Energía y Minas. Mapas Petroleros del Ecuador. 2023. Available online: https://www.recursosyenergia.gob.ec/mapas/ (accessed on 27 June 2023).

- EP Petroecuador. Cifras Institucionales. 2023. Available online: https://www.eppetroecuador.ec/?p=3721 (accessed on 27 June 2023).

- Facchinelli, F.; Pappalardo, S.E.; Codato, D.; Diantini, A.; Della Fera, G.; Crescini, E.; De Marchi, M. Unburnable and unleakable carbon in Western Amazon: Using VIIRS nightfire data to map gas flaring and policy compliance in the Yasuní biosphere reserve. Sustainability 2020, 12, 58. [Google Scholar] [CrossRef]

- Durango-Cordero, J.; Saqalli, M.; Parra, R.; Elger, A. Spatial inventory of selected atmospheric emissions from oil industry in Ecuadorian Amazon: Insights from comparisons among satellite and institutional datasets. Saf. Sci. 2019, 120, 107–116. [Google Scholar] [CrossRef]

- Facchinelli, F.; Pappalardo, S.E.; Della Fera, G.; Crescini, E.; Codato, D.; Diantini, A.; Moncayo Jimenez, D.R.; Fajardo Mendoza, P.E.; Bignante, E.; De Marchi, M. Extreme citizens science for climate justice: Linking pixel to people for mapping gas flaring in Amazon rainforest. Environ. Res. Lett. 2022, 17, 024003. [Google Scholar] [CrossRef]

- Instituto Ecuatoriano de Normalización. NTE INEN 0111: 1998 Cilindros de Acero Soldados para gas Licuado de Petróleo GLP. Requisitos e Inspección; INEN: Quito, Ecuador, 1998. [Google Scholar]

- Orellana, M. Estimación Del Costo de Comercialización de Los Cilindros de GLP En La CEM “Austrogas”. Bachelor’s Thesis, Universidad de Cuenca, Cuenca, Ecuador, 2011. [Google Scholar]

- Echeverria, M.; Viloria, A.; Ricaurte, M. Identification of Operational Improvements in the Production of LPG through the Simulation of Processes: Case Study Ecuadorian Market. Bol. Acad. Nac. Ing. Y Hábitat 2021, 52, 78–84. [Google Scholar]

- Pazos, J. Optimización de la Captación de Gas Natural y Producción de GLP en los Complejos Petroleros del Nororiente Ecuatoriano. Master’s Thesis, Instituto de Altos Estudios Nacionales, Quito, Ecuador, 2008. [Google Scholar]

- Ricaurte, M.; Ordóñez, P.; Navas-Cárdenas, C.; Meneses, M.; Tafur, J.; Viloria, A. Industrial processes online teaching: A good practice for undergraduate engineering students in times of COVID-19. Sustainability 2022, 14, 4776. [Google Scholar] [CrossRef]

- Instituto Ecuatoriano de Normalización. Catálogo de Normas Técnicas; INEN: Quito, Ecuador, 2023; Available online: http://apps.normalizacion.gob.ec/descarga/ (accessed on 27 June 2023).

- The World Bank. World Development Indicators Database. 2023. Available online: https://databank.worldbank.org/home# (accessed on 27 June 2023).

- Montenegro, J.; Veloz, C.; Ricaurte, M. Estimating water content of natural gas mixtures considering heavy hydrocarbons contribution using artificial neural networks. Pet. Sci. Technol. 2023, 41, 819–833. [Google Scholar] [CrossRef]

- Ricaurte, M.; Fernández, J.M.; Viloria, A. An improved method for calculating critical temperatures and critical pressures in natural gas mixtures with up to nC11 hydrocarbons. Oil Gas Sci. Technol.–Rev. d’IFP Energies Nouv. 2019, 74, 53. [Google Scholar] [CrossRef]

- Tannehill, C.; Chandra, A. Budget Estimate Capital Cost Curves for Gas Conditioning and Processing-Updated 2018; GPSA: Tulsa, OK, USA, 2018. [Google Scholar]

- Kidnay, A.; Parrish, W.; McCartney, D. Fundamentals of Natural Gas Processing, 3rd ed.; Taylor & Francis Group: New York, NY, USA, 2020. [Google Scholar] [CrossRef]

- Gas Processors Suppliers Association. Engineering Data Book, 12th ed.; GPSA: Tulsa, OK, USA, 2004. [Google Scholar]

- Towering Skills. Cost Indices. Available online: https://toweringskills.com/financial-analysis/cost-indices/#chemical-engineering-plant-cost-index-cepci (accessed on 25 June 2023).

- Chemical Engineering. The Chemical Engineering Plant Cost Index. Available online: https://www.chemengonline.com/pci-home (accessed on 25 June 2023).

- Cleveland, C.; Morris, C. Dictionary of Energy, 2nd ed.; Elsevier: Amsterdam, The Netherlands, 2015; ISBN 978-0-08-096811-7. [Google Scholar]

- López, M. Optimización del Transporte de Crudo Pesado, Mediante la Implementación de un Sistema de Calentamiento de Fluido en el Campo Ishpingo-Tambococha-Tiputini (ITT). Bachelor’s Thesis, Universidad Central del Ecuador, Quito, Ecuador, 2017. [Google Scholar]

- Sánchez, N. Estudio de Condiciones Técnicas para la Inyección de CO2 Como Método de Recuperación Mejorada en el Campo Edén Yuturi EPF Bloque 12. Bachelor’s Thesis, Universidad Tecnológica Equinoccial, Quito, Ecuador, 2016. [Google Scholar]

- Quezada, D.; Vázquez, C. Estudio de Simulación Matemática para la Evaluación de un Fracturamiento Hidráulico en el Campo Lobo. Bachelor’s Thesis, Universidad Central del Ecuador, Quito, Ecuador, 2018. [Google Scholar]

- Vicuña, S. Evaluación de la Factibilidad de Industrializar Helio a Partir de Gas Natural y Gases de Pozos Petroleros Producidos en Ecuador. Bachelor’s Thesis, Escuela Politécnica Nacional, Quito, Ecuador, 2011. [Google Scholar]

- Jiménez, C. Optimización de los Procesos en las Facilidades de Producción en el Campo Sacha, Estación Sacha Central. Bachelor’s Thesis, Escuela Politécnica Nacional, Quito, Ecuador, 2009. [Google Scholar]

- Martínez, G. Estudio Técnico de la Obtención de CO2 a Partir del Gas Asociado en el Campo Indillana y su Aprovechamiento para ser Utilizado en Recuperación Mejorada. Bachelor’s Thesis, Universidad Central del Ecuador, Quito, Ecuador, 2017. [Google Scholar]

- Godoy, J.C.; Villamar, D.; Soria, R.; Vaca, C.; Hamacher, T.; Ordóñez, F. Preparing the Ecuador’s power sector to enable a large-scale electric land transport. Energies 2021, 14, 5728. [Google Scholar] [CrossRef]

- United States Environmental Protection Agency. Methane Emissions from the Natural Gas Industry. Volume 14: Glycol Dehydrators; EPA: Austin, TX, USA, 1995. [Google Scholar]

- U.S. Energy Information Administration. Henry Hub Natural Gas Spot Price. Available online: https://www.eia.gov/dnav/ng/hist/rngwhhdM.htm (accessed on 28 June 2023).

- Carrillo, C.; Parra, R. Comportamiento del margen de refinación en el sector hidrocarburífero del Ecuador en el 2018. FIGEMPA Investig. Y Desarro. Univ. Cent. Ecuador 2021, 11, 30–39. [Google Scholar] [CrossRef]

- EP Petroecuador. Precios de Combustibles. 2021. Available online: https://www.eppetroecuador.ec/?p=6855 (accessed on 28 June 2023).

- Agencia de Regulación y Control de Energía y Recursos Naturales no Renovables. Precio de Combustibles. Available online: https://www.controlrecursosyenergia.gob.ec/precios-combustibles/ (accessed on 26 June 2023).

- Katysheva, E. Creation of the Integrated Field Model to Increase the Oil and Gas Assets Management. In Proceedings of the 20th International Multidisciplinary Scientific GeoConference SGEM, Albena, Bulgaria, 16–25 August 2020. [Google Scholar] [CrossRef]

- Marinina, O.; Nechitailo, A.; Stroykov, G.; Tsvetkova, A.; Reshneva, E.; Turovskaya, L. Technical and economic assessment of energy efficiency of electrification of hydrocarbon production facilities in underdeveloped areas. Sustainability 2023, 15, 9614. [Google Scholar] [CrossRef]

- Katysheva, E. Analysis of the Interconnected development potential of the oil, gas and transport industries in the Russian Arctic. Energies 2023, 16, 3124. [Google Scholar] [CrossRef]

- Katysheva, E.G. Application of bigdata technology to improve the efficiency of Arctic shelf fields development. IOP Conf. Ser. Earth Environ. Sci. 2021, 937, 042080. [Google Scholar] [CrossRef]

| Mole Percent (Mole %) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Compounds | ITT Gas | EY Gas | OY Gas | LA Gas | PA Gas | SH Gas | CU Gas | LI Gas | AU Gas | SA Gas | IN Gas |

| C1 | 45.01 | 30.93 | 71.20 | 55.87 | 3.82 | 37.10 | 14.56 | 25.97 | 55.22 | 58.54 | 38.58 |

| C2 | 4.91 | 5.31 | 9.55 | 11.80 | 1.40 | 10.53 | 4.27 | 9.34 | 9.36 | 10.54 | 6.56 |

| C3 | 4.97 | 7.41 | 9.05 | 14.78 | 4.76 | 16.48 | 11.56 | 17.13 | 14.46 | 13.77 | 9.35 |

| i-C4 | 0.97 | 1.72 | 1.90 | 2.07 | 1.16 | 2.66 | 2.37 | 2.37 | 2.81 | 4.43 | 2.41 |

| n-C4 | 2.02 | 2.73 | 2.22 | 4.64 | 2.94 | 6.75 | 5.38 | 6.92 | 4.94 | 0.00 | 1.40 |

| C5+ | 1.12 | 1.84 | 1.98 | 3.17 | 4.71 | 6.77 | 5.96 | 8.18 | 3.57 | 0.82 | 1.45 |

| N2 | 30.51 | 5.94 | 0.73 | 2.09 | 1.13 | 2.65 | 1.81 | 1.82 | 3.82 | 2.55 | 4.81 |

| CO2 | 10.49 | 44.12 | 3.36 | 5.58 | 80.08 | 17.06 | 54.09 | 28.27 | 5.82 | 9.35 | 35.44 |

| Pressure (psia) | 128.70 | 112.70 | 54.70 | 39.70 | 64.20 | 40.45 | 38.70 | 45.20 | 40.95 | 39.70 | 64.70 |

| Temperature (°F) | 161.00 | 130.00 | 80.00 | 84.00 | 189.05 | 129.61 | 142.52 | 153.77 | 119.66 | 84.00 | 160.00 |

| Flowrate (MMscfd) [15] | 2.47 | 4.73 | 1.02 | 7.06 | 7.72 | 17.65 | 4.80 | 8.97 | 10.66 | 21.50 | 4.11 |

| References | [34] | [35] | [36] | [22] | [37] | [37] | [37] | [37] | [37] | [38] | [39] |

| Feed SA Gas Conditions | |

|---|---|

| Components | mole % |

| C1 | 58.54 |

| C2 | 10.54 |

| C3 | 13.77 |

| i-C4 | 4.43 |

| n-C4 | 0.00 |

| C5+ | 0.82 |

| N2 | 2.55 |

| CO2 | 9.35 |

| Pressure (psia) | 39.70 |

| Temperature (°F) | 84.00 |

| Flowrate (MMscfd) | 21.50 |

| GPM C3+ | 5.5 |

| C3+ Gas Content | 19.02 mole % |

| SA Gas Processing Specifications | |

| Separation Efficiency (C3+) | 90% |

| Value | Unit | Source | |

|---|---|---|---|

| Natural gas price * | 2.65 | USD/MMBTU | [42] |

| Natural gas processing cost † | 3.0 | USD/Mscf | [43] |

| Liquefied petroleum gas price ‡ | 65.89 | USD/bbl | [15] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ortiz, D.; Calderón, D.; Viloria, A.; Ricaurte, M. A Techno-Economic Analysis of Natural Gas Valuation in the Amazon Region to Increase the Liquefied Petroleum Gas (LPG) Production in Ecuador. Resources 2023, 12, 91. https://doi.org/10.3390/resources12080091

Ortiz D, Calderón D, Viloria A, Ricaurte M. A Techno-Economic Analysis of Natural Gas Valuation in the Amazon Region to Increase the Liquefied Petroleum Gas (LPG) Production in Ecuador. Resources. 2023; 12(8):91. https://doi.org/10.3390/resources12080091

Chicago/Turabian StyleOrtiz, Darwin, Damián Calderón, Alfredo Viloria, and Marvin Ricaurte. 2023. "A Techno-Economic Analysis of Natural Gas Valuation in the Amazon Region to Increase the Liquefied Petroleum Gas (LPG) Production in Ecuador" Resources 12, no. 8: 91. https://doi.org/10.3390/resources12080091

APA StyleOrtiz, D., Calderón, D., Viloria, A., & Ricaurte, M. (2023). A Techno-Economic Analysis of Natural Gas Valuation in the Amazon Region to Increase the Liquefied Petroleum Gas (LPG) Production in Ecuador. Resources, 12(8), 91. https://doi.org/10.3390/resources12080091