1. Introduction

The beginning of the XXI century was characterized by numerous challenges in the external environment. The advanced development of information technologies was a powerful driver for the globalization of the world economy and the formation of its turbulence. Under these conditions, the frequency and variety of financial crises at the national and international levels actualized the problem of systemic risks, which have become an important issue for discussion in the banking sector of the world’s leading countries [

1]. In fact, the term “systemic risk” has been widely used in the economic literature since the mid-1980s, but in the first decades of the XXI century, the concept of systemic risk gained significant popularity, leading to a sharp increase in the need for banking systems in the world’s leading countries for effective approaches to managing systemic risks [

2]. Specifically, the search for effective methods of managing systemic risks led to the strengthening of the traditional microprudential approach to regulation and supervision of the banking sector. The approach was based on a new vision that requires banking regulators to pay closer attention to the relations between financial institutions and the corresponding structure of the banking system, ensuring the correction of political decisions to support its financial stability [

3]. This was accompanied by a change in the paradigm of banking supervision and the creation of new regulatory bodies, such as the European Systemic Risk Council, the Financial Stability Oversight Council in the United States, and the Prudential Regulation Authority (Financial Policy Committee, FPC) at the Bank of England [

4]. Focusing on the problem of systemic risk has led to a serious rethinking of the goals, functions, and tools of existing banking regulators and their institutional transformation. This has given systemic risk a key role in the macroprudential policy of many financial regulators of the world’s leading countries [

5]. At the same time, in the banking systems of countries with developing and transition economies, the processes of financial globalization, disintermediation, and rapid development of shadow banking activities form devastating systemic risks.

The increased impact of the systemic crisis on the banking system under the turbulence of the world economy has sharply exacerbated the social demand for effective methods of crisis management, including systemic ones. The global financial crisis empirically confirmed the limited possibilities of diversification as a risk reduction tool in the stock, commodity, or currency markets. The excessive risk distribution within the system can increase the speed of its spread from one financial institution to another [

6], reducing the effectiveness of available tools to minimize systemic risks, and sharpening the problems of systemic risk management. Accordingly, the impact of the COVID-19 pandemic had completely devastating consequences for a number of banking and financial organizations. In this case, in contrast to previous financial crises that had an endogenous nature, the financial crisis caused by the COVID-19 pandemic is exogenous. Therefore, it requires additional studies of the main interrelations and interdependencies of the systemic risk formation in the banking sector in the conditions of the COVID-19 pandemic. Thus, the presented study is designed to fill the existing gap in determining the main interrelations and interdependencies in terms of systemic banking risk during the exogenous financial crisis caused by the COVID-19 pandemic.

2. Literature Review

The increased influence of systemic risk on the sustainable development of the banking system has led to a high research interest in various aspects of systemic risk formation [

7,

8]. Modern researchers consider systemic risk as the occurrence of large-scale negative events. The events, being caused by both exogenous shocks (global or local) occurring outside the financial system and endogenous shocks occurring in the financial system itself, affect the activities of systemically significant intermediaries and markets [

9]. At the same time, systemic events are considered large-scale in the case when they can lead to the bankruptcy of financial intermediaries or disrupt the stability of financial markets [

10]. Modern studies on the structure of systemic risk distinguish “horizontal” and “vertical” risks. Horizontal risks arise from the activities of the financial system, while bilateral relations between the financial system and the economy lead to vertical ones. In this case, the negative impact of systemic risk and systemic events depends on the degree of their impact on consumption, investment, and economic growth [

11]. At the same time, the high interdependence of financial intermediaries causes the formation of systemic risk for the entire financial system containing a set of financial intermediaries operating within a country [

12].

Thus, systemic risk is to be understood as the probability of negative adverse events caused by exogenous or endogenous shocks that lead to financial market instability, including the insolvency or liquidity loss of a significant number of interconnected financial intermediaries [

13]. In addition, the structural complexity of a systemic risk causes inconsistency in modern researchers’ opinions regarding the ways of managing systemic risks. Accordingly, Zhou and Li believe that the most effective way to reduce systemic risk is to simultaneously eliminate its main forms: The risk of proliferation, the risk of macroeconomic shock, and the risk of imbalance. These forms of risks can exist both independently and in combination with each other [

14].

The risk of proliferation is often a local problem that may eventually become systemic due to its spread. Thus, one bank may cause the bankruptcy of another, even if the latter initially seemed solvent [

15,

16]. The risk of a macroeconomic shock is associated with systemic exogenous shocks that simultaneously negatively affect both the financial intermediary sector and the markets. Both of them are sensitive to economic downturns; therefore, the general deterioration of economic conditions can also lead to systemic risks in the financial sector [

17]. The risk of an imbalance is associated with an endogenous factor, which implies a gradual increase in imbalances in the financial system over a certain period of time, causing a long-term negative impact [

18]. Moreover, modern researchers identify a number of market shortcomings, including information asymmetry, external factors, socially oriented policies, incomplete markets, etc. These shortcomings can also have a negative impact on the financial system, leading to a significantly greater vulnerability of the financial system compared to other sectors of the economy [

19].

Studies on the financial sector show that systemic financial crises can also be caused by imbalances in the structure of financial intermediaries’ resources [

20]. Modern researchers identify the following causes of financial sector imbalances that increase its systemic vulnerability:

- (1)

Herd behavior of counterparties buying the same or similar assets on the financial market; such behavior is inherent in investors when general information about the profitability of financial instruments is unavailable [

21].

- (2)

Low bank interest rates, which lead to a less thorough study of borrowers’ credit history [

22].

- (3)

The need to ensure the financial security of the banking sector and protect the interests of depositors, which is a source of moral risk and, accordingly, the risk of imbalance.

- (4)

The occurrence of an imbalance during the recapitalization of the bank by the government, as well as when the central bank performs the role of lender of last resort [

23,

24].

According to modern researchers, in case the potential increase in systemic risks is neglected by financial market actors, even minor adverse events can lead to the materialization of systemic risks that negatively affect the activities of the financial market as a whole [

25]. In this context, it is relatively logical that there is a sharp surge of research interest in the impact of the COVID-19 pandemic on the formation of systemic risk [

26]. The study by Rizwan et al. [

1] was devoted to the definition of the main trends in the development of systemic risk and the identification of systemically valuable financial institutions on the example of eight significant national banking systems: Canada, China, France, Germany, Italy, Spain, Great Britain, and the USA using CATFIN [

1]. Nevertheless, although the study used systemic indicators of banking risk during the active phase of the COVID-19 pandemic, it does not address the problems of interrelationships and mutual influence of the main indicators characterizing the development of the COVID-19 pandemic and systemic banking risks.

Of particular note is the study by Solarz and Waliszewski [

27] presenting a holistic concept of the COVID-19 pandemic as a systemic risk. Using the advantages of a systematic approach in a multidisciplinary multi-country study, the researchers identified the COVID-19 pandemic itself as a critical systemic risk. According to Solarz and Waliszewski [

27], the scale of the losses caused by the COVID-19 pandemic not only puts it on a par with the global financial crisis (IFC) in terms of systemic risk but also determines significant differences in the post-pandemic recession, including the following:

- (1)

Clearly exogenous nature of the crisis, not caused by economic imbalances.

- (2)

Uncertainty replacing measurable risk since non-economic factors are the source of the risk.

- (3)

Truly global spread of the crisis, as there are hardly any countries not affected by the COVID-19 pandemic [

27].

Using a systemic risk matrix based on the Swan typology, the researchers define the COVID-19 pandemic as a “Green Swan” model and pure uncertainty. They argue that the COVID-19 pandemic should be described in the context of systemic risk [

27]. The conclusions of the previous researchers, indeed, discover a new perspective for studying the impact of the COVID-19 pandemic on various aspects of human activity. However, this study has a predominantly theoretical and largely interdisciplinary aspect, not focusing on the study of systemic risks directly in the banking sector.

In addition, a significant part of modern research is aimed at studying certain aspects of minimizing systemic risks. It should be noted that studies suggest increasing the stability of the banking sector through the use of more complex and diversified interbank lending structures, more stable than incomplete ones [

28]. The studies also implement a network theory that allows banks to prevent the collapse of the network through mutual liquidity support [

29,

30].

Thus, the analysis of theoretical sources shows that there is a significant number of studies on systemic risks in the financial and banking sector [

31,

32,

33]. Nevertheless, the problems of the COVID-19 pandemic’s impact on the formation of systemic risks in the banking sector are clearly insufficiently investigated. In most cases, studies do not address specific indicators of the COVID-19 pandemic’s development. The present study aims to fill this gap by determining the interrelations and interdependencies of individual indicators of systemic risk formation and indicators of the COVID-19 pandemic’s development.

Problem Statement

The analysis of theoretical sources revealed that, despite a significant increase in the number of studies devoted to the formation of systemic risk in the banking sector during the pandemic [

3,

34,

35], the effect of COVID-19 on the formation of systemic risk is currently insufficiently developed. At the same time, the results of the analysis and the previous researchers’ approach to the study of the COVID-19 pandemic as a systemic risk [

27] determined the main hypotheses of this study:

Hypothesis 1 (H1): The number of COVID-19 cases contributes to the systemic risk formation in the banking sector through an increase in household debt.

Hypothesis 2 (H2): The number of COVID-19 cases contributes to the systemic risk formation in the banking sector through an increase in overdue loans.

Hypothesis 3 (H3): The number of COVID-19 cases contributes to the formation of systemic risk in the banking sector through changes in the liquidity of banking institutions’ capital.

Hypothesis 4 (H4): The number of fatal COVID-19 cases contributes to the formation of systemic risk in the banking sector, through an increase in household debt.

Hypothesis 5 (H5): The number of fatal COVID-19 cases does not have a significant impact on the formation of systemic risk in the banking sector through an increase in overdue loans.

Hypothesis 6 (H6): The number of fatal COVID-19 cases does not have a significant impact on the formation of systemic risk in the banking sector through changes in the liquidity of banking institutions’ capital.

Hypothesis 7 (H7): The COVID-19 pandemic has a significant impact on the formation of systemic risk in the banking sector with an increase in the number of cases.

Thus, the main motivation of this study was the increased social demand for effective methods of managing systemic risks. This demand also caused the need to identify the main interrelations and interdependencies of the systemic banking risk under the influence of the COVID-19 pandemic. At the same time, the lack of research on this issue in modern scientific literature determined the topic of the study, its main purpose, and its objectives.

The aim of the study was to determine the main interrelations and interdependencies of the systemic risk formation in the banking sector under the influence of the COVID-19 pandemic. To this end, the following scientific tasks were formulated and consistently solved: (1) Review current scientific publications on the research problem in order to form the main working hypotheses; (2) develop a methodological design of the study, identify the main data sources; (3) test the study on the example of data from China; (4) test the working hypotheses; (4) formulate the main conclusions of the study and present its results.

The developed approach was tested on the basis of data from China. The choice of country for testing was due not only to the size of the national financial market but also to the significant role of the Chinese economy in shaping world politics. An important role in choosing a national economy for testing was the longer period of statistical monitoring of the COVID-19 pandemic: China became the first country to take the COVID-19 hit and morbidity statistics in China have been available since January 2020. Moreover, an additional factor in choosing the national economy for testing was the differences in the dynamics of China’s systemic risks identified by previous researchers [

26].

3. Materials and Methods

To achieve the study aim, a multi-stage desk research project was developed and implemented. The study is based on a quantitative approach to secondary information. The information is the result of long-term statistical observations obtained from reliable sources [

36]. The methodological basis of this study was the time-series model.

The main stages of the study are presented in

Figure 1.

At the first stage of the study, an analysis of theoretical sources on the study issue was carried out. Then, based on the experience of previous researchers, the methodological design of the study was developed. Additionally, at this stage, the most effective tools for the formed methodological design of the study were determined, providing the most objective information within the framework of this study. At the next stage of the study, the main sources of information were selected, and the main boundaries of the study were identified, including (a) the implementation limitations of the study and (b) time intervals for analyzing the time series model. Since the time series model was chosen as the methodological model of the study, a set of econometric and economic-statistical methods was used for the analysis, including the method of correlation-regression analysis and the method of trend forecasting.

The choice of a time point for building a time series model is due to the duration of the COVID-19 pandemic, which the World Health Organization announced in March 2020 [

37]. Regarding the formation peculiarities of the statistical information, a scale of one-quarter was assumed to be the most appropriate for the developed time series model. When determining the time limits of the time model, it was noted that it was China that took the first blow of COVID-19 [

37]. The statistics on COVID-19 in China have been available since January 2020, after the WHO received an official notification of the identification and classification by Chinese researchers of a previously unknown pathogen. Therefore, the initial boundary of the study was January 2020. The final boundary of the study was October 2022, determined as the last period of available quarterly statistical data.

The choice of indicators for the analysis was based on the result of the previous researchers’ experience. However, it was formed under the influence of the first implementation limitation of this study, namely, the imperfection of the statistical information system. A number of indicators that may be significant in the analysis of the formation of systemic risk require a 1-year collection period of statistical information due to the limited time of the COVID-19 pandemic impact. Therefore, considering the influence of the main implementation limitation, the indicators selected for further analysis provided reliable information with the selected time interval of research of one-quarter: (1) China’s overdue loan ratio; (2) the Chinese household debt (% of GDP); and (3) the capital liquidity ratio [

36].

To analyze the impact of the COVID-19 pandemic on the formation of these indicators of the formation of systemic risk in the banking sector, the following indicators were selected that characterize the dynamics of the COVID-19 pandemic in China: (4) The number of detected cases of COVID-19 and (5) the number of deaths from COVID-19 [

36].

To assess the normality and the reliability of the sample during the study, the indicators of the average value and standard deviation were used. When calculating the mean (

µ), Formula (1) was used:

where

x represents the value of the analyzed indicator and

n is the total number of values in the time series.

When calculating the index of the standard (root mean square) deviation

σ, Formula (2) was used:

where

x is the value of the analyzed indicator,

n is the total number of values in the time series, and

µ is the mean.

When calculating the coefficient of variation (

cv), Formula (3) was used:

where

σ is the standard (root mean square) deviation and

µ is the mean.

When calculating the standard error of the time series (

s), Formula (4) was used:

When calculating the median of the time series (

me), Formula (5) was used:

where

h is the length of the median interval,

nm is the frequency of the median interval, and

is the cumulative frequency of the previous interval.

When calculating the correlation coefficient (

Correl (

X,

Y)), Formula (6) was used:

where

represent average values of samples.

All mathematical modeling operations for the time series under study in this study were performed using software of the Microsoft Excel spreadsheet processor. The graphical objects used to visualize the study results were made in the software environment of Microsoft Office applications.

4. Results

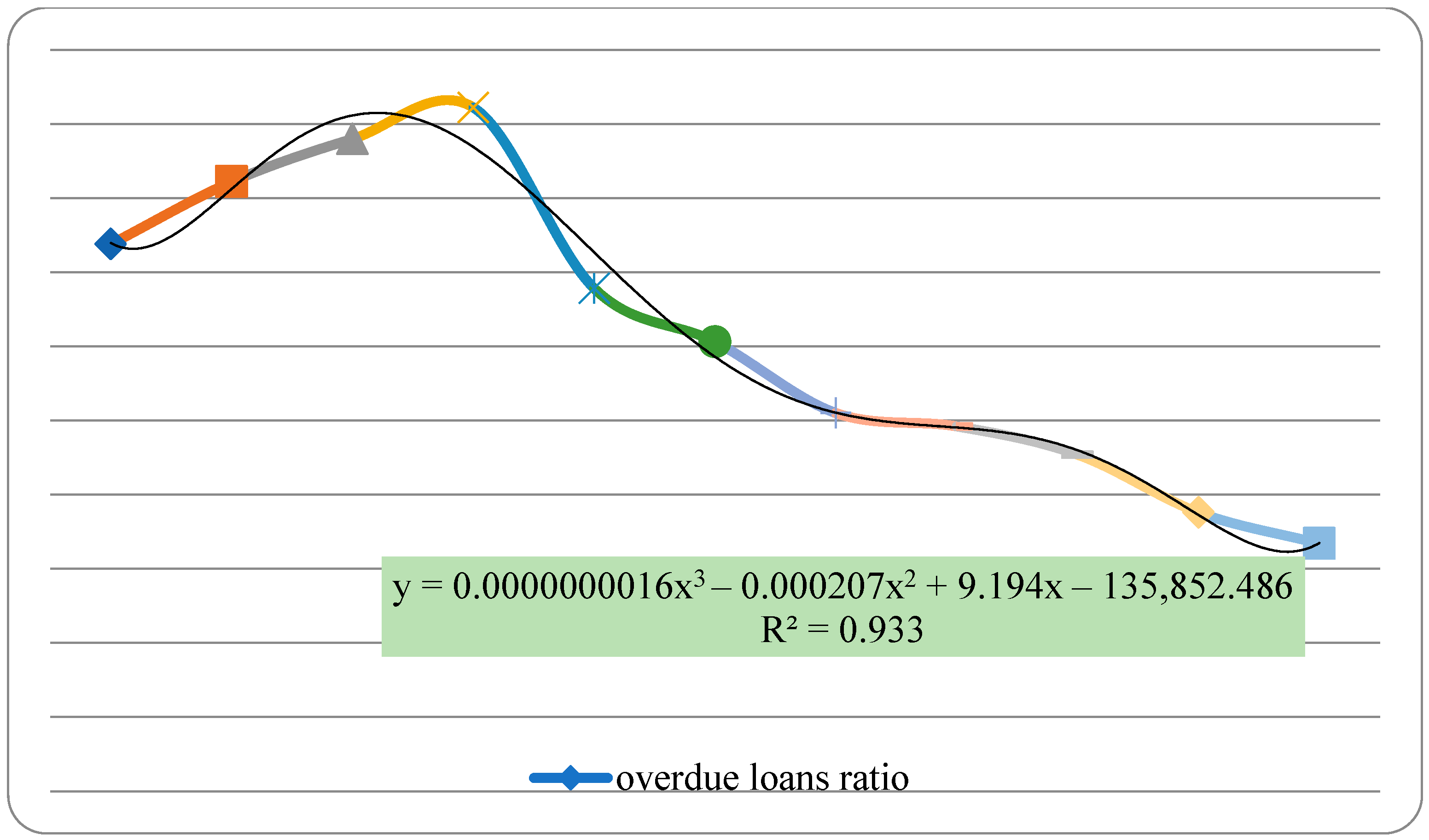

First, we analyzed the dynamics of China’s overdue loan ratio within the framework of the developed time series model. The quarterly updated data on the ratio of overdue loans in China from January 2020 to October 2021, a total of 12 periods, were used for the analysis. The results of descriptive statistics for the selected time interval of changes in the overdue loan ratio are presented in

Table 1.

The analysis of descriptive statistics for the overdue loan ratio at the selected time interval proved the normality and reliability sample. The dynamics of the overdue loan ratio in China are graphically shown in

Figure 2.

Based on the results of the study, a mathematical model was constructed for this indicator. The model belongs to the polynomial model (3 degrees) and is described by the equation: y = 0.0000000016x3 − 0.000207x2 + 9.194x − 135,852.486. At the same time, the value of the approximation reliability R2 = 0.933 indicated very high compliance of the model with the analyzed data and the expediency of using the selected model for further analysis and forecasting.

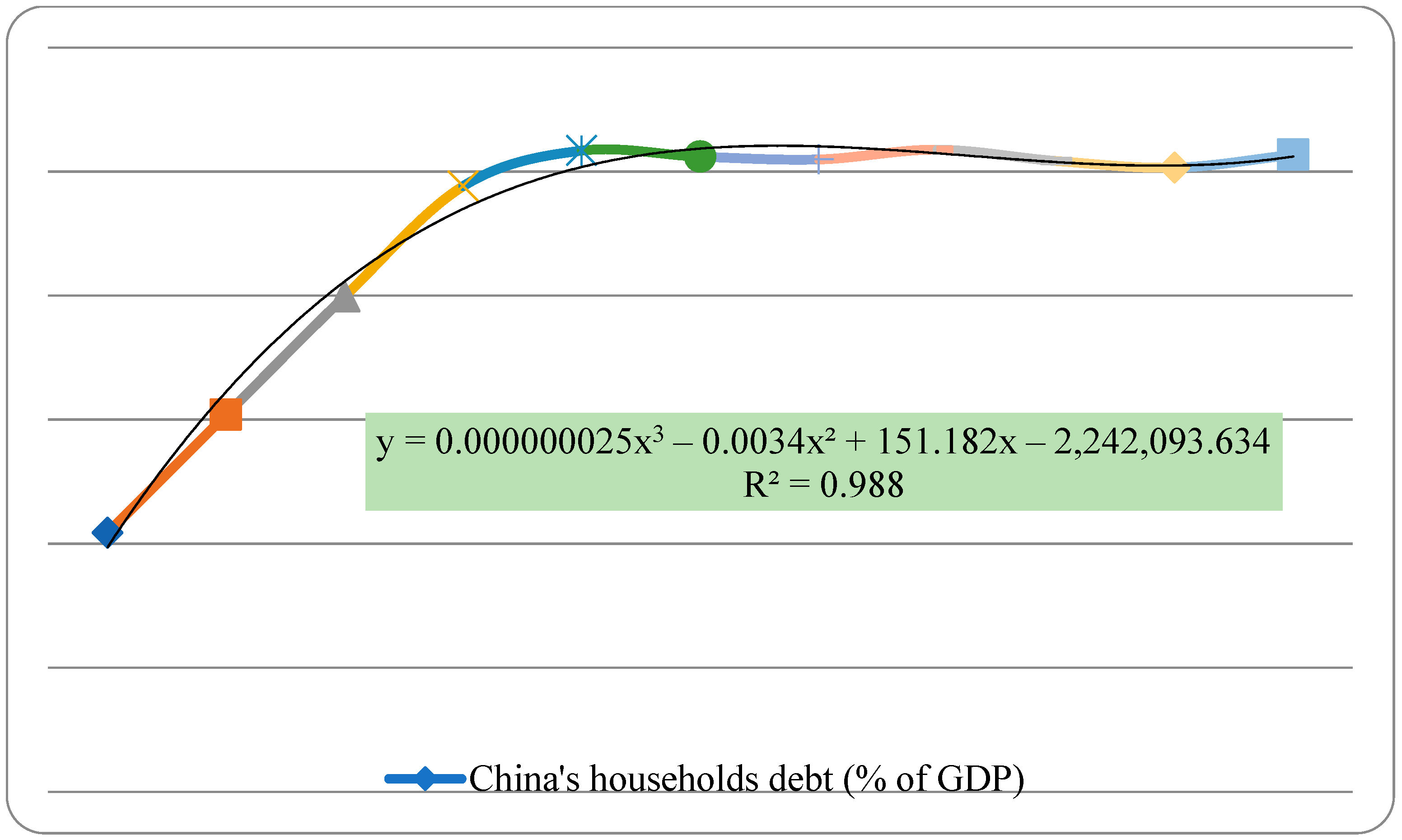

Let us analyze the dynamics of household debt in China (in % of GDP) within the framework of the developed time series model. The quarterly updated data on household debt in China (in % of GDP) from January 2020 to October 2021, a total of 12 periods, were used for the analysis. The results of descriptive statistics for the selected time interval of changes in household debt are presented in

Table 2.

The analysis of descriptive statistics of the household debt dynamics in China at the selected time interval proved the normality and reliability of the sample. The dynamics of household debt in China are graphically shown in

Figure 3.

Based on the results of the study, a mathematical model was constructed for this indicator. The model belongs to polynomial models (3 degrees) and is described by the equation: y = 0.000000025x3 − 0.0034x2 + 151.182x − 2,242,093.634. At the same time, the value of the approximation reliability R2= 0.9885 indicated very high compliance of the model with the analyzed data and the expediency of using the selected model for further analysis and forecasting.

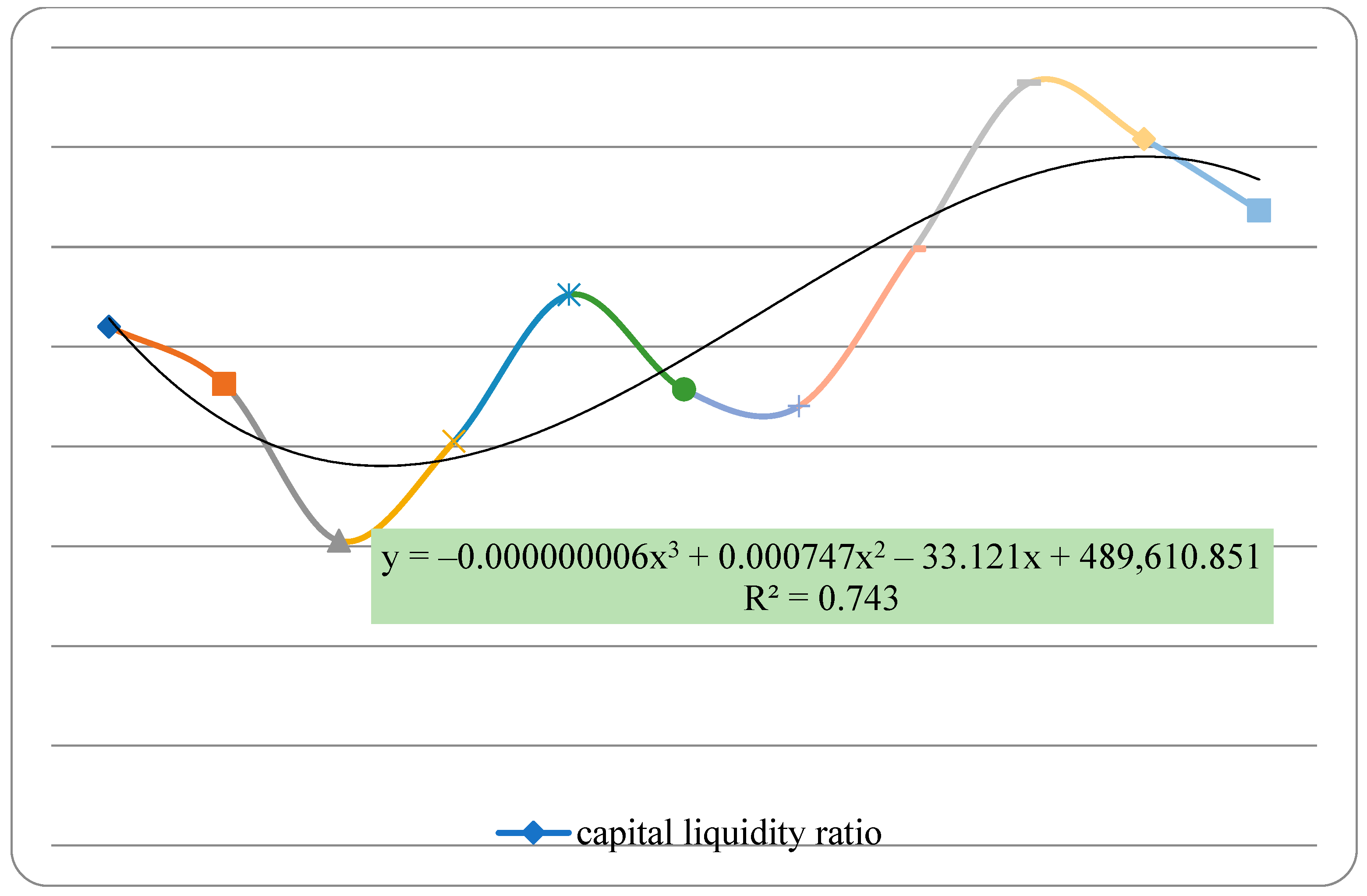

Let us analyze the dynamics of the capital liquidity ratio within the framework of the developed time series model. The quarterly updated data on changes in the capital liquidity ratio from January 2020 to October 2021, for a total of 12 periods, were used for the analysis. The results of descriptive statistics for the selected time interval of the capital liquidity ratio dynamics are presented in

Table 3.

The analysis of descriptive statistics of the dynamics of capital liquidity at the selected time interval allows us to conclude that the sample is normal and reliable. The dynamics of capital liquidity are graphically shown in

Figure 4.

Based on the results of the study, a mathematical model was constructed for this indicator. The model belongs to polynomial models (3 degrees) and is described by the equation: y = −0.000000006x3 + 0.000747x2 − 33.121x + 489,610.851. At the same time, the value of the approximation reliability R2 = 0.743 indicated high compliance of the model with the analyzed data and the expediency of using the selected model for further analysis and forecasting.

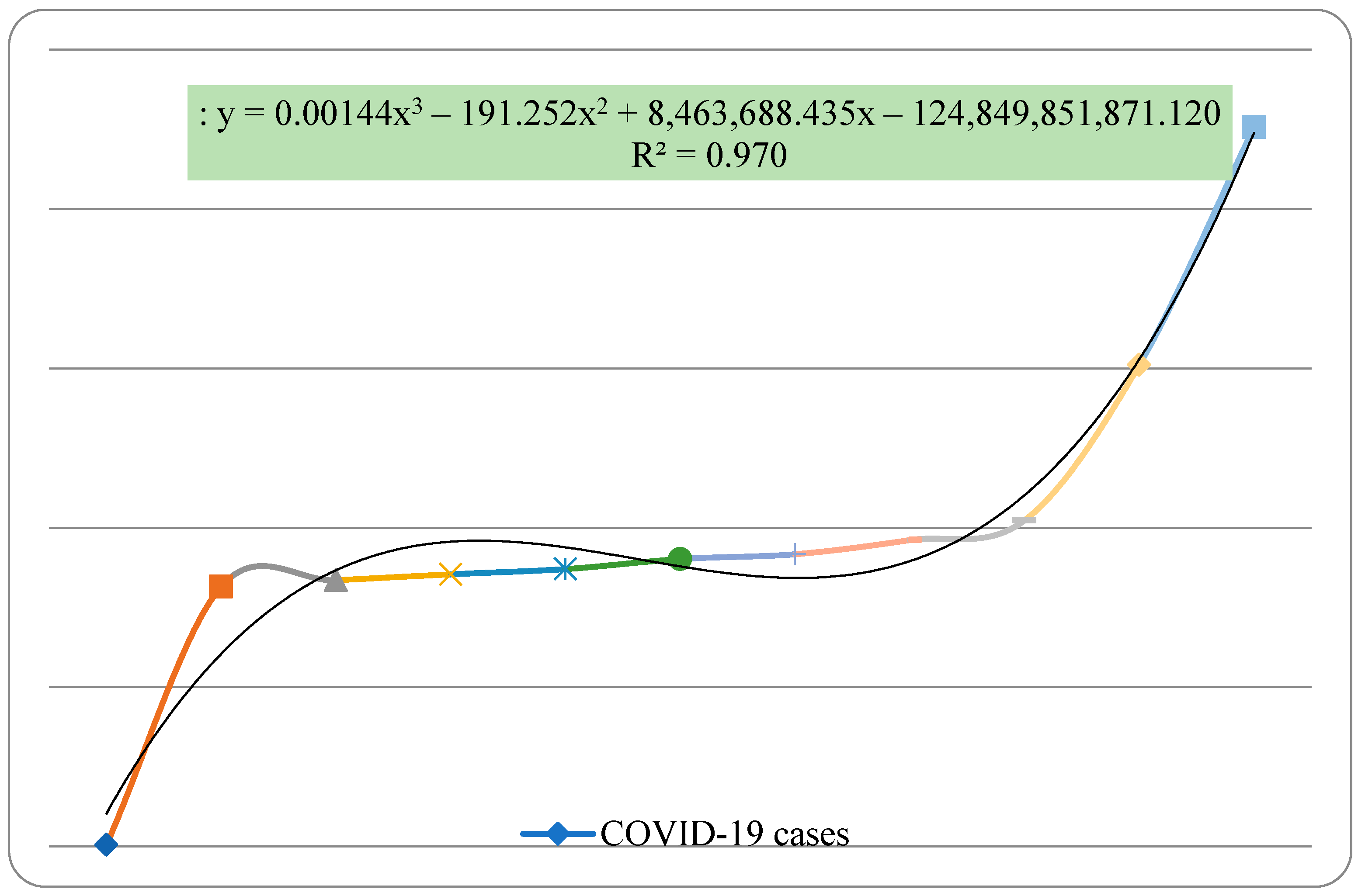

Next, analyzed the data characterizing the incidence of COVID-19 in China in the selected time interval. We analyzed the dynamics of the number of detected COVID-19 cases within the framework of the developed time series model. The results of descriptive statistics for the dynamics of detected COVID-19 cases are presented in

Table 4.

The analysis of descriptive statistics of detected COVID-19 cases at the selected time interval proved that the sample is normal and reliable. The dynamics of detected cases of COVID-19 are graphically shown in

Figure 5.

Based on the results of the study, a mathematical model was constructed for this indicator. The model belongs to polynomial models (3 degrees) and is described by the equation: y = 0.00144x3 − 191.252x2 + 8,463,688.435x − 124,849,851,871.120. At the same time, the value of the accuracy of the approximation R2 = 0.970 indicates very high compliance of the model with the analyzed data and the expediency of using the selected model for further analysis and forecasting.

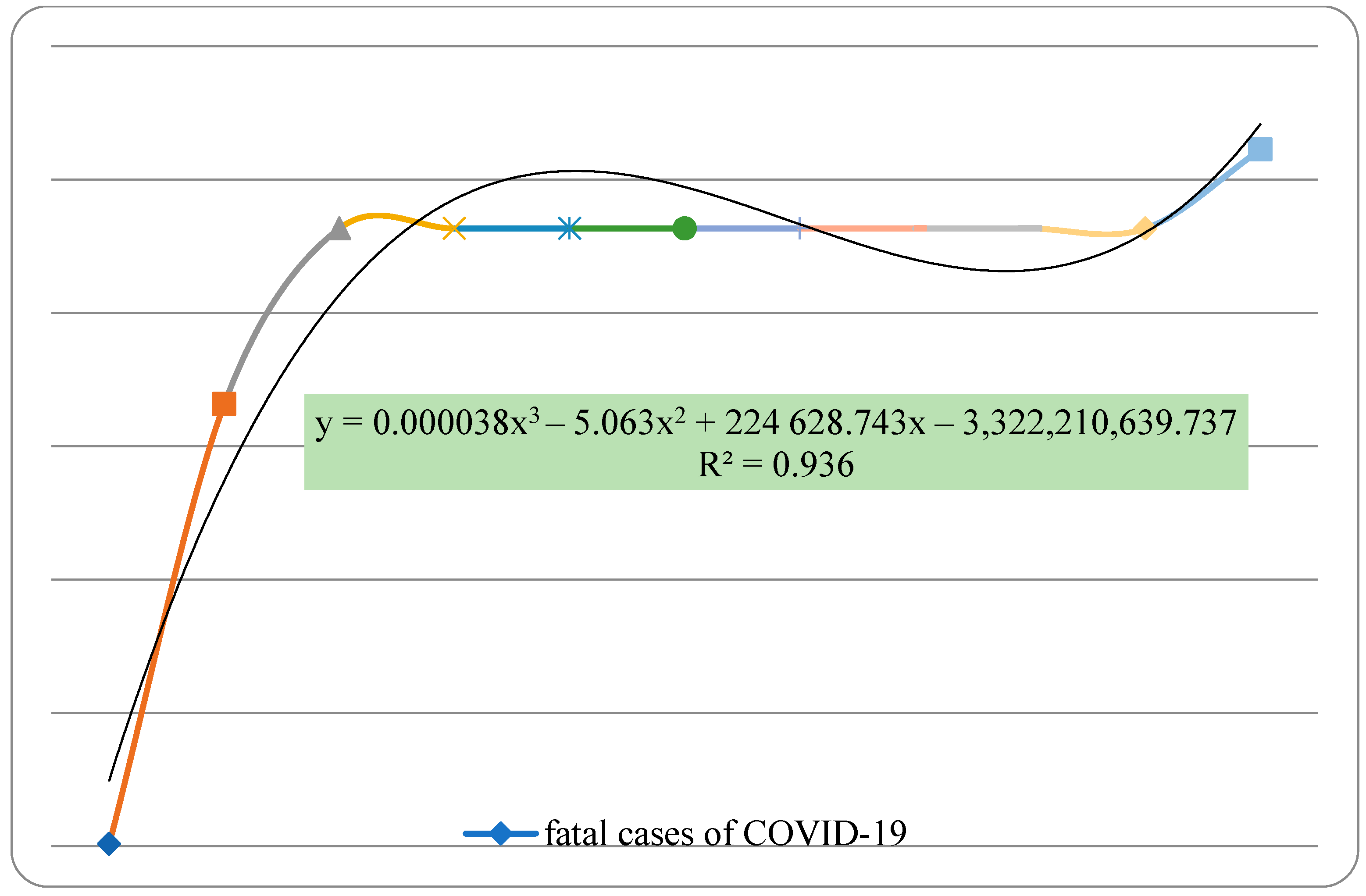

Let us analyze the dynamics of deaths from COVID-19 within the framework of the developed time series model. The results of descriptive statistics for the selected time interval of COVID-19 deaths in China are presented in

Table 5.

The analysis of descriptive statistics of deaths from COVID-19 in China at the selected time interval allows us to conclude that the sample is normal and reliable. The dynamics of deaths from COVID-19 in China are graphically shown in

Figure 6.

Based on the results of the study, a mathematical model was constructed for this indicator. The model belongs to polynomial models (3 degrees) and is described by the equation: y = 0.000038x3 − 5.063x2 + 224,628.743x – 3,322,210,639.737. At the same time, the value of the approximation reliability R2 = 0.936 indicates very high compliance of the model with the analyzed data and the expediency of using the selected model for further analysis and forecasting.

We studied the main directions of the pandemic impact on the formation of systemic risk in the banking sector. All analyzed indicators are related to the dynamics of detected COVID-19 cases within the framework of the developed time series model. The results of the correlation analysis of Chinese household debt (in % of GDP) relative dynamics showed that there was a stable correlation between the indicators of the overdue loan ratio and detected COVID-19 cases (). Consequently, a high number of detected COVID-19 cases contributes to the growth in household debt in China (in% of GDP), which increases the level of systemic risk in the banking sector. Thus, hypothesis H1 (the number of COVID-19 cases contributes to the amplification of systemic risks in the banking sector, through an increase in household debt) has been proven.

The results of the correlation analysis of the overdue loan ratio dynamics showed that there was a stable interrelation between the indicators of the overdue loan ratio and detected COVID-19 cases (). Consequently, with an increase in the number of detected COVID-19 cases, the overdue loan ratio decreases, which does not prove that the systemic risk of the banking sector increases due to an increased overdue loan ratio. Thus, hypothesis H2 (an increase in cases of the detected COVID-19 disease contributes to the strengthening of systemic risks in the banking sector, through an increase in overdue loans) has been refuted.

The results of the correlation analysis of the capital liquidity ratio dynamics showed that there was a stable direct correlation between the indicators of the capital liquidity ratio and detected COVID-19 cases (). Consequently, an increase in cases of detected COVID-19 diseases contributes to an increase in the capital liquidity ratio (in% of GDP). As the analysis of theoretical sources showed, an increase in liquidity as a result of negative expectations can lead to a loss of bank profitability. In the medium and long term, it increases the level of systemic risk in the banking sector. Thus, hypothesis H3 (the number of COVID-19 cases contributes to the amplification of systemic risks in the banking sector through changes in the liquidity of banking institutions’ capital due to negative expectations) has been proven. At the same time, it should be noted that this influence can be present exclusively in the long and medium terms; therefore, the analysis of the COVID-19 pandemic impact on the formation of capital liquidity in the banking sector requires further clarification and an individual approach when using the proposed method in the real sector of the economy.

The results of the correlation analysis of household debt dynamics in China (in % of GDP) showed that there is a very stable direct correlation between the indicators of the overdue loan ratio and fatal COVID-19 cases (). Consequently, an increase in the number of fatal COVID-19 cases contributes to an increase in household debt in China. This increases the level of systemic risk in the banking sector. Thus, hypothesis H4 (the number of fatal COVID-19 cases contributes to the amplification of systemic risks in the banking sector, through an increase in household debt) has been proven.

The results of the correlation analysis of the dynamics of the capital liquidity ratio showed that there was sufficient feedback between the indicators of the overdue loan ratio and deaths from COVID-19 disease (). Consequently, an increase in fatal cases of COVID-19 reduces the ratio of overdue loans. Thus, hypothesis H5 (the number of fatal COVID-19 cases does not have a significant impact on the amplification of systemic risks in the banking sector, through an increase in non-performing loans) has been refuted.

The results of the correlation analysis of the capital liquidity ratio dynamics showed that there was an extremely weak direct correlation between the indicators of the capital liquidity ratio and deaths from COVID-19 disease (). Consequently, an increase in deaths from COVID-19 does not have a significant impact on the level of systemic risk in the banking sector. Thus, hypothesis H6 (the number of fatal COVID-19 cases does not have a significant impact on the amplification of systemic risks in the banking sector through changes in the capital liquidity index of banking institutions) has been proven. Based on the results of the analysis, it can be concluded that the COVID-19 pandemic has a significant impact on the formation of banking systemic risk with an increase in the number of detected diseases. Hypothesis H7 has been proved.

As the results of the analysis showed, the impact of the COVID-19 pandemic on the dynamics of each of the analyzed indicators has some peculiarities. At the same time, the sustainable direct correlation between the share of household debt from GDP and the number of detected diseases and fatal COVID-19 cases suggests that the COVID-19 pandemic contributes to the formation of systemic risk in the banking sector. In addition, a stable correlation between an increase in the number of detected diseases and an increase in the liquidity ratio of bank capital, which can be caused by negative expectations and lead to a loss of bank profitability in the short and long term, can also contribute to the formation of systemic risk. It should be noted that the problem of systemic risk formation in the banking sector is insufficiently studied. This is a multidimensional problem that cannot be completely solved within the framework of this study. According to some researchers, the solution to this problem should be based on a systematic study of the interrelations and correlations between the COVID-19 pandemic and the factors of systemic risk formation. This also includes considering the transition of the world community to a long-term COVID-19 containment regime, with the organization of special additional monitoring to collect data characterizing individual indicators of systemic risk formation.

5. Discussion

The advantage of the study is the identification of stable interrelations and correlations between individual factors of the formation of systemic risk in the banking sector and indicators characterizing the development of the COVID-19 pandemic.

It should be noted that the indicator approach is the most common in modern research. It involves the provision of a relative assessment of each bank and bank rating based on the systemic significance criterion [

16]. Moreover, the results of modern research include additive approaches that involve determining the overall systemic risk with its subsequent distribution among banks (for example, the Marginal Expected Shortfall (MES) method [

38]. Non-additive approaches aimed at determining the systemic risk of an individual bank, for example, the Conditional Value at Risk (CoVaR) method [

8], are rarely used. However, the use of these methods to determine the COVID-19 pandemic impact on the formation of systemic risk is often complicated by the disadvantages of the multifactorial and multidimensional nature of the systemic risk formation problem.

Recently, the focus of scientists’ views has changed towards the use of extended indicators in assessing systemically important banks. These include Marginal Expected Shortfall (MES) [

39,

40], the Systemic Risk Measure (SRISK) [

41], and the Conditional Value at Risk (CoVaR) [

3,

42]. The above characteristics can be assessed using open data on the activities of banks. For example, with the help of the MES approach, the expected losses of a financial institution are determined when the market falls below a certain threshold (level) for a given period of time [

43]. The Shapley value is an approach used in corporate game theory that makes it possible to assess the impact of a bank on system-wide risk and thereby determine its importance in the banking system [

44]. At the same time, the study draws attention to the fact that the above methods are designed to assess systemic importance from the positions that do not cover the indicator approach.

Furthermore, there are proposals in the studies to use various stress-testing systems to assess systemic risk. In particular, they point to the possibility of applying a methodology similar to SRISK for the national banking system. This methodology is based on the fact that the program draws a sample of the largest (systemic) banks and then calculates the expected capital deficit that may arise in the event of a crisis [

45,

46]. The disadvantage of this methodology is that it does not take into account other indicators, except for capital adequacy, and is also universal for all countries of the world, which eliminates the peculiarities of national economies [

34,

47,

48].

Thus, the results of our study provide confirmation of the stable correlation between individual indicators of systemic risk formation in the banking sector and the main indicators of the COVID-19 pandemic development. The results of this study can be used in the real sector of the banking economy to develop measures for minimizing systemic risk in the banking sector. At the same time, the present study results may be in demand by academic researchers in terms of promising areas for further research, actualized by the transition of the world community to a long-term regime of containment of COVID-19 [

37].