The Impact of Dual-Channel Investments and Contract Mechanisms on Telecommunications Supply Chains

Abstract

1. Introduction

2. The Related Literature

3. The Model

4. The Equilibrium and Coordination Analysis Without Innovation Investment

4.1. A Centralized Dual-Channel Supply Chain

4.2. A Decentralized Dual-Channel Supply Chain

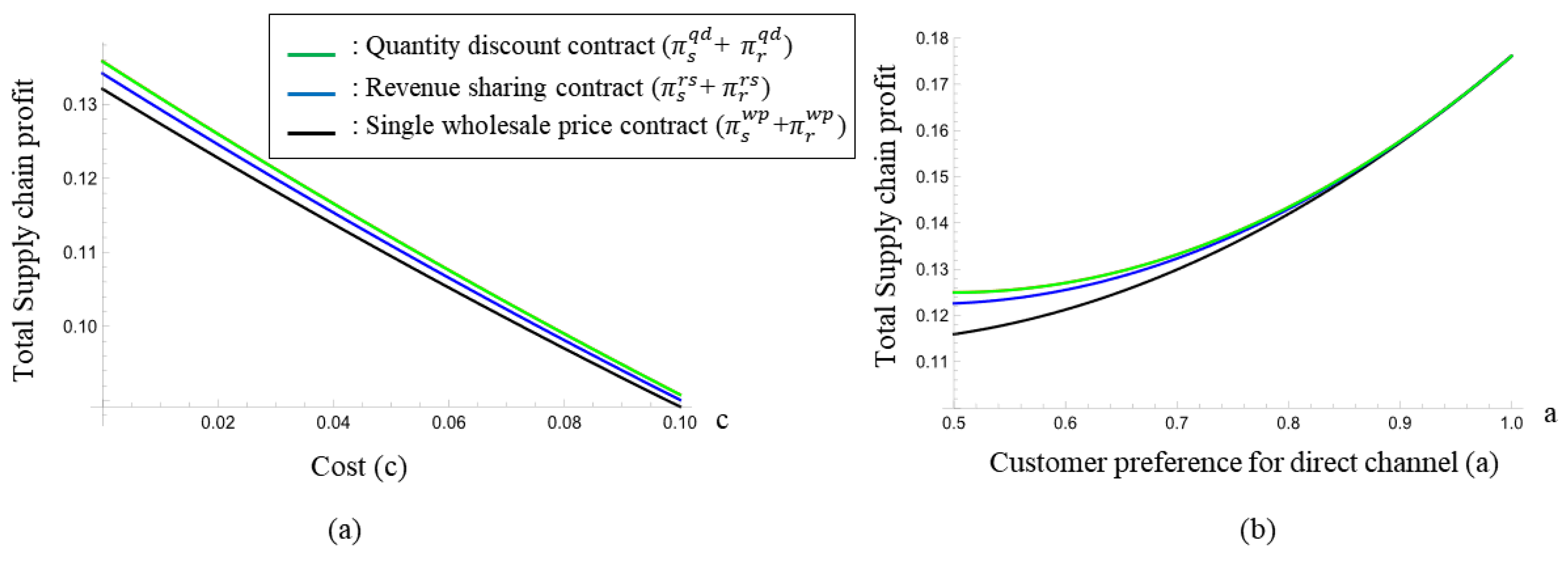

4.3. A Numerical Example

5. The Impact of Coordination on Investment and Spillover

5.1. A Centralized Dual-Channel Supply Chain with Investment

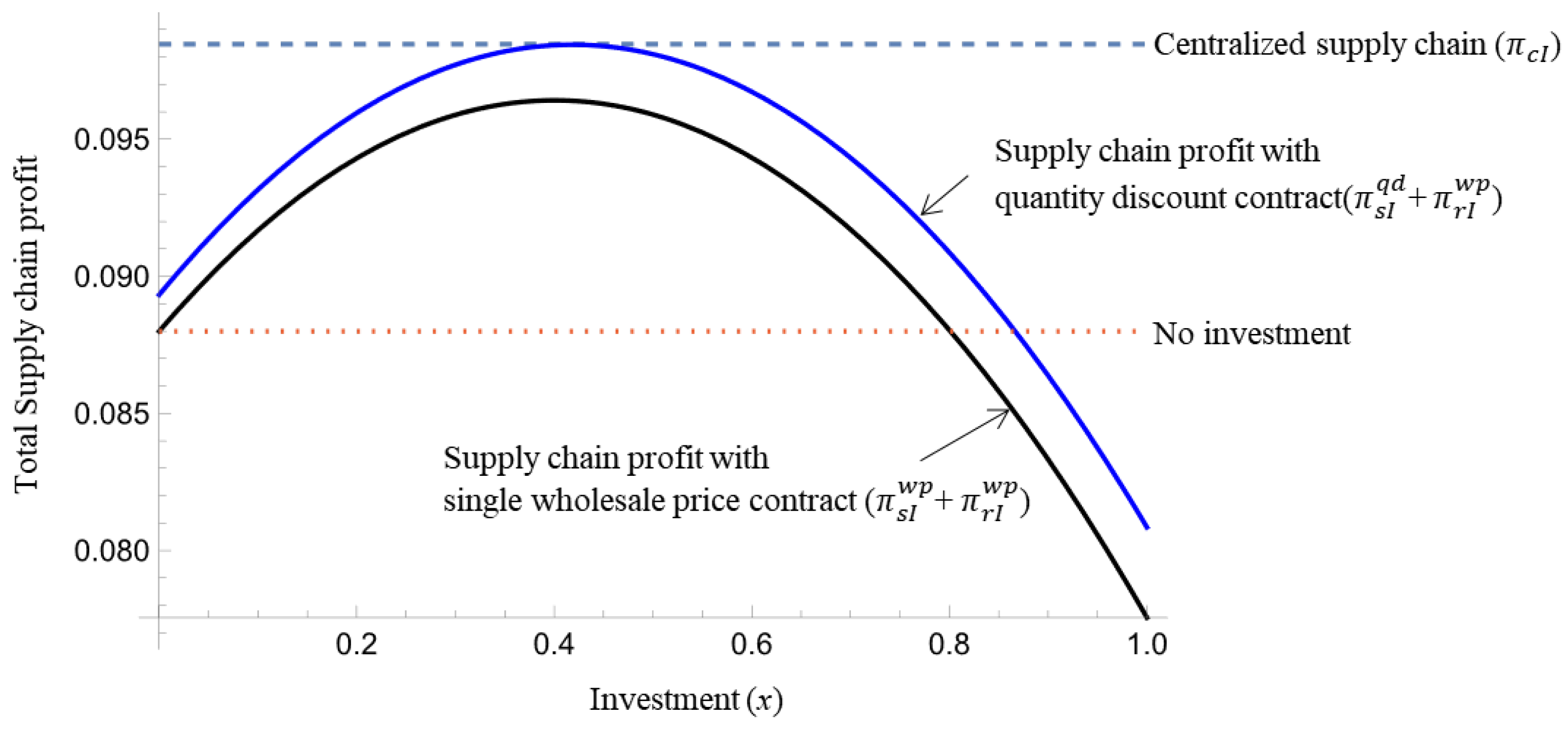

5.2. A Decentralized Dual-Channel Supply Chain with Supplier Investment

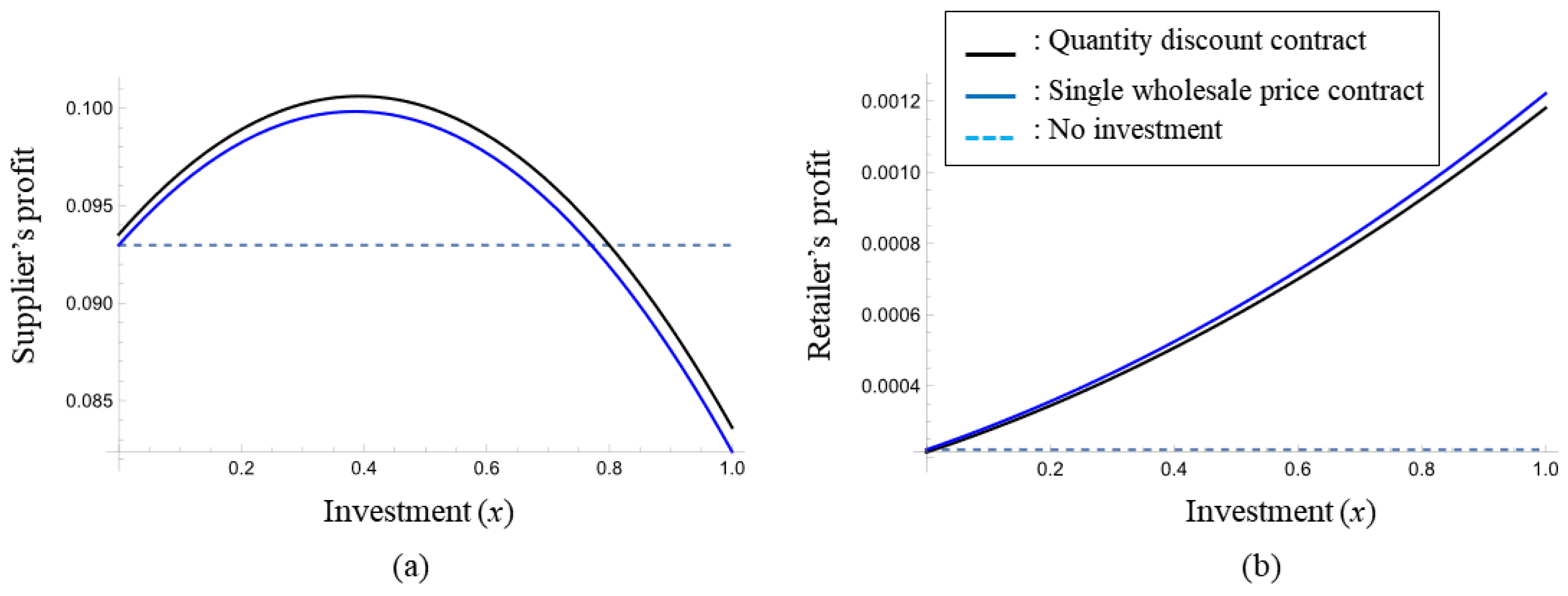

5.3. A Decentralized Dual-Channel Supply Chain with Retailer Investment

6. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

References

- CRTC. An Examination of the Regulatory Framework for Mobile Virtual Network Operators and Other Wholesale Mobile Services; CRTC: Quebec, ON, Canada, 2019. [Google Scholar]

- Taylor, W. Competitive Effects of MVNOs and Assessment of Regulated MVNO Access-Spark New Zealand; NERA ECONOMIC CONSULTING: Sydney, Australia, 2018. [Google Scholar]

- EUROPEAN COMMISSION Case M.7018—TELEFÓNICA DEUTSCHLAND/E-PLUS; European Commission: Brussels, Belgium, 2014; Volume 45.

- OECD. Wireless Market Structures and Network Sharing; OECD Publishing: Berlin, Germany, 2015. [Google Scholar]

- Frontier Economics. UK Mobile Market Dynamics; Frontier Economics: London, UK, 2018. [Google Scholar]

- Sher, P.J.; Yang, P.Y. The effects of innovative capabilities and R&D clustering on firm performance: The evidence of Taiwan’s semiconductor industry. Technovation 2005, 25, 33–43. [Google Scholar]

- Cao, M.; Zhang, Q. Supply chain collaboration: Impact on collaborative advantage and firm performance. J. Oper. Manag. 2011, 29, 163–180. [Google Scholar] [CrossRef]

- Cachon, G.P. Supply Chain Coordination with Contracts. In Handbooks in Operations Research and Management Science; North Holland: Amsterdam, The Netherlands, 2003; Volume 11, pp. 227–339. [Google Scholar]

- Özer, Ö.; Uncu, O.; Wei, W. Selling to the “Newsvendor” with a forecast update: Analysis of a dual purchase contract. Eur. J. Oper. Res. 2007, 182, 1150–1176. [Google Scholar] [CrossRef]

- Sethi, S.P.; Yan, H.; Zhang, H. Quantity flexibility contracts: Optimal decisions with information updates. Decis. Sci. 2004, 35, 691–712. [Google Scholar] [CrossRef]

- Milner, J.M.; Kouvelis, P. Order quantity and timing flexibility in supply chains: The role of demand characteristics. Manag. Sci. 2005, 51, 970–985. [Google Scholar] [CrossRef]

- Weng, Z.K. Coordinating order quantities between the manufacturer and the buyer: A generalized newsvendor model. Eur. J. Oper. Res. 2004, 156, 148–161. [Google Scholar] [CrossRef]

- Arshinder, K.; Kanda, A.; Deshmukh, S.G. A review on supply chain coordination: Coordination mechanisms, managing uncertainty and research directions. Supply Chain Coord. Under Uncertain. 2011, 39–82. [Google Scholar]

- Shen, B.; Choi, T.; Minner, S. A review on supply chain contracting with information considerations: Information updating and information asymmetry. Int. J. Prod. Res. 2019, 57, 4898–4936. [Google Scholar] [CrossRef]

- Cai, G.G. Channel selection and coordination in dual-channel supply chains. J. Retail. 2010, 86, 22–36. [Google Scholar] [CrossRef]

- Chen, J.; Zhang, H.; Sun, Y. Implementing coordination contracts in a manufacturer Stackelberg dual-channel supply chain. Omega 2012, 40, 571–583. [Google Scholar] [CrossRef]

- Xu, G.; Dan, B.; Zhang, X.; Liu, C. Coordinating a dual-channel supply chain with risk-averse under a two-way revenue sharing contract. Int. J. Prod. Econ. 2014, 147, 171–179. [Google Scholar] [CrossRef]

- Xie, J.; Zhang, W.; Liang, L.; Xia, Y.; Yin, J.; Yang, G. The revenue and cost sharing contract of pricing and servicing policies in a dual-channel closed-loop supply chain. J. Clean. Prod. 2018, 191, 361–383. [Google Scholar] [CrossRef]

- Zhou, Y.; Guo, J.; Zhou, W. Pricing/service strategies for a dual-channel supply chain with free riding and service-cost sharing. Int. J. Prod. Econ. 2018, 196, 198–210. [Google Scholar] [CrossRef]

- Jabarzare, N.; Rasti-Barzoki, M. A game theoretic approach for pricing and determining quality level through coordination contracts in a dual-channel supply chain including manufacturer and packaging company. Int. J. Prod. Econ. 2020, 221, 107480. [Google Scholar] [CrossRef]

- Tahirov, N.; Glock, C.H. Manufacturer encroachment and channel conflicts: A systematic review of the literature. Eur. J. Oper. Res. 2022, 302, 403–426. [Google Scholar] [CrossRef]

- David, A.; Adida, E. Competition and coordination in a two-channel supply chain. Prod. Oper. Manag. 2015, 24, 1358–1370. [Google Scholar] [CrossRef]

- Modak, N.M.; Kelle, P. Managing a dual-channel supply chain under price and delivery-time dependent stochastic demand. Eur. J. Oper. Res. 2019, 272, 147–161. [Google Scholar] [CrossRef]

- Wang, J.; Shin, H. The impact of contracts and competition on upstream innovation in a supply chain. Prod. Oper. Manag. 2015, 24, 134–146. [Google Scholar] [CrossRef]

- Ghosh, D.; Shah, J. Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int. J. Prod. Econ. 2015, 164, 319–329. [Google Scholar] [CrossRef]

- Yoon, D. Supplier encroachment and investment spillovers. Prod. Oper. Manag. 2016, 25, 1839–1854. [Google Scholar] [CrossRef]

- Hu, B.; Mai, Y.; Pekeč, S. Managing innovation spillover in outsourcing. Prod. Oper. Manag. 2020, 29, 2252–2267. [Google Scholar] [CrossRef]

- Shen, B.; Xu, X.; Chan, H.L.; Choi, T. Collaborative innovation in supply chain systems: Value creation and leadership structure. Int. J. Prod. Econ. 2021, 235, 108068. [Google Scholar] [CrossRef]

- Chen, Y.; Chen, Y. Strategic outsourcing under technology spillovers. Nav. Res. Logist. (NRL) 2014, 61, 501–514. [Google Scholar] [CrossRef]

- Isaksson, O.H.D.; Simeth, M.; Seifert, R.W. Knowledge spillovers in the supply chain: Evidence from the high tech sectors. Res. Policy 2016, 45, 699–706. [Google Scholar] [CrossRef]

- Dewenter, R.; Haucap, J. Incentives to Licence Virtual Mobile Network Operators (MVNOs); TPRC: Enschede, The Netherlands, 2006. [Google Scholar]

- Foros, Ø. Strategic investments with spillovers, vertical integration and foreclosure in the broadband access market. Int. J. Ind. Organ. 2004, 22, 1–24. [Google Scholar] [CrossRef]

- Kim, J.; Kim, Y.; Gaston, N.; Lestage, R.; Kim, Y.; Flacher, D. Access regulation and infrastructure investment in the mobile telecommunications industry. Telecommun. Policy 2011, 35, 907–919. [Google Scholar] [CrossRef]

- Khalifa, N.B.; Benhamiche, A.; Simonian, A.; Bouillon, M. Profit and strategic analysis for MNO-MVNO partnership. In Proceedings of the 2018 IFIP networking conference (IFIP networking) and workshops, Zurich, Switzerland, 14–16 May 2018; IEEE: Piscataway, NJ, USA, 2018; pp. 325–333. [Google Scholar]

- Zhu, Y.; Yu, H.; Berry, R.A. The Cooperation and competition between an added Value MVNO and an MNO allowing secondary access. In Proceedings of the 2019 International Symposium on Modeling and Optimization in Mobile, Ad Hoc, and Wireless Networks (WiOPT), Avignon, France, 3–7 June 2019; IEEE: Piscataway, NJ, USA, 2019; pp. 1–8. [Google Scholar]

- Tsay, A.A.; Agrawal, N. Channel dynamics under price and service competition. Manuf. Serv. Oper. Manag. 2000, 2, 372–391. [Google Scholar] [CrossRef]

- Yao, D.; Liu, J.J. Competitive pricing of mixed retail and e-tail distribution channels. Omega 2005, 33, 235–247. [Google Scholar] [CrossRef]

- Dan, B.; Xu, G.; Liu, C. Pricing policies in a dual-channel supply chain with retail services. Int. J. Prod. Econ. 2012, 139, 312–320. [Google Scholar] [CrossRef]

- Li, G.; Li, L.; Sun, J. Pricing and service effort strategy in a dual-channel supply chain with showrooming effect. Transp. Res. Part. E: Logist. Transp. Rev. 2019, 126, 32–48. [Google Scholar] [CrossRef]

- Chiang, W.K.; Chhajed, D.; Hess, J.D. Direct marketing, indirect profits: A strategic analysis of dual-channel supply-chain design. Manag. Sci. 2003, 49, 1–20. [Google Scholar] [CrossRef]

- Li, G.; Li, L.; Sethi, S.P.; Guan, X. Return strategy and pricing in a dual-channel supply chain. Int. J. Prod. Econ. 2019, 215, 153–164. [Google Scholar] [CrossRef]

- Chen, J.; Pun, H.; Zhang, Q. Eliminate demand information disadvantage in a supplier encroachment supply chain with information acquisition. Eur. J. Oper. Res. 2023, 305, 659–673. [Google Scholar] [CrossRef]

- Sawadogo, F. Demand price elasticity of mobile voice communication: A comparative firm level data analysis. Inf. Econ. Policy 2021, 57, 100939. [Google Scholar] [CrossRef]

- Gilbert, S.M.; Cvsa, V. Strategic commitment to price to stimulate downstream innovation in a supply chain. Eur. J. Oper. Res. 2003, 150, 617–639. [Google Scholar] [CrossRef]

- Yenipazarli, A. To collaborate or not to collaborate: Prompting upstream eco-efficient innovation in a supply chain. Eur. J. Oper. Res. 2017, 260, 571–587. [Google Scholar] [CrossRef]

- Simchi-Levi, K.; Kaminsky, P. Designing and Managing the Supply Chain; McGraw Hill Higher Education: Columbus, OH, USA, 2008. [Google Scholar]

- Cachon, G.P.; Netessine, S. Game theory in supply chain analysis. Models Methods Appl. Innov. Decis. Mak. 2006, 200–233. [Google Scholar]

| Variables | Description |

|---|---|

| w | The unit wholesale price offered by the MNO to the MVNO |

| The retail price of the direct channel | |

| The retail price of the indirect channel | |

| Demand from the direct channel | |

| Demand for the indirect channel | |

| a | Customer preference for the direct channel ( < a < 1) |

| b | Cross-price elasticity |

| c | The operating cost of the telecommunication service |

| x | Investment level for innovation |

| The supplier’s (MNO’s) profit | |

| The retailer’s (MVNO’s) profit |

| Single Wholesale Price | Revenue Sharing | Quantity Discount | |

|---|---|---|---|

| w | |||

| Centralized Dual Channel | Single Wholesale Price Contract | Quantity Discount Contract | |

|---|---|---|---|

| x | |||

| w | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, Y. The Impact of Dual-Channel Investments and Contract Mechanisms on Telecommunications Supply Chains. Systems 2025, 13, 539. https://doi.org/10.3390/systems13070539

Kim Y. The Impact of Dual-Channel Investments and Contract Mechanisms on Telecommunications Supply Chains. Systems. 2025; 13(7):539. https://doi.org/10.3390/systems13070539

Chicago/Turabian StyleKim, Yongjae. 2025. "The Impact of Dual-Channel Investments and Contract Mechanisms on Telecommunications Supply Chains" Systems 13, no. 7: 539. https://doi.org/10.3390/systems13070539

APA StyleKim, Y. (2025). The Impact of Dual-Channel Investments and Contract Mechanisms on Telecommunications Supply Chains. Systems, 13(7), 539. https://doi.org/10.3390/systems13070539