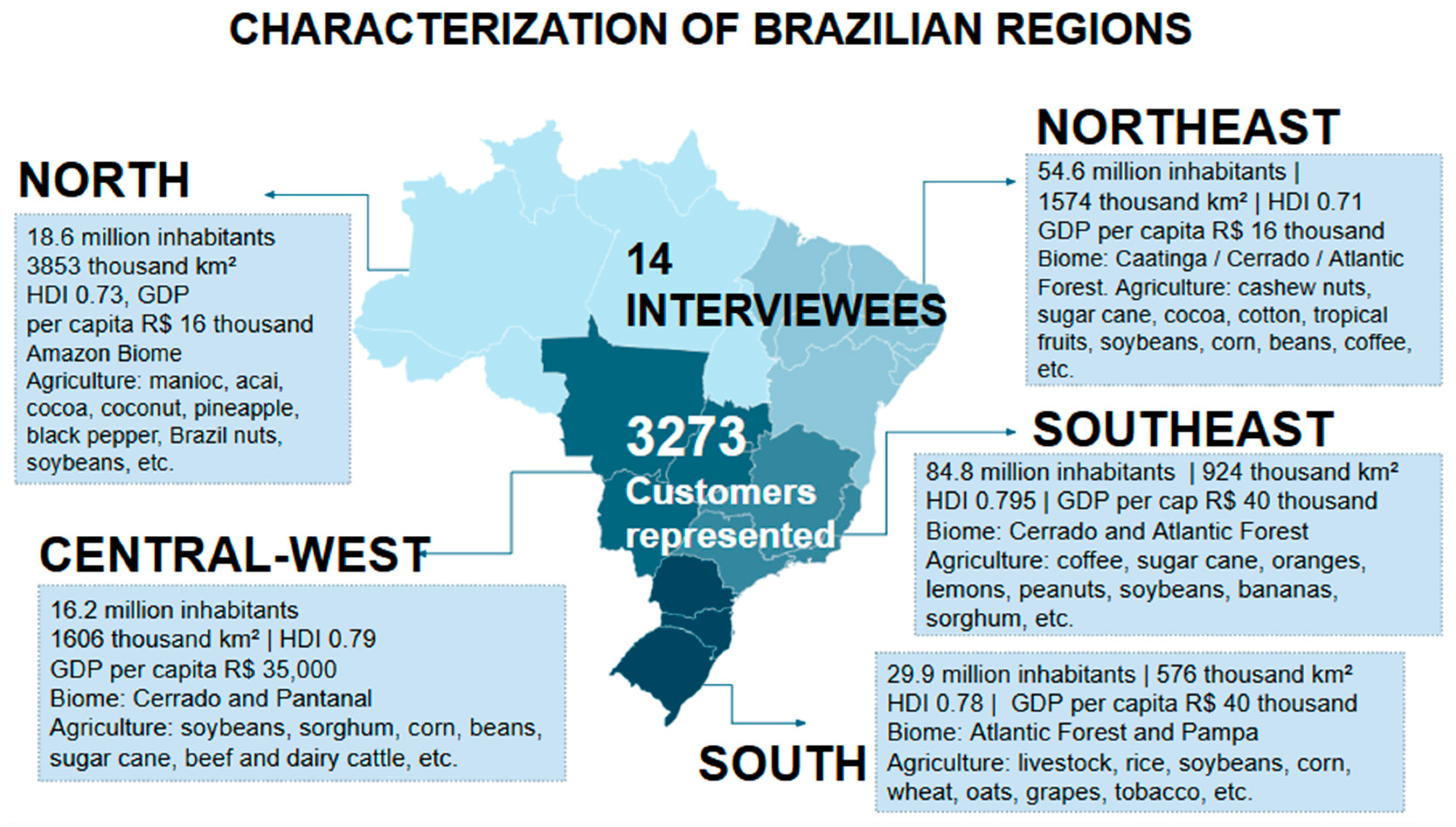

3.2.1. Sustainability of Brazilian Agribusiness

After characterising the interviewees, we sought to map their perception of the sustainability of Brazilian agriculture, the sentiments involved, and the motivations for their responses.

Feelings about a particular company, business, sector, or country have a significant impact on sales, investment decisions, and the financial market, and are widely studied in behavioural economics and economic psychology [

30]. In a climate change scenario, the need to transition to a green economy and the perception of businesses with a lower environmental impact can attract or repel investment. It should be noted that, in this respect, Brazilian agriculture has been the target of criticism regarding its productive sustainability, often related to forest deforestation.

With this in mind, we sought to conduct an analysis of feelings and perceptions regarding the sustainability of Brazilian agribusiness from the perspective of rural credit concession managers. These managers are directly involved in agribusiness and provide direct services to producers and dealers in agricultural machinery, inputs, products, and services.

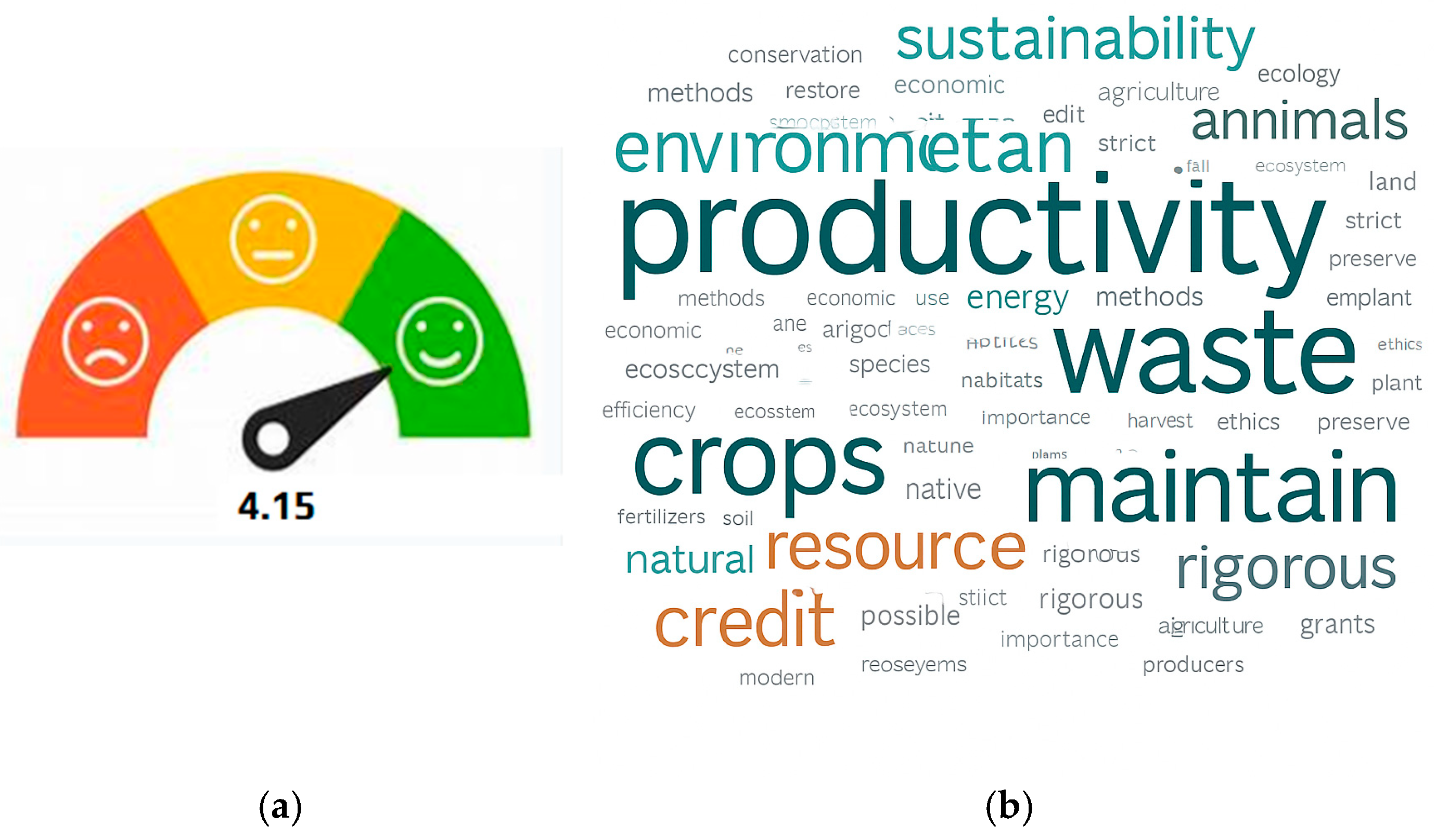

When asked about their critical perception of the phrase “Brazilian agriculture is sustainable”, graded from 1—“Strongly Disagree” to 5—“Strongly Agree”, the average response was 4.15 points. In general, it appears that financial agents who visit farms and serve clients, including farmers and agricultural dealers, have a positive perception of the sustainability level of Brazilian agriculture (see

Figure 2a).

Sentiment analysis on agribusiness sustainability was also cnducted. A word cloud was created to reflect the interviewees’ involvement in the topic and represent the intensity or frequency of the most frequently mentioned terms (

Figure 2b).

The word cloud analysis suggests that, from the perspective of the interviewees, Brazilian agriculture is directly associated with the terms “productivity”, “natural resources”, “credit”, “preservation”, “environment”, “sustainability”, and other concepts that are directly and positively linked to sustainable development. In addition, there were several links between Brazilian agriculture and social, environmental and financial sustainability approaches, such as: “reducing pollution”, “maintaining the productive quality of the land”, “not silting up rivers”, “avoiding soil contamination”, “maintaining the planet’s living conditions”, “improving people’s quality of life”, “financially viable”, “natural fertilization”, “consortium farming”, “using renewable energy”, “technological advances”, “protecting forests” etc.

Of all the terms mentioned, increasing productivity to reduce environmental impacts was the one most often mentioned. Interviewee 1 (E1) stated that “you can’t have sustainability with hunger,” emphasising the importance of addressing a social need, which is a key component of the sustainability tripod. The strictness of Brazilian legislation was also mentioned by more than 50% of the interviewees, with E11 reporting that “there are so many things that Brazilian producers have to observe to produce, that it’s not possible not to be sustainable”.

Regarding the agricultural certification of farms, several interviewees reported dissatisfaction with the effectiveness and limitations of the CAR (

Table 1), which could be an effective tool for assuming this role. According to E4, “farms need to be certified to defend local agricultural production abroad and block bad producers”. Of the 14 interviewees, 10 expressed a positive view on the need for an effective, nationally applicable certification for farms, including: “It would be great to give access to the differentiated rate”; “International certifications mainly reach large producers. Medium-sized producers generally don’t do it. And these certifications are not related to the granting of financial loans”; “It allows the product to be valued and production to be more profitable”; “It’s important to recognize producers who have already adopted sustainable practices, because what we have in Brazil is focused on investment (implementation), in other words, those who are already sustainable don’t have recognition or an incentive to continue adopting the practices, which sometimes result in higher costs”. The smallest percentage said they were neutral (22%) or negative to the proposal (7%), with concerns related to the increase in bureaucracy and cost, as shown in the table below.

The widespread dissatisfaction with the CAR is related to what the interviewees perceive as a lack of analysis of the registry by the public entity responsible for it. They perceive this as preventing customers who have proven sustainable practices from benefiting from the 0.05% interest rate reduction.

The following areas for improvement in the process were identified:

- -

Ensure predictable access to rural credit for producers;

- -

Streamline credit approval by replacing environmental documentation requirements;

- -

Enable interest rate reduction incentives;

- -

Certify the sustainability and quality of agricultural production;

- -

Advocate for agricultural production in international markets;

- -

Promote the value of production and ensure its profitability;

- -

Guide and encourage sustainable initiatives;

- -

Restrict access for non-compliant or environmentally harmful producers.

3.2.3. Regulatory Influences on Rural Credit

The new regulations that changed how environmental concerns are considered in the granting of rural credit for the 2023/2024 crop year combined both command-and-control instruments and market-based mechanisms. The command-and-control approach was implemented through the prohibition of credit granting for agricultural operations in areas flagged for deforestation. As a market-based mechanism, a 0.5% reduction in rural credit interest rates was announced for producers holding a CAR with the status “analysed” and who adopt sustainable practices.

Concerning changes in rural credit-granting practices, all interviewees (100%) reported perceiving changes. However, two of them noted that while the intention to promote sustainability had advanced, the actual credit-granting process had not changed in practice. The remaining twelve participants presented narratives highlighting that the recent changes were more restrictive—limiting access to credit—than they were promotive of sustainability.

Interviewee E6 reported that the financial institution undertook internal organisational measures to comply with the new regulations, including an online alignment meeting with all credit managers. E9 stated unequivocally: “Clients with deforestation alerts are no longer served”. E11 described the observed changes and expressed frustration: “There is now a system validation for deforestation, and proposals are blocked because of it. Several system errors have been identified. The absence of CAR analysis was disappointing to clients. In my region, no client has a CAR in ‘analysed’ status, even though many practice sustainability. Similarly, E7 noted practical challenges and risks to producers: “There were many changes. Producers faced difficulties in adapting to the new resolution, which prevented some from accessing rural credit. Environmental compliance processes were required. We experienced delays in system updates. Some producers have the necessary licenses, but interdepartmental communication failures resulted in legal deforestation being flagged as illegal. This delays credit approval. If a client proves compliance, I can proceed with the proposal, but if the system takes too long to reflect this, the client may miss the planting window and be forced to seek financing from more expensive sources”.

According to E10, financial institutions have effectively taken on an environmental oversight role: “Environmental concern has increased. It’s evident—there’s a trickle-down effect: from government to banks, and from banks to producers, requiring compliance. It’s as though oversight mechanisms have expanded—now, beyond IBAMA, banks also play this role. The credit process remains the same, but producers are now required to make adjustments”.

Regarding deforestation alerts issued via the MAPBIOMAS satellite system, E4 pointed out that “the satellite does not differentiate between brush and forest; sometimes, lack of land clearing is flagged as deforestation. For example, if an area is not cleared for three years, trees can grow to 3–4 m in height. In this livestock context, tree growth in Brazil should not be interpreted as a shift in economic activity. Now, producers are required to obtain environmental permits even for pasture cleaning”.

E13 shared several illustrative cases: “I own three land registrations, each with different restrictions. Two are embargoed due to a lack of irrigation use permits. The agency responsible hasn’t analysed the submitted projects and maintains the embargo. Another case involves the creation of the Parque Nacional do Descobrimento, which took 3% of my property, previously used for cattle ranching. Twelve years later, the park still exists, but the formal expropriation process remains unfinished. Due to new legislation, I can no longer access credit for the remaining 97% of my property, which is still eligible for economic use, because the entire property is flagged due to 3% deforestation. I feel penalised three times: through land expropriation, lack of compensation, and now, loss of credit access—forcing me to seek costlier financing alternatives”.

Similarly, E14 noted that the CAR system now flags overlaps between productive and protected areas, such as Areas of Permanent Preservation (APPs), Legal Reserves (LRs), or deforested zones. This affects even compliant producers whose declared property boundaries overlap with those of noncompliant neighbours who are not themselves seeking credit, but whose environmental irregularities negatively impact others. E14 concluded: “Despite this regulatory progress, incentives for producers who engage in sustainable practices remain scarce. There is an observable effort to link sustainability with credit access, but currently, we, as a financial institution, have not yet succeeded in adequately rewarding sustainable clients”.

A combined analysis of the interviews reveals the perception of consistent challenges nationwide stemming from the implementation of new rural credit regulations for the 2023/2024 crop year, with the following issues emerging as particularly significant:

- (i)

Increased concern and monitoring of deforestation indicators by both producers and credit managers;

- (ii)

Credit restrictions due to overlapping areas in the Rural Environmental Registry (CAR);

- (iii)

Inability to segregate the financed area, a practice that had been permitted until July 2023;

- (iv)

Lack of CAR analysis by the government, which prevents the granting of the 0.5% interest rate reduction benefit on rural credit;

- (v)

Delays in the environmental control system’s updates hinder credit approval for areas where environmental agencies authorised vegetation suppression;

- (vi)

Deforestation alerts that surprised clients, including pasture clearing, vegetation suppression for renewable energy generation, and in areas expropriated or cleared for public utility works such as parks, roads, or squares;

- (vii)

Increased bureaucracy and costs for producers to prove the legality of their actions.

Concerning clients who adopt sustainable practices, 100% of interviewees reported having such clients in their portfolios, engaged in various activities such as renewable energy generation, use of biodigesters in livestock farming, integrated forest-livestock systems, use of bioinputs, biological pesticides, biological fertilization, and the cultivation of sustainable forestry such as cocoa, açaí, eucalyptus, and intercropped farming of coconut and passion fruit. However, it was noted that only a few of these practices were eligible for subsidised credit rates. Among the 3273 clients included in the analysis, only one was granted the 0.5% interest rate reduction due to a CAR classified as “analysed”.

In addition to the issues related to deforestation alerts and lack of CAR analysis, other challenges were identified, including resource scarcity, the absence of a Regional Zoning by Productivity Level (ZarcPRO) for certain crops in specific regions, and difficulties faced by smallholders in presenting required documentation.

ZarcPRO is a technical zoning tool validated through research, which estimates the productivity potential of a given crop under specific weather and climate conditions. It is a requirement for credit approval for certain crops, production systems, and regions [

31].

Another issue examined is that of the distribution of resources according to client classification (small, medium, or large producers) and the perceived importance of credit availability for each profile in promoting regional and national development.

Concerning the promotion of regional development, 64% of interviewees stated that it is essential for resources to reach all three client types (small, medium, and large producers, in that order). They consider that smallholders should be prioritised, as they need credit to produce and sustain their family income. Medium producers were also seen as crucial for supplying local and regional markets and for driving technology adoption, training, and job creation for other families. However, regarding national development, perceptions shifted. About 43% of interviewees believed that it is essential for resources to reach medium producers, 36% valued all three profiles equally, and 21% favoured large producers.

E10 argued that subsidised credit should be directed to small and medium producers, reasoning that large producers have their own capital and do not rely on government support. Interviewee E1 suggested that subsidised credit should benefit all three groups due to their distinct contributions to development: “Smallholders depend on Pronaf subsidised credit for family subsistence. Medium and large producers are less dependent, but they are the ones who generate jobs, promote technology transfer, and develop the entire supply chain, including industry, commercialisation, and training”. E9 agreed, stating that “Credit should reach all. Smallholders supply food to their families and communities (vegetables, dairy, meat, etc.). Medium producers add value and generate jobs, initiating agribusiness value chains with larger food distribution volumes. Large producers generate significant employment, tax revenue, and government income that support education, healthcare, and social services. Thus, all should be supported”.

There was no strong indication that subsidised credit should prioritise large producers, since these are typically large estates whose production costs far exceed the limited public credit lines. Such producers often reach their maximum individual credit limits through family members and also have access to working capital from private sources.

Regarding the availability of credit, E2 pointed out: “There is a shortage of funds for large producers because the resources run out quickly. There is also a lack of investment credit for small and medium producers. For operating costs, the available amounts have generally met the needs of small and medium producers”. However, E3 added that “only smallholders are left out due to complex documentation requirements”.

The interviewees seem to perceive a clear asymmetry in regulatory compliance capacity. While, according to them, medium producers typically possess the educational background necessary to understand and fulfil regulatory requirements, large producers benefit from dedicated administrative teams that manage documentation processes. In contrast, smallholders frequently lack both institutional support and awareness, often failing to recognise themselves as eligible beneficiaries of available credit programs. This is consistent with Khan et al.’s [

18] remarks regarding the lack of appropriate financial literacy by most small-scale farmers in developing countries.

Regulatory asymmetries may be mitigated through the proportional application of norms relative to the scale of the producer, thereby promoting equity in both regulatory compliance and access to associated benefits.

E4 also emphasised the difficulties faced by smallholders, particularly regarding collateral. Small producers are not allowed to mortgage their family residence, which is considered protected property. Without collateral, they are often denied credit. Although credit guarantees were not a specific focus of this research, this point is retained as it reflects an element of credit policy that restricts access for smallholders and represents an area for potential improvement. This is in line with Khan et al. [

18], who identified a lack of collateral as an important demand-side constraint to the success of agricultural finance.

Subsidised credit lines, for both medium and large producers, are generally capped at BRL 3 million per individual. However, there is a significant distinction between the maximum amount available and the effective availability of funds. As explained by E4, “larger volumes are made available to large producers, but these are quickly exhausted. While BRL 3 million represents a small portion of a large producer’s operational needs, for a medium producer, this amount is quite substantial. Furthermore, medium and small producers do not always seek financing from financial institutions to fund their production”.

Interviewees also advocated for a more regionally tailored allocation of credit resources as a way to reduce social and developmental inequalities across different regions. In this regard, E14 made a significant contribution, suggesting that “credit for smallholders requires closer monitoring and should be tied to the adoption of sustainable practices that make their work profitable. Small producers have less access to information and technical innovations—they still spray pesticides without PPE, without analysis, and harm aquifers, etc. It is not enough to offer credit and increase their workload without providing a profitable alternative that improves their quality of life and that of future generations”.

E9 reported that credit lines for large producers are depleted first, partly because financial institutions and credit managers prioritise higher-value contracts. The administrative effort required to approve BRL 3 million is the same as for BRL 150,000—the same checks, documentation, and requirements apply. Thus, focusing on higher credit values is more efficient, not only to meet institutional profit and operational targets, but also to accelerate the circulation of government-incentivised funds through the regional agribusiness supply chain. E9 further emphasised that increasing credit requirements is not the path to improvement. Instead, the credit process should be simplified for small and medium producers, ensuring equal access to funding opportunities.

Environmental regulation seem to have introduced several challenges in the pursuit of sustainable development in Brazilian agribusiness. An analysis of interviewees’ perceptions revealed that the smaller a producer’s Annual Gross Revenue, the greater the challenges faced in adopting sustainability. Smallholders encounter social, informational, legal, bureaucratic, and cost-related barriers. As E2 observed, “while smallholders need a great deal of support just to gather the documents required for credit, medium producers are hesitant to invest without a guarantee of benefits”. E6 pointed out that environmental oversight is a state-level responsibility, which results in inconsistencies in the timing and quality of environmental assessments.

Across the interviews, bureaucratic and economic difficulties emerged as the most frequent obstacles to the adoption of sustainable practices by Brazilian rural producers.

The environmental policy, by limiting credit access in cases of deforestation and by granting subsidised rates (interest reduction) to those who have already internalised the environmental costs of production, has exposed operational weaknesses—such as the federal government’s limited capacity to analyse the CAR and the lack of synchronisation among environmental protection systems. These gaps compromise the ability to quickly verify the legality of vegetation suppression, creating uncertainty among producers regarding their access to funding to maintain production. On the other hand, this policy represents both a national and international commitment by the Brazilian government to promoting agribusiness with environmental responsibility, engaging all actors in the effort to preserve natural resources.

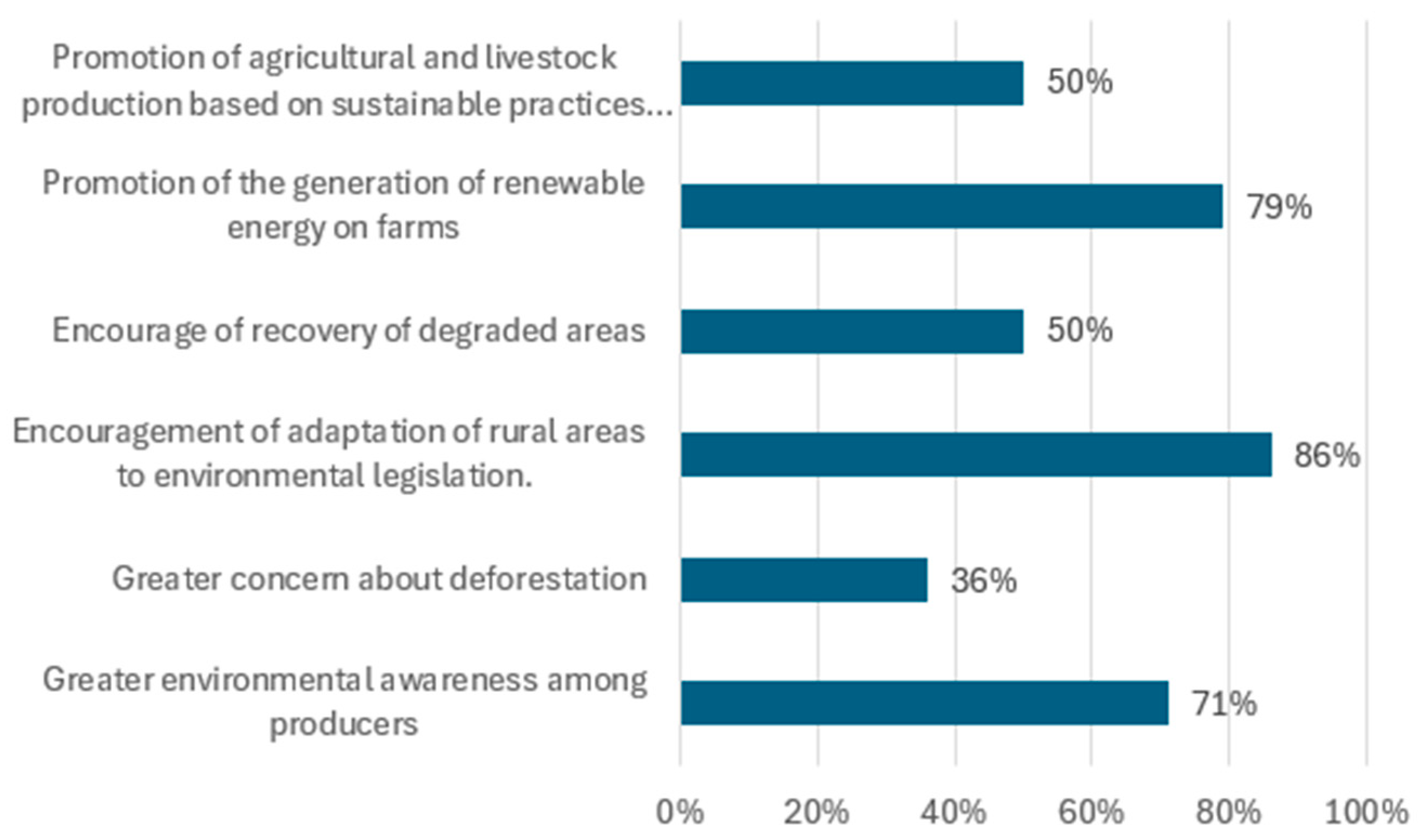

The environmental benefits derived from the regulation—serving as indicators of its effectiveness—were also examined. According to the interviewees, the most significant contributions of the regulation include the promotion of environmental compliance in rural areas, especially in terms of CAR registration with geospatial coordinates (86%), incentivising clean energy generation (79%), and increasing environmental awareness among producers (71%), as shown in

Figure 4.

Concerning these benefits, it is noteworthy that deforestation control received the lowest score among perceived contributions. Many respondents highlighted the strictness of the Forest Code and the difficulties associated with its enforcement. They pointed out that if environmental fines were effectively imposed on non-compliant producers, such regulation alone could already be sufficient to mitigate deforestation in productive areas.

E1 added that producers who rely on rural credit are already environmentally conscious, as they depend on nature for the success of their crops and therefore do not engage in deforestation on their properties. As such, degraded areas are scarce, since “a degraded area yields low financial returns, which is undesirable to producers. Many cattle ranching properties are now taking advantage of the RenovAgro incentive (for recovering degraded areas) to transition from livestock to agricultural production in these areas”.

Regarding the recovery of degraded areas, E14 reported that no such areas exist on the properties under their management, stating: “We were only able to implement one project of BRL 1 million (which is a low amount for agricultural production) for pasture recovery, and that was after two years of searching”. E2 added that the recovery of degraded land is usually initiated by the producers themselves, motivated by the need to prevent erosion and leaching, which negatively affect soil productivity. According to the interviewee, existing environmental legislation would already be sufficient to stop deforestation.

Reinforcing the argument concerning deforestation, E4 stated that “professional agriculture does not engage in deforestation; this has long been a concern”. Similarly, E8 declared: “I do not know any rural producer who deforests. IBAMA’s oversight is extensive. There is already environmental awareness. Those who do not have INCRA authorisation—those are the ones who deforest, cut down trees, and set fires”.

In terms of compliance with environmental regulations, there has been a clear incentive to register in the CAR system. Many producers appear to be motivated by the desire to secure the interest rate reductions outlined in the 2023/24 Agricultural Plan guidelines. E14 reported that the requirement for georeferencing of rural areas—a condition for CAR registration—served as a major driver of compliance with environmental legislation.

Despite these efforts, many criticisms emerged concerning the lack of positive incentives and tangible benefits of the environmental policy in promoting sustainability within the agricultural sector. Credit restrictions and the disproportionate efforts required to overcome administrative hurdles were seen as obstacles, particularly for small and medium producers. This seems to be in line with Khan et al.’s [

18] analysis of the main constraints to agricultural finance success, which include stern eligibility criteria, and sluggish, time-consuming, complicated application procedures.

The lack of regulatory balance in terms of the consideration of the size of the producer or production scale made it more difficult for small and medium producers to access credit, at least according to the interviewees. They view the immediate application of the policy, without a transition period or trial phase, as having increased the risks associated with credit access, leading to uncertainty and insecurity among producers regarding their investments and long-term projects. These factors suggest the potential for increased operational costs, restricted entry for new market players, and even rising food prices, which could hinder economic growth in the sector.

One notable positive outcome of the policy seems to have been the joint mobilisation of actors across the agribusiness sector around the goal of sustainability. Currently, the requirement for documented evidence of forest preservation on agricultural properties, along with CAR registration and legal compliance, has gained strategic importance for protecting production activities against international trade barriers and has contributed to the sector’s credibility, both domestically and abroad. These mechanisms are likely to foster not only confidence in the sustainability of national agribusiness but also greater public and market acceptance.

As a result, the study found that although the environmental policy impacting rural credit in the 2023/24 agricultural season seems to have imposed strict and timely restrictions and increased operational costs, it does not appear to have prevented credit from reaching producers.

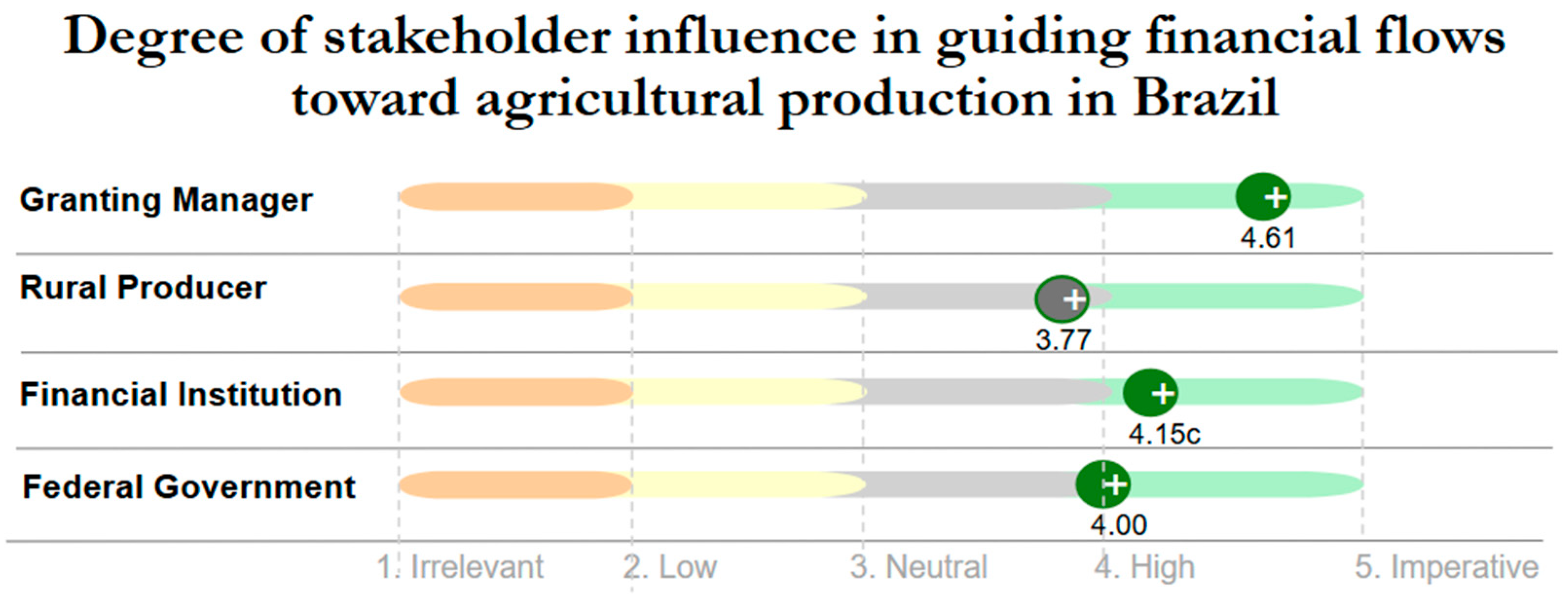

3.2.4. Policy Implementation

In this subsection, we aim to identify the implementation techniques employed in the strategic deployment of environmental policy for sustainable agribusiness and to highlight potential areas for improvement to achieve better outcomes.

Environmental preservation cannot be achieved through isolated efforts. Instead, it requires a collective movement involving all stakeholders. Companies that invest in ESG practices increase their market value, thereby creating a more favourable business environment. For the transition to a green economy, this model of sustainable capitalism must extend to inter-institutional and cross-sectoral relationships [

14].

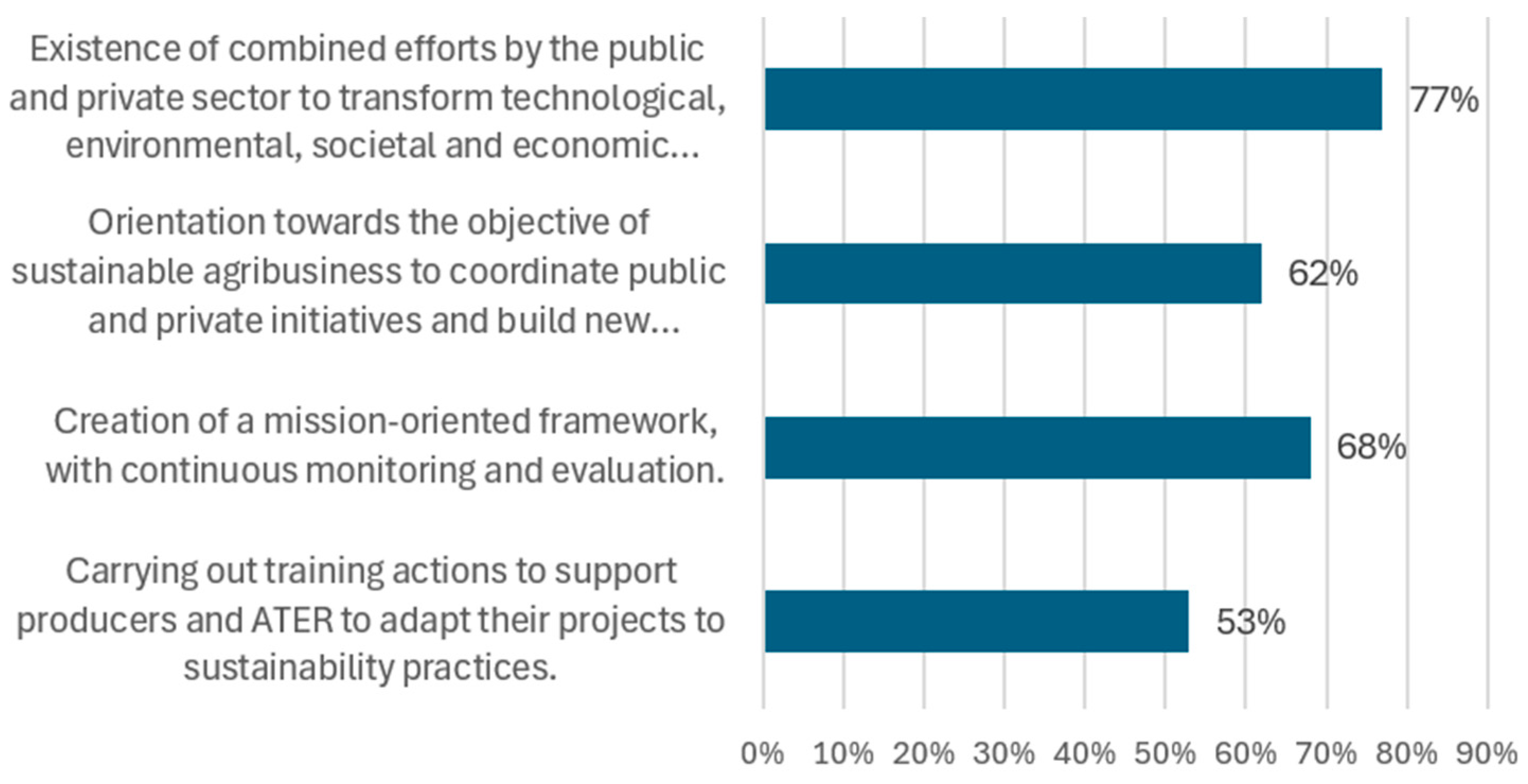

Numerous implementation strategies and theories exist, many of which share significant similarities. This study focused on the four stages of implementation as outlined in the theoretical framework proposed by Mazzucato [

14], with the results presented in

Figure 5.

The interviewees are part of a Brazilian public financial institution, which is the largest executor of public policies in the Brazilian government. These professionals have responsibilities that go far beyond financial transactions; they play a role in coordinating with regional public authorities, private institutions, trade unions, and the business community. These agents are aware of the financial and political value of each stakeholder, including workers, citizens, trade unions, community groups, state institutions, private institutions, and NGOs, for the success of implementing an environmental public policy with both individual and national reach, in urban and rural areas.

Regarding capacity-building actions, E7 acknowledged their existence but mentioned that they were not structured in a way that would provide visibility and attract the interest of the local community. However, E7 stated that “financial institutions have carried out capacity-building directly with clients to maintain the pace of credit disbursement.” E14 reported the organisation of “field days” and “agribusiness fairs” as educational actions in the program. Such events, promoted by state institutions and local governments, bring stakeholders together and facilitate the alignment of knowledge, promoting the pursuit of a common objective.

Regarding the creation of a mission-oriented framework, E1 reported the existence of several control and monitoring panels, both for the agribusiness manager and the regional representative. E12 added that financial institutions have their national controls, and the Central Bank of Brazil provides a national dashboard that consolidates resources and the allocation of funds by program, subprogram, region, state, gender, etc.

In relation to an orientation toward sustainable agribusiness goals, E2 stated that “there is much orientation but little practice”. The guidance for sustainable agribusiness objectives is evident in the dissemination of the Plano Safra. It gathered public, private, and state institutions, as well as associations, with online broadcasting and availability for re-viewing at any time.

Regarding combined efforts from the public and private sectors, E2 reported difficulties. E7 revealed a similar perception: “I observe initiatives, but both public and private institutions need to try harder. The lack of analysis of the CAR by the public entity, which left thousands of producers disappointed, is one example”. E10 pointed out that private institutions have more concerns, take more actions, and implement sustainable initiatives more promptly than public ones. E11 observed that efforts are more individual than combined. E14 shared that in their region, there is a strong integration between agribusiness actors and synchronisation of combined efforts.

Another suggestion for improving the implementation of environmental policy could be derived from analysing the 2023 Common Agricultural Policy (CAP) reform in Europe, which recognises agriculture as a contributor to environmental and climate goals, provides targeted support to smaller farms, and offers flexibility for Member States to adapt measures to local realities. The issue of smaller farms is a significant concern in developing countries. As argued by Khan et al. [

18] (p. 18), in these countries, the majority of the small-scale farmers lack the appropriate financial literacy. Hence, targeted support would be an essential issue to incorporate into the policy. Given the heterogeneity of Brazilian regions, the flexibility to adapt policies to local realities would be an interesting feature to consider.

Findings reveal that, in general, the implementation of environmental policy is perceived as being aligned with the strategy of stakeholder economic theory; however, there is still much room for improvement, both in individual and combined efforts from stakeholders.