1. Introduction

FDI uniquely connects domestic and international markets, playing a crucial role in enabling emerging markets to accelerate the establishment of a new development paradigm and foster high-quality growth. The proactive attraction and utilization of FDI are essential components of advancing high-level openness and constructing a new open economy [

1]. Since the initiation of reform and opening up, China has emerged as one of the most successful developing nations in attracting FDI, leveraging its resource advantages in land, labor, and energy, alongside its active engagement in the international division of labor, as well as its expansive market and significant potential [

2]. According to the World Investment Report [

3], China’s FDI scale surpassed that of other countries for the first time in 2014, positioning it as the world’s largest recipient of FDI inflows, overtaking the United States. In 2023, 53,766 new foreign-invested enterprises were established in the country, reflecting a year-on-year increase of 39.7%. The actual FDI utilized amounted to 11.33 trillion Yuan, which remains historically high. Over the years, foreign-invested enterprises have become significant market players in China. However, the current uncertainties in the international environment and the escalating geopolitical tensions have introduced new challenges to China’s FDI utilization. On one hand, the growing divergence in economic development among countries has resulted in a decline in external demand, rendering it unstable and unreliable [

4]. On the other hand, the increasing uncertainty in the global economic landscape and the rising pressure on domestic factor costs in China have intensified international competition for capital attraction. Thus, there is an urgent need to investigate how to establish a more advanced open economic system and create a first-class business environment that is market-oriented, rule-of-law-driven, and internationalized [

5]. This approach aims to attract high-quality FDI and ensure that it effectively contributes to the economy’s high-quality development.

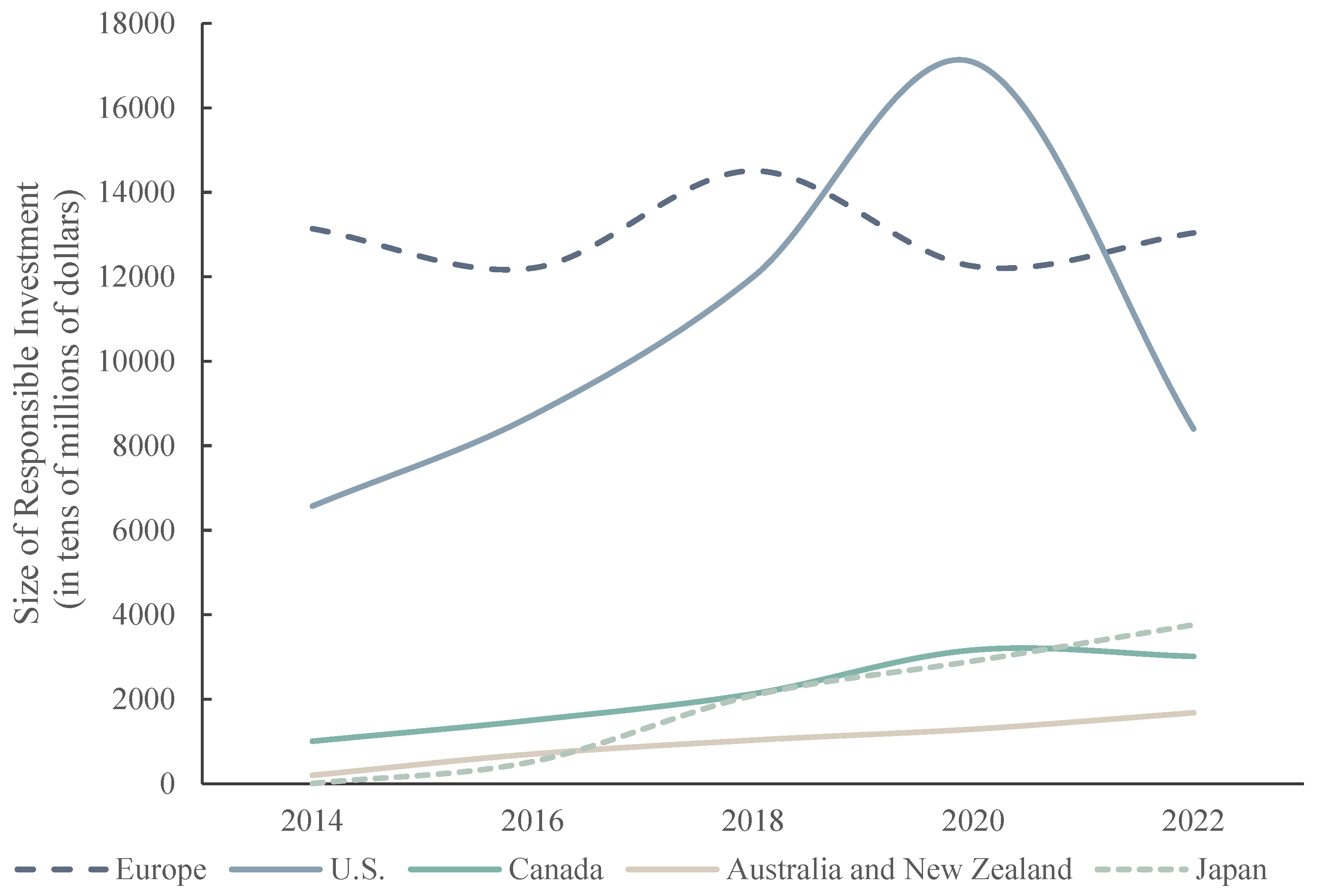

In recent years, the demand for green recovery has driven a significant increase in the scale of global responsible investment (see

Figure 1). The social responsibility requirements stemming from sustainable development are reshaping the business philosophies of enterprises across various countries. Consequently, environmental factors are playing an increasingly critical role in the decision-making processes of FDI enterprises in China [

6]. On one hand, corporate environmental responsibility has become a crucial component of strategic management in developed Western countries. Increasingly stringent laws and regulations in these regions, particularly in Europe and the United States, mandate that listed companies disclose their sustainable development practices. Many organizations have also integrated Environmental, Social, and Governance (ESG) criteria into their research and investment decision-making processes. Consequently, FDI enterprises with advanced environmental technologies are more likely to expand their investments in regions with higher levels of environmental governance, seeking new opportunities for their emerging green technologies and products [

7]. On the other hand, FDI that flows into China predominantly targets the manufacturing, mining, and power sectors, which, while experiencing rapid growth, have also contributed to significant environmental degradation. In response to China’s stringent environmental regulations, polluting FDI enterprises are compelled to invest heavily in pollution-control measures, thereby constraining their sustainable development potential in host countries [

8]. This dynamic has led to a declining share of polluting FDI in the market and has catalyzed an upgrade in the quality of FDI.

Cities are a crucial unit in China’s economic and social development, and their green, low-carbon initiatives significantly contribute to achieving the country’s overall low-carbon goals, thereby advancing sustainable development [

9]. Currently, the low-carbon city pilot policy (LC), which emphasizes administrative order-based environmental regulation, serves as the central strategy in China’s response to global climate change [

10]. When high-quality FDI enterprises with strong management capabilities, technological advantages, and substantial capital establish operations in low-carbon pilot cities, these cities can foster a conducive low-carbon and environmental ecosystem. This environment not only enables enterprises to secure increased financial support for environmental protection but also encourages them to actively engage in green innovation activities. These activities include developing effective countermeasures to minimize negative impacts and seeking viable solutions [

11]. Additionally, China has introduced a carbon emissions trading scheme (ETS) that emphasizes market incentives for environmental regulation [

12]. This approach integrates the market’s flexible regulatory functions with greenhouse gas emissions control, aiming to manage carbon emissions in a cost-effective manner while creating new pathways to address the increasing conflict between environmental sustainability and development. As a result, this policy significantly enhances the environmental responsibility of high-quality enterprises.

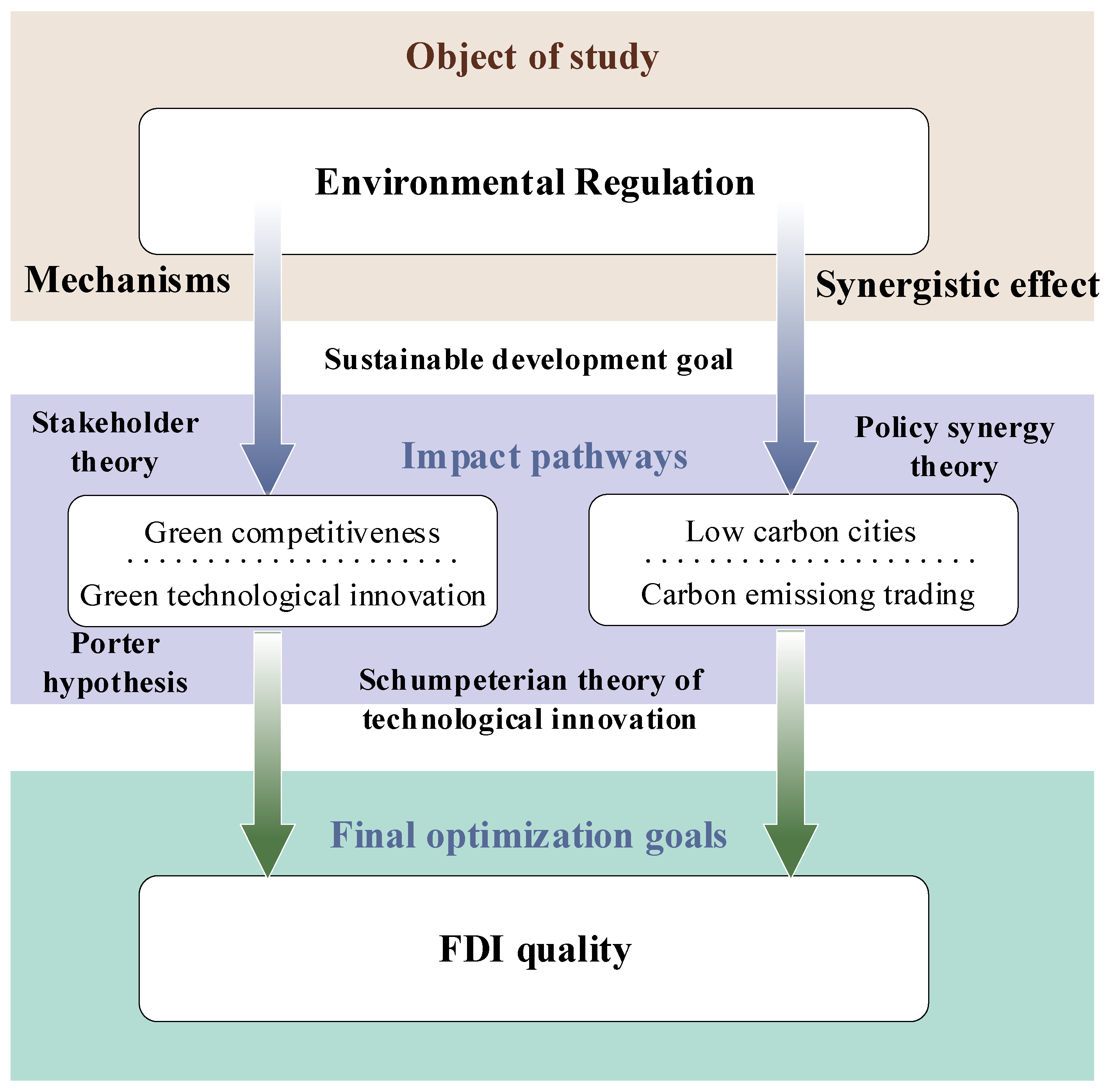

This raises several questions: As a manifestation of China’s green development concept, can the pilot low-carbon city policy, which focuses on executive-directed environmental regulation, and the market-incentivized ETS both positively influence the attraction of high-quality FDI? If so, can the positive effects of both be characterized as “having both the fish and the bear’s paw”, or as “two evils in harmony and two benefits in separation”? Building on a theoretical analysis of the relationship between ER and FDI quality, this study examines the direct impacts, pathways, synergistic effects, and heterogeneity of environmental regulation on the quality of regional FDI through the construction of an empirical model. The findings aim to provide insights for decarbonization practices and support the pursuit of high-quality, sustainable economic development in emerging markets, such as China. Specifically, this study develops a theoretical framework based on policy synergy theory, Porter’s hypothesis, and the pollution shelter hypothesis to examine the relationship between environmental regulation and FDI quality. FDI quality is measured as the core explanatory variable using panel data from China’s prefectural-level municipalities, spanning 2005 to 2021. A difference-in-differences (DID) model is constructed to empirically analyze the impact of environmental regulation on FDI quality while also assessing the synergistic effects of the LC and ETS. Various methods are employed to test the robustness of the empirical results. Subsequently, we construct a mechanism-testing model to investigate the role of green competitiveness and technological innovation capability. We also explored the heterogeneity of this facilitating effect across subgroups concerning environmental protection efforts and urban factor endowments. Furthermore, we examine the spatial perspective on the relationship between ER and FDI quality.

Our findings may contribute as follows:

First, most existing studies tend to evaluate the effects of LC or ETS within separate frameworks, with limited focus on comparing the differences in their impacts. Furthermore, there is a notable lack of research on the synergistic effects of these two distinct types of environmental policies. The theory of policy synergies posits that analogous policy instruments enable different components of the policy system to collaborate, resulting in comprehensive effects [

13]. By integrating policy synergy theory, Porter’s hypothesis, and the pollution heaven hypothesis with a theoretical clarification of existing research findings, this study comprehensively analyzes the heterogeneity of these two environmental policy types. This approach not only expands the theoretical framework of sustainable development and green governance but also provides empirical insights for the formulation of future environmental regulations.

Second, FDI quality combines capital stock, technological advancement, and managerial expertise [

14]. Within the context of high-quality economic development, existing studies widely acknowledge the positive role of FDI. However, most research has focused on the dynamics of FDI from a quantitative perspective, often overlooking the “quality” of FDI. By exploring the relationship between environmental regulation and FDI quality, our study enriches the theoretical literature on the factors influencing FDI. Furthermore, it offers valuable practical insights on stabilizing and sustaining FDI growth, particularly regarding strategies to promote high-quality FDI inflows that enhance the quality and efficiency of emerging market economies.

Third, regarding research methodology, this study employs LC and ETS as exogenous shocks. It utilizes propensity score matching with DID and placebo tests to mitigate sample selection bias, thereby addressing endogeneity issues and verifying the robustness of the findings. Additionally, the analysis includes a comprehensive examination of heterogeneity based on the strength of urban environmental protection and factor endowments. It investigates the channels through which environmental regulations influence FDI quality, focusing on green competitiveness and green innovation. Finally, we also examine the relationship between ER and FDI quality from a spatial perspective. This research provides empirical evidence to enhance coordination between LC and ETS, fostering policy synergies that promote the continuous improvement of FDI quality in China.

3. Methodology

3.1. Methods

As two significant policies for environmental regulation in China, the exogenous impacts of the dual pilots of the LC and ETS on the pilot cities manifest in two dimensions: the ‘individual effect’ and the ‘time effect’. The ‘individual effect’ refers to the differences between pilot and non-pilot cities, while the ‘time effect’ pertains to the duration of the policy impact. When examining the aforementioned effects, most scholars currently employ the traditional DID model to evaluate the impacts of policy implementation [

51]. The DID model is grounded in the principles of randomized experiments, enabling the identification of both individual and time-series double differences resulting from exogenous policy interventions. It effectively eliminates factors that change over time and lack identifiability. Compared to conventional methods of policy effect assessment, the DID model adeptly addresses the endogeneity problem, ultimately allowing for the accurate identification of genuine policy effects. Considering that the LC and ETS pilots have different specific times of policy implementation in different regions, this paper uses a multi-period DID model to test the impact of environmental regulation and FDI quality.

We construct the following model:

In Equation (1), i and t represent the city and year, respectively. QFDIi,t serves as the dependent variable in this study, indicating FDI quality. The variable didi,t is the central explanatory variable, representing ER through the cross-multiplication of year and individual dummies. Specifically, didi,t = 1 indicates that city i has been designated as a dual-pilot (LC and ETS) city in year t; otherwise, didi,t = 0. The coefficient β reflects the DID statistic, which is of primary interest in this analysis, capturing the net effect of establishing dual-pilot cities on FDI quality. If β > 0 and is statistically significant, it suggests that implementing ER significantly enhances FDI quality at the city level. Conversely, if β < 0 and is significant, it indicates a considerable reduction in FDI quality due to these regulations. If β is not statistically significant, it implies that environmental regulation does not have a meaningful impact on FDI quality in the city context. The term Xi,t represents other control variables that may influence FDI quality, while εi,t denotes the random disturbance term.

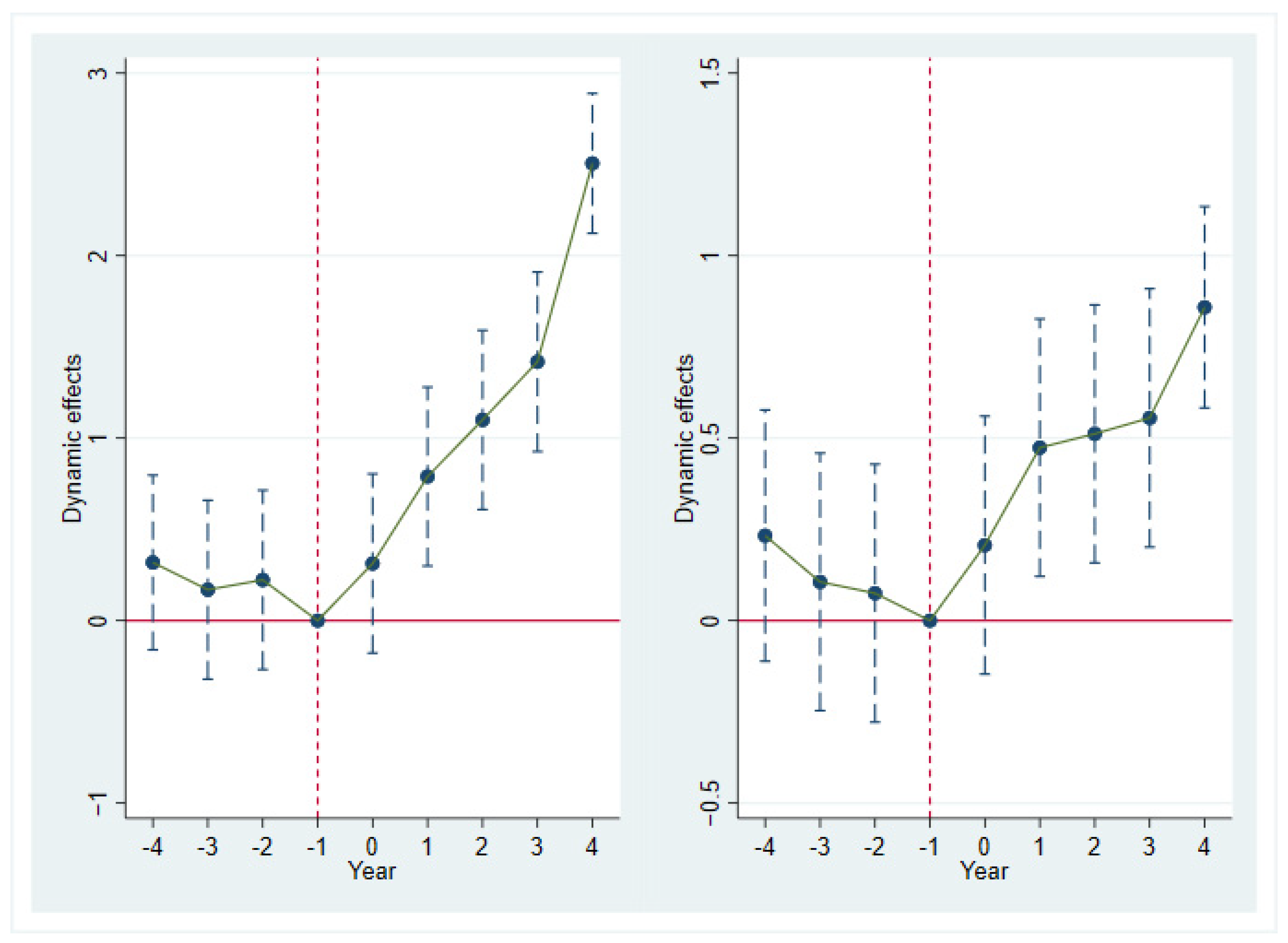

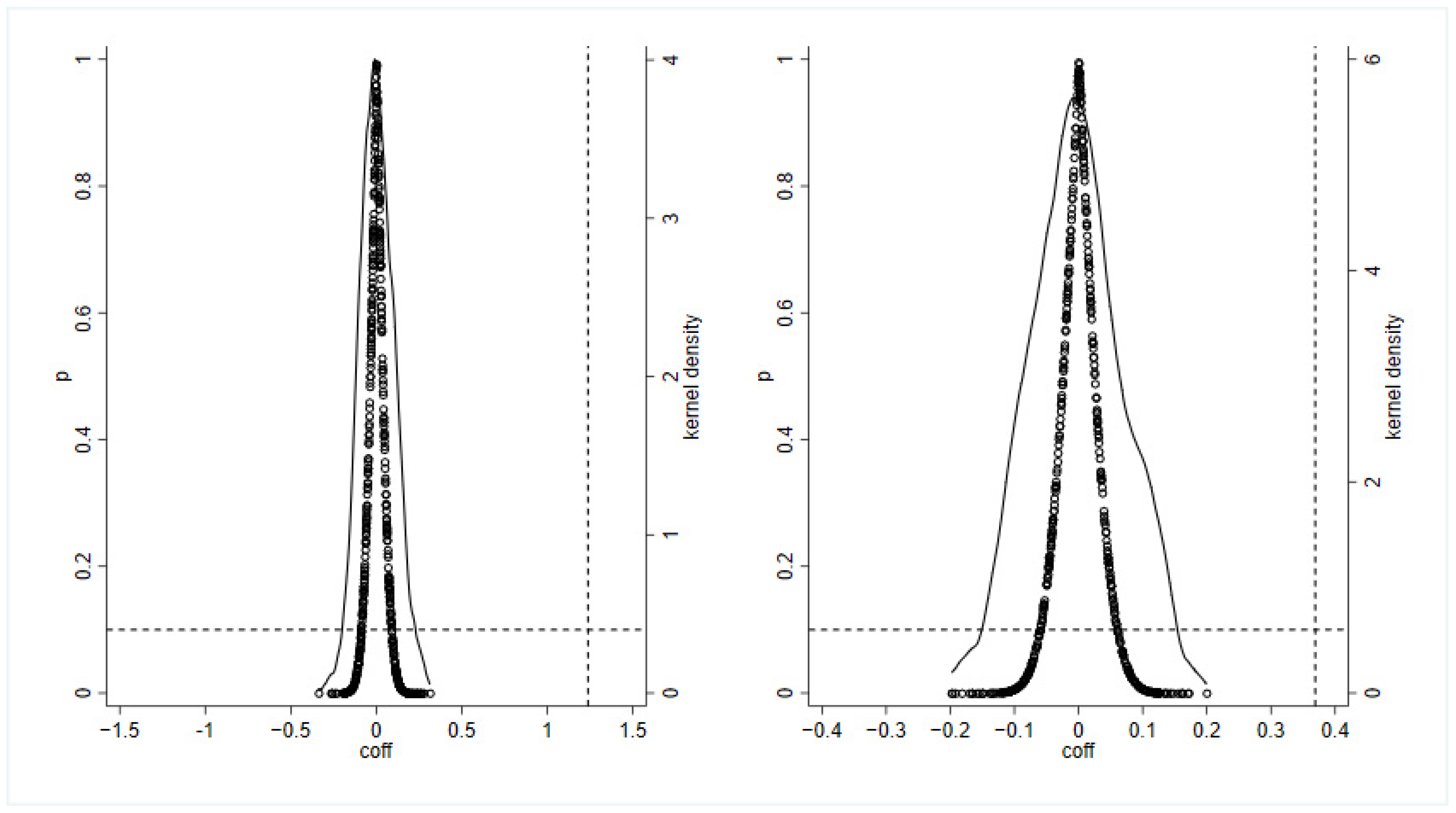

To meet the requirements for employing the DID model, it is essential to pass the common trend test. This entails that the tested variables exhibit consistent time effects or trends in both the experimental and control groups prior to the policy intervention; failure to do so may result in an overestimation or underestimation of the ER implementation effect in Equation (1). We assess the common trend hypothesis using an event analysis approach, selecting four periods before and four periods after the policy implementation to evaluate and analyze the dynamic effects of ER. The specific model construction is as follows:

In Equation (2), didi, t − j represents the cross-multiplier of the city dummy variable and the year dummy variable, assigned a value of 1 when the city implements the ER in year t − j; otherwise, it takes a value of 0. The coefficients β0, β−4 to β−1, and β1 to β4 correspond to the years surrounding the implementation of ER, specifically the four years prior to implementation and the four years following it. If the coefficients β−4 to β−1 are not statistically significant, this supports the validity of the common trend hypothesis.

To explore the transmission mechanism of “ER—FDI quality”, this study selects mechanistic variables that are theoretically related to FDI quality or congruent with common understanding. The analysis employs a combination of model regression and literature review to test these mechanisms.

In the first step, based on Equation (1), we assess whether the policy variable did has a significant effect on the explanatory variable

QFDI. In the second step, we construct Equation (3) to examine the impact of the policy variable did on the mechanism variable

M. In the third step, if the tests show significant effects of the policy variable did on both the explanatory variable

QFDI and the mechanism variable

M, we will conduct an empirical analysis informed by relevant theories and existing research to determine whether the influence pathway is realized. Consequently, this paper establishes the following mechanism testing model:

In Equation (3), Mi,t represents the mediating variable, while the coefficient β denotes the effect of the ER on this mediating variable. The remaining variables are consistent with those in the baseline model.

We construct a spatial econometric model to examine whether there is a spatial spillover effect of ER on FDI quality. We establish Equations (4)–(6):

Here, Equation (4) is denoted as the Spatial Error Model (SEM), which is able to identify the effect of spatial variables on the measurement space. Th variable

θ denotes the spatial error coefficient, and

W denotes the spatial weight matrix. Equation (5) is expressed as a spatial lag model (SAR) that is able to identify the impact of the dependent variable in the region on the dependent variable in its neighboring regions. The variable

γ denotes the coefficient of the spatial lag term of

QFDI. Equation (6) denotes the Spatial Durbin Model (SDM), which is able to identify both the impact of explanatory variables on the explained variables within the region and reflect the spatial spillover impact of the explanatory variables in the region on the explanatory variables in neighboring regions. The variable

ρ denotes the coefficient of the spatial lag term of

did.

The foundation for developing a spatial econometric model to assess whether the ER has spatial spillover effect on FDI quality lies in the necessity to determine if FDI quality exhibits spatial relevance. To examine this spatial correlation, we utilize the Moran’s I’ index. The calculation of the Moran’s I’ index is provided in Equations (7)–(9):

Here,

S2 is the variance of

QFDI,

is the mean value of

QFDI, and

n is the number of sample cities. If Moran’s I is greater than 0, it means that there is a positive spatial correlation between the provinces, and vice versa for negative correlation.

3.2. Variables

3.2.1. Dependent Variable

There is currently no broad consensus among established studies regarding the measurement of FDI quality. Based on the findings of Shangguan and Guo [

52] and Ye et al. [

53], we categorize the quality of FDI in the following two ways:

(1) Average size of FDI (

QFDI1) is measured by the ratio of the actual utilization of foreign capital to the number of foreign investment projects in the sample cities (see Equation (10)). Generally, a larger average size of FDI indicates a more pronounced driving effect on profit growth, scale expansion, technology upgrading, and the regional export capacity of local enterprises. It also suggests a stronger capacity for environmental protection, particularly in energy conservation and emission reduction, thereby increasing the likelihood of adopting proactive measures for the implementation of various environmental regulations.

(2) FDI performance index (

QFDI2) encompasses both the overall scale of FDI inflows and the external spillovers of FDI to the host country. These external spillovers comprehensively reflect the economic, social, and technological benefits generated by FDI during localized production in the host nation. This study adopts the FDI performance index published by the United Nations Conference on Trade and Development in the World Investment Report to construct the FDI performance index for each region (see Equation (11)). This index measures the degree of FDI attraction in a region; a higher degree of FDI inflow indicates more pronounced effects on economic growth, technological spillovers, and industry linkages associated with FDI.

QFDI2 denotes the amount of foreign investment actually utilized in city i in year t, while FDIi,t represents the total amount of foreign investment used in the entire country during the same year. GDPi,t refers to the Gross Domestic Product (hereinafter referred to as GDP) of city i in year t, whereas GDPi,t indicates the GDP of the entire country in that year.

3.2.2. Independent Variable (didi,t)

In this paper, the dual-pilot environmental policies of LC and ETS are treated as a quasi-natural experiment. Given the temporal sequences and geospatial differences in the implementation of these policies, the asymptotic DID model is employed as the empirical method, with policy dummy variables serving as the core explanatory variables.

First, the variable Treati is defined as the pilot city dummy variable; if a sample city is included in both pilot policy lists simultaneously, it is classified as the treatment group and assigned a value of 1; otherwise, it is assigned a value of 0. Second, the variable Timet is established as the time dummy variable, where a city that becomes a dual-pilot in a given year and in subsequent years is assigned a value of 1; otherwise, it is assigned a value of 0. Finally, the interaction term between the city dummy and the time dummy is designated as the core explanatory variable for this study. Thus, the interaction term of the city dummy variable and the time dummy variable is defined as the policy dummy variable didi,t.

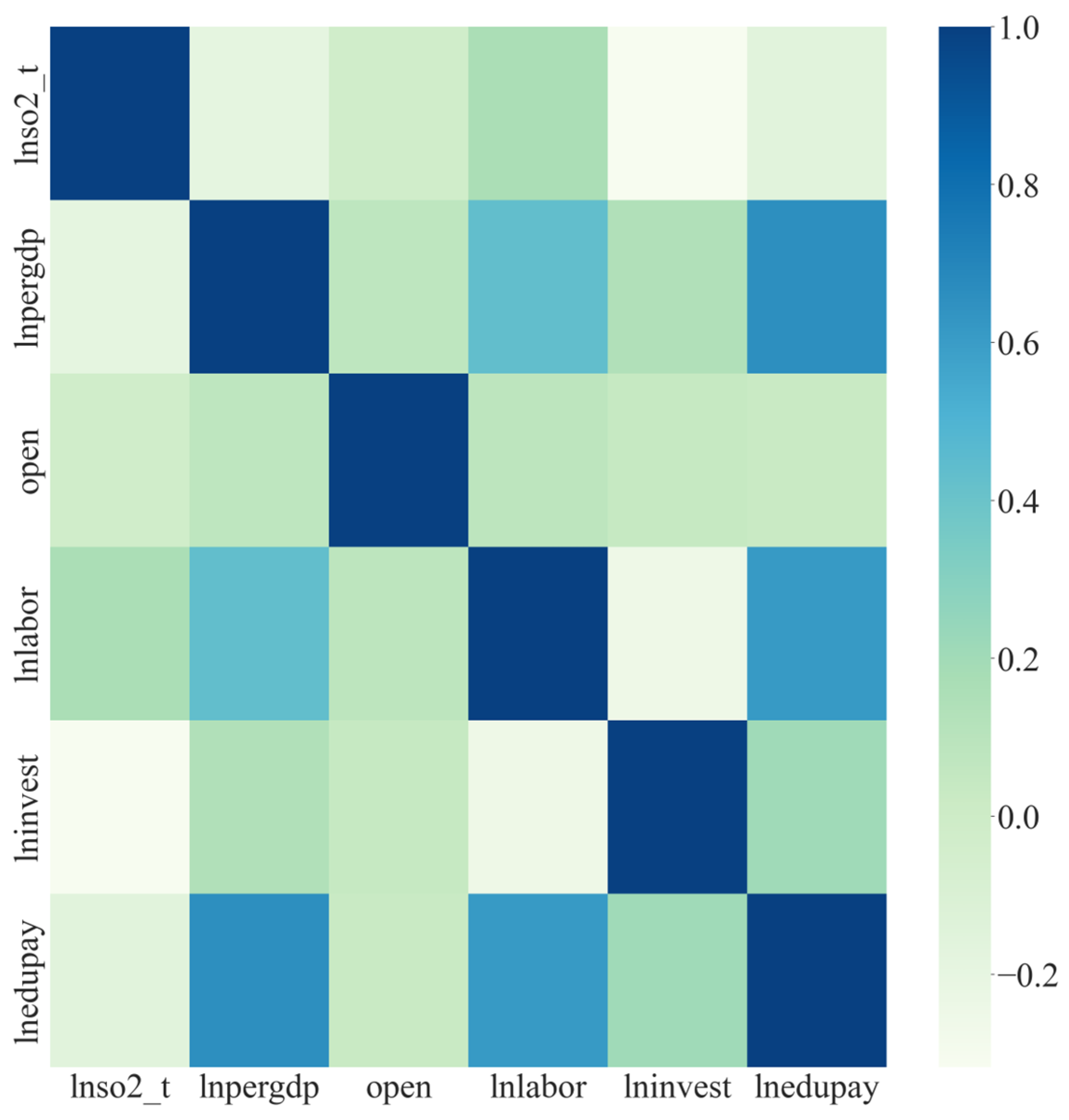

3.2.3. Control Variables

Drawing upon the research findings of Hou et al. [

54] and Li and Xiao [

55] and taking into account data availability, this paper selects the following control variables: the level of economic development, the degree of openness to external trade, the level of air pollution, the size of the labor force, the level of investment in fixed assets, the level of technological innovation, and the quality of the labor force. The specific measurements of these control variables are presented in the accompanying

Table 2.

3.2.4. Mechanism Variables

(1) Green Competitiveness (GTFP). This paper builds on the findings of Xia et al. [

56] to define green competitiveness by assessing green total factor productivity based on non-expected output, employing the non-oriented SBM model–GML index. The specific measurements are as follows:

Equation (12) is the objective function and Equation (13) is the qualification, where

n is the number of decision-making units (DMUs) and

m is the number of input variables. Variables

s1 and

s2 represent desired and non-desired outputs, respectively. Variables

x, y and

z are the elements in the input, desired output, and undesired output matrices, respectively, and

λ is the weight vector. The selection and measurement of input indicators, desired outputs, and non-desired outputs are shown in

Table 3.

(2) Green technological innovation (greeninn). This paper uses the number of green patent applications to measure urban green innovation. In order to eliminate the right-skewed distribution of green patent applications, this paper draws on existing studies, adds 1 to the number of green patent applications, and logarithmizes it.

3.3. Data Source

Considering the scientific rigor, rationality, and data availability, this paper collects panel data from 267 prefecture-level cities in China covering the period from 2005 to 2021 to assess the impact of ER on the quality of FDI. The relevant city-level data are sourced from the China Statistical Yearbook, China Urban Statistical Yearbook, China Environmental Statistical Yearbook, China Energy Statistical Yearbook, and the China Population and Employment Statistical Yearbook from previous years. All variables denominated in U.S. dollars, including FDI, are converted from RMB based on the average annual exchange rate between RMB and U.S. dollars and then calculated accordingly. Following established methodologies, the relevant variables are logarithmized to address issues of heteroscedasticity and scale. Data processing is performed using Stata 16.0 and MaxDEA.

5. Discussions and Conclusions

In the context of China’s efforts to promote green and low-carbon economic and social development, this paper examines whether China’s ER affects the quality of FDI. Utilizing panel data from 267 prefecture-level cities in China from 2005 to 2021, this study employs a quasi-natural experiment framework comparing two ER approaches: LC and ETS. The analysis explores the direct impact, the pathways of influence, the synergistic effects, and the heterogeneity of ER on the quality of FDI. The findings and discussions presented in this paper are as follows:

The results of our benchmark regression analysis indicate that ER effectively enhances the quality of FDI. This finding aligns with the results obtained from the policy network analysis model employed by [

61]. The mechanism through which ER influences FDI quality can be conceptualized as the interaction and collaboration among various stakeholders, including government agencies (such as central and local governments), ETS, FDI enterprises, consumers, and other market participants, within a specific environmental policy framework [

62]. The implementation of top-down ER by China’s central government indicates a shift in the country’s economic development from “brisk” growth to high-quality growth. The imperative for local governments to prioritize environmental considerations over economic gains has evolved. By raising environmental standards, the influx of high-pollution and high-energy-consumption FDI will be curtailed through the mechanisms of “pushing” and “correcting.” Consequently, local governments will be better positioned to attract high-quality FDI that incorporates advanced technologies. Simultaneously, FDI enterprises seeking to profit from investments in emerging markets like China will enhance their competitiveness through low-end industry transfers and high-tech reverse feedback, thereby aligning with the host country’s ER. This aligns with the findings of [

63].

In the future, while China and other developing countries and emerging markets have made significant strides in environmental protection, gaps remain in comparison to developed nations regarding environmental protection laws and regulations, policy frameworks, and the cultivation of environmental awareness. These gaps are unlikely to be fully addressed in the short term, underscoring the importance of strengthening exchanges and cooperation with the international community. By engaging with advanced concepts and practices in international environmental protection and learning from the successful experiences of developed countries in formulating environmental laws, implementing policies, and fostering technological innovation, developing countries can enhance both the effectiveness of their environmental protection efforts and the quality of their economic development.

The results of our mechanism analysis indicate that ER can enhance the quality of FDI through two primary pathways: improving green competitiveness and fostering green technological innovation. Research by [

64] highlights that green competitiveness serves as a crucial engine for the high-quality development of regions and cities. When a region’s green development exhibits positive growth trends, it can create increased investment and collaboration opportunities for multinational corporations. A favorable investment climate and promising development prospects constitute the core competitive advantages of a region in attracting FDI. This not only facilitates the short-term influx of high-quality FDI but also supports a stable virtuous cycle of attracting such investments over the long term through the clustering and scaling effects of high-quality industrial agglomeration [

65]. These dynamics align with the characteristics of the environmental Kuznets curve. On the other hand, within the context of escalating ER in China, the tightening of these regulations positively influences green technological innovation, primarily through external pressures from stakeholders and internal incentives for enterprises [

66]. Green technological innovation is pivotal for integrating environmental and economic objectives, enhancing a region’s capacity to attract and retain high-quality FDI by improving economic efficiency and establishing green brand value. This observation further suggests that the weak version of Porter’s hypothesis demonstrates significant applicability in China.

The results of our heterogeneity test indicate that ER significantly upgrades the quality of FDI in the sub-sample of regions characterized by higher environmental protection and non-resource-based economies. Simultaneously, the impact of ER on FDI quality exhibits a negative spatial spillover effect. According to signaling theory, stringent enforcement and supervision of ER in these areas convey a clear policy signal to investors, demonstrating the region’s strong commitment to sustainable development and a low-carbon economy [

67]. This effectively attracts high-quality FDI that prioritizes long-term stability, sustainable development, and good governance. On the other hand, resource-based cities, with their excessive reliance on energy resources such as coal and oil during their economic development, have experienced more pronounced environmental pollution issues in their early production phases. Consequently, when ER is enacted, these cities encounter the dual pressures of significant emission reduction demands and limited technical capabilities, leading to less effective implementation outcomes. In contrast, non-resource-based cities demonstrate a lower dependency on resources, a stronger foundation for economic development, and a more rational organization of new energy industries. This positions non-resource cities to enhance the quality of FDI more effectively in response to ER.

In the future, developing countries and emerging markets should adhere to the principle of customizing their development models to local conditions and urban policies. They should leverage the comparative advantages of each region and align local industrial development strategies with the availability of production factors to formulate a series of attractive policy combinations tailored to high-quality FDI enterprises. This approach aims to reduce the overall operational costs for foreign-invested firms and enhance their competitiveness and development potential within their respective countries.

The results of our synergy effect test indicate that, compared to single-pilot environmental policies, the designation of a dual-pilot city has a stronger positive impact on the quality of FDI. This suggests that dual-pilot environmental policies are more effective in influencing FDI quality than single-pilot policies alone. This enhanced effect may stem from the follow-cost theory, which posits that LC can improve the level of green technological innovation in cities. Indeed, this aligns with the policy synergies outlined in policy synergy theory. This, in turn, reduces the environmental follow-costs for enterprises at the micro level, encouraging them to proactively reduce emissions. Additionally, LC initiatives can optimize the regional industrial structure at the macro level, further enhancing FDI quality. For ETS, transitioning to an LC-city can significantly elevate FDI quality and drive the city’s green and high-quality development. Therefore, a synergistic effect may exist between the low-carbon pilot city and the carbon emissions trading policy regarding their impact on regional FDI quality. This finding aligns with the Motivation, Incentives, and Information analytical framework [

68]. In the context of China’s current environmental governance, local governments retain considerable autonomy, with primary pressure focused on achieving end results rather than managing the entire process. Consequently, the motivations driving local government autonomy significantly influence outcomes. In the context of the overarching environmental emission reduction targets and in response to central government policy pressures, market incentives, and the transmission of green information, the dual pilot approach of LC and ETS exerts a more substantial impact on FDI quality than the single pilot approach.