Research on Pricing and Effort Investment Decisions for Dual-Channel Fresh Product Supply Chain Under the Participation of Third-Party Logistics Provider

Abstract

1. Introduction

- How will 3PL’s homogeneous and differentiated logistics strategies affect pricing and effort investment decisions in the dual-channel fresh product supply chain?

- Which model (the traditional retail channel model, the homogeneous cold-chain service dual-channel model, or the differentiated cold-chain service dual-channel model) generates the highest system profit, and what is the underlying mechanism?

- How do consumer behavior factors influence the optimal strategy and system profit?

2. Literature Review

2.1. Dual-Channel Fresh Product Supply Chain

2.2. The Participation of Third-Party Logistics Providers

2.3. Research Gap

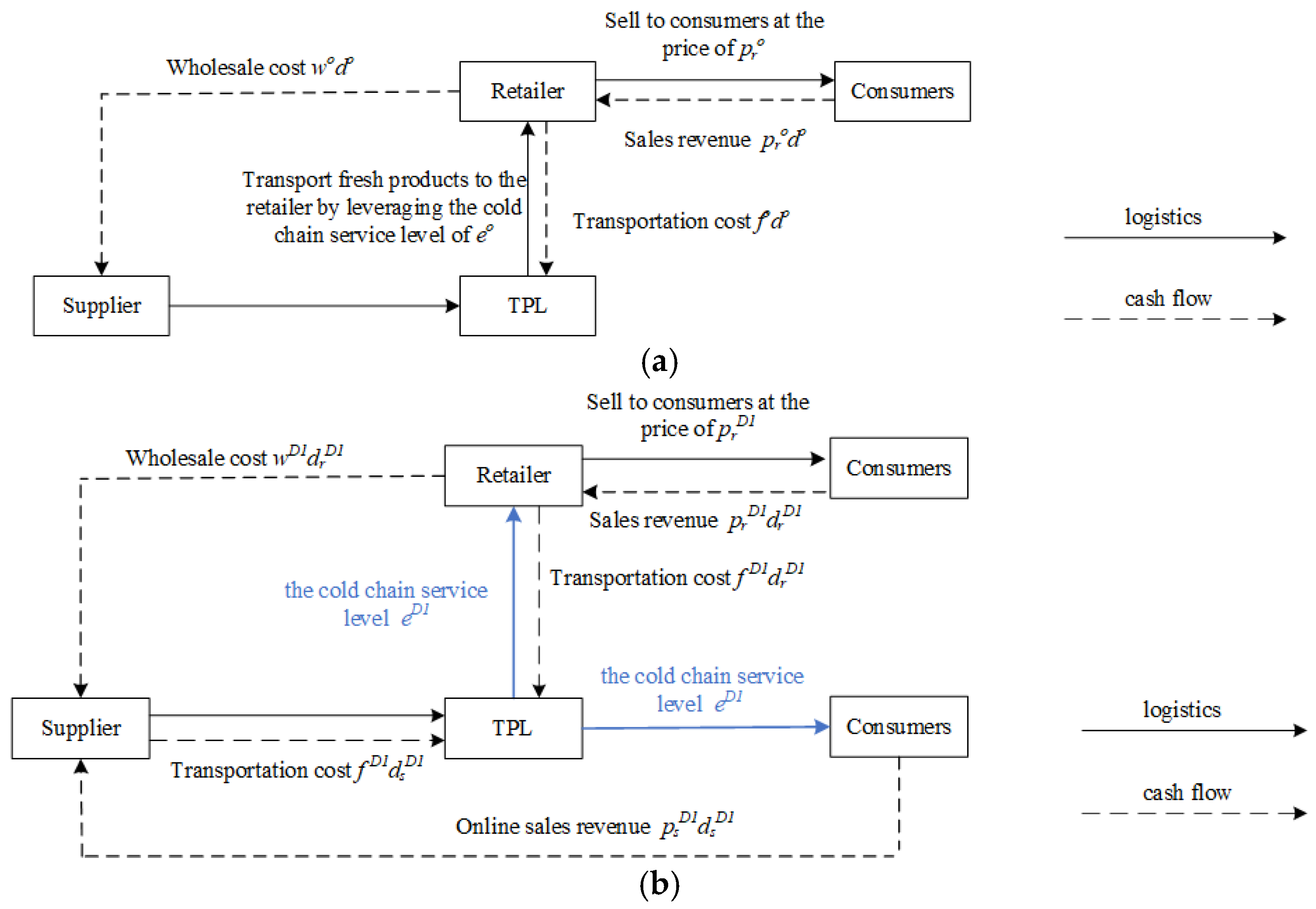

3. Model Framework

3.1. Model Description and Symbolic Explanations

3.1.1. Model Description and Research Hypotheses

3.1.2. Model Assumptions and Symbolic Explanations

3.2. Consumer Demand Function

3.2.1. Demand Function of Traditional Retail Channel

3.2.2. Homogeneous Cold-Chain Service Dual-Channel Demand Function

- (1)

- When , that is , consumers do not perceive any difference in the utility of purchasing fresh products through online channels and offline channels.

- (2)

- When , consumers will make a choice between online direct sales channels and offline retail channels.

3.2.3. Differentiated Cold-Chain Service Dual-Channel Demand Function

- (1)

- When , that is , consumers do not perceive any difference in the utility of purchasing fresh products through online channels and offline channels.

- (2)

- When , consumers will make a choice between online direct sales channels and offline retail channels.

3.3. Mathematical Model

3.3.1. Traditional Retail Channel Decision-Making Model

3.3.2. Homogeneous Logistics Service Dual-Channel Decision-Making Model

3.3.3. Differentiated Logistics Service Dual-Channel Decision-Making Model

4. Numerical Experiments

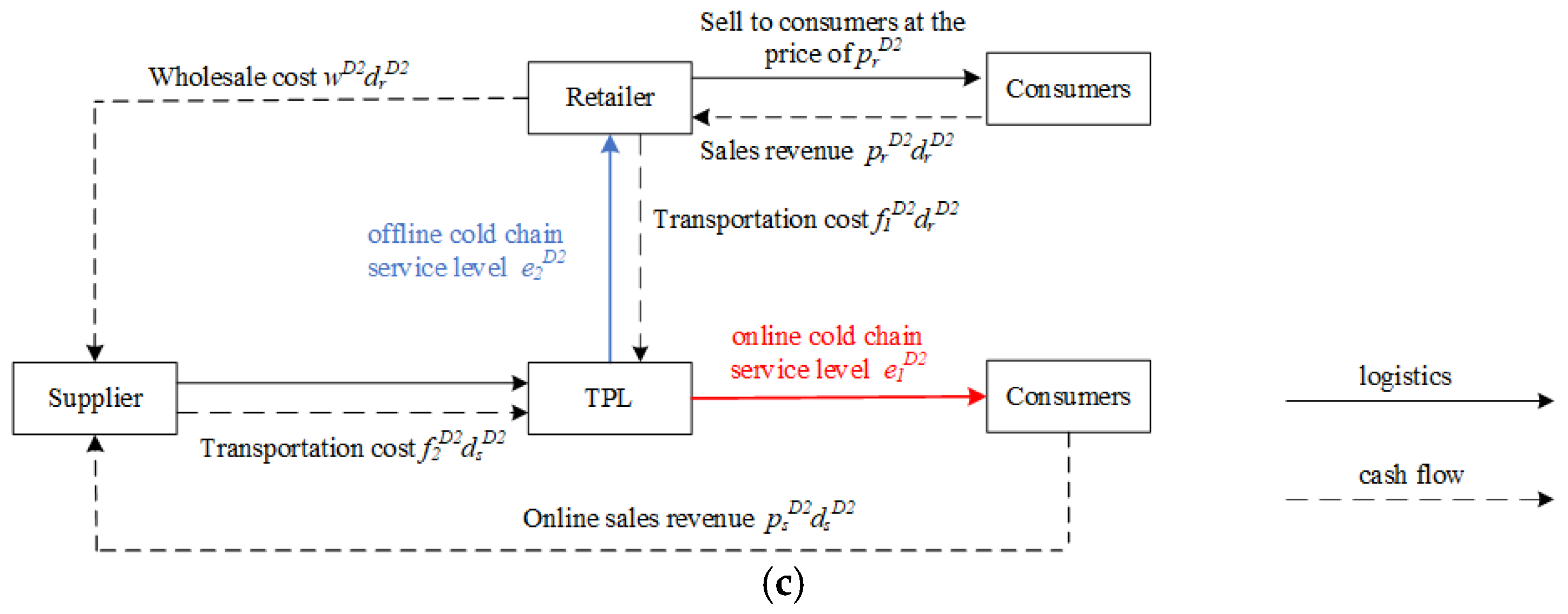

4.1. Comparative Analysis of Profits Under Different Models

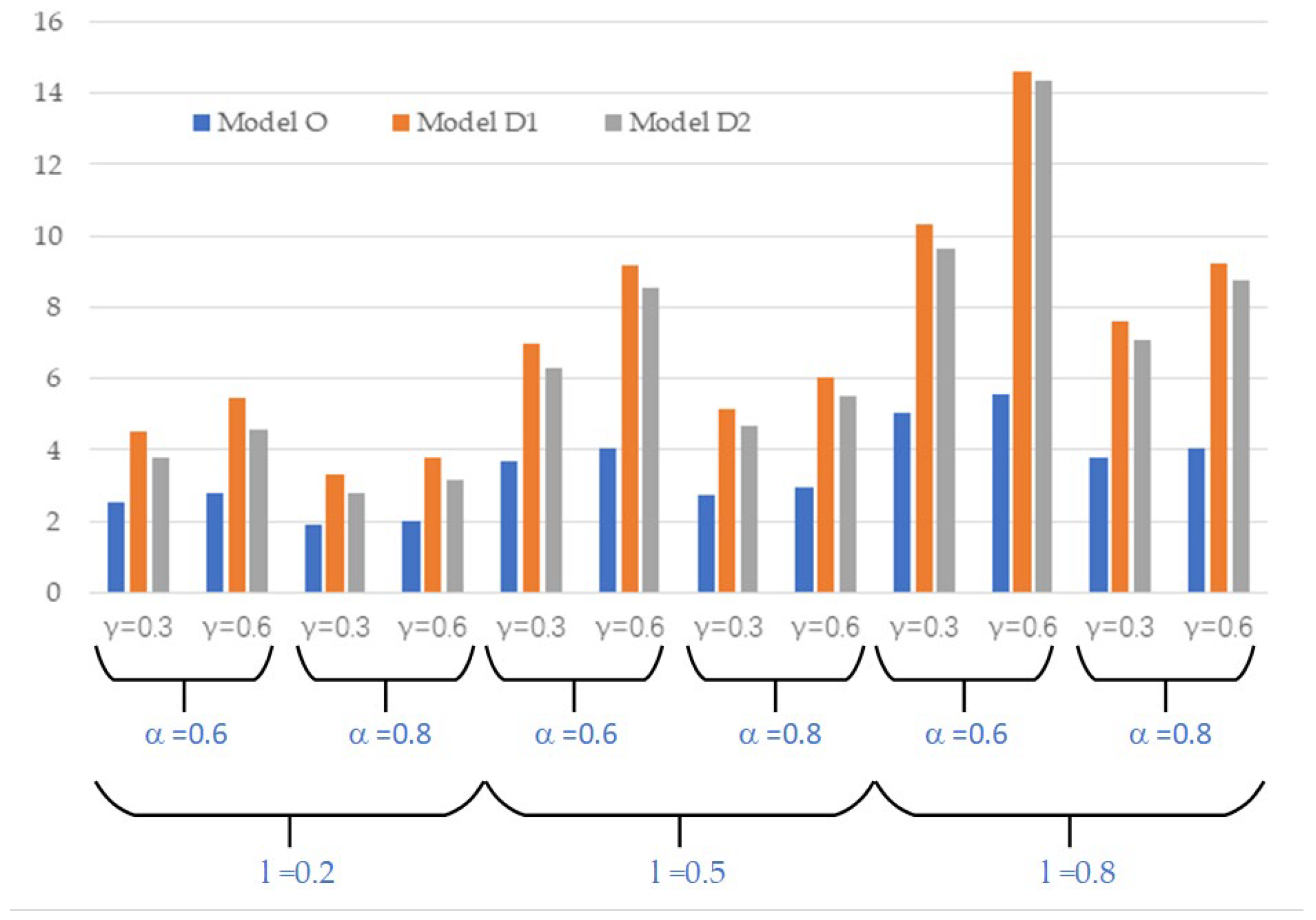

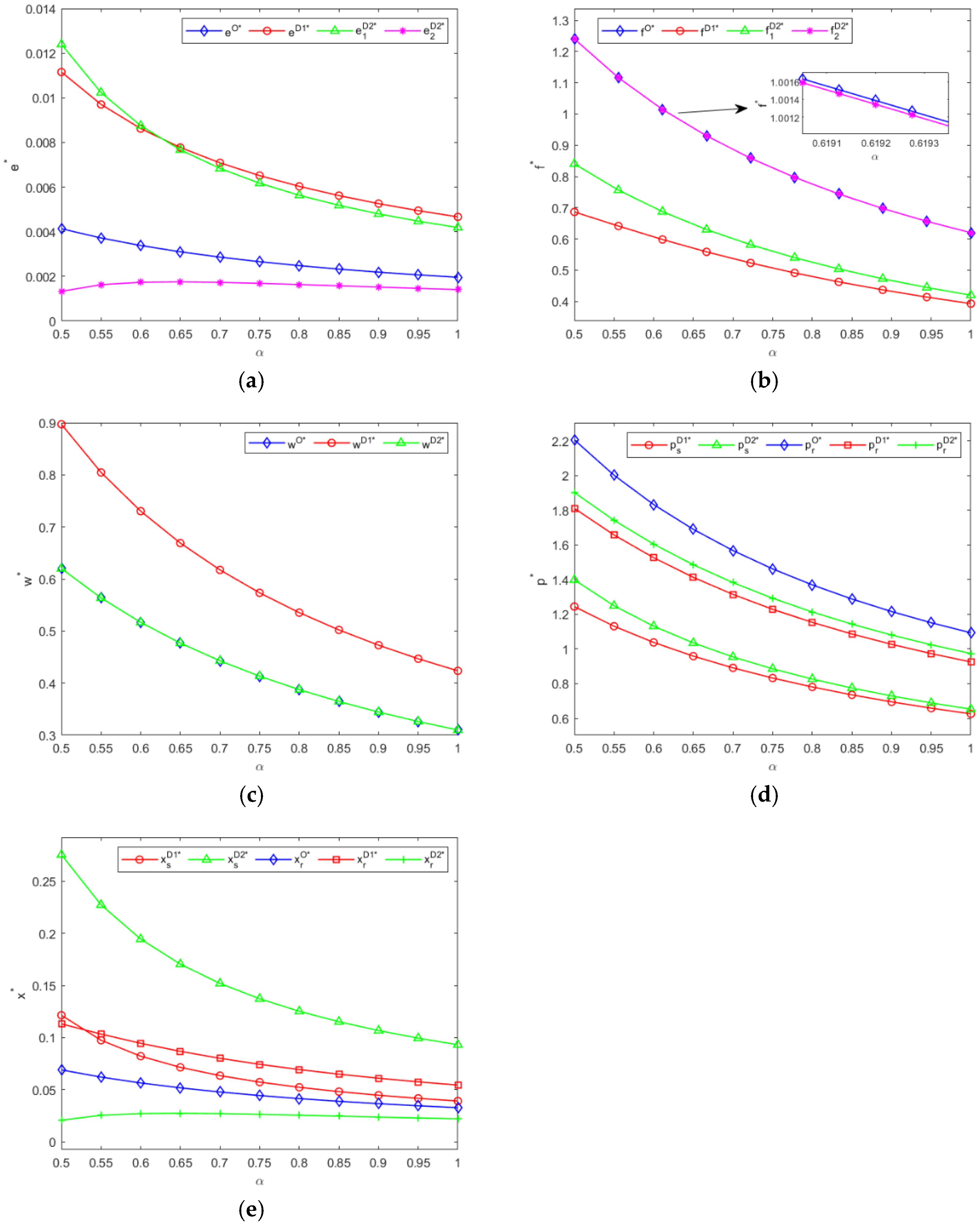

4.2. The Influence of the Consumers’ Price Sensitivity Coefficient

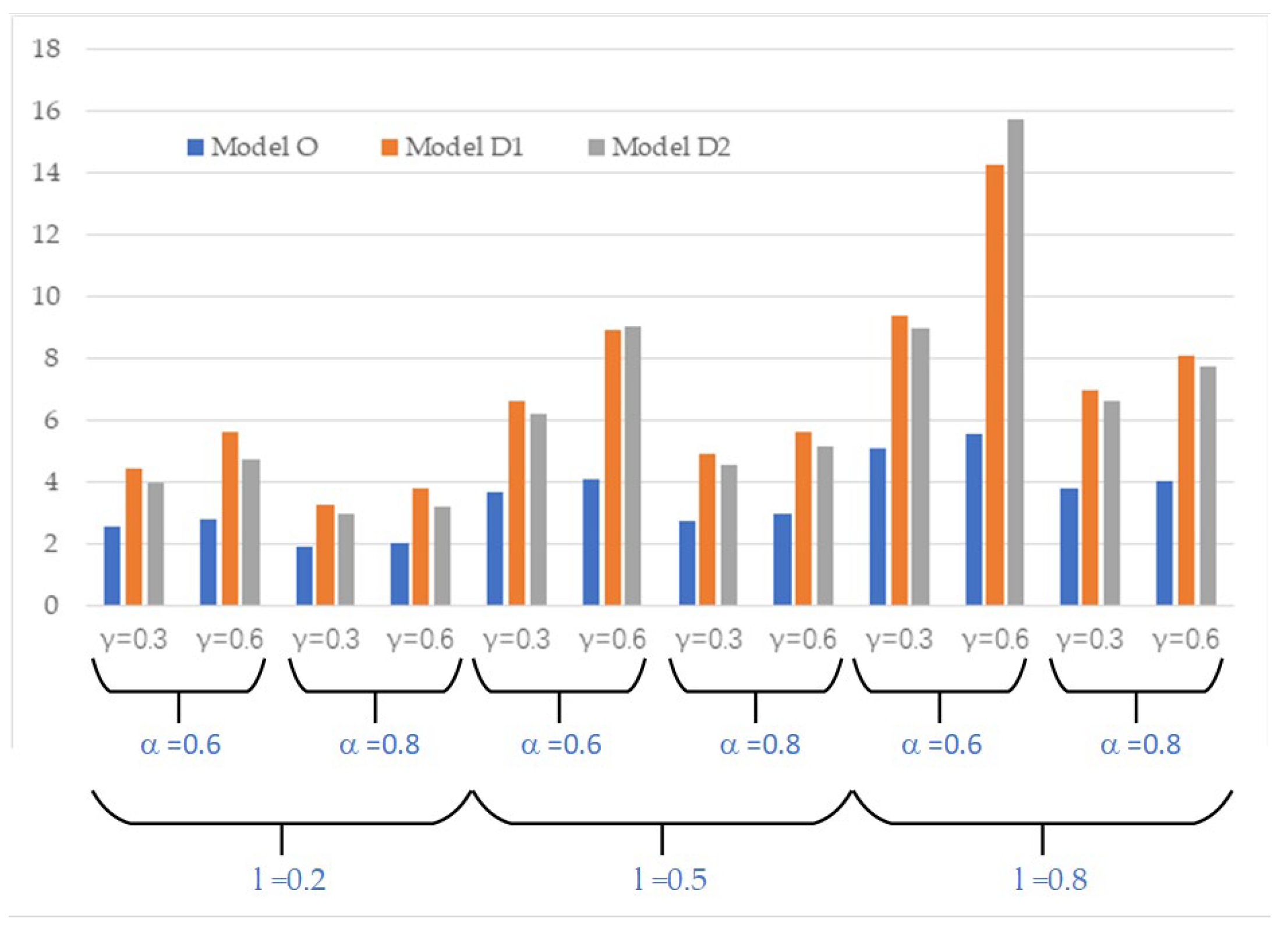

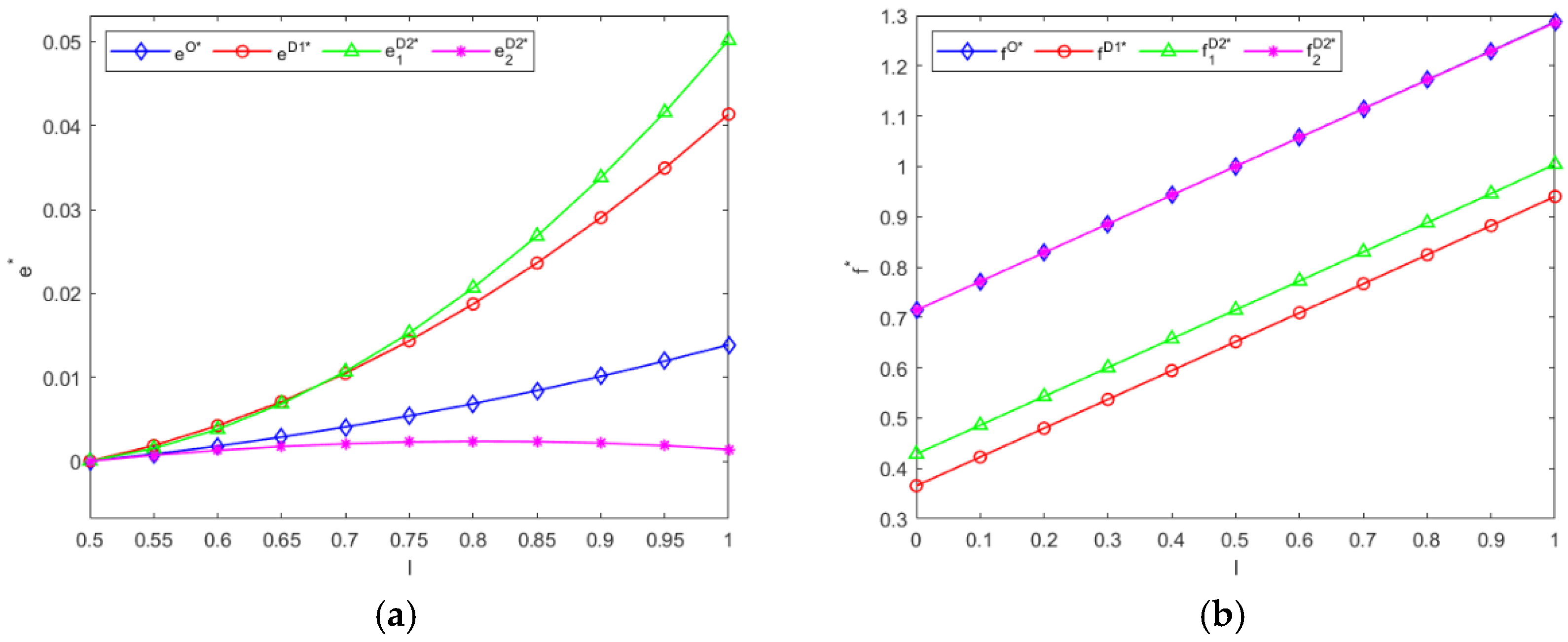

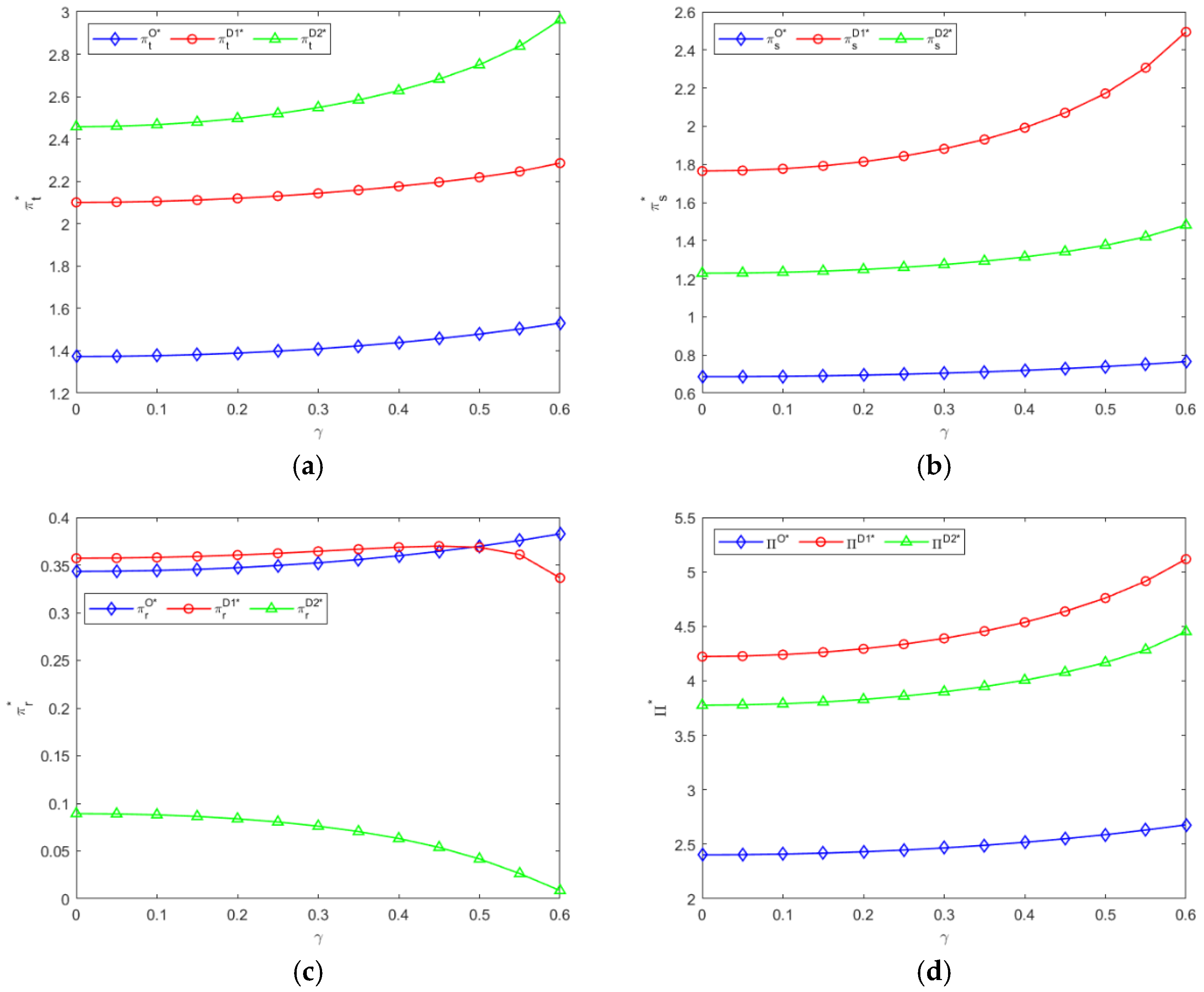

4.3. The Influence of the Consumers’ Freshness Sensitivity Coefficient

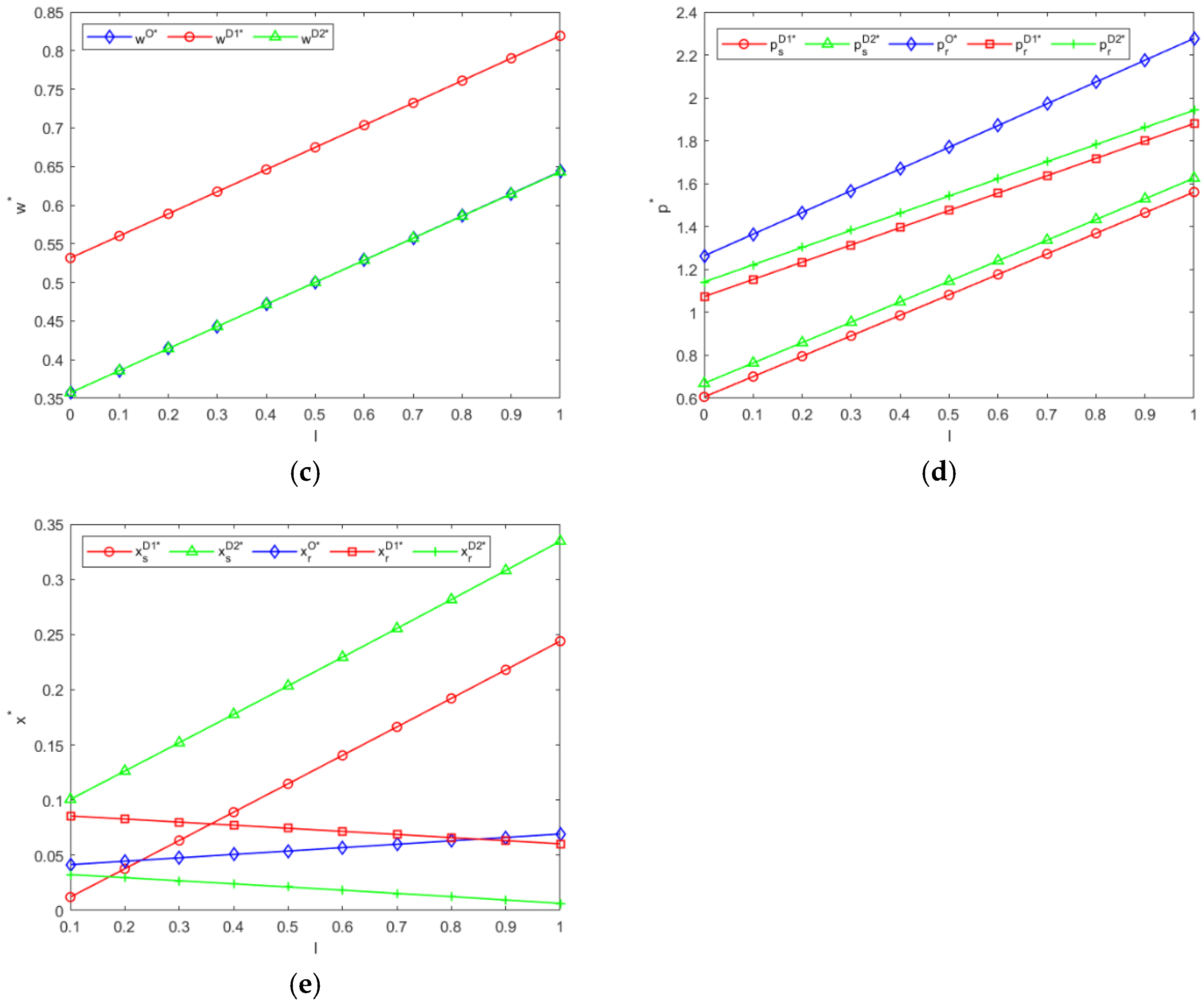

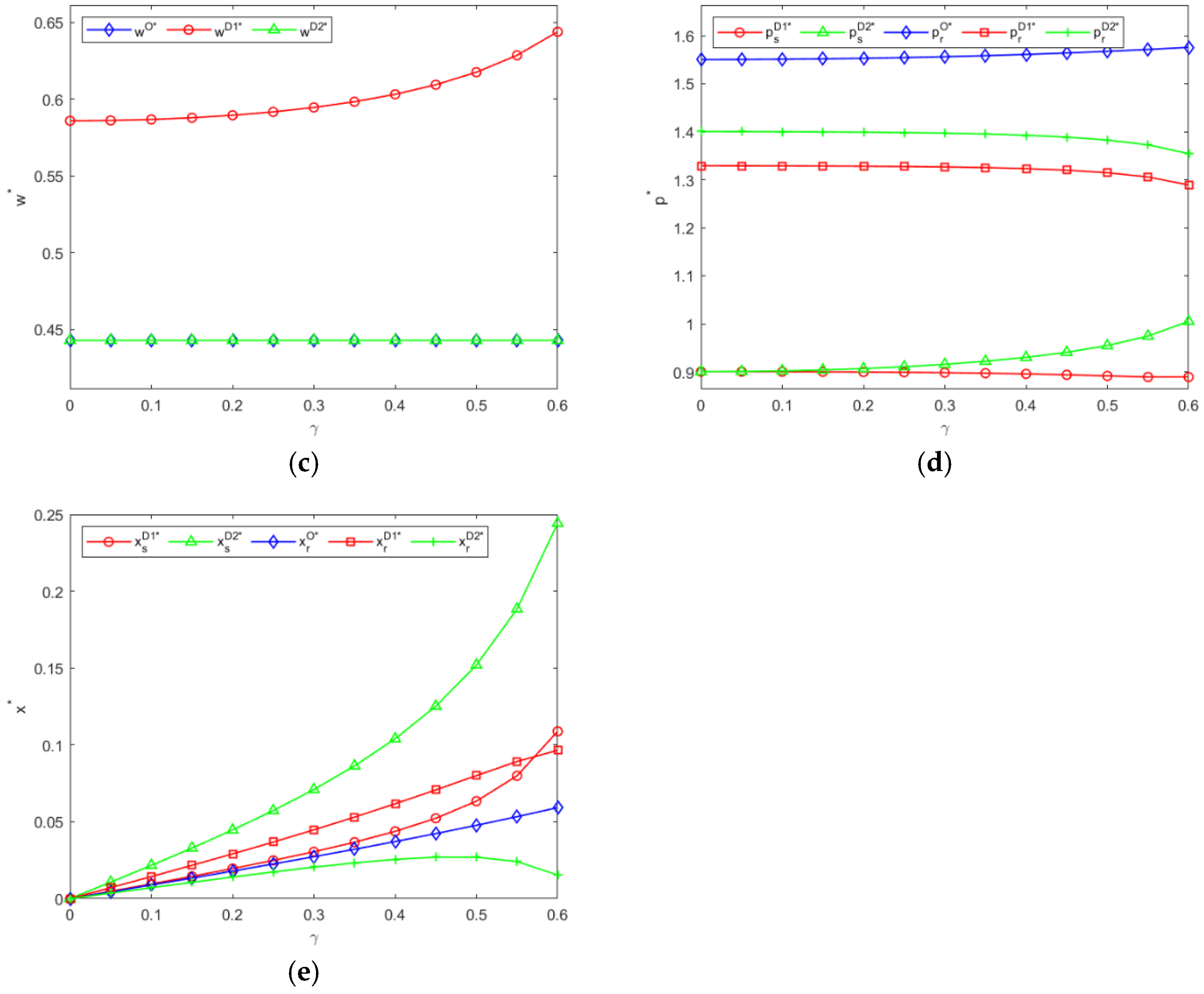

4.4. The Influence of the Consumers’ Marketing Effort Sensitivity Coefficient

5. Research Discussions

5.1. Comparison with Prior Research

- (1)

- Innovation of the three-tier dual-channel supply chain model with 3PL participation: Most previous studies (e.g., Reference [2]) focused on the two-tier supplier-retailer system and regarded 3PL as a cost provider rather than an independent decision-maker. By introducing 3PL as a decision-maker into the dual-channel supply chain system and considering the two scenarios of whether it provides the same level of cold chain service for both online and offline channels, this study explains how the cold-chain service strategy of 3PL spreads through the supply chain to influence pricing and effort investment decisions, which provides an insight that traditional models lack. The numerical experiment part of this study found that compared with differentiated cold chain services, homogeneous cold chain services reduced transportation costs, which could not be achieved in the two-tier framework (Figure 5b, Figure 7b and Figure 9b). Furthermore, when consumers are highly sensitive to product freshness and marketing efforts, the total profit of the dual-channel system under D2 Model is higher than that under D1 Model (Figure 2 and Figure 4). This challenges the assumption that standardization can always optimize profits and also highlights the role of consumers in strategy selection.

- (2)

- Multi-dimensional utility function: Different from the two-factor (freshness, price) demand model in [2,5,45], this study integrates price, freshness, and marketing efforts into the utility function, and considers the corresponding marketing efforts invested by the supplier and retailer for their respective sales channels. Research has found that when consumer marketing sensitivity increases, the growth rate of online marketing efforts in the D2 model is faster than that of online marketing efforts in the D1 model (Figure 7e). This indicates that the marketing efforts of the D1 and D2 models are also influenced by the differences in consumer preferences. This mechanism has been ignored in previous studies. This addresses the limitation of Zhang et al. [34], which is that marketing efforts are not differentiated by channels, providing a more realistic description of dual-channel dynamics.

5.2. Practical Implications for Industry

- (1)

- The strategic choice of 3PL and the overall supply chain: As shown in Figure 6a,d, Figure 8a,d and Figure 10a,d, although the D2 Model can enhance the profits of 3PL, the overall profit of the supply chain is generally higher under the D1 Model. The D2 model is only applicable to specific scenarios where consumers are highly sensitive to product freshness and marketing efforts. For example, when , , and , the total profit of the system under the D2 Model is nearly 10% higher than that under the D1 Model. This reflects the fact that individual rationality may lead to collective irrationality. From the perspective of 3PL individuals, the D2 Model can enable them to obtain more profits. However, from the perspective of the entire supply chain, in most cases, the D1 Model can bring more profits. Therefore, from the perspective of the overall sustainable development of the supply chain, 3PL should try to choose homogeneous cold-chain services to create more profits for the supply chain through economies of scale, and the supply chain should also provide corresponding compensation to encourage it to abandon the implementation of differentiated cold chain service strategies.

- (2)

- Consumer Behavior-Driven Adaptation: In price-sensitive markets, supply chains ought to adopt the D1 strategy. By leveraging economies of scale, this strategy can effectively reduce costs and stimulate consumer demand. This strategic approach is well-exemplified by Meituan’s implementation of a dual-track model that integrates both online and offline channels. Meituan’s business model demonstrates how enterprises can cater to price-sensitive consumers by optimizing operational efficiency and expanding market reach through a multi-channel presence, which aligns with the underlying principles of the D1 strategy. In contrast, for markets that are highly sensitive to product freshness and marketing effort, the D2 strategy should be employed, with a particular emphasis on the online channel. The three major shipping models pioneered by JD Logistics enable Lingnan lychees to reach customers across the country within 48 h while maintaining freshness, resonates with the core focus of the D2 strategy on online service excellence. JD Logistics’ achievement showcases the potential of prioritizing online channels in freshness-sensitive markets to ensure rapid and High-quality product delivery.

5.3. Research Limitations

5.4. Future Research Directions

6. Conclusions and Implications

- (1)

- In most cases, the D1 Model can significantly reduce the transportation cost of the supply chain through economies of scale and result in higher system profits. Therefore, for supply chain managers who hope to optimize the cost structure and increase overall profits, adopting the D1 Model is a choice worth considering. Although the D1 model performs better in most cases, in markets where consumers are highly sensitive to freshness and marketing efforts, the D2 Model can result in higher profits. Therefore, supply chain managers should flexibly select logistics service strategies based on the characteristics of the target market.

- (2)

- When it comes to pricing and marketing strategies, research indicates that consumers’ high price sensitivity can lead to supply chain members lowering prices and reducing marketing investment. Therefore, supply chain managers need to closely monitor changes in market dynamics and consumer behavior and adjust pricing strategies in a timely manner to maintain market competitiveness. On the contrary, when consumers are highly sensitive to freshness and marketing efforts, the supply chain should increase prices and marketing investment. This requires supply chain managers to increase investment in product preservation, packaging, advertising and promotion, etc., in order to meet consumers’ expectations.

- (3)

- Regarding supply chain collaboration and cooperation, to achieve more efficient supply chain operations, suppliers and retailers should establish long-term and stable cooperative relationships with 3PL, which helps to reduce transaction costs and improve service quality. Supply chain managers should attach importance to communication and collaboration with 3PL, understand the characteristics of its cold chain services, jointly formulate logistics service standards and performance evaluation systems, and ensure the efficient operation of the supply chain.

- (4)

- Regarding service models and technological applications, 3PL should innovate its service model. For instance, JD Logistics has adopted “direct delivery from point to point” (for small-batch products, it ensures that the products reach the air sorting center directly through alternating loading on individual vehicles), “direct airport delivery” (for large-batch orders, prioritizing designated flights for support), and “cold dry direct delivery” (customized for medium-distance transportation, it provides high-quality full-process temperature control services for areas accessible within 72 h). These service models can meet the transportation demands of different distances and timeliness requirements, which helps to enhance customer satisfaction and loyalty and strengthen the competitiveness of the supply chain.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | Cold chain sevice level measurement is shown in Note 1. To measure 3PL’s cold-chain service level, we recognize that the service level can be assessed through multiple stakeholders’ evaluations, including consumers, suppliers, and retailers (as relevant studies in the field, such as References [32,33], have suggested). 3PL’s cold-chain service level is influenced by several key service attributes, and a practitioner should identify these attributes based on the characteristics of the cold-chain logistics industry. Then, the practitioner collects the scores of relevant service attributes. These attributes may encompass aspects such as temperature control accuracy during transportation, the efficiency of refrigeration equipment maintenance, the timeliness of delivery in the cold-chain context, and the accuracy of freshness tracking information. After obtaining the scores of these service attributes, the practitioner calculates a cold-chain service level score by taking the weighted average of these scores. |

| 2 | (1) Marketing effort measurement is shown in Note 2. To measure marketing effort, we understand that it can be evaluated through a comprehensive set of factors, including consumer responses, market performance indicators, and stakeholder feedback (as relevant studies in the field, such as Reference [42], have suggested). Marketing effort is influenced by multiple marketing attributes, and a practitioner should identify these attributes based on the specific marketing context, industry, and target audience. Then, the practitioner collects the scores of relevant marketing attributes. These attributes may encompass the following: advertising reach and frequency, content engagement, promotion effectiveness, brand perception, customer relationship management efforts, etc., After obtaining the scores of these marketing attributes, the practitioner calculates a marketing effort score by taking the weighted average of these scores. The weights can be assigned based on the relative importance of each attribute to the overall marketing objectives. For example, if the primary goal is to increase brand awareness, advertising reach and frequency may be given a higher weight. (2) In practice, different industry environments and marketing strategies may have different priorities for these marketing attributes. For instance, online sellers may pay more attention to the quality of online marketing content, social media engagement, search engine optimization effectiveness, online advertising reach and conversion rate, etc., while offline sellers focus more on in-store promotion effectiveness, customer service quality, local advertising reach, community involvement, etc. |

References

- Luo, J.Q.; Gao, C.H.; Liao, R.H. Research on Channel Cooperation Strategy of Fresh Produce Considering Two Service Offerings. Ind. Eng. Manag. 2024, 29, 20–30. [Google Scholar] [CrossRef]

- Wang, D.; Tian, X.Y.; Guo, M.C. Pricing decision and channel selection of fresh agricultural products dual-channel supply chain based on blockchain. PLoS ONE 2024, 19, e0297484. [Google Scholar] [CrossRef] [PubMed]

- Xie, J.C.; Liu, J.J.; Huo, X.; Meng, Q.C.; Chu, M.Y. Fresh food dual-channel supply chain considering consumers’ low-carbon and freshness preferences. Sustainability 2021, 13, 6445. [Google Scholar] [CrossRef]

- Feng, Y.; Li, Z.H.; Zhang, Y.Z. Evaluation of Contractual Efficiency of Fresh Produce Supply Chain with TPL Intervention under Retailer Dominance. Manag. Comment. 2018, 30, 215–225. [Google Scholar] [CrossRef]

- Zhang, W.S.; Wu, L.; Ji, L.L. Blockchain technology adoption strategies for the shipping costs bearer in the fresh product supply chain. Front. Sustain. Food Syst. 2025, 9, 1550985. [Google Scholar] [CrossRef]

- Leylaparast, P.; Gholamian, M.R.; Noroozi, M. Integration of pricing, sustainability and 3PL delivery time according to freshness date in a dual-channel fruit supply chain: A game theoretic approach. J. Ind. Manag. Optim. 2025, 21, 504–523. [Google Scholar] [CrossRef]

- Ratchford, B.; Soysal, G.; Zentner, A.; Gauri, D.K. Online and offline retailing: What we know and directions for future research. J. Retail. 2022, 98, 152–177. [Google Scholar] [CrossRef]

- Li, Z.; Liu, Q.; Ye, C.; Dong, M.; Zheng, Y. Achieving resilience: Resilient price and quality strategies of fresh food dual-channel supply chain considering the disruption. Sustainability 2022, 14, 6645. [Google Scholar] [CrossRef]

- Wang, W.B.; Zhu, A.M.; Yu, L.J.; Wer, H.J. Research on cooperative advertising strategies for dual channel supply chain of fresh agricultural products considering carbon reduction efficiency under retailer leadership. PLoS ONE 2024, 19, e0303525. [Google Scholar]

- Yan, B.; Fan, J.; Wu, J.-W. Channel choice and coordination of fresh agricultural product supply chain. RAIRO-Oper. Res. 2021, 55, 679–699. [Google Scholar] [CrossRef]

- Zhou, T.; Meng, X.Q.; Tao, M. Research on Dual-channel Equal-price and Differential-price Decisions and Coordination in Supply Chain Considering the Efforts of Green and Freshness Preservation. Mod. Manag. 2023, 43, 164–170. [Google Scholar] [CrossRef]

- Chen, X.; Li, J.; Wang, Z.B. Equilibrium decisions for fresh product supply chain considering consumers’ freshness preference. Netw. Spat. Econ. 2023, 23, 771–797. [Google Scholar] [CrossRef]

- Hu, H.L.; Cao, Y.; Wu, K. Selection and Pricing of Fresh Supply Chain Sales Model Based on Pre-sale. Oper. Res. Manag. Sci. 2022, 31, 128–134. [Google Scholar]

- Jiang, Y.C.; Liu, C.; Bai, S.Z.; Li, H. Optimal Decision-making in Dual-channel Supply Chain of Fresh Agri-product by Applying Blockchain. Syst. Eng. 2023, 41, 63–72. [Google Scholar]

- Xiao, Q.; Zhang, Q.Y.; Gao, Z.Y. A quantum gaming study on thepricing of fresh mixed dual-channel supply chains considering the level of preservation effort. J. Ind. Manag. Optim. 2025, 21, 79–102. [Google Scholar] [CrossRef]

- Gan, W.; Huang, B. Exploring Data Integrity of Dual-Channel Supply Chain Using Blockchain Technology. Comput. Intell. Neurosci. 2022, 2022, 3838282. [Google Scholar] [CrossRef]

- Xu, J.; Xiong, S.H.; Cui, T.Y.; Zhang, D.M.; Li, Z.B. Incorporating Consumers’ Low-Carbon and Freshness Preferences in Dual-Channel Agri-Foods Supply Chains: An Analysis of Decision-Making Behavior. Agriculture 2023, 13, 1647. [Google Scholar] [CrossRef]

- Guo, X.Y.; Hu, H.T.; Li, J.T. Dual channel supply chain pricing and refrigeration decisions for fresh products considering refrigeration temperature. Ind. Eng. Manag. 2024, 29, 62–71. [Google Scholar] [CrossRef]

- Zhao, S.; Li, W.l.; Cao, X.N.; Liu, X.B. The fresh agricultural products double channel supply chain coordination mechanism under the pre-sale model. J. Manag. Eng. 2021, 35, 162–177. [Google Scholar] [CrossRef]

- Wu, S.; Li, B.; Li, Y.r. Advance selling decisions of retailer in dual channel of the fresh product supply chain. J. Syst. Eng. 2023, 38, 372–394. [Google Scholar] [CrossRef]

- Wang, W.L.; He, Z.Y.; Zhang, S.X. Joint Decision of Freshness-Keeping Effort and Promotion Effort in a Dualchannel Fresh Produce Supply Chain from a Dynamic Perspective. Available online: https://kns.cnki.net/kcms/detail/11.2835.g3.20230627.1119.005.html (accessed on 19 June 2025).

- Modak, N.M.; Senapati, T.; Simic, V.; Pamucar, D.; Saha, A.; Cárdenas-Barrón, L.E. Managing a sustainable dual-channel supply chain for fresh agricultural products using blockchain technology. Expert Syst. Appl. 2024, 244, 122929. [Google Scholar] [CrossRef]

- Zhao, Y.; Li, Y.H.; Yao, Q.; Guan, X. Dual-channel retailing strategy vs. omni-channel buy-online-and-pick-up-in-store behaviors with reference freshness effect. Int. J. Prod. Econ. 2023, 263, 108967. [Google Scholar] [CrossRef]

- Yu, Y.L.; Xiao, T.J.; Feng, Z.W. Price and cold-chain service decisions versus integration in a fresh agri-product supply chain with competing retailers. Ann. Oper. Res. 2020, 287, 465–493. [Google Scholar] [CrossRef]

- Cui, X.; Li, C.F.; Zhou, C.; Mi, X.X.; Shen, Y. Logistics Cooperation and Operational Decision Making in Fresh E-commerce Supply Chain under Stochastic Demand. Chin. J. Manag. Sci. 2022, 32, 87–98. [Google Scholar] [CrossRef]

- Ye, J.; Gu, B.J.; Fu, Y.F. Cold Chain Logistics Services and Pricing Decisions in the Supply Chain of Fresh Agricultural Products under Different Trade Patterns. Chin. J. Manag. Sci. 2023, 31, 95–107. [Google Scholar] [CrossRef]

- Chen, X.L.; Huang, L.; Ma, L.J. Research on agricultural product supply chain coordination contract with cost-sharing TPL service providers. J. Ind. Eng./Eng. Manag. 2021, 035, 218–225. [Google Scholar]

- Yu, Y.L.; Xiao, T.J. Pricing and cold-chain service level decisions in a fresh agri-products supply chain with logistics outsourcing. Comput. Ind. Eng. 2017, 111, 56–66. [Google Scholar] [CrossRef]

- Dan, B.; Ma, S.X.; Liu, M.L.; Tian, Y.; Lei, T. Research on supply chain information sharing of fresh agricultural products considering 3PL preservation efforts. Chin. J. Manag. Sci. 2024, 32, 122–132. [Google Scholar] [CrossRef]

- Chen, J.; Cai, Z.H. Preservation Mode Selection in Fresh Agri-food Dual-Channel Supply Chain Considering Freshness Competition. Fresh Preserv. Process. 2024, 24, 61–70. [Google Scholar]

- Wang, G.L.; Ma, C.X.; Zhou, X.J. Fresh Supply Chain Preservation and Outsourcing Decisions Considering Cost Advantages. J. Syst. Eng. 2023, 38, 101–120. [Google Scholar] [CrossRef]

- Yu, Y.L.; Xiao, T.J. Analysis of cold-chain service outsourcing modes in a fresh agri-product supply chain. Transp. Res. Part E Logist. Transp. Rev. 2021, 148, 102264. [Google Scholar] [CrossRef]

- Yu, Y.L.; Feng, Y. Fresh produce supply chain decision-making under different cold chain service models. Chin. J. Manag. Sci. 2021, 29, 135–143. [Google Scholar] [CrossRef]

- Zhang, K.J.; Ma, M.Q. Differential Game Model of a Fresh Dual-Channel Supply Chain Under Different Return Modes. IEEE Access 2021, 9, 8888–8901. [Google Scholar] [CrossRef]

- Yang, L.; Tang, R. Comparisons of sales modes for a fresh product supply chain with freshness-keeping effort. Transp. Res. Part E Logist. Transp. Rev. 2019, 125, 425–448. [Google Scholar] [CrossRef]

- Tang, R.H.; Yang, L. Financing strategy in fresh product supply chains under e-commerce environment. Electron. Commer. Res. Appl. 2020, 39, 100911. [Google Scholar] [CrossRef]

- Bai, S.Z.; Jia, X.L. Research on Operational Strategy of Capital-Constrained Dual-channel Supply Chain of Fresh Agricultural Products. Chin. J. Manag. Sci. 2024, 32, 275–285. [Google Scholar] [CrossRef]

- Tang, R.; Peng, Y.Y. Coordination mechanism of dual channels of fresh food supply chain based on differential game. Comput. Integr. Manuf. Syst. 2018, 24, 1034–1045. [Google Scholar] [CrossRef]

- Wang, L.; Dan, B. Research on freshness incentive mechanism of fresh produce supply chain considering consumer utility. J. Manag. Eng. 2015, 29, 200–206. [Google Scholar] [CrossRef]

- Xiong, F.; Fang, J.Y.; Yuan, J.; Jin, P. A study on incentives and coordination of fresh efforts in fresh produce supply chain under allied behavioral preferences. Chin. J. Manag. Sci. 2019, 27, 115–126. [Google Scholar] [CrossRef]

- Han, X.H.; Zhou, W.L.; Shen, Y.; Hou, R. Trade-Old-for-Remanufactured Program: Strategy Selection, Pricing and Coordination. Manag. Rev. 2018, 30, 177–194. [Google Scholar] [CrossRef]

- Pu, X.J.; Fan, W.D.; Wu, Y. A Study of Channel Patterns, Effort Inputs and Operational Efficiency of Fresh Produce Supply Chains. Chin. J. Manag. Sci. 2015, 23, 105–112. [Google Scholar] [CrossRef]

- Cai, K.Y.; He, Z.; Lou, Y.Q.; He, S.G. Risk-aversion information in a supply chain with price and warranty competition. Ann. Oper. Res. 2020, 287, 21–107. [Google Scholar] [CrossRef]

- Yan, B.; Jin, Z.J.; Liu, Y.P.; Yang, J.B. Decision on Risk-averse Dual-channel Supply Chain under Demand Disruption. Commun. Nonlinear Sci. Numer. Simul. 2018, 55, 206–224. [Google Scholar] [CrossRef]

- Li, W.L.; Zhao, S. Research on dual channel supply chain decision-making of high quality agricultural products considering the application of traceability system. Oper. Res. Manag. 2019, 28, 98–108. [Google Scholar]

| Article | 3PL Participation | Online Channel Operators | Freshness Consistency | Freshness Preserver | Freshness Preservation Effort | Marketing Effort |

|---|---|---|---|---|---|---|

| [34] | - | Retailer | No | Both | √ | √ |

| [35] | - | Both | Yes | Retailer | √ | - |

| [2] | - | Supplier | Yes | Retailer | - | - |

| [9] | - | Supplier | Yes | Supplier | √ | - |

| [10] | - | Supplier | No | Supplier | - | - |

| [36] | - | Retailer | Yes | Retailer | √ | - |

| [8] | - | Supplier | No | Both | √ | - |

| [16] | - | Both | Yes | Supplier | √ | - |

| [12] | - | Retailer | No | Retailer | √ | - |

| [17] | - | Both | Yes | Supplier | √ | - |

| [35] | - | Supplier | No | Retailer | √ | - |

| [18] | - | Supplier | No | Both | - | - |

| [30] | Yes | Supplier | No | All | √ | - |

| [37] | - | Supplier | Yes | Supplier | √ | - |

| [21] | - | Supplier | Yes | Supplier | √ | √ |

| [38] | - | Supplier | No | Both | √ | - |

| [5] | Yes | - | - | 3PL | √ | - |

| [29] | Yes | - | - | 3PL | √ | - |

| This paper | Yes | Supplier | Yes | 3PL | √ | √ |

| Symbols | Explanations |

|---|---|

| 3PL’s decision variable, unit transportation price of fresh products | |

| 3PL’s decision variable, the cold-chain service level | |

| 3PL’s decision variable, the online channel cold-chain service level under D2 Model | |

| 3PL’s decision variable, the offline channel cold-chain service level under D2 Model | |

| Supplier’s decision variable, unit wholesale price of fresh products | |

| Supplier’s decision variable, online unit sales price of fresh products under the dual-channel model | |

| Supplier’s decision variables, offline marketing efforts in the dual-channel model | |

| Retailer’s decision variable, the offline unit sales price of fresh products | |

| Retailer’s decision variable, the offline marketing efforts of fresh products | |

| The overall profit of the supply chain | |

| Subscript, 3PL | |

| Subscript, the supplier | |

| Subscript, the retailer | |

| Online market purchase volume | |

| Offline market purchase volume | |

| The utility that consumers obtain from purchasing fresh products through online direct sales channels | |

| The utility that consumers obtain from purchasing fresh products through offline retail channels | |

| O | Superscript, decision-making situation of the traditional retail channel |

| D1 | Superscript, decision-making situation of the homogeneous cold-chain service dual-channel |

| D2 | Superscript, decision-making situation of the differentiated cold-chain service dual-channel |

| 10 | 0.6 | 0.8 | 0.12 | 30 | 15 | 25 | 24 | 28 |

| 0.2 | 0.6 | 0.3 | 2.52893 | 4.66691 | 3.70566 |

| 0.6 | 2.78759 | 7.49167 | 6.99136 | ||

| 0.8 | 0.3 | 1.88212 | 3.44397 | 2.73195 | |

| 0.6 | 2.02173 | 4.21113 | 3.48686 | ||

| 0.5 | 0.6 | 0.3 | 3.68478 | 7.97184 | 7.03746 |

| 0.6 | 4.06178 | 18.9435 | 19.3598 | ||

| 0.8 | 0.3 | 2.74212 | 5.8337 | 5.13536 | |

| 0.6 | 2.94558 | 8.24241 | 7.68837 | ||

| 0.8 | 0.6 | 0.3 | 5.05932 | 12.7725 | 11.8675 |

| 0.6 | 5.57729 | 38.1862 | 40.2186 | ||

| 0.8 | 0.3 | 3.76447 | 9.27873 | 8.5946 | |

| 0.6 | 4.04391 | 14.511 | 14.1661 |

| 0.2 | 0.6 | 0.3 | 2.52893 | 4.4953 | 3.78256 |

| 0.6 | 2.78759 | 5.45294 | 4.57323 | ||

| 0.8 | 0.3 | 1.88212 | 3.32983 | 2.80752 | |

| 0.6 | 2.02173 | 3.78237 | 3.141 | ||

| 0.5 | 0.6 | 0.3 | 3.68478 | 6.99419 | 6.29638 |

| 0.6 | 4.06178 | 9.16693 | 8.56442 | ||

| 0.8 | 0.3 | 2.74212 | 5.1712 | 4.65656 | |

| 0.6 | 2.94558 | 6.05304 | 5.49359 | ||

| 0.8 | 0.6 | 0.3 | 5.05932 | 10.3167 | 9.63286 |

| 0.6 | 5.57729 | 14.6226 | 14.3559 | ||

| 0.8 | 0.3 | 3.76447 | 7.60812 | 7.10034 | |

| 0.6 | 4.04391 | 9.21292 | 8.74271 |

| 0.2 | 0.6 | 0.3 | 2.52893 | 4.4353 | 3.97268 |

| 0.6 | 2.78759 | 5.61411 | 4.75857 | ||

| 0.8 | 0.3 | 1.88212 | 3.2869 | 2.95548 | |

| 0.6 | 2.02173 | 3.77642 | 3.20924 | ||

| 0.5 | 0.6 | 0.3 | 3.68478 | 6.6257 | 6.1747 |

| 0.6 | 4.06178 | 8.93423 | 9.01006 | ||

| 0.8 | 0.3 | 2.74212 | 4.91159 | 4.58595 | |

| 0.6 | 2.94558 | 5.62358 | 5.16214 | ||

| 0.8 | 0.6 | 0.3 | 5.05932 | 9.38616 | 8.94571 |

| 0.6 | 5.57729 | 14.2908 | 15.7121 | ||

| 0.8 | 0.3 | 3.76447 | 6.95181 | 6.6311 | |

| 0.6 | 4.04391 | 8.08596 | 7.741 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, Y.; Zhu, A.; Yu, L.; Wang, W. Research on Pricing and Effort Investment Decisions for Dual-Channel Fresh Product Supply Chain Under the Participation of Third-Party Logistics Provider. Systems 2025, 13, 538. https://doi.org/10.3390/systems13070538

Wu Y, Zhu A, Yu L, Wang W. Research on Pricing and Effort Investment Decisions for Dual-Channel Fresh Product Supply Chain Under the Participation of Third-Party Logistics Provider. Systems. 2025; 13(7):538. https://doi.org/10.3390/systems13070538

Chicago/Turabian StyleWu, Yunting, Aimin Zhu, Lijuan Yu, and Wenbo Wang. 2025. "Research on Pricing and Effort Investment Decisions for Dual-Channel Fresh Product Supply Chain Under the Participation of Third-Party Logistics Provider" Systems 13, no. 7: 538. https://doi.org/10.3390/systems13070538

APA StyleWu, Y., Zhu, A., Yu, L., & Wang, W. (2025). Research on Pricing and Effort Investment Decisions for Dual-Channel Fresh Product Supply Chain Under the Participation of Third-Party Logistics Provider. Systems, 13(7), 538. https://doi.org/10.3390/systems13070538