Identifying Key Factors of Reputational Risk in Finance Sector Using a Linguistic Fuzzy Modeling Approach

Abstract

1. Introduction

2. Literature Review

3. Reputational Risk in Finance

Reputational Risk Models and Study Directions

| Category | Factor | Reference Studies |

|---|---|---|

| Environmental | Region | [5] |

| Institution Type | [2,5,50,51,52,53,54] | |

| Growth opportunities | [39,50,55,56] | |

| Perceptions of stakeholders | [1] | |

| Financial | Size (Asset) | [5,8,33,49,50,51,53,55,56,57] |

| Leverage | [5,8,39,44,50,52,54,55,57,58,59] | |

| Assets’ opacity | [8,39,52,54,55,56,58] | |

| Earnings Volatility | [8,55,58] | |

| Stock Price Volatility | [8,50,52,58] | |

| Firm Performance | [39,60] | |

| Revenue | [61] | |

| Return on Asset (RoA) | [5,6,7,8,55,59,61] | |

| Shareholder Value | [6,7,8] | |

| Return on Equity (RoE) | [58] | |

| Capital Efficiency | [8,57] | |

| Cash Flow Volatility | [56,60] | |

| Capital Cost | [8] | |

| Frequency of Dividends | [8,57] | |

| Market Value | [1,2,3,4] | |

| Loan Commitments | [62] | |

| Organizational | Reputation awareness | [5,40,63,64] |

| Risk culture (CRO, Risk Committee awareness) | [5,8,50,55,58,60] | |

| Age/Year | [5] | |

| Industrial Diversification | [8,59] | |

| Institutional Ownership | [8,50,57,58,59] | |

| Social Responsibility Support | - | |

| Assessment of Big auditors (PwC, EY, KPMG, Deloitte, etc.) | [51,52] | |

| Assessment of Big rating agency (S&P, Fitch, Moody’s, etc.) | [54] | |

| Number of Fraud Issues | [3,65] |

4. Materials and Methods

4.1. Materials

4.2. Methods

- Investigation of the dependencies between the factors;

- Investigation of the intensity and the direction of the relations between the factors;

- Investigation of the weights of the effects of the factors on RR;

- Consideration of the uncertainties caused by measuring the level of RR with human perception;

- Consideration of the uncertainties caused by assessment of the influence of factors on RR by using subjective domain expertise.

- Get input: Begin with a predetermined list of factors provided in Table 1.

- Assign linguistic terms: Assign linguistic terms for trapezoidal fuzzy numbers representing preciseness and triangular fuzzy numbers for reliability. These fuzzy numbers will be used for DEMATEL and FCM.

- Collect expert assessments: Gather assessments from experts for each factor combination, represented by a combination of trapezoidal and triangular fuzzy numbers (Equation (1)).

- Calculate fuzzy numbers: For each expert assessment and each factor combination:

- ○

- Calculate the trapezoidal fused fuzzy number () using the reliability value () as a weight (Equations (2) and (3)).

- ○

- Convert the fused fuzzy number into a crisp value () for further calculations (Equation (4)).

- Build the direct influence matrix: Construct the fuzzy direct influence matrix ) using the crisp values derived in the previous step (Equation (5)).

- Normalize the direct influence matrix: Normalize the direct influence matrix to create a normalized fuzzy direct influence matrix () (Equation (6)).

- Build the total influence matrix: Compute the fuzzy total influence matrix () by multiplying the normalized matrix with the inverse of identity matrix minus direct influence matrix () (Equation (7)).

- Calculate threshold: Determine threshold values by calculating the maximum, minimum, and average values of the total influence matrix, applying specific weightings (0.3 for max, 0.2 for min, and 0.5 for average).

- Confirm influence: Merge the fuzzy total influence matrices from all experts using arithmetic averaging. Compare the values in the fuzzy total influence matrix with the threshold values to confirm significant influences.

- Construct direction matrix: For each confirmed influence, determine its direction to build a direction matrix.

- Build initial relation vector: Collect initial evaluations from experts on confirmed influences and construct an initial relation vector.

- Iterate convergence function: Iterate the convergence function until the model stabilizes, ensuring that the influences are consistent with the expert assessments (Equation (8)).

- Aggregate results: Aggregate the results from all experts by arithmetic averaging.

- Rank: Rank the factors based on the aggregated results, reflecting their relative importance as assessed by the experts.

- Generate output: The final output is a ranked and weighted list of factors, indicating their significance based on the expert evaluations and the integrated fuzzy logic model.

| Algorithm 1: Integrated Hesitant Fuzzy z-DEMATEL and FCM Algorithm |

| INPUT: Predetermined factor list given in Table 1. BEGIN Assign LTSs for trapezoidal preciseness and triangular reliability for DEMATEL and FCM Collect expert assessments by using LTSs for each factor combination as shown in Equation (1): FOR EACH Expert assessment FOR EACH Factor combination of each expert assessment BEGIN Calculate trapezoidal fused fuzzy number by using Equations (2) and (3): Convert fused fuzzy number to crisp value as in Equation (4): where , , , , , , , END Build the fuzzy direct influence matrix as in Equation (5): Normalize the direct influence matrix to build the normalized fuzzy direct influence matrix () by using Equation (6): Build the fuzzy total influence matrix () as given in Equation (7): Calculate the maximum, minimum, and arithmetic average for the total influence matrix. Specify the threshold value by multiplying the maximum value by 0.3, the minimum value by 0.2, and the average by 0.5. END Merge the fuzzy total influence matrices of experts by arithmetic averaging. Compare values of the fuzzy total influence matrix with the threshold values IF The value is greater than the threshold values THEN Confirm an influence between the values. END FOR EACH Expert assessment FOR EACH Confirmed influence BEGIN Decide the directions of the influences to construct a direction matrix. Build the initial relation vector by collecting expert evaluations for the confirmed influences Iterate the convergence function by using Equation (8) until models are converged: Aggregate the converged results. END Merge the results of experts by arithmetic averaging. END Rank the factors. END OUTPUT: Ranked and weighted factors |

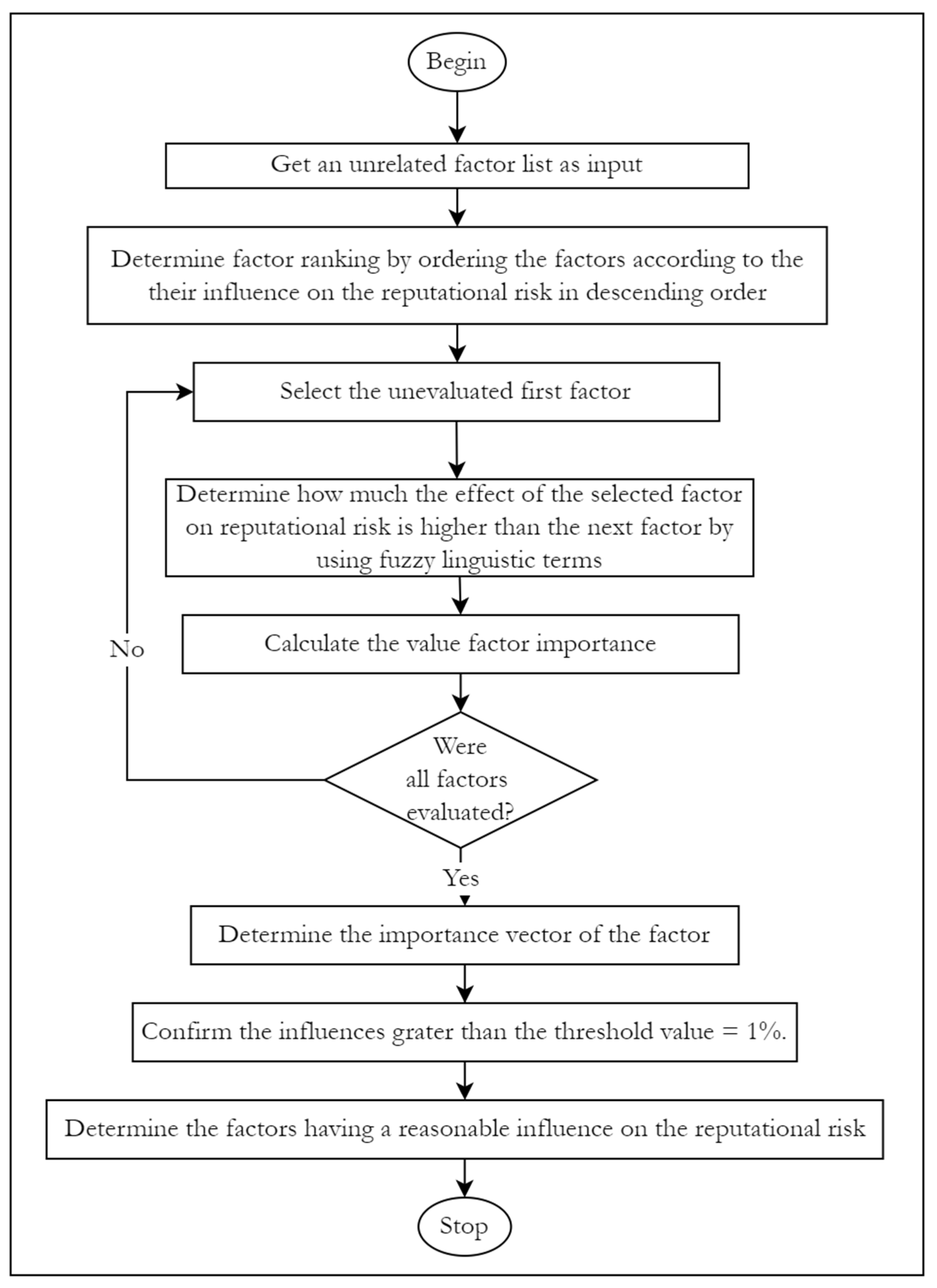

- Get input: Start with a predetermined list of factors, as shown in Table 1.

- Arrange criteria: Organize the criteria based on the frequency of their indication by experts.

- Remove interrelated factors: Identify and remove factors that are interrelated to simplify the analysis.

- Determine unrelated factors: Create a list of factors that are unrelated and unique (denoted as ).

- Sort factors by importance: Sort the remaining factors in descending order of importance.

- Determine importance differences: For each pair of successive factors, determine the difference in importance using a predefined set of linguistic terms.

- Calculate initial coefficient and weight values: Set the coefficient value and the weight of the first factor to 1 as a starting point.

- Calculate coefficients and weights: For each successive factor, calculate the coefficient and weight using expert evaluations of comparative importance (Equations (9)–(11)).

- Determine relative importance: Calculate the relative importance of each factor using the weights derived in the previous step (Equation (12)).

- Set threshold and final weights: Establish a threshold importance weight of 1%. Determine the final weights for each factor, adjusting them based on whether they exceed the threshold (Equation (13)).

- Aggregate weights: Combine the weights calculated for each decision maker to obtain an overall weighting for each factor.

- Rank: Rank the factors based on the aggregated weights to reflect their overall importance.

- Generate output: The final output is a ranked and weighted list of factors, highlighting their significance based on the SWARA algorithm and expert evaluations.

| Algorithm 2: Fuzzy SWARA Algorithm |

| INPUT: Predetermined factor list given in Table 1. BEGIN Arrange criteria according to frequency of indication Remove interrelated factors Determine unrelated factor list Sort the factors according to importance in descending order: Determine the importance difference between each successive factor pair by using the linguistic term set. Set to 1 for the first coefficient value () and the first factor weight (): , Calculate coefficient values and factor weights of each succeeding criteria with the help of the expert evaluations about the comparative importance of the factors by using Equations (9)–(11): Calculate the related importance of each factor by using the relative assessments carried out in previous step by using Equation (12): Set threshold importance weight as 1% and determine the final factor weights as shown in Equation (13): Aggregate the weights found for every decision maker Rank the factors by using the aggregated results END OUTPUT: Ranked and weighted factors |

5. Application

5.1. Data

5.2. Data Collection and Analysis Steps

5.3. Results and Discussions

5.4. Limitations

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Walker, K. A systematic review of the corporate reputation literature: Definition, measurement, and theory. Corp. Reput. Rev. 2010, 12, 357–387. [Google Scholar] [CrossRef]

- Cummins, J.D.; Lewis, C.M.; Wei, R. The market value impact of operational loss events for US banks and insurers. J. Bank. Financ. 2006, 30, 2605–2634. [Google Scholar] [CrossRef]

- Perry, J.; De Fontnouvelle, P. Measuring Reputational Risk: The Market Reaction to Operational Loss Announcements. SSRN Electron. J. 2005, 861364. Available online: https://ssrn.com/abstract=861364 (accessed on 9 September 2024). [CrossRef]

- Gillet, R.; Hübner, G.; Plunus, S. Operational risk and reputation in the financial industry. J. Bank. Financ. 2010, 34, 224–235. [Google Scholar] [CrossRef]

- Heidinger, D.; Gatzert, N. Awareness, determinants and value of reputation risk management: Empirical evidence from the banking and insurance industry. J. Bank. Financ. 2018, 91, 106–118. [Google Scholar] [CrossRef]

- McShane, M.K.; Nair, A.; Rustambekov, E. Does enterprise risk management increase firm value? J. Account. Audit. Financ. 2011, 26, 641–658. [Google Scholar] [CrossRef]

- Tahir, I.M.; Razali, A.R. The Relationship between enterprise risk management (ERM); firm value: Evidence from Malaysian public listed companies. Int. J. Econ. Manag. Sci. 2011, 1, 32–41. [Google Scholar]

- Hoyt, R.E.; Liebenberg, A. The value of enterprise risk management. J. Risk Insur. 2011, 78, 795–822. [Google Scholar] [CrossRef]

- Kunitsyna, N.; Britchenko, I.; Kunitsyn, I. Reputational risks, value of losses and financial sustainability of commercial banks. Entrep. Sustain. Issues 2018, 5, 943–955. [Google Scholar] [CrossRef]

- Bandyopadhyay, A. Basic Statistics for Risk Management in Banks and Financial Institutions; Oxford University Press: Oxford, UK, 2022. [Google Scholar]

- Ayyildiz, E.; Erdogan, M. A comprehensive approach to evaluate risk mitigation strategies in offshore wind farms using spherical fuzzy decision making analysis. Ocean Eng. 2024, 311, 118881. [Google Scholar] [CrossRef]

- Erfani, A.; Tavakolan, M. Risk evaluation model of wind energy investment projects using modified fuzzy group decision-making and monte carlo simulation. Arthaniti J. Econ. Theory Pract. 2023, 22, 7–33. [Google Scholar] [CrossRef]

- Karaşan, A.; Kaya, İ.; Erdoğan, M.; Çolak, M. A multicriteria decision making methodology based on two-dimensional uncertainty by hesitant Z-fuzzy linguistic terms with an application for blockchain risk evaluation. Appl. Soft Comput. 2021, 113, 10801. [Google Scholar] [CrossRef]

- Djenadic, S.; Tanasijevic, M.; Jovancic, P.; Ignjatovic, D.; Petrovic, D.; Bugaric, U. Risk evaluation: Brief review and innovation model based on fuzzy logic and MCDM. Mathematics 2022, 10, 811. [Google Scholar] [CrossRef]

- Akram, M.; Luqman, A.; Alcantud, J.C.R. An integrated ELECTRE-I approach for risk evaluation with hesitant Pythagorean fuzzy information. Expert Syst. Appl. 2022, 200, 116945. [Google Scholar] [CrossRef]

- Chen, H.; Wang, J.; Feng, Z.; Liu, Y.; Xu, W.; Qin, Y. Research on the risk evaluation of urban wastewater treatment projects based on an improved fuzzy cognitive map. Sustain. Cities Soc. 2023, 98, 104796. [Google Scholar] [CrossRef]

- Cheng, S.; Jianfu, S.; Alrasheedi, M.; Saeidi, P.; Mishra, A.R.; Rani, P. A new extended VIKOR approach using q-rung orthopair fuzzy sets for sustainable enterprise risk management assessment in manufacturing small and medium-sized enterprises. Int. J. Fuzzy Syst. 2021, 23, 1347–1369. [Google Scholar] [CrossRef]

- Akomea-Frimpong, I.; Jin, X.; Osei-Kyei, R. Fuzzy Analysis of Financial Risk Management Strategies for Sustainable Public–Private Partnership Infrastructure Projects in Ghana. Infrastructures 2024, 9, 76. [Google Scholar] [CrossRef]

- Yazdi, A.K.; Okereke, P.; Wanke, P.F.; Aeini, S.A.S.; Mehdiabadi, A. Credit rating ranking of Iranian banks based on CAMELS and hybrid multi-criteria decision analysis methods in uncertain environments. Int. J. Oper. Res. 2024, 49, 358–384. [Google Scholar] [CrossRef]

- Quynh, V.T.N. An extension of fuzzy TOPSIS approach using integral values for banking performance evaluation. Multidiscip. Sci. J. 2024, 6, 2024155. [Google Scholar] [CrossRef]

- Roghani, B.; Tabesh, M.; Cherqui, F. A Fuzzy Multidimensional Risk Assessment Method for Sewer Asset Management. Int. J. Civ. Eng. 2024, 22, 1–17. [Google Scholar] [CrossRef]

- Ghorbani, A.; Noorbakhsh, A.; Mazaheri, T. Development of A Comprehensive Multi-Criteria Decision-Making Model in Managing the Operational Risks of Banking System. J. Invest. Knowl. 2024, 13, 911–938. [Google Scholar]

- Ahmed, I.E.; Mehdi, R.; Mohamed, E.A. The role of artificial intelligence in developing a banking risk index: An application of Adaptive Neural Network-Based Fuzzy Inference System (ANFIS). Artif. Intell. Rev. 2023, 56, 13873–13895. [Google Scholar] [CrossRef] [PubMed]

- Roy, P.K.; Shaw, K. An integrated fuzzy credit rating model using fuzzy-BWM and new fuzzy-TOPSIS-Sort-C. Complex Intell. Syst. 2023, 9, 3581–3600. [Google Scholar] [CrossRef]

- Roy, P.; Shaw, K. A fuzzy MCDM decision-making model for m-banking evaluations: Comparing several m-banking applications. J. Ambient Intell. Humaniz. Comput. 2023, 14, 11873–11895. [Google Scholar] [CrossRef]

- Yang, X. Financial Risk Assessment Model Based on Fuzzy Logic. J. Electr. Syst. 2024, 20, 192–205. [Google Scholar] [CrossRef]

- Adeabah, D.; Andoh, C.; Asongu, S.; Gemegah, A. Reputational risks in banks: A review of research themes, frameworks, methods, and future research directions. J. Econ. Surv. 2023, 37, 321–350. [Google Scholar] [CrossRef]

- Rajagopal, V.; Shanmugam, V.; Nandre, R. Quantifying reputation risk using a fuzzy cognitive map: A case of a pharmaceutical supply chain. J. Adv. Manag. Res. 2022, 19, 78–105. [Google Scholar] [CrossRef]

- Wang, H.M.; Yu, T.H.K.; Hsiao, C.Y. The causal effect of corporate social responsibility and corporate reputation on brand equity: A fuzzy-set qualitative comparative analysis. J. Promot. Manag. 2021, 27, 630–641. [Google Scholar] [CrossRef]

- Basel Committee of Banking Supervision. Enhancements to the Basel II Framework. 2009. Available online: https://www.bis.org/publ/bcbs157.pdf (accessed on 3 September 2024).

- Basel Committee on Banking Supervision. Basel III: A Global Regulatory Framework for More Resilient Banks and Banking Systems, Bank for International Settlements. 2010. Available online: https://www.bis.org/publ/bcbs189.pdf (accessed on 3 September 2024).

- Basel Committee on Banking Supervision. Basel III: Finalising Post-Crisis Reforms, Bank for International Settlements Communications CH-4002 Basel, Switzerland. 2017. Available online: https://www.bis.org/bcbs/publ/d424.pdf (accessed on 3 September 2024).

- Savram, M.; Karakoç, A. Bankacılık sektöründe itibar riskinin önemi. In Proceedings of the International Conference on Euroasian Economies, Almaata, Kazakhstan, 11–13 October 2012. [Google Scholar]

- Maung, M.; Wilson, C.; Yu, W. Does reputation risk matter? Evidence from cross-border mergers and acquisitions. J. Int. Financ. Mark. Inst. Money 2020, 66, 101204. [Google Scholar] [CrossRef]

- U.S. Government Printing Office. Dodd-Frank Wall Street Reform and Consumer Protection Act, 111th Congress Public Law 203. 2010. Available online: https://www.govinfo.gov/content/pkg/PLAW-111publ203/pdf/PLAW-111publ203.pdf (accessed on 3 September 2024).

- Swanepoel, E.; Lotriet, R. Dodd-Frank and risk-taking: Reputation impact in banks. Banks Bank Syst. 2017, 12, 36. [Google Scholar] [CrossRef][Green Version]

- Gundogdu, A. The relationship between corporate governance and reputation in financial markets: Evidence from Turkey. Int. J. Contemp. Econ. Adm. Sci. 2015, 5, 85–108. [Google Scholar]

- Joosub, T.S. Risk Management Strategies to Maintain Corporate Reputation. Doctoral Dissertation, University of South Africa, Pretoria, South Africa, 2006. [Google Scholar]

- Gatzert, N.; Martin, M. Determinants and value of enterprise risk management: Empirical evidence from the literature. Risk Manag. Insur. Rev. 2015, 18, 29–53. [Google Scholar] [CrossRef]

- Regan, L. A framework for integrating reputation risk into the enterprise risk management process. J. Financ. Transform. 2008, 22, 187–194. [Google Scholar]

- Mukherjee, N.; Zambon, S.; Lucius, H. Do Banks Manage Reputational Risk?—A Case Study of European Investment Bank. 2015. Available online: https://web.actuaries.ie/sites/default/files/erm-resources/do_banks_manage_reputational_risk_a_case_study_of_european_investment_bank.pdf (accessed on 23 August 2024).

- Tonello, M. Reputation Risk: A Corporate Governance Perspective; The Conference Board Research Report No: R-1412-07-WG; The Conference Board: New York, NY, USA, 2007. [Google Scholar]

- Eckert, C.; Gatzert, N. Modeling operational risk incorporating reputation risk: An integrated analysis for financial firms. Insur. Math. Econ. 2017, 72, 122–137. [Google Scholar] [CrossRef]

- Sturm, P. Operational and reputational risk in the European banking industry: The market reaction to operational risk events. J. Econ. Behav. Organ. 2013, 85, 191–206. [Google Scholar] [CrossRef]

- Xifra, J.; Ordeix, E. Managing reputational risk in an economic downturn: The case of Banco Santander. Public Relat. Rev. 2009, 35, 353–360. [Google Scholar] [CrossRef]

- Rayner, J. Managing Reputational Risk: Curbing Threats, Leveraging Opportunities; John Wiley & Sons: Hoboken, NJ, USA, 2004. [Google Scholar]

- Lemke, F.; Petersen, H.L. Teaching reputational risk management in the supply chain. Supply Chain Manag. Int. J. 2013, 18, 413–428. [Google Scholar] [CrossRef]

- Zhu, X.; Wang, Y.; Li, J. What drives reputational risk? Evidence from textual risk disclosures in financial statements. Humanit. Soc. Sci. Commun. 2022, 9, 318. [Google Scholar] [CrossRef]

- Kumar, A.; Dash, M.K. Causal modelling and analysis evaluation of online reputation management using fuzzy Delphi and DEMATEL. Int. J. Strateg. Decis. Sci. 2017, 8, 27–45. [Google Scholar] [CrossRef][Green Version]

- Liebenberg, A.; Hoyt, R.E. The determinants of enterprise risk management: Evidence from the appointment of chief risk officers. Risk Manag. Insur. Rev. 2003, 6, 37–52. [Google Scholar] [CrossRef]

- Beasley, M.S.; Clune, R.; Hermanson, D.R. Enterprise risk management: An empirical analysis of factors associated with the extent of implementation. J. Account. Public Policy 2005, 24, 521–531. [Google Scholar] [CrossRef]

- Golshan, M.; Rasid, A. What Leads Firms to Enterprise Risk Management Adoption. In Proceedings of the 2012 International Conference on Economics, Business and Marketing Management (IPEDR 2012), Singapore, 26–28 February 2012. [Google Scholar]

- Fiordelisi, F.; Soana, M.G.; Schwizer, P. Reputational losses and operational risk in banking. Eur. J. Financ. 2014, 20, 105–124. [Google Scholar] [CrossRef]

- Lechner, P.; Gatzert, N. Determinants and value of enterprise risk management: Empirical evidence from Germany. Eur. J. Financ. 2018, 24, 867–887. [Google Scholar] [CrossRef]

- Beasley, M.; Pagach, D.; Warr, R. Information conveyed in hiring announcements of senior executives overseeing enterprise-wide risk management processes. J. Account. Audit. Financ. 2008, 23, 311–332. [Google Scholar] [CrossRef]

- Pagach, D.; Warr, R. The effect of enterprise risk management on firm performance. Mod. Econ. 2010, 13, 1–26. [Google Scholar] [CrossRef]

- Hoyt, R.E.; Liebenberg, A. The Value of Enterprise Risk Management: Evidence from the US Insurance Industry. 2008. Available online: https://www.soa.org/globalassets/assets/files/resources/essays-monographs/2008-erm-symposium/mono-2008-m-as08-1-hoyt.pdf (accessed on 23 August 2024).

- Pagach, D.; Warr, R. The characteristics of firms that hire chief risk officers. J. Risk Insur. 2011, 78, 185–211. [Google Scholar] [CrossRef]

- Razali, A.R.; Tahir, I.M. Review of the literature on enterprise risk management. Bus. Manag. Dyn. 2011, 1, 8. [Google Scholar]

- Gordon, L.A.; Loeb, M.; Tseng, C.Y. Enterprise risk management and firm performance: A contingency perspective. J. Account. Public Policy 2009, 28, 301–327. [Google Scholar] [CrossRef]

- Grace, D.; Randolph, T.; Olawoye, J. Participatory risk assessment a new approach for safer food in vulnerable African communities. In Participatory Research and Gender Analysis; Routledge: London, UK, 2013; pp. 167–174. [Google Scholar]

- Xudoyorov, O. Importance of credit risk management in banks. Экoнoмика И Бизнес Теoрия И Практика 2017, 5, 242–244. [Google Scholar]

- Aula, P.; Heinonen, J. The reputable firm. In The Reputable Firm; Springer: Cham, Switzerland, 2016; pp. 201–210. [Google Scholar]

- Barnett, M.L.; Jermier, J.M.; Lafferty, B.A. Corporate reputation: The definitional landscape. Corp. Reput. Rev. 2006, 9, 26–38. [Google Scholar] [CrossRef]

- Murphy, J.; Baxter, R.; Eyerman, J.; Cunningham, D.; Kennet, J. A system for detecting interviewer falsification. In Proceedings of the American Association for Public Opinion Research 59th Annual Conference, Phoenix, AZ, USA, 20–23 May 2004. [Google Scholar]

- Zadeh, L.A. Fuzzy sets. Inf. Control 1965, 3, 338–353. [Google Scholar] [CrossRef]

- Zadeh, L.A. The concept of a linguistic variable and its application to approximate reasoning—I. Inf. Sci. 1975, 8, 199–249. [Google Scholar] [CrossRef]

- Casillas, J.; Cordón, O.; Herrera, F.; Magdalena, L. Accuracy Improvements to Find the Balance Interpretability-Accuracy in Linguistic Fuzzy Modeling: An Overview; Springer: Berlin/Heidelberg, Germany, 2003; pp. 3–24. [Google Scholar]

- Atanassov, K.T. Intuitionistic Fuzzy Sets. In Proceedings of the VII ITKR Session, Sofia, Bulgaria, 20–23 June 1983. [Google Scholar]

- Torra, V. Hesitant fuzzy sets. Int. J. Intell. Syst. 2010, 25, 529–539. [Google Scholar] [CrossRef]

- Zadeh, L.A. A note on Z-numbers. Inf. Sci. 2011, 181, 2923–2932. [Google Scholar] [CrossRef]

- Nutt, C. Comparing methods for weighting decision criteria. Omega 1980, 8, 163–172. [Google Scholar] [CrossRef]

- Odu, G.O. Weighting methods for multi-criteria decision making technique. J. Appl. Sci. Environ. Manag. 2019, 23, 1449–1457. [Google Scholar] [CrossRef]

- Roszkowska, E. Rank ordering criteria weighting methods—A comparative overview. Optimum. Stud. Ekon. 2013, 5, 14–33. [Google Scholar] [CrossRef]

- De Feo, G.; De Gisi, S. Using an innovative criteria weighting tool for stakeholders involvement to rank MSW facility sites with the AHP. Waste Manag. 2010, 30, 2370–2382. [Google Scholar] [CrossRef]

- Mardani, A.; Nilashi, M.; Zakuan, N.; Loganathan, N.; Soheilirad, S.; Saman, M.Z.M.; Ibrahim, O. A systematic review and meta-Analysis of SWARA and WASPAS methods: Theory and applications with recent fuzzy developments. Appl. Soft Comput. 2017, 57, 265–292. [Google Scholar] [CrossRef]

- Saeidi, P.; Mardani, A.; Mishra, A.R.; Cajas, V.E.C.; Carvajal, M.G. Evaluate sustainable human resource management in the manufacturing companies using an extended Pythagorean fuzzy SWARA-TOPSIS method. J. Clean. Prod. 2022, 370, 133380. [Google Scholar] [CrossRef]

- İlbahar, E.; Çolak, M.; Karaşan, A.; Kaya, İ. A combined methodology based on Z-fuzzy numbers for sustainability assessment of hydrogen energy storage systems. Int. J. Hydrogen Energy 2022, 47, 15528–15546. [Google Scholar] [CrossRef]

- Kaya, İ.; Işık, G.; Karaşan, A.; Kutlu Gündoğdu, F.; Baraçlı, H. Evaluation of Potential Locations for Hydropower Plants by Using a Fuzzy Based Methodology Consists of Two-Dimensional Uncertain Linguistic Variables. J. Inf. Sci. Eng. 2022, 38, 923–935. [Google Scholar]

| Id | Experience (Year) | Institution | Title |

|---|---|---|---|

| 1 | 21 | Commercial Bank | Chief Risk Officer |

| 2 | 18 | Investment Bank | Chief Risk Officer |

| 3 | 19 | Commercial Bank | Risk Director |

| 4 | 17 | Participant Bank | Risk Director |

| 5 | 15 | Investment Bank | Risk Manager |

| 6 | 13 | Investment Bank | Risk Manager |

| 7 | 11 | Commercial Bank | Risk Manager |

| 8 | 7 | Participant Bank | Business Architect |

| Step | Relation Magnitude | Reliability |

|---|---|---|

| DEMATEL | Between High Influence (HiI) and Low Influence (LoI) | High Determinant (HiD) |

| DEMATEL | Very Low Influence (VeLI) | Low Determinant (LoD) |

| DEMATEL | Between No Influence (NoI) and Low Influence (LoI) | Very High Determinant (VeHD) |

| FCM | Positive High (PH) | High Determinant (HiD) |

| FCM | Between Positive Absolutely High (PAH) and Positive High (PH) | Low Determinant (LoD) |

| FCM | Between Positive Very Low (PVL) and Positive Low (PL) | Very High Determinant (VeHD) |

| DEMATEL + FCM | SWARA | |||||

|---|---|---|---|---|---|---|

| Factor | Aggregated Membership | Rank | Factor | Weight | Normalized Weight | Rank |

| F7-Firm Performance | 97.6% | 1 | F15-Market Value | 73.9 | 31.8% | 1 |

| F8-Revenue | 97.5% | 2 | F1-Size (Asset) | 50.514 | 21.7% | 2 |

| E3-Growth opportunities | 95.4% | 3 | F8-Revenue | 20.955 | 9.0% | 3 |

| F11-Capital Efficiency | 93.9% | 4 | O2-Risk culture (CRO, Risk Committee-awareness) | 19.964 | 8.6% | 4 |

| O2-Risk culture (CRO, Risk Committee-awareness) | 90.7% | 5 | F9-Shareholder Value | 15.706 | 6.8% | 5 |

| E4-Perceptions of stakeholders | 89.7% | 6 | F7-Firm Performance | 12.193 | 5.2% | 6 |

| F1-Size (Asset) | 88.9% | 7 | O1-Reputation awareness | 10.651 | 4.6% | 7 |

| O1-Reputation awareness | 88.7% | 8 | F3-Return on Asset (RoA) | 9.110 | 3.9% | 8 |

| F10-ROE | 87.2% | 9 | F2-Leverage | 6.705 | 2.9% | 9 |

| F3-Return on Asset (RoA) | 87.2% | 10 | E4-Perceptions of stakeholders | 5.541 | 2.4% | 10 |

| F16-Loan Commitments | 86.3% | 11 | F10-ROE | 5.025 | 2.2% | 11 |

| O4-Industrial Diversification | 83.1% | 12 | F11-Capital Efficiency | 1.543 | 0.7% | 12 |

| F4-Assets’ opacity | 81.6% | 13 | F6-Stock Price Volatility | 0.565 | 0.2% | 13 |

| F15-Market Value | 80.2% | 14 | F16-Loan Commitments | 0 | 0.0% | 14 |

| F9-Shareholder Value | 75.9% | 15 | E3-Growth opportunities | 0 | 0.0% | 15 |

| O8-Assesstment of Big rating agency | 75.6% | 16 | F4-Assets’ opacity | 0 | 0.0% | 16 |

| E2-Institution Type | 73.7% | 17 | O4-Industrial Diversification | 0 | 0.0% | 17 |

| E1-Region | 70.6% | 18 | F12-Cash Flow Volatility | 0 | 0.0% | 18 |

| O5-Institutional Ownership | 63.7% | 19 | O7-Assessment of Big auditors | 0 | 0.0% | 19 |

| O7-Assessment of Big auditors | 62.0% | 20 | O8-Assesstment of Big rating agency | 0 | 0.0% | 20 |

| F2-Leverage | 57.9% | 21 | F13-Capital Cost | 0 | 0.0% | 21 |

| F14-Frequency of Dividends | 57.1% | 23 | F5-Earnings Volatility | 0 | 0.0% | 22 |

| O3-Age/Year | 57.1% | 23 | O5-Institutional Ownership | 0 | 0.0% | 23 |

| O6-Social Responsibility Support | 57.1% | 23 | O9-Number of Fraud Issues | 0 | 0.0% | 24 |

| O9-Number of Fraud Issues | 54.8% | 25 | F14-Frequency of Dividends | 0 | 0.0% | 25 |

| F6-Stock Price Volatility | 40.5% | 26 | E1-Region | 0 | 0.0% | 26 |

| F5-Earnings Volatility | 34.1% | 27 | E2-Institution Type | 0 | 0.0% | 27 |

| F12-Cash Flow Volatility | 27.4% | 28 | O3-Age/Year | 0 | 0.0% | 28 |

| F13-Capital Cost | 20.5% | 29 | O6-Social Responsibility Support | 0 | 0 | 29 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hanay, U.; İnce, H.; Işık, G. Identifying Key Factors of Reputational Risk in Finance Sector Using a Linguistic Fuzzy Modeling Approach. Systems 2024, 12, 440. https://doi.org/10.3390/systems12100440

Hanay U, İnce H, Işık G. Identifying Key Factors of Reputational Risk in Finance Sector Using a Linguistic Fuzzy Modeling Approach. Systems. 2024; 12(10):440. https://doi.org/10.3390/systems12100440

Chicago/Turabian StyleHanay, Uğur, Hüseyin İnce, and Gürkan Işık. 2024. "Identifying Key Factors of Reputational Risk in Finance Sector Using a Linguistic Fuzzy Modeling Approach" Systems 12, no. 10: 440. https://doi.org/10.3390/systems12100440

APA StyleHanay, U., İnce, H., & Işık, G. (2024). Identifying Key Factors of Reputational Risk in Finance Sector Using a Linguistic Fuzzy Modeling Approach. Systems, 12(10), 440. https://doi.org/10.3390/systems12100440