1. Introduction

Supply chains in the modern global environment, characterized by increased uncertainty, growing geopolitical rivalry, and unpredictable climatic conditions, have evolved into fluid networks that are interdependent, foundational to national fitness, and crucial for regional prosperity [

1]. Such a transition can be seen primarily through transnational infrastructure developments, such as the China-Pakistan Economic Corridor (CPEC), the marquee project of the Belt and Road Initiative, in which China has invested more than USD 60 billion [

2]. As a key interconnection point between Asia, the Middle East, and Africa, CPEC has the potential to transform the region’s connectivity and reinvent industrial growth. However, the strategic potential of the project is jeopardized by several significant weaknesses, including political instability, infrastructural deficiencies, and environmental imbalances [

3]. In those high-risk environments, resilience can no longer be considered a nice feature or a fancy side dish; it is a necessary condition for long-term sustainability, autonomous economic decisions, and sustainable development [

4].

Although resilience is of paramount importance, supply chains that operate within megaproject ecosystems, such as CPEC, do not always possess adequate capabilities to cope with rapid environmental changes and system-level shocks [

5,

6]. Traditional resiliency concepts, based on redundancy or reactive risk management, are no longer sufficient to address the multidimensional uncertainties that the present times have been experiencing [

7,

8,

9]. At the same time, digital transformation is presenting itself as an effective counterbalance to these constraints [

1,

10]; and new technologies, including big data analytics, fintech adoption, Internet of Things, and circular economy activities, promise to provide new opportunities to leverage adaptive capacity, real-time visibility, and operational agility. The realization of such a tool’s potential, however, requires more than the implementation of technology; it also requires the reorganisation of organisational processes and strategic capability in firms [

11]. The paradox, which is the enabling and reliance nature of digital technologies on hidden dynamic capabilities, continues to be an issue among the firms facing institutional gaps and dynamic environments [

12,

13,

14,

15,

16].

In recent years, the academic debate surrounding digital transformation and supply chain resilience has intensified, yet it has often been presented in a superficial manner rather than being properly contextualized [

17]. Available literature tends to employ sharp, technology-centred lenses, such as evaluating the effects of big data analytics on firm performance or the contribution that fintech can make to financial inclusion, without explaining how such tools can coexist or interface with each other in a system of coherent capabilities [

18]. Moreover, the literature has been skewed towards developed economies that already possess developed institutional infrastructure, thus ignoring the complex market forces in developing economies [

19]. In high-risk environments like the CPEC, there are three significant gaps extant: (1) truncated theorization of the interaction of digital tools with one another, especially big-data analytics, fintech, internet-of-things, and circular economy activities; (2) inadequate empirical testing of mediating factors via which digital capabilities affect resilience. (3) the absence of a contextual study on the moderating effect of environmental dynamism in these relationships. These inadequacies hinder both theory building and the production of frameworks that can guide practitioners in uncertain lands.

However, addressing these voids necessitates a nuanced, context-sensitive investigation that bridges digital innovation, resilience strategy, and environmental volatility. As recent reviews of the supply chain literature have called for more integrative, contextually grounded research, especially in emerging economies and high-stakes infrastructure settings, the need for a theory-informed empirical exploration of digital-enabling pathways has become increasingly urgent [

20,

21,

22,

23,

24,

25]. Responding to these calls, the present study develops and tests a conceptual model grounded in dynamic capability theory (DCT), which emphasizes a firm’s ability to sense, seize, and transform in response to environmental change. In doing so, it positions digital capabilities not as static resources, but as orchestrated and reconfigurable assets that evolve in tandem with the increasing complexity of the context. The study addresses the following research question:

RQ1: How does big data analytics management capability (BDMC) enable supply chain resilience (SCR) in the CPEC context and through which mechanism? RQ2: How do fintech adoption, circular economy activities, and the Internet of Things mediate the relationship through which BDMC enhances SCR? RQ3: Additionally, how does environmental dynamism moderate the relationship between the BDMC-SCR nexus?

The theoretically robust and empirically testable framework enables this study to contribute to a deeper understanding of how digital transformation unfolds in a complex, underdeveloped environment. This paper makes significant contributions to both theory and practice in several important respects. First, it views BDMC as a dynamic capability, which combines multiple digital enablers, thereby providing a fresh perspective on the strategic deployment of technology to achieve resilience within firms. Second, it alters the watershed mechanism of novelty, i.e., mediating mechanisms, namely fintech adoption, circular economy activities, and the Internet of Things, that explain the logic of transformation between analytics and resilience. Third, this study broadens the scope of DCT, which has traditionally been applied to a virtual world, by incorporating two critical factors: IoT as a mediator and environmental dynamism as a moderator, thereby extending its application into the real world.

Empirically, this study may be one of the first to examine the entire dynamics of relations in a megaproject context, providing exceptionally valuable insight into the interactive effects of digital capabilities under pressure, to the authors’ best knowledge. In practice, this work creates a strategic guide for companies and policymakers active in the development corridor, such as CPEC, highlighting the importance of holistic digital planning, situational flexibility, and system-level innovations. Lastly, the model also helps achieve the following key sustainable development goals (SDGs): SDG 8 (decent work and economic growth); SDG 9 (industry, innovation, and infrastructure); SDG 11 (sustainable cities and communities); SDG 12 (responsible consumption and production); SDG 13 (climate action); and SDG 17 (partnerships for the goals), highlighting the general societal and environmental significance of constructing the supply chains of a digital resilience nature.

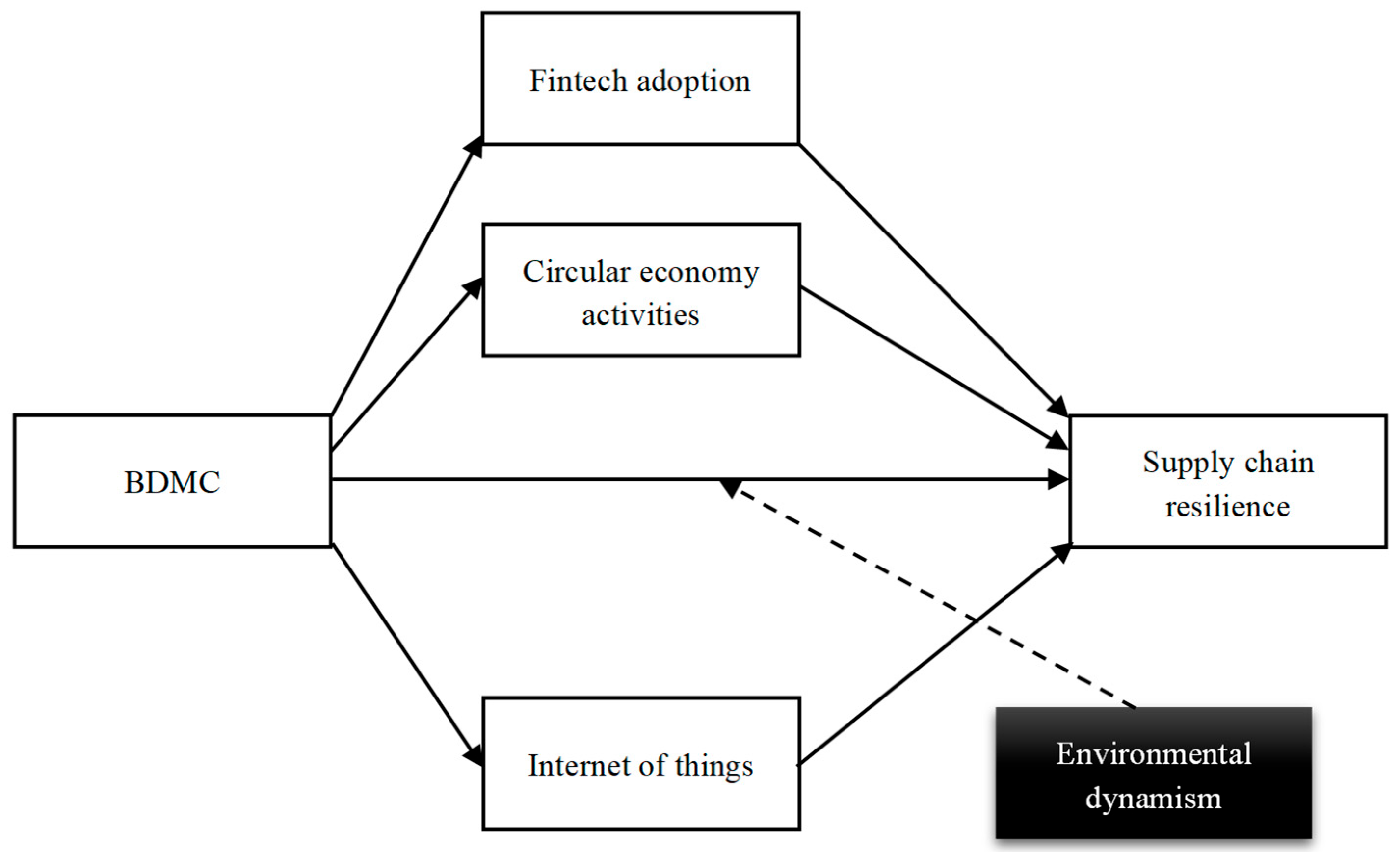

Figure 1 shows the conceptual model of this study.

2. Literature Review and Hypotheses Development

2.1. Dynamic Capability Theory

In the modern, profoundly dynamic, and digitally connected global market, achieving supply chain resilience has become a critical strategic necessity for companies operating in an environment of complex interdependence and increased uncertainty [

22]. As the intellectual threat of technological disruption, geopolitical ambiguity, and environmental instability enters the global value chain, the expressive risk-management paradigm that has taken comfort in redundancy or locally optimized architecture is shown to be ineffective [

6]. This observation becomes especially relevant in megaproject ecosystems, such as the CPEC, where companies must contend with an overwhelming level of operational complexity, institutional voids, and infrastructural fragilities [

3]. In this regard, the ability to foresee, absorb, and adjust to interruptions is no longer a pillar of uncritical response, but a proactive, embedded skill that forms the backbone of long-term competitiveness and socioeconomic productivity. Recent research on digital transformation [

26] and organisational resilience [

27] tends to examine these phenomena separately, thereby overlooking the symbiotic relationship between them.

In the supply chain literature, the technological enablers, i.e., the use of the IoT, fintech adoption, big-data analytics, or the resilience mechanisms at the process level, i.e., operational flexibility and redundancy, are studied extensively, yet little attention is paid to how the firms combine these abilities to foster adaptive responses [

11]. Such an analytical blind spot has created a conceptual vacuum: as individual technologies are still being touted as revolutionary, little is understood about strategic arrangements and combinations in which firms can create a sustained resilience. In addition, existing studies have favored stable institutions, paying little regard to the unique dynamics and limitations that arise in emerging economies [

20]. This focus leads to a skeletal interpretation of how organisations within unstable ecosystems, such as those along the CPEC, can develop resilience in the face of enduring environmental dynamism—a phenomenon that digital transformation can make possible.

The available body of current texts has retained a consistent pattern of focusing on the assertion that existing digital technologies are strength-enabling [

26], but this seems to be effective only when these technologies are molded into the strategic design of an organisation [

27]. Such tools, when used in isolation, have limited value; their potential to transform can only become a reality when they are combined with higher-order functionality that includes sensing trends, steering adoption, and enabling their incorporation into dynamic environments [

28]. Such a discrepancy, wherein digital enablers serve as a tool dependent on the level of maturity of an organisation, indirectly demands the creation of a theoretical model that reflects the alignment between technological and strategic capacities in an uncertain environment.

Dynamic capability theory (DCT) can be considered an effective analytical tool for studying organisational resilience. DCT is conceptualized as the ability of an organisation to sense, seize, and reconfigure its internal and external resources in adaptive responses to changing environmental conditions. Therefore, DCT differs from static accounts of resources by emphasizing adaptive processes [

29]. The same theoretical orientation is especially relevant when considering how companies based in uncertain megaproject settings can leverage their digital opportunities to address their vulnerabilities. Dynamic capabilities enable a firm to change its value chain in the face of disruption, unlike conventional capabilities, which only allow a firm to optimize its value chain. The current model suggests that big data analytics management capability (BDMC) is a dynamic capability that enables digital transformation, as well as strategic renewal through this competence.

However, the given study develops a conceptual framework that traverses various and mutually constituting mechanisms. BDMC is the most fundamental enabler that enhances the firm’s ability to read environmental cues, drive cross-functional digital innovation, and reconfigure its supply chain. Three mediating pathways in this trajectory include fintech adoption, circular economic activities, and the Internet of Things, which strategically place digitally enabled channels through which BDMC can be converted into supply chain resilience.

While circular economy activities are often specified in a formal format in prior literature, the current study employs a reflective specification. This choice is based on the conceptualization that the observed indicators of circularity (e.g., product reuse, material recycling, design for disassembly) are manifestations of a familiar underlying construct strategic circular orientation. These indicators are assumed to be manifestations of a shared cause and are considered interchangeable in measurement, thus justifying the reflective treatment. Furthermore, environmental dynamism is postulated as a severe boundary condition; in the case of increased volatility, the value of dynamic capabilities is significantly enhanced, as stable routines are no longer relevant. On their own, these frameworks outline a digital-mediated, capabilities-based route to resilience that broadens the debate about DCT into empirical contexts where there is a high risk and little research coverage.

2.2. Big Data Analytics Management Capability (BDMC) and Supply Chain Resilience

The key idea of dynamic capability theory (DCT) is that organisational success depends on the ongoing reconfiguration of resources, rather than the ownership of superior resources [

29]. In this context, resilience, i.e., the ability to predict, absorb, and recover from disruptions, can be perceived because of the sensing, seizing, and reconfiguration capabilities of an organisation, rather than a predetermined property [

9]. When conceptualized as a dynamic capability, BDMC serves exactly this purpose: it enables firms to sense new risks, seize data-driven opportunities and transform supply chain processes based on uncertainty [

30]. The existing literature in various domains supports the hypothesis that BDMC can be regarded as a relevant predictor of operational agility, strategic decision-making, and increased risk visibility, i.e., sets of characteristics central to organisational resilience. Within healthcare and manufacturing, it has been demonstrated that BDMC can enhance crisis responsiveness by generating predictive intelligence and establishing high-velocity feedback loops [

31]. Similar outcomes are observed in the domain of logistics, where BDMC supports real-time resource distribution and supply-demand synchronization, a crucial functionality in supply disruption management [

32].

Taken together, these notes support a recurring trend: BDMC facilitates the conversion of informational resources into actionable steps, which enhances organisational resilience. In the context of CPEC, where volatility, infrastructure intensity, and a lack of institutional strength prevail, the importance of BDMC’s role becomes even more crucial. Companies that conduct business in CPEC must contend with political unpredictability, infrastructural uncertainty, and environmental risk, which require quick, innovative, and flexible management decision-making. In turn, BDMC goes beyond its traditional scope of work as a provider of operational support and turns into a valuable strategic resource. By enabling companies to predict interruptions, rebalance operations, and maintain continuity capacities, the core of organisational resilience in a dynamic environment, big data analytics management capability (BDMC) emerges as a crucial tool for maintaining corporate efficacy in the CPEC environment. Therefore, based on DCT.

H1. BDMC positively and significantly impacts supply chain resilience.

2.3. Fintech Adoption as a Potential Mediator

The dynamic capability theory posits that firms operating in turbulent environments must possess both valuable resources and the capacity to develop higher-order capabilities, thereby facilitating adaptation, innovation, and the reconfiguration of resources in response to external changes [

29]. In this context, organisational tools such as big data analytics management capability (BDMC) play a central role in enabling organisations to identify new technological trends, capture digital opportunities, and realign operational routines. A good example of such an opportunity is fintech adoption (FTA), a rapidly evolving range of digital financial technologies that enhance efficiency, transparency, and agility in financial transactions and supply chain financing [

33]. Literature emphasizes that BDMC is a vital mechanism through which institutions promote the adoption of emerging technology [

22]. It provides the competencies necessary to aid firms in defining and executing the emerging technological innovations by yielding analytical frameworks, governance architectures, and cross-functional learning pathways [

34].

It appears that, based on empirical evidence from the banking and logistics sectors, data-driven companies tend to implement fintech solutions to structure financial flows and manage liquidity market risks [

35]. As such, the work under consideration contributes to the discussion of dynamic capability theory by further introducing the concept of BDMC as a factor that facilitates an organisation’s ability to identify the strategic utility of fintech and implement it within its workflows without disruption. The capability in question holds exceptional importance in the CPEC environment, characterized by capital constraints, erratic cash flows, and financing inefficiencies. Given the above discussion, we propose:

H2a. BDMC positively and significantly influences fintech adoption (FTA).

Fintech not only amplifies the uptake but also serves as a framework that increases resilience. It is impossible to imagine its absence in the environment of turbulent supply chains, where decentralizing finance, accelerating transaction processing, and reducing the use of conventional intermediaries [

36] are key strategies. Digital trade-finance platforms can enhance the liquidity of working capital, and blockchain-driven payment systems can simultaneously reduce settlement delays and the threat of fraud [

37]. Fintech has the potential to level the procurement and delivery cycles in weak ecosystems, such as CPEC, where businesses regularly face payment delays and a lack of credit. In line with this, basing the argument on the dimensions of dynamic capabilities theory (DCT) of seizing and transforming, H2b suggests that:

H2b. Fintech adoption (FTA) positively and significantly influences SCR.

Building on the logic above, H2c theorizes that FTA serves as a mediating conduit through which big data analytics management capability (BDMC) enhances resilience. Rather than directly transforming supply chains, BDMC first empowers firms to adopt fintech by enabling digital sensing and strategic decision-making. In turn, fintech reshapes financial infrastructures and workflows, facilitating responsive and flexible supply chain operations. This two-step capability logic, BDMC, enables FTA, and FTA enables supply chain resilience (SCR), is consistent with the DCT view that dynamic capabilities operate through the orchestration of complementary resources [

29].

In high-risk environments like CPEC, where firms must manage chronic uncertainty and capital volatility, this mediated pathway is not merely plausible; it is essential. H2c expands, as Aamri [

19] states that fintech acts as an intermediary channel, in which BDMC improves SCR. Instead of directly interfering with supply chains, BDMC will initially provide firms with the digital sensing and strategic decision-making abilities required to embrace fintech. Fintech, in its turn, redesigns financial infrastructures and working processes, thus enabling supply chain processes that are responsive and flexible. The two-step logic of BDMC’s capability in facilitating FTA and FTA in facilitating SCR aligns with the dynamic capability’s theory statement, which posits that dynamic capabilities are enacted through the coordination of complementary resources [

30]. This mediated pathway is not only possible in high-risk settings like the CPEC, where firms are forced to deal with constant chronic uncertainty and capital volatility, but it is a necessity. Therefore, based on the above, we propose that:

H2c. Fintech adoption (FTA) positively and significantly mediates the relationship between BDMC and SCR.

2.4. Circular Economy Activities (CEA) as a Potential Mediator

Dynamic capabilities theory emphasizes the importance of an organisation’s ability to sense environmental threats, seize new opportunities, and redesign internal activities considering uncertainty and change [

29]. In this regard, CEA, including the design-out of waste, the maintenance of resources in use, and the regeneration of natural systems, represents a significant step towards substituting traditional linear supply chains with sustainable and resilient ecosystems [

11]. This transformation cannot be achieved in a vacuum; it requires the firm to know how to generate, process, and implement data-driven insights, which we refer to as big data analytics management capability (BDMC). BDMC refers to a dynamic capability that allows firms to identify inefficiencies, map material flow, and explore circular opportunities along the value chain [

36,

38]. Organisations can predict patterns of waste, find ways to recirculate resources, and assess the lifecycle effects of production through advanced data analytics. Previous research on manufacturing and logistics shows that the companies that are more advanced in terms of BDMC are more willing to implement the principles of the circular economy (i.e., remanufacturing, recycling, and reverse logistics) [

11,

20]. These results highlight how BDMC enables circular economy activities, providing firms with the cognitive and analytical means to sense and implement circular economy practices. This ability is consequently important in turbulent and resource-scarce situations, where environmental controls are changing as well as the flow of raw materials is somewhat unpredictable, as is the case in CPEC. Therefore, we hypothesize that:

H3a. BDMC positively and significantly affects circular economy activities.

Implementing a circular economy in supply chain networks will enhance resilience by diversifying the sourcing portfolio, reducing resource dependency, and enabling the creation of modular, regenerative supply structures [

39]. The circular economy paradigm encourages redundancy through reuse and remanufacturing, while also increasing flexibility by allowing companies to alternate between resource inputs or production strategies. Empirical evidence suggests that circular supply chains are better equipped to withstand shocks, decrease the risk of disruption, and maintain operations during crises [

40,

41]. Against the backdrop of the CPEC, characterized by delays in infrastructure, environmental disturbances, and regulatory uncertainties, the CEA provides a strategic cushion against volatility for firms operating within this corridor. Therefore, we hypothesize that:

H3b. CEA positively and significantly affects supply chain resilience.

BDMC does not directly bring resilience into an organisation; instead, it mediates a change in adaptive logic, specifically the transition from linear to circular systems. Therefore, CEA can be considered a critical point that transforms analytical understanding into adaptive capacity [

11]. This dynamic aligns with the principles of DCT, revolving around reconfiguration. Big data analytics management capability (BDMC) enables firms to identify sustainability issues and reconfigure their operational systems towards circularity, thereby promoting resilience in challenging environments [

29]. This mediated pathway is especially salient in the emerging megaproject environment where the technology, environmental, and strategic logics must be merged, as in the case of CPEC. Therefore, we hypothesize that:

H3c. CEA strongly mediates the relationship between BDMC and SCR.

2.5. Internet of Things (IoT) as a Potential Mediator

Dynamic capabilities theory has proven useful in explaining how companies in turbulent environments can leverage internal capabilities to integrate, adapt, and recombine technological resources in their quest to achieve sustained performance [

29]. In such an analytical lens, big data analytics management capability (BDMC) serves as a dynamic capability; it does not just deal with the normal processing of data, but it enables organizations to sense what is on the horizon in terms of technological possibilities, suitable digital innovations, and reconfigure operations to meet the change [

22]. A good example is IoT, which is a connected world of sensors, devices, and platforms, and it constantly produces and streams real-time data to enable proactive decision-making in the supply chain. Companies with advanced BDMC capabilities create a more conducive environment for IoT, as the analytical skills, governance framework, and data-driven culture associated with this capability can bestow on organisations [

22]. The empirical investigations in the areas of logistics, healthcare, and smart manufacturing emphasize that companies that have already developed their data capabilities demonstrate better performance when using IoT to improve visibility, automate workflows, and optimize processes [

12]. BDMC, as an essential precondition for IoT implementation in the CPEC environment, characterized by lags in infrastructural development, unstable demand patterns, and transportation bottlenecks, can facilitate adaptive sensing and system-wide interoperability. As a result, we propose a hypothesis:

H4a. Big data analytics management capability (BDMC) positively and significantly influences IoT.

Once implemented, IoT acts as a digital enabler of supply chain resilience by providing end-to-end visibility, real-time disruption monitoring, and automated response capabilities [

7]. IoT-enabled devices facilitate predictive maintenance, geolocation tracking, and temperature or inventory monitoring, which are essential in pre-empting delays, breakdowns, or losses, especially in high-risk corridors like CPEC. IoT systems enable supply chain actors to detect disruptions quickly, reroute shipments, or trigger contingency protocols. Such capabilities directly align with the “sensing” and “responding” dimensions of resilience and have been shown to reduce lead times and improve continuity during crisis events [

8]. Therefore, we hypothesize that:

H4b. IoT positively and significantly impacts supply chain resilience.

Taken together, big data analytics management capability (BDMC) and Internet of Things (IoT) operate as interconnected layers of dynamic capability. While BDMC enables firms to conceptualize and adopt IoT infrastructure, it is through IoT that real-time analytics are operationalized and embedded into daily supply chain operations [

22]. In this way, IoT acts as a mediating mechanism, translating BDMC into tangible resilience outcomes by enabling fast sensing, information sharing, and decision execution across the supply chain. This perspective aligns with the dynamic capabilities theory’s emphasis on capability orchestration, where sensing leads to reconfiguration via digital intermediaries. In the volatile and infrastructure-sensitive context of CPEC, this mediated pathway is particularly salient, offering firms a real-time, data-driven shield against uncertainty. Therefore, we hypothesize that:

H4c. IoT strongly mediates the relationship between BDMC and supply chain resilience.

2.6. Moderating Role of Environmental Dynamism

Dynamic capabilities theory emphasizes that the value of organisational capabilities is not static but contingent upon the environmental context, particularly under conditions of volatility, uncertainty, and change [

30]. In stable environments, firms can rely on routines and incremental improvements. However, in highly dynamic environments, where technological, regulatory, and market shifts are frequent and unpredictable, dynamic capabilities such as BDMC become increasingly vital for achieving resilience [

29]. Environmental dynamism refers to the speed and unpredictability of change in a firm’s external environment, encompassing political, economic, and technological aspects [

42].

However, past research shows that when companies operate in a setting involving a high level of environmental dynamism, companies with well-developed dynamic capabilities outperform those with static or misfit capabilities [

18]. Big data analytics management capability (BDMC) enables organisations to identify signs of disruption and respond quickly by leveraging data-informed intelligence to restructure their supply chain operations. However, the strategic payoff of BDMC is likely to be stronger under conditions of high volatility, when faster sensing and adaptation are needed more [

43]. In CPEC, a politically unstable and uncertain regulatory and infrastructural environment, environmental dynamism is not a one-time phenomenon. Firms in this environment must continually reform their supply chains to survive systemic shocks. The ability to take advantage of BDMC is thus not only beneficial but a necessity. As a result, we propose a hypothesis:

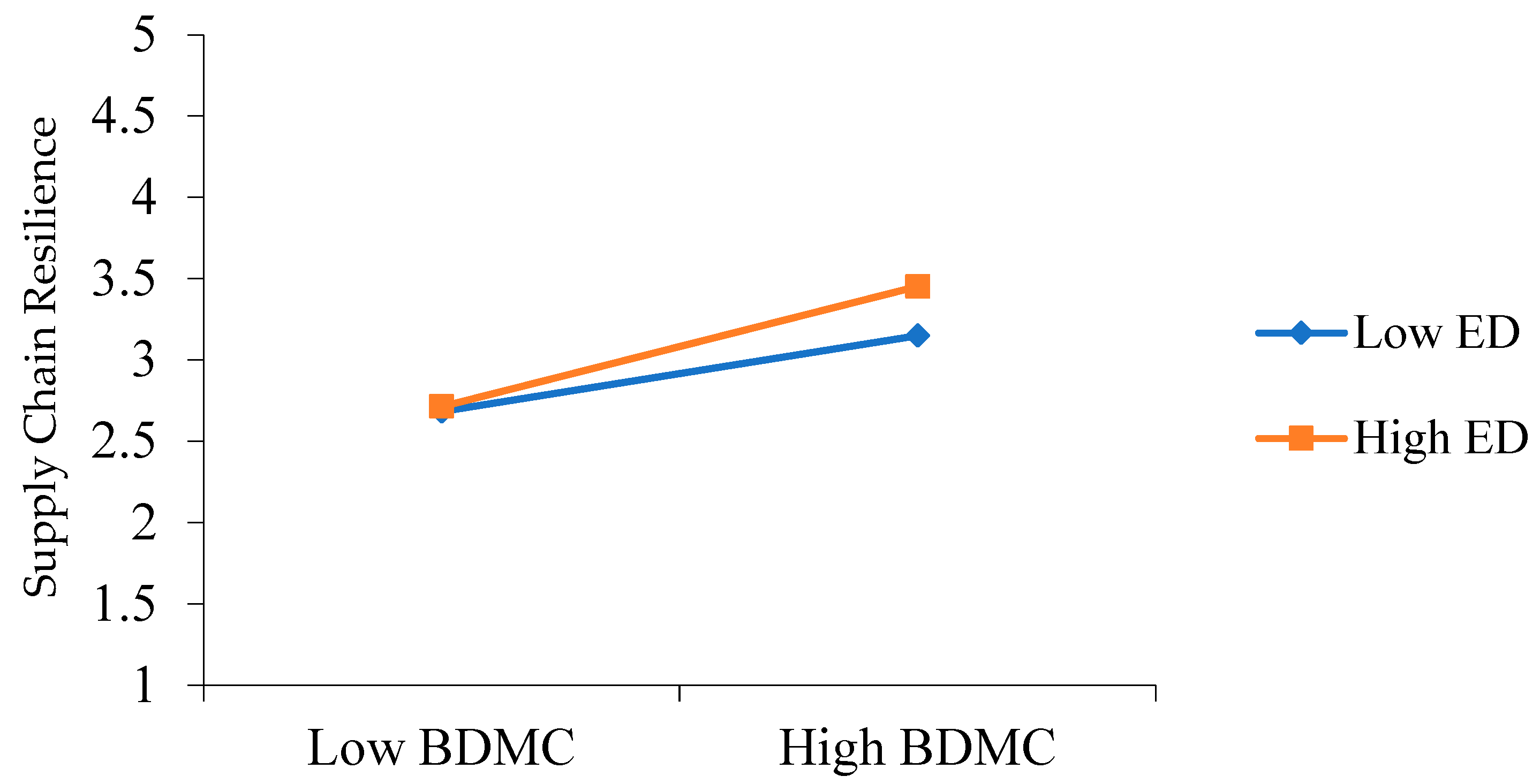

H5. Environmental dynamism moderates the relationship between BDMC and SCR, such that the positive relationship is stronger with a higher level of environmental dynamism.

3. Methodology

In the direction of a strict empirical test of the analytical framework based on dynamic capabilities theory, the investigation presented here resorts to a multi-stage data collection approach targeting professionals integrated into the CPEC infrastructure and supply chain environment. The CPEC setting, characterized by high-volatile sectors and institutionally complicated contexts, presents a suitable environment for studying how organisations can implement digital capabilities, particularly big data analytics management capability (BDMC), to enhance supply chain resilience in a highly dynamic environment. The urban industrial centers of Karachi, Lahore, and Islamabad, which comprise the three cities where more than 50% of Pakistan’s GDP is generated, served as the data collection sites. Serving as a key hub in the analysis of supply chain activities modulated by technological transformation and sustainability demands, Karachi is a core location in which the country makes a significant industrial contribution of 42% nationally [

44]. In every city, some businesses are significantly engaged in digital innovation and infrastructure-based growth, which makes them particularly pertinent to this study.

The sampling frame encompassed mid-to-senior-level professionals involved in strategic planning, digital transformation, sustainability, operations, and financial projects. This was at the intersection of BDMC’s capabilities, fintech adoption, the Internet of Things, circular economy activities (CEA), and environmental dynamism. The sectors of the sample include the logistics industry, manufacturing industry, agribusiness industry, energy industry, and financial services industry, which form part of the Vision 2025 strategy as well as the overall goals of the CPEC [

44].

Given the absence of a centralized CPEC linked professional directory and the need to access a targeted but difficult-to-reach population, this study employed non-probability snowball sampling. This approach is particularly useful in reaching organizationally diverse but interconnected networks [

45,

46]. However, snowball sampling can introduce potential biases, such as over-representation of digitally connected or highly networked participants, which may skew the sample toward more technologically progressive firms. To mitigate this bias, the initial respondents were selected from diverse industries and organisational types, including private, public, and public-private partnerships, across all three cities. Moreover, referrals were capped at a maximum of three waves to prevent over-dependence on a single network strand.

Initial participants were identified through LinkedIn, business forums, and industry events. Successive recommendations extended the sample to encompass both public and private CPEC stakeholders. To provide transparency, the sectoral and geographical composition of the final sample is detailed in

Table 1, including the share of respondents by city and sector. Furthermore, participants were asked to disclose the referral source (where applicable), enabling the mapping of referral chains to monitor diversity and representation. The eligibility criteria required an organisational affiliation with CPEC initiatives and a demonstrable investment in digital or environmental innovation. The inclusion threshold was determined using two criteria: the presence of related certificates (e.g., ISO 14001, ISO 27001) [

47,

48], and publicly available information on the application of technologies such as fintech or IoT, which was verified through corporate websites and sustainability reports.

To mitigate common method bias and bolster causal inference, a time-lagged, four-wave survey design was employed, consistent with recommendations by Podsakoff, MacKenzie [

49]. Predictor and outcome variables were measured at different points in time to reduce perceptual inflation. Each wave was spaced by a two-week interval (time 1 to time 4), a lag period justified by prior studies that argue short timeframes are adequate for capturing short-term cognitive-behavioral shifts in innovation adoption and environmental response. This approach also minimizes recall decay while preserving the temporal logic of causal paths. Moreover, Participants were briefed through personalized emails and phone calls. Ethical standards were strictly adhered to informed consent was obtained, and participants were assured of anonymity and data confidentiality.

A total of 700 questionnaires were distributed at Time 1 BDMC, with 585 responses returned, resulting in an 83.5% response rate. Time 2 FTA, CEA, IoT resulted in 539 valid responses (92.1%), Time 3 environmental dynamism returned 498 responses (92.3%), and Time 4 SCR yielded 474 responses (95.1%). After removing 15 incomplete, 10 never met the selection criteria and eight erroneous, the final dataset comprised 441 responses, representing a cumulative valid response rate of 63%. Moreover, a detailed attrition analysis was conducted. Independent sample t-tests revealed no statistically significant differences (

p > 0.05) between retained respondents and dropouts on key time 1 variables, such as BDMC and organisational size, indicating that attrition did not introduce systematic bias. This response level exceeds the minimum recommended threshold of 200 observations required for structural equation modelling [

50], This enhances both the generalizability and statistical power of the findings. The demographic and organizational distribution, as well as sector and city breakdowns with shares, are presented in

Table 1 and

Figure 2.

To further address common method bias, a marker variable technique was employed. Six theoretically unrelated marker constructs (M1–M6) were added to the model; each linked to endogenous constructs. The path coefficients from these marker variables to the latent constructs were examined. As shown in

Table 2, none of the paths from M1 to M6 were statistically significant (all

p-values > 0.05), indicating that the marker variables had no substantial influence on the main model constructs. This suggests that common method variance is not a serious concern in this study, in line with the recommendations of [

51].

Additionally, full collinearity variance inflation factors (VIFs) were assessed at the construct level to detect both vertical and lateral collinearity, which can also indicate potential method bias. All VIF values were well below the conservative threshold of 3.3 recommended by Kock [

52] (see

Table 3), supporting the absence of multicollinearity and common method variance. This further validates the robustness of the model’s estimations. In summary, the combination of a time-lagged survey design, marker variable technique, and full collinearity assessment provides a comprehensive, multi-method approach to minimizing and detecting common method bias.

Variable Measurement

To facilitate empirical evaluation, the scales adopted to measure each building block in the proposed framework were well-validated and drawn from previous research studies. The Likert scale was chosen due to its potential for quantifying perceptions, attitudes, and opinions, and because it is regularly used in the social science community to measure subjective experiences. On the other hand, the semantic differential scale involves the evaluation or perception of participants, where pairs of opposite adjectives (e.g., happy-sad) are presented and rated on a numerical scale. Regarding the consistent representation of model goals and characteristics of the constructs to be examined, a five-point Likert-type scale with the following points was selected (1 = strongly disagree to 5 = strongly agree). The BDMC was adopted with six items adopted from [

38], supply chain resilience on a five-item scale adopted from [

53], fintech adoption on a five-item scale adopted from [

36], circular economy activities on a five-item scale adopted from [

53], IoT on a five-item scale adopted from [

54,

55,

56] and environmental dynamism on a five-item scale [

42] were adopted, respectively. The scale items are presented in the

Appendix A. Although formative specification is commonly used for circular economy activities, this study adopts a reflective specification for the construct. This decision is grounded in both theoretical and empirical considerations. First, measurement items are assumed to reflect an underlying common latent construct of circular economy activities rather than independently causing it. Second, the items are conceptually interchangeable and are expected to co-vary, meaning that a change in one item implies a change in the others. Third, adopting a reflective approach aligns with prior empirical studies that operationalize circular economy activities using reflective indicators. By maintaining this approach, the measurement model ensures internal consistency and facilitates the assessment of reliability and validity using established psychometric techniques. Nonetheless, this specification is carefully justified considering the conceptual model and the research objectives.

5. Discussion

In an era marked by escalating global disruptions, institutional volatility, and digital convergence, the imperative for supply chain resilience has never been more urgent, particularly in geopolitical hotspots such as the China-Pakistan economic corridor (CPEC), where cross-border infrastructure is vulnerable to regional security dynamics, governance instability, and ecological degradation. This study draws upon dynamic capabilities theory to investigate how big data analytics management capability functions as a strategic enabler of supply chain resilience, operating through three mediating mechanisms: fintech adoption, circular economy activities, and the Internet of Things, all within the context of environmental dynamism, a key boundary condition in emerging markets. The findings provide robust empirical support for the theorized model and yield several significant insights for both academia and practice.

First, the direct relationship between BDMC and SCR (β = 0.301,

p < 0.001) confirms the foundational proposition of DCT: that adaptive capabilities grounded in data analytics are essential for sensing, seizing, and reconfiguring in response to environmental uncertainty [

22,

59]. However, this direct influence explains only part of the story as BDMC’s role is predominantly indirect and orchestration-based, unfolding through layered channels and cross-functional routines. The mediating roles of circular economy activities (CEA, β = 0.175), the Internet of Things (IoT, β = 0.114), and fintech adoption (FTA, β = 0.081) indicate the layered architecture of BDMC and its embeddedness in operational and sustainability infrastructures. This affirms the logic of dynamic capabilities as layered and integrative, where digital sensing and analytical capacity must be channelled through operational mechanisms to generate resilience outcomes [

11,

37,

55]. Among these, CEA emerged as the strongest mediator-an insight that warrants deeper interpretation. Circularity contributes not only to waste minimization but to supply chain buffering, reverse logistics agility, and resource independence-factors essential in volatile megaprojects like CPEC. In terms of resilience stages, CEA enhances readiness (e.g., by reducing dependency on virgin resources), response (e.g., by reusing materials), recovery (e.g., by shortening replenishment cycles), and growth (e.g., by innovating closed-loop models). By contrast, IoT primarily strengthens visibility and real-time response, while fintech enhances liquidity and transaction flexibility each addressing different facets of resilience. Importantly, these channels may act in both complementary and substitutive ways, depending on resource constraints. For example, under capital scarcity, fintech adoption may be prioritized over IoT integration due to lower infrastructure requirements. Conversely, in data-rich contexts, IoT complements CEA by enabling the monitoring of reuse cycles.

Further, the significant moderation effect of ED on the BDMC-SCR relationship (β = 0.068,

p = 0.026) provides compelling evidence for the conditional value of dynamic capabilities. Consistent with DCT, the returns from BDMC intensify under high environmental volatility, where traditional capabilities become insufficient [

42]. The small yet significant ΔR

2 (0.622) and f

2 (0.011) (see

Table 9) suggest modest but meaningful amplification, validating CPEC as an empirically relevant context. Its institutional voids, transnational governance, and security-sensitive operations exemplify environments where resilience must be designed, not assumed. This research contributes theoretically by clarifying that BDMC does not act in isolation, but rather as an orchestrating capability whose impact is realized through complementary digital and circular pathways. This opens the “black box” of capability orchestration by identifying micro foundations, such as data governance protocols, cross-functional collaboration routines, and analytics talent, showing how capability translates into action in high-risk, multi-stakeholder environments.

The robustness checks offer valuable theoretical and practical insights that extend beyond the baseline model. The presence of endogeneity, as indicated by the gaussian copula, suggests that resilience enhancing capabilities and outcomes may reinforce each other in practice, creating feedback loops [

62]. This aligns with the dynamic capabilities view, where firms that are already resilient tend to reinvest in data analytics and digital infrastructure, thereby deepening their advantage over time. Acknowledging this bidirectionality enriches our theoretical framing and highlights the need for future research using longitudinal or instrumental approaches to disentangle causal sequencing. The nonlinear effects uncovered through quadratic testing emphasize that the value of big data analytics management capability is not linear. Instead, diminishing or accelerating returns may occur depending on a firm’s digital maturity [

64]. This implies that managers should not expect uniform benefits from incremental investments; instead, strategic thresholds or tipping points may need to be crossed before the benefits of resilience gain materialization. Finally, the detection of unobserved heterogeneity through FIMIX-PLS indicates that firms follow differentiated pathways toward resilience [

65]. This underscores the context-dependent nature of digital transformation in CPEC megaprojects. For practitioners, the implication is clear: resilience strategies must be tailored to the firm’s type, sector, and maturity stage, rather than relying on a one-size-fits-all approach. Taken together, these robustness results deepen this study’s contribution by showing that the BDMC resilience relationship is shaped by reciprocal causality, nonlinear dynamics, and heterogeneous trajectories.

5.1. Theoretical Implications

This study provides several meaningful theoretical contributions by advancing the understanding of dynamic capabilities in the context of supply chain resilience, particularly within infrastructure-intensive and geopolitically complex environments like CPEC. Anchored in dynamic capabilities theory, the findings respond to a growing scholarly need for more integrative and context-sensitive frameworks that account for digital complexity, sustainability imperatives, and environmental turbulence. While DCT has been mostly applied to stable firm contexts, this study extends its relevance to volatile, cross-organisational networks, where orchestration-not just reconfiguration is critical. The study enriches the conceptualization of big data analytics management capability by demonstrating that it is not merely a standalone resource, but a dynamic enabler that activates and coordinates fintech, circular, and IoT practices to enhance resilience. The significant indirect effects of BDMC on SCR via CEA, IoT, and FTA support a networked and layered view of resilience emergence. This reinforces that dynamic capabilities operate not through linear causality but via bundles of complementary mechanisms each addressing different resilience stages and interplaying with environmental constraints. The moderating role of environmental dynamism (β = 0.068, p = 0.026) confirms DCT’s foundational claim that dynamic capabilities become increasingly valuable in turbulent environments. In the context of megaprojects like CPEC, which face chronic uncertainty, political friction, and infrastructure delays, dynamic capabilities offer a vital framework for explaining adaptive advantage.

5.2. Practical Implications

Beyond theoretical contributions, this study yields strategically actionable insights for firms, industry leaders, and policymakers operating in high-risk, digitally transitioning supply chains such as those within the CPEC landscape. The findings underscore that digital tools, such as fintech, IoT, and CEA, only yield resilience dividends when orchestrated through a mature BDMC.

The capability to govern data, nurture analytics talent, and embed cross-functional routines becomes the backbone of supply chain adaptability. Managers should approach these tools in phased alignment. For instance, Saeedikiya, Salunke [

66] recommend sequencing interventions across firm, network, and ecosystem levels: (1) build data governance and analytics teams, (2) pilot IoT in visible use cases, (3) integrate fintech solutions for liquidity enhancement, (4) launch circular pilots in high-waste nodes each tied to measurable metrics.

Among the three mediators, CEA had the strongest indirect effect (β = 0.175), suggesting circularity is not just a compliance measure but a strategic pathway to agility. Firms should embed CEA into core operations to buffer against disruption, reduce waste induced dependency, and enhance sustainability credentials. The benefits of IoT hinge on BDMC maturity: without robust analytics, IoT generated data remains underutilized. Thus, investment in real-time analytics infrastructure is a prerequisite. Meanwhile, the mediating role of fintech adoption (β = 0.081) indicates that financial digitization through blockchain settlements, liquidity platforms, and smart contracts can enhance supply chain flexibility and transparency. The moderation effect of environmental dynamism confirms that in volatile institutional settings, BDMC is not optional but foundational. Analytics capabilities should be distributed, real time, and cross-functional, enabling firms to sense and respond with agility. For policymakers, this study provides direction on intervention levers: supporting BDMC development, democratizing access to digital finance, incentivizing circular transitions, and expanding IoT infrastructure especially in cross-border megaproject corridors.

5.3. Limitations with Future Research Directions

While this study offers novel insights into how BDMC fosters supply chain resilience in the volatile context of the CPEC, several limitations present avenues for future exploration. First, this study employed a cross-sectional design, albeit with a time-lagged structure to reduce common method bias. Nonetheless, longitudinal studies would provide stronger causal inference and allow researchers to capture how dynamic capabilities evolve in response to environmental turbulence. Future research could adopt a panel or case-based approach to trace capability development and resilience outcomes longitudinally. Second, while the model integrated key mediators of fintech adoption, circular economy activities, and IoT, other emerging enablers, such as blockchain, artificial intelligence, and digital twins, were not examined. Incorporating these could yield a more comprehensive view of digital orchestration in supply chains. Third, data were drawn exclusively from Pakistani firms operating within the CPEC framework. While this enhances contextual relevance and provides rich insights into an important belt and road initiative corridor, it also raises questions about the generalizability of findings to other settings. Institutional, cultural, and infrastructural differences across countries may influence how BDMC translates into resilience outcomes. Fourth, comparative studies across other belt and road corridors, or among firms in different institutional environments, such as those in Southeast Asia, Central Asia, or the African BRI regions, would help test the boundary conditions of the model and broaden its theoretical utility. Future research could also explore cross-country validation using multi-sample structural equation modelling (SEM) or multi-group analysis to examine whether the proposed relationships hold consistently across varying contexts. The study centered on managerial perceptions. Future research might triangulate findings with performance metrics, supplier and customer perspectives, or industry level data to enhance robustness. Moreover, the robustness analyses revealed evidence of endogeneity, nonlinearity, and unobserved heterogeneity. While these do not invalidate the findings, they suggest that the estimated effects may be more complex than captured in a linear, single segment PLS-SEM model. Future studies could address endogeneity more directly by applying instrumental variable techniques, such as two-stage least squares or longitudinal cross-lagged designs, to untangle better causal directions [

62]. The significant quadratic effects highlight the need to theorize and empirically test nonlinear dynamics, such as thresholds, diminishing returns, or U-shaped relationships, which may better capture how digital capabilities translate into resilience [

64]. The discovery of unobserved heterogeneity suggests that firms follow distinct digital resilience pathways, depending on their sector, size, or digital maturity [

65]. Future research could employ configurational methods (e.g., fsQCA) or multi-group PLS approaches to explore these differentiated strategies more systematically. By addressing these methodological complexities, subsequent work can build on our findings to develop a more nuanced and context-sensitive understanding of how big data analytics management capability supports resilience in megaproject supply chains.