The Alignment Between Digital Servitization Strategies and Digital Servitization Capabilities in Chinese Manufacturing Enterprises: A Multi-Case Study

Abstract

1. Introduction

2. Literature Review

2.1. Digital Servitization Capabilities (DSCs)

2.2. Digital Servitization Strategy (DS Strategy)

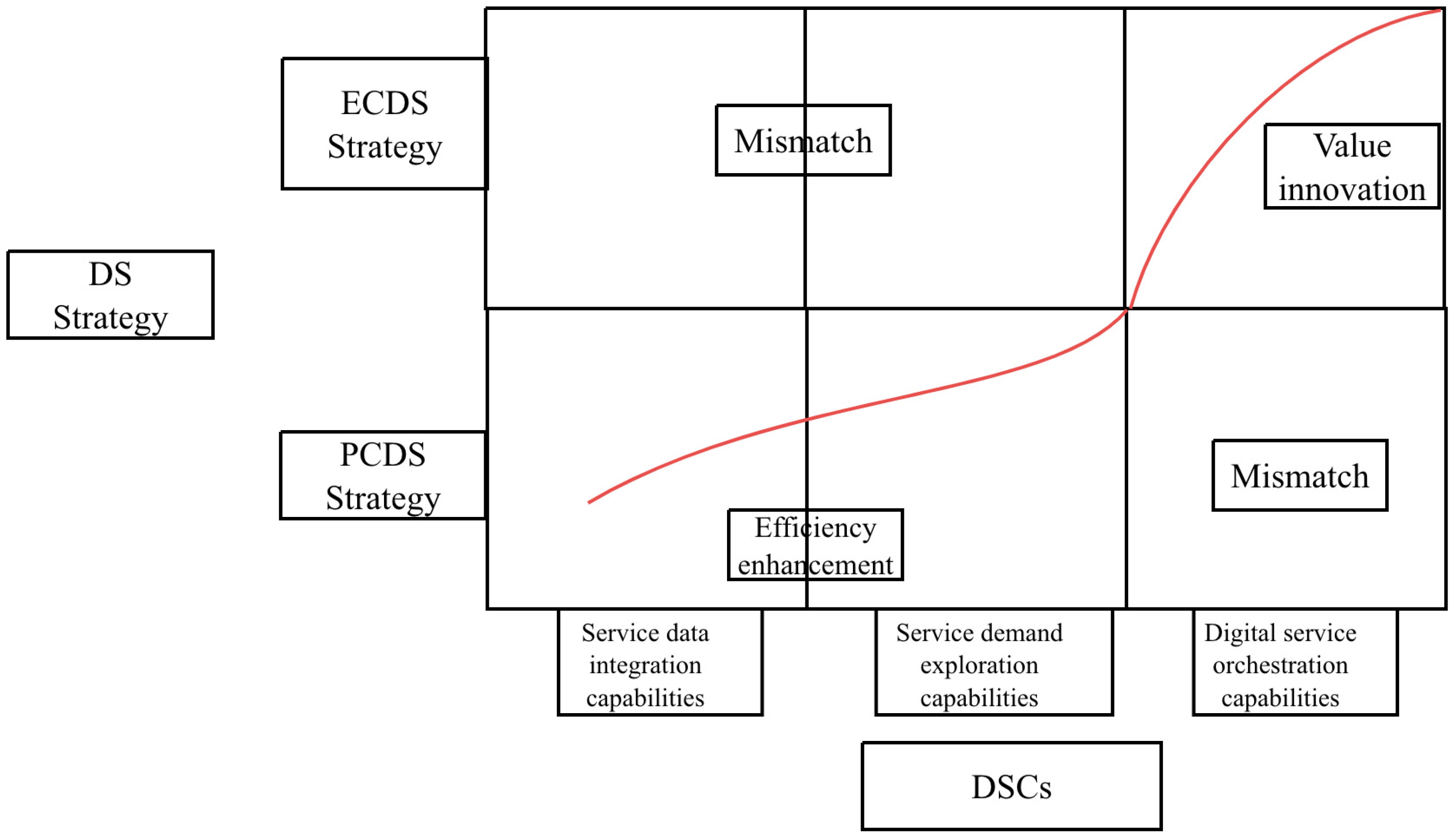

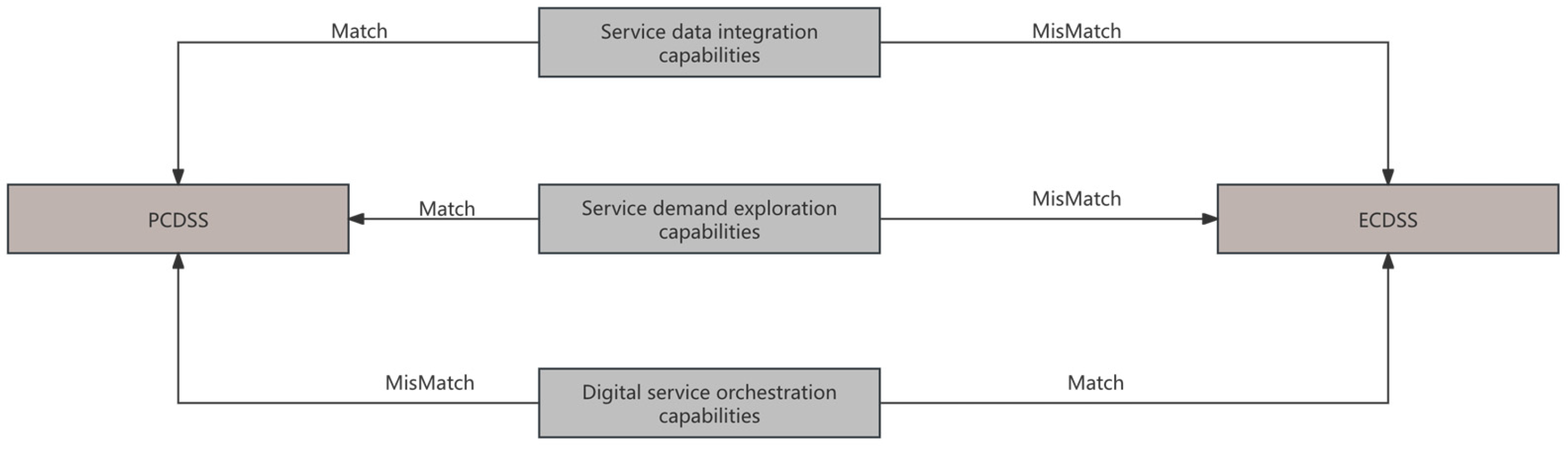

2.3. DS Strategy and DSCs

2.4. Theoretical Dialogue

- (1)

- The Dynamic Capability Stream

- (2)

- The Strategic Fit Stream

- (3)

- The Service-Dominant Logic Stream

3. Methods

3.1. Method Selection

3.2. Case Selection

3.3. Measurement of Variables

3.3.1. DSCs

3.3.2. DS Strategy

3.3.3. Performance

3.4. Data Collection

3.4.1. The Design Logic of the Interview Outline

3.4.2. Principles and Screening Criteria for Data Collection

3.5. Data Analysis

4. Case Analysis and Major Findings

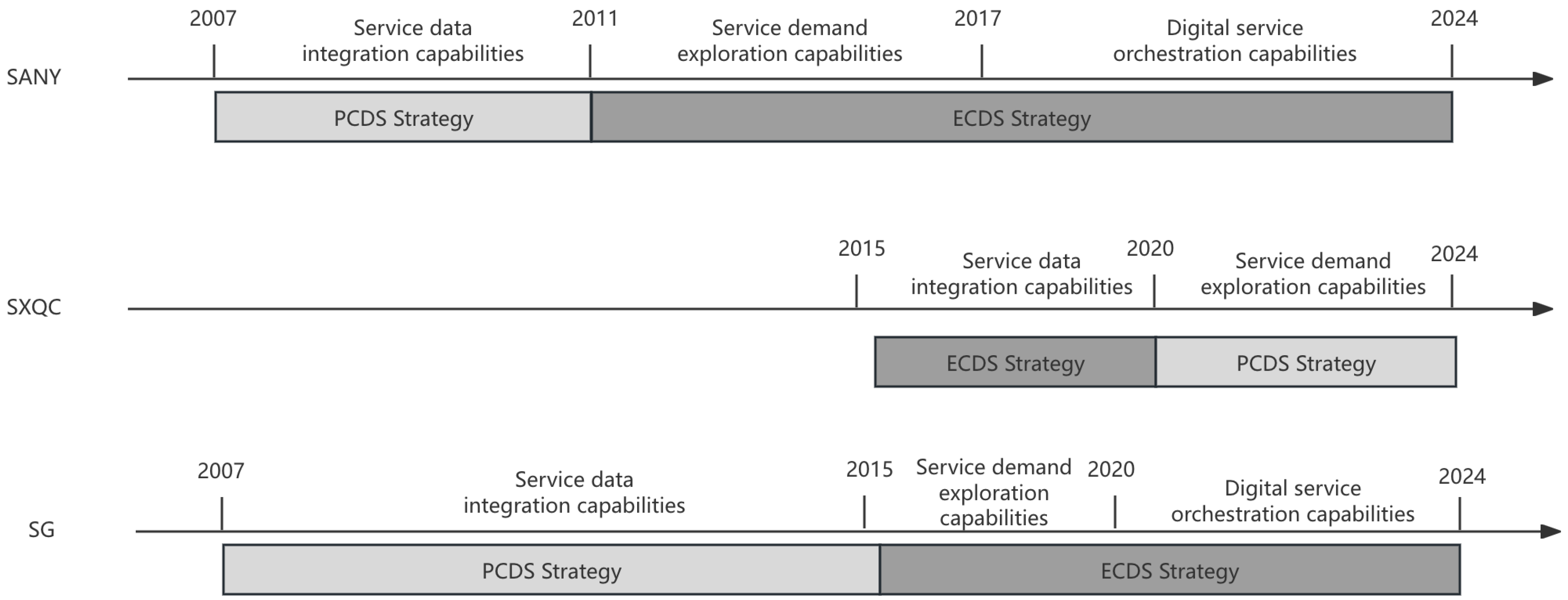

4.1. Intra-Case Analysis and Findings

4.1.1. DSCs of Case Enterprises

4.1.2. DS Strategy of Case Enterprises

4.1.3. Performance of Case Enterprises

4.2. Inter-Case Analysis and Findings

4.2.1. The Alignment Between DSCs and the PCDS Strategy

- (1)

- SANY’s “Service data integration capability + PCDS Strategy” (2007–2011)

- (2)

- SG’s “Service data integration capability + PCDS Strategy” (2007–2015)

- (3)

- SG’s “Service demand exploration capabilities + PCDS Strategy” (2016–2018)

- (4)

- SXQC’s “ Service demand exploration capabilities + PCDS Strategy” (2021–2024)

- (5)

- Digital service orchestration capabilities + PCDS strategy

4.2.2. DSCs and the ECDS Strategy

- (1)

- SXQC’s “Service data integration capability + ECDS Strategy” (2012–2020)

- (2)

- SANY’s “Service demand exploration capabilities+ ECDS Strategy” (2012–2017)

- (3)

- SXQC “Service demand exploration capabilities + ECDS Strategy” (2021–2022)

- (4)

- SANY’s “Digital service orchestration capability + ECDS Strategy” (2018–2024)

- (5)

- SG’s “Digital service orchestration capability + ECDS Strategy” (2019–2024)

5. Discussion

6. Conclusions

7. Implications

8. Research Limitations and Future Prospects

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Yu, P.; Gao, M. Research on Dynamic Evolution Mechanism of Manufacturing Servitization—Based on the Perspective of Innovation Strategy. Systems 2024, 12, 225. [Google Scholar] [CrossRef]

- Giancamilli, G.; Generosi, A.; Agostinelli, T.; Mazzuto, G.; Mengoni, M. Methodological Framework to Define Connected Machines’ Specifications for Smart Factories. In Proceedings of the International Conference of the Italian Association of Design Methods and Tools for Industrial Engineering, Palermo, Italy, 11–13 September 2024. [Google Scholar]

- Zhou, G. Has artificial intelligence promoted manufacturing servitization: Evidence from chinese enterprises. Sustainability 2024, 16, 2526. [Google Scholar] [CrossRef]

- Ohtamäki, M.; Parida, V.; Oghazi, P.; Gebauer, H.; Baines, T. Digital servitization business models in ecosystems: A theory of the firm. J. Bus. Res. 2019, 104, 380–392. [Google Scholar] [CrossRef]

- Momeni, K.; Raddats, C.; Martinsuo, M. Mechanisms for developing operational capabilities in digital servitization. Int. J. Oper. Prod. Manag. 2023, 43, 101–127. [Google Scholar] [CrossRef]

- Chirumalla, K.; Leoni, L.; Oghazi, P. Moving from servitization to digital servitization: Identifying the required dynamic capabilities and related microfoundations to facilitate the transition. J. Bus. Res. 2023, 158, 113668. [Google Scholar] [CrossRef]

- Chen, L.; Dai, Y.; Ren, F.; Dong, X. Data-driven digital capabilities enable servitization strategy—From service supporting the product to service supporting the client. Technol. Forecast. Soc. Change 2023, 197, 122901. [Google Scholar] [CrossRef]

- Zhou, D.; Yan, T.; Dai, W.; Feng, J. Disentangling the interactions within and between servitization and digitalization strategies: A service-dominant logic. Int. J. Prod. Econ. 2021, 238, 108175. [Google Scholar] [CrossRef]

- Cimini, C.; Adrodegari, F.; Paschou, T.; Rondini, A.; Pezzotta, G. Digital servitization and competence development: A case-study research. CIRP J. Manuf. Sci. 2021, 32, 447–460. [Google Scholar] [CrossRef]

- Chen, Y.; Visnjic, I.; Parida, V.; Zhang, Z. On the road to digital servitization–The (dis) continuous interplay between business model and digital technology. Int. J. Oper. Prod. Manag. 2021, 41, 694–722. [Google Scholar] [CrossRef]

- Coreynen, W.; Matthyssens, P.; Vanderstraeten, J.; van Witteloostuijn, A. Unravelling the internal and external drivers of digital servitization: A dynamic capabilities and contingency perspective on firm strategy. Ind. Mark. Manag. 2020, 89, 265–277. [Google Scholar] [CrossRef]

- Neuhüttler, J.; Feike, M.; Kutz, J.; Blümel, C.; Bienzeisler, B. Digital factory transformation from a servitization perspective: Fields of action for developing internal smart services. Sci 2023, 5, 22. [Google Scholar] [CrossRef]

- Jia, Y.; Cui, L.; Su, J.; Wu, L.; Akter, S.; Kumar, A. Digital servitization in digital enterprise: Leveraging digital platform capabilities to unlock data value. Int. J. Prod. Econ. 2024, 278, 109434. [Google Scholar] [CrossRef]

- Ruffoni, E.P.; Reichert, F.M. Exploring configurations of digital servitization capabilities for value creation: An fsQCA approach. Ind. Mark. Manag. 2024, 122, 131–144. [Google Scholar] [CrossRef]

- Marcon, É.; Marcon, A.; Ayala, N.F.; Frank, A.G.; Story, V.; Burton, J.; Raddats, C.; Zolkiewski, J. Capabilities supporting digital servitization: A multi-actor perspective. Ind. Mark. Manag. 2022, 103, 97–116. [Google Scholar] [CrossRef]

- Marelli, A.; Sbarba, A.D.; Goretzki, L. Insights on the role of performance measurement systems in the digital servitization landscape: A longitudinal case study. Qual. Res. Account. Manag. 2024, 22, 286–320. [Google Scholar] [CrossRef]

- Fang, K.; Wu, X.; Zhang, W.; Lei, L. Unfolding the resource configuration and interaction in digital servitization: An exploratory two-stage research design. Int. J. Oper. Prod. Manag. 2025, 45, 594–627. [Google Scholar] [CrossRef]

- Lerch, C.; Gotsch, M.J.R.-T.M. Digitalized Product-Service Systems in Manufacturing Firms: A Case Study Analysis. Res.-Technol. Manag. 2015, 58, 45–52. [Google Scholar] [CrossRef]

- Coreynen, W.; Matthyssens, P.; Van Bockhaven, W. Boosting servitization through digitization: Pathways and dynamic resource configurations for manufacturers. Ind. Mark. Manag. 2017, 60, 42–53. [Google Scholar] [CrossRef]

- Frank, A.G.; Mendes, G.H.; Ayala, N.F.; Ghezzi, A. Servitization and Industry 4.0 convergence in the digital transformation of product firms: A business model innovation perspective. Technol. Forecast. Soc. Change 2019, 141, 341–351. [Google Scholar] [CrossRef]

- Kohtamäki, M.; Rabetino, R.; Parida, V.; Sjödin, D.; Henneberg, S. Managing Digital Servitization Toward Smart Solutions: Framing the Connections Between Technologies, Business Models, and Ecosystems; Elsevier: Amsterdam, The Netherlands, 2022; pp. 253–267. [Google Scholar]

- Xie, J.; Ma, L.; Li, J. Servitization, digitalization or hand in hand: A study on the sustainable development path of manufacturing enterprises. Sustainability 2023, 15, 10644. [Google Scholar] [CrossRef]

- Kolagar, M.; Environment, T. Orchestrating the ecosystem for data-driven digital services and solutions: A multi-level framework for the realization of sustainable industry. Bus. Strategy Environ. 2024, 33, 6984–7005. [Google Scholar] [CrossRef]

- Münch, C.; Marx, E.; Benz, L.; Hartmann, E.; Matzner, M. Capabilities of digital servitization: Evidence from the socio-technical systems theory. Technol. Forecast. Soc. Change 2022, 176, 121361. [Google Scholar] [CrossRef]

- Ayala, N.F.; da Silva, J.R.; Tinoco, M.A.C.; Saccani, N.; Frank, A.G. Artificial Intelligence Capabilities in Digital Servitization: Identifying Digital Opportunities for Different Service Types. Int. J. Prod. Econ. 2025, 284, 109604. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Sklyar, A.; Kowalkowski, C.; Tronvoll, B.; Sörhammar, D. Organizing for digital servitization: A service ecosystem perspective. J. Bus. Res. 2019, 104, 450–460. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Building Theories from Case Study Research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods; Sage: Newcastle upon Tyne, UK, 2009. [Google Scholar]

- Ardolino, M.; Rapaccini, M.; Saccani, N.; Gaiardelli, P.; Crespi, G.; Ruggeri, C. The role of digital technologies for the service transformation of industrial companies. Int. J. Prod. Res. 2018, 56, 2116–2132. [Google Scholar] [CrossRef]

- Mccracken, G.; Mccracken, G.D. The Long Interview; Sage: Newcastle upon Tyne, UK, 1988. [Google Scholar]

- Yin, R.K. Case Study Research: Design and methods; Sage: Thousand Oaks, CA, USA, 2013; Volume 14, pp. 69–71. [Google Scholar]

- Miles, M.B.; Huberman, A.M. Drawing Valid Meaning from Qualitative Data: Toward a Shared Craft. Educ. Res. 1984, 13, 20–30. [Google Scholar] [CrossRef]

- Bary, G. Analysis of chaos-coherence peculiarities within the chaotic phenomena of fluid at finite temperature. Solitons Fractals 2022, 164, 112572. [Google Scholar] [CrossRef]

- Jovanovic, V.; Stevanov, B.; Šešlija, D.; Dudić, S.; Tešić, Z. Energy efficiency optimization of air supply system in a water bottle manufacturing system. J. Clean. Prod. 2014, 85, 306–317. [Google Scholar] [CrossRef]

- Allmendinger, G.; Lombreglia, R. Four strategies for the age of smart services. Harv. Bus. Rev. 2005, 83, 131. [Google Scholar]

- Chen, D.; Wang, S. Digital transformation, innovation capabilities, and servitization as drivers of ESG performance in manufacturing SMEs. Sci. Rep. 2024, 14, 24516. [Google Scholar] [CrossRef]

- Rapaccini, M.; Paiola, M.; Cinquini, L.; Giannetti, R. Digital servitization journey in small- and medium-sized enterprises: The contribution of knowledge-intensive business firms. J. Bus. Ind. Mark. 2023, 38, 1362–1375. [Google Scholar] [CrossRef]

- Sui, X.; Hu, H.; Wang, R. The impact of digital transformation on the servitization transformation of manufacturing firms. Res. Int. Bus. Financ. 2025, 73, 102588. [Google Scholar] [CrossRef]

| Method | Applicable Scenarios | The Adaptability Defect of This Research |

|---|---|---|

| Large-scale sample analysis | Verify the static relationships in mature theories | The construct is not yet mature, and the scale is missing |

| Single-case analysis | Deeply deconstruct complex phenomena | Lack of comparative verification among cases |

| QCA | Analyze multiple concurrent causal relationships | The microscopic action mechanism is difficult to analyze and exhibits issues when matching relationships |

| Multiple-case studies | The questions of “how” and the “mechanism” |

| Case Study | SANY | SXQC | SG |

|---|---|---|---|

| Establishment time | 1994 | 1968 | 1999 |

| Industry affiliation | Construction machinery | Automobile manufacturing | Energy equipment |

| Main business | Concrete machinery, excavation machinery, lifting machinery, and other mechanical products | Integrated vehicle manufacturing, special-purpose vehicle production, automotive parts and components manufacturing, and after-market services | Energy conversion equipment, industrial services, and energy infrastructure operations |

| Starting time of DS | 2007 | 2012 | 2007 |

| Variables | Measurement | Feature Representation |

|---|---|---|

| DS strategy | PCDS strategy | Digital technology embedded in products and value-added services |

| ECDS strategy | Cross-enterprise data sharing and platform-based services | |

| DSCs | Service data integration capability | Data collection, interconnection, and interoperability |

| Service demand exploration capability | Data analysis and precise insights | |

| Digital service orchestration capability | Service network reconfiguration and value co-creation | |

| Performance | The financial performance and market performance of enterprises | Operating revenue, profit growth rate, the proportion of labor costs, administrative expenses, selling expenses, awards and honors obtained, industry influence, etc. |

| Source | Enterprise | Interviewee | Time | Duration | Approach | Screening Criteria | Triangular Verification Method |

|---|---|---|---|---|---|---|---|

| Interview | SANY | General Manager of the Digitalization Department, Secretary to the General Manager | April 2020 | 70 min | Face to face | Managers or key personnel in critical departments with at least 5 years of working experience | Interview recording → transcription of text → confirmation by interviewee → cross-checking with annual report |

| Deputy Minister of Strategic Management and R&D Director | August 2024 | 80 min | Face to face | ||||

| Deputy General Manager of the Digitalization Department and Chief Engineer of the System Solutions Department | April 2020–October 2020 | Three sessions totaling 3 h | Tencent meeting | ||||

| SXQC | The head of the Enterprise Management Department and the technical backbone of the Digitalization Department | August 2021 | 90 min | Face to face | |||

| The head of the Strategic Management Department and key employees | June 2024 | 70 min | Face to face | ||||

| Key business personnel of the Marketing Department | September 2024 | 70 min | Face to face | ||||

| Technical backbone of the Digitalization Department and employees of the Strategic Management Department | November 2022–April 2023 | Three sessions of 2.5 h each | Tencent meeting | ||||

| SG | Chairman of the enterprise | November 2020 | 90 min | Face to face | |||

| Minister of the System Solutions Department | October 2023 | 90 min | Face to face | ||||

| The head of the Strategic Management Department, the head of the Enterprise Management Department, and two department employees | December 2023 | 150 min | Face to face | ||||

| Office Director and Key Member of the System Solutions Department | March 2024–June 2024 | 210 min | Tencent meeting, telephone | ||||

| Archival materials | SANY, SXQC, and SG | Official media channels such as the enterprise’s official website and official WeChat and Weibo accounts; news reports, newspapers, and magazines; conference PPTs; etc. | The growth rate of the case enterprise’s operating income/profit, digital service-oriented investment, and related reports on the case enterprise’s digital service-oriented transformation | Official channel release | Annual report data ←→ interviews ←→ third-party reports | ||

| Literature and materials | SANY, SXQC, and SG | 27 journal papers have been published in the past five years | Literature on the implementation of digital service-oriented strategies and the construction of digital service capabilities in case enterprises | CSSCI, SCI, and SSCI journals; published within five years | Literature ←→ interviews ←→ annual report data | ||

| Enterprise | Digital Servitization Capabilities | Specific Approaches | Representative Evidence |

|---|---|---|---|

| SANY | Service data integration capabilities (2007–2011) | It is imperative to strive to break through the internal data silos of enterprises by means of technological approaches. | Deploy production equipment, logistics equipment, etc., for integration with the Internet of Things platform, enabling real-time data acquisition and transmission. Establish a preliminary data hub. Facilitate the substitution of labor with machines and simultaneously monitor the status of equipment via sensors. |

| Service demand exploration capability (2012–2017) | Optimize business processes by conducting in-depth data analysis and obtaining profound customer insights. Transition from a passive stance of merely responding to customer demands to an active approach of proactively uncovering customers’ latent needs. | Utilize tools, including the “Customer Cloud” APP v8.1.3 and CRM v1.0 system, to gather customer usage data. Integrate machine learning techniques to construct a “digital profile” of customers, thereby accurately discerning personalized requirements. Introduce scenario-specific solutions, such as “Ecological Smart Wind Power” and “Smart Mines”. This extends customer demands from the procurement of single equipment to comprehensive life-cycle management. | |

| Digital service orchestration capability (2018–2024) | The digital platform collaborates in harmony with the ecosystem to enable the online and intelligent delivery of services across the entire value chain, thereby endowing the external industrial chain with enhanced capabilities. | Through the RootCloud v1.0 platform, the real-time operating status of equipment across the globe is monitored. As a result, the fault repair rate has witnessed a 50% increase. By leveraging the open capabilities of the platform, upstream and downstream enterprises are empowered. For example, in collaboration with Shugen Internet, digital service capabilities are disseminated to industries, including environmental protection and logistics, thus giving rise to a cross-domain service ecosystem. | |

| SXQC | Service data integration capabilities (2015–2020) | Centering on data integration and the enhancement of internal efficiency, the realization of data interconnection is achieved via technical tools. | By virtue of Internet of Things (IoT) technologies, the interconnection of production equipment is accomplished. Subsequently, a data hub platform is established to integrate data from various aspects such as production, quality, and logistics. Through the vehicle networking system, data regarding vehicle operations is gathered, which provides the necessary data foundation for remote fault diagnosis and the supply of spare parts. |

| Service demand exploration capability (2021–2024) | Centering on precise customer-demand-driven services, service content is optimized through data analysis. | It is feasible to analyze customers’ operational data via the “Tianxingjian v3.2.8” Vehicle Networking Platform, offering suggestions for optimizing fuel consumption and vehicle health management services. This platform supports the early warning of malfunctions and the optimization of customers’ operations. By means of the management cockpit, the full cycle of orders can be monitored in real time to unearth the collaborative value of the supply chain. | |

| SG | Service data integration capabilities (2007–2015) | The interconnection of equipment and the interoperability of data are realized. Through technical measures, the data silos within enterprises are eliminated. | By integrating resources via the industrial Internet, a Turbine Equipment MRO v1.0(SG, Xi’an, China) management system oriented towards the full life cycle of equipment was constructed. This system enables the monitoring of equipment status and the diagnosis of faults. Through the integration of data via research and development, production, and the supply chain by means of systems such as ERP and CRM, a data hub platform was preliminarily established to support cross-departmental collaboration. |

| Service demand exploration capability (2016–2018) | Shift from a “product-centric” approach to a “customer-centric” approach. | The remote monitoring and diagnostic platform encompasses 1200 pieces of equipment globally. By collecting customers’ usage data and integrating machine learning techniques, a “digital profile” of customers is constructed to accurately identify personalized requirements. The “Distributed Energy System Solution” and the “Energy Interconnected Island” technology were introduced to integrate energy systems, such as cooling, heating, electricity, and water. | |

| Digital service orchestration capability (2019–2024) | The industrial chain is empowered through models such as supply-chain finance and intelligent logistics. For example, the Lianyide Supply Chain Company was established to integrate the trading of bulk commodities and financial services. | The industrial Internet platform for intelligent operation and maintenance of equipment in the process industry was completed. It encompasses 300 users and more than 1200 core pieces of equipment. Leveraging the online services of this platform, the company has acquired the capacity to offer users systematic services, including monitoring and diagnosis, condition assessment, and inspection and maintenance guidance. |

| Enterprise | DS Strategy | Concrete Approaches | Exemplary Evidence |

|---|---|---|---|

| SANY | PCDS strategy (2008–2011) | Leverage digital technologies to elevate the intelligence quotient of products. | Opt to provide remote operation and maintenance services, including remote fault diagnosis and predictive maintenance, centered around the product. For example, the “Customer Cloud” APP v8.1.3 is offered to enable one-click service solicitation. The enterprise’s back-end system can rapidly pinpoint issues through data analysis. |

| ECDS strategy (2012–2024) | Transcend the boundaries of single-product offerings and integrate industrial chain resources to formulate comprehensive solutions. | The Board of Directors set the establishment of an intelligent industrial chain cluster ecosystem as its goal, and they developed digital products, including the “Genyun Platform” and the “Yiweixun v17.2.3.1” APP, to enable the construction and operation of the industrial chain service platform. | |

| SXQC | ECDS strategy (2015–2022) | Through the integration of resources in a platform-based and scenario-specific manner, an ecologically closed “technology + service + data” loop is established. | Formulate an integrated solution model encompassing “Internet of Vehicles + Finance + Aftermarket”. Conduct an in-depth analysis of vehicle usage data to optimize product performance. Place emphasis on the management of ecological partners. Collaborate with upstream and downstream enterprises such as FAST and HANDE Axle to jointly explore international markets, thereby establishing an industrial ecosystem featuring “R&D + manufacturing + service”. This approach is designed to stimulate collaborative innovation within the supply chain. |

| PCDS strategy (2023–2024) | Devote attention to elevating production output, decreasing costs, and augmenting the level of product intelligence through digital technologies during both the production and application phases of products. | SXQC has strategically planned and established intelligent production factories to boost production volume. In collaboration with enterprises such as Huawei, it has launched a panoramic ecological model integrating “green products + super-fast charging + intelligent networking + segmented scenarios”. This initiative is designed to optimize the power utilization efficiency within the logistic scenarios of electric heavy-duty trucks, thereby constructing a high-quality and highly efficient ecological closed-loop system. | |

| SG | PCDS strategy (2007–2015) | Centered around equipment manufacturing, efforts are made to extend services associated with product functions. | Shift from solely selling equipment to extending services to include fundamental offerings such as installation, commissioning, inspection, and maintenance. Establish a data center platform to preliminarily accomplish the monitoring of equipment operating conditions and fault diagnosis. |

| ECDS strategy (2016–2024) | An ecological service network that takes customer needs as its core integrates resources across the industrial chain to offer comprehensive solutions. | With distributed energy system solutions at its core, a strategic layout was implemented to integrate seven value-added services, namely, equipment, EPC (engineering, procurement, and construction), services, operation, and finance. In 2019, SG launched the “Chain-Easy-Access” supply-chain service platform, aiming to realize the interconnection and interoperability of resources upstream and downstream of the industrial chain. |

| Enterprise | Phase | Typical Data of Corporate Performance |

|---|---|---|

| SANY | 2008–2011 | During the period from 2009 to 2011, SANY exhibited a notable upward trend in both sales revenue and profits. The sales revenue increased from CNY 18.976 billion to CNY 50.776 billion. Over the course of these three years, profits also increased from CNY 1.906 billion to CNY 8.649 billion. Moreover, the proportion of labor costs to revenue decreased to 4.74%. In July 2011, SANY was recognized as one of the top 500 companies in the world in terms of market value, thereby becoming the first domestic enterprise to be included in this prestigious list. |

| 2012–2015 | Between 2012 and 2015, SANY experienced a substantial decline in sales volume. The operating revenue decreased from CNY 46.832 billion to CNY 23.367 billion, representing a contraction of 52% compared to the peak in 2011. This situation resulted in losses and deficits that had not been witnessed for several years. In 2012 and 2013, respectively, the total profit of the enterprise declined by 34.26% and 39.32%. | |

| 2016–2024 | In the “Service 10,000 Miles” initiative carried out in 2020, the inspection and parameter calibration of more than 20,000 excavators were automatically accomplished via terminals. This achievement resulted in a 50% reduction in manpower requirements and a twofold increase in efficiency. Currently, 98% of SANY’s service operations can be conducted online. This has significantly enhanced both service efficiency and service coverage. In 2017, Root Internet, which was developed by the Internet of Things Division, emerged as one of the three major industrial Internet platforms in China. According to the list of the world’s top 50 construction machinery manufacturers in 2020 released by the British magazine International Construction, the ranking of SANY ascended from the ninth place in 2015 to the fifth place globally. In the first three quarters of 2024, the operating revenue increased by 3.9%, and the gross profit increased by 28.3%. | |

| SXQC | 2015–2020 | The micro-vehicle business incurred successive losses. The operating revenue dropped precipitously from CNY 247 million to CNY 33 million, and the company reported negative gross profit for three consecutive years. In the heavy-truck market, the growth rate decelerated. In 2015, the company initiated a transition towards new energy, yet the strategic layout progressed at a sluggish pace. As a result, the market share remained below 5%. |

| 2021–2022 | The new-energy business of SXQC demonstrated relatively limited competitiveness. In 2022, although its hydrogen-fueled heavy-duty trucks ranked second in terms of sales volume within the industry, the proportion of its core patents accounted for only 45%. As the technological moat remains underdeveloped, the company faced challenges in competing with companies such as BYD. | |

| 2023–2024 | During 2023 and 2024, the vehicle sales volume of SXQC exhibited a continuous upward trend. At present, its market share reaches 16.6%, ranking third within the industry. The sales volume of new-energy vehicle models exceeded 10,000 units, registering a year-on-year growth rate of 200%. The new-energy light-truck segment witnessed remarkable performance. Specifically, the Zhiyun S300 model firmly maintained the second-highest sales volume in the industry. The “5G New Energy Heavy-Truck Intelligent Manufacturing Application and Practice Industrial Park”, which was established in 2022, carried out unmanned operation throughout the entire production process of vehicle frames. As a result, production efficiency was enhanced by 40%. The painting workshop optimized energy consumption by leveraging big data technology, resulting in annual cost savings of CNY 8.19 million. | |

| SG | 2007–2015 | For enterprises applying power equipment, the downtime was curtailed by over 20%. Simultaneously, equipment maintenance costs were trimmed by 10%, and the amount of funds tied up in spare parts was slashed by 20%. In the context of the main business, the operating revenue from energy conversion equipment gradually declined. Conversely, the operating revenue from services and the operation of energy infrastructure increased annually. |

| 2016–2018 | The company ventured into new domains, including distributed energy cogeneration and clean energy in the coal chemical industry, and it carried out numerous first-of-its-kind projects. Through process reengineering and supply-chain integration, both the management expense ratio and the sales expense ratio experienced a decline. From 2015 to 2017, the company’s operating revenue demonstrated a sustained upward trend. | |

| 2019–2024 | The energy consumption per CNY 10,000 of the output value of SG’s Energy Internet Island stands at merely 4.52 kg of standard coal. At present, it is the smart manufacturing base within the global industry that features the lowest energy consumption and the least emissions per CNY 10,000 of the output value. The total operating revenue has increased from CNY 3.96 billion to CNY 10.36 billion. Both the revenue and profit of the digital industry have hit historical peaks, with the digital economy accounting for 96.9% of the total. The proportion of industrial services and operations in the total sales orders reached 80.61%. In 2021, SG was recognized by the Ministry of Industry and Information Technology of the People’s Republic of China as a “Demonstration Factory for Intelligent Manufacturing of Large-scale Power Equipment” and a “Demonstration Unit for Green Design of Industrial Products”. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, L.; Chen, J.; Dong, H. The Alignment Between Digital Servitization Strategies and Digital Servitization Capabilities in Chinese Manufacturing Enterprises: A Multi-Case Study. Systems 2025, 13, 707. https://doi.org/10.3390/systems13080707

Zhang L, Chen J, Dong H. The Alignment Between Digital Servitization Strategies and Digital Servitization Capabilities in Chinese Manufacturing Enterprises: A Multi-Case Study. Systems. 2025; 13(8):707. https://doi.org/10.3390/systems13080707

Chicago/Turabian StyleZhang, Le, Juhong Chen, and Hailin Dong. 2025. "The Alignment Between Digital Servitization Strategies and Digital Servitization Capabilities in Chinese Manufacturing Enterprises: A Multi-Case Study" Systems 13, no. 8: 707. https://doi.org/10.3390/systems13080707

APA StyleZhang, L., Chen, J., & Dong, H. (2025). The Alignment Between Digital Servitization Strategies and Digital Servitization Capabilities in Chinese Manufacturing Enterprises: A Multi-Case Study. Systems, 13(8), 707. https://doi.org/10.3390/systems13080707