How Business Environments Affect Enterprise Vitality: A Complex Adaptive Systems Theory Perspective

Abstract

1. Introduction

2. Theoretical Framework

3. Theoretical Mechanism and Research Hypothesis

3.1. Institutional Dimension: Enterprise Risk Mitigation Mechanism

3.2. Resource Dimension: Resource Provision Reconfiguration Mechanism

3.3. Capability Dimension: Enterprise Capability Cultivation Mechanism

3.4. Heterogeneity Analysis

4. Research Design and Methodology

4.1. Econometric Model Specification

4.2. Variable Selection and Measurement

4.2.1. Dependent Variable

4.2.2. Independent Variable

4.2.3. Control Variables

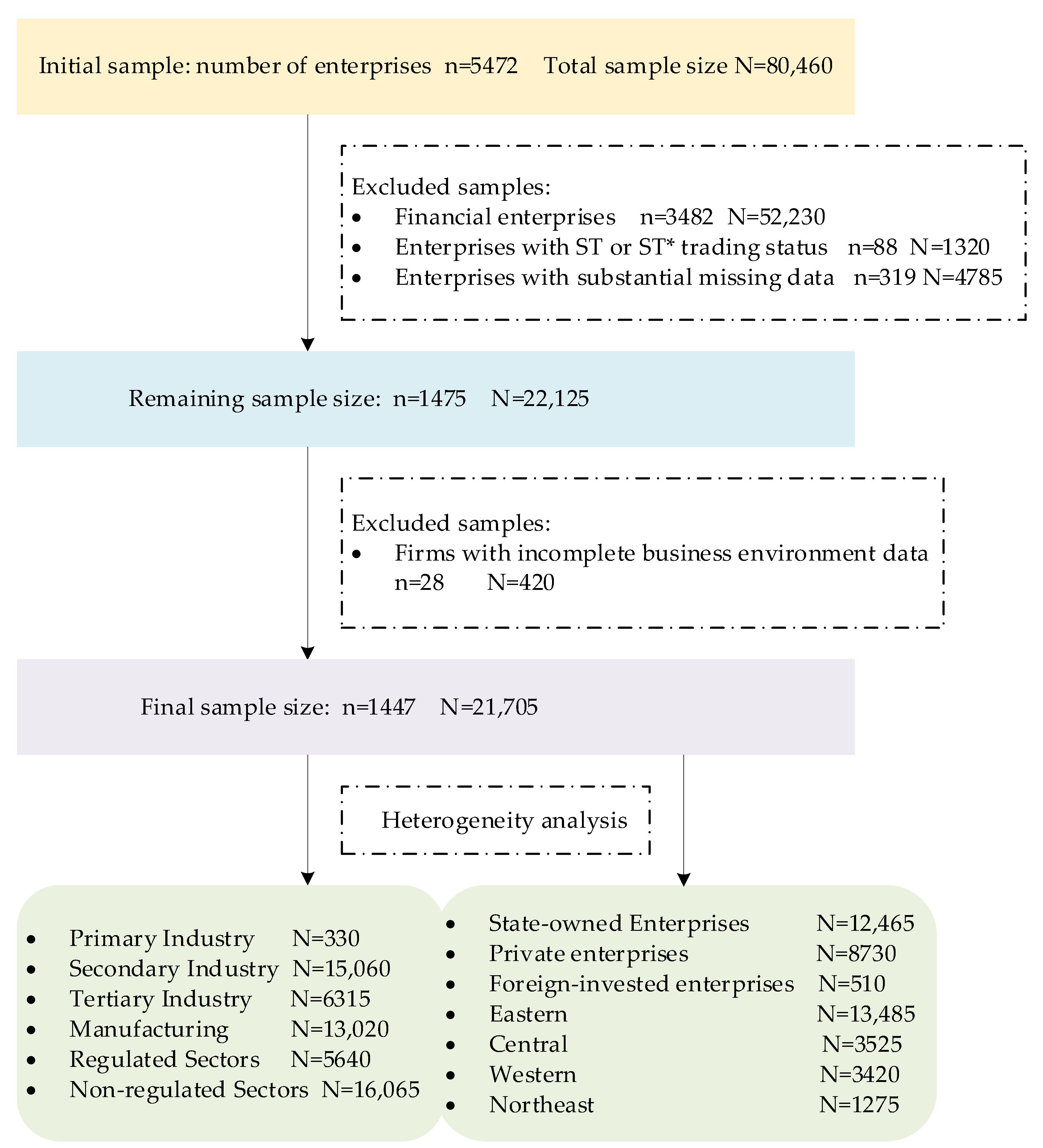

4.3. Data Sources and Processing Procedures

5. Empirical Results and Analysis

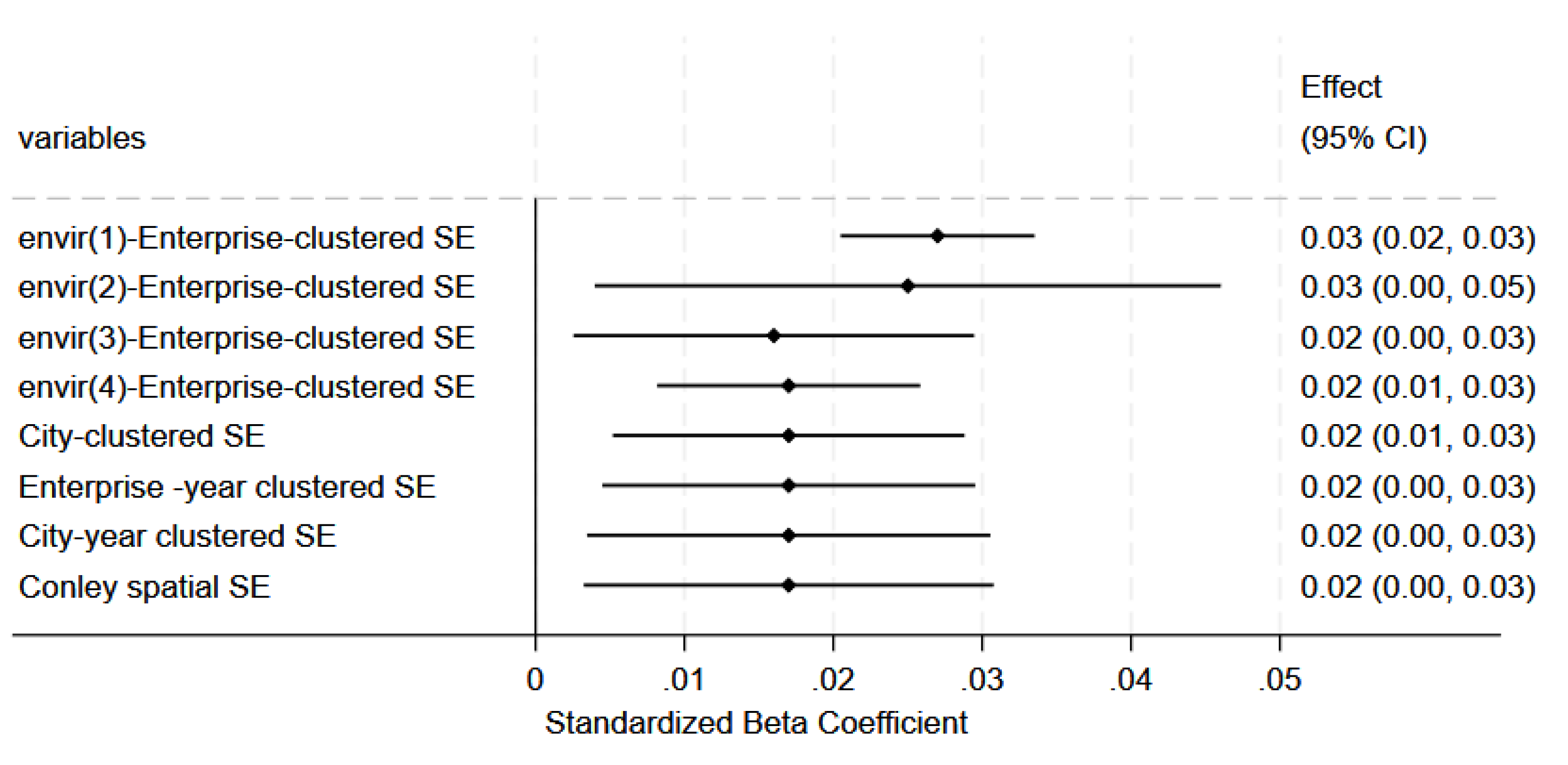

5.1. Impact of Business Environment on Enterprise Vitality

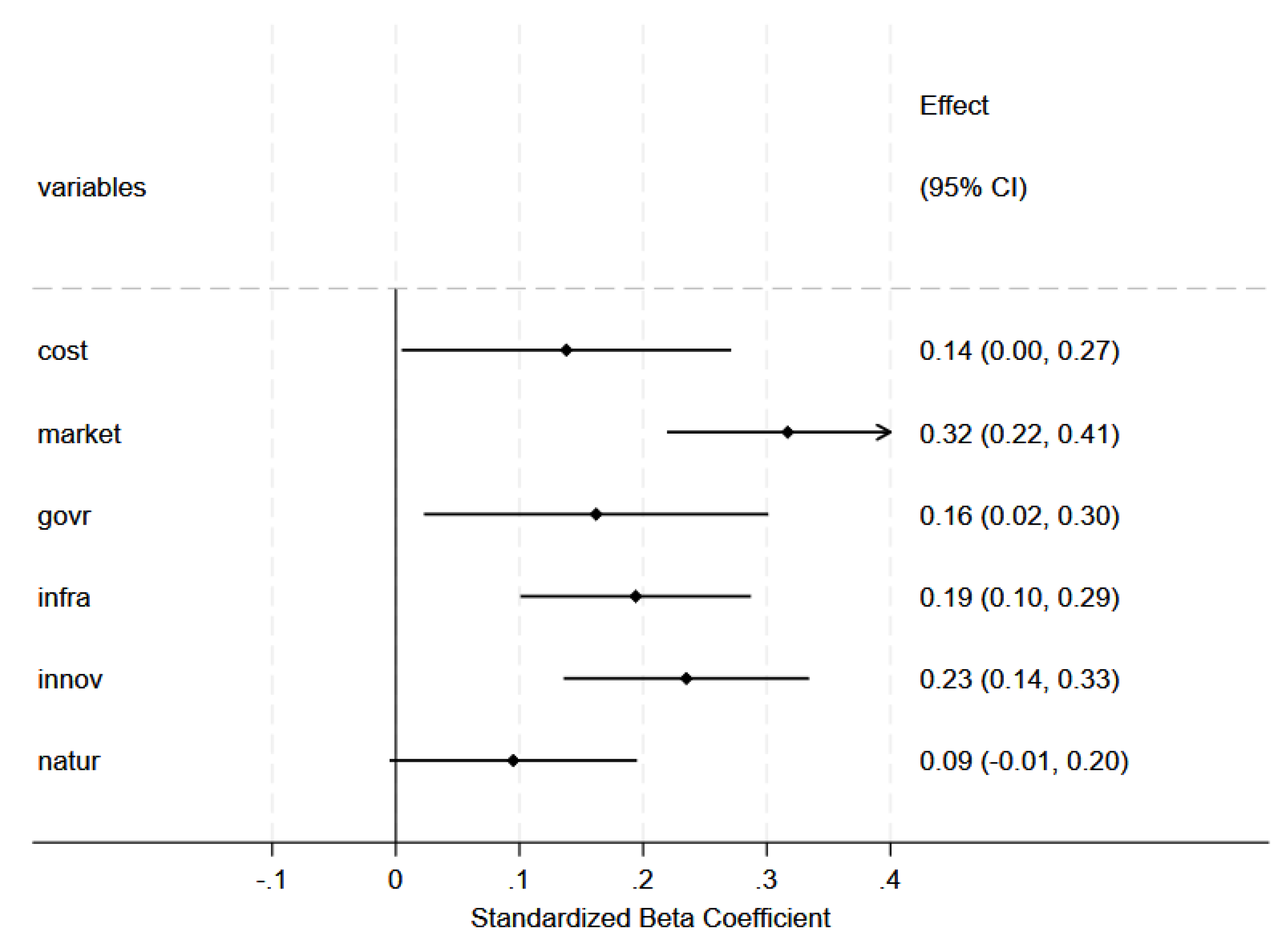

5.2. Effects of Business Environment Subsystems on Enterprise Vitality

5.3. Robustness Check

5.4. Endogeneity Test

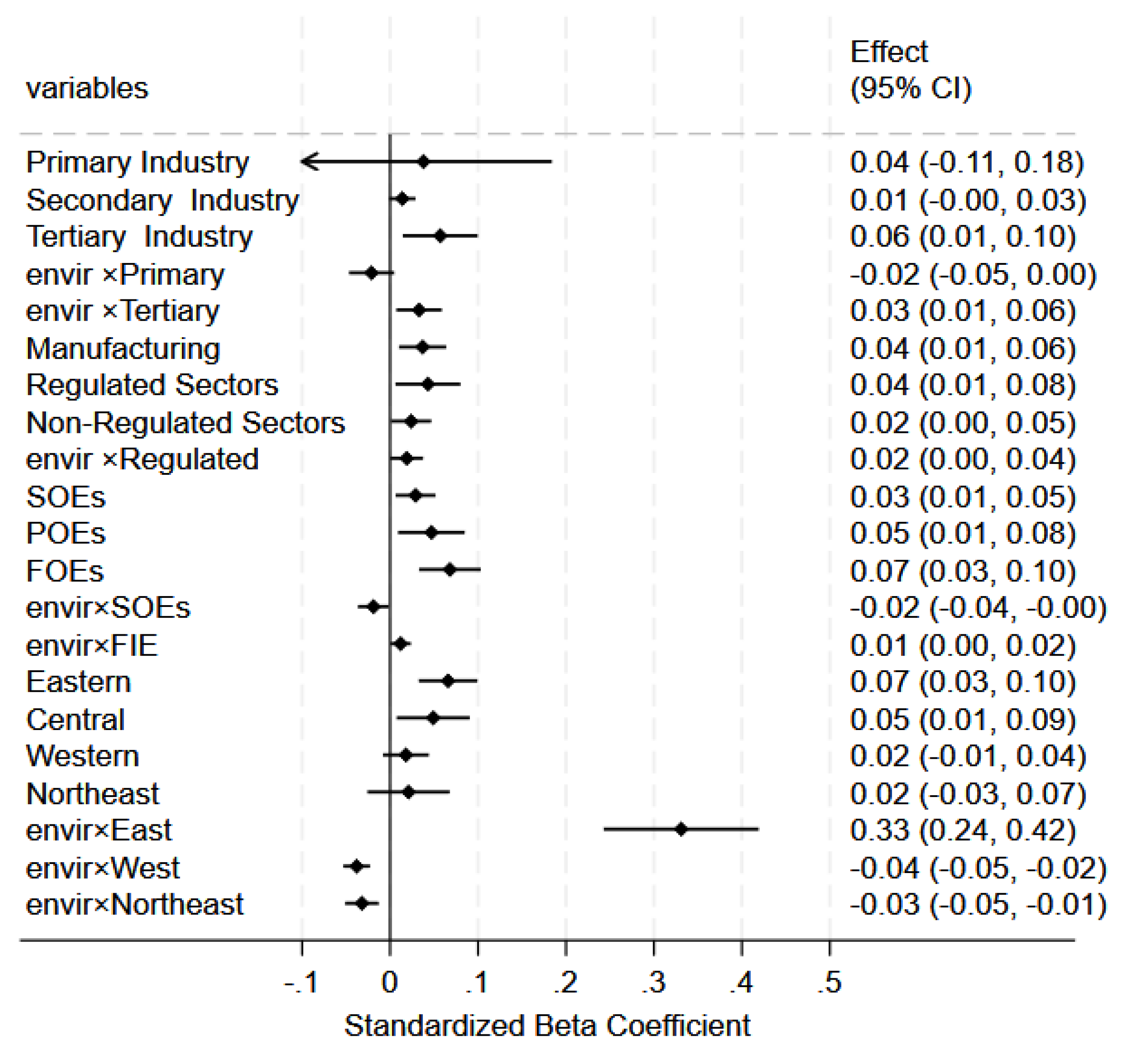

6. Heterogeneity Test

6.1. Industry Heterogeneity

6.2. Ownership Heterogeneity

6.3. Regional Disparities in Business Environment

7. Mechanism Tests

7.1. Test of Enterprise Risk Mitigation Mechanism

7.2. Test of Resource Provision Reconfiguration Mechanism

7.3. Test of Regional Disparities in a Business Environment

7.4. Placebo Testing

8. Conclusions and Policy Implications

8.1. Conclusions

8.2. Policy Implications

9. Discussion

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Bagautdinova, N.G.; Sarkin, A.V.; Gafurov, I.R. Development of the theory and practice of competitiveness Strategies Russian machine-building enterprises. Procedia Econ. Financ. 2014, 14, 23–29. [Google Scholar] [CrossRef][Green Version]

- Yang, G.; Deng, F. The impact of digital transformation on enterprise vitality -evidence from listed companies in China. Technol. Anal. Strateg. Manag. 2023, 36, 3955–3972. [Google Scholar] [CrossRef]

- Wang, X.; Bai, X. Research on the Time and Space Differences in the Measurement of the Level of China’s Enterprise Vitality. Soft Sci. 2022, 36, 91–98. [Google Scholar] [CrossRef]

- Zhao, X.; Wang, J. Financial Development, Institutional Environment and Business Investment Growth -Empirical Analysis Based on Listed Companies in Manufacturing Industry. Financ. Econ. 2020, 29–40. [Google Scholar]

- Li, N.; Xie, Y.; Wang, L.; Jin, Z. Does the Policy of Financial Reform Pilot Zone Alleviate Maturity Mismatch of Corporate Investment and Financing? J. Mod. Finance 2024, 29, 3–14. [Google Scholar] [CrossRef]

- Krammer, S.M.; Strange, R.; Lashitew, A. The export performance of emerging economy firms: The influence of firm capabilities and institutional environments. Int. Bus. Rev. 2018, 27, 218–230. [Google Scholar] [CrossRef]

- Liu, J.; Liu, L. How does the optimization of business environment affect modes of import: Soft environment optimization or hard environment improvement. Ind. Econ. Res. 2022, 99–113. [Google Scholar] [CrossRef]

- Liu, Z.; Wang, H.; Wen, Y. Research on the Effect of Financial Agglomeration and Institutional Quality on Enterprises’ Export Behaviour. China Finance Rev. Int. 2022, 14, 102–123+126. [Google Scholar]

- Dai, X.; Qin, S. How Does Optimization of Business Environment Increase the Domestic Value-added of Enterprise’s Export. J. Int. Trade 2020, 15–29. [Google Scholar] [CrossRef]

- Zhang, J.; Chen, X.; Zhao, X. A perspective of government investment and enterprise innovation: Marketization of business environment. J. Bus. Res. 2023, 164, 113925. [Google Scholar] [CrossRef]

- Khazaei, M. Relationship of profitability of world’s top companies with entrepreneurship, competitiveness, and business environment indicators. Appl. Econ. 2020, 53, 2584–2597. [Google Scholar] [CrossRef]

- Sun, Y.; Wang, T. Does Improved Business Environment Improve Business Performance?—Empirical Evidence based on A-Share Listed Companies from 2008 to 2020 in China. J. Hohai Univ. (Philos. Soc. Sci.) 2022, 24, 121–128+132. [Google Scholar] [CrossRef]

- Gao, Y.; Sun, X.; Liu, N.; Zhang, W.; Xu, J. Complex Business Environment Systems and Corporate Innovation. Systems 2024, 12, 360. [Google Scholar] [CrossRef]

- Tian, J.; Cui, D.; Yuan, H. The Impact of Social Credit System Construction on Investment and Financing Maturity Mismatch of Agriculture-related Enterprises. Rural. Financ. Res. 2024, 55–69. [Google Scholar] [CrossRef]

- Zhang, Q. Business Environment, Tax Burden, and Corporate Performance: Evidence from State-owned Manufacturing Firms. Jiang-Huai Trib. 2022, 50–56. [Google Scholar] [CrossRef]

- Li, W.; Yuan, Q. Knowledge Management-based Enterprise Vitality Shaping: An Organizational Behavior Progressive Model. Bus. Manag. J. 2002, 4–10. [Google Scholar] [CrossRef]

- Zhu, J.; Zhang, Z.; Lee, A.; Hua, Y. Measurement and analysis of corporate operating vitality in the age of digital business models. Appl. Econ. Lett. 2019, 27, 511–517. [Google Scholar] [CrossRef]

- Chen, S.; Liu, Y.; Liu, T. A Study on the Vitality of Enterprises in Guangdong Province: Current Status and Countermeasures. Urban Insight 2020, 20–33. [Google Scholar] [CrossRef]

- Bripi, F. The role of regulation on entry: Evidence from the Italian provinces. World Bank Econ. Rev. 2016, 30, 383–411. [Google Scholar] [CrossRef]

- Yu, W.; Liang, P. Uncertainty, Business Environment and Private Enterprises’ Vitality. China Ind. Econ. 2019, 136–154. [Google Scholar] [CrossRef]

- Wang, S.; Yuan, C.; Liu, Z. Tax Reform, Business Environment and Market Vitality: Debate on the Effect of Policy Synergy. J. World Econ. 2024, 47, 3–29. [Google Scholar] [CrossRef]

- Holland, J.H. Complex Adaptive Systems. Daedalus 1992, 121, 17–30. Available online: http://www.jstor.org/stable/20025416 (accessed on 1 July 2025).

- Tesfatsion, L. Agent-based computational economics: Modelling economies as complex adaptive systems. Inf. Sci. 2003, 149, 262–268. [Google Scholar] [CrossRef]

- Ahmad, M.A.; Baryannis, G.; Hill, R. Defining Complex Adaptive Systems: An Algorithmic Approach. Systems 2024, 12, 45. [Google Scholar] [CrossRef]

- Maitland, R.; Baets, W. The Rise of Emergent Corporate Sustainability: A Self-Organised View. Systems 2021, 9, 35. [Google Scholar] [CrossRef]

- North, D.C. Institutions, Institutional Change and Economic Performance, 1st ed.; Cambridge University Press: Cambridge, UK, 1990; pp. 3–152. [Google Scholar]

- Yao, B.; Liu, J.; Wei, W.; Wei, Y. Business Environment, Entry Barrier and Enterprise Pricing Ability. Econ. Perspect. 2024, 92–111. [Google Scholar]

- Asadzade, Z. The importance of competition in the formation of a favourable business environment. Int. J. Innov. Technol. Econ. 2024, 2, 46. [Google Scholar] [CrossRef]

- Jin, T. Optimising the Business Environment and the Sustainability of New Retail Firms’ Surplus: A Perspective Based on Financing Constraints and Resource Allocation Efficiency. J. Commer. Econ. 2024, 159–162. [Google Scholar]

- Li, Z.; Bai, X. Does Business Environment Break the Political Resource Curse? -An Analysis Based on the Political Affiliation and Firm Productivity. Chin. J. Manag. Sci. 2024, 32, 274–284. [Google Scholar] [CrossRef]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Clarke, G.; Li, Y.; Xu, L. Business environment, economic agglomeration and job creation around the world. Appl. Econ. 2016, 48, 3088–3103. [Google Scholar] [CrossRef]

- Da Silva, A.; Cardoso, A.J.M. Coopetition Networks for Small and Medium Enterprises: A Lifecycle Model Grounded in Service-Dominant Logic. Systems 2024, 12, 461. [Google Scholar] [CrossRef]

- Dabboussi, S. Mitigating emissions in major oil-exporting countries: Accounting for the role of natural resources rents, institutional quality, and business environment. Appl. Econ. 2023, 56, 8422–8436. [Google Scholar] [CrossRef]

- Teece, D.J.; Gary, P.; Amy, S. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. Available online: https://www.jstor.org/stable/3088148 (accessed on 2 July 2025). [CrossRef]

- Nguimkeu, P. Some effects of business environment on retail firms. Appl. Econ. 2015, 48, 1647–1654. [Google Scholar] [CrossRef]

- Chen, Y.; Guo, C. Industrial Diversification, Entrepreneurship, and Urban Economic Resilience. Systems 2025, 13, 366. [Google Scholar] [CrossRef]

- Yu, W.; Liu, L.; Chen, G. The Effect of Government Information Disclosure on the Allocation of Entrepreneurs’ Activities. Econ. Rev. 2023, 40–57. [Google Scholar] [CrossRef]

- Lv, L.; Miao, M.; Guo, L.; Chen, Y. Opening public data and entrepreneurial activity: Evidence from China. Appl. Econ. 2025, 1–16. [Google Scholar] [CrossRef]

- Gogokhia, T.; Berulava, G. Business environment reforms, innovation and firm productivity in transition economies. Eurasian Bus. Rev. 2021, 11, 221–245. [Google Scholar] [CrossRef]

- Zeng, G.; Li, Y. The Innovation Quality Elevation Path of SRDI SMEs: Based on the Perspective of Innovation Incentive Policies and Business Environment Optimization. Soft Sci. 2025, 39, 93–100. [Google Scholar] [CrossRef]

- Shao, C. Entrepreneurship, Regional business environment and Firm Investment Efficiency: New Evidence from China’s Time-Honored Brands. South China J. Econ. 2024, 39–56. [Google Scholar] [CrossRef]

- Sun, Y.; Zhang, X.; Liu, J. The building evaluation system of innovation vitality on enterprises: Based on an exploratory factor analysis. Front. Eng. Manag. 2025, 12, 689–703. [Google Scholar] [CrossRef]

- Yu, J. Local and global principal component analysis for process monitoring. J. Process Control 2012, 22, 1358–1373. [Google Scholar] [CrossRef]

- Bonzo, D.C.; Hermosilla, A.Y. Clustering panel data via perturbed adaptive simulated annealing and genetic algorithms. Adv. Complex Syst. 2002, 5, 339–360. [Google Scholar] [CrossRef]

- Zhang, S.; Kang, B.; Zhang, Z. Evaluation of Doing Business in Chinese Provinces: Indicator System and Quantitative Analysis. Bus. Manag. J. 2020, 42, 5–19. [Google Scholar] [CrossRef]

- Li, Z. Evaluation of the Business Environment in Chinese Cities, 1st ed.; China Development Press: Beijing, China, 2019; pp. 3–152. [Google Scholar]

- Yu, W.; Liang, P.; Gao, N. Can Higher Level of Disclosure Bring Greater Efficiency?—The Empirical Research on the Effect of Government Information Disclosure on Firms’ Investment Efficiency. China Econ. Q. 2020, 19, 1041–1058. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- Bartik, T.J. Who Benefits from State and Local Economic Development Policies? 1st ed.; W.E. Upjohn Institute for Employment Research: Kalamazoo, MI, USA, 1991; pp. 1–380. [Google Scholar]

- Voelkle, M.C.; Oud, J.H.L.; Davidov, E.; Schmidt, P. An SEM approach to continuous time modeling of panel data: Relating authoritarianism and anomia. Psychol Methods 2012, 17, 176–192. [Google Scholar] [CrossRef] [PubMed]

- Du, Y.; Yue, S. Bank-enterprise common shareholders and corporate operational risk. Secur. Mark. Herald 2025, 36–46+57. [Google Scholar]

| Existing Theories | CAS Theoretical Framework | Falsifiable Hypotheses |

|---|---|---|

| IBV • Core proposition: Institutions are viewed as exogenous rule sets, with enterprises adapting to institutional constraints through strategic choices to mitigate risks. • Limitation: Treats institutions as static, thereby overlooking mutual interaction and co-evolution between enterprises and institutions. | Institutional dimension • Institutions are endogenously generated rules within the system, constantly debugged and reshaped through interactions among various actors. Their optimization aims to mitigate systemic risks arising from rule uncertainty and friction, thereby creating stability expectations. • Corresponding subsystems: Government and Public Services Market environment | • H1a and H3b Improvements in the business environment, particularly in the government and public services, are hypothesized to exert a stronger enhancing effect on the vitality of private enterprises. This is because private enterprises are more disadvantaged in interactions with governmental authorities and are consequently more sensitive to refinements in “rulesets”. Should empirical findings demonstrate a stronger effect on state-owned enterprises (SOEs), this hypothesis would be falsified. |

| RBV • Core proposition: Focuses on internal resource endowments of enterprises, which are viewed as the source of competitive advantage. • Limitation: Exhibits a static analytical orientation, failing to adequately explain how external environments dynamically influence the reconfiguration of resource flows and access channels. | Resource Dimension • Resources are conceptualized as “resource flows” circulating within the system. System optimization can reconfigure the pathways, velocity, and direction of these flows, thereby directly reducing factor allocation costs. • Corresponding subsystems: Operational costs Infrastructure Quality | • H1b and H3a Improvements in the business environment, particularly through reductions in operational costs, are hypothesized to exert a stronger enhancing effect on the vitality of manufacturing industries within the secondary industry. This is because such enterprises are most sensitive to cost fluctuations. Should empirical findings demonstrate that business environment enhancements produce stronger effects on the broader secondary industry than specifically on manufacturing industries, this hypothesis would be falsified. |

| DCT • Core proposition: Enterprises adapt to environmental changes through higher-order capabilities (integrating, building…). • Limitation: Often treats capabilities as a “black-box” attribute of enterprises, underestimating the role of external systems in triggering and cultivating such adaptive learning processes. | Capability Dimension • Dynamic capabilities are conceptualized as adaptive learning behaviors manifested through enterprises’ interactions with complex environments. The external environment serves as the bedrock for cultivating and activating such capabilities. • Corresponding subsystems: Innovation Ecosystem Natural Ecology and Environment | • H1c and H3c Optimizing the business environment, particularly the innovation ecosystem, is hypothesized to exert a stronger enhancing effect on enterprise vitality in the eastern region. This is because enterprises in this region exhibit greater dependence on knowledge spillovers and innovation ecosystems for their adaptive learning processes. Should empirical evidence demonstrate stronger effects in the central or western regions, this hypothesis would be falsified. |

| Gaps in Theoretical Synthesis • Limited theoretical perspectives with divergent thematic focus • Emphasis on static analysis to the neglect of dynamic dimensions | Theoretical Breakthrough • Systemic emergence: Enterprise vitality is conceptualized as a macro-level emergent outcome resulting from interactions and couplings among the six subsystems. • Non-linear interactions: The influences of the business environment and its subsystems are not fixed but dynamically evolve across contexts. | • H1 and H2 The theoretical framework predicts that neither business environment nor all its subsystems are universally equally important across all contexts. Their dominant effects can be a priori and directionally predicted based on enterprise characteristics (sector, ownership, region), as specified in H3a, b, and c above. These predictions will be rigorously tested in subsequent empirical analyses. |

| Objective Level | Tier-1 Indicator | Tier-2 Indicator | Tier-3 Indicator | Calculation Formula | Unit | Data Source |

|---|---|---|---|---|---|---|

| Enterprise Vitality | Viability | Solvency Capacity | Debt-to- Asset Ratio | Total Liabilities divided by Total Assets | / | CSMAR Database-China Listed Firms Research Series- Financial Indicators- Solvency |

| Current Ratio | Current Assets divided by Current Liabilities | / | ||||

| Operational Capacity | Total Asset Turnover | Net Operating Revenue divided by Average Total Assets | / | CSMAR Database-China Listed Firms Research Series- Financial Indicators-Operating Capacity | ||

| Current Asset Turnover | Net Operating Revenue divided by Average Current Assets | / | ||||

| Growth | Profitability | Return on Equity | Net Profit divided by Average Net Assets | / | CSMAR Database-China Listed Firms Research Series- Financial Indicators- Growth Capability | |

| Return on Assets | (Total Profit plus Financial Expenses) divided by Average Total Assets | / | CSMAR Database-China Listed Firms Research Series- Financial Indicators-Earning Capacity | |||

| Development Capacity | Operating Profit Growth Rate | Current Year Operating Profit Increase divided by Prior Year Operating Profit | / | CSMAR Database-China Listed Firms Research Series- Financial Indicators-Growth Capability | ||

| Capital Accumulation Rate | Current Year Equity Increase divided by Beginning Equity | / | ||||

| Competitive Capacity | Market Share | Enterprise Operating Revenue divided by Industry Total Revenue | / | CSMAR Database-China Listed Firms Research Series- Financial Indicators-Earning Capacity | ||

| Regeneration | Innovation Capacity | R&D Intensity | Total R&D Expenditure divided by Operating Revenue | / | CSMAR Database-China Listed Firms Research Series-Listed Firm’s R&D and Innovation-R&D | |

| Intangible Assets Ratio | Year-End Net Intangible Assets divided by Year-End Total Assets | / | CSMAR Database-China Listed Firms Research Series- Financial Indicators-Ratio Structure | |||

| Transformation Capacity | 1 divided by Fixed Assets Allocation Ratio | Total Assets divided by Net Fixed Assets | / | CSMAR Database-China Listed Firms Research Series- Financial Indicators-Ratio Structure | ||

| Non-Core Business Profit Margin | Non-Core Business Profit divided by Operating Revenue | / | CSMAR Database-China Listed Firms Research Series- Financial Indicators-Growth Capability |

| Objective Level | Tier-1 Indicator | Tier-2 Indicator | Tier-3 Indicator | Transformations | Unit | Data Source |

|---|---|---|---|---|---|---|

| Business Environment | Operational Costs (cost) | Labor Cost Intensity | Average Annual Salary | natural logarithm | Chinese Yuan (CNY) | EPS Data Platform- China City Database |

| Tax Burden | Local Fiscal Revenue divided by GDP | / | / | |||

| Market Environment (market) | Economic Development | GDP per Capita | natural logarithm | CNY | ||

| FDI Absorption | FDI Inflows | natural logarithm | USD 10,000 | |||

| Household Consumption Expenditure | Retail Sales Volume | natural logarithm | CNY 10,000 | |||

| Fixed Capital Formation | Gross Fixed Capital Formation | natural logarithm | CNY 10,000 | |||

| Government and Public Services (govr) | Government Expenditure-to-GDP | Per Capita Fiscal Expenditure | natural logarithm | / | ||

| Education Service Accessibility | Education Expenditure divided by Total Fiscal Expenditure | / | % | |||

| Healthcare Service Coverage | Hospital Beds per 10,000 Population | natural logarithm | unit | |||

| Financial Market Depth | Outstanding Bank Loans | natural logarithm | CNY 10,000 | |||

| Infrastructure Quality (infra) | Road Infrastructure Density | Road Area per Capita | natural logarithm | m2 | EPS Data Platform- China Urban and Rural Construction Database | |

| Digital Infrastructure Penetration | Broadband Subscriptions | natural logarithm | 10,000 household | EPS Data Platform- China City Database | ||

| Freight Logistics Infrastructure | Road Freight Traffic | natural logarithm | 10,000 metric tons | |||

| Innovation Ecosystem (innov) | Innovation Performance | Patents Granted per 10,000 Population | natural logarithm | per 10,000 persons | China Urban Statistical Yearbook https://www.stats.gov.cn/sj/ndsj/ (accessed on 10 January 2025) | |

| R&D Expenditure Intensity | R&D Expenditure divided by Fiscal Expenditure | / | % | EPS Data Platform- China City Database | ||

| Human Capital Stock | Tertiary Students per 10,000 Population | natural logarithm | person | |||

| Natural Ecology and Environment (natur) | Air Quality Index | PM2.5 Concentration | natural logarithm | μg/m3 | Macro Datas https://www.macrodatas.cn/article/1147473457 (accessed on 25 January 2025) | |

| Urban Green Space Ratio | Green Space per Capita | natural logarithm | m2 | EPS Data Platform-China Urban and Rural Construction Database |

| Variable Name | Variable Symbol | Variable Definition/Transformations | Unit | Data Source |

|---|---|---|---|---|

| Economic development level | lnpgdp | the logarithm of GDP per capita | CNY per person | EPS Data Platform-China City Database |

| Population density | lnden | the logarithm of population density | Persons per square kilometer | |

| Industrial structure | ins | the ratio of secondary and tertiary industry value-added to GDP | / | |

| Enterprise scale | lnsize | the logarithm of the total assets of the enterprise | CNY | CSMAR Database-China Listed Firms Research Series-Financial Indicators-Earning Capacity |

| Ownership concentration | conce | the shareholding percentage of the largest shareholder | % | CSMAR Database-China Listed Firms Research Series-Equity Nature |

| Enterprise age | age | ln(yearc − yearf + 1) | / | CSMAR Database-China Listed Firms Research Series-China Listed Firm’s Basic Information |

| The quadratic term of enterprise age | sage | the quadratic term of enterprise age | / |

| Variables | Mean | Median | Standard Deviation | Minimum | Maximum | Observations |

|---|---|---|---|---|---|---|

| vit | −0.005 | −0.023 | 0.202 | −0.547 | 0.787 | 21,705 |

| envir | 1.392 | 0.920 | 1.655 | −0.952 | 5.983 | 21,705 |

| cost | 0.011 | 0.001 | 0.031 | −0.023 | 0.127 | 21,705 |

| market | 0.153 | 0.008 | 0.429 | −0.324 | 1.767 | 21,705 |

| govr | 0.089 | 0.005 | 0.248 | −0.188 | 1.023 | 21,705 |

| infra | 0.091 | 0.005 | 0.254 | −0.192 | 1.047 | 21,705 |

| innov | 0.103 | 0.005 | 0.290 | −0.219 | 1.192 | 21,705 |

| natur | 0.015 | 0.001 | 0.043 | −0.032 | 0.176 | 21,705 |

| lnpgdp | 10.97 | 11.07 | 0.668 | 9.184 | 12.15 | 21,705 |

| lnden | 7.971 | 7.977 | 0.669 | 6.317 | 9.392 | 21,705 |

| ins | 0.945 | 0.962 | 0.056 | 0.750 | 1 | 21,705 |

| lnsize | 22.00 | 21.88 | 1.359 | 19.03 | 25.81 | 21,705 |

| conce | 0.359 | 0.338 | 0.153 | 0.0870 | 0.750 | 21,705 |

| age | 2.792 | 2.833 | 0.356 | 1.792 | 3.466 | 21,705 |

| sage | 7.915 | 8.027 | 1.914 | 3.210 | 12.01 | 21,705 |

| Variables | Enterprise-Clustered SE | City-Clustered SE | Enterprise-Year Clustered SE | City-Year Clustered SE | Conley Spatial SE | |||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| envir | 0.027 *** | 0.025 ** | 0.016 ** | 0.017 *** | 0.017 *** | 0.017 ** | 0.017 ** | 0.017 ** |

| (8.12) | (2.33) | (2.33) | (3.77) | (2.82) | (2.50) | (2.46) | (2.42) | |

| age | 0.124 *** | 0.179 *** | 0.262 *** | 0.086 *** | 0.086 *** | 0.086 *** | 0.086 ** | 0.086 ** |

| (3.02) | (3.51) | (2.64) | (2.62) | (2.75) | (2.61) | (2.07) | (2.03) | |

| sage | −0.024 *** | −0.040 *** | −0.059 ** | −0.005 ** | −0.005 ** | −0.005 ** | −0.005 ** | −0.005 ** |

| (−3.97) | (−3.74) | (−2.27) | (−2.13) | (−2.15) | (−2.11) | (−2.10) | (−2.02) | |

| lnsize | −0.023 *** | −0.011 *** | −0.012 *** | −0.022 *** | −0.022 *** | −0.022 *** | −0.022 *** | −0.022 *** |

| (−4.32) | (−3.42) | (−3.65) | (−4.34) | (−3.62) | (−4.30) | (−3.61) | (−3.49) | |

| conce | −0.154 *** | −0.020 ** | −0.026 *** | −0.095 *** | −0.095 *** | −0.095 *** | −0.095 *** | −0.095 *** |

| (−4.83) | (−2.09) | (−3.90) | (−3.29) | (−4.07) | (−3.21) | (−2.82) | (−3.65) | |

| lnpgdp | 0.027 *** | 0.012 *** | 0.012 ** | 0.014 *** | 0.014 ** | 0.014 ** | 0.014 ** | 0.014 ** |

| (5.80) | (3.61) | (2.36) | (2.83) | (2.29) | (2.05) | (2.01) | (2.02) | |

| lnden | 0.014 ** | 0.002 ** | 0.003 * | 0.004 * | 0.004 * | 0.004 * | 0.004 * | 0.004 * |

| (2.02) | (2.49) | (1.88) | (1.85) | (1.84) | (1.80) | (1.79) | (1.74) | |

| ins | 0.182 *** | 0.016 ** | 0.017 ** | 0.091 *** | 0.091 *** | 0.091 ** | 0.091 ** | 0.091 ** |

| (3.19) | (2.01) | (2.34) | (2.78) | (2.69) | (2.46) | (2.07) | (1.99) | |

| Constant | 0.723 *** | 0.061 ** | 0.166 ** | 0.494 ** | 0.494 ** | 0.494 ** | 0.494 ** | 0.494 ** |

| (4.82) | (2.39) | (1.99) | (2.14) | (2.45) | (2.08) | (2.40) | (2.06) | |

| Individual FE | No | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time FE | No | No | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry FE | No | No | No | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.036 | 0.018 | 0.024 | 0.606 | 0.606 | 0.606 | 0.606 | 0.606 |

| [95% CI] | [0.02, 0.03] | [0.00, 0.05] | [0.00, 0.03] | [0.01, 0.03] | [0.01, 0.03] | [0.00, 0.03] | [0.00, 0.03] | [0.00, 0.03] |

| Pesaran CD Test | 14.73 *** (p = 0.000) | |||||||

| Observations | 21,705 | 21,705 | 21,705 | 21,705 | 21,705 | 21,705 | 21,705 | 21,705 |

| Variables | cost | market | govr | infra | innov | natur |

|---|---|---|---|---|---|---|

| factor | 0.138 ** | 0.317 *** | 0.162 ** | 0.194 *** | 0.235 *** | 0.095 * |

| (2.03) | (6.36) | (2.28) | (4.08) | (4.64) | (1.86) | |

| Constant | −0.455 *** | −0.498 *** | −0.421 *** | −0.490 *** | −0.463 *** | −0.402 *** |

| (−3.56) | (−3.87) | (−4.35) | (−3.47) | (−4.01) | (−2.63) | |

| Control Variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.152 | 0.157 | 0.209 | 0.123 | 0.223 | 0.164 |

| Partial R2 | 0.008 | 0.038 | 0.011 | 0.015 | 0.022 | 0.003 |

| Quantile Shift Effect | 0.182 | 0.418 | 0.214 | 0.256 | 0.310 | 0.125 |

| [95% CI] | [0.00, 0.27] | [0.22, 0.41] | [0.02. 0.30] | [0.10, 0.29] | [0.14, 0.33] | [−0.01, 0.20] |

| Observations | 21,705 | 21,705 | 21,705 | 21,705 | 21,705 | 21,705 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) |

|---|---|---|---|---|---|---|---|---|

| Excluding Real Estate Companies | Excluding Municipalities | Maximum Likelihood Estimation | Complete-Case Analysis | Without Winsorizing the Sample | Winsorized at the 5% Level | Entrepreneur Characteristic | Measured by a Dynamic Factor Model | |

| envir | 0.030 *** | 0.034 *** | 0.016 *** | 0.019 *** | 0.037 ** | 0.017 *** | 0.027 *** | 0.042 *** |

| (2.81) | (3.25) | (3.69) | (3.34) | (2.24) | (4.48) | (3.29) | (4.75) | |

| bossage | 0.153 | |||||||

| (0.58) | ||||||||

| edu | 0.338 ** | |||||||

| (2.31) | ||||||||

| Constant | −0.679 *** | −0.509 ** | −0.256 *** | −0.312 *** | −0.309 ** | −0.558*** | −0.763 *** | −0.461 *** |

| (−2.81) | (−2.13) | (−2.79) | (−3.02) | (−2.06) | (−2.75) | (−4.82) | (−3.34) | |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.169 | 0.158 | 0.153 | 0.061 | 0.165 | 0.036 | 0.308 | |

| F-statistic | 69.767 | 60.103 | 42.965 | 39.378 | 89.03 | 73.161 | 54.823 | |

| Observations | 20,205 | 17,280 | 21,705 | 13,635 | 21,705 | 21,705 | 21,705 | 21,705 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) |

|---|---|---|---|---|---|---|

| SGMM (2008–2022) | SGMM (2009–2022) | SGMM (2008–2021) | SGMM Lag (2,2) | SGMM Lag (2,3) | SGMM Lag (2,4) | |

| envir | 0.050 ** | 0.015 *** | 0.017 *** | 0.003 ** | 0.004 *** | 0.003 *** |

| (2.19) | (2.77) | (3.39) | (2.44) | (2.85) | (2.62) | |

| L.vit | 0.202 ** | 0.487 *** | 0.447 *** | 0.823 *** | 0.826 *** | 0.822 *** |

| (2.43) | (3.33) | (3.35) | (33.70) | (36.20) | (39.19) | |

| Constant | 0.191 ** | 0.107 *** | 0.116 *** | 0.129 ** | 0.133 ** | 0.136 ** |

| (2.28) | (3.08) | (3.14) | (2.06) | (2.17) | (2.24) | |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry FE | No | No | No | No | No | No |

| AR(1) [P] | 0.001 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| AR(2) [P] | 0.528 | 0.139 | 0.179 | 0.149 | 0.136 | 0.140 |

| Hansen test [P] | 0.307 | 0.295 | 0.312 | 0.322 | 0.311 | 0.309 |

| IV(N) | 28 | 45 | 42 | 66 | 87 | 106 |

| IV-to-panels ratio | 0.019 | 0.031 | 0.029 | 0.045 | 0.060 | 0.073 |

| Diff-in-Hansen tests [P] | 0.114 | 0.157 | 0.128 | 0.172 | 0.123 | 0.118 |

| Observations | 20,145 | 18,600 | 18,600 | 20,145 | 20,145 | 20,145 |

| Variables | L.envir | envir_iv | L.envir and envir_iv | Bartik | All |

|---|---|---|---|---|---|

| envir | 0.061 *** | 0.108 *** | 0.074 *** | 0.856 *** | 0.410 *** |

| (4.81) | (4.77) | (3.98) | (4.63) | (2.89) | |

| Conley spatial SE | 0.059 | 0.068 | 0.061 | 0.203 | 0.312 |

| Chi-sq(1) p-value | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| Kleibergen–Paap rk Wald F statistic | 24.371 | 20.034 | 20.027 | 22.368 | 33.421 |

| Sanderson–Windmeijer F | 35.221 | 21.654 | |||

| Anderson–Rubin 95% CI | [0.036, 0.086] | [0.063, 0.153] | [0.037, 0.111] | [0.492, 1.220] | [0.132, 0.688] |

| Hansen J statistic (p-value) | 0.342 | 0.255 | |||

| Control variables | Yes | Yes | Yes | Yes | Yes |

| Individual FE | Yes | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.163 | 0.085 | 0.164 | 0.174 | 0.796 |

| F-statistic | 188.147 | 249.966 | 188.606 | 105.27 | 75.49 |

| Observations | 15,495 | 16,695 | 15,495 | 21,705 | 15,495 |

| Variables | Primary Industry (1) | Secondary Industry (2) | Tertiary Industry (3) | Manufacturing (4) | Regulated Sectors (5) | Non-Regulated Sectors (6) |

|---|---|---|---|---|---|---|

| envir | 0.038 | 0.014 * | 0.057 *** | 0.037 *** | 0.043 ** | 0.024 ** |

| (0.51) | (1.83) | (2.62) | (2.70) | (2.28) | (2.05) | |

| Constant | 0.294 *** | −0.637 ** | −0.340 *** | −0.454 * | −0.744 ** | −0.690 ** |

| (3.02) | (−2.34) | (−3.62) | (−1.85) | (−2.08) | (−2.19) | |

| Control Variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| [95%CI] | [−0.11, 0.18] | [0.00, 0.03] | [0.01, 0.10] | [0.01, 0.06] | [0.01, 0.06] | [0.01, 0.08] |

| Adjusted R2 | 0.201 | 0.275 | 0.130 | 0.302 | 0.153 | 0.249 |

| F-statistic | 7.260 | 57.140 | 7.941 | 56.726 | 8.144 | 53.278 |

| Observations | 330 | 15,060 | 6315 | 13,020 | 5640 | 16,065 |

| Interaction terms | envir × Primary −0.021 (−1.6) envir × Tertiary 0.033 ** (2.5) | envir × Regulated 0.019 ** (2.00) | ||||

| Wald(P) | (1) vs. (2) 0.329 (3) vs. (2) 0.018 (1) vs. (3) 0.048 | (5) vs. (6) 0.025 | ||||

| BH Adj. Significant | envir × Primary No envir × Tertiary Yes | envir × Regulated Yes | ||||

| Variables | Ownership Heterogeneity | Regional Disparities |

|---|---|---|

| envir (POEs/Central) | 0.051 *** (3.54) | 0.109 *** (2.65) |

| envir × SOEs | −0.019 ** (−2.13) | |

| envir × FIE | 0.012 ** (2.01) | |

| envir × East | 0.331 *** (7.36) | |

| envir × West | −0.038 *** (−4.89) | |

| envir × Northeast | −0.032 *** (−3.28) | |

| Constant | 0.243 *** (2.76) | 0.316 *** (4.56) |

| BH Adj. Significant | Yes | Yes |

| [95% CI] | [0.02, 0.08] | [0.03, 0.19] |

| Control Variables | Yes | Yes |

| Individual FE | Yes | Yes |

| Time FE | Yes | Yes |

| Industry FE | Yes | Yes |

| Adjusted R2 | 0.216 | 0.218 |

| Observations | 21,705 | 21,705 |

| Wald(P) | SOEs vs. POEs 0.038 FIEs vs. POEs 0.061 SOEs vs. FIEs 0.002 | Eastern vs. Central 0.000 Western vs. Central 0.040 Northeast vs. Central 0.062 Eastern vs. Western 0.000 Eastern vs. Northeast 0.000 Western vs. Northeast 0.125 |

| Subsample Results | SOEs 0.029 ** (2.50) POEs 0.047 ** (2.43) FIEs 0.068 *** (3.80) | Eastern 0.066 *** (3.87) Central 0.049 ** (2.31) Western 0.018(1.35) Northeast 0.021(0.88) |

| Variables | Testing the Mechanism of Enterprise Risk Mitigation | Testing the Mechanism of Resource Provision Reconfiguration | Testing the Mechanism of Enterprise Capability Cultivation | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| L_envir | −0.025 ** (−2.23) | 0.015 ** (2.02) | 0.018 ** (2.41) | 0.071 ** (2.11) | 0.204 *** (5.36) | 0.198 *** (3.88) |

| lever | −0.001 *** (−4.40) | |||||

| resour | 0.183 *** (9.14) | |||||

| innov | 0.213 *** (4.73) | |||||

| Constant | 2.044 *** (3.49) | 0.865 *** (4.08) | −0.529 *** (−3.78) | −0.760 *** (−3.60) | 0.523 *** (4.03) | −0.37 *** (−3.44) |

| Control Variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes | Yes | Yes | Yes |

| Adjusted R2 | 0.248 | 0.625 | 0.610 | 0.632 | 0.421 | 0.072 |

| Observations | 20,145 | 18,600 | 20,145 | 18,600 | 20,145 | 18,600 |

| Variables | Testing the Mechanism of Enterprise Risk Mitigation (1) | Testing the Mechanism of Resource Provision Reconfiguration (2) | Testing the Mechanism of Enterprise Capability Cultivation (3) |

|---|---|---|---|

| envir | 0.001 (0.08) | 0.002 (0.43) | 0.016 (1.17) |

| Constant | 2.945 *** (6.25) | −0.618 *** (−4.23) | 0.589 *** (5.01) |

| Control Variables | Yes | Yes | Yes |

| Individual FE | Yes | Yes | Yes |

| Time FE | Yes | Yes | Yes |

| Industry FE | Yes | Yes | Yes |

| Adjusted R2 | 0.248 | 0.611 | 0.403 |

| Observations | 20,145 | 20,145 | 20,145 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, X.; Li, Z.; Cheng, F. How Business Environments Affect Enterprise Vitality: A Complex Adaptive Systems Theory Perspective. Systems 2025, 13, 864. https://doi.org/10.3390/systems13100864

Wang X, Li Z, Cheng F. How Business Environments Affect Enterprise Vitality: A Complex Adaptive Systems Theory Perspective. Systems. 2025; 13(10):864. https://doi.org/10.3390/systems13100864

Chicago/Turabian StyleWang, Xiaolin, Zhenyang Li, and Feng Cheng. 2025. "How Business Environments Affect Enterprise Vitality: A Complex Adaptive Systems Theory Perspective" Systems 13, no. 10: 864. https://doi.org/10.3390/systems13100864

APA StyleWang, X., Li, Z., & Cheng, F. (2025). How Business Environments Affect Enterprise Vitality: A Complex Adaptive Systems Theory Perspective. Systems, 13(10), 864. https://doi.org/10.3390/systems13100864