The Impact of VAT Credit Refunds on Enterprises’ Sustainable Development Capability: A Socio-Technical Systems Theory Perspective

Abstract

1. Introduction

2. Literature Review and Research Hypotheses

2.1. Literature Review

2.1.1. Socio-Technical Systems Theory

2.1.2. Sustainable Development Capability

2.1.3. VAT Credit Refunds

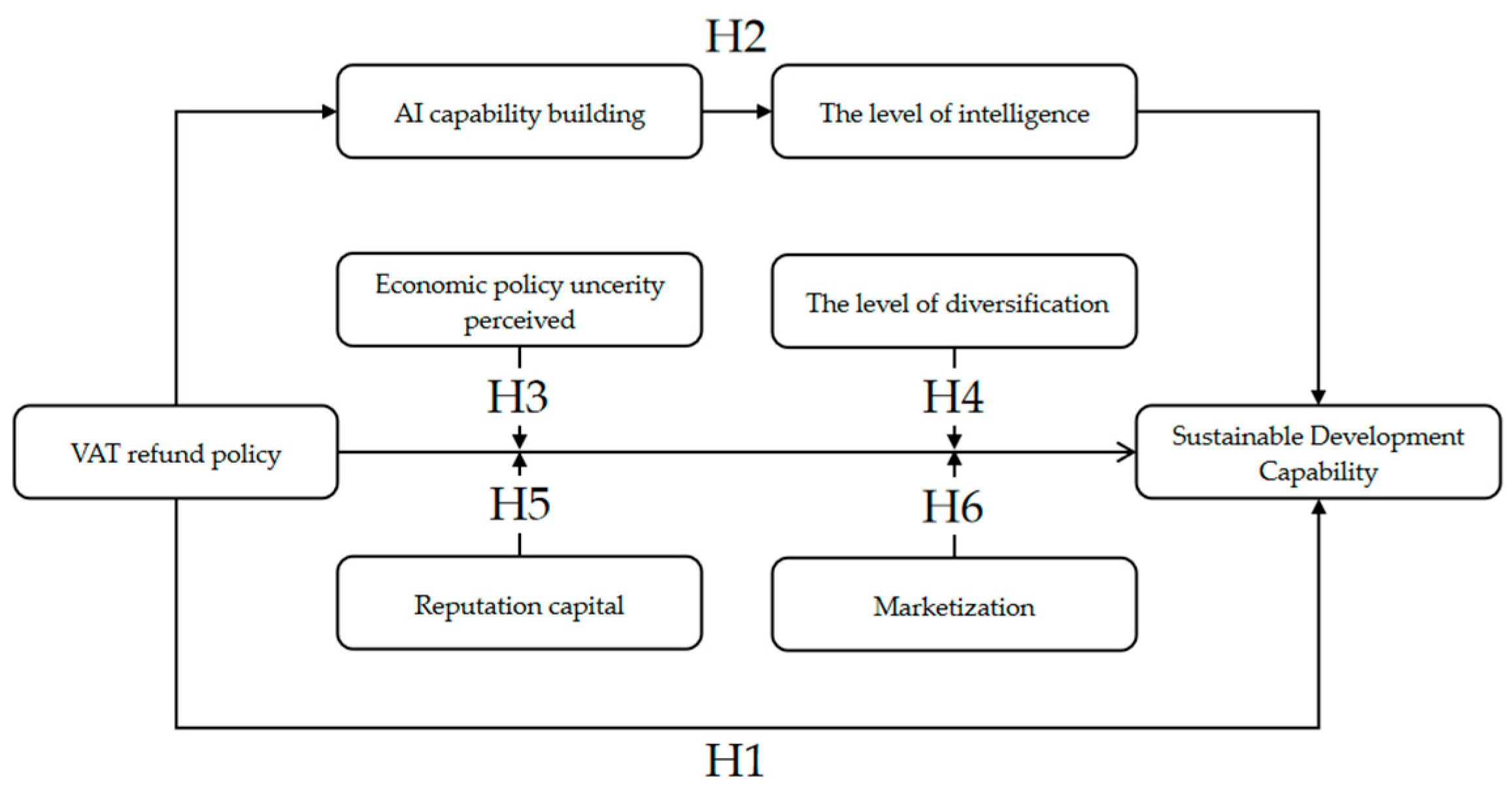

2.2. Theoretical Mechanism

3. Empirical Strategy

3.1. Selection of Sample and Data Sources

3.2. Model Construction

3.3. Variable Definitions

3.3.1. Dependent Variable

3.3.2. Independent Variable

3.3.3. Mediating Variable

3.3.4. Control Variables

3.4. Descriptive Statistics

4. Empirical Results and Analysis

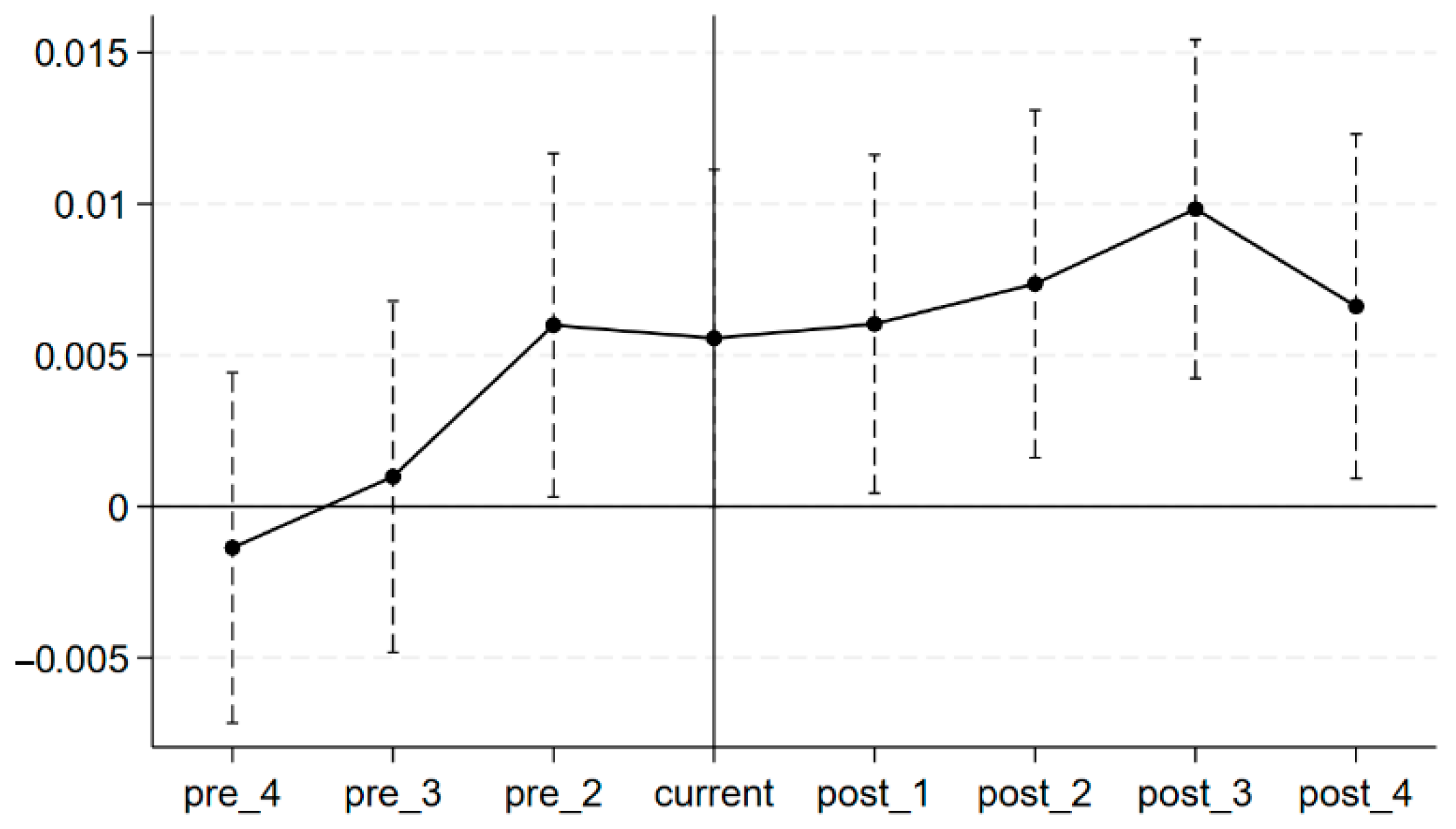

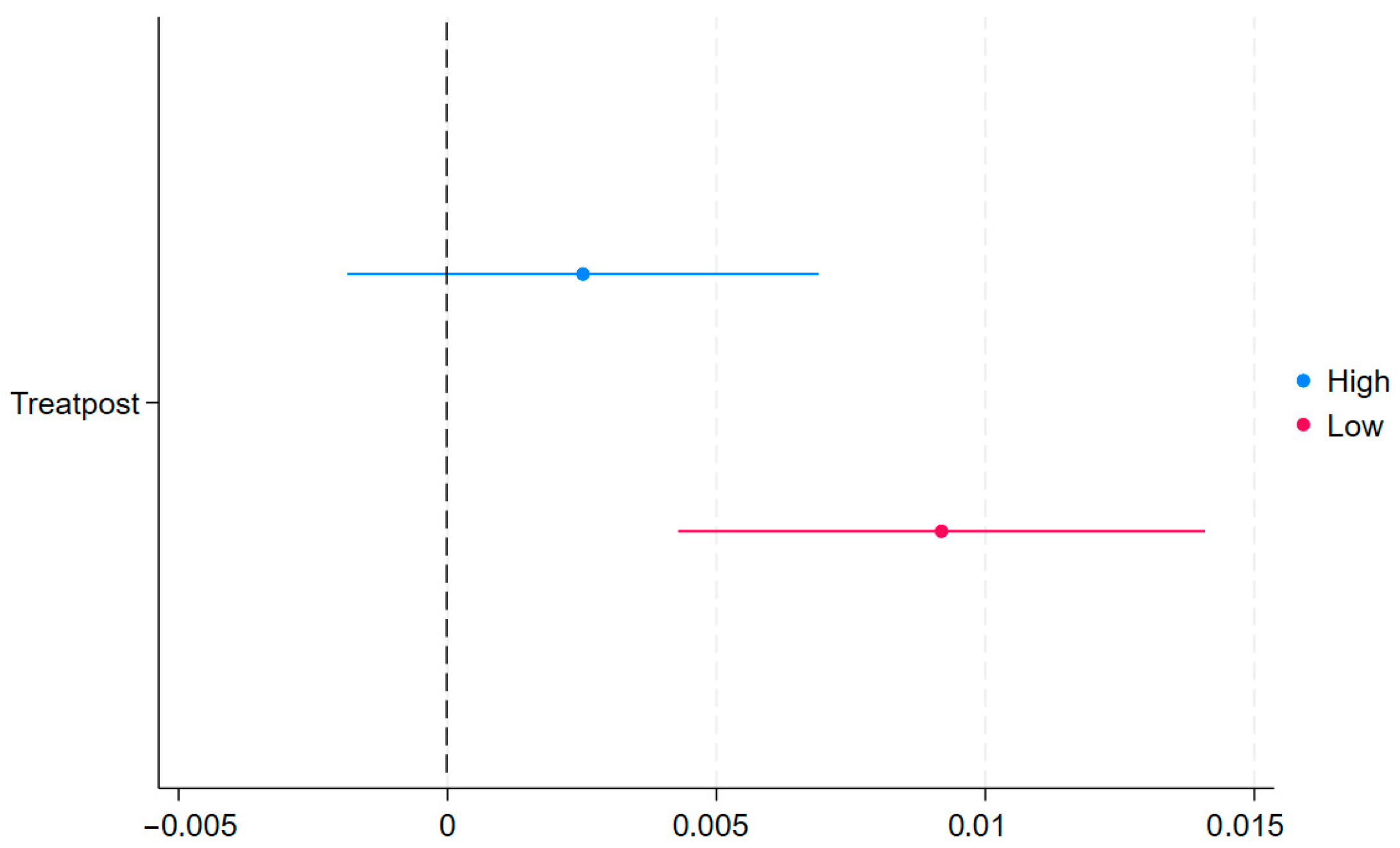

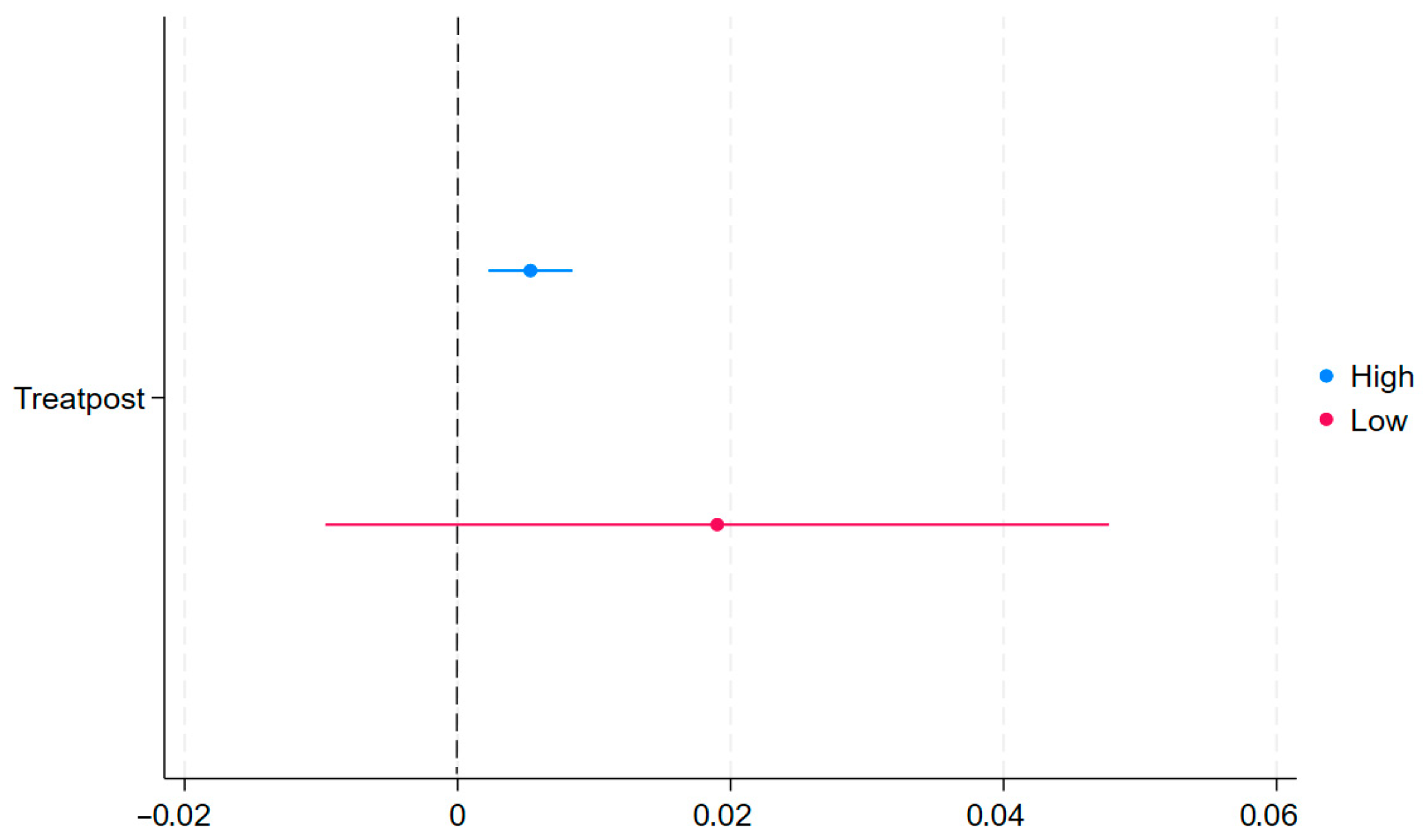

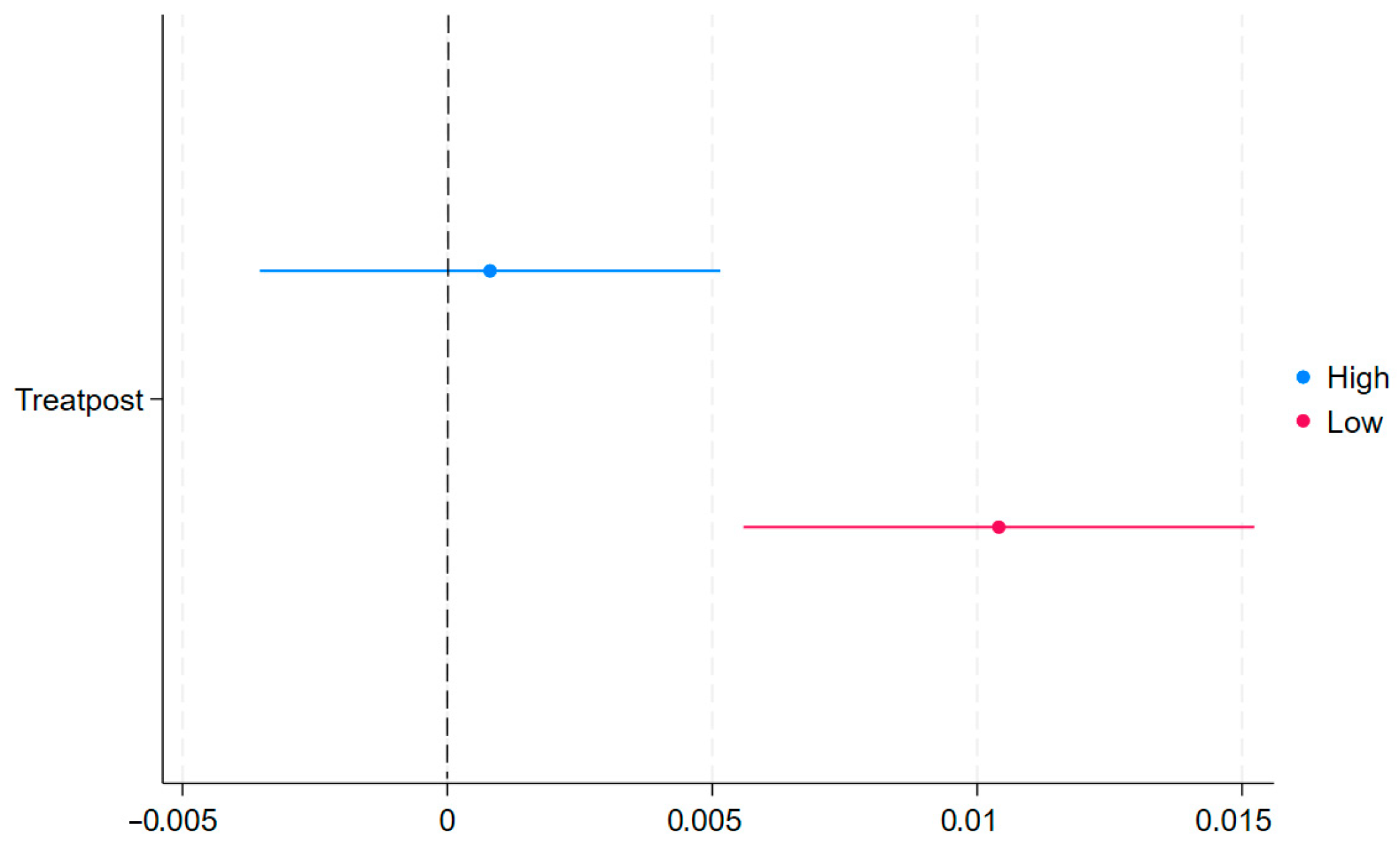

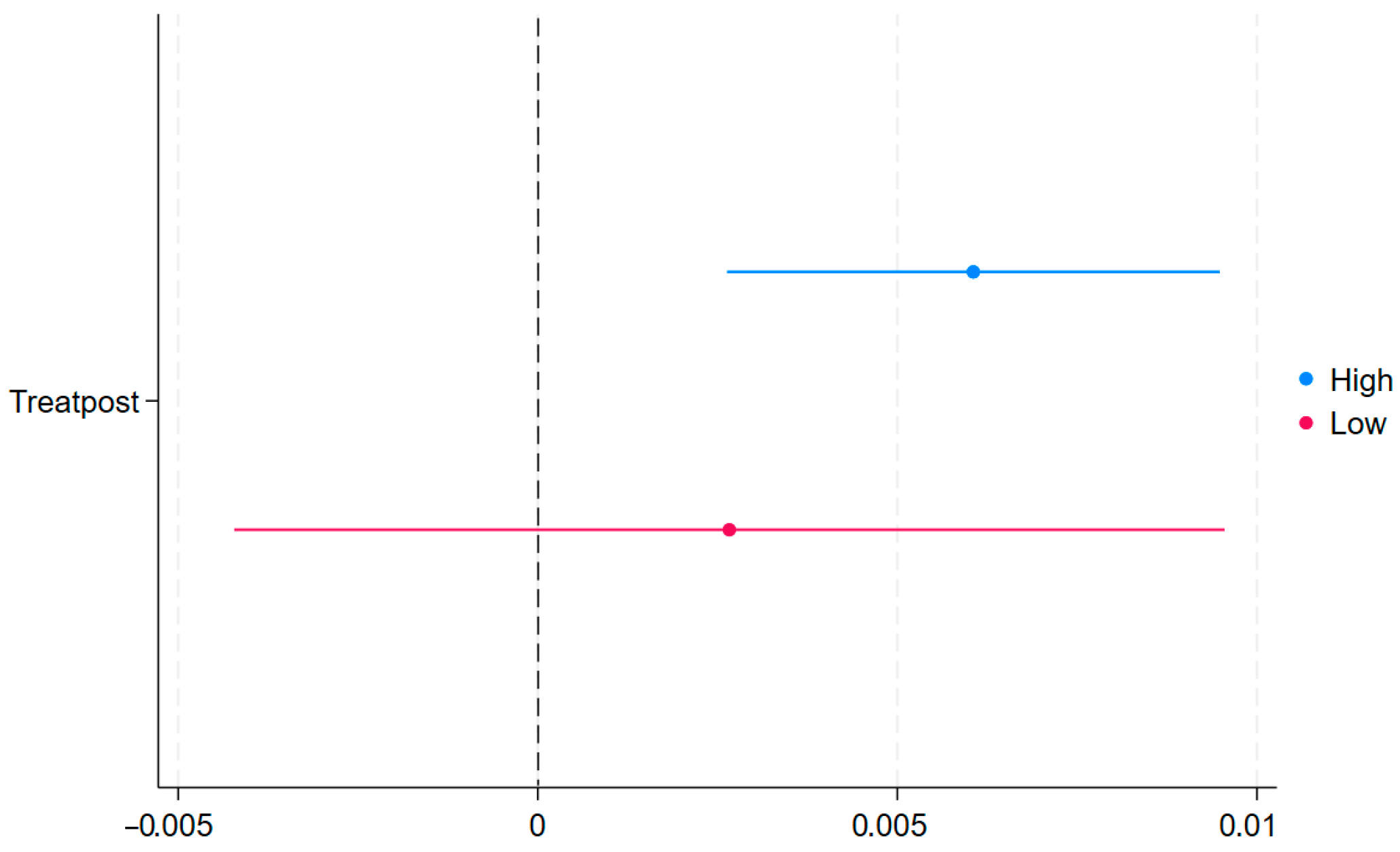

4.1. Test for Parallel Trends

4.2. Baseline Regression Analysis

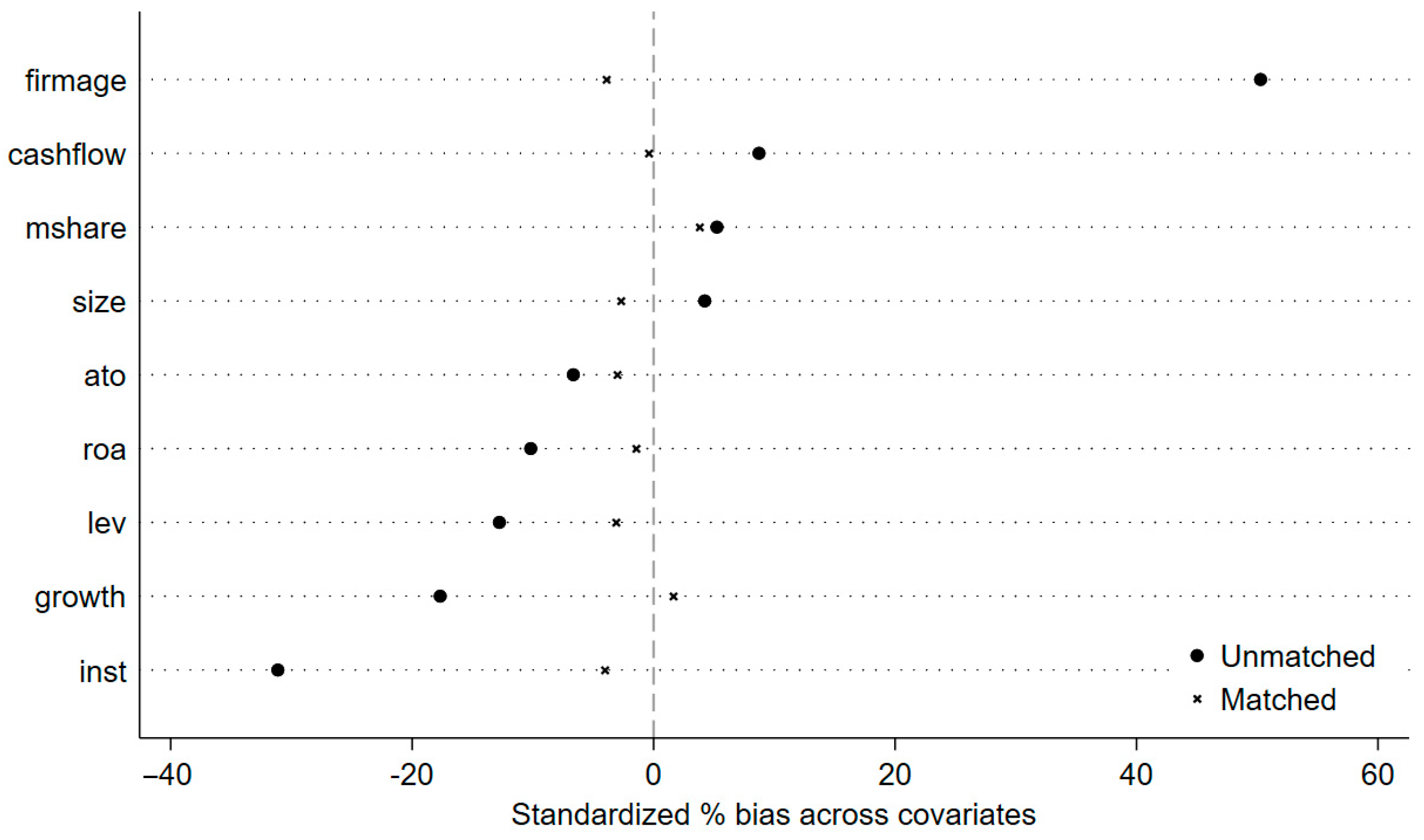

4.3. Robustness Test

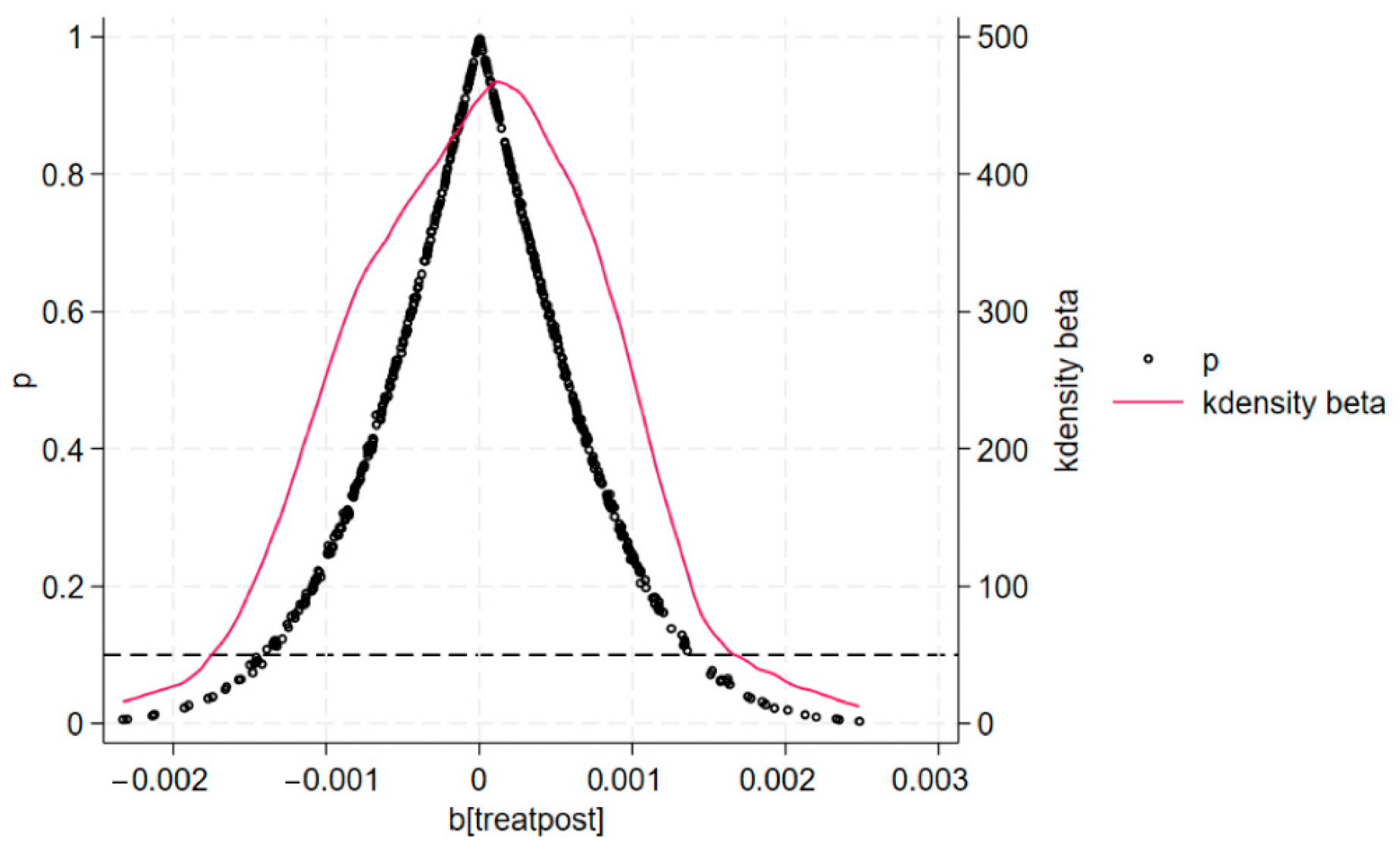

4.3.1. Placebo Test

4.3.2. Increased High-Dimensional Interaction Fixed Effects

4.3.3. Exclusion of Special Samples Test

4.3.4. Substitution of Dependent Variables

4.4. Mediating Mechanism Test

4.5. Heterogeneity Test

4.5.1. Perception of Economic Policy Uncertainty

4.5.2. Level of Diversification

4.5.3. Reputation Capital

4.5.4. Level of Marketization

5. Further Analysis

5.1. Firm-Level Characteristics

5.1.1. Enterprise Scale

5.1.2. Industry Type

5.2. Long-Term Effects

5.3. Economic Consequences Test

5.3.1. ESG Performance

5.3.2. Green Innovation

6. Conclusions and Policy Recommendations

- (1)

- Optimize the Refund Process to Enhance Policy Implementation Efficiency. Current challenges, such as complex refund procedures and prolonged processing times, can be mitigated by deploying automated approval systems—such as AI-driven tax audit platforms—and intelligent data processing technologies like blockchain-enabled tax refund tracking systems. These innovations not only streamline procedural complexity and accelerate processing but also improve transparency and foster trust between tax authorities and enterprises. For instance, the adoption of blockchain technology by the Shenzhen local tax bureau has already demonstrated substantial reductions in refund delays. Concurrently, shifting the institutional mindset from a “compliance-based review” to a “service-oriented facilitation” approach can enhance organizational adaptability and strengthen enterprises’ perceived benefits, thereby reinforcing the policy’s incentive effect.

- (2)

- Strengthen Policy Support Mechanisms through Institutional Synergy. The effectiveness of VAT credit refunds can be significantly amplified by harmonizing fiscal, financial, and industrial policies. For example, integrating refund data into credit scoring systems used by commercial banks could enable firms to leverage expected refunds as collateral for innovation financing. Establishing inter-agency information-sharing platforms among tax, financial, and industrial bodies can strengthen coordination, minimize administrative fragmentation, and promote an integrated policy framework. This systemic integration aligns closely with STST’s emphasis on structural coordination between social and technical subsystems.

- (3)

- Promote Digital Resource Allocation and Collaborative Innovation within Industrial Chains. Developing open digital platforms—such as cloud-based supply chain management systems—can facilitate data interoperability among upstream and downstream firms, enabling joint R&D initiatives and process innovation. Governments can support small and medium-sized enterprises’ (SMEs) access to these platforms by providing subsidies for digital transformation and organizing matchmaking services to stimulate industrial collaboration. For instance, Zhejiang Province’s “Digital Empowerment Plan” illustrates how local governments can assist SMEs in adopting digital tools and engaging in collaborative innovation networks. This approach not only enhances technical capabilities but also reshapes inter-organizational dynamics, fostering resilient and adaptive socio-technical systems.

- (4)

- Develop a Targeted and Adaptive VAT Credit Refund Policy Framework. To ensure precise stimulation of enterprise SDC, a differentiated policy system should be established. For example, firms heavily engaged in green innovation or AI-driven transformation could benefit from accelerated refund processing or additional financial incentives. Real-time data analytics platforms could monitor the flow and efficacy of refund funds, enabling dynamic adjustments to policy parameters. Furthermore, formalizing institutional collaboration among tax authorities, technology agencies, and financial regulators to implement an “identify–support–feedback–optimize” policy cycle would embody the adaptive and co-evolutionary principles of STST, thereby supporting the optimal allocation of policy resources.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Zhang, D.; Lucey, B.M. Sustainable behaviors and firm performance: The role of financial constraints’ alleviation. Econ. Anal. Policy 2022, 74, 220–233. [Google Scholar] [CrossRef]

- Lee, C.-C.; He, Z.-W.; Yuan, Z. A pathway to sustainable development: Digitization and green productivity. Energy Econ. 2023, 124, 106772. [Google Scholar] [CrossRef]

- Wang, C.; Deng, X.; Wang, D.; Pan, X. Financial regulation, financing constraints, and enterprise innovation performance. Int. Rev. Financ. Anal. 2024, 95, 103387. [Google Scholar] [CrossRef]

- Liu, Y.; He, Z. Synergistic industrial agglomeration, new quality productive forces and high-quality development of the manufacturing industry. Int. Rev. Econ. Financ. 2024, 94, 103373. [Google Scholar] [CrossRef]

- Huang, X.; Hu, X.; Huang, B. The effect of enterprise quality management on innovation incentives in enterprises—Based on the reform of China’s value-added tax system. Int. Rev. Econ. Financ. 2024, 94, 103385. [Google Scholar] [CrossRef]

- Yu, W.; Yan, Y.; Zhu, K.; Zhang, P. Can value-added tax refund policy inhibit corporate financial fraud? Evidence from China. Emerg. Mark. Rev. 2024, 63, 101212. [Google Scholar] [CrossRef]

- Pessoa, M. How to Manage Value-Added Tax Refunds; IMF How Notes; International Monetary Fund: Washington, DC, USA, 2021. [Google Scholar] [CrossRef]

- Xue, R.; Chen, J. ESG performance and stability of new quality productivity forces: From perspective of China’s modernization construction. Int. Rev. Econ. Financ. 2025, 98, 103911. [Google Scholar] [CrossRef]

- Yue, S.; Bajuri, N.H.; Khatib, S.F.A.; Lee, Y. New quality productivity and environmental innovation: The hostile moderating roles of managerial empowerment and board centralization. J. Environ. Manag. 2024, 370, 122423. [Google Scholar] [CrossRef] [PubMed]

- Zhou, X.; Zhao, Y.; Chen, D. Emissions trading scheme’s effect on enterprises’ sustainable development in China: A differential game and a quasi-natural experiment. Energy Econ. 2025, 147, 108554. [Google Scholar] [CrossRef]

- Jie, G.; Jiahui, L. Media attention, green technology innovation and industrial enterprises’ sustainable development: The moderating effect of environmental regulation. Econ. Anal. Policy 2023, 79, 873–889. [Google Scholar] [CrossRef]

- Cherns, A. The principles of sociotechnical design. Hum. Relat. 1976, 29, 783–792. [Google Scholar] [CrossRef]

- Bostrom, R.P.; Heinen, J.S. MIS problems and failures: A socio-technical perspective. Part I: The causes. MIS Q. 1997, 1, 17–32. [Google Scholar] [CrossRef]

- Carayon, P.; Karsh, B.-T. Sociotechnical issues in the implementation of imaging technology. Behav. Inf. Technol. 2000, 19, 247–262. [Google Scholar] [CrossRef]

- Klaser, K.; Cuel, R.; Casari, P. The future of hybrid work in Italy: A survey-based socio-technical-system analysis. J. Innov. Knowl. 2023, 8, 100426. [Google Scholar] [CrossRef]

- Andras, P.; Esterle, L.; Guckert, M.; Han, T.A.; Lewis, P.R.; Milanovic, K.; Payne, T.; Perret, C.; Pitt, J.; Powers, S.T.; et al. Trusting intelligent machines: Deepening trust within socio-technical systems. IEEE Technol. Soc. Mag. 2018, 37, 76–83. [Google Scholar] [CrossRef]

- Davis, M.C. Socio-technical systems thinking and the design of contemporary workspace. In Organizational Behaviour and the Physical Environment; Routledge: Abingdon, UK, 2019; pp. 128–146. [Google Scholar] [CrossRef]

- Mumford, E. The story of socio-technical design: Reflections on its successes, failures and potential. Inf. Syst. J. 2006, 16, 317–342. [Google Scholar] [CrossRef]

- Ai, F.Y.; Wang, M.Z. Economic benefit evaluation of industrial enterprises based on bp neural network optimization algorithm. Lat. Am. Appl. Res.-Int. J. 2018, 48, 223–227. [Google Scholar] [CrossRef]

- Matias, D.M.; Kone, M.; Karim, P.G.; San Jose, D.; Mariano, B.J.; Ortiz, A.M.; Dubey, P.K.; Garcia, G. The need for transnational networks and transdisciplinary education for sustainable development in UNESCO biosphere reserves in the global south. Curr. Opin. Environ. Sustain. 2025, 75, 101553. [Google Scholar] [CrossRef]

- Friedman, A.L.; Miles, S. Developing stakeholder theory. J. Manag. Stud. 2022, 39, 1–21. [Google Scholar] [CrossRef]

- Bentley, T.A.; Teo, S.T.T.; McLeod, L.; Tan, F.; Bosua, R.; Gloet, M. The role of organisational support in teleworker wellbeing: A socio-technical systems approach. Appl. Ergon. 2016, 52, 207–215. [Google Scholar] [CrossRef]

- Fuenfschilling, L.; Truffer, B. The interplay of institutions, actors and technologies in socio-technical systems—An analysis of transformations in the australian urban water sector. Technol. Forecast. Soc. Chang. 2016, 103, 298–312. [Google Scholar] [CrossRef]

- Chen, S.; Xiao, Y.; Zhang, Z. Value-added tax credit refund and environmental protection investment: Evidence from chinese heavy-polluting enterprises. J. Clean. Prod. 2024, 450, 141945. [Google Scholar] [CrossRef]

- Liu, L.; Cao, L.; Cao, Y.; Lu, M.; Shan, Y. VAT credit refunds and firm productivity: Evidence from China’s VAT reform. Int. Rev. Financ. Anal. 2024, 93, 103171. [Google Scholar] [CrossRef]

- Zhang, X.; Deng, G.; Chen, L.; Abbass, K. Sustainable development and climate action: The role of tax policy and innovation. J. Environ. Manag. 2025, 389, 126091. [Google Scholar] [CrossRef] [PubMed]

- Chen, W.; Meng, F. Sustainable development, economic policy uncertainty and tax risk. Sustain. Account. Manag. Policy J. 2025, 16, 1–43. [Google Scholar] [CrossRef]

- McMeekin, A.; Southerton, D. Sustainability transitions and final consumption: Practices and socio-technical systems. Technol. Anal. Strateg. Manag. 2012, 24, 345–361. [Google Scholar] [CrossRef]

- Xu, K.; Geng, C.; Wei, X.; Jiang, H. Financing development, financing constraint and r&d investment of strategic emerging industries in China. J. Bus. Econ. Manag. 2020, 21, 1010–1034. [Google Scholar] [CrossRef]

- Schmidt, G.M.; Druehl, C.T. When is a disruptive innovation disruptive? J. Prod. Innov. Manag. 2008, 25, 347–369. [Google Scholar] [CrossRef]

- Liu, Y.; Wang, W.; Liu, C. The effect of a VAT rate reduction on enterprise costs: Empirical research based on China’s VAT reform practice. Front. Environ. Sci. 2022, 10, 912574. [Google Scholar] [CrossRef]

- He, Y. Taxing and trading for a greener future: The impacts of China’s environmental and trade policies on environmental sustainability. J. Environ. Manag. 2024, 372, 123401. [Google Scholar] [CrossRef]

- González, X.; Miles-Touya, D.; Pazó, C. R&D, worker training and innovation: Firm-level evidence. Ind. Innov. 2016, 23, 694–712. [Google Scholar] [CrossRef]

- Fehr, R.; Fulmer, A.; Awtrey, E.; Miller, J.A. The grateful workplace: A multilevel model of gratitude in organizations. AMR 2017, 42, 361–381. [Google Scholar] [CrossRef]

- Geels, F.W. Ontologies, socio-technical transitions (to sustainability), and the multi-level perspective. Res. Policy 2010, 39, 495–510. [Google Scholar] [CrossRef]

- Kim, R.M.; Kaplan, S.M. Interpreting socio-technical co-evolution: Applying complex adaptive systems to IS engagement. Inf. Technol. People 2006, 19, 35–54. [Google Scholar] [CrossRef]

- Bahoo, S.; Cucculelli, M.; Qamar, D. Artificial intelligence and corporate innovation: A review and research agenda. Technol. Forecast. Soc. Chang. 2023, 188, 122264. [Google Scholar] [CrossRef]

- Daly, S.J.; Wiewiora, A.; Hearn, G. Shifting attitudes and trust in AI: Influences on organizational AI adoption. Technol. Forecast. Soc. Chang. 2025, 215, 124108. [Google Scholar] [CrossRef]

- Wang, C.; Yin, X.; Yu, F. The impact of FinTech on corporate green innovation: The case of chinese listed enterprises. J. Environ. Manag. 2025, 392, 126605. [Google Scholar] [CrossRef] [PubMed]

- Paeplow, J.; Schoormann, T.; Möller, F.; Strobel, G. AI startups for good: A taxonomy and archetypes of sustainable business models. J. Clean. Prod. 2025, 520, 146144. [Google Scholar] [CrossRef]

- Duan, D.; Chen, S.; Feng, Z.; Li, J. Industrial robots and firm productivity. Struct. Chang. Econ. Dyn. 2023, 67, 388–406. [Google Scholar] [CrossRef]

- Fairhurst, G.T.; Green, S.; Courtright, J. Inertial Forces and the Implementation of a Socio-Technical Systems Approach: A Communication Study. Organ. Sci. 1995, 6, 168–185. [Google Scholar] [CrossRef]

- Zhang, G.; Han, J.; Pan, Z.; Huang, H. Economic policy uncertainty and capital structure choice: Evidence from China. Econ. Syst. 2015, 39, 439–457. [Google Scholar] [CrossRef]

- Pástor, Ľ.; Veronesi, P. Political uncertainty and risk premia. J. Financ. Econ. 2013, 110, 520–545. [Google Scholar] [CrossRef]

- Demir, E.; Ersan, O. Economic policy uncertainty and cash holdings: Evidence from BRIC countries. Emerg. Mark. Rev. 2017, 33, 189–200. [Google Scholar] [CrossRef]

- Mao, S.; Yang, G. Do diversified M&As improve R&D activity? Evidence from chinese listed companies. Financ. Res. Lett. 2025, 72, 106465. [Google Scholar] [CrossRef]

- Sohl, T.; McCann, B.T.; Vroom, G. Business model diversification: Demand relatedness, entry sequencing, and curvilinearity in the diversification-performance relationship. Long Range Plan. 2022, 55, 102215. [Google Scholar] [CrossRef]

- Xue, X.; Zhang, J.; Liong, W.K.J.; Ali, A. Influence of star employees’ role stress on their unethical pro-organizational behavior: A perspective from the transactional theory of stress and coping. Curr. Psychol. 2024, 43, 17525–17543. [Google Scholar] [CrossRef]

- Ji, D.; Zhang, Q.; Yu, S.; Wan, K. Market concentration construction and high-quality development of enterprises: Empirical evidence from chinese a-share listed companies. Econ. Anal. Policy 2025, 87, 621–641. [Google Scholar] [CrossRef]

- Nie, J.; Shen, J.; Chen, Y. The effect of new quality productivity on port sustainability: Evidence from China. J. Sea Res. 2025, 204, 102575. [Google Scholar] [CrossRef]

- Xu, T.; Yang, G.; Chen, T. The role of green finance and digital inclusive finance in promoting economic sustainable development: A perspective from new quality productivity. J. Environ. Manag. 2024, 370, 122892. [Google Scholar] [CrossRef]

- Liu, H.; Li, X. How digital technology can improve new quality productive forces?—Perspective of total factor agricultural carbon productivity. J. Asian Econ. 2025, 98, 101921. [Google Scholar] [CrossRef]

- Wang, S.; Qu, C.; Yin, L. Digital literacy, labor migration and employment, and rural household income disparities. Int. Rev. Econ. Financ. 2025, 99, 104040. [Google Scholar] [CrossRef]

- Deng, G.; Fu, X.; Zou, J.; Yan, J. Enterprise digitalization and bank-enterprise ESG consistency: Evidence from China. Int. Rev. Financ. Anal. 2025, 103, 104196. [Google Scholar] [CrossRef]

- He, G.; Li, X.; Luo, J. The impact of the shanghai–hong kong stock market connection on corporate innovation: Evidence from mainland china. Int. J. Financ. Econ. 2023, 28, 3132–3161. [Google Scholar] [CrossRef]

- He, G.; Li, A.Z.; Lin, T. Does digitalization imply uncertainty about the future prospects of a firm? Evidence from analyst forecast accuracy. Financ. Rev 2025, fire.70009. [Google Scholar] [CrossRef]

- He, G.; Li, Z.; Yu, L.; Zhou, Z. Contribution to poverty alleviation: A waste or benefit for corporate financing? J. Int. Financ. Mark. Inst. Money 2023, 89, 101875. [Google Scholar] [CrossRef]

- Islam, N.; Dai, E.; Sakamoto, H. Role of TFP in China’s growth. Asian Econ. J. 2006, 20, 127–159. [Google Scholar] [CrossRef]

- Shi, L.; Yang, S.L.; Ma, Y.; Yang, Y. A Novel Method of Combination Weighting for Multiple Attribute Decision Making. J. Syst. Eng. 2012, 27, 481–491. [Google Scholar] [CrossRef]

- Poquet, O.; De Laat, M. Developing capabilities: Lifelong learning in the age of AI. Br. J. Educ. Technol. 2021, 52, 1695–1708. [Google Scholar] [CrossRef]

- Zhai, X.; Chu, X.; Chai, C.S.; Jong, M.S.Y.; Istenic, A.; Spector, M.; Liu, J.-B.; Yuan, J.; Li, Y. A review of artificial intelligence (AI) in education from 2010 to 2020. Complexity 2021, 8812542. [Google Scholar] [CrossRef]

- Li, J.; Nie, H.; Ruan, R.; Shen, X. Subjective perception of economic policy uncertainty and corporate social responsibility: Evidence from China. Int. Rev. Financ. Anal. 2024, 91, 103022. [Google Scholar] [CrossRef]

- Lee, C.-C.; Lee, C.-C.; Xiao, S. Policy-related risk and corporate financing behavior: Evidence from China’s listed companies. Econ. Model. 2021, 94, 539–547. [Google Scholar] [CrossRef]

- Liu, T.; Chen, X.; Yang, S. Economic policy uncertainty and enterprise investment decision: Evidence from China. Pac.-Basin Financ. J. 2022, 75, 101859. [Google Scholar] [CrossRef]

- Lee, J.M. Rethinking the performance implication of regional diversification: The interplay between intra- and inter-regional diversification. J. Bus. Res. 2025, 199, 115519. [Google Scholar] [CrossRef]

- Isogai, A.; Nozaki, M.; Yamamoto, R. ESG business diversification and investment performance. Financ. Res. Lett. 2025, 77, 107132. [Google Scholar] [CrossRef]

- Schneider, B.R. A comparative political economy of diversified business groups, or how states organize big business. Rev. Int. Political Econ. 2009, 16, 178–201. [Google Scholar] [CrossRef]

- Cao, Z.; Chen, S.X.; Lee, E. Does business strategy influence interfirm financing? Evidence from trade credit. J. Bus. Res. 2022, 141, 495–511. [Google Scholar] [CrossRef]

- Lee, P.M.; Pollock, T.G.; Jin, K. The contingent value of venture capitalist reputation. Strateg. Organ. 2011, 9, 33–69. [Google Scholar] [CrossRef]

- Brammer, S.; Millington, A. Corporate reputation and philanthropy: An empirical analysis. J. Bus. Ethics 2005, 61, 29–44. [Google Scholar] [CrossRef]

- Armitage, S.; Marston, C. Corporate disclosure, cost of capital and reputation: Evidence from finance directors. Br. Account. Rev. 2008, 40, 314–336. [Google Scholar] [CrossRef]

- Vu, U.; Tolstoy, D. Examining the complementary roles of market-driven and market-driving orientations in the geographical diversification strategies of e-commerce SMEs. J. Bus. Res. 2025, 194, 115375. [Google Scholar] [CrossRef]

- Li, Y.; Liang, Z.; Pang, S. Comparison between mean-variance and monotone mean-variance preferences in general markets: A new perspective. Oper. Res. Lett. 2025, 61, 107298. [Google Scholar] [CrossRef]

- Pillai, R.; Islam, M.A.; Sreejith, S.; Al-Malkawi, H.A. Comparative analysis of environmental, social and governance (ESG) ratings: Do sectors and regions differ? J. Manag. Gov. 2025, 29, 69–109. [Google Scholar] [CrossRef]

- Wang, X.; Qin, C.; Liu, Y.; Tanasescu, C.; Bao, J. Emerging enablers of green low-carbon development: Do digital economy and open innovation matter? Energy Econ. 2023, 127, 107065. [Google Scholar] [CrossRef]

- Li, J.; Sun, R.; Zhao, M. How mayors’ promotion incentives shape corporate green innovation disclosure? Evidence from China’s new environmental protection law. Int. Rev. Financ. Anal. 2025, 103, 104181. [Google Scholar] [CrossRef]

- Casarin, A.A.; Mercadier, A.; Delfino, M.E. Firm size in gas distribution. Economies of scale, regulatory dynamics, and policy implications. Energy Policy 2024, 193, 114256. [Google Scholar] [CrossRef]

- Smyth, R. Should china be promoting large-scale enterprises and enterprise groups? World Dev. 2000, 28, 721–737. [Google Scholar] [CrossRef]

- Gharbi, S.; Sahut, J.-M.; Teulon, F. R&D investments and high-tech firms’ stock return volatility. Technol. Forecast. Soc. Chang. 2014, 88, 306–312. [Google Scholar] [CrossRef]

- Zou, C.; Li, S.; Xiong, B.; Liu, H.; Ma, F. Revolution and significance of “green energy transition” in the context of new quality productive forces: A discussion on theoretical understanding of “energy triangle”. Pet. Explor. Dev. 2024, 51, 1611–1627. [Google Scholar] [CrossRef]

- Müller, L.; Joubrel, M. A novel approach to sustainable mean-variance portfolio optimization: Accounting for ESG-related uncertainty. Financ. Res. Lett. 2025, 85, 108056. [Google Scholar] [CrossRef]

- Rainville, A.; Dikker, I.; Buggenhagen, M. Tracking innovation via green patent classification systems: Are we truly capturing circular economy progress? J. Clean. Prod. 2025, 486, 144385. [Google Scholar] [CrossRef]

- Liu, P.; Xu, Y.; Lu, J. Air pollution, sustainable development, and corporate R&D: Evidence from emerging countries. J. Environ. Manag. 2024, 369, 122368. [Google Scholar] [CrossRef] [PubMed]

- Rahman, S. The importance of green patents for CDS pricing: The role of environmental disclosures. Energy Econ. 2024, 139, 107905. [Google Scholar] [CrossRef]

| Factor | Sub-Factor | Indicator | Measurement Method |

|---|---|---|---|

| Sustainable Laborers | Employee Quality | Highly Educated Employees | Percentage of employees with postgraduate degrees or above |

| Proportion of R&D Personnel | Ratio of R&D personnel to total employees | ||

| Digital Background of the Management Team | Whether the senior management team has a digital background | ||

| Management Quality | Functional experience breadth of the CEO | Count of CEO functional experiences | |

| Sustainable Labor Objects | Ecological Environment | Environmental Performance | Environmental score from Huazheng ESG rating system |

| Future Development | Proportion of Fixed Assets | Fixed assets/total assets | |

| Robot Penetration Rate | Firm-level robot penetration rate | ||

| Sustainable Labor Materials | Technological Labor Materials | Enterprise Innovation Level | Ln (number of patent applications + 1) |

| Green Labor Materials | Green Technology Level | Ln (number of green patent applications + 1) | |

| Proportion of Green Patents | Number of green patent applications/total patent applications | ||

| Digital Labor Materials | Level of Digitization | Ln (frequency of digital-related terms + 1) | |

| Proportion of Digital Assets | Digital-related assets/total intangible assets |

| Variable Type | Variable Name | Variable Symbol | Variable Definition |

|---|---|---|---|

| Dependent Variable | Sustainable Development Capability | SDC | The weighted sum of entropy values for sustainable laborers, sustainable labor objects, and sustainable labor materials |

| Independent Variable | VAT Credit Refund Policy Dummy Variable | Treat × Post | See above for a detailed definition |

| Mediating variable | AI capability building | AIC | AI-related investments/total annual assets |

| Intelligent transformation | It | Ln (composite frequency count of key technology) | |

| Control Variables | Firm Size | Size | Natural logarithm of total assets |

| Leverage Ratio | Lev | Total liabilities at year-end/total assets | |

| Return on Assets | Roa | Net income for the year/the average balance of total assets | |

| Asset Turnover Ratio | ATO | Operating revenue/average total assets | |

| Cash Flow Ratio | Cashflow | Net cash flow from operating activities/operating revenue | |

| Firm Age | FirmAge | Ln (current year − year of establishment + 1) | |

| Firm Growth | Growth | (Current year’s operating revenue/previous year’s operating revenue) − 1 | |

| Management Shareholding Ratio | Mshare | Proportion of shares held by management to total tradable shares | |

| Institutional Ownership | INST | Ratio of shares held by institutional investors to total tradable shares | |

| Year fixed effects | Year | Time-specific factors are commonly faced by all samples within the same year | |

| Firm fixed effects | Firm | Firm-specific factors that do not change over time |

| Variable | Observations | Mean | Std. Dev. | Median | Min | Max |

|---|---|---|---|---|---|---|

| SDC | 13,402 | 0.110 | 0.0900 | 0.0800 | 0.0300 | 0.350 |

| Treat | 13,402 | 0.620 | 0.490 | 1 | 0 | 1 |

| Post | 13,402 | 0.540 | 0.500 | 1 | 0 | 1 |

| Treatpost | 13,402 | 0.330 | 0.470 | 0 | 0 | 1 |

| AIC | 13,402 | 0 | 0.0100 | 0 | 0 | 0.0200 |

| It | 13,402 | 0.920 | 1.160 | 0 | 0 | 3.580 |

| Size | 13,402 | 22.59 | 1.190 | 22.46 | 20.70 | 25 |

| Lev | 13,402 | 0.450 | 0.190 | 0.450 | 0.130 | 0.790 |

| Roa | 13,402 | 0.0300 | 0.0500 | 0.0300 | −0.0800 | 0.120 |

| Ato | 13,402 | 0.570 | 0.320 | 0.500 | 0.140 | 1.360 |

| Cashflow | 13,402 | 0.0500 | 0.0600 | 0.0400 | −0.0600 | 0.160 |

| Firmage | 13,402 | 3.030 | 0.260 | 3.040 | 2.480 | 3.430 |

| Growth | 13,402 | 0.310 | 0.530 | 0.150 | −0.320 | 1.810 |

| Mshare | 13,402 | 0.0800 | 0.140 | 0 | 0 | 0.440 |

| Inst | 13,402 | 0.450 | 0.230 | 0.470 | 0.0400 | 0.810 |

| Variables | SDC | SDC | PSM-DID |

|---|---|---|---|

| SDC | |||

| Treatpost | 0.006 *** | 0.006 *** | 0.006 *** |

| (0.002) | (0.002) | (0.002) | |

| Control variables | No | Yes | Yes |

| Year and firm fixed effects | Yes | Yes | Yes |

| Constant | 0.067 *** | −0.043 | −0.020 |

| (0.010) | (0.047) | (0.046) | |

| Observations | 14,208 | 14,208 | 14,131 |

| R-squared | 0.788 | 0.790 | 0.789 |

| Variables | Increased High-Dimensional Interaction Fixed Effects | Exclusion of Special Samples Test | TFP | Adding the Environmental Dimension and the Social Dimension |

|---|---|---|---|---|

| SDC | SDC | Lp | SDC | |

| Treatpost | 0.053 *** | 0.004 ** | 0.040 *** | 0.015 *** |

| (0.002) | (0.002) | (0.007) | (0.004) | |

| Control variables | Yes | Yes | Yes | Yes |

| Year and firm fixed effects | Yes | Yes | Yes | Yes |

| Constant | 0.015 | −0.093 | −6.433 *** | −0.212 * |

| (0.020) | (0.059) | (0.214) | 0.117 | |

| Observations | 13,630 | 9,713 | 13,997 | 14,091 |

| R-squared | 0.175 | 0.821 | 0.970 | 09786 |

| Mediation Path | Effect Value | Standard Error | 95% Confidence Interval | |

|---|---|---|---|---|

| Upper Limit | Lower Limit | |||

| VAT Credit Refund—AI Capability building—Sustainable Development Capability | 0.0109 | 0.0024 | 0.0163 | 0.0067 |

| VAT Credit Refund—Level of Intelligent Transformation—Sustainable Development Capability | 0.2555 | 0.0110 | 0.2771 | 0.2335 |

| VAT Credit Refund—AI Capability Building—Level of Intelligent Transformation—Sustainable Development Capability | 0.0192 | 0.0038 | 0.0272 | 0.0120 |

| Total Indirect Effect | 0.2856 | 0.0111 | 0.3074 | 0.2638 |

| Mediation Path | Effect Value | Standard Error | 95% Confidence Interval | |

|---|---|---|---|---|

| Upper Limit | Lower Limit | |||

| VAT Credit Refund—AI Capability building—Sustainable Development Capability | 0.0117 | 0.0007 | 0.0104 | 0.0131 |

| VAT Credit Refund—Level of Intelligent Transformation—Sustainable Development Capability | 0.0120 | 0.0008 | 0.0104 | 0.0137 |

| VAT Credit Refund—AI Capability Building—Level of Intelligent Transformation—Sustainable Development Capability | 0.0092 | 0.0004 | 0.0084 | 0.101 |

| Total Indirect Effect | 0.0329 | 0.0012 | 0.0306 | 0.0353 |

| Variables | Low Uncertainty Perception | High Uncertainty Perception | Low Diversification Level | High Diversification Level |

|---|---|---|---|---|

| SDC | SDC | SDC | SDC | |

| Treatpost | 0.009 *** | 0.003 | 0.022 | 0.006 *** |

| (0.003) | (0.002) | (0.016) | (0.002) | |

| Control variables | Yes | Yes | Yes | Yes |

| Year and firm fixed effects | Yes | Yes | Yes | Yes |

| Constant | −0.038 | −0.031 | −0.650 * | −0.007 |

| (0.062) | (0.062) | (0.378) | (0.042) | |

| Observations | 6923 | 6862 | 273 | 13,849 |

| R-squared | 0.822 | 0.812 | 0.857 | 0.788 |

| Variables | Low Reputation Capital | High Reputation Capital | Low Level of Marketization | High Level of Marketization |

|---|---|---|---|---|

| SDC | SDC | SDC | SDC | |

| Treatpost | 0.012 *** | 0.000 | 0.003 | 0.007 *** |

| (0.003) | (0.002) | (0.004) | (0.002) | |

| Control variables | Yes | Yes | Yes | Yes |

| Year and firm fixed effects | Yes | Yes | Yes | Yes |

| Constant | −0.071 | −0.022 | −0.157 | −0.008 |

| (0.070) | (0.062) | (0.114) | (0.045) | |

| Observations | 6603 | 7319 | 2292 | 11,769 |

| R-squared | 0.805 | 0.803 | 0.741 | 0.797 |

| Variables | Large-Scale | Small-Scale | High-Tech | Non-High-Tech |

|---|---|---|---|---|

| SDC | SDC | SDC | SDC | |

| Treatpost | 0.003 | 0.010 *** | 0.000 | 0.008 *** |

| (0.002) | (0.003) | (0.009) | (0.002) | |

| Control variables | Yes | Yes | Yes | Yes |

| Year&Firm fixed effects | Yes | Yes | Yes | Yes |

| Constant | −0.049 | −0.038 | 0.040 | −0.154 *** |

| (0.070) | (0.092) | (0.082) | (0.053) | |

| Observations | 8888 | 5072 | 6312 | 7817 |

| R-squared | 0.813 | 0.795 | 0.816 | 0.692 |

| Variables | Lag (1) | Lag (2) | Lag (3) | Short-Term Outcomes | |

|---|---|---|---|---|---|

| SDC | SDC | SDC | ROE | GPM | |

| Treatpost | 0.007 *** | 0.006 *** | 0.007 *** | −0.001 | 0.001 |

| (0.002) | (0.002) | (0.002) | (0.001) | (0.002) | |

| Control variables | Yes | Yes | Yes | Yes | Yes |

| Year firm fixed effects | Yes | Yes | Yes | Yes | Yes |

| Constant | −0.101 * | −0.084 | 0.092 | −0.236 *** | 0.317 *** |

| (0.056) | (0.064) | (0.077) | (0.024) | (0.061) | |

| Observations | 11,442 | 9862 | 8509 | 14,155 | 14,155 |

| R-squared | 0.810 | 0.822 | 0.830 | 0.939 | 0.889 |

| Variables | ESG | Green Innovation |

|---|---|---|

| SDC | 0.675 *** | 0.806 *** |

| (0.152) | (0.137) | |

| Control variables | Yes | Yes |

| Year and firm fixed effects | Yes | Yes |

| Constant | −3.350 *** | −6.075 *** |

| (0.679) | (0.648) | |

| Observations | 14,155 | 14,155 |

| R-squared | 0.679 | 0.780 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

She, J.; Sun, M.; Yan, H. The Impact of VAT Credit Refunds on Enterprises’ Sustainable Development Capability: A Socio-Technical Systems Theory Perspective. Systems 2025, 13, 669. https://doi.org/10.3390/systems13080669

She J, Sun M, Yan H. The Impact of VAT Credit Refunds on Enterprises’ Sustainable Development Capability: A Socio-Technical Systems Theory Perspective. Systems. 2025; 13(8):669. https://doi.org/10.3390/systems13080669

Chicago/Turabian StyleShe, Jinghuai, Meng Sun, and Haoyu Yan. 2025. "The Impact of VAT Credit Refunds on Enterprises’ Sustainable Development Capability: A Socio-Technical Systems Theory Perspective" Systems 13, no. 8: 669. https://doi.org/10.3390/systems13080669

APA StyleShe, J., Sun, M., & Yan, H. (2025). The Impact of VAT Credit Refunds on Enterprises’ Sustainable Development Capability: A Socio-Technical Systems Theory Perspective. Systems, 13(8), 669. https://doi.org/10.3390/systems13080669