Abstract

This study explores how the quality of information systems quality in management accounting (ISQMA) is associated with corporate sustainability (CS), focusing on the role of financial reporting accuracy and contextual enablers such as artificial intelligence (AI) and green corporate governance (GCG). Drawing on the Resource-Based View and Contingency Theory, the study investigates whether accurate financial data reporting (AFDR) functions as a mechanism through which ISQMA contributes to sustainability outcomes, and whether the presence of AI and GCG strengthens these associations. Empirical data were collected from 257 accounting and finance professionals working in Jordanian commercial banks, providing a robust setting where digital infrastructure and sustainability imperatives converge. The results reveal that ISQMA is positively associated with both AFDR and CS, with AFDR partially mediating this relationship. Moreover, AI and GCG were found to strengthen the relationships between ISQMA and AFDR, and between ISQMA and CS, respectively. These findings underscore that accurate, reliable financial reporting, and strong governance practices enhance the value of digital information systems in achieving corporate sustainability objectives. By integrating information quality, technological capabilities, and governance mechanisms, this study offers a comprehensive understanding of how banks can align their digital infrastructure with sustainable performance goals. The insights contribute to the growing discourse on digitally enabled sustainability and offer actionable implications for both practitioners and policymakers in emerging markets.

1. Introduction

In response to mounting environmental, regulatory, and stakeholder pressures, corporate sustainability (CS) has evolved from a peripheral objective into a central strategic priority [1,2]. Organizations are increasingly expected to integrate environmental, social, and economic goals into core business operations. This paradigm shift places considerable demands on internal information systems, especially in management accounting, to provide high-quality, timely, and decision-useful information that supports sustainability efforts [3]. Among these systems, the quality of information systems quality in management accounting (ISQMA) is critical in enabling effective planning, monitoring, and resource allocation aligned with sustainability objectives [4,5]. However, despite ISQMA’s acknowledged importance, empirical studies have paid limited attention to its indirect contribution to CS, particularly through the accuracy of financial data reporting (AFDR) [6].

AFDR serves as a pivotal mechanism in ensuring organizational transparency, compliance, and stakeholder trust. Accurate financial data is foundational for both internal decision-making and external disclosures, especially in the context of rising sustainability reporting requirements [7]. Despite its centrality, the mediating role of AFDR between ISQMA and CS has not been sufficiently theorized or tested, particularly in emerging economies such as Jordan. This study seeks to fill that gap by examining how internal system quality translates into sustainability outcomes via financial data accuracy.

At the same time, the integration of artificial intelligence (AI) into accounting and reporting processes is transforming the nature of financial systems. AI tools enhance data processing capabilities, automate validation routines, and enable predictive analytics, all of which potentially strengthen the ISQMA–AFDR relationship [8,9]. Yet prior research has often presented AI as uniformly beneficial, without addressing its risks—such as algorithmic opacity, ethical concerns, or potential misalignment with regulatory frameworks [10,11]. This study introduces a more balanced perspective by evaluating both the enabling and constraining aspects of AI as a contextual factor.

Green corporate governance (GCG)—a governance framework that explicitly incorporates environmental and social considerations into corporate oversight—has also emerged as a key driver of sustainability performance [12]. GCG influences how sustainability information is interpreted, reported, and acted upon at the strategic level. It fosters ethical decision-making, strengthens disclosure integrity, and ensures alignment with stakeholder expectations and regulatory requirements [13,14]. Nonetheless, limited research exists on how GCG shapes the effectiveness of internal systems and financial reporting in achieving sustainability goals.

Taken together, the interaction between ISQMA, AFDR, AI, and GCG has been largely overlooked within a unified empirical framework. Most studies examine these elements independently or in digitally mature economies, leaving a gap in contexts with evolving technological infrastructure and regulatory frameworks [15,16,17]. This study addresses this research void by focusing on Jordan’s commercial banking sector where digital adoption is increasing, yet remains inconsistent, and where sustainability disclosures are gaining regulatory momentum.

This research is grounded in the Resource-Based View (RBV) [18] and Contingency Theory (CT) [19]. RBV explains how strategically valuable internal capabilities—such as ISQMA and data accuracy—enhance firm performance. CT, in turn, highlights the importance of aligning internal processes with external conditions, including technological and governance factors. This dual-theoretical approach enables an exploration of both mechanisms and boundary conditions that influence sustainability outcomes.

This study makes three distinct contributions. First, it positions AFDR as a central explanatory mechanism in the ISQMA–CS relationship. Second, it introduces AI and GCG as boundary conditions, providing a more nuanced understanding of how digital and governance capabilities shape sustainability performance. Third, it contributes empirical insights from the underexplored Jordanian banking sector, extending current knowledge beyond high-income, digitally advanced settings.

The remainder of this paper is structured as follows: Section 2 presents the theoretical framework; Section 3 presents research questions and hypotheses development; Section 4 outlines the research design and methodology; Section 5 discusses the empirical results; and Section 6 elaborates on theoretical and managerial implications, limitations, and future research directions.

2. Theoretical Framework

2.1. Underpinning Theories

This study draws upon two complementary but distinct theoretical frameworks—Resource-Based View (RBV) and Contingency Theory (CT)—to explain how the quality of internal systems and contextual factors jointly influence corporate sustainability (CS).

The RBV posits that sustained competitive advantage arises from the possession and strategic deployment of resources that are valuable, rare, inimitable, and non-substitutable (VRIN) [20]. Within this framework, information systems quality in management accounting (ISQMA) is conceptualized as a strategic resource. It encompasses dimensions such as reliability, timeliness, accuracy, and relevance, which collectively enable firms to make informed decisions and support long-term sustainability objectives [15,21]. Moreover, accurate financial data reporting (AFDR)—as a manifestation of ISQMA—is treated as an intangible resource that enhances transparency, compliance, and stakeholder trust [22]. The alignment of ISQMA and AFDR thus forms an internal capability that is difficult to replicate, especially when it integrates technological customization, firm-specific processes, and embedded expertise [23,24].

However, while the RBV effectively explains the internal value of ISQMA and AFDR, it falls short in accounting for dynamic external pressures such as evolving regulatory frameworks, technological disruptions, and rising stakeholder demands for accountability and environmental, social, and governance (ESG) transparency. In these environments, the assumption of resource stability that underpins RBV may not hold [18]. For instance, even highly valuable resources like accurate data may not translate into sustainability performance unless supported by adaptive technologies and governance mechanisms.

To address these limitations, this study incorporates Contingency Theory (CT), which argues that organizational effectiveness depends on the degree of fit between internal processes and the external environment [25,26,27]. CT posits that no single structure or strategy is universally optimal; rather, the appropriateness of any internal configuration—such as digital systems or reporting practices—is contingent on specific environmental variables. This theory is particularly relevant in the context of sustainability performance, where external contingencies such as technological sophistication and governance quality determine how effectively internal capabilities are leveraged.

In particular, CT provides explanatory power where RBV does not—namely, in recognizing that the value of internal resources is not inherent but conditional. For example, artificial intelligence (AI) capabilities represent a technological contingency that can either enhance or constrain the ISQMA–AFDR relationship. AI-enabled tools such as machine learning algorithms, real-time dashboards, and anomaly detection systems elevate the accuracy and responsiveness of financial reporting [28,29]. However, these benefits are not automatic. Their effectiveness is dependent on the firm’s digital maturity, ethical data practices, and regulatory readiness, making AI a situational amplifier rather than a universally effective enhancer [9].

Similarly, green corporate governance(GCG) constitutes a governance-related contingency that moderates the relationship between AFDR and CS. GCG includes institutional arrangements such as ESG-integrated board oversight, environmental risk auditing, sustainability committees, and robust disclosure frameworks [13,30]. In environments with high GCG maturity, the utility of accurate financial information is significantly elevated as organizations are structurally equipped to interpret, act upon, and disclose sustainability metrics [31,32]. Thus, GCG operates not as a resource but as a boundary condition that shapes how firms translate information quality into sustainability value.

Together, RBV and CT offer a robust and context-sensitive framework for understanding the mechanisms and conditions under which ISQMA contributes to CS. RBV explains the internal strategic role of ISQMA and AFDR, while CT highlights how their effectiveness is contingent upon external factors like AI and GCG. This theoretical integration avoids the shortcomings of applying either framework in isolation and supports a nuanced view of how digital systems, financial reporting quality, and institutional configurations interact to shape sustainability outcomes.

2.2. Accuracy of Financial Data Reporting

Accuracy financial data reporting (AFDR) refers to the degree to which financial information reflects the true economic reality of a firm’s operations, free from material misstatements, omissions, or distortions [33]. It captures the correctness, completeness, and reliability of quantitative and qualitative disclosures, including financial statements, footnotes, and performance metrics [9]. Unlike broader constructs such as financial transparency or reporting reliability—which emphasize interpretive clarity or stakeholder-oriented disclosure—AFDR specifically focuses on the factual precision and numerical integrity of reported data. This distinction is crucial for internal control, external assurance, and compliance purposes, particularly in contexts where decision-making relies heavily on the verifiability of financial outputs [34].

High-quality AFDR is indispensable for stakeholders—including investors, regulators, auditors, and senior management—who require dependable information for timely, evidence-based decisions. It aligns with global reporting standards such as the International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), enhancing the comparability, uniformity, and credibility of disclosures across firms and jurisdictions [35,36]. Accurate financial reporting is particularly vital in sustainability contexts, where environmental liabilities, carbon disclosures, and social expenditures must be quantifiable and supported by traceable documentation. As such, AFDR underpins both financial and non-financial performance metrics that inform ESG evaluations [37].

Technological advances—especially in artificial intelligence (AI)—are transforming how organizations produce and verify financial data. Tools such as automated journal entries, real-time anomaly detection, and predictive modeling enhance the accuracy of complex financial processes by reducing human error and increasing processing speed [38,39]. However, this transition toward AI-enabled reporting introduces new challenges, including algorithmic opacity, cybersecurity risks, and ethical concerns regarding automated decision-making [40,41]. Maintaining AFDR in this context requires the development of transparent AI governance frameworks, frequent system audits, and ethical oversight mechanisms to ensure that data integrity is preserved [42,43].

Internal audit functions (IAF) serve as an institutional mechanism for enhancing AFDR. Effective IAFs mitigate opportunistic reporting behaviors [44], monitor the integrity of financial transactions [45], and improve stakeholder perceptions of financial credibility [46]. A strong internal audit function not only reinforces compliance and reliability but also serves as a critical check on algorithm-generated financial data, ensuring that AI-based reporting is both accurate and accountable. Moreover, the involvement of internal auditors in the review of ESG-related metrics strengthens confidence in sustainability disclosures, particularly under evolving regulatory frameworks such as the EU’s CSRD [34].

Despite its importance, AFDR remains underexplored as a mediating mechanism between information systems quality in management accounting (ISQMA) and corporate sustainability (CS). Most prior research has focused on AFDR as a compliance outcome or an audit objective rather than a strategic enabler of sustainability performance [3]. This study addresses this gap by positioning AFDR as a pivotal construct that links system quality with long-term sustainability objectives. In doing so, it reconceptualizes AFDR not merely as an output of financial control but as a strategic capability embedded within a firm’s digital infrastructure, audit architecture, and sustainability governance.

3. Research Questions and Hypotheses Development

As organizations navigate increasing environmental and governance pressures, the strategic role of digital infrastructure—particularly information systems quality in management accounting (ISQMA)—has become essential for enhancing corporate sustainability. ISQMA facilitates accurate, timely, and relevant financial reporting, which enables more effective decision-making and supports the organization’s long-term sustainability agenda. In this context, the accuracy of financial data reporting (AFDR) is conceptualized as a key mechanism through which ISQMA influences sustainability outcomes. At the same time, emerging digital technologies such as artificial intelligence (AI) are reshaping how financial data are processed and validated, potentially strengthening the link between ISQMA and AFDR. Additionally, green corporate governance (GCG)—reflected in practices such as board-level environmental oversight and sustainability-integrated strategic planning—may amplify the effect of ISQMA on sustainability by embedding environmental responsibility into corporate decision-making structures. To explore these relationships, this study examines the direct effect of ISQMA on CS, the mediating role of AFDR, and the moderating roles of AI and GCG on their respective pathways. The following research questions guide the investigation:

- RQ1. To what extent is the implementation of ISQMA associated with CS performance in the context of commercial banks?

- RQ2. Does AFDR serve as a mediating mechanism in the relationship between ISQMA and CS?

- RQ3. Does AI moderate the association between ISQMA and AFDR?

- RQ4. Does GCG moderate the association between ISQMA and CS?

3.1. Information Systems Quality in Management Accounting and Corporate Sustainability

Information systems quality in management accounting (ISQMA) refers to the extent to which management accounting systems produce information that is timely, accurate, relevant, and complete, enabling informed decision-making and effective organizational control [47]. These systems help organizations translate raw data into actionable insights, which are particularly critical in supporting sustainability-oriented strategies. A high-quality ISQMA contributes not only to operational efficiency but also to strategic agility, by facilitating dynamic decision-making in response to evolving sustainability regulations, stakeholder expectations, and market pressures [3]. It enables firms to proactively monitor, report, and manage environmental, social, and economic dimensions of performance.

Corporate sustainability (CS), in contrast, reflects an organization’s capacity to balance financial goals with environmental stewardship and social responsibility over the long term. Increasingly, sustainability is not just a moral imperative but also a strategic necessity, and it requires robust information systems to support integrated thinking and reporting [48]. From the lens of the Resource-Based View (RBV), ISQMA qualifies as a strategic resource when it possesses the VRIN characteristics: valuable, rare, inimitable, and non-substitutable. These systems provide a competitive advantage when embedded in organizational routines and are linked with firm-specific processes for sustainability integration [49]. Firms with strong ISQMA capabilities are better equipped to monitor environmental performance, manage social impacts, and adapt reporting to stakeholders’ expectations [50].

Empirical research has supported this link. For instance, Chopra et al. [51] find that firms with advanced information systems demonstrate improved ESG reporting and enhanced transparency. Similarly, Mishra et al. [12] show that sustainability governance improves when management accounting systems produce higher-quality data. Thus, ISQMA strengthens a firm’s ability to measure and report sustainability metrics while guiding strategic decisions. In addition, Enterprise Resource Planning (ERP) systems and advanced digital accounting infrastructures serve as foundational technologies that extend the utility of ISQMA by integrating financial and non-financial data across business functions, enhancing coherence in sustainability efforts [52,53].

ISQMA also supports the effectiveness of management control systems by delivering high-quality accounting information necessary for planning, forecasting, and performance evaluation [54]. These control systems direct employee behavior towards sustainability goals through mechanisms such as budgeting, performance monitoring, and investment appraisals related to environmental or social initiatives [55]. Moreover, integrated ISQMA reduces information asymmetry and supports coordination across departments, enabling unified and transparent sustainability strategies.

Recent studies further reveal that digital transformation, through technologies like ERP, business analytics, and artificial intelligence, is reshaping how ISQMA contributes to sustainability [56,57]. These technologies help reduce human errors, generate real-time data streams, and enhance traceability of ESG metrics, ensuring more accurate and timely sustainability disclosures [3]. This evolution broadens the strategic scope of ISQMA from financial oversight to sustainability enablement. Given this theoretical foundation and empirical support, the following hypothesis is proposed:

H1:

Information systems quality in management accounting (ISQMA) is positively associated with corporate sustainability (CS).

3.2. Information Systems Quality in Management Accounting and Financial Reporting Accuracy

Accuracy financial data reporting (AFDR) refers to the degree to which financial statements are free from errors, presented timely and with precise information, and conformed to established accounting principles [58]. Accurate financial reporting supports decision-making for both internal and external stakeholders and underpins trust in financial disclosures. The quality of ISQMA plays a crucial role in ensuring that such reporting is not only precise but also delivered efficiently and consistently [59]. As organizations increasingly adopt integrated reporting standards, AFDR becomes essential not only for conventional financial disclosures but also for accurate reporting of ESG-related financial metrics [9]. This makes AFDR a strategic component of both financial stewardship and sustainability accountability.

Information systems quality in management accounting (ISQMA) is conceptualized through dimensions such as timeliness, reliability, accuracy, integration, and relevance [47]. High-quality ISQMA enables organizations to collect, process, and report financial data with improved consistency and minimal manual intervention, thereby reducing the risk of data entry errors and enhancing overall reporting integrity [60]. Beyond the technical performance of accounting systems, recent interdisciplinary research emphasizes the socio-technical dimension of AIS, highlighting that the reliability of ISQMA must align with user interpretability, ethical considerations, and contextual decision-making needs [61,62]. As digital platforms gain prominence, the relevance and accessibility of financial data also determine its utility for real-time decision-making and external accountability.

According to the RBV, ISQMA constitutes a valuable and unique resource [18]. When aligned with internal processes and organizational strategy, it becomes a source of sustainable competitive advantage by strengthening internal controls, supporting regulatory compliance, and increasing transparency [63]. As a VRIN resource, ISQMA contributes to a higher reporting precision and mitigates the risk of financial misstatements and restatements. Importantly, the integration of ISQMA with broader enterprise systems—such as Enterprise Resource Planning (ERP) and Business Intelligence tools—enhances audit trails and reduces reporting cycle times, while enabling strategic foresight and accurate environmental liability tracking [52,57].

Empirical studies have consistently affirmed the positive relationship between ISQMA and financial reporting quality. For example, Mohsen et al. [64] found that improvements in system reliability and integration significantly reduced discrepancies in financial reporting. Similarly, Sheela et al. [65] reported that digital enhancements in accounting information systems lead to greater auditability and reporting accuracy in firms operating in volatile environments. In addition, artificial intelligence (AI)-enabled AIS offer capabilities such as anomaly detection, automated reconciliations, and predictive analytics, thereby reinforcing the reliability of financial disclosures [9]. Nevertheless, such advancements require careful governance to mitigate risks of algorithmic bias, data privacy concerns, and unintended distortions in reporting.

The timeliness and integration dimensions of ISQMA are particularly critical in dynamic sectors where delayed or fragmented financial information could undermine agility and stakeholder trust [15]. Moreover, while standardization of reporting principles ensures comparability, excessive rigidity can obscure localized sustainability challenges or distort managerial decision-making [66]. Thus, a high-performing ISQMA should be adaptable, ethically grounded, and aligned with strategic reporting priorities. Given the strong theoretical rationale and empirical support, the following hypothesis is proposed:

H2:

Information systems quality in management accounting (ISQMA) is positively associated with the accuracy of financial data reporting (AFDR).

3.3. The Mediating Mechanism of Financial Reporting Accuracy

Corporate sustainability (CS) represents a firm’s long-term commitment to balancing economic viability, environmental responsibility, and social accountability [67,68]. Achieving these objectives demands strategic decision-making rooted in verifiable and high-quality information. Within this framework, the accuracy of financial data reporting (AFDR)—defined as the production and disclosure of error-free, timely, and consistent financial information—plays a vital role in reinforcing internal control systems, building stakeholder trust, and guiding sustainability-oriented strategies [69]. From a RBV, AFDR can be considered a valuable, rare, and difficult-to-imitate resource that enables firms to align financial planning with long-term sustainability objectives by optimizing resource allocation, minimizing regulatory risks, and supporting transparent governance practices [70].

Empirical evidence affirms the criticality of AFDR in sustainability performance. For example, Khan and Gupta [71] found that firms with higher reporting accuracy demonstrated enhanced environmental compliance and improved ESG scores. Lin and Qamruzzaman [72] established a direct relationship between accurate financial disclosures and stronger investor confidence and sustainable investment inflows. In particular, AFDR enables firms to quantify and report non-financial indicators—such as environmental liabilities, carbon emissions, and social expenditures—more reliably, thereby strengthening both internal sustainability metrics and external legitimacy [73]. In this sense, AFDR is more than a regulatory necessity; it is a strategic enabler of sustainable value creation and future-oriented corporate resilience.

While ISQMA improves financial management practices, its impact on sustainability often operates through AFDR. High-quality ISQMA systems—characterized by timeliness, accuracy, reliability, and integration—enhance the quality of financial reporting by reducing human error, ensuring consistency, and facilitating real-time oversight [74]. These systems establish a robust foundation for transparent reporting, enabling organizations to monitor sustainability expenditures, environmental performance, and social investments with greater precision. Accordingly, the AFDR serves as a mediating variable through which ISQMA can influence CS [3,75]. This mediation highlights the indirect pathway whereby ISQMA enhances CS not by direct intervention, but by improving the fidelity and usefulness of the financial data upon which sustainability decisions are based.

From the RBV perspective, both ISQMA and AFDR qualify as strategic resources that generate competitive advantage when effectively integrated into organizational routines [76]. This view is supported by empirical findings. For instance, Monteiro et al. [77] showed that improvements in system design indirectly elevated sustainability performance through higher financial reporting precision. Similarly, Wang and Hou [78] found that digital accounting systems contributed to better ESG outcomes when mediated by improved AFDR. In dynamic environments where sustainability is increasingly tied to data-driven accountability, the ability to report accurate financial information is a critical bridge between digital infrastructure and sustainability excellence. Thus, we propose the following hypotheses:

H3:

Accuracy of financial data reporting (AFDR) is positively associated with corporate sustainability (CS).

H4:

Accuracy of financial data reporting (AFDR) mediates the relationship between information systems quality in management accounting (ISQMA) and corporate sustainability (CS).

3.4. The Moderating Role of Artificial Intelligence

Artificial intelligence (AI) in management accounting encompasses the use of intelligent technologies—such as machine learning, natural language processing, and automation tools—to improve data processing, financial reporting accuracy, and strategic decision-making [40,79]. AI has increasingly transformed Accounting Information Systems (AIS) by automating repetitive tasks (e.g., data entry and account reconciliation), reducing human error, and enhancing the precision and timeliness of reported financial information [9,80,81]. In doing so, AI enables more reliable and real-time financial oversight, thus improving the quality of information produced by management accounting systems. As organizations contend with dynamic regulatory and sustainability requirements, AI supports compliance by enhancing audit traceability, anomaly detection, and automated validation of ESG-related disclosures [82,83].

In this study, AI is conceptualized as a moderating variable that conditions the strength of the relationship between information systems quality in management accounting (ISQMA) and accuracy financial data reporting (AFDR). Organizations with advanced AI capabilities are better positioned to process complex financial data accurately and efficiently, thereby amplifying the reliability and integrity of financial reporting systems [84]. This aligns with Contingency Theory (CT), which asserts that an organization’s performance depends on the fit between its internal capabilities and external technological context [17]. From this lens, AI represents a digital contingency that enhances the adaptive and analytical capacity of ISQMA, enabling firms to align internal financial systems with external demands for accuracy, transparency, and sustainability [85].

Empirical research affirms AI’s moderating influence. Studies have demonstrated that AI-enhanced AIS lead to fewer reporting inconsistencies, improved audit readiness, and stronger financial governance [86]. For instance, Mehdiyev et al. [87] documented improvements in both reporting precision and managerial foresight following AI adoption in accounting workflows. Likewise, Ren [88] found that AI-enhanced decision systems improved organizational responsiveness to regulatory and stakeholder demands. AI’s predictive analytics capabilities further allow accountants to simulate future financial outcomes, optimize resource allocation, and align internal reporting with dynamic sustainability goals, further improving the strategic value of reporting outputs [89,90].

Nonetheless, the integration of AI in AIS is not without challenges. Accounting scholars highlight the socio-technical complexities of AI implementation, including shifts in accountability, potential algorithmic bias, data privacy concerns, and over-reliance on opaque decision-making systems [91,92]. In poorly governed environments, AI-driven automation may lead to decision-making distortions, such as automation bias or excessive reliance on algorithmic outputs, potentially undermining financial transparency and judgment [57,61]. These risks necessitate strong digital governance mechanisms, particularly when AI influences high-stakes areas such as financial disclosures and sustainability reports. In this study, however, AI is primarily viewed through a performance-enhancing lens, focusing on its ability to elevate the functional link between ISQMA and AFDR. Accordingly, the following hypothesis is proposed:

H5:

Artificial intelligence (AI) positively moderates the relationship between information systems quality in management accounting (ISQMA) and the accuracy of financial data reporting (AFDR), such that this relationship is stronger at higher levels of AI implementation.

3.5. The Moderating Role of Green Corporate Governance

Green corporate governance(GCG) refers to the integration of environmental sustainability principles into corporate governance frameworks, emphasizing environmentally responsible decision-making, transparent environmental, social, and governance (ESG) disclosure, and alignment with long-term sustainability goals [93]. GCG extends traditional governance structures by embedding ecological accountability into board responsibilities, stakeholder engagement, and risk management strategies [94]. It aims to ensure that corporate decisions not only generate financial value but also promote environmental stewardship and sustainable development. Recent empirical research affirms that firms with strong green governance structures exhibit superior environmental performance and greater alignment with sustainability benchmarks [95].

For instance, Haislip [96] found that boards with environmental expertise and dedicated ESG committees are more likely to monitor sustainability metrics rigorously, improving the accuracy and reliability of ESG disclosures. Similarly, Ramirez et al. [97] reported that green-oriented governance enhances firms’ transparency and mitigates sustainability-related risks, especially in industries under environmental scrutiny. GCG plays a particularly critical role in converting internal data quality into strategic sustainability outcomes, acting as a safeguard against greenwashing and enhancing stakeholder trust.

Governance mechanisms such as sustainability reporting oversight, green auditing, and ESG-linked executive compensation play a critical role in shaping firm behaviors toward environmental responsibility [98]. These mechanisms increase accountability in financial reporting and reduce the likelihood of greenwashing, reinforcing the credibility of sustainability claims. Moreover, GCG has been linked to stronger investor confidence, improved brand reputation, and more resilient long-term financial performance [99].

Within the context of this study, GCG is conceptualized as a moderating variable that influences the strength of the relationship between information systems quality in management accounting (ISQMA) and corporate sustainability (CS). High-quality governance structures enable firms to better translate accurate, timely financial data into actionable sustainability strategies, thereby enhancing the ISQMA–CS linkage under varying environmental governance conditions. This aligns with Contingency Theory (CT), which posits that the effectiveness of internal systems is contingent upon their fit with the external and institutional context [100]. As a contextual moderator, GCG supports the institutionalization of sustainability practices by ensuring that ISQMA outputs—such as financial accuracy, transparency, and traceability—are strategically leveraged in decision-making.

GCG practices, including environmental risk assessment, ESG disclosure mandates, and sustainability-aligned incentives, strengthen the organizational capacity to interpret and apply financial data toward ecological objectives [101,102]. These mechanisms facilitate stronger integration between internal accounting data and external sustainability mandates, reinforcing the alignment between financial information systems and stakeholder expectations. Empirical studies highlight that strong GCG practices positively impact sustainability outcomes by promoting transparency, ethical decision-making, and effective environmental risk management [103]. For example, Zhen and Rahman [104] found that firms with advanced GCG systems exhibited better environmental and social outcomes due to more rigorous internal data verification processes and stakeholder alignment. Additionally, research emphasizes that weak or symbolic governance structures can undermine the effectiveness of sustainability strategies, particularly when environmental goals are decoupled from financial oversight [105]. This reinforces the importance of embedding GCG into the decision architecture that guides how ISQMA insights are interpreted and applied.

Therefore, GCG is not only an ethical imperative but also a strategic enhancer that conditions how ISQMA outputs contribute to corporate sustainability. Based on this theoretical and empirical rationale, the following hypothesis is proposed:

H6:

Green corporate governance (GCG) positively moderates the relationship between information system quality in management accounting (ISQMA) and corporate sustainability (CS), such that this relationship becomes stronger when green corporate governance (GCG) practices are high.

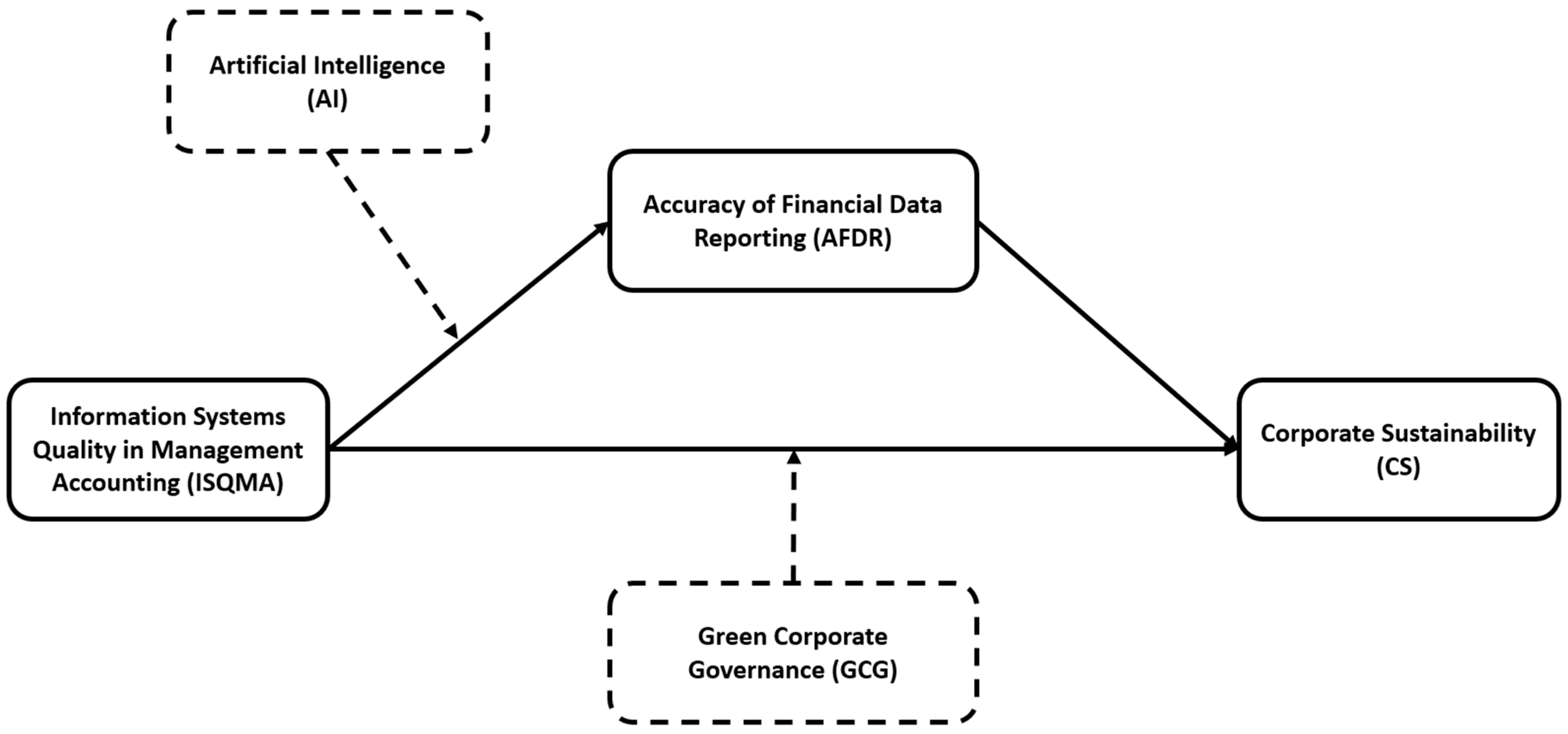

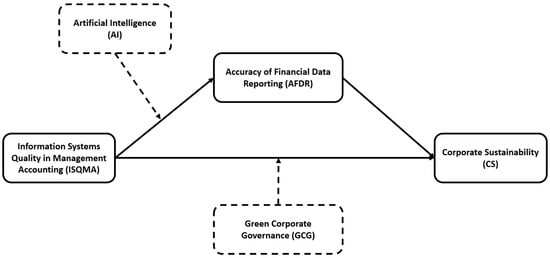

3.6. Conceptual Framework

This study integrates the RBV and CT to propose a model examining how ISQMA contributes to CS. The model posits that ISQMA enhances CS both directly and indirectly through the mediating role of the AFDR. AFDR reflects the ability of ISQMA to generate timely, precise, and error-free financial data that supports strategic sustainability decisions. The model also incorporates two contextual moderators. AI strengthens the link between ISQMA and AFDR by enhancing data processing, automation, and predictive capacity, while GCG reinforces the ISQMA–CS relationship by embedding sustainability principles into governance mechanisms. Together, these elements form an integrative framework that captures both the internal quality of information systems and the external contingencies that shape their impact on sustainability outcomes, as illustrated in Figure 1.

Figure 1.

The conceptual model.

4. Research Design and Methods

4.1. Sampling and Data Collection

This study employs a quantitative approach using a descriptive, cross-sectional design to empirically investigate how ISQMA is associated with CS via AFDR, considering the moderating roles of AI and GCG. The target population comprised accounting and finance professionals from the 18 local and foreign commercial banks listed on the Amman Stock Exchange (ASE) in Jordan [106]. While the Central Bank of Jordan licenses 27 banks—18 commercial, 3 Islamic, and 6 foreign bank branches—this study focuses exclusively on the 18 commercial banks. This selection reflects the fact that Islamic banks operate under Sharia-compliant financial systems and foreign branches follow parent-country policies, which differ markedly from the regulatory and operational context of domestic commercial banks [107]. Limiting the study to these 18 banks ensured homogeneity in financial reporting, governance practices, and ISQMA infrastructure, thereby improving internal consistency and validity.

Given the absence of precise information regarding the exact number of employees within the accounting and finance departments of these banks [108], a purposive sampling technique was adopted. Purposive sampling is particularly effective when targeting respondents who possess specialized knowledge, experience, and decision-making responsibilities relevant to the study’s specific context and research objectives [109]. Data were collected through structured questionnaires distributed electronically via email and online platforms, complemented by personal interviews to ensure comprehensive respondent participation and enhance data validity.

After contacting all 18 commercial banks through their respective human resources departments, 13 banks agreed to participate, reflecting substantial institutional engagement. Consequently, a total of 390 questionnaires were disseminated, with approximately 30 questionnaires per bank. Of these, 265 completed questionnaires were returned, resulting in a favorable response rate of 67.9%, exceeding the threshold typically deemed acceptable for organizational research [110]. Following rigorous screening procedures for completeness and accuracy, the final dataset consisted of 257 valid questionnaires. This sample size provides sufficient statistical power for structural equation modeling (SEM), aligning with best practices in empirical research [111]. Given the cross-sectional nature of the data, the analysis is designed to uncover relational patterns rather than infer direct causality.

4.2. Measures

The measurement instruments employed in this study were carefully selected and adapted from validated scales in the previous literature to ensure methodological rigor, clarity, and contextual relevance. A structured questionnaire, initially developed in English, was translated into Arabic through a robust forward–backward translation process to ensure conceptual equivalence and linguistic accuracy [112]. Subsequently, a pilot test was conducted to refine the questionnaire for clarity and appropriateness, thereby enhancing its validity and reliability for respondents in the Jordanian banking context. All constructs were rated on a five-point Likert scale ranging from 1 (“strongly disagree”) to 5 (“strongly agree”), enabling nuanced participant evaluations and supporting the statistical assumptions required for structural equation modeling. To ensure transparency and conceptual alignment, Appendix A provides a mapping of questionnaire items to their respective constructs and associated hypotheses.

Specifically, the ISQMA construct was assessed using six items adapted from Knauer et al. [52] and Papiorek and Hiebl [47], covering dimensions such as fast system access, user-friendliness, automation, flexibility, integration, and data quality. These items correspond to Hypotheses H1, H2, H4, H5, and H6, where ISQMA functions as the primary predictor in explaining variations in CS and AFDR, with its effects potentially conditioned by AI and GCG.

GCG was measured with two items derived from Peng [113], Subedi [114], and Wang et al. [100], capturing governance contributions to economic growth and investor confidence. These items operationalize the moderator role of GCG as proposed in Hypothesis H6.

The AFDR construct was operationalized through four items adapted from Johri [9] and Monteiro et al. [115], emphasizing the reliability, clarity, and decision usefulness of financial data. AFDR is defined as the degree to which financial reporting is internally consistent, accurate, and capable of informing sound managerial decisions. This construct is conceptually distinct from general notions of financial transparency or audit reliability, as it captures the internal quality and interpretability of financial data used in management accounting. These items test the mediating role of AFDR between ISQMA and CS as posited in Hypotheses H2 and H3.

AI was captured by a seven-item scale based on Paschen et al. [116] and Wijayati et al. [117], focusing on AI capabilities in data retrieval, decision-making support, data privacy, and auditability. These items reflect AI’s moderating influence on the ISQMA–AFDR relationship, consistent with Hypothesis H5.

Lastly, CS was measured using five items adapted from Bağış et al. [118] and Svensson and Wagner [119], addressing financial health, cost efficiency, competitive advantage, and brand value. These items serve as outcome variables across Hypotheses H1, H3, and H6, where CS is examined as a function of ISQMA, AFDR, and the interactive effects of AI and GCG.

5. Data Analysis and Results

5.1. Demographic Profile

To ensure the reliability and contextual relevance of the findings, demographic data were collected from a sample of 257 accounting and finance professionals employed across Jordanian commercial banks. The sample was predominantly male (75.9%), with females comprising 24.1%, reflecting gender patterns commonly observed in financial sectors across the MENA region. The majority of respondents were between 30 and 40 years old (47.1%), followed by those above 50 (24.5%), between 41 and 50 (19.5%), and under 30 (8.9%), indicating a workforce largely composed of mid-career professionals with a balance of adaptability and experience in using accounting information systems [9]. Educationally, 67.3% held a bachelor’s degree, 28.4% had a master’s degree, and 4.2% possessed other graduate qualifications, suggesting a well-educated sample capable of engaging with complex financial and sustainability reporting processes [108]. Regarding work experience, 46.4% had between 5 and 10 years of experience, 32.2% had more than 10 years, and 21.4% had less than 5 years, which indicates a professional base with substantive domain knowledge [106]. The sample was also stratified by role: 49% were auditors, 37% financial analysts, and 14% financial managers—ensuring a representative distribution of functions critical to financial reporting and governance [120]. This diverse demographic composition enhances the validity and generalizability of the study’s insights.

5.2. PLS-SEM Analysis

To analyze the structural relationships among the study variables, Partial Least Squares Structural Equation Modeling (PLS-SEM) was employed using SmartPLS version 4.1.0.5 [121]. PLS-SEM is particularly well-suited for exploratory research in fields such as information systems, accounting, and corporate sustainability, as it accommodates complex models, small sample sizes, and both reflective and formative constructs [111,122]. Unlike covariance-based SEM, which is more appropriate for theory testing, PLS-SEM is advantageous for theory development and predictive modeling—making it a fitting choice for this study [123]. Moreover, PLS-SEM is robust to violations of normality and allows for the simultaneous estimation of measurement and structural models, yielding more accurate and meaningful parameter estimates [124]. Following the two-step approach recommended by Anderson and Gerbing [125], the analysis first assessed the measurement model for reliability and validity before proceeding to test the hypothesized structural relationships.

5.3. Measurement Model Assessment

To ensure the robustness of the measurement model, this study conducted a comprehensive assessment of construct reliability and validity following established guidelines in social science research [126]. Construct reliability was evaluated using both Cronbach’s Alpha and Composite Reliability (CR). As shown in Table 1, all constructs demonstrated strong internal consistency, with Cronbach’s Alpha values exceeding the minimum threshold of 0.70 [127], and CR values surpassing 0.70 [124]. These results confirm that the measurement scales used in this study are both consistent and reliable. Furthermore, indicator reliability was assessed through standardized factor loadings, all of which exceeded 0.60, suggesting that each indicator significantly contributes to its associated construct [126]. To further support construct reliability, the variance inflation factors (VIFs) for all indicators were also assessed, with results falling well below the multicollinearity threshold of 3.3 [124,128], ensuring that collinearity bias is not a concern.

Table 1.

Construct reliability and convergent validity assessment.

Convergent validity was examined through the average variance extracted (AVE), where all constructs achieved AVE values above the recommended cutoff of 0.50, indicating that the latent variables explain more than half of the variance in their observed indicators [129]. As reported in Table 1, these results provide strong evidence of convergent validity. Moreover, outer loadings for individual items consistently exceeded 0.70 [126], further strengthening the case for item convergence and internal construct coherence.

Discriminant validity was tested using three complementary approaches: cross-loadings, the Fornell–Larcker criterion, and the Heterotrait–Monotrait (HTMT) ratio. According to the Fornell–Larcker criterion (Table 2), the square roots of the AVEs (displayed on the diagonals) were greater than the corresponding inter-construct correlations, confirming that each construct captures a distinct conceptual domain [129]. HTMT values, also presented in Table 2, were well below the conservative threshold of 0.85 [130], reinforcing the absence of multicollinearity and indicating that no construct pair shared excessive conceptual overlap. The cross-loading matrix additionally confirmed that each item loaded more strongly on its corresponding construct than on any other, supporting discriminant integrity.

Table 2.

HTMT and Fornell–Larcker criterions for discriminant validity.

Collectively, these psychometric evaluations demonstrate that the reflective measurement model possesses high internal consistency reliability, convergent validity, and discriminant validity. These properties collectively support the use of the structural model for subsequent hypothesis testing and ensure that the observed associations reflect meaningful empirical relationships rather than measurement deficiencies.

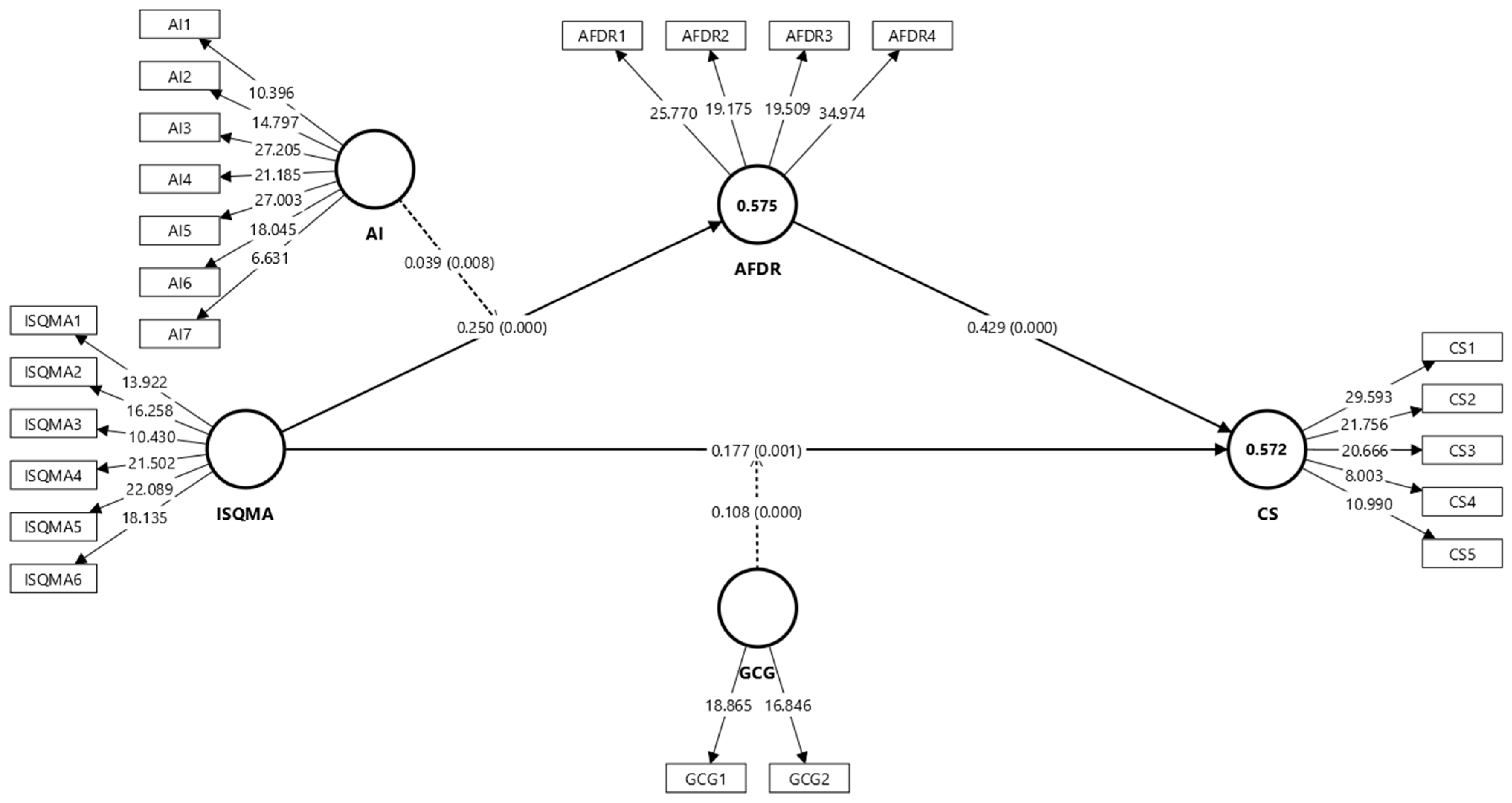

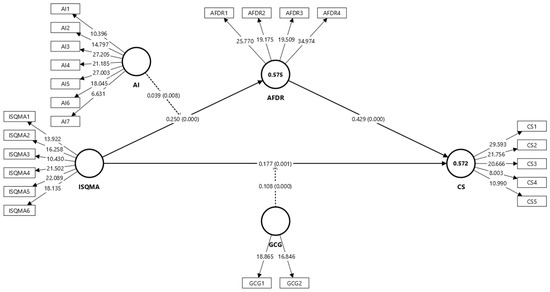

5.4. Structural Model Assessment

To evaluate the hypothesized relationships among the latent constructs, the structural model assessment was performed using PLS-SEM, an approach well-suited for complex models involving mediation and moderation, especially in exploratory studies within accounting and information systems [111,122]. As shown in Figure 2, the model’s path relationships were analyzed through a bootstrapping procedure with 5000 resamples to test the significance of direct, mediating, and moderating effects. The R2 values for the endogenous variables—AFDR and CS—were 0.575 and 0.572, respectively, indicating moderate explanatory power. These R2 values suggest that the model explains 57.5% of the variance in financial reporting accuracy and 57.2% of the variance in corporate sustainability, reflecting meaningful predictive relevance in the context of digitalized banking environments.

Figure 2.

PLS-SEM structural model with standardized path coefficients.

The overall model fit was confirmed through several global fit indices. The Standardized Root Mean Square Residual (SRMR) value was 0.067, below the recommended threshold of 0.08, and the Normed Fit Index (NFI) was 0.948, exceeding the minimum acceptable value of 0.90, both suggesting a good model fit [131]. Additionally, the Chi-square statistic stood at 794.878, providing further evidence of model adequacy. Multicollinearity was assessed using Variance Inflation Factors (VIFs), and all values were well below the conservative cutoff of 3.3, indicating no multicollinearity concerns [124]. These diagnostics collectively indicate that the structural paths are not distorted by collinearity, and the model fits the observed data well.

The path coefficient analysis provided strong empirical support for the hypothesized direct effects. ISQMA was found to be positively associated with CS (H1: β = 0.177, p < 0.001) and with AFDR (H2: β = 0.250, p < 0.001). Furthermore, AFDR exhibited a strong positive association with CS (H3: β = 0.429, p < 0.001), reinforcing its role as a critical intermediary. All direct paths are statistically significant, and the effect size of AFDR → CS is particularly notable, highlighting the centrality of financial data quality in explaining sustainability outcomes.

Mediation analysis confirmed that AFDR partially mediates the relationship between ISQMA and CS (H4: indirect effect = 0.107, p < 0.001), with bootstrapped confidence intervals excluding zero, which meets the criteria for a significant indirect effect [132]. The indirect path demonstrates that accurate financial reporting transmits the benefits of systems quality to sustainability-related performance, aligning with the proposed theoretical framework. As summarized in Table 3, these results provide comprehensive empirical validation for the model and deepen understanding of how internal information systems and financial reporting mechanisms are associated with corporate sustainability in digitally evolving banking institutions.

Table 3.

Results of structural model: path coefficients, VIF, and moderation effects.

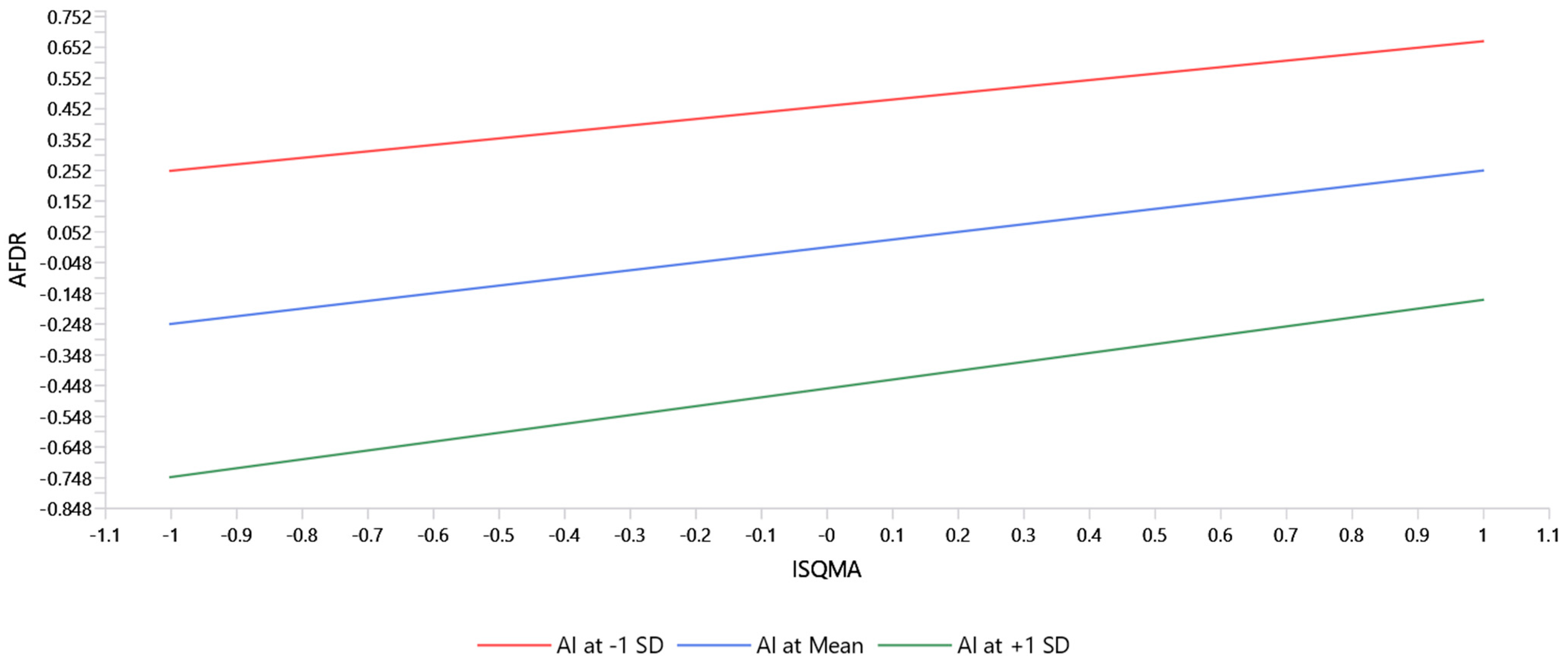

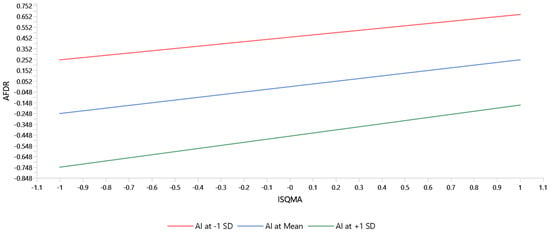

5.5. Moderation Analysis

The moderation analysis aimed to examine whether AI and GCG significantly influence the strength of two key relationships in the model: between ISQMA and AFDR, and between ISQMA and CS. As presented in Table 3, the interaction term between ISQMA and AI was found to be significant (H5: β = 0.039, p < 0.010), confirming that AI positively moderates the relationship between ISQMA and AFDR. This indicates that organizations with higher levels of AI integration benefit more from high-quality management accounting systems in terms of producing accurate and reliable financial reports. Figure 3 displays the graphical results of this two-way interaction effect, illustrating that the positive association between ISQMA and AFDR is stronger when AI capabilities are high. This finding reinforces the view that AI-enhanced decision environments improve the efficacy of internal reporting systems.

Figure 3.

Moderation effect of artificial intelligence on the ISQMA–AFDR relationship.

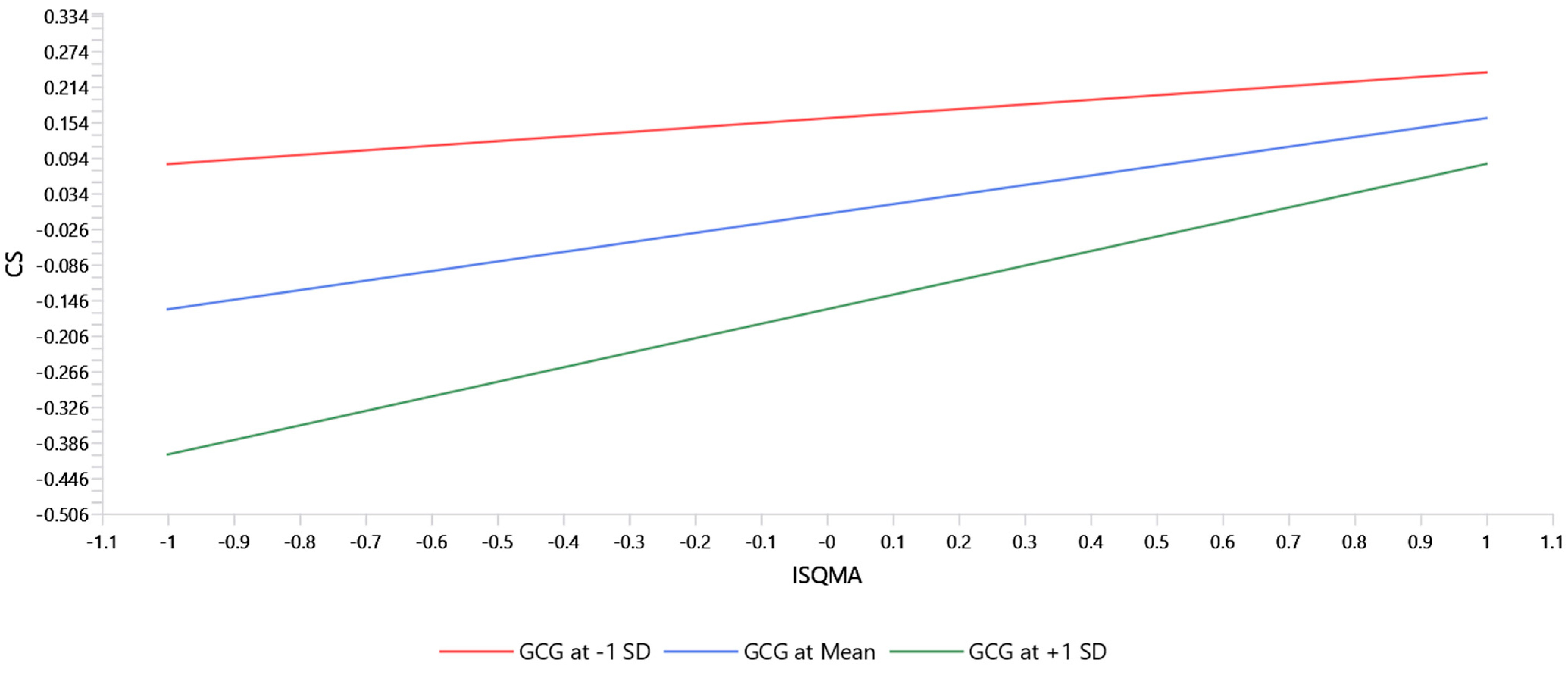

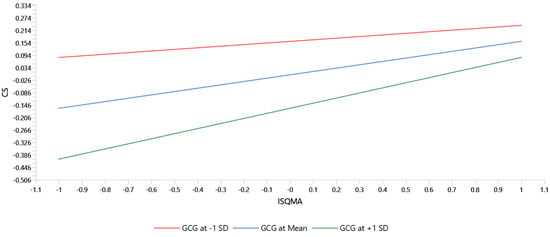

In a similar vein, the interaction between ISQMA and GCG was also found to be significant (H6: β = 0.108, p = 0.001), providing evidence that GCG positively moderates the ISQMA–CS relationship. This suggests that strong green governance practices—such as environmental oversight, ethical leadership, and transparent ESG reporting—amplify the positive association between ISQMA and corporate sustainability outcomes. As shown in Figure 4, the two-way interaction plot demonstrates that under high GCG conditions, the effect of ISQMA on CS is more pronounced. These moderation results support the theoretical proposition from CT that internal system effectiveness is contingent upon complementary contextual factors. Thus, both AI and GCG serve as critical enablers that condition the strength of the relationships between ISQMA, AFDR, and CS, offering valuable insights into how digital and governance infrastructures shape sustainability performance.

Figure 4.

Moderation effect of green corporate governance on the ISQMA–CS relationship.

6. Discussion and Implications

6.1. Discussion of Key Findings

The findings of this study provide valuable insights into how the quality of information systems quality in management accounting contributes to corporate sustainability through the mediating role of financial reporting accuracy and the moderating roles of artificial intelligence and green corporate governance. First, the positive and significant relationship between ISQMA and CS (H1) confirms that high-quality accounting information systems are instrumental in supporting an organization’s ability to implement and sustain sustainability-oriented strategies. This supports earlier research emphasizing that timely, accurate, and integrated information systems enable managers to make informed decisions that align operational efficiency with long-term environmental and social goals [5,52,133]. This finding is consistent with studies by Wang and Zhu [3] and Papiorek and Hiebl [47] which emphasize that robust digital systems play a central role in helping financial institutions implement data-driven sustainability strategies.

Second, the results demonstrate that ISQMA significantly improves the accuracy of financial data reporting (H2), which in turn significantly contributes to corporate sustainability (H3). This supports the notion that financial data accuracy functions as a critical internal capability that bridges the technical quality of accounting systems and broader sustainability outcomes. Accurate and reliable financial reporting improves managerial transparency and accountability while also reducing information asymmetries with stakeholders, a vital condition for mitigating risks such as greenwashing or regulatory non-compliance [34,134]. The mediation analysis further confirmed that accuracy of financial reporting partially transmits the effects of ISQMA on CS (H4), aligning with the RBV which posits that unique, valuable, and well-managed internal resources—such as high-quality financial systems—contribute to sustained competitive advantage [18]. This finding is consistent with Johri [9] and Monteiro et al. [115], who showed that financial reporting accuracy enhances stakeholder confidence and enables firms to build reputational capital linked to sustainability outcomes.

Furthermore, the results revealed that AI positively moderates the relationship between ISQMA and AFDR (H5), indicating that the benefits of ISQMA on reporting accuracy are amplified in organizations with greater AI integration. This finding resonates with recent studies asserting that AI-driven tools enhance data validation, error detection, and processing speed, thereby strengthening the reliability and usefulness of accounting outputs [43,82,84]. This finding aligns with Abdallah et al. [40], Damerji and Salimi [41], and Khan and Gupta [71], who emphasized that AI technologies elevate the decision-making capacity of accounting systems, particularly under dynamic regulatory conditions.

Lastly, the study confirmed that GCG significantly strengthens the positive relationship between ISQMA and CS (H6). This finding reinforces CT, which emphasizes that the effectiveness of organizational systems depends on the alignment between internal processes and external governance environments [19]. Organizations with strong GCG are more likely to translate digital and accounting capabilities into sustainability outcomes through enhanced oversight, ethical conduct, and ESG-oriented strategies [113,135]. This result is consistent with Sarwar et al. [94] and Wang et al. [100], who highlighted that green governance acts as a regulatory and cultural scaffold that reinforces digital investment outcomes in sustainability.

Overall, these findings not only support the hypothesized relationships but also extend the prior literature by confirming the associative links between digital infrastructure quality, financial transparency, and sustainability performance under varying technological and governance conditions. By integrating ISQMA, AFDR, AI, and GCG within a single model, this study contributes to a more nuanced understanding of how firms in emerging economies build resilient and accountable sustainability systems.

6.2. Theoretical Implications

This study offers several important theoretical contributions to the literature on information systems, management accounting, and corporate sustainability. First and foremost, by integrating the RBV and CT, the study extends current theoretical understanding of how internal technological capabilities and external contextual enablers jointly shape sustainability outcomes. The confirmation that ISQMA positively influences CS reinforces RBV’s central tenet that firms gain a competitive advantage through the effective deployment of valuable, rare, and well-integrated internal resources [18]. ISQMA, as a strategic technological asset, contributes not only to operational efficiency but also to long-term sustainability performance—an insight that enriches the accounting and information systems literature with a sustainability-oriented lens [47,52]. This finding advances RBV by illustrating how ISQMA serves not merely as a technical tool, but as a strategic resource that facilitates informed decision-making, stakeholder communication, and sustainable development in data-centric organizations.

Second, the study highlights the mediating role of AFDR, positioning it as a pivotal mechanism that explains how the technical quality of accounting information systems is transformed into broader sustainability outcomes. This mediation pathway has been underexplored in prior research and helps bridge the micro-level focus of information system capabilities with macro-level sustainability goals, offering a more integrated explanation of ISQMA’s impact. It also advances theoretical discussions on transparency, accountability, and information quality as drivers of corporate legitimacy and stakeholder trust [9,115]. By framing AFDR as a mediating capability, the study extends RBV by identifying accurate financial reporting as an embedded knowledge-based asset that enhances the resource value of ISQMA in achieving competitive advantage through sustainability.

Third, the incorporation of AI and GCG as moderators provides a novel theoretical lens through the CT framework. The finding that AI strengthens the ISQMA–AFDR relationship underscores the importance of technological readiness and innovation capacity as contingent conditions that enhance the effectiveness of internal systems [40,41,42,136]. Simultaneously, the moderating effect of GCG on the ISQMA–CS relationship demonstrates how institutional and governance frameworks shape the translation of digital capabilities into sustainable performance. This reflects Fiedler’s [19] assertion that organizational outcomes depend on the fit between internal systems and external environments, especially in contexts demanding ethical leadership and ESG alignment [113,137]. These insights enhance CT by offering empirical support for the premise that both technological and institutional contingencies condition the performance impact of internal capabilities in sustainability-sensitive contexts.

Collectively, these theoretical implications contribute to a more holistic understanding of how digital infrastructures, governance structures, and reporting mechanisms interact to shape corporate sustainability. By building and empirically validating a multi-path framework, the study advances the conceptual boundaries of both RBV and CT in the sustainability context—thus addressing a notable gap in the intersection of information systems and the corporate sustainability literature, particularly in emerging markets. The study also provides a conceptual foundation for future research to explore how organizations can align internal information systems with evolving governance and technological environments to improve sustainability-related outcomes.

6.3. Managerial Implications

The findings of this study provide several actionable insights for managers and decision-makers in the banking and financial services sector, particularly those operating in emerging markets where the integration of digital technologies and sustainability practices is gaining momentum. First, the demonstrated positive effect of ISQMA on CS underscores the need for firms to invest in high-quality, integrated, and user-friendly accounting information systems. Managers should prioritize the development and continuous improvement of information systems that enhance data accuracy, automation, customization, and system-wide integration, as these features directly contribute to the organization’s ability to monitor and achieve its sustainability goals [5,52,138]. This recommendation aligns with increasing global regulatory scrutiny and stakeholder demand for real-time sustainability metrics, thus requiring digital infrastructures that support timely ESG reporting and strategic planning.

Second, the study highlights the crucial role of AFDR as a mediating mechanism between ISQMA and CS. Managers must ensure that financial data is not only technically accurate but also timely, transparent, and accessible to both internal decision-makers and external stakeholders. This can be achieved through strengthened internal audit functions, data validation protocols, and real-time reporting dashboards, all of which reduce the risk of greenwashing, enhance regulatory compliance, and foster stakeholder trust [9,115]. Implementing standardized financial reporting templates aligned with ESG disclosure frameworks such as GRI and CSRD can further institutionalize these practices, ensuring consistency and comparability across reporting periods.

Third, the findings suggest that the strategic use of AI can amplify the impact of ISQMA on financial data quality. Managers should consider adopting AI-driven solutions such as predictive analytics, machine learning algorithms, and automated financial reporting tools that enhance the speed and accuracy of data processing. These technologies can help organizations move beyond traditional reporting to real-time monitoring and proactive sustainability management [9]. However, this also requires upskilling the workforce, updating IT infrastructure, and addressing data privacy and governance concerns to ensure AI adoption is both ethical and effective. In particular, organizations should implement AI governance frameworks that define roles, accountability, and transparency in algorithmic decision-making, thereby aligning digital transformation with stakeholder trust and compliance objectives.

Lastly, the study underscores the importance of GCG in enhancing the sustainability outcomes of digital transformation efforts. Senior executives and board members should embed environmental and social governance principles into the corporate strategy, promote sustainability-oriented decision-making, and establish oversight mechanisms that ensure alignment between digital investments and long-term sustainability objectives [100,114,137]. Specific actions include integrating sustainability KPIs into executive performance reviews, appointing ESG-focused leadership roles, and maintaining an open disclosure culture that highlights environmental and social impacts alongside financial metrics. Collectively, these managerial practices can enable firms to better leverage information systems not only for operational efficiency but also for meaningful contributions to environmental and societal well-being, thus fulfilling the dual imperative of digital innovation and corporate responsibility.

6.4. Limitations and Future Research Directions

Despite its theoretical and practical contributions, this study is subject to several limitations that offer opportunities for future research. First, the data were collected using a cross-sectional survey design, which limits the ability to infer causal relationships among the constructs over time. Accordingly, the findings reflect associative patterns rather than definitive causal effects. Future studies could employ longitudinal designs to capture temporal changes in information systems quality and sustainability outcomes, enabling deeper insight into how these relationships evolve. Second, this study focused exclusively on the commercial banking sector in Jordan, potentially limiting generalizability to other industries or national contexts. Replicating this research in other sectors—particularly in more digitally mature or environmentally regulated economies—could enhance external validity and provide comparative insights.

Third, while purposive sampling was useful for targeting informed respondents, it may have introduced selection bias. Future research could use probability-based or stratified sampling to ensure broader organizational representation. Fourth, the construct of green corporate governance (GCG) was measured using only two items, which may limit the comprehensiveness and precision of the moderation analysis. Future research should consider adopting or refining multi-dimensional scales that capture the wider scope of GCG, including board oversight, ESG transparency, and environmental accountability practices. Finally, although this study incorporated both mediating and moderating mechanisms, future research could explore additional variables such as digital mindset, data governance maturity, or regulatory pressure as boundary conditions shaping the information systems–sustainability relationship. Employing qualitative or mixed-methods approaches could also provide richer contextual understanding and validate the observed statistical associations.

6.5. Conclusions

This study investigated how ISQMA is associated with CS, with AFDR as a mediating mechanism and AI and GCG as moderators. Grounded in the RBV and CT, the findings confirm that ISQMA is positively linked to both AFDR and CS, while AFDR partially mediates the ISQMA–CS relationship, indicating the importance of accurate reporting in sustainability-oriented strategies. This partial mediation reinforces that financial data quality serves not only as an outcome of effective systems but also as a critical conduit through which system quality influences broader sustainability practices. The moderating roles of AI and GCG further demonstrate that the effectiveness of ISQMA is contingent upon the technological readiness and governance environment of the firm, highlighting the critical role of external enablers in strengthening the digital–sustainability nexus. AI was found to significantly enhance the ISQMA–AFDR link, while GCG strengthened the ISQMA–CS association, affirming that advanced technologies and governance frameworks elevate the utility of information systems in sustainability contexts. These insights contribute to an integrative understanding of how internal digital capabilities and contextual factors interact to support sustainability initiatives in the banking sector. By clarifying these interrelationships and emphasizing the associative—not causal—nature of the findings, this study responds to methodological limitations inherent in cross-sectional designs. Ultimately, the results validate a multi-level framework where system quality, reporting accuracy, and institutional supports jointly inform digital transformation outcomes aligned with sustainability objectives. Collectively, the conclusions offer theoretical and practical contributions to the growing discourse on how digital infrastructure, accurate data reporting, and responsible governance can jointly inform sustainable business practices, particularly within emerging markets.

Author Contributions

Writing—original draft, N.N.; formal analysis, N.N.; supervision, D.Ç.; project administration D.Ç.; writing—review and editing, N.N. and D.Ç. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki and approved by the Business Faculty Research Ethics Committee of Girne American University.

Informed Consent Statement

All participants in this study provided their informed consent.

Data Availability Statement

The data from this study can be requested from the corresponding author, Nidal Neiroukh.

Conflicts of Interest

The authors report no conflicts of interest.

Appendix A

Table A1.

Mapping of Questionnaire Items to Constructs, Sources, and Related Hypotheses.

Table A1.

Mapping of Questionnaire Items to Constructs, Sources, and Related Hypotheses.

| Construct | Sample Items | Source | Related Hypotheses |

|---|---|---|---|

| Information Systems Quality in Management Accounting (ISQMA) | 1. Fast access and calculation times 2. User-friendliness 3. Automation and standardization 4. Flexibility/customization 5. Full integration of the IT system 6. Data quality | Knauer et al. [52]; Papiorek and Hiebl [47] | H1, H2, H4, H5, H6 |

| Accuracy of Financial Data Reporting (AFDR) | 1. The accuracy of financial information helps decision-making 2. FI is carefully prepared to ensure its reliability 3. FI is easily understood by its user 4. FI represents in a reliable way what you want to portray | Johri [9] Monteiro et al. [115] | H2, H3 |

| Artificial Intelligence (AI) | 1. AI can help me find lost data 2. AI provides accurate data 3. AI supports important decisions 4. AI can display hard-to-measure data 5. AI protects privacy 6. AI helps complete tasks 7. AI is auditable | Paschen et al. [116]; Wijayati et al. [117] | H5 |

| Green Corporate Governance (GCG) | 1. Green corporate governance encourages economic growth 2. Green corporate governance enhances cost efficiency and investor confidence | Peng [113]; Subedi [114]; Wang et al. [100] | H6 |

| Corporate Sustainability (CS) | 1. Our company’s profitability is in good standing 2. Our firm has a good competitive position 3. We are successful in reducing costs 4. We have a high brand value 5. Our financial condition is good | Bağış et al. [118]; Svensson and Wagner [119] | H1, H3, H6 |

References

- Li, X.; Khan, I.U. Green Transformation in Portfolio: The Role of Sustainable Practices in Investment Decisions. Sustainability 2025, 17, 1055. [Google Scholar] [CrossRef]

- Zhao, X.; Qian, Y. Does Digital Technology Promote Green Innovation Performance? J. Knowl. Econ. 2024, 15, 7568–7587. [Google Scholar] [CrossRef]

- Wang, X.; Zhu, W. Exploring the Relationship Between Accounting Information System (AIS) Quality and Corporate Sustainability Performance Using the IS Success Model. Sustainability 2025, 17, 1595. [Google Scholar] [CrossRef]

- Jourabchi Amirkhizi, P.; Pedrammehr, S.; Pakzad, S.; Shahhoseini, A. Generative Artificial Intelligence in Adaptive Social Manufacturing: A Pathway to Achieving Industry 5.0 Sustainability Goals. Processes 2025, 13, 1174. [Google Scholar] [CrossRef]

- Lutfi, A.; Al-Okaily, M.; Alsyouf, A.; Alrawad, M. Evaluating the D&M IS Success Model in the Context of Accounting Information System and Sustainable Decision Making. Sustainability 2022, 14, 8120. [Google Scholar] [CrossRef]

- Khodayareyeganeh, S.; Pourzamani, Z.; Jahanshad, A.; Royai, R.A. A Comparative Study of the Effect of Community Development on Improving the Quality of Financial Reporting of Companies with an Emphasis on the Efficiency and Effectiveness of Strategic Management Accounting Techniques a Comparative Study of Iran and Japan). Int. J. Nonlinear Anal. Appl. 2024, 15, 243–261. [Google Scholar] [CrossRef]

- Kazemi, A.; Mehrani, S.; Homayoun, S. Risk in Sustainability Reporting: Designing a DEMATEL-Based Model for Enhanced Transparency and Accountability. Sustainability 2025, 17, 549. [Google Scholar] [CrossRef]

- Datsenko, H.; Kudyrko, O.; Krupelnytska, I.; Maister, L.; Hladii, I.; Kopchykova, I. Innovative Approaches to the Use of Artificial Intelligence in Accounting, Control, and Analytical Processes to Enhance Enterprise Competitiveness. Salud Cienc. Tecnol.-Ser. Conf. 2024, 3, 1. [Google Scholar] [CrossRef]

- Johri, A. Impact of Artificial Intelligence on the Performance and Quality of Accounting Information Systems and Accuracy of Financial Data Reporting. In Accounting Forum; Routledge: London, UK, 2025. [Google Scholar]

- Li, W.; Zhang, M. Digital Transformation, Absorptive Capacity and Enterprise ESG Performance: A Case Study of Strategic Emerging Industries. Sustainability 2024, 16, 5018. [Google Scholar] [CrossRef]

- Silva, P.D.; Gunarathne, N.; Kumar, S. Exploring the Impact of Digital Knowledge, Integration and Performance on Sustainable Accounting, Reporting and Assurance. Meditari Account. Res. 2024, 33, 497–552. [Google Scholar] [CrossRef]

- Mishra, N.K.; Mishra, N.; Sharma, P.P. Unraveling the Relationship between Corporate Governance and Green Innovation: A Systematic Literature Review. Manag. Res. Rev. 2025, 48, 825–845. [Google Scholar] [CrossRef]

- Suhartini, D.; Tjahjadi, B.; Fayanni, Y. Impact of Sustainability Reporting and Governance on Firm Value: Insights from the Indonesian Manufacturing Sector. Cogent Bus. Manag. 2024, 11, 2381087. [Google Scholar] [CrossRef]

- Darnall, N.; Ji, H.; Iwata, K.; Arimura, T.H. Do ESG Reporting Guidelines and Verifications Enhance Firms’ Information Disclosure? Corp. Soc. Responsib. Environ. Manag. 2022, 29, 1214–1230. [Google Scholar] [CrossRef]

- Tran Thanh Thuy, N. Effect of Accounting Information System Quality on Decision-Making Success and Non-Financial Performance: Does Non-Financial Information Quality Matter? Cogent Bus. Manag. 2025, 12, 2447913. [Google Scholar] [CrossRef]

- Karagiorgos, A.; Lazos, G.; Stavropoulos, A.; Karagiorgou, D.; Valkani, F. Information System Assisted Knowledge Accounting and Cognitive Managerial Implications. EuroMed J. Bus. 2022, 20, 1–20. [Google Scholar] [CrossRef]

- Xiao, Y.; Xiao, L. The Impact of Artificial Intelligence-Driven ESG Performance on Sustainable Development of Central State-Owned Enterprises Listed Companies. Sci. Rep. 2025, 15, 8548. [Google Scholar] [CrossRef] [PubMed]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Fiedler, F.E. A Contingency Model of Leadership Effectiveness. In Advances in Experimental Social Psychology; Berkowitz, L., Ed.; Academic Press: Cambridge, MA, USA, 1964; Volume 1, pp. 149–190. [Google Scholar]

- Malhotra, G.; Dandotiya, G.; Shaiwalini, S.; Khan, A.; Homechaudhuri, S. Benchmarking for Organisational Competitiveness: A Resource-Based View Perspective. Benchmarking Int. J. 2024, 32, 943–964. [Google Scholar] [CrossRef]

- Cobbinah, J.; Osei, A.; Amoah, J.O. Innovating for a Greener Future: Do Digital Transformation and Innovation Capacity Drive Enterprise Green Total Factor Productivity in the Knowledge Economy? J. Knowl. Econ. 2025. [Google Scholar] [CrossRef]

- Gopal, S.; Pitts, J. Regulation and Frameworks: Current and Future Reporting Trends. In The FinTech Revolution: Bridging Geospatial Data Science, AI, and Sustainability; Gopal, S., Pitts, J., Eds.; Springer Nature: Cham, Switzerland, 2024; pp. 183–224. ISBN 978-3-031-74418-1. [Google Scholar]

- Al-atrsh, M.A. The Impact of Sustainability Financial Data Governance, Political Connection on Financial Reporting Quality. 2023. Available online: https://assets-eu.researchsquare.com/files/rs-3262012/v1/b1c6760d-f741-4e86-ac5f-1f6495f98b87.pdf?c=1692213426 (accessed on 25 May 2025).

- Yusuf, R.; Muyiwa, E.D. The Future of Accounting: Efficacy of Big Data on Accountant’s Functions in the Accounting Information Systems. Asian J. Econ. Bus. Account. 2024, 24, 162–177. [Google Scholar] [CrossRef]

- Beer, M.; Voelpel, S.C.; Leibold, M.; Tekie, E.B. Strategic Management as Organizational Learning: Developing Fit and Alignment through a Disciplined Process. Long Range Plan. 2005, 38, 445–465. [Google Scholar] [CrossRef]

- Kathuria, R.; Joshi, M.P.; Porth, S.J. Organizational Alignment and Performance: Past, Present and Future. Manag. Decis. 2007, 45, 503–517. [Google Scholar] [CrossRef]

- Powell, T.C. Organizational Alignment as Competitive Advantage. Strateg. Manag. J. 1992, 13, 119–134. [Google Scholar] [CrossRef]

- Arkhipova, D.; Montemari, M.; Mio, C.; Marasca, S. Digital Technologies and the Evolution of the Management Accounting Profession: A Grounded Theory Literature Review. Meditari Account. Res. 2024, 32, 35–64. [Google Scholar] [CrossRef]

- Zhen, X.; Zhen, L. Accounting Information Systems and Strategic Performance: The Interplay of Digital Technology and Edge Computing Devices. J. Grid Comput. 2023, 22, 5. [Google Scholar] [CrossRef]

- Zahari, A.I.; Said, J.; Muhamad, N.; Ramly, S.M. Ethical Culture and Leadership for Sustainability and Governance in Public Sector Organisations within the ESG Framework. J. Open Innov. Technol. Mark. Complex. 2024, 10, 100219. [Google Scholar] [CrossRef]