A Catalyst for the Improvement of Inclusive Public Service: The Role of High-Speed Rail

Abstract

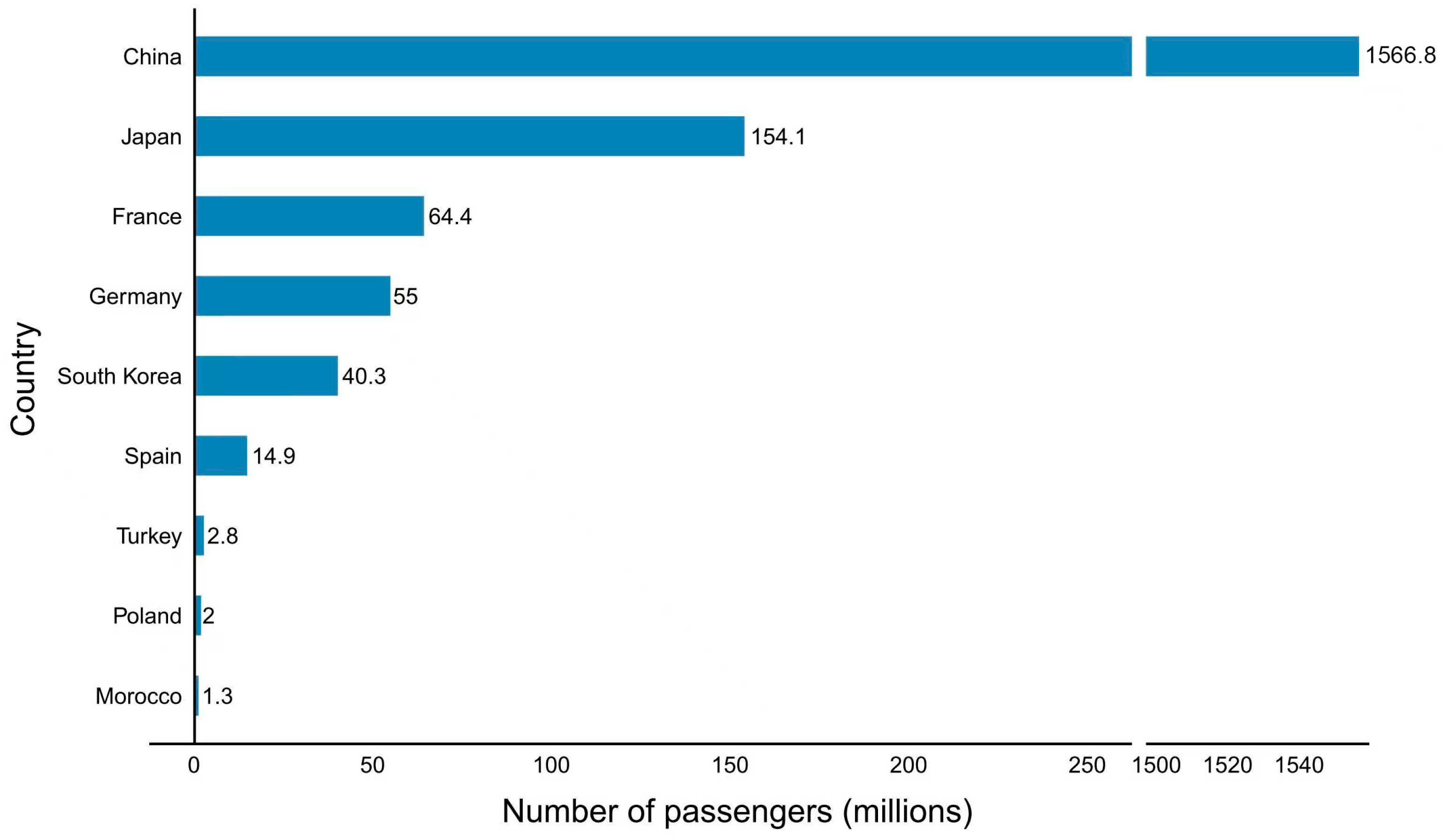

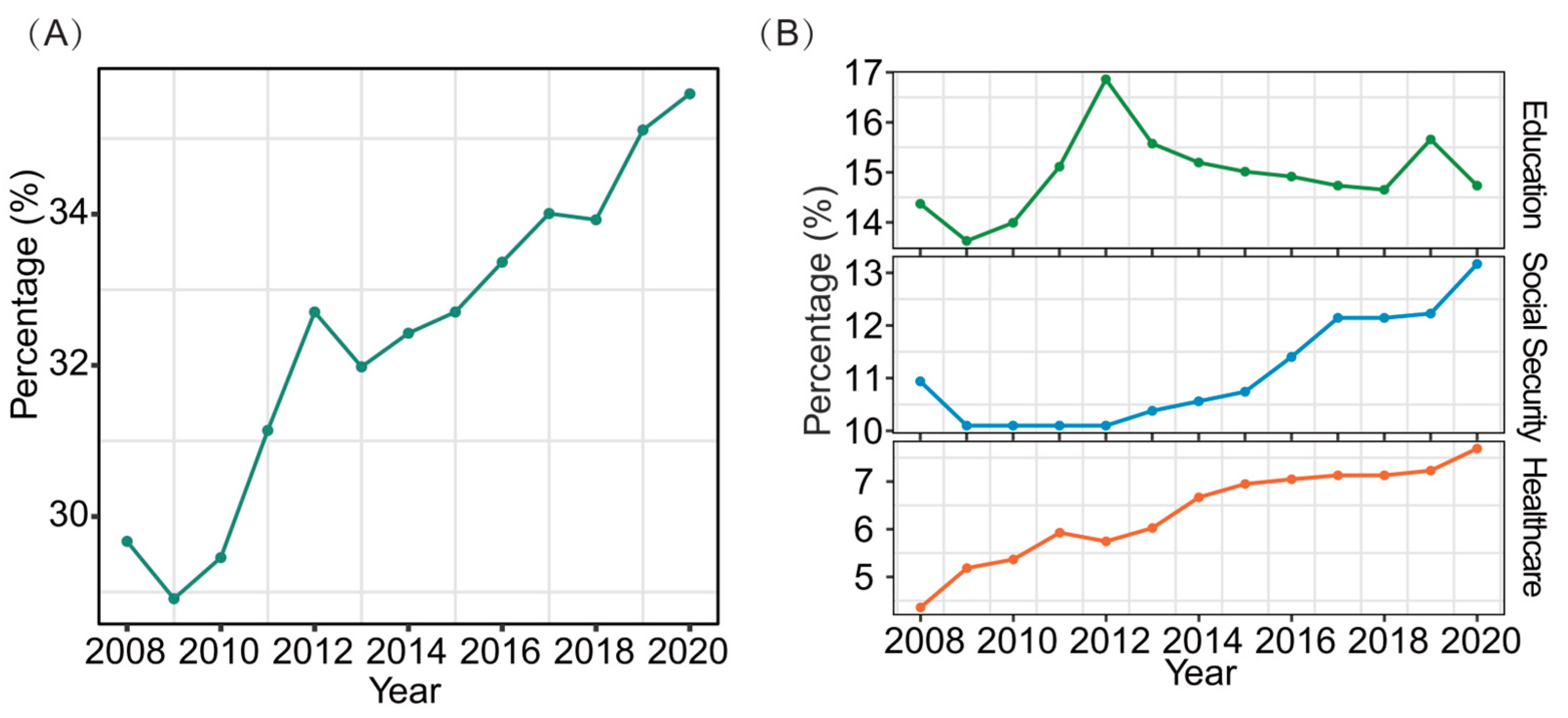

1. Introduction

2. Literature Review

2.1. Impact of HSR on Labor Mobility

2.2. Impact of HSR on Market Integration

2.3. The Impact of Fiscal Competition on the Supply of BPS

2.4. Summary of Existing Literature

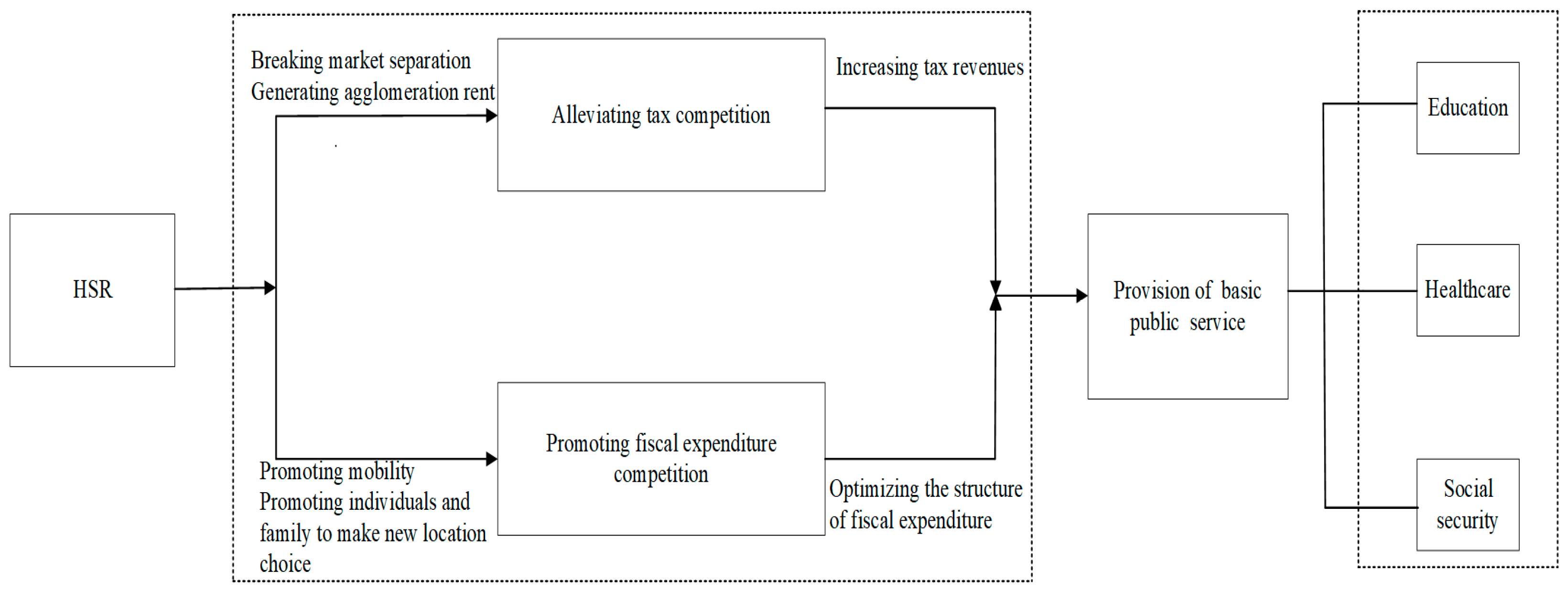

3. Theoretical Analysis and Research Hypothesis

3.1. HSR and the Provision of BPS

3.2. The Mechanism of HSR Influencing the Provision of BPS

4. Data and Methodology

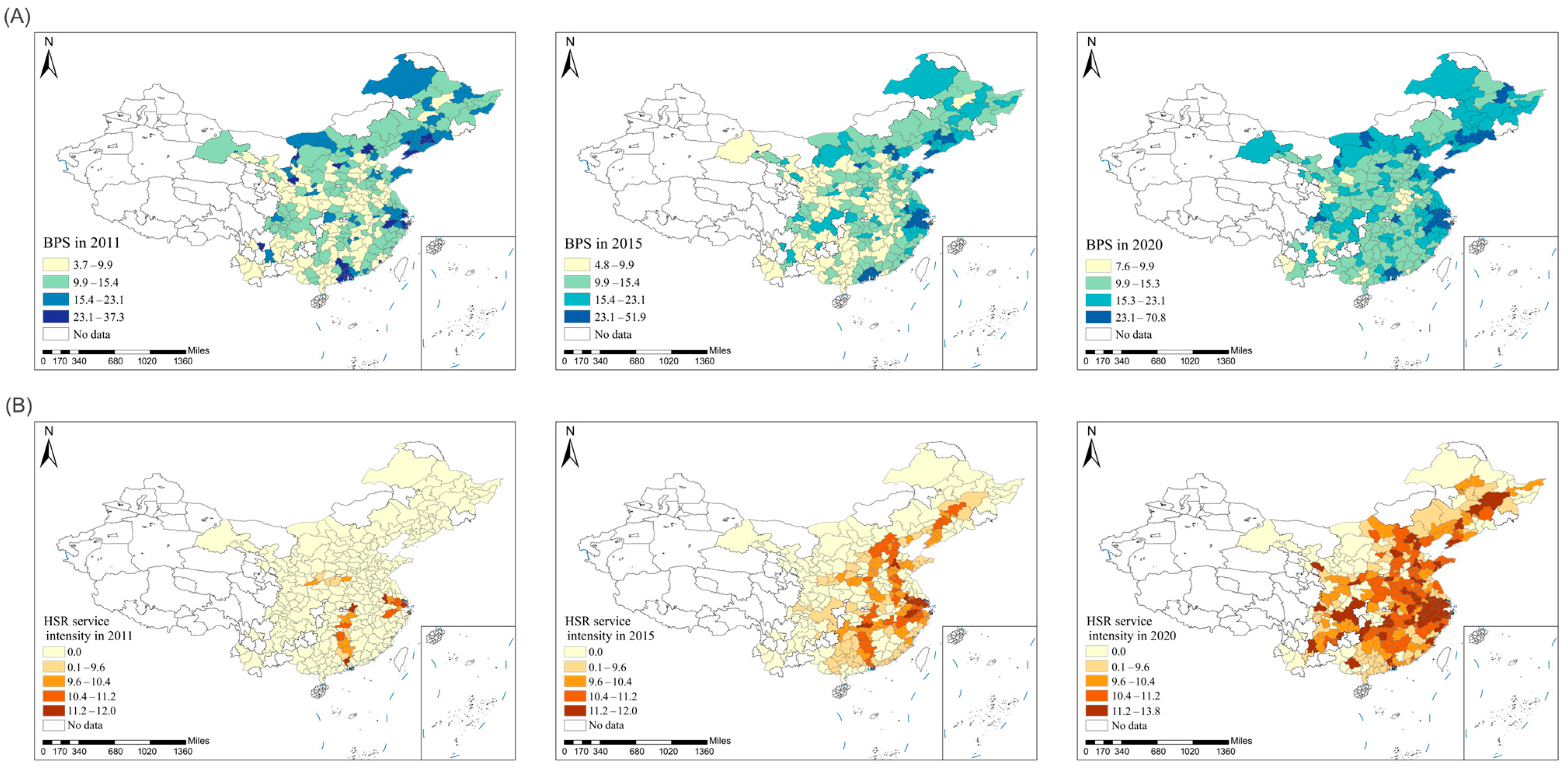

4.1. Variable Definition

4.1.1. Explained Variables

4.1.2. Core Explanatory Variable

4.1.3. Control Variables

4.1.4. Mechanism Variables

4.2. Sample Selection and Data Source

4.3. Model Specification

5. Empirical Results and Analysis

5.1. Analysis of the Baseline Regression Results

5.2. Endogeneity Test

5.3. Robustness Tests

5.3.1. Addition of Potentially Omitted Control Variables

5.3.2. Difference in Difference Estimation

5.3.3. Parallel Trend Test

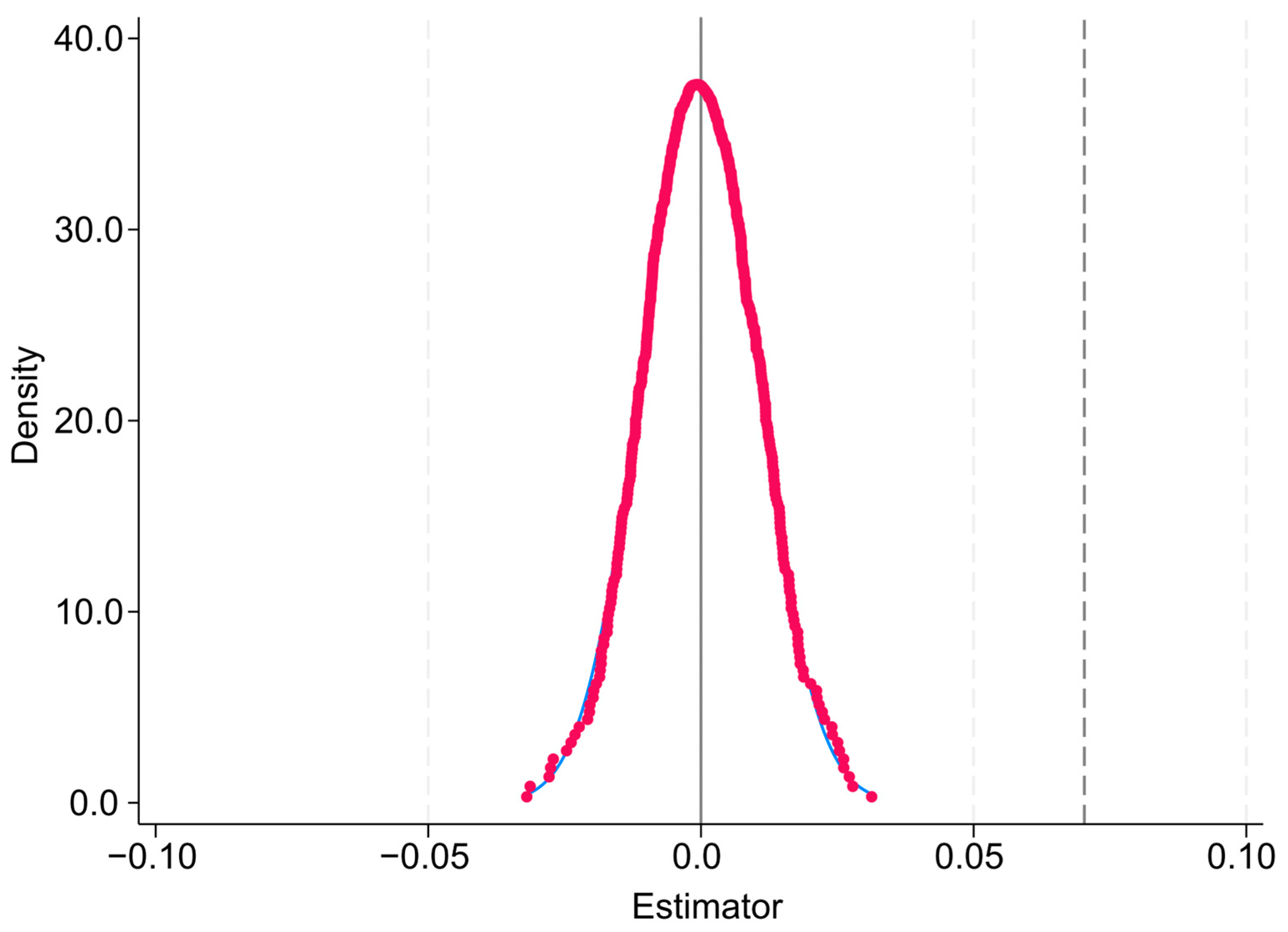

5.3.4. Placebo Test

5.3.5. Replacement of Core Explanatory Variables

5.3.6. Substitution of Explained Variables

5.3.7. Excluding Municipalities Directly Under the Central Government

5.3.8. The Winsorization of the Upper and Lower 1% of the Sample Data

5.4. Mechanism Analysis

5.5. Heterogeneity Analysis

5.5.1. Heterogeneity Analysis: City Level

5.5.2. Heterogeneity Analysis: Location

5.5.3. Heterogeneity Analysis: Fiscal Decentralization

5.5.4. Heterogeneity Analysis: Financial Autonomy

6. Conclusions and Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Zhang, C.; Zhao, L.; Song, X.; Zhang, Q.; Zhang, X. Spatial-Temporal Coupling Characteristics and Interaction Effects of Economic Resilience and People’s Livelihoods and Well-Being: An Analysis of 78 Cities in the Yellow River Basin. Sustain. Cities Soc. 2024, 112, 105638. [Google Scholar] [CrossRef]

- Jackson, E.A.; Jabbie, M. Understanding Market Failure in the Developing Country Context. In Decent Work and Economic Growth; Leal Filho, W., Azul, A.M., Brandli, L., Özuyar, P.G., Wall, T., Eds.; Springer International Publishing: Cham, Switzerland, 2019; pp. 1–10. ISBN 978-3-319-71058-7. [Google Scholar]

- Sachs, J.D.; Lafortune, G.; Fuller, G.; Drumm, E. Implementing the SDG Stimulus. Sustainable Development Report 2023; SDSN: Paris, France; Dublin University Press: Dublin, Ireland, 2023. [Google Scholar]

- Fu, Y.; Zhang, Y. Chinese Decentralization and Fiscal Expenditure Structural Bias: The Cost of Competing for Growth. J. Manag. World 2007, 3, 4–12+22. [Google Scholar] [CrossRef]

- Li, S.; Li, G. Fiscal Decentralization, Government Self-Interest and Fiscal Expenditure Structure Bias. Econ. Anal. Pol. 2024, 81, 1133–1147. [Google Scholar] [CrossRef]

- Wang, Y.; Li, J.; Ma, W.; Li, Y.; Xiong, X.; Yu, X. Fiscal Decentralization and Citizens’ Satisfaction with Public Services: Evidence from a Micro Survey in China. Cities 2024, 150, 105095. [Google Scholar] [CrossRef]

- Shen, Y.; Cheng, Y.; Yu, J. From Recovery Resilience to Transformative Resilience: How Digital Platforms Reshape Public Service Provision during and Post COVID-19. Public Manag. Rev. 2023, 25, 710–733. [Google Scholar] [CrossRef]

- Larsen, A.G.; Følstad, A. The Impact of Chatbots on Public Service Provision: A Qualitative Interview Study with Citizens and Public Service Providers. Gov. Inf. Q. 2024, 41, 101927. [Google Scholar] [CrossRef]

- Martin, G.P. The Third Sector, User Involvement and Public Service Reform: A Case Study in the Co-Governance of Health Service Provision. Public Adm. 2011, 89, 909–932. [Google Scholar] [CrossRef]

- Schiff, K.J. Does Collective Citizen Input Impact Government Service Provision? Evidence from SeeClickFix Requests. Public Adm. Rev. 2025, 85, 32–45. [Google Scholar] [CrossRef]

- Chen, X. Local Autonomy and Service Delivery: How Does Home Rule Shape the Provision of Local Public Services? Public Manag. Rev. 2024, 26, 1–24. [Google Scholar] [CrossRef]

- Mudzusi, T.N.; Munzhedzi, P.H.; Mahole, E. Governance Challenges in the Provision of Municipal Services in the Vhembe District Municipality. Afr. Public Serv. Deliv. Perform. Rev. 2024, 12, 10. [Google Scholar] [CrossRef]

- Cordella, A.; Tempini, N. E-Government and Organizational Change: Reappraising the Role of ICT and Bureaucracy in Public Service Delivery. Gov. Inf. Q. 2015, 32, 279–286. [Google Scholar] [CrossRef]

- Ramolobe, K.; Khandanisa, U. The Role of Public–Private Partnership in Achieving Local Government Sustainable Development. Afr. Public Serv. Deliv. Perform. Rev. 2024, 12, 6. [Google Scholar] [CrossRef]

- Yin, L.; Wu, C. Promotion Incentives and Air Pollution: From the Political Promotion Tournament to the Environment Tournament. J. Environ. Manag. 2022, 317, 115491. [Google Scholar] [CrossRef]

- Smirnov, A.; Smolokurov, E.; Fir, Y. Features of The Development of High Speed Railway Communications. Transp. Res. Procedia 2022, 61, 139–146. [Google Scholar] [CrossRef]

- Wang, F.; Wei, X.; Liu, J.; He, L.; Gao, M. Impact of High-Speed Rail on Population Mobility and Urbanisation: A Case Study on Yangtze River Delta Urban Agglomeration, China. Transp. Res. Part A Policy Pract. 2019, 127, 99–114. [Google Scholar] [CrossRef]

- Li, Y.; Chen, Z.; Wang, P. Impact of High-Speed Rail on Urban Economic Efficiency in China. Transp. Policy 2020, 97, 220–231. [Google Scholar] [CrossRef]

- Yang, Y.; Zhang, J.; Tong, Y.; Liu, W.; Ma, Z. High-Speed Rail in Shrinking Cities: A Weapon for Downturn or a Catalyst for Change. Cities 2024, 155, 105483. [Google Scholar] [CrossRef]

- Pu, L.; Ma, G.; Liu, C. Interregional Infrastructure, Competition for Capital, and Local Public Expenditure Policies: Evidence from China’s High-Speed Rail Network. Pac. Econ. Rev. 2023, 28, 295–313. [Google Scholar] [CrossRef]

- Meng, X.; Ding, T.; Wang, H. Incentives for Local Government Expenditures on People’s Livelihood: The Role of High-Speed Rail. Socioecon. Plan. Sci. 2023, 89, 101700. [Google Scholar] [CrossRef]

- Chen, Z.; Haynes, K.E. Impact of High-Speed Rail on Regional Economic Disparity in China. J. Transp. Geogr. 2017, 65, 80–91. [Google Scholar] [CrossRef]

- Xu, F.; Liu, Q.; Zheng, X.; Cao, L.; Yang, M. Research on the Impact of China’s High-Speed Rail Opening on Enterprise Market Power: Based on the Perspective of Market Segmentation. Transp. Policy 2022, 128, 121–137. [Google Scholar] [CrossRef]

- Guirao, B.; Campa, J.L.; Casado-Sanz, N. Labour Mobility between Cities and Metropolitan Integration: The Role of High Speed Rail Commuting in Spain. Cities 2018, 78, 140–154. [Google Scholar] [CrossRef]

- Feng, Q.; Chen, Z.; Cheng, C.; Chang, H. Impact of High-Speed Rail on High-Skilled Labor Mobility in China. Transp. Policy 2023, 133, 64–74. [Google Scholar] [CrossRef]

- Guirao, B.; Lara-Galera, A.; Campa, J.L. High Speed Rail Commuting Impacts on Labour Migration: The Case of the Concentration of Metropolis in the Madrid Functional Area. Land Use Policy 2017, 66, 131–140. [Google Scholar] [CrossRef]

- Li, G.; Pu, K.; Long, M. High-Speed Rail Connectivity, Space-Time Distance Compression, and Trans-Regional Tourism Flows: Evidence from China’s Inbound Tourism. J. Transp. Geogr. 2023, 109, 103592. [Google Scholar] [CrossRef]

- Kim, K.S. High-Speed Rail Developments and Spatial Restructuring. Cities 2000, 17, 251–262. [Google Scholar] [CrossRef]

- Martin-Barroso, D.; Nunez-Serrano, J.A.; Velazquez, F.J. The Effect of Accessibility on Productivity in Spanish Manufacturing Firms. J. Reg. Sci. 2015, 55, 708–735. [Google Scholar] [CrossRef]

- Sasaki, K.; Ohashi, T.; Ando, A. High-Speed Rail Transit Impact on Regional Systems: Does the Shinkansen Contribute to Dispersion? Ann. Reg. Sci. 1997, 31, 77–98. [Google Scholar] [CrossRef]

- Ke, X.; Chen, H.; Hong, Y.; Hsiao, C. Do China’s High-Speed-Rail Projects Promote Local Economy?—New Evidence from a Panel Data Approach. China Econ. Rev. 2017, 44, 203–226. [Google Scholar] [CrossRef]

- Liu, L.; Huang, R. A High-Speed Rail-Facilitated Evolution of the City-Network Structure in Less-Developed Regions: Evidence from Jiangxi Province, China. Sustainability 2025, 17, 904. [Google Scholar] [CrossRef]

- Liu, L.; Zhang, M. High-Speed Rail Impacts on Travel Times, Accessibility, and Economic Productivity: A Benchmarking Analysis in City-Cluster Regions of China. J. Transp. Geogr. 2018, 73, 25–40. [Google Scholar] [CrossRef]

- Gunasekera, K.; Anderson, W.; Lakshmanan, T.R. Highway-Induced Development: Evidence from Sri Lanka. World Dev. 2008, 36, 2371–2389. [Google Scholar] [CrossRef]

- Tao, P.; Gong, F.; Zhu, K. Tax Competition among Local Governments: Evidence from the Spillovers of Location-Based Tax Incentives in China. China Econ. Rev. 2023, 82, 102077. [Google Scholar] [CrossRef]

- Young, A. The Razor’s Edge: Distortions and Incremental Reform in the People’s Republic of China. Q. J. Econ. 2000, 115, 1091–1135. [Google Scholar] [CrossRef]

- Poncet, S. A Fragmented China: Measure and Determinants of Chinese Domestic Market Disintegration. Rev. Int. Econ. 2005, 13, 409–430. [Google Scholar] [CrossRef]

- Lejour, A.M.; Verbon, H.A. Tax Competition and Redistribution in a Two-Country Endogenous-Growth Model. Int. Tax Public Financ. 1997, 4, 485–497. [Google Scholar] [CrossRef]

- Wang, H.; Yang, G.; Ouyang, X.; Tan, Z. Does Environmental Information Disclosure Promote the Supply of Environmental Public Goods? Evidence Based on a Dynamic Spatial Panel Durbin Model. Environ. Impact Assess. Rev. 2022, 93, 106725. [Google Scholar] [CrossRef]

- Mintz, J.; Tulkens, H. Commodity Tax Competition between Member States of a Federation: Equilibrium and Efficiency. J. Public Econ. 1986, 29, 133–172. [Google Scholar] [CrossRef]

- Oates, W.E. An Essay on Fiscal Federalism. J. Econ. Lit. 1999, 37, 1120–1149. [Google Scholar] [CrossRef]

- Keen, M.; Konrad, K.A. The theory of International Tax Competition and Coordination. Handbook of Public Economics. 2013, 5, 257–328. [Google Scholar] [CrossRef][Green Version]

- Zodrow, G.R.; Mieszkowski, P. Pigou, Tiebout, Property Taxation, and the Underprovision of Local Public Goods. J. Urban Econ. 1986, 19, 356–370. [Google Scholar] [CrossRef]

- Wilson, J.D. Trade, Capital Mobility, and Tax Competition. J. Political Econ. 1987, 95, 835–856. [Google Scholar] [CrossRef]

- Wilson, J.D. Theories of Tax Competition. Nat. Tax J. 1999, 52, 269–304. [Google Scholar] [CrossRef]

- Eggert, W.; Sørensen, P.B. The Effects of Tax Competition When Politicians Create Rents to Buy Political Support. J. Public Econ. 2008, 92, 1142–1163. [Google Scholar] [CrossRef][Green Version]

- Faggian, A.; Modrego, F.; McCann, P. Human Capital and Regional Development. In Regional Dynamics and Growth: Advances in Regional Economics; Edward Elgar Publishing: Camberley, UK, 2019. [Google Scholar]

- Gu, H.; Wang, J.; Ling, Y. Economic Geography of Talent Migration and Agglomeration in China: A Dual-Driver Framework. China Econ. Rev. 2024, 86, 102180. [Google Scholar] [CrossRef]

- Tiebout, C.M. A Pure Theory of Local Expenditures. J. Political Econ. 1956, 64, 416–424. [Google Scholar] [CrossRef]

- Baicker, K. The Spillover Effects of State Spending. J. Public Econ. 2005, 89, 529–544. [Google Scholar] [CrossRef]

- Wilson, J.D.; Gordon, R.H. Expenditure Competition. J. Public Econ. Theory 2003, 5, 399–417. [Google Scholar] [CrossRef]

- Jia, S.; Zhou, C.; Qin, C. No Difference in Effect of High-Speed Rail on Regional Economic Growth Based on Match Effect Perspective? Transp. Res. Part A Policy Pract. 2017, 106, 144–157. [Google Scholar] [CrossRef]

- Ji, Y.; Huang, Y.; Yang, M.; Leng, H.; Ren, L.; Liu, H.; Chen, Y. Physics-Informed Deep Learning for Virtual Rail Train Trajectory Following Control. Reliab. Eng. Syst. Saf. 2025, 261, 111092. [Google Scholar] [CrossRef]

- Baldwin, R.E.; Krugman, P. Agglomeration, Integration and Tax Harmonisation. Eur. Econ. Rev. 2004, 48, 1–23. [Google Scholar] [CrossRef]

- Ludema, R.D.; Wooton, I. Economic Geography and the Fiscal Effects of Regional Integration. J. Int. Econ. 2000, 52, 331–357. [Google Scholar] [CrossRef]

- Andersson, F.; Forslid, R. Tax Competition and Economic Geography. J. Public Econ. Theory 2003, 5, 279–303. [Google Scholar] [CrossRef]

- Zheng, L.; Chang, Z.; Martinez, A.G. High-Speed Rail, Market Access, and the Rise of Consumer Cities: Evidence from China. Transp. Res. Part A Policy Pract. 2022, 165, 454–470. [Google Scholar] [CrossRef]

- Luo, H.; Zhao, S.; Cui, M.; Zhong, S.; Ma, J. The Evolution of Spatial Equity of High-Speed Rail Accessibility in China: An Operation Frequency Based Approach. Int. J. Sustain. Transp. 2023, 17, 1265–1277. [Google Scholar] [CrossRef]

- Jofre-Monseny, J. Is Agglomeration Taxable? J. Econ. Geogr. 2011, 13, 177–201. [Google Scholar] [CrossRef]

- Brülhart, M.; Jametti, M.; Schmidheiny, K. Do Agglomeration Economies Reduce the Sensitivity of Firm Location to Tax Differentials? Econ. J. 2012, 122, 1069–1093. [Google Scholar] [CrossRef]

- Hannes Winner, H.W. Fiscal Competition and the Composition of Public Expenditure: An Empirical Study. Contemp. Econ. 2012, 6, 38. [Google Scholar] [CrossRef]

- Brueckner, J.K. Strategic Interaction Among Governments: An Overview of Empirical Studies. Int. Reg. Sci. Rev. 2003, 26, 175–188. [Google Scholar] [CrossRef]

- Case, A.C.; Rosen, H.S.; Hines, J.R. Budget Spillovers and Fiscal Policy Interdependence. J. Public Econ. 1993, 52, 285–307. [Google Scholar] [CrossRef]

- Jiang, Y. Public Service Equalization, Digital Financial Inclusion and the Rural Revitalization: Evidence from Chinese 283 Prefecture-Level Cities. Int. Rev. Econ. Financ. 2024, 96, 103648. [Google Scholar] [CrossRef]

- Yang, Y.; Gong, B. Digital Financial Inclusion and Public Service Equalization. Financ. Res. Lett. 2025, 71, 106440. [Google Scholar] [CrossRef]

- Wang, H.; Xu, K. How City Shrinkage Affect Public Service Provision for Disadvantaged Groups? Evidence from China. World Dev. 2025, 186, 106823. [Google Scholar] [CrossRef]

- Marlow, M.L. Fiscal Decentralization and Government Size. Public Choice 1988, 56, 259–269. [Google Scholar] [CrossRef]

- Ihori, T.; Yang, C.C. Interregional Tax Competition and Intraregional Political Competition: The Optimal Provision of Public Goods under Representative Democracy. J. Urban Econ. 2009, 66, 210–217. [Google Scholar] [CrossRef][Green Version]

- Zhou, K.; Qu, Z.; Wei, Z.; Zhao, J. Does Government Fiscal Pressure Matter for Firm Environmental Performance? The Role of Environmental Regulation and Tax Competition. Econ. Anal. Pol. 2023, 80, 1187–1204. [Google Scholar] [CrossRef]

- Du, T.W.; Zhang, Y.S.; Li, T.Y. Fiscal Competition, Soft Budget Constraints and Local Fiscal Sustainability. J. Financ. Econ. 2020, 46, 93–107. [Google Scholar] [CrossRef]

- Milligan, K.; Moretti, E.; Oreopoulos, P. Does Education Improve Citizenship? Evidence from the United States and the United Kingdom. J. Public Econ. 2024, 88, 1667–1695. [Google Scholar] [CrossRef]

- Herrera, S.; Pang, G. Efficiency of Public Spending In Developing Countries: An Efficiency Frontier Approach; World Bank Publications: Washington, DC, USA, 2005; Volume 1. [Google Scholar]

- Zheng, S.; Kahn, M.E. China’s Bullet Trains Facilitate Market Integration and Mitigate the Cost of Megacity Growth. Proc. Natl. Acad. Sci. USA 2013, 110, E1248–E1253. [Google Scholar] [CrossRef]

- Hanley, D.; Li, J.; Wu, M. High-Speed Railways and Collaborative Innovation. Reg. Sci. Urban Econ. 2022, 93, 103717. [Google Scholar] [CrossRef]

- Luo, X.; Mao, W.; Wang, B.; Liu, C. The Impacts of Aviation and High-Speed Rail on Urban Innovation Capacity in China. Prog. Geogr. 2022, 41, 2203–2217. [Google Scholar] [CrossRef]

- Li, C.T.; Yan, X.W.; Song, M.; Yang, W. Fintech and corporate Innovation—Evidence from Chinese NEEQ-ListedCompanies. China Ind. Econ. 2020, 1, 81–98. [Google Scholar] [CrossRef]

- Liang, K. The Effect of Population Aging on the Fiscal Burden of Local Governments. In 2023 International Conference on Economic Management, Financial Innovation and Public Service (EMFIPS 2023); Atlantis Press: Dordrecht, The Netherlands, 2024. [Google Scholar]

- Panizza, U.; Presbitero, A.F. Public Debt and Economic Growth: Is There a Causal Effect? J. Macroecon. 2014, 41, 21–41. [Google Scholar] [CrossRef]

- Beck, T.; Levine, R.; Levkov, A. Big Bad Banks? The Winners and Losers from Bank Deregulation in the United States. J. Financ. 2010, 65, 1637–1667. [Google Scholar] [CrossRef]

- Tang, Z.; Wang, L.; Wu, W. The Impact of High-Speed Rail on Urban Carbon Emissions: Evidence from the Yangtze River Delta. J. Transp. Geogr. 2023, 110, 103641. [Google Scholar] [CrossRef]

- Wong, Z.; Chen, A.; Shen, C.; Wu, D. Fiscal Policy and the Development of Green Transportation Infrastructure: The Case of China’s High-Speed Railways. Econ. Change Restruct. 2022, 55, 2179–2213. [Google Scholar] [CrossRef]

- Chen, Y.; Fan, Z.; Gu, X.; Zhou, L.-A. Arrival of Young Talent: The Send-Down Movement and Rural Education in China. Am. Econ. Rev. 2020, 110, 3393–3430. [Google Scholar] [CrossRef]

- Keen, M.; Marchand, M. Fiscal Competition and the Pattern of Public Spending. J. Public Econ. 1997, 66, 33–53. [Google Scholar] [CrossRef]

- Bucovetsky, S. Public Input Competition. J. Public Econ. 2005, 89, 1763–1787. [Google Scholar] [CrossRef]

- Qian, Y.; Roland, G. Federalism and the Soft Budget Constraint. Am. Econ. Rev. 1998, 1143–1162. [Google Scholar] [CrossRef]

- Zhang, H.; Lu, S.; Chen, S. Does Centralization of Tax Administration Regulate Tax Competition? Evidence from a Quasi-Natural Experiment in China. Econ. Anal. Pol. 2024, 84, 1084–1098. [Google Scholar] [CrossRef]

- Eyraud, L.; Lusinyan, L. Vertical Fiscal Imbalances and Fiscal Performance in Advanced Economies. J. Monet. Econ. 2013, 60, 571–587. [Google Scholar] [CrossRef]

- Liu, C.; Li, L. Place-Based Techno-Industrial Policy and Innovation: Government Responses to the Information Revolution in China. China Econ. Rev. 2021, 66, 101600. [Google Scholar] [CrossRef]

| First-Level Indicators | Second-Level Indicators | Calculation Method |

|---|---|---|

| healthcare | Per capita budgetary expenditure on healthcare | General public budget expenditure on healthcare/resident population |

| Number of beds in healthcare institutions | Number of beds in healthcare institutions per 10,000 population | |

| Number of medical and health staff | Number of health staff per 10,000 population | |

| education | Per capita budgetary expenditure on education | General public budget expenditure on education/resident population |

| Pupil–teacher ratio in secondary schools | Pupil–teacher ratio in general secondary schools | |

| Pupil–teacher ratio in primary schools | Pupil–teacher ratio in general primary schools | |

| social security | Per capita budgetary expenditure on social security | General public budget expenditure on social security and employment/resident population |

| Basic pension insurance participation rate | Number of participants in basic old-age insurance/resident population | |

| Basic medical insurance participation rate | Number of basic medical insurance participants/resident population | |

| Basic unemployment insurance participation rate | Number of participants in basic unemployment insurance/resident population |

| KMO Value | 0.729 | |

| Bartlett Test of Sphericity | Approximate Chi-Square | 16,199.727 |

| df | 45 | |

| p value | 0 | |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| BPS | 3666 | 14.795 | 7.543 | 3.002 | 94.882 |

| Ln(Hsr + 1) | 3666 | 3.466 | 4.873 | 0.000 | 13.753 |

| urban | 3666 | 0.527 | 0.158 | 0.130 | 1.000 |

| industrct | 3666 | 40.203 | 9.651 | 11.800 | 83.870 |

| edup | 3666 | 9.052 | 0.830 | 4.070 | 12.210 |

| fd | 3666 | 0.403 | 0.071 | 0.149 | 0.852 |

| lndens | 3666 | 5.729 | 0.926 | 0.683 | 7.882 |

| scale | 3666 | 0.196 | 0.109 | 0.043 | 1.485 |

| Taxcompet | 3666 | 0.306 | 0.140 | 0.020 | 1.143 |

| Expencompet | 3666 | 0.602 | 0.368 | 0.135 | 4.061 |

| BPS | |||||||

|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| Ln(Hsr + 1) | 0.073 *** | 0.073 *** | 0.073 *** | 0.075 *** | 0.078 *** | 0.074 *** | 0.070 *** |

| (4.138) | (4.133) | (4.114) | (4.256) | (4.410) | (4.195) | (2.619) | |

| urban | 1.786 | 1.816 | 0.895 | 0.551 | 0.365 | −0.288 | |

| (1.422) | (1.445) | (0.708) | (0.435) | (0.288) | (−0.121) | ||

| instruct | 0.017 | 0.019 | 0.029 | 0.024 | 0.041* | ||

| (1.084) | (1.207) | (1.546) | (1.488) | (1.934) | |||

| edup | 2.419 *** | 2.500 *** | 2.537 *** | 2.246 * | |||

| (5.112) | (5.284) | (5.359) | (1.870) | ||||

| fd | 5.937 *** | 5.658 *** | 12.458 *** | ||||

| (3.176) | (3.019) | (3.618) | |||||

| lndens | 0.799 * | 0.674 | |||||

| (1.917) | (0.870) | ||||||

| scale | −7.404 *** | ||||||

| (−3.405) | |||||||

| Constant | 14.542 *** | 13.601 *** | 12.887 *** | −8.603 ** | −11.790 *** | −16.437 *** | −14.694 |

| (184.685) | (20.407) | (13.752) | (−1.999) | (−2.669) | (−3.263) | (−1.346) | |

| Individual fixed effect | YES | YES | YES | YES | YES | YES | YES |

| Year fixed effects | YES | YES | YES | YES | YES | YES | YES |

| Observations | 3666 | 3666 | 3666 | 3666 | 3666 | 3666 | 3666 |

| R2 | 0.843 | 0.843 | 0.843 | 0.844 | 0.844 | 0.844 | 0.846 |

| First Stage | Second Stage | ||

|---|---|---|---|

| Ln(Hsr + 1) | BPS | BPS | |

| (1) | (2) | (3) | |

| Ln(Hsr + 1)-iv | −0.013 *** | ||

| (−5.419) | |||

| Ln(Hsr + 1) | 0.606 *** | 0.058 ** | |

| (3.499) | (2.450) | ||

| Constant | 352.461 *** | 2.791 | −17.918 |

| (5.377) | (0.384) | (−1.164) | |

| Control variable | YES | YES | YES |

| Individual fixed effect | YES | YES | YES |

| Year fixed effects | YES | YES | YES |

| Observations | 3666 | 3666 | 3380 |

| R2 | 0.651 | 0.803 | 0.879 |

| Kleibergen–Paap rk Wald F | 29.360 | ||

| Kleibergen–Paap rk LM | 29.380 *** |

| BPS | |

|---|---|

| Ln(Hsr + 1) | 0.061 *** |

| (3.508) | |

| urban | 0.127 |

| (0.101) | |

| industrct | 0.036 ** |

| (2.189) | |

| edup | 4.789 *** |

| (7.758) | |

| fd | 11.956 *** |

| (5.226) | |

| lndens | 0.634 |

| (1.553) | |

| scale | −5.698 *** |

| (−3.702) | |

| debatscale | 0.078 *** |

| (3.158) | |

| populationaging | −0.004 |

| (−0.056) | |

| Year/Individual fixed effect | YES |

| Constant | −37.673 *** |

| (−5.989) | |

| Observations | 3666 |

| R2 | 0.853 |

| BPS | ||||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| HSR-DID | 0.460 *** | |||||

| (2.633) | ||||||

| Ln(Hsr + 1) | 0.083 *** | 0.065 ** | 0.055 ** | |||

| (2.817) | (2.404) | (2.354) | ||||

| DC | 10.922 *** | |||||

| (5.537) | ||||||

| num | 0.253 *** | |||||

| (3.670) | ||||||

| Constant | −11.467 *** | −9.075 | −18.797 | 57.724 *** | −11.576 | −22.076 |

| (−2.585) | (−0.965) | (−1.442) | (5.206) | (−1.111) | (−1.624) | |

| Control variables | YES | YES | YES | YES | YES | YES |

| Year fixed effect | YES | YES | YES | YES | YES | YES |

| Individual fixed effect | YES | YES | YES | YES | YES | YES |

| Observations | 3666 | 3666 | 3666 | 3666 | 3614 | 3666 |

| R2 | 0.844 | 0.851 | 0.846 | 0.732 | 0.836 | 0.881 |

| Taxcompet | Expencompet | |

|---|---|---|

| (1) | (2) | |

| Ln(Hsr + 1) | 0.002 ** | 0.008 *** |

| (2.312) | (5.688) | |

| Control variables | YES | YES |

| Constant | 0.106 | 1.780 *** |

| (0.343) | (3.251) | |

| Individual fixed effect | YES | YES |

| Year fixed effects | YES | YES |

| Observations | 3666 | 3666 |

| R2 | 0.206 | 0.575 |

| City Level | ||

|---|---|---|

| Central City | Peripheral City | |

| Ln(Hsr + 1) | 0.016 | 0.035 ** |

| (0.224) | (1.996) | |

| Control variables | YES | YES |

| Individual/Year fixed effect | YES | YES |

| Observations | 429 | 3237 |

| R2 | 0.807 | 0.822 |

| BPS | |||

|---|---|---|---|

| (1) | (2) | (3) | |

| Ln(Hsr + 1) | 0.171 * | 0.002 | 0.433 *** |

| (1.696) | (0.056) | (3.653) | |

| Control Variables | YES | YES | YES |

| Individual/Year fixed effects | YES | YES | YES |

| Observation | 1261 | 1300 | 1105 |

| R2 | 0.843 | 0.878 | 0.748 |

| Fiscal Decentralization | ||

|---|---|---|

| High Degree of Fiscal Decentralization | Low Degree of Fiscal Decentralization | |

| Ln(Hsr + 1) | 0.090 *** | 0.040 * |

| (3.296) | (1.747) | |

| Control variables | YES | YES |

| Individual/Year fixed effect | YES | YES |

| Observations | 1833 | 1833 |

| R2 | 0.852 | 0.776 |

| Financial Autonomy | ||

|---|---|---|

| High Degree of Financial Autonomy | Low Degree of Financial Autonomy | |

| Ln(Hsr + 1) | 0.055 ** | 0.005 |

| (2.136) | (0.179) | |

| Control variables | YES | YES |

| Individual/Year fixed effect | YES | YES |

| Observations | 1833 | 1833 |

| R2 | 0.867 | 0.666 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

He, J.; Wang, J.; Tan, K.; Ma, C.; Huang, J. A Catalyst for the Improvement of Inclusive Public Service: The Role of High-Speed Rail. Systems 2025, 13, 380. https://doi.org/10.3390/systems13050380

He J, Wang J, Tan K, Ma C, Huang J. A Catalyst for the Improvement of Inclusive Public Service: The Role of High-Speed Rail. Systems. 2025; 13(5):380. https://doi.org/10.3390/systems13050380

Chicago/Turabian StyleHe, Jiangye, Junwei Wang, Kehu Tan, Chang Ma, and Junda Huang. 2025. "A Catalyst for the Improvement of Inclusive Public Service: The Role of High-Speed Rail" Systems 13, no. 5: 380. https://doi.org/10.3390/systems13050380

APA StyleHe, J., Wang, J., Tan, K., Ma, C., & Huang, J. (2025). A Catalyst for the Improvement of Inclusive Public Service: The Role of High-Speed Rail. Systems, 13(5), 380. https://doi.org/10.3390/systems13050380