Decision-Making Models and Coordination in a Closed-Loop Supply Chain Considering Patent Protection for DfR

Abstract

:1. Introduction

2. Literature Review

2.1. Overview of a Closed-Loop Supply Chain

2.2. The Influence of DfR on a Closed-Loop Supply Chain

2.3. Patent Protection of DfR

2.4. The Coordination between Manufacturers and Remanufacturers

3. Problem Description

4. Notation and Assumptions

5. Decision-Making and Coordination Model

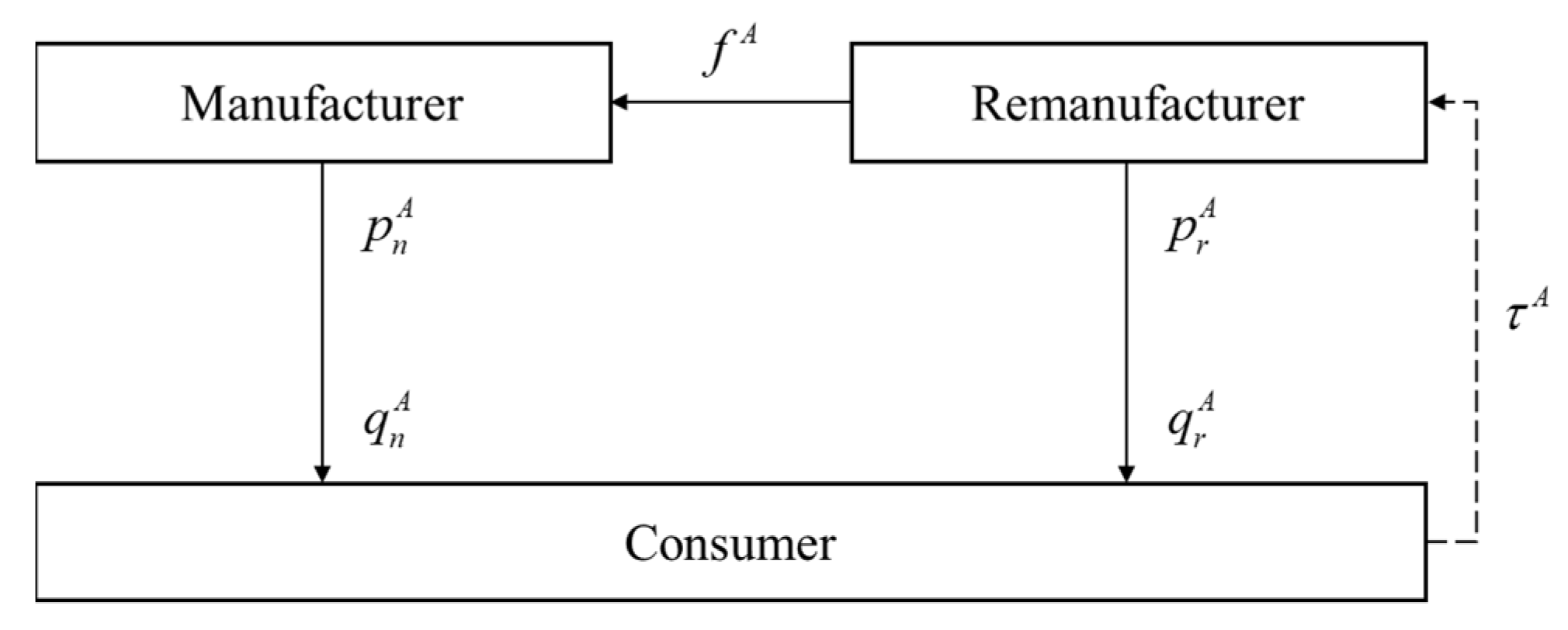

5.1. Decentralized Decision-Making without DfR

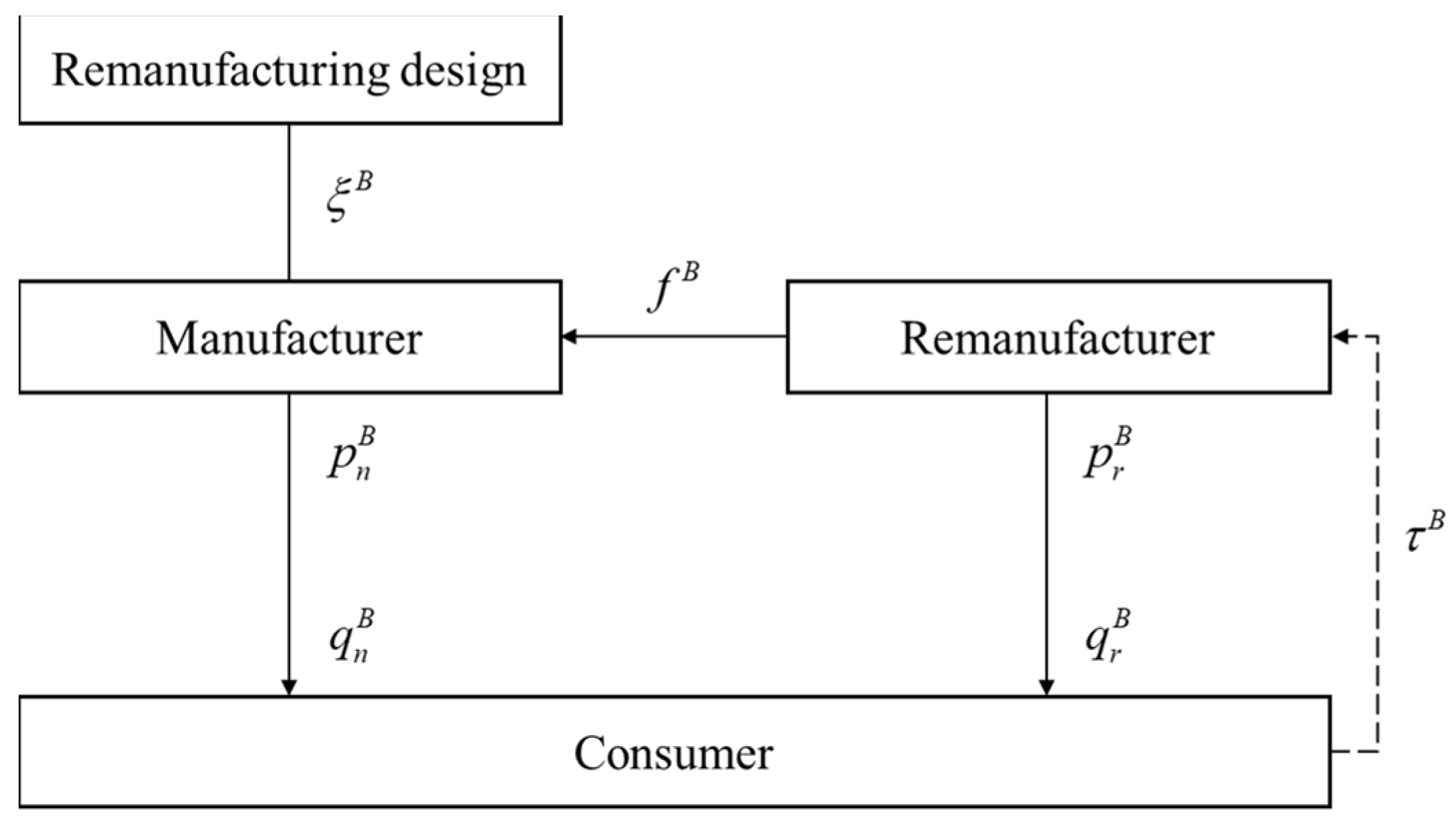

5.2. Decentralized Decision-Making of DfR

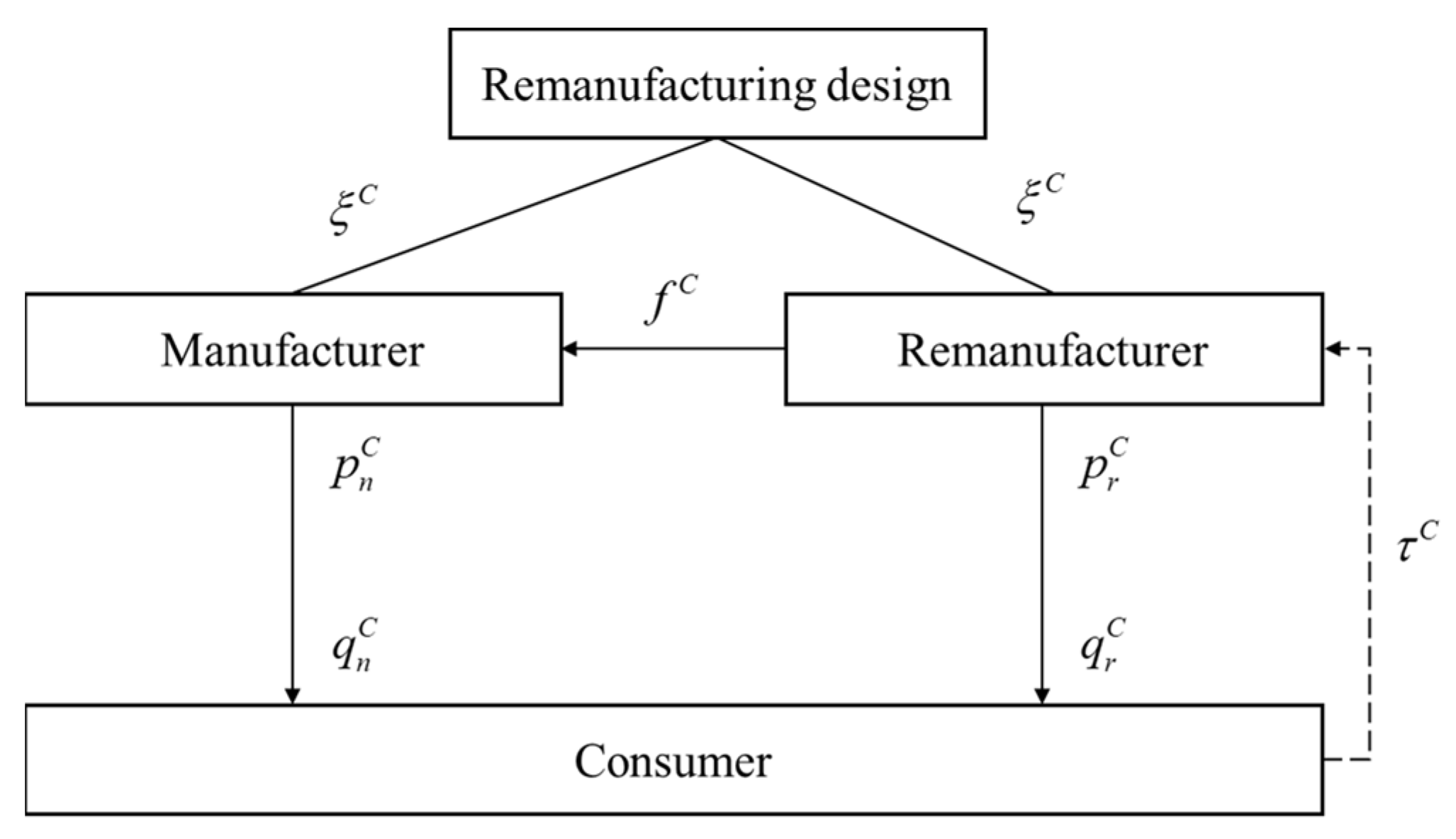

5.3. Centralized Decision-Making

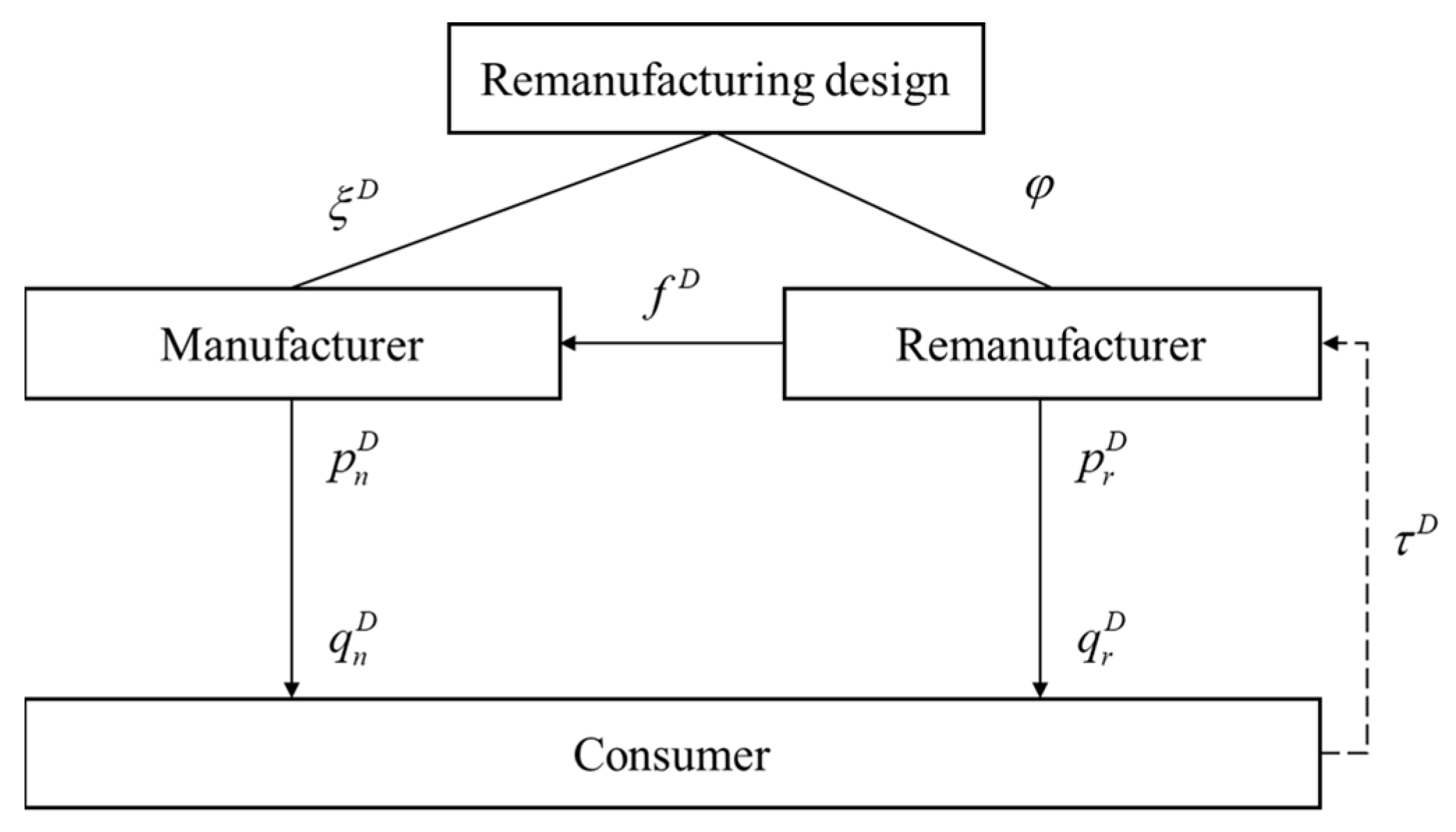

5.4. Coordinated Decision-Making

6. Numerical Simulation

- (1)

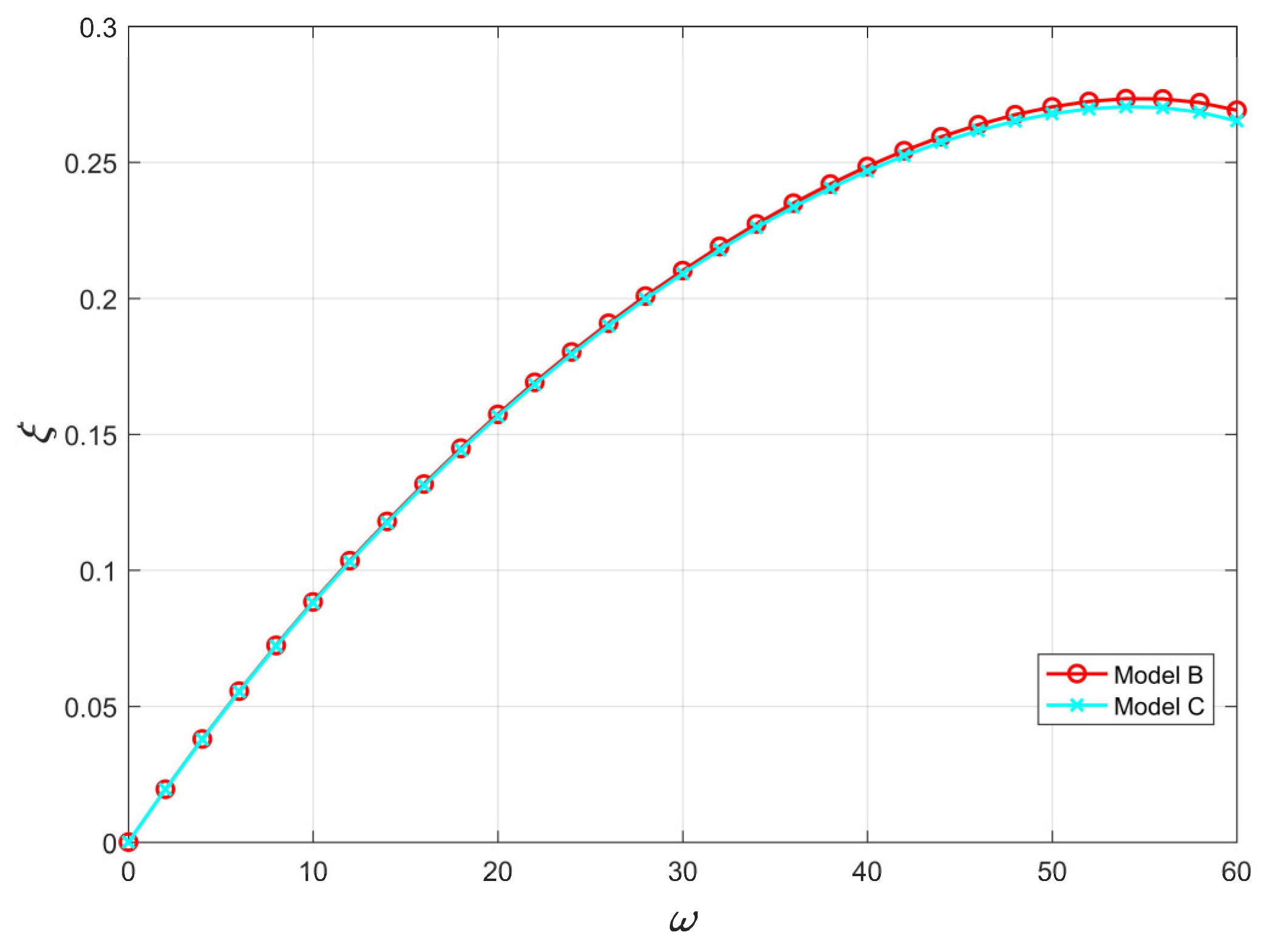

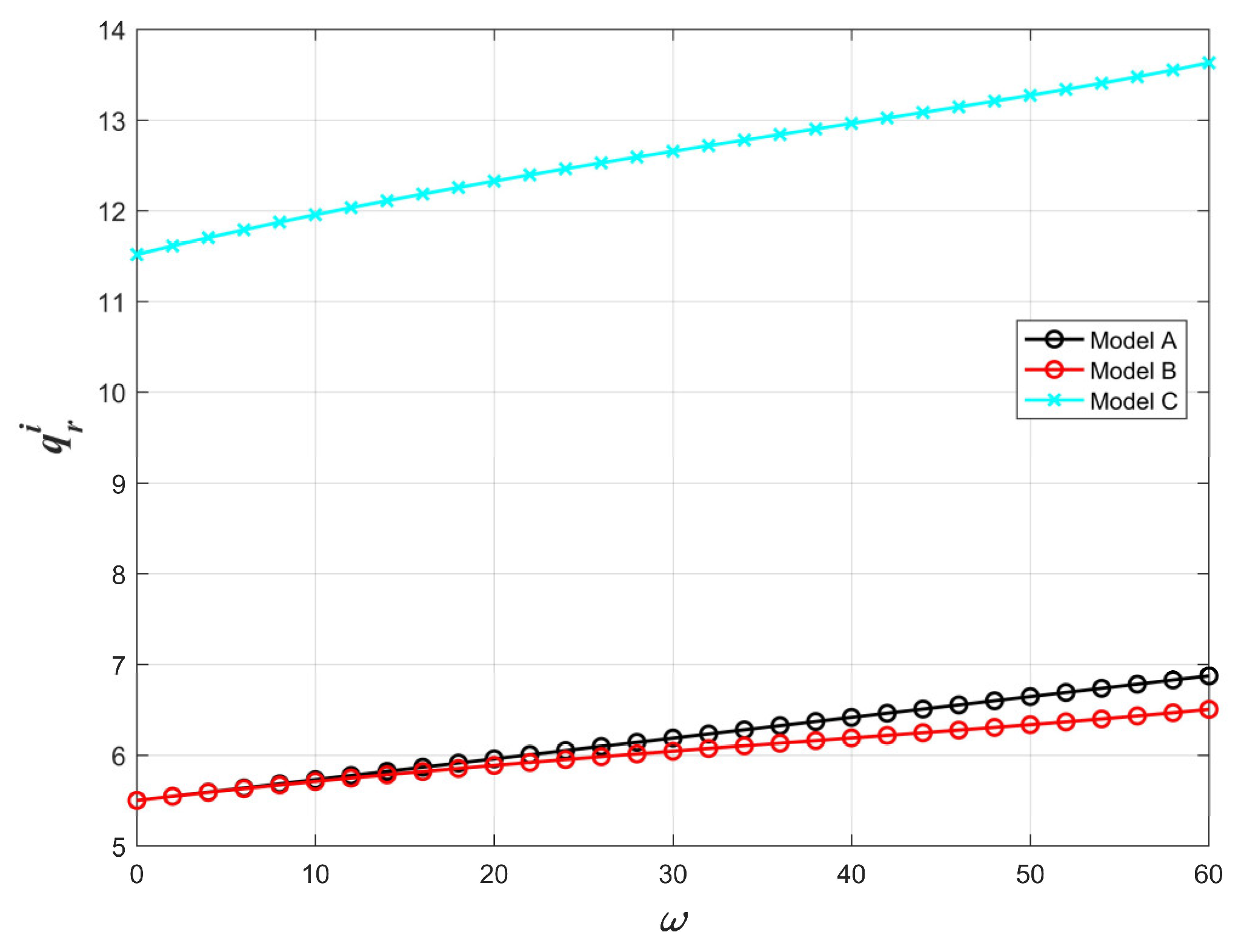

- When the level of DfR satisfies , it shows that, for a given value, there is a higher preference for remanufactured goods and lower carbon emissions, and both parties will focus on selling remanufactured goods under centralized decision-making. Furthermore, lower remanufacturing carbon emissions result in a lower level of DfR required by the manufacturer and, thus, a lower DfR level, which also verifies Proposition 6.

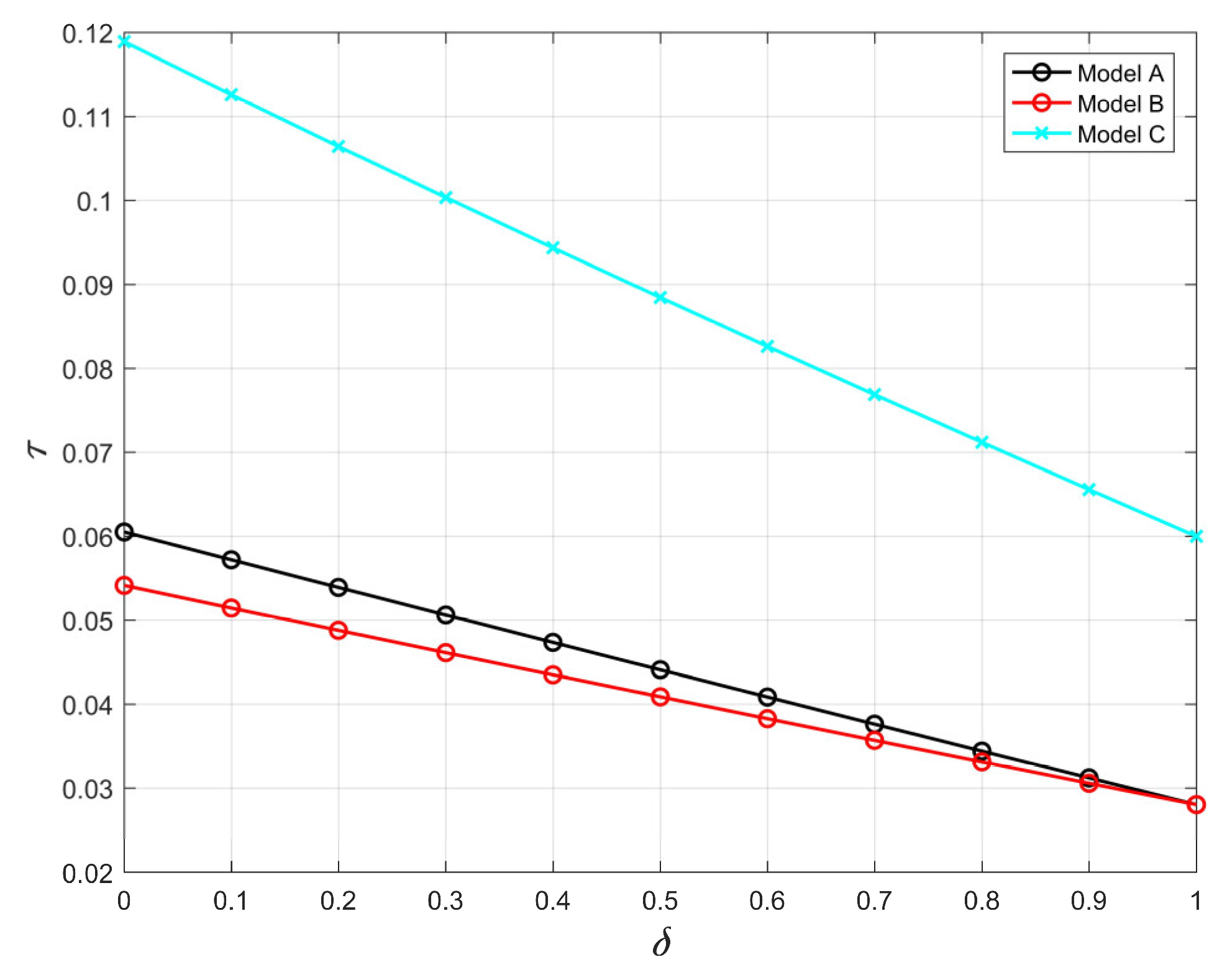

- (2)

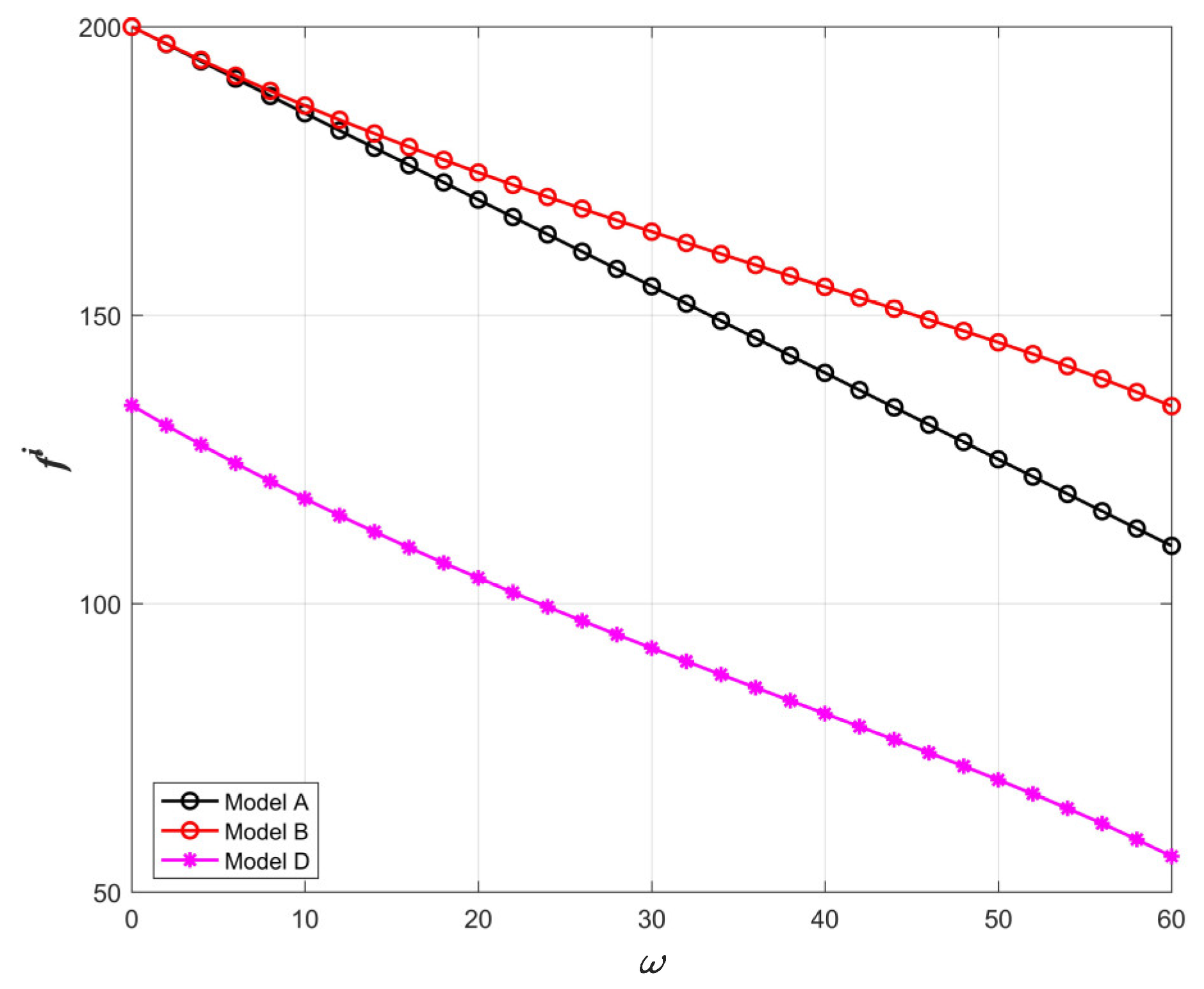

- When the unit patent license fee satisfies , it shows that the manufacturer has to bear the design cost under the decentralized decision-making of DfR compared with no DfR. Therefore, a higher patent license fee is needed to pass on this part of the cost, which verifies Proposition 3. Under coordinated decision-making, the patent license fee is minimized because the remanufacturer shares part of the DfR cost, which verifies Proposition 7.

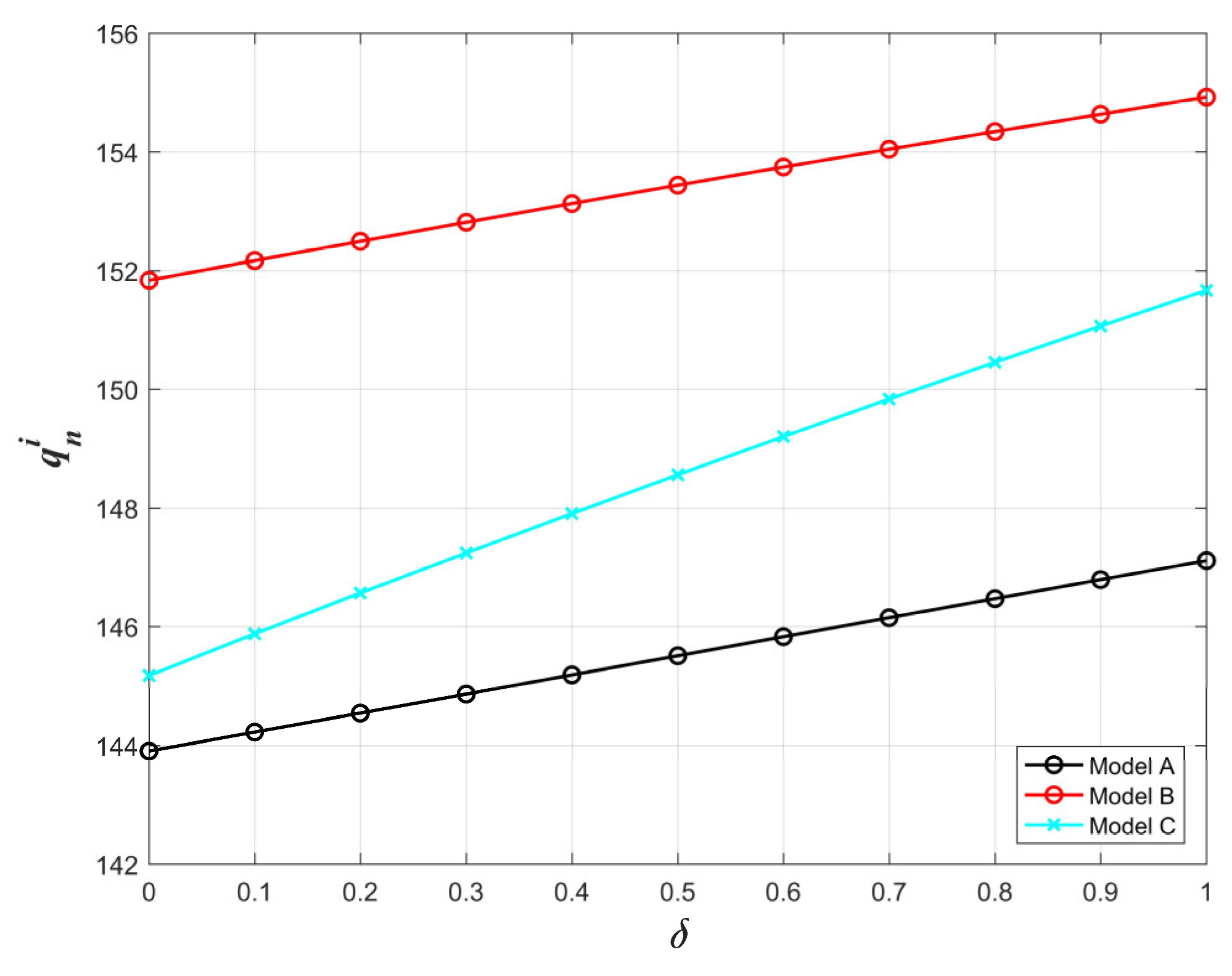

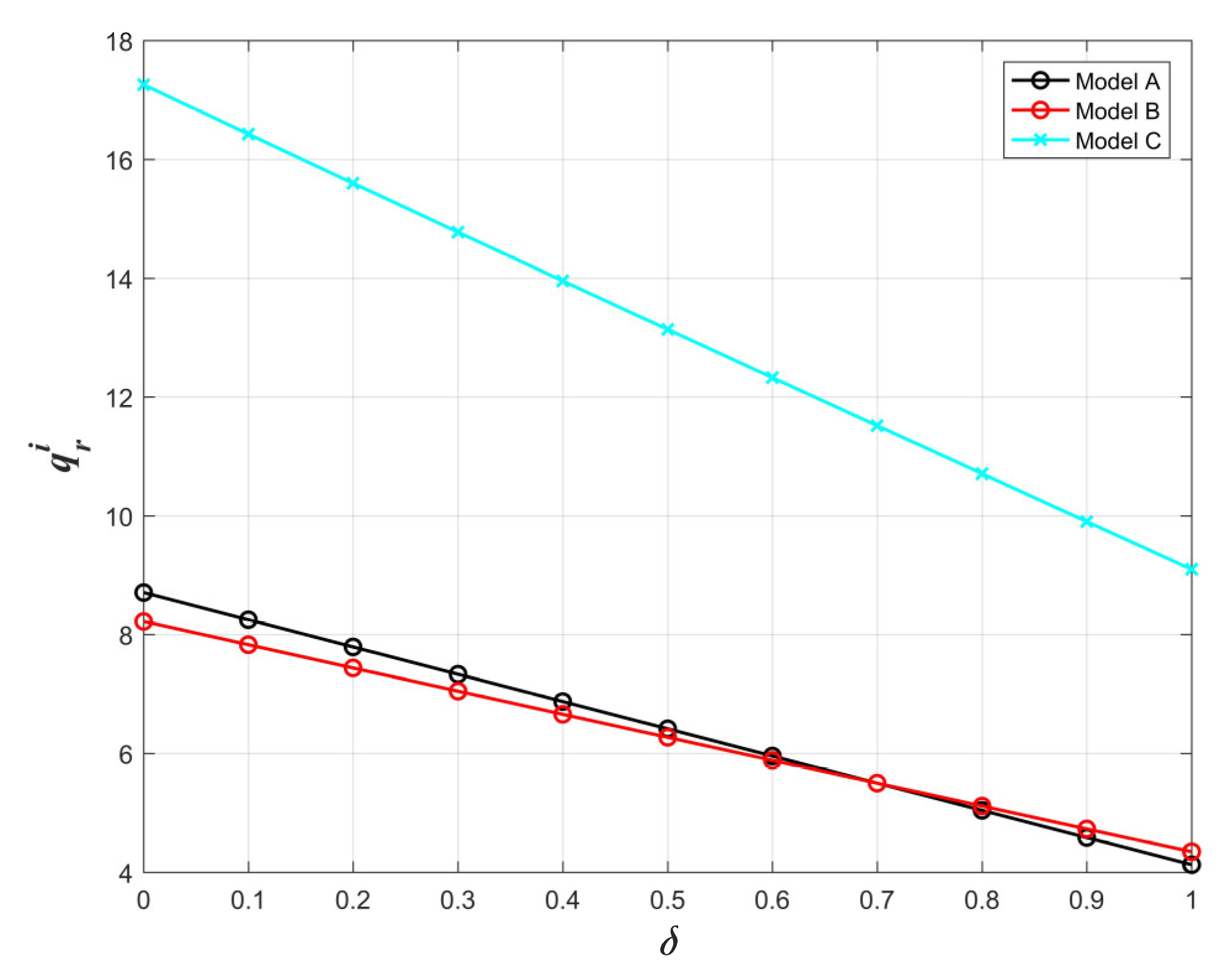

- (3)

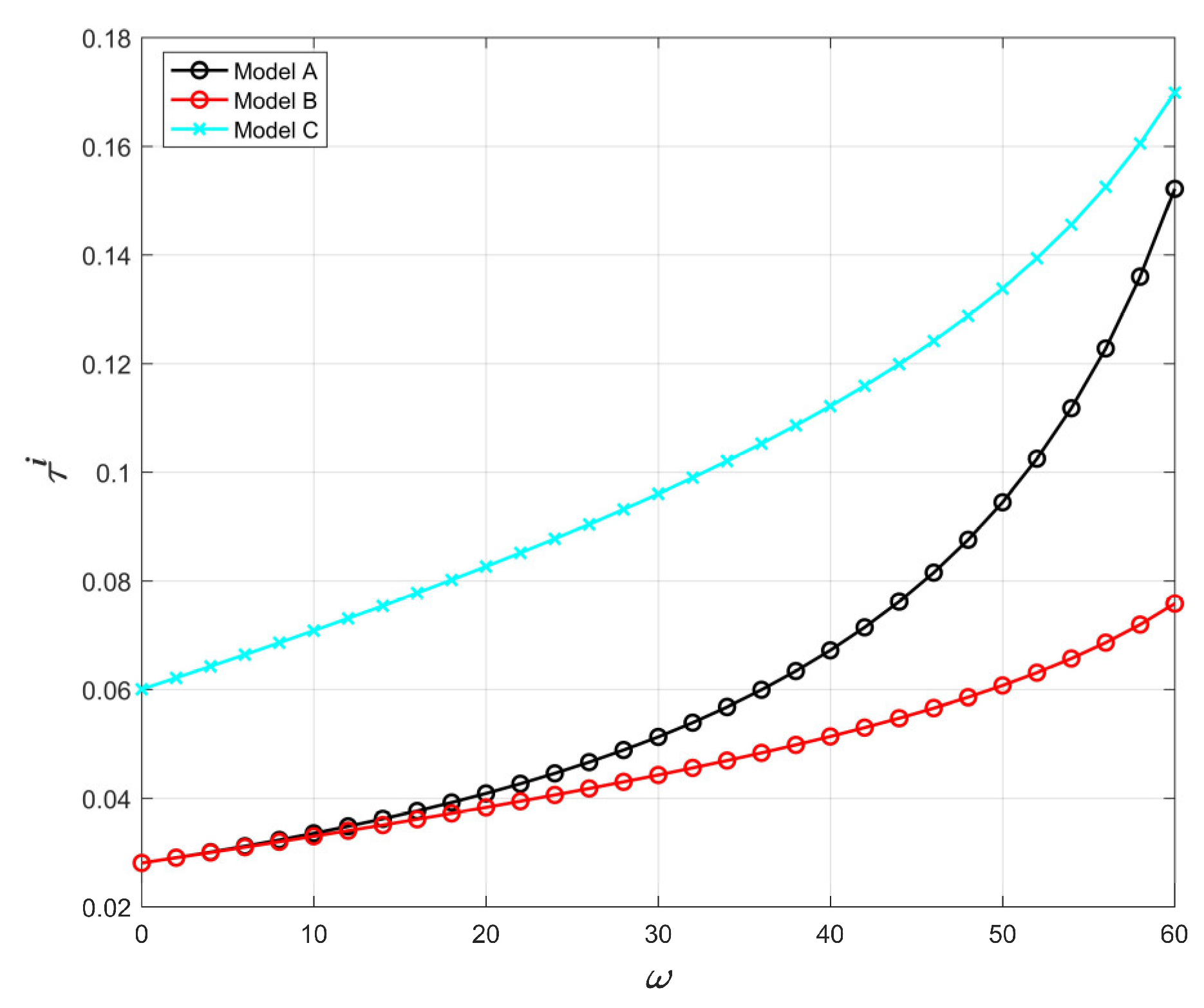

- When the recycling rate of used products satisfies , it shows that, compared with without DfR, the carbon emission costs reduced by the remanufacturer under the decentralized decision-making of DfR are smaller than the increased royalties. Therefore, its profits are reduced, the recycling incentive is weakened, and the recycling rate is reduced, which verifies Proposition 4. Under centralized decision-making, the unified decision-making of both parties maximizes the profits of the supply chain, effectively avoids the double marginal effect, and promotes recycling remanufacturing. In addition, the recycling rate is the highest, which verifies Proposition 5.

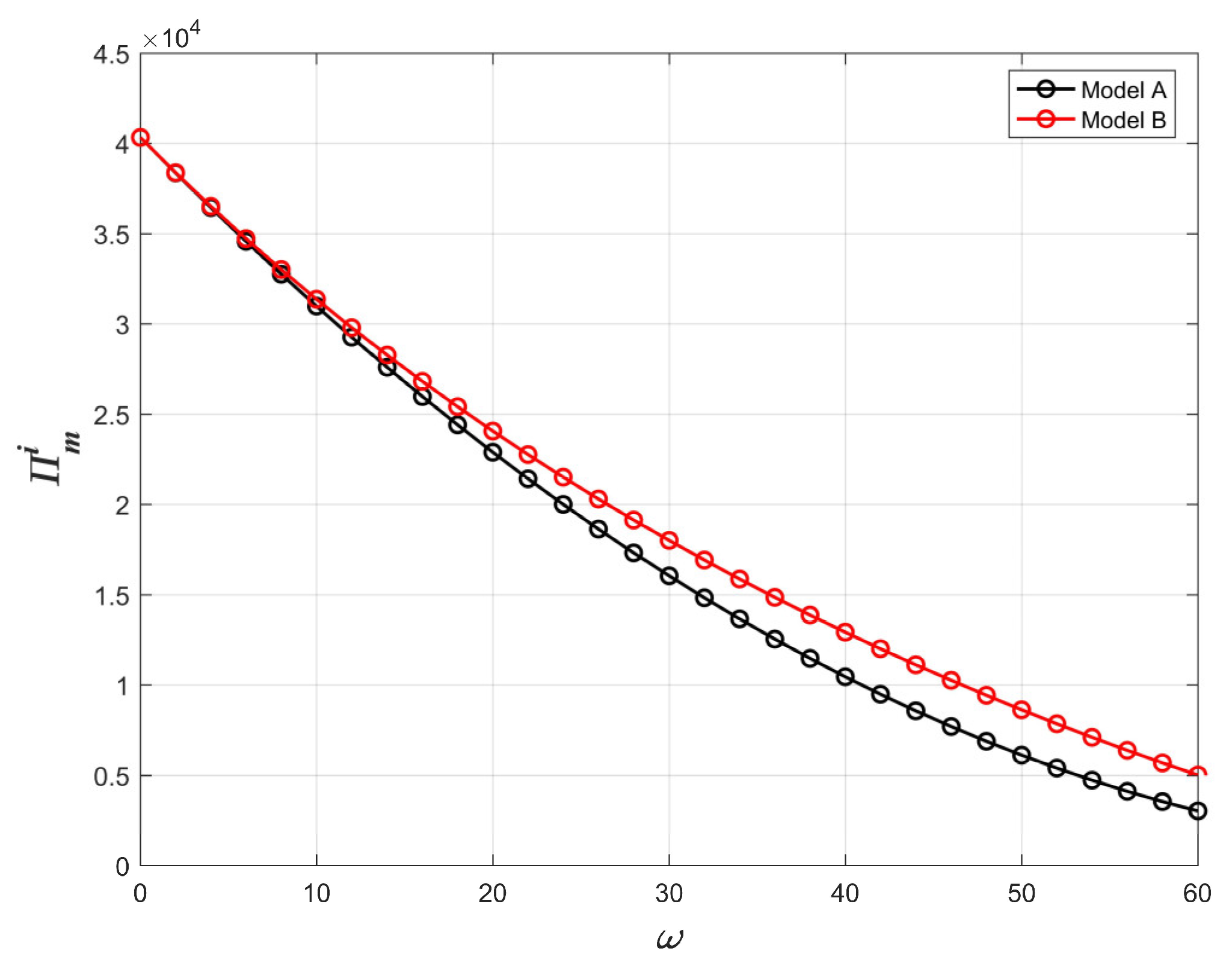

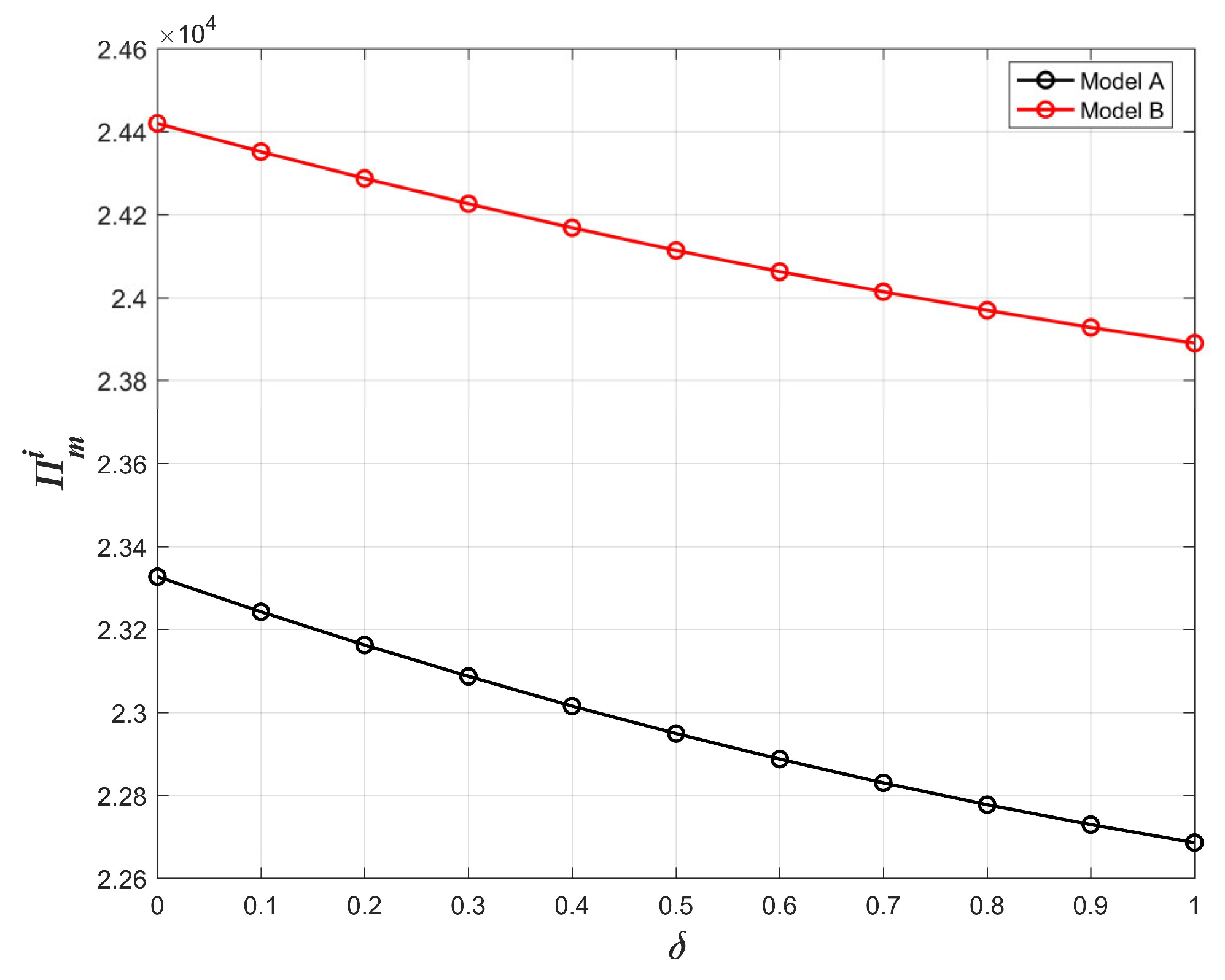

- (4)

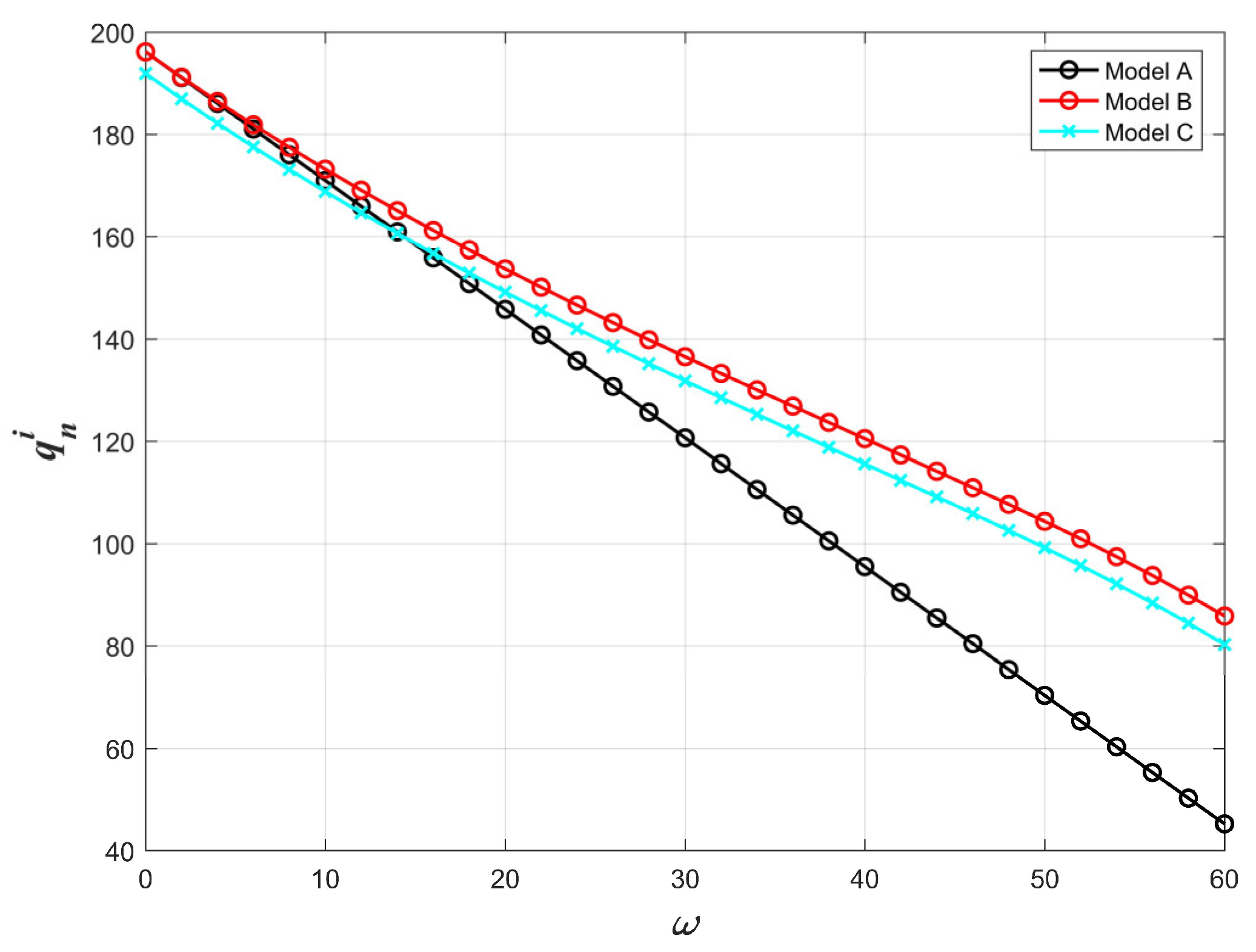

- When the manufacturer’s profits satisfy , it shows that the new product output increases after DfR, and the manufacturer’s sales revenue increases; it can also secure revenue by adjusting the patent license fee, so the profit increases compared with the pre-DfR, which verifies Proposition 3. The manufacturer’s profits are further increased compared with decentralized decision-making via contract coordination.

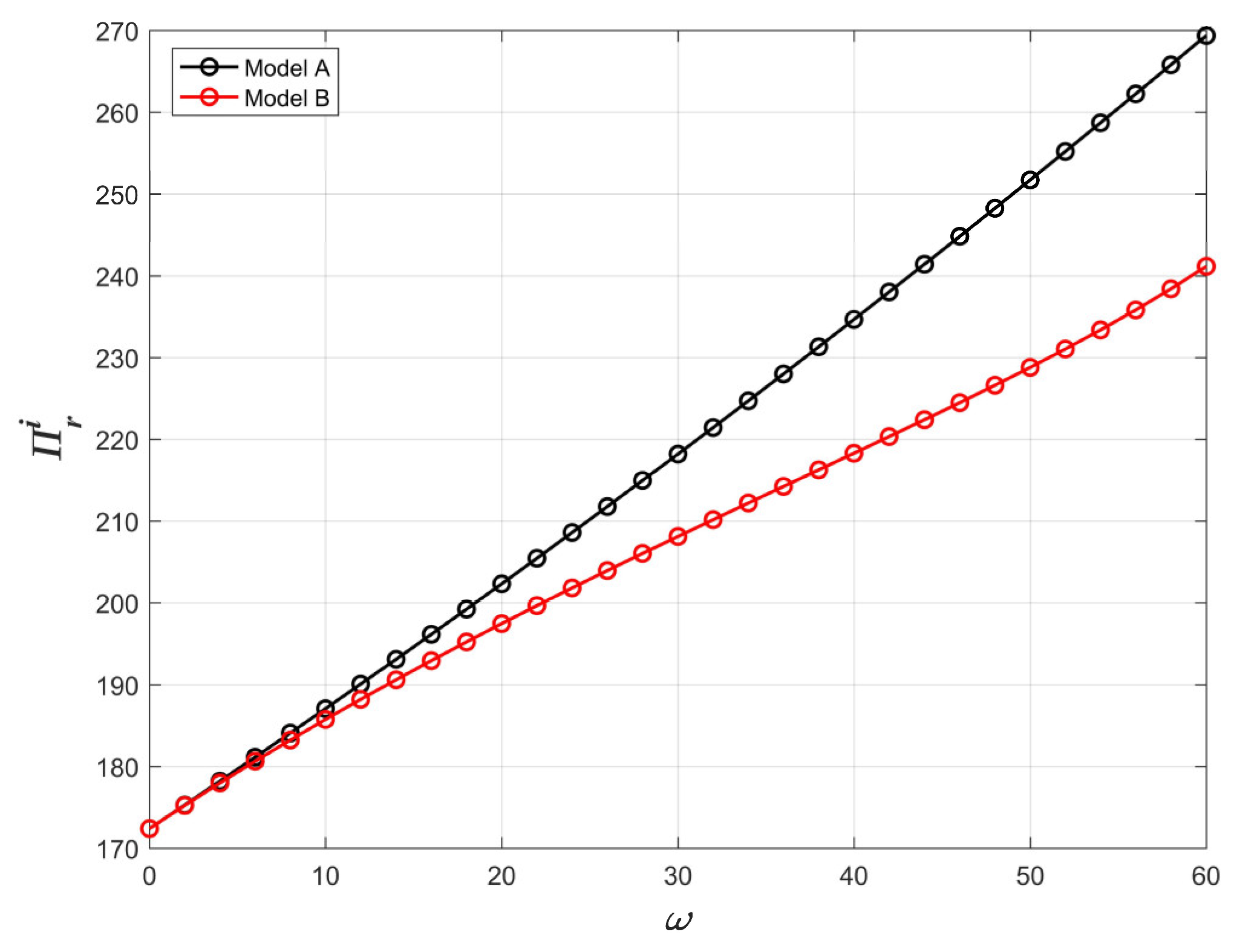

- (5)

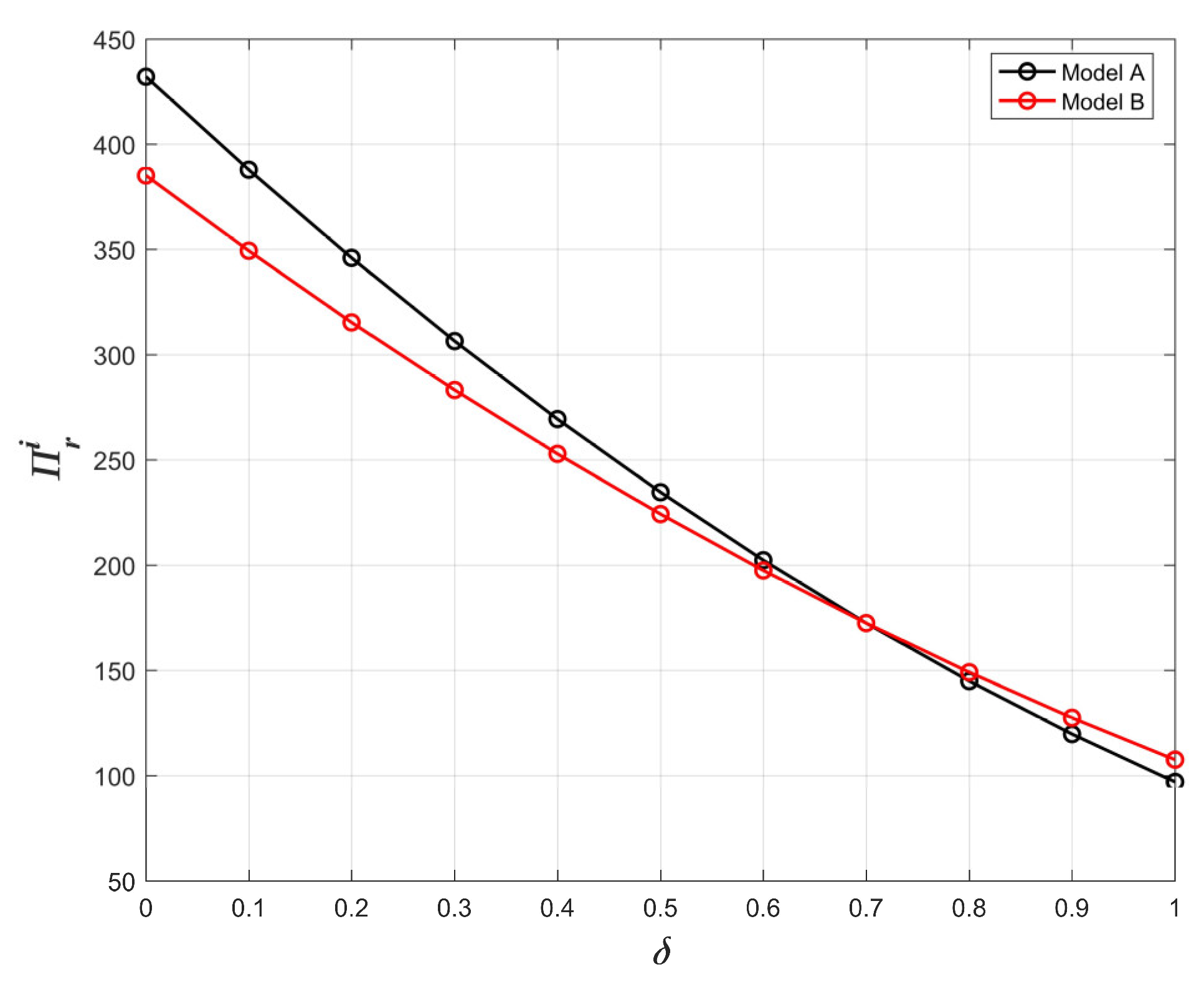

- When the remanufacturer profits satisfy , it shows that, for a given value of , DfR acts as a disincentive to remanufacturing, and the remanufacturer’s profits are the lowest, which verifies Proposition 4. The remanufacturer’s profits are significantly enhanced and peak after contract coordination.

- (6)

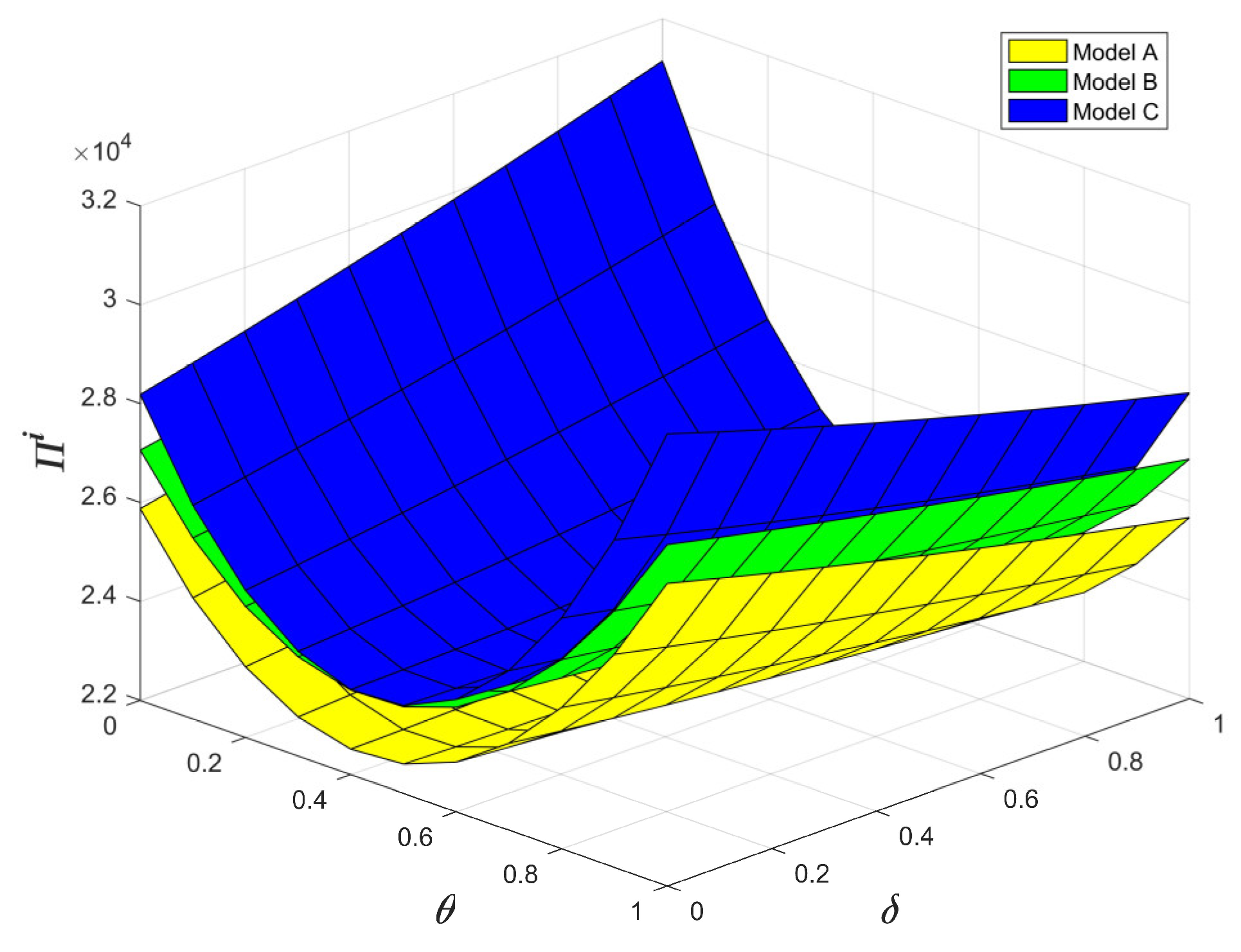

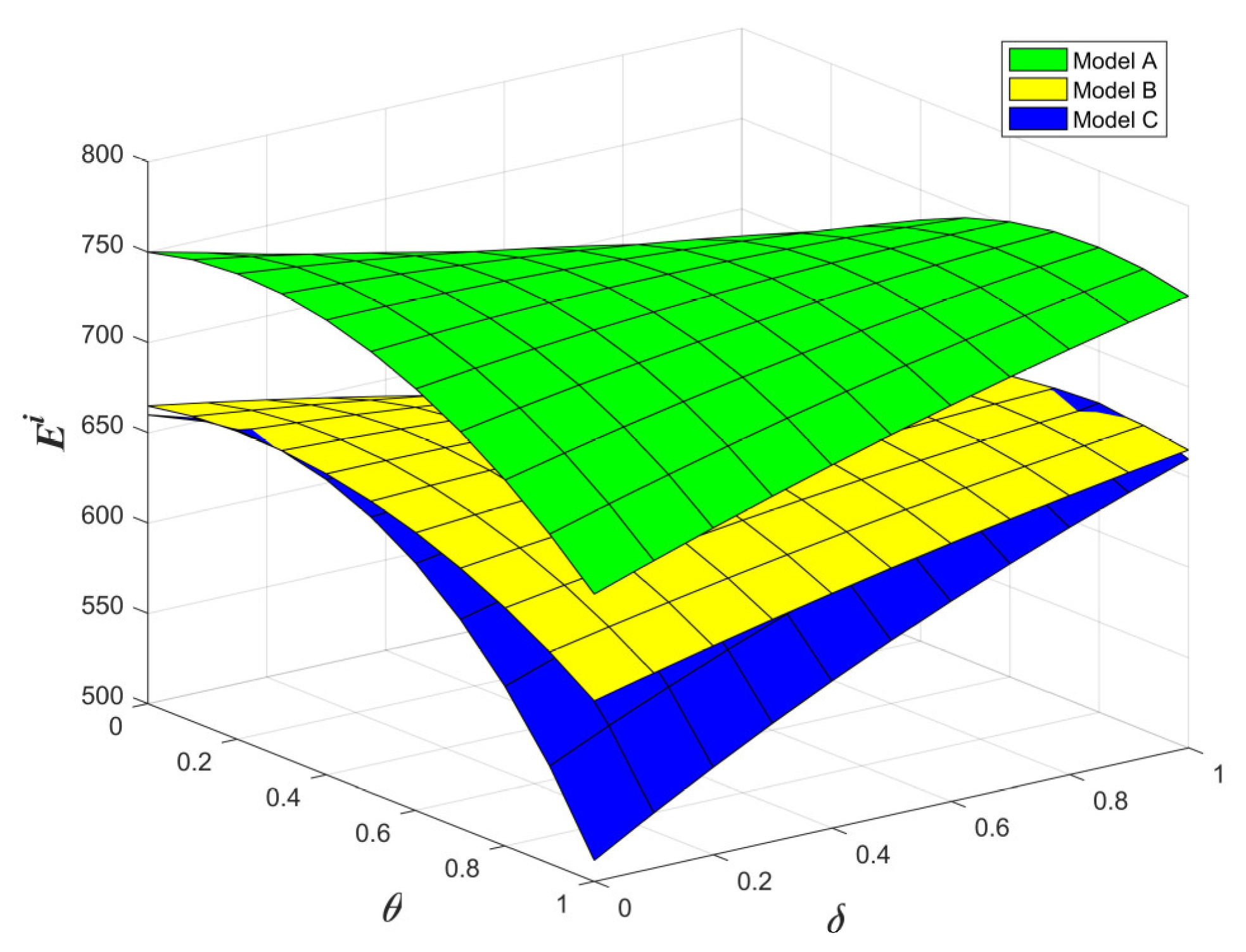

- When the total profits of the supply chain satisfy , and the total carbon emissions satisfy , it shows that DfR can effectively increase the total profit of the supply chain and reduce carbon emissions. In addition, centralized decision-making avoids the double marginal effect, maximizes the total profits of the supply chain, and minimizes carbon emissions. Coordinated decision-making can achieve same the total profits and carbon emissions of a closed-loop supply chain with centralized decision-making, and, at the same time, the respective profits of the manufacturer and the remanufacturer will be higher than under decentralized decision-making. Coordinated decision-making can achieve the same total profits and carbon emissions for a closed-loop supply chain as centralized decision-making can, and, at the same time, it can increase the profits of both the manufacturer and remanufacturer compared with decentralized decision-making. This shows that DfR can improve both overall economic efficiency and environmental performance. Moreover, a cost-sharing DfR contract can improve both the economic and environmental efficiency of a closed-loop supply chain.

6.1. Impact of Carbon Tax Rates on Manufacturer/Remanufacturer Decisions

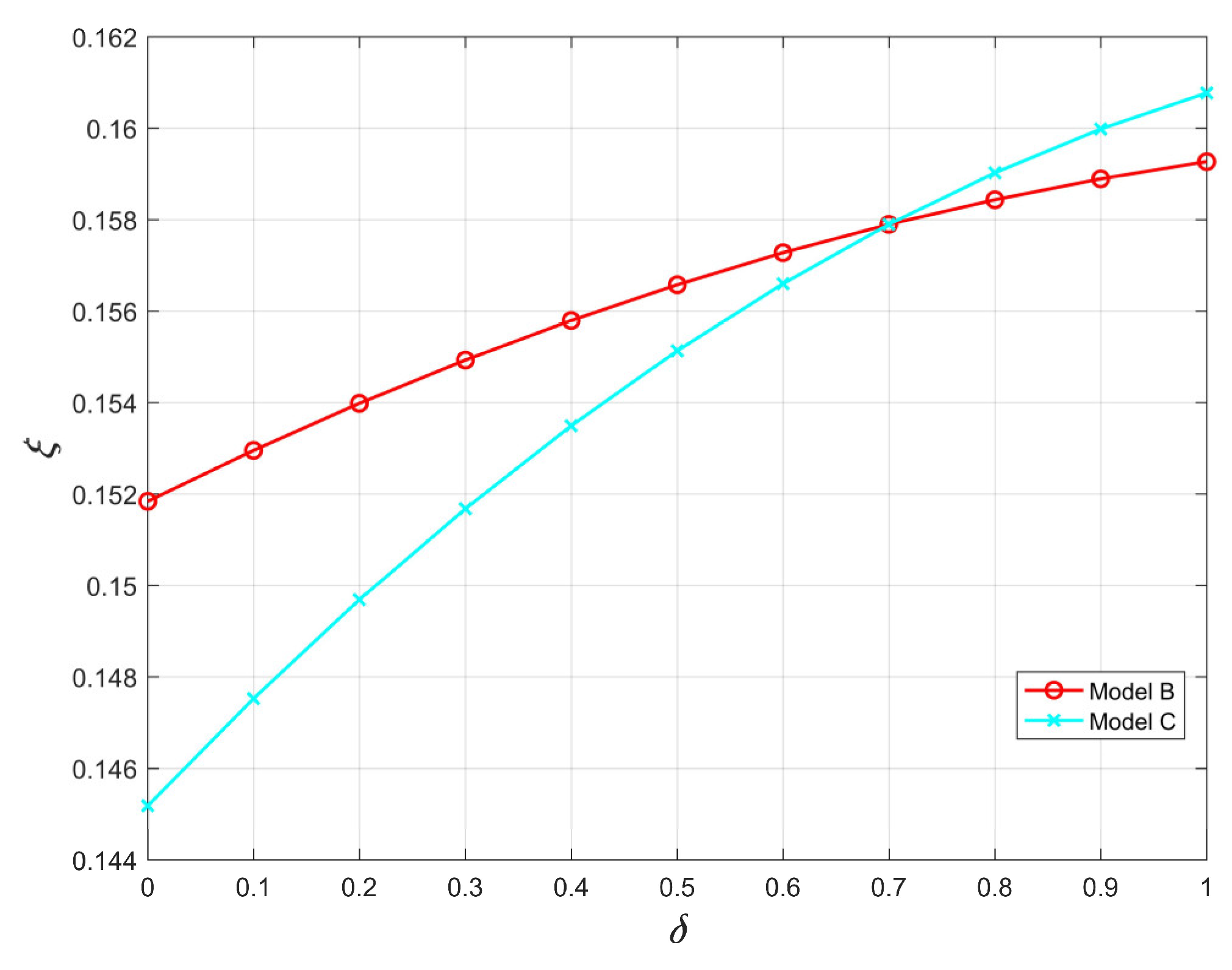

6.2. Impact of Carbon Emission Ratios on Manufacturer/Remanufacturer Decisions

6.3. Impact of Preference for Remanufactured Products and Carbon Emission Ratio

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhang, C.T.; Ren, M.L. Coordination strategy of closed-loop supply chain for remanufacture of patented products under competitive demands. Appl. Math. Model. 2016, 40, 6243–6255. [Google Scholar] [CrossRef]

- Su, J.; Li, C.; Zeng, Q.; Yang, J.; Zhang, J. A greeIn Proceedings of then closed-loop supply chain coordination mechanism based on third-party recycling. Sustainability 2019, 11, 5335. [Google Scholar] [CrossRef] [Green Version]

- Jian, J.; Guo, Y.; Jiang, L.; An, Y.; Su, J. A multi-objective optimization model for green supply chain considering environmental benefits. Sustainability 2019, 11, 5911. [Google Scholar] [CrossRef] [Green Version]

- Chen, J.; Liang, L.; Yao, D.Q. An analysis of intellectual property licensing strategy under duopoly competition: Component or product-based? Int. J. Prod. Econ. 2017, 193, 502–513. [Google Scholar] [CrossRef]

- Puška, A.; Stojanović, I. Fuzzy Multi-Criteria Analyses on Green Supplier Selection in an Agri-Food Company. J. Intell. Manag. Decis. 2022, 1, 2–16. [Google Scholar] [CrossRef]

- Huang, Y.; Wang, Z. Information sharing in a closed-loop supply chain with technology licensing. Int. J. Prod. Econ. 2017, 191, 113–127. [Google Scholar] [CrossRef]

- Chen, L.; Su, S. Optimization of the Trust Propagation on Supply Chain Network Based on Blockchain Plus. J. Intell. Manag. Decis. 2022, 1, 17–27. [Google Scholar] [CrossRef]

- Fleischmann, M. Reverse Logistics Network Structures and Design; SSRN: Rochester, NY, USA, 2003. [Google Scholar]

- Van Wassenhove, L.N.; Guide, V.D.R. The Evolution of Closed-Loop Supply Chain Research; INSEAD: Fontainebleau, France, 2008. [Google Scholar]

- Ferguson, M.E.; Toktay, L.B. The effect of competition on recovery strategies. Prod. Oper. Manag. 2006, 15, 351–368. [Google Scholar] [CrossRef] [Green Version]

- Örsdemir, A.; Kemahlıoğlu-Ziya, E.; Parlaktürk, A.K. Competitive quality choice and remanufacturing. Prod. Oper. Manag. 2014, 23, 48–64. [Google Scholar] [CrossRef]

- Wu, X.; Zhou, Y. The optimal reverse channel choice under supply chain competition. Eur. J. Oper. Res. 2017, 259, 63–66. [Google Scholar] [CrossRef]

- Huang, H.; Meng, Q.; Xu, H.; Zhou, Y. Cost information sharing under competition in remanufacturing. Int. J. Prod. Res. 2019, 57, 6579–6592. [Google Scholar] [CrossRef]

- Chai, Q.; Xiao, Z.; Zhou, G. Competitive strategies for original equipment manufacturers considering carbon cap and trade. Transp. Res. Part D Transp. Environ. 2020, 78, 102193. [Google Scholar] [CrossRef]

- Qiao, H.; Su, Q. The prices and quality of new and remanufactured products in a new market segment. Int. Trans. Oper. Res. 2021, 28, 872–903. [Google Scholar] [CrossRef]

- Soon, A.; Heidari, A.; Khalilzadeh, M.; Antucheviciene, J.; Zavadskas, E.K.; Zahedi, F. Multi-Objective Sustainable Closed-Loop Supply Chain Network Design Considering Multiple Products with Different Quality Levels. Systems 2022, 10, 94. [Google Scholar] [CrossRef]

- Ijomah, W.L.; McMahon, C.A.; Hammond, G.P.; Newman, S.T. Development of robust design-for-remanufacturing guidelines to further the aims of sustainable development. Int. J. Prod. Res. 2007, 45, 4513–4536. [Google Scholar] [CrossRef]

- Hatcher, G.; Ijomah, W.; Windmill, J. Integration of remanufacturing issues into the design process. The Design Society. In Proceedings of the 18th International Conference on Engineering Design (ICED 11), Impacting Society through Engineering Design, Lyngby, Denmark, 15–19 August 2011. [Google Scholar]

- Wu, C.H. OEM product design in a price competition with remanufactured product. Omega 2013, 41, 287–298. [Google Scholar] [CrossRef]

- Subramanian, R.; Ferguson, M.E.; Beril Toktay, L. Remanufacturing and the component commonality decision. Prod. Oper. Manag. 2013, 22, 36–53. [Google Scholar] [CrossRef]

- Kamien, M.I.; Tauman, Y. Patent licensing: The inside story. Manch. Sch. 2002, 70, 7–15. [Google Scholar] [CrossRef]

- Hong, X.; Govindan, K.; Xu, L.; Du, P. Quantity and collection decisions in a closed-loop supply chain with technology licensing. Eur. J. Oper. Res. 2017, 256, 820–829. [Google Scholar] [CrossRef]

- Ghosh, D.; Gouda, S.; Shankar, R.; Swami, S.; Thomas, V.C. Strategic decision making under subscription-based contracts for remanufacturing. Int. J. Prod. Econ. 2018, 200, 134–150. [Google Scholar] [CrossRef]

- Zhou, Y.W.; Guo, J.; Zhou, W. Pricing/service strategies for a dual-channel supply chain with free riding and service-cost sharing. Int. J. Prod. Econ. 2018, 196, 198–210. [Google Scholar] [CrossRef]

- He, P.; He, Y.; Shi, C.V.; Xu, H.; Zhou, L. Cost-sharing contract design in a low-carbon service supply chain. Comput. Ind. Eng. 2020, 139, 106160. [Google Scholar] [CrossRef]

- Chen, H.; Dong, Z.; Li, G.; He, K. Remanufacturing process innovation in closed-loop supply chain under cost-sharing mechanism and different power structures. Comput. Ind. Eng. 2021, 162, 107743. [Google Scholar] [CrossRef]

- Wu, D.; Chen, J.; Li, P.; Zhang, R. Contract coordination of dual channel reverse supply chain considering service level. J. Clean. Prod. 2020, 260, 121071. [Google Scholar] [CrossRef]

- Rezayat, M.R.; Yaghoubi, S.; Fander, A. A hierarchical revenue-sharing contract in electronic waste closed-loop supply chain. Waste Manag. 2020, 115, 121–135. [Google Scholar] [CrossRef]

- Jian, J.; Li, B.; Zhang, N.; Su, J. Decision-making and coordination of green closed-loop supply chain with fairness concern. J. Clean. Prod. 2021, 298, 126779. [Google Scholar] [CrossRef]

- Feng, L.; Govindan, K.; Li, C. Strategic planning: Design and coordination for dual-recycling channel reverse supply chain considering consumer behavior. Eur. J. Oper. Res. 2017, 260, 601–612. [Google Scholar] [CrossRef]

- Shi, Z.; Wang, N.; Jia, T.; Chen, H. Reverse revenue sharing contract versus two-part tariff contract under a closed-loop supply chain system. Math. Probl. Eng. 2016, 2016, 5464570. [Google Scholar] [CrossRef] [Green Version]

- Cao, J.; Zhao, Y.W.; Wu, S.S.; Zhou, G.G. Remanufacturing game with patent protection and government regulation. J. Manag. Sci. 2020, 23, 1–23. [Google Scholar]

- Zhu, X.; Ding, L.; Guo, Y.; Zhu, H. Decision and coordination analysis of extended warranty service in a remanufacturing closed-loop supply chain with dual price sensitivity under different channel power structures. RAIRO Oper. Res. 2022, 56, 1149–1166. [Google Scholar] [CrossRef]

- Wang, N.; Zhang, Y. Carbon emission reduction and coordination decisions of closed-loop supply chain under patent protection. J. Control. Decis. 2020, 1378–1388. [Google Scholar] [CrossRef]

- Su, J.; Zhang, F.; Hu, H.; Jian, J.; Wang, D. Co-Opetition Strategy for Remanufacturing the Closed-Loop Supply Chain Considering the Design for Remanufacturing. Systems 2022, 10, 237. [Google Scholar] [CrossRef]

| Symbol | Meaning |

|---|---|

| Price/quantity of new products, | |

| Price/quantity of remanufactured products, | |

| Unit production cost of new/remanufactured products | |

| Unit patent license fee | |

| Carbon tax rate | |

| Total market volume | |

| Consumers’ willingness to pay for remanufactured products | |

| Cost factor of recycling waste products | |

| Recycling rate of used products, | |

| The coefficient of DfR | |

| The level of DfR, | |

| Unit carbon emissions of new products without DfR | |

| Ratio of carbon emissions from remanufactured products to carbon emissions from new products | |

| Carbon emissions, | |

| Manufacturer’s profit, | |

| Remanufacturer’s profit, | |

| Total supply chain profit, |

| Variants | Model A | Model B | Model C | Model D | ||

|---|---|---|---|---|---|---|

| - | 0.4255 | 0.4219 | 0.4219 | 0.4219 | 0.4219 | |

| 142.30 | 163.83 | 154.85 | 154.85 | 154.85 | 154.85 | |

| 170.00 | 182.77 | - | 108.40 | 108.40 | 108.40 | |

| 0.08 | 0.06 | 0.15 | 0.15 | 0.15 | 0.15 | |

| 11.00 | 10.64 | 23.21 | 23.21 | 23.21 | 23.21 | |

| 23,214.89 | 26,382.98 | - | 26,446.62 | 26,589.04 | 26,731.47 | |

| 387.08 | 362.15 | - | 726.38 | 583.96 | 441.53 | |

| 23,601.97 | 26,745.13 | 27,173.00 | 27,173.00 | 27,173.00 | 27,173.00 | |

| 744.50 | 488.91 | 487.81 | 487.81 | 487.81 | 487.81 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jian, J.; Wang, G.; Hu, H.; Su, J. Decision-Making Models and Coordination in a Closed-Loop Supply Chain Considering Patent Protection for DfR. Systems 2023, 11, 127. https://doi.org/10.3390/systems11030127

Jian J, Wang G, Hu H, Su J. Decision-Making Models and Coordination in a Closed-Loop Supply Chain Considering Patent Protection for DfR. Systems. 2023; 11(3):127. https://doi.org/10.3390/systems11030127

Chicago/Turabian StyleJian, Jie, Gan Wang, Hongyuan Hu, and Jiafu Su. 2023. "Decision-Making Models and Coordination in a Closed-Loop Supply Chain Considering Patent Protection for DfR" Systems 11, no. 3: 127. https://doi.org/10.3390/systems11030127