Examining Investor Interaction with Digital Robo-Advisory Systems: Green Value and Interface Quality in a Socio-Technical Context

Abstract

1. Introduction

2. Literature Review

2.1. FinTech and Robo-Advisory Landscape in Saudi Arabia

2.2. Robo-Advisory Services: Global Trends and Characteristics

2.3. Investor Behaviour and FinTech Adoption in Saudi Arabia

2.4. Green FinTech and Green Perceived Value (GPV)

2.5. Summary of Gaps and Research Motivation

2.6. Theoretical Background

2.6.1. Diffusion of Innovation (DOI)

2.6.2. Technology Acceptance Model (TAM)

2.6.3. Value-Based Adoption Model (VAM)

2.6.4. Perceived Trust

2.6.5. Theoretical Integration Supporting the Proposed Model

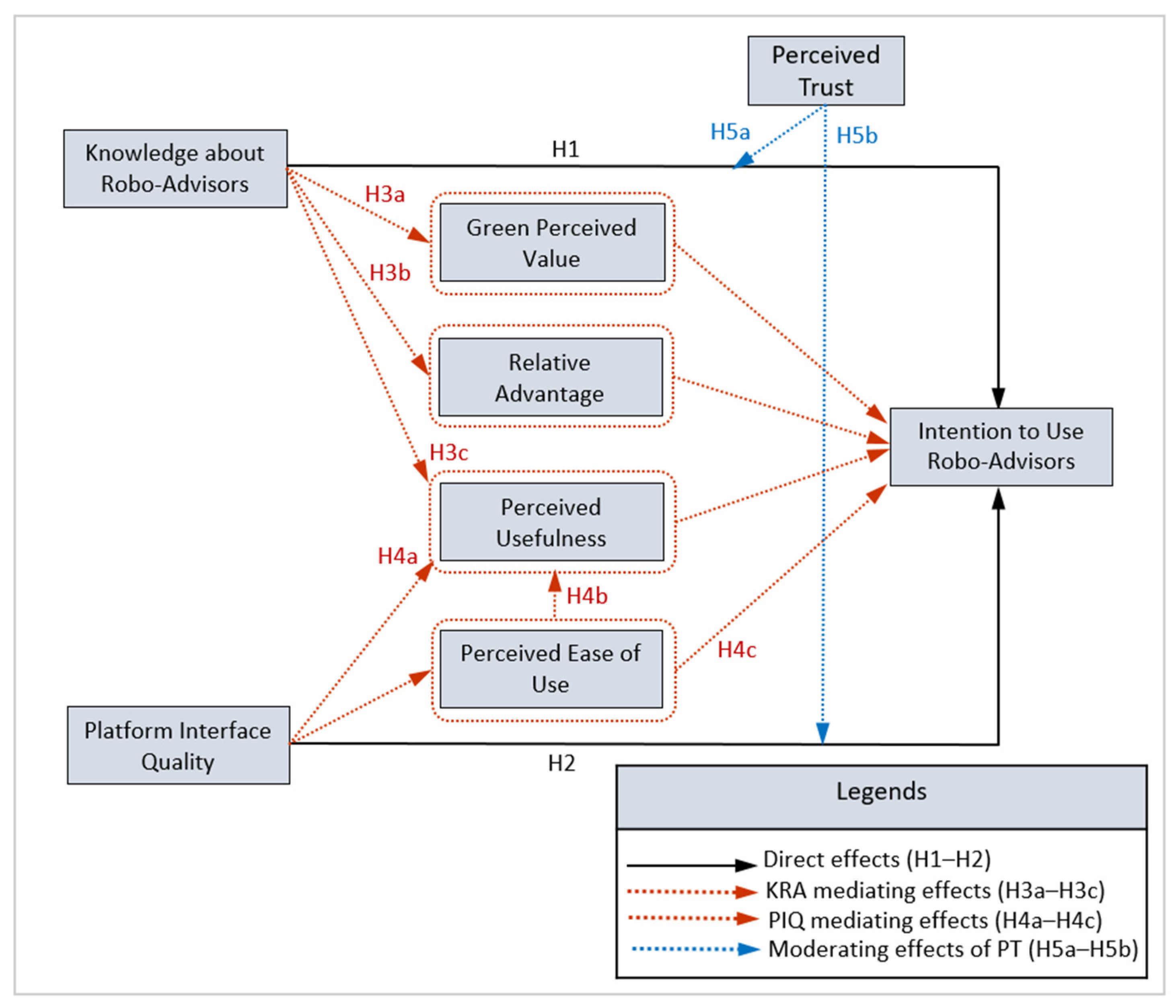

2.7. Hypothesis Formulation

3. Materials and Methods

3.1. Measurement Scale Design

3.2. Sampling and Data Collection Process

3.3. Analysis of Data

3.3.1. Common Method Bias

3.3.2. Evaluation of the Measurement (Outer) Model

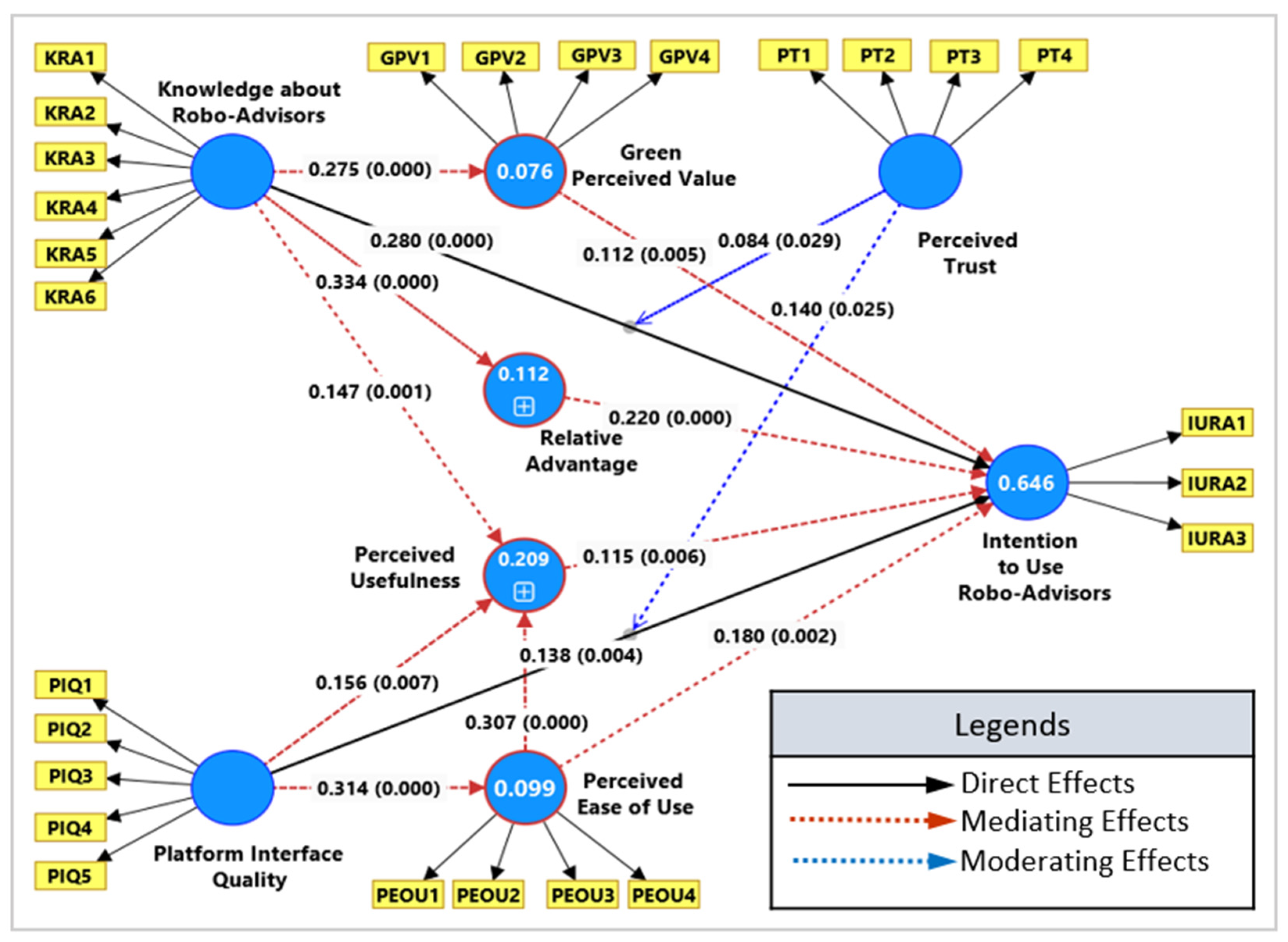

3.3.3. Evaluation of the Structural (Inner) Model

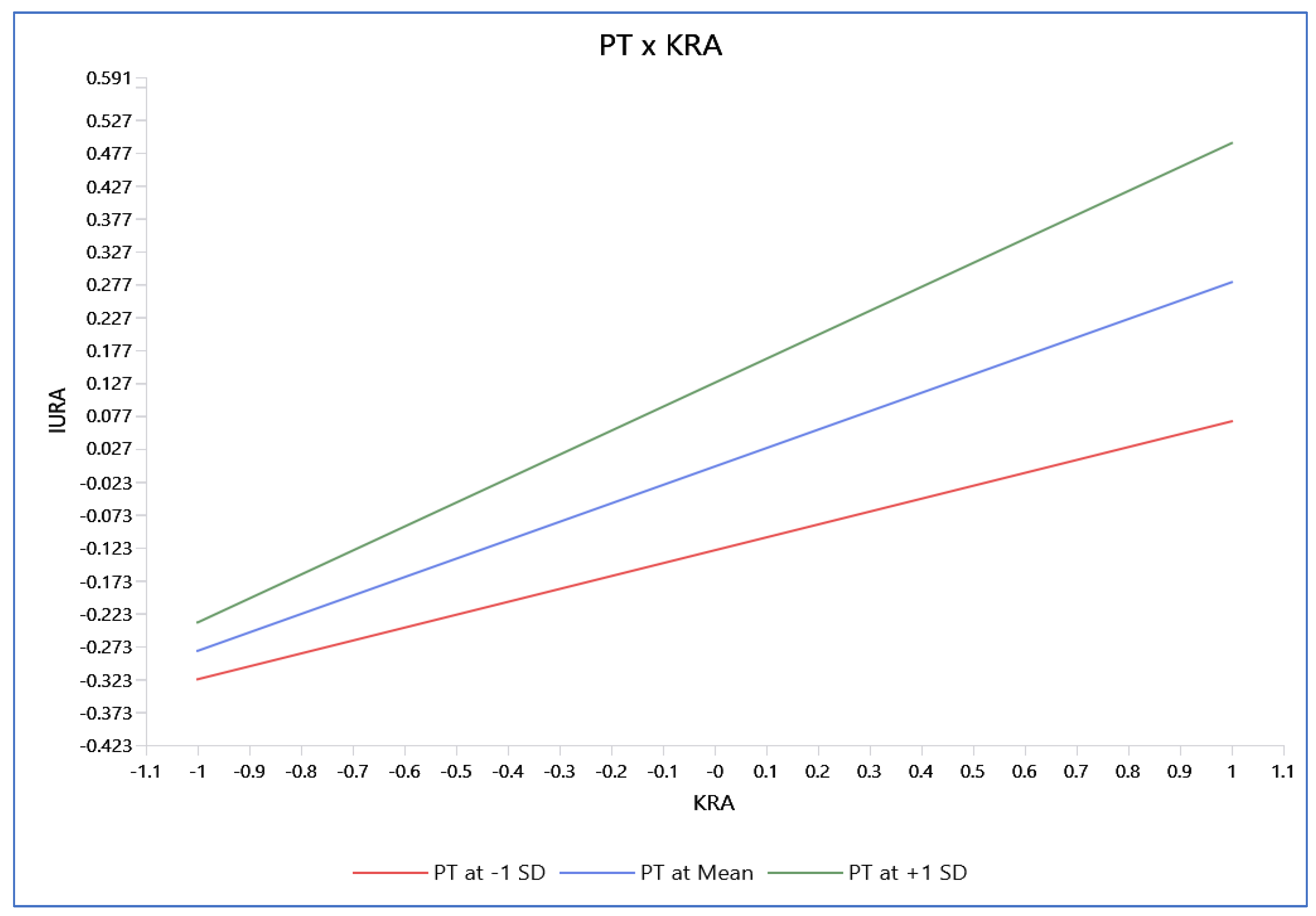

3.3.4. Structural Model–Hypotheses Testing

3.3.5. Assessing Group Heterogeneity

4. Discussion

5. Research Implications

5.1. Theoretical Implications

5.2. Implications for Practice

- Implementing explainable AI frameworks that allow users to understand how investment recommendations are generated, thereby reducing uncertainty and algorithmic opacity.

- Establishing strict data privacy and protection protocols to safeguard sensitive financial information and build confidence in automated decision-making processes.

- Integrating user feedback and correction mechanisms within platforms, enabling users to review, adjust, or query AI-generated advice, which supports perceived control and trust.

- Developing national AI ethics guidelines for financial technologies, in collaboration with regulatory bodies, to ensure fair, unbiased, and inclusive financial decision-making across demographic groups.

6. Limitations and Future Research

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| DOI | Diffusion of Innovation |

| TAM | Technology Acceptance Model |

| VAM | Value-Based Adoption Model |

| GPV | Green Perceived Value |

| IURA | Intention to Use Robo-Advisors |

| KRA | Knowledge about Robo-Advisors |

| PEOU | Perceived Ease of Use |

| PIQ | Platform Interface |

| PT | Perceived Trust |

| PU | Perceived Usefulness |

| RA | Relative Advantage |

| PLS-SEM | Partial Least Squares Structural Equation Modeling |

| SB-SEM | Covariance-Based Structural Equation Modeling |

| ESG | Environmental, Social, and Governance |

Appendix A

Appendix A.1

| Constructs | Sources |

|---|---|

| Knowledge about Robo-Advisors (KRA) KRA1: I have the knowledge necessary to use robo-advisor. KRA2: Robo-advisor is compatible with other technologies I use. KRA3: I have the support system necessary to use robo-advisor. KRA4: I understand how robo-advisors make investment decisions using algorithms. KRA5: I am familiar with basic financial concepts needed to evaluate robo-advisory services. KRA6: I can assess the risks and benefits associated with using a robo-advisor for financial planning. | [21,68] |

| Relative Advantage (RA) RA1: Robo-Advisors have more advantages than other options of investment advisory. RA2: Robo-Advisors are more convenient than other options of investment advisory. RA3: Robo-Advisors are more efficient than other options of investment advisory. RA4: Robo-Advisors are more effective than other options of investment advisory. | [87]. |

| Perceive Usefulness (PU) PU1: I would find robo-advisor useful in making financial decisions. PU2: I can do my financial planning effectively with the help of a robo advisor. PU3: Using robo-advisor would help me accomplish my financial goals more quickly. PU4: Using robo-advisors would improve my performance in managing investments | [21] |

| Perceived Ease of Use (PEOU) PEOU1: I find it easy to learn how to use the application. PEOU2: The use of investment platforms is cumbersome and unclear. PEOU3: It is easy to adjust the depot according to my ideas. PEOU4: It is an easy thing to deal with the platform. | [88] |

| Perceived Trust (PT) PT1: I believe robo-advisory services can be trusted. PT2: I can rely on the advice of robo advisor. PT3: I trust that robo-advisor is safe and has reliable features. PT4: I trust the transactions done by robo-advisors. | [21] |

| Platform Interface Quality (PIQ) PIQ1: The robo-advisor’s interface is visually professional and easy to navigate. PIQ2: The platform provides clear, understandable information about investment options, including green investments. PIQ3: I find the platform responsive and smooth to use across different devices. PIQ4: The platform uses visuals or summaries that help me understand investment risks and benefits. PIQ5: The robo-advisor’s platform helps reduce paper usage and promotes eco-friendly investing processes. | devised by this study |

| Green Perceived Value (GPV) GPV1: Using Robo-Advisors helps reduce environmental impact compared to traditional investment advisory methods. GPV2: Robo-Advisors promote paperless and eco-friendly investment processes. GPV3: I believe that using Robo-Advisors contributes to sustainable financial services. GPV4: Robo-Advisors reflect my personal values of supporting environmentally responsible solutions. | devised by this study |

| Intention to Use Robo-Advisors (IURA) IURA1: I intend to use digital investment platforms in the future. IURA2: I recommend my friends to use the application. IURA3: Also, in view of other investment opportunities, I would prefer digital investment platforms. | [88] |

References

- Faour, A.; Al-Sowaidi, A.S.S.S. Fintech Revolution: How Established Banks Are Embracing Innovation to Stay Competitive. J. Bus. Manag. Stud. 2023, 5, 166–172. [Google Scholar] [CrossRef]

- Mathur, P.; Sharma, A.M. Robo-Advisors in Investment Management. In Risks and Challenges of AI-Driven Finance: Bias, Ethics, and Security; IGI Global Scientific Publishing: Hershey, PA, USA, 2024; pp. 121–145. [Google Scholar] [CrossRef]

- Dias, F.S. An Introduction to Robo-Advisors, Notable Fintech Implementations, and Underlying Theory. In Fintech and the Emerging Ecosystems; Springer: Cham, Switzerland, 2025; pp. 285–300. [Google Scholar] [CrossRef]

- Barile, D.; Secundo, G.; Bussoli, C. Exploring Artificial Intelligence Robo-Advisor in Banking Industry: A Platform Model. Manag. Decis. 2024. ahead of print. [Google Scholar] [CrossRef]

- Fatima, S.; Chakraborty, M. Adoption of Artificial Intelligence in Financial Services: The Case of Robo-Advisors in India. IIMB Manag. Rev. 2024, 36, 113–125. [Google Scholar] [CrossRef]

- Namyslo, N.M.; Jung, D.; Sturm, T. The State of Robo-Advisory Design: A Systematic Consolidation of Design Requirements and Recommendations. Electron. Mark. 2025, 35, 1–29. [Google Scholar] [CrossRef]

- Onabowale, O. The Rise of AI and Robo-Advisors: Redefining Financial Strategies in the Digital Age. Int. J. Res. Public Rev. 2025, 6, 4832. [Google Scholar] [CrossRef]

- Wu, B.; Chen, F.; Li, L.; Xu, L.; Liu, Z.; Wu, Y. Institutional Investor ESG Activism and Exploratory Green Innovation: Unpacking the Heterogeneous Responses of Family Firms across Intergenerational Contexts. Br. Account. Rev. 2024, 57, 101324. [Google Scholar] [CrossRef]

- Arenas-Parra, M.; Rico-Pérez, H.; Quiroga-Garcia, R. The Emerging Field of Robo Advisor: A Relational Analysis. Heliyon 2024, 10, e35946. [Google Scholar] [CrossRef]

- Cha, Y.; Xiao, F. Are All Robo-Advisors the Same? Out-Group Homogeneity Bias in Investors’ Perceptions of Robo-Advisors. Financ. Res. Lett. 2025, 85, 107908. [Google Scholar] [CrossRef]

- Chen, A.; Wang, S.; Mehta, A.M.; Asif, M.; Xu, S.; Shahzad, M.F. FinTech Adoption for ESG Integration through Robo Advisors, Personalization, and Perceived Trust. Sci. Rep. 2025, 15, 31125. [Google Scholar] [CrossRef] [PubMed]

- Luo, H.; Liu, X.; Lv, X.; Hu, Y.; Ahmad, A.J. Investors’ Willingness to Use Robo-Advisors: Extrapolating Influencing Factors Based on the Fiduciary Duty of Investment Advisors. Int. Rev. Econ. Financ. 2024, 94, 103411. [Google Scholar] [CrossRef]

- Cardillo, G.; Chiappini, H. Robo-Advisors: A Systematic Literature Review. Financ. Res. Lett. 2024, 62, 105119. [Google Scholar] [CrossRef]

- Zhu, H.; Vigren, O.; Söderberg, I.L. Implementing Artificial Intelligence Empowered Financial Advisory Services: A Literature Review and Critical Research Agenda. J. Bus. Res. 2024, 174, 114494. [Google Scholar] [CrossRef]

- Joy, M.; Khan, R. Integrating FinTech into Saudi Arabia’s Financial Landscape: A Study of Vision 2030 Objectives and Regulatory Developments. Acc. Financ. Manag. J. 2025, 10, 3543–3551. [Google Scholar] [CrossRef]

- FintechSaudi. Annual Fintech Report. 2023. Available online: https://fintechsaudi.com/wp-content/uploads/2024/10/Annual%20Fintech%20Report%202023_-_English.pdf (accessed on 13 July 2025).

- Hamadien, A.M. Understanding Factors Facilitating the Diffusion of Financial Technology (FinTech) A Case Study of the Gulf Cooperation Council, University of Bradford, UK, 2022. Available online: https://bradscholars.brad.ac.uk/handle/10454/19901 (accessed on 9 July 2025).

- Kaddour, A.; Alsayed, H.I.; Altrasi, M. Navigating FinTech Growth in the Asian Market. In The Palgrave Handbook of FinTech in Africa and Middle East; Palgrave Macmillan: Singapore, 2025; pp. 1–16. [Google Scholar] [CrossRef]

- Perzhanovskiy, N. Robo-Advisors in Saudi Arabia and How They Work. LenderKi. Available online: https://lenderkit.com/blog/robo-advisors-in-saudi-arabia-and-how-they-work/ (accessed on 14 July 2025).

- Nasr, T. Best Robo-Advisors in Saudi Arabia in 2025 (Compared). Robo-Advisorfinder. Available online: https://www.robo-advisorfinder.com/blog/best-robo-advisors-in-saudi-arabia (accessed on 14 July 2025).

- Ansari, Y.; Bansal, R. Robo-Advisory Financial Services and the Dynamics of New Innovation in Saudi Arabia. J. Open Innov. Technol. Mark. Complex. 2024, 10, 100397. [Google Scholar] [CrossRef]

- Alotaibi, I.S. Financial Inclusion through Fintech Services in Saudi Arabia: Empirical Study. In International Conference on Intelligent and Innovative Practices in Engineering and Management 2024, IIPEM 2024; Institute of Electrical and Electronics Engineers Inc.: New York, NY, USA, 2024. [Google Scholar] [CrossRef]

- Singh, S.; Kumar, A. Investing in the Future: An Integrated Model for Analysing User Attitudes towards Robo-Advisory Services with AI Integration. Vilakshan-XIMB J. Manag. 2025, 22, 158–175. [Google Scholar] [CrossRef]

- Chen, Y.; Aw, E.C.X.; Tan, G.W.H. Financial Empowerment through Robo-Advisors: Understanding the Keys to Trust and Loyalty. Ind. Manag. Data Syst. 2025, 125, 2178–2205. [Google Scholar] [CrossRef]

- Alkadi, R.S.; Abed, S.S. AI in Banking: What Drives Generation Z to Adopt AI-Enabled Voice Assistants in Saudi Arabia? Int. J. Financ. Stud. 2025, 13, 36. [Google Scholar] [CrossRef]

- Liu, X.; Kim, T.H.; Lee, M.J. The Impact of Green Perceived Value Through Green New Products on Purchase Intention: Brand Attitudes, Brand Trust, and Digital Customer Engagement. Sustainability 2025, 17, 4106. [Google Scholar] [CrossRef]

- Hasan, R.; Ashfaq, M.; Shao, L. Evaluating Drivers of Fintech Adoption in the Netherlands. Glob. Bus. Rev. 2024, 25, 1576–1589. [Google Scholar] [CrossRef]

- Luong, T.B.; Nguyen, D.T.A. Examining Social Media Influence’s Role in the TPB Model for Young Vietnamese Visiting Green Hotels. J. Ecotourism 2025, 24, 20–42. [Google Scholar] [CrossRef]

- Xie, X.; Gong, C.; Su, Z.; Nie, Y.; Kim, W. Consumers’ Behavioral Willingness to Use Green Financial Products: An Empirical Study within a Theoretical Framework. Behav. Sci. 2024, 14, 634. [Google Scholar] [CrossRef] [PubMed]

- Mohapatra, N.; Shekhar, S.; Singh, R.; Khan, S.; Santos, G.; Carvalho, S. Unveiling the Nexus Between Use of AI-Enabled Robo-Advisors, Behavioural Intention and Sustainable Investment Decisions Using PLS-SEM. Sustainability 2025, 17, 3897. [Google Scholar] [CrossRef]

- Al-Baity, H.H. The Artificial Intelligence Revolution in Digital Finance in Saudi Arabia: A Comprehensive Review and Proposed Framework. Sustainability 2023, 15, 13725. [Google Scholar] [CrossRef]

- Wang, X.; Hu, W.; Guan, N. A Systemic Approach to Evaluating Fintech-Driven Competitiveness in Commercial Banks: Integrating Delphi and ANP Methods. Systems 2025, 13, 342. [Google Scholar] [CrossRef]

- Hatem, A.; Saied, A.H. The Adoption of Fintech Solutions in Saudi Arabia’s e-Commerce Landscape: Impact on Security, Convenience, and Financial Inclusion. World J. Adv. Res. Rev. 2025, 2025, 1369–1376. [Google Scholar] [CrossRef]

- Abdeldayem, M.; Aldulaimi, S. Innovative Pathways in Capital Markets: The Fusion of Behavioural Finance and Fintech for Strategic Investor Decision-Making. Int. J. Organ. Anal. 2025. ahead of print. [Google Scholar] [CrossRef]

- Boubaker, R.; Zammel, M. Exploring FinTech Market Landscape in the MENA Region; Palgrave Macmillan: Singapore, 2025; pp. 1–29. [Google Scholar] [CrossRef]

- Butt, A.H.; Ahmad, H.; Muzaffar, A.; Irshad, W.; Mumtaz, M.U.; Zubair Ahmad Khan, T. WeChat Gamification: Mobile Payment Impact on Word of Mouth and Customer Loyalty. Span. J. Mark. ESIC 2025, 29, 95–113. [Google Scholar] [CrossRef]

- Kumari, A. The Future of Global Fintech Careers in the Global FinTech Landscape. In Decentralized Finance and Tokenization in FinTech; IGI Global Scientific Publishing: Hershey, PA, USA, 2024; pp. 215–237. [Google Scholar] [CrossRef]

- Statista. Wealth Management—Saudi Arabia. Statista. Available online: https://www.statista.com/outlook/fmo/wealth-management/saudi-arabia (accessed on 14 July 2025).

- FintechSaudi. Fintech Saudi Deep Dives: Wealth Management Solution Opportunities in KSA. 2021. Available online: https://fintechsaudi.com/wp-content/uploads/2021/06/Wealth%20Management%20English_Final.pdf (accessed on 14 July 2025).

- CMA. Annual Report 1444–1445 H (2023). 2023. Available online: https://cma.org.sa/en/Market/Reports/Documents/cma_2023_report_en.pdf (accessed on 13 July 2025).

- RiyadhValleyCo. Fintech: Robo Advisory’s Impact & Innovations. 2023. Available online: https://rvc.com.sa/wp-content/uploads/2023/10/Robo-Advisory_V3.pdf (accessed on 13 July 2025).

- Al Faisal, N.; Nahar, J.; Waliullah, M.; Borna, R.S. The Role of Digital Banking Features in Bank Selection an Analysis of Customer Preferences for Online and Mobile Banking. Innov. Eng. J. 2024, 1, 41–58. [Google Scholar] [CrossRef]

- Butt, A.H.; Ahmad, H. AI Chatbot Innovation—Leading toward Consumer Satisfaction, Electronic Word of Mouth and Continuous Intention in Online Shopping. J. Telecommun. Digit. Econ. 2023, 11, 156–184. [Google Scholar] [CrossRef]

- Gómez Sánchez, L.; Tobon, S. Sustainable Investing among Young Generations: Balancing Ideals and Financial Realities. Discov. Sustain. 2025, 6, 1–14. [Google Scholar] [CrossRef]

- Adula, M.; Kant, S.; Genale, M. Green Financing Effect on Sustenance Finance Models With Mediation of Corporate Social Responsibility in Ethiopia. In Building Business Models with Machine Learning; IGI Global Scientific Publishing: Hershey, PA, USA, 2024; pp. 159–174. [Google Scholar] [CrossRef]

- Barile, D.; Secundo, G.; Mariani, M.; Brandonisio, A. A New Era: Managing Green Investments through Robo-Advisors. Manag. Decis. 2025. [Google Scholar] [CrossRef]

- Mohapatra, N.; Das, M.; Shekhar, S.; Singh, R.; Khan, S.; Tewari, L.M.; Félix, M.J.; Santos, G. Assessing the Role of Financial Literacy in FinTech Adoption by MSEs: Ensuring Sustainability Through a Fuzzy AHP Approach. Sustainability 2025, 17, 4340. [Google Scholar] [CrossRef]

- Teng, Z.; Xia, H.; He, Y. Rewiring Sustainability: How Digital Transformation and Fintech Innovation Reshape Environmental Trajectories in the Industry 4.0 Era. Systems 2025, 13, 400. [Google Scholar] [CrossRef]

- Hossain, M.N.; Hidayat-ur-Rehman, I.; Bhuiyan, A.B.; Salleh, H.M. Evaluating the Influence of IT Governance, Fintech Adoption, and Financial Literacy on Sustainable Performance. Stud. Econ. Financ. 2025. ahead of print.. [Google Scholar] [CrossRef]

- Glova, J.; Panko, M. The Effects of Environmental, Social, and Governance Factors on Financial Performance and Market Valuation in the European Automotive Industry. Int. J. Financ. Stud. 2025, 13, 82. [Google Scholar] [CrossRef]

- Ali, J. Environmental Resilience: Transition to Regenerative Supply Chain Management. AIMS Environ. Sci. 2024, 11, 107–128. [Google Scholar] [CrossRef]

- Huang, X.; Li, D.; Sun, M. Fintech and Corporate ESG Performance: An Empirical Analysis Based on the NEV Industry. Sustainability 2025, 17, 434. [Google Scholar] [CrossRef]

- Manta, O.; Vasile, V.; Rusu, E. Banking Transformation Through FinTech and the Integration of Artificial Intelligence in Payments. FinTech 2025, 4, 13. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations; Free Press: New York, NY, USA, 1962. [Google Scholar]

- Rogers, E.M. Diffusion of Innovations, 5th ed; Free Press: New York, NY, 2003. [Google Scholar]

- Hidayat-ur-Rehman, I.; Hossain, M.N.; Bhuiyan, A.B.; Zulkifli, N. Toward Comprehensive Understanding of M-Wallet Adoption: The Significance of User Perceptions and Financial Autonomy. Int. J. Innov. Sci. 2025. ahead of print. [Google Scholar] [CrossRef]

- Tsai, S.C.; Chen, C.H. Exploring the Innovation Diffusion of Big Data Robo-Advisor. Appl. Syst. Innov. 2022, 5, 15. [Google Scholar] [CrossRef]

- Davis, F.D. Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Q. 1989, 13, 319–340. [Google Scholar] [CrossRef]

- Abdo, K.W.; Hidayat-Ur-Rehman, I.; Aljehani, S.B.; Aloufi, E.M.; Alshehri, A. Factors Influencing Intentions to Use Apple Pay: A Behavioral Perspective. PLoS ONE 2025, 20, e0327122. [Google Scholar] [CrossRef]

- Kim, H.W.; Chan, H.C.; Gupta, S. Value-Based Adoption of Mobile Internet: An Empirical Investigation. Decis. Support Syst. 2007, 43, 111–126. [Google Scholar] [CrossRef]

- Berto, A.; Bursan, R. Value Adoption Model (VAM) and Users’ Intentions to Use Mobile Banking: Examining Perceived Usefulness, Perceived Sacrifice and Perceived Risk. J. Ilm. Manaj. Kesatuan 2023, 11, 393–402. [Google Scholar] [CrossRef]

- Amnas, M.B.; Selvam, M.; Parayitam, S. FinTech and Financial Inclusion: Exploring the Mediating Role of Digital Financial Literacy and the Moderating Influence of Perceived Regulatory Support. J. Risk Financ. Manag. 2024, 17, 108. [Google Scholar] [CrossRef]

- Lee, C.; Yun, H.; Lee, C.; Lee, C.C. Factors Affecting Continuous Intention to Use Mobile Wallet: Based on Value-Based Adoption Model. J. Soc. e-Bus. Stud. 2015, 20, 117–135. [Google Scholar] [CrossRef]

- Moore, G.C.; Benbasat, I. Development of an Instrument to Measure the Perceptions of Adopting an Information Technology Innovation. Inf. Syst. Res. 1991, 2, 192–222. [Google Scholar] [CrossRef]

- Tornatzky, L.G.; Klein, K.J. Innovation characteristics and innovation adoption-implementation: A meta-analysis of findings. IEEE Trans. Eng. Manag. 1982, EM-29, 28–45. [Google Scholar] [CrossRef]

- Venkatesh, N.; Davis, F.D. A Theoretical Extension of the Technology Acceptance Model: Four Longitudinal Field Studies. Manag. Sci. 2000, 46, 186–204. [Google Scholar] [CrossRef]

- Karahanna, E.; Straub, D.W.; Chervany, N.L. Information Technology Adoption across Time: A Cross-Sectional Comparison of Pre-Adoption and Post-Adoption Beliefs. MIS Q. Manag. Inf. Syst. 1999, 23, 183–213. [Google Scholar] [CrossRef]

- Yi, T.Z.; Rom, N.A.M.; Hassan, N.M.; Samsurijan, M.S.; Ebekozien, A. The Adoption of Robo-Advisory among Millennials in the 21st Century: Trust, Usability and Knowledge Perception. Sustainability 2023, 15, 6016. [Google Scholar] [CrossRef]

- Hidayat-ur-Rehman, I. The Role of Financial Literacy in Enhancing Firm’s Sustainable Performance through Fintech Adoption: A Moderated Mediation Analysis. Int. J. Innov. Sci. 2024. ahead of print. [Google Scholar] [CrossRef]

- Wang, Q.; Niu, G.; Zhou, Y.; Gan, X. Education and FinTech Adoption: Evidence from China. China Financ. Rev. Int. 2025, 15, 140–165. [Google Scholar] [CrossRef]

- Noreen, U.; Shafique, A.; Ahmed, Z.; Ashfaq, M. Banking 4.0: Artificial Intelligence (AI) in Banking Industry & Consumer’s Perspective. Sustainability 2023, 15, 3682. [Google Scholar] [CrossRef]

- Shin, D.; Kee, K.F.; Shin, E.Y. Algorithm Awareness: Why User Awareness Is Critical for Personal Privacy in the Adoption of Algorithmic Platforms? Int. J. Inf. Manag. 2022, 65, 102494. [Google Scholar] [CrossRef]

- Fan, L.; Chatterjee, S. The Utilization of Robo-Advisors by Individual Investors: An Analysis Using Diffusion of Innovation and Information Search Frameworks. J. Financ. Couns. Plan. 2020, 31, 130–145. [Google Scholar] [CrossRef]

- Khoo, C.C.; Ong, S.F.; Liew, C.Y. Factors Which Affect Investors’ Intention to Adopt Robo-Advisory Services in Malaysia. In AIP Conference Proceedings; American Institute of Physics Inc.: Melville, NY, USA, 2024; Volume 2951. [Google Scholar] [CrossRef]

- Riahi, Y.; Garrouch, K. A Model Explaining Perceived Investment Value and Switching Intentions toward FinTech: The Case of Crowdlending. J. Financ. Serv. Mark. 2024, 29, 553–567. [Google Scholar] [CrossRef]

- Bailusy, M.N.; Pollack, J.; Fahri, J.; Amarullah, D.; Buamonabot, I. Determinants of Indonesian Smes’ Intentions to Adopt Fintech: An Innovation Diffusion Theory Perspective. J. Indones. Econ. Bus. 2025, 40, 196–213. [Google Scholar] [CrossRef]

- Rani, V.; Kumar, J. Gender Differences in FinTech Adoption: What Do We Know, and What Do We Need to Know? J. Model. Manag. 2024, 19, 1215–1236. [Google Scholar] [CrossRef]

- Sharma, V.; Rupeika-Apoga, R.; Singh, T.; Gupta, M. Sustainable Investments in the Blue Economy: Leveraging Fintech and Adoption Theories. J. Risk Financ. Manag. 2025, 18, 368. [Google Scholar] [CrossRef]

- Rani, S.; Mittal, A.; Singh, H. Enhancing User Experience and Satisfaction in Robo-Advisor Platforms: A Multi-Dimensional Analysis of Usability Factors and Interface Design Elements. In Proceedings of the International Conference on Communication, Computer Sciences and Engineering, IC3SE 2024, Gautam Buddha Nagar, India, 9–11 May 2024; Institute of Electrical and Electronics Engineers Inc.: New York, NY, USA, 2024; pp. 1726–1730. [Google Scholar] [CrossRef]

- Di, X. From Prosperity to Deadlock: What’s Wrong with Financial Supervision on Robo-Advisors in China. Asian J. Law Econ. 2022, 13, 223–253. [Google Scholar] [CrossRef]

- Mezzanotte, F.E. An Examination into the Investor Protection Properties of Robo-Advisory Services in Switzerland. Cap. Mark. Law J. 2020, 15, 489–508. [Google Scholar] [CrossRef]

- Xia, Y.; Chen, Y.; Luo, H.; Yang, Y.; Wang, X. Research and Improvement on the Development of Robo-Advisor: Present and Prospect. In ACM International Conference Proceeding Series; Association for Computing Machinery: New York, NY, USA, 2022; pp. 172–178. [Google Scholar] [CrossRef]

- Deo, S.; Sontakke, N.S. Usability, User Comprehension, and Perceptions of Explanations for Complex Decision Support Systems in Finance: A Robo-Advisory Use Case. Computer 2021, 54, 38–48. [Google Scholar] [CrossRef]

- Dikmen, M.; Burns, C. The Effects of Domain Knowledge on Trust in Explainable AI and Task Performance: A Case of Peer-to-Peer Lending. Int. J. Hum. Comput. Stud. 2022, 162, 102792. [Google Scholar] [CrossRef]

- Back, C.; Morana, S.; Spann, M. When Do Robo-Advisors Make Us Better Investors? The Impact of Social Design Elements on Investor Behavior. J. Behav. Exp. Econ. 2023, 103, 101984. [Google Scholar] [CrossRef]

- Shuhaiber, A.; Al-Omoush, K.S.; Alsmadi, A.A. Investigating Trust and Perceived Value in Cryptocurrencies: Do Optimism, FinTech Literacy and Perceived Financial and Security Risks Matter? Kybernetes 2025, 54, 330–357. [Google Scholar] [CrossRef]

- Kaur, P.; Dhir, A.; Bodhi, R.; Singh, T.; Almotairi, M. Why Do People Use and Recommend M-Wallets? J. Retail. Consum. Serv. 2020, 56, 102091. [Google Scholar] [CrossRef]

- Seiler, V.; Fanenbruck, K.M. Acceptance of Digital Investment Solutions: The Case of Robo Advisory in Germany. Res. Int. Bus. Financ. 2021, 58, 101490. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); SAGE Publications: Thousand Oaks, CA, USA, 2017. [Google Scholar]

- Erdfelder, E.; FAul, F.; Buchner, A.; Lang, A.G. Statistical Power Analyses Using G*Power 3.1: Tests for Correlation and Regression Analyses. Behav. Res. Methods 2009, 41, 1149–1160. [Google Scholar] [CrossRef]

- Krejcie, R.V.; Morgan, D.W. Sample Size Determination Table. Educ. Psychol. Meas. 1970, 30, 607–610. [Google Scholar] [CrossRef]

- Thompson, S. Sampling; John Wiley & Sons: Hoboken, NJ, USA, 2012. [Google Scholar]

- Hair, J.F.; Howard, M.C.; Nitzl, C. Assessing Measurement Model Quality in PLS-SEM Using Confirmatory Composite Analysis. J. Bus. Res. 2020, 109, 101–110. [Google Scholar] [CrossRef]

- Kock, N. Common Method Bias in PLS-SEM: A Full Collinearity Assessment Approach. Int. J. e-Collab. 2015, 11, 1–10. [Google Scholar] [CrossRef]

- Podsakoff, P.M.; MacKenzie, S.B.; Lee, J.-Y.; Podsakoff, N.P. Common Method Biases in Behavioral Research: A Critical Review of the Literature and Recommended Remedies. J. Appl. Psychol. 2003; 88, 879. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A New Criterion for Assessing Discriminant Validity in Variance-Based Structural Equation Modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef]

- Shmueli, G.; Ray, S.; Velasquez Estrada, J.M.; Chatla, S.B. The Elephant in the Room: Predictive Performance of PLS Models. J. Bus. Res. 2016, 69, 4552–4564. [Google Scholar] [CrossRef]

- Rigdon, E.E.; Ringle, C.M.; Sarstedt, M. Structural Modeling of Heterogeneous Data with Partial Least Squares. Rev. Mark. Res. 2010, 7, 255–296. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis, 7th ed.; Prentice Hall: Englewood Cliffs, NJ, USA, 2010. [Google Scholar]

- Hatlevik, O.E.; Christophersen, K.A. Digital Competence at the Beginning of Upper Secondary School: Identifying Factors Explaining Digital Inclusion. Comput. Educ. 2013, 63, 240–247. [Google Scholar] [CrossRef]

| Category | Attributes | Frequency | Percentage (%) |

|---|---|---|---|

| Gender | Male | 211 | 54.5 |

| Female | 176 | 45.5 | |

| Age-Group | 20 to 30 years | 82 | 21.20 |

| 31 to 40 years | 127 | 32.80 | |

| 41 to 50 years | 116 | 30.00 | |

| 51 to 60 years | 49 | 12.70 | |

| Above 60 years | 13 | 3.40 | |

| Education | High School/Diploma | 77 | 19.9 |

| Bachelor’s degree | 134 | 34.6 | |

| Master’s Degree | 153 | 39.5 | |

| Ph.D. | 23 | 5.9 | |

| Employment | Student | 60 | 15.5 |

| Employee | 144 | 37.2 | |

| Self Employed | 161 | 41.6 | |

| Retired | 22 | 5.7 | |

| Nationality | Saudi | 296 | 76.5 |

| Non-Saudi | 91 | 23.5 | |

| Level of Investment | Less than SAR 50,000 | 55 | 14.2 |

| SAR 50,000 to 100,000 | 128 | 33.1 | |

| SAR 100,001 to 150,000 | 65 | 16.8 | |

| SAR 150,001 to 200,000 | 86 | 22.2 | |

| Above SAR 200,000 | 53 | 13.7 | |

| Region | Riyadh Region | 87 | 22.5 |

| Makkah Region | 64 | 16.5 | |

| Madinah Region | 45 | 11.6 | |

| Eastern Province | 57 | 14.7 | |

| Asir Region | 13 | 3.4 | |

| Tabuk Region | 33 | 8.5 | |

| Hail Region | 17 | 4.4 | |

| Northern Borders Region | 7 | 1.8 | |

| Jazan Region | 12 | 3.1 | |

| Najran Region | 11 | 2.8 | |

| Al-Baha Region | 8 | 2.1 | |

| Al-Jawf Region | 14 | 3.6 | |

| Qassim Region | 19 | 4.9 |

| Constructs. | α >0.6 | Composite Reliability | AVE | Items | Indicators’ reliability |

|---|---|---|---|---|---|

| >0.7 | >0.5 | ≥0.7 | |||

| GPV | 0.885 | 0.895 | 0.742 | GPV1 GPV2 GPV3 GPV4 | 0.856 0.881 0.885 0.822 |

| IURA | 0.862 | 0.876 | 0.783 | IURA1 IURA2 IURA3 | 0.898 0.914 0.840 |

| KRA | 0.891 | 0.893 | 0.650 | KRA1 KRA2 KRA3 KRA4 KRA5 KRA6 | 0.855 0.817 0.857 0.739 0.839 0.719 |

| PEOU | 0.883 | 0.889 | 0.740 | PEOU1 PEOU2 PEOU3 PEOU4 | 0.881 0.802 0.883 0.873 |

| PIQ | 0.912 | 0.915 | 0.741 | PIQ1 PIQ2 PIQ3 PIQ4 PIQ5 | 0.831 0.882 0.888 0.848 0.854 |

| PT | 0.956 | 0.956 | 0.883 | PT1 PT2 PT3 PT4 | 0.948 0.944 0.941 0.925 |

| PU | 0.840 | 0.853 | 0.673 | PU1 PU2 PU3 PU4 | 0.834 0.869 0.802 0.776 |

| RA | 0.900 | 0.902 | 0.770 | RA1 RA2 RA3 RA4 | 0.888 0.891 0.870 0.860 |

| GPV | IURA | KRA | PEOU | PIQ | PT | PU | RA | |

|---|---|---|---|---|---|---|---|---|

| GPV | ||||||||

| IURA | 0.605 | |||||||

| KRA | 0.294 | 0.625 | ||||||

| PEOU | 0.541 | 0.657 | 0.361 | |||||

| PIQ | 0.373 | 0.494 | 0.232 | 0.349 | ||||

| PT | 0.351 | 0.532 | 0.544 | 0.427 | 0.539 | |||

| PU | 0.483 | 0.573 | 0.315 | 0.453 | 0.314 | 0.436 | ||

| RA | 0.563 | 0.689 | 0.367 | 0.583 | 0.342 | 0.449 | 0.560 |

| GPV | IURA | KRA | PEOU | PIQ | PT | PU | RA | |

|---|---|---|---|---|---|---|---|---|

| GPV | 0.861 | |||||||

| IURA | 0.544 | 0.885 | ||||||

| KRA | 0.275 | 0.545 | 0.806 | |||||

| PEOU | 0.481 | 0.585 | 0.324 | 0.860 | ||||

| PIQ | 0.338 | 0.445 | 0.212 | 0.314 | 0.861 | |||

| PT | 0.328 | 0.489 | 0.504 | 0.395 | 0.504 | 0.939 | ||

| PU | 0.429 | 0.512 | 0.279 | 0.404 | 0.283 | 0.389 | 0.821 | |

| RA | 0.506 | 0.617 | 0.334 | 0.520 | 0.311 | 0.418 | 0.492 | 0.877 |

| Statistical Indicators | Endogenous Variables | R Square | R Square Adjusted | Criteria |

|---|---|---|---|---|

| R2 | GPV | 0.076 | 0.073 | 0.75: Substantial, 0.35: Moderate, 0.25: Weak [89] |

| IURA | 0.646 | 0.638 | ||

| PEOU | 0.099 | 0.096 | ||

| PU | 0.209 | 0.203 | ||

| RA | 0.112 | 0.110 |

| Effect Size (f2) | Exogenous Variables | GPV | IURA | PEOU | PU | RA | 0.35: Substantial, 0.15: Medium effect, 0.02: Weak effect [89] |

| GPV | 0.021 | ||||||

| KRA | 0.082 | 0.146 | 0.024 | 0.126 | |||

| PEOU | 0.056 | 0.099 | |||||

| PIQ | 0.035 | 0.109 | 0.027 | ||||

| PT | 0.012 | ||||||

| PU | 0.025 | ||||||

| RA | 0.077 |

| Collinearity (Inner VIF) | Exogenous Variables | GPV | IURA | PEOU | PU | RA | VIF ≤ 5.0 [89] |

| GPV | 1.656 | ||||||

| KRA | 1.000 | 1.517 | 1.134 | 1.000 | |||

| PEOU | 1.636 | 1.202 | |||||

| PIQ | 1.544 | 1.000 | 1.126 | ||||

| PT | 3.932 | ||||||

| PU | 1.505 | ||||||

| RA | 1.770 |

| Q2 | Endogenous Variables | Q2 predict | RMSE | MAE | A Q2 value greater than 0 indicates the exogenous constructs’ predictive relevance for the endogenous construct. [89] |

| GPV | 0.066 | 0.972 | 0.822 | ||

| IURA | 0.423 | 0.763 | 0.588 | ||

| PEOU | 0.083 | 0.970 | 0.733 | ||

| PU | 0.108 | 0.951 | 0.780 | ||

| RA | 0.102 | 0.953 | 0.757 |

| Hyp. | Relationship | Path Coefficient | St. Dev. | t Statistics | p Score | Comments |

|---|---|---|---|---|---|---|

| H1 | KRA → IURA | 0.280 | 0.044 | 6.406 | 0.000 | Supported |

| H2 | PIQ → IURA | 0.138 | 0.048 | 2.847 | 0.004 | Supported |

| H3a | KRA → GPV → IURA | 0.031 | 0.014 | 2.266 | 0.023 | Mediation confirmed |

| H3b | KRA → RA → IURA | 0.074 | 0.022 | 3.291 | 0.001 | Mediation confirmed |

| H3c | KRA → PU → IURA | 0.017 | 0.009 | 1.950 | 0.051 | Not Supported |

| H4a | PIQ → PU → IURA | 0.018 | 0.010 | 1.830 | 0.067 | Mediation confirmed |

| H4b | PIQ → PEOU → PU → IURA | 0.011 | 0.005 | 2.220 | 0.026 | Mediation confirmed |

| H4c | PIQ → PEOU → IURA | 0.057 | 0.024 | 2.374 | 0.018 | Mediation confirmed |

| H5a | PT x KRA → IURA | 0.084 | 0.038 | 2.187 | 0.029 | Moderation Confirmed |

| H5b | PT x PIQ → IURA | 0.14 | 0.062 | 2.238 | 0.025 | Moderation Confirmed |

| Hyp. | β (O.I.) | β (Y.I.) | STDEV (O.I.) | STDEV (Y.I.) | p Value (O.I.) | p Value (Y.I.) | Remarks |

|---|---|---|---|---|---|---|---|

| KRA → IURA | 0.338 | 0.199 | 0.060 | 0.057 | 0.000 | 0.000 | No Moderation |

| PIQ → IURA | 0.208 | 0.126 | 0.086 | 0.067 | 0.016 | 0.059 | Moderation |

| KRA → GPV → IURA | 0.002 | 0.047 | 0.020 | 0.023 | 0.936 | 0.041 | Moderation |

| KRA → RA → IURA | 0.060 | 0.085 | 0.032 | 0.031 | 0.060 | 0.006 | Moderation |

| KRA → PU → IURA | 0.019 | 0.009 | 0.014 | 0.010 | 0.182 | 0.370 | No Moderation |

| PIQ → PU → IURA | 0.033 | 0.008 | 0.020 | 0.009 | 0.097 | 0.411 | No Moderation |

| PIQ → PEOU → PU → IURA | 0.003 | 0.009 | 0.005 | 0.009 | 0.579 | 0.320 | No Moderation |

| PIQ → PEOU → IURA | 0.073 | 0.033 | 0.036 | 0.034 | 0.045 | 0.329 | Moderation |

| PT x KRA → IURA | 0.058 | 0.151 | 0.061 | 0.056 | 0.343 | 0.007 | Moderation |

| PT x PIQ → IURA | 0.216 | 0.122 | 0.088 | 0.094 | 0.013 | 0.195 | Moderation |

| Hyp. | β (P.I.) | β (U.I.) | STDEV (P.I.) | STDEV (U.I.) | p Value (P.I.) | p Value (U.I.) | Remarks |

|---|---|---|---|---|---|---|---|

| KRA → IURA | 0.209 | 0.361 | 0.070 | 0.059 | 0.003 | 0.000 | No Moderation |

| PIQ → IURA | 0.047 | 0.200 | 0.064 | 0.097 | 0.467 | 0.039 | Moderation |

| KRA → GPV → IURA | 0.030 | 0.038 | 0.021 | 0.021 | 0.155 | 0.061 | No Moderation |

| KRA → RA → IURA | 0.109 | 0.040 | 0.045 | 0.021 | 0.015 | 0.053 | Moderation |

| KRA → PU → IURA | 0.013 | 0.014 | 0.012 | 0.013 | 0.294 | 0.295 | No Moderation |

| PIQ → PU → IURA | 0.021 | 0.010 | 0.016 | 0.010 | 0.194 | 0.352 | No Moderation |

| PIQ → PEOU → PU → IURA | 0.011 | 0.008 | 0.008 | 0.007 | 0.154 | 0.251 | No Moderation |

| PIQ → PEOU → IURA | 0.044 | 0.064 | 0.032 | 0.031 | 0.161 | 0.042 | Moderation |

| PT x KRA → IURA | 0.018 | 0.158 | 0.075 | 0.057 | 0.811 | 0.006 | Moderation |

| PT x PIQ → IURA | 0.087 | 0.149 | 0.078 | 0.133 | 0.266 | 0.263 | No Moderation |

| Hyp. | β (H.I.) | β (L.I.) | STDEV (H.I.) | STDEV (L.I.) | p Value (H.I.) | p Value (L.I.) | Remarks |

|---|---|---|---|---|---|---|---|

| KRA → IURA | 0.343 | 0.203 | 0.065 | 0.066 | 0.000 | 0.002 | No Moderation |

| PIQ → IURA | 0.138 | 0.127 | 0.081 | 0.075 | 0.088 | 0.091 | No Moderation |

| KRA → GPV → IURA | 0.015 | 0.051 | 0.015 | 0.027 | 0.317 | 0.063 | Moderation |

| KRA → RA → IURA | 0.046 | 0.121 | 0.024 | 0.038 | 0.055 | 0.001 | Moderation |

| KRA → PU → IURA | 0.025 | 0.005 | 0.014 | 0.009 | 0.075 | 0.597 | No Moderation |

| PIQ → PU → IURA | 0.022 | 0.011 | 0.015 | 0.014 | 0.132 | 0.447 | No Moderation |

| PIQ → PEOU → PU → IURA | 0.011 | 0.007 | 0.006 | 0.009 | 0.085 | 0.401 | No Moderation |

| PIQ → PEOU → IURA | 0.067 | 0.043 | 0.028 | 0.041 | 0.016 | 0.287 | Moderation |

| PT x KRA → IURA | 0.128 | 0.050 | 0.050 | 0.068 | 0.011 | 0.465 | Moderation |

| PT x PIQ → IURA | 0.207 | 0.088 | 0.088 | 0.096 | 0.018 | 0.361 | Moderation |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hidayat-ur-Rehman, I.; Alam, M.N.; Alsolamy, M.; Alharbi, S.H.H.; AlAnazi, T.M.B.; Bhuiyan, A.B. Examining Investor Interaction with Digital Robo-Advisory Systems: Green Value and Interface Quality in a Socio-Technical Context. Systems 2025, 13, 787. https://doi.org/10.3390/systems13090787

Hidayat-ur-Rehman I, Alam MN, Alsolamy M, Alharbi SHH, AlAnazi TMB, Bhuiyan AB. Examining Investor Interaction with Digital Robo-Advisory Systems: Green Value and Interface Quality in a Socio-Technical Context. Systems. 2025; 13(9):787. https://doi.org/10.3390/systems13090787

Chicago/Turabian StyleHidayat-ur-Rehman, Imdadullah, Mohammad Nurul Alam, Majed Alsolamy, Saleh Hamed H. Alharbi, Tawfeeq Mohammed B. AlAnazi, and Abul Bashar Bhuiyan. 2025. "Examining Investor Interaction with Digital Robo-Advisory Systems: Green Value and Interface Quality in a Socio-Technical Context" Systems 13, no. 9: 787. https://doi.org/10.3390/systems13090787

APA StyleHidayat-ur-Rehman, I., Alam, M. N., Alsolamy, M., Alharbi, S. H. H., AlAnazi, T. M. B., & Bhuiyan, A. B. (2025). Examining Investor Interaction with Digital Robo-Advisory Systems: Green Value and Interface Quality in a Socio-Technical Context. Systems, 13(9), 787. https://doi.org/10.3390/systems13090787