1. Introduction

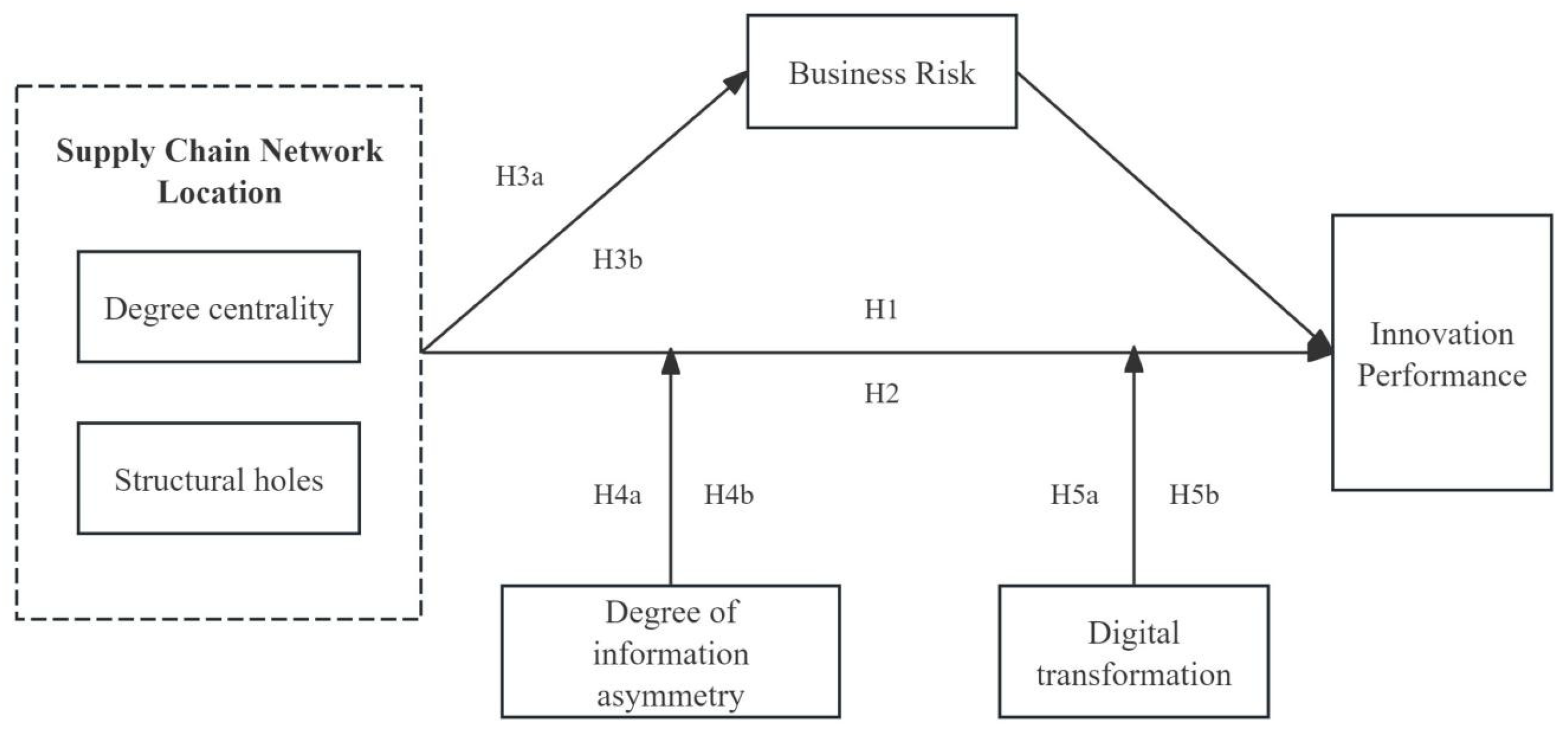

The deepening integration of the world economy has intensified market competition, prompting countries to actively seek new drivers of development. As the foundation of China’s economy, the manufacturing industry should embrace innovation-driven development, increase investment in R&D, and achieve high-quality development through technological innovation. Innovation performance refers to the economic and social benefits achieved by enterprises or other organizations from innovation [

1]. It reflects the efficiency and outcomes of the innovation process, emphasizing the importance of value creation throughout the entire course of innovation activities, covering all stages from technological creation to market performance [

2]. As a core measure of the effectiveness of innovation activities, innovation performance directly reflects the efficiency of utilizing innovation resources and the capability to transform innovative outcomes. Therefore, it is a critical driving force for promoting high-quality development in manufacturing enterprises and even the entire industry.

With the rapid advancement of technology, the degree of resource interdependence among enterprises has increased, and their capabilities to build supply chains have also strengthened, ultimately leading to the formation of supply chain networks [

3]. Enterprises at different supply chain network locations can access different information and resources [

4]. Those located at the central position can enhance their risk-bearing capacity and alleviate financial constraints by accessing information and integrating resources [

5] and thereby significantly improve the diversity level of innovation [

6]. On one hand, those occupying structural holes can obtain abundant information and provide more innovation resources [

7]; on the other hand, due to their complex network relationships, they may trigger risks across the entire network, intensify operational pressures, and hinder the improvement of innovation performance [

8].

Although scholars have explored the mechanisms through which supply chain network locations influence the innovation performance from the perspectives of knowledge integration [

9,

10] and financial constraints [

11], most studies have focused on cross-industry analyses [

12], neglecting the potential and differential impacts of network locations on innovation performance in different industries. Therefore, this research analyzes the impacts of supply chain network locations on the innovation performance of manufacturing firms based on the Social Network Theory, the Resource Dependence Theory, and the Prospect Theory. This research provides theoretical support and managerial insights for manufacturing enterprises in China to optimize their innovation strategies and adjust their supply chain network locations.

The potential contributions are as follows: First, this research analyzes innovation performance from a supply chain network perspective. The impacts of supply chain network locations on innovation performance are explored based on the Social Network Theory, which enriches the understanding of factors influencing the innovation performance and provides a new theoretical foundation for innovation management. Second, this research analyzes the mechanisms through which supply chain network locations affect the innovation performance. It not only validates the proposition that “innovation performance is influenced by the network in which a firm is embedded” but also explores the mediating role of operational risks, as well as the moderating effects of digital transformation and information asymmetry. This comprehensive analysis of the mechanisms helps manufacturing enterprises accurately understand the complex relationships between network locations and innovation performance, thereby offering guidance for developing business strategies.

4. Empirical Results

4.1. Descriptive Statistics and Correlation Analysis

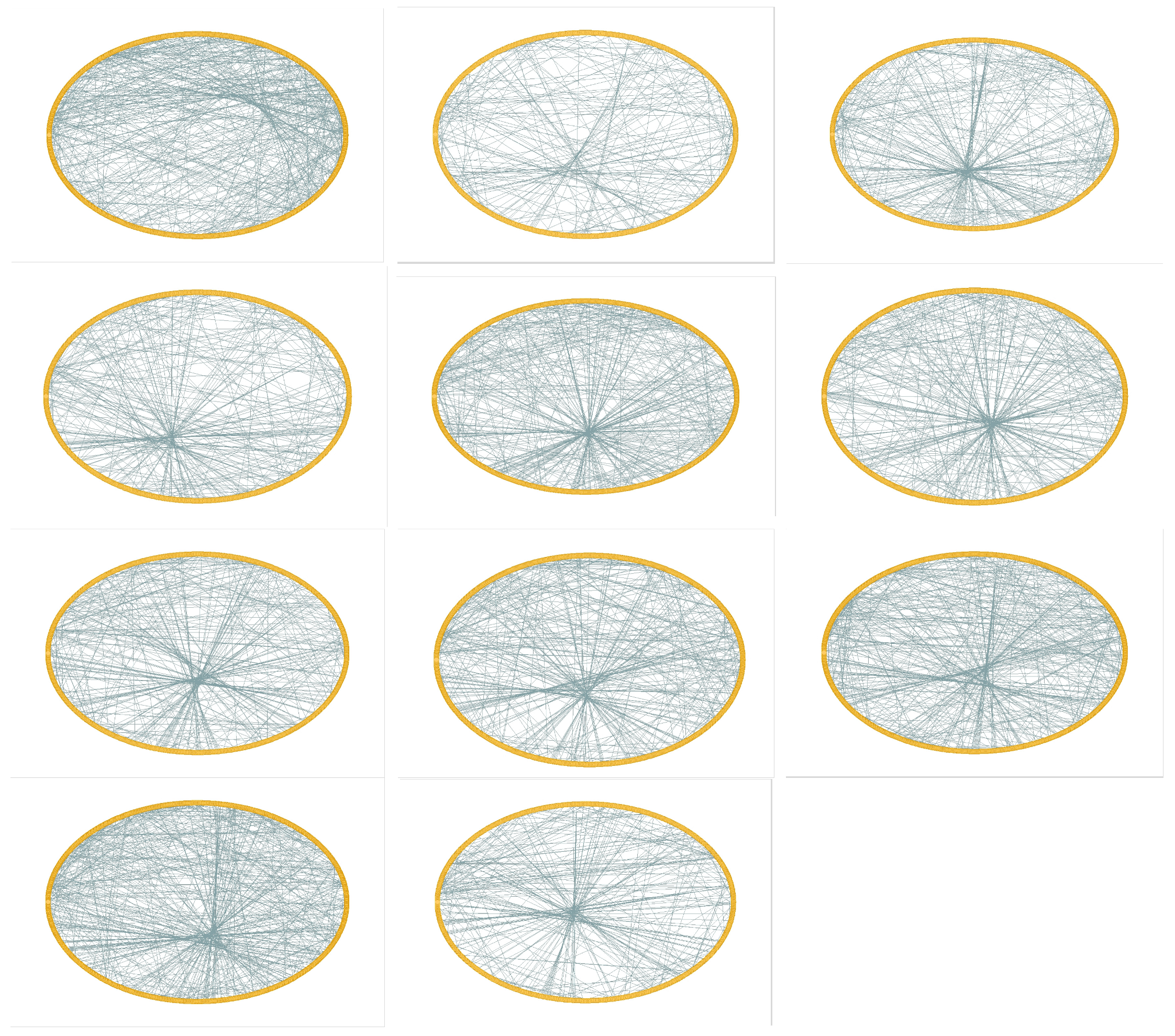

Descriptive statistics for all variables across 4324 observations are presented in

Table 1. The maximum value of innovation performance (Pat) is 5.860, the minimum value is 0.000, and the standard deviation is 1.450, indicating that there are significant differences in the innovation performance of manufacturing enterprises in the supply chain network, and the innovation performance is relatively low. The maximum value of centrality (Degree) is 7, the minimum value is 1, the mean is 1.930, and the standard deviation is 1.360. This indicates that the network centrality among different enterprises varies greatly. The higher the centrality, the more central the enterprise is. According to the structural hole theory [

60], the lower the CI value, the more significant is the location of the structural hole occupied by the enterprise. The maximum value of the structural hole (CI) is 0.810, the minimum value is 0, and the average value is 0.230, indicating that there are fewer manufacturing enterprises occupying the location of the structural hole in the supply chain network. The maximum value of operational risk (Risk) is 34.940, the minimum value is 0.150, and the average value is 4340, indicating that there is an extreme differentiation phenomenon of operational risk in the sample enterprises. The maximum value of information asymmetry (ASY) is 0.620, the minimum value is −2.920, the average is −0.400, and the standard deviation is 0.610. This indicates that the degree of information asymmetry among the sample enterprises varies significantly, but most of the sample enterprises perform well in terms of information transparency. The maximum value of Digital Transformation (DCG) is 65.810, the minimum value is 22.980, the average is 37.130, and the standard deviation is 10.600, indicating that there is a significant imbalance in the digitalization process of different enterprises.

Table 2 shows the correlations among the variables. The results show that network centrality, structural holes, and innovation performance commitment are positively correlated at a significance level of 1%, indicating that there is a certain positive correlation. Furthermore, by calculating the variance inflation factor (VIF) of each variable, it was found that the values were all less than 5, indicating no serious multicollinearity among the explanatory variables. The results are presented in

Table 3.

4.2. Baseline Regression Results

To investigate the impact of a firm’s supply chain network location on its innovation performance, we first performed F-tests and Hausman tests. The

p-values for both tests were below 0.01, leading us to reject the null hypotheses at the 1% significance level. These results indicate that the fixed-effects model is more appropriate and provides more reliable estimates for our sample data than alternative models. To control for potential industry and time effects, industry (ind) and year dummy variables are included in all the regression models. The results are presented in

Table 4.

Column (1) presents the baseline regression results for network centrality (Degree). The coefficient of 0.0826 is significant at the 1% level, suggesting that a central network location enhances the innovation performance of manufacturing firms. In Column (2), control variables are added to this model. The coefficient on Degree remains positive and significant at the 1% level (0.0813), providing support for hypothesis H1. This result indicates that a central location enables firms to access more information and resources, thereby boosting innovation.

The baseline result for structural holes (CI) is shown in Column (3). The coefficient is 0.314 and is significant at the 1% level, indicating that occupying structural holes also fosters innovation. After adding control variables in Column (4), the coefficient on CI becomes 0.319 and remains significant at the 1% level, confirming hypothesis H2. This finding demonstrates a significant positive relationship between occupying more structural holes and achieving higher innovation performance.

4.3. Endogeneity Test

A firm’s location in the supply chain network may affect its innovation performance with a time lag. The resources and advantages gained from a network location often require time to be translated into innovative outcomes. Consequently, current innovation performance is likely a result of past network positioning rather than contemporaneous position. This lag creates a potential endogeneity issue in the model. To address this, we employed a two-stage least squares (2SLS) approach to estimate the model.

We used the two-period lagged values of the centrality and structural hole indices (DegreeIV and CIIV) as instrumental variables (IVs) for their contemporaneous counterparts (Degree and CI) in the first-stage regression. The first-stage regression results, presented in

Table 5 (columns (1) and (3)), demonstrate that the instrumental variables are strongly correlated with the endogenous regressors. The coefficients are positive and statistically significant at the 1% level. Furthermore, the F-statistics for both tests are well above the standard threshold of 10, confirming that weak instruments are not a concern. We then proceed to the second-stage estimation. The results, shown in columns (2) and (4) of

Table 5, indicate that after addressing endogeneity via 2SLS, the effects of both network centrality and structural holes on firm innovation performance remain positive and significant at the 1% level. This robust finding further validates our baseline results.

4.4. Robustness Test

To ensure the robustness of the results, this research employs multiple robustness tests. The outcomes of these tests are shown in

Table 6.

First, the measurement method of independent variables was replaced. This research refers to the research of Shi Jinyan [

18]: the structural hole theory posits that nodes occupying these positions control information flow. Similarly, betweenness measures the extent to which a node acts as an intermediary or “bridge” on the paths between other nodes. Both concepts capture a node’s strategic control over information: high structural hole richness provides access to heterogeneous information, while high betweenness centrality indicates a pivotal location on necessary communication paths. Given this conceptual alignment, we use betweenness (multiplied by 100 for scale compatibility) as an alternative proxy for the structural hole (CI). The regression results are presented in

Table 6. Column (1) shows the baseline result using CI, and column (2) shows the result using betweenness. The coefficient for betweenness is 0.145 and is significant at the 1% level. The positive and significant effect after changing the measurement confirms the robustness of the finding that structural holes promote innovation performance.

Second, the measurement method of the dependent variable was replaced. We remeasured innovation performance by replacing the dependent variable. Instead of using only invention patents, we used the sum of utility model and design patents (Pat1), applying the same logarithmic transformation (ln(1 + Pat1)). The results are shown in columns (3) and (4) of

Table 6. When either network centrality or structural holes are the core explanatory variables, the coefficients remain positive and significant at the 1% level. These results, consistent in both sign and significance with our baseline findings, further support the main conclusions.

Third, we test robustness by adjusting the sample period to 2012–2022. The results, shown in columns (5) and (6) of

Table 6, remain consistent with the baseline results, confirming that our findings are not sensitive to the chosen time window.

4.5. The Mediating Effect of Operational Risks

To examine the mediating effect of operational risks in the relationship between the centrality of the supply chain network and the innovation performance of enterprises, the mediating effect was gradually verified from column (1) to column (3), as shown in

Table 7. Column (1) lists the baseline regression of supply chain network centrality on innovation performance. In Column (2), the dependent variable is operational risk (Risk). The coefficient on centrality is −0.223 and is significant at the 1% level. Since a lower Z-score indicates a higher risk of financial distress, this result shows that a more central network location increases the operational risk. In Column (3), operational risk (Risk) is added as a mediator to the regression model from Column (1). The coefficient is −0.0775 and is significant at the 1% level. Concurrently, the coefficient on network centrality decreases from 0.0813 in Column (1) to 0.0775 in Column (3), while remaining statistically significant. This result suggests that operational risk partially mediates the relationship between supply chain network centrality and innovation performance. Thus, Hypothesis H3a is supported.

Similarly, Columns (4), (5), and (6) examine the mediating role of operational risk in the relationship between structural holes and innovation performance. Column (4) shows the baseline regression of structural holes (CI) on innovation performance (coef. = 0.319, significant). In Column (5), the dependent variable is operational risk (Risk). The coefficient is −0.940 and is significant at the 1% level. The results show a significant negative coefficient for CI. In column (6), the operation risk (Risk) is added to the regression model of the supply chain network structure hole and innovation performance. The results show that the coefficient of operation risk is 0.303 and is significant at the 1% level. Meanwhile, the coefficient value of the structural hole decreased from 0.319 in column (4) to 0.303 in column (6) but still maintained statistical significance. This indicates the existence of a mediating effect, and the hypothesis H3b is supported.

4.6. The Moderating Effect of Digital Transformation

To avoid multicollinearity, all variables involved in the interaction terms were mean-centered before testing the moderating effects. Furthermore, we accounted for the inherent time lag in digital transformation—where the full effects of such initiatives take time to materialize. Specifically, we employed a cross-lagged model that introduces a one-period lag for the digital transformation variable when examining its interplay with supply chain network location and innovation performance. The moderating role of digital transformation is presented in

Table 8.

Column (2) shows the results for the interaction between digital transformation (L.DCG) and network centrality (Degree). The coefficient on the interaction term (L.DCG∗Degree) is 0.00848 and is significant at the 1% level. This positive and significant coefficient indicates that digital transformation strengthens the positive relationship between network centrality and innovation performance, thus supporting Hypothesis H4a. Similarly, Column (4) presents the results for the interaction between digital transformation (L.DCG) and structural holes (CI). The coefficient on the interaction term (L.DCG∗CI) is 0.0416 and is also significant at the 1% level. This provides evidence that digital transformation also enhances the effect of structural holes on innovation performance, supporting Hypothesis H4b.

4.7. The Moderating Effect of Information Asymmetry

The results for the moderating effect of information asymmetry (ASY) are presented in

Table 9. Column (2) shows the interaction between information asymmetry and network centrality. The coefficient on the interaction term (ASY∗Degree) is −0.123 and is significant at the 1% level. This negative and significant coefficient indicates that a higher degree of information asymmetry weakens the positive effect of network centrality on innovation performance. Thus, information asymmetry acts as a significant negative moderator, supporting Hypothesis H5a. Similarly, Column (4) shows the interaction between information asymmetry and structural holes. The coefficient on the interaction term (ASY∗CI) is −0.674 and is significant at the 1% level. This result demonstrates that information asymmetry also attenuates the positive relationship between structural holes and innovation performance, confirming Hypothesis H5b.

4.8. Regional Heterogeneity Test

Manufacturing firms are categorized into eastern, central, and western regions based on their location. Columns (1)–(3) in

Table 10 reveal significant regional heterogeneity in the relationship between supply chain network centrality and innovation performance, a finding supported by significant Chow Test results. The results show a striking regional contrast. For firms in the eastern region, network centrality has a strong positive effect on innovation performance (coef. = 0.134, significant at 1%). In contrast, for firms in the central region, the effect is significantly negative (coef. = −0.0849, significant at 1%). The coefficient for the western region is positive but statistically insignificant (coef. = 0.00694). This heterogeneity is likely attributable to disparities in regional economic development, resource acquisition, and business environments. Firms in the more developed eastern region appear better equipped to leverage their central network positions to enhance innovation, possibly due to superior resources and a more advanced economic ecosystem. Conversely, firms in the central region may struggle to convert this specific advantage into innovation outcomes, potentially due to resource constraints.

A similar pattern of regional heterogeneity is observed for structural holes (CI) in Columns (4)–(6) of

Table 10, again confirmed by significant Chow Test results. The impact is significant at the 1% level only in the eastern region (coef. = 0.532). The coefficients for the central (coef. = −0.269) and western (coef. = −0.0252) regions are not statistically significant, indicating no clear link between structural holes and innovation performance in these areas. This divergence can be explained by regional disparities in network maturity and institutional development. In the eastern region, mature supply chains, a concentration of talent and technology, and well-developed market institutions allow firms occupying structural holes to efficiently integrate diverse, cross-regional resources, significantly boosting innovation. In the central and western regions, however, fragmented industrial chains, a scarcity of innovative elements, and a less advanced institutional environment hinder firms from capitalizing on the informational and brokerage advantages of structural holes, resulting in an insignificant effect on innovation. This contrast underscores how regional economic structures and network characteristics shape the innovation mechanism.

5. Conclusions and Future Research Agenda

This research empirically investigates data from listed manufacturing enterprises from 2013 to 2023. From the perspective of social networks, it explores the influence and mechanism of the supply chain network location on the innovation performance of manufacturing enterprises. The main research conclusions are as follows:

First, supply chain network location has a significant positive impact on the innovation performance. Enterprises located in central network locations can more easily access diverse external resources and information, converting these into advantages that enhance innovation. Similarly, enterprises located in structural holes can leverage their brokerage position to control resource flows. This facilitated flow of information and resources is conducive to developing innovation activities and improving performance.

Second, operational risk plays a mediating role in the path between supply chain network location and innovation performance. A favorable network position helps firms mitigate operational risks, thereby freeing up resources that would otherwise be allocated to managing uncertainties. These resources can be reallocated to innovation activities, such as new product development, R&D, and product optimization. Firms occupying central locations and abundant structural holes assume higher levels of operational risk, which in turn exerts a significant impact on their innovation performance. They can better anticipate and plan for future business developments and market demands, allowing them to avoid risks proactively. This enhanced stability and predictability support long-term, strategic decision-making in the innovation process, enabling firms to operate more efficiently and focus on driving technological progress.

Third, information asymmetry plays a negative moderating role in the relationship between supply chain network location and innovation performance. It heightens the uncertainties and risks inherent in the innovation process. When information asymmetry is high, even centrally located or brokerage firms face greater uncertainty and risk due to insufficient or unverifiable information, which weakens the positive impact of network location on innovation. Furthermore, information asymmetry can erode trust among supply chain partners, undermining the stability and efficiency of collaborative relationships. Since innovation often requires sharing information, resources, and risks with partners, this distrust can reduce cooperation efficiency, potentially lead to partnership breakdowns, and ultimately terminate innovation projects, thereby lowering innovation performance.

Fourth, digital transformation positively moderates the relationship between supply chain network location and innovation performance. It enhances this relationship by providing numerous advantages for innovation. Digital tools help break down information barriers, expand information channels, and improve control over supply chain information, even for firms in peripheral network locations. For firms occupying central or brokerage locations, digital transformation enables more efficient integration of resources from diverse nodes, achieves optimal resource allocation, and further leverages their positional advantages. This allows for the precise allocation of previously scattered resources to innovation activities, thereby boosting innovation performance.

This research contributes to the existing literature but has several limitations. First, relying solely on data from listed companies results in an incomplete mapping of the supply chain network, potentially affecting the accurate identification of key nodes. Future studies could employ methods like surveys to incorporate data from non-listed firms and expand the research scope. Second, future research could investigate the impact of global supply chain networks on firm innovation, analyzing innovative behaviors and their drivers within international networks. This could inform strategies for optimizing supply chains to enhance innovation performance and the global competitiveness of domestic firms. Finally, this study does not deeply explore the evolution of dynamic supply chain networks. These networks are in constant flux, and their structural dynamics create endogenous risks. Factors such as shifts in alliance partnerships, market volatility, and technological disruption can destabilize the network, leading to accumulated uncertainties. Moreover, the network’s topological structure dictates unique risk transmission mechanisms, where local risks can propagate rapidly through multiple pathways, creating a networked risk contagion effect. Future research should focus on the long-term impact and evolutionary patterns of dynamic supply chain networks on firm innovation to help develop forward-looking innovation strategies.