1. Introduction

In the context of increasingly severe environmental challenges, CGI has gained global recognition as a fundamental imperative. CGI represents enterprises’ capabilities to integrate existing knowledge with environmental expertise, driving innovation in product design, production processes, and end-of-pipe technologies to minimize environmental impacts [

1,

2]. This form of innovation has garnered increasing attention in the modern economy, as it simultaneously promotes corporate sustainable development and safeguards the environment and ecosystem [

3]. From a national perspective, some major economies, like the US and Japan, are actively working to establish their core competitive advantage by advancing CGI [

4]. From an enterprise perspective, environmental management has emerged as a significant component of enterprise strategy. Enterprises that can carry out CGI in time will be more competitive and sustainable [

5]. From a realistic perspective, China, after experiencing several years of rapid economic growth, urgently needs to transition from resource-, factor-, and capital-driven development toward green and innovation-driven growth [

6]. This underscores the significance of stimulating enterprises’ enthusiasm for green technology innovation, a matter of profound concern and extensive discourse among governments and scholars.

In parallel, the digital economy has entered an advanced phase of spatial evolution, wherein DIA functions as both a catalyst and structural node for economic modernization. However, DIA is not merely a geographic concentration of firms—it represents a complex system characterized by inter-firm linkages, knowledge flows, digital infrastructure, and adaptive feedback loops. DIA not only contributes to fostering high-quality economic development but also serves as a strategic focal point for reshaping international competitiveness. Nevertheless, China’s level of DIA currently lags behind that of developed countries. Globally renowned DIA has established leading positions in specific areas of digital technology, such as software services in Silicon Valley in the United States and game design in Sweden. Therefore, to enhance China’s influence in the digital domain and foster new competitive advantages for the future, it is imperative to expeditiously nurture and grow DIA.

DIA refers to clusters of enterprises and related institutions that are geographically concentrated and engage in digital product manufacturing, service provision, technology application, and infrastructure development [

7]. These agglomerations represent an advanced form of industrial organization, where firms benefit from proximity-based knowledge exchange, resource sharing, and technological collaboration [

8]. Such agglomeration strengthens innovation within digital sectors and promotes the restructuring and modernization of conventional industries, thereby supporting the development of a modern industrial system [

9]. From a systems perspective, DIA can be conceptualized as a key component of the broader regional innovation architecture, consisting of interlinked actors—including firms, platforms, and supporting institutions—that interact through digital infrastructure and knowledge flows. Within this system, firms may benefit from agglomeration-related externalities such as knowledge spillovers and technological complementarities [

10]. This raises a key question: can firms embedded in such digital industrial systems effectively leverage these advantages to enhance their green innovation performance?

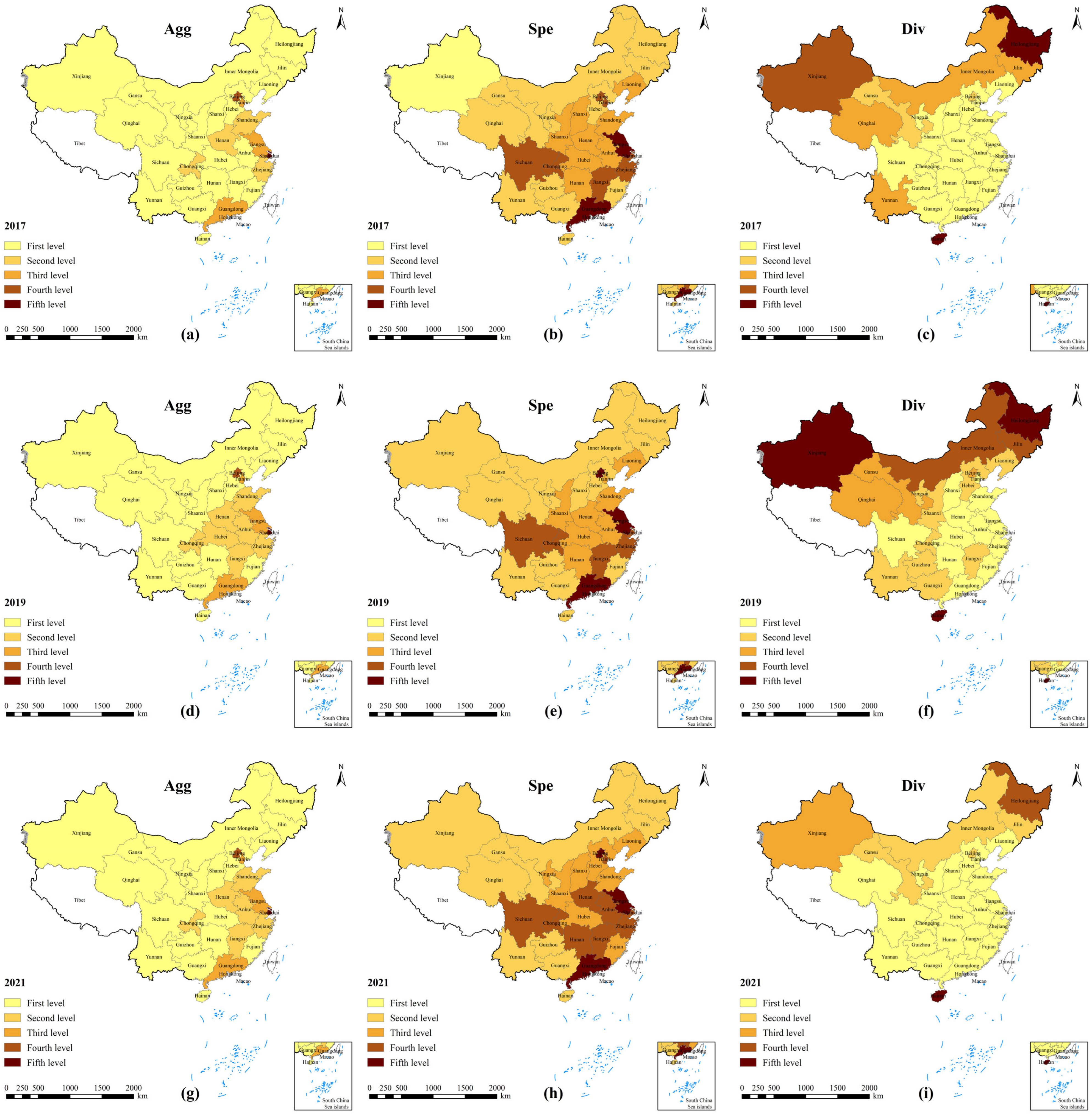

Given these problems, a thorough exploration of the effect of DIA on CGI has strong academic value. The analysis relies on a panel dataset of Chinese A-share companies spanning 2017–2021 to investigate how DIA and its various forms influence CGI. The aim is to provide a micro-level foundation for existing macro-level research. The research reveals that DIA significantly stimulates CGI, and distinguishing between different agglomeration modes indicates that specialized agglomeration primarily drives this effect, with diversified agglomeration having a less pronounced impact. Furthermore, this study thoroughly explores the potential mechanisms of DIA (especially specialization agglomeration) to promote CGI and finds that knowledge spillovers are a crucial mechanism by which DIA influences CGI. Overall, this study offers firm-level insights into how DIA, especially specialization agglomeration, contributes to CGI in today’s Chinese economic environment.

3. Research Hypothesis

3.1. DIA and CGI

Digital industries differ significantly from traditional manufacturing sectors. These industries are typically highly knowledge-intensive, heavily reliant on intangible assets such as data, software, and algorithmic knowledge, and characterized by strong network externalities—where the value of participation increases as more users, firms, or platforms join the system [

30]. These features suggest that the mechanisms through which agglomeration affects innovation in the digital context may be distinct and potentially more powerful than in traditional industries. Drawing from theories of digital innovation ecosystems and platform economics, DIA can be viewed not only as a geographic concentration of firms but also as a socio-technical system that enables dynamic knowledge exchange, interoperability, and value co-creation across firms [

31]. Within such ecosystems, firms interact and evolve through shared platforms, digital infrastructure, and complementary innovation activities. These ecosystem-level interactions promote deeper knowledge flows, collaborative experimentation, and rapid dissemination of green technologies, especially under shared policy and environmental objectives.

Within the framework of agglomeration, DIA can be classified into digital industry specialization agglomeration and digital industry diversification agglomeration. Specialized agglomeration of digital industries reflects the distribution of digital industries of the same type in space. As emphasized by Marshall (1961) [

32], the concentration and specialization of the same industry are more conducive to generating agglomeration economies. Specialized agglomeration of digital industries can generate both economies of scale and technological spillovers. On the one hand, specialized agglomeration of digital industry can achieve efficient sharing of specialized labor, intermediate inputs, and infrastructure within a region. This, in turn, can help lower the cost of firms’ purchases of products and services related to green development, allowing them to concentrate their resources on technological R&D, thus providing vital funding for CGI. On the other hand, within specialized agglomeration zones, similar enterprises find it easier to engage in communication and exchange regarding production processes and techniques. This facilitates knowledge spillovers through channels such as factor flows, industry connections, learning, and imitation. Knowledge spillovers not only promote the dissemination of new ideas but also enable firms to acquire new knowledge and technologies from their competitors. This enhances the heterogeneity of firms’ knowledge, aiding in breaking away from conventional thinking and traditional cognitive paradigms. Furthermore, this heightened awareness of their own knowledge and capability inadequacy instills a stronger sense of “catching up” or “leading” among latecomer enterprises, consequently enhancing their green innovation capabilities and enabling them to participate more effectively in market competition.

The diversified agglomeration of digital industries reflects the spatial distribution of diverse digital industries within the same area. In theory, diversified agglomeration in the digital industry can also promote CGI. First, diversified agglomeration of the digital industry broadens the diversity of intermediate product supplies within clusters, providing firms with more choices of intermediate products. This not only enhances production efficiency but also allows firms to flexibly select intermediate products that align with high-level pollution treatment technologies, thereby facilitating CGI. Second, diversified agglomeration of digital industry facilitates firms’ acquisition, use, imitation, absorption, and recombination of various complementary knowledge resources from different industries. This encourages the collision of diverse ideas and mutual learning, stimulating new creativity and further enhancing corporate green innovation capabilities. Additionally, the labor pool built by the diversified agglomeration of digital industry contributes to improving the efficiency of matching between firms and labor. This enables firms to selectively choose labor that aligns with the promotion of green technological innovation, thereby elevating corporate green technology innovation levels.

Therefore, theoretically, under the effect of agglomeration externalities brought about by specialized agglomeration and diversified agglomeration of digital industry, DIA contributes to promoting firms’ green innovation. However, as digital industry agglomeration zones in China have only recently been established, regional diversification within the digital sector remains limited [

7]. This significantly restricts the positive externalities associated with the digital industrial diversified agglomeration, which may lead to an insignificant impact on CGI. As a result, the driving force behind CGI is primarily attributed to specialized digital industry agglomeration. Based on this premise, the hypothesis below is proposed:

H1: DIA can significantly promote CGI.

H2: The specialized agglomeration of the digital industry can significantly promote CGI, whereas the impact of diversified agglomeration in the digital industry on CGI may not be as pronounced.

3.2. DIA, Knowledge Spillovers, and CGI

When agglomeration effects occur, knowledge spillovers between firms through interaction and learning are often unavoidable. According to Arrow (1962) [

33], despite the extensive protection afforded to information by the law, information itself is an intangible entity that can never be fully regarded as a possessable commodity. This is because in any form of information production, the use of information itself leads to its disclosure, at least partially. In other words, the very nature of information is such that it is disclosed in the course of its use, which makes it difficult for information to be fully controlled or possessed. Therefore, the exchange of knowledge and technology between firms is easier when they are geographically close to each other. Within the agglomeration area, the digital industry is able to obtain substantial knowledge and technology spillovers through technological externalities between firms. This situation allows firms to benefit from the innovations of surrounding firms, which in turn facilitates the accumulation of knowledge and technology needed for green innovation. Such agglomeration effects significantly increase the likelihood of successful innovation.

First, DIA triggers knowledge spillover effects among enterprises. It is manifested in vertical exchanges and interactions among suppliers, producers, downstream distributors, and customers based on the supply chain. Knowledge and technology are embedded in innovative products and technologies. By engaging in learning by doing and learning by use, downstream firms in the supply chain can internalize external knowledge and technology, thereby facilitating indirect access to innovation spillovers. This approach not only makes industrial collaboration more flexible, precise, and efficient, but also helps enterprises to keep abreast of cutting-edge information technology and development dynamics promptly and accurately, thus increasing the success rate for green innovation. In short, through learning by doing and learning by using, downstream firms can gain access to technology and knowledge spillovers, which, in turn, facilitate industrial collaboration and the success of green innovation. Horizontally, knowledge spillovers are reflected in the competition and imitation behaviors among enterprises within the same market, and the technological achievements of enterprises that prioritize innovation will also benefit other enterprises in the agglomeration area. By learning new knowledge and technologies from their competitors, enterprises acquire heterogeneous knowledge, break through cognitive inertia and paradigms, and overcome the limitations of their own knowledge and capabilities, thus enhancing their green innovation capabilities.

Second, there are knowledge spillovers that occur between laborers during the process of DIA. As digital industries agglomerate in a region, a situation known as “labor pooling” develops, making it easier for specialized laborers to engage in face-to-face exchanges [

34]. Such exchanges not only improve the flow efficiency of explicit knowledge among enterprises but also promote the spread and proliferation of tacit knowledge and technology. To sum up, DIA stimulates the generation of new ideas, concepts, and modes by optimizing the communication platform for practitioners, and it provides the best green technological innovation learning environment for high-tech talents. Therefore, the knowledge spillover effect triggered by digital industry agglomeration helps promote CGI.

Finally, DIA has had a demonstrative and stimulating effect on entrepreneurship and green innovation culture. By forming a diversified enterprise network structure, DIA promotes the dissemination and application of the concepts of energy conservation and emission reduction, as well as green and clean technologies. This environment makes it easier for enterprises to reach a consensus and deepens their awareness of the environment, which, in turn, promotes the focus of R&D towards green transformation and upgrading. This process further promotes the development and application of green technologies. In short, DIA promotes the development of enterprises in the field of green innovation through demonstration and incentive effects, and facilitates the birth and diffusion of green technologies.

H3: Knowledge spillovers serve as a key channel through which DIA enhances CGI.

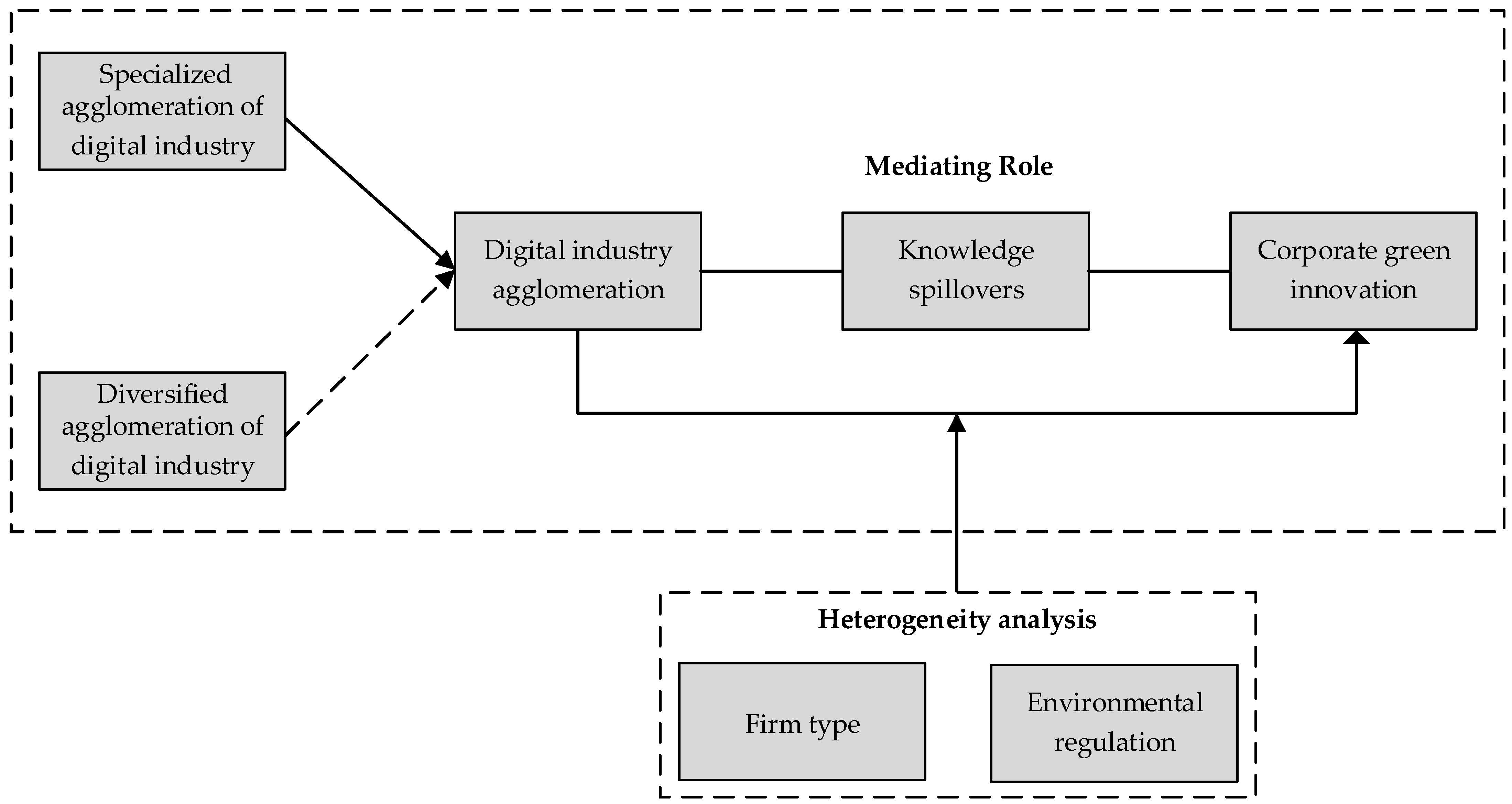

Figure 1 illustrates the theoretical framework developed in this study.

6. Mechanism Analysis

The regression results above suggest that specialization agglomeration plays the dominant role in enhancing CGI, while diversification agglomeration does not significantly promote CGI. To analyze the pathway through which DIA impacts CGI, this paper draws on Jiang (2022) [

49] to construct the following mechanism testing model.

Within Equation (5), serves as a mediator variable, that is, knowledge spillover.

Following Huang et al. (2022) [

50], knowledge spillover is captured through patent collaborations between listed companies (including their subsidiaries) and external firms.

represents DIA, including overall agglomeration level (Agg) and specialization agglomeration in the digital industry (Spe). As indicated by the aforementioned analysis, due to the insignificant impact of diversified agglomeration in the digital industry on CGI, this mechanism is no longer analyzed. The other variables have the same meaning as the variables above.

Table 7 reports the mediation analysis results. Columns (2) and (4) indicate that both DIA and its specialization dimension exhibit positive signs, with DIA significant at the 5% level and specialization showing marginal significance at 10%. These findings are consistent with our prediction that DIA and specialization in the digital industry contribute to promoting knowledge spillover. Knowledge spillovers can promote CGI by providing an external ‘knowledge spillover pool’ that supplements the complex technologies and cross-disciplinary knowledge required for green innovation [

51]. In knowledge-intensive environments, enterprises are more likely to acquire heterogeneous knowledge, break out of habitual thinking patterns, and enhance the flexibility and diversity of green innovation [

52]. In addition, knowledge spillovers reduce the R&D costs and uncertainty of green innovation and help strengthen enterprises’ resource bases and risk-bearing capabilities, thereby continuously promoting green innovation [

53,

54,

55]. In summary, based on the above findings, knowledge spillover acts as a mediator in the link between DIA and CGI, consistent with H3.

8. Conclusions

Drawing on firm-level data from China’s A-share market between 2017 and 2021, this study explores how DIA influences CGI. We have found the following: (1) The results indicate that DIA significantly promotes CGI, with a 1% increase in DIA associated with a 1.503% increase in green innovation output. (2) When disaggregating agglomeration patterns, we find that the driving force is mainly derived from specialized agglomeration, whereas diversified agglomeration has no statistically significant effect. (3) Our mechanism analysis indicates that knowledge spillovers serve as the key channel through which DIA fosters corporate green innovation. (4) Our heterogeneity analysis demonstrates that the effects of DIA are stronger for non-high-tech enterprises and in regions with lower environmental regulation intensity.

Our findings align with recent studies highlighting the positive impact of specialized agglomeration on innovation outcomes [

57,

58], suggesting that firms benefit more from depth than breadth when it comes to knowledge compatibility and absorptive capacity. However, these findings differ from studies that advocate for the innovation benefits of industrial diversification [

59,

60]. One potential explanation lies in the stage of digital ecosystem development in China: the dominance of specialized clusters and the immature structure of diversified agglomerations may limit the realization of external economies of scope. Moreover, in regions where institutional support, technological complementarity, and market matching are underdeveloped, diversification may fail to translate into meaningful innovation synergies. We suggest that the insignificant impact of diversification is not evidence of its ineffectiveness in principle, but rather a reflection of structural or contextual thresholds yet to be overcome in China’s current digital industrial landscape.

8.1. Theoretical Implications

First, this study extends the industrial agglomeration literature by incorporating a digital perspective, emphasizing firm-level green innovation (CGI) rather than traditional regional innovation metrics, and empirically distinguishing the effects of specialized versus diversified agglomeration within the digital industry. Specifically, prior studies have primarily examined how industrial agglomeration influences regional-level green innovation [

11,

14]. However, research that explores its effect on CGI—particularly through the lens of DIA—remains relatively scarce [

61]. The digital industry is a typical technology-intensive and knowledge-intensive industry, with its development and production processes fundamentally different from traditional manufacturing and service industries [

7,

26]. The objective of this research is to examine how DIA affects CGI, with a particular focus on distinguishing the effects of specialization and diversification agglomeration patterns at the firm level.

Second, this study advances the understanding of CGI mechanisms by identifying knowledge spillovers as a significant mediating channel and incorporating heterogeneity analysis to clarify boundary conditions. Specifically, while previous studies have confirmed the impact of knowledge spillovers on CGI, they have noted that firms within agglomerations attribute their innovation to these spillovers [

21,

62]. However, empirical analyses exploring the detailed connection between DIA, knowledge spillovers, and CGI are still limited. In this context, our study further explores the mechanism through which DIA influences CGI via knowledge spillovers. Moreover, this study introduces heterogeneity analysis, demonstrating that the effects of DIA are stronger for non-high-tech enterprises and in regions with lower environmental regulation intensity, which supplements the boundary conditions of DIA’s impact on CGI.

8.2. Practical Implications

First, government departments and industrial planning bodies should prioritize the development of specialized digital industry parks. Our findings suggest that DIA’s influence on CGI mainly stems from specialization agglomeration. To leverage this mechanism, governments should strategically plan and expand specialized digital clusters that co-locate firms sharing similar technological bases and environmental innovation needs. Governments can assist these parks by providing customized policy measures, including funding for environmentally friendly technology R&D and preferential land-use policies, to accelerate the growth of the digital economy. Moreover, authorities should encourage these parks to act as centers that foster the deep convergence between digital and traditional industries, ultimately creating internationally competitive zones of digital industry clustering.

Second, policymakers should take a phased approach to cultivating diversification agglomeration by enhancing cross-sector innovation ecosystems. Although diversification agglomeration does not yet show significant effects on CGI in our empirical analysis, this may be due to its limited maturity and insufficient spillover channels in the current industrial context. Rather than dismissing its potential, policymakers should proactively invest in foundational infrastructure to support future diversification benefits. This includes building open innovation platforms that connect digital firms with actors in green manufacturing, energy, and services; encouraging university–industry collaborations; and developing digital-green pilot zones that integrate diverse knowledge domains.

Finally, policymakers are encouraged to implement tailored approaches to reflect the diverse influence of DIA under different firm structures and regulatory environments. The empirical findings indicate that CGI gains from DIA tend to be stronger for non-high-tech firms and under less stringent environmental regulation. This implies that a one-size-fits-all approach may not fully unlock the potential of digital clusters. Therefore, targeted policies such as inclusive digital infrastructure investments, tailored environmental regulatory frameworks, and specialized innovation support schemes for lagging firms or regions should be implemented. Moreover, future digital industry policies should incorporate flexibility to adapt to sector-specific and regional characteristics, ensuring that the green innovation dividends of digital agglomeration are equitably distributed.

8.3. Limitations and Future Directions

Similarly to previous research, the design of this research has some limitations and provides direction for future research. First, given the difficulty of accessing detailed data, our analysis relies on a province-level indicator for DIA. Although this choice improves comparability, it may fail to capture variations within provinces. Firms within the same province may experience significantly different levels of digital industry concentration depending on their local context. Consequently, the provincial-level measurement might attenuate the estimated effects or mask localized agglomeration dynamics. Future research could leverage more granular city- or district-level data to construct refined DIA indicators, enabling a more precise analysis of spatial heterogeneity and the localized spillover effects of digital industry ecosystems.

Second, mechanism analysis needs to be further expanded. The effect of DIA patterns on CGI may also rely on a number of other mediating variables that have not yet been addressed in current research, like labor reserves and input shares. These mediating variables can be the subject of further research. Investigating these would deepen the understanding of how DIA systems generate green innovation through multi-dimensional element synergies.

Third, this study is based on listed A-share firms, which typically exhibit higher innovation intensity and better access to policy instruments than SMEs or unlisted digital enterprises. Therefore, policy recommendations derived from this study may not generalize to all firm types. Future research could extend the analysis to a broader range of firms, particularly SMEs and non-listed enterprises, by incorporating alternative datasets such as industrial surveys or administrative firm-level records. Such efforts would help verify the robustness and generalizability of the observed agglomeration–innovation relationships across different ownership structures, firm sizes, and levels of market exposure.