Digital Economy, Government Innovation Preferences, and Regional Innovation Capacity: Analysis Using PVAR Model

Abstract

1. Introduction

- (1)

- What are the mechanisms through which the digital economy and government innovation preferences affect regional innovation capabilities?

- (2)

- What are the interactive effects of the digital economy and government innovation preferences on technological and product innovation?

- (3)

- How do the effects of the digital economy and government innovation policies on regional innovation capabilities vary across time dimensions?

2. Literature Review

2.1. Mechanism of Digital Economy’s Influence on Regional Innovation System

2.2. Role Mechanism and Influence Path of Government Innovation Preference on Regional Innovation System

2.3. Synergy Between the Digital Economy and Government Innovation Preferences in the Innovation System

2.4. Long-Term Dynamic Evolution of the Digital Economy, Government Innovation Preferences and Regional Innovation System

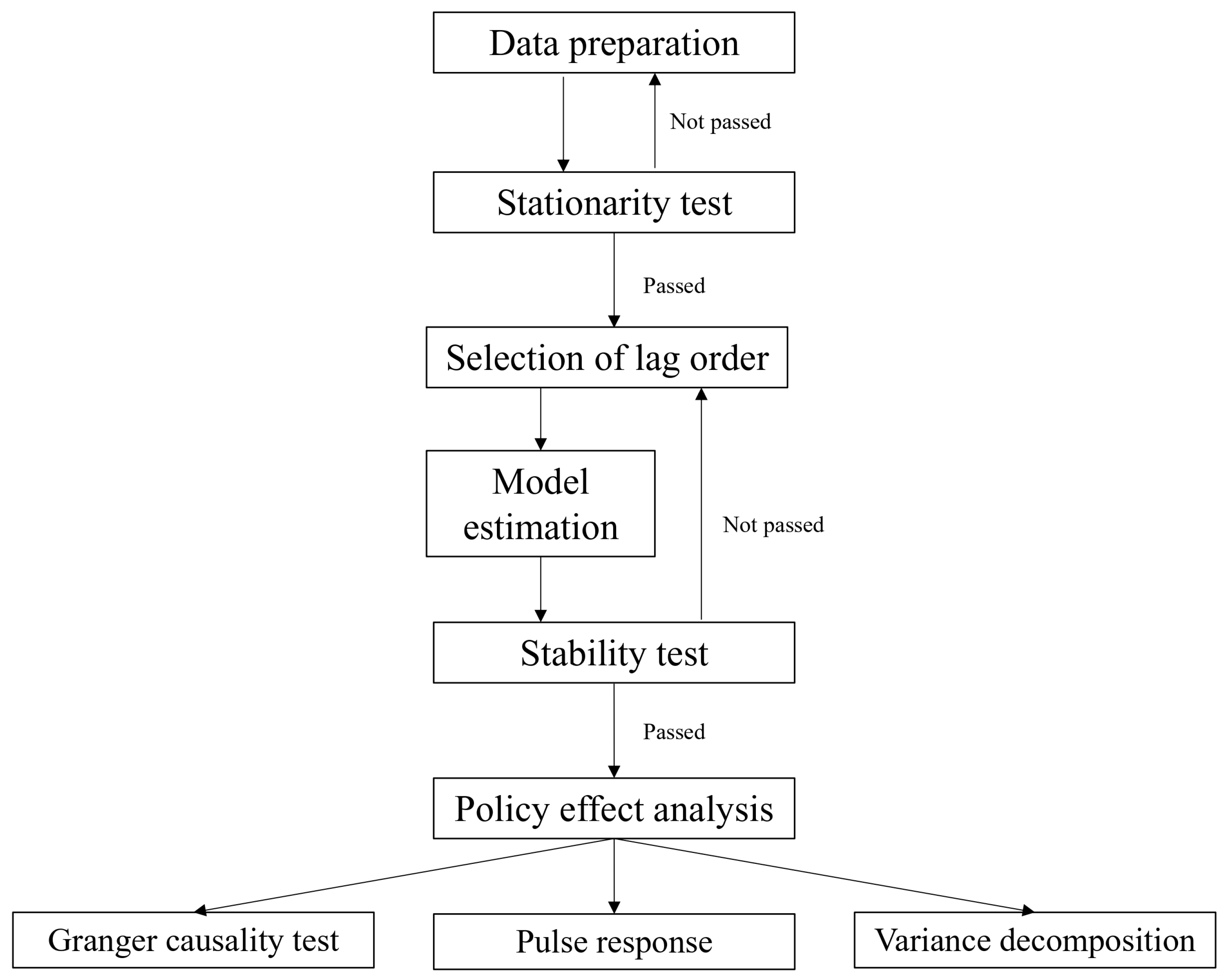

3. Research Design

3.1. Selection of Indicators

3.1.1. Regional Innovation Capacity

3.1.2. Digital Economy

3.1.3. Government Innovation Preferences

3.2. Data Sources and Processing

3.3. Model Setting and Method Selection

4. Research Results

4.1. Descriptive Statistical Analysis

4.2. Smoothness and Significance Tests

4.3. Determination of the Optimal Lag Order

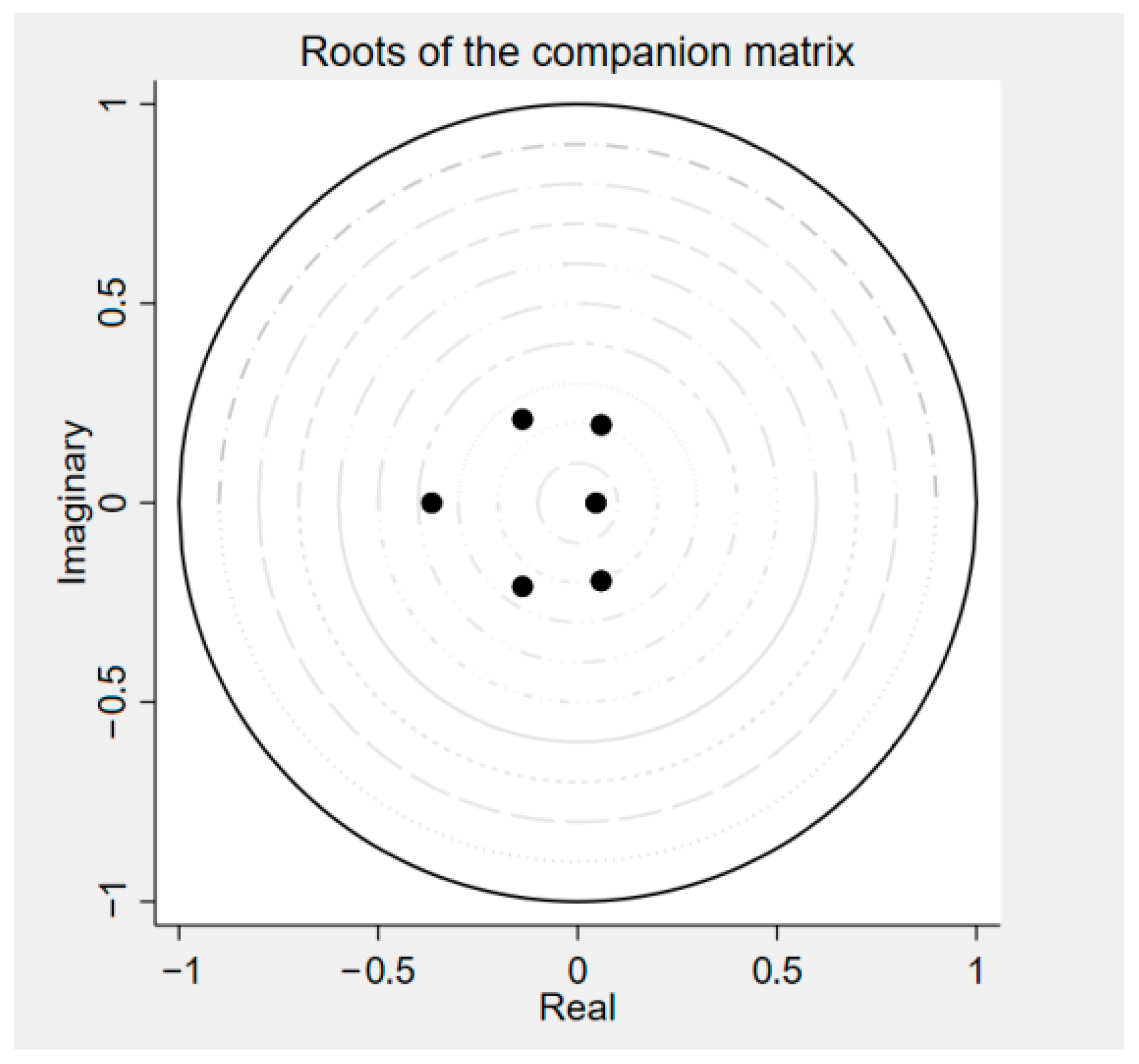

4.4. PVAR Model Analysis

4.4.1. GMM Estimation of PVAR Model 1

4.4.2. GMM Estimation of PVAR Model 2

4.5. Granger Causality Test

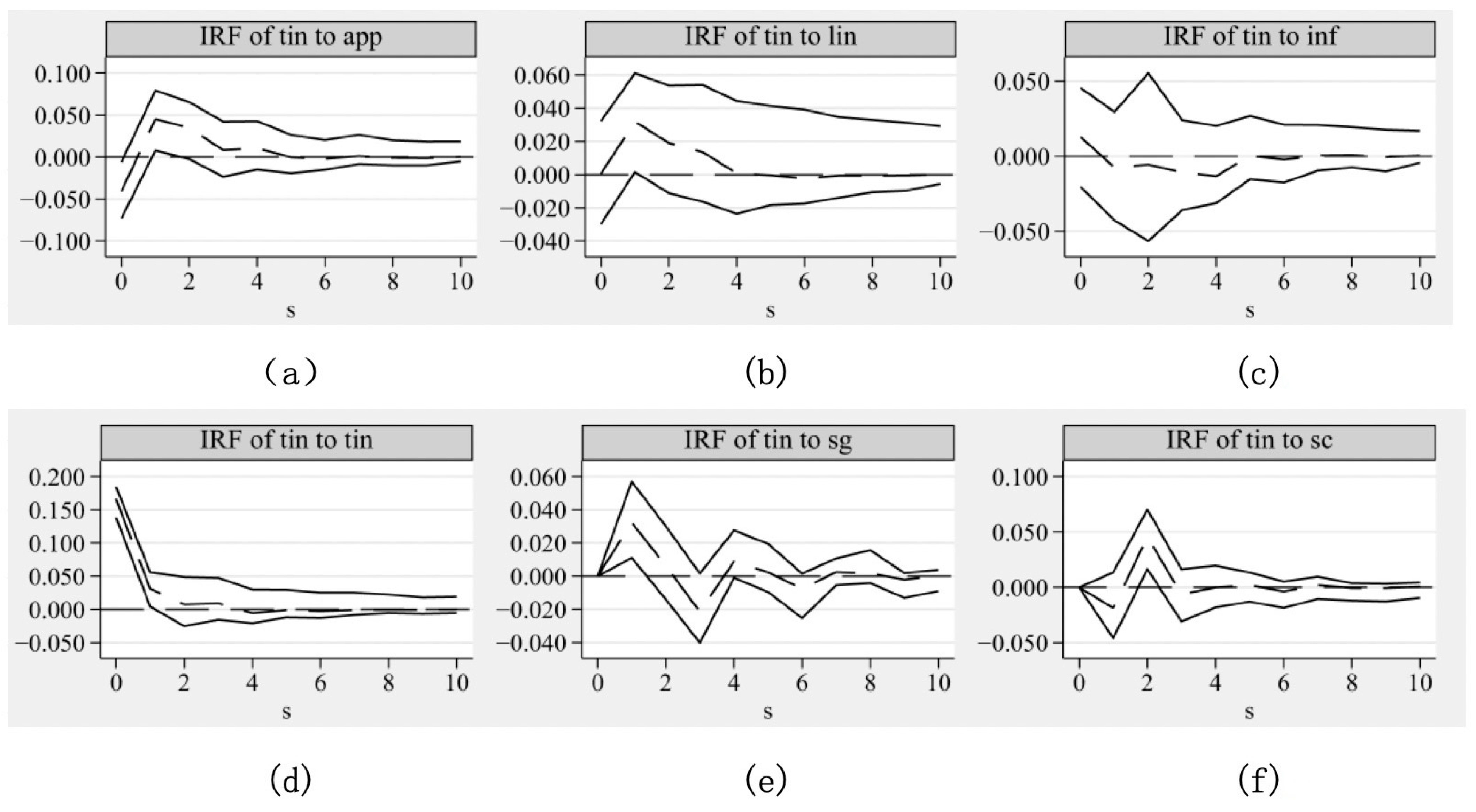

4.6. Impulse Response Function

4.6.1. The Impulse Response Function of PVAR Model 1

4.6.2. The Impulse Response Function of PVAR Model 2

4.7. Variance Decomposition

4.7.1. Variance Decomposition of PVAR Model 1

4.7.2. Variance Decomposition of PVAR Model 2

5. Conclusions and Implications

5.1. Conclusions

5.2. Implications

5.3. Limitations and Prospects

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

Appendix C

| Variant | Model 1 | Variant | Model 2 | ||||

|---|---|---|---|---|---|---|---|

| APP | Original hypothesis | Chi-square | Conclusion | Original hypothesis | Chi-square | Conclusion | |

| LIN is not the reason | 2.7539 * | rejection | APP | LIN is not the reason | 2.8386 | acceptance | |

| INF is not the reason | 0.00024 | acceptance | INF is not the reason | 0.00086 ** | rejection | ||

| TIN is not the reason | 0.00872 | acceptance | TIN is not the reason | 0.10958 | acceptance | ||

| SG is not the reason | 2.0727 | acceptance | SG is not the reason | 2.0179 | acceptance | ||

| SC is not the reason | 2.3323 | acceptance | SC is not the reason | 2.2637 | acceptance | ||

| ALL is not the reason | 6.3974 | acceptance | ALL is not the reason | 6.4838 | acceptance | ||

| LIN | APP is not the reason | 1.7212 | acceptance | LIN | APP is not the reason | 2.2731 * | rejection |

| INF is not the reason | 0.6928 | acceptance | INF is not the reason | 0.40247 | acceptance | ||

| TIN is not the reason | 1.7787 | acceptance | TIN is not the reason | 0.1887 | acceptance | ||

| SG is not the reason | 0.42931 * | rejection | SG is not the reason | 0.55352 | acceptance | ||

| SC is not the reason | 0.30292 | acceptance | SC is not the reason | 0.47571 | acceptance | ||

| ALL is not the reason | 4.6662 | acceptance | ALL is not the reason | 3.1393 | acceptance | ||

| INF | APP is not the reason | 2.1344 * | rejection | INF | APP is not the reason | 1.9988 | acceptance |

| INF is not the reason | 0.04365 | acceptance | INF is not the reason | 0.10224 | acceptance | ||

| TIN is not the reason | 0.84437 | acceptance | TIN is not the reason | 0.00138 | acceptance | ||

| SG is not the reason | 0.04092 | acceptance | SG is not the reason | 0.01154 | acceptance | ||

| SC is not the reason | 0.03916 | acceptance | SC is not the reason | 0.00778 | acceptance | ||

| ALL is not the reason | 4.4391 | acceptance | ALL is not the reason | 5.809 | acceptance | ||

| SG | APP is not the reason | 0.9441 * | rejection | SG | APP is not the reason | 0.96837 | acceptance |

| LIN is not the reason | 2.2294 | acceptance | LIN is not the reason | 0.30861 | acceptance | ||

| INF is not the reason | 3.2297 | acceptance | INF is not the reason | 1.9825 | acceptance | ||

| TIN is not the reason | 1.5785 | acceptance | TIN is not the reason | 1.2483 | acceptance | ||

| SC is not the reason | 1.8751 | acceptance | SC is not the reason | 1.1659 * | rejection | ||

| ALL is not the reason | 12.545 | acceptance | ALL is not the reason | 5.469 | acceptance | ||

| SC | APP is not the reason | 1.2798 | acceptance | SC | APP is not the reason | 1.3171 | acceptance |

| LIN is not the reason | 0.216 | acceptance | LIN is not the reason | 0.19576 | acceptance | ||

| INF is not the reason | 0.01649 ** | rejection | INF is not the reason | 0.01416 | acceptance | ||

| TIN is not the reason | 0.00513 | acceptance | TIN is not the reason | 0.39214 | acceptance | ||

| SG is not the reason | 1.2254 | acceptance | SG is not the reason | 1.2379 * | rejection | ||

| ALL is not the reason | 2.7453 | acceptance | ALL is not the reason | 2.8252 | acceptance | ||

| TIN | APP is not the reason | 1.1723 | acceptance | TIN | APP is not the reason | 1.2128 *** | rejection |

| LIN is not the reason | 0.45288 * | rejection | LIN is not the reason | 0.34852 | acceptance | ||

| INF is not the reason | 0.14507 | acceptance | INF is not the reason | 0.10603 | acceptance | ||

| SG is not the reason | 0.24094 | acceptance | SG is not the reason | 1.3217 * | rejection | ||

| SC is not the reason | 2.3458 ** | rejection | SC is not the reason | 2.6702 * | rejection | ||

| ALL is not the reason | 4.4219 | acceptance | ALL is not the reason | 4.9667 | acceptance | ||

References

- Kong, H.; Sun, L.; Zhang, W. Digitization and Green Technology Innovation of Chinese Firms Under Government Subsidy Policies. Systems 2024, 12, 447. [Google Scholar] [CrossRef]

- Xia, C.; Zhai, G. The Spatiotemporal Evolution Pattern of Urban Resilience in the Yangtze River Delta Urban Agglomeration Based on TOPSIS-PSO-ELM. Sustain. Cities Soc. 2022, 87, 104223. [Google Scholar] [CrossRef]

- Luo, D.; Liang, L.; Wang, Z.; Chen, L.; Zhang, F. Exploration of Coupling Effects in the Economy–Society–Environment System in Urban Areas: Case Study of the Yangtze River Delta Urban Agglomeration. Ecol. Indic. 2021, 128, 107858. [Google Scholar] [CrossRef]

- Yang, J.; Liu, N. Whether Low-Carbon City Pilot Policy Can Promote the Transition to a Green Lifestyle? Evidence from China. J. Syst. Sci. Syst. Eng. 2025. [Google Scholar] [CrossRef]

- Zhao, Z.; Gao, G. The Impact of Digital Trade on China’s Position in the GVC: An Empirical Analysis Based on Sino-Russian Cross-Border Panel Data. Sustainability 2024, 16, 5493. [Google Scholar] [CrossRef]

- Liang, L.; Li, Y. How Does Government Support Promote Digital Economy Development in China? The Mediating Role of Regional Innovation Ecosystem Resilience. Technol. Forecast. Soc. Chang. 2023, 188, 122328. [Google Scholar] [CrossRef]

- Pan, W.; Xie, T.; Wang, Z.; Ma, L. Digital Economy: An Innovation Driver for Total Factor Productivity. J. Bus. Res. 2022, 139, 303–311. [Google Scholar] [CrossRef]

- Wu, M.; Ma, Y.; Gao, Y.; Ji, Z. The Impact of Digital Economy on Income Inequality from the Perspective of Technological Progress-Biased Transformation: Evidence from China. Empir. Econ. 2024, 67, 567–607. [Google Scholar] [CrossRef]

- David, A.; Yigitcanlar, T.; Li, R.Y.M.; Corchado, J.M.; Cheong, P.H.; Mossberger, K.; Mehmood, R. Understanding Local Government Digital Technology Adoption Strategies: A PRISMA Review. Sustainability 2023, 15, 9645. [Google Scholar] [CrossRef]

- Xu, J.; Li, W. Study on the Impact of Digital Economy on Innovation Output Based on Dynamic Panel Data Model. Eur. J. Innov. Manag. 2023, 28, 877–899. [Google Scholar] [CrossRef]

- Meng, Q.; Li, M.; Liu, W.; Li, Z.; Zhang, J. Pricing Policies of Dual-Channel Green Supply Chain: Considering Government Subsidies and Consumers’ Dual Preferences. Sustain. Prod. Consum. 2021, 26, 1021–1030. [Google Scholar] [CrossRef]

- Meng, Q.; Wang, Y.; Zhang, Z.; He, Y. Supply Chain Green Innovation Subsidy Strategy Considering Consumer Heterogeneity. J. Clean. Prod. 2021, 281, 125199. [Google Scholar] [CrossRef]

- Wu, B.; Gu, Q.; Liu, Z.; Liu, J. Clustered Institutional Investors, Shared ESG Preferences and Low-Carbon Innovation in Family Firm. Technol. Forecast. Soc. Chang. 2023, 194, 122676. [Google Scholar] [CrossRef]

- Yi, J.; Murphree, M.; Meng, S.; Li, S. The More the Merrier? Chinese Government R&D Subsidies, Dependence, and Firm Innovation Performance. J. Prod. Innov. Manag. 2021, 38, 289–310. [Google Scholar] [CrossRef]

- Shi, Y.; Zhai, G.; Xu, L.; Zhou, S.; Lu, Y.; Liu, H.; Huang, W. Assessment Methods of Urban System Resilience: From the Perspective of Complex Adaptive System Theory. Cities 2021, 112, 103141. [Google Scholar] [CrossRef]

- Li, G.; Kou, C.; Wen, F. The Dynamic Development Process of Urban Resilience: From the Perspective of Interaction and Feedback. Cities 2021, 114, 103206. [Google Scholar] [CrossRef]

- Renn, O.; Laubichler, M.; Lucas, K.; Kröger, W.; Schanze, J.; Scholz, R.W.; Schweizer, P.-J. Systemic Risks from Different Perspectives. Risk Anal. 2022, 42, 1902–1920. [Google Scholar] [CrossRef] [PubMed]

- Fancourt, D.; Aughterson, H.; Finn, S.; Walker, E.; Steptoe, A. How Leisure Activities Affect Health: A Narrative Review and Multi-Level Theoretical Framework of Mechanisms of Action. Lancet Psychiatry 2021, 8, 329–339. [Google Scholar] [CrossRef]

- Dai, D.; Fan, Y.; Wang, G.; Xie, J. Digital Economy, R&D Investment, and Regional Green Innovation—Analysis Based on Provincial Panel Data in China. Sustainability 2022, 14, 6508. [Google Scholar] [CrossRef]

- Li, Z.; Wang, J. The Dynamic Impact of Digital Economy on Carbon Emission Reduction: Evidence City-Level Empirical Data in China. J. Clean. Prod. 2022, 351, 131570. [Google Scholar] [CrossRef]

- Hui, P.; Zhao, H.; Liu, D.; Li, Y. How Does Digital Finance Affect Regional Innovation Capacity? A Spatial Econometric Analysis. Econ. Model. 2023, 122, 106250. [Google Scholar] [CrossRef]

- Huaping, G.; Binhua, G. Digital Economy and Demand Structure of Skilled Talents—Analysis Based on the Perspective of Vertical Technological Innovation. Telemat. Inform. Rep. 2022, 7, 100010. [Google Scholar] [CrossRef]

- Li, J.; Chen, L.; Chen, Y.; He, J. Digital Economy, Technological Innovation, and Green Economic Efficiency—Empirical Evidence from 277 Cities in China. Manag. Decis. Econ. 2022, 43, 616–629. [Google Scholar] [CrossRef]

- Wang, L.; Shao, J. Digital Economy, Entrepreneurship and Energy Efficiency. Energy 2023, 269, 126801. [Google Scholar] [CrossRef]

- Tian, Z.; Li, Y.; Niu, X.; Liu, M. The Impact of Digital Economy on Regional Technological Innovation Capability: An Analysis Based on China’s Provincial Panel Data. PLoS ONE 2023, 18, e0288065. [Google Scholar] [CrossRef] [PubMed]

- Xu, J.; Li, W. The Impact of the Digital Economy on Innovation: New Evidence from Panel Threshold Model. Sustainability 2022, 14, 15028. [Google Scholar] [CrossRef]

- Kanbur, R.; Ortiz-Juarez, E.; Sumner, A. Is the Era of Declining Global Income Inequality Over? Struct. Chang. Econ. Dyn. 2024, 70, 45–55. [Google Scholar] [CrossRef]

- Zhang, C.; Liu, B.; Yang, Y. Digital Economy and Urban Innovation Level: A Quasi-Natural Experiment from the Strategy of “Digital China”. Humanit. Soc. Sci. Commun. 2024, 11, 574. [Google Scholar] [CrossRef]

- Subramanian, K.P.; Qamashoui, A.A.A.; V, R.; Jayashree, R.; Christopher, B.P. Ruksana Integrating Blockchain Technology to Mitigate Trade Credit Risks and Boost SME Growth in Oman. J. Ecohumanism 2024, 3, 9982–9994. [Google Scholar] [CrossRef]

- Samara, E.; Kilintzis, P.; Katsoras, E.; Martinidis, G.; Kosti, P. A Dynamic Analysis to Examine Regional Development in the Context of a Digitally Enabled Regional Innovation System: The Case of Western and Central Macedonia (Greece). Systems 2024, 12, 200. [Google Scholar] [CrossRef]

- Li, Y.; Fu, K.; Gong, X.; Xiang, Z.; Zhang, J.; Liao, C. Research on Value Co-Creation Mechanism of Platform Enterprises in Digital Innovation Ecosystem: A Case Study on Haier HOPE Platform in China. Front. Psychol. 2022, 13, 1055932. [Google Scholar] [CrossRef]

- Wang, S.; Su, H.; Hou, Q. Evolutionary Game Study on Multi-Agent Value Co-Creation of Service-Oriented Digital Transformation in the Construction Industry. PLoS ONE 2023, 18, e0285697. [Google Scholar] [CrossRef] [PubMed]

- Li, Y.; Wei, Y.; Li, Y.; Lei, Z.; Ceriani, A. Connecting Emerging Industry and Regional Innovation System: Linkages, Effect and Paradigm in China. Technovation 2022, 111, 102388. [Google Scholar] [CrossRef]

- Ye, M.; Zeng, W. Government Innovation Preferences, Institutional Fragility, and Digital Economic Development. Econ. Anal. Policy 2024, 81, 541–555. [Google Scholar] [CrossRef]

- Hu, R.; Yu, C.; Jin, Y.; Pray, C.; Deng, H. Impact of Government Policies on Research and Development (R&D) Investment, Innovation, and Productivity: Evidence from Pesticide Firms in China. Agriculture 2022, 12, 709. [Google Scholar] [CrossRef]

- Dai, X.; Chapman, G. R&D Tax Incentives and Innovation: Examining the Role of Programme Design in China. Technovation 2022, 113, 102419. [Google Scholar] [CrossRef]

- Belderbos, R.; Park, J.; Carree, M. Do R&D Investments in Weak IPR Countries Destroy Market Value? The Role of Internal Linkages. Strateg. Manag. J. 2021, 42, 1401–1431. [Google Scholar] [CrossRef]

- Zhang, J.; Yang, J.; Zhao, F. Do Government Innovation Preferences Enhance Ecological Resilience in Resource-Based Cities?—Based on Mediating Effect and Threshold Effect Perspectives. PLoS ONE 2024, 19, e0303672. [Google Scholar] [CrossRef]

- Song, S.; Wen, J.; Li, Y.; Li, L. How Does Digital Economy Affect Green Technological Innovation in China? New Evidence from the “Broadband China” Policy. Econ. Anal. Policy 2024, 81, 1093–1112. [Google Scholar] [CrossRef]

- Zhang, Q.; Zhao, X. Can the Digital Economy Facilitate the Optimization of Industrial Structure in Resource-Based Cities? Struct. Chang. Econ. Dyn. 2024, 71, 405–416. [Google Scholar] [CrossRef]

- Luo, S.; Yimamu, N.; Li, Y.; Wu, H.; Irfan, M.; Hao, Y. Digitalization and Sustainable Development: How Could Digital Economy Development Improve Green Innovation in China? Bus. Strategy Environ. 2023, 32, 1847–1871. [Google Scholar] [CrossRef]

- Dou, Q.; Gao, X. The Double-Edged Role of the Digital Economy in Firm Green Innovation: Micro-Evidence from Chinese Manufacturing Industry. Environ. Sci. Pollut. Res. 2022, 29, 67856–67874. [Google Scholar] [CrossRef] [PubMed]

- You, C.; Khattak, S.I.; Ahmad, M. Capturing the Asymmetrical Effect of Macroeconomic Factors on Public-Sector Innovation in Chinese Local Government: A Dynamic Technology Forecasting Approach. SAGE Open 2024, 14, 21582440241292966. [Google Scholar] [CrossRef]

- Zhang, K.; Wang, Z.; Yang, Q.; Wang, Y. The Changing Role between Public and Private R&D Investments in Regional Innovation: Threshold Analysis from Guangdong, China. Reg. Stud. Reg. Sci. 2025, 12, 76–94. [Google Scholar]

- Yousaf, Z.; Radulescu, M.; Sinisi, C.I.; Serbanescu, L.; Păunescu, L.M. Towards Sustainable Digital Innovation of SMEs from the Developing Countries in the Context of the Digital Economy and Frugal Environment. Sustainability 2021, 13, 5715. [Google Scholar] [CrossRef]

- Cooke, P.; Heidenreich, M.; Braczyk, H.-J. Introduction: Regional Innovation Systems—An Evolutionary Approach. In Regional Innovation Systems; Routledge: London, UK, 2004; ISBN 978-1-00-357238-1. [Google Scholar]

- Yin, S.; Zhang, N.; Ullah, K.; Gao, S. Enhancing Digital Innovation for the Sustainable Transformation of Manufacturing Industry: A Pressure-State-Response System Framework to Perceptions of Digital Green Innovation and Its Performance for Green and Intelligent Manufacturing. Systems 2022, 10, 72. [Google Scholar] [CrossRef]

- Khattak, S.I.; Khan, A.M.; Khan, M.K.; Li, C.; Liu, J.; Pi, Z. Do Regional Government Green Innovation Preferences Promote Industrial Structure Upgradation in China? Econometric Assessment Based on the Environmental Regulation Threshold Effect Model. Front. Environ. Sci. 2022, 10, 995990. [Google Scholar] [CrossRef]

- Acemoglu, D.; Makhdoumi, A.; Malekian, A.; Ozdaglar, A. Learning from Reviews: The Selection Effect and the Speed of Learning. Econometrica 2022, 90, 2857–2899. [Google Scholar] [CrossRef]

- Huang, Y.; Duan, K.; Urquhart, A. Time-Varying Dependence between Bitcoin and Green Financial Assets: A Comparison between Pre- and Post-COVID-19 Periods. J. Int. Financ. Mark. Inst. Money 2023, 82, 101687. [Google Scholar] [CrossRef]

- Simionescu, M.; Schneider, N.; Gavurova, B. A Bayesian Vector-Autoregressive Application with Time-Varying Parameters on the Monetary Shocks–Production Network Nexus. J. Appl. Econ. 2024, 27, 2395114. [Google Scholar] [CrossRef]

- Henderson, R.; Cockburn, I. Measuring Competence? Exploring Firm Effects in Pharmaceutical Research. Strateg. Manag. J. 1994, 15, 63–84. [Google Scholar] [CrossRef]

- Akcigit, U.; Grigsby, J.; Nicholas, T.; Stantcheva, S. Taxation and Innovation in the Twentieth Century. Q. J. Econ. 2022, 137, 329–385. [Google Scholar] [CrossRef]

- Jang, S.; Kim, J.; von Zedtwitz, M. The Importance of Spatial Agglomeration in Product Innovation: A Microgeography Perspective. J. Bus. Res. 2017, 78, 143–154. [Google Scholar] [CrossRef]

- Zhang, P.; Thurasamy, R. Bridging Big Data Analytics Capability and Competitive Advantage in China’s Agribusiness: The Mediator of Absorptive Capacity. Systems 2025, 13, 3. [Google Scholar] [CrossRef]

- Stephen, M.M. Digital Economies: SMEs and E-Readiness: SMEs and E-Readiness; IGI Global: Hershey, PA, USA, 2009; ISBN 978-1-60566-421-7. [Google Scholar]

- Aldrich, D.F. Mastering the Digital Marketplace: Practical Strategies for Competitiveness in the New Economy; John Wiley & Sons: Hoboken, NJ, USA, 1999; ISBN 978-0-471-34546-6. [Google Scholar]

- Cao, C. Analysis of the Status of Digital Economy in China’s Economy. Adv. Econ. Manag. Political Sci. 2024, 59, 42–47. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, L.; Duan, Y. Agricultural Information Dissemination Using ICTs: A Review and Analysis of Information Dissemination Models in China. Inf. Process. Agric. 2016, 3, 17–29. [Google Scholar] [CrossRef]

- Saidani, M.; Yannou, B.; Leroy, Y.; Cluzel, F.; Kendall, A. A Taxonomy of Circular Economy Indicators. J. Clean. Prod. 2019, 207, 542–559. [Google Scholar] [CrossRef]

- Moraga, G.; Huysveld, S.; Mathieux, F.; Blengini, G.A.; Alaerts, L.; Van Acker, K.; de Meester, S.; Dewulf, J. Circular Economy Indicators: What Do They Measure? Resour. Conserv. Recycl. 2019, 146, 452–461. [Google Scholar] [CrossRef] [PubMed]

- Geng, Y.; Fu, J.; Sarkis, J.; Xue, B. Towards a National Circular Economy Indicator System in China: An Evaluation and Critical Analysis. J. Clean. Prod. 2012, 23, 216–224. [Google Scholar] [CrossRef]

- Niebel, T. ICT and Economic Growth—Comparing Developing, Emerging and Developed Countries. World Dev. 2018, 104, 197–211. [Google Scholar] [CrossRef]

- Lai, S.; Chen, H.; Zhao, Y. Measurement and Prediction of the Development Level of China’s Digital Economy. Humanit. Soc. Sci. Commun. 2024, 11, 1756. [Google Scholar] [CrossRef]

- Lee, C.-Y. The Differential Effects of Public R&D Support on Firm R&D: Theory and Evidence from Multi-Country Data. Technovation 2011, 31, 256–269. [Google Scholar] [CrossRef]

- Liu, C. Infrastructure Public–Private Partnership (PPP) Investment and Government Fiscal Expenditure on Science and Technology from the Perspective of Sustainability. Sustainability 2021, 13, 6193. [Google Scholar] [CrossRef]

- Zhao, C.; Feng, F.; Chen, Y.; Li, X. Local Government Competition and Regional Innovation Efficiency: From the Perspective of China-Style Fiscal Federalism. Sci. Public Policy 2021, 48, 488–489. [Google Scholar] [CrossRef]

- Sarpong, D.; Boakye, D.; Ofosu, G.; Botchie, D. The Three Pointers of Research and Development (R&D) for Growth-Boosting Sustainable Innovation System. Technovation 2023, 122, 102581. [Google Scholar] [CrossRef]

- Chu, H.; Ning, Y.; Qie, X. Measurement and Spatial Correlation Analysis of the Development Level of the Digital Economy in the Yangtze River Delta Urban Agglomeration. Sustainability 2023, 15, 13329. [Google Scholar] [CrossRef]

- Sims, C.A. Macroeconomics and Reality. Econometrica 1980, 48, 1–48. [Google Scholar] [CrossRef]

- Nguyen, H.M.; Nguyen, L.D. The Relationship between Urbanization and Economic Growth: An Empirical Study on ASEAN Countries. Int. J. Soc. Econ. 2018, 45, 316–339. [Google Scholar] [CrossRef]

- Zhang, Y.; Chen, H.; He, Z. Environmental Regulation, R&D Investment, and Green Technology Innovation in China: Based on the PVAR Model. PLoS ONE 2022, 17, e0275498. [Google Scholar] [CrossRef]

- Aziz, O.G. FDI Inflows and Economic Growth in Arab Region: The Institutional Quality Channel. Int. J. Financ. Econ. 2022, 27, 1009–1024. [Google Scholar] [CrossRef]

- Asogwa, F.O.; Onyeke, Q.O.; Kuma, P.M.; Arazue, W.O.; Nkalu, C.N. Do Macroeconomic Indicators Determine Income Inequality in Selected African Countries? J. Public Aff. 2022, 22, e2560. [Google Scholar] [CrossRef]

- Setiawan, R. Testing the Dynamic Relationship of Inflation and Interest Rates: Fisher Effect Testing. J. Ilm. Manaj. Ekon. Akunt. (MEA) 2022, 6, 1030–1041. Available online: https://journal.stiemb.ac.id/index.php/mea/article/view/2942 (accessed on 28 April 2022).

- Ghaddab, S.; De Peretti, C.; Belkacem, L. Are Stock Markets Efficient with Respect to the Google Search Volume Index? A Robustness Check of the Literature Studies. Res. Int. Bus. Financ. 2025, 73, 102574. [Google Scholar] [CrossRef]

- Andrews, D.W.K.; Lu, B. Consistent Model and Moment Selection Procedures for GMM Estimation with Application to Dynamic Panel Data Models. J. Econom. 2001, 101, 123–164. [Google Scholar] [CrossRef]

- Abas, A.; Bendory, T.; Sharon, N. The Generalized Method of Moments for Multi-Reference Alignment. IEEE Trans. Signal Process. 2022, 70, 1377–1388. [Google Scholar] [CrossRef]

- Zhang, Z.; Wu, L. Graph Neural Network-Based Bearing Fault Diagnosis Using Granger Causality Test. Expert Syst. Appl. 2024, 242, 122827. [Google Scholar] [CrossRef]

- Granger, C.W.J. Investigating Causal Relations by Econometric Models and Cross-Spectral Methods. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Chen, X.; Lee, S.; Liao, Y.; Seo, M.H.; Shin, Y.; Song, M. SGMM: Stochastic Approximation to Generalized Method of Moments. J. Financ. Econom. 2025, 23, nbad027. [Google Scholar] [CrossRef]

- Aguirregabiria, V.; Collard-Wexler, A.; Ryan, S.P. Dynamic Games in Empirical Industrial Organization☆. In Handbook of Industrial Organization; Ho, K., Hortaçsu, A., Lizzeri, A., Eds.; Elsevier: Amsterdam, The Netherlands, 2021; Volume 4, pp. 225–343. [Google Scholar]

- Xu, A.; Qiu, K.; Jin, C.; Cheng, C.; Zhu, Y. Regional Innovation Ability and Its Inequality: Measurements and Dynamic Decomposition. Technol. Forecast. Soc. Chang. 2022, 180, 121713. [Google Scholar] [CrossRef]

| Variable Type | Primary Indicator | Secondary Indicators | Secondary Indicator Code | Tertiary Indicators |

|---|---|---|---|---|

| Explained variable | Regional innovation capacity | Technological innovation | TIN | Patent applications |

| product innovation | PIN | Output value of new products | ||

| Explanatory variable | Digital economy | Infrastructure | INF | Internet broadband access |

| Talent inputs | LIN | Number of researchers | ||

| digital application | APP | Number of high-tech enterprises | ||

| Government innovation preferences | Intensity of government innovation preferences | SG | Fiscal expenditure on science and technology as a share of GDP | |

| Structure of government innovation preferences | SC | Share of fiscal expenditure on science and technology in total local fiscal expenditure |

| Variable | Mean | Std. Dev. | Min | Max. |

|---|---|---|---|---|

| app | 0.140595 | 0.180925 | −0.54022 | 0.994881 |

| pin | 0.105344 | 0.243127 | −1.44951 | 1.595077 |

| lin | 0.122771 | 0.261372 | −0.38396 | 1.775935 |

| inf | 0.105211 | 0.13489 | −0.63076 | 0.85388 |

| tin | 0.075888 | 0.19477 | −0.72957 | 0.469608 |

| sg | 0.029759 | 0.461268 | −2.1941 | 2.44367 |

| sc | 0.016387 | 0.460644 | −2.3333 | 2.553538 |

| Variant | LLC | Fisher-ADF | Fisher-PP | Conclusion |

|---|---|---|---|---|

| APP | −2.59564 ** (0.0047) | 23.3484 (0.8007) | 22.7340 (0.8260) | uneven |

| d_APP | −4.50604 *** (0.0000) | 54.2873 *** (0.0043) | 66.8124 *** (0.0001) | smoothly |

| LIN | −11.6468 *** (0.0000) | 49.9160 (0.0127) | 63.4975 *** (0.0003) | smoothly |

| d_LIN | −14.5672 *** (0.0000) | 60.7023 *** (0.0008) | 100.114 *** (0.0000) | smoothly |

| INF | −5.48898 *** (0.0000) | 38.8875 (0.1283) | 33.4659 (0.3027) | uneven |

| d_INF | −4.73791 *** (0.0000) | 74.8382 *** (0.000) | 78.7518 *** (0.0000) | smoothly |

| TIN | 7.53241 *** (0.0000) | 30.9103 (0.4198) | 32.3073 (0.4198) | uneven |

| d_TIN | −7.62648 *** (0.0000) | 97.1347 *** (0.0000) | 97.2272 *** (0.0000) | smoothly |

| PIN | 11.4640 *** (0.0000) | 52.0668 *** (0.0075) | 73.3011 *** (0.0000) | smoothly |

| d_PIN | −15.9440 *** (0.0000) | 61.4279 *** (0.0006) | 105.816 *** (0.0000) | smoothly |

| SG | −4.1184 *** (0.0000) | 34.5329 (0.2599) | 42.5460 * (0.0642) | uneven |

| d_SG | −8.74416 *** (0.0000) | 44.3106 * (0.0447) | 90.7318 *** (0.0000) | smoothly |

| SC | −4.41890 *** (0.0000) | 31.1382 (0.4086) | 40.1990 (0.1011) | uneven |

| d_SC | −8.49212 *** (0.0000) | 44.47269 * (0.0432) | 80.7482 *** (0.000) | smoothly |

| AIC | BIC | HQIC | |

|---|---|---|---|

| 1 | −0.517739 * | 2.98199 * | −0.893559 * |

| 2 | 0.8587 | 5.86447 | 2.85745 |

| 3 | 67. | 74.2994 | 70.0915 |

| AIC | BIC | HQIC | |

|---|---|---|---|

| 1 | −0.088362 * | 3.5881 * | 1.49966 * |

| 2 | 1.39594 | 6.40172 | 3.39469 |

| 3 | 53.0856 | 59.9969 | 55.789 |

| h_TIN | h_APP | h_LIN | h_INF | h_SG | h_SC | |

|---|---|---|---|---|---|---|

| L1.h_TIN | 0.082 (0.099) | −0.008 * (0.090) | −0.253 (0.190) | 0.092 (0.100) | −0.095 (0.193) | −0.014 (0.198) |

| L1.h_APP | 0.128 (0.132) | −0.035 (0.103) | 0.170 (0.129) | 0.167 * (0.114) | −0.704 (0.651) | −0.771 (0.681) |

| L1.h_LIN | −0.113 (0.075) | −0.080 (0.048) | 0.018 (0.051) | −0.013 (0.062) | −0.056 * (0.083) | −0.043 (0.092) |

| L1.h_INF | −0.250 * (0.139) | −0.002 (0.107) | 0.121 (0.145) | −0.069 (0.198) | 0.116 (0.305) | 0.040 (0.309) |

| L1.h_SG | 0.285 (0.208) | −0.206 (0.135) | 0.085 ** (0.155) | 0.028 (0.144) | 0.371 (0.405) | 0.460 (0.416) |

| L1.h_SC | −0.267 (0.212) | 0.198 (0.138) | −0.105 (0.160) | −0.029 (0.143) | −0.614 (0.401) | −0.699 * (0.393) |

| h_PIN | h_APP | h_LIN | h_INF | h_SG | h_SC | |

|---|---|---|---|---|---|---|

| L1.h_PIN | −0.511 ** (0.225) | 0.015 (0.046) | 0.031 (0.070) | 0.002 (0.042) | −0.139 (0.121) | −0.102 (0.163) |

| L1.h_APP | −0.204 (0.207) | −0.031 (0.101) | 0.198 (0.131) | 0.159 (0.112) | −0.717 (0.651) | −0.785 (0.684) |

| L1.h_LIN | −0.030 (0.055) | −0.080 * (0.047) | 0.032 (0.054) | −0.018 * (0.058) | −0.048 (0.081) | −0.040 (0.091) |

| L1.h_INF | −0.187 (0.133) | −0.003 (0.104) | 0.083 (0.130) | −0.055 (0.198) | 0.103 (0.317) | 0.039 (0.324) |

| L1.h_SG | 0.295 * (0.273) | −0.211 (0.141) | 0.109 ** (0.158) | 0.014 (0.162) | 0.448 (0.439) | 0.508 (0.457) |

| L1.h_SC | −0.305 (0.273) | 0.205 (0.144) | −0.121 (0.163) | −0.017 (0.160) | −0.692 (0.423) | −0.749 * (0.427) |

| Phase | APP | LIN | INF | Sum1 | SC | SG | Sum2 | Sum3 | |

|---|---|---|---|---|---|---|---|---|---|

| TIN | 1 | 0.056 | 0 | 0.006 | 0.062 | 0.001 | 0.004 | 0.005 | 0.067 |

| TIN | 2 | 0.106 | 0.029 | 0.006 | 0.141 | 0.023 | 0.023 | 0.046 | 0.187 |

| TIN | 3 | 0.127 | 0.036 | 0.007 | 0.17 | 0.025 | 0.069 | 0.094 | 0.264 |

| TIN | 4 | 0.126 | 0.039 | 0.009 | 0.174 | 0.037 | 0.067 | 0.104 | 0.278 |

| TIN | 5 | 0.128 | 0.039 | 0.014 | 0.181 | 0.039 | 0.067 | 0.106 | 0.287 |

| TIN | 6 | 0.128 | 0.039 | 0.014 | 0.181 | 0.039 | 0.067 | 0.106 | 0.287 |

| TIN | 7 | 0.127 | 0.039 | 0.014 | 0.18 | 0.041 | 0.067 | 0.108 | 0.288 |

| TIN | 8 | 0.127 | 0.039 | 0.014 | 0.18 | 0.041 | 0.067 | 0.108 | 0.288 |

| TIN | 9 | 0.127 | 0.039 | 0.014 | 0.18 | 0.041 | 0.067 | 0.108 | 0.288 |

| TIN | 10 | 0.127 | 0.039 | 0.014 | 0.18 | 0.041 | 0.067 | 0.108 | 0.288 |

| Phase | APP | LIN | INF | Sum1 | SC | SG | Sum2 | Sum3 | |

|---|---|---|---|---|---|---|---|---|---|

| PIN | 1 | 0.003 | 0.001 | 0.052 | 0.056 | 0.005 | 0.01 | 0.015 | 0.071 |

| PIN | 2 | 0.006 | 0.004 | 0.057 | 0.067 | 0.006 | 0.01 | 0.016 | 0.083 |

| PIN | 3 | 0.007 | 0.017 | 0.055 | 0.079 | 0.007 | 0.02 | 0.027 | 0.106 |

| PIN | 4 | 0.01 | 0.017 | 0.056 | 0.083 | 0.007 | 0.02 | 0.027 | 0.11 |

| PIN | 5 | 0.01 | 0.018 | 0.057 | 0.085 | 0.007 | 0.02 | 0.027 | 0.112 |

| PIN | 6 | 0.01 | 0.018 | 0.058 | 0.086 | 0.007 | 0.02 | 0.027 | 0.113 |

| PIN | 7 | 0.01 | 0.018 | 0.058 | 0.086 | 0.007 | 0.02 | 0.027 | 0.113 |

| PIN | 8 | 0.01 | 0.018 | 0.058 | 0.086 | 0.008 | 0.02 | 0.028 | 0.114 |

| PIN | 9 | 0.01 | 0.018 | 0.058 | 0.086 | 0.008 | 0.02 | 0.028 | 0.114 |

| PIN | 10 | 0.01 | 0.018 | 0.058 | 0.086 | 0.008 | 0.02 | 0.028 | 0.114 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, H.; Chang, M.; Su, Y.; Xu, X.; Jiang, C. Digital Economy, Government Innovation Preferences, and Regional Innovation Capacity: Analysis Using PVAR Model. Systems 2025, 13, 382. https://doi.org/10.3390/systems13050382

Wu H, Chang M, Su Y, Xu X, Jiang C. Digital Economy, Government Innovation Preferences, and Regional Innovation Capacity: Analysis Using PVAR Model. Systems. 2025; 13(5):382. https://doi.org/10.3390/systems13050382

Chicago/Turabian StyleWu, Huabin, Miao Chang, Yuelong Su, Xiangdong Xu, and Chunyan Jiang. 2025. "Digital Economy, Government Innovation Preferences, and Regional Innovation Capacity: Analysis Using PVAR Model" Systems 13, no. 5: 382. https://doi.org/10.3390/systems13050382

APA StyleWu, H., Chang, M., Su, Y., Xu, X., & Jiang, C. (2025). Digital Economy, Government Innovation Preferences, and Regional Innovation Capacity: Analysis Using PVAR Model. Systems, 13(5), 382. https://doi.org/10.3390/systems13050382