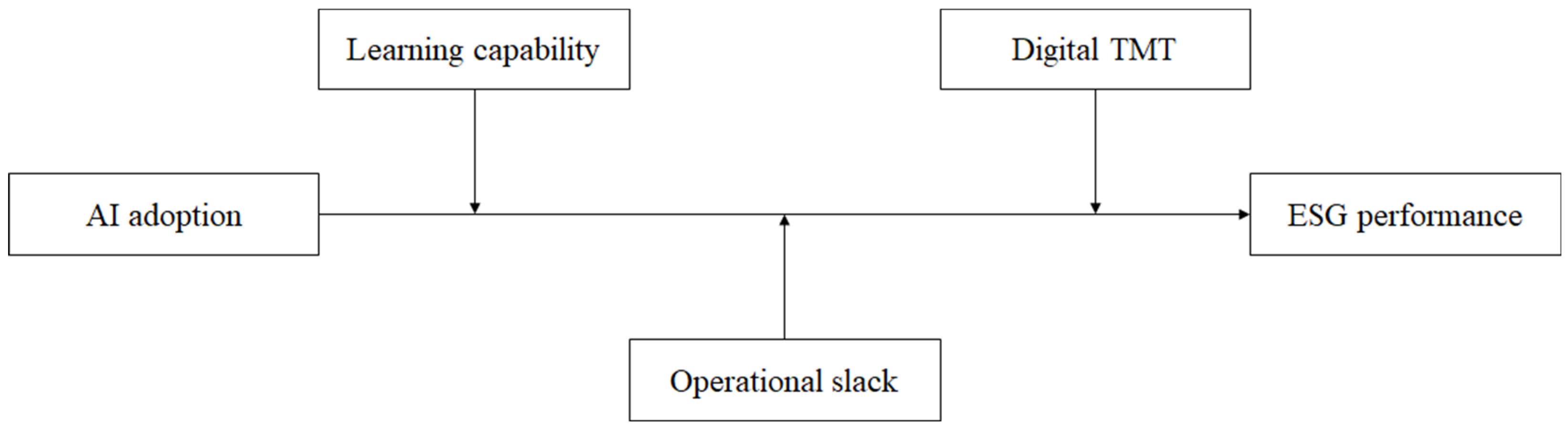

Exploring the Conditional ESG Payoff of AI Adoption: The Roles of Learning Capability, Digital TMT, and Operational Slack

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

2.1. Literature Review

2.1.1. Literature on DCV

2.1.2. Literature on ESG Performance

2.1.3. Literature on AI Adoption

2.1.4. Literature on Learning Capability, Digital TMT, and Operational Slack

2.2. Hypothesis Development

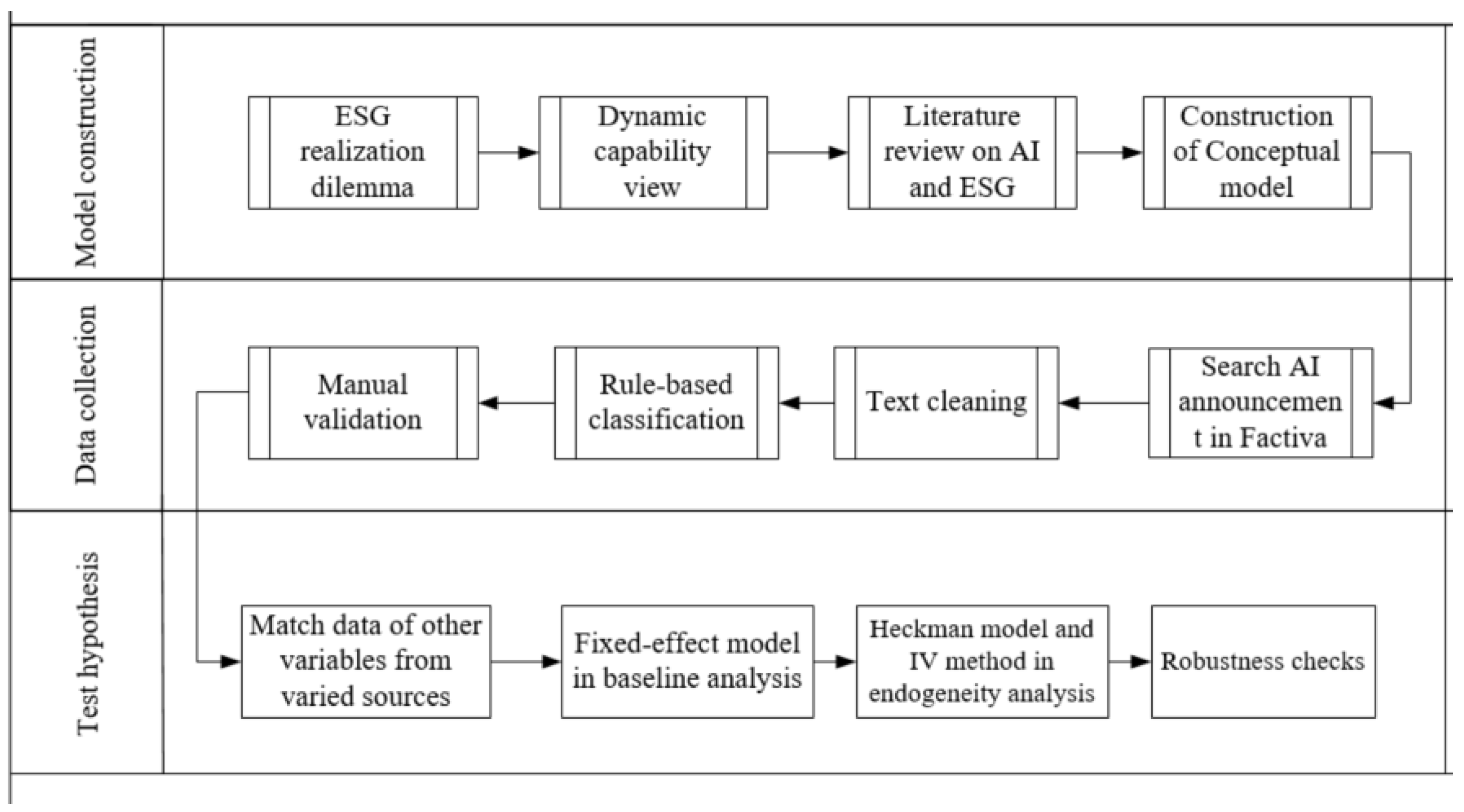

3. Data Collection and Variable Operationalization

3.1. Data Collection

3.2. Variable Concepts and Measurement

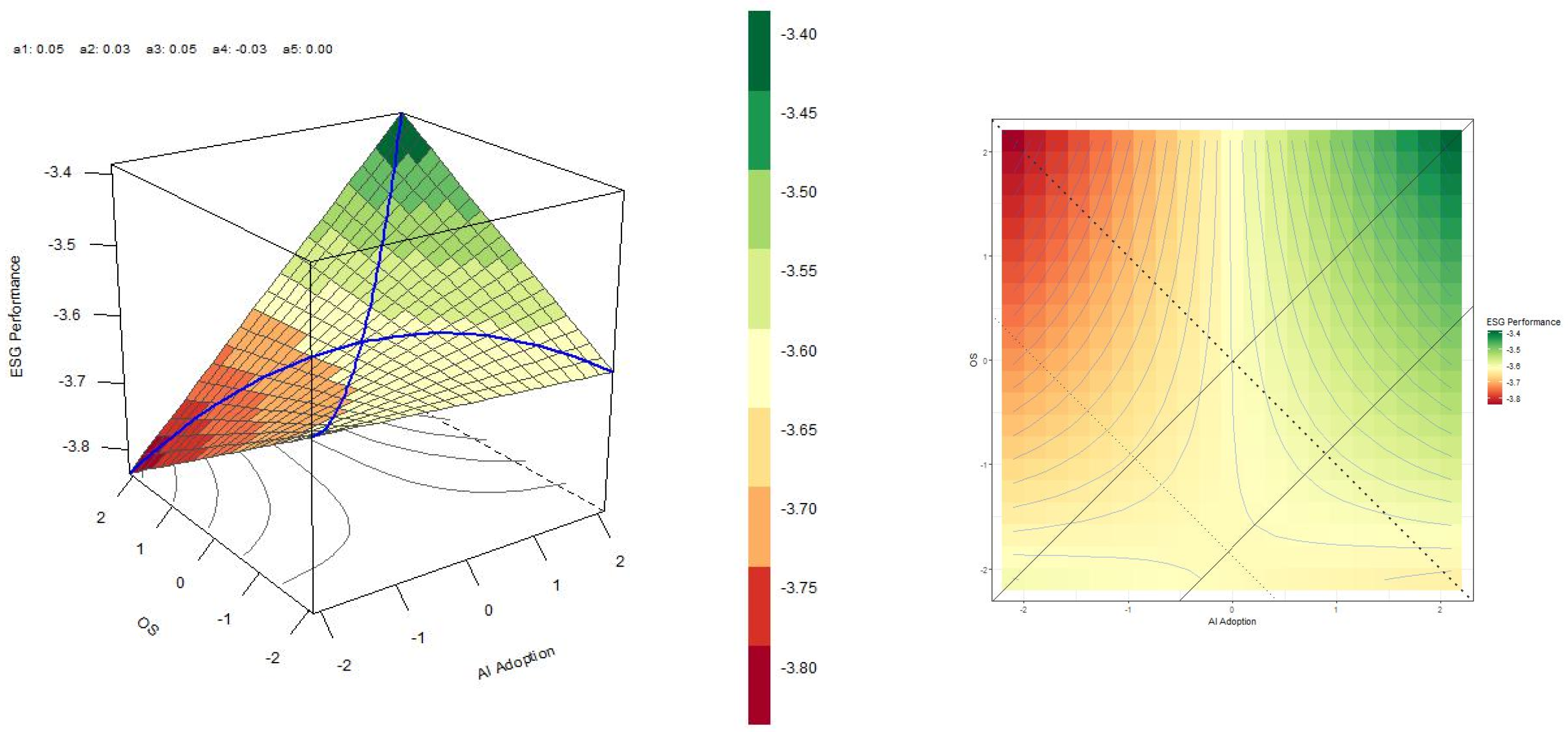

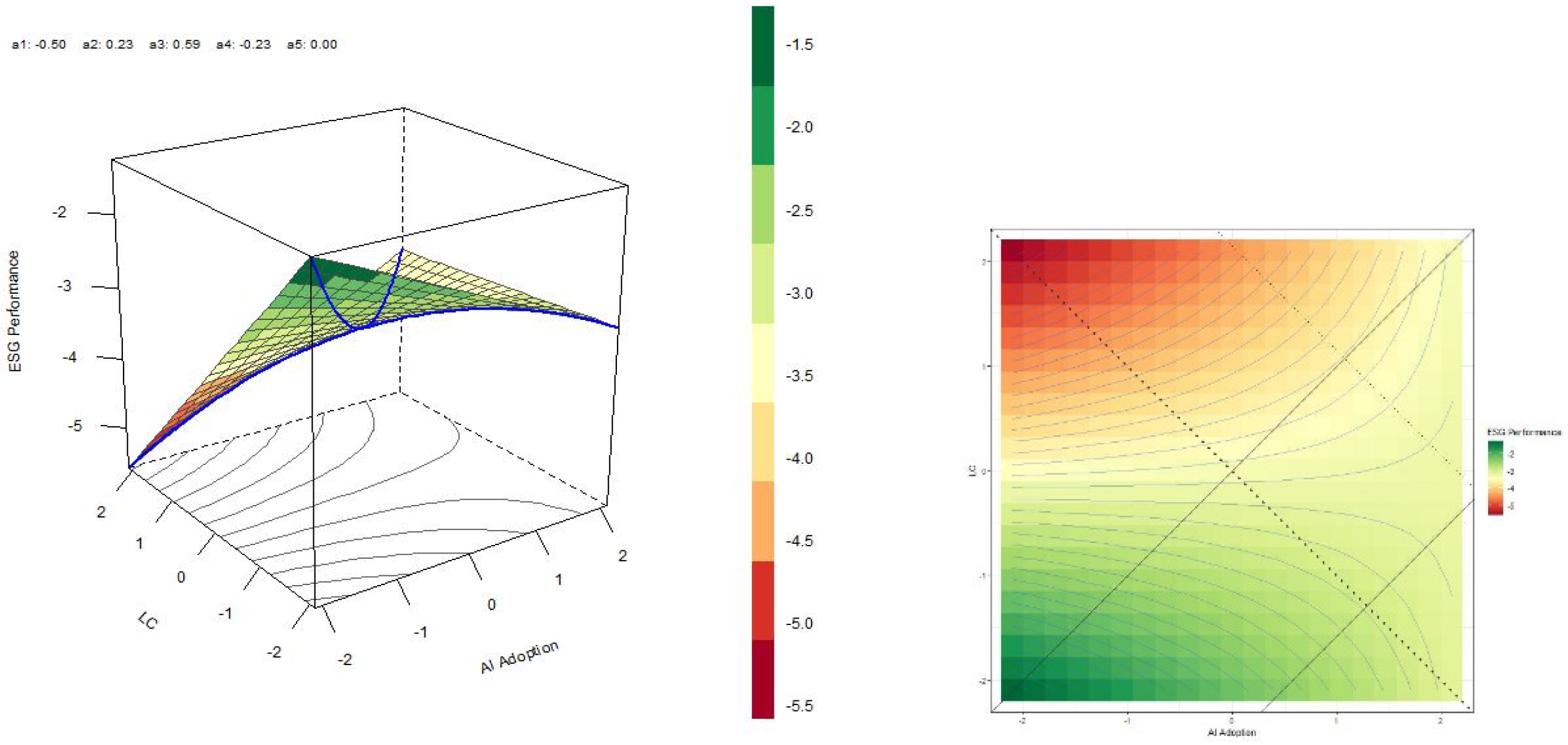

3.3. Model Construction

4. Results

4.1. Baseline Analysis

4.2. Endogeneity Analysis

4.3. Robustness Checks

5. Conclusions and Discussion

5.1. Theoretical Implications

5.2. Practical Implications

5.3. Limitations and Future Work

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

- (“artificial intelligence” or AI or “machine learning” or “deep learning” or “neural network” or “natural language processing” or “NLP” or “computer vision” or “intelligent algorithm” or “AI-powered” or “AI-driven” or “generative AI” or “chatbot” or “virtual assistant” or “intelligent automation”) and (construct or constructs or constructing or constructed or construction or adopt or adopts or adopted or adopting or adoption or use or uses or using or used or usage or usages or utilize or utilizes or utilizing or utilized or utilization or develop or develops or developing or developed or development or exploit or exploits or exploiting or exploitation or apply or applies or applying or applied or application or equip or equips or equipping or equipped or equipment or establish or establishes or establishing or established or establishment).

References

- Bunker, R.B.; Harris, D.; Cagle, C.S. An Analysis of Environmental, Social, and Corporate Governance (ESG) Ratings of Lean Versus Non-Lean Companies. J. Account. Financ. 2022, 22. [Google Scholar] [CrossRef]

- Fang, M.; Nie, H.; Shen, X. Can enterprise digitization improve ESG performance? Econ. Model. 2023, 118, 106101. [Google Scholar] [CrossRef]

- Zhang, Y.; Wan, D.; Zhang, L. Green credit, supply chain transparency and corporate ESG performance: Evidence from China. Financ. Res. Lett. 2024, 59, 104769. [Google Scholar] [CrossRef]

- Lopez-de-Silanes, F.; McCahery, J.A.; Pudschedl, P.C. ESG performance and disclosure: A cross-country analysis. Singap. J. Leg. Stud. 2020; 217–241, early access. [Google Scholar]

- Mathews, A. How Unilever is Leveraging AI to Drive Innovation and Sustainability. Available online: https://aimresearch.co/market-industry/how-unilever-is-leveraging-ai-to-drive-innovation-and-sustainability (accessed on 19 May 2025).

- Alzoubi, Y.I.; Mishra, A. Green artificial intelligence initiatives: Potentials and challenges. J. Clean. Prod. 2024, 468, 143090. [Google Scholar] [CrossRef]

- Mckinsy. McKinsey and Microsoft Join Forces to Accelerate Decarbonization Transformations. Available online: https://www.mckinsey.com/about-us/new-at-mckinsey-blog/mckinsey-and-microsoft-join-forces-to-accelerate-decarbonization-transformations (accessed on 31 March 2024).

- Liu, J.; Liu, L.; Qian, Y.; Song, S. The effect of artificial intelligence on carbon intensity: Evidence from China’s industrial sector. Socio-Econ. Plan. Sci. 2022, 83, 101002. [Google Scholar] [CrossRef]

- Wang, Q.; Sun, T.; Li, R. Does artificial intelligence promote green innovation? An assessment based on direct, indirect, spillover, and heterogeneity effects. Energy Environ. 2023, 36, 1005–1037. [Google Scholar] [CrossRef]

- Abdallah, M.; Talib, M.A.; Feroz, S.; Nasir, Q.; Abdalla, H.; Mahfood, B. Artificial intelligence applications in solid waste management: A systematic research review. Waste Manag. 2020, 109, 231–246. [Google Scholar] [CrossRef]

- Zhuk, A. Artificial intelligence impact on the environment: Hidden ecological costs and ethical-legal issues. J. Digit. Technol. Law 2023, 1, 932–954. [Google Scholar] [CrossRef]

- Leon, M. The Escalating AI’s Energy Demands and the Imperative Need for Sustainable Solutions. WSEAS Trans. Syst. 2024, 23, 444–457. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Warner, K.S.; Wäger, M. Building dynamic capabilities for digital transformation: An ongoing process of strategic renewal. Long Range Plan. 2019, 52, 326–349. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Martin, R. How successful leaders think. Harv. Bus. Rev. 2007, 85, 60. [Google Scholar]

- Velte, P. Does ESG performance have an impact on financial performance? Evidence from Germany. J. Glob. Responsib. 2017, 8, 169–178. [Google Scholar] [CrossRef]

- Aroul, R.R.; Sabherwal, S.; Villupuram, S.V. ESG, operational efficiency and operational performance: Evidence from Real Estate Investment Trusts. Manag. Financ. 2022, 48, 1206–1220. [Google Scholar] [CrossRef]

- Junius, D.; Adisurjo, A.; Rijanto, Y.A.; Adelina, Y.E. The impact of ESG performance to firm performance and market value. J. Apl. Akunt. 2020, 5, 21–41. [Google Scholar] [CrossRef]

- Crace, L.; Gehman, J. What really explains ESG performance? Disentangling the asymmetrical drivers of the triple bottom line. Organ. Environ. 2023, 36, 150–178. [Google Scholar] [CrossRef]

- Neumann, O.; Guirguis, K.; Steiner, R. Exploring artificial intelligence adoption in public organizations: A comparative case study. Public Manag. Rev. 2024, 26, 114–141. [Google Scholar] [CrossRef]

- Shahzadi, G.; Jia, F.; Chen, L.; John, A. AI adoption in supply chain management: A systematic literature review. J. Manuf. Technol. Manag. 2024, 35, 1125–1150. [Google Scholar] [CrossRef]

- Khan, F.; Ullah Jan, S.; Zia-ul-haq, H.M. Artificial intelligence adoption, audit quality and integrated financial reporting in GCC markets. Asian Rev. Account. 2024. [Google Scholar] [CrossRef]

- Dangelico, R.M.; Pujari, D.; Pontrandolfo, P. Green product innovation in manufacturing firms: A sustainability-oriented dynamic capability perspective. Bus. Strategy Environ. 2017, 26, 490–506. [Google Scholar] [CrossRef]

- Akter, S.; McCarthy, G.; Sajib, S.; Michael, K.; Dwivedi, Y.K.; D’Ambra, J.; Shen, K.N. Algorithmic bias in data-driven innovation in the age of AI. Int. J. Inf. Manag. 2021, 60, 102387. [Google Scholar] [CrossRef]

- Egorova, A.A.; Grishunin, S.V.; Karminsky, A. The Impact of ESG factors on the performance of Information Technology Companies. Procedia Comput. Sci. 2022, 199, 339–345. [Google Scholar] [CrossRef]

- Aydoğmuş, M.; Gülay, G.; Ergun, K. Impact of ESG performance on firm value and profitability. Borsa Istanb. Rev. 2022, 22, S119–S127. [Google Scholar] [CrossRef]

- Tarmuji, I.; Maelah, R.; Tarmuji, N.H. The impact of environmental, social and governance practices (ESG) on economic performance: Evidence from ESG score. Int. J. Trade Econ. Financ. 2016, 7, 67. [Google Scholar] [CrossRef]

- Redondo Alamillos, R.; De Mariz, F. How can European regulation on ESG impact business globally? J. Risk Financ. Manag. 2022, 15, 291. [Google Scholar] [CrossRef]

- Gurol, B.; Lagasio, V. Women board members’ impact on ESG disclosure with environment and social dimensions: Evidence from the European banking sector. Soc. Responsib. J. 2022, 19, 211–228. [Google Scholar] [CrossRef]

- Cao, M.; Duan, K.; Ibrahim, H. Green investments and their impact on ESG ratings: An evidence from China. Econ. Lett. 2023, 232, 111365. [Google Scholar] [CrossRef]

- Peng, Y.; Chen, H.; Li, T. The impact of digital transformation on ESG: A case study of Chinese-listed companies. Sustainability 2023, 15, 15072. [Google Scholar] [CrossRef]

- Bethlehem, J. Selection bias in web surveys. Int. Stat. Rev. 2010, 78, 161–188. [Google Scholar] [CrossRef]

- Abraham, S.; Shrives, P.J. Improving the relevance of risk factor disclosure in corporate annual reports. Br. Account. Rev. 2014, 46, 91–107. [Google Scholar] [CrossRef]

- Linlin, L.; Peter, K.; Andy, C.; TCE, C.; Tienan, W. An empirical study on digitalization’s impact on operational efficiency and the moderating role of multiple uncertainties. IEEE Trans. Eng. Manag. 2024, 71, 11463–11478. [Google Scholar]

- Shankar, V.; Parsana, S. An overview and empirical comparison of natural language processing (NLP) models and an introduction to and empirical application of autoencoder models in marketing. J. Acad. Mark. Sci. 2022, 50, 1324–1350. [Google Scholar] [CrossRef]

- Schwartz, R.; Dodge, J.; Smith, N.A.; Etzioni, O. Green AI. Commun. ACM 2020, 63, 54–63. [Google Scholar] [CrossRef]

- Georgiou, S.; Kechagia, M.; Sharma, T.; Sarro, F.; Zou, Y. Green AI: Do deep learning frameworks have different costs? In Proceedings of the 44th International Conference on Software Engineering, Pittsburgh, PA, USA, 21–29 May 2022. [Google Scholar]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Jansen, J.J.; Van Den Bosch, F.A.; Volberda, H.W. Managing potential and realized absorptive capacity: How do organizational antecedents matter? Acad. Manag. J. 2005, 48, 999–1015. [Google Scholar] [CrossRef]

- Lane, P.J.; Koka, B.R.; Pathak, S. The reification of absorptive capacity: A critical review and rejuvenation of the construct. Acad. Manag. Rev. 2006, 31, 833–863. [Google Scholar] [CrossRef]

- Lichtenthaler, U.; Lichtenthaler, E. A capability-based framework for open innovation: Complementing absorptive capacity. J. Manag. Stud. 2009, 46, 1315–1338. [Google Scholar] [CrossRef]

- Li, J.; Wu, T.; Hu, B.; Pan, D.; Zhou, Y. Artificial intelligence and corporate ESG performance. Int. Rev. Financ. Anal. 2025, 102, 104036. [Google Scholar] [CrossRef]

- Yang, Z.h.; Xu, M.; Xiu, X.; Li, G.b. TMT’s technical orientation and ambidextrous innovation capability in digital transformation age. Manag. Decis. Econ. 2025, 46, 1934–1955. [Google Scholar] [CrossRef]

- Senadjki, A.; Yong, H.N.A.; Ganapathy, T.; Ogbeibu, S. Unlocking the potential: The impact of digital leadership on firms’ performance through digital transformation. J. Bus. Socio-Econ. Dev. 2023, 4, 161–177. [Google Scholar] [CrossRef]

- Bharadwaj, A.; El Sawy, O.A.; Pavlou, P.A.; Venkatraman, N. Digital business strategy: Toward a next generation of insights. MIS Q. 2013, 37, 471–482. [Google Scholar] [CrossRef]

- Bourgeois, L.J. On the measurement of organizational slack. Acad. Manag. Rev. 1981, 6, 29–39. [Google Scholar] [CrossRef]

- George, G. Slack resources and the performance of privately held firms. Acad. Manag. J. 2005, 48, 661–676. [Google Scholar] [CrossRef]

- Nohria, N.; Gulati, R. Is slack good or bad for innovation? Acad. Manag. J. 1996, 39, 1245–1264. [Google Scholar] [CrossRef]

- Tan, J.; Peng, M.W. Organizational slack and firm performance during economic transitions: Two studies from an emerging economy. Strateg. Manag. J. 2003, 24, 1249–1263. [Google Scholar] [CrossRef]

- Rane, N.; Choudhary, S.; Rane, J. Artificial intelligence driven approaches to strengthening Environmental, Social, and Governance (ESG) criteria in sustainable business practices: A review. Soc. Gov. Criteria Sustain. Bus. Pract. 2024. SSRN preprint. Available online: https://ssrn.com/abstract=4843215 (accessed on 19 May 2025). [CrossRef]

- Wamba, S.F.; Bawack, R.E.; Guthrie, C.; Queiroz, M.M.; Carillo, K.D.A. Are we preparing for a good AI society? A bibliometric review and research agenda. Technol. Forecast. Soc. Change 2021, 164, 120482. [Google Scholar] [CrossRef]

- Duan, Y.; Edwards, J.S.; Dwivedi, Y.K. Artificial intelligence for decision making in the era of Big Data–evolution, challenges and research agenda. Int. J. Inf. Manag. 2019, 48, 63–71. [Google Scholar] [CrossRef]

- Bag, S.; Gupta, S.; Kumar, S. Industry 4.0 adoption and 10R advance manufacturing capabilities for sustainable development. Int. J. Prod. Econ. 2021, 231, 107844. [Google Scholar] [CrossRef]

- Dwivedi, Y.K.; Hughes, L.; Ismagilova, E.; Aarts, G.; Coombs, C.; Crick, T.; Duan, Y.; Dwivedi, R.; Edwards, J.; Eirug, A. Artificial Intelligence (AI): Multidisciplinary perspectives on emerging challenges, opportunities, and agenda for research, practice and policy. Int. J. Inf. Manag. 2021, 57, 101994. [Google Scholar] [CrossRef]

- Huang, X.; Yang, F.; Zheng, J.; Feng, C.; Zhang, L. Personalized human resource management via HR analytics and artificial intelligence: Theory and implications. Asia Pac. Manag. Rev. 2023, 28, 598–610. [Google Scholar] [CrossRef]

- Zhang, H. Exploring the Impact of AI on Human Resource Management: A case study of organizational adaptation and employee dynamics. IEEE Trans. Eng. Manag. 2024, 71, 14991–15004. [Google Scholar] [CrossRef]

- Teece, D.; Peteraf, M.; Leih, S. Dynamic capabilities and organizational agility: Risk, uncertainty, and strategy in the innovation economy. Calif. Manag. Rev. 2016, 58, 13–35. [Google Scholar] [CrossRef]

- Del Giudice, M.; Khan, Z.; De Silva, M.; Scuotto, V.; Caputo, F.; Carayannis, E. The microlevel actions undertaken by owner-managers in improving the sustainability practices of cultural and creative small and medium enterprises: A United Kingdom–Italy comparison. J. Organ. Behav. 2017, 38, 1396–1414. [Google Scholar] [CrossRef]

- Albort-Morant, G.; Leal-Rodríguez, A.L.; Fernández-Rodríguez, V.; Ariza-Montes, A. Assessing the origins, evolution and prospects of the literature on dynamic capabilities: A bibliometric analysis. Eur. Res. Manag. Bus. Econ. 2018, 24, 42–52. [Google Scholar] [CrossRef]

- Kessel, L.; Graf-Vlachy, L. Chief digital officers: The state of the art and the road ahead. Manag. Rev. Q. 2022, 72, 1249–1286. [Google Scholar] [CrossRef]

- Zhang, Y.; Jin, S. How does digital transformation increase corporate sustainability? The moderating role of top management teams. Systems 2023, 11, 355. [Google Scholar] [CrossRef]

- Bausch, D.; Kraemer, T.; Mauroner, O. Technology-Induced Stress and Employee Resistance in the Context of Digital Transformation and Identification of Countermeasures. Int. J. Innov. Technol. Manag. 2024, 21, 2450029. [Google Scholar] [CrossRef]

- Slack, N. The changing nature of operations flexibility. Int. J. Oper. Prod. Manag. 2005, 25, 1201–1210. [Google Scholar] [CrossRef]

- Greve, H.R. A behavioral theory of R&D expenditures and innovations: Evidence from shipbuilding. Acad. Manag. J. 2003, 46, 685–702. [Google Scholar]

- Brynjolfsson, E.; Mcafee, A. The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies; WW Norton & Company: New York, NY, USA, 2014. [Google Scholar]

- Alareeni, B.A.; Hamdan, A. ESG impact on performance of US S&P 500-listed firms. Corp. Gov. Int. J. Bus. Soc. 2020, 20, 1409–1428. [Google Scholar] [CrossRef]

- Ren, X.; Zeng, G.; Zhao, Y. Digital finance and corporate ESG performance: Empirical evidence from listed companies in China. Pac.-Basin Financ. J. 2023, 79, 102019. [Google Scholar] [CrossRef]

- Wiengarten, F.; Lo, C.K.; Lam, J.Y. How does sustainability leadership affect firm performance? The choices associated with appointing a chief officer of corporate social responsibility. J. Bus. Ethics 2017, 140, 477–493. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive capacity: A new perspective on learning and innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Escribano, A.; Fosfuri, A.; Tribó, J.A. Managing external knowledge flows: The moderating role of absorptive capacity. Res. Policy 2009, 38, 96–105. [Google Scholar] [CrossRef]

- Bellamy, M.A.; Ghosh, S.; Hora, M. The influence of supply network structure on firm innovation. J. Oper. Manag. 2014, 32, 357–373. [Google Scholar] [CrossRef]

- Körber, M.; Cotta, D. Supply chain in the C-suite: The effect of chief supply chain officers on incidence of product recalls. Supply Chain Manag. 2021, 26, 495–513. [Google Scholar] [CrossRef]

- Chun, M.; Mooney, J. CIO roles and responsibilities: Twenty-five years of evolution and change. Inf. Manag. 2009, 46, 323–334. [Google Scholar] [CrossRef]

- Kunisch, S.; Menz, M.; Langan, R. Chief digital officers: An exploratory analysis of their emergence, nature, and determinants. Long Range Plan. 2022, 55, 101999. [Google Scholar] [CrossRef]

- Al-Shaer, H.; Zaman, M.; Albitar, K. CEO gender, critical mass of board gender diversity and ESG performance: UK evidence. J. Account. Lit. 2024, ahead of print. [Google Scholar] [CrossRef]

- Dotzel, T.; Shankar, V. The relative effects of business-to-business (vs. business-to-consumer) service innovations on firm value and firm risk: An empirical analysis. J. Mark. 2019, 83, 133–152. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. The net-enabled business innovation cycle and the evolution of dynamic capabilities. Inf. Syst. Res. 2002, 13, 147–150. [Google Scholar] [CrossRef]

- Li, H.; Lam, H.K.S.; Ho, W.; Yeung, A.C.L. The impact of chief risk officer appointments on firm risk and operational efficiency. J. Oper. Manag. 2022, 68, 241–269. [Google Scholar] [CrossRef]

- Li, S.; Shang, J.; Slaughter, S.A. Why do software firms fail? Capabilities, competitive actions, and firm survival in the software industry from 1995 to 2007. Inf. Syst. Res. 2010, 21, 631–654. [Google Scholar] [CrossRef]

- Yiu, L.M.D.; Lam, H.K.S.; Yeung, A.C.L.; Cheng, T.C.E. Enhancing the financial returns of R&D Investments through operations management. Prod. Oper. Manag. 2020, 29, 1658–1678. [Google Scholar] [CrossRef]

- Hendricks, K.B.; Hora, M.; Singhal, V.R. An empirical investigation on the appointments of supply chain and operations management executives. Manag. Sci. 2015, 61, 1562–1583. [Google Scholar] [CrossRef]

- Lu, J.; Wang, W. Managerial conservatism, board independence and corporate innovation. J. Corp. Financ. 2018, 48, 1–16. [Google Scholar] [CrossRef]

- Liu, X.; Ma, C.; Ren, Y.-S. How AI powers ESG performance in China’s digital frontier? Financ. Res. Lett. 2024, 70, 106324. [Google Scholar] [CrossRef]

- Putri, C.M.; Puspawati, D. The effect of ESG disclosure, company size, and leverage on company’s financial performance in Indonesia. Int. J. Bus. Manag. Technol. 2023, 7, 252–262. [Google Scholar]

- Gavrilakis, N.; Floros, C. ESG performance, herding behavior and stock market returns: Evidence from Europe. Oper. Res. 2023, 23, 3. [Google Scholar] [CrossRef]

- Toh, P.K.; Polidoro, F. A competition-based explanation of collaborative invention within the firm. Strateg. Manag. J. 2013, 34, 1186–1208. [Google Scholar] [CrossRef]

- Hegde, S.P.; Mishra, D.R. Married CEOs and corporate social responsibility. J. Corp. Financ. 2019, 58, 226–246. [Google Scholar] [CrossRef]

- Chari, M.D.R.; Devaraj, S.; David, P. Research note the impact of information technology investments and diversification strategies on firm performance. Manag. Sci. 2008, 54, 224–234. [Google Scholar] [CrossRef]

- Lev, B.; Sougiannis, T. The capitalization, amortization, and value-relevance of R&D. J. Account. Econ. 1996, 21, 107–138. [Google Scholar] [CrossRef]

- Lisboa, I. Family Impact on Capital Structure: Does Financial Crisis Matter? J. Bus. Econ. 2015, 6, 306–316. [Google Scholar] [CrossRef][Green Version]

- George, G.; Schillebeeckx, S.J. Digital transformation, sustainability, and purpose in the multinational enterprise. J. World Bus. 2022, 57, 101326. [Google Scholar] [CrossRef]

- Vitolla, F.; Raimo, N.; Campobasso, F.; Giakoumelou, A. Risk disclosure in sustainability reports: Empirical evidence from the energy sector. Util. Policy 2023, 82, 101587. [Google Scholar] [CrossRef]

- Vogel, R.; Güttel, W.H. The dynamic capability view in strategic management: A bibliometric review. Int. J. Manag. Rev. 2013, 15, 426–446. [Google Scholar] [CrossRef]

- Gao, Y.; Liu, S.; Yang, L. Artificial intelligence and innovation capability: A dynamic capabilities perspective. Int. Rev. Econ. Financ. 2025, 98, 103923. [Google Scholar] [CrossRef]

- Nishant, R.; Kennedy, M.; Corbett, J. Artificial intelligence for sustainability: Challenges, opportunities, and a research agenda. Int. J. Inf. Manag. 2020, 53, 102104. [Google Scholar] [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. In Managing Digital Transformation; Routledge: London, UK, 2021; pp. 13–66. [Google Scholar]

| Variable Name | Measurement | Source | References |

|---|---|---|---|

| Dependent Variable | |||

| ESG Performance | Bloomberg ESG combined score (0–10) reflecting overall ESG performance | Bloomberg | [67,68] |

| Independent Variable | |||

| AI Adoption (AI) | Number of AI-related corporate announcements per firm-year | Factiva | [35,77] |

| Moderators | |||

| Operational Slack (OS) | Sum of days of inventory and accounts receivable, minus days of accounts payable | Compustat | [69] |

| Learning Capability (LC) | Research and development expenses | Compustat | [72,78] |

| Digital TMT (DIGI TMT) | Dummy variable | ||

| Control variables | |||

| Firm Size (SIZE) | The natural logarithm of a firm’s total assets | Compustat | [79,80] |

| Firm Age (AGE) | The number of years since a firm was founded | Compustat | [35] |

| Leverage (LEVE) | The ratio of the book value of debt to assets | Compustat | [79,81] |

| Market-to-Book Ratio (MTBR) | A firm’s market value of equity divided by book value of equity | Compustat | [79,82] |

| Capital Expenditures (CAPX) | Capital expenditures | Compustat | [83] |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) |

|---|---|---|---|---|---|---|---|---|---|---|

| (1) ESG | 1.000 | |||||||||

| (2) AI | 0.601 | 1.000 | ||||||||

| (0.000) | ||||||||||

| (3) OS | −0.014 | 0.001 | 1.000 | |||||||

| (0.198) | (0.950) | |||||||||

| (4) LC | 0.045 | 0.027 | −0.037 | 1.000 | ||||||

| (0.000) | (0.012) | (0.001) | ||||||||

| (5) DIGI TMT | 0.021 | 0.029 | −0.003 | −0.036 | 1.000 | |||||

| (0.049) | (0.007) | (0.808) | (0.001) | |||||||

| (6) SIZE | 0.075 | 0.036 | −0.126 | 0.681 | 0.035 | 1.000 | ||||

| (0.000) | (0.001) | (0.000) | (0.000) | (0.001) | ||||||

| (7) AGE | 0.020 | 0.020 | −0.154 | 0.205 | 0.065 | 0.489 | 1.000 | |||

| (0.067) | (0.070) | (0.000) | (0.000) | (0.000) | (0.000) | |||||

| (8) LEVE | 0.001 | −0.002 | −0.021 | 0.003 | −0.057 | −0.013 | −0.092 | 1.000 | ||

| (0.949) | (0.823) | (0.049) | (0.798) | (0.000) | (0.228) | (0.000) | ||||

| (9) MTBR | 0.034 | 0.029 | −0.020 | −0.081 | −0.048 | −0.067 | −0.122 | 0.724 | 1.000 | |

| (0.002) | (0.008) | (0.062) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |||

| (10) CAPX | 0.065 | 0.042 | −0.117 | 0.548 | 0.031 | 0.861 | 0.340 | −0.002 | −0.042 | 1.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.004) | (0.000) | (0.000) | (0.840) | (0.000) |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| ESG Performance | ||||

| AI | 0.050 *** | 0.0495 *** | 0.049 *** | 0.050 *** |

| (0.002) | (0.00236) | (0.002) | (0.002) | |

| OS | 1.20 × 10−6 | |||

| (1.06 × 10−5) | ||||

| OS × AI | 2.73 × 10−5 *** | |||

| (4.41 × 10−6) | ||||

| LC | −0.000 | |||

| (0.000) | ||||

| LC × AI | 0.000 *** | |||

| (0.000) | ||||

| DIGI TMT | −0.050 | |||

| (0.217) | ||||

| DIGI TMT × AI | 0.199 *** | |||

| (0.014) | ||||

| SIZE | 0.141 ** | 0.130 ** | 0.081 | 0.127 ** |

| (0.065) | (0.0653) | (0.072) | (0.054) | |

| AGE | 0.160 *** | 0.160 *** | 0.163 *** | 0.161 *** |

| (0.020) | (0.0198) | (0.020) | (0.020) | |

| LEVE | 0.008 | 0.0120 | 0.008 | 0.009 |

| (0.009) | (0.00854) | (0.007) | (0.008) | |

| MTBR | −0.000 | −3.77 × 10−5 ** | −0.000 ** | −0.000 * |

| (0.000) | (1.78 × 10−5) | (0.000) | (0.000) | |

| CAPX | −0.099 | −0.0857 | −0.077 | −0.131 |

| (0.100) | (0.100) | (0.103) | (0.092) | |

| Constant | −4.150 *** | −3.615 *** | −3.335 *** | −3.299 *** |

| (0.947) | (0.954) | (1.027) | (0.761) | |

| Observations | 8469 | 8469 | 8469 | 8469 |

| Number of gvkey | 941 | 941 | 941 | 941 |

| R-squared | 0.207 | 0.212 | 0.223 | 1.243 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| ESG Performancei,t+1 | ||||

| AIi,t | 0.026 *** | 0.025 *** | 0.025 *** | 0.026 *** |

| (0.002) | (0.002) | (0.002) | (0.002) | |

| OSi,t | 0.000 | |||

| (0.000) | ||||

| OSi,t × AIi,t | 0.000 *** | |||

| (0.000) | ||||

| LCi,t | −0.000 | |||

| (0.000) | ||||

| LCi,t × AIi,t | 0.000 *** | |||

| (0.000) | ||||

| DIGI TMTi,t | 0.026 | |||

| (0.224) | ||||

| DIGI TMTi,t × AIi,t | 0.151 *** | |||

| (0.012) | ||||

| SIZEi,t | 0.126 | 0.118 | 0.082 | 0.113 * |

| (0.077) | (0.075) | (0.088) | (0.067) | |

| AGEi,t | 0.179 *** | 0.178 *** | 0.179 *** | 0.180 *** |

| (0.025) | (0.026) | (0.026) | (0.025) | |

| LEVEi,t | 0.008 | 0.012 | 0.011 | 0.011 |

| (0.009) | (0.011) | (0.011) | (0.010) | |

| MTBRi,t | −0.000 | −0.000 | −0.000 | −0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| CAPXi,t | −0.093 | −0.082 | −0.070 | −0.126 |

| (0.111) | (0.114) | (0.113) | (0.106) | |

| Constant | −4.438 *** | −4.146 *** | −3.945 *** | −3.857 *** |

| (1.014) | (1.017) | (1.119) | (0.893) | |

| Observations | 7528 | 7528 | 7528 | 7528 |

| Number of gvkey | 941 | 941 | 941 | 942 |

| F statistics | 67.67 | 71.23 | 50.13 | 66.59 |

| Stage I | Stage II (ESG Performance) | ||||

|---|---|---|---|---|---|

| Variables | AI | Model 1 | Model 2 | Model 3 | Model 4 |

| IV | 8.753 | ||||

| (0.192) | |||||

| AI | 0.490 *** | 0.491 *** | 0.048 *** | 0.050 *** | |

| (0.033) | (0.003) | (0.003) | (0.002) | ||

| OS | 1.24 × 10−6 | ||||

| (0.000) | |||||

| OS × AI | 0.000 | ||||

| (4.16 × 10−6) | |||||

| LC | −0.000 | ||||

| (0.000) | |||||

| LC × AI | 0.000 | ||||

| (0.000) | |||||

| DIGI TMT | −0.048 | ||||

| (0.279) | |||||

| DIGI TMT × AI | 0.199 *** | ||||

| (0.011) | |||||

| SIZE | −0.700 | 0.105 | 0.130 | 0.079 | 0.126 |

| (0.600) | (0.077) | (0.070) | (0.070) | (0.069) | |

| AGE | 0.823 *** | 0.201 *** | 0.160 *** | 0.164 *** | 0.161 *** |

| (0.135) | (0.023) | (0.016) | (0.016) | (0.016) | |

| LEVE | −0.054 | 0.005 | 0.012 | 0.008 | 0.009 |

| (0.178) | (0.011) | (0.021) | (0.021) | (0.020) | |

| MTBR | 0.000 | −0.000 | −0.000 | −0.000 | −0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| CAPX | 1.057 | −0.045 | −0.0853 | −0.076 | −0.131 |

| (0.685) | (0.113) | (0.080) | (0.080) | (0.078) | |

| Constant | −113.773 | −4.171 *** | −4.138 *** | −3.868 *** | −3.831 |

| (6.894) | (1.182) | (0.777) | (0.812) | (0.759) | |

| Year fixed | YES | YES | YES | YES | YES |

| Industry fixed | YES | YES | YES | YES | YES |

| Observations | 8469 | 8469 | 8469 | 8469 | 8469 |

| Number of gvkey | 941 | 941 | 941 | 941 | 941 |

| R-squared | 0.056 | 0.061 | 0.212 | 0.061 | 0.081 |

| F statistics | 360.46 | 54.5 | 9.03 | 8.70 | 7.96 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| E | S | G | E | S | G | E | S | G | E | S | G | |

| AI | 0.064 *** | 0.052 *** | 0.019 *** | 0.064 *** | 0.063 *** | 0.064 *** | 0.051 *** | 0.051 *** | 0.052 *** | 0.018 *** | 0.018 *** | 0.019 *** |

| (0.003) | (0.003) | (0.002) | (0.003) | (0.003) | (0.003) | (0.003) | (0.003) | (0.003) | (0.002) | (0.002) | (0.002) | |

| OS | 0.000 | −0.000 | 0.000 | |||||||||

| (0.000) | (0.000) | (0.000) | ||||||||||

| OS × AI | 0.000 *** | 0.000 *** | 0.000 *** | |||||||||

| (0.000) | (0.000) | (0.000) | ||||||||||

| LC | 0.000 | −0.000 | 0.000 | |||||||||

| (0.000) | (0.000) | (0.000) | ||||||||||

| LC × AI | 0.000 *** | 0.000 *** | 0.000 *** | |||||||||

| (0.000) | (0.000) | (0.000) | ||||||||||

| DIGI TMT | −0.298 | 0.292 | 0.337 | |||||||||

| (0.228) | (0.439) | (0.647) | ||||||||||

| DIGI TMT × AI | 0.237 *** | 0.201 *** | 0.159 *** | |||||||||

| (0.023) | (0.021) | (0.021) | ||||||||||

| SIZE | 0.229 * | 0.133 * | 0.325 *** | 0.217 * | 0.142 | 0.213 ** | 0.117 | 0.067 | 0.119 * | 0.310 *** | 0.217 ** | 0.314 *** |

| (0.123) | (0.071) | (0.086) | (0.122) | (0.126) | (0.106) | (0.072) | (0.082) | (0.062) | (0.083) | (0.090) | (0.073) | |

| AGE | 0.140 *** | 0.186 *** | 0.007 | 0.140 *** | 0.138 *** | 0.142 *** | 0.186 *** | 0.193 *** | 0.185 *** | 0.007 | 0.004 | 0.006 |

| (0.036) | (0.027) | (0.022) | (0.036) | (0.038) | (0.036) | (0.028) | (0.029) | (0.027) | (0.022) | (0.024) | (0.022) | |

| LEVE | −0.007 | 0.000 | 0.013 | −0.002 | −0.007 | −0.006 | 0.006 | 0.000 | 0.003 | 0.020 | 0.014 * | 0.015 * |

| (0.013) | (0.016) | (0.009) | (0.012) | (0.012) | (0.012) | (0.010) | (0.014) | (0.013) | (0.012) | (0.008) | (0.009) | |

| MTBR | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 | −0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| CAPX | −0.079 | −0.086 | 0.023 | −0.063 | −0.080 | −0.118 | −0.068 | −0.042 | −0.120 | 0.044 | 0.011 | −0.004 |

| (0.152) | (0.121) | (0.147) | (0.152) | (0.155) | (0.135) | (0.120) | (0.124) | (0.118) | (0.145) | (0.148) | (0.136) | |

| Constant | −5.082 *** | −5.719 *** | 1.774 | −4.405 ** | −3.552 * | −4.062 *** | −5.144 *** | −5.120 *** | −4.787 *** | 1.984 | 3.184 | 2.296 |

| (1.761) | (1.138) | (1.780) | (1.771) | (1.881) | (1.492) | (1.155) | (1.356) | (1.052) | (1.776) | (1.941) | (1.637) | |

| Year fixed | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Industry fixed | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES | YES |

| Observations | 8469 | 8469 | 8469 | 8469 | 8469 | 8469 | 8469 | 8469 | 8469 | 8469 | 8469 | 8469 |

| Number of gvkey | 941 | 941 | 941 | 941 | 941 | 941 | 941 | 941 | 941 | 941 | 941 | 941 |

| R-squared | 0.158 | 0.13 | 0.045 | 0.161 | 0.168 | 0.182 | 0.136 | 0.145 | 0.151 | 0.063 | 0.09 | 0.079 |

| F statistic | 71.5 | 68.75 | 20.68 | 72.83 | 56.58 | 62.78 | 76.34 | 55.45 | 63.23 | 19.3 | 21.78 | 22.96 |

| Before COVID-19 | After COVID-19 | |||||||

|---|---|---|---|---|---|---|---|---|

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 1 | Model 2 | Model 3 | Model 4 |

| ESG Performance | ESG Performance | |||||||

| AI | 0.012 *** | 0.012 *** | 0.012 *** | 0.011 *** | 0.057 *** | 0.057 *** | 0.057 *** | 0.057 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | (0.005) | (0.005) | (0.005) | (0.005) | |

| OS | 0.000 *** | −0.000 *** | ||||||

| (0.000) | (0.000) | |||||||

| OS × AI | 0.000 * | 0.000 *** | ||||||

| (0.000) | (0.000) | |||||||

| LC | 0.000 | −0.000 | ||||||

| (0.000) | (0.000) | |||||||

| LC × AI | 0.000 *** | 0.000 *** | ||||||

| (0.000) | (0.000) | |||||||

| DIGI TMT | 0.020 | −0.438 *** | ||||||

| (0.147) | (0.130) | |||||||

| DIGI TMT × AI | 0.141 *** | 0.100 *** | ||||||

| (0.013) | (0.034) | |||||||

| SIZE | −0.005 | −0.009 | −0.110 *** | −0.015 | 0.065 | 0.216 | 0.186 | 0.212 |

| (0.039) | (0.036) | (0.040) | (0.029) | (0.262) | (0.261) | (0.249) | (0.250) | |

| AGE | 0.179 *** | 0.188 *** | 0.182 *** | 0.176 *** | 0.027 | 0.029 | 0.035 | 0.035 |

| (0.026) | (0.029) | (0.027) | (0.025) | (0.031) | (0.031) | (0.031) | (0.031) | |

| LEVE | 0.003 | 0.002 | 0.000 | 0.003 | 0.053 | 0.049 | 0.052 | 0.052 |

| (0.004) | (0.004) | (0.004) | (0.005) | (0.042) | (0.039) | (0.039) | (0.041) | |

| MTBR | −0.000 | 0.000 | −0.000 | −0.000 * | −0.000 | −0.000 | −0.000 | −0.000 |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| CAPX | 0.118 | 0.117 | 0.080 | 0.064 | −0.184 | −0.200 | −0.183 | −0.180 |

| (0.106) | (0.089) | (0.097) | (0.085) | (0.134) | (0.136) | (0.130) | (0.133) | |

| Constant | −4.965 *** | −5.156 *** | −3.737 *** | −4.286 *** | 2.694 | 1.923 | 1.851 | 1.584 |

| (1.452) | (1.415) | (1.370) | (1.218) | (2.773) | (2.664) | (2.699) | (2.558) | |

| Year fixed | YES | YES | YES | YES | YES | YES | YES | YES |

| Industry fixed | YES | YES | YES | YES | YES | YES | YES | YES |

| Observations | 4705 | 4705 | 4705 | 4705 | 3764 | 8469 | 8469 | 8469 |

| Number of gvkey | 941 | 941 | 941 | 941 | 941 | 941 | 941 | 941 |

| R-squared | 0.041 | 0.055 | 0.093 | 0.099 | 0.308 | 0.31 | 0.311 | 0.311 |

| F statistic | 32.06 | 19.93 | 28.96 | 39.51 | 23.89 | 46.82 | 20.97 | 29.73 |

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| ESG Performance | ||||

| AI | 0.006 *** | 0.006 *** | 0.006 *** | 0.006 *** |

| (0.001) | (0.001) | (0.001) | (0.001) | |

| OS | 2.40 × 10−6 | |||

| (2.94 × 10−5) | ||||

| OS × AI | 3.82 × 10−6 *** | |||

| (9.65 × 10−7) | ||||

| LC | −0.000 | |||

| (0.000) | ||||

| LC × AI | 4.00 × 10−6 *** | |||

| (1.52 × 10−6) | ||||

| DIGI TMT | 0.077 | |||

| (0.086) | ||||

| DIGI TMT × AI | 0.029 *** | |||

| (0.007) | ||||

| SIZE | 0.080 | 0.080 ** | 0.073 | 0.078 ** |

| (0.037) | (0.038) | (0.034) | (0.086) | |

| AGE | 0.036 *** | 0.036 *** | 0.037 *** | 0.036 *** |

| (0.009) | (0.009) | (0.009) | (0.009) | |

| LEVE | 0.007 | 0.007 | 0.007 | 0.007 |

| (0.008) | (0.009) | (0.008) | (0.008) | |

| MTBR | 0.000 | −7.92 × 10−7 ** | −1.14 × 10−6 | 1.63 × 10−7 * |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| CAPX | −0.015 | −0.012 | −0.006 | −0.020 |

| (0.049) | (0.049) | (0.049) | (0.050) | |

| Constant | 2.554 *** | 2.610 *** | 2.584 *** | 2.680 *** |

| (0.428) | (0.435) | (0.438) | (0.442) | |

| Observations | 8469 | 8469 | 8469 | 8469 |

| Number of gvkey | 941 | 941 | 941 | 941 |

| F value | 14.68 | 13.66 | 12.08 | 13.45 |

| R-squared | 0.001 | 0.001 | 0.002 | 0.002 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, L.; Wang, X.; Tang, L.; Sun, Z.; Wang, X. Exploring the Conditional ESG Payoff of AI Adoption: The Roles of Learning Capability, Digital TMT, and Operational Slack. Systems 2025, 13, 399. https://doi.org/10.3390/systems13060399

Liu L, Wang X, Tang L, Sun Z, Wang X. Exploring the Conditional ESG Payoff of AI Adoption: The Roles of Learning Capability, Digital TMT, and Operational Slack. Systems. 2025; 13(6):399. https://doi.org/10.3390/systems13060399

Chicago/Turabian StyleLiu, Linlin, Xiaohong Wang, Liqing Tang, Zhaoxuan Sun, and Xue Wang. 2025. "Exploring the Conditional ESG Payoff of AI Adoption: The Roles of Learning Capability, Digital TMT, and Operational Slack" Systems 13, no. 6: 399. https://doi.org/10.3390/systems13060399

APA StyleLiu, L., Wang, X., Tang, L., Sun, Z., & Wang, X. (2025). Exploring the Conditional ESG Payoff of AI Adoption: The Roles of Learning Capability, Digital TMT, and Operational Slack. Systems, 13(6), 399. https://doi.org/10.3390/systems13060399