1. Introduction

Since the in-depth development of financial globalization, the financial systems of various countries around the world have become increasingly interconnected, making them more sensitive to external environmental factors. In addition, geopolitical uncertainty is gradually increasing, global economic volatility is intensifying, and financial risks are becoming more frequent. Therefore, many scholars suspect that the existing financial regulatory framework is not enough to maintain the stability of the financial system, so they are exploring policy instruments to maintain financial stability [

1,

2,

3,

4]. In the aftermath of the global financial crisis in 2008, macroprudential policy, as the third pillar of the financial stabilization framework, formally emerged onto the historical stage. The report of the 20th National Congress of the Communist Party of China (hereinafter referred to as the 20th National Congress of the CPC) clearly states that it is necessary to “strengthen and improve modern financial regulation, enhance the financial stability guarantee system” and “hold the bottom line of not allowing systemic risks to occur”, emphasizing the importance of macroprudential policy. Macroprudential policy is a series of policy measures implemented by the government to mitigate systemic financial risks through financial regulation and policy instruments.

The core objective of macroprudential policy is to maintain the stability of the financial system, prevent the accumulation and outbreak of systemic risks [

5,

6], and lay a stable financial environment for the optimization of the economic structure and long-term growth. In addition, as a flexible instrument that can be dynamically adjusted, macroprudential policy can promote the high-quality development of the real economy through the rational allocation of economic resources, which plays an important role in urban planning and spatial layout. Therefore, macroprudential policy has regained favor in the post-crisis period [

7]. According to the statistics of the International Monetary Fund [

8], there are 12 major macroprudential policy instruments in the world, and more than 140 countries implemented macroprudential policy from 2000 to 2017. Monitoring data from the Bank for International Settlements (BIS) indicated that 78% of central banks worldwide incorporated macroprudential policy into their crisis response toolkit in 2020, marking 42% increase from 2008. The global experience demonstrates that macroprudential policy has a substantial capacity to mitigate systemic risks and stabilize economic cycles. However, its efficacy is contingent upon the precision of policy design, the flexibility of instrument combinations, and the effectiveness of international and domestic coordination mechanisms. To this end, the macroprudential policy framework should be continuously improved and its applicability to new risks such as digital finance and emerging industries should be explored.

In recent years, the global economic environment has undergone a period of heightened uncertainty. Consequently, the resilience of economic systems to risk has emerged as a pivotal concern for academic and policy communities. The urban economy, as the spatial carrier of the modern economy, exhibits both innovation-driven advantages and vulnerabilities due to its high degree of agglomeration and systemic complexity. These vulnerabilities have prompted widespread attention. The report of the 20th National Congress of the CPC underscored the significance of urban economic resilience for long-term city development, particularly in promoting industrial optimization and stable economic growth. This issue is particularly salient for developing countries grappling with global economic uncertainty.

Urban economic resilience is defined as the capacity of the urban economic system to withstand, mitigate, and recover from external shocks, reaching or surpassing its original level. Su (2015) asserted that economic resilience serves as a crucial indicator of a nation’s economic resilience to external shocks [

9]. Economic resilience refers to the ability to achieve rapid recovery from external shocks, reallocate resources, adjust industrial structure, and continuously transform and upgrade after experiencing economic shocks, and it is an important indicator for evaluating a country’s economic ability to resist external shocks [

9,

10,

11,

12]. Urban economic resilience is not only related to the stable operation of the urban economy, but also directly affects the sustainable development of cities. Statistical evidence indicated that in 2020, 23% of the top 600 cities in terms of global GDP rankings were projected to encounter economic downturns that surpass the national average, largely attributable to a singular industrial structure or the buildup of financial risks [

13]. This underscores the imperative for a comprehensive examination of the mechanisms that underpin urban economic resilience, particularly in the context of the myriad challenges posed by global financial cycle fluctuations, geopolitical conflicts, and climate change. The development of policy instruments to enhance the risk-resistant and resilient capacity of the urban economy has emerged as a pivotal issue in achieving sustainable development.

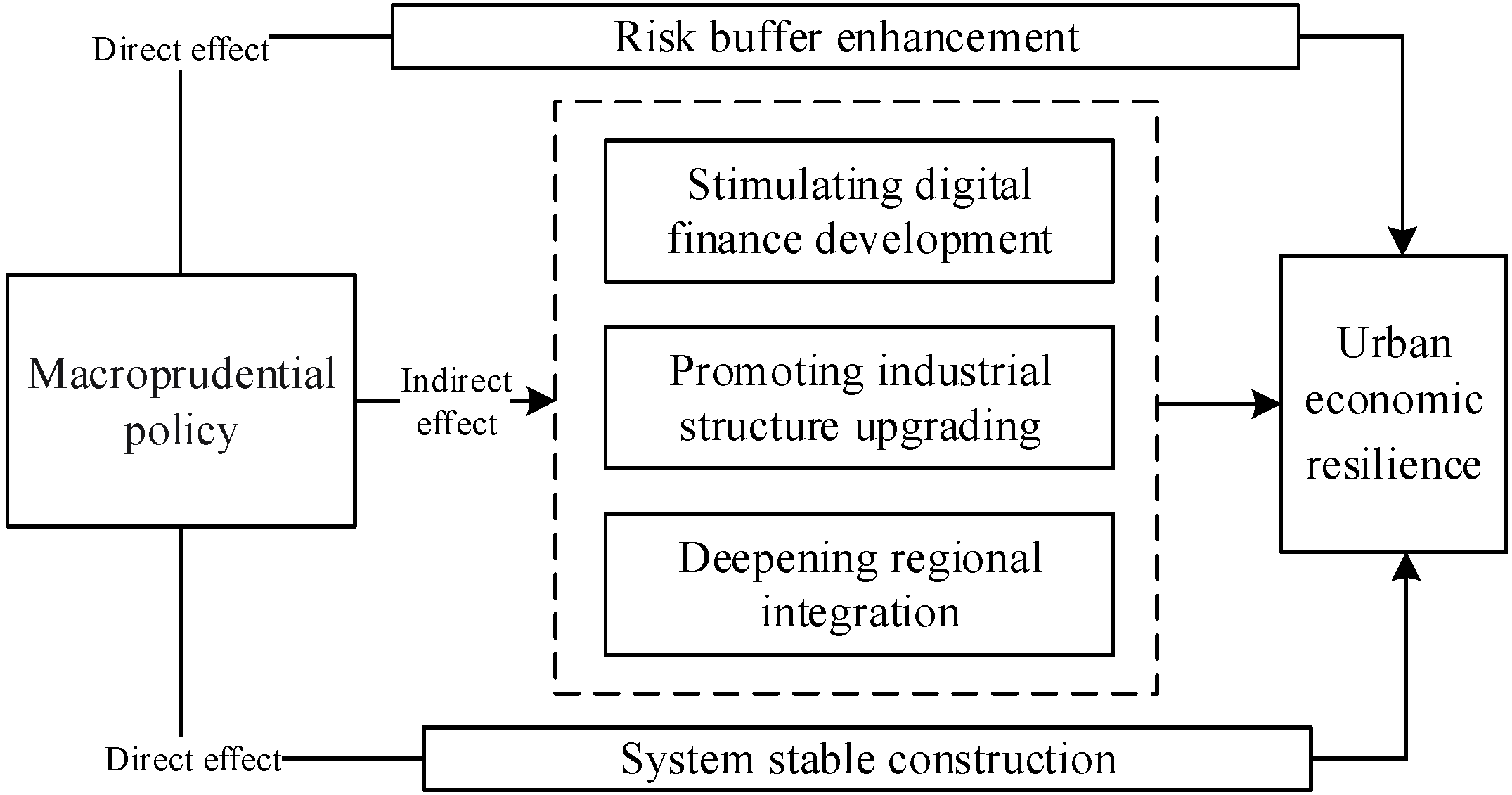

In the contemporary economic landscape, there has been a notable escalation in economic uncertainties, accompanied by a rise in market volatility and the emergence of novel challenges and features in economic development. Macroprudential policy, as a policy framework focusing on the overall stability of the macroeconomy, plays a pivotal role in stabilizing the financial market and ensuring the rational allocation of financial resources. Additionally, it fosters a conducive financial environment for the healthy development of the real economy, thereby promoting the urban economy to achieve high-quality and sustainable growth within the context of the new normal. Consequently, in the context of the new normal economy, it is of great practical significance and far-reaching strategic value to study the impact of macroprudential policy on urban economic resilience. This paper attempts to overcome the limitations of the prevailing theoretical framework by systematically elucidating the micro-mechanisms and spatial effects of macroprudential policy on urban economic resilience. To this end, a three-dimensional analytical model is constructed, encompassing “policy instruments, conduction path, and resilience performance”. The research findings contribute to the advancement of the theoretical framework of economic resilience by offering insights into the role of macroprudential policy in enhancing urban economic resilience. In addition, the study provides a valuable reference point for local governments in formulating customized risk prevention and control strategies. Specifically, the following aspects are examined.

Firstly, in the current research, the dynamic effect has not been fully explored, and the short-term inhibitory effect and the long-term structural optimization effect of macroprudential policy need to be further weighed. This paper deepens the static theory into a dynamic structural optimization effect through the three levels of industrial structure upgrading, which provides theoretical support for the dynamic adjustment of policy instruments.

Secondly, in the context of the new economic normal, finance has emerged as the predominant catalyst for urban economic development. This paper undertakes a comprehensive examination of the pivotal domains of urban economic development, delves into the impact of macroprudential policy on urban economy resilience, transcends the constraints imposed by a single disciplinary perspective, and fosters theoretical innovation through the integration of regional economics and behavioral finance.

Thirdly, the majority of extant research focuses on the national level. However, this paper delves deeper into the urban level of macroprudential policy and explores the policy mechanism through the channels of digital financial development, industrial structure upgrading, and regional integration.

By elucidating the role of macroprudential policy, this study provides a framework for decision-making that can enhance urban economic resilience from the perspective of implementation effects. This framework can more effectively guide the sustainable development of the urban economy and enhance its ability to withstand external shocks. The results of the study are expected to have an important reference value for improving the financial regulatory system under China’s new urbanization strategy.

6. Further Analysis

The above empirical tests sufficiently confirm the role of macroprudential policy in enhancing urban economic resilience, which is still valid after a series of robustness tests. To further analyze the internal mechanisms of macroprudential policy affecting urban economic resilience, this section conducts analysis from two dimensions: transmission pathways and heterogeneity characteristics. First, we focus on examining the mechanisms of potential transmission channels such as digital finance development, industrial structure upgrading, and regional integration. Second, the heterogeneity analysis is conducted based on the digital development level, financial pressure, and other dimensions to reveal the differentiated effect of macroprudential policy. The series of tests not only helps clarify the transmission pathways of macroprudential policy on urban economic resilience but also provides a scientific basis for differentiated policy formulation.

6.1. Channels

6.1.1. Digital Finance Development

Digital finance, with its inclusiveness, efficiency, and innovation, has become an important engine to promote the high-quality development of the urban economy, by providing broader financing support and technology empowerment for the real economy. Therefore, the mediating effect of digital finance was tested based on formulas (3) and (4). Column (1) in

Table 8 shows that macroprudential policy can promote the development of digital finance. Column (2) in

Table 8 shows the results of incorporating MPI and DIFI into the regression equation simultaneously. The regression coefficient of DIFI is significantly positive at the 1% significance level and is lower than 0.037 (Column (4) in

Table 5), meaning that macroprudential policy stimulates digital finance development, reduces the vulnerability level and systemic risk of the financial system [

35], and improves the ability of the urban economy to resist risks, thus enhancing the urban economic resilience. Therefore, H2 is verified.

6.1.2. Industrial Structure Upgrading

As one of the key ways to enhance urban economic resilience, industrial structure upgrading can effectively reduce the transmission effect of economic fluctuations by increasing the proportion of modern service industries such as finance and information technology [

72]. Based on the above assumptions in this paper, the mediating effect of industrial structure upgrading was studied. Column (3) in

Table 8 shows that macroprudential policy can promote the upgrading of industrial structure. Column (4) in

Table 8 shows that, in the regression equation, both MPI and STR are introduced. The coefficient of STR remains significantly positive at the 1% significance level and is less than 0.037 (Column (4) in

Table 5), meaning that industrial structure upgrading has a mediating effect. The high-end evolution of the industrial structure has further improved the total factor productivity and the efficiency of resource allocation, so that the urban economy has a stronger buffer space, faster recovery speed, and better transformation path in the face of external shocks. Thus, H3 is supported.

6.1.3. Regional Integration

Regional integration, as an important strategy for modern economic development, can respond to shocks and make up for the insufficient governance capacity of individual cities by efficiently integrating resources, effectively reducing market fragmentation and institutional barriers [

73]. Based on the aforementioned assumptions, this paper examines the mediating effect of regional integration. At present, there are two main ways to measure regional integration: one is to introduce the market segmentation index based on the relative price index [

74], and the other is to express the process of regional integration by the implementation of national urban agglomeration policy [

75]. In contrast, the market segmentation index has two significant advantages in measuring regional integration. First, its construction relies on the “glacier cost” model [

76], and measures the degree of interregional market integration based on the “relative price method”, which reveals the internal economic logic of interregional price fluctuations and can directly reflect the actual transaction costs of cross-regional flow of commodities and factors, providing a clear micro mechanism support for empirical analysis. Second, the index is comparable and robust. The index is calculated based on the consumer price sub-indexes systematically published in local statistical yearbooks, which avoids common subjective setting errors in policy variables and can generate continuous and comparable annual panel data, which is conducive to accurately describing the dynamic evolution process of regional integration level. Therefore, although the policy variables of urban agglomeration are helpful to identify the institutional shock effect, the market segmentation index shows unique value in both theoretical connotation and data quality, and is more suitable as the core proxy variable of regional integration to accurately identify the transmission efficiency of macroprudential policy at the spatial level. Based on this, Column (5) in

Table 8 shows that macroprudential policy can promote regional integration. According to the data in Column (6), when MPI and INTEGR are included in the regression equation at the same time, it can be observed that the regression coefficient of INTEGR is significantly negative at the 5% level, and the coefficient of MPI is 0.036, which is significantly positive at the 1% level and smaller than 0.037 (Column (4) in

Table 5). The above results show that in the process of preventing systemic financial risks, macroprudential policy promotes regional integration. According to the growth pole theory, in the early stage of regional integration, labor, capital, technology, and other factors will gather to the city center or core cities [

77], which is conducive to the centralized allocation of resources by the government and improves the efficiency of resource allocation. It enhances the risk resistance ability of the region when it defends and encounters shocks [

78]. Therefore, H4 is proved.

6.2. Heterogeneity Tests

6.2.1. Heterogeneity of Smart Cities

By guiding the flow of financial resources and strengthening risk monitoring, macroprudential policy provides institutional guarantee for the steady development of digital finance, and ultimately improves urban economic resilience. Based on this logic, this paper argues that smart city pilot cities, with their better infrastructure, can effectively respond to macroprudential policy and enhance urban economic resilience. First of all, relying on digital infrastructure such as the Internet of Things and big data platforms, smart cities can realize high-precision monitoring and early warning of regional financial risks, industrial structure dynamics, and factor flows and provide accurate information basis and fast transmission channels for the implementation of macroprudential policy [

79]. Secondly, the integration of transportation, information, and public services promoted by smart cities objectively promotes the connectivity with surrounding areas, enlarges the radiation scope and synergistic effect of digital finance [

80], and thus further strengthens the risk resistance and recovery capacity of the economic system at the regional level. Therefore, through the heterogeneity test of the smart city pilot, it is tested whether the effect of macroprudential policy depends on an efficient “digital governance system”. Given this, referring to the research of Song et al. (2021) [

81], this paper classifies the sample cities according to whether they are smart city pilot cities and studies the association between macroprudential policy and urban economic resilience. As shown in Columns (1) and (2) of

Table 9, the regression coefficient of MPI in the smart-city group is significant at the 1% significance level, and the value was significantly higher than that of the non-smart-city group. It means that the smart city pilots have a high degree of digital economy development and can effectively cooperate with macroprudential policy to promote urban economic resilience. Therefore, compared with smart city pilot cities, non-pilot cities are limited by weak digital infrastructure and insufficient data integration ability. The implementation of macroprudential policy often faces problems such as information asymmetry and long transmission delay, which makes it difficult to give full play to the expected effects on urban economic resilience.

6.2.2. Heterogeneity of National Big Data Comprehensive Pilot Zone

Macroprudential policy can inhibit excessive leverage and speculative financing and promote the transformation and upgrading of traditional industries to the direction of high added value, thus promoting industrial structure upgrading and ultimately improving urban economic resilience. Based on this logic, this paper argues that the national big data comprehensive pilot zone (hereinafter referred to as the big data pilot zone) has significantly accelerated the deep integration of data elements and traditional industrial systems through institutional innovation and technology empowerment [

82]. Specifically, by building a standardized data circulation market and unified data standards, the big data pilot zone breaks the “data island” in the industry, so that the credit and financial resources guided by macroprudential policy can be more accurately allocated to links and enterprises with potential [

83]. This process can promote a deeper and wider range of industrial structure optimization, greatly enhance the adaptability and urban economic resilience to internal and external shocks, and make macroprudential policy play a more significant role in improving economic resilience in the test area. Therefore, through the heterogeneity test of the big data pilot zone, it can be determined whether the promoting effect of macroprudential policy on urban economic resilience is significantly dependent on the support of efficient data element ecology. Given this, this paper records the cities not included in the big data pilot zone as 0, and the cities in the experimental area as 1, and performs group regression to investigate the relationship between macroprudential policy and urban economic resilience. As shown in Columns (3) and (4) of

Table 9, the regression coefficient of MPI in the group of the big data pilot zone is 0.040, which passes the significance test at the 1% level, while the coefficient of MPI in the non-big data pilot zone is −0.001. The results mean that compared with the non-big data pilot zone, the big data pilot zone has significant advantages in promoting the construction of new information infrastructure, laying a digital foundation for macroprudential policy and enhancing urban economic resilience.

6.2.3. Heterogeneity of Fiscal Pressure

The effectiveness of macroprudential policy is deeply dependent on the fiscal ecological environment of local governments. This paper argues that fiscal pressure restricts the effect of macroprudential policy on improving urban economic resilience mainly by distorting the behavior of local governments. On the one hand, high fiscal pressure will drive local governments to compete for local financial resources through urban investment platforms and other channels, leading to the contraction of credit supply of financial institutions in the field of supporting innovation and digitalization [

84,

85]. This not only weakens the function of macroprudential policy in optimizing the allocation of digital financial resources, but also reduces the overall utilization efficiency of financial resources, thus hindering the transmission path of macroprudential policy to enhance urban economic resilience with the development of digital finance. On the other hand, local governments facing high fiscal pressure often lack the motivation to promote regional coordinated development. Therefore, through the heterogeneity test of fiscal pressure, we can effectively identify the institutional constraints on the effects of macroprudential policy and clarify the internal mechanism of the differentiation of their effects in different fiscal ecological environments. Given this, referring to the research of Lin et al. (2022) [

86], this paper measures fiscal pressure by calculating the difference between urban general public budget expenditure and revenue and the ratio of the region’s GDP. The samples are divided into a high-fiscal-pressure group and a low-financial-stress group according to the median value, and group regression was performed. As shown in Columns (5) and (6) of

Table 9, the regression coefficient of MPI of the high-financial-pressure group is 0.008, which is not statistically significant, while that of the low-financial-pressure group is 0.068, which is significant at the level of 5%. This result shows that compared with cities with greater fiscal pressure, cities with less fiscal pressure play a more significant role in improving urban economic resilience. The reason may be that cities with less fiscal pressure can provide more suitable fiscal environment and institutional space, corresponding to stronger autonomy and sustainability of policy implementation.

6.3. Spatial Spillover Effects Analysis

The urban economic system is not isolated but is closely connected with neighboring cities through the flow of factors, industrial linkages, and financial networks. Macroprudential policy can generate spillover effects on neighboring cities through channels such as cross-regional credit transmission, risk contagion, or resource reallocation. Second, ignoring spatial dependence can lead to model specification errors, such as overestimating or underestimating the local policy effects. Through spatial econometric analysis, the differentiated impacts of policy on local and neighboring cities can be identified, thereby revealing the mechanisms of regional cooperation or competition. Additionally, this test can provide a basis for policy coordination, such as optimizing the differentiated combination of macroprudential instruments at the urban agglomeration level to avoid “beggar-thy-neighbor” or “free-riding” phenomena, ultimately enhancing the overall economic resilience of the region. Therefore, this section examines the spatial spillover effects of macroprudential policy on urban economic resilience.

6.3.1. Spatial Autocorrelation Test

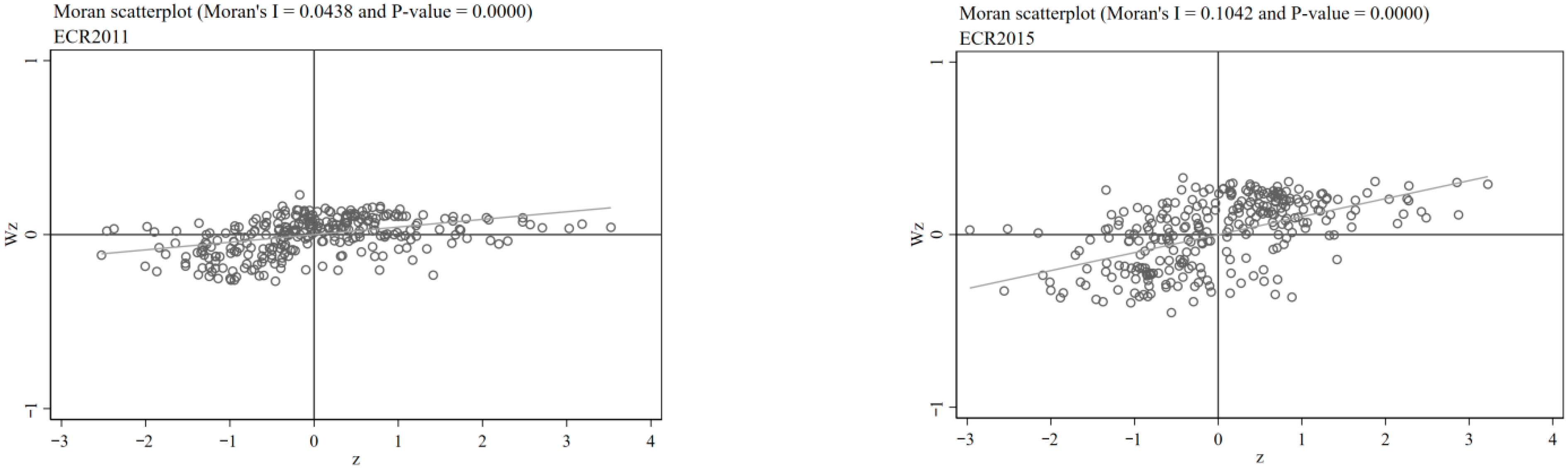

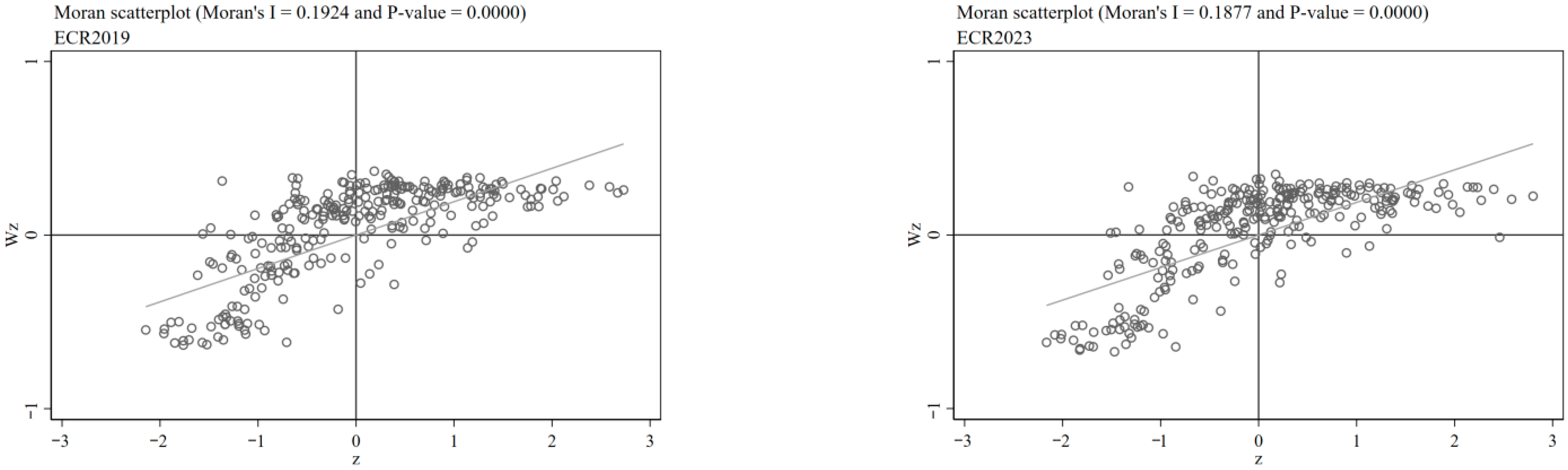

The premise of constructing the spatial econometric model is to ensure that the explanatory variable has spatial correlation. Based on the spatial adjacency matrix (W), this paper analyzes the global Moran’s I indexes of urban economic resilience, and the results are shown in

Table 10. The results show that, except for 2013, all indicators are significantly positive at the 1% level, indicating that urban economic resilience is not randomly distributed in space, but shows positive spatial dependence characteristics.

Global spatial autocorrelation solely reflects the general state of the spatial autocorrelation of urban economic resilience. If there is spatial heterogeneity, the accuracy of the test would decline. To further investigate the distributional properties of the variables in order to demonstrate their aggregation status, we conducted a local autocorrelation test and drew Moran’s I scatter plot [

87]. There are four types of spatial linkages in the Moran’s I index scatter plot. The scatter plot of Moran’s I index shows four types of spatial correlation. The first type is the first quadrant (H-H type), which shows positive spatial correlation, that is, high-level cities and high-level cities are clustered in space. The second category is the second quadrant (L-H type), showing negative spatial correlation; that is, low-level cities and high-level cities are spatially adjacent. The third category is the third quadrant (L-L type), showing positive spatial correlation; that is, low-level cities and low-level cities are spatially adjacent. The fourth category is the fourth quadrant (H-L type), which shows negative spatial correlation; that is, high-level cities and low-level cities are spatially clustered adjacent to each other. The local spatial autocorrelation test results (

Figure 2) show that the local Moran’s I index in representative years significantly exceeds 0, and most cities are located in the first and third quadrants of the region with positive spatial correlation, which further confirms the significant spatial agglomeration effect of urban economic resilience. This is consistent with the findings of Ai et al. [

88].

6.3.2. Spatial Effect Analysis

The model settings were determined through LM test, Hausman test and LR test, and the Spatial Durbin Model was used for bidirectional fixed effects. In order to further study the spatial effects of macroprudential policy on urban economic resilience, the regression results of the Spatial Durbin Model are decomposed into direct effects, indirect effects and total effects, and the results are shown in

Table 11. Rho represents the spatial autocorrelation coefficient, which reflects the direction of the spatial spillover effect of the explanatory variable in the region. The results show that the Rho of the model is positive and passes the significance level test of 1%, indicating that macroprudential policy has a positive spatial spillover effect. Apart from the direct effect of macroprudential policy on urban economic resilience passing the significance test at the 5% level, neither the indirect effect nor the total effect of macroprudential policy on urban economic resilience passed the significance test, indicating that the total spatial effect of macroprudential policy on regional economic resilience is not significant. Therefore, macroprudential policy currently has a relatively limited impact on the resilience of local cities, and its radiation effect on other regions is also relatively weak. In order to verify the reliability of the conclusion, this paper converts the spatial adjacency matrix into the spatial distance matrix for re-estimation, and the results show that the signs of core variables are basically consistent with the benchmark regression, indicating that the model has good robustness.

The preliminary analysis of spatial spillover effects shows that the test based on the traditional geographical distance weight matrix does not identify significant spatial spillover effects of macroprudential policy on urban economic resilience. Considering that the explanatory power of economic ties for regional interaction may go beyond geographical proximity, this study further establishes the inter-city investment network matrix as the spatial weight setting, so as to more accurately describe the substantive economic ties between regions and more reliably identify the possible spatial spillover effects of macroprudential policy. Even under the inter-city investment matrix that is more consistent with the logic of economic correlation, the model does not capture significant spatial spillover effects. This result prompts us to revisit the possibility that the externality of the policy may itself be weak and that its effects are theoretically overestimated.

This empirical finding may be due to the following reasons: firstly, macroprudential policy has a strong geographical targeting. Its original purpose is to defuse local financial risks, and policy instruments (such as real estate loan concentration management) mainly regulate financial institutions and market behaviors in a specific region. Secondly, although there are close economic and investment exchanges between cities, the territorial framework of financial regulation and the lack of policy coordination among local governments may hinder the effective spillover of risk signals and policy intentions, resulting in a significant attenuation of policy impact across administrative divisions. Therefore, the insignificant spatial spillover effect of macroprudential policy does not mean that regions are completely isolated, but more likely reflects that the scope of influence has a strong localized tendency, and the cross-regional coordination and linkage mechanism still needs to be further strengthened.

6.4. Follow-Up Research on the Improvement of Urban Economic Resilience

The improvement of urban economic resilience builds a stable development environment and a virtuous cycle mechanism for regional innovation capacity. On the one hand, resilient cities can better withstand external economic shocks and avoid the interruption of capital investment and R&D cycle necessary for innovation activities due to short-term fluctuations, which provides a basic guarantee for the development of regional innovation capacity. On the other hand, the improvement of urban economic resilience is often driven by a diversified industrial structure. Diverse regions are thought to have greater potential to promote new types of restructuring among local industries and open up new paths to growth, a phenomenon known as the Jacobs externality, named after the pioneering research of Jacobs (1969) [

89]. Therefore, we believe that the improvement of urban economic resilience can promote regional innovation capacity by reducing innovation risk and optimizing innovation ecology. Therefore, according to the Evaluation Report on China’s Regional Innovation Capability from 2011 to 2023, the utility value of regional innovation capability of each province is sorted out to construct regional innovation capability (INNO1) for testing. As one of the important achievements of the national Innovation Survey system, the report includes an index system covering the five dimensions of innovation investment, output, environment, performance, and potential, comprehensively covering key areas such as R&D investment, number of R&D personnel, patent application and authorization, high-tech industry cultivation status, science and technology policy support, and achievement transformation efficiency. Through a series of steps such as data standardization processing, weight distribution and comprehensive evaluation model, this paper evaluates and analyzes the innovation capability of 31 regions (provinces, autonomous regions and municipalities directly under the Central Government) in China [

90], so as to achieve an objective and comprehensive evaluation of the innovation capability and development level of all regions in China.

To further verify the above conjecture, the following formula is constructed.

As shown in

Table 12, in the regression results of all control variables in Column (1) and the control fixed effects and control variables in Column (2), the interaction term coefficients of ECR ×MPI remain significantly positively correlated at the 1% significance level. Urban economic resilience not only buffers innovation risks by enhancing system stability, but also provides continuous endogenous driving force for regional innovation by optimizing innovation ecology and factor allocation, forming a virtuous cycle of “enhanced resilience, active innovation and sustainable economy”.

In order to effectively supplement the above mechanism analysis based on innovation capacity at the provincial level and further verify the promoting effect of urban economic resilience on regional innovation activities at the municipal level, this paper introduces the natural logarithm of the total number of annual patent applications +1 in prefecture-level cities as the proxy variable of municipal innovation capability (INNO2) for supplementary tests [

91]. The purpose of “+1” is to avoid missing log values and ensure that all observations can enter the regression analysis, while minimizing the distortion of the data distribution as much as possible. The selection of this index is mainly based on the following considerations. Firstly, patent application data have the advantages of public availability, strong objectivity, and consistent statistical caliber, which can accurately reflect the innovation output dynamics of prefecture-level cities at the micro level. Secondly, as a key output link in the innovation process, patent application can directly reflect the actual efficiency of transforming knowledge accumulation and technology input into intellectual property market results in a region, which is an important refinement and support for the macro innovation capability system.

In this test, Formula (5) is used. The regression results are shown in

Table 12, and in the regression results of all control variables in Column (1) and the control fixed effects and control variables in Column (2), the interaction term coefficients of ECR × MPI remain significantly positively correlated at the 1% significance level. The above results further confirm the significant role of urban economic resilience in enhancing regional innovation capabilities. Combined with the above tests, it can be seen that the general enhancement of urban economic resilience forms a synergistic and integrated effect in space through mechanisms such as knowledge spillover, factor flow, and innovation network expansion, so as to optimize regional innovation ecology in a wider range and promote the systematic improvement of provincial overall innovation capacity. Therefore, the construction of urban economic resilience is not only an important support for local high-quality development, but also a key path to build a regional collaborative innovation system and enhance regional comprehensive competitiveness.

7. Conclusions and Implications

7.1. Concluding Remarks

In view of the increasing fluctuations in the global economic environment, this paper systematically reveals the multi-dimensional impact mechanism of macroprudential policies on urban economic resilience and its follow-up research by analyzing the data of urban economic development. The main results are as follows:

First, macroprudential policy can significantly enhance urban economic resilience and enhance the ability of local economic systems to withstand external shocks and recover growth. This is also confirmed again by the robustness and endogeneity tests.

Second, macroprudential policy plays an important role through the three transmission paths of digital finance development, industrial structure upgrading, and regional integration. Specifically, it expands the coverage of digital financial services by standardizing the financial system and improves the financing environment of small and medium-sized enterprises to activate the microeconomy. At the same time, it helps guide credit flow to high-tech industries to promote structural transformation and consolidate the industrial foundation of urban economic resilience. In addition, by coordinating regional supervision and connecting markets, barriers to factor flow should be broken, so as to realize risk sharing and resource complementarity in a broader field. Macroprudential policy enhances urban economic resilience through the above transmission paths.

Third, heterogeneity analysis further finds that there are significant regional differences in the effects of macroprudential policy. The policy effects are particularly prominent in cities with good digital foundation, such as “smart city” pilot and national big data comprehensive pilot zone, indicating that the development of digital infrastructure and data factor market provides strong support for the implementation of macroprudential policy. In cities with low fiscal pressure, the effect of policies on improving economic resilience is more obvious, reflecting the important impact of fiscal health on the efficiency of policy transmission.

Fourth, after testing the spatial adjacency matrix, distance matrix and investment matrix, the spatial econometric results show that macroprudential policy has a significant direct promotion effect on local economic resilience, but its spatial spillover effect is not significant.

Fifth, the empirical test also shows that the improvement of urban economic resilience can further stimulate regional innovation capacity, forming a virtuous cycle of “enhanced resilience–active innovation–sustainable economy”, highlighting that macroprudential policy not only plays a key role in preventing financial risks, but also provides institutional guarantee for building a resilient and dynamic regional innovation system.

7.2. Management Implications

Based on the above empirical analysis results, the following management implications are put forward to strengthen the role of macroprudential policy in promoting urban economic resilience.

Firstly, the macroprudential policy framework should be optimized to strengthen its role in supporting urban economic resilience. Specifically, we should first improve the policy transmission mechanism, pay attention to the synergistic effect of financial development, industrial structure upgrading and macroprudential policy, and guide capital to favor high-value-added industries and the digital economy. Second, we should improve the financial risk early warning mechanism, use big data and artificial intelligence technology to enhance the ability to identify systemic risks, and enhance the stability of the urban financial system. Finally, it is necessary to strengthen forward-looking policy formulation, dynamically adjust policy intensity according to the monitoring indicators of urban economic resilience, and ensure that policy accurately meets the risk prevention and control needs of cities.

Secondly, differentiated regional policy combinations should be implemented to enhance the ability of coordinated urban governance and risk resistance. First of all, priority should be given to promoting digitally empowered macroprudential policy instruments in smart city pilot areas and big data pilot zones to form replicable policy experience. Second, the government should provide targeted policy support for cities with high fiscal pressure and resolve local government debt risks through fiscal and financial coordination mechanisms to avoid distorting the allocation of credit resources. Finally, the government should promote cross-regional market integration, reduce barriers to factor flow, give full play to economies of scale, and enhance the overall resilience of urban agglomerations.

Thirdly, it is necessary to strengthen supporting policies and measures to lay a solid foundation for the long-term resilience of the economy. On the one hand, the government should increase R&D investment and innovation, cultivate new technologies and new forms of business, and enhance the adaptive capacity and innovation-driven capacity of urban economy. On the other hand, the government should also focus on improving infrastructure, particularly the resilience of key areas such as transportation and energy. This can not only effectively buffer the chain impact of extreme events on the economic system, but also realize efficient crisis coordination and resource complementation by relying on the urban agglomeration network.

Through the above measures, a virtuous circle of “policy regulation–market response–resilience enhancement” can be built to provide institutional guarantees for the high-quality development of the urban economy.

7.3. Limitations and Directions for Future Research

Despite many insights provided by this study, some questions remain unresolved. First, based on the sample of Chinese cities, this study has conducted an in-depth investigation on the economic effects of macroprudential policy. The conclusions of this paper may need to be treated with caution when directly applying them to other economies. Subsequent research can further verify the boundary conditions found in this paper through cross-country comparison or by building a more universal theoretical framework. In fact, the in-depth analysis focusing on the case of China provides a valuable reference for understanding the policy implementation of emerging market countries, and also lays a necessary empirical foundation for subsequent comparative research. Second, the degree of deviation of urban real economic output as a measure of urban economic resilience fails to fully cover the multi-dimensional connotations of economic resilience, such as resistance ability, recovery speed, and adaptation and transformation potential, which may lead to biases in the portrayal of core concepts. Third, there may be an interaction mechanism among the mediating effects of digital finance development, industrial structure upgrading and regional integration, which has not been deeply explored in existing research. Future research can be deepened from the following aspects. First, the research sample should be expanded to the transnational city level, and the differentiated mechanism of macroprudential policy affecting economic resilience should be explored through comparative analysis of urban cases under different institutional backgrounds and development stages. Second, a multi-dimensional evaluation index system of urban economic resilience should be constructed, which comprehensively incorporates the dimensions of resistance, recovery, and transformation of the economic system to enhance the scenario adaptability and practical guidance value of the research conclusions. Third, the interaction should be deeply analyzed between digital financial development, industrial structure upgrading, and regional integration in the process of macroprudential policy affecting urban economic resilience and improving the mechanism analysis framework. Studying these aspects will contribute to a deeper understanding of the intrinsic link between macroprudential policy and urban economic resilience.