1. Introduction

In the contemporary economic landscape shaped by intertwined globalization and digitalization, patent-intensive industries have emerged as pivotal engines for innovation-driven growth and economic diversification, becoming the focal point of next-generation industrial cluster development. The

2023 Special Action Plan for Patent Commercialization (2023–2025) explicitly calls for accelerating patent conversion and industrialization of high-value patents, emphasizing quality enhancement to provide technological underpinnings for clustered development. Building on this framework, The

2024 Implementation Plan for Building an Intellectual Property Powerhouse emphasizes accelerating high-value patent commercialization, refining IP frameworks in emerging sectors, and advancing patent-intensive industrial clusters through integrated strategies. The

2024 Annual Guidelines for Promoting High-Quality Intellectual Property Development adds specificity by advocating lifecycle optimization of IP creation, utilization, protection, and management. This approach seeks to unlock innovation potential and deepen IP-industry synergy, thereby propelling high-quality cluster development. Collectively, these policy initiatives underscore how patent-intensive industrial clusters, leveraging their unique strengths, have become indispensable drivers of economic advancement [

1]. The alignment of these industrial clusters with innovation-driven development trends holds critical significance for facilitating economic growth pattern transformation and enhancing the operational efficiency of national innovation systems [

2].

Existing research predominantly examines the connotations and characteristics of patent-intensive industries [

3], with limited scholarly attention directed toward their clustered formations. In the knowledge economy era, these sectors symbolize innovation vitality and developmental potential due to their concentrated innovation activities. Beyond technological excellence, they drive holistic industrial development through resource aggregation, structural optimization, and value chain upgrading, serving as robust engines for regional prosperity and competitiveness enhancement. Therefore, deepening understanding of their formation mechanisms and evolutionary trajectories is crucial for effective policy formulation and high-quality economic development. Amid escalating tech competition, knowledge-driven emerging industrial clusters undergo spatial and organizational reconfiguration across multiple scales [

4]. Spatial arrangements and organizational patterns of patent-intensive clusters are also evolving, manifesting in inter-regional collaboration dynamics, value chain integration, and innovation resource diffusion. Inadequate comprehension of these evolutionary patterns may impede regional economic coordination and constrain innovation capacities. For instance, fragmented inter-regional collaboration mechanisms lead to redundant resource allocation, while ambiguous competitive boundaries hinder technological exchange [

5]. Incomplete value chains limit cluster expansion, and uneven innovation resource distribution creates regional capacity gaps [

6]. Thus, Urgent research is warranted to elucidate evolutionary dynamics, providing empirical foundations for coordinated regional development and innovation capacity enhancement. This study addresses critical knowledge gaps to inform evidence-based policymaking in the rapidly evolving landscape of innovation-driven industrial clusters.

The current economic development paradigm increasingly emphasizes shifting from “factor-driven” to “innovation-driven” growth. Simultaneously, “location-based space” is evolving into “flow space.” This evolution dissolves regional boundaries in technological innovation while transforming innovation models from closed linear approaches to open network-based frameworks [

7]. In this context, establishing and sustaining efficient innovation networks has become pivotal for innovation success. As open innovation deepens, patent-intensive industrial clusters emerge as both knowledge innovation hubs and critical nodes in innovation networks. These networks extend beyond internal R&D, production, and marketing processes to encompass upstream and downstream enterprises and institutions across value chains, forming complex multi-tiered innovation ecosystems [

8]. Through network linkages, clusters significantly accelerate knowledge, technology, information flows, optimize resource allocation, and expedite innovation commercialization. Conversely, network development strengthens clusters’ innovation capacity and competitive advantages, elevating their position in global value chains. Studying these innovation networks offers critical insights into evolutionary patterns under globalization and open innovation, while providing practical implications for regional economic coordination and overall innovation enhancement. This research addresses key knowledge gaps to inform evidence-based strategies in the rapidly evolving innovation landscape.

Given this context, the study utilizes co-invention patent data (2012–2023) from the China National Intellectual Property Administration to investigate cluster innovation networks. It analyzes the connection characteristics within industrial cluster innovation networks and further reveals the evolutionary trajectories of their spatial patterns. The research seeks to address three questions: (1) What evolutionary characteristics define the innovation networks and spatial patterns of industrial clusters? (2) How do innovation linkages manifest at local versus cross-regional levels within cluster networks? (3) What are the changing characteristics of community structures in patent-intensive industrial cluster collaboration networks? Based on this, the present study offers three innovative aspects and contributions. Firstly, while existing research has largely focused on macro-level industrial distribution or firm-level innovation behavior, there is a lack of systematic investigation into innovation networks in patent-intensive industries at the cluster scale. This study adopts a cluster perspective, starting from the spatial agglomeration patterns of patent-intensive industries and delving into the internal innovation networks and community structures within clusters. This approach allows for a multi-level analysis from macro to micro scales. It not only broadens the theoretical scope of innovation network research but also offers a systematic foundation for scientific planning and precise policy-making in patent-intensive industries. Secondly, previous studies on innovation collaboration have often overlooked structural differences across spatial scales. By integrating patent data from listed companies with spatial and network analysis, this study accurately identifies distinct patterns of local versus cross-regional innovation collaboration at different spatial scales. This contributes not only to refining innovation network theory within the Chinese context but also offers practical insights for cluster firms in selecting partners and achieving synergistic innovation. Thirdly, unlike traditional research that overemphasizes geographical proximity, this study applies a community detection algorithm to examine patent-intensive industrial clusters in China. From both structural and temporal evolutionary perspectives, it reveals a shift in the innovation network—from geographically clustered communities to those dominated by technological linkages. This analysis enhances the understanding of innovation network evolution mechanisms and offers a new pathway for interpreting cluster-based innovation ecosystems.

4. Development Trajectory of Patent-Intensive Industries

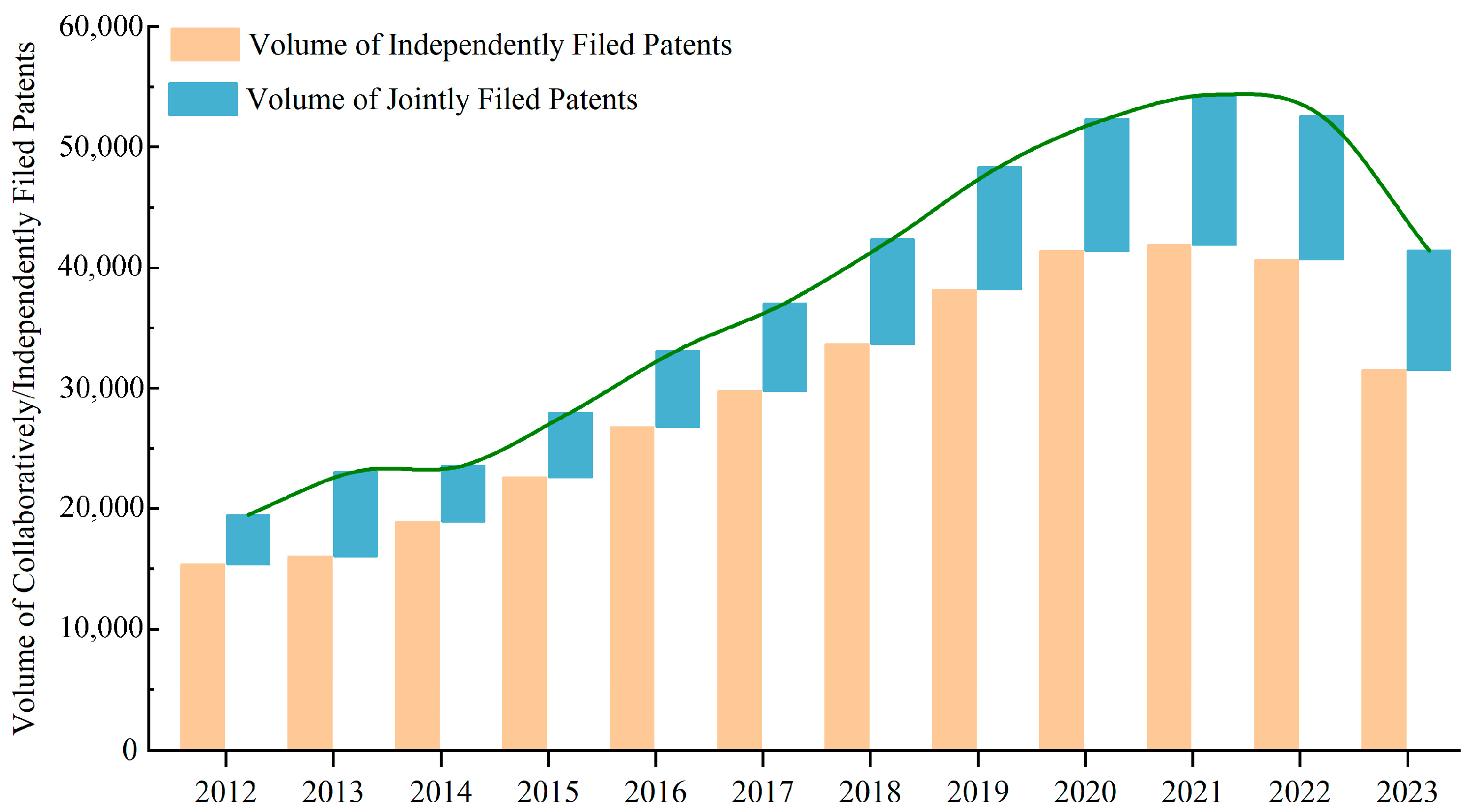

Overall, the total number of invention patent applications in patent-intensive industries has exhibited a fluctuating rise-then-fall pattern, demonstrating distinct stage-specific characteristics (as shown in

Figure 1).

Specifically, from 2012 to 2015, the number of invention patent applications showed a slow growth trend. During this period, patent-intensive industries witnessed a steady increase in independently filed invention patents. Given the pronounced cumulative effect of technological output, a strong correlation exists between patent application volume and existing patent portfolios [

55]. Despite enterprises’ progress in technological innovation, the low-end positioning of these industries remained fundamentally unchanged. The period 2016–2021 marked a golden era of vigorous development for patent-intensive industries, with total invention patent applications surging at a high-growth pace. During this phase, China introduced the

Catalog of Patent-Intensive Industries (Trial), providing clear industry definitions and development guidance. Adhering to an innovation-driven development strategy, China positioned technological advancement as a core engine for socioeconomic progress [

56]. As a critical vehicle for innovation, patent-intensive industries received unprecedented attention, injecting robust momentum into national technological advancement and industrial upgrading. Both independently and jointly filed patents exhibited rapid growth, aligning closely with overall patent application trends. This phenomenon indicates enterprises have reached consensus on pursuing independent R&D and open collaborative innovation, forming a synergistic forward momentum. Post-2021 saw a downturn in invention patent applications within patent-intensive industries. Two primary factors explain this reversal. Firstly, economic pressures from the COVID-19 pandemic compelled numerous enterprises to curtail R&D investments, slowing industry growth [

57]. Secondly, intensified global competition for market share and resources triggered trade protectionist measures and technological blockades, elevating barriers to technology acquisition [

58]. These challenges not only hindered R&D activities but also severely disrupted patent filing strategies. Notably, while independently filed patents declined significantly, jointly filed patents maintained relative stability. The divergence shows enterprises increasingly prefer resource-pooling collaboration when facing complex innovation challenges. This trend is mainly driven by resource constraints and risk mitigation considerations [

59]. Collaborative R&D enables more efficient cost-sharing and risk distribution, thereby enhancing overall R&D efficiency and market competitiveness.

In summary, patent-intensive industries exhibit a robust development trajectory, experiencing only temporary fluctuations while maintaining positive long-term prospects. The evolving patterns in jointly and independently filed invention patent applications reflect a strategic shift within these industries—from traditional closed R&D models toward open collaborative innovation frameworks. Analysis of development trends indicates that patent-intensive industries align with both the inherent logic and external conditions for cluster-based growth, demonstrating potential to evolve into world-class industrial clusters. Since cluster evolution occurs not in isolation but through interconnected dynamics within broader industrial ecosystems, examining patent-intensive industries helps establish the macro-context for cluster evolution, thereby enabling comprehensive understanding of internal competitive and cooperative dynamics as well as interaction mechanisms between clusters and their external environments.

5. Network Characteristics and Community Structure of Patent-Intensive Industrial Clusters

5.1. Spatial Evolution Pattern of Patent-Intensive Industrial Clusters

Currently, the geographical boundaries of China’s patent-intensive industrial clusters are yet to be clearly defined. This study selects prefecture-level cities as the basic analytical units. We construct a spatial density distribution model to examine the agglomeration characteristics of patent-intensive industries across geographic spaces, thereby initiating a preliminary exploration of cluster territorial scope.

Using kernel density analysis, this study reveals the spatial evolution of patent-intensive industrial clusters from 2012 to 2023. Results are shown in

Figure 2. Color gradients in the figure represent kernel density values, indicating the agglomeration intensity of patent-intensive industries across regions.

Over time, China’s patent-intensive industries show increasingly pronounced spatial clustering. Innovation entities are predominantly distributed in eastern regions, demonstrating “multi-core agglomeration” and “patch-like” distribution patterns. Notably, Beijing-Tianjin-Hebei, Yangtze River Delta, and Pearl River Delta regions exhibit the most significant agglomeration, with intensity decreasing from central cities to peripheries, forming a distinct “core-periphery” spatial structure. Cities like Xi’an, Zhengzhou, Chengdu, and Changsha also show moderate clustering.

From 2012 to 2015, innovation entities radiated outward from Shenzhen and Beijing, forming two major clusters in Pearl River Delta and Beijing-Tianjin-Hebei. Simultaneously, the Yangtze River Delta centered on Shanghai showed notable secondary agglomeration. Provincial capitals including Xi’an, Chengdu, and Guiyang displayed contiguous block-like distribution patterns.

From 2016 to 2019, enterprise distribution intensified in these regions. Pearl River Delta and Beijing-Tianjin-Hebei maintained high-density distribution with significant kernel density increases. The Yangtze River Delta, as a secondary cluster, expanded westward, developing more low and medium-density zones. Patent activities decreased around Changsha, slightly reducing low-density zones. Other regions continued provincial capital-centered contiguous clustering.

From 2020 to 2023, high-density zones remained concentrated in the aforementioned regions, with some expanding outward or evolving into higher-density zones. Beijing-Tianjin-Hebei recorded the highest kernel density growth, with small-scale density peaks emerging at regional edges. High-density zones in Yangtze River Delta expanded from Shanghai to Suzhou and Jiaxing, with medium-density zones also extending significantly. Enterprises showed contiguous distribution in high-density zones, reflecting typical “Matthew Effect” characteristics. Cities like Wuhan and Zhengzhou also demonstrated notable spatial evolution.

Benefiting from the implementation of the 2014 Beijing-Tianjin-Hebei Collaborative Development Plan Outline, the Beijing-Tianjin-Hebei region established a vertical division system at an early stage characterized by “R&D in Beijing, transformation in Tianjin and Hebei.” Within this framework, Tianjin’s integrated circuit industry and Hebei’s automotive manufacturing sector have formed strong linkages with Beijing’s patent output. Since the Yangtze River Delta integration was elevated to a national strategy in 2018, a synergistic mechanism has been formed between Shanghai’s construction of a global sci-tech innovation center and the G60 Science and Technology Innovation Corridor. This synergy has facilitated the extension of industrial chains from Shanghai’s Zhangjiang High-Tech Park to secondary innovation nodes, including Suzhou Industrial Park and Jiaxing Science and Technology City. Notably, between 2020 and 2023, a vertical collaboration network emerged involving integrated circuit design in Shanghai, semiconductor packaging and testing in Suzhou, and electronic component manufacturing in Jiaxing. This closed-loop industrial chain of design-manufacturing-packaging has driven the outward diffusion of kernel density, demonstrating the efficiency of optimized resource allocation under market mechanisms. Furthermore, collaborations between Shanghai’s Zhangjiang Laboratory and Suzhou BioBay have led to the establishment of joint laboratories. At the same time, digital technology spillovers from Hangzhou’s Future Sci-Tech City—home to the Alibaba ecosystem—have extended to the Jiaxing G60 corridor. These collaborations have effectively reduced innovation costs and increased patent output across the involved cities. In addition, the diffusion effect of talent mobility has also contributed to the increased agglomeration in the Beijing-Tianjin-Hebei, Yangtze River Delta, and Pearl River Delta regions. Graduates from top universities in Beijing, such as Tsinghua University and Peking University, have been systematically relocating to surrounding cities like Tianjin and Shijiazhuang through the Beijing-Tianjin-Hebei Talent Integration Plan. Unlike the policy-driven agglomeration in Beijing-Tianjin-Hebei and the Yangtze River Delta, the patent-intensive industries in the Pearl River Delta rely more on spontaneous collaboration among market entities. Since the establishment of the Shenzhen Special Economic Zone in 1980, the Pearl River Delta has developed a model combining a flexible policy environment with market-oriented exploration. Leading companies such as Huawei, Tencent, and DJI have engaged thousands of SMEs in upstream and downstream industrial chains through market mechanisms like technology outsourcing and joint R&D. These enterprises spontaneously form collaborative relationships based on order demands and technological complementarity, resulting in a regional division characterized by “R&D in Shenzhen, manufacturing in Dongguan, and component production in Foshan.” Meanwhile, the Guangdong-Hong Kong-Macao Greater Bay Area operates under the “one country, two systems” framework, which effectively facilitates cross-border flows of factors and injects global resources into market collaboration. The core advantage of this market-led model lies in its greater flexibility.

5.2. Innovation Network Characteristics of Patent-Intensive Industrial Clusters

5.2.1. Overall Characteristics of Innovation Networks in Patent-Intensive Industrial Clusters

We employ social network analysis (SNA) to examine the overall characteristics of China’s patent-intensive industry innovation network. The results are presented in

Table 1. During the study period, the innovation network density of China’s patent-intensive industries showed consistent growth, rising from 0.037 in 2012–2015 to 0.044 in 2020–2023. This increase indicates that the number of actual connections among nodes in the network grew relative to the potential number of connections, reflecting higher collaboration frequency and stronger interaction among innovation entities. The average clustering coefficient reflects the degree of agglomeration in the interconnected networks among node cities. A higher clustering coefficient suggests a greater tendency for node cities to form “small-world” structures. Although this indicator peaked at 0.503 in 2016–2019 and slightly declined to 0.493 in 2020–2023, it demonstrated an overall upward trend. This implies the presence of multiple tightly connected local subgroups within the network, especially in the mid-to-later periods. Meanwhile, the average path length in the network continued to decrease across the three periods. This reduction indicates diminished loss and resistance in knowledge flows between city nodes, along with a lower risk of information distortion. The network as a whole exhibits a high degree of organization and cohesion.

5.2.2. Innovation Network Connectivity Characteristics in Patent-Intensive Industrial Clusters

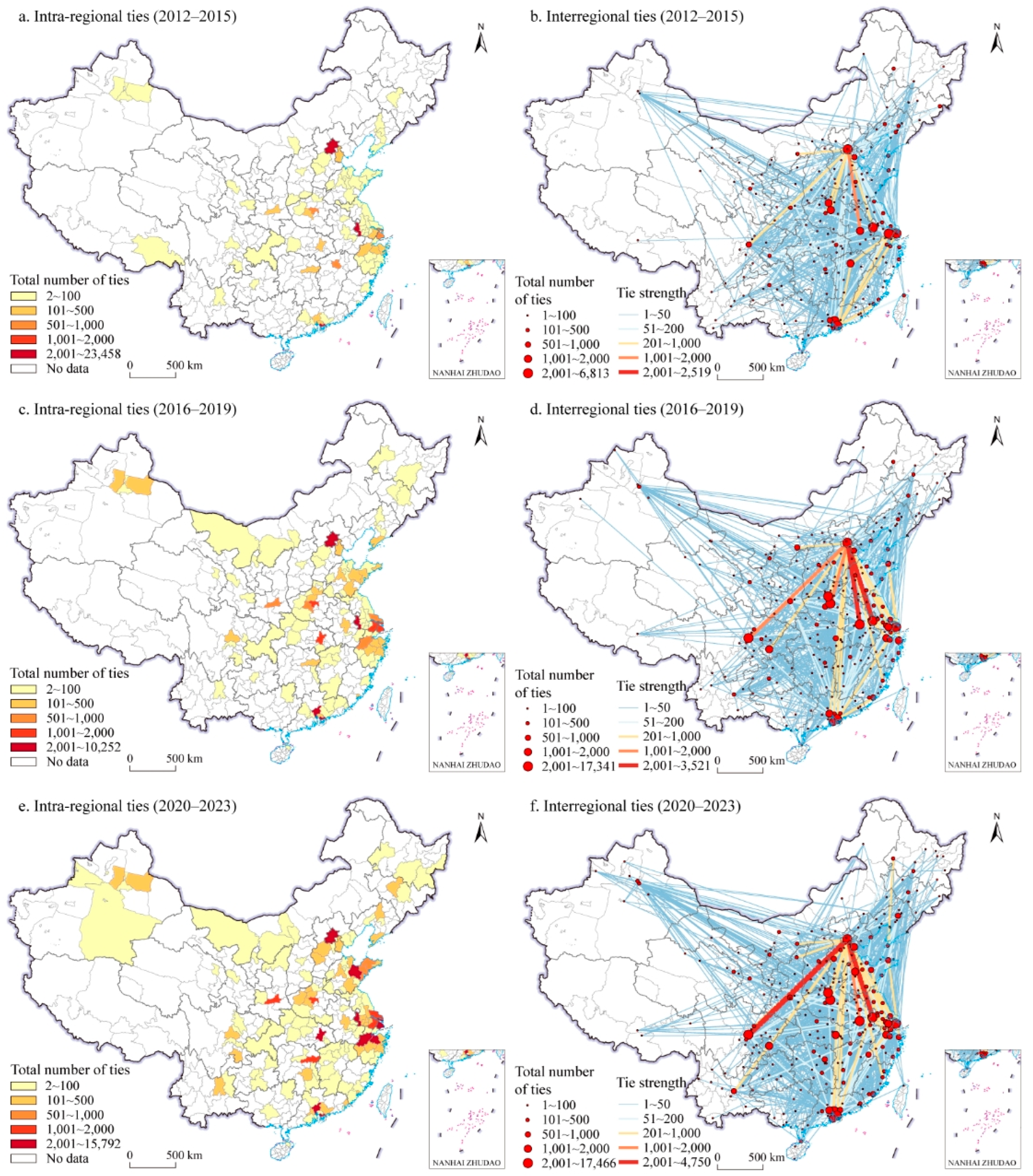

Figure 3 visualizes an undirected weighted network model constructed using social network analysis. Nodes represent cities where patent applicants are located, while connecting lines signify inter-city patent collaborations, revealing innovation linkages within patent-intensive industrial clusters at local and cross-regional levels.

Overall, the core nodes of China’s patent-intensive industrial cluster network align closely with economically advanced regions, showing a spatially uneven innovation pattern where intensity is higher in the east than the west. Over time, collaboration has shifted from few-core dominance to multi-core interconnected cluster networks. The architecture evolved from a triangular structure supported by Beijing-Tianjin-Hebei, Yangtze River Delta, and Pearl River Delta regions to a diversified multilateral framework. At the Intra-regional linkages, eastern clusters demonstrate multi-core leadership with strong synergy and diversified development, while western clusters exhibit isolated leading regions with uneven progress. Regarding interregional linkages, the innovation network’s scale and density continue to grow, yet core nodes remain concentrated in eastern and central regions. These core nodes actively build tightly connected networks, reinforcing stable core cluster groups.

During 2012–2015, patent-intensive industrial clusters exhibited distinct spatial disparities in innovation collaboration at both local and cross-regional scales. Cities like Shenzhen, Beijing, Nanjing, and Shanghai excelled in local innovation cooperation, forming robust networks that enhanced knowledge flow and sharing. Shenzhen stood out for its exceptional synergy in driving intra-regional collaboration. For interregional innovation linkages, Beijing, Shenzhen, Dongguan, and Shanghai emerged as pivotal hubs, radiating influence across broader regions.

Between 2016 and 2019, cities including Beijing, Nanjing, Guangzhou, Shenzhen, and Shanghai established tightly-knit local innovation networks. The number of high-connectivity regions tripled compared to the previous phase, with Beijing surpassing others to become the top city in total local connections. Cross-regional collaboration intensity surged significantly, though disparities in inter-city cooperation frequency widened. Beijing further solidified its dominance in the innovation network, strengthening ties with Nanjing, Shenzhen, and Chengdu.

From 2020 to 2023, multiple Yangtze River Delta cities advanced to the top tier of local innovation connectivity, achieving substantial progress in intra-regional collaboration. Simultaneously, western regions such as Korla and Yili began developing patent-intensive industries and building localized innovation networks. Beijing and Chengdu formed the strongest partnership in the patent-intensive cluster network, while other core nodes expanded and deepened, resulting in an increasingly complex innovation architecture.

The majority of listed companies in patent-intensive industries are concentrated in eastern regions such as the Pearl River Delta, Beijing-Tianjin-Hebei, and the Yangtze River Delta. This geographic concentration has established cities like Beijing, Nanjing, Shanghai, and Shenzhen as primary hubs for both local and cross-regional collaboration, resulting in a “rich-club phenomenon.” The well-developed market mechanisms and abundant resources in eastern regions have intensified competition among enterprises. Against this backdrop, companies have widely heightened their awareness of patent protection, regarding it as a key strategy to enhance core competitiveness. Several cities have established relatively comprehensive industrial chain systems, featuring not only close inter-firm connections but also robust auxiliary institutions such as technical consulting agencies and specialized service providers. This has further deepened the division of labor and collaboration. Innovation activities within and between these core clusters dominate, facilitating the establishment and development of cluster-network-based innovation cooperation models. In western China, cities like Changji and Ürümqi seized early opportunities presented by the Belt and Road Initiative and the Western Development Strategy. They demonstrated strong execution capabilities and foresight in planning patent-intensive industries and implementing supporting measures. Conversely, cities such as Korla and Yili, benefiting from natural resource endowments, initially focused more on traditional sectors like infrastructure construction and resource development. As national emphasis on innovation-driven development strategies increased, these cities began shifting their focus toward patent-intensive industries and deepening local collaboration.

Cities including Yichang, Jinhua, Ürümqi, Hohhot, Baoding, and Yantai have formed preliminary innovation partnerships based on geographic proximity, though cross-regional innovation activities remain relatively limited. Historically, China’s regional spatial development planning prioritized transportation corridors and central cities’ nodal functions but paid insufficient consideration to intra-regional urban functional networks and interactions with peripheral cities. This led to spatially constrained urban development policies. Extensive research indicates that the functional division of labor within metropolitan clusters and urban agglomerations can create economies of scale unattainable by individual cities [

60]. Therefore, cities should position themselves within the multi-tiered spatial structure of “urban agglomerations–metropolitan circles–central cities–peripheral cities.” Integrating cross-regional network resources can foster innovative models such as distributed networked manufacturing, service alliances, and platform economies. This thereby promotes value-added regional value chains and enables vertical specialization and horizontal leapfrogging. Less-developed cities like Lishui, Cangzhou, Yuncheng, Yingkou, and Maanshan predominantly occupy marginal positions in cluster networks, aligning with their developmental levels and comprehensive capabilities. Constrained by historical legacies, market maturity, industrial structure, and resource endowments, these cities face challenges such as population outflow and low economic efficiency. Significant developmental gaps exist compared to advanced regions. Blindly imitating or engaging in homogeneous competition during industrial development will hinder breakthroughs. Therefore, the priority is to base strategies on the actual development level and core competitiveness of local industries, implementing tailored development approaches. This means focusing on cultivating distinctive regional products and leading industries that align with local characteristics, industry specifics, and market shifts. Simultaneously, actively pursue collaboration with developed regions and industry leaders. Through measures such as introducing and assimilating advanced technologies, fostering integrated innovation, expanding and optimizing industrial chains, and building cooperative platforms, drive technological upgrades and enhance product quality within local industries.

5.3. Evolution of Community Structure in Patent-Intensive Industrial Clusters

Existing research suggests that an increase in modularity often corresponds to an improvement in community quality [

61]. The results obtained using the Louvain community detection method show that the modularity Q-values for all three periods remained at high levels: 0.53 (2012–2015), 0.49 (2016–2019), and 0.61 (2020–2023). It indicates that patent-intensive industrial clusters exhibited significant community structural characteristics at each development stage. Notably, the Q-value in the third period showed a clear upward trend. This not only reveals a concentration trend of patent collaboration within specific groups but also reflects that the community division during this period better aligns with the actual structure of patent-intensive industrial clusters. The analysis reveals that the community structure within the collaboration network of patent-intensive industrial clusters demonstrates a clear orientation toward technology-driven linkages and strategic synergy, rather than strictly adhering to the principle of geographical proximity. This indicates that connections among innovation entities are primarily driven by technological complementarity, shared R&D risks, and the need for strategic resource integration.

During 2012–2015, the patent-intensive industrial cluster, based on 191 nodes, formed 6 closely connected communities. During this period, four major communities emerged, with their core hub nodes highly concentrated in first-tier cities such as Beijing, Shanghai, Guangzhou, and Shenzhen. These communities collectively covered 90% of the total urban units. The formation of large communities during this phase was primarily driven by the strategic leadership of leading enterprises in core cities. National high-tech enterprises located in parks such as Zhongguancun in Beijing and Zhangjiang in Shanghai leveraged their technological monopolies and resource integration capabilities to proactively build innovation ecosystems centered around themselves. This was achieved by establishing collaborative relationships with local supporting enterprises and external technologically complementary partners. Among them, the innovation community with Beijing as its primary hub exhibited the largest scale, encompassing 85 nodes, highlighting its strong cohesion and extensive radiating effect. In contrast, cities such as Jixi and Quanzhou demonstrated relatively low node patent output, with collaboration networks characterized by strong localization. This outcome reflects insufficient willingness and capacity for external technological cooperation among innovation entities in these cities—most of which are small and medium-sized application-oriented enterprises. Their development relies more heavily on localized knowledge spillovers, indicating a need for improvement in knowledge flow and cross-regional collaboration. As a result, these urban nodes struggle to integrate into broader innovation networks. Some cities, such as Suizhou and Tangshan, despite having relatively weak local collaboration, engaged in frequent cross-border collaborative activities. In these cities, certain leading enterprises or “boundary-spanner” firms adopted an outward-oriented collaboration strategy to overcome technological bottlenecks and access key markets. They proactively established targeted alliances with industry leaders within core innovation communities. Such strategic initiatives have facilitated the integration of their respective urban nodes into these central networks. This phenomenon validates Bathelt’s theoretical perspective that strengthening cross-regional innovation linkages can break the path dependence of local development and maximize the benefits of innovation resource integration [

62].

From 2016 to 2019, both the number of nodes and communities in the patent-intensive industrial cluster showed significant growth, forming 8 larger communities around 235 core nodes. Compared to the previous period, the innovation network became denser, reflecting not only the rapid expansion of China’s patent-intensive industries but also signaling a positive momentum towards higher-level and broader development of industrial clusters. During this stage, the community centered around Shanghai as its core hub developed into the largest community system. Its influence extended not only to some cities in the Yangtze River Delta region but also reached distant cities like Changsha and Guiyang. On one hand, leading enterprises in innovation hubs have actively established branches in other regions or formed joint R&D alliances with local firms to attract regional talent and gain proximity to local markets. On the other hand, companies from other regions have also sought to integrate into high-end technology value chains by moving closer to innovation-rich areas. This bidirectional, strategic pursuit of resources has become a core driver behind the cross-regional expansion of innovation communities. Similarly, communities centered around Beijing and Chongqing have extended their collaboration networks to western cities such as Hulunbuir and Hami, further confirming this trend. The strong demand for cutting-edge knowledge and complex technologies in patent-intensive industries dictates that collaboration must be prioritarily driven by technological and strategic considerations rather than geographical proximity. The primary criterion for partner selection is no longer physical distance, but rather the ability to access critical technological complementarities, share high R&D risks, and jointly capture future market opportunities. This decision-making mechanism, based on capability matching and strategic synergy, motivates innovation actors to transcend administrative boundaries and proactively seek partners with specialized technical expertise or scarce innovation resources. As a result, cross-regional collaboration networks centered around technology chains have emerged. For example, a Shenzhen company specializing in AI algorithms may establish a tripartite patent collaboration with a top-tier hospital in Beijing and a precision manufacturer in Shanghai, driven by the potential application of its technology in medical image recognition. The formation of such partnerships stems from the high degree of complementarity in technical capabilities and market channels among the involved parties. Moreover, advancements in search and communication technologies in the digital era have further diminished the limiting effect of geographical distance. The collective collaboration behaviors of enterprises—guided by technological and strategic needs—have shaped the unique structure of innovation networks in patent-intensive industries. These networks break geographical constraints and follow an endogenous technology-driven logic, which fundamentally explains the highly dynamic and cross-regional nature of their community evolution. This study finds that the cluster development characteristics of patent-intensive industries align with Boschma’s (2005) theoretical perspective [

63]. Geographical proximity is not a necessary prerequisite or decisive factor for innovation. Rather, it functions as an enhancer of other proximity effects.

The period 2020–2023 witnessed robust development momentum in patent-intensive industrial clusters. The number of nodes covered by these clusters showed significant growth, reaching 273. Concurrently, the number of communities expanded to 10. This expansion reflects growth in the clusters’ geographic scope, number of participating entities, and breadth of collaboration. It also reveals increasing complexity and diversification within their internal cooperative structures. Advances in transportation and information technologies have further enabled innovation to overcome geographical constraints. Consequently, innovation communities have achieved broader and more flexible expansion in their topological structure. Patent pools, built upon industrial clusters and technology alliances, are now widely recognized for their positive role in overcoming patent crises and facilitating cluster restructuring [

64]. Firms merging or joining larger communities can leverage patent pool mechanisms. Internally, this enables cross-licensing to build technological barriers. Externally, it allows unified licensing systems to manage scattered patent resources. Within the same community, innovators often possess related and complementary technologies. This creates concentrated technological advantages that can influence industry direction. Optimized collaboration networks and stronger patent pools enhance the “coupling” effect between innovation supply and demand. This fosters a stable mechanism for interactive regional development [

65]. Notably, the largest community during this period comprised 132 nodes, the biggest size observed across the three time periods analyzed. This further solidified the dominant position of mega-communities in patent collaboration. In the self-organization of innovation networks, entities typically choose their optimal technological development path based on core competencies and technical strengths. If a highly concentrated community structure exists, new entrants can often integrate more easily. Simultaneously, the number of small communities (under 15 nodes) peaked at seven. Their flexible organizational structures and decision-making processes allow rapid adaptation to market changes and technological innovations, enabling them to build distinctive advantages. The rapid development of frontier technologies like AI and smart manufacturing continuously generates new collaboration fields, technological pathways, and market demands. These emerging areas often possess unique innovation needs and collaboration potential, driving the formation and growth of specialized small communities with specific strengths.

6. Conclusions and Implications

Leveraging innovation networks to implement cross-organizational knowledge integration and resource sharing is essential for deepening collaboration between local and cross-border innovators, accelerating the development, transfer, and application of patented technologies, and ultimately achieving industrial upgrading and regional innovation. In the knowledge economy, patent-intensive industries have garnered significant academic attention due to their strong innovation capabilities and intellectual property advantages. This study analyzed the characteristics and evolution of innovation networks within patent-intensive industrial clusters using joint invention patent data from listed companies (2012–2023). It focused on the structural features of China’s patent-intensive industry innovation network, their changes over the past decade, how these changes reflect local and cross-regional innovation linkages, and the patterns of community division within these clusters. This study yields the following key findings.

Firstly, patent-intensive industries achieved significant progress from 2012 to 2023. Concurrently, corporate strategies shifted from large-scale independent R&D towards actively embracing open collaborative innovation. Amidst global economic integration and deep value chain restructuring, these industries secured high positions due to superior resource integration and allocation efficiency. Strengthened policy support and shifting market demand created unprecedented opportunities. However, intensifying competition and emerging technologies rendered closed-door innovation strategies ineffective for maintaining advantages in markets prioritizing cost and speed. Consequently, firms urgently need to break traditional innovation boundaries and seek external inspiration to generate more competitive outcomes. The rapid growth in joint inventions strongly evidences this trend, showing firms accelerating innovation through cross-border collaboration, knowledge sharing, and technological complementarity to find new growth points. This open model facilitates knowledge exchange, technology integration, reduces R&D risks and costs, and provides broad market prospects and lasting competitive advantages.

Secondly, China’s patent-intensive industries exhibit significant spatial agglomeration with a distinct core-periphery structure. The “east-high, west-low” geographic distribution reveals regional economic disparities and points to the need for policy adjustments and optimized resource allocation. High-density areas act as core nodes, forming a multi-lateral cross-border network. Eastern and Central China, benefiting from early economic opening and industrial upgrading, accumulated significant innovation capabilities and talent. Consequently, most core nodes are located there, possessing the cumulative technological characteristics needed to lead cluster development. The value of core nodes extends beyond their own advancement; through tight network interactions, they effectively drive development in surrounding and peripheral areas. Technology spillovers, knowledge flows, and deep industrial chain collaboration create efficient and dynamic interactions between core and periphery, promoting cluster upgrading.

Thirdly, the community structure of the collaborative network within China’s patent-intensive industrial clusters exhibits distinct characteristics driven by technological relevance and strategic synergy, rather than strictly adhering to the principle of geographical proximity. The innovation network evolution is gradual, continuous, and stable. Leveraging cross-cluster characteristics and technology spillover capabilities, these clusters continuously expand and deepen their geographic reach, creating new growth points. Some large or highly specialized communities merged to form mega-communities after adjustment and optimization. Simultaneously, emerging fields led to a gradual increase in the number of small communities. This evolution reflects market selection mechanisms and the clusters’ inherent self-adjustment and optimization, helping maintain robust operation, promote efficient resource utilization, and drive sustainable development.

Based on the above conclusions, this study proposes the following policy implications:

- (1)

Promote Open Collaborative Innovation and Strengthen Industry-University-Research Integration

According to the research findings, the traditional closed R&D model no longer meets the needs of patent-intensive industrial development. Therefore, policymakers should actively promote the implementation of open collaborative innovation within the industry. During the initial cultivation stage, policies should focus on establishing connections among enterprises by setting up cross-border collaboration guidance funds targeted at small and medium-sized enterprises, universities, and research institutes. Support should be provided for enterprises to jointly build collaborative R&D platforms with universities and research institutions in core hub cities, with particular encouragement for directed cooperation aimed at breaking through “bottleneck” technologies. In the expansion and integration phase, policymakers should support strategic cross-regional R&D alliances and encourage leading enterprises to form innovation consortiums based on technological complementarity. Such cross-regional consortiums should be granted expedited project approval and provided with matching funds. Most importantly, open innovation platforms should be established based on industrial chains and industrial clusters. This will facilitate the creation of diverse and adaptive interaction mechanisms among upstream and downstream players in the industrial chain, enterprises, and other innovation entities. By building cross-industry and cross-regional innovation networks, deep integration of technological innovation chains and industrial chains can be achieved. This will gradually establish a dynamic innovation ecosystem, stimulating the innovative vitality of patent-intensive industries.

- (2)

Implementing Differentiated Regional Development Strategies for Efficient Resource Allocation

China’s patent-intensive industries exhibit a distinct spatial agglomeration pattern, characterized by higher concentrations in the east and lower densities in the west. This “core-periphery” structure highlights regional development imbalances but also reveals potential opportunities. High-density areas function as core nodes within the cluster network. Their interconnected, cross-regional network further demonstrates the importance of regional connectivity for the industry’s comprehensive development. Such spatial linkages play a vital role in allocating innovation resources, facilitating interactions among innovation entities, and diffusing innovation outcomes. Policymakers must fully recognize the significance of this network structure. They should account for technological disparities across different regions. By implementing precise regional development strategies, policymakers can promote positive interactions between core nodes and peripheral areas. This approach will enable efficient resource allocation and balanced industrial growth. Core hub cities must enhance their radiating and driving functions. This involves supporting the construction of high-level scientific and technological infrastructure with global influence, as well as open pilot platforms. Additionally, these cities should encourage their research institutions and leading enterprises to provide technical services and knowledge spillovers to the entire country. Meanwhile, these cities should be guided to focus on breakthroughs in original innovation and foundational common technologies, avoiding excessive duplication in low-end segments. For peripheral and outer-tier cities, the approach of developing full industrial chains should be abandoned in favor of implementing a precise embeddedness strategy. They should be supported to leverage their local specialized industrial foundations, proactively connect with resources from core cities, and strive to develop singular strengths in niche technological areas. By establishing initiatives such as satellite R&D centers and cross-regional project collaborations, these cities can embed themselves into the national innovation network, gradually shifting from passive acceptance to active collaboration.

- (3)

Clarifying Industrial Positioning to Guide Collaborative Cluster Development

Given that the division of communities within patent-intensive industrial clusters is not solely based on geographical proximity, policymakers should regularly conduct market research. This research aims to comprehensively understand and identify the core competitiveness and potential advantages of the region’s patent-intensive industries. This will help precisely position the direction of industrial development. On this basis, policymakers should fully leverage policy guidance and financial support, among other measures, to actively guide and encourage enterprises to engage in in-depth collaboration around shared goals of technological innovation and market expansion. This ensures that enterprises with interconnected technological development directions can achieve cooperation. Support should be provided for communities with strong technological correlations and intensive innovation collaboration to establish patent pools and technical standard alliances, thereby reducing the costs and risks of collaborative innovation. Furthermore, policymakers must closely monitor dynamic changes in market demand and guide the development of industrial clusters to closely align with these demands. They can regularly organize industry exchange events and market demand seminars. These initiatives provide platforms for information sharing and market insights among enterprises. This enables businesses to promptly adjust their product development directions and market strategies, allowing them to adapt to evolving market conditions and trends.