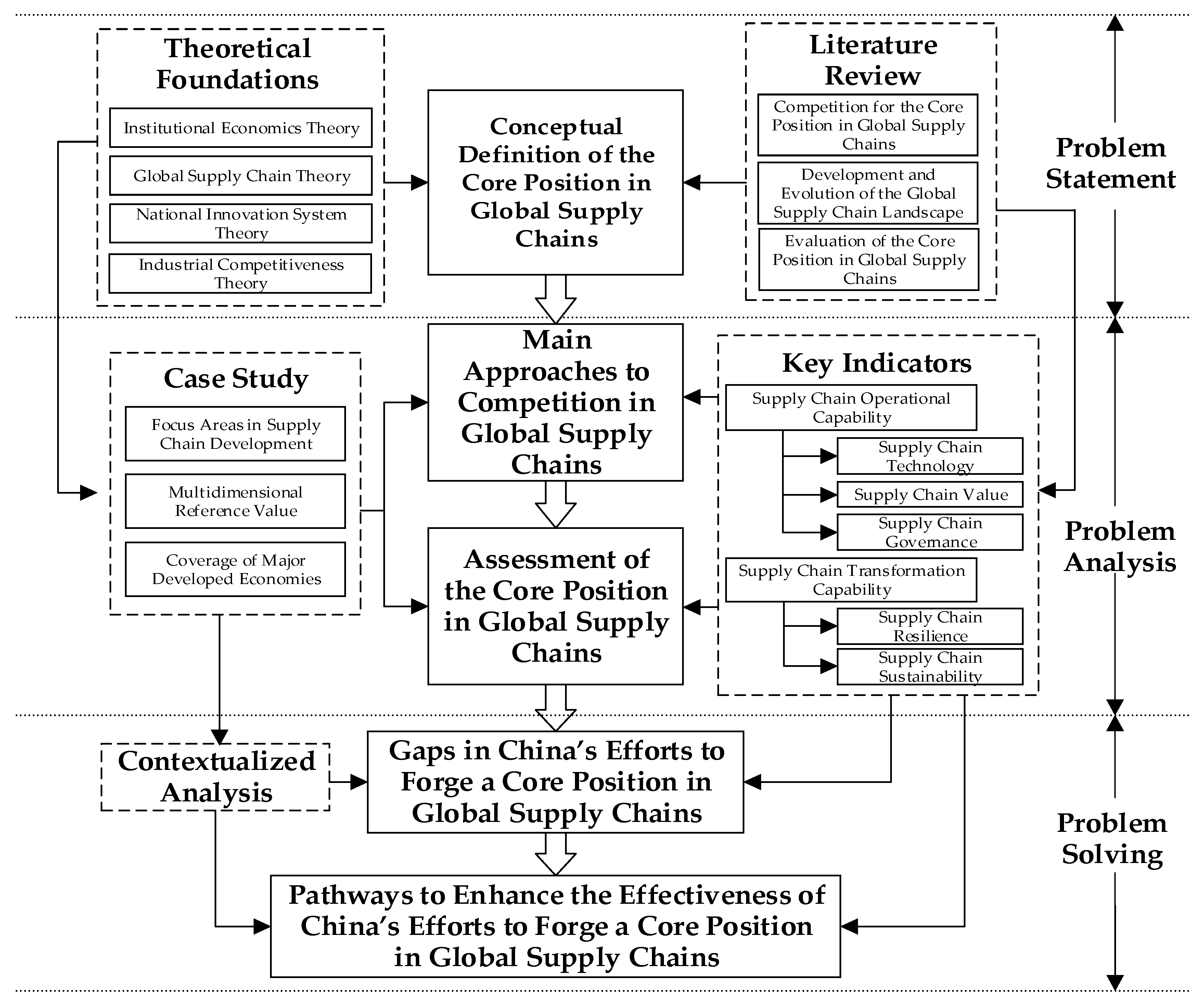

Pathways for China’s Key Industries to Secure Core Positions in Global Supply Chains: A Comparative and Empirical Study

Abstract

1. Introduction

- (1)

- Possession of industry-leading core technologies. The ability to command cutting-edge, proprietary technologies is a key indicator of a country’s or region’s position at the global technological frontier. Securing these core technologies strengthens the bargaining power and discourse authority of its strategic industries within the architecture of global supply chains [18].

- (2)

- Extensive supply-chain network and scale. Core-position countries or regions typically maintain complex, large-scale supply-chain networks. Broad collaboration with diverse intermediaries and suppliers ensures wide coverage and integration across the value chain [19].

- (3)

- Broad international influence. Core nations or regions exert substantial sway over global industry trends, standards, and resource flows [20].

- (4)

- Robust risk-control capability. A defining attribute of a core position is the capacity to identify, assess, and respond effectively to diverse risks—including natural disasters, political instability, and market volatility—while implementing timely and effective countermeasures [21].

- (5)

- Gaining control over green rule-making. Achieving green sustainability and low-carbon transformation in supply chains has become a global consensus, so many developed countries are gradually transforming the establishment of green standards in the supply chain sector into control over supply chains [22].

- To systematically review and assess the institutional arrangements and practical pathways that developed countries have employed to build core positions for key-industry supply chains;

- To conduct an in-depth analysis of the internal logic and evolutionary trends of global supply-chain systems, revealing the progress and gaps in China’s developed cities;

- To propose strategic pathways tailored to China’s developed cities, including whole-industry-chain coordination, prioritization of key industries, phased regional advancement, and multi-stakeholder collaboration.

2. Literature Review and Theoretical Foundations

2.1. Literature Review

2.2. Theoretical Foundations

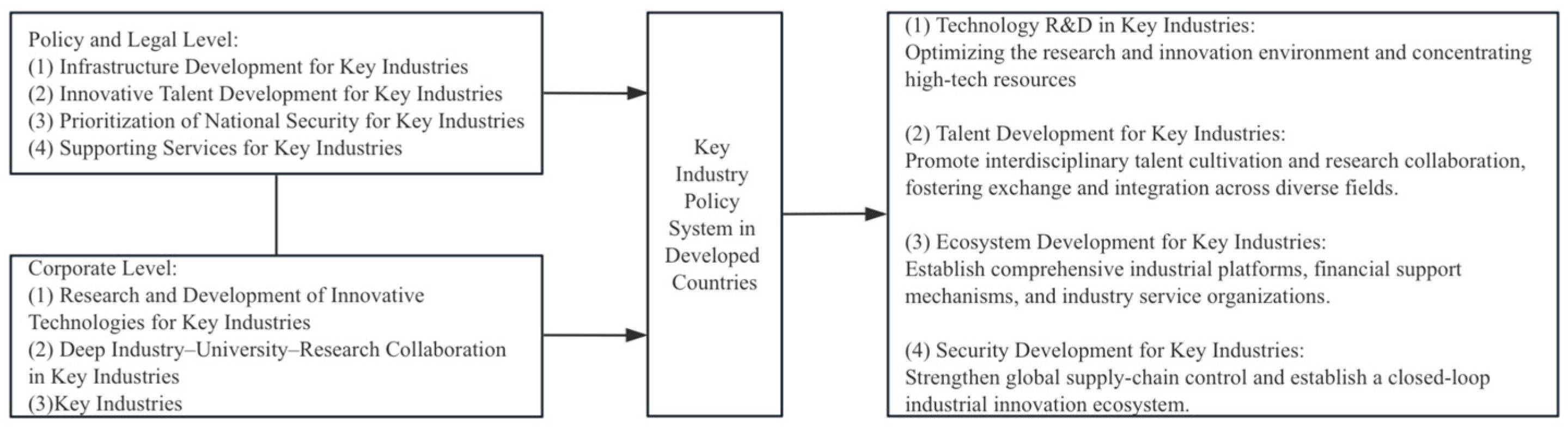

3. Case Studies of Core Supply Chain Leadership in Advanced Economies

3.1. Research Design: Multiple-Case Comparison with Contextualised Analysis

3.2. Case Description and Selection Criteria

3.2.1. Case-Selection Logic

3.2.2. Case-Selection

- (1)

- Case 1—Los Angeles, United States (Aerospace).

- (2)

- Case 2—Munich, Germany (High-End Equipment Manufacturing).

- (3)

- Case 3—London, United Kingdom (Biopharmaceuticals)

- (4)

- Case 4—Tokyo, Japan (Automotive Manufacturing)

3.3. Data Sources and Collection

3.4. Case Analyses and Discussions

3.4.1. Common Practices in Developed Economies

- (1)

- Policy Guidance and Global Industrial Layout

- (2)

- Strengthening Basic Research and Forming Innovation Ecosystems

- (3)

- Cultivating Intermediary Service Platforms for Key Industries

- (4)

- Enhancing Human Capital and Promoting Collaborative Innovation

- (5)

- Driving Economic Restructuring to Support Key Industries

3.4.2. Effectiveness Evaluation of Developed Countries in Establishing Core Positions in Global Supply Chains

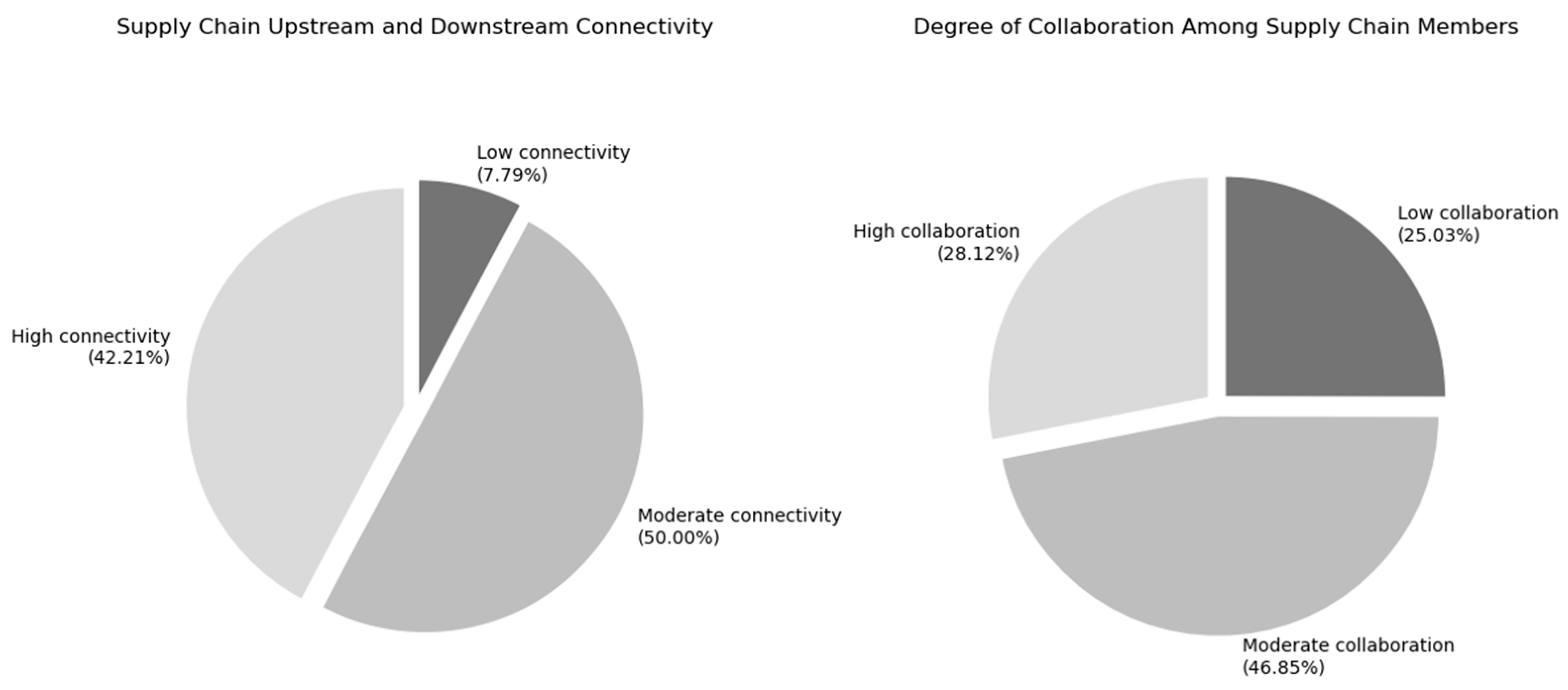

4. Identifying China’s Gaps and Empirical Assessment in Global Supply Chain Core Positioning

4.1. Comparative Analysis of International Benchmarks and Identified Gaps

4.2. Survey-Based Empirical Assessment

5. Evidence-Based Strategic Pathways for Strengthening China’s Position in Global Supply Chains

5.1. Strengthening Core Technological Breakthroughs in Key Industry Supply Chains

5.2. Promoting the Transformation and Upgrading of Key Industries

5.3. Improving Governance Levels of Key Industry Supply Chains

5.4. Enhancing the Resilience of Key Industry Supply Chains

5.5. Promoting the Sustainable Development of Key Industry Supply Chains

6. Conclusions and Limitations

6.1. Key Research Findings

6.2. Limitations and Future Research Directions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Gereffi, G. The Global Economy: Organization, Governance, and Development. In The Handbook of Economic Sociology; Smelser, N.J., Swedberg, R., Eds.; Princeton University Press: Princeton, NJ, USA, 2010; pp. 160–182. [Google Scholar]

- Zhao, S.X.B.; Gong, Z. Post-pandemic De-Globalization? Analysis of Likely Changes in Global Supply Chains In COVID-19 Pandemic, Crisis Responses and the Changing World: Perspectives in Humanities and Social Sciences; Zhao, S.X.B., Wong, J.H.C., Lowe, C., Monaco, E., Corbett, J., Eds.; Springer Nature: Singapore, 2021; pp. 39–56. [Google Scholar] [CrossRef]

- Gereffi, G. Global Value Chains and International Competition. Antitrust Bull. 2011, 56, 37–56. [Google Scholar] [CrossRef]

- Mondliwa, P.; Roberts, S.; Ponte, S. Competition and Power in Global Value Chains. Compet. Change 2021, 25, 328–349. [Google Scholar] [CrossRef]

- Levy, D.L. Political Contestation in Global Production Networks. Acad. Manag. Rev. 2008, 33, 943–963. [Google Scholar] [CrossRef]

- Edler, J.; Blind, K.; Kroll, H.; Schubert, T. Technology Sovereignty as an Emerging Frame for Innovation Policy: Defining Rationales, Ends and Means. Res. Policy 2023, 52, 104765. [Google Scholar] [CrossRef]

- Dallas, M.P.; Ponte, S.; Sturgeon, T.J. Power in Global Value Chains. Rev. Int. Polit. Econ. 2019, 26, 666–694. [Google Scholar] [CrossRef]

- Ghosh, D.; Mehta, P.; Avittathur, B. Supply Chain Capabilities and Competitiveness of High-Tech Manufacturing Start-Ups in India. Benchmarking Int. J. 2019, 28, 1783–1808. [Google Scholar] [CrossRef]

- Fagerberg, J.; Lundvall, B.-Å.; Srholec, M. Global Value Chains, National Innovation Systems and Economic Development. Eur. J. Dev. Res. 2018, 30, 533–556. [Google Scholar] [CrossRef]

- Pietrobelli, C.; Rabellotti, R. Global Value Chains Meet Innovation Systems: Are There Learning Opportunities for Developing Countries? World Dev. 2011, 39, 1261–1269. [Google Scholar] [CrossRef]

- Maher, S.; Aquanno, S.M. The New Finance Capital: Corporate Governance, Financial Power, and the State. Crit. Sociol. 2022, 48, 55–73. [Google Scholar] [CrossRef]

- Szepanski, A. Finance, World Market, and Imperialism. In Capitalism in the Age of Catastrophe: The Newest Developments of Financial Capital in Times of Polycrisis; Szepanski, A., Ed.; Springer Nature: Cham, Switzerland, 2024; pp. 241–271. [Google Scholar] [CrossRef]

- Robinson, W.I. Debate on the New Global Capitalism: Transnational Capitalist Class, Transnational State Apparatuses, and Global Crisis. Int. Crit. Thought 2017, 7, 171–189. [Google Scholar] [CrossRef]

- Zahoor, N.; Wu, J.; Khan, H.; Khan, Z. De-globalization, International Trade Protectionism, and the Reconfigurations of Global Value Chains. Manag. Int. Rev. 2023, 63, 823–859. [Google Scholar] [CrossRef]

- Guarascio, D.; Reljic, J.; Zezza, F. Assessing EU Energy Resilience and Vulnerabilities: Concepts, Empirical Evidence and Policy Strategies; Österreichische Forschungsstiftung für Internationale Entwicklung: Vienna, Austria, 2024; ÖFSE Working Paper, Working Paper 77. [Google Scholar] [CrossRef]

- Ibrahim, H.W.; Zailani, S.; Tan, K.C. A Content Analysis of Global Supply Chain Research. Benchmarking Int. J. 2015, 22, 1429–1462. [Google Scholar] [CrossRef]

- Hofmann, E.; Sternberg, H.; Chen, H.; Pflaum, A.; Prockl, G. Supply Chain Management and Industry 4.0: Conducting Research in The Digital Age. Int. J. Phys. Distrib. Logist. Manag. 2019, 49, 945–955. [Google Scholar] [CrossRef]

- Elisabeth, B.R.; Yilmaz, U. Strengthening Advanced Manufacturing Innovation Ecosystems: The Case of Massachusetts. Technol. Forecast. Soc. Change 2018, 136, 178–191. [Google Scholar] [CrossRef]

- Wiedmer, R.; Griffis, S.E. Structural Characteristics of Complex Supply Chain Networks. J. Bus. Logist. 2021, 42, 264–290. [Google Scholar] [CrossRef]

- Hohenstein, N.-O. Supply Chain Risk Management in the COVID-19 Pandemic: Strategies and Empirical Lessons for Improving Global Logistics Service Providers’ Performance. Int. J. Logist. Manag. 2022, 33, 1336–1365. [Google Scholar] [CrossRef]

- Ivanov, D.; Dolgui, A. Viability of Intertwined Supply Networks: Extending the Supply Chain Resilience Angles Towards Survivability. A Position Paper Motivated By COVID-19 Outbreak. Int. J. Prod. Res. 2020, 58, 2904–2915. [Google Scholar] [CrossRef]

- Cáceres, S.B.; Ear, S. The Geopolitics of China’s Global Resources Quest. Geopolitics 2012, 17, 47–79. [Google Scholar] [CrossRef]

- Zhan, J.X. GVC Transformation and A New Investment Landscape in the 2020s: Driving Forces, Directions, and a Forward-Looking Research and Policy Agenda. J. Int. Bus. Policy 2021, 4, 206–220. [Google Scholar] [CrossRef]

- Irfan, I.; Sumbal, M.S.U.K.; Khurshid, F.; Chan, F.T.S. Toward A Resilient Supply Chain Model: Critical Role of Knowledge Management and Dynamic Capabilities. Ind. Manag. Data Syst. 2022, 122, 1153–1182. [Google Scholar] [CrossRef]

- Zhang, Q.; Du, D.; Xia, Q.; Ding, J. Revealing the Energy Pyramid: Global Energy Dependence Network and National Status Based on Industry Chain. Appl. Energy 2024, 367, 123330. [Google Scholar] [CrossRef]

- Gao, H.; Ren, M.; Shih, T.-Y. Co-evolutions in Global Decoupling: Learning from The Global Semiconductor Industry. Int. Bus. Rev. 2023, 32, 102118. [Google Scholar] [CrossRef]

- Mosbah, S.; Ryerson, M.S. Can US Metropolitan Areas Use Large Commercial Airports as Tools to Bolster Regional Economic Growth? J. Plan. Lit. 2016, 31, 317–333. [Google Scholar] [CrossRef]

- Davies, P.; Sivich, L. Augmented Reality and Other Visualization Technologies for Manufacturing in Boeing. SAE Int. J. Aerosp. 2011, 4, 1133–1139. [Google Scholar] [CrossRef]

- Juan, S.-J.; Li, E.Y.; Hung, W.-H. An Integrated Model of Supply Chain Resilience and Its Impact on Supply Chain Performance Under Disruption. Int. J. Logist. Manag. 2021, 33, 339–364. [Google Scholar] [CrossRef]

- Lopes, N.M.; Aparicio, M.; Neves, F.T. Knowledge Mapping Analysis of Situational Awareness and Aviation: A Bibliometric Study. Int. J. Cogn. Comput. Eng. 2024, 5, 279–296. [Google Scholar] [CrossRef]

- Evans, R.; Karecha, J. Staying on Top: Why is Munich so Resilient and Successful? Eur. Plan. Stud. 2013, 22, 1259–1279. [Google Scholar] [CrossRef]

- Sternberg, R.; Tamásy, C. Munich as Germany’s No. 1 High Technology Region: Empirical Evidence, Theoretical Explanations and the Role of Small Firm/Large Firm Relationships. Reg. Stud. 1999, 33, 367–377. [Google Scholar] [CrossRef]

- Fuerlinger, G.; Fandl, U.; Funke, T. The Role of The State in The Entrepreneurship Ecosystem: Insights from Germany. Triple Helix 2015, 2, 1–26. [Google Scholar] [CrossRef]

- Herzog, S.; Mason, C.; Hruskova, M. The Role of Large Corporations in Entrepreneurial Ecosystems—A Case Study of Munich. Eur. Plan. Stud. 2024, 32, 1295–1317. [Google Scholar] [CrossRef]

- Fabiano, G.; Marcellusi, A.; Favato, G. Public–private contribution to biopharmaceutical discoveries: A bibliometric analysis of biomedical research in UK. Scientometrics 2020, 124, 153–168. [Google Scholar] [CrossRef]

- Gillespie, J.J.; Privitera, G.J.; Gaspero, J. Biopharmaceutical Entrepreneurship, Open Innovation, and the Knowledge Economy. J. Innov. Manag. 2019, 7, 2. [Google Scholar] [CrossRef]

- Florio, M.; Gamba, S. Biomed Europa: After the Coronavirus, A Public Infrastructure to Overcome the Pharmaceutical Oligopoly. Ann. Public Coop. Econ. 2021, 92, 387–409. [Google Scholar] [CrossRef]

- Simonet, D. The New Public Management Theory in the British Health Care System: A Critical Review. Adm. Soc. 2015, 47, 802–826. [Google Scholar] [CrossRef]

- Zhang, R.; Yan, W. The 50-Year Spatial Transition of Suburban Industrial Parks and Impacts on Sustainable Urbanization in The Tokyo Metropolitan Area. Sustain. Cities Soc. 2024, 113, 105679. [Google Scholar] [CrossRef]

- Dzienis, A.M.; McCaleb, A. Digital and Green Transitions and Automotive Industry Reconfiguration: Evidence from Japan and China. J. Contemp. Asia 2024, 55, 1–27. [Google Scholar] [CrossRef]

- Zhang, B.; Yin, X.; Xiong, J.; Yuan, Z. The Evolution of Complex Global Innovation Collaboration Network: A Multilevel Analysis of a CoPS Industry 2001–2020. IEEE Trans. Eng. Manag. 2025, 72, 1039–1051. [Google Scholar] [CrossRef]

- Toma, S.G.; Naruo, S. Total Quality Management and Business Excellence: The Best Practices at Toyota Motor Corporation. Amfiteatru Econ. J. 2017, 19, 566–580. [Google Scholar]

- Yu, Z.; Razzaq, A.; Rehman, A.; Shah, A.; Jameel, K.; Mor, R.S. Disruption in Global Supply Chain and Socio-Economic Shocks: A Lesson From COVID-19 For Sustainable Production and Consumption. Oper. Manag. Res. 2022, 15, 233–248. [Google Scholar] [CrossRef]

- Alka, T.A.; Raman, R.; Suresh, M. Research Trends in Innovation Ecosystem and Circular Economy. Discov. Sustain. 2024, 5, 323. [Google Scholar] [CrossRef]

- Cole, R.; Aitken, J. The Role of Intermediaries in Establishing a Sustainable Supply Chain. J. Purch. Supply Manag. 2020, 26, 100533. [Google Scholar] [CrossRef]

- López, L.V.; Solé, À.P.; Gonzalez-Pujol, I. Diversifying Economic Risks: Japan’s Economic Hedging Toward China. Int. Relat. Asia-Pac. 2024, 24, 315–355. [Google Scholar] [CrossRef]

- Huo, B.; Ye, Y.; Zhao, X.; Shou, Y. The Impact of Human Capital on Supply Chain Integration and Competitive Performance. Int. J. Prod. Econ. 2016, 178, 132–143. [Google Scholar] [CrossRef]

- Jiang, Y.; Gu, J. (Eds.) Industrial Transformation and Reconstruction. In Technology and Industrial Transformation of China; Springer Nature: Singapore, 2023; pp. 93–121. [Google Scholar] [CrossRef]

- Pan, X.; Guo, S.; Chu, J. P2P Supply Chain Financing, R&D Investment and Companies’ Innovation Efficiency. J. Enterp. Inf. Manag. 2021, 34, 578–597. [Google Scholar] [CrossRef]

- Di Giovanni, J.; Kalemli-Özcan, Ṣ.; Silva, A.; Yildirim, M.A. Global Supply Chain Pressures, International Trade, and Inflation; National Bureau of Economic Research: Cambridge, MA, USA, 2022; Working Paper No. w30240. [Google Scholar] [CrossRef]

- Boström, M.; Jönsson, A.M.; Lockie, S.; Mol, A.P.J.; Oosterveer, P. Sustainable and Responsible Supply Chain Governance: Challenges and Opportunities. J. Clean. Prod. 2015, 107, 1–7. [Google Scholar] [CrossRef]

- Ambulkar, S.; Blackhurst, J.; Grawe, S. Firm’s Resilience to Supply Chain Disruptions: Scale Development and Empirical Examination. J. Oper. Manag. 2015, 33–34, 111–122. [Google Scholar] [CrossRef]

- Tian, H.; Lin, J.; Jiang, C. The Impact of Carbon Emission Trading Policies on Enterprises’ Green Technology Innovation—Evidence from Listed Companies in China. Sustainability 2022, 14, 7207. [Google Scholar] [CrossRef]

- Yang, Y.; Wang, B. Stage Identification and Strategy Optimization of Industrial Evolution of China’s Digital Economy Supporting Low-Carbon Effect. Int. J. Low-Carbon Technol. 2023, 18, 295–305. [Google Scholar] [CrossRef]

- Yan, Z.J.; Zámborský, P.; Liang, H. A Sociological View Toward the Economic and Technological Development Zones in China. Chin. Manag. Stud. 2021, 15, 598–612. [Google Scholar] [CrossRef]

- Luo, L.; Liu, X.; Zhao, X.; Flynn, B.B. The Impact of Supply Chain Quality Leadership on Supply Chain Quality Integration and Quality Performance. Supply Chain Manag. Int. J. 2022, 28, 508–521. [Google Scholar] [CrossRef]

- Fang, S.; Qin, Y. Social Identification in Open Innovation Projects: Role of Knowledge Collaboration and Resource Interdependence. Systems 2025, 13, 129. [Google Scholar] [CrossRef]

- Sukegawa, S. ASEAN’s Initiatives for Free Trade in East Asia under AEC. J. Contemp. East Asia Stud. 2021, 10, 42–64. [Google Scholar] [CrossRef]

- Rasiah, R.; Wong, S.H. Industrial Upgrading in The Semiconductor Industry in East Asia. Innov. Dev. 2021, 11, 413–440. [Google Scholar] [CrossRef]

- Verschuur, J.; Koks, E.E.; Hall, J.W. Ports’ Criticality in International Trade and Global Supply-Chains. Nat. Commun. 2022, 13, 4351. [Google Scholar] [CrossRef] [PubMed]

- Hensher, D.A.; Zhang, Z.; Rose, J. Transport and Logistics Challenges for China: Drivers of Growth, and Bottlenecks Constraining Development. Road Transp. Res. 2015, 24, 32–41. Available online: https://search.informit.org/doi/10.3316/informit.560558437747420 (accessed on 5 August 2025).

- Jin, L.; Chen, J.; Chen, Z.; Sun, X.; Yu, B. Impact of COVID-19 on China’s International Liner Shipping Network Based on AIS Data. Transp. Policy 2022, 121, 90–99. [Google Scholar] [CrossRef]

- Hong, J.; Liao, Y.; Zhang, Y.; Yu, Z. The Effect of Supply Chain Quality Management Practices and Capabilities on Operational and Innovation Performance: Evidence from Chinese Manufacturers. Int. J. Prod. Econ. 2019, 212, 227–235. [Google Scholar] [CrossRef]

- Zhang, X.; Fan, X.; He, M. Analysis on The Effects of Global Supply Chain Reconfiguration on China’s High-End Equipment Manufacturing Industry. Int. J. Phys. Distrib. Logist. Manag. 2024, 54, 1–39. [Google Scholar] [CrossRef]

- Makarova, I.; Shubenkova, K.; Mavrin, V.; Mukhametdinov, E.; Boyko, A.; Almetova, Z.; Shepelev, V. Features of Logistic Terminal Complexes Functioning in The Transition to The Circular Economy and Digitalization. In Modelling of the Interaction of the Different Vehicles and Various Transport Modes; Springer: Berlin/Heidelberg, Germany, 2020; pp. 415–527. [Google Scholar] [CrossRef]

- Starkova, O.; Andreichikov, O. Intellectual Capital of IT Companies in The Development Processes of Innovative Technologies and Digital Transformations: Historical and Genetic Analysis. Dev. Manag. 2024, 4, 64–75. [Google Scholar] [CrossRef]

- Shan, Z.; Wang, Y. Strategic Talent Development in The Knowledge Economy: A Comparative Analysis of Global Practices. J. Knowl. Econ. 2024, 15, 1–27. [Google Scholar] [CrossRef]

- Jin, H.; Wang, Z. A Review of Research on the Impact of the Digital Economy on Automotive Supply Chain Resilience. In Digitalization and Management Innovation III; IOS Press: Amsterdam, The Netherlands, 2025; pp. 94–108. [Google Scholar] [CrossRef]

- Danyluk, M. Seizing the Means of Circulation: Choke Points and Logistical Resistance in Coco Solo, Panama. Antipode 2023, 55, 1368–1389. [Google Scholar] [CrossRef]

- Gong, X.; Song, M.; Wang, S.; Jiao, R.J.; Helo, P. Crowdsourced Manufacturing in Industry 4.0: Implications and Prospects. Systems 2025, 13, 183. [Google Scholar] [CrossRef]

- Heng, Q. Navigating China’s Economic Development in The New Era: From High-Speed to High-Quality Growth. China Q. Int. Strateg. Stud. 2018, 4, 177–192. [Google Scholar] [CrossRef]

- Li, L. China’s manufacturing locus in 2025: With a comparison of “Made-in-China 2025” and “Industry 4.0”. Technol. Forecast. Soc. Change 2018, 135, 66–74. [Google Scholar] [CrossRef]

- Wu, W.; Zhang, T.; Xie, X.; Huang, Z. Regional Low Carbon Development Pathways for The Yangtze River Delta Region in China. Energy Policy 2021, 151, 112172. [Google Scholar] [CrossRef]

- Huang, K.; Wang, K.; Lee, P.K.; Yeung, A.C. The Impact of Industry 4.0 On Supply Chain Capability and Supply Chain Resilience: A Dynamic Resource-Based View. Int. J. Prod. Econ. 2023, 262, 108913. [Google Scholar] [CrossRef]

- Hu, M.; Jiang, S.; Song, D.; Han, Q. The Influence of Short-Term Managerial Myopia on Supply Chain Concentration: The Moderating Role of Long-Term Incentives for The Supervisory Board. Transp. Res. Part E Logist. Transp. Rev. 2024, 188, 103610. [Google Scholar] [CrossRef]

- Shan, C.; Ji, X. Environmental Regulation and Green Technology Innovation: An Analysis of the Government Subsidy Policy’s Role in Driving Corporate Green Transformation. Ind. Eng. Innov. Manag. 2024, 7, 39–46. [Google Scholar] [CrossRef]

- Khan, H.U.; Ali, S.; Shah, S.S.A. The Regional Comprehensive Economic Partnership (RCEP): An Analysis of Its Potential Benefits for China. Lib. Arts Soc. Sci. Int. J. 2022, 6, 175–189. [Google Scholar] [CrossRef]

- Al-kfairy, M. Strategic Integration of Generative AI in Organizational Settings: Applications, Challenges and Adoption Requirements. IEEE Eng. Manag. Rev. 2025, 1–14. [Google Scholar] [CrossRef]

- Wang, M.; Wang, Y.; Mardani, A. Empirical Analysis of The Influencing Factors of Knowledge Sharing in Industrial Technology Innovation Strategic Alliances. J. Bus. Res. 2023, 157, 113635. [Google Scholar] [CrossRef]

- Zhu, L.; Luo, J.; Dong, Q.; Zhao, Y.; Wang, Y.; Wang, Y. Green Technology Innovation Efficiency of Energy-Intensive Industries in China from The Perspective of Shared Resources: Dynamic Change and Improvement Path. Technol. Forecast. Soc. Change 2021, 170, 120890. [Google Scholar] [CrossRef]

| Theoretical Lens | Core Tenets | Specific Contribution to This Study |

|---|---|---|

| Institutional Economics | Formal rules (laws, policies) and informal norms (culture, conventions) shape actors’ incentive structures, transaction costs, and cooperative modes. | Explains how heterogeneous institutional architectures condition the formation and governance of supply chain networks and influence the emergence of core-position advantages. |

| GSC/GVC Theory | Production is decomposable into functionally distinct stages dispersed across borders, forming networked chains coordinated by lead firms. | Provides the analytical scaffold for our cross-national case analysis of how key activities (e.g., design, fabrication, logistics, finance) are allocated and upgraded, and how lead firms leverage standards, finance, and data to capture value. |

| National Innovation Systems | Innovation outcomes reflect system-level interactions among firms, universities, government, and intermediary bodies within a specific institutional milieu. | Informs the policy-oriented section: we assess how China’s NIS characteristics enable—or constrain—the translation of global supply-chain opportunities into sustained technological upgrading. |

| Industrial Competitiveness | A nation’s or region’s relative strength in a particular industry arises from factor conditions, firm strategy, demand characteristics, and supporting institutions. | Allows a multi-level (macro–meso–micro) diagnosis of competitiveness sources, linking firm-level capabilities to industry-level performance and national comparative advantage. |

| Evaluation Dimension | System Level | Indicator Level | Code |

|---|---|---|---|

| Global Supply Chain Competitiveness | Supply Chain Technology | Technological autonomy in strategic core domains | A1 |

| Technological catch-up gap with global frontier | A2 | ||

| Level of R&D investment | A3 | ||

| Supply Chain Value | Market penetration at global scale | A4 | |

| Value-added level in the global value chain | A5 | ||

| Global pricing power in supply chain markets | A6 | ||

| Supply Chain Governance | Effectiveness in coordinating upstream and downstream firms | A7 | |

| Participation in setting international standards | A8 | ||

| Extent of international influence | A9 | ||

| Supply Chain Resilience | Diversification of suppliers for key raw materials or components | A10 | |

| Risk of supply chain disruption | A11 | ||

| Revenue vulnerability to supply disruptions | A12 | ||

| Supply Chain Sustainability | Investment in green supply chain development | A13 | |

| Mastery of recycling technologies for key parts or materials | A14 | ||

| Regulatory exposure under global carbon agreements | A15 |

| Evaluation Dimension | Supply Chain Technology | Supply Chain Value | Supply Chain Governance | Supply Chain Resilience | Supply Chain Sustainability |

|---|---|---|---|---|---|

| United States (Los Angeles) | Single-crystal turbine blades withstand 1700 °C, outperforming competitors by one generation | 80% global aircraft engine market share; 54% global civil aircraft market | FAA airworthiness standards adopted by 128 countries | Dual-source supplier system for engines mitigates geopolitical supply risks | Boeing 787 lightweight materials reduce carbon emissions per unit output by 12% |

| Germany (Munich) | 0.5 μm precision in 5-axis machining, 2 μm ahead of global peers | 48% global high-end machine tool market | 85% industrial carbon footprint data integrated into German platforms | Hydrogen-powered smelting ensures laser production during gas supply disruptions | Green hydrogen certification significantly reduces auto sheet carbon footprint |

| United Kingdom (London) | Enhertu targeted breast cancer drug, 40% more effective than chemotherapy | 70% global ADC patent licensing | NICE drug efficacy framework shapes global pricing strategies | Blockchain vaccine cold-chain tracking cuts transport losses by 23% | NHS sustainable procurement achieves 92% packaging recycling rate |

| Japan (Tokyo) | 0.1 μm precision in automotive fuel injection systems | 43% global hybrid vehicle patents; 65% monopoly in high-end fuel injection | CHAdeMO fast-charging protocol covers 30% European public chargers | “3+1” auto parts supplier system counters chip shortages | Supercritical fluid extraction lowers rare earth recycling costs by 67% |

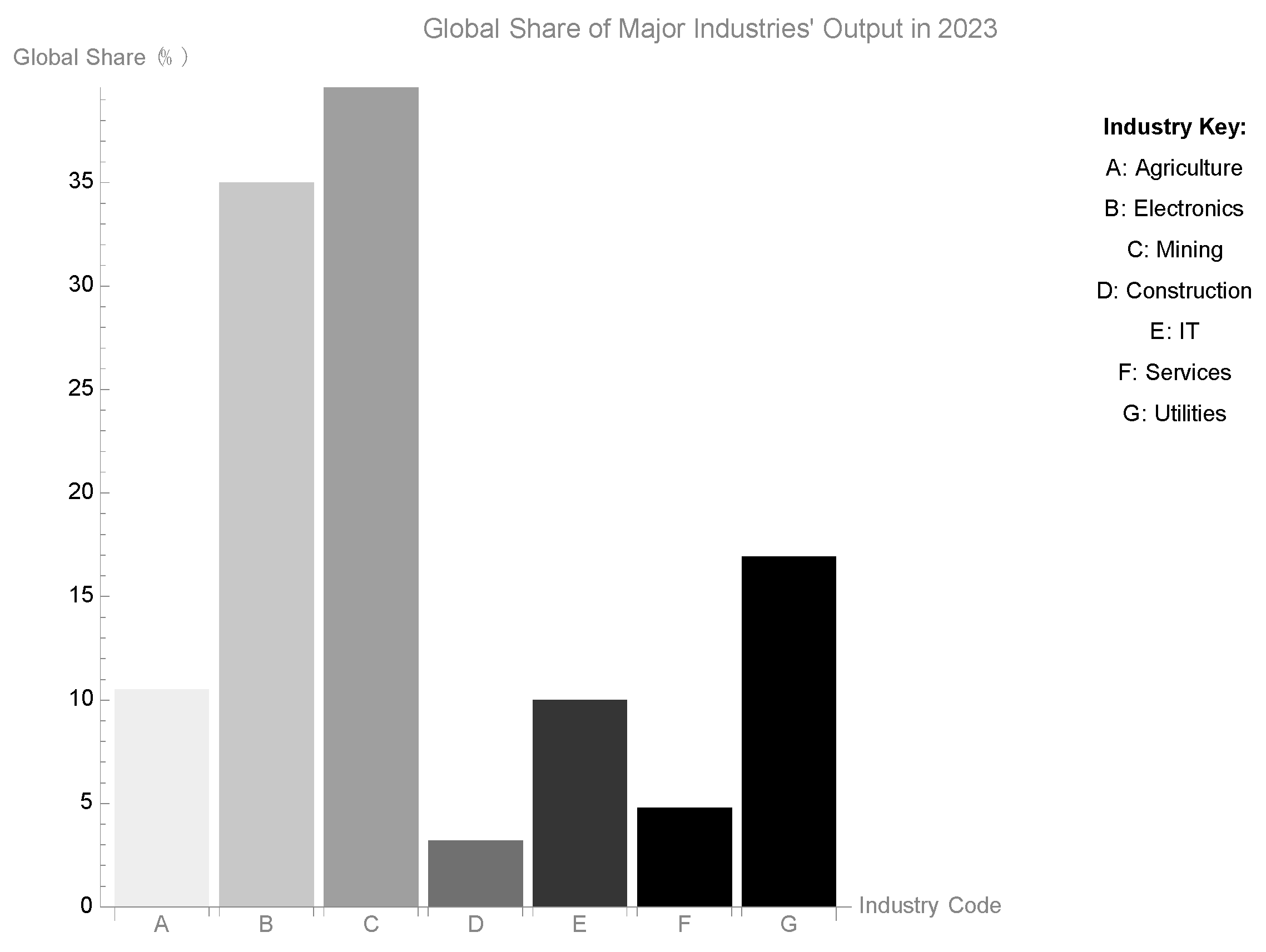

| Industry | Global Output (USD Billion) | Leading Nation | Leading Nation’s Share (%) |

|---|---|---|---|

| IT and Information Services | 1900 | USA | 36.4 |

| Computers & Electronics | 1317 | China | 26.8 |

| Chemicals | 1146 | China | 29.1 |

| Machinery & Equipment | 1135 | China | 32.0 |

| Motor Vehicles | 1093 | China | 24.3 |

| Basic Metals | 976 | China | 45.6 |

| Metal Products | 846 | China | 25.6 |

| Pharmaceuticals | 696 | USA | 28.4 |

| Electrical Equipment | 602 | China | 36.1 |

| Other Transport Equipment | 386 | USA | 34.5 |

| Evaluation Dimension | Supply Chain Technology | Supply Chain Value | Supply Chain Governance | Supply Chain Resilience | Supply Chain Sustainability |

|---|---|---|---|---|---|

| United States (Los Angeles) | R&D intensity 3.46% of GDP (2023) | Aerospace & aviation output 16.9% of global total (2023) | Aerospace & cloud-security standards—highest global adoption rate | Overseas production bases cover 92% of markets; regional hubs in 57 countries | SEC climate-risk disclosures |

| Germany (Munich) | R&D intensity 3.21% | High-end machinery output 26.5% of global total | Machinery safety & Industrie 4.0 norms—global adoption leader | Overseas bases cover 76%; hubs in 29 countries | EU CSRD compliance |

| United Kingdom (London) | R&D intensity 2.93% | Biopharma output 13% of global total | Biopharma & financial-services standards—global adoption leader | Overseas bases cover 51%; hubs in 17 countries | ISSB standards |

| Japan (Tokyo) | R&D intensity 3.59% | Automotive output 21.8% of global total | Semiconductor-materials & machinery standards—global adoption leader | Overseas bases cover 89%; hubs in 41 countries | TCFD framework |

| China | R&D intensity 2.64% | ICT output 12.4%; clean-energy equipment 35% of global total (2023) | 5G and high-speed-rail standards—regional adoption leader | Overseas bases cover 68%; hubs in 32 countries | Enterprise GHG Accounting Guidelines |

| Component | Code | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|---|

| Supply Chain Technology | A1 | 0.105 | 0.927 | 0.021 | 0.077 | 0.105 |

| A2 | 0.211 | 0.855 | 0.139 | 0.164 | 0.163 | |

| A3 | 0.187 | 0.912 | 0.053 | 0.085 | 0.123 | |

| Supply Chain Value | A4 | 0.904 | 0.16 | 0.031 | 0.155 | 0.112 |

| A5 | 0.925 | 0.151 | 0.011 | 0.078 | 0.087 | |

| A6 | 0.914 | 0.171 | 0.029 | 0.106 | 0.138 | |

| Supply Chain Governance | A7 | 0.251 | 0.214 | 0.043 | 0.04 | 0.708 |

| A8 | 0.046 | 0.03 | −0.065 | 0.14 | 0.891 | |

| A9 | 0.054 | 0.139 | −0.001 | 0.197 | 0.867 | |

| Supply Chain Resilience | A10 | 0.068 | 0.042 | −0.083 | 0.87 | 0.121 |

| A11 | 0.097 | 0.126 | 0.05 | 0.912 | 0.115 | |

| A12 | 0.166 | 0.139 | 0.121 | 0.871 | 0.147 | |

| Supply Chain Sustainability | A13 | 0.029 | 0.11 | 0.857 | 0.005 | −0.044 |

| A14 | 0.023 | 0.045 | 0.926 | 0.035 | 0.019 | |

| A15 | 0.013 | 0.021 | 0.923 | 0.028 | 0.000 |

| Component | Code | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|---|

| Supply Chain Technology | A1 | −0.089 | 0.419 | −0.046 | −0.036 | −0.053 |

| A2 | −0.042 | 0.352 | 0.006 | −0.007 | −0.029 | |

| A3 | −0.052 | 0.396 | −0.032 | −0.04 | −0.047 | |

| Supply Chain Value | A4 | 0.371 | −0.065 | −0.005 | −0.011 | −0.039 |

| A5 | 0.388 | −0.064 | −0.013 | −0.045 | −0.045 | |

| A6 | 0.375 | −0.061 | −0.005 | −0.039 | −0.02 | |

| Supply Chain Governance | A7 | 0.03 | −0.007 | 0.022 | −0.097 | 0.349 |

| A8 | −0.058 | −0.087 | −0.006 | −0.045 | 0.47 | |

| A9 | −0.071 | −0.04 | 0.012 | −0.023 | 0.439 | |

| Supply Chain Resilience | A10 | −0.042 | −0.045 | −0.05 | 0.391 | −0.05 |

| A11 | −0.043 | −0.018 | −0.001 | 0.403 | −0.065 | |

| A12 | −0.014 | −0.027 | 0.028 | 0.373 | −0.047 | |

| Supply Chain Sustainability | A13 | −0.007 | 0.003 | 0.344 | −0.016 | −0.014 |

| A14 | −0.009 | −0.04 | 0.378 | −0.007 | 0.026 | |

| A15 | −0.008 | −0.048 | 0.378 | −0.006 | 0.02 |

| Global Supply Chain Competitiveness | System Level | Delphi-Based Weighting | Indicator Code | Score |

|---|---|---|---|---|

| 61.094 | Supply Chain Technology | 60.813 | A1 | 60.175 |

| A2 | 60.523 | |||

| A3 | 60.691 | |||

| Supply Chain Value | 61.665 | A4 | 59.664 | |

| A5 | 59.663 | |||

| A6 | 59.665 | |||

| Supply Chain Governance | 69.871 | A7 | 65.005 | |

| A8 | 72.241 | |||

| A9 | 71.212 | |||

| Supply Chain Resilience | 60.809 | A10 | 66.553 | |

| A11 | 59.662 | |||

| A12 | 59.664 | |||

| Supply Chain Sustainability | 47.402 | A13 | 47.763 | |

| A14 | 46.383 | |||

| A15 | 48.105 |

| Rank | Imported Goods | Import Value | Exported Goods | Export Value |

|---|---|---|---|---|

| 1 | Agricultural Products | 164,488,317 | Mechanical & Electrical Products | 1,391,958,950 |

| 2 | Mechanical & Electrical | 653,630,947 | High-Tech Products | 592,789,130 |

| 3 | High-Tech Products | 479,161,857 | Apparel & Accessories | 112,062,133 |

| 4 | Crude Oil | 237,327,190 | Cultural Products | 101,958,352 |

| 5 | Metal Ores | 167,206,006 | Textile Yarns & Fabrics | 94,540,911 |

| 6 | Foodstuffs | 146,298,459 | Plastic Products | 70,895,770 |

| 7 | Natural Gas | 45,226,348 | Agricultural Products | 69,586,095 |

| 8 | Coal | 37,230,469 | Steel Products | 59,291,326 |

| 9 | Medicinal Materials | 36,426,196 | Foodstuffs | 53,823,893 |

| 10 | Unwrought Copper | 33,562,176 | Furniture | 45,170,967 |

| Rank | Commodity | Import Value | YoY Import Growth (%) | Export Value | YoY Export Growth (%) |

|---|---|---|---|---|---|

| 1 | High-Tech Products | 479,161,857 | −5.2 | 592,789,130 | −5.8 |

| 2 | Electric Vehicles | 5,726,466 | +12.3 | 29,464,912 | +80.2 |

| 3 | Automobiles (Incl. Chassis) | 33,212,587 | −5.8 | 71,651,109 | +76.8 |

| 4 | Auto Parts | 19,351,014 | −6.7 | 61,658,646 | +14.9 |

| 5 | Integrated Circuits | 245,906,784 | −10.6 | 95,677,067 | −5.0 |

| 6 | Aircraft | 5,783,741 | +10.0 | 3,325,306 | +76.7 |

| 7 | Ships | 317,627 | −53.4 | 19,444,580 | +35.4 |

| 8 | Agricultural Products | 164,488,317 | +5.0 | 69,586,095 | +6.3 |

| 9 | Refined Oil | 19,651,721 | +50.0 | 34,000,866 | +5.4 |

| 10 | Medicinal Materials | 36,426,196 | +13.2 | 16,373,878 | −31.1 |

| 11 | Medical Instruments | 9,695,601 | +0.9 | 12,956,803 | +2.4 |

| 12 | Steel Products | 8,912,459 | −21.5 | 59,291,326 | −3.4 |

| Evaluation Dimension | Supply Chain Technology | Supply Chain Value | Supply Chain Governance | Supply Chain Resilience | Supply Chain Sustainability |

|---|---|---|---|---|---|

| Other Countries’ Strategies |

|

|

|

|

|

| China’s Gaps |

|

|

|

|

|

| Improvement Pathways |

|

|

|

|

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Luo, J.; Li, T. Pathways for China’s Key Industries to Secure Core Positions in Global Supply Chains: A Comparative and Empirical Study. Systems 2025, 13, 758. https://doi.org/10.3390/systems13090758

Luo J, Li T. Pathways for China’s Key Industries to Secure Core Positions in Global Supply Chains: A Comparative and Empirical Study. Systems. 2025; 13(9):758. https://doi.org/10.3390/systems13090758

Chicago/Turabian StyleLuo, Jianwen, and Tiantian Li. 2025. "Pathways for China’s Key Industries to Secure Core Positions in Global Supply Chains: A Comparative and Empirical Study" Systems 13, no. 9: 758. https://doi.org/10.3390/systems13090758

APA StyleLuo, J., & Li, T. (2025). Pathways for China’s Key Industries to Secure Core Positions in Global Supply Chains: A Comparative and Empirical Study. Systems, 13(9), 758. https://doi.org/10.3390/systems13090758