Tracing the Tin Flows and Stocks in China: A Dynamic Material Flow Analysis from 2001 to 2022

Abstract

1. Introduction

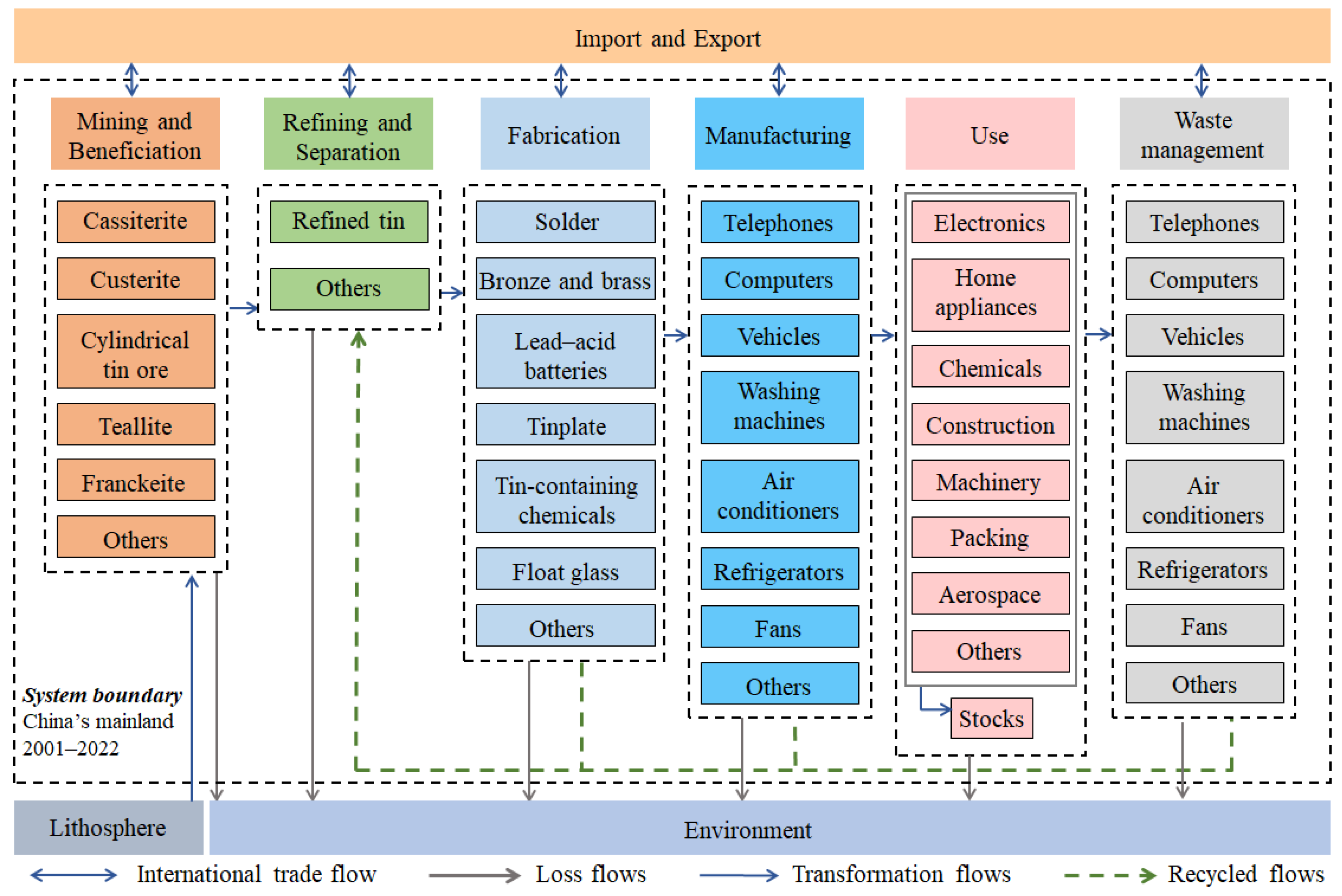

2. Methods and Data

2.1. Temporal Scope and System Boundary

2.2. Tin Flows and Stocks Analysis

2.3. Uncertainty Analysis

2.4. Data Sources

3. Results

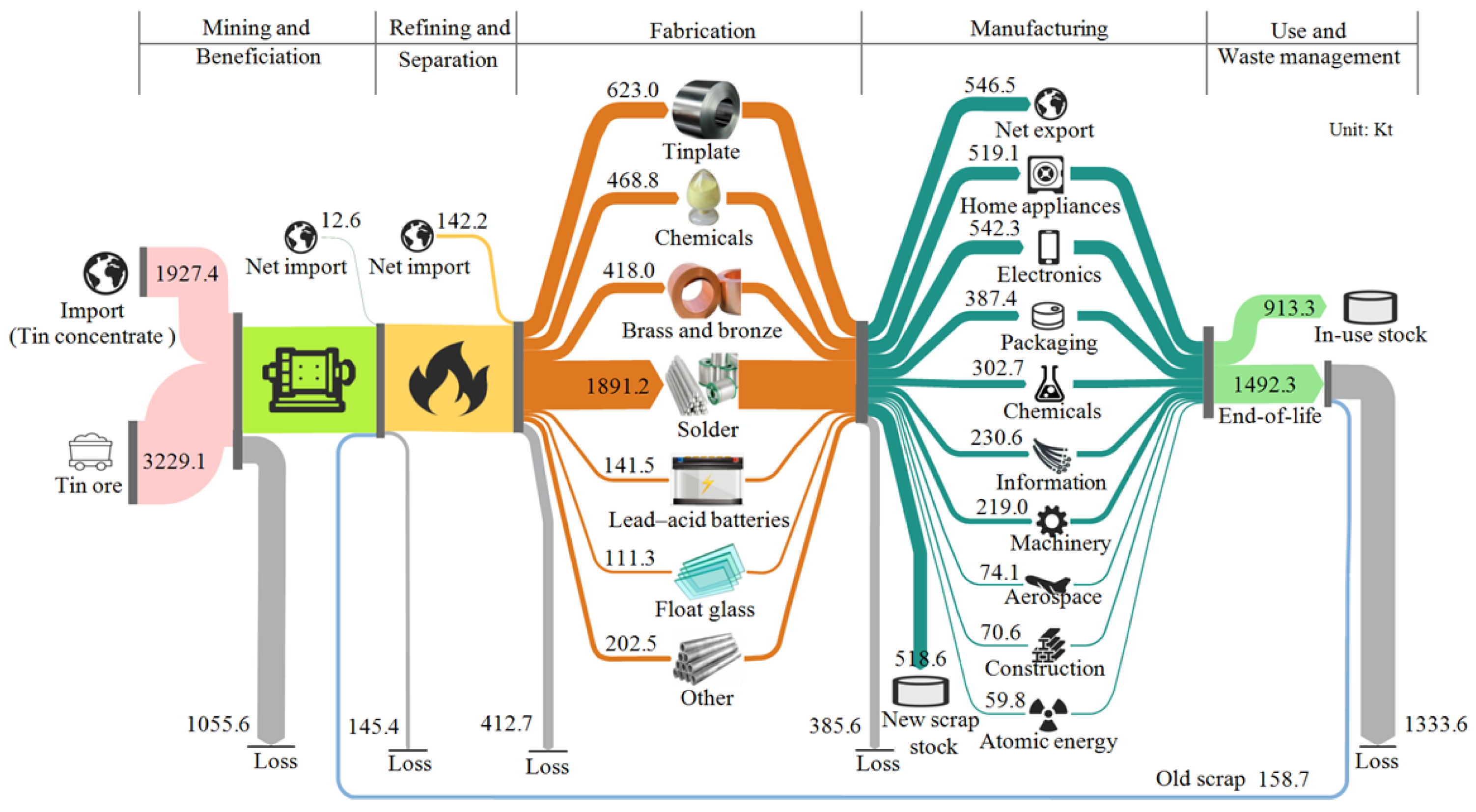

3.1. Evolution of Tin Cycle in China

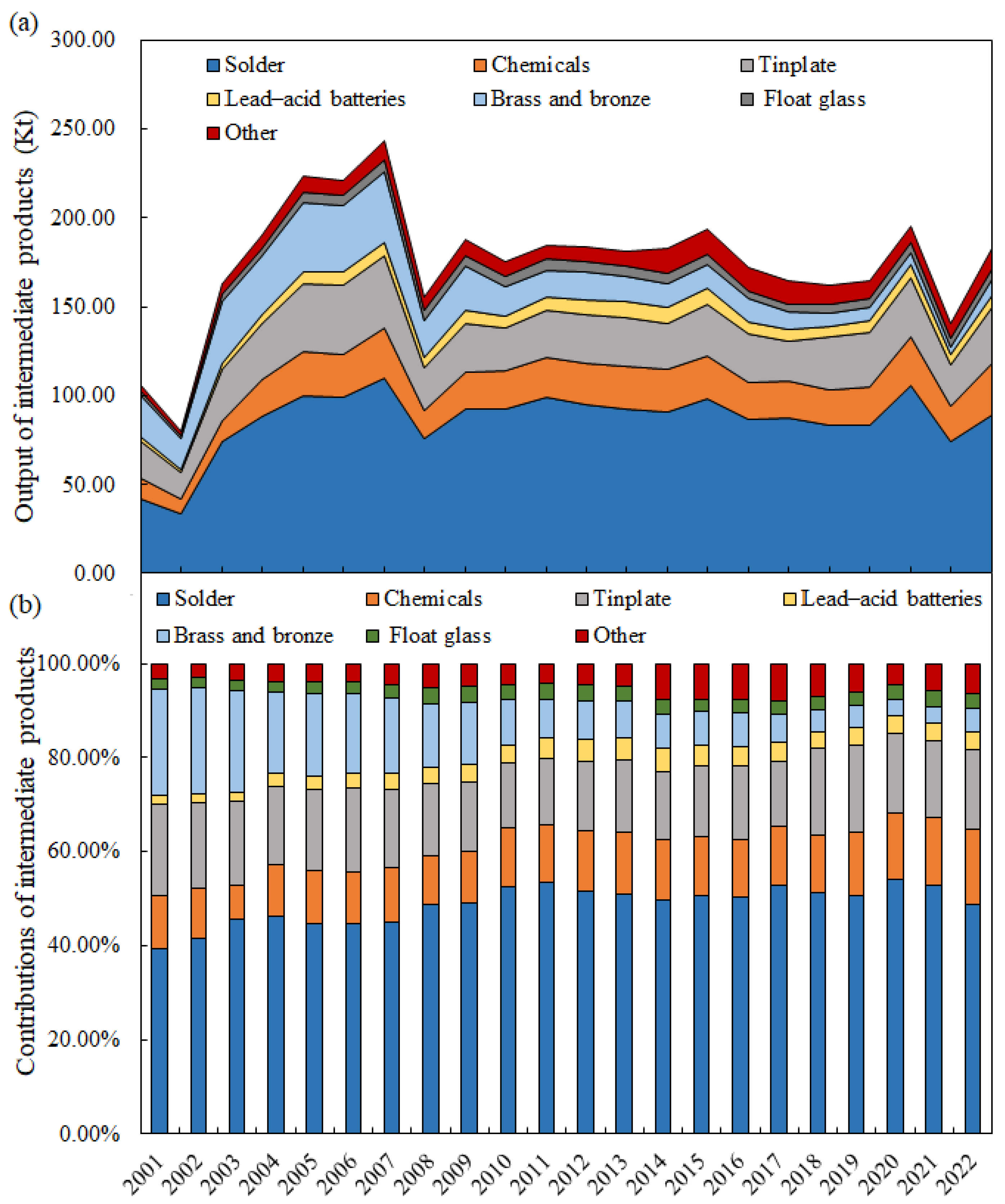

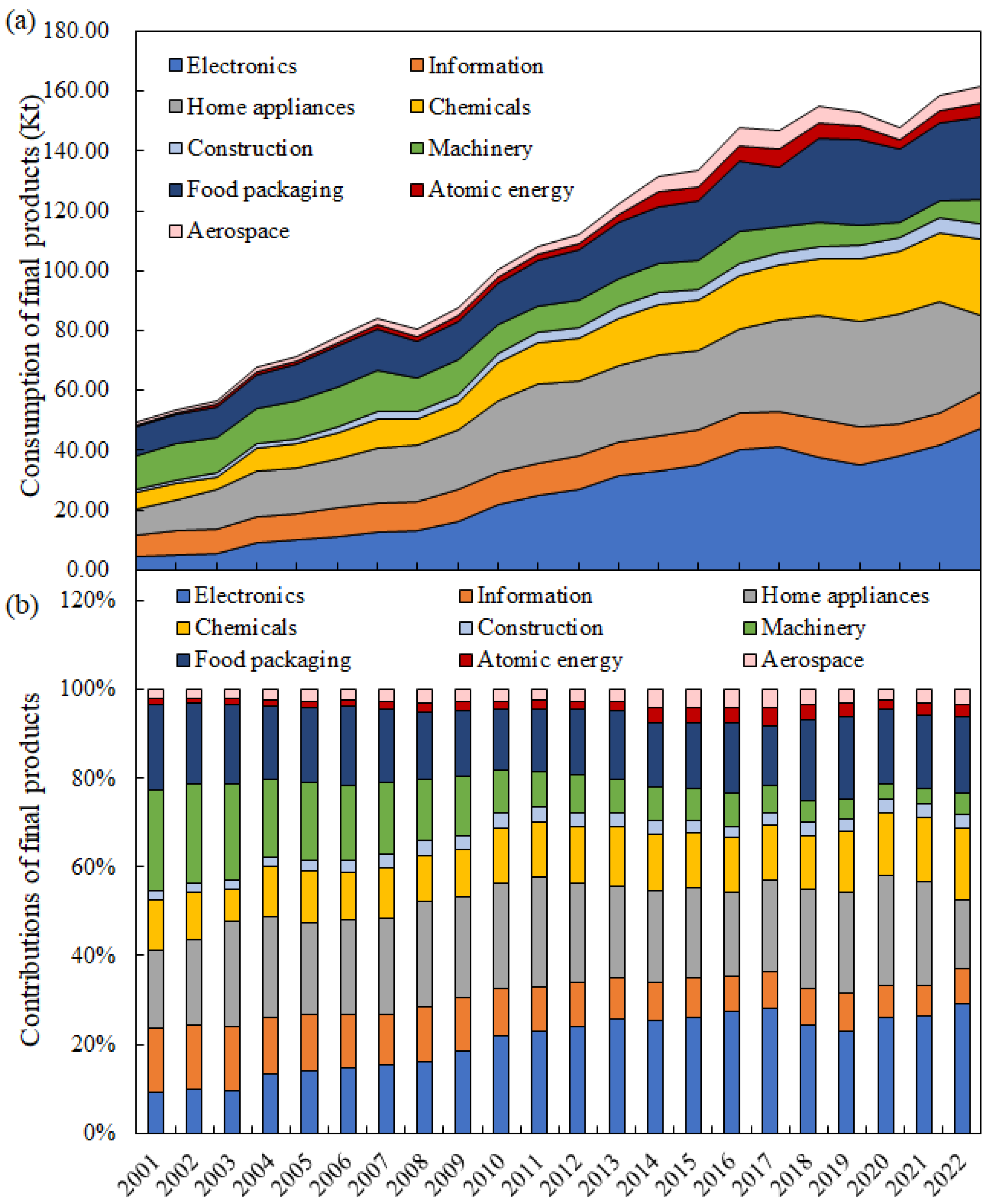

3.1.1. Tin Consumption Patterns

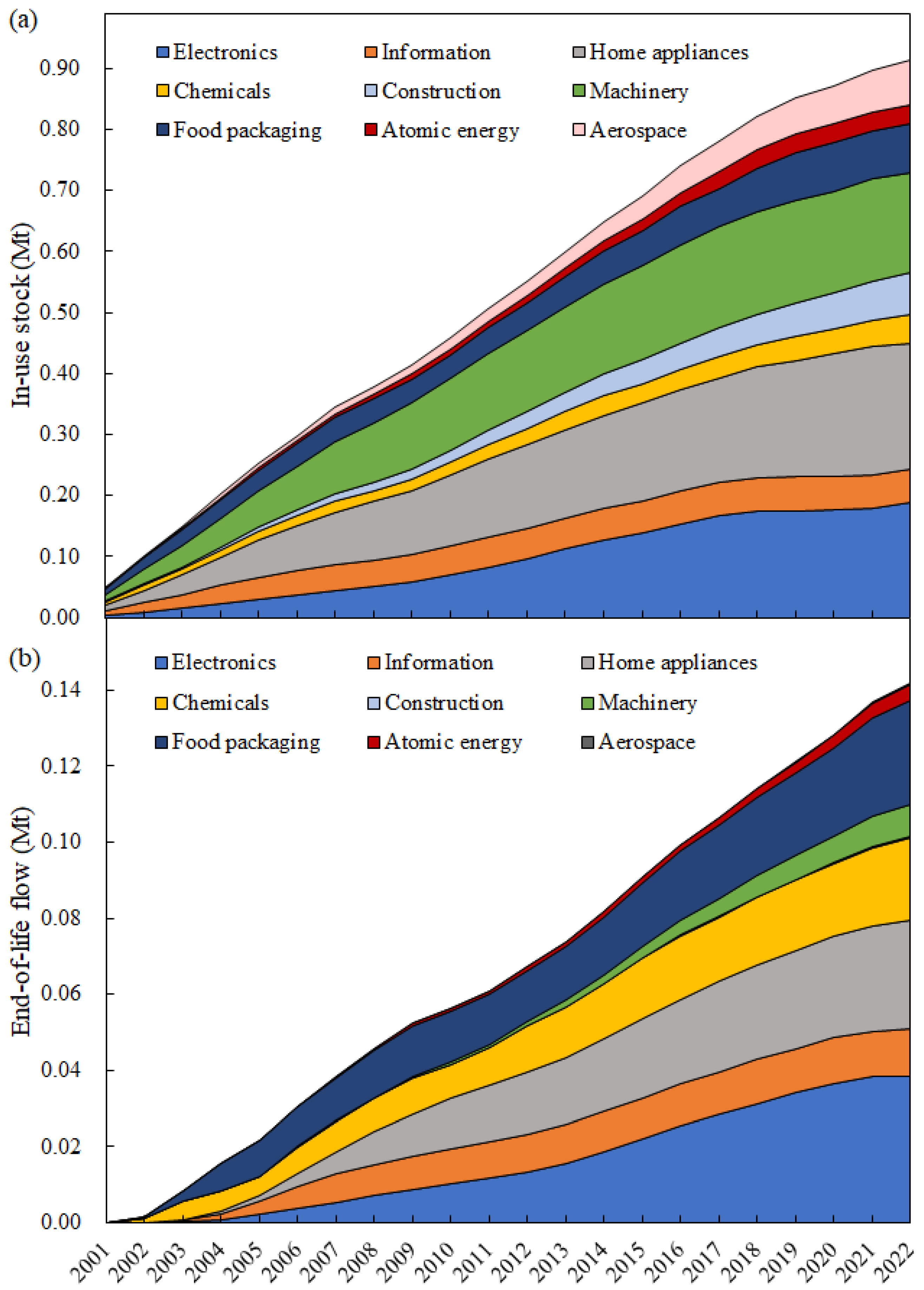

3.1.2. In-Use Tin Stocks and EoL Tin Flows

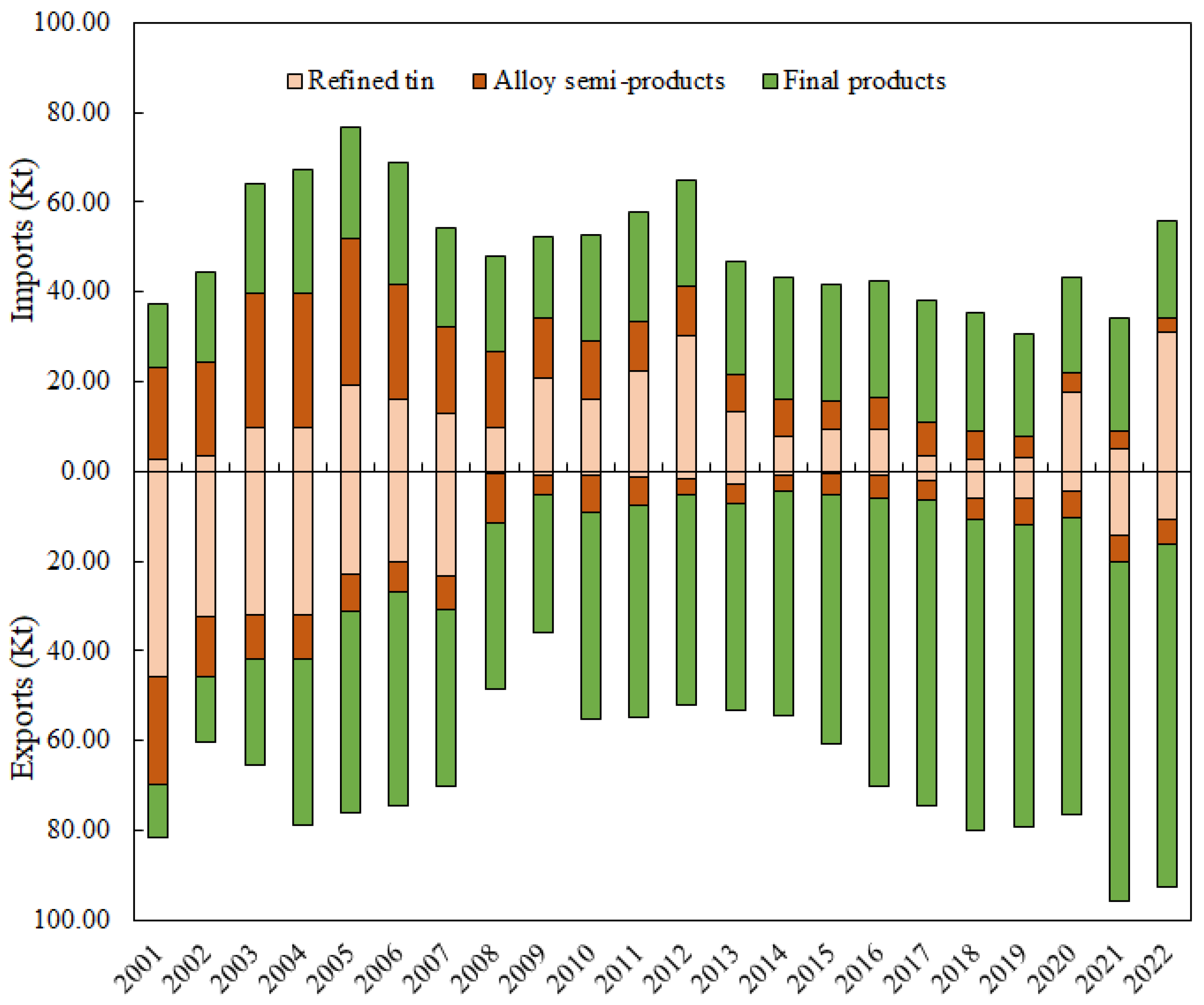

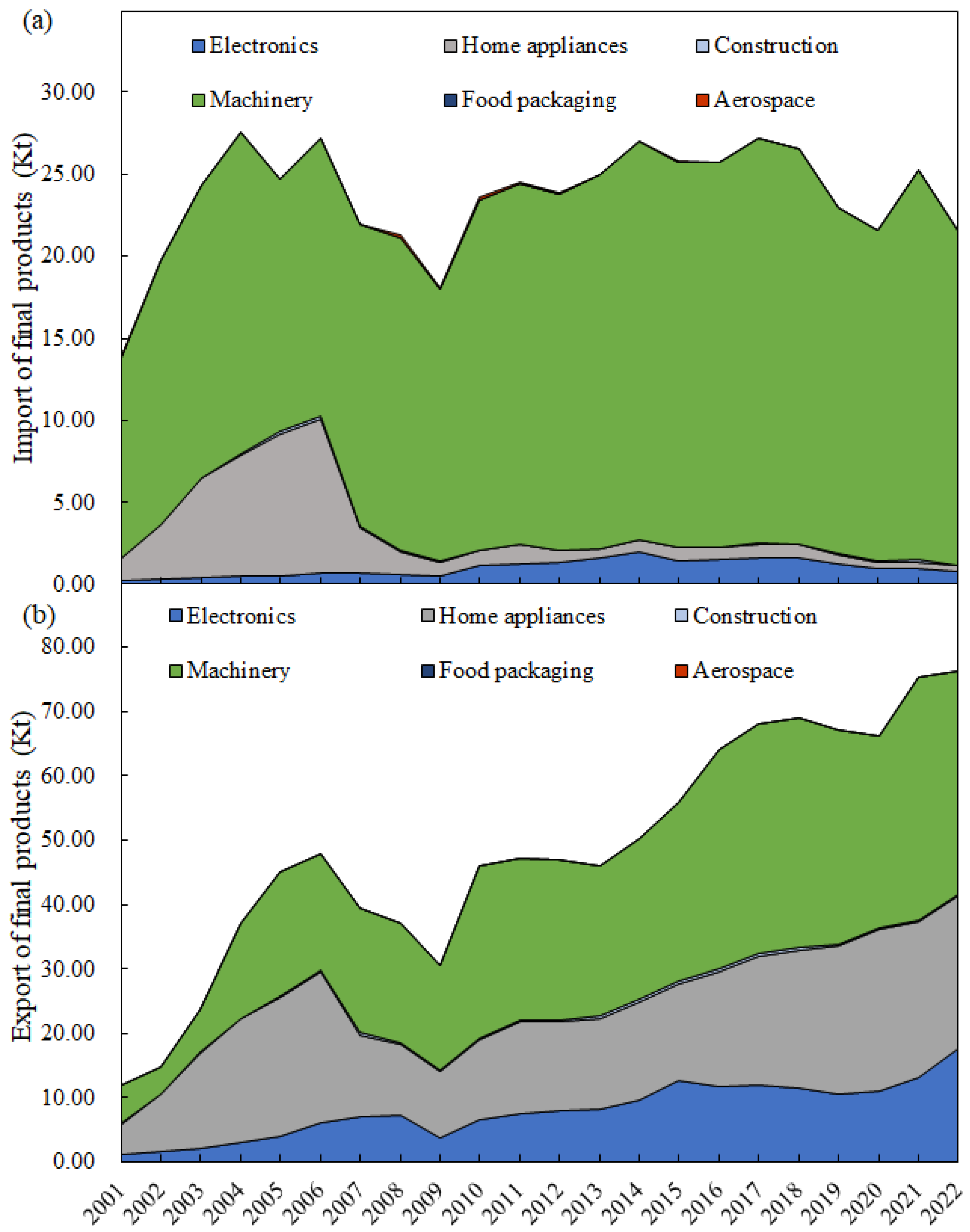

3.1.3. International Trade Patterns

3.2. Uncertainty Analysis Results

4. Discussion

4.1. Results Comparison

4.2. Advancing the Recycling of Tin

4.3. Advancing Geological Exploration

4.4. Optimizing Tin Trade Structure

4.5. Promote Regional Cooperation

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Valero, A.; Valero, A.; Calvo, G.; Ortego, A. Material bottlenecks in the future development of green technologies. Renew. Sustain. Energy Rev. 2018, 93, 178–200. [Google Scholar] [CrossRef]

- Calvo, G.; Valero, A. Strategic mineral resources: Availability and future estimations for the renewable energy sector. Environ. Dev. 2022, 41, 100640. [Google Scholar] [CrossRef]

- Li, H.; Qin, W.; Li, J.; Tian, Z.; Jiao, F.; Yang, C. Tracing the global tin flow network: Highly concentrated production and consumption. Resour. Conserv. Recycl. 2021, 169, 105495. [Google Scholar] [CrossRef]

- Chen, W.; Hu, L.; Zhang, T.; Hong, J.; Geng, Y. Evaluating the environmental impacts of tin ingot production in China: Insight from life cycle assessment. Environ. Impact Assess. Rev. 2025, 115, 108049. [Google Scholar] [CrossRef]

- Yang, X.; Guo, Y.; Liu, Q.; Zhang, D. Dynamic co-evolution analysis of low-carbon technology innovation compound system of new energy enterprise based on the perspective of sustainable development. J. Clean. Prod. 2022, 349, 131330. [Google Scholar] [CrossRef]

- Yu, S.; Duan, H.; Cheng, J. An evaluation of the supply risk for China’s strategic metallic mineral resources. Resour. Policy 2021, 70, 101891. [Google Scholar] [CrossRef]

- Fan, X.; Li, H.; Yu, Q.; Xu, J.; Li, M. Assessment of sustainable supply capability of Chinese tin resources based on the entropy weight-TOPSIS model. Sustainability 2023, 15, 13076. [Google Scholar] [CrossRef]

- China Nonferrous Metals Industry Association (CNMIA). 2023 Report on the Development of Non-Ferrous Metals in China; Metallurgical Industry Press: Beijing, China, 2023. [Google Scholar]

- China Bulk Commodity (CBC). China Bulk Commodity Database. Available online: https://www.cbcie.com/news/index.html (accessed on 13 July 2025).

- Izard, C.; Müller, D. Tracking the devil’s metal: Historical global and contemporary U.S. tin cycles. Resour. Conserv. Recycl. 2010, 54, 1436–1441. [Google Scholar] [CrossRef]

- Wang, X.; Tian, X.; Geng, Y. Uncovering the key determinants on the disruption of ores supply. Resour. Conserv. Recycl. 2025, 212, 107953. [Google Scholar] [CrossRef]

- Brunner, P.; Rechberger, H. Handbook of Material Flow Analysis: For Environmental, Resource, and Waste Engineers; CRC Press: Boca Raton, FL, USA, 2016. [Google Scholar]

- Deng, T.; Zhang, Y.; Fu, C. Modelling dynamic interactions between material flow and stock: A review of dynamic material flow analysis. Ecol. Indic. 2023, 156, 111098. [Google Scholar] [CrossRef]

- Widiyanti, A.; Rancak, G.T.; Ramadan, B.S.; Hanaseta, E. Comprehensive literature review of material flow analysis (MFA) of plastics waste: Recent trends, policy, management, and methodology. J. Mater. Cycles Waste Manag. 2025, 27, 1–18. [Google Scholar] [CrossRef]

- Houssini, K.; Li, J.; Tan, Q. Complexities of the global plastics supply chain revealed in a trade-linked material flow analysis. Commun. Earth Environ. 2025, 6, 257. [Google Scholar] [CrossRef]

- Wang, R.; Haller, P. Dynamic material flow analysis of wood in Germany from 1991 to 2020. Resour. Conserv. Recycl. 2024, 201, 107339. [Google Scholar] [CrossRef]

- Islam, M.T.; Huda, N. Material flow analysis (MFA) as a strategic tool in E-waste management: Applications, trends and future directions. J. Environ. Manag. 2019, 244, 344–361. [Google Scholar] [CrossRef] [PubMed]

- Augiseau, V.; Barles, S. Studying construction materials flows and stock: A review. Resour. Conserv. Recycl. 2017, 123, 153–164. [Google Scholar] [CrossRef]

- Chen, W.; Wang, P.; Zhao, S.; Chen, W.Q. Material flow analysis of rare earth elements: A comprehensive review. Sci. Technol. Rev. 2022, 40, 14–26. (In Chinese) [Google Scholar]

- Wiedenhofer, D.; Baumgart, A.; Matej, S.; Virág, D.; Kalt, G.; Lanau, M.; Tingley, D.D.; Liu, Z.; Guo, J.; Tanikawa, H.; et al. Mapping and modelling global mobility infrastructure stocks, material flows and their embodied greenhouse gas emissions. J. Clean. Prod. 2024, 434, 139742. [Google Scholar] [CrossRef]

- Li, Y.; Li, M.; Sang, P. A bibliometric review of studies on construction and demolition waste management by using CiteSpace. Energy Build. 2022, 258, 111822. [Google Scholar] [CrossRef]

- Li, Q.; Dai, T.; Wang, G.; Cheng, J.; Zhong, W.; Wen, B.; Liang, L. Iron material flow analysis for production, consumption, and trade in China from 2010 to 2015. J. Clean. Prod. 2018, 172, 1807–1813. [Google Scholar] [CrossRef]

- Rabab, N.; Geng, Y.; Cai, W.; Gu, W.; Gao, Z.; Shi, J. Uncovering the key features of iron metabolism in Pakistan from 2005 to 2020: A dynamic material flow analysis. Struct. Change Econ. Dyn. 2024, 71, 261–269. [Google Scholar] [CrossRef]

- Grund, S.; van Genderen, E.; van Leeuwen, M. Using Material Flow Analysis to Identifying Global and Regional Opportunities for Zinc Circularity. J. Adv. Manuf. Process. 2025, e70020. [Google Scholar] [CrossRef]

- Choi, H.; Hwang, Y.; Kim, J.; Kang, H.; Kim, D. Material flow and domestic demand analysis for nickel in South Korea. J. Clean. Prod. 2024, 449, 141711. [Google Scholar] [CrossRef]

- Yuan, N.; Geng, Y.; Mei, Y.; Gao, Z. Material flow analysis of molybdenum in China during 2000–2020. JOM 2024, 76, 2004–2015. [Google Scholar] [CrossRef]

- Zhu, E.; Geng, Y.; Xiao, S.; Guo, T.; Gao, Z.Y.; Gao, Z. Mapping the evolution of manganese flows and stocks in China from 2000 to 2021. Resour. Environ. Sustain. 2024, 16, 100152. [Google Scholar] [CrossRef]

- Eheliyagoda, D.; Li, J.; Geng, Y.; Zeng, X. The role of China’s aluminum recycling on sustainable resource and emission pathways. Resour. Policy 2022, 76, 102552. [Google Scholar] [CrossRef]

- Lei, Y.; Xu, X.; Li, J.; Wang, H.; Yue, Q.; Chen, W. Material flows and embodied carbon emissions of aluminum used in China’s photovoltaic industry from 2000 to 2020. Resour. Conserv. Recycl. 2025, 215, 108055. [Google Scholar] [CrossRef]

- Glöser, S.; Soulier, M.; Tercero Espinoza, L. Dynamic analysis of global copper flows. Global stocks, postconsumer material flows, recycling indicators, and uncertainty evaluation. Environ. Sci. Technol. 2013, 47, 6069–6724. [Google Scholar] [CrossRef]

- Lin, S.; Mao, J.; Chen, W.; Shi, L. Indium in mainland China: Insights into use, trade, and efficiency from the substance flow analysis. Resour. Conserv. Recycl. 2019, 149, 312–321. [Google Scholar] [CrossRef]

- Li, Z.; Wang, C.; Chen, J. Supply and demand of lithium in China based on dynamic material flow analysis. Renew. Sustain. Energy Rev. 2024, 203, 114786. [Google Scholar] [CrossRef]

- Zhang, Q.; Huang, Z.; Liu, B.; Ma, T. Sustainable lithium supply for electric vehicle development in China towards carbon neutrality. Energy 2025, 320, 135243. [Google Scholar] [CrossRef]

- Zheng, B.; Zhang, Y.; Geng, Y.; Wei, W.; Ge, Z.; Gao, Z. Investigating lanthanum flows and stocks in China: A dynamic material flow analysis. J. Clean. Prod. 2022, 368, 133204. [Google Scholar] [CrossRef]

- Zhao, S.; Wang, P.; Chen, W.; Wang, L.; Wang, Q.; Chen, W. Supply and demand conflicts of critical heavy rare earth element: Lessons from gadolinium. Resour. Conserv. Recycl. 2023, 199, 107254. [Google Scholar] [CrossRef]

- Liang, Z.; Geng, Y.; Zhong, C.; Xiao, S.; Wei, W. Tracking the evolution of niobium cycle in China from 2000 to 2021: A dynamic material flow analysis. J. Clean. Prod. 2024, 434, 140455. [Google Scholar] [CrossRef]

- Han, Z.; Liu, Q.; Ouyang, X.; Song, H.; Gao, T.; Liu, Y. Tracking two decades of global gallium stocks and flows: A dynamic material flow analysis. Resour. Conserv. Recycl. 2024, 202, 107391. [Google Scholar] [CrossRef]

- Gao, Z.; Geng, Y.; Li, M.; Liang, J.; Houssini, K. Tracking the global anthropogenic gallium cycle during 2000–2020: A trade-linked multiregional material flow analysis. Glob. Environ. Change 2024, 87, 102859. [Google Scholar] [CrossRef]

- Zhu, X.; Geng, Y.; Gao, Z.; Tian, X.; Xiao, S.; Houssini, K. Investigating zirconium flows and stocks in China: A dynamic material flow analysis. Resour. Policy 2023, 80, 103139. [Google Scholar] [CrossRef]

- Xiao, S.; Geng, Y.; Pan, H.; Gao, Z.; Yao, T. Uncovering the key features of dysprosium flows and stocks in China. Environ. Sci. Technol. 2022, 56, 8682–8690. [Google Scholar] [CrossRef]

- Yang, C.; Tan, Q.; Zeng, X.; Zhang, Y.; Wang, Z.; Li, J. Measuring the sustainability of tin in China. Sci. Total Environ. 2018, 635, 1351–1359. [Google Scholar] [CrossRef]

- Brunner, P.; Rechberger, H. Practical handbook of material flow analysis. Int. J. Life Cycle Assess. 2004, 9, 337–338. [Google Scholar] [CrossRef]

- Chowdhury, R.; Zhang, X. Phosphorus use efficiency in agricultural systems: A comprehensive assessment through the review of national scale substance flow analyses. Ecol. Indic. 2021, 121, 107172. [Google Scholar] [CrossRef]

- China Nonferrous Metals Industry Association (CNMIA). The Yearbook of Nonferrous Metals Industry of China 2002–2022; China Nonferrous Metals Industry Yearbook Press: Beijing, China, 2003–2024. [Google Scholar]

- China Nonferrous Metals Industry Association (CNMIA). 2023 The Yearbook of Nonferrous Metals Industry of China; China Nonferrous Metals Industry Yearbook Press: Beijing, China, 2025. [Google Scholar]

- The United States Geological Survey (USGS). Mineral Commodity Summaries. 2023. Available online: https://doi.org/10.3133/mcs2023 (accessed on 13 July 2025).

- UN Comtrade. 2000–2022. Available online: https://comtrade.un.org/data (accessed on 13 July 2025).

- Liu, L.; Zhao, H.; Liu, X.; Dai, T.; Liu, G. Cobalt material flow in the United States from 1995 to 2015. Resour. Sci. 2021, 43, 524–534. (In Chinese) [Google Scholar] [CrossRef]

- Huang, C.; Vause, J.; Ma, H.; Li, Y.; Yu, C. Substance flow analysis for nickel in mainland China in 2009. J. Clean. Prod. 2014, 84, 450–458. [Google Scholar] [CrossRef]

- Li, X.; Ren, Q.; Luo, Y.; Dai, T.; Wen, B.; Wang, M. Metabolic process of mechanical products iron resources based on material flow analysis in China. Resour. Sci. 2018, 40, 2329–2340. (In Chinese) [Google Scholar]

- Guo, X.; Yan, K.; Zhang, J.; Huang, G.; Tian, Q. Analysis of metal resource exploitation potential in typical e-waste. Trans. Nonferrous Met. Soc. China 2018, 28, 365–376. (In Chinese) [Google Scholar]

- Zheng, B.; Zhang, Y.; Geng, Y.; Wei, W.; Tan, X.; Xiao, S.; Gao, Z. Measuring the anthropogenic cycles of light rare earths in China: Implications for the imbalance problem. Sci. Total Environ. 2023, 879, 163215. [Google Scholar] [CrossRef] [PubMed]

- Mei, Y.; Geng, Y.; Xiao, S.; Su, C.; Gao, Z.; Wei, W. Dynamic material flow analysis of rhenium in China for 2011–2020. Resour. Policy 2023, 86, 104141. [Google Scholar] [CrossRef]

- Zhong, Q.; Li, Y.; Wang, Y.; Wang, H.; Li, H.; Liang, Y.; Liang, S. Revisiting metal footprints of nations with a reserve-side scarcity indicator. Ecol. Indic. 2022, 145, 109677. [Google Scholar] [CrossRef]

- Yang, C.; Zeng, X.; Li, H.; Tian, Z.; Liu, W.; Qin, W.; Li, J. Uncovering the evolution of tin use in the United States and its implications. Front. Environ. Sci. Eng. 2021, 15, 118. [Google Scholar] [CrossRef]

- Ma, J.; Huang, D.; Tian, Y.; Yang, H.; Chen, X.; Xu, B.; Yang, B.; Li, Y. Separation and recovery of tin and copper from tin refining sulfur slag using a new process of airtight sulfuration-Vacuum distillation. J. Clean. Prod. 2022, 378, 134553. [Google Scholar] [CrossRef]

- Xu, W.; Chen, X.; Liu, D.; Jiang, W.; Yang, B. Systematic thermodynamic and experimental studies for recovering indium and tin from indium tin oxide waste target with hydrogen. J. Clean. Prod. 2023, 429, 139328. [Google Scholar] [CrossRef]

- Fogarasi, S.; Imre-Lucaci, F.; Fogarasi, M.; Imre-Lucaci, Á. Technical and environmental assessment of selective recovery of tin and lead from waste solder alloy using direct anodic oxidation. J. Clean. Prod. 2019, 213, 872–883. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, J.; Cao, C.; Su, Z.; Chen, Y.; Lu, M.; Liu, S.; Jiang, T. New understanding on the separation of tin from magnetite-type, tin-bearing tailings via mineral phase reconstruction processes. J. Mater. Res. Technol. 2019, 8, 5790–5801. [Google Scholar] [CrossRef]

- Yu, Y.; Li, L.; Wang, J. Sn recovery from a tin-bearing middling with a high iron content and the transformation behaviours of the associated As, Pb, and Zn. Sci. Total Environ. 2020, 744, 140863. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, W.; Hu, L.; Wang, Y.; Gao, Z.; Geng, Y. Tracing the Tin Flows and Stocks in China: A Dynamic Material Flow Analysis from 2001 to 2022. Systems 2025, 13, 622. https://doi.org/10.3390/systems13080622

Chen W, Hu L, Wang Y, Gao Z, Geng Y. Tracing the Tin Flows and Stocks in China: A Dynamic Material Flow Analysis from 2001 to 2022. Systems. 2025; 13(8):622. https://doi.org/10.3390/systems13080622

Chicago/Turabian StyleChen, Wei, Lulu Hu, Yaqi Wang, Ziyan Gao, and Yong Geng. 2025. "Tracing the Tin Flows and Stocks in China: A Dynamic Material Flow Analysis from 2001 to 2022" Systems 13, no. 8: 622. https://doi.org/10.3390/systems13080622

APA StyleChen, W., Hu, L., Wang, Y., Gao, Z., & Geng, Y. (2025). Tracing the Tin Flows and Stocks in China: A Dynamic Material Flow Analysis from 2001 to 2022. Systems, 13(8), 622. https://doi.org/10.3390/systems13080622