Dual-Dimensional Digital Transformation Systematically Reshapes the U-Curve of Knowledge and Political Distance on Subsidiary Exit

Abstract

1. Introduction

2. Theoretical Development and Hypotheses

2.1. The U-Shaped Effects of Knowledge Distance on Subsidiary Exit

2.2. The U-Shaped Effects of Political Distance on Subsidiary Exit

2.3. The Moderation Effect of Breadth of Digital Transformation

2.4. The Moderation Effect of Depth of Digital Transformation

3. Materials and Methods

3.1. Sample and Data Collection

3.2. Measurements

3.2.1. Dependent Variable

3.2.2. Independent Variables

3.2.3. Mediator Variables

3.2.4. Control Variables

3.3. Model

4. Results

4.1. Hypothesis Testing Results

4.2. Heterogeneity Analysis

4.3. Robustness Check

4.4. Endogeneity Test

5. Discussion

5.1. Theoretical Implications

5.2. Managerial Implications

5.3. Limitations and Future Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| Size | Firm Size |

| TMT | Total Number of Top Management Team |

| MO | Management Ownership |

| ROE | Return on Equity |

| FL | Financial Leverage |

| GS | Government Subsidies |

| EF | Economic Freedom |

| CD | Culture Distance |

| Exit | Oversea Subsidiary Exit |

| KD | Knowledge Distance |

| PD | Political Distance |

| BDT | Breadth of Digital Transformation |

| DDT | Depth of Digital Transformation |

| MNEs | Multinational Enterprises |

| CSMAR | China Stock Market and Accounting Research |

| OECD | Organisation for Economic Co-operation and Development |

| LPM | Linear Probability Model |

| IPW | Inverse Probability Weighting |

| SMD | Standardized Mean Difference |

| 2SRI | Two-Stage Residual Inclusion |

References

- Ouyang, H.; Park, C.; Oh, C.H. The Impact of Reverse Knowledge Transfers on Exploitative and Exploratory Innovations in MNCs: The Role of Knowledge Distance. J. Bus. Res. 2024, 179, 114682. [Google Scholar] [CrossRef]

- Witt, M.A. De-Globalization: Theories, Predictions, and Opportunities for International Business Research. J. Int. Bus. Stud. 2019, 50, 1053–1077. [Google Scholar] [CrossRef]

- Berry, H.; Guillén, M.F.; Zhou, N. An Institutional Approach to Cross-National Distance. J. Int. Bus. Stud. 2010, 41, 1460–1480. [Google Scholar] [CrossRef]

- Kang, J.; Lee, J.Y.; Ghauri, P.N. The Interplay of Mahalanobis Distance and Firm Capabilities on MNC Subsidiary Exits from Host Countries. Manag. Int. Rev. 2017, 57, 379–409. [Google Scholar] [CrossRef]

- Lee, E.T.; Park, Y.-R.; Kwak, J. Knowledge Distance and Innovation Performance: The Moderating Role of Internationalization Breadth and Depth. Asian Bus. Manag. 2023, 22, 1131–1154. [Google Scholar] [CrossRef]

- Tan, Q.; Sousa, C.M.P. Giving a Fish or Teaching to Fish? Exploring the Effects of Home-Country Governmental Support on Foreign Exit Decisions. Int. Mark. Rev. 2020, 37, 1181–1203. [Google Scholar] [CrossRef]

- Feliciano-Cestero, M.M.; Ameen, N.; Kotabe, M.; Paul, J.; Signoret, M. Is Digital Transformation Threatened? A Systematic Literature Review of the Factors Influencing Firms’ Digital Transformation and Internationalization. J. Bus. Res. 2023, 157, 113546. [Google Scholar] [CrossRef]

- Nwankpa, J.K.; Roumani, Y.; Datta, P. Process Innovation in the Digital Age of Business: The Role of Digital Business Intensity and Knowledge Management. J. Knowl. Manag. 2022, 26, 1319–1341. [Google Scholar] [CrossRef]

- Aguilera-Caracuel, J.; Aragón-Correa, J.A.; Hurtado-Torres, N.E.; Rugman, A.M. The Effects of Institutional Distance and Headquarters’ Financial Performance on the Generation of Environmental Standards in Multinational Companies. J. Bus. Ethics 2012, 105, 461–474. [Google Scholar] [CrossRef]

- Ojala, A. Geographic, Cultural, and Psychic Distance to Foreign Markets in the Context of Small and New Ventures. Int. Bus. Rev. 2015, 24, 825–835. [Google Scholar] [CrossRef]

- Keig, D.L.; Brouthers, L.E.; Marshall, V.B. The Impact of Formal and Informal Institutional Distances on MNE Corporate Social Performance. Int. Bus. Rev. 2019, 28, 101584. [Google Scholar] [CrossRef]

- Cui, V.; Tian, X.; Yu, R. Fragmentation in International Business: A Geographic-and-Political Perspective. Int. Bus. Rev. 2025, 34, 102458. [Google Scholar] [CrossRef]

- Luo, Y.; Tung, R.L. International Expansion of Emerging Market Enterprises: A Springboard Perspective. J. Int. Bus. Stud. 2007, 38, 481–498. [Google Scholar] [CrossRef]

- Brown, L.W.; Liou, R.-S.; Hasija, D. Emerging Market Multinational Corporations’ Cross-Border Mergers and Acquisitions and Political Distance: Does Corporate Political Activity Matter? Thunderbird Int. Bus. Rev. 2023, 65, 533–546. [Google Scholar] [CrossRef]

- Lissillour, R.; Cui, Y.; Guesmi, K.; Chen, W.; Chen, Q. Value Network and Firm Performance: The Role of Knowledge Distance and Environmental Uncertainty. J. Knowl. Manag. 2023, 28, 44–68. [Google Scholar] [CrossRef]

- White, G.O.; Boddewyn, J.J.; Rajwani, T.; Hemphill, T.A. Regulator Vulnerabilities to Political Pressures and Political Tie Intensity: The Moderating Effects of Regulatory and Political Distance. Manag. Int. Rev. 2018, 58, 743–769. [Google Scholar] [CrossRef]

- Gonchar, K.; Greve, M. The Impact of Political Risk on FDI Exit Decisions. Econ. Syst. 2022, 46, 100975. [Google Scholar] [CrossRef]

- Nambisan, S.; Zahra, S.A.; Luo, Y. Global Platforms and Ecosystems: Implications for International Business Theories. J. Int. Bus. Stud. 2019, 50, 1464–1486. [Google Scholar] [CrossRef]

- Yin, W. Identifying the Pathways through Digital Transformation to Achieve Supply Chain Resilience: An fsQCA Approach. Environ. Sci. Pollut. Res. 2023, 30, 10867–10879. [Google Scholar] [CrossRef]

- Yang, Z.; Hu, W.; Shao, J.; Shou, Y.; He, Q. How Does Digitalization Alter the Paradox of Supply Base Concentration? The Effects of Digitalization Intensity and Breadth. Int. J. Oper. Prod. Manag. 2023, 43, 1690–1722. [Google Scholar] [CrossRef]

- Xia, T.; Liu, X. Cross-National Knowledge Distance and Host Country Innovation—The Mediating Roles of Local Talents and Third-Country Exporting. Thunderbird Int. Bus. Rev. 2025, 67, 99–113. [Google Scholar] [CrossRef]

- Hölzl, W.; Janger, J. Distance to the Frontier and the Perception of Innovation Barriers across European Countries. Res. Policy 2014, 43, 707–725. [Google Scholar] [CrossRef]

- Castellani, D.; Montresor, S.; Schubert, T.; Vezzani, A. Multinationality, R&D and Productivity: Evidence from the Top R&D Investors Worldwide. Int. Bus. Rev. 2017, 26, 405–416. [Google Scholar] [CrossRef]

- Capaldo, A.; Lavie, D.; Messeni Petruzzelli, A. Knowledge Maturity and the Scientific Value of Innovations: The Roles of Knowledge Distance and Adoption. J. Manag. 2017, 43, 503–533. [Google Scholar] [CrossRef]

- Lane, J.N.; Ganguli, I.; Gaule, P.; Guinan, E.; Lakhani, K.R. Engineering Serendipity: When Does Knowledge Sharing Lead to Knowledge Production? Strateg. Manag. J. 2021, 42, 1215–1244. [Google Scholar] [CrossRef]

- Wen, J.; Qualls, W.J.; Zeng, D. To Explore or Exploit: The Influence of Inter-Firm R&D Network Diversity and Structural Holes on Innovation Outcomes. Technovation 2021, 100, 102178. [Google Scholar] [CrossRef]

- Bryan Jean, R.-J.; Sinkovics, R.R.; Kim, D. Antecedents and Outcomes of Supplier Innovativeness in International Customer–Supplier Relationships: The Role of Knowledge Distance. Manag. Int. Rev. 2017, 57, 121–151. [Google Scholar]

- Fainshmidt, S.; White, G.O.; Cangioni, C. Legal Distance, Cognitive Distance, and Conflict Resolution in International Business Intellectual Property Disputes. J. Int. Manag. 2014, 20, 188–200. [Google Scholar] [CrossRef]

- Konara, P.; Shirodkar, V. Regulatory Institutional Distance and MNCs’ Subsidiary Performance: Climbing up vs. Climbing down the Institutional Ladder. J. Int. Manag. 2018, 24, 333–347. [Google Scholar] [CrossRef]

- Klopf, P.; Nell, P.C. How “Space” and “Place” Influence Subsidiary Host Country Political Embeddedness. Int. Bus. Rev. 2018, 27, 186–197. [Google Scholar] [CrossRef]

- Nguyen, H.T.T.; Larimo, J.; Ghauri, P. Understanding Foreign Divestment: The Impacts of Economic and Political Friction. J. Bus. Res. 2022, 139, 675–691. [Google Scholar] [CrossRef]

- Song, S. Divesting or Keeping Overseas Subsidiary Production under Rising Production Costs and Uncertain Market Demands in Host Countries. Int. Bus. Rev. 2024, 33, 102320. [Google Scholar] [CrossRef]

- Wu, X.; Xiong, Y. Regional Differences in Urban Residents’ Consumption Behaviour in China: From the Perspective of the Habit Formation Time Effect. Econ. Res.-Ekon. Istraživanja 2022, 36, 2117229. [Google Scholar] [CrossRef]

- Chao, M.C.-H.; Kumar, V. The Impact of Institutional Distance on the International Diversity–Performance Relationship. J. World Bus. 2010, 45, 93–103. [Google Scholar] [CrossRef]

- Adarkwah, G.K.; Dorobantu, S.; Sabe, C.A. Geopolitical Volatility and Subsidiary Investments. Strateg. Manag. J. 2024, 45, 2275–2306. [Google Scholar] [CrossRef]

- Nadkarni, S.; Prügl, R. Digital Transformation: A Review, Synthesis and Opportunities for Future Research. Manag. Rev. Q. 2021, 71, 233–341. [Google Scholar] [CrossRef]

- Kraus, S.; Durst, S.; Ferreira, J.J.; Veiga, P.; Kailer, N.; Weinmann, A. Digital Transformation in Business and Management Research: An Overview of the Current Status Quo. Int. J. Inf. Manag. 2022, 63, 102466. [Google Scholar] [CrossRef]

- Shahrzadi, L.; Mansouri, A.; Alavi, M.; Shabani, A. Causes, Consequences, and Strategies to Deal with Information Overload: A Scoping Review. Int. J. Inf. Manag. Data Insights 2024, 4, 100261. [Google Scholar] [CrossRef]

- Yu, H.; Fletcher, M.; Buck, T. Managing Digital Transformation during Re-Internationalization: Trajectories and Implications for Performance. J. Int. Manag. 2022, 28, 100947. [Google Scholar] [CrossRef]

- Banalieva, E.R.; Dhanaraj, C. Internalization Theory for the Digital Economy. J. Int. Bus. Stud. 2019, 50, 1372–1387. [Google Scholar] [CrossRef]

- Meyer, K.E.; Li, J.; Brouthers, K.D.; Jean, R.-J. International Business in the Digital Age: Global Strategies in a World of National Institutions. J. Int. Bus. Stud. 2023, 54, 577–598. [Google Scholar] [CrossRef]

- Rong, K.; Ling, Y.; Yang, T.; Huang, C. Cross-Border Data Transfer: Patterns and Discrepancies. J. Int. Bus. Policy 2025, 8, 10–32. [Google Scholar] [CrossRef]

- Pollman, E. Tech, Regulatory Arbitrage, and Limits. Eur. Bus. Organ. Law Rev. 2019, 20, 567–590. [Google Scholar] [CrossRef]

- Su, H.; Cai, F.; Huang, Y. Institutional Constraints and Exporting of Emerging-Market Firms: The Moderating Role of Innovation Capabilities and Digital Transformation. Manag. Decis. Econ. 2022, 43, 2641–2656. [Google Scholar] [CrossRef]

- Luo, Y. A General Framework of Digitization Risks in International Business. J. Int. Bus. Stud. 2022, 53, 344–361. [Google Scholar] [CrossRef]

- Jiang, K.; Chen, L.; Li, J.; Du, X. The Risk Effects of Corporate Digitalization: Exacerbate or Mitigate? Humanit. Soc. Sci. Commun. 2025, 12, 317. [Google Scholar] [CrossRef]

- Bertello, A.; Ferraris, A.; Bresciani, S.; Bernardi, P.D. Big Data Analytics (BDA) and Degree of Internationalization: The Interplay between Governance of BDA Infrastructure and BDA Capabilities. J. Manag. Gov. 2021, 25, 1035–1055. [Google Scholar] [CrossRef]

- Massa, S.; Annosi, M.C.; Marchegiani, L.; Messeni Petruzzelli, A. Digital Technologies and Knowledge Processes: New Emerging Strategies in International Business. J. Knowl. Manag. 2023, 27, 330–387. [Google Scholar] [CrossRef]

- Ira Putri Hutasoit, D.; Elisabeth, D.; Indra Sensuse, D. Knowledge Sharing for Multinational Corporations Using Technology: A Systematic Literature Review. In Proceedings of the 2020 3rd International Conference on Algorithms, Computing and Artificial Intelligence, Sanya, China, 24–26 December 2020; Association for Computing Machinery: New York, NY, USA, 2020; pp. 1–8. [Google Scholar]

- Camisón, C.; Forés, B. Knowledge Absorptive Capacity: New Insights for Its Conceptualization and Measurement. J. Bus. Res. 2010, 63, 707–715. [Google Scholar] [CrossRef]

- Bucher, J.; Bader, B.; Deller, J. Cross-Border Knowledge Transfer in the Digital Age: The Final Curtain Call for Long-Term International Assignments? J. Manag. Stud. 2024, 61, 1792–1824. [Google Scholar] [CrossRef]

- Teece, D.J. The Multinational Enterprise, Capabilities, and Digitalization: Governance and Growth with World Disorder. J. Int. Bus. Stud. 2025, 56, 7–22. [Google Scholar] [CrossRef]

- Autio, E.; Nambisan, S.; Thomas, L.D.W.; Wright, M. Digital Affordances, Spatial Affordances, and the Genesis of Entrepreneurial Ecosystems. Strateg. Entrep. J. 2018, 12, 72–95. [Google Scholar] [CrossRef]

- Lin, B.; Xie, Y. Does Digital Transformation Improve the Operational Efficiency of Chinese Power Enterprises? Util. Policy 2023, 82, 101542. [Google Scholar] [CrossRef]

- Tang, R.W. Institutional Unpredictability and Foreign Exit−reentry Dynamics: The Moderating Role of Foreign Ownership. J. World Bus. 2023, 58, 101389. [Google Scholar] [CrossRef]

- Haans, R.F.J.; Pieters, C.; He, Z. Thinking about U: Theorizing and Testing U—And Inverted U-shaped Relationships in Strategy Research. Strateg. Manag. J. 2016, 37, 1177–1195. [Google Scholar] [CrossRef]

- Huang, X.; Gao, Y. Integration of Digital and Real Industry Technologies and Enterprise Total Factor Productivity: A Study Based on Chinese Enterprise Patent Information. China Ind. Econ. 2023, 11, 118–136. [Google Scholar] [CrossRef]

- Bahar, D.; Rapoport, H. Migration, Knowledge Diffusion and the Comparative Advantage of Nations. Econ. J. 2018, 128, F273–F305. [Google Scholar] [CrossRef]

- Hutzschenreuter, T.; Kleindienst, I.; Lange, S. The Concept of Distance in International Business Research: A Review and Research Agenda. Int. J. Manag. Rev. 2016, 18, 160–179. [Google Scholar] [CrossRef]

- Deng, Z.; Zhu, Z.; Johanson, M.; Hilmersson, M. Rapid Internationalization and Exit of Exporters: The Role of Digital Platforms. Int. Bus. Rev. 2022, 31, 101896. [Google Scholar] [CrossRef]

- Li, W.; Wang, S.; Deng, X. The Impact of Digital Finance on Business Environment: Mediating Role of Industrial Structural Upgrading and Moderating Role of Digital Infrastructure. Financ. Res. Lett. 2024, 67, 105775. [Google Scholar] [CrossRef]

- Krulčić, E.; Doboviček, S.; Pavletić, D.; Čabrijan, I. A Dynamic Assessment of Digital Maturity in Industrial SMEs: An Adaptive AHP-Based Digital Maturity Model (DMM)with Customizable Weighting and Multidimensional Classification (DAMA-AHP). Technologies 2025, 13, 282. [Google Scholar] [CrossRef]

- Pörtner, L.; Riel, A.; Schmidt, B.; Leclaire, M.; Möske, R. Data Management Maturity Model—Process Dimensions and Capabilities to Leverage Data-Driven Organizations Towards Industry 5.0. Appl. Syst. Innov. 2025, 8, 41. [Google Scholar] [CrossRef]

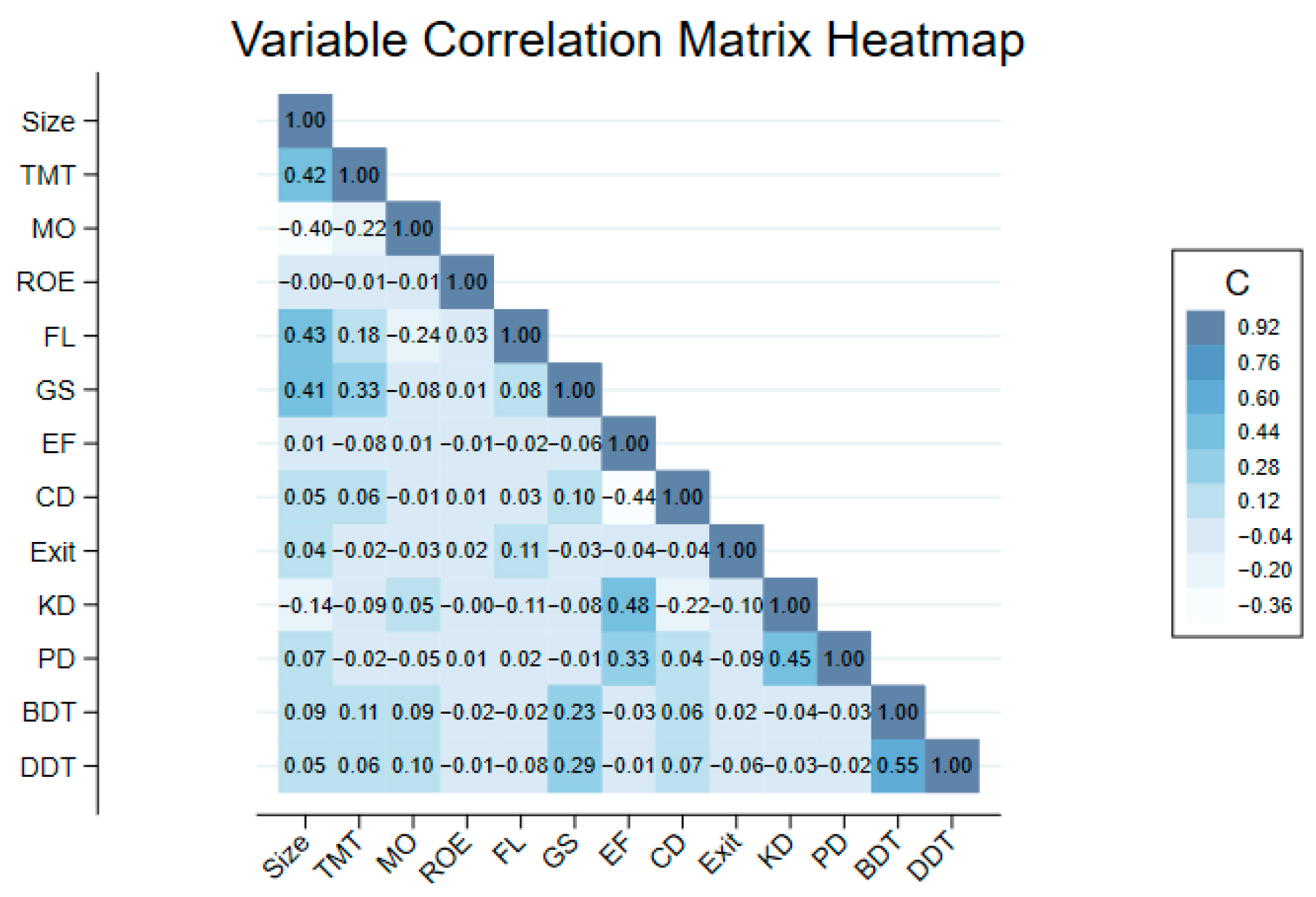

| Size | TMT | MO | ROE | FL | GS | EF | CD | Exit | KD | PD | BDT | DDT | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Size | 1 | 0.419 ** | −0.401 ** | −0.005 | 0.433 ** | 0.407 ** | 0.006 | 0.054 ** | 0.039 ** | −0.142 ** | 0.075 ** | 0.090 ** | 0.050 ** |

| TMT | 0.419 ** | 1 | −0.219 ** | −0.009 | 0.177 ** | 0.327 ** | −0.082 ** | 0.062 ** | −0.019 * | −0.091 ** | −0.016 | 0.107 ** | 0.065 ** |

| MO | −0.401 ** | −0.219 ** | 1 | −0.01 | −0.240 ** | −0.081 ** | 0.011 | −0.012 | −0.028 ** | 0.054 ** | −0.054 ** | 0.094 ** | 0.103 ** |

| ROE | −0.005 | −0.009 | −0.01 | 1 | 0.026 ** | 0.005 | −0.007 | 0.011 | 0.022 * | −0.003 | 0.007 | −0.019 * | −0.007 |

| FL | 0.433 ** | 0.177 ** | −0.240 ** | 0.026 ** | 1 | 0.082 ** | −0.019 * | 0.031 ** | 0.110 ** | −0.110 ** | 0.016 | −0.016 | −0.082 ** |

| GS | 0.407 ** | 0.327 ** | −0.081 ** | 0.005 | 0.082 ** | 1 | −0.057 ** | 0.097 ** | −0.033 ** | −0.081 ** | −0.005 | 0.234 ** | 0.290 ** |

| EF | 0.006 | −0.082 ** | 0.011 | −0.007 | −0.019 * | −0.057 ** | 1 | −0.443 ** | −0.038 ** | 0.485** | 0.325** | −0.032** | −0.013 |

| CD | 0.054 ** | 0.062 ** | −0.012 | 0.011 | 0.031 ** | 0.097 ** | −0.443 ** | 1 | −0.039 ** | −0.221 ** | 0.039 ** | 0.056 ** | 0.074 ** |

| Exit | 0.039 ** | −0.019 * | −0.028 ** | 0.022 * | 0.110 ** | −0.033 ** | −0.038 ** | −0.039 ** | 1 | −0.105 ** | −0.086 ** | 0.022 * | −0.057 ** |

| KD | −0.142 ** | −0.091 ** | 0.054 ** | −0.003 | −0.110 ** | −0.081 ** | 0.485 ** | −0.221 ** | −0.105 ** | 1 | 0.448 ** | −0.042 ** | −0.026 ** |

| PD | 0.075 ** | −0.016 | −0.054 ** | 0.007 | 0.016 | −0.005 | 0.325 ** | 0.039 ** | −0.086 ** | 0.448 ** | 1 | −0.034 ** | −0.021 * |

| BDT | 0.090 ** | 0.107 ** | 0.094 ** | −0.019 * | −0.016 | 0.234 ** | −0.032 ** | 0.056 ** | 0.022 * | −0.042 ** | −0.034 ** | 1 | 0.545 ** |

| DDT | 0.050 ** | 0.065 ** | 0.103 ** | −0.007 | −0.082 ** | 0.290 ** | −0.013 | 0.074 ** | −0.057 ** | −0.026 ** | −0.021 * | 0.545 ** | 1 |

| Mean | 23.109 | 16.500 | 0.099 | 0.109 | 0.481 | 0.126 | 71.895 | 12.288 | 0.150 | 13.045 | 17.268 | 1.880 | 15.580 |

| SD | 1.374 | 3.761 | 0.158 | 3.777 | 0.217 | 0.311 | 7.683 | 5.596 | 0.358 | 13.599 | 8.351 | 1.441 | 33.041 |

| Exit | |||||||

|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | |

| Size | −0.181 | −0.169 | −0.185 | −0.167 | −0.185 | −0.149 | −0.161 |

| (0.029) | (0.029) | (0.029) | (0.029) | (0.029) | (0.029) | (0.029) | |

| TMT | 0.032 | 0.035 | 0.031 | 0.034 | 0.033 | 0.031 | 0.028 |

| (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | |

| MO | −0.015 | −0.022 | −0.015 | −0.022 | −0.015 | −0.025 | −0.018 |

| (0.103) | (0.105) | (0.102) | (0.104) | (0.102) | (0.106) | (0.103) | |

| ROE | 0.021 | 0.019 | 0.021 | 0.020 | 0.023 | 0.019 | 0.021 |

| (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | |

| FL | 0.108 *** | 0.111 *** | 0.107 *** | 0.110 *** | 0.105 ** | 0.107 ** | 0.101 ** |

| (0.066) | (0.068) | (0.066) | (0.067) | (0.067) | (0.069) | (0.067) | |

| GS | −0.010 | −0.008 | −0.013 | −0.009 | −0.013 | 0.001 | −0.003 |

| (0.040) | (0.039) | (0.041) | (0.040) | (0.040) | (0.038) | (0.039) | |

| EF | 0.104 | 0.020 | 0.065 | 0.010 | 0.051 | 0.029 | 0.067 |

| (0.005) | (0.003) | (0.004) | (0.004) | (0.005) | (0.003) | (0.004) | |

| CD | 0.013 | 0.032 | 0.020 | 0.035 | 0.028 | 0.041 | 0.032 |

| (0.004) | (0.003) | (0.004) | (0.003) | (0.004) | (0.004) | (0.004) | |

| KD | −0.533 | −0.610 | −0.534 | ||||

| (0.011) | (0.012) | (0.011) | |||||

| KD2 | 0.409 ** | 0.449 *** | 0.406 ** | ||||

| (<0.001) | (<0.001) | (<0.001) | |||||

| PD | 0.064 | 0.062 | 0.059 | ||||

| (0.003) | (0.003) | (0.003) | |||||

| PD2 | 0.110 *** | 0.098 *** | 0.107 *** | ||||

| (<0.001) | (<0.001) | (<0.001) | |||||

| BDT | −0.032 | 0.073 ** | |||||

| (0.009) | (0.008) | ||||||

| BDT_KD | −0.021 | ||||||

| (<0.001) | |||||||

| BDT_KD2 | 0.072 *** | ||||||

| (<0.001) | |||||||

| BDT_PD | −0.022 *** | ||||||

| (<0.001) | |||||||

| BDT_PD2 | −0.081 *** | ||||||

| (<0.001) | |||||||

| DDT | −0.063 ** | −0.058 ** | |||||

| (<0.001) | (<0.001) | ||||||

| DDT_KD | 0.048 *** | ||||||

| (<0.001) | |||||||

| DDT_KD2 | −0.051 *** | ||||||

| (<0.001) | |||||||

| DDT_PD | 0.002 | ||||||

| (<0.001) | |||||||

| DDT_PD2 | −0.052 *** | ||||||

| (<0.001) | |||||||

| FE firm | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FE host country | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FE year | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.262 | 0.271 | 0.266 | 0.272 | 0.269 | 0.273 | 0.268 |

| R2_a | 0.188 | 0.198 | 0.192 | 0.199 | 0.195 | 0.199 | 0.194 |

| F | 2.109 | 31.648 | 13.812 | 35.356 | 23.868 | 26.428 | 20.833 |

| Observations | 12,193 | 12,193 | 12,193 | 12,193 | 12,193 | 12,193 | 12,193 |

| Exit | ||||||||

|---|---|---|---|---|---|---|---|---|

| Developed Economies | Developing Economies | |||||||

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | Model 8 | |

| Size | −0.197 * | −0.211 * | −0.185 | −0.194 | −0.272 | −0.273 | −0.219 | −0.214 |

| (0.030) | (0.030) | (0.030) | (0.029) | (0.060) | (0.058) | (0.061) | (0.059) | |

| TMT | −0.002 | −0.006 | −0.004 | −0.011 | 0.119 | 0.112 | 0.113 | 0.109 |

| (0.004) | (0.004) | (0.004) | (0.004) | (0.010) | (0.010) | (0.010) | (0.010) | |

| MO | −0.011 | −0.003 | −0.017 | −0.009 | −0.028 | −0.025 | −0.021 | −0.024 |

| (0.122) | (0.120) | (0.123) | (0.120) | (0.189) | (0.190) | (0.209) | (0.198) | |

| ROE | 0.020 | 0.022 | 0.020 | 0.022 | 0.028 ** | 0.032 ** | 0.024 * | 0.024 * |

| (0.003) | (0.003) | (0.003) | (0.003) | (0.001) | (0.001) | (0.001) | (0.001) | |

| FL | 0.170 *** | 0.163 *** | 0.169 *** | 0.161 *** | 0.072 *** | 0.069 *** | 0.067 *** | 0.065 *** |

| (0.076) | (0.078) | (0.074) | (0.077) | (0.025) | (0.025) | (0.024) | (0.024) | |

| GS | −0.009 | −0.014 | −0.001 | −0.007 | −0.003 | −0.006 | 0.014 | 0.014 |

| (0.048) | (0.049) | (0.047) | (0.047) | (0.032) | (0.033) | (0.029) | (0.030) | |

| EF | 0.033 | 0.167 | 0.056 | 0.176 | 0.029 | −0.007 | 0.023 | 0.016 |

| (0.006) | (0.008) | (0.006) | (0.008) | (0.004) | (0.004) | (0.006) | (0.004) | |

| CD | 0.037 | 0.020 | 0.036 | 0.020 | 0.037 | 0.021 | 0.040 | 0.032 |

| (0.006) | (0.007) | (0.006) | (0.007) | (0.004) | (0.004) | (0.003) | (0.004) | |

| KD | −0.553 | −0.507 | 4.189 | 1.805 | ||||

| (0.013) | (0.012) | (42.076) | (6.239) | |||||

| KD2 | 0.483 ** | 0.446 ** | 4.144 | 1.838 | ||||

| (<0.001) | (<0.001) | (1.878) | (0.307) | |||||

| PD | 0.085 | 0.080 | −0.090 | −0.084 | ||||

| (0.003) | (0.003) | (0.004) | (0.004) | |||||

| PD2 | 0.077 ** | 0.086 ** | 0.020 | 0.026 | ||||

| (<0.001) | (<0.001) | (<0.001) | (<0.001) | |||||

| BDT | −0.040 | 0.051 | −227.150 | 0.090 * | ||||

| (0.010) | (0.009) | (122.771) | (0.012) | |||||

| BDT_KD | −0.051 ** | −470.362 | ||||||

| (<0.001) | (21.806) | |||||||

| BDT_KD2 | 0.098 *** | −243.181 | ||||||

| (<0.001) | (0.968) | |||||||

| BDT_PD | −0.020 * | −0.041 ** | ||||||

| (<0.001) | (<0.001) | |||||||

| BDT_PD2 | −0.061 *** | −0.081 ** | ||||||

| (<0.001) | (<0.001) | |||||||

| DDT | −0.075 ** | −0.068 ** | −72.132 ** | −0.084 ** | ||||

| (<0.001) | (<0.001) | (0.292) | (<0.001) | |||||

| DDT_KD | 0.038 ** | −150.898 ** | ||||||

| (<0.001) | (0.054) | |||||||

| DDT_KD2 | −0.050 *** | −78.883 ** | ||||||

| (<0.001) | (0.002) | |||||||

| DDT_PD | −0.002 | −0.002 | ||||||

| (<0.001) | (<0.001) | |||||||

| DDT_PD2 | −0.039 ** | −0.036 ** | ||||||

| (<0.001) | (<0.001) | |||||||

| FE firm | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FE host country | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FE year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.283 | 0.278 | 0.283 | 0.278 | 0.355 | 0.355 | 0.354 | 0.354 |

| R2_a | 0.202 | 0.197 | 0.202 | 0.197 | 0.221 | 0.222 | 0.220 | 0.220 |

| F | 107.731 | 10.62 | 43.260 | 149.32 | 18.34 | 11.82 | 24.18 | 24.85 |

| Observations | 9499 | 9499 | 9499 | 9499 | 2694 | 2694 | 2694 | 2694 |

| Exit | |||||||

|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | |

| Size | 0.098 *** | 0.114 *** | 0.097 *** | 0.110 *** | 0.093 ** | 0.109 *** | 0.088 ** |

| (0.033) | (0.036) | (0.033) | (0.035) | (0.033) | (0.035) | (0.033) | |

| TMT | −0.041 | −0.047 | −0.045 | −0.048 | −0.048 | −0.047 | −0.045 |

| (0.013) | (0.012) | (0.013) | (0.012) | (0.013) | (0.012) | (0.013) | |

| MO | −0.024 | −0.029 | −0.028 | −0.036 | −0.035 | −0.015 | −0.019 |

| (0.345) | (0.322) | (0.330) | (0.315) | (0.324) | (0.315) | (0.326) | |

| ROE | 0.020 *** | 0.021 *** | 0.021 *** | 0.022 *** | 0.022 *** | 0.020 *** | 0.020 *** |

| (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | |

| FL | 0.078 *** | 0.075 *** | 0.077 *** | 0.074 *** | 0.082 *** | 0.074 *** | 0.078 *** |

| (0.073) | (0.076) | (0.074) | (0.076) | (0.074) | (0.075) | (0.073) | |

| GS | −0.118 ** | −0.137 ** | −0.126 ** | −0.141 ** | −0.128 ** | −0.089 | −0.078 |

| (0.231) | (0.243) | (0.237) | (0.249) | (0.241) | (0.230) | (0.222) | |

| EF | −0.103 *** | 0.209 *** | −0.019 | 0.208 *** | −0.019 | 0.213 *** | −0.018 |

| (0.004) | (0.005) | (0.004) | (0.005) | (0.004) | (0.005) | (0.004) | |

| CD | −0.126 *** | −0.216 *** | −0.083 *** | −0.216 *** | −0.084 *** | −0.209 *** | −0.076 *** |

| (0.006) | (0.005) | (0.006) | (0.005) | (0.006) | (0.005) | (0.006) | |

| KD | −1.092 *** | −1.101 *** | −1.082 *** | ||||

| (0.006) | (0.006) | (0.006) | |||||

| KD2 | 0.870 *** | 0.883 *** | 0.851 *** | ||||

| (<0.001) | (<0.001) | (<0.001) | |||||

| PD | −0.143 *** | −0.167 *** | −0.169 *** | ||||

| (0.004) | (0.004) | (0.005) | |||||

| PD2 | 0.113 *** | 0.061 ** | 0.065 ** | ||||

| (<0.001) | (<0.001) | (0.001) | |||||

| BDT | −0.054 | 0.120 *** | |||||

| (0.052) | (0.033) | ||||||

| BDT_KD | −0.040 | ||||||

| (0.003) | |||||||

| BDT_KD2 | 0.120 * | ||||||

| (<0.001) | |||||||

| BDT_PD | −0.050 ** | ||||||

| (0.002) | |||||||

| BDT_PD2 | −0.130 *** | ||||||

| (<0.001) | |||||||

| DDT | −0.042 | −0.043 | |||||

| (0.002) | (0.002) | ||||||

| DDT_KD | 0.081 * | ||||||

| (<0.001) | |||||||

| DDT_KD2 | −0.148 ** | ||||||

| (<0.001) | |||||||

| DDT_PD | −0.074 | ||||||

| (<0.001) | |||||||

| DDT_PD2 | −0.176 ** | ||||||

| (<0.001) | |||||||

| FE year | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Observations | 12,193 | 12,193 | 12,193 | 12,193 | 12,193 | 12,193 | 12,193 |

| Exit | |||||||

|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | |

| Size | −0.181 | −0.169 | −0.185 | −0.164 | −0.183 | −0.164 | −0.180 |

| (0.029) | (0.029) | (0.029) | (0.029) | (0.029) | (0.029) | (0.029) | |

| TMT | 0.032 | 0.035 | 0.031 | 0.035 | 0.031 | 0.034 | 0.031 |

| (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | (0.004) | |

| MO | −0.015 | −0.022 | −0.015 | −0.023 | −0.016 | −0.018 | −0.014 |

| (0.103) | (0.105) | (0.102) | (0.108) | (0.104) | (0.105) | (0.103) | |

| ROE | 0.021 | 0.019 | 0.021 | 0.020 | 0.023 | 0.019 | 0.022 |

| (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | (0.002) | |

| FL | 0.108 *** | 0.111 *** | 0.107 *** | 0.110 *** | 0.105 ** | 0.108 ** | 0.103 ** |

| (0.066) | (0.068) | (0.066) | (0.067) | (0.066) | (0.070) | (0.068) | |

| GS | −0.010 | −0.008 | −0.013 | −0.009 | −0.012 | −0.005 | −0.008 |

| (0.040) | (0.039) | (0.041) | (0.040) | (0.041) | (0.040) | (0.042) | |

| EF | 0.104 | 0.020 | 0.065 | 0.019 | 0.067 | 0.029 | 0.067 |

| (0.005) | (0.003) | (0.004) | (0.003) | (0.004) | (0.003) | (0.004) | |

| CD | 0.013 | 0.032 | 0.020 | 0.031 | 0.017 | 0.034 | 0.021 |

| (0.004) | (0.003) | (0.004) | (0.003) | (0.004) | (0.003) | (0.004) | |

| KD | −0.533 | −0.526 | −0.531 | ||||

| (0.011) | (0.011) | (0.011) | |||||

| KD2 | 0.409 ** | 0.407 ** | 0.409 ** | ||||

| (<0.001) | (<0.001) | (<0.001) | |||||

| PD | 0.064 | 0.058 | 0.060 | ||||

| (0.003) | (0.003) | (0.003) | |||||

| PD2 | 0.110 *** | 0.102 *** | 0.098 *** | ||||

| (<0.001) | (<0.001) | (<0.001) | |||||

| BDT | −0.023 | 0.057 ** | |||||

| (0.007) | (0.010) | ||||||

| BDT_KD | 0.001 | ||||||

| (<0.001) | |||||||

| BDT_KD2 | 0.048 *** | ||||||

| (<0.001) | |||||||

| BDT_PD | −0.010 | ||||||

| (<0.001) | |||||||

| BDT_PD2 | −0.058 *** | ||||||

| (<0.001) | |||||||

| DDT | −0.017 | −0.004 | |||||

| (0.011) | (0.011) | ||||||

| DDT_KD | 0.058 *** | ||||||

| (<0.001) | |||||||

| DDT_KD2 | −0.048 ** | ||||||

| (<0.001) | |||||||

| DDT_PD | −0.002 | ||||||

| (0.001) | |||||||

| DDT_PD2 | −0.044 *** | ||||||

| (<0.001) | |||||||

| FE firm | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FE host country | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FE year | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.262 | 0.271 | 0.266 | 0.272 | 0.267 | 0.272 | 0.267 |

| R2_a | 0.188 | 0.198 | 0.192 | 0.199 | 0.193 | 0.199 | 0.193 |

| F | 2.109 | 31.648 | 13.812 | 34.518 | 56.927 | 25.960 | 16.622 |

| Observations | 12,193 | 12,193 | 12,193 | 12,193 | 12,193 | 12,193 | 12,193 |

| Exit | |||||||

|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | Model 7 | |

| Size | −0.155 | −0.149 | −0.158 | −0.145 | −0.161 | −0.140 | −0.148 |

| (0.041) | (0.040) | (0.041) | (0.040) | (0.041) | (0.040) | (0.040) | |

| TMT | 0.043 | 0.045 | 0.043 | 0.044 | 0.044 | 0.041 | 0.041 |

| (0.004) | (0.005) | (0.004) | (0.005) | (0.004) | (0.005) | (0.004) | |

| MO | −0.022 | −0.029 | −0.020 | −0.030 | −0.019 | −0.032 | −0.023 |

| (0.129) | (0.135) | (0.129) | (0.134) | (0.127) | (0.137) | (0.129) | |

| ROE | 0.055 ** | 0.051 * | 0.054 ** | 0.052 * | 0.054 ** | 0.051 * | 0.054 ** |

| (0.008) | (0.007) | (0.007) | (0.007) | (0.007) | (0.007) | (0.008) | |

| FL | 0.168 *** | 0.175 *** | 0.166 *** | 0.172 *** | 0.165 *** | 0.175 *** | 0.164 *** |

| (0.062) | (0.061) | (0.062) | (0.062) | (0.062) | (0.061) | (0.062) | |

| GS | 0.018 | 0.020 | 0.016 | 0.018 | 0.016 | 0.021 | 0.017 |

| (0.041) | (0.039) | (0.041) | (0.040) | (0.041) | (0.039) | (0.041) | |

| EF | 0.100 | 0.024 | 0.060 | 0.011 | 0.045 | 0.027 | 0.052 |

| (0.005) | (0.004) | (0.005) | (0.005) | (0.005) | (0.004) | (0.005) | |

| CD | 0.026 | 0.037 | 0.037 | 0.039 | 0.045 | 0.047 | 0.051 |

| (0.005) | (0.004) | (0.005) | (0.004) | (0.005) | (0.004) | (0.005) | |

| KD | −0.625 | −0.718 | −0.597 | ||||

| (0.018) | (0.018) | (0.018) | |||||

| KD2 | 0.433 * | 0.496 ** | 0.409 * | ||||

| (<0.001) | (<0.001) | (<0.001) | |||||

| PD | 0.074 | 0.067 | 0.064 | ||||

| (0.003) | (0.003) | (0.003) | |||||

| PD2 | 0.120 *** | 0.092 *** | 0.097 *** | ||||

| (<0.001) | (<0.001) | (<0.001) | |||||

| BDT | −0.057 | 0.044 | |||||

| (0.009) | (0.009) | ||||||

| BDT_KD | −0.038 | ||||||

| (0.001) | |||||||

| BDT_KD2 | 0.089 *** | ||||||

| (<0.001) | |||||||

| BDT_PD | −0.023 ** | ||||||

| (<0.001) | |||||||

| BDT_PD2 | −0.064 *** | ||||||

| (<0.001) | |||||||

| DDT | −0.058 | −0.055 | |||||

| (0.001) | (0.001) | ||||||

| DDT_KD | 0.031 | ||||||

| (<0.001) | |||||||

| DDT_KD2 | −0.042 * | ||||||

| (<0.001) | |||||||

| DDT_PD | −0.013 | ||||||

| (<0.001) | |||||||

| DDT_PD2 | −0.042 * | ||||||

| (<0.001) | |||||||

| FE firm | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FE host country | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| FE year | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.260 | 0.269 | 0.265 | 0.270 | 0.266 | 0.270 | 0.266 |

| R2_a | 0.183 | 0.192 | 0.187 | 0.193 | 0.189 | 0.193 | 0.189 |

| F | 6.547 | 66.147 | 13.742 | 14.21 | 15.524 | 85.772 | 16.184 |

| Observations | 9175 | 9175 | 9175 | 9175 | 9175 | 9175 | 9175 |

| Balance Metrics (SMD) | |||

|---|---|---|---|

| Before Matching | After Matching | After Matching | |

| Size | −0.108 | 0.006 | 0.006 |

| TMT | 0.054 | 0.001 | 0.001 |

| MO | 0.079 | 0.001 | 0.001 |

| ROE | −0.061 | <0.001 | <0.001 |

| FL | −0.310 | 0.014 | 0.014 |

| GS | 0.091 | 0.005 | 0.005 |

| EF | 0.105 | 0.030 | 0.03 |

| CD | 0.108 | 0.004 | 0.004 |

| KD2 | 0.036 | 0.049 | |

| PD2 | 0.208 | 0.018 | |

| Exit | ||

|---|---|---|

| Model 1 | Model 2 | |

| Size | −0.142 | −0.149 |

| (0.031) | (0.030) | |

| TMT | 0.019 | 0.015 |

| (0.004) | (0.004) | |

| MO | −0.014 | −0.007 |

| (0.105) | (0.100) | |

| ROE | 0.019 | 0.021 |

| (0.002) | (0.002) | |

| FL | 0.114 ** | 0.112 ** |

| (0.057) | (0.056) | |

| GS | −0.014 | −0.020 |

| (0.034) | (0.034) | |

| EF | 0.018 | 0.062 |

| (0.003) | (0.004) | |

| CD | 0.039 | 0.022 |

| (0.004) | (0.004) | |

| KD | −0.567 | |

| (0.011) | ||

| KD2 | 0.413 *** | |

| (<0.001) | ||

| PD | 0.055 | |

| (0.002) | ||

| PD2 | 0.111 *** | |

| (<0.001) | ||

| FE firm | Yes | Yes |

| FE host country | Yes | Yes |

| FE year | Yes | Yes |

| R2 | 0.276 | 0.271 |

| R2_a | 0.203 | 0.198 |

| F | 25.940 | 13.003 |

| Observations | 12,193 | 12,193 |

| Exit | ||

|---|---|---|

| Model 1 | Model 2 | |

| Size | −0.171 | −0.184 |

| (0.029) | (0.029) | |

| TMT | 0.036 | 0.034 |

| (0.004) | (0.004) | |

| MO | −0.018 | −0.016 |

| (0.105) | (0.100) | |

| ROE | 0.019 | 0.021 |

| (0.002) | (0.002) | |

| FL | 0.111 *** | 0.108 *** |

| (0.068) | (0.065) | |

| GS | −0.009 | −0.014 |

| (0.039) | (0.041) | |

| EF | 0.021 | 0.062 |

| (0.003) | (0.005) | |

| CD | 0.037 | 0.010 |

| (0.003) | (0.004) | |

| KD | −0.149 | |

| (0.011) | ||

| KD2 | 1.159 | |

| (0.002) | ||

| Resid_KD | −0.071 | |

| (0.015) | ||

| Resid_KD2 | −0.327 | |

| (0.002) | ||

| PD | −0.541 | |

| (0.021) | ||

| PD2 | 2.815 | |

| (0.022) | ||

| Resid_PD | 0.141 | |

| (0.021) | ||

| Resid_PD2 | −1.290 | |

| (0.022) | ||

| FE firm | Yes | Yes |

| FE host country | Yes | Yes |

| FE year | Yes | Yes |

| R2 | 0.272 | 0.266 |

| R2_a | 0.198 | 0.192 |

| F | 26.410 | 11.396 |

| Observations | 12,193 | 12,193 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, Z.; Wang, L. Dual-Dimensional Digital Transformation Systematically Reshapes the U-Curve of Knowledge and Political Distance on Subsidiary Exit. Systems 2025, 13, 773. https://doi.org/10.3390/systems13090773

Zhou Z, Wang L. Dual-Dimensional Digital Transformation Systematically Reshapes the U-Curve of Knowledge and Political Distance on Subsidiary Exit. Systems. 2025; 13(9):773. https://doi.org/10.3390/systems13090773

Chicago/Turabian StyleZhou, Zhengyuan, and Lei Wang. 2025. "Dual-Dimensional Digital Transformation Systematically Reshapes the U-Curve of Knowledge and Political Distance on Subsidiary Exit" Systems 13, no. 9: 773. https://doi.org/10.3390/systems13090773

APA StyleZhou, Z., & Wang, L. (2025). Dual-Dimensional Digital Transformation Systematically Reshapes the U-Curve of Knowledge and Political Distance on Subsidiary Exit. Systems, 13(9), 773. https://doi.org/10.3390/systems13090773