Abstract

The rapid emergence of the platform economy has accelerated the practice of embedded innovation, with ecosystem partner selection serving as a critical first step in platform enterprises’ innovation collaborations and playing a key role in enhancing innovation efficiency and outcomes. Based on the theory of embedded innovation, this study identifies the core innovation demands of platform enterprises at distinct stages. It then employs QFD to quantify decision indicator weights for ecosystem partner selection. By integrating Prospect Theory with Field Theory, this study develops both a decision evaluation model and an optimization model to achieve the optimal screening of ecosystem partners. Specifically, this study contributes in the following ways: (1) It constructs an embedded innovation direction selection model to uncover the evolving innovation demands at each stage. Within the QFD framework, we map these demands onto selection evaluation indicators, assess their importance via the maximum entropy principle, and determine indicator weights through a correlation matrix. (2) It proposes a Prospect Theory-based TOPSIS evaluation model, incorporating decision-makers’ psychological preferences to mitigate bias arising from singular or excessive risk attitudes. This model ranks potential partners according to their closeness to an ideal solution. Finally, (3) it designs a Field Theory-based optimization model that accounts for the platform enterprise’s perspective, partner-matching rationality, and continuity of interaction. This model emphasizes the complementarity and synergy of innovation resources to enhance cooperation fit and strategic alignment between the platform and its partners. Finally, this study conducts an empirical analysis on platform enterprise XM and validates the model’s feasibility and stability through sensitivity testing and comparative analyses. This study enriches the understanding of ecosystem partner selection within platform ecosystems by advancing methods for quantifying partner demands and refining the selection of evaluation indicators. It also deepens the depiction of non-rational characteristics in behavioral decision-making and elucidates the mechanisms underlying the ongoing interactions between platform enterprises and their ecosystem partners. These theoretical contributions not only extend the scope of research on platform ecosystems and embedded innovation but also provide feasible approaches for platform enterprises to improve partner governance and foster collaborative innovation in dynamic and complex environments. Ultimately, the findings offer strong support for enhancing innovation performance and building sustainable competitive advantages.

1. Introduction

In recent years, the rapid advancement of emerging technologies (e.g., internet, big data, artificial intelligence) coupled with robust innovation-driven policies across nations has fostered a conducive technological and institutional environment for innovation and entrepreneurial activities. This evolution has precipitated the emergence of numerous high-potential technology-based startups. Despite their innovative prowess, these startups frequently encounter developmental constraints due to resource limitations and experiential gaps [1], necessitating collaboration with large enterprises to leverage complementary resources for enhanced competitiveness and accelerated growth [2]. Concurrently, platform enterprises have emerged as pivotal organizational forms, wielding substantial capital, expansive user bases, massive datasets, and elite talent pools. Their ecosystems have become critical hubs for cross-industry business and innovation, establishing platform-based collaborative innovation as a strategic developmental paradigm [3,4]. This symbiotic relationship manifests through dual mechanisms: On the one hand, technology-based startups, as ecosystem partners, gain low-cost access to multifarious resources within platform ecosystems, compensating for innovation resource deficits while enabling novel resource combinations to explore innovation opportunities, thereby driving new product/service development and innovation performance enhancement [5]. On the other hand, as technological complexity escalates, platform enterprises confront capability gaps in critical technological domains, requiring reliance on technology-based startups’ innovation capacities to overcome technological barriers, accelerate product iteration, and ultimately propel strategic advancement. The complementary advantages between platform enterprises and technology-based startups, aligned through shared strategic objectives, form the foundation for collaborative innovation. This context has engendered embedded innovation—a process wherein platform enterprises integrate R&D-capable technology-based startups into their ecosystems via equity investments. Through resource sharing, deep interaction, and collaborative synergy, both parties exploit complementary strengths to enhance cooperation efficiency [6]. Crucially, embedded innovation facilitates acquisition and integration of heterogeneous resources while mitigating constraints from resource disparity, thereby unlocking the platform ecosystem’s full innovation potential [7]. The success of embedded innovation largely hinges on whether platform enterprises can make informed and strategic selections of technology-based startups that are both highly compatible and capable as ecosystem partners. A sound partner selection not only increases the likelihood of successful collaborative innovation but also enhances the openness and dynamism of the platform ecosystem, thus generating greater commercial value. In practice, however, platform enterprises encounter multifaceted challenges. On one hand, selecting ecosystem partners is inherently complex, requiring careful trade-offs across multiple dimensions—including innovation demands, resource complementarity, strategic alignment, and governance mechanisms. A single misjudgment in any of these dimensions can compromise collaborative efficiency or lead to unnecessary resource expenditure. On the other hand, the collaborative innovation process itself is fraught with uncertainty. It involves diverse technological trajectories, the dynamic evolution of platform ecosystems, and the unpredictability of inter-organizational cooperation, all of which significantly elevate collaboration risks and hinder stable innovation progress.

Given these challenges, there is a pressing need for systematic investigation into the selection of ecosystem partners by platform enterprises engaged in embedded innovation. This study aims to develop a theoretically grounded decision-making framework that integrates the identification of innovation demands, the characterization of behavioral preferences, and the modeling of interaction mechanisms. Such a framework is expected to provide strong support for high-quality collaborative practices and facilitate the continuous evolution and value co-creation of platform ecosystems.

Accordingly, this study focuses on the following three critical research questions:

- (1)

- How can the mechanism of complementarity between platform enterprises and ecosystem partners be manifested through the mapping of embedded innovation demands to the evaluation indicators of potential partners? Specifically, how can the varying levels of attention that platform enterprises assign to different innovation demands be systematically operationalized as corresponding indicator weights, thereby enhancing the relevance and explanatory power of the evaluation system?

- (2)

- The evaluation process of ecosystem partners is often influenced by decision-makers’ anticipatory judgments and bounded rationality, rendering the outcomes vulnerable to subjective preferences and psychological expectations. How can a decision evaluation model be designed that combines methodological rigor with practical flexibility—one that captures the rational logic of “maximizing benefits while minimizing losses” and, at the same time, avoids distortions stemming from overly risk-seeking or risk-averse tendencies?

- (3)

- Based on the preliminary evaluation, how can resource complementarity and the gravitational pull of strategic alignment be incorporated into the optimization logic for partner selection? How can the model ultimately identify high-quality partners who demonstrate both strong innovation capabilities and a high degree of strategic fit, thereby supporting the sustainable development of platform enterprises?

To address the above questions, this study, from the theoretical framework of embedded innovation, systematically identifies the core demands of platform enterprises across different innovation stages. The Quality Function Deployment (QFD) method is employed to translate these demands and their relative importance into specific evaluation indicators and their respective weights, ensuring that selected partners can effectively meet the complementarity requirements of platform enterprises. Subsequently, Prospect Theory and the TOPSIS method are integrated into the evaluation process to account for the psychological preferences of decision-makers, enabling the derivation of a priority ranking that approximates the ideal partner profile. Furthermore, Field Theory is introduced to dynamically enhance the alignment of ecosystem partners in terms of resource complementarity and strategic fit, thereby optimizing the overall partner selection process.

The main contributions of this paper are as follows: First, at the theoretical level, drawing on the “cognition–behavior–outcome” framework, this study divides the embedded innovation process into three stages: strategic consensus, resource sharing, and mutual benefit. It identifies the innovation demands of platform enterprises at each stage. Based on these demands, an evaluation indicator system for selecting ecosystem partners is constructed. By mapping innovation demands to evaluation indicators, the complementarity mechanism between platform enterprises and ecosystem partners is revealed. This systematically elucidates the partner selection logic and decision-making mechanisms of platform enterprises, thereby broadening the research focus of existing studies and enriching the theoretical understanding of complementary relationships within platform ecosystems. Second, at the methodological level, this paper develops a partner selection model driven by embedded innovation demands. The QFD method is applied to quantify the importance of innovation demands into indicator weights, improving the evaluation system’s alignment with practical demands. Additionally, by incorporating decision-makers’ psychological attitudes and risk preferences, a TOPSIS decision evaluation model based on Prospect Theory is developed. This model produces a ranking of ecosystem partners that better reflects the “seeking benefits and avoiding harm” decision logic observed in real-world practice. On this foundation, Field Theory is further introduced to develop an optimized model for partner selection from the dual perspectives of resource complementarity and interactive dynamics. This enhances the dynamic co-evolution mechanism between platform enterprises and their ecosystem partners, thereby improving the model’s adaptability and explanatory power in complex environments.

The remainder of this paper is structured as follows. Section 2 reviews the literature on complementarity among stakeholders in platform ecosystem and the selection of innovation partners. Section 3 constructs a demand-driven evaluation-indicator system for ecosystem partners in embedded innovation. Section 4 presents the research framework, detailing how QFD maps innovation demands to indicator weights, how Prospect Theory and TOPSIS form the evaluation model, and how Field Theory further refines the matching logic. Section 5 validates the proposed model’s feasibility and stability through a case study, sensitivity analysis, and multi-method comparison. Section 6 discusses the managerial implications and theoretical contributions of the findings. Finally, Section 7 concludes this paper, outlines its limitations, and suggests directions for future research.

2. Literature Review

2.1. Research on Complementarity in Platform Ecosystem

As a new organizational paradigm in the platform economy era, the platform ecosystem comprises platform enterprises and their complements [8]. Its defining features are multilateral interactions and ecological reciprocity effects. Platform enterprises—acting as system architects—achieve innovation goals and sustain competitive advantage while strategically selecting technology-based startups. By sharing resources (e.g., financial support, established supply chain networks, and brand equity), they forge interdependent relationships and guide startup development. Meanwhile, startups—as partners—benefit from complementary collaboration, jointly driving innovation and value co-creation [9,10]. Startups play a critical role in platform ecosystems by embodying the principles of modularity and complementarity [11]. This complementarity arises both between platform enterprises and complements and among system members—for instance, the synergy between software applications and diverse content types [12]. Such collaboration among partners triggers network effects, laying a foundation for accessing heterogeneous resources and enhancing overall innovation performance [13]. However, as ecosystems evolve, selecting and governing partners becomes challenging. If platform enterprises allow too many complementary partners with overlapping functions, it may fuel excessive competition and undermine innovation incentives [14]. Moreover, high-reputation complementary partners often adopt multi-host strategies that grant them stronger bargaining power and incentivize differentiated feature design for their own benefit, thereby increasing governance costs for the platform enterprise [15]. The acquisition of complementary partners is closely tied to governance effectiveness: strong governance attracts more partners [16], whereas an excessive number of complementary partners can impose coordination burdens and weaken the platform’s incentives for quality improvement and innovation investment. At the same time, high heterogeneity and diverse interaction patterns among partners further complicate governance and impair performance.

2.2. Research on Partner Selection in Innovation Collaboration

Within innovation collaboration frameworks, selecting ecosystem partners is widely recognized as a complex multi-attribute decision-making problem. Existing studies propose various solutions by focusing on different subjects, methodological approaches, and indicator systems [17]. From the perspective of subjects, virtual enterprises—as agile organizations—often model partner selection as a two-sided matching problem involving multiple attributes, employing heterogeneous preference evaluation languages to capture differences in technology, resources, and other dimensions, followed by the development of matching strategies that balance satisfaction for both parties [18]. From a strategic-operations integration perspective, aligning partner selection with collaborative manufacturing processes enhances alliance efficiency and resource complementarity by synergizing strategic goals with operational execution [19]. In customer-oriented contexts, multi-attribute decision-making methods are flexibly applied according to user types (e.g., passive, standard, confident) to ensure precise alignment between alliance member configurations and market demand [20]. Meanwhile, partner selection in strategic alliances remains a prominent topic. In such arrangements, firms share knowledge, technologies, and resources, often relinquishing partial control [21]. Researchers suggest that under the joint influence of project complexity and collaborative experience, criteria such as partner similarity, complementarity, and coverage become central to decision-making, while prior success in comparable projects significantly enhances mutual trust [22]. In cross-border e-commerce contexts, addressing institutional and cultural differences in international operations necessitates a comprehensive evaluation of factors such as compatibility, capability, complementarity, reputation, and commitment to ensure long-term alliance stability and sustainability [23]. With the rise of the digital economy, constructing scientifically grounded partner selection models has become a critical pathway for strategic alliance firms undergoing digital transformation [24]. The digital technologies are integrated into traditional supply chain decision frameworks to establish systematic models under uncertainty, enabling optimal partner portfolio design in digital supply chains [25]. Additional studies explore partner identification and selection mechanisms within innovation consortia, drawing from knowledge collaboration [26], knowledge capabilities [27], and industry–academia–research cooperation perspectives [28].

Regarding indicator systems and methods, dynamic multi-stage evaluation frameworks integrated with quantitative algorithms have demonstrated improvements in decision accuracy and efficiency across different innovation phases. For instance, partner selection is divided into “pre-selection” and “refinement and optimization” stages, introducing multidimensional indicators (e.g., capability, performance) alongside SVM and intuitionistic fuzzy TOPSIS methods to systematically screen and rank candidates [29]. Building on this, other studies extend the model into three stages—“pre-selection, optimal selection, and optimization”—by employing multi-color sets, fuzzy comprehensive evaluations, and ant colony algorithms to effectively identify and fine-tune partners in virtual enterprises [30]. From an innovation resource allocation perspective, innovation objectives and resource contributions are considered core decision factors. Combining gray relational analysis with evaluation matrices enhances both the quality and diversity of candidate partner portfolios [31]. Furthermore, robust fuzzy-possibility AHP approaches that balance resource inputs and associated costs help minimize decision errors while improving the quality of strategic alliance matches [32]. In the domain of technological similarity and network analysis, patent heterogeneity networks and SimRank algorithms are leveraged to assess technological similarity between entities, with spectral clustering and visualization tools further applied to identify potential partners [28]. Similarly, some research adopts criteria such as structural homogeneity, partner diversity, and technology fusion potential, utilizing multi-layer network link prediction methods to identify collaborative candidates in AI-related fields [33]. In the context of digital transformation, partner selection models grounded in fuzzy set theory, Prospect Theory, and Field Theory—reflecting “symbiosis-mutualism-regeneration” relational dynamics—facilitate dynamic equilibrium and optimal partner matching [24]. Additionally, methods that map collaboration demands to decision attributes through QFD, combined with fuzzy axiomatic design and cloud models, propose viable partner screening paths in uncertain environments [34]. Additionally, approaches such as two-stage DEA [35], the Louvain algorithm [36], Hotelling game models [37], and Elman neural networks have been applied [27], offering a diverse set of decision-making tools tailored to different partner selection scenarios.

In summary, although existing studies have extensively investigated various subjects, perspectives, and methodologies related to ecosystem partner selection for innovation collaboration in platform enterprises, several gaps remain. First, current research primarily emphasizes complementarity between platform enterprises and ecosystem partners and its implications for ecosystem governance [16], yet lacks systematic exploration of partner selection mechanisms from an embedded innovation perspective. Second, most studies concentrate on collaboration processes, resource acquisition, or cost control, with limited attention to how decision-makers’ innovation demands influence partner selection decisions [34]. Finally, while multi-attribute decision-making approaches are commonly adopted, interactions and dynamic co-evolution between selecting entities and potential partners are often overlooked, leading to insufficient analysis of the dynamic nature of the selection process [24]. To address these gaps, this paper, under the theoretical lens of embedded innovation, systematically identifies core innovation demands of platform enterprises at different stages, applies QFD to construct and quantify a decision indicator system and corresponding weights for ecosystem partner selection, and integrates Prospect Theory with Field Theory to reflect decision-makers’ psychological preferences and the resource complementarity between platform enterprises and potential partners. Through case analysis, sensitivity testing, and comparative evaluation, the robustness and applicability of the proposed model are validated. This study enriches the understanding of ecosystem partner selection within platform ecosystems by advancing methods for quantifying partner demands and refining the selection of evaluation indicators. It also deepens the depiction of non-rational characteristics in behavioral decision-making and elucidates the mechanisms underlying the ongoing interactions between platform enterprises and their ecosystem partners. These theoretical contributions not only extend the scope of research on platform ecosystems and embedded innovation but also provide feasible approaches for platform enterprises to improve partner governance and foster collaborative innovation in dynamic and complex environments. Ultimately, the findings offer strong support for enhancing innovation performance and building sustainable competitive advantages.

3. Ecosystem Partner Selection Indicators Driven by Embedded Innovation Demands

3.1. Embedded Innovation

Innovation serves as the fundamental driver of high-quality development in the platform economy. However, conventional innovation paradigms lack the internet-driven mindset inherent to sharing, platform, and traffic economies, resulting in misalignment with contemporary platform enterprises’ innovation practices. Confronted with ubiquitous connectivity challenges, escalating R&D complexity in emerging technologies, and tech giants’ growing industry influence, leading platform enterprises such as Haier, Xiaomi, and Tencent have pioneered novel collaborative models with diverse industry partners. Concretely, these platform enterprises strategically integrate technology-based startups into their ecosystems through equity investments, achieving complementary advantages, fostering resource sharing, accelerating innovation incubation, and utilizing the technologies of these startups to execute strategic goals. Building on network embedding theory, Li et al. [6] conducted comprehensive case analyses, demonstrating that embedding technology-based startups within platform ecosystems enables critical resource sharing (knowledge, channels, traffic, brand equity) to accelerate technological innovation realization and diffusion. Concurrently, platform enterprises harness these startups’ innovative potential to lower entry barriers for new ventures while advancing strategic goals through intra-ecosystem resource complementarities. This integrative process constitutes “embedded innovation”. Crucially, embedded innovation does not imply indiscriminate collaboration, but rather, the strategic selection of ecosystem partners whose capabilities complement the platform enterprise, thereby enhancing collective innovation capacity. For instance, when entering the wristband market, Xiaomi strategically partnered with Huami Technology Co., Ltd. (Hefei, China)—a values-aligned firm—integrating it into Xiaomi’s ecosystem through targeted equity investment. The resultant synergy, combining shared technological expertise and resources, propelled products like the Xiaomi Mi Band to rapid market success, securing strong consumer approval and substantial market share.

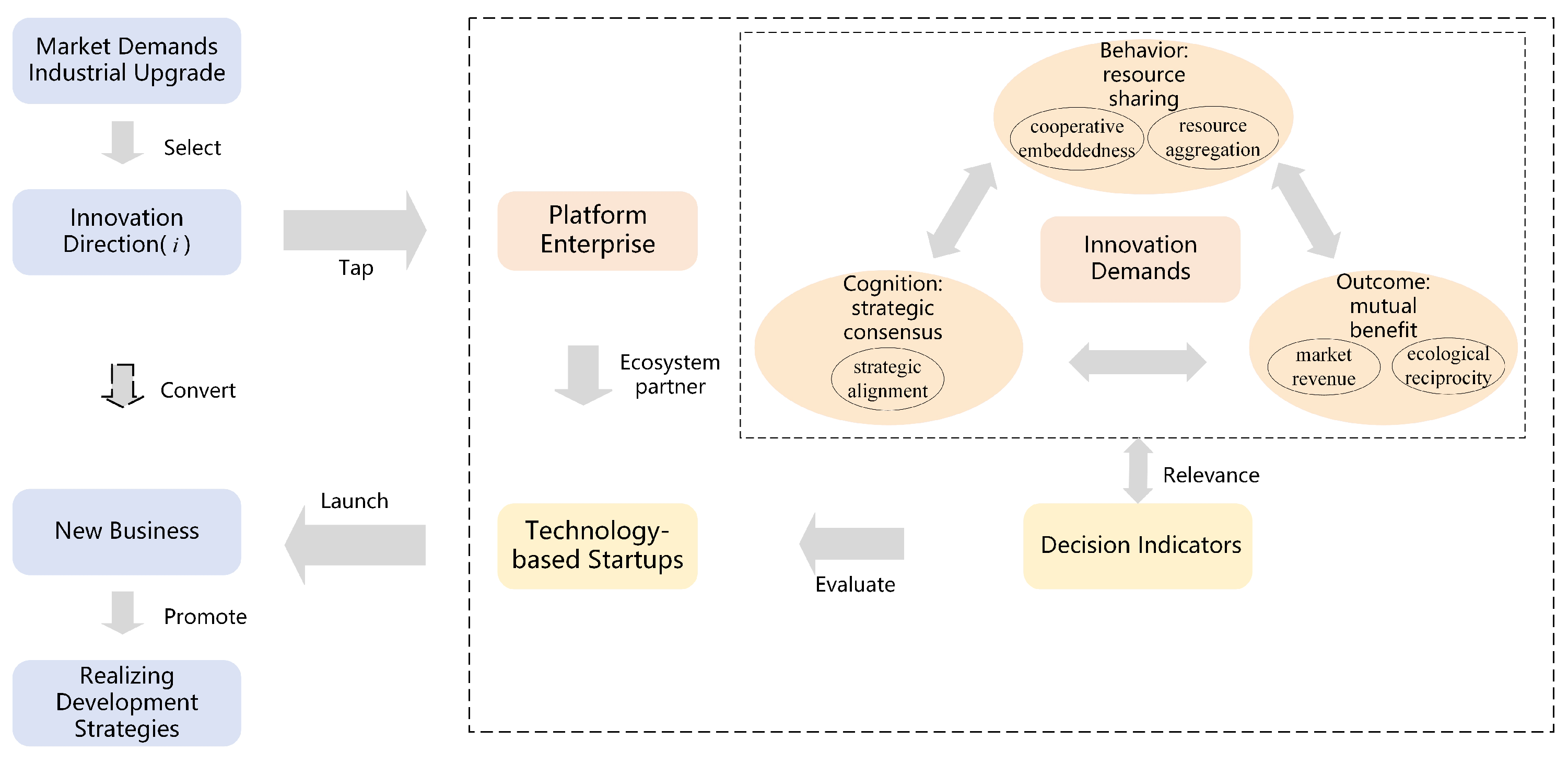

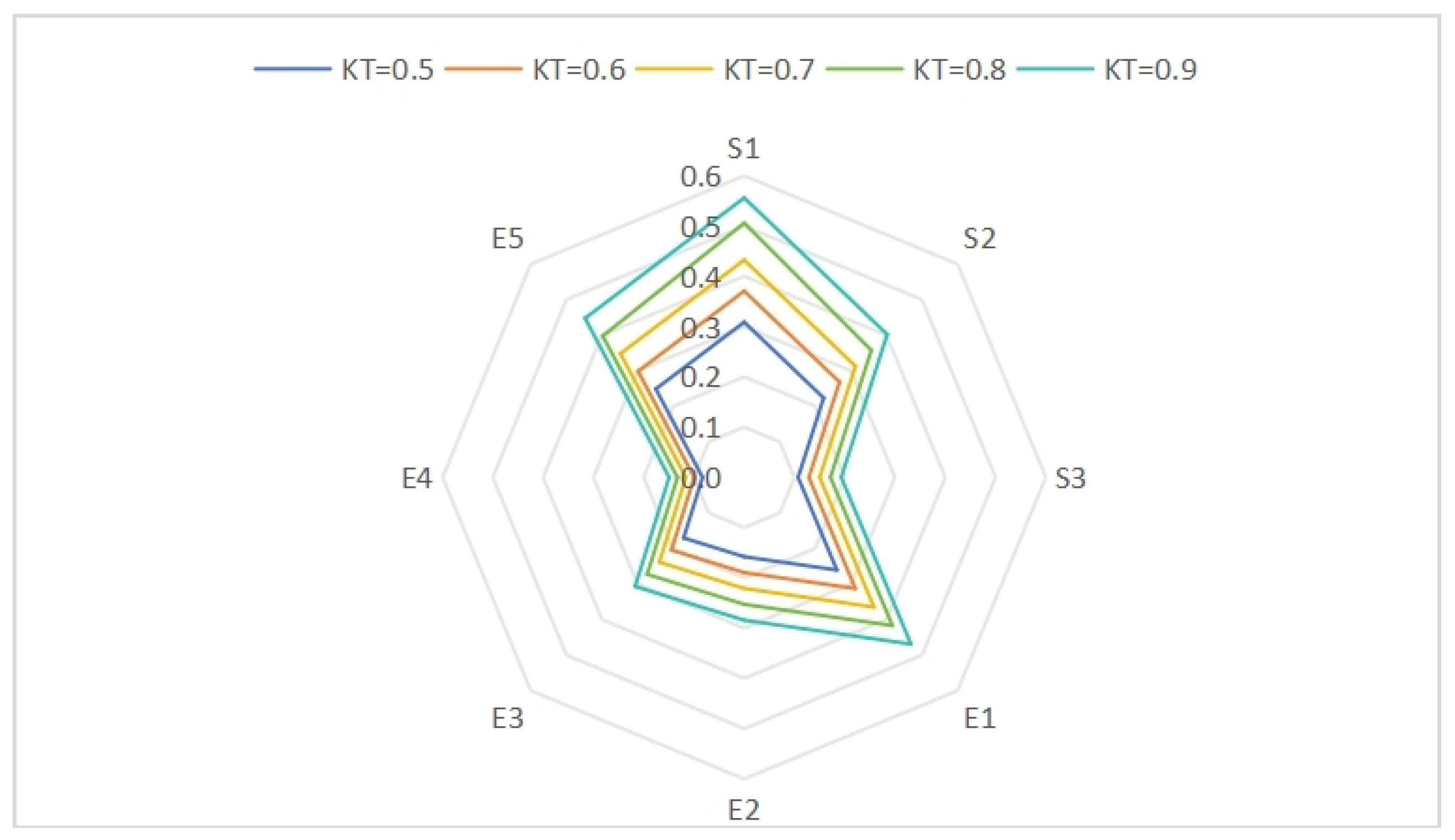

Drawing on the preceding analysis of embedded innovation concepts and practices, this paper develops an ecosystem partner selection process for platform enterprises that is driven by embedded innovation demands, as depicted in Figure 1. Specifically, when a platform enterprise actively responds to industrial transformation trends and gains a comprehensive understanding of user demands and future market potential, it selects an emerging technological direction—hereinafter referred to as “innovation direction i”—as the focal breakthrough for its next-stage business strategy. To achieve this strategic objective, the platform enterprise further uncovers key innovation demands that confer market competitive advantages within this direction. Based on these demands, it evaluates and screens technology-based startups within and beyond the ecosystem, considering their R&D capabilities, market performance, and collaboration potential. After selecting one or more startups as core ecosystem partners for innovation direction i, the platform enterprise provides strategic investments and ecosystem support to these partners. It subsequently launches a new business incubation mechanism centered on embedded innovation, thereby facilitating the realization of its strategic development goals.

Figure 1.

Embedded innovation demand-driven platform enterprise ecosystem partner selection process.

Evidently, the implementation of embedded innovation constitutes a complex and multi-stage process characterized by diverse evolutionary pathways. Drawing upon the “cognition–behavior–outcome” framework, this study conceptualizes the embedded innovation process within platform ecosystems as comprising three distinct but interrelated phases: strategic consensus, resource sharing, and mutual benefit. First, in the strategic consensus phase, alignment between platform enterprises and technology-based startups in terms of values, reputational orientation, and strategic vision serves as the cornerstone for trust formation and the initiation of collaborative innovation [38]. Startups integrate their developmental trajectories into the broader strategic framework of platform enterprises. This alignment facilitates goal convergence and interest compatibility, thereby reinforcing the stability and continuity of their collaborative engagement. Second, during the resource-sharing phase, platform enterprises embed strategically aligned startups into their ecosystems through equity-based investments. Platform enterprises play a central role in enabling startups and incumbent firms to gain competitive advantages in user access, traffic generation, supply chain coordination, and digital transformation. Functioning as the ecosystem’s orchestrator, the platform enterprise connects startups with incumbent firms, thereby facilitating the circulation of knowledge, technologies, and external resources. A dynamic and open-resource infrastructure is thus constructed, which enhances resource fluidity, complementarities, and collaborative innovation efficiency across the ecosystem [39,40]. Finally, in the mutual benefit phase, platform enterprises transition from being facilitators of innovation to active co-creators of value. By constructing an ecosystem centered on value co-creation, they incentivize startups to engage proactively, leveraging complementary resources to drive product innovation and service enhancement. The focus moves beyond individual innovation outcomes toward the holistic performance of the ecosystem. In terms of value distribution, platform enterprises assume direct responsibility for market returns, reflecting their deeper integration into innovation processes. By deprioritizing short-term or localized interests in favor of ecosystem-level optimization, they reduce collaborative transaction costs and expand market reach, thereby fostering accelerated growth and enhanced competitiveness among ecosystem members [41].The revenue-sharing mechanism grounded in co-creation and mutual benefit maintains a long-term balance of interests among all parties and ensures the platform ecosystem’s sustainability.

3.2. Embedded Innovation Demands

Platform enterprises respond to rapidly changing market demands through embedded innovation mechanisms; they promptly capture opportunities and deploy innovative business strategies. The bidirectional arrows in Figure 1 illustrate the interactions and dynamic coupling among the three stages: strategic consensus, resource sharing, and mutual benefit. This coupling indicates that throughout the collaboration process, consensus on strategic objectives, resource allocation, and benefit distribution are mutually reinforcing. Such dynamics not only deepen the collaboration but also enhance its effectiveness. Consequently, they drive continuous collaborative innovation and sustainable development between platform enterprises and their ecosystem partners.

In the strategic consensus stage, platform enterprises assume leadership in directing members’ strategic orientations while maintaining stable collaborative relationships. To establish ecosystem dominance, the platform enterprise demands to assess the strategic alignment between its own innovation direction and that of its ecosystem partners, which includes value congruence between parties, partner reputation, innovation direction relevance to platform strategy, and strategic spillover effects on other innovations [42]. We assume that the strategic alignment demand for platform enterprises in exploring the new business innovation direction i is denoted as .

In the resource-sharing stage, resource allocation efficiency is jointly determined by a cooperative embeddedness capability and resource aggregation level [43]. Within the platform-centric innovation network, ecosystem members optimize resource value through boundary delineation and comparative advantage utilization, enhancing allocation efficiency [44]. Consequently, when selecting ecosystem partners, platform enterprises need to evaluate both the collaborative embeddedness () and the resource aggregation level () to ensure maximal resource sharing. On this basis, we assume that the resource-sharing demand for innovation direction i is given by .

In the mutual benefit stage, platform enterprises make decisions with the goal of maximizing overall ecosystem benefits, aiming to attract more technology-based startups to embed within the platform ecosystem, expand the user base, and enhance market competitiveness, thereby enlarging the platform’s ecosystem and benefits [45]. Consequently, platform enterprises must simultaneously evaluate product/service market revenue () and embedded innovation-derived ecological reciprocity effects () [46], while investing implementation costs () to ensure collaborative innovation continuity. We assume that the mutual benefit demand for innovation direction i is represented by .

Building upon the analysis of embedded innovation demands, we propose an optimization model to guide platform enterprises in selecting the most suitable innovation directions and ecosystem partners. We assume that there are innovation directions, and represent the platform’s decision vector, where the value of each decision variable xi is defined as follows:

Based on the above analysis, we construct the innovation directions and ecosystem partner selection model as

The model captures the interdependence between innovation direction choices and the configuration of innovation demands. The model is formulated as a single-level discrete optimization framework that integrates constrained decision variables, bounded parameters, and underlying assumptions. It is solved using a genetic algorithm under predefined constraints to determine the optimal configuration. Initial parameters in Equation (2) are randomly initialized within predefined ranges. To balance diversity and computational efficiency, the number of candidate innovation directions or ecosystem partners is set to , In selecting innovation directions, platform enterprises place significant emphasis on the strategic alignment between potential ecosystem partners and their emerging business strategies, as well as on the spillover implications that such choices may exert on other innovation trajectories. To capture this consideration, the parameter is specified. The embeddedness of innovation collaboration reflects the extent to which partners are integrated into the platform ecosystem, while resource aggregation assesses the capacity to integrate and mobilize heterogeneous resources within the system. Higher levels of embeddedness generally indicate closer interactions and stronger organizational coordination, which facilitate more effective identification, acquisition, and orchestration of resources, while also mitigating systemic resource inefficiencies during collaboration. Accordingly, the parameters and are defined. Mutual benefit is pivotal for achieving equilibrium and sustainable development within platform ecosystems. Beyond immediate market revenue, platform enterprises prioritize ecological reciprocity, namely the sustainability of collaborative relationships and the ecosystem’s co-evolutionary potential. Hence, the parameters and are introduced to capture these dynamics. To explore how a platform enterprise may maximize overall demand satisfaction under resource constraints, a ceiling of is imposed for resource allocation in ecosystem partner selection and innovation direction deployment.

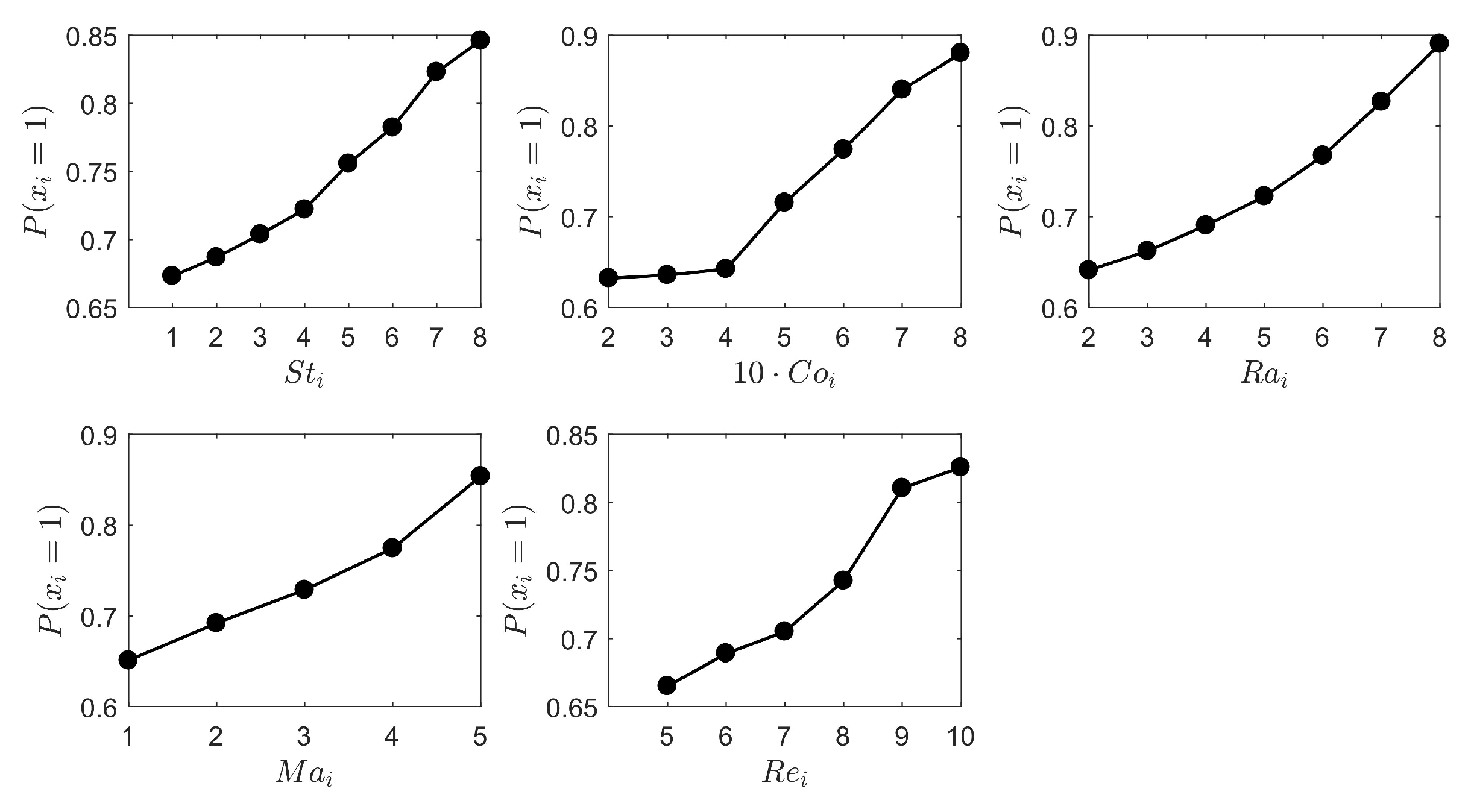

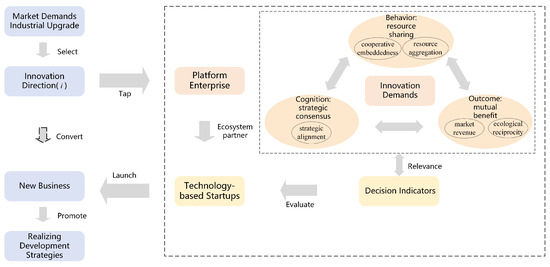

This study randomly assigns these values in multiple simulations and calculates the probability corresponding to . However, the randomly assigned demand parameters may be overly dispersed, resulting in x = 1 occurring only once in most cases, which makes it challenging to establish a cumulative probability for . Thus, we conducted 100 simulations (as shown in Figure 2) and used the rounded value of as the abscissa, with the corresponding probability as the ordinate, to analyze how demand factors (, , , , , ) influence decision-making regarding the selection of innovation directions by platform enterprises.

Figure 2.

Parameters of innovation demand and their probability of being selected.

As evidenced in Figure 2, five critical factors—strategic alignment, collaborative embeddedness, resource aggregation, market revenue, and ecological reciprocity—exhibit significant positive correlations with platform enterprises’ ecosystem partner selection probabilities across innovation trajectories. Specifically, the strategic alignment of an innovation direction reflects the consistency of values between the parties, the reputation of ecosystem partners, and the relevance of their technological innovation to the platform enterprise’s new business strategy. Through strategic alignment, the objectives and interests of both parties become harmonized; moreover, the product innovations of ecosystem partners not only support the growth of the platform enterprise’s core business but also strengthen their collaborative ties. The collaborative embeddedness capability and resource aggregation level collectively determine resource allocation efficiency. When both the ecosystem partners in a particular innovation direction and the platform enterprise possess strong resource aggregation capabilities, they can integrate a wider range of heterogeneous resources, thereby significantly expanding the resource base of the platform ecosystem. Furthermore, the ecosystem’s resources are not limited to internal assets; they also involve the coordination and sharing of external relational networks. Resource allocation efficiency is determined by the ecosystem partner’s adaptability and their capacity to manage both internal and external relationships, including maintaining close interactions with the platform enterprise and upholding external organizational ties. Market revenue level and ecological reciprocity effects are critical factors influencing the platform enterprise’s decision in selecting ecosystem partners. When an innovation direction exhibits greater market revenue potential, technology firms in that field typically display a stronger innovative impetus, and consequently, by entering that direction, the platform enterprise can secure higher market revenues, thereby enhancing its ecosystem’s competitiveness. In addition, ecological reciprocity effects serve as the core for fostering sustainable cooperation among multiple parties within the ecosystem, not merely reinforcing platform–partner ties but generating network-wide value accretion that ensures ecosystem viability. In summary, during the process of embedded innovation, platform enterprises tend to select ecosystem partners that exhibit high strategic alignment, strong cooperative embeddedness, robust resource aggregation levels, elevated market revenue levels, and significant ecological reciprocity effects in the given innovation direction.

3.3. Ecosystem Partner Selection Decision Indicators

The innovation direction optimization model presented in the previous section underscores that a platform enterprise’s innovation demands critically determine its choice of innovation direction and ecosystem partners. However, extant studies on partner selection predominantly examine partners’ attributes or capabilities in isolation and overlook the alignment between a platform enterprise’s innovation demands and a partner’s resources and competencies [47]. Drawing on the phases of embedded innovation—strategic consensus, resource sharing, and mutual benefit—a set of innovation demands (labeled ) encompass strategic alignment, collaborative embeddedness, resource aggregation level, market revenue potential, and ecological reciprocity effects. We operationalize these demands as specific requirements for evaluating potential partners, aiming to maximize the platform enterprise’s innovation outcomes by assessing firms across five dimensions: organizational culture, coordination capability, resource integration, profitability, and organizational learning. Relevant evaluation indicators are selected with reference to established studies [48,49]. Specifically, an organizational culture that provides the cognitive foundation for successful innovation collaboration, and constitutes a prerequisite for strategic synergy within the ecosystem [6]. Beyond integrating technologies and resources, shared values, behavioral norms, and strategic orientations support long-term partnerships. Platform enterprises typically prioritize technology-based startups that have demonstrated market viability; earned recognition from industry experts, end users, and investors; and exhibited high congruence in values and objectives. We evaluated organizational culture using value alignment (), corporate reputation (), and strategic goal compatibility (). Coordination capability captures a partner’s relational networks and interaction mechanisms in the ecosystem, which directly affects the efficiency of resource identification, acquisition, and allocation. Effective innovation collaboration depends on robust networks that minimize communication friction and foster trust. We assessed coordination capability based on adaptability to collaboration (), network relationship skills (), interaction effectiveness (), and conflict resolution ability (). Resource integration capability reflects the depth and effectiveness of combining complementary assets, forming the material basis for synergy. Platform enterprises contribute scale advantages—such as digital infrastructure, physical channels, brand equity, and stable supply chains—while partners bring advanced R&D capabilities and frontier technologies. Leveraging the shareable nature of digital resources, both parties co-create a dynamic resource pool that reduces acquisition costs and enhances performance. We measured integration capability through the complementary technology level (), unit cost/quality ratio (), and the original innovation level (). Profitability is the key criterion for value capture within the ecosystem. Platform enterprises focus on converting innovation into market outcomes, where actual performance relative to expectations determines collaboration success. Specifically, firms must assess growth potential in new domains, market opportunities and risks, and user conversion efficiency—including attraction, activation, and retention—to secure competitive advantage. Sustainable business models are equally critical. We evaluated profitability via business growth potential (), user conversion efficiency (), and the sustainability of the revenue model (). Organizational learning capability drives continuous evolution and stability across ecosystem participants. In later collaboration stages, firms emphasize product or service complementarities to spark joint innovation and foster management and business-model innovations that support ecosystem adaptation. Sustaining healthy partnerships through trust and coordination mechanisms underpins long-term competitiveness. Learning capability was assessed by product/service complementarity (), management and business-model innovation (), and partnership health ().

All metrics are positively oriented—that is, higher values indicate greater partner suitability. To ensure analytical consistency, we treated them as qualitative criteria and employed two main quantification approaches: (1) survey-based instruments with targeted items (e.g., complementary technology, value alignment, strategic compatibility) and (2) expert or managerial fuzzy judgments (e.g., original innovation level, service complementarity, partnership health). These methods may be applied individually or in combination to collect raw data. In the digital economy, increased demand and technological advances have deepened and broadened embedded innovation, rendering precise measurement challenging due to interaction complexity and fuzzy boundaries. Fuzzy-set theory offers both theoretical rigor and practical utility for addressing such ambiguities. Accordingly, we applied the fuzzy-set theory to standardize and quantify our evaluation indicators. Common approaches include linguistic fuzzy numbers, interval fuzzy numbers, and triangular fuzzy numbers. The seven-point semantic scale—extensively validated in psychology, market research, and education—provides finer discrimination than a five-point scale without causing respondent confusion [50]. Based on actual conditions and evaluation requirements, the assessments are divided into seven levels: very unimportant, unimportant, slightly unimportant, average, slightly important, important, very important. Referring to relevant studies [34], these semantic terms were then converted into triangular fuzzy numbers, resulting in specific indicator values, as follows: [(0.000, 0.000, 0.286), (0.000, 0.286, 0.427), (0.286, 0.427, 0.571), (0.427, 0.571, 0.714), (0.571, 0.714, 0.857), (0.714, 0.857, 1.000), (0.857, 1.000, 1.000)]. During the evaluation process, platform enterprises should consider the practical demands of decision-makers, such as industry experts and managers, when selecting the most appropriate quantitative methods and standards for indicator assessment. The overall evaluation results indicate that as the values of indicators increase, the corresponding enhancement in the decision evaluation for selecting ecosystem partners substantially fosters embedded innovation between platform enterprises and their ecosystem partners.

4. Ecosystem Partner Selection Decision Model

4.1. Research Model Framework

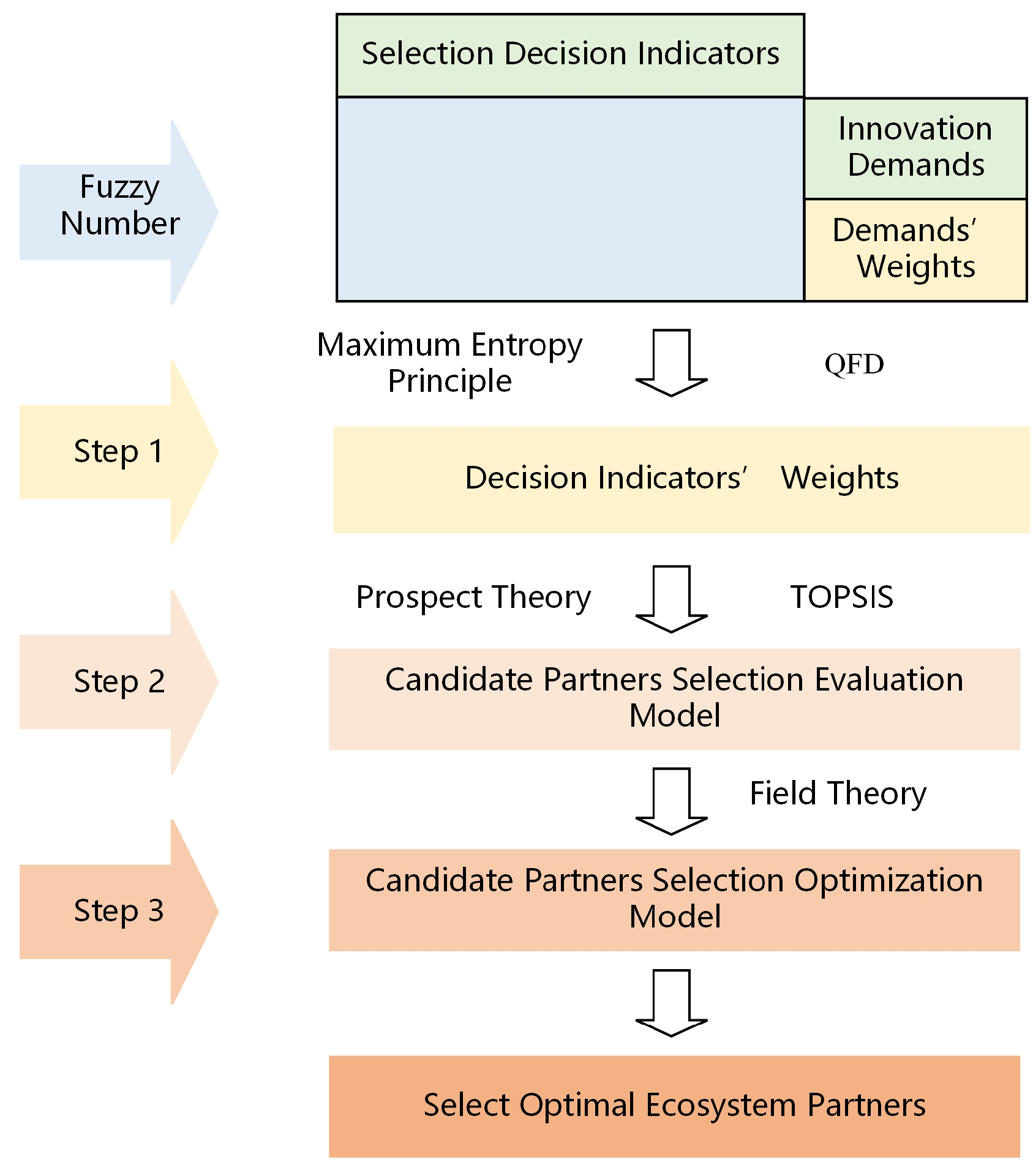

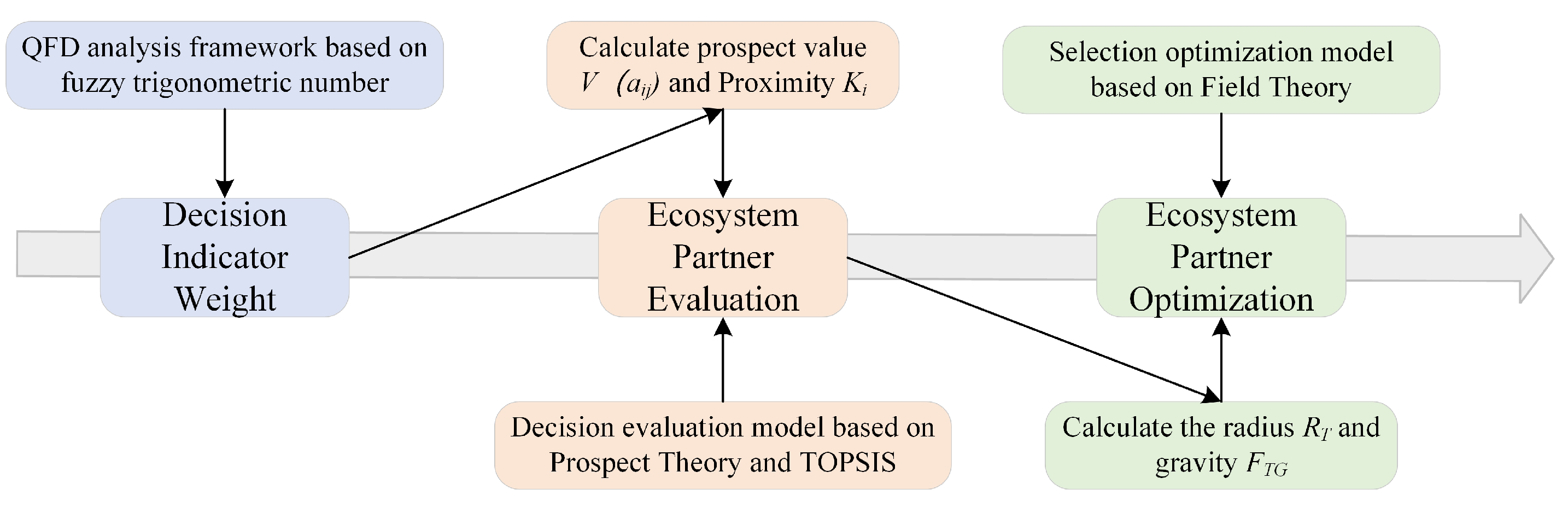

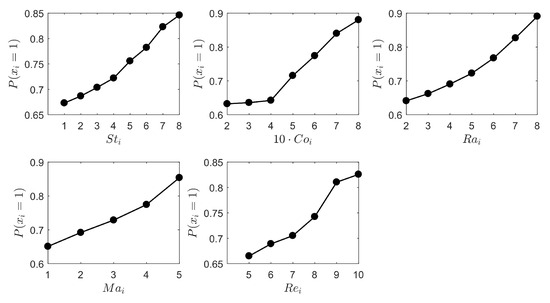

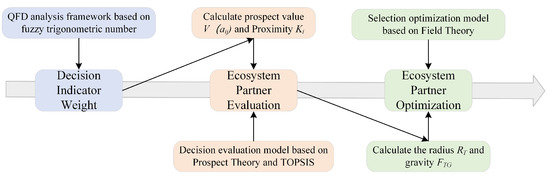

The construction of the selection model framework is as follows: First, we identified platform enterprise’s core innovation demands through the embedded innovation process and employed QFD to translate these demands and their relative importance into decision indicators and weights for partner selection. This transformation provided the computational foundation for our selection model, explicitly capturing the link between innovation demands and evaluation indicators. Second, we integrated the Prospect Theory and TOPSIS to incorporate decision-makers’ behavioral biases. We calculated each alternative partner’s prospect value, applied the previously derived indicator weights, and then used TOPSIS to measure each option’s distances from the positive and negative ideal solutions. This yielded a ranking that reflects proximity to the ideal solution. Finally, we introduced the Field Theory to refine partner optimization. By considering both the complementarity of innovation resources and the TOPSIS-based evaluation results, we constructed a dynamic selection mechanism grounded in Field Theory. This mechanism ensures that chosen partners align closely with the platform enterprise’s resource complementarities and strategic demands, thereby enhancing overall selection optimality. Figure 3 illustrates our proposed partner selection model framework, which comprises phases: demand identification, indicator weighting, evaluation and optimization.

Figure 3.

Embedded innovation demand-driven platform enterprise ecosystem partner selection evaluation and optimization model framework.

Step 1: Under the QFD framework, the expert panel uses semantic evaluation terms to assess the importance of each innovation demand and its correlation with decision indicators. We convert these linguistic judgments into triangular fuzzy numbers to form two matrices: one for the fuzzy importance of innovation demands and another for the demand–indicator correlations. Applying the maximum entropy principle, we translate fuzzy importance into precise weights. These weights, derived from the correlation matrix, serve as inputs for the subsequent evaluation model.

Step 2: We gather indicator data for candidate partners via expert interviews and surveys, then convert semantic scores into triangular fuzzy numbers. A decision matrix is constructed, and reference points under the Prospect Theory are defined. We transform each criterion value into a prospect value using a prospect-value function, identify positive and negative ideal solutions, and apply TOPSIS to compute each alternative’s relative closeness to the ideal. Ranking these closeness scores yields an ordered list of partners that best satisfy the platform enterprise’s innovation demands.

Step 3: We assess each candidate’s resource profile against the platform enterprise’s innovation demands. If a startup offers complementary resources lacking in the platform enterprise, it enters the candidate pool. We then calculate each candidate’s cooperative innovation–capability radius (). Setting thresholds for radius () and gravitation (), we filter candidates exceeding both thresholds and further evaluate the interplay between collaborative gravitation and resistance. Finally, we rank and select the most suitable ecosystem partners as strategic collaborators.

4.2. Selection Decision Indicator Weights Based on Fuzzy Number QFD

QFD is widely used to translate an enterprise’s component demands into specific resource or capability requirements for partners [51]. For example, Zhao et al. [52] and Zheng et al. [53] applied QFD to partner selection in virtual enterprises and new-energy-vehicle supplier selection, respectively. In QFD analysis, expert judgment on demands’ importance and indicator correlations often rely on vague linguistic terms. To enhance accuracy, we employed triangular fuzzy numbers to quantify this uncertainty. As defined earlier, the embedded innovation demands of platform enterprises are denoted as , and ecosystem partner decision indicators as . Expert evaluators assess both demand importance and demand–indicator relationships through semantic terms, subsequently converting them into triangular fuzzy numbers. Let represent the expert weight evaluation of ; the group decision mean is derived via triangular fuzzy arithmetic operations:

This study transforms semantic evaluations into group decision mean, effectively capturing incomplete weight information. Guided by the maximum entropy principle [52], we derived rational weight assignments by maximizing entropy subject to partial information constraints. Subsequently, after applying centroid-based defuzzification, a nonlinear optimization model was employed, which integrates expert-evaluated demand weight as constraints, thereby yielding precise weight values:

Let denote the fuzzy evaluation value provided by expert for the interrelationship between decision indicator and innovation demand . The group decision mean of is calculated as

Based on the above formulas, the relationship values between all and are organized into a fuzzy relationship matrix:

The weight of each decision indicator is calculated as follows:

4.3. Selection Decision Evaluation Model Based on Prospect Theory and TOPSIS

Established studies [54] incorporated the Prospect Theory into partner selection to account for risk preferences and psychological factors. Combining the Prospect Theory with TOPSIS addresses the limitations of assuming fully rational decision-makers in traditional TOPSIS and yields evaluations that better reflect real-world decision processes [55]. The combined implementation framework proceeds as follows:

Given two triangular fuzzy numbers with defined distance metrics and defuzzification formulas,

To eliminate the effects of differing indicator scales, all triangular fuzzy numbers corresponding to each indicator are normalized using a matrix normalization technique, as specified by the following formula:

where denotes the decision-maker’s expected value for indicator . Let represent the normalized reference point. The prospect value function is expressed as

where and () are risk attitude coefficients for gains and losses, respectively, with higher values indicating greater risk propensity. () quantifies loss aversion intensity. Following the established literature [56], we set and .

In the decision-making process, to describe the issues of risk aversion for gains and risk preference for losses, the ratio of the weight with occurrence probability p to the deterministic weight is used as the decision weight for gains and losses:

where gain/loss risk coefficients and [56].

Using the prospect value function, we transform the utility value of each element in the evaluation matrix into a prospect value. Thus, for candidate ecosystem partner under criterion , the prospect value on indicator becomes

The prospect matrix is expressed as .

Define and as positive/negative ideal attributes:

The proximity coefficient is calculated through

4.4. Selection Decision Optimization Model Based on Field Theory

Integrating Field Theory into the partner selection framework enables a comprehensive understanding of the systemic relationships and dynamic interactions among ecosystem actors [48]. Field Theory offers a robust analytical perspective to examine both the complementarity of innovation resources and the underlying motivations for collaboration between partners. By analyzing fluctuations in gravitational forces across varying radii [57], this approach uncovers the mechanisms driving inter-organizational dynamics and facilitates more adaptive and informed partner selection.

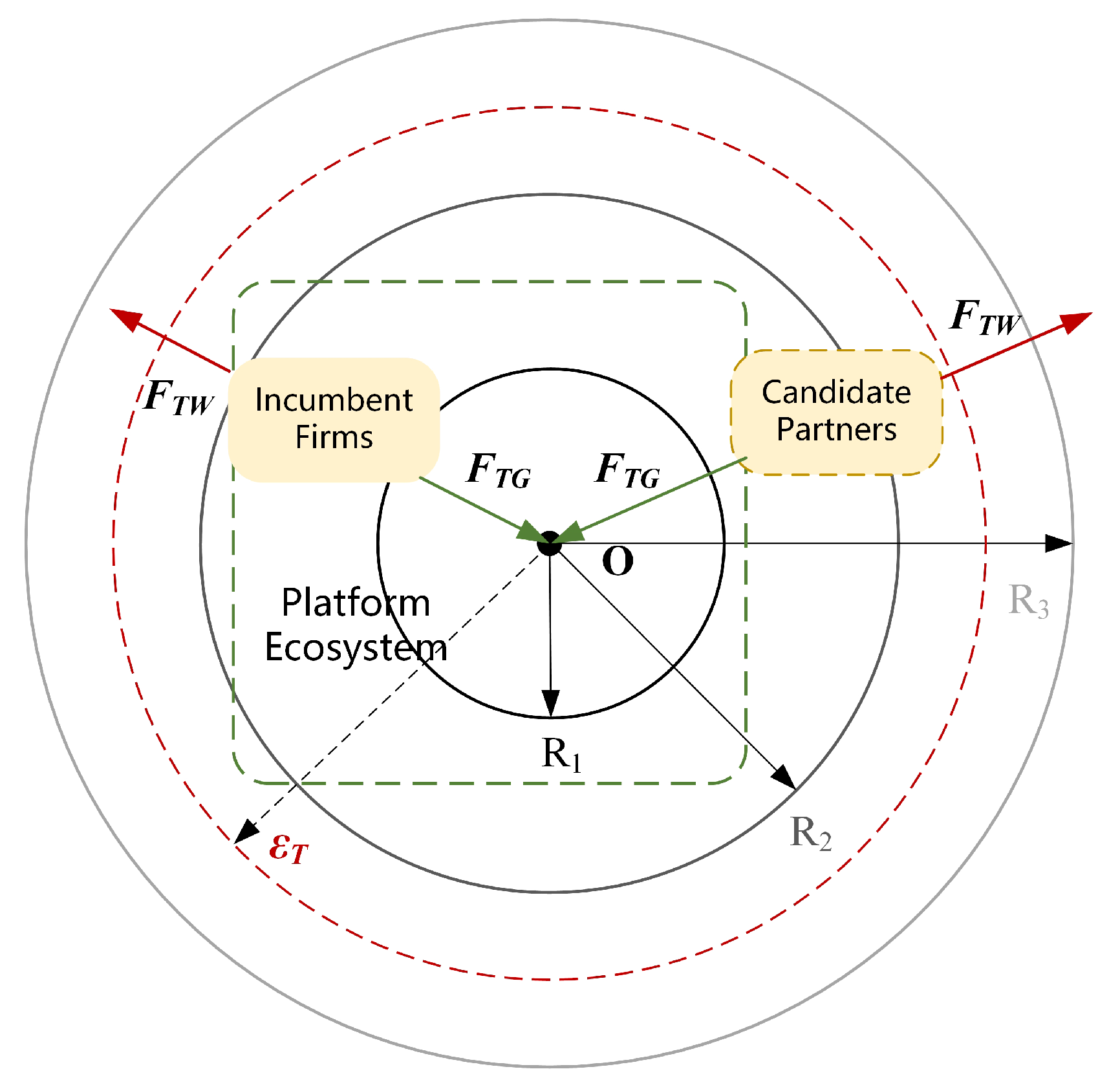

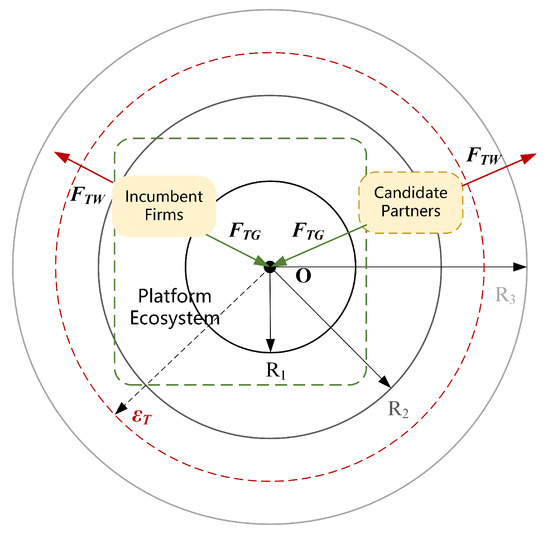

The cooperative innovation capability field (see Figure 4) provides a visual representation of the interactive structure of innovation capacities across firms.

Figure 4.

Embedded innovation collaboration capability field and gravity model.

Platform enterprises pursue embedded innovation collaboration to accelerate technological advancement and strategic growth. The embedded innovation capability field (Figure 4) visualizes inter-firm collaborative dynamics. Let field source O represent platform enterprise entity generating unique innovation resources, The mass of the platform enterprise’s collaborative innovation capability reflects the overall status of its innovation resources and can be characterized by resource vectors and resource utilization rates. Specifically, the resource vector is defined as and each component indicates the availability of the i-th type of innovation resource. Simultaneously, the resource utilization rate is represented by the vector , where denotes the utilization degree of the corresponding innovation resource . To reflect the dynamic impact of market demand fluctuations on the supply of innovation resources, a time vector is introduced.

Thus, the collaborative innovation capability mass of the platform enterprise can be defined as

The resource vector of a candidate partner is denoted as , representing the candidate’s available resources. To reflect the complementarity between the platform enterprise and candidate ecosystem partners in resource allocation, we introduce the resource space saturation vector and the resource demand vector and . The collaborative innovation capability mass of candidate ecosystem partners can be defined as

The collaborative radius quantifies each candidate’s static collaborative innovation competencies. Let represent the platform enterprise’s capability and G (values from Equation (16)) represent candidates’ evaluated capabilities. The collaboration innovation capability radius is calculated as

Given that platform enterprise occupies the core position in the platform ecosystem, we standardize , and the collaborative innovation capability radius is . To further explore the significance of , the collaborative innovation capability field is stratified into , a strong collaborative innovation capability layer; , a medium collaborative innovation capability layer; , a weak collaborative innovation capability layer; and , a negligible collaborative innovation capability layer, as illustrated in Figure 4.

Collaborative innovation capacity field intensity E, inversely distance-dependent, is calculated via

where is the field source (partner) collaborative innovation capability mass, is the collaborative innovation capability radius, is the collaborative innovation capability effect, and is the incremental improvement in a unit’s collaborative innovation capability mass stemming from its collaborative innovation resources.

The collaborative innovation capability gravitation calculation formula is as follows:

Candidate ecosystem partners incur willingness resistance during the process of embedding into the platform ecosystem, comprising opportunity cost and risk cost :

We establish a radius threshold and a gravitation threshold to guide the selection of potential partners, whether internal or external to the platform ecosystem. As illustrated in Figure 4, a partner’s eligibility for integration is determined by the interplay between the innovation capability gravitation and willingness resistance . Specifically, when , a candidate partner qualifies for ecosystem embeddedness if its collaborative innovation capability radius falls within the specified threshold and its innovation capability gravitation exceeds both the designated gravitation threshold and its willingness resistance. Otherwise, the candidate partner is deemed ineligible for selection. This selection optimization framework provides a theoretical foundation for platform enterprise to dynamically refine ecosystem partnerships and optimize the structural configuration of the platform ecosystem.

5. Example Analysis

5.1. Background and Process of Ecosystem Partner Selection

5.1.1. Platform Enterprise Overview

This study examines the case of XM—an innovative platform enterprise—to illustrate how it selects ecosystem partners during embedded innovation by detailing the calculation and application of indicator weights, evaluation models, and optimization models. XM specializes in smart hardware and the Internet of Things (IoT), operating under a “Hardware–Ecosystem–Services” triad that integrates R&D, design, and manufacturing of intelligent devices with multi-scenario IoT platforms and value-added software services for users, vehicles, and homes. During its business expansion phase, XM adopted an “Investment + Incubation” strategy, combining internal incubation with external investment to proactively identify high-potential startup teams both inside and outside its ecosystem. This dual approach not only attracted technology-driven startups with robust innovation capabilities and proven market potential but also leveraged supply chain collaboration and resource integration to optimize costs and share risks, thereby rapidly forging a sustainable competitive advantage. To date, XM’s consumer-grade IoT platform has connected more than 900 million non-terminal devices, covering 90% of daily life scenarios, and its ecosystem comprises over 400 partner firms—forming a closed-loop innovation and industrial network. This case is highly representative: on one hand, XM exemplifies cutting-edge practices in dynamic partner selection and synergistic innovation among leading platform enterprises (e.g., Tencent and Haier) and technology-based startups; on the other hand, its “Hardware–Ecosystem–Services” model and “Investment + Incubation” pathway provide a replicable framework for other technology-driven, fast-cycling platform enterprises.

5.1.2. Problem Statement

As customer demands become increasingly personalized and dynamic, technological development grows more complex. To sustain rapid growth, XM has explored market demands and industry trends to designate innovation direction i as its strategic focus for new business. However, in contrast to its established technical capabilities in core businesses, XM’s expertise in direction i remains nascent, with relatively limited core technology reserves. To accelerate breakthroughs and lower entry barriers in this domain, XM opted to partner with technology-based startups that hold first-mover advantages. Such collaborations facilitate resource sharing and complementary strengths, thereby reducing technological obstacles and advancing strategic objectives. Guided by the partner selection process proposed herein, XM conducted a preliminary screening of both internal and external firms using quantitative and qualitative metrics alongside market research, evaluating their R&D prowess, market performance, and synergy potential in direction i. The results identified three incumbent firms within XM’s ecosystem that possess strong research capabilities and a solid technical base for collaboration. Concurrently, five external firms demonstrated notable competitiveness in key product markets of direction i, exhibiting rapid market responsiveness and commercial viability. Constrained by finite resources and management capacities, XM adopted a dual strategy for resource allocation: dynamically phasing out underperforming incumbents within the ecosystem while selecting three out of eight candidate firms—spanning both internal and external sources—as strategic partners for innovation direction i, to be supported via targeted investment and incubation.

To ensure objectivity and rigor, XM convened an expert panel of 20 senior managers, consultants, and professors with over five years of practical or research experience in the IoT domain—nominated through academic–industry collaborations, industry association referrals, and internal recommendations. Based on comprehensive demand analyses and field investigations, this panel provided a scientifically grounded evaluation of the candidate partners.

5.1.3. Ecosystem Partner Selection Calculation Process

Building on the decision-making framework for platform enterprise under embedded innovation, the following steps (see Figure 5) were implemented: First, drawing on the innovation demands identified in Section 3 and the corresponding evaluation indicator system, the expert panel semantically assessed the importance of each demand and its relation to the evaluation indicators. Using the fuzzy triangular number-based QFD weight-calculation model introduced in Section 4.2, the weights () of all indicators were determined. Second, the panel then rated each candidate’s performance against these indicators. By integrating the values from Section 4.2 and applying the Prospect Theory-based TOPSIS model from Section 4.3, they derived evaluation scores () for each candidate. Finally, experts assessed XM’s and candidates’ innovation resources and utilization efficiency. Employing the Field Theory-based optimization model from Section 4.4, along with , they computed each candidate’s innovation-capability radius () and gravitational force (). Candidates falling within the capability radius and exhibiting sufficient gravitational pull were shortlisted and ranked, resulting in the selection of high-quality, highly aligned ecosystem partners.

Figure 5.

Implementation steps of example analysis.

5.2. Ecosystem Partner Selection Decision Indicator Weights

To identify the most suitable ecosystem partners, the expert panel first conducted a semantic evaluation of the perceived importance of innovation demands. These qualitative assessments were converted into fuzzy values in triangular form and then translated into precise numerical weights (Equation (4)). The results are presented in Table 1.

Table 1.

Innovation demand importance evaluation and weights.

Subsequently, the panel evaluated the interrelationships between innovation demands and partner selection indicators. Evaluative phrases were mapped to triangular fuzzy numbers to construct a fuzzy correlation matrix (Table 2).

Table 2.

Fuzzy relational matrix between innovation demands and selection decision indicators.

5.3. Ecosystem Partner Selection Decision Evaluation

Using a fuzzy-set quantification approach and the agreed-upon decision indicators, experts anonymously assessed eight candidate ecosystem partners. Through iterative feedback and aggregation, consensus emerged among panel members and industry executives, yielding the final partner evaluations. The methodological sequence for the Prospect Theory-based multi-attribute decision evaluation model proceeds as follows:

The qualitative evaluations for each candidate were converted into triangular fuzzy numbers. For each indicator, the mean of the two intermediate fuzzy values was established as the reference point, followed by the normalization of all values. Utilizing Equations (10)–(13), the prospect decision matrix for candidate partner indicators was generated (Table 3).

Table 3.

Prospect decision matrix for candidate partners.

Positive and negative ideal solutions were determined for each indicator, establishing benchmarking criteria for subsequent calculations.

Incorporating precalculated weights from Equation (24), Equations (15) and (16) were applied to calculate the positive and negative ideal solutions. Closeness coefficients for each candidate were then derived (Table 4).

Table 4.

Positive and negative ideal solutions and closeness.

The evaluation results of candidate ecosystem partners were ranked as . While the Prospect Theory-based TOPSIS method effectively measures proximity to ideal solutions for partner selection, marginal disparities in evaluation metrics (e.g., 1.6% difference between and ) risk ranking reversals and decision inaccuracies. To enhance selection rigor, the Field Theory-based optimization model was implemented for quantitative refinement.

5.4. Ecosystem Partner Selection Decision Optimization

Based on the selection decision indicator system, platform enterprise XM and its candidate ecosystem partners were systematically assessed for their innovation resources, resulting in a detailed inventory of resource availability and utilization, as shown in Table 5. In this table, “1” indicates the presence of a resource, “0” indicates its absence, and the value in parentheses denotes the utilization rate of that resource.

Table 5.

Innovation resource profiles of XM and candidate ecosystem partners.

During preliminary screening, collaborative innovation capability masses (M for XM, m for candidates) were calculated using Equations (17) and (18). Based on the evaluation results in Table 4 (values ), the cooperative innovation capability radius of each candidate (as shown in Table 6) was calculated using Equation (19), and the partner’s zone classification was determined accordingly. Given that and , the collaborative innovation capability is categorized into four distinct layers: , and . Following the established literature [48,57] and expert advice, the capability radius threshold was set at .

Table 6.

Results of field model parameters.

The results presented in Table 6 demonstrate that candidate partners and exhibit radius values exceeding 1.5, consequently excluding them from consideration. The remaining six candidates are clustered within an equivalent collaborative innovation capability stratum, necessitating additional scrutiny to identify optimal collaborative partners.

Following the methodology in ref. [58], we assign a coefficient and incorporate golden ratio principles to establish the critical threshold for collaborative innovation gravitation at 0.305 (). Gravitational force was calculated using Equations (20)–(22), and the results are summarized in Table 6. Applying , we find that candidates , and exceed this threshold, with the following hierarchical ranking: . These four entities meet established screening parameters, while and are excluded from further consideration.

Empirical studies [48] suggest that enterprises with more extensive innovation resource portfolios and higher resource utilization capacities tend to exhibit a lower propensity for external collaboration. This study defines 10% of a candidate’s proprietary resource base as the quantitative benchmark for assessing collaborative resistance. Quantitative analysis reveals positive margins between collaborative innovation attraction and resistance metrics across all candidates (Table 6), with attraction values consistently exceeding resistance thresholds, thereby meeting the final screening criteria. Based on these calculations, the final ranking of the candidate partners for platform enterprise XM is as follows: . Accordingly, and are selected as ecosystem partners, whereas , and are excluded from consideration.

5.5. Sensitivity Analysis

To validate the robustness and reliability of the proposed ecosystem partner selection framework for platform enterprises, we performed sensitivity analyses on critical model parameters through three dimensions.

5.5.1. Robustness of Indicator Weights Under the QFD Framework

In calculating the indicator weights for evaluating ecosystem partners, this study employs a seven-level linguistic scale tailored to practical requirements. To address the imprecision associated with linguistic terms, triangular fuzzy numbers are applied to improve analytical accuracy and reliability. To test the impact of modifications to the fuzzy number ranges, the original seven-level fuzzy terms are adjusted to the following set: . The indicator weights are then recalculated using the QFD method (Table 7). Results show that the updated weights are highly consistent with the original values, with a maximum absolute difference of no more than 0.002, and the overall ranking remains unchanged. These findings demonstrate that minor adjustments to the fuzzy parameters within a reasonable range exert limited influence on the weight assignment process, thereby confirming the stability and reliability of the expert-based weighting method within the QFD framework for evaluating ecosystem partners.

Table 7.

Sensitivity analysis of QFD-based indicator weights.

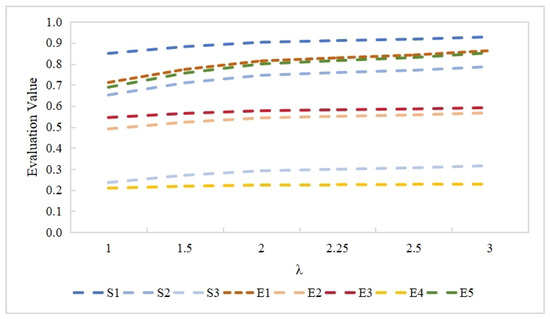

5.5.2. Robustness of the Prospect Theory-Based TOPSIS Evaluation Model

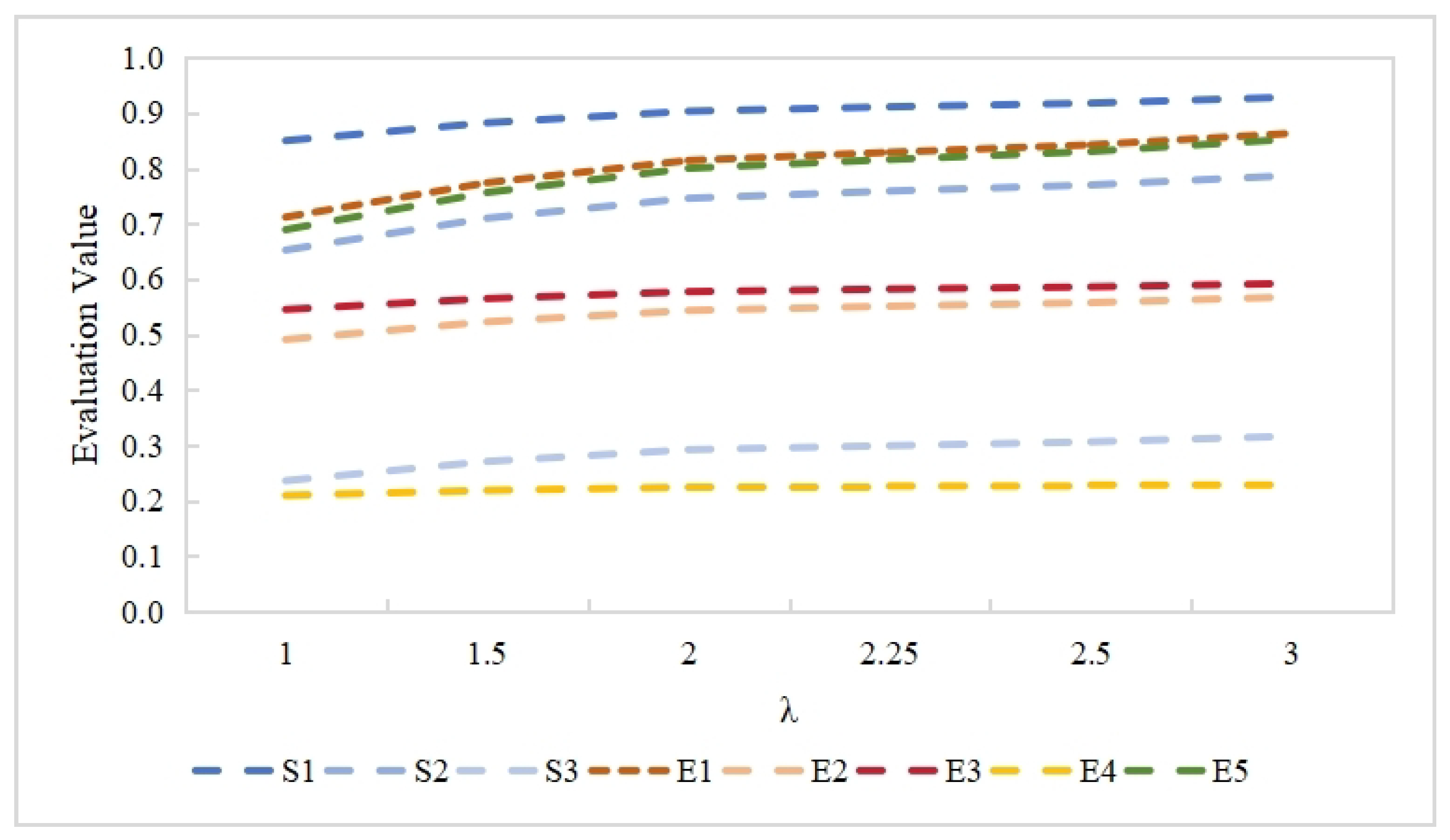

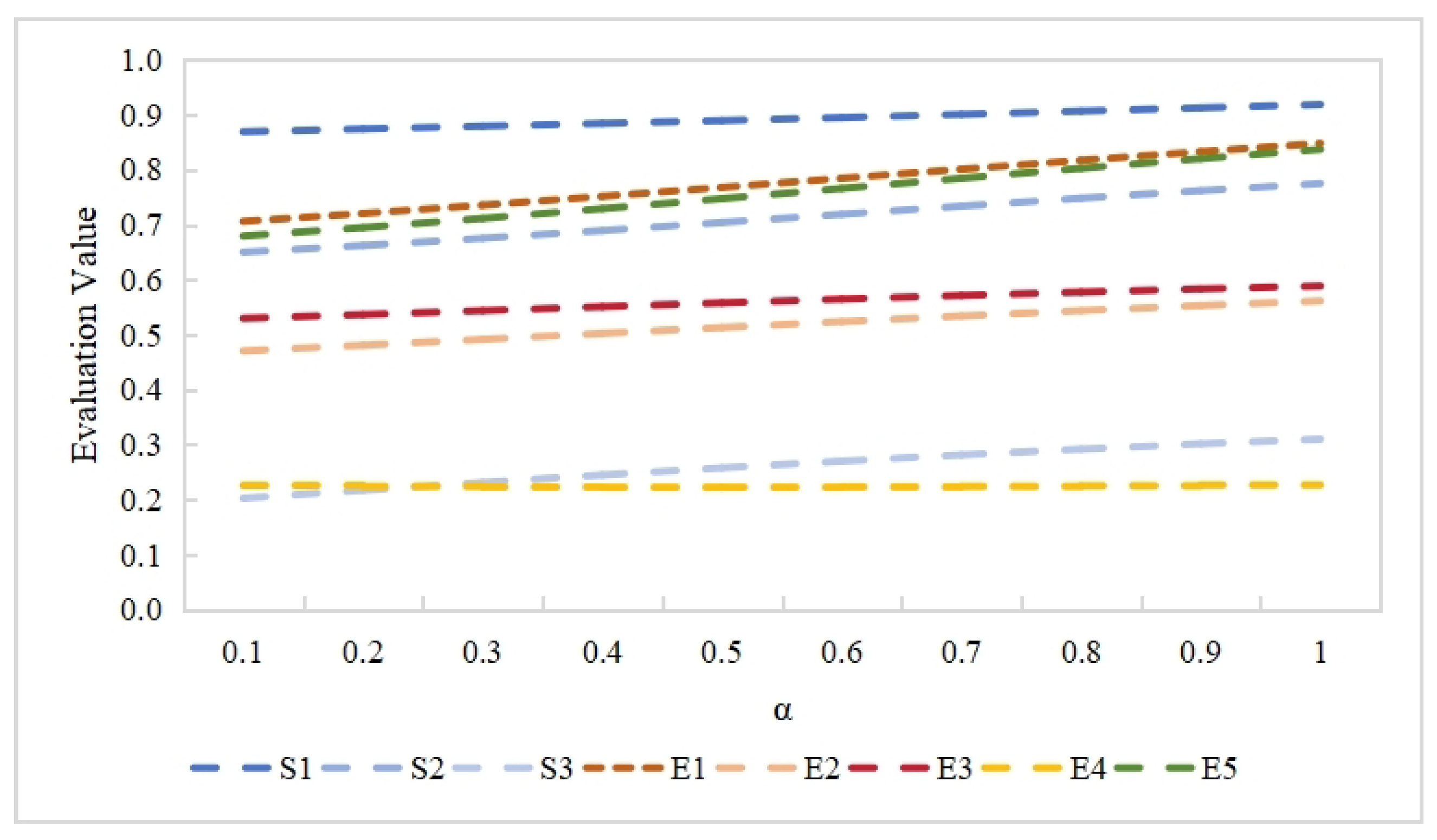

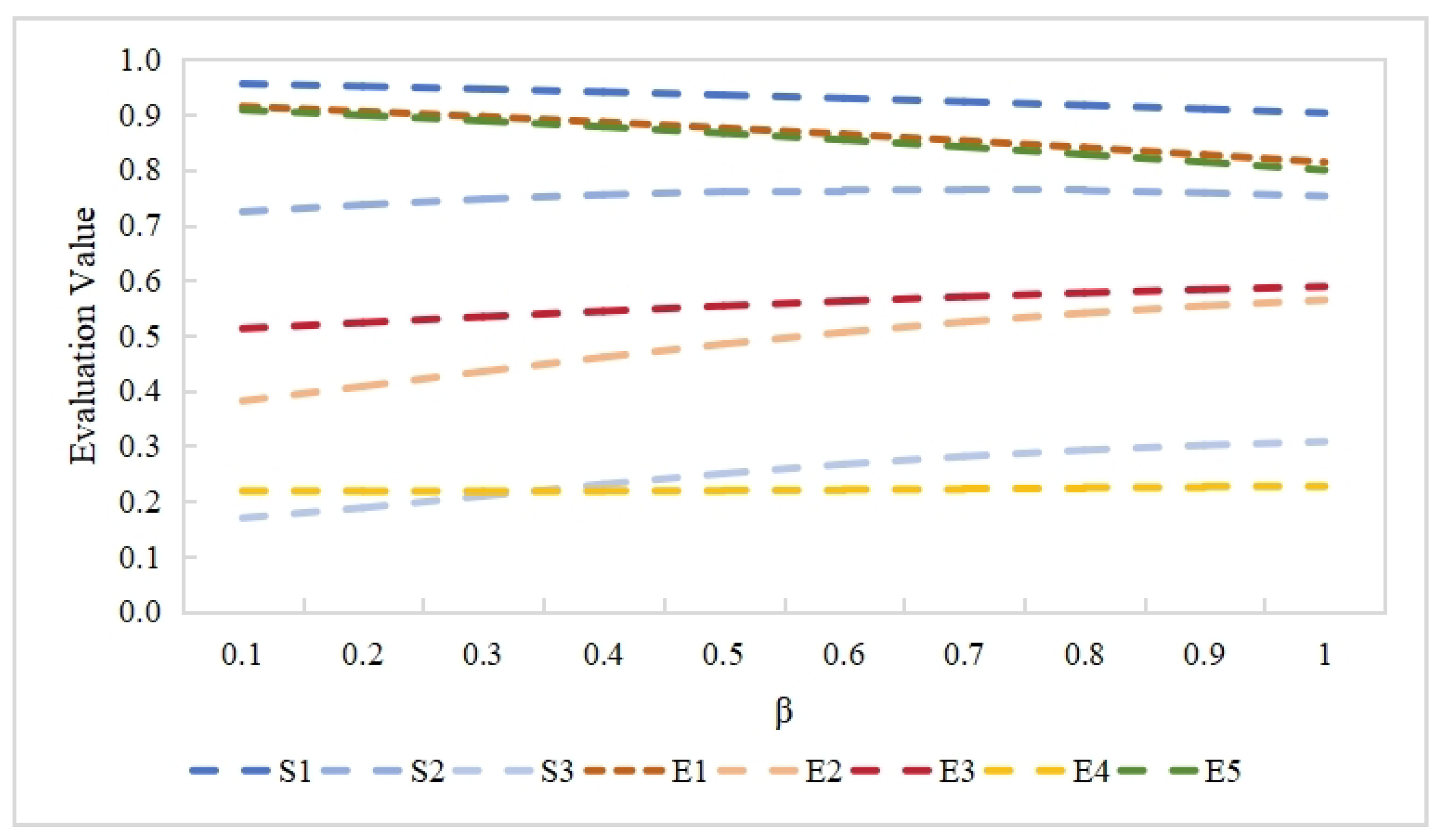

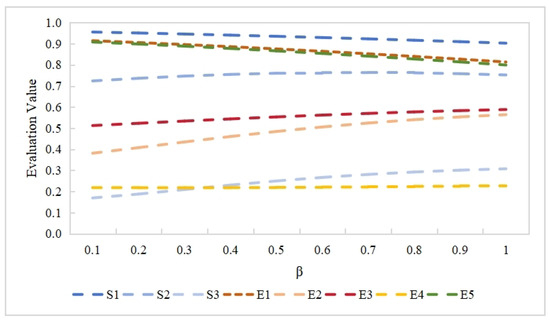

Decision-makers’ risk preferences significantly influence outcomes in ecosystem partner selection [59]. In the Prospect Theory-based TOPSIS model proposed in this study, the parameters and represent the exponent coefficients for gains and losses, capturing decision-makers’ sensitivity and attitudes toward risk. To assess the effects of parameter variations on evaluation results and rankings, and are varied within (0, 1], and within [1, 3], to evaluate eight candidate ecosystem partners. The results (Figure 6, Figure 7 and Figure 8) reveal that parameter changes have notable effects on evaluation scores. Specifically, as and increase, the closeness scores of all candidates generally rise, indicating that greater sensitivity to gains or stronger loss aversion reduces psychological distance to the ideal solution and thereby enhances overall evaluation scores. In contrast, changes in yield more differentiated outcomes. For example, the scores of partners , and decline as increases, while the scores of , and improve. This pattern arises because partners with initially high scores (e.g., ) become more distant from the negative ideal solution as increases, reducing their relative closeness. Notably, when or , ranks below ; however, as and continue to rise, surpasses . This suggests that possesses a relative advantage over on certain indicators, and higher or values amplify its gain performance and tolerance for minor losses, resulting in a faster increase in its closeness score.

Figure 6.

Sensitivity analysis of parameter .

Figure 7.

Sensitivity analysis of parameter .

Figure 8.

Sensitivity analysis of parameter .

Overall, the analysis demonstrates that risk preference parameters directly affect evaluation outcomes and can potentially influence final decisions. In particular, and shape the curvature of the value function for gains and losses, respectively, where higher values reflect stronger risk-seeking behavior. The parameter represents the relative psychological weighting of losses versus gains, with higher values indicating greater loss aversion. Despite the influence of these parameters on evaluation scores, the final selection of the optimal ecosystem partner remains unchanged, indicating that the proposed model maintains robust performance across varying levels of risk preference.

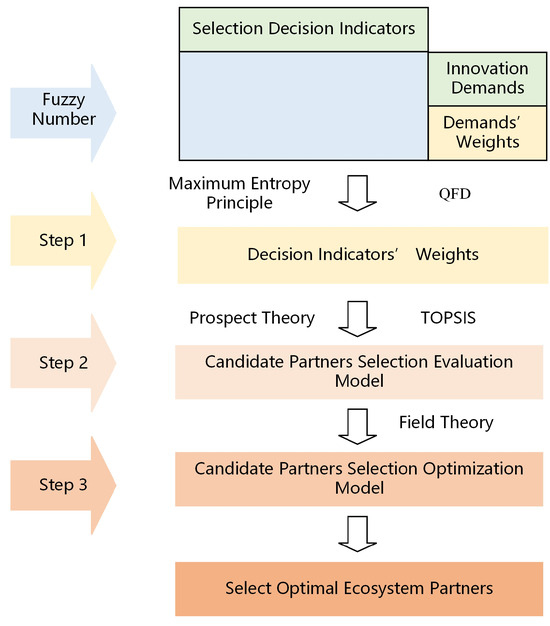

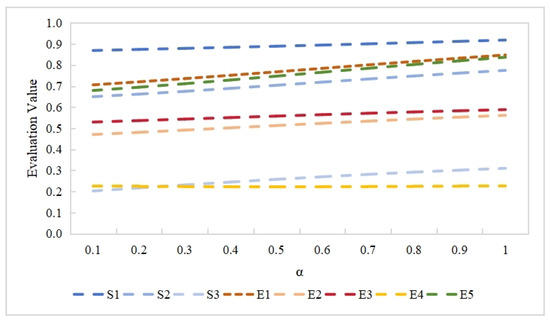

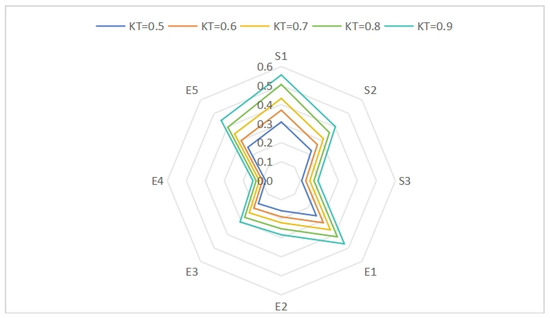

5.5.3. Robustness of the Field Theory-Based Optimization Model

In our Field Theory-based model, quantifies the synergistic effect between the platform and a partner, reflecting collaborative efficiency relative to an ideal environment [48]. We conducted sensitivity tests by varying from 0.6 to 0.9 and then comparing the resulting partner gravitation scores (Figure 9). As increases, gravitation scores rise across all candidates, indicating that an enhanced collaboration environment strengthens the platform’s ability to attract high-quality partners. This finding aligns with Tiwana [16] and underscores the critical role of environmental support in platform ecosystems. Despite score fluctuations under different settings, the partner ranking remains stable, confirming the model’s reliability across varying levels of innovation efficiency.

Figure 9.

Sensitivity analysis of parameter .

5.6. Comparative Analysis

Through systematic case analysis, decision indicators and corresponding weighting coefficients for candidate ecosystem partners were established according to innovation demands. Following the application of Prospect Theory to evaluate decision indicators of XM’s candidate ecosystem partners, a Field Theory-based optimization model was implemented to complete the partner screening process. To verify methodological validity, comparative analyses were conducted using both a Prospect Theory-incorporated VIKOR approach and a fuzzy information axiom method, with a systematic comparison of inter-method selection discrepancies. The tripartite methodological outcomes for XM’s candidate ecosystem partners are presented in Table 8, which demonstrates substantial consistency in hierarchical rankings across approaches. Notably, and were unanimously selected through all methodologies, thereby reinforcing the proposed framework’s validity. From an algorithmic perspective, the VIKOR method identifies positive and negative ideal solutions through extreme attribute values. Compromise solutions are subsequently derived through three key metrics: group utility , individual regret , and compromise index . The Prospect Theory-enhanced VIKOR variant integrates decision-makers’ risk preferences and environmental uncertainties by combining reference points with prospect values, thereby enhancing evaluation objectivity [48]. In contrast, the fuzzy information axiom method quantifies informational ambiguity through the logarithmic computation of enterprise-specific acceptable attribute ranges relative to systemic boundaries [34]. While both methods demonstrate domain-specific effectiveness, inherent limitations emerge: VIKOR’s dependency on fixed reference points may induce solution infeasibility when violating preset conditions, while the fuzzy axiom method faces comparability constraints under non-overlapping attribute ranges. Furthermore, neither methodology adequately addresses resource complementarity between platform enterprises and candidates.

Table 8.

Evaluation and ranking of three methods in comparison.

Comparative implementation of Prospect Theory-based TOPSIS and the collaborative innovation capability field model yielded identical ordinal rankings and equivalent final partner selections. However, significant methodological divergence emerged in discriminative capacity; the TOPSIS variant exhibited marginal inter-candidate differentiation (e.g., 1.6% discrepancy between and ), potentially compromising decision accuracy through ranking instability. Conversely, the field model demonstrated enhanced discriminatory power with adjacent ranking differentials spanning 5–39%, producing more definitive prioritization. This heightened discriminative capacity not only validates Prospect Theory-based TOPSIS outcomes but also systematically incorporates resource complementarity considerations, thereby elevating selection accuracy and scientific rigor.

Cross-methodological analysis confirms that the proposed Prospect Theory–Field Theory framework comprehensively integrates decision-maker preferences with quantitative assessments of collaborative innovation capacity, resource allocation profiles, and complementarity metrics. Empirical validation through case studies and comparative methodological evaluation substantiates the model’s scientific robustness, operational reliability, and practical utility in ecosystem partner selection contexts.

6. Discussion

6.1. Result Analysis and Managerial Implications

The selection of ecosystem partners is critical for platform enterprises’ embedded innovation. Innovation demands not only initiate partner selection but also serve as the core decision criterion. Drawing on stage characteristics in embedded innovation—strategic consensus, resource sharing, and mutual benefit—this study examines platform enterprises’ innovation demands in terms of strategic alignment, cooperation embeddedness, resource aggregation, market return, and ecosystem reciprocity. Empirical results show that experts assigned the greatest importance to ecosystem reciprocity (0.234), cooperation embeddedness (0.232), and strategic alignment (0.214), indicating that these factors most strongly influence partner selection. Specifically, ecosystem reciprocity reflects the ultimate value goal of embedded innovation for platform enterprises [60]. Compared with a short-term orientation focused on market gains or local interest maximization, platform enterprises should shift toward system-wide value co-creation. This requires continuously enhancing resource integration and scenario linkage capabilities and building a multi-level, sustainable incentive system that stimulates the innovation enthusiasm and synergy of technology-based startups and other ecosystem participants. Such efforts facilitate ongoing product and service improvement and boost the ecosystem’s overall value in functional compatibility, module synergy, and system coherence [61]. Moreover, cooperation embeddedness is key to establishing close organizational ties between a platform enterprise and its ecosystem partners. This depends on the co-evolution of organizational structures and institutional arrangements. Platform enterprises can employ cross-shareholding, joint R&D, and co-development of experimental platforms to increase interaction frequency and depth, reduce cognitive barriers and cooperation friction, and foster collaborative innovation through shared resources and information. High levels of cooperation embeddedness quickly establish trust mechanisms and enable innovative synergies via resource bundling and capability complementarity, thereby accelerating the transformation and industrialization of scientific achievements. However, these embedding mechanisms must remain flexible to account for startups’ developmental heterogeneity and avoid path dependence or rigid partnerships [62]. Finally, strategic alignment ensures consistency in values, development paths, and strategic intent between platform enterprises and ecosystem partners, providing the ideological foundation and strategic safeguard for smooth collaboration. Its influence spans the entire collaboration cycle. In a diversified, dynamically evolving ecosystem, platform enterprises should maintain strategic direction while embracing partner diversity. Mechanisms such as co-creation meetings and joint planning processes strengthen the ongoing alignment of cognition and objectives. High strategic alignment unifies interests, reduces potential conflicts, and enhances the resilience and sustainability of ecosystem collaboration [42].