Systematically Formulating Investments for Carbon Offset by Multiple-Objective Portfolio Selection: Classifying, Evolving, and Optimizing

Abstract

1. Introduction

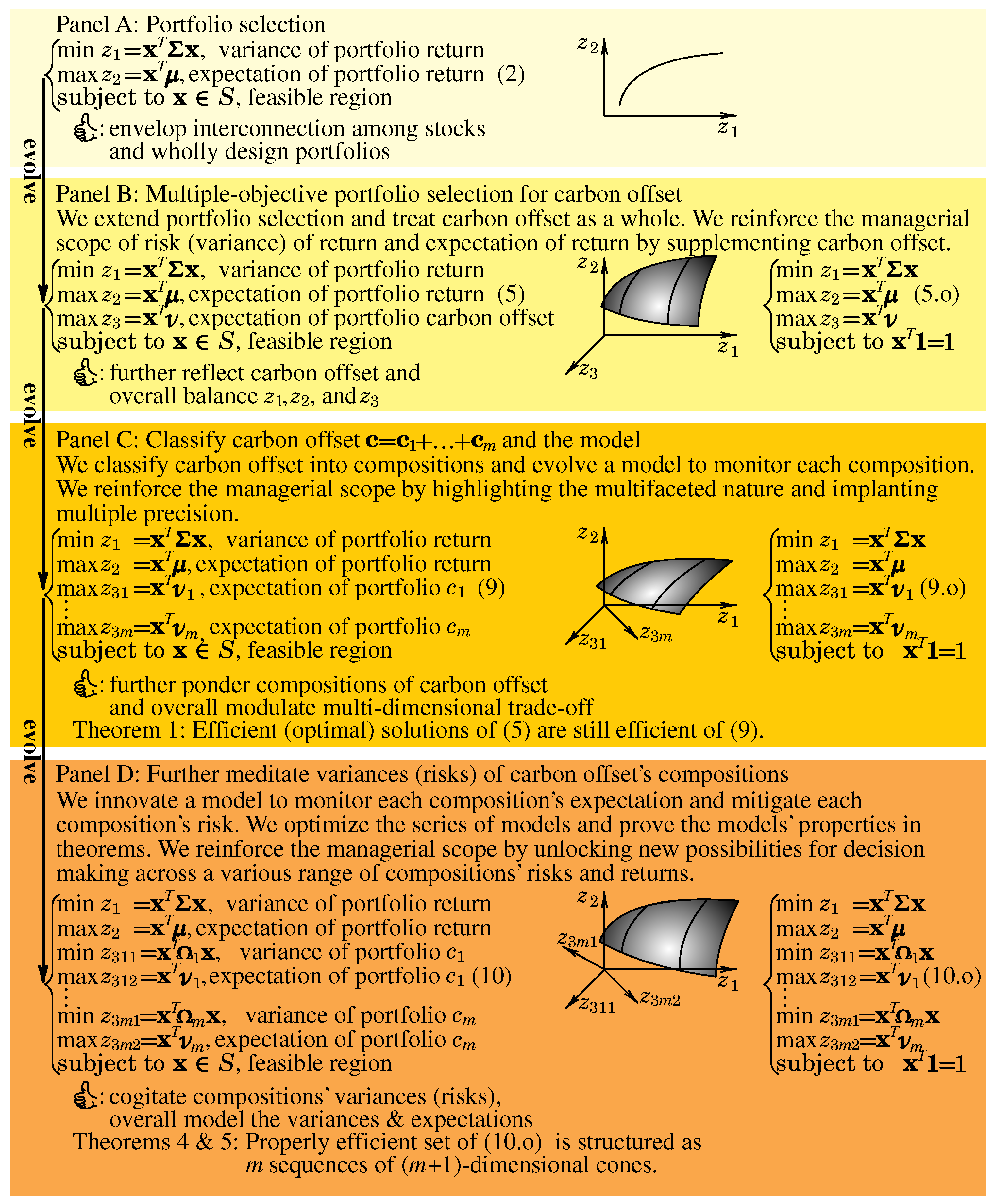

- Panel A: portfolio selection;

- Panel B: multiple-objective portfolio selection for carbon offset;

- Panel C: classify carbon offset and the model; and

- Panel D: further meditate variances (risks) of carbon offset’s compositions.

- Formulate and evolve (for the models and model evolution);

- Envisage (for the figures); and

- Optimize.

1.1. Carbon Offset

1.2. The Urgency to Engineer Carbon Offset Investments by Multiple-Objective Portfolio Selection in Stock Markets

1.3. Portfolio Selection as the Birth of Modern Finance

1.4. The Rise of Multiple-Objective Portfolio Selection as Extensions of Portfolio Selection

1.5. Theoretical Originality and Practical Contribution

1.5.1. Overall Originality and Contribution

1.5.2. Formulating

1.5.3. Classifying

- In (4), for the vector of carbon offsets of the n stocks as (as an vector) and a portfolio weight vector (as an vector), we calculate the portfolio carbon offset c (as a scalar).

- Similarly, for the vector of carbon offset’s first compositions of the n stocks as (as an vector) and a portfolio weight vector (as an vector), we follow (4) and calculate the portfolio (as a scalar) as follows:

1.5.4. Evolving

1.5.5. Optimizing

1.6. Paper Structure

2. Theoretical Background: Multiple-Objective Optimization and Portfolio Optimization

2.1. Multiple-Objective Optimization

- Set of efficient decision vectors as an efficient set (denoted as E);

- Set of nondominated criterion vectors as a nondominated set (denoted as N);

- Set of properly efficient decision vectors as a properly efficient set; and

- Set of properly nondominated criterion vectors as a properly nondominated set.

2.2. Multiple-Objective Portfolio Optimization

2.2.1. Analytical Methods

2.2.2. Repetitive Quadratic Programming

2.2.3. Parametric Quadratic Programming

2.2.4. Heuristic Methods

2.2.5. Other Latest Methods

2.3. Investments for Carbon Offset

3. Formulation and Evolution

3.1. Further Justifying and Illuminating (5)

3.2. Proving the Consistency of Efficient Solutions from (5) to (9)

4. Optimization

4.1. Graphically Comparing Portfolio Optimization Methods

4.2. Optimizing (5.o)

4.3. Optimizing (9.o)

4.4. Optimizing (10.o)

4.5. Sensitivity Analyses

5. Illustration

6. Discussion

6.1. Practical, Theoretical, and Managerial Implications

6.2. Generality of the Formulation

6.3. Future Directions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Lists of Major Symbols and Meanings

Appendix A.1. English Symbols

- 1.

- is a vector, denotes the vector with all entries equal to one, and is introduced in (5.o).

- 2.

- is a vector, denotes the vector of carbon offset of the n stocks, and is introduced in (4).

- 3.

- c is a scalar, denotes the portfolio carbon offset, and is introduced in (4).

- 4.

- … are vectors, denote the vector of carbon offset’s first composition of the n stocks …the vector of carbon offset’s last composition of the n stocks, and are introduced in (6).

- 5.

- … are scalars, denote portfolio …portfolio , and are introduced in (7).

- 6.

- E is set, denotes the set of efficient decision vectors as efficient set, and is introduced in Section 2.1.

- 7.

- are scalars, denote objective functions, and are introduced in (11).

- 8.

- k is a scalar, denotes the number of objectives, and is introduced in (11).

- 9.

- N is set, denotes the set of nondominated criterion vectors as nondominated set, and is introduced in Section 2.1.

- 10.

- n is a scalar, denotes the number of stocks, and is introduced in Section 1.3.

- 11.

- is a random vector, denotes the return vector of n stocks, and is introduced in Section 1.3.

- 12.

- r is a random variable (random scalar), denotes portfolio return, and is introduced in (1).

- 13.

- 14.

- is an vector, denotes a portfolio weight vector, and is introduced in Section 1.3.

- 15.

- is a vector and is introduced in (24).

- 16.

- Z is a set, denotes the feasible region in criterion space, and is introduced in (11).

- 17.

- is a vector, denotes a criterion vector, and is introduced in (11).

- 18.

- is a scalar, denotes the variance of r, and is introduced in (2).

- 19.

- is a scalar, denotes the expectation of r, and is introduced in (2).

- 20.

- are scalars, denote the expectations of general portfolio objectives, and are introduced in (3).

- 21.

- … are scalars, denote the expectation of portfolio …the expectation of portfolio , and are introduced in (9).

- 22.

- … are scalars, denote the variance of portfolio …variance of portfolio , and are introduced in (10).

- 23.

- … are scalars, denote the expectation of portfolio …expectation of portfolio , and are introduced in (10).

Appendix A.2. Greek Symbols

- 1.

- is a vector and is introduced in (25).

- 2.

- is a vector and is introduced in (26).

- 3.

- is a vector and is introduced in (30).

- 4.

- is a vector and is introduced in (31).

- 5.

- is a vector and is introduced in (36).

- 6.

- is a vector and is introduced in (37).

- 7.

- is an vector, denotes the expectations of stock returns (i.e., , and is introduced in (2).

- 8.

- are vectors, denote vectors of the expectations of general stock objectives, and are introduced in (3).

- 9.

- is a vector, denotes the expectations of stock carbon offsets, and is introduced in (5).

- 10.

- … are vectors, denote the expectations of stock …, and are introduced in (9).

- 11.

- … are matrices, denote the covariance matrices of …, and are introduced in (10).

- 12.

- is an matrix, denotes the covariance matrix of , and is introduced in (2).

- 13.

- is a vector and is introduced in (33).

| 1 | Morgan Stanley predicts that voluntary carbon offset markets will advance from $2 billion in 2020 to $250 billion in 2050. Data source: “Where the Carbon Offset Market Is Poised to Surge”, Morgan Stanley. https://www.morganstanley.com/ideas/carbon-offset-market-growth (accessed on 1 March 2025). |

| 2 | Steuer [10] illuminated multiple-objective optimization. |

| 3 | Please note the difference between c (portfolio carbon offset as a scalar) and (stock carbon offsets as a vector). |

| 4 | Please note the difference between (portfolio level as a scalar) and (stock level as a vector). |

| 5 | We fantasize full and precise optimization (rather than partial and heuristic optimization) and will compare optimization methods in Section 4. |

| 6 | Pistikopoulos et al. [43] (pp. 6–7) defined parametric programming as optimization with parameters, while ordinary optimization (e.g., quadratic programming) carries no parameters. |

| 7 | By Assumption 1, we deduce , and is well-defined. |

| 8 | Data source: “Global Carbon Offsets Report”, OPIS, a Dow Jones company. https://www.opisnet.com/product/pricing/spot/carbon-offsets-report/ (accessed on 4 March 2025) |

References

- Huber, E.; Bach, V.; Finkbeiner, M. A qualitative meta-analysis of carbon offset quality criteria. J. Environ. Manag. 2024, 352, 119983. [Google Scholar] [CrossRef] [PubMed]

- de Mello, F.P. Voluntary carbon offset programs in aviation: A systematic literature review. Transp. Policy 2024, 147, 158–168. [Google Scholar] [CrossRef]

- Wei, J.; Zhao, K.; Zhang, L.; Yang, R.; Wang, M. Exploring development and evolutionary trends in carbon offset research: A bibliometric perspective. Environ. Sci. Pollut. 2021, 28, 18850–18869. [Google Scholar] [CrossRef] [PubMed]

- Hyams, K.; Fawcett, T. The ethics of carbon offsetting. WIREs Clim. Chang. 2013, 4, 91–98. [Google Scholar] [CrossRef]

- González-Ramírez, J.; Kling, C.L.; Valcu, A. An overview of carbon offsets from agriculture. Annu. Rev. Resour. Econ. 2012, 4, 145–160. [Google Scholar] [CrossRef]

- Lovell, H.C. Governing the carbon offset market. WIREs Clim. Chang. 2010, 1, 353–362. [Google Scholar] [CrossRef]

- Markowitz, H.M. Portfolio Selection: Efficient Diversification in Investments, 1st ed.; John Wiley & Sons: New York, NY, USA, 1959. [Google Scholar]

- Rubinstein, M. Markowitz’s “portfolio selection”: A fifty-year retrospective. J. Financ. 2002, 57, 1041–1045. [Google Scholar] [CrossRef]

- Markowitz, H.M. Portfolio Selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Steuer, R.E. Multiple Criteria Optimization: Theory, Computation, and Application; John Wiley & Sons: New York, NY, USA, 1986. [Google Scholar]

- Markowitz, H.M. Foundations of portfolio selection. J. Financ. 1991, 46, 469–477. [Google Scholar] [CrossRef]

- Sharpe, W.F. Optimal Portfolios without Bounds on Holdings. Ph.D. Thesis, Graduate School of Business, Stanford University, Stanford, CA, USA, 2001. Available online: https://web.stanford.edu/~wfsharpe/mia/opt/mia_opt2.htm (accessed on 28 May 2025).

- Markowitz, H.M. How to represent mark-to-market possibilities with the general portfolio selection model. J. Portf. Manag. 2013, 39, 1–3. [Google Scholar] [CrossRef]

- Fama, E.F. Multifactor portfolio efficiency and multifactor asset pricing. J. Financ. Quant. Anal. 1996, 31, 441–465. [Google Scholar] [CrossRef]

- Cochrane, J.H. Presidential address: Discount rates. J. Financ. 2011, 66, 1047–1108. [Google Scholar] [CrossRef]

- Harvey, C.R.; Siddique, A. Conditional skewness in asset pricing tests. J. Financ. 2000, 55, 1263–1296. [Google Scholar] [CrossRef]

- Lo, A.W.; Petrov, C.; Wierzbicki, M. It’s 11pm—Do you know where your liquidity is? The mean-variance-liquidity frontier. J. Invest. Manag. 2003, 1, 55–93. [Google Scholar]

- Pedersen, L.H.; Fitzgibbons, S.; Pomorski, L. Responsible investing: The ESG-efficient frontier. J. Financ. Econ. 2021, 142, 572–597. [Google Scholar] [CrossRef]

- Chow, G. Portfolio selection based on return, risk, and relative performance. Financ. Anal. J. 1995, 51, 54–60. [Google Scholar] [CrossRef]

- Ehrgott, M.; Klamroth, K.; Schwehm, C. An MCDM Approach to Portfolio Optimization. Eur. J. Oper. Res. 2004, 155, 752–770. [Google Scholar] [CrossRef]

- Steuer, R.E.; Qi, Y.; Hirschberger, M. Suitable-portfolio investors, nondominated frontier sensitivity, and the effect of multiple objectives on standard portfolio selection. Ann. Oper. Res. 2007, 152, 297–317. [Google Scholar] [CrossRef]

- Dorfleitner, G.; Leidl, M.; Reeder, J. Theory of social returns in portfolio choice with application to microfinance. J. Asset Manag. 2012, 13, 384–400. [Google Scholar] [CrossRef]

- Hirschberger, M.; Steuer, R.E.; Utz, S.; Wimmer, M.; Qi, Y. Computing the nondominated surface in tri-criterion portfolio selection. Oper. Res. 2013, 61, 169–183. [Google Scholar] [CrossRef]

- Utz, S.; Wimmer, M.; Steuer, R.E. Tri-criterion modeling for constructing more-sustainable mutual funds. Eur. J. Oper. Res. 2015, 246, 331–338. [Google Scholar] [CrossRef]

- Qi, Y.; Steuer, R.E.; Wimmer, M. An analytical derivation of the efficient surface in portfolio selection with three criteria. Ann. Oper. Res. 2017, 251, 161–177. [Google Scholar] [CrossRef]

- Qi, Y.; Steuer, R.E. On the analytical derivation of efficient sets in quad-and-higher criterion portfolio selection. Ann. Oper. Res. 2020, 293, 521–538. [Google Scholar] [CrossRef]

- Utz, S.; Steuer, R.E. Empirical analysis of the trade-offs among risk, return, and climate risk in multi-criteria portfolio optimization. Ann. Oper. Res. 2024, Epub ahead of printing. [Google Scholar] [CrossRef]

- Spronk, J.; Hallerbach, W.G. Financial modelling: Where to go? With an illustration for portfolio management. Eur. J. Oper. Res. 1997, 99, 113–127. [Google Scholar] [CrossRef]

- Bana e Costa, C.A.; Soares, J.O. Multicriteria approaches for portfolio selection: An overview. Rev. Financ. Mark. 2001, 4, 19–26. [Google Scholar]

- Steuer, R.E.; Na, P. Multiple criteria decision making combined with finance: A categorized bibliography. Eur. J. Oper. Res. 2003, 150, 496–515. [Google Scholar] [CrossRef]

- Zopounidis, C.; Galariotis, E.; Doumpos, M.; Sarri, S.; Andriosopoulos, K. Multiple criteria decision aiding for finance: An updated bibliographic survey. Eur. J. Oper. Res. 2015, 247, 339–348. [Google Scholar] [CrossRef]

- Aouni, B.; Doumpos, M.; Pérez-Gladish, B.; Steuer, R.E. On the increasing importance of multiple criteria decision aid methods for portfolio selection. J. Oper. Res. Soc. 2018, 69, 1525–1542. [Google Scholar] [CrossRef]

- La Torre, D.; Boubaker, S.; Pérez-Gladish, B.; Zopounidis, C. Preface to the special issue on multidimensional finance, insurance, and investment. Int. Trans. Oper. Res. 2023, 30, 2137–2138. [Google Scholar] [CrossRef]

- Qi, Y.; Steuer, R.E. An analytical derivation of properly efficient sets in multi-objective portfolio selection. Ann. Oper. Res. 2025, 346, 1573–1595. [Google Scholar] [CrossRef]

- Qi, Y. Parametrically computing efficient frontiers of portfolio selection and reporting and utilizing the piecewise-segment structure. J. Oper. Res. Soc. 2020, 71, 1675–1690. [Google Scholar] [CrossRef]

- Sharpe, W.F. Portfolio Theory and Capital Markets, 1st ed.; McGraw-Hill: New York, NY, USA, 1970. [Google Scholar]

- Merton, R.C. An analytical derivation of the efficient portfolio frontier. J. Financ. Quant. Anal. 1972, 7, 1851–1872. [Google Scholar] [CrossRef]

- Sharpe, W.F. Capital asset prices: A theory of market equilibrium. J. Financ. 1964, 19, 425–442. [Google Scholar]

- Huang, C.; Litzenberger, R.H. Foundations for Financial Economics; Prentice Hall: Englewood Cliffs, NJ, USA, 1988. [Google Scholar]

- Bodie, Z.; Kane, A.; Marcus, A.J. Investments, 12th ed.; McGraw-Hill Education: New York, NY, USA, 2021. [Google Scholar]

- Markowitz, H.M. The optimization of a quadratic function subject to linear constraints. Nav. Res. Logist. Q. 1956, 3, 111–133. [Google Scholar] [CrossRef]

- Markowitz, H.M.; Todd, G.P. Mean-Variance Analysis in Portfolio Choice and Capital Markets; Frank J. Fabozzi Associates: New Hope, PA, USA, 2000. [Google Scholar]

- Pistikopoulos, E.N.; Diangelakis, N.A.; Oberdieck, R. Multi-parametric Optimization and Control, 1st ed.; John Wiley & Sons: Hoboken, NJ, USA, 2021. [Google Scholar]

- Goh, C.; Yang, X. Analytic efficient solution set for multi-criteria quadratic programs. Eur. J. Oper. Res. 1996, 92, 166–181. [Google Scholar] [CrossRef]

- Jayasekara, P.L.; Adelgren, N.; Wiecek, M.M. On convex multiobjective programs with application to portfolio optimization. J.-Multi-Criteria Decis. Anal. 2019, 27, 189–202. [Google Scholar] [CrossRef]

- Jayasekara, P.L.; Pangia, A.C.; Wiecek, M.M. On solving parametric multiobjective quadratic programs with parameters in general locations. Ann. Oper. Res. 2023, 320, 123–172. [Google Scholar] [CrossRef]

- Deb, K. Multi-Objective Optimization Using Evolutionary Algorithms; John Wiley & Sons: New York, NY, USA, 2001. [Google Scholar]

- Goli, A.; Tirkolaee, E.B. Designing a portfolio-based closed-loop supply chain network for dairy products with a financial approach: Accelerated Benders decomposition algorithm. Comput. Oper. Res. 2023, 155, 106244. [Google Scholar] [CrossRef]

- Tirkolaee, E.B. Circular–sustainable–reliable waste management system design: A Possibilistic multi-objective mixed-integer linear programming model. Systems 2024, 12, 435. [Google Scholar] [CrossRef]

- Biswas, S.; Belamkar, P.; Sarma, D.; Tirkolaee, E.B.; Bera, U.K. A multi-objective optimization approach for resource allocation and transportation planning in institutional quarantine centres. Ann. Oper. Res. 2025, 346, 781–825. [Google Scholar] [CrossRef]

- Lou, J.; Hultman, N.; Patwardhan, A.; Mintzer, I. Corporate motivations and co-benefit valuation in private climate finance investments through voluntary carbon markets. NPJ Clim. Action 2023, 2, 32. [Google Scholar] [CrossRef]

- Lee, J. Investing in carbon emissions reduction in the EOQ model. J. Oper. Res. Soc. 2020, 71, 1289–1300. [Google Scholar] [CrossRef]

- Ngilangwa, B.N. Factors contributing an organization to invest in carbon offset projects. Int. J. Manag. Soc. Sci. 2015, 3, 56–71. [Google Scholar]

- Bolton, P.; Kacperczyk, M. Do investors care about carbon risk? J. Financ. Econ. 2021, 142, 517–549. [Google Scholar] [CrossRef]

- Yan, H.; Li, X.; Huang, Y.; Li, Y. The impact of the consistency of carbon performance and carbon information disclosure on enterprise value. Financ. Res. Lett. 2020, 37, 101680. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lin, L.; Qi, Y. Systematically Formulating Investments for Carbon Offset by Multiple-Objective Portfolio Selection: Classifying, Evolving, and Optimizing. Systems 2025, 13, 441. https://doi.org/10.3390/systems13060441

Lin L, Qi Y. Systematically Formulating Investments for Carbon Offset by Multiple-Objective Portfolio Selection: Classifying, Evolving, and Optimizing. Systems. 2025; 13(6):441. https://doi.org/10.3390/systems13060441

Chicago/Turabian StyleLin, Long, and Yue Qi. 2025. "Systematically Formulating Investments for Carbon Offset by Multiple-Objective Portfolio Selection: Classifying, Evolving, and Optimizing" Systems 13, no. 6: 441. https://doi.org/10.3390/systems13060441

APA StyleLin, L., & Qi, Y. (2025). Systematically Formulating Investments for Carbon Offset by Multiple-Objective Portfolio Selection: Classifying, Evolving, and Optimizing. Systems, 13(6), 441. https://doi.org/10.3390/systems13060441