Executive Cognitive Styles and Enterprise Digital Strategic Change Under Environmental Dynamism: The Mediating Role of Absorptive Capacity in a Complex Adaptive System

Abstract

1. Introduction

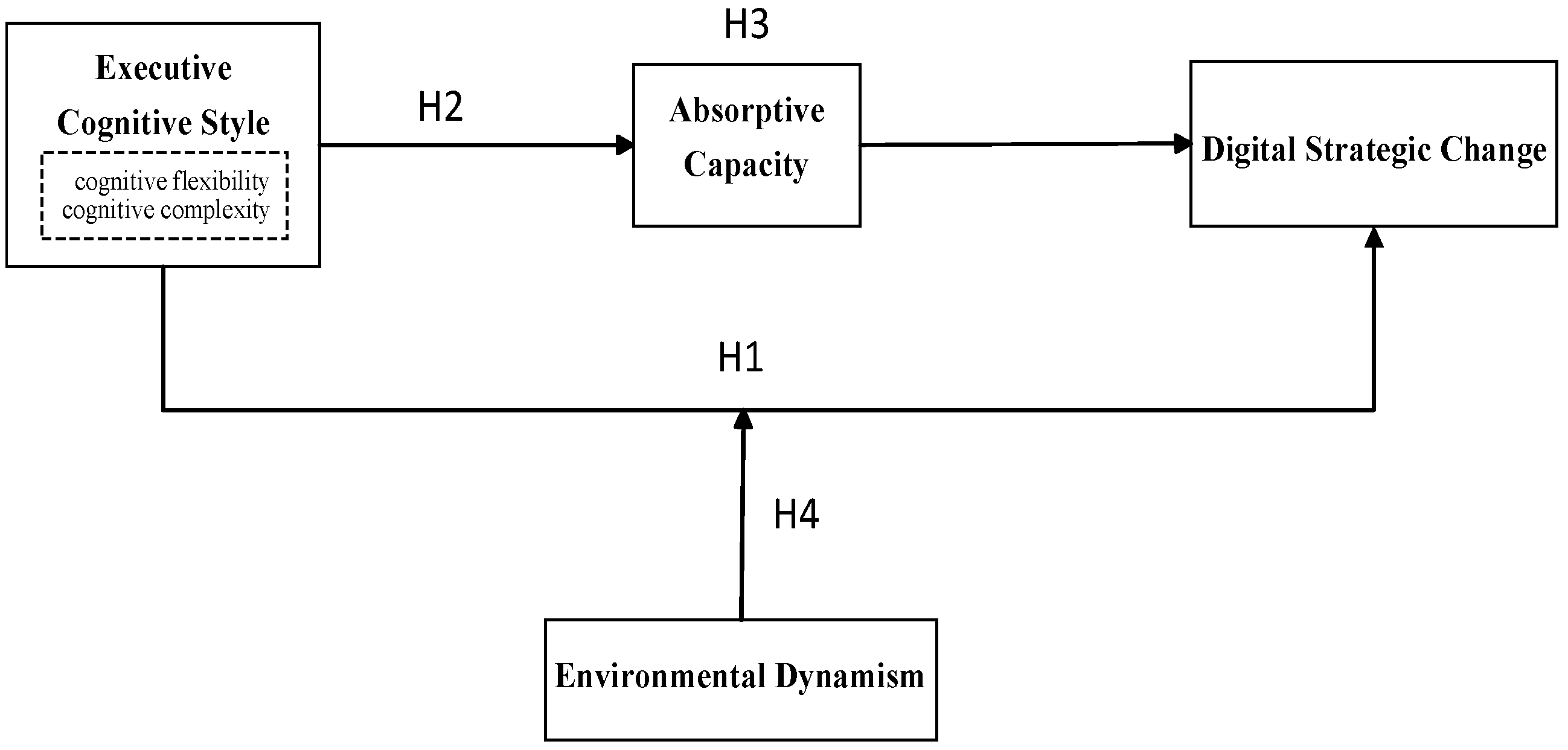

2. Literature Review and Research Hypothesis

2.1. Research on Firm Digital Strategy

2.2. Research Hypothesis

2.2.1. Executive Cognitive Style and Digital Strategic Change

2.2.2. The Mediating Role of Absorptive Capacity

2.2.3. The Moderating Effect of Environmental Dynamism

3. Research Design

3.1. Sample Selection and Data Source

3.2. Variable Definition and Measurement

- Dependent Variable: Digital Strategic Change (DSC)

- 2.

- Independent Variable: manager cognitive style

- 3.

- Mediating variable: absorptive capacity (AC)

- 4.

- Moderating variable: environmental dynamism (ED)

- 5.

- Control variables

3.3. Model Setting

4. Empirical Analysis

4.1. Descriptive Statistical Analysis

4.2. Analysis of Empirical Results

4.2.1. Benchmark Regression

4.2.2. Mediating-Effect Test

4.2.3. Moderating-Effect Test

4.3. Robustness Test

4.3.1. Adjusting for Fixed Effects

4.3.2. Replacing Measures of Core Variables

4.3.3. Lagged and Lead Variables

4.4. Heterogeneity Test

4.4.1. Heterogeneity Test Based on Digital Economy Development Level

4.4.2. Heterogeneity Test Based on Firm Life Cycle

4.4.3. Heterogeneity Test Based on Factor Intensity

5. Research Conclusions and Recommendations

5.1. Research Conclusions

5.2. Suggestions

5.3. Limitations and Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Yuan, C.; Xiao, T.; Geng, C.; Sheng, Y. Digital Transformation and Division of Labor between Enterprises: Vertical Specialization or Vertical Integration. China Ind. Econ. 2021, 9, 137–155. [Google Scholar]

- Nambisan, S.; Wright, M.; Feldman, M. The Digital Transformation of Innovation and Entrepreneurship: Progress, Challenges and Key Themes. Res. Policy 2019, 48, 103773. [Google Scholar] [CrossRef]

- Guo, X.; Li, M.; Wang, Y.; Mardani, A. Does Digital Transformation Improve the Firm’s Performance? From the Perspective of Digitalization Paradox and Managerial Myopia. J. Bus. Res. 2023, 163, 113868. [Google Scholar] [CrossRef]

- Annarelli, A.; Battistella, C.; Nonino, F.; Parida, V.; Pessot, E. Literature Review on Digitalization Capabilities: Co-Citation Analysis of Antecedents, Conceptualization and Consequences. Technol. Forecast. Soc. Change 2021, 166, 120635. [Google Scholar] [CrossRef]

- Yu, Y.; Wei, Y.; Wen, X. Research on the Impact of Slack Resources on Digital Transformation of Enterprises: A Non-Linear Relationship. J. Manag. 2024, 37, 141–158. [Google Scholar]

- Sun, W.; Mao, N.; Lan, F.; Wang, L. Policy Empowerment, Digital Ecosystem and Enterprise Digital Transformation: A Quasi Natural Experiment Based on the National Big Data Comprehensive Experimental Zone. China Ind. Econ. 2023, 9, 117–135. [Google Scholar]

- Kohli, R.; Melville, N.P. Digital Innovation: A Review and Synthesis. Inf. Syst. J. 2019, 29, 200–223. [Google Scholar] [CrossRef]

- Hambrick, D.C.; Mason, P.A. Upper Echelons: The Organization as a Reflection of Its Top Managers. Acad. Manag. Rev. 1984, 9, 193–206. [Google Scholar] [CrossRef]

- Pan, X.; Xu, G. The Impact of Managers’ IT Experience on the Enterprises’ Digital Transformation: Empirical Evidence from China. Appl. Econ. 2024, 56, 3652–3668. [Google Scholar] [CrossRef]

- Tang, X.; Gao, X.; Zhao, T.Q.; Ding, S. Executive Team Heterogeneity and Corporate Digital Transformation. China Soft Sci. 2022, 10, 83–98. [Google Scholar]

- Qingjin, W.; Renbo, S.; Tiantian, D.; Changlin, H. How Does Boundary-Spanning Search Promote Enterprise Management Innovation? The Role of Cognitive Flexibility and Absorptive Capacity. Sci. Technol. Prog. Policy 2022, 39, 67–78. [Google Scholar]

- Zhou, J.; Lan, S.; Liu, Y.; Rong, T.; Huisingh, D. Research on the Relations between Cognition and Intelligent Transformation of Executive Teams in Small and Medium-Sized Manufacturing Enterprises. Adv. Eng. Inform. 2022, 52, 101539. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Broekhuizen, T.; Bart, Y.; Bhattacharya, A.; Dong, J.Q.; Fabian, N.; Haenlein, M. Digital Transformation: A Multidisciplinary Reflection and Research Agenda. J. Bus. Res. 2021, 122, 889–901. [Google Scholar] [CrossRef]

- Fonseca, L.; Amaral, A.; Oliveira, J. Quality 4.0: The EFQM 2020 Model and Industry 4.0 Relationships and Implications. Sustainability 2021, 13, 3107. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive Capacity: A Review, Reconceptualization, and Extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Snow, C.C.; Hambrick, D.C. Measuring Organizational Strategies: Some Theoretical and Methodological Problems. Acad. Manag. Rev. 1980, 5, 527–538. [Google Scholar] [CrossRef]

- Bharadwaj, A.; El Sawy, O.A.; Pavlou, P.A.; Venkatraman, N.V. Digital Business Strategy: Toward a Next Generation of Insights. MIS Q. 2013, 37, 471–482. [Google Scholar] [CrossRef]

- Gobble, M.M. Digital Strategy and Digital Transformation. Res.-Technol. Manag. 2018, 61, 66–71. [Google Scholar] [CrossRef]

- Hanelt, A.; Bohnsack, R.; Marz, D.; Antunes Marante, C. A Systematic Review of the Literature on Digital Transformation: Insights and Implications for Strategy and Organizational Change. J. Manag. Stud. 2021, 58, 1159–1197. [Google Scholar] [CrossRef]

- Bai, F.; Liu, D.; Dong, K.; Shang, M.; Yan, A. Research on How Executive Connections Affect Enterprise Digital Transformation: Empirical Evidence from China. Sustainability 2023, 15, 2037. [Google Scholar] [CrossRef]

- Yu, F.; Liu, M.X.; Wang, L.F.; Li, L. Impact of Knowledge Couplings on Manufacturing Firms’ Green Innovation: The Moderating Effect of Slack Resources. Nankai Bus. Rev. 2019, 22, 54–65. [Google Scholar]

- Matarazzo, M.; Penco, L.; Profumo, G.; Quaglia, R. Digital Transformation and Customer Value Creation in Made in Italy SMEs: A Dynamic Capabilities Perspective. J. Bus. Res. 2021, 123, 642–656. [Google Scholar] [CrossRef]

- Cai, C.; Geng, Y.; Yang, F. Academic Background of Senior Executives and Enterprise Digital Transformation. Sci. Rep. 2024, 14, 21865. [Google Scholar] [CrossRef] [PubMed]

- Zhou, C.; Zhang, H.; Ying, J.; He, S.; Zhang, C.; Yan, J. Artificial Intelligence and Green Transformation of Manufacturing Enterprises. Int. Rev. Financ. Anal. 2025, 104, 104330. [Google Scholar] [CrossRef]

- Zhu, J.; Jin, Y. How Flexible Leadership Ability Affects Manufacturing Enterprises’ Digital Transformation Willingness: The Role of Innovation Commitment and Environmental Dynamics. PLoS ONE 2023, 18, e0288047. [Google Scholar] [CrossRef] [PubMed]

- Kong, D.; Liu, B.; Zhu, L. Stem CEOs and Firm Digitalization. Financ. Res. Lett. 2023, 58, 104573. [Google Scholar] [CrossRef]

- Wang, H.J.; Lu, Y.S.; Song, T.B. Seeking Change in Stability? TMT Stability and Enterprise Digital Transformation. R&D Manag. 2023, 35, 97–110. [Google Scholar]

- Deng, S.; Rui, M. Top Manager’s Cognition and Firm’s Ambidexterity: A Case Study Based on Strategic Transformation of Zhejiang Kinghing Capital Co., Ltd. China Ind. Econ. 2013, 11, 135–147. [Google Scholar]

- Lee, O.K.; Sambamurthy, V.; Lim, K.H.; Wei, K.K. How Does IT Ambidexterity Impact Organizational Agility? Inf. Syst. Res. 2015, 26, 398–417. [Google Scholar] [CrossRef]

- March, J.G. Exploration and Exploitation in Organizational Learning. Organ. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

- Bogner, W.C.; Barr, P.S. Making Sense in Hypercompetitive Environments: A Cognitive Explanation for the Persistence of High Velocity Competition. Organ. Sci. 2000, 11, 212–226. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic Capabilities and Strategic Management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Eggers, J.P.; Kaplan, S. Cognition and Capabilities: A Multi-Level Perspective. Acad. Manag. Ann. 2013, 7, 295–340. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive Capacity: A New Perspective on Learning and Innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Qianying, Y.; Yantai, C. Impacts of Executive Cognition on Product Innovation in the New Digital Context. Sci. Res. Manag. 2023, 44, 167. [Google Scholar]

- Lin, C.; Kunnathur, A. Strategic Orientations, Developmental Culture, and Big Data Capability. J. Bus. Res. 2019, 105, 49–60. [Google Scholar] [CrossRef]

- Jie, C.; Tingting, W.; Haiqing, H. The Influence of Cognitive Flexibility on Entrepreneurial Bricolage in Spin-Outs. Sci. Technol. Prog. Policy 2020, 37, 28–35. [Google Scholar]

- Wang, Q.; Shi, R.; Zhang, K.; Han, C.; Gao, Y. The Impact of Entrepreneurs’ Cognitive Flexibility on the Business Performance of New Ventures: An Empirical Study Based on Chinese New Ventures. Curr. Psychol. 2023, 42, 24668–24681. [Google Scholar] [CrossRef]

- Johnson, D.R.; Hoopes, D.G. Managerial Cognition, Sunk Costs, and the Evolution of Industry Structure. Strateg. Manag. J. 2003, 24, 1057–1068. [Google Scholar] [CrossRef]

- Kim, K.; Seo, E.H.; Kim, C.Y. The Relationships between Environmental Dynamism, Absorptive Capacity, Organizational Ambidexterity, and Innovation Performance from the Dynamic Capabilities Perspective. Sustainability 2025, 17, 449. [Google Scholar] [CrossRef]

- Miroshnychenko, I.; Strobl, A.; Matzler, K.; De Massis, A. Absorptive Capacity, Strategic Flexibility, and Business Model Innovation: Empirical Evidence from Italian SMEs. J. Bus. Res. 2021, 130, 670–682. [Google Scholar] [CrossRef]

- Tortora, D.; Chierici, R.; Briamonte, M.F.; Tiscini, R. ‘I Digitize so I Exist’: Searching for Critical Capabilities Affecting Firms’ Digital Innovation. J. Bus. Res. 2021, 129, 193–204. [Google Scholar] [CrossRef]

- Zuo, L.; Zhou, J. The Relationship between Cognitive Flexibility, Entrepreneurial Bricolage and New Venture Performance: The Moderating Effect of Environmental Dynamism. Forecasting 2017, 36, 17–23. [Google Scholar]

- Sarwar, Z.; Gao, J.; Khan, A. Nexus of Digital Platforms, Innovation Capability, and Strategic Alignment to Enhance Innovation Performance in the Asia Pacific Region: A Dynamic Capability Perspective. Asia Pac. J. Manag. 2024, 41, 867–901. [Google Scholar] [CrossRef]

- Liu, S.; He, J. The Impact of Top Management Team’s Complex Knowledge Structure on Ambidextrous Innovation of Sci-Tech Enterprises: An Empirical Study Based on Strategic Reference Point Theory. East China Econ. Manag. 2025, 39, 35–46. [Google Scholar]

- Yu, C.; Gu, X.; Yang, X.; Xie, H. Innovation Rhythm and Innovation Performance for High-Quality Development: The Role of Digital Transformation and Environmental Dynamism. Res. Dev. Manag. 2023, 35, 65–77. [Google Scholar]

- Covin, J.G.; Lisanti, A.; Latorre, G.; Brownell, K.M.; Kreiser, P.M. Strategic Learning Self-Efficacy, Strategic Decision-Making Style, and Environment as Determinants of Firm Growth. J. Innov. Knowl. 2025, 10, 100657. [Google Scholar] [CrossRef]

- Xin, B.; Mu, S. Factors Influencing Enterprise Service Innovation Performance from a Configuration Perspective: An Empirical Analysis Based on fsQCA. Sci. Sci. Technol. Manag. 2023, 44, 169–184. [Google Scholar]

- Jun, M.; Xi, Y.; Zeng, X. Strategy Choice: Management Cognition and Experiential Search. Sci. Sci. Manag. S. 2007, 11, 114–119. [Google Scholar]

- Wu, F.; Hu, H.; Lin, H.; Ren, X. Enterprise Digital Transformation and Capital Market Performance: Empirical Evidence from Stock Liquidity. Manag. World 2021, 37, 130–144. [Google Scholar]

- Deng, S.J. Top Managerial Cognition and the Evolution of Firms’ Dynamic Capabilities. Doctoral Dissertation, Fudan University, Shanghai, China, 2010. [Google Scholar]

- Tsai, W. Knowledge Transfer in Intraorganizational Networks: Effects of Network Position and Absorptive Capacity on Business Unit Innovation and Performance. Acad. Manag. J. 2001, 44, 996–1004. [Google Scholar] [CrossRef]

- Xue, L.; Jiang, L.; Huang, Y.; Liang, Z. Resource Heterogeneity, Knowledge Flow and Synergy Innovation of Industry–University–Research Institute: An Empirical Study on AI Industry. Stud. Sci. Sci. 2019, 37, 2241–2251. [Google Scholar]

- Zhong, C.; Huang, R.; Duan, Y.; Sunguo, T.; Dello Strologo, A. Exploring the Impacts of Knowledge Recombination on Firms’ Breakthrough Innovation: The Moderating Effect of Environmental Dynamism. J. Knowl. Manag. 2024, 28, 698–723. [Google Scholar] [CrossRef]

- Liu, J.; Luo, F.K.; Wang, J. Environmental Uncertainty and Investment in Enterprise Innovation Activities: The Moderating Effect of Government Subsidies and Integration of Industry and Finance. Bus. Manag. J. 2019, 41, 21–39. [Google Scholar]

- Ghosh, D.; Olsen, L. Environmental Uncertainty and Managers’ Use of Discretionary Accruals. Account. Organ. Soc. 2009, 34, 188–207. [Google Scholar] [CrossRef]

- Richard, O.C.; Wu, J.; Markoczy, L.A.; Chung, Y. Top Management Team Demographic-Faultline Strength and Strategic Change: What Role Does Environmental Dynamism Play? Strateg. Manag. J. 2019, 40, 987–1009. [Google Scholar] [CrossRef]

- Kang, Y.; Zhu, D.H.; Zhang, Y.A. Being Extraordinary: How CEOs’ Uncommon Names Explain Strategic Distinctiveness. Strateg. Manag. J. 2021, 42, 462–488. [Google Scholar] [CrossRef]

- Zhen, H.X.; Wang, X.; Fang, H.X. Administrative Protection of Intellectual Property Rights and Corporate Digital Transformation. Econ. Res. J. 2023, 58, 62–79. [Google Scholar]

- Henfridsson, O.; Bygstad, B. The Generative Mechanisms of Digital Infrastructure Evolution. MIS Q. 2013, 37, 907–931. [Google Scholar] [CrossRef]

- Liu, Y.; Chen, X.D. The Effect of Digital Economy on Industrial Structure Upgrade in China. Res. Econ. Manag. 2021, 42, 15–29. [Google Scholar]

- Anthony, J.H.; Ramesh, K. Association between Accounting Performance Measures and Stock Prices: A Test of the Life Cycle Hypothesis. J. Account. Econ. 1992, 15, 203–227. [Google Scholar] [CrossRef]

- Yu, Z.; Zhou, B.; Xie, X.; Wang, Z. Participation in the Reconstruction of the GVCs and Sino-US Trade Frictions. China Ind. Econ. 2018, 7, 24–42. [Google Scholar]

| Categories | Keyword Thesaurus |

|---|---|

| Digital strategy | Digitalization, digital transformation, information, intelligence, intelligent manufacturing, internalization, Industrial Internet, Industry 4.0, green manufacturing, mobile Internet, mobile Internet, Internet medical, e-commerce, mobile payment, third-party payment, NFC payment, smart energy, B2B, B2C, C2B, C2C, 020, smart wear, intelligent transportation, intelligence Neng Medical, intelligent customer service, intelligent home, intelligent investment advisory, intelligent cultural travel, intelligent environmental protection, smart grid, intelligent marketing, digital marketing, unmanned retail, Internet finance, network connection, Fintech, quantitative finance, open bank, information technology, artificial intelligence, big data, blockchain, digital finance, Internet of Things, Smart Internet, cloud computing, 5G, business intelligence, intelligent data analysis, image understanding, investment decision aid systems, intelligent robotics, machine learning, deep learning, semantic search, biometrics, face recognition, voice recognition, identity verification, autonomous driving, natural language processing, digital currency, distributed computing, differential privacy technology, intelligent financial contracts, stream computing, graph computing, memory computing, multi-party security computing, brain-like computing, green computing, cognitive computing, fusion architecture, 100 million level concurrency, EB level storage, information physics system, data mining, text mining, data visualization, heterogeneous data, credit information, augmented reality, mixed reality, virtual reality |

| Variable Type | Variable Symbol | Variable Name | Variable Definition |

|---|---|---|---|

| Dependent Variable | DSC | Digital Strategic Change | Natural logarithm of 1 + total frequency of digital strategic change keywords in annual reports |

| Independent Variable | CF | Cognitive Flexibility | Natural logarithm of 1 + total frequency of external environment perception keywords in annual reports |

| CC | Cognitive Complexity | Breadth of attention allocation across five dimensions: external environment perception, rapid response, innovation and change, integration and reconfiguration of resources and capabilities, and organizational learning | |

| Mediating Variable | AC | Absorptive Capacity | R&D expenditure intensity, patent citations |

| Moderating Variable | ED | Environmental Dynamism | Ratio of the standard deviation to the mean of the firm’s operating income over the past five years |

| Control Variables | Size | Firm Size | Logarithm of total assets at the end of the period |

| Age | Firm Age | Difference between the observation year and the year of establishment | |

| Lev | Liability | Total assets/total liabilities | |

| ROE | Return on net assets | Net profit/shareholders’ equity balance | |

| TMT | Top Management Team Size | Total number of top executives | |

| Board | Board Size | Natural logarithm of the number of board members | |

| Indep | Board Independence | Ratio of independent directors to total number of board members | |

| Dual | CEO Duality | Dummy variable: 1 if the chairman also serves as CEO, 0 otherwise | |

| Top1 | Top1 Shareholding | Ratio of the number of shares held by the largest shareholder of the enterprise to the total number of shares of the enterprise | |

| SOE | State Ownership | Dummy variable: 1 if the firm is state-owned, 0 otherwise | |

| MDA | MD&A Word Count | Total word count of the MD&A section in annual reports | |

| Year | Year | Year fixed-effects dummy variables | |

| Ind | Industry | Industry fixed-effects dummy variables |

| Variables | Sample Size | Mean Value | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| DSC | 14,165 | 2.852 | 1.268 | 0 | 5.924 |

| CF | 14,165 | 3.568 | 0.498 | 2.079 | 4.905 |

| CC | 14,165 | 0.384 | 0.135 | 0 | 0.685 |

| AC | 14,165 | 0.0493 | 0.0504 | −0.0233 | 0.413 |

| ED | 14,165 | 0.0462 | 0.0402 | −0.0285 | 0.293 |

| Size | 14,165 | 22.73 | 1.292 | 20.10 | 26.75 |

| Age | 14,165 | 2.985 | 0.289 | 1.946 | 3.611 |

| Lev | 14,165 | 0.431 | 0.186 | 0.0575 | 0.886 |

| ROE | 14,165 | 0.0530 | 0.128 | −1.087 | 0.363 |

| TMT | 14,165 | 6.549 | 2.376 | 2 | 15 |

| Board | 14,165 | 2.129 | 0.193 | 1.609 | 2.708 |

| Indep | 14,165 | 37.62 | 5.475 | 30 | 60 |

| Dual | 14,165 | 0.252 | 0.434 | 0 | 1 |

| Top1 | 14,165 | 32.14 | 14.51 | 6.528 | 74.30 |

| SOE | 14,165 | 0.388 | 0.487 | 0 | 1 |

| MDA | 14,165 | 20.78 | 11.58 | 1.191 | 273.9 |

| (1) | (2) | (3) | |

|---|---|---|---|

| DSC | DSC | DSC | |

| CF | 0.329 *** | ||

| (0.019) | |||

| CC | 0.982 *** | ||

| (0.057) | |||

| Size | 0.119 *** | 0.119 *** | 0.120 *** |

| (0.009) | (0.008) | (0.008) | |

| Age | −0.047 | −0.048 | −0.052 * |

| (0.031) | (0.031) | (0.031) | |

| Lev | 0.015 | 0.037 | 0.043 |

| (0.053) | (0.052) | (0.052) | |

| ROE | 0.239 *** | 0.259 *** | 0.244 *** |

| (0.063) | (0.063) | (0.063) | |

| TMT | 0.016 *** | 0.018 *** | 0.015 *** |

| (0.003) | (0.003) | (0.003) | |

| Board | 0.065 | 0.084 | 0.050 |

| (0.051) | (0.051) | (0.051) | |

| Indep | 0.004 ** | 0.005 *** | 0.004 ** |

| (0.002) | (0.002) | (0.002) | |

| Dual | 0.078 *** | 0.076 *** | 0.075 *** |

| (0.018) | (0.018) | (0.018) | |

| Top1 | −0.001 ** | −0.001 ** | −0.001 ** |

| (0.001) | (0.001) | (0.001) | |

| SOE | −0.081 *** | −0.076 *** | −0.123 *** |

| (0.019) | (0.019) | (0.019) | |

| MDA | 0.020 *** | 0.015 *** | 0.019 *** |

| (0.001) | (0.001) | (0.001) | |

| Year | YES | YES | YES |

| Ind | YES | YES | YES |

| _cons | −0.492 ** | −1.650 *** | −0.789 *** |

| (0.230) | (0.237) | (0.228) | |

| N | 14,165 | 14,165 | 14,165 |

| R2 | 0.522 | 0.531 | 0.532 |

| F | 135.162 | 150.464 | 151.039 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| AC1 | AC1 | DSC | DSC | |

| CF | 0.004 *** | 0.325 *** | ||

| (0.001) | (0.019) | |||

| CC | 0.007 *** | 0.974 *** | ||

| (0.002) | (0.057) | |||

| AC1 | 1.189 *** | 1.234 *** | ||

| (0.194) | (0.194) | |||

| Size | −0.002 *** | −0.002 *** | 0.121 *** | 0.122 *** |

| (0.000) | (0.000) | (0.008) | (0.008) | |

| Age | −0.007 *** | −0.007 *** | −0.040 | −0.043 |

| (0.001) | (0.001) | (0.031) | (0.031) | |

| Lev | −0.045 *** | −0.045 *** | 0.091 * | 0.099 * |

| (0.002) | (0.002) | (0.053) | (0.053) | |

| ROE | −0.031 *** | −0.031 *** | 0.296 *** | 0.283 *** |

| (0.003) | (0.003) | (0.063) | (0.063) | |

| TMT | 0.002 *** | 0.002 *** | 0.016 *** | 0.014 *** |

| (0.000) | (0.000) | (0.003) | (0.003) | |

| Board | −0.000 | −0.001 | 0.084 * | 0.051 |

| (0.002) | (0.002) | (0.051) | (0.051) | |

| Indep | 0.000 *** | 0.000 *** | 0.005 *** | 0.004 ** |

| (0.000) | (0.000) | (0.002) | (0.002) | |

| Dual | 0.002 *** | 0.002 *** | 0.073 *** | 0.072 *** |

| (0.001) | (0.001) | (0.018) | (0.018) | |

| Top1 | −0.000 *** | −0.000 *** | −0.001 * | −0.001 ** |

| (0.000) | (0.000) | (0.001) | (0.001) | |

| SOE | −0.003 *** | −0.003 *** | −0.072 *** | −0.119 *** |

| (0.001) | (0.001) | (0.019) | (0.019) | |

| MDA | 0.001 *** | 0.001 *** | 0.014 *** | 0.018 *** |

| (0.000) | (0.000) | (0.001) | (0.001) | |

| Year | YES | YES | YES | YES |

| Ind | YES | YES | YES | YES |

| _cons | 0.094 *** | 0.105 *** | −1.762 *** | −0.919 *** |

| (0.010) | (0.010) | (0.238) | (0.228) | |

| N | 14,165 | 14,165 | 14,165 | 14,165 |

| R2 | 0.441 | 0.440 | 0.533 | 0.533 |

| F | 121.507 | 142.149 | 120.392 | 142.937 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| AC2 | AC2 | DSC | DSC | |

| CF | 0.058 ** | 0.324 *** | ||

| (0.029) | (0.019) | |||

| CC | 0.498 *** | 0.939 *** | ||

| (0.086) | (0.057) | |||

| AC2 | 0.089 *** | 0.087 *** | ||

| (0.006) | (0.006) | |||

| Size | 0.795 *** | 0.795 *** | 0.048 *** | 0.051 *** |

| (0.013) | (0.013) | (0.009) | (0.009) | |

| Age | −0.183 *** | −0.186 *** | −0.031 | −0.036 |

| (0.046) | (0.046) | (0.030) | (0.030) | |

| Lev | −0.501 *** | −0.491 *** | 0.082 | 0.085 * |

| (0.078) | (0.078) | (0.052) | (0.052) | |

| ROE | 0.360 *** | 0.359 *** | 0.227 *** | 0.213 *** |

| (0.094) | (0.094) | (0.062) | (0.062) | |

| TMT | 0.022 *** | 0.021 *** | 0.016 *** | 0.014 *** |

| (0.005) | (0.005) | (0.003) | (0.003) | |

| Board | 0.205 *** | 0.194 ** | 0.065 | 0.033 |

| (0.077) | (0.076) | (0.051) | (0.051) | |

| Indep | 0.007 *** | 0.006 ** | 0.005 *** | 0.004 ** |

| (0.003) | (0.003) | (0.002) | (0.002) | |

| Dual | 0.124 *** | 0.123 *** | 0.065 *** | 0.065 *** |

| (0.027) | (0.027) | (0.018) | (0.018) | |

| Top1 | −0.001 | −0.001 | −0.001 ** | −0.001 ** |

| (0.001) | (0.001) | (0.001) | (0.001) | |

| SOE | 0.255 *** | 0.232 *** | −0.099 *** | −0.143 *** |

| (0.029) | (0.029) | (0.019) | (0.019) | |

| MDA | 0.001 | 0.002 | 0.014 *** | 0.018 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | |

| Year | YES | YES | YES | YES |

| Ind | YES | YES | YES | YES |

| _cons | −13.837 *** | −13.782 *** | −0.412 * | 0.404 * |

| (0.357) | (0.342) | (0.247) | (0.239) | |

| N | 14,165 | 14,165 | 14,165 | 14,165 |

| R2 | 0.452 | 0.453 | 0.540 | 0.540 |

| F | 556.003 | 559.637 | 161.354 | 160.396 |

| (1) | (2) | |

|---|---|---|

| DSC | DSC | |

| CF | 0.328 *** | |

| (0.019) | ||

| CC | 0.993 *** | |

| (0.057) | ||

| CF_ED_c | −0.697 * | |

| (0.386) | ||

| CC_ED_c | 3.217 ** | |

| (1.335) | ||

| ED | −0.428 ** | −0.684 *** |

| (0.191) | (0.193) | |

| Size | 0.118 *** | 0.119 *** |

| (0.008) | (0.008) | |

| Age | −0.048 | −0.053 * |

| (0.031) | (0.031) | |

| Lev | 0.038 | 0.049 |

| (0.052) | (0.052) | |

| ROE | 0.251 *** | 0.232 *** |

| (0.063) | (0.063) | |

| TMT | 0.018 *** | 0.015 *** |

| (0.003) | (0.003) | |

| Board | 0.080 | 0.049 |

| (0.051) | (0.051) | |

| Indep | 0.005 *** | 0.004 ** |

| (0.002) | (0.002) | |

| Dual | 0.077 *** | 0.076 *** |

| (0.018) | (0.018) | |

| Top1 | −0.001 ** | −0.001 ** |

| (0.001) | (0.001) | |

| SOE | −0.078 *** | −0.128 *** |

| (0.019) | (0.019) | |

| MDA | 0.015 *** | 0.019 *** |

| (0.001) | (0.001) | |

| Year | Yes | Yes |

| Ind | Yes | Yes |

| _cons | −1.610 *** | −0.748 *** |

| (0.238) | (0.229) | |

| N | 14,165 | 14,165 |

| R2 | 0.532 | 0.532 |

| F | 129.564 | 130.730 |

| (1) | (2) | |

|---|---|---|

| DSC | DSC | |

| CF | 0.341 *** | |

| (0.020) | ||

| CC | 0.954 *** | |

| (0.058) | ||

| Size | 0.118 *** | 0.118 *** |

| (0.009) | (0.009) | |

| Age | −0.048 | −0.051 * |

| (0.031) | (0.031) | |

| Lev | 0.042 | 0.041 |

| (0.053) | (0.053) | |

| ROE | 0.244 *** | 0.231 *** |

| (0.065) | (0.065) | |

| TMT | 0.018 *** | 0.016 *** |

| (0.003) | (0.003) | |

| Board | 0.089 * | 0.056 |

| (0.052) | (0.052) | |

| Indep | 0.006 *** | 0.005 *** |

| (0.002) | (0.002) | |

| Dual | 0.068 *** | 0.069 *** |

| (0.018) | (0.018) | |

| Top1 | −0.001 ** | −0.002 *** |

| (0.001) | (0.001) | |

| SOE | −0.077 *** | −0.123 *** |

| (0.019) | (0.020) | |

| MDA | 0.015 *** | 0.019 *** |

| (0.001) | (0.001) | |

| Year | YES | YES |

| Ind | YES | YES |

| Ind×Year | YES | YES |

| _cons | −1.694 *** | −0.783 *** |

| (0.240) | (0.231) | |

| N | 14,165 | 14,165 |

| R2 | 0.547 | 0.546 |

| F | 147.931 | 145.103 |

| (1) | (2) | |

|---|---|---|

| DSC1 | DSC1 | |

| CF | 0.035 *** | |

| (0.004) | ||

| CC | 0.147 *** | |

| (0.012) | ||

| Size | 0.035 *** | 0.035 *** |

| (0.002) | (0.002) | |

| Age | −0.020 *** | −0.021 *** |

| (0.006) | (0.006) | |

| Lev | −0.020 * | −0.018 * |

| (0.011) | (0.011) | |

| ROE | −0.014 | −0.016 |

| (0.013) | (0.013) | |

| TMT | 0.003 *** | 0.003 *** |

| (0.001) | (0.001) | |

| Board | 0.011 | 0.007 |

| (0.011) | (0.010) | |

| Indep | 0.001 *** | 0.001 *** |

| (0.000) | (0.000) | |

| Dual | 0.026 *** | 0.026 *** |

| (0.004) | (0.004) | |

| Top1 | −0.000 *** | −0.001 *** |

| (0.000) | (0.000) | |

| SOE | −0.022 *** | −0.029 *** |

| (0.004) | (0.004) | |

| MDA | 0.002 *** | 0.002 *** |

| (0.000) | (0.000) | |

| Year | YES | YES |

| Ind | YES | YES |

| _cons | 2.712 *** | 2.792 *** |

| (0.049) | (0.047) | |

| N | 14,165 | 14,165 |

| R2 | 0.567 | 0.569 |

| F | 100.543 | 107.556 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| DSC | DSC | F.DSC | F.DSC | |

| L.CF | 0.292 *** | |||

| (0.020) | ||||

| L.CC | 0.813 *** | |||

| (0.061) | ||||

| CF | 0.298 *** | |||

| (0.021) | ||||

| CC | 0.830 *** | |||

| (0.062) | ||||

| Size | 0.119 *** | 0.120 *** | 0.118 *** | 0.120 *** |

| (0.009) | (0.009) | (0.009) | (0.009) | |

| Age | −0.006 | −0.012 | −0.011 | −0.014 |

| (0.034) | (0.034) | (0.033) | (0.033) | |

| Lev | 0.067 | 0.064 | 0.002 | −0.003 |

| (0.056) | (0.057) | (0.057) | (0.057) | |

| ROE | 0.175 *** | 0.186 *** | 0.232 *** | 0.222 *** |

| (0.066) | (0.066) | (0.070) | (0.070) | |

| TMT | 0.020 *** | 0.017 *** | 0.021 *** | 0.018 *** |

| (0.004) | (0.004) | (0.004) | (0.004) | |

| Board | 0.133 ** | 0.099 * | 0.117 ** | 0.090 |

| (0.055) | (0.055) | (0.056) | (0.056) | |

| Indep | 0.005 *** | 0.004 ** | 0.005 *** | 0.004 ** |

| (0.002) | (0.002) | (0.002) | (0.002) | |

| Dual | 0.075 *** | 0.075 *** | 0.086 *** | 0.085 *** |

| (0.019) | (0.019) | (0.020) | (0.020) | |

| Top1 | −0.001 * | −0.001 ** | −0.001 | −0.001 |

| (0.001) | (0.001) | (0.001) | (0.001) | |

| SOE | −0.079 *** | −0.112 *** | −0.073 *** | −0.108 *** |

| (0.021) | (0.021) | (0.021) | (0.021) | |

| MDA | 0.015 *** | 0.018 *** | 0.013 *** | 0.017 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | |

| Year | YES | YES | YES | YES |

| Ind | YES | YES | YES | YES |

| _cons | −1.693 *** | −0.911 *** | −1.561 *** | −0.826 *** |

| (0.256) | (0.247) | (0.259) | (0.250) | |

| N | 12,056 | 12,056 | 12,056 | 12,056 |

| R2 | 0.523 | 0.522 | 0.508 | 0.507 |

| F | 126.877 | 124.278 | 108.533 | 106.711 |

| Digital Economy Development Level | ||||

|---|---|---|---|---|

| (1) High-Level | (2) Low-Level | (3) High-Level | (4) Low-Level | |

| DSC | DSC | DSC | DSC | |

| CF | 0.467 *** | 0.042 | ||

| (0.023) | (0.041) | |||

| CC | 1.227 *** | 0.187 * | ||

| (0.069) | (0.110) | |||

| Size | 0.116 *** | 0.109 *** | 0.123 *** | 0.109 *** |

| (0.010) | (0.015) | (0.010) | (0.015) | |

| Age | 0.004 | −0.103 * | −0.024 | −0.103 * |

| (0.036) | (0.057) | (0.037) | (0.057) | |

| Lev | 0.009 | 0.141 | −0.029 | 0.148 |

| (0.063) | (0.090) | (0.064) | (0.090) | |

| ROE | 0.183 ** | 0.385 *** | 0.171 ** | 0.384 *** |

| (0.076) | (0.108) | (0.076) | (0.108) | |

| TMT | 0.020 *** | 0.015 *** | 0.016 *** | 0.015 ** |

| (0.004) | (0.006) | (0.004) | (0.006) | |

| Board | 0.026 | 0.133 | 0.018 | 0.120 |

| (0.064) | (0.081) | (0.065) | (0.082) | |

| Indep | 0.002 | 0.008 *** | 0.002 | 0.008 *** |

| (0.002) | (0.003) | (0.002) | (0.003) | |

| Dual | 0.066 *** | 0.051 | 0.080 *** | 0.047 |

| (0.022) | (0.032) | (0.022) | (0.032) | |

| Top1 | −0.002 *** | −0.001 | −0.002 ** | −0.001 |

| (0.001) | (0.001) | (0.001) | (0.001) | |

| SOE | −0.029 | −0.112 *** | −0.122 *** | −0.118 *** |

| (0.024) | (0.031) | (0.025) | (0.031) | |

| MDA | 0.014 *** | 0.012 *** | 0.020 *** | 0.012 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | |

| Year | YES | YES | YES | YES |

| Ind | YES | YES | YES | YES |

| _cons | −1.826 *** | −0.702 * | −0.773 *** | −0.580 |

| (0.289) | (0.423) | (0.282) | (0.384) | |

| N | 9512 | 4653 | 9512 | 4653 |

| R2 | 0.569 | 0.433 | 0.565 | 0.433 |

| F | 129.019 | 28.247 | 120.547 | 28.415 |

| (1) Growth | (2) Maturity | (3) Decline | (4) Growth | (5) Maturity | (6) Decline | |

|---|---|---|---|---|---|---|

| DSC | DSC | DSC | DSC | DSC | DSC | |

| CF | 0.596 *** | 0.194 *** | 0.026 | |||

| (0.030) | (0.030) | (0.044) | ||||

| CC | 0.812 *** | 1.237 *** | 0.067 | |||

| (0.089) | (0.085) | (0.141) | ||||

| Size | 0.083 *** | 0.124 *** | 0.124 *** | 0.084 *** | 0.125 *** | 0.124 *** |

| (0.012) | (0.013) | (0.021) | (0.013) | (0.013) | (0.021) | |

| Age | −0.021 | −0.053 | −0.094 | −0.020 | −0.062 | −0.094 |

| (0.044) | (0.049) | (0.074) | (0.045) | (0.048) | (0.074) | |

| Lev | −0.144 * | −0.020 | 0.036 | −0.198 ** | 0.001 | 0.038 |

| (0.082) | (0.080) | (0.116) | (0.084) | (0.078) | (0.116) | |

| ROE | 0.119 | 0.218 ** | 0.078 | 0.110 | 0.214 ** | 0.077 |

| (0.101) | (0.100) | (0.122) | (0.104) | (0.098) | (0.123) | |

| TMT | 0.017 *** | 0.017 *** | 0.014 * | 0.013 ** | 0.016 *** | 0.014 * |

| (0.005) | (0.005) | (0.008) | (0.005) | (0.005) | (0.008) | |

| Board | 0.037 | 0.042 | 0.277 ** | 0.028 | 0.012 | 0.271 ** |

| (0.077) | (0.076) | (0.124) | (0.079) | (0.075) | (0.124) | |

| Indep | 0.004 | 0.007 *** | 0.005 | 0.003 | 0.006 ** | 0.005 |

| (0.003) | (0.003) | (0.004) | (0.003) | (0.003) | (0.004) | |

| Dual | 0.054 ** | 0.061 ** | 0.079 * | 0.060 ** | 0.061 ** | 0.078 * |

| (0.026) | (0.028) | (0.043) | (0.027) | (0.028) | (0.043) | |

| Top1 | −0.001 | −0.002 ** | 0.002 | −0.001 | −0.002 ** | 0.002 |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | (0.001) | |

| SOE | −0.098 *** | 0.004 | −0.139 *** | −0.144 *** | −0.052 * | −0.142 *** |

| (0.029) | (0.029) | (0.044) | (0.030) | (0.029) | (0.045) | |

| MDA | 0.013 *** | 0.013 *** | 0.013 *** | 0.020 *** | 0.014 *** | 0.014 *** |

| (0.001) | (0.001) | (0.002) | (0.001) | (0.001) | (0.002) | |

| _cons | −1.377 *** | −1.234 *** | −1.446 ** | 0.420 | −0.950 *** | −1.367 ** |

| (0.351) | (0.366) | (0.592) | (0.345) | (0.346) | (0.567) | |

| N | 6063 | 5756 | 2312 | 6063 | 5756 | 2312 |

| R2 | 0.602 | 0.511 | 0.423 | 0.581 | 0.525 | 0.423 |

| F | 88.881 | 40.760 | 14.888 | 59.080 | 55.981 | 14.877 |

| (1) Technology– Capital-Intensive | (2) Labor-Intensive | (3) Technology– Capital-Intensive | (4) Labor-Intensive | |

|---|---|---|---|---|

| DSC | DSC | DSC | DSC | |

| CF | 0.428 *** | 0.028 | ||

| (0.023) | (0.036) | |||

| CC | 1.212 *** | 0.130 | ||

| (0.068) | (0.104) | |||

| Size | 0.120 *** | 0.101 *** | 0.119 *** | 0.102 *** |

| (0.010) | (0.015) | (0.010) | (0.015) | |

| Age | 0.007 | −0.235 *** | 0.009 | −0.237 *** |

| (0.036) | (0.057) | (0.036) | (0.057) | |

| Lev | 0.128 ** | −0.218 ** | 0.144 ** | −0.220 ** |

| (0.060) | (0.097) | (0.060) | (0.096) | |

| ROE | 0.188 ** | 0.435 *** | 0.205 *** | 0.427 *** |

| (0.074) | (0.109) | (0.074) | (0.109) | |

| TMT | 0.021 *** | 0.006 | 0.018 *** | 0.006 |

| (0.004) | (0.006) | (0.004) | (0.006) | |

| Board | 0.066 | 0.144 * | 0.037 | 0.140 |

| (0.061) | (0.087) | (0.061) | (0.087) | |

| Indep | 0.003 | 0.010 *** | 0.001 | 0.010 *** |

| (0.002) | (0.003) | (0.002) | (0.003) | |

| Dual | 0.065 *** | 0.084 ** | 0.063 *** | 0.083 ** |

| (0.021) | (0.034) | (0.021) | (0.034) | |

| Top1 | −0.001 | −0.003 *** | −0.001 * | −0.003 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | |

| SOE | −0.102 *** | 0.004 | −0.163 *** | −0.001 |

| (0.023) | (0.034) | (0.023) | (0.034) | |

| MDA | 0.016*** | 0.009 *** | 0.022 *** | 0.009 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | |

| _cons | −2.072 *** | 0.104 | −0.901 *** | 0.147 |

| (0.278) | (0.426) | (0.267) | (0.410) | |

| N | 10,247 | 3918 | 10,247 | 3918 |

| R2 | 0.573 | 0.449 | 0.572 | 0.449 |

| F | 141.472 | 20.706 | 139.026 | 20.791 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guo, X.; Fan, C.; Chen, Y. Executive Cognitive Styles and Enterprise Digital Strategic Change Under Environmental Dynamism: The Mediating Role of Absorptive Capacity in a Complex Adaptive System. Systems 2025, 13, 775. https://doi.org/10.3390/systems13090775

Guo X, Fan C, Chen Y. Executive Cognitive Styles and Enterprise Digital Strategic Change Under Environmental Dynamism: The Mediating Role of Absorptive Capacity in a Complex Adaptive System. Systems. 2025; 13(9):775. https://doi.org/10.3390/systems13090775

Chicago/Turabian StyleGuo, Xiaochuan, Chunyun Fan, and You Chen. 2025. "Executive Cognitive Styles and Enterprise Digital Strategic Change Under Environmental Dynamism: The Mediating Role of Absorptive Capacity in a Complex Adaptive System" Systems 13, no. 9: 775. https://doi.org/10.3390/systems13090775

APA StyleGuo, X., Fan, C., & Chen, Y. (2025). Executive Cognitive Styles and Enterprise Digital Strategic Change Under Environmental Dynamism: The Mediating Role of Absorptive Capacity in a Complex Adaptive System. Systems, 13(9), 775. https://doi.org/10.3390/systems13090775