Configurations Driving High Performance in Hydrogen Fuel Cell Vehicle Enterprises

Abstract

1. Introduction

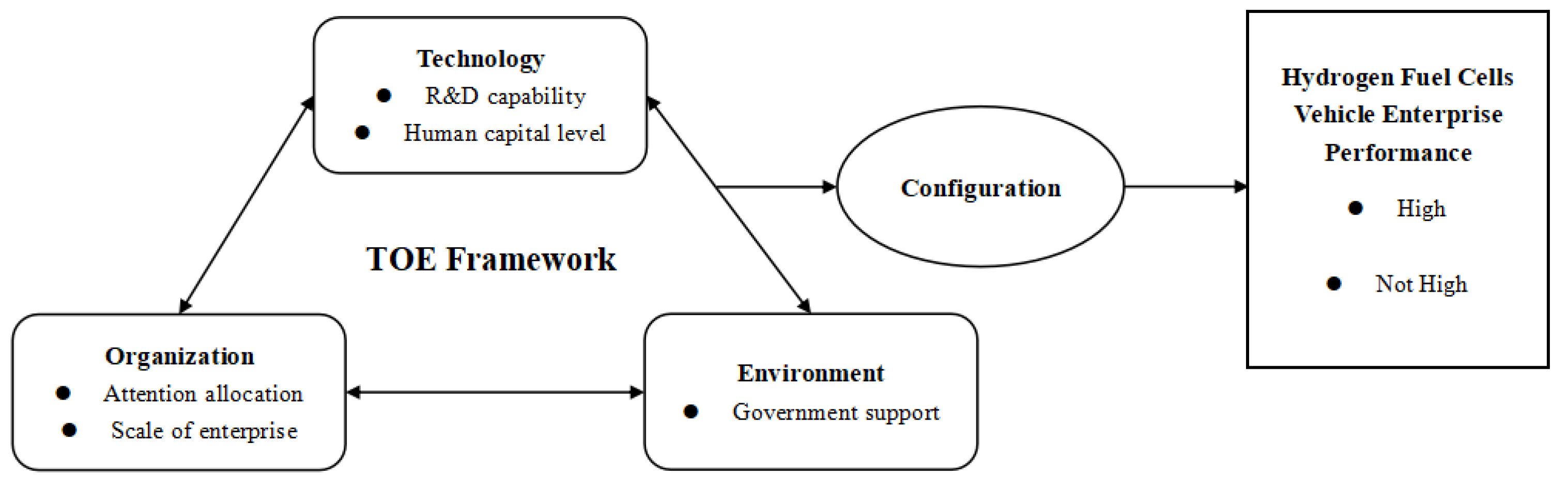

2. Antecedent Conditions of HFCV Enterprise Performance Under the TOE Framework

2.1. Technical Dimension

2.2. Organizational Dimension

2.3. Environmental Dimension

3. Methods and Data

3.1. Research Methods

3.2. Data Construction

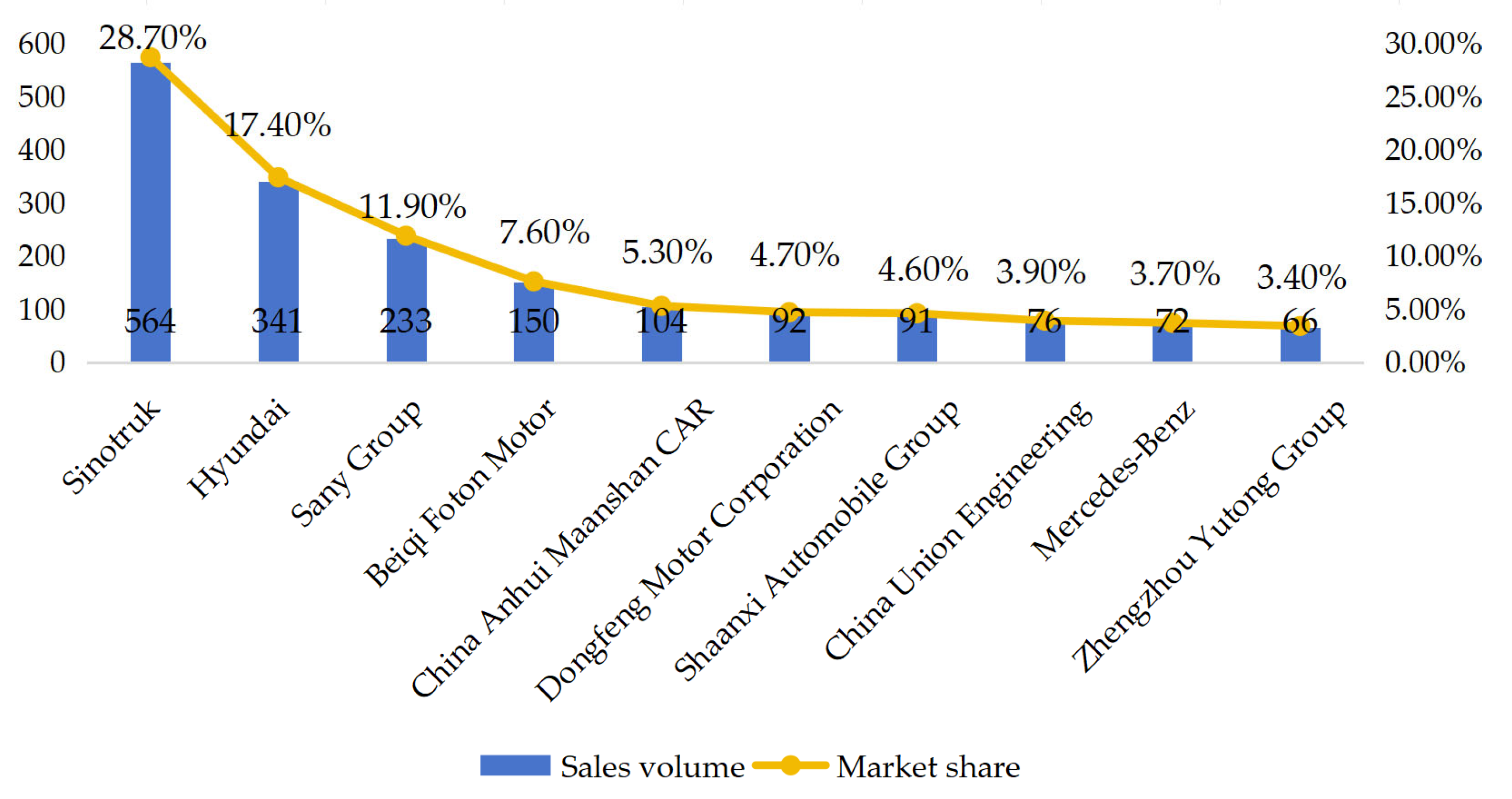

3.2.1. Sample Selection and Data Source

- Must have the 2021 company annual report with HFCV operating data.

- Exclude samples other than HFCV companies. The HFCV industry has the most obvious and extensive technological innovation in the hydrogen chain. The theme of this paper is the high performance of enterprises, so, for example, enterprises that produce hydrogen do not meet the research requirements.

- Exclude enterprises that do not use fuel cells, power systems, etc., as their main products. Some enterprises are group companies, and the related products are only a small branch of the enterprise layout, and their viability is unmatched by other enterprises in the sample.

- Exclude enterprises lacking sufficient information to support the study’s variables.

3.2.2. Measurement of Variables

3.3. Variable Calibration

4. Results

4.1. Necessary Condition Analysis

4.2. Configuration Analysis

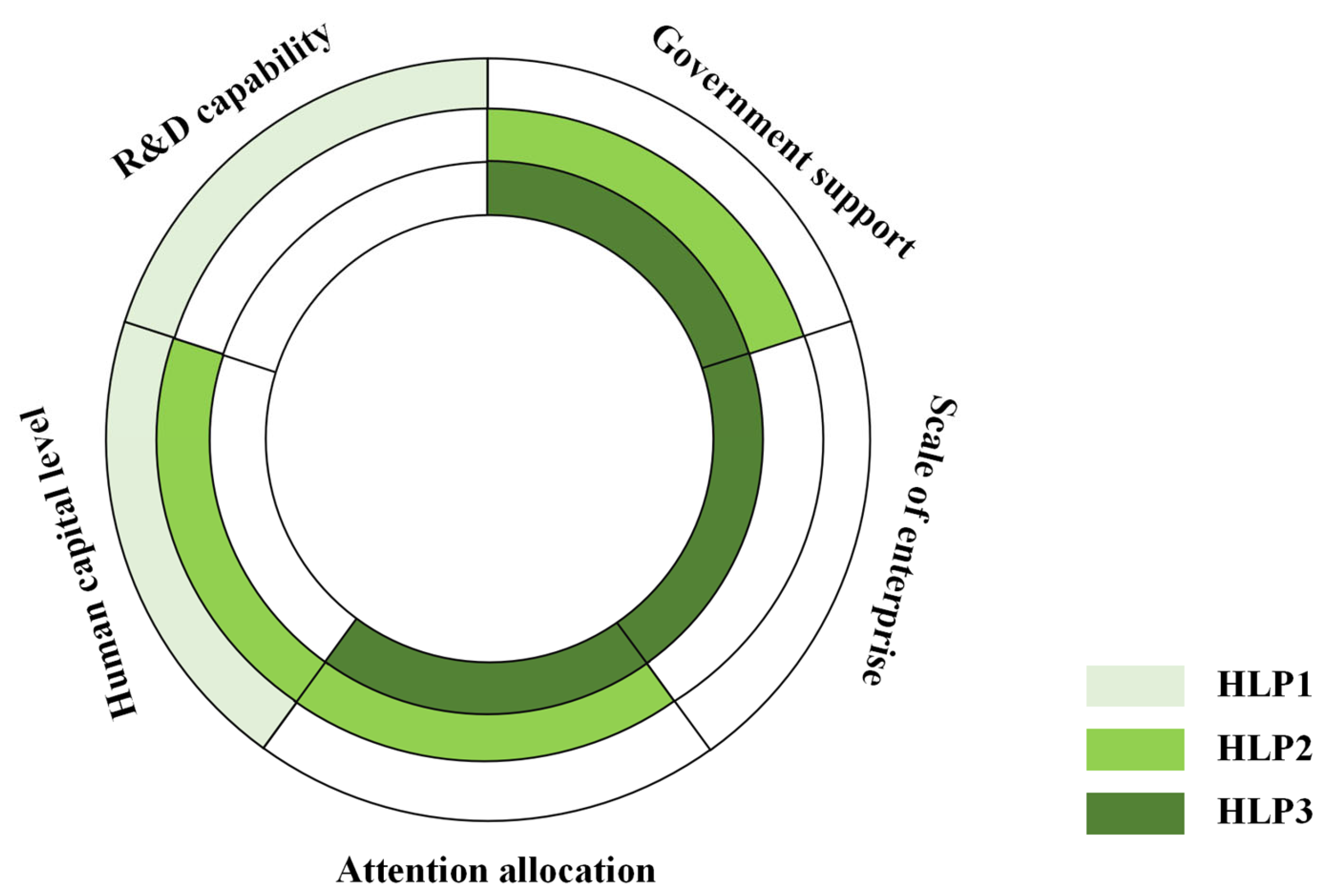

4.2.1. Configuration Analysis of High Performance of Sample Enterprises

4.2.2. Configuration Analysis of Non-Performance of Sample Enterprises

4.3. Robustness Test

5. Discussion and Insights

5.1. Discussion

5.2. Theoretical Contributions

5.3. Management Insights

6. Conclusions and Prospects

6.1. Conclusions

6.2. Limitations and Prospects

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Code | Full Name of the Enterprise | Code | Full Name of the Enterprise |

|---|---|---|---|

| 1 | Beijing Sinohytec Co., Ltd. | 21 | Guangzhou Automobile Group Co., Ltd. |

| 2 | Shanxi Meijin Energy Co., Ltd. | 22 | Beiqi Foton Motor Co., Ltd. |

| 3 | Shenzhen Center Power Tech Co., Ltd. | 23 | Yutong Bus Co., Ltd. |

| 4 | Fujian Snowman Co., Ltd. | 24 | Dongfeng Automobile Co., Ltd. |

| 5 | Zhongshan Broad-Ocean Motor Co., Ltd. | 25 | Xiamen King Long Motor Group Co., Ltd. |

| 6 | Changzhou Tenglong Auto Parts Co., Ltd. | 26 | Sinotruk Jinan Truck Co., Ltd. |

| 7 | Anhui Quanchai Engine Co., Ltd. | 27 | Shanghai Sinotec Co., Ltd. |

| 8 | Weichai Power Co., Ltd. | 28 | Great Wall Motor Company Limited |

| 9 | Advanced Technology & Materials Co., Ltd. | 29 | Hunan Corun New Energy Co., Ltd. |

| 10 | Beijing Dynamic Power Co., Ltd. | 30 | Haima Automobile Co., Ltd. |

| 11 | Dongfang Electric Corporation Limited | 31 | Hanma Technology Group Co., Ltd. |

| 12 | Fuxin Dare Automotive Parts Co., Ltd. | 32 | Yangzhou YaxingMotor Coach Co., Ltd. |

| 13 | Chongqing Zongshen Power Machinery Co., Ltd. | 33 | Zhejiang Kangsheng Co., Ltd. |

| 14 | Qingdao Hanhe Cable Co., Ltd. | 34 | Hangcha Group Co., Ltd. |

| 15 | Jiangsu Lopal Tech. Co., Ltd. | 35 | Jiangsu Huachang Chemical Co., Ltd. |

| 16 | Lifan Technology (Group) Co., Ltd. | 36 | China Shipbuilding Industry Group Power Co., Ltd. |

| 17 | Nanjing Yueboo Power System Co., Ltd. | 37 | Zhejiang Narada Power Source Co., Ltd. |

| 18 | FAW Jiefang Group Co., Ltd. | 38 | Weifu High-Technology Group Co., Ltd. |

| 19 | Zhongtong Bus Holding Co., Ltd. | 39 | Sinosteel New Materials Co., Ltd. |

| 20 | SAIC Motor Corporation Limited | 40 | Shenzhen Everwin Precision Technology Co., Ltd. |

Appendix B

| Dimension | Measurement Item |

|---|---|

| Economic values | Hydrogen fuel cell systems, core components, and automotive sections have production capacity |

| Hydrogen fuel cell systems, core components, and vehicle sales increased significantly | |

| Hydrogen fuel cell systems, core components, and automobile production increased significantly | |

| Significant increase in market share of hydrogen fuel cell systems, core components, and automobiles | |

| Abundant types and models of hydrogen fuel cell systems, core components, and automotive products | |

| Significantly increased profits in hydrogen fuel cell systems, core components, and automobiles | |

| Significantly lower production costs for hydrogen fuel cell systems, core components, and automotive-related products | |

| Social values | Hydrogen fuel cell system, core components, and automotive section of the pollution reduction and emission reduction effect significantly better |

| Significantly improved its position in the hydrogen fuel cell system, core components, and automotive section of the industry | |

| The company has an innovative ecological chain of “the whole life cycle of hydrogen energy” | |

| The company’s hydrogen fuel cell system, core components, and automotive section of the effective customer stability | |

| Enterprise capability | Hydrogen fuel cell system, core components, and automobile section technology and equipment level significantly enhanced |

| Maintaining close cooperation with many domestic and foreign hydrogen fuel cell technology enterprises and research institutions | |

| Significant increase in independent intellectual property rights for hydrogen fuel cell systems, core components, and automotive sections | |

| Hydrogen fuel cell systems, core components, and automotive sections join Technical Innovation Alliance and other associations | |

| Hydrogen fuel cell systems’, core components’, and automotive parts’ quality and safety assurance significantly improved | |

| Hydrogen fuel cell system, core component, and automotive section product talent advantage is obvious | |

| Significantly improved risk management in hydrogen fuel cell systems, core components, and automotive sections | |

| The company continues to develop the hydrogen fuel cell system, core components, and automotive section in the future |

Appendix C

| Condition Variables | Configuration of High Performance | Configuration of Not-High Performance | ||||

|---|---|---|---|---|---|---|

| 1 | 2 | 1 | 2 | 3 | 4 | |

| RD | ⬤ | ○ | • | ○ | ○ | |

| HC | ⬤ | ⬤ | ○ | ○ | ○ | ○ |

| AA | ○ | ⬤ | ○ | • | ○ | |

| ES | • | ○ | ○ | |||

| GS | ⬤ | ○ | ○ | ○ | ○ | |

| Consistency | 0.8937 | 0.9482 | 0.9664 | 0.9237 | 0.9021 | 0.8724 |

| Raw coverage | 0.1656 | 0.2405 | 0.1852 | 0.1619 | 0.2554 | 0.2133 |

| Unique coverage | 0.1358 | 0.2107 | 0.0297 | 0.0233 | 0.0178 | 0.0000 |

| Overall solution consistency | 0.9289 | 0.9148 | ||||

| Overall solution coverage | 0.3763 | 0.3510 | ||||

Appendix D

| Condition Variables | Configuration of High Performance | Configuration of Not-High Performance | ||||

|---|---|---|---|---|---|---|

| 1 | 2 | 1 | 2 | 3 | 4 | |

| RD | ○ | ⬤ | • | ○ | ○ | |

| HC | ⬤ | ⬤ | ○ | ○ | ○ | ○ |

| AA | ⬤ | ○ | ○ | • | ○ | |

| ES | • | ○ | ○ | |||

| GS | ⬤ | ⬤ | ○ | ○ | ○ | ○ |

| Consistency | 0.9678 | 0.9686 | 0.9586 | 0.9555 | 0.9278 | 0.9145 |

| Raw coverage | 0.3438 | 0.2082 | 0.3458 | 0.3106 | 0.4214 | 0.3973 |

| Unique coverage | 0.1891 | 0.05352 | 0.0328 | 0.0044 | 0.0130 | 0.0000 |

| Overall solution consistency | 0.9696 | 0.9314 | ||||

| Overall solution coverage | 0.3973 | 0.5039 | ||||

References

- Aydin, M.; Degirmenci, T.; Ahmed, Z.; Apergis, N. Do the Energy Taxes, Green Technological Innovation, and Energy Productivity Enable the Green Energy Transition in EU Countries? Evidence from Novel Panel Data Estimators. Renew. Energy 2025, 249, 123236. [Google Scholar] [CrossRef]

- Singh, A.P. Assessment of India’s Green Hydrogen Mission and Environmental Impact. Renew. Sustain. Energy Rev. 2024, 203, 114758. [Google Scholar] [CrossRef]

- He, L.; Ke, N.; Mao, R.; Qi, W.; Zhang, H. From Curtailed Renewable Energy to Green Hydrogen: Infrastructure Planning for Hydrogen Fuel-Cell Vehicles. Manuf. Serv. Oper. Manag. 2024, 26, 1750–1767. [Google Scholar] [CrossRef]

- Zhu, Z.; Zhu, Z.; Xu, P.; Xue, D. Exploring the Impact of Government Subsidy and R&D Investment on Financial Competitiveness of China’s New Energy Listed Companies: An Empirical Study. Energy Rep. 2019, 5, 919–925. [Google Scholar]

- Lin, W.-L.; Cheah, J.-H.; Azali, M.; Ho, J.A.; Yip, N. Does Firm Size Matter? Evidence on the Impact of the Green Innovation Strategy on Corporate Financial Performance in the Automotive Sector. J. Clean. Prod. 2019, 229, 974–988. [Google Scholar] [CrossRef]

- Harichandan, S.; Kar, S.K. An Empirical Study on Consumer Attitude and Perception towards Adoption of Hydrogen Fuel Cell Vehicles in India: Policy Implications for Stakeholders. Energy Policy 2023, 178, 113587. [Google Scholar] [CrossRef]

- Furnari, S.; Crilly, D.; Misangyi, V.F.; Greckhamer, T.; Fiss, P.C.; Aguilera, R.V. Capturing Causal Complexity: Heuristics for Configurational Theorizing. Acad. Manag. Rev. 2021, 46, 778–799. [Google Scholar] [CrossRef]

- Du, Y.Z.; Jia, L.D. Configuration Perspective and Qualitative Comparative Analysis (QCA): A New Way of Management Research. Manag. World 2017, 6, 155–167. [Google Scholar]

- Ragin, C.C. Redesigning Social Inquiry: Fuzzy Sets and Beyond; University of Chicago Press: Chicago, IL, USA, 2009; ISBN 0226702790. [Google Scholar]

- Tran, M.; Banister, D.; Bishop, J.D.K.; McCulloch, M.D. Realizing the Electric-Vehicle Revolution. Nat. Clim. Change 2012, 2, 328–333. [Google Scholar] [CrossRef]

- Yong, T.; Park, C. A Qualitative Comparative Analysis on Factors Affecting the Deployment of Electric Vehicles. Energy Procedia 2017, 128, 497–503. [Google Scholar] [CrossRef]

- Maqbool, R.; Sudong, Y. Critical Success Factors for Renewable Energy Projects; Empirical Evidence from Pakistan. J. Clean. Prod. 2018, 195, 991–1002. [Google Scholar] [CrossRef]

- Tornatzky, L.G.; Fleischer, M.; Chakrabarti, A.K. The Processes of Technological Innovation; Lexington Books: Lanham, MD, USA, 1990. [Google Scholar]

- Wang, S.; Zhang, H. Inter-Organizational Cooperation in Digital Green Supply Chains: A Catalyst for Eco-Innovations and Sustainable Business Practices. J. Clean. Prod. 2024, 472, 143383. [Google Scholar] [CrossRef]

- Jiang, H.; Lu, J.; Zhang, R.; Xiao, X. Investigation of Diverse Urban Carbon Emission Reduction Pathways in China: Based on the Technology–Organization–Environment Framework for Promoting Socio-Environmental Sustainability. Land 2025, 14, 260. [Google Scholar] [CrossRef]

- Schumpeter, J.A. Capitalism, Socialism and Democracy; George Allen & Unwin: London, UK, 1976. [Google Scholar]

- Zeng, S.; Shu, X.; Ye, W. Total Factor Productivity and High-Quality Economic Development: A Theoretical and Empirical Analysis of the Yangtze River Economic Belt, China. Int. J. Environ. Res. Public Health 2022, 19, 2783. [Google Scholar] [CrossRef]

- Peng, Y.; Tao, C. Can Digital Transformation Promote Enterprise Performance?—From the Perspective of Public Policy and Innovation. J. Innov. Knowl. 2022, 7, 100198. [Google Scholar] [CrossRef]

- Shi, X.; Cai, L.; Song, H. Discovering Potential Technology Opportunities for Fuel Cell Vehicle Firms: A Multi-Level Patent Portfolio-Based Approach. Sustainability 2019, 11, 6381. [Google Scholar] [CrossRef]

- Hooge, S.; Dalmasso, C. Breakthrough R&D Stakeholders: The Challenges of Legitimacy in Highly Uncertain Projects. Proj. Manag. J. 2015, 46, 54–73. [Google Scholar] [CrossRef]

- Mazzelli, A.; Foss, N.J. How Learning and Legitimacy Goals Influence Inter-Firm Imitation in R&D Investment Decisions. BRQ Bus. Res. Q. 2025, 28, 349–370. [Google Scholar]

- Awode, S.S.; Oduola, M.O. The Interplay between Technological Innovation and Human Capital Development in Driving Industrial Productivity and Competitiveness in Africa. J. Econ. Dev. 2025, 27, 56–71. [Google Scholar] [CrossRef]

- Wang, J.; Xu, B.; Liu, M.; Yu, J.; Chen, M.; Tian, G. How Technological Heterogeneity in FDI Shapes Entrepreneurial Structures. Int. Rev. Financ. Anal. 2025, 101, 103986. [Google Scholar] [CrossRef]

- Davis, D.R.; Dingel, J.I. A Spatial Knowledge Economy. Am. Econ. Rev. 2019, 109, 153–170. [Google Scholar] [CrossRef]

- Barney, J.; Wright, M.; Ketchen, D.J., Jr. The Resource-Based View of the Firm: Ten Years after 1991. J. Manag. 2001, 27, 625–641. [Google Scholar] [CrossRef]

- Liu, Y.; Guo, Z.; He, Q. Configuring Technological Innovation and Resource Synergies for Performance in New Energy Vehicle Enterprises: A Path Analysis Using Empirical and Comparative Methods. Sustainability 2025, 17, 5196. [Google Scholar] [CrossRef]

- Jugend, D.; Jabbour, C.J.C.; Scaliza, J.A.A.; Rocha, R.S.; Junior, J.A.G.; Latan, H.; Salgado, M.H. Relationships among Open Innovation, Innovative Performance, Government Support and Firm Size: Comparing Brazilian Firms Embracing Different Levels of Radicalism in Innovation. Technovation 2018, 74, 54–65. [Google Scholar] [CrossRef]

- Stock, G.N.; Greis, N.P.; Fischer, W.A. Firm Size and Dynamic Technological Innovation. Technovation 2002, 22, 537–549. [Google Scholar] [CrossRef]

- Hsu, C.-W.; Lien, Y.-C.; Chen, H. R&D Internationalization and Innovation Performance. Int. Bus. Rev. 2015, 24, 187–195. [Google Scholar] [CrossRef]

- Ocasio, W. Towards an Attention–based View of the Firm. Strateg. Manag. J. 1997, 18, 187–206. [Google Scholar] [CrossRef]

- Kleinknecht, R.; Haq, H.U.; Muller, A.R.; Kraan, K.O. An Attention-Based View of Short-Termism: The Effects of Organizational Structure. Eur. Manag. J. 2020, 38, 244–254. [Google Scholar] [CrossRef]

- He, L.; Huang, L.; Yang, G. Invest in Innovation or Not? How Managerial Cognition and Attention Allocation Shape Corporate Responses to Performance Shortfalls. Manag. Organ. Rev. 2021, 17, 815–850. [Google Scholar] [CrossRef]

- Hanelt, A.; Bohnsack, R.; Marz, D.; Antunes Marante, C. A Systematic Review of the Literature on Digital Transformation: Insights and Implications for Strategy and Organizational Change. J. Manag. Stud. 2021, 58, 1159–1197. [Google Scholar] [CrossRef]

- Guo, D.; Guo, Y.; Jiang, K. Government-Subsidized R&D and Firm Innovation: Evidence from China. Res. Policy 2016, 45, 1129–1144. [Google Scholar]

- Květoň, V.; Horák, P. The Effect of Public R&D Subsidies on Firms’ Competitiveness: Regional and Sectoral Specifics in Emerging Innovation Systems. Appl. Geogr. 2018, 94, 119–129. [Google Scholar] [CrossRef]

- Wang, Z.; Li, X.; Xue, X.; Liu, Y. More Government Subsidies, More Green Innovation? The Evidence from Chinese New Energy Vehicle Enterprises. Renew. Energy 2022, 197, 11–21. [Google Scholar] [CrossRef]

- Montmartin, B.; Herrera, M. Internal and External Effects of R&D Subsidies and Fiscal Incentives: Empirical Evidence Using Spatial Dynamic Panel Models. Res. Policy 2015, 44, 1065–1079. [Google Scholar] [CrossRef]

- Zheng, L.; Ulrich, K.; Sendra-García, J. Qualitative Comparative Analysis: Configurational Paths to Innovation Performance. J. Bus. Res. 2021, 128, 83–93. [Google Scholar] [CrossRef]

- Rihoux, B.; Ragin, C.C. Configurational Comparative Methods: Qualitative Comparative Analysis (QCA) and Related Techniques; Sage Publications: Thousand Oaks, CA, USA, 2009; Volume 51, ISBN 1412942357. [Google Scholar]

- Gnanaweera, K.A.K.; Kunori, N. Corporate Sustainability Reporting: Linkage of Corporate Disclosure Information and Performance Indicators. Cogent Bus. Manag. 2018, 5, 1423872. [Google Scholar] [CrossRef]

- Solikhah, B.; Wahyudin, A.; Rahmayanti, A.A.W. The Extent of Intellectual Capital Disclosure and Corporate Governance Mechanism to Increase Market Value. J. Asian Financ. Econ. Bus. 2020, 7, 119–128. [Google Scholar] [CrossRef]

- Xie, X.; Huo, J.; Zou, H. Green Process Innovation, Green Product Innovation, and Corporate Financial Performance: A Content Analysis Method. J. Bus. Res. 2019, 101, 697–706. [Google Scholar] [CrossRef]

- Rao, S.; Pan, Y.; He, J.; Shangguan, X. Digital Finance and Corporate Green Innovation: Quantity or Quality? Environ. Sci. Pollut. Res. 2022, 29, 56772–56791. [Google Scholar] [CrossRef]

- Silvestre, B.S.; Ţîrcă, D.M. Innovations for Sustainable Development: Moving toward a Sustainable Future. J. Clean. Prod. 2019, 208, 325–332. [Google Scholar] [CrossRef]

- Haber, S.; Reichel, A. Identifying Performance Measures of Small Ventures—The Case of the Tourism Industry. J. Small Bus. Manag. 2005, 43, 257–286. [Google Scholar] [CrossRef]

- Albertini, E. A Descriptive Analysis of Environmental Disclosure: A Longitudinal Study of French Companies. J. Bus. Ethics 2014, 121, 233–254. [Google Scholar] [CrossRef]

- Li, X.R.; Mou, C.L.; and Cui, T.T. Grouping and Path of Factors Influencing Innovation Performance of Listed Companies in Pharmaceutical Manufacturing Industry under TOE Framework. Financ. Account. Mon. 2023, 44, 114–120. (In Chinese) [Google Scholar]

- Ramos, R.; Surinach, J.; Artís, M. Regional Economic Growth and Human Capital: The Role of over-Education. Reg. Stud. 2012, 46, 1389–1400. [Google Scholar] [CrossRef]

- Tan, H.B.; Fan, Z.T.; and Du, Y.Z. Technology Management Capability, Attention Allocation and Local Government Website Development—A Group Analysis Based on the TOE Framework. J. Manag. World 2019, 35, 81–94. (In Chinese) [Google Scholar]

- Hasangapon, M.; Iskandar, D.; Purnama, E.D.; Tampubolon, L.D.R. The Effect of Firm Size and Total Assets Turnover (Tato) on Firm Value Mediated by Profitability in Wholesale and Retail Sector Companies. Primanomics J. Ekon. Bisnis 2021, 19, 49–63. [Google Scholar] [CrossRef]

- Gao, W.; and Hu, X.Y. New Energy Vehicle Policy Effect: Scale or Innovation Intermediary? Sci. Res. Manag. 2020, 41, 32–44. (In Chinese) [Google Scholar]

- Peretto, P.F.; Valente, S. Growth on a Finite Planet: Resources, Technology and Population in the Long Run. J. Econ. Growth 2015, 20, 305–331. [Google Scholar] [CrossRef]

- Li, W.; Tan, S.; Liu, X.; Wang, Z.; Li, G. Identifying the Effective and Ineffective Configurations of the Mandatory Waste Management Policy in China: A Qualitative Comparative Analysis. J. Environ. Plan. Manag. 2024, 67, 3003–3025. [Google Scholar] [CrossRef]

- Tan, S.; Li, W.; Liu, X.; Wang, Y.; Wang, M. Exploring Paths Underpinning the Implementation of Municipal Waste Sorting: Evidence from China. Environ. Impact Assess. Rev. 2024, 106, 107510. [Google Scholar] [CrossRef]

- Caves, K.M.; Meuer, J.; Rupietta, C. Advancing Educational Leadership Research Using Qualitative Comparative Analysis (QCA). In Challenges and Opportunities of Educational Leadership Research and Practice; Bowers, A.J., Shoho, A.R., Barnett, B.G., Eds.; Information Age Publishing: Charlotte, NC, USA, 2015; pp. 147–170. [Google Scholar]

- Hwang, H.; Lee, Y.; Seo, I.; Chung, Y. Successful Pathway for Locally Driven Fuel Cell Electric Vehicle Adoption: Early Evidence from South Korea. Int. J. Hydrogen Energy 2021, 46, 21764–21776. [Google Scholar] [CrossRef]

- Shih, T.; Hu, M.-C.; Chou, J.C.-P. Navigating an Emerging Innovation Ecosystem: A Case Study of Fuel Cell Innovation in Taiwan. Asian J. Technol. Innov. 2025, 33, 176–194. [Google Scholar] [CrossRef]

- Tan, S.; Li, W.; Liu, X.; Li, P.; Yan, L.; Liang, C. Synergistic Systems of Digitalization and Urbanization in Driving Urban Green Development: A Configurational Analysis of China’s Yellow River Basin. Systems 2025, 13, 426. [Google Scholar] [CrossRef]

- Artz, K.W.; Norman, P.M.; Hatfield, D.E.; Cardinal, L.B. A Longitudinal Study of the Impact of R&D, Patents, and Product Innovation on Firm Performance. J. Prod. Innov. Manag. 2010, 27, 725–740. [Google Scholar] [CrossRef]

- Ahmad, G.N.; Prasetyo, M.R.P.; Buchdadi, A.D.; Widyastuti, U.; Kurniawati, H. The Effect of CEO Characteristics on Firm Performance of Food and Beverage Companies in Indonesia, Malaysia and Singapore. Calitatea 2022, 23, 111–122. [Google Scholar]

- Jiang, Z.; Xu, C. Policy Incentives, Government Subsidies, and Technological Innovation in New Energy Vehicle Enterprises: Evidence from China. Energy Policy 2023, 177, 113527. [Google Scholar] [CrossRef]

- Liu, Q.; Wen, X.; Peng, H.; Cao, Q. Key Technology Breakthrough in New Energy Vehicles: Configuration Path Evolution from Innovative Ecosystem Perspective. J. Clean. Prod. 2023, 423, 138635. [Google Scholar] [CrossRef]

| Variable Type | Variable | Description of Indicators | Indicator Sources |

|---|---|---|---|

| Condition variable | RD | Total number of “invention patents and utility models granted as of the end of the reporting period plus 1 to take a logarithmic number” | CNRDS |

| HC | Percentage of “employees with education level of bachelor’s degree or above” | CSMAR | |

| AA | “The time interval” between when companies published information on expanding hydrogen to 2014 | Annual report of enterprises | |

| ES | Total “enterprise assets” | CSMAR | |

| GS | Number of “Hydrogen Energy Policy Provisions Issued in the Province” | Provincial government portals | |

| Result variable | EP | “Frequency counts and averaging of words” related to corporate annual reports | Annual report of enterprises |

| Variable | Fuzzy-Set Calibration | Descriptive Statistics | |||||

|---|---|---|---|---|---|---|---|

| Full Out | Crossover | Full In | Minimum | Maximum | Mean | Standard Deviation | |

| RD | 5.6569 | 6.6307 | 8.0064 | 3.6636 | 9.7003 | 6.6923 | 1.4433 |

| HC | 0.1374 | 0.2572 | 0.3526 | 0.0176 | 0.6010 | 0.2572 | 0.1515 |

| AA | 31.0000 | 23.0000 | 10.0000 | 1.0000 | 40.0000 | 19.7500 | 11.8619 |

| ES | 61.0509 | 115.3969 | 488.3054 | 13.8436 | 9169.2270 | 540.8000 | 1505.2269 |

| GS | 16.0000 | 41.0000 | 45.0000 | 5.0000 | 66.0000 | 33.55500 | 19.0478 |

| EP | 7.7500 | 12.0000 | 14.2500 | 2.0000 | 19.0000 | 11.3000 | 4.2919 |

| Variable | High Performance | Not-High Performance | ||

|---|---|---|---|---|

| Consistency | Coverage | Consistency | Coverage | |

| RD | 0.5515 | 0.5591 | 0.4960 | 0.5131 |

| ~RD | 0.5197 | 0.5027 | 0.5738 | 0.5662 |

| HC | 0.6707 | 0.6472 | 0.4431 | 0.4362 |

| ~HC | 0.4157 | 0.4225 | 0.6416 | 0.6653 |

| AA | 0.6192 | 0.6135 | 0.4952 | 0.5005 |

| ~AA | 0.4959 | 0.4905 | 0.6176 | 0.6233 |

| ES | 0.5783 | 0.5797 | 0.4823 | 0.4932 |

| ~ES | 0.4944 | 0.4835 | 0.5891 | 0.5877 |

| GS | 0.6658 | 0.6642 | 0.4377 | 0.4456 |

| ~GS | 0.4442 | 0.4365 | 0.6701 | 0.6716 |

| Condition Variables | Configuration of High Performance | ||

|---|---|---|---|

| HLP1 | HLP2 | HLP3 | |

| RD | ⬤ | ⭘ | • |

| HC | ⬤ | ⬤ | ⭘ |

| AA | ⭘ | ⬤ | ⬤ |

| ES | • | ⬤ | |

| GS | ⬤ | ⬤ | |

| Case | FJF CSICP | BSH DPC | ATM SAIC |

| Consistency | 0.8937 | 0.9482 | 0.8664 |

| Raw coverage | 0.1656 | 0.2405 | 0.0949 |

| Unique coverage | 0.1303 | 0.1819 | 0.0399 |

| Overall solution consistency | 0.9228 | ||

| Overall solution coverage | 0.4162 | ||

| Condition Variables | Configuration of Not-High Performance | |||

|---|---|---|---|---|

| NLP1 | NLP2 | NLP3 | NLP4 | |

| RD | • | ⭘ | ⭘ | |

| HC | ⭘ | ⭘ | ⭘ | ⭘ |

| AA | ⭘ | • | ⭘ | |

| ES | ○ | ○ | ||

| GS | ⭘ | ⭘ | ⭘ | ⭘ |

| Consistency | 0.9664 | 0.9237 | 0.9021 | 0.8724 |

| Raw coverage | 0.1852 | 0.1619 | 0.2554 | 0.2133 |

| Unique coverage | 0.0297 | 0.0233 | 0.0178 | 0.0000 |

| Overall solution consistency | 0.9148 | |||

| Overall solution coverage | 0.3510 | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, W.; Wang, M.; Liu, X.; Tan, S. Configurations Driving High Performance in Hydrogen Fuel Cell Vehicle Enterprises. Systems 2025, 13, 779. https://doi.org/10.3390/systems13090779

Li W, Wang M, Liu X, Tan S. Configurations Driving High Performance in Hydrogen Fuel Cell Vehicle Enterprises. Systems. 2025; 13(9):779. https://doi.org/10.3390/systems13090779

Chicago/Turabian StyleLi, Wei, Mengxin Wang, Xiaoguang Liu, and Shizheng Tan. 2025. "Configurations Driving High Performance in Hydrogen Fuel Cell Vehicle Enterprises" Systems 13, no. 9: 779. https://doi.org/10.3390/systems13090779

APA StyleLi, W., Wang, M., Liu, X., & Tan, S. (2025). Configurations Driving High Performance in Hydrogen Fuel Cell Vehicle Enterprises. Systems, 13(9), 779. https://doi.org/10.3390/systems13090779