1. Introduction

The metaverse is an emerging concept that refers to a network of interconnected, three-dimensional virtual spaces accessible online, where users interact through digital avatars [

1]. It functions as a digital economy parallel to the physical one, offering the possibility to create, sell, and purchase virtual goods and services [

2,

3]. The literature outlines the metaverse as an evolutionary stage of the internet, marking the transition from a two-dimensional digital environment to a three-dimensional, persistent, and interoperable one [

4]. Unlike conventional digital platforms, the metaverse offers an immersive, reality-like experience, facilitating direct real-time interactions through avatars in a shared virtual space [

5]. In the banking context, metaverse banking, also known as MetaFi, refers to the provision of financial services within these digital environments [

6]. Thus, banking institutions can recreate virtual branches where customers, represented digitally, can access financial advice, carry out banking operations, and make transactions, eliminating geographical barriers [

7,

8].

The metaverse operates on the basis of a complex technological infrastructure that integrates emerging technologies such as virtual reality (VR), augmented reality (AR), blockchain, artificial intelligence (AI), and 5G networks [

9], with the aim of creating persistent and interoperable digital environments [

10,

11]. Virtual and augmented reality facilitate user immersion in interactive three-dimensional spaces, allowing them to navigate and interact in real time through personalized avatars [

12,

13]. Blockchain ensures transparent and decentralized registration of digital property, enabling the trading of virtual assets through non-fungible tokens (NFTs) and digital currencies [

6,

14,

15]. Artificial intelligence also contributes to the automation of interactions and the personalization of experiences within the metaverse, while 5G networks support real-time connectivity, which is essential for the continuous functioning of these spaces [

16,

17,

18]. The economic foundation of the metaverse is a decentralized digital economy, where users can create, exchange, and own virtual assets, thus shaping an interactive and self-regulating ecosystem [

18,

19,

20].

The massive investments made by large technology companies in the development of the metaverse have contributed significantly to the growth of global interest in this concept. A prime example is Facebook’s rebranding to Meta at the end of 2021, considered a catalyst in the adoption and promotion of technologies associated with the metaverse [

21]. Economic estimates highlight the major potential of this digital ecosystem. According to forecasts by Citi, the metaverse could reach approximately 5 billion users and a market value of between

$8 trillion and

$13 trillion by 2030 [

22,

23]. McKinsey, in turn, estimates an economic value of approximately

$5 trillion over the same period [

24]. In terms of user adoption, a Gartner report predicts that by 2025, about 25% of the global population will spend at least one hour a day in metaverse environments [

25].

These optimistic projections have led to increased interest from the financial and banking sector, considered to be one of the industries that will undergo profound transformations under the influence of the metaverse [

26,

27]. More and more financial institutions are exploring the concept of metaverse banking, which involves providing banking services in a virtual space, with a view to expanding their digital presence and developing innovative channels for interacting with customers [

28,

29]. Relevant examples include JPMorgan Chase, which became the first major bank with a presence in the metaverse by opening a virtual lounge in Decentraland, called “Onyx Lounge,” designed to promote blockchain services and interact with users in an immersive environment [

30]. HSBC also purchased virtual land on The Sandbox platform to develop digital experiences in the field of sports and entertainment [

31]. This initiative reflects the bank’s desire to strengthen its presence in metaverse ecosystems and create alternative forms of interaction with the public, especially among digital-native consumers. In Asia, South Korea’s Kookmin Bank has launched its own platform in the metaverse for digitized financial advice [

32], and Union Bank of India has opened a metaverse area to showcase banking products and services in a 3D format [

33].

The emergence of banking in the metaverse generates both promising prospects and significant challenges for the financial sector. On the one hand, the metaverse offers the possibility of an immersive banking experience through virtual branches where customers can interact with bank representatives in the form of avatars, but also through the development of innovative financial products associated with digital assets [

34,

35]. This form of interaction can reintroduce the social dimension into the customer–bank relationship, contributing to the personalization of services in the digital environment [

36,

37]. On the other hand, integrating the metaverse into banking services involves major risks related to cybersecurity, personal data protection, and user trust, as well as challenges related to technological infrastructure, the lack of an adequate legal framework, and the possible disruption of traditional banking models [

38,

39,

40].

Implementing banking services in the metaverse poses significant challenges in terms of cybersecurity. Unlike traditional digital environments, the metaverse’s expansive virtual spaces open up new avenues for cyberattacks and fraud specific to this context. According to an industry report, financial institutions that have begun experimenting in the metaverse saw a more than 40% increase in cyber-attacks in the first quarter of 2022 compared to the previous quarter [

41]. Among the most common risks are digital scams, microtransaction abuse, and manipulation of the economic mechanisms of virtual worlds [

42]. These threats differ from classic frauds, such as bank data theft or phishing, as they may involve actions such as infiltrating virtual economies, manipulating avatars, or illegally exploiting digital objects for financial gain [

43].

A key factor in the adoption of banking services in the metaverse is user trust. Studies on the acceptance of financial technologies show that the level of perceived trust in technology and the service provider significantly influences the intention to use [

44,

45]. In the case of banking in the metaverse, customers must be convinced that the virtual space is secure, stable, and managed responsibly by the financial institution. If the public perceives the metaverse as unstable, marked by NFT fraud or lacking clear regulations, this perception can generate major reluctance to use virtual financial services. In this context, transparency, effective communication, and the institution’s reputation become key elements [

46,

47]. Banks must clearly communicate their cybersecurity measures and provide guarantees regarding the safety of funds and the compliance of operations. A survey conducted by KPMG shows that most bank executives identified consumer mistrust as one of the main obstacles to the adoption of the financial metaverse, thus highlighting the importance of trust capital in this new digital context [

48].

Another major obstacle to the adoption of banking in the metaverse is technological barriers. The lack of mature digital infrastructure, high costs for equipment such as virtual or augmented reality devices, and the absence of interoperability standards between metaverse platforms create difficulties for both users and financial institutions [

49]. Users are often discouraged by high technical requirements, while banks must invest heavily in integrating these new technologies into their existing systems [

50,

51].

At the same time, the lack of a clear legal framework governing activities in the metaverse raises many questions. Issues such as ownership of digital assets, virtual identity, taxation, and personal data protection are not yet fully regulated, creating legal uncertainty for financial service providers [

52,

53,

54]. Without clear and harmonized international rules, the risk of litigation or abuse increases, and user confidence can be seriously affected.

In addition, the transition to the metaverse involves a profound transformation of the traditional banking model. Financial institutions need to rethink their operational structure, redefine their relationship with customers, and integrate new forms of interaction based on avatars and three-dimensional virtual spaces. This transition requires investment not only in technology, but also in staff training, the development of products adapted to the virtual environment, and digital inclusion policies [

55,

56,

57]. Without these adaptations, there is a risk that banks will not be able to fully exploit the potential offered by the metaverse.

The exploration of the “metaverse in banking” through bibliometric analysis is of high relevance given the emerging and disruptive nature of the concept, as well as the current lack of systematic synthesis in the literature. In the context of accelerated digital transformation within the financial sector, the metaverse presents itself as a potential game-changer offering immersive, interactive, and decentralized banking experiences. However, despite its growing relevance, the scientific literature on the topic remains fragmented, interdisciplinary, and rapidly expanding, making it difficult to achieve a coherent understanding of prevailing research directions, recurring themes, and existing gaps.

A bibliometric approach allows for a rigorous mapping of the global scientific landscape, identifying the most influential themes, authors, sources, and collaboration networks, while also highlighting temporal and structural trends in the field. This research thus contributes not only to consolidating existing knowledge but also to laying a solid foundation for future academic inquiry and for the strategic development of metaverse-based solutions in banking ecosystems.

The structure of this study is as follows:

Section 1 presents the introduction, outlining the background, research motivation, and significance of investigating the metaverse in the banking sector.

Section 2 provides a literature review, situating the study within existing research and emphasizing how bibliometric analysis enables a systematic understanding of the evolution of this topic across scientific and interdisciplinary domains.

Section 3 describes the materials and methods, detailing the bibliometric approach, selection criteria, and analytical tools used.

Section 4 presents the results of the bibliometric analysis, including trends in publication output, keyword co-occurrence, and collaboration patterns.

Section 5 discusses the findings, synthesizing key insights, highlighting thematic clusters, and identifying directions for future research. Finally,

Section 6 concludes the study, summarizing the main contributions and implications of the analysis.

2. Literature Review

In the context of research on the metaverse in banking, bibliometrics allows for a systematic understanding of how this topic has evolved in the scientific literature and related interdisciplinary areas.

Recent advances in FinTech, artificial intelligence, blockchain technology, and immersive environments have significantly redefined the architecture of financial services, including their migration to virtual spaces such as the metaverse. Although the literature in the field of information systems has captured this digital transformation from a technological and behavioral perspective, key financial concerns, particularly those related to financial inclusion, systemic risk, market structure, and regulatory design, have often been treated marginally or ignored. Integrating these dimensions is essential for positioning banking in the metaverse within the broader discourse on financial stability and institutional trust.

A significant body of literature has analyzed how FinTech innovations can expand access to financial services. Studies conducted in emerging markets highlight how regulatory infrastructure, institutional maturity, and consumer attitudes shape the inclusive nature of digital finance. For example, research conducted in Vietnam [

58], Jordan [

59], and India [

60] underscores the role of government initiatives, user openness to innovation, and technological infrastructure in facilitating adoption, particularly among previously excluded populations. During the pandemic, Das and Das [

61] found that FinTech helped maintain banking services in rural areas of Assam, thus reinforcing its role in crisis resilience. However, this potential for expanding access is often limited by psychological, institutional, and infrastructural frictions. Chin et al. [

62] highlighted the resistance of Malaysian consumers to virtual platforms, suggesting that innovation alone does not guarantee inclusion without overcoming barriers related to trust and usability. Similarly, Jha and Dangwal [

63] reported hesitation among urban micro-entrepreneurs, emphasizing the need for financial education policies and tailored incentives.

In virtual financial ecosystems, traditional risks take on new forms and dimensions. Credit and liquidity risks, while conceptually persistent, are operationalized differently in the metaverse, where tokenized assets and smart contracts govern exchanges. Anestiawati et al. [

64] demonstrated that digitized credit environments generated by FinTech exhibit notable asymmetries between developed and emerging economies, particularly in terms of default risk and information asymmetry. Atta [

59] and Alsahlawi [

65] associated FinTech adoption with improved risk management capabilities in commercial banks, although this depends on the effectiveness of internal controls and regulatory alignment. Meanwhile, volatility, particularly in cryptocurrency payments, remains a serious concern. Quan et al. [

66] and Han et al. [

67] analyzed user perceptions of digital currency volatility, concluding that behavioral factors such as loss aversion and risk sensitivity directly influence adoption intent. In the context of systemic threats, Manning et al. [

68] discussed the implications of crypto assets for money laundering and terrorist financing, highlighting the inability of current compliance mechanisms to keep pace with the pace of technological innovation.

This complex landscape of risks poses urgent challenges for regulators. Although early analyses, such as those by Arner et al. [

69], conceptualized FinTech as a post-crisis phenomenon requiring updated legal responses, recent empirical work highlights both regulatory inertia and regulatory fragmentation. Mugerman et al. [

70] offer a critical perspective on regulatory failures in mutual funds, warning that insufficient oversight may enable systemic abuses. Gomber et al. [

71] emphasize the importance of adaptive regulation, especially in the context of rapid technological disruption. Empirical studies in the Gulf Cooperation Council countries [

72], North America [

73], and Indonesia [

74] show that fragmented regulatory architectures affect banking stability and limit the scalability of FinTech solutions. Wu and Lin [

75], analyzing open banking APIs in the US, showed that progressive data sharing frameworks can stimulate innovation but may generate new supervisory risks, especially if privacy and interoperability issues are not fully addressed.

The regulatory response is further complicated by international variations in FinTech adoption. Cultural, psychological, and institutional factors significantly influence the degree of adoption at the country level. Studies based on behavioral theories such as the Technology Acceptance Model (TAM) and Prospect Theory offer useful insights into consumer decisions regarding innovative payment systems [

66,

76]. Research by Nalluri and Chen [

77] has shown that institutional inefficiencies and lack of trust remain the main barriers in developing economies. Han et al. [

67] found that loss aversion interacts with perceptions of usefulness and ease of use in cryptocurrency payment systems in tourism, highlighting the need for user-centered design. These differences between countries are also supported by comparative analyses, such as those by Anestiawati et al. [

74] and Gupta and Xia [

78], which highlight divergent regulatory maturities and consumer expectations in Asian FinTech ecosystems.

Beyond adoption and regulation, broader questions arise regarding the implications of banking in the metaverse for market structure and institutional design. Elia et al. [

79] have raised fundamental questions about the disruptive potential of FinTech in redefining financial intermediation. Kliestik et al. [

80] have expanded on this view, suggesting that emerging technologies such as generative AI, blockchain, and digital twins, once integrated into financial systems, may transform decision-making processes, pricing mechanisms, and operational risks in ways that are only beginning to be understood by regulators and researchers. Similarly, Andronie et al. [

81] have shown that FinTech applications based on the Internet of Things impose new data management paradigms, which may create unforeseen vulnerabilities in algorithmic governance. These concerns are not purely theoretical. The work of Wu and Lin [

75] shows that open banking generates efficiency gains at the cost of regulatory gaps in platform-based financial services.

In this context, the policy implications of banking in the metaverse are profound. While immersive platforms can offer innovative tools for delivering financial services, they call into question basic assumptions about jurisdiction, regulatory applicability, and consumer protection. For example, Azizah [

74] highlighted the tension between innovations in digital assets and the Sharia-compliant legal framework, raising questions about the harmonization of innovation and ethical finance. Similarly, Kalai and Toukabri [

73] found that different regulatory approaches in Canada and the US generate significantly different outcomes in FinTech-based financial services, with implications for systemic risk transmission. Gupta and Xia [

78] warned that the rapid expansion of FinTech in Asia may exceed the capacity of regulators, while Allen et al. [

82] discussed how state-led innovation in China, through digital currencies and financial platforms, is restructuring the fundamental infrastructure of the financial system. These perspectives converge on a central conclusion: public policy frameworks must evolve not only to accommodate technological innovation, but also to protect the integrity and stability of the financial system.

These perspectives converge on a central conclusion: public policy frameworks must evolve not only to accommodate technological innovation, but also to protect the integrity and stability of the financial system. While these arguments are often situated within theoretical or comparative contexts, concrete cases demonstrate the urgency of regulatory transformation in virtual financial ecosystems. A relevant illustration is the 2022 cyberattack on Ronin Network, the blockchain infrastructure supporting the metaverse-based financial gaming platform Axie Infinity. In this incident, attackers exploited systemic vulnerabilities in validator node governance and smart contract implementation to exfiltrate over

$620 million in cryptocurrency, constituting one of the most severe breaches in decentralized finance to date [

83]. Subsequent investigations linked the operation to the Lazarus Group, a state-sponsored cybercriminal entity, underscoring the transnational nature of digital threats and the limited capacity of current oversight frameworks to respond effectively. This case highlights the necessity of extending regulatory architectures to cover algorithmic infrastructures, digital asset custody, and the cross-border dimensions of cyber resilience in metaverse banking.

Another case is Celsius Network, a crypto lending and digital asset management platform, which suspended customer withdrawals in June 2022 following a severe liquidity crisis and filed for bankruptcy shortly thereafter. With over 1.7 million users affected, this event exposed major shortcomings in regulatory oversight, operational transparency, and consumer protection in the virtual finance sphere [

84]. The platform’s operating model, based on promises of high returns without adequate risk coverage, demonstrated how vulnerable decentralized financial services can become in the absence of clear control mechanisms and legal accountability. The Celsius case highlights the urgent need to harmonize the legal framework governing digital financial services, including in the context of their expansion into metaverse environments, where legal boundaries and transnational regulation are becoming increasingly complex.

3. Materials and Methods

Bibliometric analysis is an essential quantitative method for investigating the structure, dynamics, and trends of research in a scientific field. This approach provides an overview of scientific output, facilitating the identification of influential authors, institutional collaborations, and emerging concepts [

85]. In the context of research on the metaverse in banking, bibliometrics allows for a systematic understanding of how this topic has evolved in the scientific literature and related interdisciplinary areas.

The tools used in this study, VOSviewer version 1.6.20 and Bibliometrix version 5.1.0, were selected for their complementary ability to analyze and visualize bibliographic data. VOSviewer is recognized for its ability to generate intuitive network maps, highlighting the relationships between keywords, authors, and publications [

86]. In parallel, the R Bibliometrix package provides a flexible platform for descriptive analyses, co-citation network analysis, and thematic trend studies [

87]. The combined use of the two tools ensures the visual accuracy and analytical depth necessary to explore the phenomenon of the metaverse in the banking sector.

The literature has shown that keyword co-occurrence analysis is useful for discovering emerging sub-themes and emerging research agendas [

87,

88]. Furthermore, mapping collaborations between authors and institutions contributes to understanding the architecture of research networks and knowledge flows [

89,

90]. In addition, bibliometrics allows for the investigation of academic productivity, journal influence, and the geographical distribution of publications [

91,

92].

By applying bibliometric and scientometric methods, this study provides a clear and empirically grounded structure for research on the metaverse in the banking sector. The main contribution consists of the analysis of 693 articles from the Web of Science Core Collection, which, through co-occurrence of keywords, factor analysis, and collaboration mapping, reveals the main thematic directions, central technological elements, and recent developments in the field. In contrast to previous studies, which were often limited in their approach, this research combines visual and quantitative tools (VOSviewer and Bibliometrix) to track publication dynamics, identify authors, institutions, and countries involved, and describe collaboration networks. The study addresses several gaps in the existing literature: (1) the absence of an overview of research dedicated to the banking metaverse; (2) the insufficiency of thematic analyses applied to areas such as user experience, digital infrastructure, ethical issues, and technology adoption models; and (3) the need for a solid analytical framework to support the formulation of future research directions. Thus, the study makes a relevant contribution both to the theoretical understanding of the phenomenon and to the orientation of future research in this field.

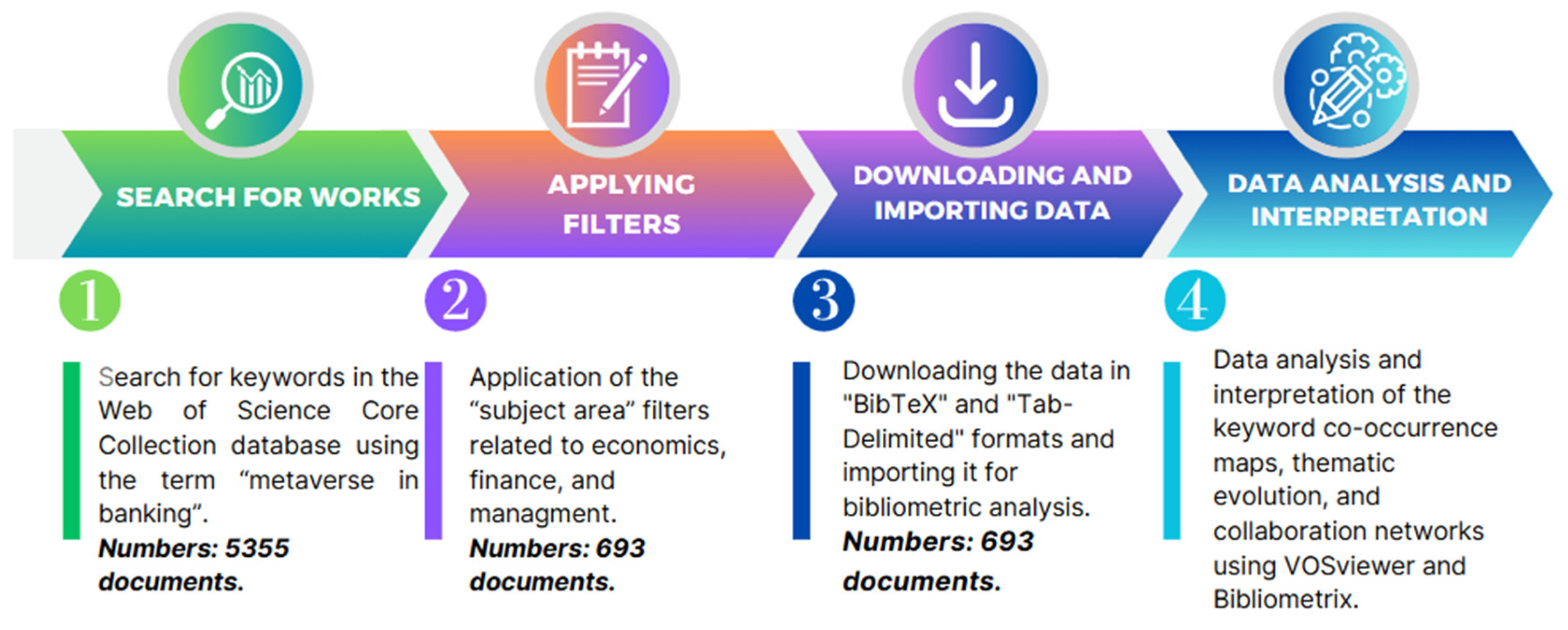

To conduct the bibliometric analysis on the concept of metaverse in banking, the initial stage consisted of querying the Web of Science Core Collection database using the key phrase “metaverse in banking,” to which the Boolean operator OR “metaverse” was added (

Figure 1). The choice of this search formula was strategic, as it allowed both the identification of studies that explicitly address the relationship between the metaverse and the banking sector, as well as the inclusion of more general works that deal with the phenomenon of the metaverse and may have relevant implications for the financial field. The aim was to balance specificity with broad coverage, avoiding the exclusion of potentially valuable contributions due to different formulations used by authors.

This extensive search yielded a total of 5355 documents. In the next stage, to ensure the relevance of the corpus to the target subject area, filters were applied based on scientific categories related to the fields of economics, finance, and management. As a result of these restrictions, the number of documents was reduced to 693, forming a representative sample for the analysis of the metaverse phenomenon in a financial context. It is important to note that no time filter was imposed, which allowed the inclusion of all indexed papers since 2008, indicating the beginning of scientific interest in the integration of the metaverse into the banking sphere.

The selected documents were downloaded in BibTeX and Tab-Delimited formats, which are compatible with the tools used in bibliometric analysis. This data was then imported into the VOSviewer and Bibliometrix platforms, where maps of keyword co-occurrence, collaboration networks between authors and institutions, and thematic evolution analyses were generated.

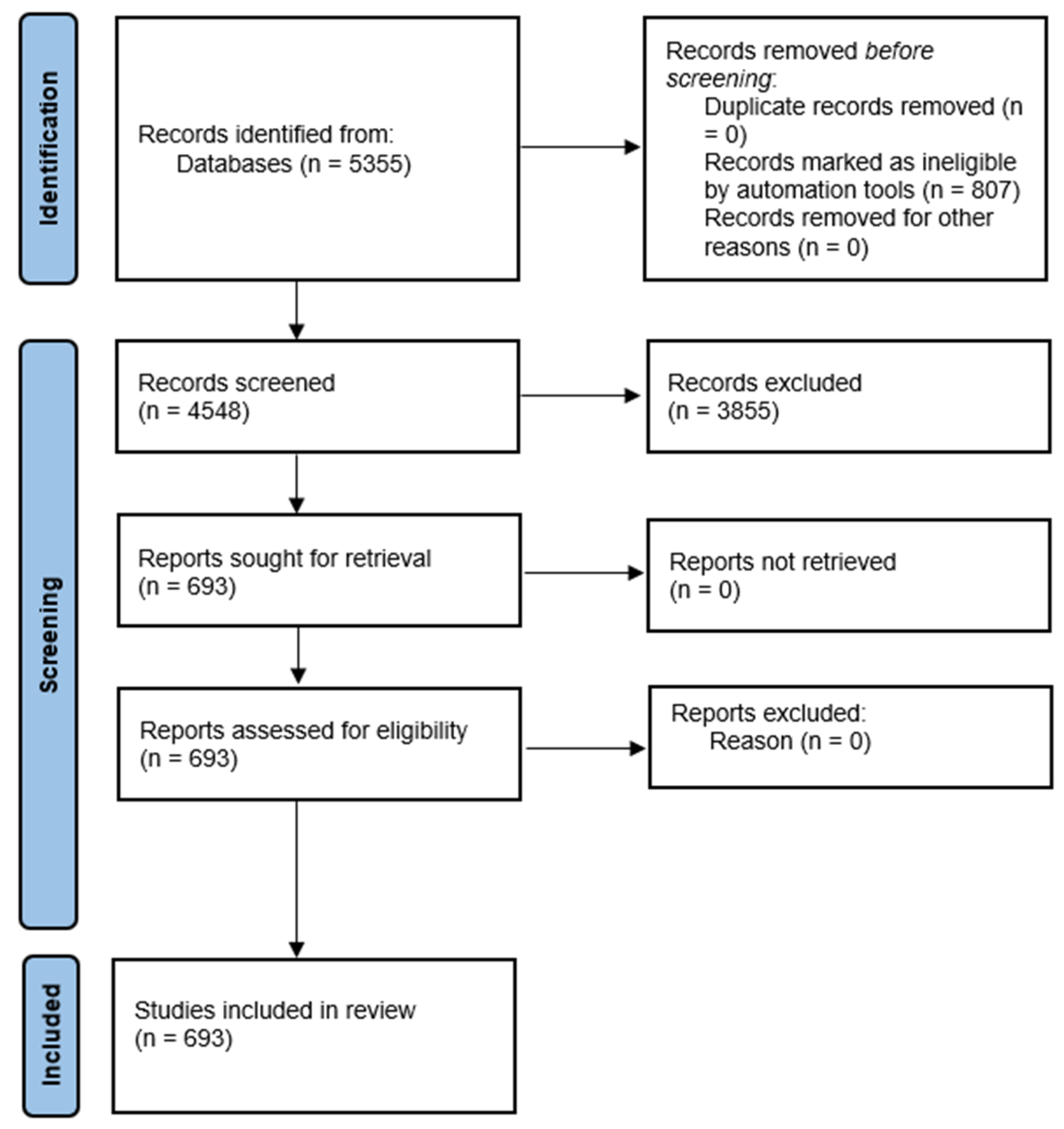

The stages were completed by rigorously applying the PRISMA (Preferred Reporting Items for Systematic Reviews and Meta-Analyses) methodology, which provided a transparent and systematic framework for documenting the literature selection process. This approach allowed for the traceability of each decision made in the filtering process, ensuring consistency and objectivity in the construction of the final set of documents included in the analysis.

The PRISMA diagram (

Figure 2) clearly highlighted the path taken from the initial identification of the 5355 papers to the final inclusion of 693 studies. In the first stage, 807 records were automatically eliminated by Web of Science tools as ineligible (e.g., not relevant to the field or incomplete). After manual screening, another 3855 documents were excluded because they did not meet the relevant thematic criteria, reflecting a careful and well-founded selection. It is important to note that no reports were subsequently removed due to lack of access or other methodological reasons, and all 693 selected papers were considered eligible for the final analysis.

4. Results

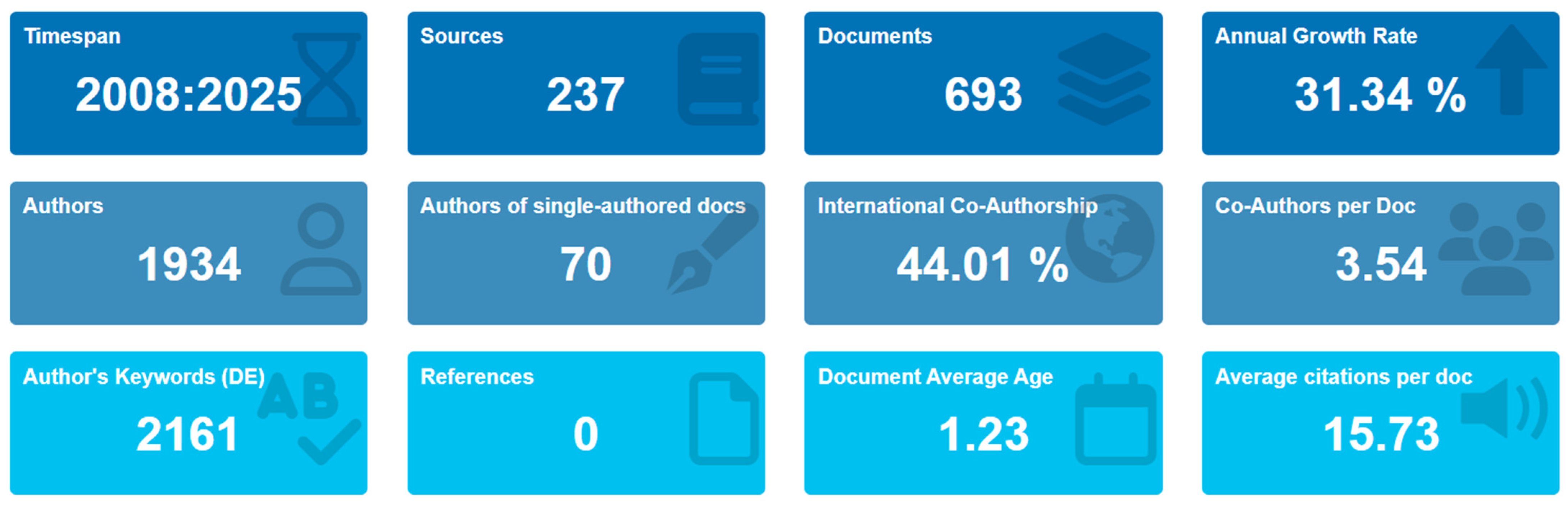

A bibliometric analysis of the literature on the metaverse in the banking sector (

Figure 3), conducted between 2008 and 2025 and based on the Web of Science Core Collection, identified a total of 693 documents published in 237 scientific sources, authored by 1934 authors. The average annual growth rate of publications is significant (31.34%), confirming the emerging and ascending nature of the subject. Scientific collaboration is high, with an average of 3.54 co-authors per document and a percentage of 44.01% international co-authorship, indicating global interest in the applicability of the metaverse in the banking field. The academic impact is also reflected in an average of 15.73 citations per article, a notable value for a relatively new field, and the average age of the documents is only 1.23 years, highlighting the recency and relevance of the analyzed corpus. The total number of author keywords (2161) confirms the conceptual diversity and multidimensionality of research in this field.

4.1. Annual Distribution of Scientific Output

Data extracted from the Web of Science Core Collection reveals a clear upward trend in the number of scientific publications dedicated to the concept of metaverse in banking. Between 2008 and 2021, scientific output was marginal, with a maximum of three articles per year. Starting in 2022, academic interest has grown significantly: 53 publications in 2022, 183 in 2023, and a peak of 304 articles recorded in 2024. For 2025, at the time of analysis (second quarter), 137 papers have already been indexed, suggesting that the upward trajectory will continue. This dynamic confirms the maturation of the metaverse theme in the banking sector, reflecting a growing interest among researchers in exploring the applications of immersive technologies in transforming the traditional banking model (

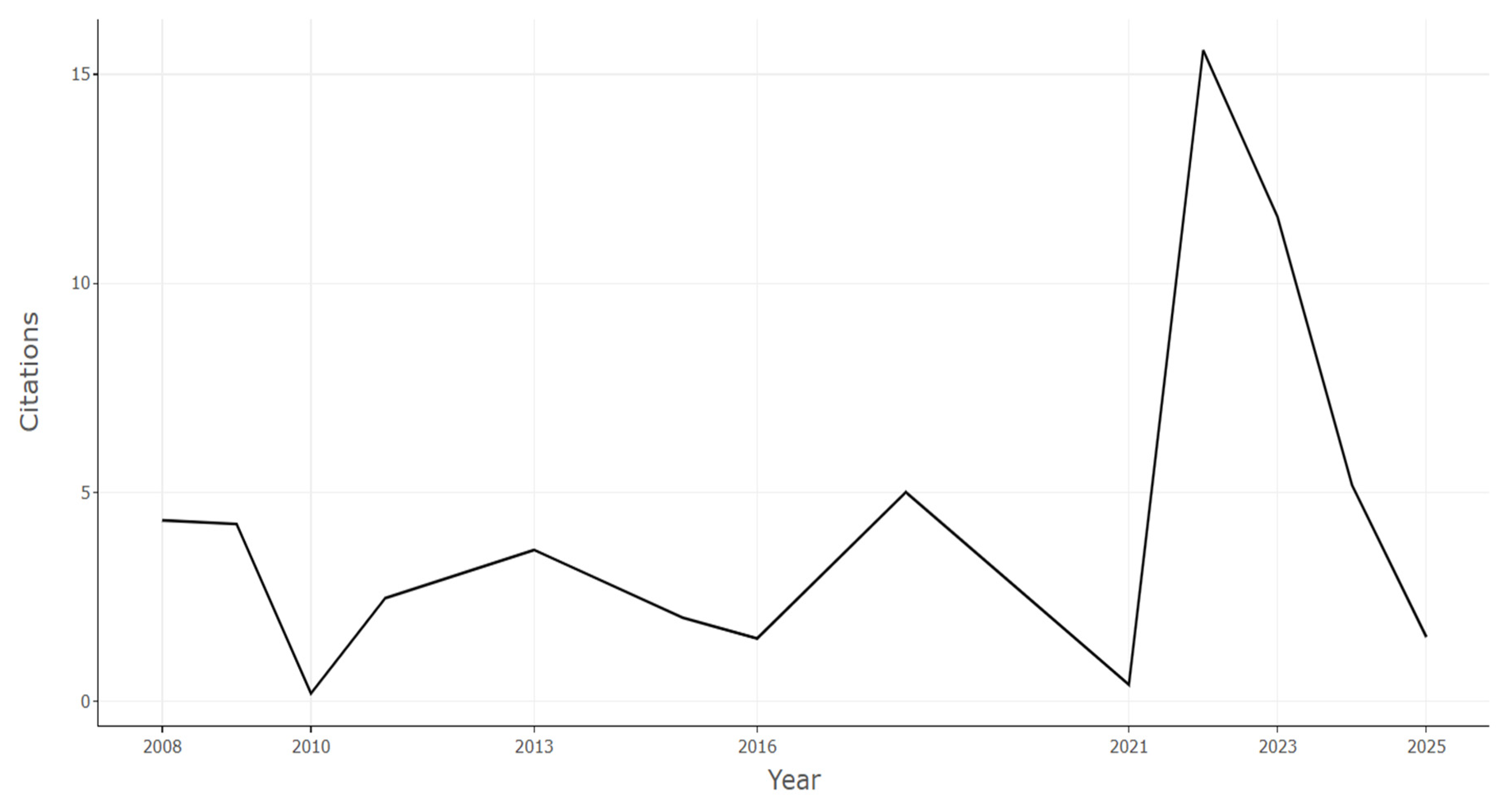

Figure 4).

Figure 5 outlines the average number of citations per year and highlights an irregular trend between 2008 and 2020, with low and fluctuating values ranging between 0 and 5 citations per year. A notable turning point occurs in 2022, when the average number of citations rises sharply, reaching a historic high of over 15.6 citations per article. Subsequently, in 2023 and 2024, a downward trend is observed, most likely correlated with the high number of recent publications that have not yet had enough time to accumulate citations. For 2025, the low average value partly reflects the fact that the year is still ongoing. Overall, these results indicate that the 2022 papers had a high scientific impact, underscoring the frontier nature and relevance of the metaverse in banking during its initial conceptual development.

4.2. Co-Compete Network Analysis of Keywords

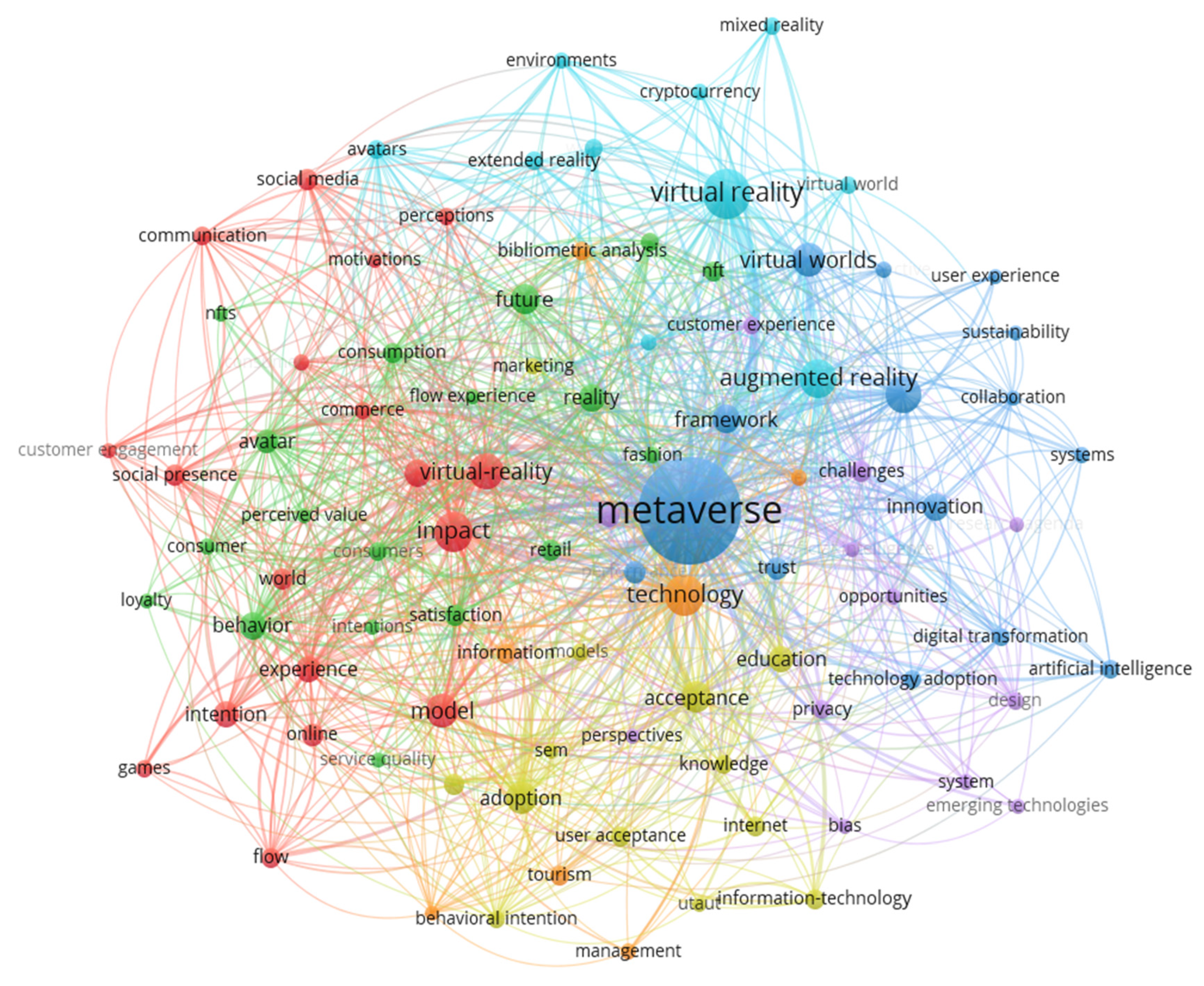

The co-occurrence map of keywords related to the concept of metaverse in banking highlights a complex network of interconnected terms, suggesting that this emerging field lies at the intersection of technology, user behavior, digital infrastructure, and financial experience design. The central term “metaverse” appears with the highest frequency and connection strength, reflecting the fact that the entire literature revolves around this notion, and the semantic extensions of the network suggest a multidimensional development of the field (

Figure 6).

The first cluster (red) focuses on the dimension of user–service interaction and digital engagement. Keywords such as communication, consumer engagement, social presence, experience, and virtual reality indicate a major concern for how users perceive and interact with banking services in the metaverse. This component is essential for the development of immersive banking platforms that stimulate active participation, satisfaction, and customer loyalty, similar to what happens in retail or the gaming industry, as suggested by the presence of the term games.

Next, the second cluster (green) expands this vision of the digital economy and consumer behavior in the metaverse. Terms such as digital fashion, consumption, retail, nft, and loyalty highlight an emerging area where banks need to rethink the types of services they offer—from loans for virtual assets to payment solutions for exclusively digital products and services. This confirms a redefinition of economic value in virtual environments, where consumer behavior is deeply influenced by interface design and the experiential nature of interaction. Importantly, these keywords reflect not just thematic co-occurrence, but also financial significance: NFTs, for example, represent tokenized ownership rights that require new valuation models and raise questions about asset-backed lending. Loyalty programs in the metaverse can be tokenized and integrated into blockchain ecosystems, creating transferable and monetizable digital rewards that alter traditional customer retention strategies. Likewise, digital consumption and retail challenge conventional payment infrastructure and require banks to develop interoperable systems for virtual currencies and digital wallets. Thus, the cluster indicates a structural transformation of financial intermediation tailored to the virtual economy.

The third cluster (dark blue) provides a strategic overview of the technological infrastructure required to implement the banking metaverse. Keywords such as blockchain, artificial intelligence, sustainability, digital transformation, and technology adoption suggest that the transition to banking in the metaverse is not possible without the integration of robust and interconnected solutions. Concerns for sustainability and performance also indicate a recent trend toward aligning these technologies with ESG principles, providing a new strategic dimension for the financial sector in the digital age.

Another thematic pillar is represented by cluster four (yellow), which focuses on technology acceptance and consists of terms such as user acceptance, behavioral intention, education, and knowledge. This conceptual area shows that the successful implementation of the metaverse in the banking sector depends largely on the level of digital literacy and users’ understanding of its benefits. The integration of classical theories such as TAM (Technology Acceptance Model) or UTAUT (Unified Theory of Acceptance and Use of Technology) is suggested by the presence of terms such as technology acceptance and models, indicating that many studies seek to explain the psychological and social barriers to adoption.

Cluster five (light purple) highlights the challenges associated with this transition, bringing together terms such as privacy, bias, challenges, design, and research agenda. These reflect concerns about personal data regulation, algorithmic fairness, and the quality of experience in fully virtual environments. Thus, the literature emphasizes that the development of the banking metaverse involves not only technological innovation but also the management of significant ethical and legal risks.

The emerging technologies that underpin this transformation are grouped in cluster six (light blue), which includes terms such as augmented reality, extended reality, human–computer interaction, and avatars (

Table 1). This set of concepts indicates that the banking metaverse is dependent on immersive and intuitive interfaces capable of reproducing or even improving the classic experiences of physical branches. Also, the introduction of avatars or virtual currencies in the banking context suggests the emergence of new forms of identification, interaction, and trading in fully digitized spaces.

Finally, cluster seven (orange) brings together the methodological and conceptual dimensions of the literature. The presence of terms such as bibliometric analysis, determinants, co-creation, and management highlights a concern for the structural and interdisciplinary understanding of the field, while also emphasizing the importance of rigorous and systematic analysis in defining the directions of development of the metaverse in the banking sector.

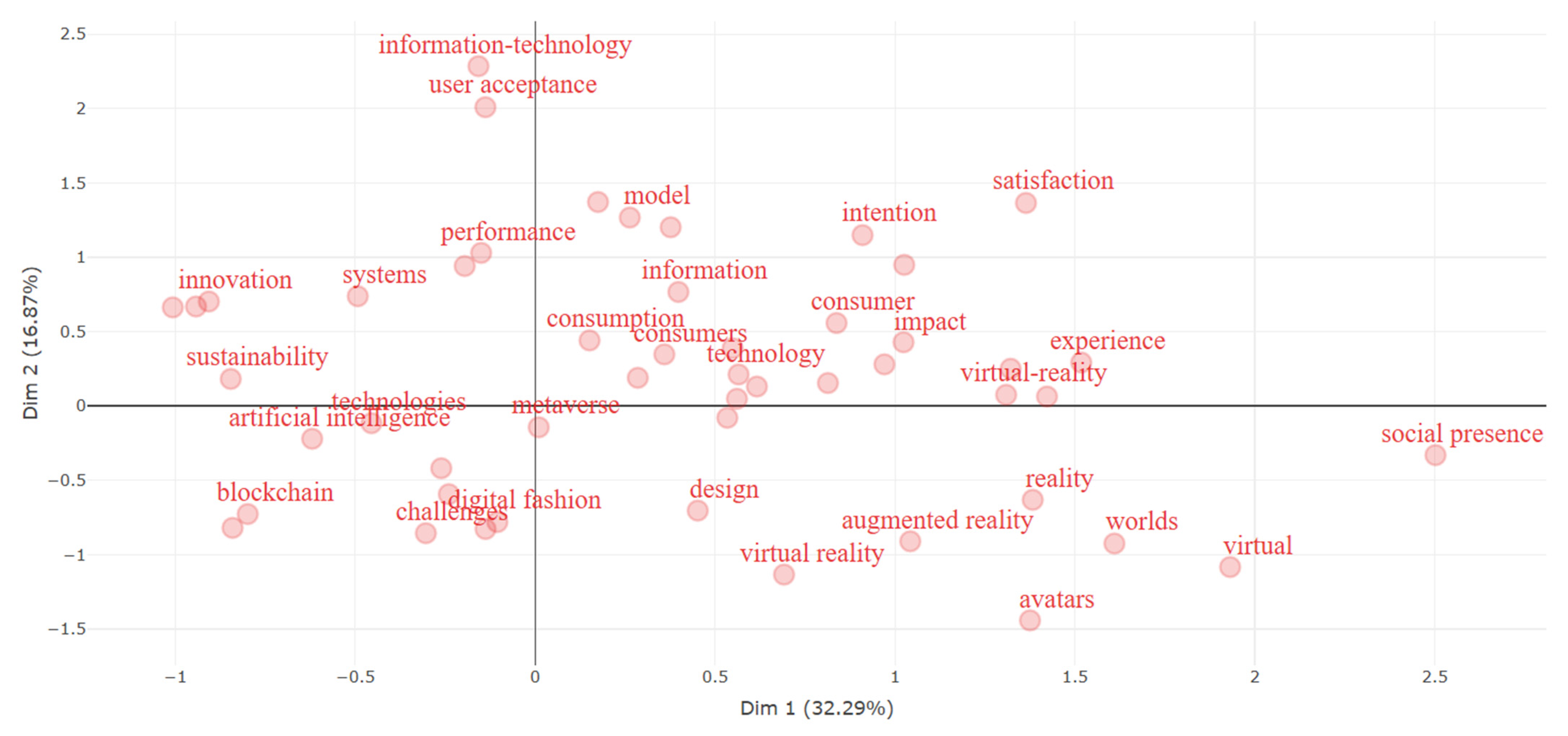

The factorial map (

Figure 7) provides a visual representation of the latent structure of the literature on the metaverse in banking, by projecting keywords into two main dimensions that account for approximately 49% of the total variance (Dim 1—32.29%, Dim 2—16.87%). The axes do not have a predefined meaning but indicate the main directions of semantic variation in the use of terms.

On the horizontal axis (Dim 1), there is a polarization between terms related to human interaction and immersive environments (right)—such as virtual reality, augmented reality, avatars, virtual, worlds, experience, social presence—and terms more associated with fundamental technologies and digital infrastructure (left), such as blockchain, artificial intelligence, innovation, systems. This distribution suggests that the literature clearly delineates two conceptual spheres: one centered on the user experience in virtual spaces and the other on the technical foundations that enable the metaverse to function.

The vertical axis (Dim 2) seems to distinguish between terms that indicate the operational and performance dimension (upper part), such as performance, information-technology, user acceptance, satisfaction, intention, and terms that indicate emerging challenges and technological solutions (lower part), such as design, digital fashion, challenges, artificial intelligence. Thus, a dissociation emerges between approaches focused on the efficient use of technology and those focused on its continuous development and adaptation.

Another relevant aspect is the close grouping in the central area of terms such as technology, consumption, consumers, and information, which suggests that they function as pivot terms, linked to both major research directions and occupying a role of articulation between the experiential and technological dimensions of the metaverse.

Isolated terms, such as social presence (far right) or blockchain (far left bottom), indicate either thematic niches less connected to the rest of the literature or emerging directions that require further integration into the general theoretical framework.

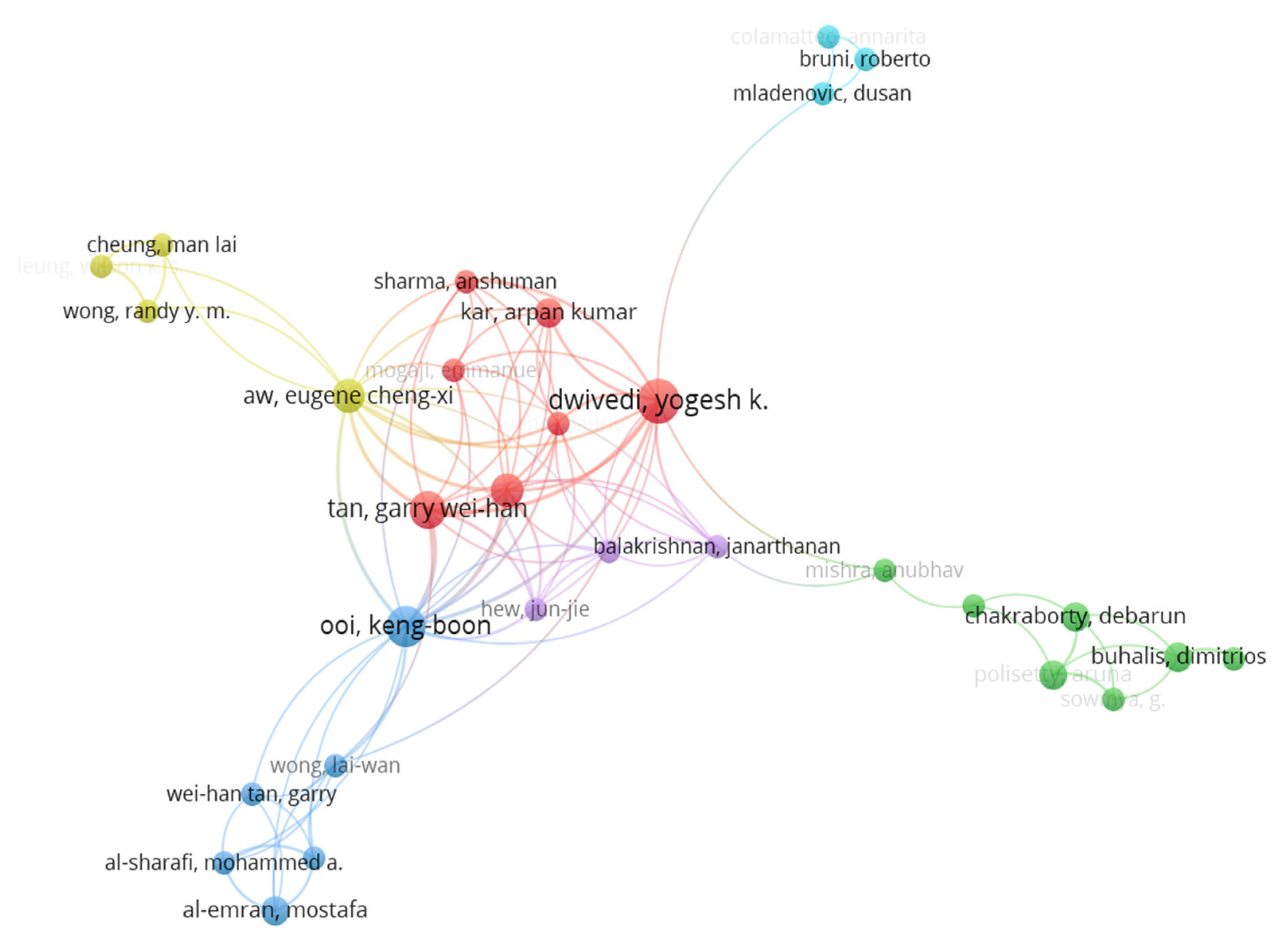

4.3. Authors’ Co-Citation Network

The co-authorship network highlights the organization of academic collaborations around research dedicated to the metaverse in the banking sector, reflecting a structure composed of six distinct clusters, each outlined according to the intensity of the links between authors. This structure reveals both the existence of a central collaborative core and the presence of peripheral or relatively isolated groups.

At the center of the network is Cluster 1, marked in red, which represents the most extensive and dense group of authors. It brings together seven researchers, among whom Dwivedi, Yogesh K., stands out, positioned centrally and with multiple direct connections to other members of the cluster, such as Tan, Garry Wei-Han, Kar, Arpan Kumar, and Sharma, Anshuman. The high cohesion and multiple links suggest the existence of a consolidated collaboration, with a high degree of stability and continuity between authors. Furthermore, this cluster is well connected to other groups, indicating a pivotal and intermediary role in the network (

Figure 8).

On the other hand, Cluster 2, represented in green, also brings together seven authors, but they are less connected to the overall network. The links are strong within the group, but the small number of external connections suggests locally concentrated collaborative activity without broad integration into the international structure of the network. Despite this, the density of internal links denotes strong coherence and sustained collaboration between members.

In an intermediate position is Cluster 3, colored blue, consisting of six authors who maintain active collaboration within the group, but also have a few selective connections to other clusters. Author Ooi, Keng-Boon, for example, plays a connecting role between this group and the central network, suggesting a moderate openness to cross-cluster collaborations. Although the cluster is not located at the center of the network, it contributes significantly to the broader integration of research through its active authors.

Cluster 4, marked in yellow, is smaller, including four authors. It maintains limited connectivity with the main network, being linked mainly through the author Aw, Eugene Cheng-Xi. Although internal collaboration is well defined, the group’s relatively peripheral position suggests focused activity with less external exposure and links.

Cluster 5, highlighted in purple, is located near the center of the network and consists of three authors who maintain both links between themselves and connections to authors in the dominant clusters. This positioning reflects collaborative activity that supports communication between networks, with the group functioning as a bridge between the central core and other relevant subnetworks.

Finally, Cluster 6, colored in cyan, is completely isolated from the rest of the network, consisting of three authors who collaborate only with each other. The total lack of external links indicates an independent group, possibly involved in a unique project or a research direction that does not overlap with the topics addressed by the main network.

Based on the number of documents published (

Table 2), there is an active core in the field of metaverse research in the banking sector, with clear differences in terms of scientific impact and collaborations.

The author with the highest output is Dwivedi, Yogesh K., with seven papers, 209 citations, and a total link strength of 24, reflecting both high productivity and good integration into collaboration networks. He is followed by Kumar, Aman, Shankar, Amit, and Ooi, Keng-Boon, each with six articles; however, Ooi stands out with a higher number of citations (132) and a much more extensive collaboration network (link strength: 30), indicating greater influence in the academic community.

Tan, Garry Wei-Han ranks fifth with five papers and intense collaborative activity (link strength: 25), coupled with a consistent number of citations (115). Next, Aw, Eugene Cheng-Xi and Cham, Tat-Huei, each with four articles, demonstrate a balance between visibility (over 85 citations each) and high network connectivity.

The last three authors in the top—Al-Emran, Mostafa, Behl, Abhishek, and Buhalis, Dimitrios—each have three papers. Among them, Buhalis stands out with 539 citations, despite a modest total link strength (five), suggesting a strong impact achieved through highly visible papers, but with more limited collaborations.

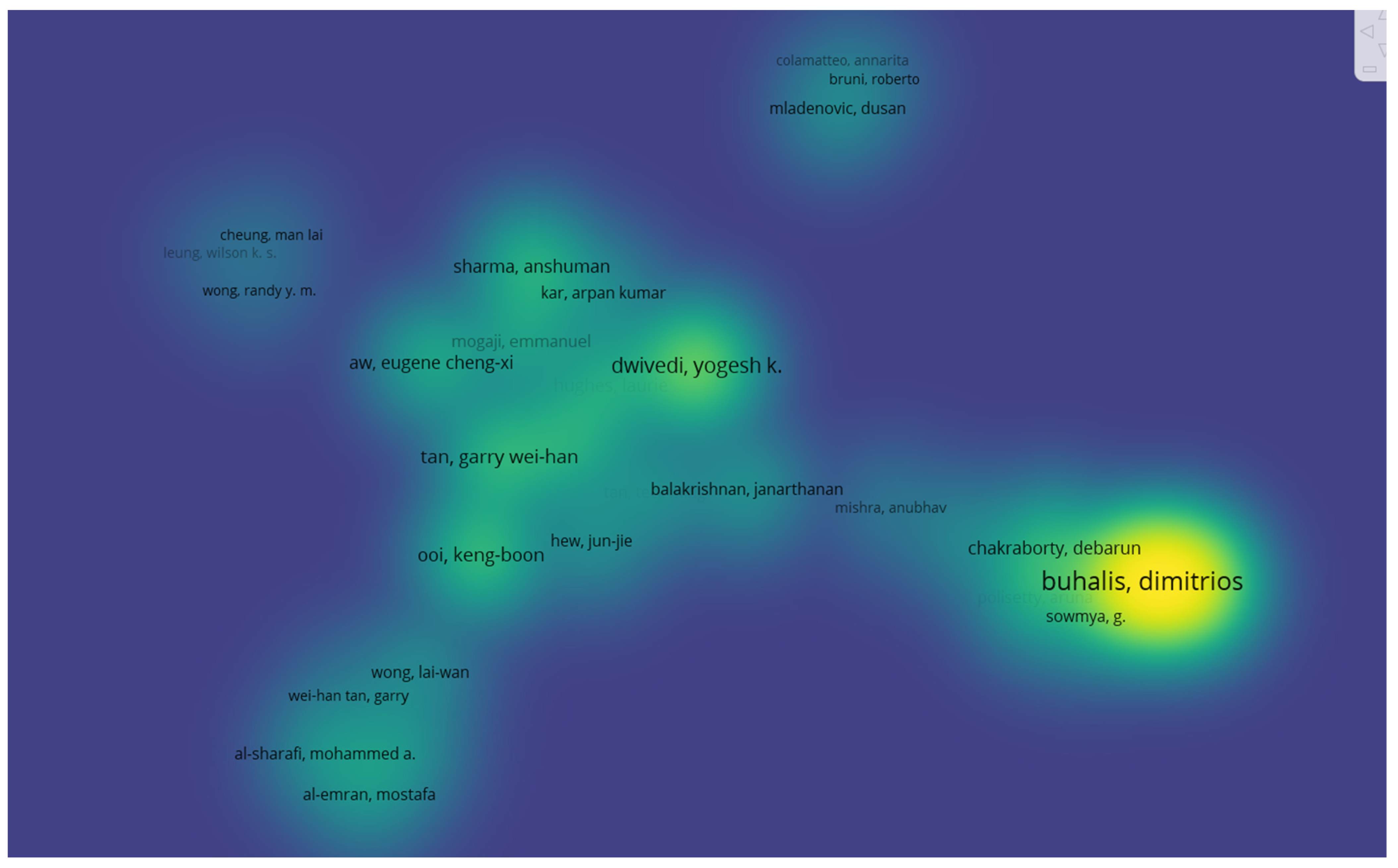

The density map (

Figure 9) visually highlights the concentration of citations in the author network. The most intense areas (yellow) indicate the authors with the highest impact in terms of citations.

Buhalis, Dimitrios clearly stands out as the author with the highest citation density, followed by Dwivedi, Yogesh K. and Ooi, Keng-Boon, who are in the central green area. Authors on the periphery (e.g., Cheung, Man Lai, Al-Emran, Mostafa) have low densities, reflecting a lower scientific impact in terms of citations.

4.4. Collaborative Institutional Analysis of Co-Authors

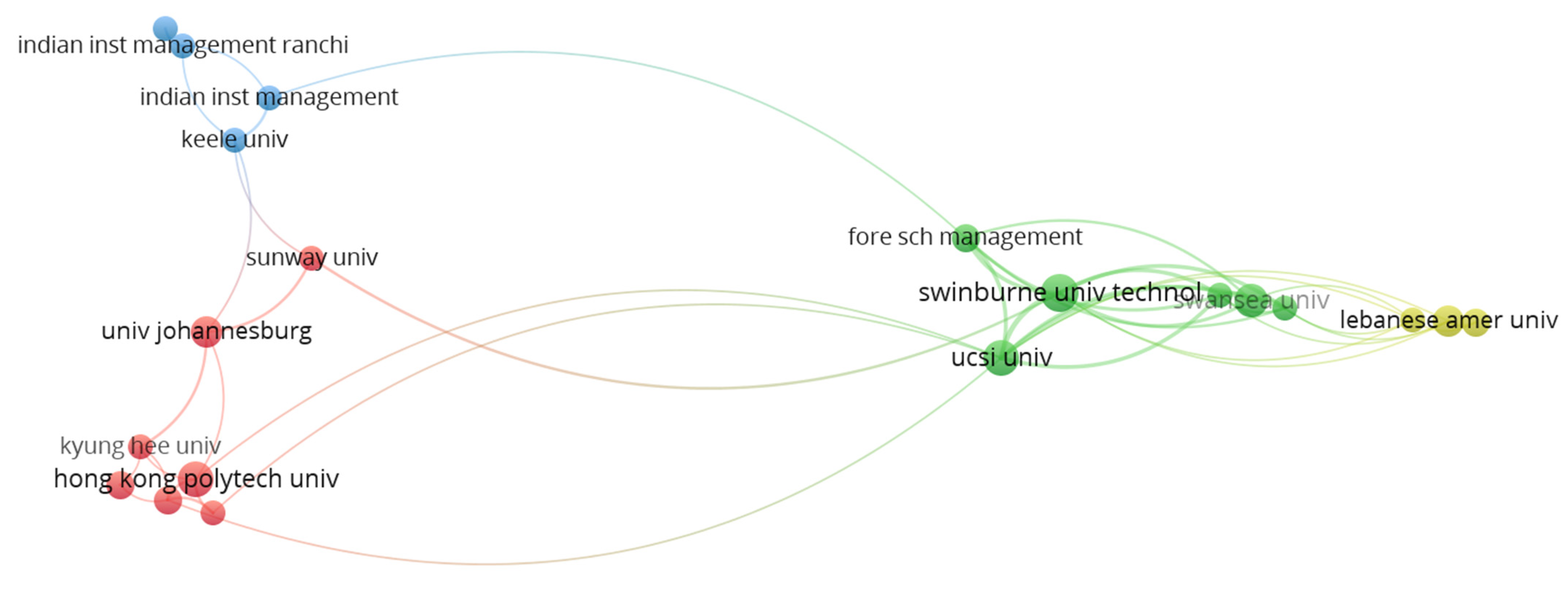

The institutional collaboration map highlights the distribution and links between universities that have contributed to research on the metaverse in banking, organized into four clusters based on co-authorship and number of published papers.

The analysis of the institutional network (

Figure 10) was carried out by applying an inclusion criterion that involved the exclusive selection of institutions that published at least four documents and recorded at least four citations.

Cluster 1 (red), comprising seven institutions, is the largest and shows significant connectivity. Universities in this group include Hong Kong Baptist University, Hong Kong Polytechnic University, Kyung Hee University, and the University of Johannesburg. This cluster appears to consist of institutions in Asia and Africa with a high level of internal collaboration, reflected in the density of connections.

Cluster 2 (green) includes six universities, such as Swinburne University of Technology, UCSI University, and Swansea University. These are very active institutions in terms of publishing articles, and their central positioning and number of connections indicate extensive collaborative activity and openness to other clusters. Their network is dense and shows high integration into the research community.

Cluster 3 (blue) consists of four institutions, including the Indian Institute of Management (with multiple campuses) and Keele University. Although smaller in number, the cluster has good internal cohesion and few external connections, suggesting consolidated research activity within a well-defined regional or institutional framework.

Cluster 4 (yellow) brings together three universities: Lebanese American University, Qatar University, and Vellore Institute of Technology. Although small in size, this cluster has links with external groups, suggesting an active interest in transnational collaboration.

Table 3 highlights the top 10 institutions based on the number of documents published in the field of banking metaverse. UCSI University leads with four articles and the most citations (241), also having the strongest collaboration network (link strength: 38). Although several institutions, such as Ajman University, Curtin University, and Swansea University, have only two documents, they stand out with a very high number of citations (238 each), indicating impactful work. In contrast, institutions such as Amman Arab University or Applied Science Private University have modest contributions, both in terms of visibility and collaborative integration.

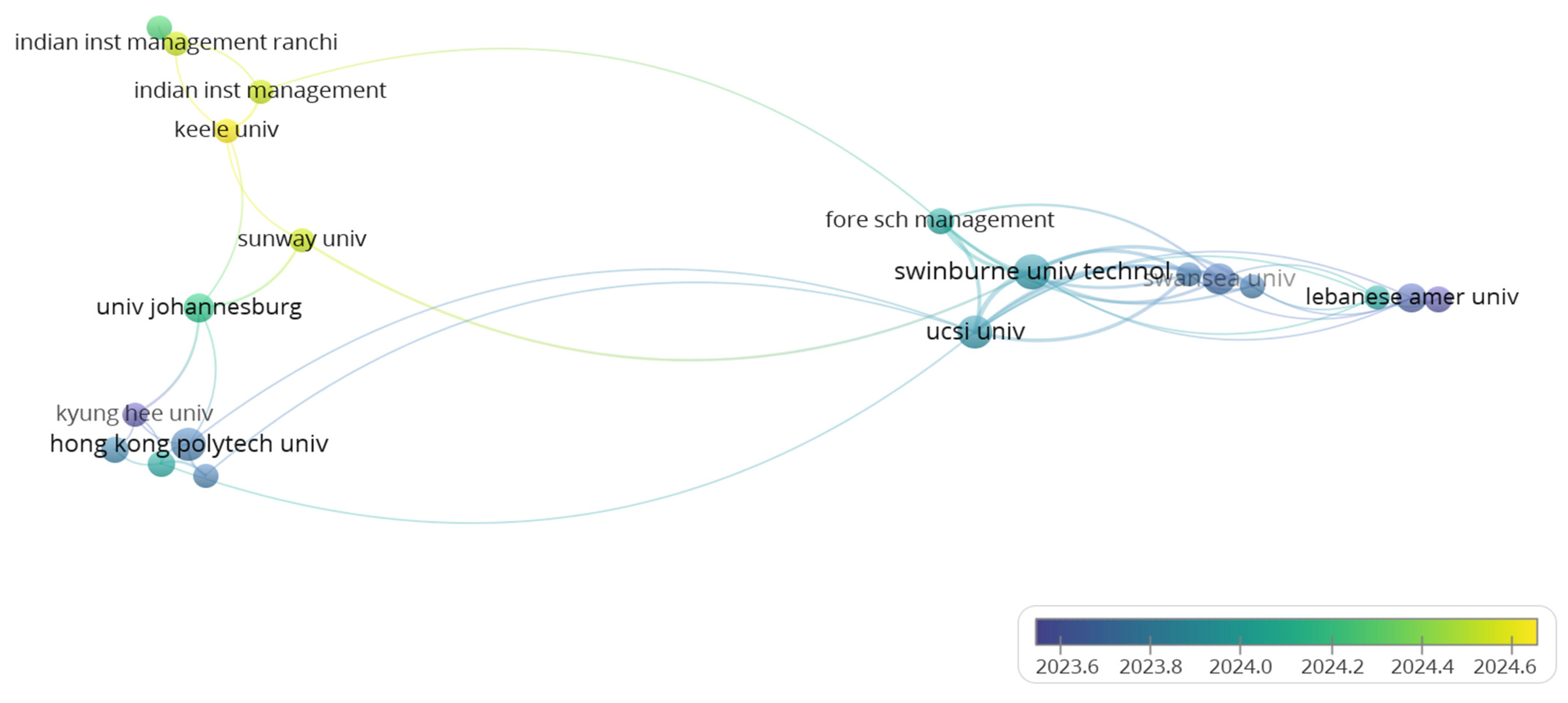

Figure 11 shows the evolution of institutions involved in publishing articles about the metaverse in banking, based on the average year of publication, on a scale from 2023.6 (purple) to 2024.6 (yellow).

It is clear that institutions with yellow shades—such as the Indian Institute of Management, Keele University, and Sunway University—published most recently, being active in 2024 and the first months of 2025.

In contrast, institutions colored blue to purple, such as Lebanese American University, Kyung Hee University, and Hong Kong Polytechnic University, were predominantly active in 2023, suggesting that they contributed to the initial phase of the research.

4.5. Country-Level Research Analysis and Collaboration

The map of international collaborations highlights the geographical structure of research on the metaverse in the banking sector, based on a selection criterion that included only those countries with at least four published articles and at least four citations. The network shown reflects a complex collaborative system, in which certain countries hold central positions and play an essential role in generating and disseminating knowledge.

Countries such as China, the United States, England, and India clearly stand out, dominating the network structure and acting as major research hubs due to their central position and high number of connections. Not only do they publish extensively, but they also maintain extensive collaborations with multiple other countries, thus consolidating their academic influence (

Figure 12).

The seven clusters identified reflect distinct regional groupings. Cluster 1 mainly brings together countries in Asia and the Middle East, such as Malaysia, Pakistan, Jordan, and the United Arab Emirates, characterized by frequent mutual collaborations. Cluster 2 is centered around Western European countries with strong connections: France, Italy, Germany, Switzerland, and England. Cluster 3 includes a variety of countries in Northern Europe, Asia, and the Middle East, such as Finland, Japan, Qatar, and Uzbekistan, indicating a diverse regional structure.

Cluster 4 includes countries such as Canada, Lithuania, Indonesia, and Nigeria, whose positioning suggests a more dispersed but constant collaborative activity. Cluster 5 brings together countries from Central and Eastern Europe: Romania, Poland, the Netherlands, and the Czech Republic, along with India, forming an emerging axis of scientific contribution. Cluster 6, which includes the US, South Korea, South Africa, and New Zealand, functions as a connecting node between the major groups in the network, indicating multidirectional influence.

Finally, Cluster 7 consists exclusively of China and Singapore, whose intense bilateral collaboration, isolated from the rest of the network, reflects a strategic research axis with its own development potential.

Therefore, the analysis highlights a dense network, fragmented into regional but interconnected groups, in which some countries act as global scientific leaders, while others outline emerging directions open to future extensive collaborations.

The map of international collaborations (

Figure 13) highlights the geographical distribution and intensity of scientific partnerships in the field of metaverse research in the banking sector. Countries are colored in different shades of blue, with darker tones indicating a higher volume of international collaborations, reflected in co-authorship.

It is clear that the United States, the United Kingdom, India, and China are the main centers of collaboration, serving as essential nodes in the global research network. These countries function as major connecting points between continents, linking scientific initiatives in North America, Europe, Asia, and Oceania.

The dense network of connections in Europe, especially between countries such as Germany, France, and Italy, together with strong collaborations between countries in the southern and northern hemispheres (e.g., cooperation between India and South Africa or between China and Australia), reflects a global, ever-expanding research landscape. At the same time, there is a growing involvement of countries in the Middle East, Southeast Asia, and Sub-Saharan Africa, albeit with a more modest presence, suggesting an emerging participation in this field.

5. Discussion

5.1. Core Insights Derived from the Bibliometric Analysis

This bibliometric analysis clearly shows that academic interest in the metaverse in the banking sector has evolved from a niche topic into a robust field of research, marked by a recent explosion in publications. The most important finding is the accelerated growth in the volume of the literature since 2022, culminating in over 300 articles in 2024. This dynamic reflects a paradigm shift in the approach to digital innovation in banking, where the metaverse is no longer seen as a marginal experiment, but as a possible strategic direction.

A second key finding derives from the analysis of keyword co-occurrence, which identified seven solid thematic clusters. The strongest themes are those centered on user–service interaction in virtual spaces, technological infrastructure (blockchain, AI), and technology acceptance models. This thematic structure suggests that the literature is not fragmented but oriented around two complementary axes: one technological and one behavioral. The importance of pivot terms such as technology, consumption, and information shows that the field is attempting to integrate innovation with user experience in a systematic way.

On a scientific level, the analysis of the co-authorship network reveals the formation of a clear core of academic leaders, including Yogesh K. Dwivedi and Keng-Boon Ooi, who not only publish frequently but are also well integrated into international collaboration networks. This is coupled with the significant scientific impact of authors such as Dimitrios Buhalis, whose few works have generated a very large number of citations. Thus, we can conclude that the field is supported by an emerging group of influential researchers who are charting future directions for development.

At the institutional level, the network shows a significant geographical concentration in Asia (Hong Kong, Malaysia, India), but also relevant contributions from Europe and the Middle East. Institutions such as UCSI University and Swinburne University of Technology stand out for their productivity and density of collaborations. In addition, chronological analysis has shown that some universities have recently become active (2024–2025), indicating a wave of expanding research. This synchronous academic mobilization across regions suggests that the theme of the banking metaverse is not localized but global.

Internationally, analysis of cooperation between countries indicates the dominant role of the US, China, India, and the UK, which act as poles of global connectivity. At the same time, solid regional networks are emerging in Western Europe, Southeast Asia, and the Middle East—as well as intense bilateral collaborations, such as between China and Singapore. The global network not only reflects diversity, but also a high capacity for knowledge dissemination and integration, which will accelerate the maturation of the field.

In conclusion, the major findings of the analysis indicate a stage of thematic crystallization, institutional consolidation, and global convergence around the concept of the metaverse in banking. With an expanding theoretical basis, increasingly dense collaborative networks, and active international interest, the banking metaverse is no longer a speculative concept, but a new territory of financial innovation with the potential to transform traditional banking services.

5.2. The Theoretical Framework for the Adoption of Technologies in the Banking Sector

The bibliometric analysis highlighted a series of recurring themes in the literature on the metaverse in the banking sector, reflected in thematic clusters associated with immersive technologies, digital infrastructure, algorithmic governance, user experience, and trust in the virtual environment. These themes can be correlated with established theoretical models in the literature on technology adoption, such as the Technology Acceptance Model (TAM), the Unified Theory of Acceptance and Use of Technology (UTAUT), Diffusion of Innovations Theory (IDT), and Theory of Planned Behavior (TPB), which provide a useful analytical framework for understanding the behavioral, organizational, and institutional dimensions involved in the adoption of the metaverse in banking.

One of the most widely used models to explain why people accept or reject a technology is the

Technology Acceptance Model (TAM), proposed by Davis [

93]. This model argues that two things matter most: perceived usefulness (how much the user believes the technology will improve their work) and perceived ease of use (how easy it is to use). If people find a technology useful and easy to use, they will tend to adopt it. In banking, this model has been applied to both traditional services, such as internet banking [

94], and emerging technologies such as blockchain, a technology that allows information to be stored and transmitted securely without the need for a central authority [

95]. In the case of banking services in the metaverse, this model helps explain users’ interest in elements such as virtual environments, integrated games (gamification), and digital identity management. These elements are appreciated because they contribute to the speed of transactions, active user involvement, and service personalization.

Another important model is the

Unified Theory of Acceptance and Use of Technology (UTAUT), formulated by Venkatesh et al. [

96]. This model takes into account several factors: social influence (the opinion of those around them), enabling conditions (whether the infrastructure is available), and performance expectations (whether the user believes the technology will help them). UTAUT is considered particularly effective in institutional contexts, being used, for example, to analyze the adoption of blockchain in the Indian banking system [

95]. A key aspect of this model is the idea that people will only use technology if they feel that the technical infrastructure and organizational support are in place. In the case of the metaverse, this means access to high-performance equipment, fast internet connections, and compatible technologies such as virtual and augmented reality (VR/AR).

A third theoretical framework is the

Diffusion of Innovations Theory (DIT), formulated by Rogers [

96]. This theory explains why some technologies are adopted more quickly than others, based on five factors: relative advantages (the technology offers clear benefits), compatibility (it fits with what users already use), complexity (how difficult it is to learn), trialability, and visibility. In the case of banking services in the metaverse, these criteria can be translated as follows: whether the services are more convenient than traditional ones (relative advantage), whether they fit in with existing habits, such as the use of mobile banking apps (compatibility), and whether they are not difficult to understand for users with an average level of digital literacy (complexity). The possibility of testing the service and seeing it in action is more limited in the virtual space, but this can be partially offset by simulations or pilot programs [

97,

98].

More and more research highlights that trust and perceived risk play an important role in the adoption of new technologies, especially in the financial sector. Lack of trust in digital infrastructure, fear of fraud, or loss of personal data are common obstacles [

99,

100]. In our bibliometric analysis, we identified clusters that address precisely these issues: ethics in the use of technology and transparency of the algorithms used. Therefore, adoption models must also include this dimension of trust, and the extended versions of TAM and UTAUT are useful for understanding consumer hesitation towards metaverse technologies.

Similarly, the

Theory of Planned Behavior (TPB), proposed by Ajzen [

101], is often used in banking to explain how the intention to use a service is influenced by attitude toward the service, what others think about it, and how capable the user feels they are of using it. In the case of banking services in the metaverse, these aspects appear in connection with group influence, belonging to a digital community, and the positive attitude of younger generations toward virtual interactions. When we take into account social norms and confidence in one’s own abilities, the phenomenon of the digital divide becomes clear: differences in access and digital competence lead to gaps in adoption, which justifies the need to analyze these phenomena from the perspective of education and socioeconomic status [

102].

Studies show that age, gender, level of education, and openness to technology influence adoption behavior [

94,

103]. Younger people, who are already accustomed to technology and digital interactions, are more willing to adopt financial services from the metaverse. In contrast, older people may feel anxiety or discomfort, especially if the interfaces are too complex. This highlights the importance of solutions tailored to different user groups, with intuitive design and personalized guidance.

Another important aspect is the ability of financial institutions to adopt innovations. It is not enough for users to be prepared; banks must also have qualified staff who are open to new ideas. Studies show that skills such as adaptability and innovative thinking among employees contribute to the successful implementation of FinTech or blockchain technologies [

104]. Clusters 1 (red) highlight user–service interaction and immersive banking experience, which can shape some models of organizational strategies and cross-sector collaborations. This suggests that the adoption of the metaverse in banking is part of a broader process of digital transformation and that financial institutions need to adopt new models of innovation.

The literature also emphasizes that economic rationality matters greatly in the adoption of technologies: users, especially those in the business environment, weigh the costs and benefits before adopting a solution [

105]. In the case of the banking metaverse, it is not enough for services to be attractive; they must bring clear benefits—such as lower costs, advanced data analysis, or easy integration between platforms. Cluster 3 (dark blue) refers to the digital infrastructure that shows precisely this combination of practical utility and digital experience.

Finally, barriers on the demand side must also be considered: lack of digital literacy, lack of access to technology, or preference for traditional methods of interacting with banks remain significant obstacles, even in developed countries [

100,

103]. Cluster 4 (yellow) and CCluster 5 (light purple) identified in the keyword analysis present issues related to trust, education, and ethics, thus showing that the metaverse is not just a matter of technology, but also one of social and cultural adaptation.

5.3. Future Research Directions on the Concept of the Metaverse in the Banking Sector

A central research direction (

Table 4) aims to deepen our understanding of how users interact with immersive banking services. Bibliometric data show that social presence perception, satisfaction, and digital engagement are becoming key concepts in understanding user behavior in the metaverse. Future studies should analyze these dimensions through robust theoretical models, such as TAM or UTAUT, further integrating behavioral, cognitive, and emotional factors that can influence the acceptance of emerging technologies.

At the same time, it is necessary to develop integrated technological models in which elements such as blockchain, artificial intelligence, extended reality, and cryptocurrencies are analyzed not in isolation but within a common framework that reflects the future architecture of banking services. This approach would allow for the investigation of technological interoperability, as well as the efficiency, security, and scalability of digital solutions.

Against the backdrop of ethical and legal concerns highlighted in the literature, future research needs to more systematically assess the risks related to data protection, algorithmic fairness, and decision-making responsibility in fully virtual environments. There is a need for adapted digital governance that clearly regulates these challenges without discouraging innovation.

Another relevant avenue is to compare digital transformation strategies between traditional banks and digitally native financial institutions. Comparative studies can highlight major differences in the degree of digitization, customer focus, organizational culture, and innovation capacity, thus outlining successful models tailored to each type of financial actor.

In addition, given the democratization potential of the metaverse, it is recommended to analyze its impact on financial inclusion. By creating alternative and accessible channels of interaction, immersive technologies can expand access to banking services in underserved areas, with positive effects on social and economic equity.

An analysis of international collaborations indicates a fragmented but promising network. Future research should explore how cross-border partnerships particularly between Eastern Europe, Southeast Asia, and Africa can accelerate knowledge sharing and technology transfer within a fair framework.

Finally, the metaverse must also be analyzed through the lens of sustainability. Its integration into banks’ ESG strategies through the responsible digitization of services, the reduction in physical resource consumption, and the promotion of inclusive financial education may constitute an emerging but vital dimension of research.

6. Conclusions

The results of the bibliometric analysis allow for a well-founded approach to the central question posed in the title: “Banking on the Metaverse: Systemic Disruption or Techno-Financial Mirage?”. Based on the 693 documents analyzed from the Web of Science Core Collection, we conclude that the metaverse in banking does not currently represent a fully realized systemic disruption or an irrelevant technological mirage, but rather an emerging paradigm that is gradually defining its conceptual contours, scientific networks, and areas of applicability.

On the one hand, the exponential growth in scientific output since 2022 (from 53 to 304 articles in 2024), together with the high impact of publications in 2022 (over 15.6 citations/article), supports the idea of an ongoing digital revolution with real potential to transform banking services. Furthermore, the semantic structure of the field highlighted by the thematic clusters covers dimensions that are essential for systemic disruption: technological infrastructure (blockchain, AI, virtual reality), user behavior (technological acceptance), immersive experience, and sustainability.

On the other hand, certain findings support the hypothesis of a “techno-financial mirage”: the lack of clear technological maturity, the focus of research on theoretical models that have not yet been validated in practice (such as TAM, UTAUT), poor international integration of some regions, and modest citation density in 2023–2024 indicate a gap between academic enthusiasm and real applicability in the banking system. In addition, analysis of collaboration networks reveals polarization: a few influential authors and institutions generate a large part of scientific output, which may limit the diversity and depth of future research.

International collaborations, centered around China, India, the United Kingdom, and the US, suggest the existence of centers of expertise that can contribute decisively to the transition from concept to implementation. However, the absence of robust empirical contributions and studies focused on the practical applicability of metaverse technologies indicates that the phenomenon is still at the level of conceptual exploration and does not currently represent a verifiable systemic disruption.

This study presents several limitations that must be considered when interpreting the results. First, the dynamics of the field analyzed are emerging, and the speed with which new publications appear may affect the relevance of the conclusions. Second, the structure of academic collaborations and networks may undergo short-term changes without necessarily reflecting consolidated trends. At the same time, the lack of a unified conceptual framework in the literature makes it difficult to clearly delimit the topics.

In conclusion, based on the evidence analyzed, the metaverse in banking is a concept with disruptive potential, but the realization of this potential depends on key factors: the maturation of technologies, the development of a coherent ethical and legal framework, and the empirical validation of adoption models. We are not yet witnessing a real systemic transformation, but neither can we reduce the phenomenon to an illusion. Thus, the metaverse in the banking sector is positioned between the two extremes of the question, explained as an emerging direction at a critical inflection point, with transformative potential, but also risks of marginalization if the identified challenges are not addressed concretely in the next stage of research and implementation.

And to support the transition from research based mainly on theoretical concepts to a practical understanding of the metaverse in banking, future studies should follow several key directions. First, it is important to test technology acceptance models, such as TAM (Technology Acceptance Model) or UTAUT (Unified Theory of Acceptance and Use of Technology), in banking institutions. These models can help us understand how customers react to the introduction of banking platforms in the virtual environment and what factors influence their decision to use them.

Secondly, research should take a closer look at how users’ interaction with immersive technologies such as virtual reality or digital avatars affects their perceptions, satisfaction, and financial behavior. This exploration is essential to assess whether the metaverse can offer a more attractive and efficient banking experience compared to traditional channels.

Another important aspect is identifying and assessing the risks associated with using the metaverse in banking. These include issues related to personal data security, financial information confidentiality, and possible inequalities in access to new technologies. A rigorous approach to these risks is necessary for technological developments to be sustainable and ethical.

Last but not least, future research should develop methods that correlate technological progress with social, economic, and institutional dimensions. This will allow for a better understanding of the implications of the metaverse on financial inclusion, banking regulation, and business models. Through these integrated approaches, future studies can help clarify the real role that the metaverse can play in transforming financial services and inform strategic decisions.