1. Introduction

The integration of the expanding intricacy of supply chains and the accelerating frequency of black swan events has heightened firms’ vulnerability to a diverse range of risks. Supply chain risks (SCR), which encompass the combination of inherent uncertainties (operational risk) and major events (disruption risk), affecting the supply chain’s capability to fulfill demand in terms of cost, quality, or timeliness [

1], have led to increasingly severe losses and social repercussions for individual firms, as well as for national and global economies. For example, due to the surge in COVID-19 cases, high-exposure sectors in China recorded year-over-year declines of 6.2% in employment, 12.7% in imports, and 21.1% in exports in April 2020 [

2]. Moreover, global supply chain disruptions contributed around 60% of the surge in U.S. inflation from early 2021 through 2022 [

3]. Amid these circumstances, firms face an urgent imperative to develop innovative strategies that enhance supply chain robustness and adaptive capacity in the face of growing external complexity and uncertainty. Data assets serve as a foundational pillar of the digital economy, functioning as a novel class of strategic productive resources alongside labor, capital, and technology [

4]. Via supporting concurrent information dissemination, intelligent decision-making, and resource optimization, data assets facilitate the digital disruption of conventional industries and the emergence of novel digital business models [

5,

6].

As data assets increasingly become a core component of firms’ intangible resources, their strategic and economic value cannot be fully realized without transparent and credible disclosure mechanisms. Data asset information disclosure not only facilitates market participants’ understanding of a firm’s digital capabilities but also reduces information asymmetry [

7], enhances market efficiency [

8], and supports data-driven decision-making [

9]. National policymakers globally have come to acknowledge the strategic value of data assets and have introduced policies to promote their standardized disclosure. For example, the U.S. implemented the Open Data Policy, which required public government data assets to be published as machine-readable data. China issued the Provisional Regulations on the Accounting Treatment of Corporate Data Resources in 2023, followed by the Guidelines on Strengthening the Management of Data Assets in 2024. These regulatory efforts formally incorporated data assets into corporate disclosure practices and specified their accounting treatment. In practice, China Mobile, the largest wireless carrier in China, had disclosed data assets totaling 616 million yuan by the end of 2024, primarily consisting of intangible assets formed through the capitalization of R&D expenditures related to big data products and AI foundation models. Leveraging its big data platform, China Mobile has accumulated over 2000 PB of data resources, achieved the highest domestic level in data governance, and recorded annual data access volumes in the hundreds of billions. These data assets are widely applied across various sectors, encompassing data governance, emergency management, and smart cultural tourism.

The management of SCR has developed into a comparatively mature body of theory. SCR is shaped by a combination of internal, network, external, and technological factors. Internally, early research claimed that demand and supply uncertainties, production capacity constraints, process inefficiencies, and quality problems increased the likelihood of disruptions [

1,

10]. At the network level, high supply chain complexity, geographic concentration of facilities, dependency on key suppliers or customers, and weak relational governance heighten vulnerability [

11]. Externally, natural disasters, geopolitical instability, public health crises, and macroeconomic volatility can trigger severe operational and disruption risks [

12]. Technological and information-related factors, such as limited visibility, weak IT system resilience, and insufficient data analytics capabilities, also impair a supply chain’s ability to anticipate and mitigate the impacts of disruptions [

13,

14]. Together, these drivers determine the scale and nature of SCR, and they also highlight potential leverage points through which effective risk management strategies can be designed.

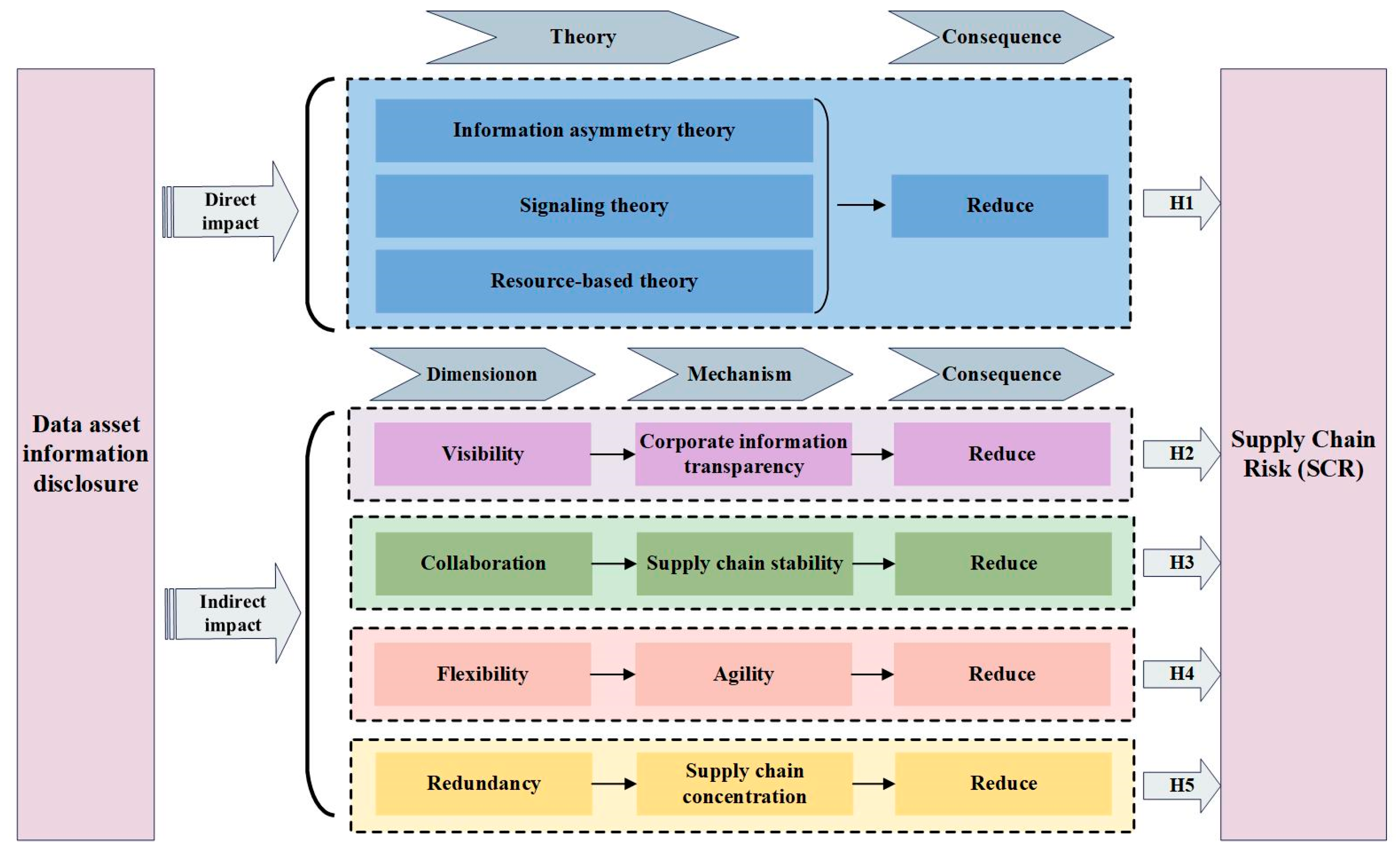

Although the literature on the economic consequences of data asset disclosure and the drivers of supply chain risk is extensive, few studies have explored the relationship between the two. Based on the above analysis, this paper poses the following research questions: Does data asset disclosure mitigate supply chain risk? If so, through which channels does it achieve this? Does this effect differ across firms with varying characteristics? Does the reduction in supply chain risk further promote collaborative innovation within the supply chain? Through these questions, this paper aims to explore how data asset disclosure reduces supply chain risk based on the four-dimensional supply chain resilience framework proposed by Christopher and Peck [

15], and to provide an in-depth analysis incorporating information asymmetry theory, signaling theory, and the resource-based view.

Specifically, enhanced visibility, achieved through the transparent and timely disclosure of operational and logistical data, enables partners to monitor inventory positions, production schedules, and transport flows in real-time, thereby mitigating demand–supply mismatches and forecasting errors [

16]. Improved collaboration, fostered by greater trust in a firm’s data governance and analytics capabilities, facilitates joint planning, information sharing, and coordinated responses to disruptions [

17]. Flexibility is strengthened as comprehensive data access allows both ecosystem participants to swiftly reallocate resources, switch suppliers, or adjust production in response to environmental changes [

18]. Finally, data assets information disclosure supports redundancy by enabling accurate risk assessment, which can justify investments in safety stock, backup capacity, and geographically diversified sourcing to buffer against unexpected shocks [

10]. Through these four resilience capabilities, data assets information disclosure ultimately enhances the supply chain’s capacity to absorb, production function shift, and disruption risks.

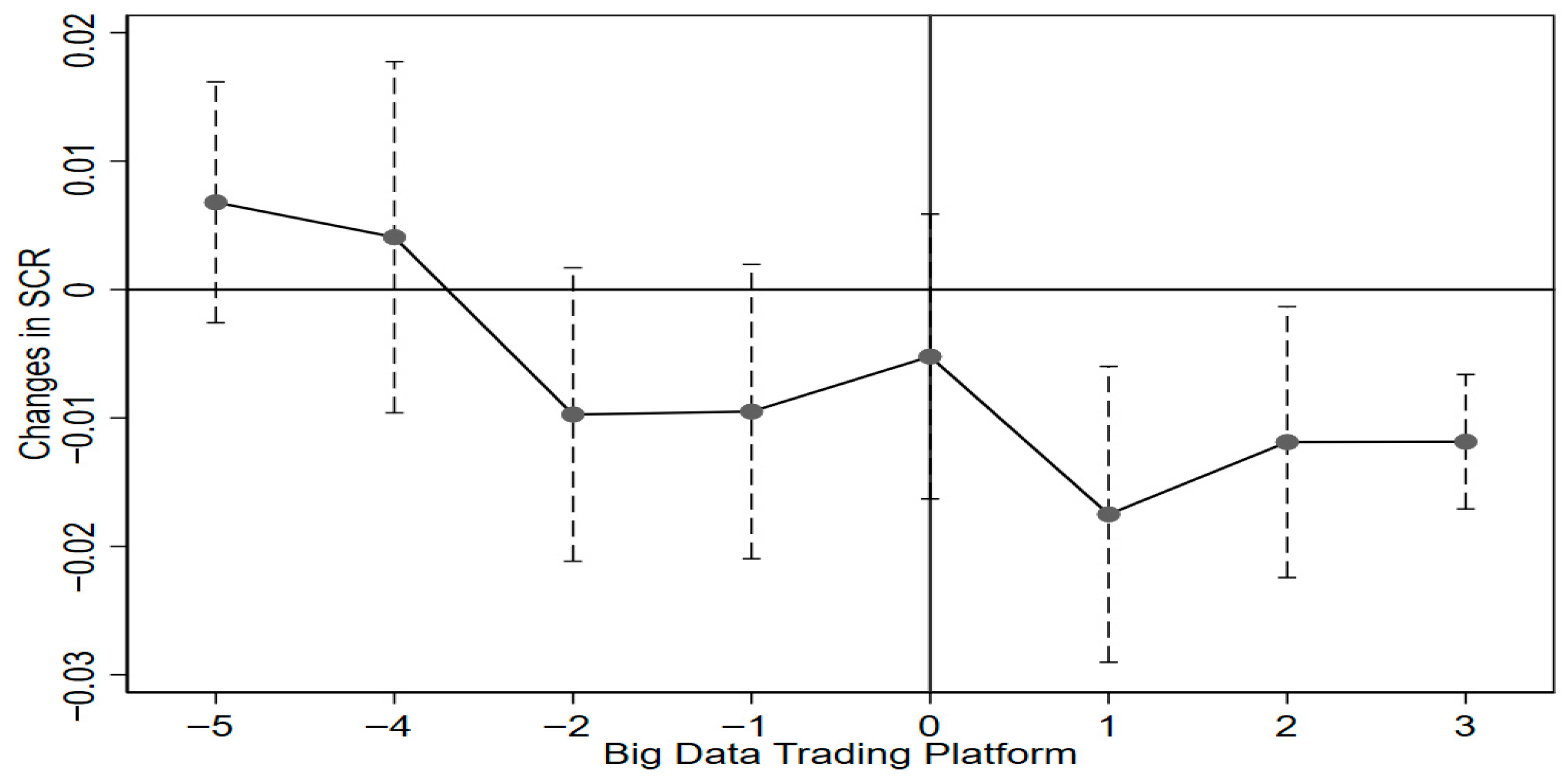

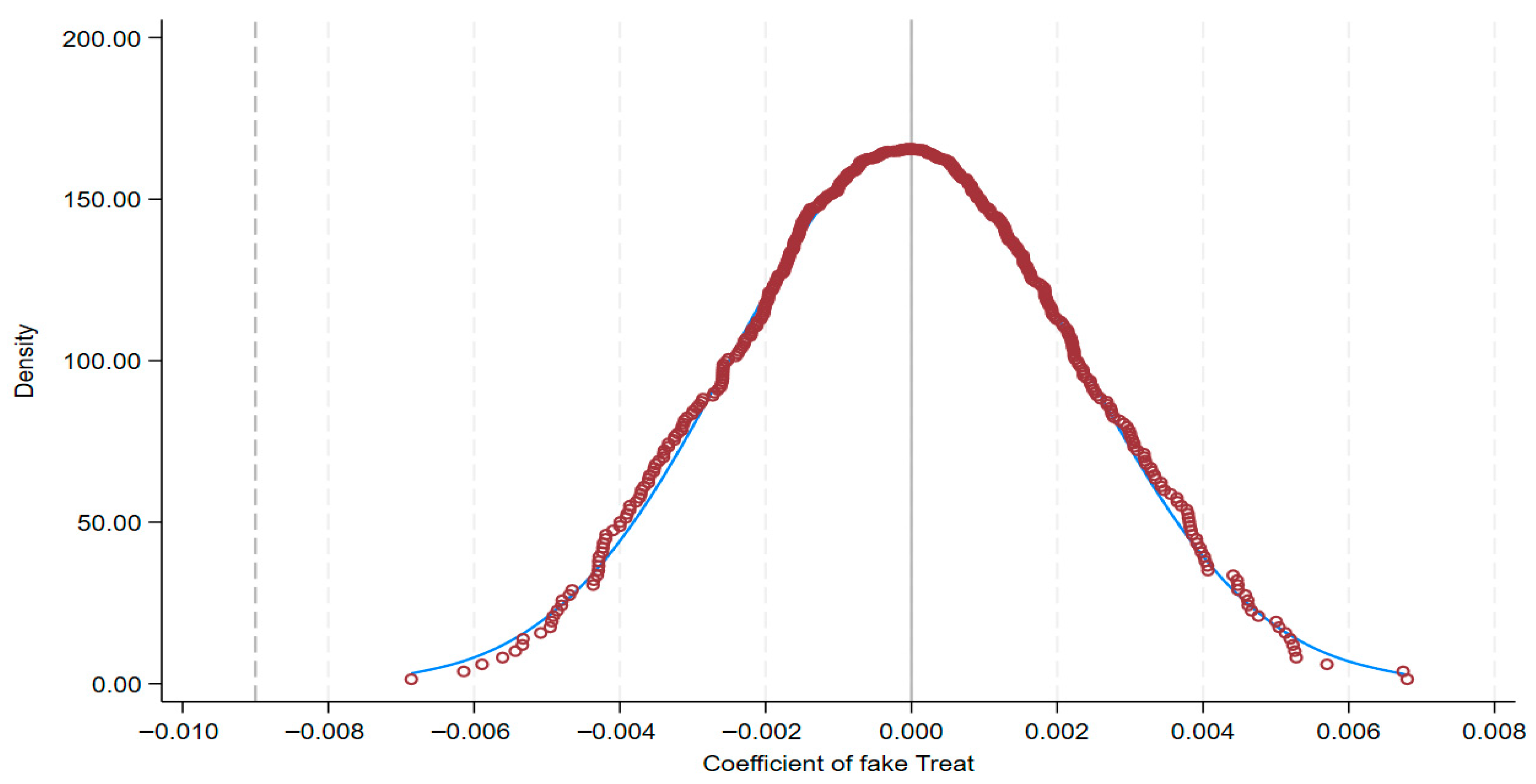

To empirically examine this, we employ a double-debiased machine learning (DDML) model, addressing potential endogeneity concerns through omitted variable tests, instrumental variable estimation, and propensity score matching, and conducting a series of robustness checks to validate the findings. To explore the mechanism channels, we perform causal mediation analysis (CMA), selecting mediating variables corresponding to visibility, collaboration, flexibility, and redundancy. Furthermore, we partition the sample into two groups based on financing constraints, marketization level, and chain master status to examine whether the effect varies across different firm characteristics. In extended analysis, we further uncover that alleviating SCR fosters collaborative innovation within the supply chain via the CMA.

The marginal contribution of this paper lies in threefold. First, unlike prior studies that examine only the economic consequences of data assets information disclosure from the aspects of stock market [

19] and firms’ decision-making [

7,

20,

21], this study provides the first empirical examination of how DAID influences SCR, uncovering the unique role of data assets in SCR management and expanding the boundary of non-mandatory disclosure research. Second, although technology-related factors have been regarded as the drivers of SCR in prior studies [

13,

14], we broaden the current research on the driving force of SCR by unleashing a new internal factor (i.e., data assets information disclosure). The CMA further deepens the understanding of the mechanism of SCR and enriches the toolkit for preventing the risks. Finally, our findings offer valuable implications for SCR management, particularly in the context of increasing global uncertainty. Rooted in the theoretical and empirical research, we propose recommendations at the micro, meso, and macro levels to foster a more resilient supply chain. Consequently, this research extends the theoretical frontier in organizational resource allocation and offers policymakers a solid foundation for balancing innovation-driven growth with SCR prevention.

The remainder of this paper is organized as follows.

Section 2 reviews the relevant literature and presents the theoretical framework and research hypotheses.

Section 3 describes the empirical design.

Section 4 reports and analyzes the empirical results. The final section concludes the paper and discusses the implications of the findings, policy recommendations, limitations, and outlook for future work.

5. Conclusions, Implications and Limitations

5.1. Conclusions

As a key driver of supply chain management, data has gained recognition as a foundational resource and critical factor of production for supply chain optimization and risk mitigation. Drawing on an analytical framework encompassing visibility, collaboration, flexibility, and redundancy, we investigate the mechanisms through which data asset information disclosure influences SCR. Using panel data on Chinese A-share listed firms from 2010 to 2024 and employing a DDML model, the empirical results show that data asset information disclosure significantly reduces SCR, and this conclusion remains robust under alternative specifications of fixed effects and standard errors. To address potential endogeneity concerns, the analysis further incorporates omitted variable tests, instrumental variable estimation, and propensity score matching. In addition, the study tests alternative model specifications, dependent variables, independent variables, fold numbers, machine learning algorithms, and sample periods, all of which consistently support the finding that data asset information disclosure mitigates SCR. CMA reveals that this effect operates through four channels: enhancing information transparency, improving supply chain visibility, strengthening agile response capabilities, and increasing supply chain concentration. Heterogeneity tests further indicate that the impact is more pronounced among firms with lower financing constraints, in regions with higher levels of marketization, and among chain master enterprises. Finally, the results demonstrate that a reduction in SCR contributes to strengthening collaborative innovation capabilities within the supply chain.

5.2. Implications

Building on the above analysis, we contend that coordinated efforts at the micro, meso, and macro levels are essential to advancing the implementation of data asset information disclosure policies and achieving tangible and effective reductions in SCR. Accordingly, this study offers policy recommendations for each of these three dimensions:

First, at the micro level, firms should strengthen their data governance capabilities by enhancing their capacity for data collection, processing, analysis, and sharing, thereby ensuring the authenticity, completeness, and usability of disclosed information and improving supply chain visibility and responsiveness. Second, they should accelerate the development of digital platforms to optimize real-time operational data sharing with supply chain partners, fostering greater value co-creation and trust. Finally, firms should maintain appropriate redundancy to bolster their capacity to respond effectively to unexpected disruptions.

Second, at the meso level, efforts should be made to accelerate the standardization of industry-wide data asset evaluation systems by establishing uniform disclosure formats, thereby enhancing the comparability of supply chain data across industries and firms. In addition, third-party institutions can be encouraged to develop corporate data exchange and collaboration platforms to facilitate the accelerated flow, integration, and optimization of supply chain information.

Finally, at the macro level, regulatory authorities should establish a comprehensive data disclosure framework that, while safeguarding data security, clearly defines the standards and mechanisms for data asset information disclosure to ensure its effectiveness. Governments may implement tax incentives or fiscal subsidies to encourage firms to engage in high-quality disclosure and participate in supply chain data collaboration, thereby reducing the costs associated with digitalization. Furthermore, a SCR monitoring platform could be developed to enable dynamic cross-regional and cross-industry surveillance, coupled with timely emergency response measures.

5.3. Limitations and Outlook for Future Work

This study is subject to certain limitations.

First, the application of data assets is continually evolving, and the associated terminology is likewise undergoing constant change. Moreover, data assets have yet to be established as a standardized term in corporate disclosure practices, which may affect the comprehensiveness of the keyword-based measurement of data asset information disclosure. In addition, in constructing DAID we retain only terms with a similarity coefficient greater than 0.5, and the sensitivity of results to this parameter choice remains to be explored.

Second, China has a relatively comprehensive top-down system of data governance and digital economy policies. Firms disclose data assets and data governance structures in their annual reports not only to meet operational needs but also to comply with policy and regulatory requirements. As a result, the mitigating effect on supply chain risk is more pronounced in the Chinese context. Accordingly, this study is limited to Chinese listed firms. Future research can explore cross-country evidence on the nexus between DAID and supply chain risk.

Finally, although we control for year and industry fixed effects and include a rich set of covariates in the CMA, we may not fully rule out the possibility that time-varying unobserved factors within the same year–industry dimension may jointly affect the mediator and the outcome. Future research could incorporate exogenous structural shocks or instrumental variables to further relax the identification assumptions of CMA.