Abstract

How do regulatory policies, funding structures, and cross-sector coordination shape knowledge flows and institutional transformation? Focusing on the smart medical device sector in Taiwan, this study explores how governance dynamics accelerate system transformation and foster demand for adaptive and integrative innovation systems. Building on the National Biotechnology Innovation System framework and qualitative system dynamics modeling, the study analyzes institutional interactions through 28 semi-structured interviews and 18 policy documents. Findings identify systemic bottlenecks, including translational gaps, coordination challenges, and barriers for traditional manufacturers. These gaps have enabled tech firms to emerge as system leaders by bridging these institutional gaps. This study extends innovation systems theory by conceptualizing an emergent governance function that addresses institutional gaps. At the policy level, the study highlights the importance of enabling institutional change in governance to address structural fragmentation and support system-wide transformation.

1. Introduction

The global medical device industry is undergoing a profound transformation, propelled by the integration of artificial intelligence (AI), machine learning (ML), and advanced data analytics into traditional healthcare technologies. This convergence has given rise to smart medical devices—digitally enhanced tools that leverage AI and ML to enable real-time monitoring, personalized diagnostics, and data-driven interventions. The fusion of AI and ML is redefining the functionality and application of medical devices, pushing healthcare toward greater intelligence and personalization [1]. While this integration facilitates highly tailored medical services, it also poses significant challenges to existing institutional frameworks, particularly in areas such as data integration, privacy protection, and cross-sectoral coordination [2]. AI’s application in medicine enhances diagnostic accuracy and workflow efficiency but introduces complexities related to bias, transparency, and the reconfiguration of patient–clinician relationships [3]. These developments necessitate innovative governance and adaptive regulatory mechanisms to address emerging issues. With the market for smart medical devices projected to expand from $175.5 billion in 2024 to over $320 billion by 2030, tackling these challenges is essential for both economic advancement and the global improvement of healthcare outcomes [4].

Although prior studies have extensively examined the technical features [5] and adoption barriers [6] associated with smart medical, they often overlook evolving institutional dynamics, including regulatory lag, reimbursement uncertainties, and cross-sector coordination failures, that critically shape innovation trajectories [7,8,9]. These institutional dynamics are central to the effective implementation of innovation policy. In the context of transformative innovation, translating broad societal goals into concrete and actionable policy agendas entails significant directionality challenges, such as managing goal conflicts, defining system boundaries, and identifying intervention points [10]. However, understanding how these institutional dynamics influence knowledge flows and systemic transformations is crucial for explaining the success or stagnation of healthcare innovations.

This study addresses this gap by examining the smart medical device innovation ecosystem through the National Biotechnology Innovation System (NBIS) framework. It investigates a central question: How do regulatory policies, funding mechanisms, and cross-sector interactions drive knowledge flows and systemic transformations in the smart medical device sector? By addressing this question, the study seeks to advance innovation system theory and provide policy insights for adaptive governance in converging technological domains.

In this study, we adopt a sectoral and application-driven definition of artificial intelligence (AI), referring specifically to narrow AI technologies that were empirically observed in the Taiwanese smart medical device sector between 2021 and 2023. These include machine learning-based diagnostic systems, AI-assisted imaging software, embedded predictive algorithms, and intelligent monitoring devices [11,12,13]. Broader conceptions of AI, such as Artificial General Intelligence (AGI) or foundational models like LLMs, are not the focus of this analysis, as they were not salient in either stakeholder discourse or policy frameworks during the period of data collection. By delineating this scope, we aim to preserve empirical fidelity while contributing to an institutional understanding of current AI-enabled system dynamics in healthcare innovation.

To explore these dynamics, the study focuses on Taiwan, leveraging its unique position in the global smart medical device landscape. Taiwan’s advanced information technology infrastructure, robust electronics manufacturing base, biomedical research capabilities, and universal healthcare system, supported by digital health initiatives, provide an ideal context for smart medical innovation [14,15]. Yet, challenges, including regulatory misalignment, reimbursement uncertainties, and limited cross-sector collaboration, impede knowledge flows and systemic integration.

Employing the NBIS framework, this study uses a qualitative system dynamics approach, integrating semi-structured interviews with policymakers, industry leaders, and researchers, alongside causal loop diagramming to model institutional interactions in Taiwan’s ecosystem. It is expected to generate significant insights for theory, policy, and practice. Theoretically, it extends innovation system theory by elucidating how institutional dynamics, such as regulatory adaptation and cross-sector coordination, shape innovation trajectories, addressing a critical literature gap. For policy, it offers actionable recommendations for adaptive governance in emerging economies, optimizing regulatory and reimbursement frameworks. Practically, it provides strategic guidance for firms navigating institutional barriers and equips policymakers with tools to enhance healthcare innovation.

In recent years, the rapid development of large language models (LLMs) has added new dimensions to the role of artificial intelligence in healthcare systems. LLMs are increasingly applied in biomedical contexts such as automated clinical documentation, medical dialogue generation, regulatory text analysis, and knowledge extraction from unstructured data [16,17]. Although these developments have yet to fully materialize in Taiwan’s smart medical device sector, they reflect a growing trend that is expected to reshape innovation ecosystems and institutional coordination. This study primarily focuses on institutional dynamics surrounding AI-enabled devices prior to the mainstream adoption of LLMs, while acknowledging these models as an emerging force relevant for future research on healthcare governance and system transformation.

2. Theoretical Framework and Literature Review

2.1. Technological Convergence in Smart Medical Devices

Technological convergence across artificial intelligence (AI), machine learning (ML), and data analytics is reshaping the innovation landscape of medical devices, enabling real-time monitoring, predictive diagnostics, and proactive healthcare interventions [18,19]. AI-powered surgical robots enhance precision in minimally invasive procedures [20]. Yet, despite these advances, fragmented global standards, cybersecurity risks, and regulatory inertia continue to constrain integration [21,22,23]. Although interoperable healthcare networks offer potential solutions [24], governance frameworks have struggled to evolve at the pace of technological change, revealing persistent gaps between innovation capabilities and institutional readiness.

While existing research emphasizes technical breakthroughs, it often overlooks how rigid regulatory structures and fragmented standardization processes delay the adoption of smart medical devices [25,26]. The lack of robust governance for validating AI algorithms across diverse clinical datasets further impedes innovation diffusion [27]. Taiwan presents a strategically relevant case for examining these challenges. Leveraging its semiconductor strengths and national initiatives such as the Smart Healthcare Flagship Program, Taiwan has promoted innovations like portable ECG monitors for telemedicine [28,29]. However, fragmented hospital information systems and inconsistent data standards continue to limit integration. These patterns highlight the need for governance frameworks that can address both technical complexities and systemic institutional inertia.

2.2. Innovation Systems and Institutional Dynamics

Innovation systems emerged as a response to the limitations of linear models of technological development, which assumed a straightforward sequence from scientific discovery to commercial application. Scholars reconceptualized innovation as a dynamic and interactive process embedded within institutional structures, shaped by the relationships among firms, universities, research institutes, users, and policymakers [30]. National Innovation Systems (NIS) highlight the role of national institutions in shaping innovation [31,32]. Regional Innovation Systems (RIS) focus on local networks and spatial proximity [33,34]. Sectoral Innovation Systems (SIS) examine how industry-specific structures and technological regimes influence innovation dynamics [35].

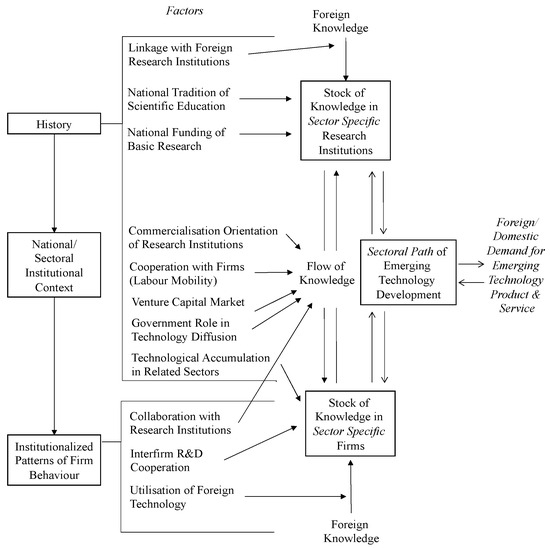

Institutional configurations play a critical role in shaping the accumulation and circulation of knowledge within biotechnology innovation systems. Bartholomew (1997) demonstrated that national differences in education systems, research funding, and industry–academia linkages significantly influence innovation outcomes [36]. Building on this foundation, Chaturvedi (2005) developed the National Biotechnology Innovation System (NBIS) framework, emphasizing sector-specific factors such as institutional flexibility, demand orientation, and public acceptance, particularly in developing country contexts [37]. This framework has since been applied to examine Taiwan’s biopharmaceutical sector, where fragmented institutional linkages and limited cross-sectoral coordination have been identified as key barriers to effective knowledge transfer [38]. This model highlights the structural and institutional components of biotechnology innovation systems, including knowledge stocks, foreign and domestic linkages, institutionalized firm behavior, and sectoral development paths (Figure 1). The present study builds upon this framework to incorporate convergence-era dynamics such as regulatory responsiveness and cross-sector coordination. This approach echoes Dodgson et al.’s (2008) observation that national innovation system frameworks such as NBIS are not static templates but evolving structures shaped by sectoral needs and institutional interactions [39]. In their study of Taiwan’s biotechnology innovation networks, they show how state-led coordination and institutional adaptation enabled the reconfiguration of innovation networks within an existing NIS framework. Similarly, this study refines NBIS internally to address the convergence-specific challenges in AI-enabled smart medical devices, including regulatory flexibility, translational capacity, and cross-sectoral collaboration. As highlighted in Kermani and Findlay (2000), the biotechnology, pharmaceutical, and medical device sectors share common challenges related to regulatory uncertainty, interdisciplinary collaboration, and the need for robust knowledge infrastructures [40]. These shared characteristics support our application of the NBIS framework beyond traditional biopharmaceutical domains. Rather than adopting an entirely new framework, we refine NBIS internally to accommodate the convergence-specific challenges observed in AI-enabled smart medical devices, particularly in the areas of institutional coordination and translational capacity.

Figure 1.

The National Biotechnology Sectoral Innovation System. (Source: [38]).

Innovation systems theory is pivotal in analyzing innovation policy and industrial development [41]. A traditional focus on institutional roles may not fully capture the rapid institutional changes in dynamic sectors like smart medical devices, where technological advancements often outpace regulatory and organizational adaptation. For instance, the European Union’s Medical Device Regulation (MDR) has increased regulatory burdens and delayed market entry for digital health innovations, particularly affecting SMEs and highlighting the need for more adaptive governance [42,43]. In Taiwan, institutional misalignments among health authorities, industrial policy agencies, and clinical validation systems highlight the limitations of conventional frameworks in addressing regulatory lags and coordination gaps [44,45]. To explore these institutional dynamics, this study applies the NBIS framework, which provides a dynamic lens for analyzing institutional evolution in the fast-evolving smart medical device sector.

To further clarify the analytical necessity of refining the NBIS framework, we acknowledge that the original formulation does not fully capture the governance complexity, regulatory fragmentation, and adaptive firm behaviors that characterize convergence-driven sectors such as smart medical devices. Specifically, the NBIS model tends to conceptualize regulation as a centralized and relatively stable function of the state, thereby overlooking the dynamic and distributed nature of regulatory processes in emerging technology domains. It also places limited emphasis on intermediary institutions and coordination failures, which are central in the diffusion of AI-enabled technologies. Moreover, while NBIS attends to commercialization incentives and public-private linkages, it underrepresents how firms strategically respond to regulatory uncertainty through experimental governance mechanisms, such as regulatory sandboxes, co-regulation, or participation in standard-setting consortia. These limitations necessitate internal refinement of NBIS to better analyze the shifting institutional configurations, multi-level governance dynamics, and firm-level adaptation strategies observed in Taiwan’s smart medical device ecosystem. Our refinements thus aim to preserve the core strengths of the NBIS framework, namely its focus on national context and sectoral institutional arrangements, while expanding its capacity to account for regulatory and governance dimensions that are central to convergence-era innovation.

2.3. The Emergence of Innovation Governance

Innovation governance has gained prominence as a response to the limitations of traditional innovation systems, which may not fully capture the dynamic and non-linear nature of innovation. In rapidly evolving fields such as smart medical devices, these models fail to account for the uncertainties introduced by technological convergence, regulatory change, and shifting societal expectations. Scholars have advanced governance frameworks that emphasize anticipation, steering, and societal embedding of innovation [46,47]. As innovation systems grow increasingly complex, science and technology policy must also shift from resource allocation toward more anticipatory and integrative forms of governance [8].

The relevance of innovation governance is particularly visible in the smart medical device sector, where AI and IoT integration outpace existing regulatory systems. In Taiwan, the Ministry of Health and Welfare has issued technical guidelines for the registration of AI- and machine learning-based software as medical devices, and established the Smart Medical Devices Information and Matchmaking Platform to support regulatory clarity and promote cross-sectoral coordination. These challenges underscore the need for governance models that balance innovation promotion with regulatory certainty. To address such governance gaps, scholars have called for soft-law instruments and multi-stakeholder dialogue to support adaptive and responsible regulatory regimes [48]. One emerging approach to enhance innovation governance, particularly in facilitating academia–industry collaboration and knowledge sharing, involves Open Science Partnerships [49]. Emerging approaches such as the FDA’s SaMD risk-based categorization demonstrate how anticipatory frameworks can enable more responsive oversight. In this context, innovation governance offers a means to navigate institutional misalignments and regulatory lag while fostering socially robust innovation.

2.4. Analytical Framework

Building on the preceding discussion of innovation systems and innovation governance, this study adopts the National Biotechnology Innovation System (NBIS) framework as its primary analytical framework [38]. While the NBIS framework captures the structural interactions among knowledge production, institutional arrangements, and sectoral development, it requires refinement to address the governance challenges and regulatory uncertainties associated with emerging smart medical technologies.

Alternative frameworks such as the Multi-Level Perspective (MLP) and the Triple Helix, while valuable for analyzing broad socio-technical transitions or university–industry–government relations, offer limited analytical precision when it comes to sector-specific institutional interactions and the role of targeted state interventions. While the Multi-Level Perspective (MLP) has played a pivotal role in conceptualizing socio-technical transitions, recent literature highlights its limitations in addressing the governance and policy coordination challenges that characterize sector-specific transitions. MLP’s abstract layering (niche, regime, landscape) lacks the granularity required to analyze institutional interactions, regulatory responsiveness, and strategic behavior in domains like smart healthcare [49,50]. While the Triple Helix model has provided a foundational lens for analyzing university–industry–government interactions, recent scholarship has highlighted its limitations in addressing the complexity of emerging innovation ecosystems. Specifically, the model tends to underrepresent the role of regulatory intermediaries, data governance, and civil society in contemporary settings [16,17]. It also lacks a concrete operational basis for analyzing sector-specific coordination challenges and institutional frictions under state-led innovation regimes. These constraints make the Triple Helix less suitable for capturing the dynamics of smart healthcare innovation, where policy-driven coordination, clinical validation, and cross-sectoral translation are central. For this reason, this study retains and refines the NBIS framework, which provides a more grounded structure for examining how knowledge infrastructures, regulatory agencies, and firm strategies co-evolve within the smart medical device sector.

This refinement is further informed by recent research highlighting how AI and blockchain technologies have been applied to support decentralized governance and address coordination challenges in healthcare innovation, particularly in multi-competitor collaborative settings [51]. These insights offer valuable perspectives for understanding coopetition and institutional responsiveness in the smart medical device sector. This theoretical positioning also aligns with the “next-generation innovation policy” perspective, which emphasizes meta-governance, concertation, and the assemblage of diverse institutional elements to address grand societal challenges [52]. Rather than shifting to a wholly new analytical architecture, the NBIS framework is internally extended to reflect these principles in a sectoral context, capturing how fragmented institutional arrangements, regulatory responsiveness, and cross-sector coordination jointly shape innovation trajectories.

To better capture the distinctive dynamics of the smart medical device sector, this study refines key analytical factors within the NBIS framework. In the dimension of Stock of Knowledge in Sector-Specific Research Institutions, the framework incorporates clinical validation capacity and data governance alongside sectoral research traditions and public–private collaboration, recognizing the growing importance of clinical translation and data infrastructures. In Institutional Patterns of Firm Behavior, the analysis extends beyond regulatory regimes and government interventions to include firm strategies under regulatory uncertainty, participation in standard-setting processes, and engagement with regulatory sandboxes, reflecting the adaptive behaviors of firms within fragmented and evolving regulatory landscapes. In the Sectoral Path of Biotechnology Development, the framework considers not only the direction of public funding but also the responsiveness of regulatory agencies, cross-institutional coordination, and the mechanisms that influence market access and technology adoption.

This adapted framework provides a systematic basis for analyzing how sector-specific knowledge infrastructures, institutional behaviors, and governance processes interact to shape the innovation trajectories of smart medical devices over time. It highlights both the structural foundations that enable innovation and the frictions that arise from regulatory lag and institutional misalignment, aligning with broader efforts to reframe innovation governance in the face of converging technologies and societal complexity.

3. Methodology

3.1. Research Design and Data Collection

This study adopts a qualitative, exploratory research design to examine the institutional dynamics shaping the smart medical device innovation system in Taiwan. Based on the National Biotechnology Innovation System (NBIS) framework, the research focuses on capturing the evolving interactions among knowledge infrastructures, actor networks, and governance structures within a sector characterized by technological convergence and regulatory complexity. Two primary sources of empirical data were utilized: (1) semi-structured interviews with key stakeholders and (2) policy documents and official reports related to smart medical device innovation. These data sources provided a comprehensive foundation for subsequent thematic analysis and system dynamics modeling. This multi-source approach enabled triangulation across different perspectives and enhanced the analytical rigor of the study.

Interviewees were purposively sampled to reflect the functional diversity of the innovation system. The organizations were classified into five categories: firms and startups, intermediary organizations, universities and research institutes, government and policy agencies, and hospitals and clinical institutions, as summarized in Table 1. A total of 28 interviewees were engaged between early 2023 and early 2025. To maintain anonymity, the names of participating organizations are not disclosed. The interview guide was structured around the three core dimensions of the NBIS framework: (1) knowledge and technology base, (2) actors and networks, and (3) institutions and governance mechanisms. While maintaining consistency across interviews, flexibility was allowed for participants to elaborate on emergent themes beyond the structured questions.

Table 1.

Organization types and roles of interviewees.

In addition to interview data, 18 policy documents and official reports published between 2015 and 2024 were analyzed to contextualize and validate the findings. The selection began with the 2015 Guidelines for the Classification and Regulatory Reference of Medical Software, which established foundational standards for smart medical devices in Taiwan. Policy documents and official reports were selected based on their relevance to the development of smart medical devices and were sourced from government websites and publicly accessible databases. These documents were categorized into five thematic areas: national science and technology policies, Smart Healthcare Flagship Programs, regulatory frameworks and approval mechanisms, health insurance and reimbursement policies, and reports from intermediary organizations and think tanks. Table 2 provides an overview of the document categories.

Table 2.

Categories of policy documents and official reports analyzed.

3.2. Thematic Analysis for Variable Identification

Key variables were identified through thematic analysis of the interview data. A hybrid coding strategy was employed, combining deductive codes informed by the NBIS framework (e.g., knowledge stock, institutional support, regulatory environment) with inductive codes derived from emergent patterns within the interview narratives. This approach enabled the identification of both theoretically anchored and context-specific insights.

Interview transcripts were transcribed verbatim and subjected to an initial phase of open coding. To reinforce analytical rigor, coding was conducted iteratively with constant comparison techniques applied throughout. The coding scheme was refined during repeated engagements with the data to ensure internal coherence and to accommodate emerging nuances. The finalized coding structure was systematically applied across the complete dataset.

The coded data were subsequently organized into thematic categories, encompassing structural conditions, actor interactions, knowledge flows, regulatory dynamics, and market adoption challenges. Key variables were distilled within each category based on their systemic relevance and recurrence across multiple interviews. Attention was directed toward temporal elements and causal inferences articulated by interviewees, which informed the development of causal loop diagrams. The thematic analysis resulted in a structured set of variables and preliminary relational patterns, providing the foundation for subsequent qualitative system dynamics modeling. A detailed mapping of variables and explanation associated with each feedback loop is provided in Appendix A, Appendix B, Appendix C and Appendix D.

3.3. System Dynamics Modeling Processes

System dynamics is a modeling approach used to capture the feedback structures and dynamic behaviors of complex systems over time [53]. This approach is particularly suited to contexts where complex, interdependent relationships and feedback processes shape systemic outcomes over time. In this study, a qualitative system dynamics modeling process was undertaken to analyze the institutional dynamics shaping the smart medical device innovation ecosystem. Causal loop diagrams (CLDs), a qualitative tool within the system dynamics methodology, were employed to visualize and structure the interrelationships among key variables identified from the interview data.

The modeling process began with the identification of key concepts and variables through thematic analysis. Variables were selected based on their systemic relevance, recurrence across interviews, and perceived influence on innovation processes. Particular attention was given to variables exhibiting strong relational prominence, temporal dynamics, or feedback characteristics. Causal relationships among variables were inferred from interviewees’ narratives, focusing on articulated mechanisms, perceived sequences of events, and descriptions of systemic behaviors. Both reinforcing and balancing feedback loops were identified by tracing how variables interacted over time. Each feedback loop was assigned a descriptive label to clarify its function within the system, including five reinforcing loops (R1–R5) and four balancing loops (B1–B4), as summarized in Table 3.

Table 3.

Summary of reinforcing and balancing feedback loops.

Preliminary CLDs were iteratively developed using Vensim PLE software, Version 10.2.0. Initial drafts were created by linking variables based on thematic coding results and were progressively refined to enhance clarity, coherence, and feedback structure representation. Special attention was paid to capturing positive and negative feedback dynamics related to regulatory adaptation, knowledge flow, actor coordination, and market adoption. Validation and refinement were integral to the modeling process. Causal links were triangulated across interview narratives, policy documents, and theoretical constructs from the NBIS framework to strengthen internal validity. Successive review cycles focused on confirming logical coherence, minimizing circular reasoning, and verifying the plausibility of causal chains.

The finalized CLDs provide a structured foundation for analyzing systemic bottlenecks, feedback dynamics, and potential intervention points within the innovation ecosystem. They serve both as analytical models and heuristic tools for understanding the interplay between governance structures and innovation trajectories.

3.4. Validation and Quality Assurance

Multiple strategies were employed to ensure the research findings’ credibility, consistency, and validity. First, triangulation across semi-structured interviews, policy documents, and academic literature enhanced the credibility of the qualitative data and minimized the risk of source bias. Second, analytical rigor was maintained through a systematic coding process that combined deductive and inductive strategies, iterative refinement of thematic categories, and constant comparison techniques. These procedures ensured internal coherence during variable extraction and subsequent causal loop diagram (CLD) construction. Finally, interpretive validity was reinforced by grounding the identification of causal relationships in both theoretical constructs and the contextual interpretations provided by stakeholders. Throughout the modeling process, attention was given to maintaining transparency in how feedback structures and system dynamics were conceptualized from the empirical evidence. These strategies contributed to a transparent, rigorous, and contextually grounded system dynamics modeling process. To further enhance the transparency and credibility of the qualitative modeling process, additional steps were taken to address potential subjectivity and ensure analytical robustness. These included maintaining an audit trail of coding decisions, peer debriefing sessions with co-researchers, and iterative refinement of loop structures through multiple review rounds. Where possible, feedback from domain experts was informally sought to assess the plausibility and completeness of the feedback loops. These efforts contributed to minimizing individual interpretive bias and reinforced the consistency of model construction across data sources.

4. Results

4.1. Knowledge Bottlenecks in Research Institutions: Translational Gaps and Systemic Constraints

In Taiwan’s smart medical device sector, knowledge production is led by research institutions such as universities and public research organizations, and is supported by intermediary organizations including Academia Sinica, the Industrial Technology Research Institute, the Metal Industries Research and Development Centre, and the Institute for Information Industry. These intermediaries help align research with clinical and industrial needs, particularly in areas such as AI diagnostics and wearable devices.

In 2023, the government allocated approximately TWD 12.5 billion (USD ~390 million) for biomedical R&D, with TWD 3.8 billion (USD ~118 million) specifically dedicated to smart medical device innovation (Ministry of Health and Welfare, 2024; Ministry of Economic Affairs, 2024). These investments supported projects such as portable ECG monitors and AI-enhanced surgical robots. Despite this substantial support, engagement in smart medical device innovation among startups remains limited. Of the more than 50 startups in the Smart Healthcare Flagship Program, only 15 to 20 focus on this area. Similarly, just 45 to 80 of an estimated 150 to 200 biotech startups are active in the smart medical device domain, with only 32 formally recognized as of 2024 (Ministry of Health and Welfare, 2024; Institute for Biotechnology and Medicine Industry, 2024).

This highlights a persistent translational gap, where academic knowledge does not readily flow into clinical or commercial applications. From the perspective of intermediary actors and firms, this gap stems from a lack of downstream integration. Even with strong research outputs and certification support, the absence of early-stage market and user alignment remains a key bottleneck to innovation diffusion.

“For medical devices to be successfully implemented, regulatory, patent, and human factors must be considered from the design stage. Intermediary organizations help universities or startups strengthen these aspects through cross-domain integration and validation”.(I11)

“There are many semi-governmental support organizations that help your secure certification if you have strong technology… but what is most lacking is the connection to the market”.(I5)

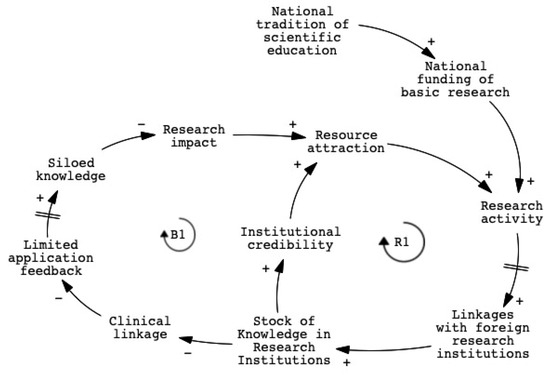

To examine this phenomenon, we developed a causal loop diagram (CLD) based on thematic analysis of 28 stakeholder interviews (see Section 3.2). Figure 2 illustrates two key feedback loops. The symbols “+” and “–” are used to indicate the directionality of causal relationships between variables in the system. A “+” symbol denotes a positive or reinforcing relationship, where an increase (or decrease) in the causal variable leads to a corresponding increase (or decrease) in the affected variable. In contrast, a “–” symbol represents a negative or balancing relationship, where an increase in the causal variable results in a decrease in the affected variable, and vice versa. These notations follow the conventions of causal loop diagramming commonly employed in system dynamics analysis. The reinforcing loop (R1) demonstrates how public funding and academic incentives drive the accumulation of research knowledge, thereby strengthening institutional resources. In contrast, the balancing loop (B1) highlights how insufficient translational capacity, stemming from cross-domain talent shortages and weak clinical engagement, limits research impact and reinforces disconnection from real-world applications. A detailed mapping of variables and explanations associated with each feedback loop is provided in Appendix A.

Figure 2.

CLD of knowledge bottlenecks in research institutions.

Variables such as “translational capacity” and “clinical linkage” appeared frequently in stakeholder narratives. Interviewees stressed that bridging scientific development with real-world needs requires clinician involvement and cross-sector collaboration. Several pointed out that technical strength alone is insufficient without supportive environments for collaboration and business integration. Stakeholder perspectives reveal the need for early engagement with clinical users and coordinated efforts across research, application, and commercialization to achieve meaningful innovation.

“Software in medical devices is itself a form of medical technology, and this is where Taiwan is strong. Our ICT sector can continue contributing to device applications, but clinical doctors must be involved. If it’s only scientists, they can’t precisely target real pain points. Clinicians need to be part of the transformation process. If we can get both sides right, Taiwan won’t be weak in this area”.(I8)

“A demonstration field site brings together people from different domains, for example through industry-academia collaboration or matchmaking with companies. The most difficult part, however, is introducing a viable business model. That ultimately determines how their technologies can actually be implemented.”(I26)

“A significant number of smart medical devices remain at the research stage and have yet to be translated into viable commercial products.”(I16)

Although international collaboration is intended to bridge local capacity gaps, it often creates additional challenges. Delays in regulatory alignment and global engagement can weaken the system’s adaptive capacity. Stakeholders noted that while Taiwan’s domestic certification process is relatively efficient, entry into international markets remains difficult. Although international collaboration aims to bridge this gap, it often introduces additional challenges. These temporal lags intensify the effects of the B1 loop and further reduce the system’s adaptive capacity.

“Getting certified in Taiwan is relatively easy, and we have experience with that. But getting FDA certification requires prior expertise. International collaboration is helpful, but without proper support, it’s hard to establish global distribution channels. Some products are like orphans and might not even be used.”(I1)

These feedback loops reveal a dual dynamic in which Taiwan’s research institutions continue to generate knowledge, but systemic constraints limit its translation into downstream innovation. Without integrative governance, institutions risk reinforcing their own isolation. Similar bottlenecks appear in other convergence-driven sectors where interdisciplinary collaboration is essential.

Taiwan’s experience reflects broader challenges in global innovation systems, particularly in sectors such as smart medical devices that depend on the integration of diverse domains. The translational gaps identified here, including weak clinical engagement, shortages of cross-domain talent, and regulatory misalignment, are not unique to Taiwan. They mirror issues faced by other economies transitioning from research-driven to application-oriented innovation systems. Similar bottlenecks have also been observed in the European Union’s Horizon 2020 program, where interdisciplinary collaboration and market integration remain critical hurdles (European Commission, 2020). Taiwan’s case offers generalizable insights into the importance of integrative governance and cross-sector coordination to better align research with global market demands. This analysis reinforces the view that translational capacity should be addressed as a system-level coordination challenge in innovation policy.

4.2. Alliance-Based Knowledge Flow: Strategic Collaborations as a Transitional Mechanism

Strategic alliances, often supported by government programs such as the Small Business Innovation Research (SBIR) initiative and medical technology funding schemes from the Ministry of Health and Welfare, have become the dominant mode of collaboration in Taiwan’s smart medical device sector. These alliances facilitate knowledge flow and project-based cooperation among research institutions, hospitals, and firms. Beyond domestic coordination, alliance-based collaboration has also served as a platform for international linkage. While such alliances promote cross-sector engagement and expand the reach of innovation activities, interviewees also pointed to persistent coordination challenges. Strategic alliances play a crucial role in enabling initial coordination, but their long-term impact depends on the development of system-level structures that can consolidate and sustain collaborative capacity.

“In the smart medical device industry, collaboration is almost always conducted through alliances. It’s a team effort. We usually work with key partners on joint R&D or product co-development. We participate in various industry associations and often collaborate with our partner companies through strategic alliances, whether it’s for product development, market access, or customer engagement. Even when there is competition, we still prefer to compete through alliances rather than going solo.”(I3)

“Because of the industry-academia alliance programs and the hospital-based demosite, we were able to facilitate more international linkages.”(I19)

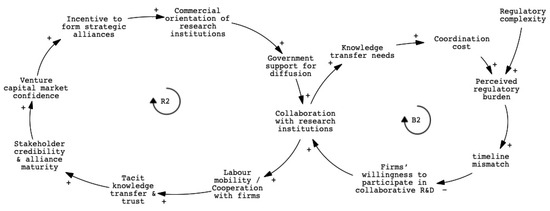

To analyze this phenomenon, we developed a causal loop diagram (CLD) based on thematic analysis. Figure 3 presents the causal loop diagram that illustrates the core dynamics of alliance-based coordination. The reinforcing loop (R2) shows how policy incentives, commercialization pressure, and institutional credibility generate momentum for alliance formation. These alliances facilitate knowledge exchange, clinical access, and early-stage regulatory navigation. In parallel, the balancing loop (B2) reflects the collaboration challenges that may arise over time. Coordination fatigue, misaligned timelines, and the short-term nature of project-based funding can reduce incentives for sustained engagement. These feedback loops indicate that while alliances serve an important transitional function, their long-term effectiveness depends on broader institutional conditions that support ongoing collaboration. A detailed mapping of variables and explanations associated with each feedback loop is provided in Appendix B.

Figure 3.

CLD of alliance-based knowledge flow and coordination frictions.

Key variables such as regulatory complexity, coordination cost, and government support for diffusion were consistently emphasized. Strategic alliances were commonly seen as effective tools for navigating early-stage regulatory requirements, particularly by enhancing institutional legitimacy and accelerating clinical validation. At the same time, many interviewees noted that sustaining collaboration beyond the life of individual projects remains difficult. This challenge stems from a lack of institutional mechanisms that ensure coordination continuity, as current funding structures are often time-limited and responsibilities among partners remain fragmented. As a result, while alliances help initiate collaboration, they offer limited support for cumulative innovation over time.

“Doctors focus on treating patients, professors focus on research, and companies focus on product development. If we want to turn all of this into a business, we need to connect these efforts. In the future, we are thinking about establishing a dedicated cross-university organization. And perhaps a policy-level institution could take on the role of integrating the many existing alliances into a centralized alliance.”(I24)

“One key issue is understanding international market regulations. When we talk about the international market, we’re really referring to the United States, Europe, and Japan—the three most important regions with the strongest purchasing power. Whether it’s for biotech drugs or medical devices, it’s essential to understand the regulatory frameworks in these countries. The challenge for many Taiwanese firms is that they primarily operate as OEMs, so they lack opportunities to fully engage with and understand these regulatory systems from the ground up.”(I8)

These patterns suggest that the limitations of alliances are not inherent to the collaboration model itself but arise from broader system conditions that constrain long-term knowledge integration. Rather than replacing alliances, policy efforts should focus on reinforcing the enabling conditions that extend their collaborative value beyond single project cycles. These conditions include sustained incentives, intermediary support, and iterative learning platforms. This analysis contributes to the NBIS framework by demonstrating that under conditions of incomplete institutional integration, alliance-based coordination can serve as a transitional governance mechanism. Its effectiveness depends not only on the capabilities of individual actors but also on the system’s ability to support ongoing collaboration across regulatory, clinical, and commercial interfaces.

4.3. Organizational Limits of Traditional Firms: Cultural and Capability Barriers to Knowledge Accumulation

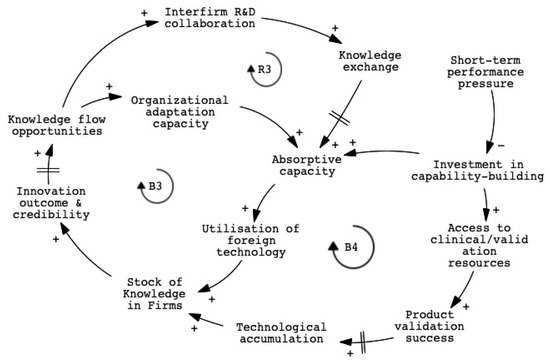

Despite growing policy support for digital health and smart technologies, many traditional firms in Taiwan’s medical device sector encounter difficulties when attempting to reconfigure their internal capabilities, as shown in Figure 4. These challenges stem not only from technological gaps but also from institutional and organizational misalignments. Firms that developed within a contract manufacturing logic often lack the absorptive capacity needed to engage with complex regulatory systems, clinical workflows, and data-driven innovation practices.

Figure 4.

CLD of organizational constraints in traditional medical device firms.

“Many companies claim that AI can improve processes, but they often encounter obstacles once entering hospitals because each hospital has a different information system, which requires a high degree of customization.”(I19)

“When traditional industries attempt to upgrade their technologies or products, they face a variety of challenges, such as resource constraints, cultural issues, and difficulties related to development and R&D.”(I3)

One key balancing loop (B3) captures how limited absorptive capacity and fragmented organizational routines prevent firms from internalizing new knowledge, even when collaborative opportunities are available. Another balancing loop (B4) reflects how short-term financial pressure and performance incentives discourage long-term investment in capability building, leading firms to prioritize incremental product adaptation over strategic transformation. A reinforcing loop (R3) suggests that when firms succeed in integrating cross-sectoral knowledge, such as regulatory expertise, clinical insight, or digital system design, they build innovation credibility that enables further collaboration and stronger engagement with both upstream and downstream partners. However, activating this virtuous cycle requires more than efforts at the firm level. It depends on supportive institutional conditions, including intermediary support, public and private translational platforms, and funding mechanisms that promote sustained innovation rather than short-term deliverables. A detailed mapping of variables and explanations associated with each feedback loop is provided in Appendix C.

Key variables emerging from the thematic analysis and reflected in the system model include absorptive capacity, technological accumulation, product validation success, and short-term performance pressure. Absorptive capacity serves as a central dynamic, enabling firms to internalize external knowledge and apply it to new technologies. However, this capacity is often constrained by limited interdisciplinary routines and weak mechanisms for knowledge retention. Technological accumulation depends on the firms’ ability to not only access but also embed knowledge over time, yet high staff turnover and fragmented project structures frequently lead to the loss of learning. Product validation success, shaped by access to clinical and regulatory resources, is further restricted by short-term financial pressures that reduce long-term investment in capability building. These variables interact through feedback loops that influence whether traditional firms can sustain innovation or remain locked in incremental adaptation.

“Taiwan’s National Health Insurance system is unstable and lacks transparency, making it difficult for companies to make reasonable forecasts. As a result, investors tend to hesitate.”(I6)

“In the medical device field, it’s difficult to achieve significant revenue from a single product alone. One option is to gradually expand the product line, like major companies do, perhaps covering an entire medical specialty. But for domestic smart medical startups, this is quite challenging. So one good option is to be acquired.”(I10)

These dynamics contribute to the broader literature on sectoral innovation systems and absorptive capacity by emphasizing that transformation is not solely determined by knowledge availability. Rather, it is shaped by how well organizational capabilities, system-wide coordination, and policy design are aligned. In settings such as Taiwan, where traditional medical device firms operate within fragmented ecosystems and lack integrative governance structures, meaningful transformation requires institutional scaffolding that enables knowledge absorption, retention, and reuse across multiple innovation cycles.

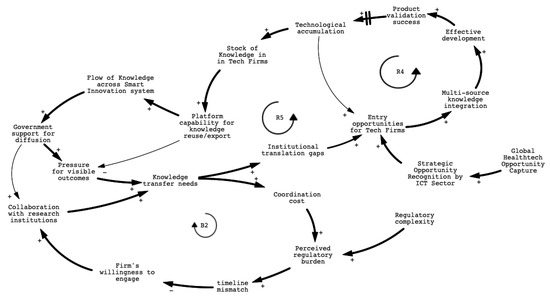

4.4. Systemic Repositioning and the Rise of Technology-Led Innovation

While traditional institutions continue to struggle with translational gaps and organizational rigidity, technology firms are gradually repositioning themselves as innovation leaders. Their growing influence in Taiwan’s smart medical device sector reflects not only firm-level initiative but also a broader system-level shift shaped by persistent coordination failures and capability misalignments (Figure 5). Rather than operating as peripheral partners, these firms increasingly drive integration across clinical, regulatory, and technological domains, often filling the structural void left by fragmented public and industrial actors.

Figure 5.

CLD of systemic repositioning and the rise of technology-led innovation.

A key inflection point in this transition was the implementation of the Medical Devices Act in 2021, which restructured Taiwan’s regulatory framework by introducing risk-based classifications and formally recognizing software-based medical devices. The reform also institutionalized early-stage technical consultation with regulators, reducing uncertainty for developers of AI-enabled and data-driven solutions. Several major ICT firms in Taiwan, including Foxconn, Wistron, Quanta, Compal, and Qisda, have increasingly entered the smart healthcare sector. Initially focused on components such as chips, displays, and embedded systems, these companies are now integrating software, data services, and medical validation to expand their role in medical device innovation. While not the origin of technology firms’ involvement, this reform significantly accelerated their ascent. In this sense, the policy shift did not trigger innovation leadership, but selectively reinforced firms already positioned to act on institutional complexity.

The growing leadership of technology firms is reinforced by multiple, mutually reinforcing feedback mechanisms. A detailed mapping of variables and explanations associated with each feedback loop is provided in Appendix D. Loop R4 highlights how these firms integrate knowledge from diverse domains, such as clinical validation, regulatory interpretation, and digital infrastructure, into their innovation pipelines. Their ability to achieve product validation success not only enhances their credibility and market confidence but also strengthens their capacity to coordinate multi-source knowledge inputs, accelerating future development cycles. Loop R5 further captures how institutional translation gaps, including the inability of traditional actors to bridge research, regulation, and application, create entry opportunities for agile and resource-rich technology firms. These firms leverage their platform capabilities and internal knowledge integration systems to respond to clinical and regulatory complexity more effectively than legacy actors. Over time, this leads to the accumulation of strategic knowledge within tech firms themselves, shifting the locus of innovation governance from public or academic institutions to private, digitally enabled entities.

At the same time, balancing loop B2 underscores the persistent coordination challenges within the traditional innovation system. Fragmented mandates, high collaboration costs, and misaligned project timelines prevent effective cross-sector engagement. As regulatory burdens and time pressures increase, legacy actors struggle to adapt, thereby unintentionally amplifying the system-level reliance on technology firms to maintain continuity and coherence across innovation phases.

Taken together, these feedback dynamics demonstrate that the emergence of technology firms as dominant actors is not simply a function of superior capability but a systemic outcome shaped by institutional fragmentation and asymmetrical responsiveness. Rather than being inserted into a fully functioning system, these firms have become de facto orchestrators by occupying the coordination space left unaddressed by traditional institutions. This realignment reflects a deeper institutional shift within the innovation system. In contrast to the traditional assumption that research institutions or established manufacturers lead sectoral transitions, this case highlights how innovation leadership can emerge from institutional voids. It suggests a form of gap-driven leadership, where actors with superior system responsiveness rise to prominence not solely through technological capability, but by occupying strategic positions left open by systemic fragmentation. For innovation governance, this implies the need to design policies that not only reward performance but also build institutional scaffolding that enables distributed coordination, long-term learning, and inclusive transformation.

Beyond domestic institutional dynamics, several global factors also exert considerable influence on Taiwan’s innovation system. Interviewees noted that geopolitical tensions, such as the ongoing U.S.–China technology competition, have shaped firm strategies around supply chain resilience and regulatory alignment. In addition, international trade policies and export control regimes have increased uncertainty for firms seeking to access global markets. These external forces have heightened the urgency for Taiwanese tech firms to develop internal regulatory capacity and diversify their clinical validation pathways, thereby accelerating their strategic repositioning within the innovation ecosystem. While these dynamics were not the primary focus of this study, they underscore the importance of considering both internal institutional gaps and external structural pressures in understanding system transformation.

5. Conclusions

This study explored how innovation develops in ecosystems where knowledge flows and coordination infrastructures are fragmented. It analyzed why smart medical innovation in Taiwan struggles to scale despite public investment and institutional support, and how technology firms have repositioned themselves as system leaders when research institutions and traditional manufacturers lack sustained translational capacity.

As a global reference point, the COVID-19 pandemic further underscored the importance of adaptive governance and data-driven innovation in health systems. Taiwan’s open health data initiatives during the pandemic, despite its non-membership in the World Health Organization (WHO), demonstrated how transparent, timely, and interoperable data infrastructures can inform AI-driven clinical decision-making. A notable example is the DeepTrace project, which applied graph neural networks to optimize contact tracing across epidemic networks [54]. This case highlights the need for innovation system frameworks to explicitly incorporate data governance and algorithmic validation strategies as core elements of systemic resilience. Future governance designs should consider how regulatory structures and funding mechanisms can incentivize the collection and validation of high-quality, interoperable datasets across institutional and national boundaries. To strengthen system-wide resilience, future innovation system frameworks should explicitly integrate data governance and algorithmic validation as core components. Regulatory structures and funding mechanisms can be designed to incentivize the collection and verification of high-quality, interoperable datasets across institutional and national boundaries. These strategies are critical not only for enabling AI-driven medical technologies to function safely and effectively across diverse clinical settings but also for ensuring equitable access and international relevance.

Using the National Biotechnology Innovation System (NBIS) framework and qualitative system dynamics modeling, the study shows that innovation leadership is not solely about technological capability. It also depends on navigating regulatory complexity, coordinating across institutional boundaries, and integrating diverse knowledge domains. Structural gaps, including the disconnection of academic research from practical applications, the lack of sustained coordination in short-term alliances, and inertia within the manufacturing sector, have contributed to the formation of institutional vacuums. These vacuums have been filled by agile, platform-oriented technology firms that leverage their internal capabilities to address emerging demands in regulatory, clinical, and commercial contexts.

Through qualitative system dynamics modeling, this study advances innovation systems theory by introducing the concept of gap-driven leadership, a form of system leadership that arises not from institutional incumbency but from the ability to respond to institutional misalignments. This perspective challenges the traditional NBIS assumption that innovation leadership resides within research institutions or established manufacturers, and instead highlights how new leadership can emerge through adaptive responses to systemic fragmentation. This study extends the NBIS framework by highlighting how coordination asymmetries and systemic responsiveness shape innovation trajectories in convergence-driven sectors. It aligns with recent efforts to capture the dynamic and nonlinear characteristics of innovation systems through approaches such as qualitative system dynamics modeling [55].

Validating algorithms across diverse clinical datasets is essential to ensure that AI-enabled medical devices are robust, inclusive, and clinically relevant across a range of healthcare settings. Innovation system frameworks should explicitly incorporate these validation processes and data governance mechanisms as core components of systemic resilience. This is particularly important in responding to real-world crises such as pandemics and addressing global health equity challenges. Understanding how open data, governance coordination, and inclusive innovation intersect can provide actionable insights for adapting frameworks such as the NBIS. Specifically, this entails embedding cross-sectoral validation capacity, data interoperability infrastructure, and regulatory responsiveness into the design and operation of innovation systems.

This study is subject to several limitations. First, the empirical analysis is based on a qualitative case study of Taiwan’s smart medical device sector. While this context provides rich insights into the dynamics of convergence-driven innovation under a state-led regime, the findings may not be directly generalizable to countries with different institutional configurations or levels of technological maturity. Second, although the NBIS framework has been refined to address the governance challenges associated with emerging digital health technologies, its applicability to other convergence sectors warrants further comparative investigation. Third, the proposed concept of gap-driven leadership represents an exploratory theoretical development based on inductive inference from interview data. Future studies could build on this concept using comparative or longitudinal designs to assess its analytical robustness. In addition, while this study included policymakers, industry leaders, researchers, and selected clinical stakeholders, it may underrepresent perspectives from patients, frontline healthcare providers, or insurance actors. These actors are central to understanding downstream adoption, trust, and systemic integration. We acknowledge this as a limitation and encourage future research to incorporate a broader set of stakeholder perspectives to more comprehensively capture the dynamics of inclusive and adaptive innovation in smart healthcare systems. We encourage further research that applies mixed-method approaches or extends the analysis to other national contexts, in order to validate and refine the framework proposed in this study. Finally, we note that global factors such as geopolitical tensions, trade policy shifts, and supply chain restructuring may indirectly shape institutional behavior and firm strategy within Taiwan’s smart medical device sector. Although this study focused on domestic governance dynamics, future research could explore how these external structural conditions interact with internal institutional change to co-define innovation trajectories in small, export-oriented economies.

For policymakers and ecosystem designers, the findings suggest that fostering inclusive and sustained innovation requires more than enhancing individual firm competitiveness. It demands governance strategies that include establishing university-based incubators to bridge academic and industry gaps, implementing multi-year funding schemes to support long-term innovation partnerships, and providing incentives for manufacturing firms to adopt smart technologies or collaborate with technology companies. The timeliness and consistency of regulatory action against harmful innovations are important metrics for evaluating the performance of an innovation system [56,57]. Similarly, in the context of beneficial innovations, regulatory frameworks must be designed to promote innovation while ensuring safety and efficacy. In rapidly evolving sectors like smart healthcare, the ability to design adaptive and integrative innovation ecosystems is critical to achieving both technological advancement and societal value. Future research could explore the applicability of gap-driven leadership in other industries or regions or investigate the specific mechanisms through which technology firms effectively respond to institutional misalignments.

Author Contributions

Conceptualization, S.-H.C. and W.-H.C.; methodology, S.-H.C. and W.-H.C.; software, W.-H.C.; validation, S.-H.C.; formal analysis, S.-H.C. and W.-H.C.; investigation, S.-H.C. and W.-H.C.; resources, S.-H.C.; data curation, W.-H.C.; writing—original draft preparation, W.-H.C.; writing—review and editing, S.-H.C.; visualization, W.-H.C.; supervision, S.-H.C.; project administration, S.-H.C. and W.-H.C.; funding acquisition, S.-H.C. All authors have read and agreed to the published version of the manuscript.

Funding

This work was funded by the National Science and Technology Council, Grant No. NSTC 110-2628-H-A49-002-MY3 and 113-2410-H-A49 -019 -MY2. This research was also partially funded by the Higher Education Sprout Project of the National Yang Ming Chiao Tung University, funded by the Ministry of Education (MOE), Taiwan.

Institutional Review Board Statement

“The study was conducted in accordance with the Declaration of Helsinki, and approved by the Human Research Ethics Committee of National Yang Ming Chiao Tung University (protocol code NYCU-REC-110-032E and date of approval: 7 July 2021; protocol code NYCU-REC-110-032E and date of approval: 6 August 2024).” for studies involving humans.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Acknowledgments

The authors would like to thank all expert participants for their time and insight sharing.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| NBIS | National Biotechnology Innovation System |

| CLD | Causal loop diagrams |

Appendix A

| R1, B1 | |

| Variable | Explanation |

| National tradition of scientific education | The historical strength and emphasis on scientific education in the country, which builds a foundation for knowledge production. |

| National funding of basic research | Government investment in basic research that enables the initiation and sustainability of scientific activity. |

| Research activity | The volume and intensity of research projects and scientific work being carried out. |

| Linkages with foreign research institutions | The extent of collaboration and knowledge exchange with international research organizations. |

| Stock of Knowledge in Research Institutions | The accumulated expertise, data, and scientific outputs within universities and research institutes. |

| Institutional credibility | The reputation and perceived reliability of research institutions in attracting partners and resources. |

| Resource attraction | The ability of institutions to attract funding, talent, and collaborative opportunities. |

| Clinical linkage | The strength of connections between research institutions and clinical environments, including user engagement and trial feedback. |

| Limited application feedback | A lack of practical, real-world input from clinical users, which weakens the translation of research into application. |

| Siloed knowledge | Knowledge that is isolated within disciplinary or institutional boundaries, impeding cross-sector innovation. |

| Research impact | The extent to which research outcomes influence policy, industry, or clinical practice. |

Appendix B

| R2, B2 | |

| Variable | Explanation |

| Incentive to form strategic alliances | Motivation for actors (firms, research institutions, etc.) to engage in collaborative partnerships. |

| Commercial orientation of research institutions | The degree to which academic and research entities focus on practical, market-driven outcomes. |

| Government support for diffusion | Public policy initiatives and funding aimed at facilitating the spread of innovation outcomes. |

| Collaboration with research institutions | The extent and quality of joint R&D or knowledge exchange between firms and academic entities. |

| Labour mobility/Cooperation with firms | The movement of talent across sectors and willingness of firms to engage with academic collaborators. |

| Tacit knowledge transfer and trust | The informal, experience-based knowledge exchange that depends heavily on trust. |

| Stakeholder credibility and alliance maturity | The perceived reliability and experience of alliance participants, which enhances collaboration quality. |

| Venture capital market confidence | Investor confidence in the viability of innovation partnerships, often influenced by alliance outcomes. |

| Knowledge transfer needs | The demand for effective knowledge sharing between firms and research entities. |

| Firms’ willingness to participate in collaborative R&D | Firms’ motivation and ability to engage in joint research efforts with external partners. |

| Timeline mismatch | The subjective sense of complexity and risk associated with navigating regulatory processes. |

| Regulatory complexity | Objective and structural difficulties in regulatory frameworks that increase transaction costs. |

| Coordination cost | The effort, time, and resources needed to align diverse actors in a collaborative effort. |

Appendix C

| R3, B3, B4 | |

| Variable | Explanation |

| Interfirm R&D collaboration | Collaborative innovation efforts between firms to share resources and reduce risk. |

| Knowledge exchange | The flow of knowledge, both formal and tacit, between organizations through collaboration. |

| Absorptive capacity | A firm’s ability to recognize, assimilate, and apply external knowledge. |

| Organizational adaptation capacity | The internal flexibility and learning capability to respond to new knowledge or change. |

| Knowledge flow opportunities | Chances for firms to acquire or apply external knowledge for innovation. |

| Innovation outcome and credibility | The success and perceived reliability of a firm’s innovation outputs. |

| Stock of Knowledge in Firms | The accumulated know-how, skills, and proprietary knowledge in firms. |

| Short-term performance pressure | Demand for immediate results, often from markets or investors, which can discourage long-term investments. |

| Investment in capability-building | Efforts to strengthen internal resources such as talent, processes, and infrastructure. |

| Access to clinical/validation resources | Availability of necessary tools and partnerships to validate new technologies. |

| Product validation success | Achievement of regulatory, clinical, or market approval, proving product viability. |

| Technological accumulation | The ability to build on past innovations to support more complex or advanced products. |

| Utilisation of foreign technology | The extent to which firms depend on or integrate technologies developed abroad. |

Appendix D

| R4, R5 | |

| Variable | Explanation |

| Technological accumulation | The growing base of internal technical capabilities and R&D outcomes in tech firms. |

| Product validation success | Achievement of approval or recognition for a product, validating its quality and functionality. |

| Effective development | Efficient design and execution of product development processes. |

| Multi-source knowledge integration | The ability to combine insights from different domains (e.g., clinical, regulatory, digital) into innovation. |

| Entry opportunities for tech firms | Disconnects between knowledge generation, regulation, and market application. |

| Coordination cost | How difficult and risky the regulatory process appears to innovators and firms. |

| Regulatory complexity | The actual structural and procedural difficulty of navigating regulations. |

References

- Ratnakar, N.C.; Prajapati, B.R.; Prajapati, B.G.; Prajapati, J.B. Smart Innovative Medical Devices Based on Artificial Intelligence. In Handbook on Augmenting Telehealth Service; CRC Press: Boca Raton, FL, USA, 2024; pp. 150–172. [Google Scholar]

- Johnson, K.B.; Wei, W.Q.; Weeraratne, D.; Frisse, M.E.; Misulis, K.; Rhee, K.; Zhao, J.; Snowdon, J.L. Precision Medicine, AI, and the Future of Personalized Health Care. Clin. Transl. Sci. 2021, 14, 86–93. [Google Scholar] [CrossRef]

- Topol, E.J. High-performance medicine: The convergence of human and artificial intelligence. Nat. Med. 2019, 25, 44–56. [Google Scholar] [CrossRef]

- Gotadki, R. Medical Devices Market Trends, Growth, Forecast 2032; Market Research Future: Pune, India, 2024. [Google Scholar]

- Papa, A.; Mital, M.; Pisano, P.; Del Giudice, M. E-health and wellbeing monitoring using smart healthcare devices: An empirical investigation. Technol. Forecast. Soc. Change 2020, 153, 119226. [Google Scholar] [CrossRef]

- Alzghaibi, H. Adoption barriers and facilitators of wearable health devices with AI integration: A patient-centred perspective. Front. Med. 2025, 12, 1557054. [Google Scholar] [CrossRef] [PubMed]

- Raffaelli, R.; Glynn, M.A. Institutional Innovation: Novel, Useful, and Legitimate. In The Oxford Handbook of Creativity, Innovation, and Entrepreneurship; Oxford University Press: Oxford, UK, 2015; pp. 407–420. [Google Scholar]

- Stern, A.D. Innovation under Regulatory Uncertainty: Evidence from Medical Technology. J. Public Econ. 2017, 145, 181–200. [Google Scholar] [CrossRef] [PubMed]

- Warty, R.R.; Smith, V.; Salih, M.; Fox, D.; Mcarthur, S.L.; Mol, B.W. Barriers to the diffusion of medical technologies within healthcare: A systematic review. IEEE Access 2021, 9, 139043–139058. [Google Scholar] [CrossRef]

- Bergek, A.; Hellsmark, H.; Karltorp, K. Directionality challenges for transformative innovation policy: Lessons from implementing climate goals in the process industry. Ind. Innov. 2023, 30, 1110–1139. [Google Scholar] [CrossRef]

- Chu, Y.C.; Lin, K.H.; Chen, Y.C.; Hsu, C.Y.; Kuo, C.T.; Cheng, Y.F.; Liao, W.H. Enhancing Clinical Accuracy in Middle Ear Disease Diagnosis with a Cloud-Based AI System Integrating CNNs and LLMs. In Proceedings of the International Conference on Biomedical and Health Informatics, Tainan, Taiwan, 30 October–2 November 2024; Springer Nature: Cham, Switzerland, 2024; pp. 164–179. [Google Scholar]

- Matulionyte, R.; Nolan, P.; Magrabi, F.; Beheshti, A. Should AI-enabled medical devices be explainable? Int. J. Law Inf. Technol. 2022, 30, 151–180. [Google Scholar] [CrossRef]

- Windecker, D.; Baj, G.; Shiri, I.; Kazaj, P.M.; Kaesmacher, J.; Gräni, C.; Siontis, G.C. Generalizability of FDA-Approved AI-Enabled Medical Devices for Clinical Use. JAMA Netw. Open 2025, 8, e258052. [Google Scholar] [CrossRef]

- Cheng, T.M. Reflections on the 20th anniversary of Taiwan’s single-payer National Health Insurance System. Health Aff. 2015, 34, 502–510. [Google Scholar] [CrossRef]

- Chiu, C.M.; Chen, M.S.; Lin, C.S.; Lin, W.Y.; Lang, H.C. Evaluating the comparative efficiency of medical centers in Taiwan: A dynamic data envelopment analysis application. BMC Health Serv. Res. 2022, 22, 435. [Google Scholar] [CrossRef]

- Cai, Y.; Amaral, M. The triple helix model and the future of innovation: A reflection on the triple helix research agenda. Triple Helix 2021, 8, 217–229. [Google Scholar] [CrossRef]

- Cai, Y.; Amaral, M. Triple Helix model of innovation: From boundaries to frontiers. Triple Helix 2022, 9, 107–117. [Google Scholar] [CrossRef]

- Altintas, L.; Sahiner, M. Transforming medical education: The impact of innovations in technology and medical devices. Expert Rev. Med. Devices 2024, 21, 797–809. [Google Scholar] [CrossRef] [PubMed]

- Shamayleh, A.; Awad, M.; Farhat, J. IoT Based Predictive Maintenance Management of Medical Equipment. J. Med. Syst. 2020, 44, 72. [Google Scholar] [CrossRef] [PubMed]

- Liu, Y.; Wu, X.; Sang, Y.; Zhao, C.; Wang, Y.; Shi, B.; Fan, Y. Evolution of surgical robot systems enhanced by artificial intelligence: A review. Adv. Intell. Syst. 2024, 6, 2300268. [Google Scholar] [CrossRef]

- Hovenga, E.; Grain, H.; Beale, T. Fragmented global standards development organisations. In Roadmap to Successful Digital Health Ecosystems; Elsevier: Amsterdam, The Netherlands, 2022; pp. 65–96. [Google Scholar]

- Mkwashi, A.; Brass, I. The Future of Medical Device Regulation and Standards: Dealing with Critical Challenges for Connected, Intelligent Medical Devices; PETRAS National Centre of Excellent in IoT Systems Cybersecurity: London, UK, 2022. [Google Scholar] [CrossRef]

- Williams, P.A.; Woodward, A.J. Cybersecurity vulnerabilities in medical devices: A complex environment and multifaceted problem. Med. Devices 2015, 8, 305–316. [Google Scholar] [CrossRef]

- Pradyumna, G.; Hegde, R.B.; Bommegowda, K.; Jan, T.; Naik, G.R. Empowering healthcare with IoMT: Evolution, machine learning integration, security, and interoperability challenges. IEEE Access 2024, 12, 20603–20623. [Google Scholar] [CrossRef]

- Han, Y.; Ceross, A.; Bergmann, J. More than red tape: Exploring complexity in medical device regulatory affairs. Front. Med. 2024, 11, 1415319. [Google Scholar] [CrossRef]

- Hulstaert, F.; Pouppez, C.; Jong, C.P.-D.; Harkin, K.; Neyt, M. Gaps in the evidence underpinning high-risk medical devices in Europe at market entry, and potential solutions. Orphanet J. Rare Dis. 2023, 18, 212. [Google Scholar] [CrossRef]

- Ahmed, M.I.; Spooner, B.; Isherwood, J.; Lane, M.; Orrock, E.; Dennison, A. A Systematic Review of the Barriers to the Implementation of Artificial Intelligence in Healthcare. Cureus 2023, 15, e46454. [Google Scholar] [CrossRef]

- Hsiao, W.W.; Lin, J.C.; Fan, C.T.; Chen, S.S. Precision health in Taiwan: A data-driven diagnostic platform for the future of disease prevention. Comput. Struct. Biotechnol. J. 2022, 20, 1593–1602. [Google Scholar] [CrossRef]

- Lu, J.R.; Liang, L.L. The Role of Digital Health Under Taiwan’s National Health Insurance System: Progress and Challenges. Health Syst. Reform 2024, 10, 2375433. [Google Scholar] [CrossRef]

- Freeman, C. Technology Policy and Economic Performance; Printer: London, UK, 1987. [Google Scholar]

- Lundvall, B.-A. National Systems of Innovation: Towards a Theory of Innovation and Interactive Learning; London Pinter: London, UK, 1992; Volume 242. [Google Scholar]

- Nelson, R.R. National Innovation Systems: A Comparative Analysis; Oxford University Press: Oxford, UK, 1993. [Google Scholar]

- Cooke, P.; Uranga, M.G.; Etxebarria, G. Regional innovation systems: Institutional and organisational dimensions. Res. Policy 1997, 26, 475–491. [Google Scholar] [CrossRef]

- Doloreux, D.; Parto, S. Regional innovation systems: Current discourse and unresolved issues. Technol. Soc. 2005, 27, 133–153. [Google Scholar] [CrossRef]

- Edquist, C. (Ed.) Systems of Innovation: Technologies, Institutions and Organizations; Routledge: Oxford, UK, 1997. [Google Scholar] [CrossRef]

- Bartholomew, S. National systems of biotechnology innovation: Complex interdependence in the global system. J. Int. Bus. Stud. 1997, 28, 241–266. [Google Scholar] [CrossRef]

- Chaturvedi, S. Evolving a national system of biotechnology innovation: Some evidence from Singapore. Sci. Technol. Soc. 2005, 10, 105–127. [Google Scholar] [CrossRef]

- Chen, S.; Forbes, I.; Martin, P. Knowledge transfer and the biopharmaceutical innovation system in Taiwan. In Innovation Systems and Capabilities in Developing Regions; Routledge: Oxfordshire, UK, 2012; pp. 97–118. [Google Scholar]

- Dodgson, M.; Mathews, J.; Kastelle, T.; Hu, M.C. The evolving nature of Taiwan’s national innovation system: The case of biotechnology innovation networks. Res. Policy 2008, 37, 430–445. [Google Scholar] [CrossRef]

- Farley, M.S.; Rouse, W.B. Technology challenges & opportunities in the biotechnology, pharmaceutical & medical device industries. Inf. Knowl. Syst. Manag. 2000, 2, 133–141. [Google Scholar] [CrossRef]

- Mytelka, L.K. Pathways and policies to (bio) pharmaceutical innovation systems in developing countries. Ind. Innov. 2006, 13, 415–435. [Google Scholar] [CrossRef]

- Ladd, M.E. The Medical Device Regulation and its impact on device development and research in Germany. Z. Fur Med. Phys. 2023, 33, 459–461. [Google Scholar] [CrossRef] [PubMed]

- Malvehy, J.; Ginsberg, R.; Sampietro-Colom, L.; Ficapal, J.; Combalia, M.; Svedenhag, P. New regulation of medical devices in the EU: Impact in dermatology. J. Eur. Acad. Dermatol. Venereol. 2022, 36, 360–364. [Google Scholar] [CrossRef] [PubMed]

- Hsu, A.Y.; Lin, C.J. The Taiwan health-care system: Approaching a crisis point? Lancet 2024, 404, 745–746. [Google Scholar] [CrossRef] [PubMed]

- Peng, J.-Y.; Lee, S.-S.; Lin, C.-R.; Lee, H.; Chen, Y.-C. Examining the Impact of the Current Reimbursement Regulation on Patient Access to Innovative Medical Devices in Taiwan: Insights From 8 Years’ Reimbursement Data. Value Health Reg. Issues 2024, 42, 100978. [Google Scholar] [CrossRef]

- Guston, D.H. Understanding ‘anticipatory governance’. Soc. Stud. Sci. 2014, 44, 218–242. [Google Scholar] [CrossRef]