Exploring the Relationship Between Corporate Social Responsibility and Organizational Resilience

Abstract

1. Introduction

2. Theory and Hypothesis Development

2.1. Corporate Social Responsibility and Organizational Resilience

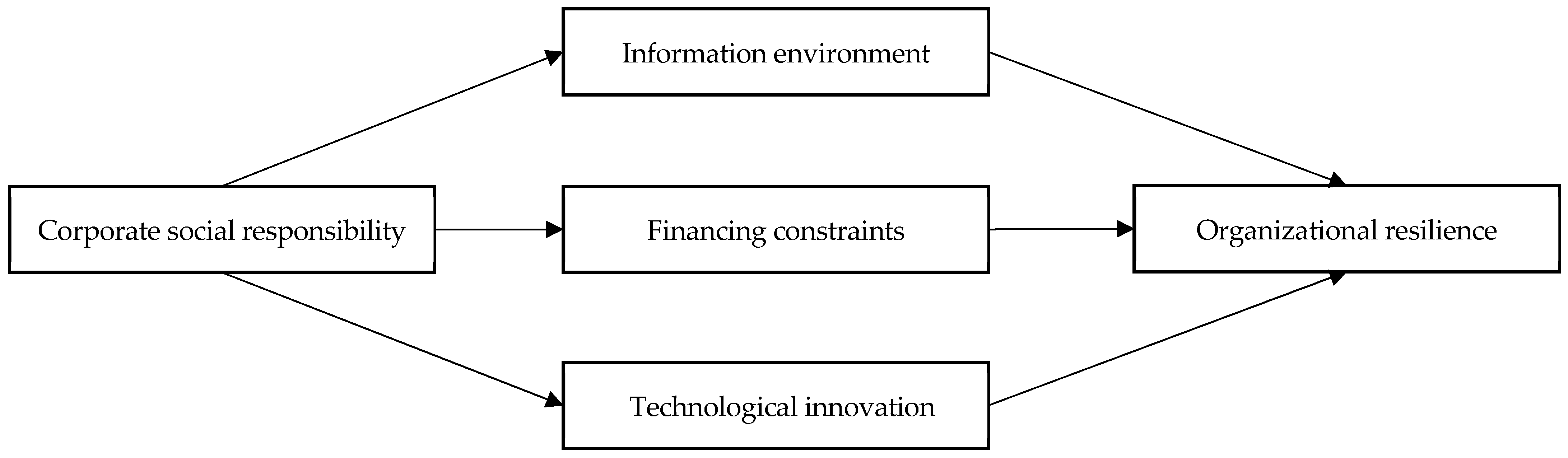

2.2. The Influence Mechanism of Corporate Social Responsibility on Organizational Resilience

2.2.1. Corporate Social Responsibility, Information Environment, and Organizational Resilience

2.2.2. Corporate Social Responsibility, Financing Constraints, and Organizational Resilience

2.2.3. Corporate Social Responsibility, Technological Innovation, and Organizational Resilience

3. Research Methodology

3.1. Data Sources

3.2. Variable Selection

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Control Variables

3.3. Empirical Models

4. Analysis of the Results

4.1. Descriptive Statistics and Correlation Analysis

4.2. Empirical Model Results

4.3. Mechanism Tests

4.3.1. Improving the Information Environment

4.3.2. Alleviating Financing Constraints

4.3.3. Boosting Technological Innovation

4.4. Endogeneity and Robustness Testing

4.4.1. Endogeneity Testing

- Consideration of Time Lags.

- 2.

- Instrumental Variable Method.

4.4.2. Robustness Test

- Replacement of the Measurement Method of the Dependent Variable.

- 2.

- Replacement of the Measurement Method of the Independent Variable.

- 3.

- Restricting the Time Period to 2010–2019.

- 4.

- Testing the Sub-Dimensions of Corporate Social Responsibility.

5. Moderating Analysis

5.1. Board Diversity

5.2. Regional Marketization

6. Conclusions

7. Discussion

7.1. Theoretical Implications

7.2. Practical Implications

7.3. Limitations and Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Zhang, Z.Q.; Bai, Y.F. Research on whether quality policies can promote the high-quality development of China’s manufacturing industry and its configuration paths in the context of sustainable development. Sustainability 2024, 16, 9539. [Google Scholar] [CrossRef]

- Linnenluecke, M.K. Resilience in business and management research: A review of influential publications and a research agenda. Int. J. Manag. Rev. 2017, 19, 4–30. [Google Scholar] [CrossRef]

- Napier, E.; Liu, S.Y.H.; Liu, J.T. Adaptive strength: Unveiling a multilevel dynamic process model for organizational resilience. J. Bus. Res. 2024, 171, 114334. [Google Scholar] [CrossRef]

- Ortiz-de-Mandojana, N.; Bansal, P. The long-term benefits of organizational resilience through sustainable business practices. Strateg. Manag. J. 2016, 37, 1615–1631. [Google Scholar] [CrossRef]

- Chen, R.J.; Liu, Y.Q.; Zhou, F. Turning danger into safety: The origin, research context and theoretical framework of organizational resilience. IEEE Access 2021, 9, 48899–48913. [Google Scholar] [CrossRef]

- Liang, L.; Li, Y. How does organizational resilience promote firm growth? The mediating role of strategic change and managerial myopia. J. Bus. Res. 2024, 177, 114636. [Google Scholar] [CrossRef]

- Li, M.W.; Cheng, S.E.; Lu, M. Impact of information technology capabilities on organizational resilience: The mediating role of social capital. Hum. Soc. Sci. Commun. 2024, 11, 1424. [Google Scholar] [CrossRef]

- Liu, Y.N.; Chen, Y.F.; Ren, Y.; Jin, B.X. Impact mechanism of corporate social responsibility on sustainable technological innovation performance from the perspective of corporate social capital. J. Clean Prod. 2021, 308, 127345. [Google Scholar] [CrossRef]

- Huang, W.C.; Chen, S.M.; Nguyen, L.T. Corporate social responsibility and organizational resilience to COVID-19 crisis: An empirical study of Chinese firms. Sustainability 2020, 12, 8970. [Google Scholar] [CrossRef]

- Godfrey, P.C.; Merrill, C.B.; Hansen, J.M. The relationship between corporate social responsibility and shareholder value: An empirical test of the risk management hypothesis. Strateg. Manag. J. 2009, 30, 425–445. [Google Scholar] [CrossRef]

- Peloza, J. Using corporate social responsibility as insurance for financial performance. Calif. Manag. Rev. 2006, 48, 52–72. [Google Scholar] [CrossRef]

- Poursoleyman, E.; Mansourfar, G.; Hassan, M.K.; Homayoun, S. Did corporate social responsibility vaccinate corporations against COVID-19? J. Bus. Ethics 2024, 189, 525–551. [Google Scholar] [CrossRef]

- Meyer, A.D. Adapting to environmental jolts. Adm. Sci. Q. 1982, 27, 515–537. [Google Scholar] [CrossRef]

- Wang, D.H.M.; Chen, P.H.; Yu, T.H.K.; Hsiao, C.Y. The effects of corporate social responsibility on brand equity and firm performance. J. Bus. Res. 2015, 68, 2232–2236. [Google Scholar] [CrossRef]

- Singh, J. The influence of CSR and ethical self-identity in consumer evaluation of cobrands. J. Bus. Ethics 2016, 138, 311–326. [Google Scholar] [CrossRef]

- Cheng, B.T.; Ioannou, I.; Serafeim, G. Corporate social responsibility and access to finance. Strateg. Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Werner, T. Gaining Access by doing good: The effect of sociopolitical reputation on firm participation in public policy making. Manag. Sci. 2015, 61, 1989–2011. [Google Scholar] [CrossRef]

- Bocquet, R.; Le Bas, C.; Mothe, C.; Poussing, N. CSR, innovation, and firm performance in sluggish growth contexts: A firm-level empirical analysis. J. Bus. Ethics 2017, 146, 241–254. [Google Scholar] [CrossRef]

- Chowdhury, M.; Prayag, G.; Patwardhan, V. The bright and dark sides of the relationship between relational capital and organizational resilience: The moderating role of human capital. Int. J. Hosp. Tour. Adm. 2024, 26, 1105–1135. [Google Scholar] [CrossRef]

- Dovbischuk, I. Innovation-oriented dynamic capabilities of logistics service providers, dynamic resilience and firm performance during the COVID-19 pandemic. Int. J. Logist. Manag. 2022, 33, 499–519. [Google Scholar] [CrossRef]

- Axjonow, A.; Ernstberger, J.; Pott, C. The impact of corporate social responsibility disclosure on corporate reputation: A non-professional stakeholder perspective. J. Bus. Ethics 2018, 151, 429–450. [Google Scholar] [CrossRef]

- Aabo, T.; Pantzalis, C.; Park, J.C. Idiosyncratic volatility: An indicator of noise trading? J. Bank Financ. 2017, 75, 136–151. [Google Scholar] [CrossRef]

- Moalla, M.; Dammak, S. Corporate ESG performance as good insurance in times of crisis: Lessons from US stock market during COVID-19 pandemic. J. Glob. Responsib. 2023, 14, 381–402. [Google Scholar] [CrossRef]

- DesJardine, M.; Bansal, P.; Yang, Y. Bouncing back: Building resilience through social and environmental practices in the context of the 2008 global financial crisis. J. Manag. 2019, 45, 1434–1460. [Google Scholar] [CrossRef]

- Harrison, J.S.; Bosse, D.A.; Phillips, R.A. Managing for stakeholders, stakeholder utility functions, and competitive advantage. Strateg. Manag. J. 2010, 31, 58–74. [Google Scholar] [CrossRef]

- Chen, Y.F.; Jin, B.X.; Ren, Y. Impact mechanism of corporate social responsibility on technological innovation performance: The mediating effect based on social capital. Sci. Res. Manag. 2020, 41, 87–98. [Google Scholar]

- Limkriangkrai, M.; Koh, S.; Durand, R.B. Environmental, social, and governance (ESG) profiles, stock returns, and financial policy: Australian evidence. Int. Rev. Financ. 2017, 17, 461–471. [Google Scholar] [CrossRef]

- Pástor, L.; Stambaugh, R.F.; Taylor, L.A. Sustainable investing in equilibrium. J. Financ. Econ. 2021, 142, 550–571. [Google Scholar] [CrossRef]

- Liu, J.Q.; Xu, Y.L. The impact of ESG investment on corporate resilience. J. Audit Econ. 2024, 39, 54–64. [Google Scholar]

- Chen, S.L.; Wang, D. Digital transformation and corporate resilience: Effects and mechanisms. J. Xi’an Univ. Financ. Econ. 2023, 36, 65–77. [Google Scholar] [CrossRef]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Pan, Q.; Li, J.X. Corporate social responsibility, technological innovation and stock price crash risk. Soft Sci. 2022, 36, 96–102+110. [Google Scholar] [CrossRef]

- Yang, C.N.; Wang, J.L.; David, L.K. The same or different? How optimal distinctiveness in corporate social responsibility affects organizational resilience during COVID-19. Bus. Ethics Environ. Responsib. 2024, 33, 583–605. [Google Scholar] [CrossRef]

- Dubey, R.; Gunasekaran, A.; Childe, S.J.; Wamba, S.F.; Roubaud, D.; Foropon, C. Empirical investigation of data analytics capability and organizational flexibility as complements to supply chain resilience. Int. J. Prod. Res. 2021, 59, 110–128. [Google Scholar] [CrossRef]

- Tsiapa, M.; Batsiolas, I. Firm resilience in regions of Eastern Europe during the period 2007–2011. Post-Communist Econ. 2019, 31, 19–35. [Google Scholar] [CrossRef]

- Williams, T.A.; Gruber, D.A.; Sutcliffe, K.M.; Shepherd, D.A.; Zhao, E.Y.F. Organizational response to adversity: Fusing crisis management and resilience research streams. Acad. Manag. Ann. 2017, 11, 733–769. [Google Scholar] [CrossRef]

- Andersson, T.; Cäker, M.; Tengblad, S.; Wickelgren, M. Building traits for organizational resilience through balancing organizational structures. Scand. J. Manag. 2019, 35, 36–45. [Google Scholar] [CrossRef]

- Xin, Q.Q.; Kong, D.M.; Hao, Y. Transparency and stock return volatility. J. Financ. Res. 2014, 10, 193–206. [Google Scholar]

- Zhang, G.L.; Xie, Q.; Gao, H.T.; Lu, J.T.; Cucari, N. Implementation of social responsibility in digital transformation: An opportunity or a challenge to corporate innovation performance. Corp. Soc. Responsib. Environ. Manag. 2025, 32, 1245–1260. [Google Scholar] [CrossRef]

- Jiang, T. Mediating effects and moderating effects in causal inference. China Indust. Econ. 2022, 5, 100–120. [Google Scholar] [CrossRef]

- Dell, M. The persistent effects of Peru’s mining mita. Econometrica 2010, 78, 1863–1903. [Google Scholar] [CrossRef]

- Chen, Y.; Fan, Z.Y.; Gu, X.M.; Zhou, L.A. Arrival of young talent: The send-down movement and rural education in China. Am. Econ. Rev. 2020, 110, 3393–3430. [Google Scholar] [CrossRef]

- Song, D.D.; Tan, Z.D.; Wang, W.; Zhai, R.X. Digital transformation and corporate social responsibility engagement: Evidence from China. Int. Rev. Financ. Anal. 2025, 97, 103805. [Google Scholar] [CrossRef]

- Cheng, X.; Yang, C.J.; Wan, X.Y. Institutional investors, information transparency and stock volatility. Rev. Invest. Stud. 2018, 37, 55–77. [Google Scholar]

- Song, Y.; Wang, J.; Chen, H.Z. The formation mechanism of organizational resilience of enterprises in the context of anti-globalization: A case study based on Huawei. Foreign Econ. Manag. 2021, 43, 3–19. [Google Scholar] [CrossRef]

- Yang, X.L.; Yang, L.G. Dose the transparency of accounting information improve the enterprise risk-taking abilities? Empirical evidence from the perspective of the enterprise life cycle. Theory Pract. Financ. Econ. 2021, 42, 82–88. [Google Scholar] [CrossRef]

- Lee, M.T.; Raschke, R.L.; Krishen, A.S. Signaling green! firm ESG signals in an interconnected environment that promote brand valuation. J. Bus. Res. 2022, 138, 1–11. [Google Scholar] [CrossRef]

- Wang, X.L.; Tang, J.L.; Ma, Z.F. The Distribution of subsidiaries, information asymmetry and organizational resilience of enterprises. Commun. Financ. Account. 2023, 14, 82–86. [Google Scholar] [CrossRef]

- Zheng, P.P.; Zhuang, Z.Y. Specialization in judicial protection of intellectual property and digital innovation of enterprises. Syst. Eng.-Theory Pract. 2024, 44, 1501–1521. [Google Scholar]

- Gao, L.; Meng, F.; Tian, Q. Impact of digital finance on enterprise technological innovation and its spatial effect. Sci. Res. Manag. 2024, 45, 72–82. [Google Scholar]

- Martin, R.; Sunley, P. On the notion of regional economic resilience: Conceptualization and explanation. J. Econ. Geogr. 2015, 15, 1–42. [Google Scholar] [CrossRef]

- Hu, H.F.; Song, X.X.; Guo, X.F. The impact of investor protection on corporate resilience. Econ. Manag. 2020, 42, 23–39. [Google Scholar]

- Feng, T.; Zhu, Z.Y. A study on the impact of heterogeneous government grants on firm resilience. J. Southwest Univ. (Soc. Sci. Ed.). 2024, 50, 144–155. [Google Scholar] [CrossRef]

- Gong, H.; Peng, Y.Y. Expert effect of technical directors, R&D and innovation performance. China Soft Sci. 2021, 1, 127–135. [Google Scholar] [CrossRef]

- Zhao, J.J.; Zhang, L.M.; Zhao, Y. Enterprise innovation performance driven by technological innovation: Based on moderated intermediary effect. Reform Econ. Syst. 2020, 6, 123–130. [Google Scholar]

- Jia, Y.; Fu, Q.W.Q.; Li, D.S. Technological innovation and firm resilience: Based on the scenario of the COVID-19 pandemic. J. Manag. Sci. 2023, 36, 17–34. [Google Scholar]

- Zhang, S.F.; Xu, M.S.; Zhu, Y.; Wang, Z.Q. Technological innovation, organizational resilience and high-quality development of manufacturing enterprises. Sci. Technol. Prog. Policy 2023, 40, 81–92. [Google Scholar]

- Bustinza, O.F.; Vendrell-Herrero, F.; Perez-Arostegui, M.N.; Parry, G. Technological capabilities, resilience capabilities and organizational effectiveness. Int. J. Hum. Resour. Manag. 2019, 30, 1370–1392. [Google Scholar] [CrossRef]

- Zhao, S.M.; Yu, X.H. Impact of corporate social responsibility on corporate innovation: Some empirical evidence from Chinese listed companies. Sci. Res. Manag. 2023, 44, 144–153. [Google Scholar]

- Lv, W.D.; Wei, Y.; Li, X.Y.; Lin, L. What dimension of CSR matters to organizational resilience? Evidence from China. Sustainability 2019, 11, 1561. [Google Scholar] [CrossRef]

- Yan, T.T.; Li, W.L.; Zhong, Y.X. Excess goodwill: The “profit tool” or the “winner’s curse”? Based on the perspective of corporate social responsibility. Bus. Manag. J. 2022, 44, 111–128. [Google Scholar] [CrossRef]

- Guo, M.Y.; Zheng, C.D.; Li, J.Y. Corporate social responsibility and debt financing cost: Evidence from China. Environ. Dev. Sustain. 2024, 26, 17475–17503. [Google Scholar] [CrossRef]

- Yi, C.J.; Zhao, X.Y. Does digital transformation improve the efficiency of Chinese multinational enterprises’ overseas investment. China Indust. Econ. 2024, 1, 150–169. [Google Scholar] [CrossRef]

- Joshi, A.; Roh, H. The role of context in work team diversity research: A meta-analytic review. Acad. Manag. J. 2009, 52, 599–627. [Google Scholar] [CrossRef]

- Bear, S.; Rahman, N.; Post, C. The impact of board diversity and gender composition on corporate social responsibility and firm reputation. J. Bus. Ethics 2010, 97, 207–221. [Google Scholar] [CrossRef]

- Bernile, G.; Bhagwat, V.; Yonker, S. Board diversity, firm risk, and corporate policies. J. Financ. Econ. 2018, 127, 588–612. [Google Scholar] [CrossRef]

- Wang, L.L.; Lian, Y.H.; Dong, J. Study on the impact mechanism of ESG performance on corporate value. Secur. Mark. Her. 2022, 5, 23–34. [Google Scholar] [CrossRef]

- Flammer, C. Competing for government procurement contracts: The role of corporate social responsibility. Strateg. Manag. J. 2018, 39, 1299–1324. [Google Scholar] [CrossRef]

- Mao, Z.H.; Li, L. Can enterprise ESG performance inhibit M&A goodwill bubbles? Mod. Econ. Res. 2023, 7, 71–83. [Google Scholar] [CrossRef]

- Aguinis, H.; Glavas, A. What we know and don’t know about corporate social responsibility: A review and research agenda. J. Manag. 2012, 38, 932–968. [Google Scholar] [CrossRef]

- Zheng, Q.Y.; Lin, J.B. Corporate social responsibility: An enabler of organizational resilience. Manag. Decis. 2024, 62, 1905–1923. [Google Scholar] [CrossRef]

- Ferrón-Vílchez, V.; Leyva-de la Hiz, D.I. Calm after the storm? The role of social and environmental practices on small and medium enterprises resilience throughout COVID-19 crisis. Bus. Ethics Environ. Responsib. 2023, 32, 179–195. [Google Scholar] [CrossRef]

| (1) Growth | (2) Volatility | (3) Growth | (4) Volatility | |

|---|---|---|---|---|

| CSR | 1.079 *** (0.047) | −0.007 *** (0.000) | 0.413 *** (0.045) | −0.004 *** (0.000) |

| Size | 24.880 *** (0.893) | −0.120 *** (0.004) | ||

| Lev | 32.660 *** (2.992) | 0.300 *** (0.028) | ||

| ROA | 34.687 *** (10.280) | −0.809 *** (0.100) | ||

| ATO | 53.817 *** (2.736) | 0.025 ** (0.012) | ||

| Cashflow | −29.811 *** (8.592) | 0.088 (0.074) | ||

| Capital | 4.570 *** (0.318) | −0.007 ** (0.003) | ||

| Fixed | −24.673 *** (4.432) | −0.058 * (0.032) | ||

| Intangible | −36.393*** (9.667) | 0.111 (0.082) | ||

| FirmAge | −8.610 *** (2.466) | 0.052 *** (0.017) | ||

| Indep | 69.077 *** (12.525) | 0.037 (0.078) | ||

| Top5 | 46.730 *** (4.462) | 0.221 *** (0.031) | ||

| Dual | 4.677 *** (1.322) | 0.028 *** (0.011) | ||

| SOE | −3.639 *** (1.260) | −0.058 *** (0.009) | ||

| Constant | −22.995 *** (3.337) | 1.531 *** (0.043) | −266.528 *** (11.019) | 2.023 *** (0.075) |

| N | 17,446.000 | 17,446.000 | 17,446.000 | 17,446.000 |

| R2 | 0.080 | 0.337 | 0.300 | 0.379 |

| Adj.R2 | 0.079 | 0.336 | 0.298 | 0.377 |

| Year | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes |

| (1) Growth | (2) Volatility | (3) Analyst | (4) FC | (5) Patent1 | |

|---|---|---|---|---|---|

| CSR | 0.413 *** (0.045) | −0.004 *** (0.000) | 0.010 *** (0.000) | −0.001 *** (0.000) | 0.004 *** (0.001) |

| Controls | Yes | Yes | Yes | Yes | Yes |

| Constant | −266.528 *** (11.019) | 2.023 *** (0.075) | −0.711 *** (0.131) | 1.895 *** (0.021) | −2.380 *** (0.182) |

| N | 17,446.000 | 17,446.000 | 17,419.000 | 17,429.000 | 17,446.000 |

| R2 | 0.300 | 0.379 | 0.418 | 0.659 | 0.508 |

| Adj.R2 | 0.298 | 0.377 | 0.417 | 0.658 | 0.507 |

| Year | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes |

| (1) Growth | (2) Volatility | (3) Growth | (4) Volatility | |

|---|---|---|---|---|

| CSR_1 | 0.273 *** (0.045) | −0.003 *** (0.000) | ||

| CSR_2 | 0.171 *** (0.048) | −0.003 *** (0.000) | ||

| Controls | Yes | Yes | Yes | Yes |

| Constant | −264.293 *** (12.539) | 1.817 *** (0.086) | −264.418 *** (14.227) | 1.883 *** (0.101) |

| N | 14,247.000 | 14,247.000 | 12,108.000 | 12,108.000 |

| R2 | 0.297 | 0.375 | 0.289 | 0.364 |

| Adj.R2 | 0.295 | 0.373 | 0.287 | 0.362 |

| Year | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes |

| (1) First stage CSR | (2) Second stage Growth | (3) Second stage Volatility | |

|---|---|---|---|

| CSR | 2.298 *** (0.515) | −0.008 ** (0.003) | |

| IV_CSR | 0.147 *** (0.016) | ||

| Kleibergen-Paaprk | 79.673 | ||

| LM statistic | <0.000> | ||

| Kleibergen-Paaprk | 80.951 | ||

| Wald F statistic | [16.380] | ||

| Controls | Yes | Yes | Yes |

| Constant | −2.764 (1.886) | −265.271 *** (11.563) | 2.021 *** (0.076) |

| N | 17,419.000 | 17,419.000 | 17,419.000 |

| R2 | 0.387 | 0.219 | 0.372 |

| Year | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes |

| Replacing the Dependent Variable | Replacing the Independent Variable | Restricting the Time Period | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| (1) Growth1 | (2) Growth2 | (3) Volatility1 | (4) Volatility2 | (5) Growth | (6) Volatility | (7) Growth | (8) Volatility | (9) Growth | (10) Volatility | |

| CSR | 0.897 *** (0.297) | 0.633 *** (0.062) | −0.004 *** (0.000) | −0.0002 *** (0.000) | 0.395 *** (0.046) | −0.003 *** (0.000) | ||||

| CSR_rank | 7.566 *** (1.245) | −0.042 *** (0.007) | ||||||||

| CSR_rl | 1.487 *** (0.172) | −0.002 *** (0.001) | ||||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −515.293 *** (42.698) | −408.382 *** (14.856) | 3.169 *** (0.101) | 0.181 *** (0.007) | −278.081 *** (11.215) | 2.088 *** (0.076) | −359.582 *** (25.242) | 1.981 *** (0.136) | −256.354 *** (11.504) | 1.856 *** (0.076) |

| N | 17,435.000 | 17,446.000 | 17,446.000 | 17,446.000 | 17,446.000 | 17,446.000 | 4848.000 | 4848.000 | 14,972.000 | 14,972.000 |

| R2 | 0.089 | 0.345 | 0.636 | 0.327 | 0.298 | 0.375 | 0.393 | 0.436 | 0.300 | 0.406 |

| Adj.R2 | 0.087 | 0.343 | 0.635 | 0.326 | 0.296 | 0.374 | 0.387 | 0.431 | 0.298 | 0.405 |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| (1) Growth | (2) Growth | (3) Growth | (4) Growth | (5) Growth | (6) Volatility | (7) Volatility | (8) Volatility | (9) Volatility | (10) Volatility | |

|---|---|---|---|---|---|---|---|---|---|---|

| CSR1 | 2.066 *** (0.178) | −0.027 *** (0.001) | ||||||||

| CSR2 | 2.369 *** (0.228) | −0.006 *** (0.001) | ||||||||

| CSR3 | 0.637 *** (0.141) | −0.003 *** (0.001) | ||||||||

| CSR4 | 0.689 *** (0.143) | −0.004 *** (0.001) | ||||||||

| CSR5 | 0.345 *** (0.128) | −0.008 *** (0.001) | ||||||||

| Controls | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Constant | −274.230 *** (11.113) | −266.863 *** (11.020) | −265.872 *** (11.049) | −265.463 *** (11.068) | −266.296 *** (11.026) | 2.123 *** (0.075) | 2.026 *** (0.076) | 2.020 *** (0.076) | 2.018 *** (0.076) | 2.015 *** (0.075) |

| N | 17,446.000 | 17,446.000 | 17,446.000 | 17,446.000 | 17,446.000 | 17,446.000 | 17,446.000 | 17,446.000 | 17,446.000 | 17,446.000 |

| R2 | 0.303 | 0.302 | 0.297 | 0.297 | 0.296 | 0.392 | 0.375 | 0.375 | 0.375 | 0.376 |

| Adj.R2 | 0.301 | 0.300 | 0.295 | 0.296 | 0.295 | 0.390 | 0.373 | 0.373 | 0.373 | 0.375 |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Growth | Volatility | Growth | Volatility | |

| CSR | 0.401 *** (0.045) | −0.003 *** (0.000) | 0.418 *** (0.047) | −0.004 *** (0.000) |

| Diversity | 7.522 *** (2.676) | 0.009 (0.018) | ||

| CSR*Diversity | 0.409 ** (0.190) | −0.002 ** (0.001) | ||

| Market | 5.106 * (2.691) | 0.006 (0.020) | ||

| CSR*Market | 0.356 ** (0.160) | −0.003 *** (0.001) | ||

| Controls | Yes | Yes | Yes | Yes |

| Constant | −255.151 *** (11.033) | 1.930 *** (0.076) | −254.126 *** (10.957) | 1.916 *** (0.077) |

| N | 17,446.000 | 17,446.000 | 17,250.000 | 17,250.000 |

| R2 | 0.301 | 0.379 | 0.303 | 0.380 |

| Adj.R2 | 0.299 | 0.377 | 0.301 | 0.378 |

| Year | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ruan, R.; Zhu, Z. Exploring the Relationship Between Corporate Social Responsibility and Organizational Resilience. Systems 2025, 13, 878. https://doi.org/10.3390/systems13100878

Ruan R, Zhu Z. Exploring the Relationship Between Corporate Social Responsibility and Organizational Resilience. Systems. 2025; 13(10):878. https://doi.org/10.3390/systems13100878

Chicago/Turabian StyleRuan, Rongbin, and Zuping Zhu. 2025. "Exploring the Relationship Between Corporate Social Responsibility and Organizational Resilience" Systems 13, no. 10: 878. https://doi.org/10.3390/systems13100878

APA StyleRuan, R., & Zhu, Z. (2025). Exploring the Relationship Between Corporate Social Responsibility and Organizational Resilience. Systems, 13(10), 878. https://doi.org/10.3390/systems13100878