Impact of Nonstandard Default Risk of the Urban Investment and Development Companies on the Urban Investment Bond Market

Abstract

:1. Introduction

2. Literature Review

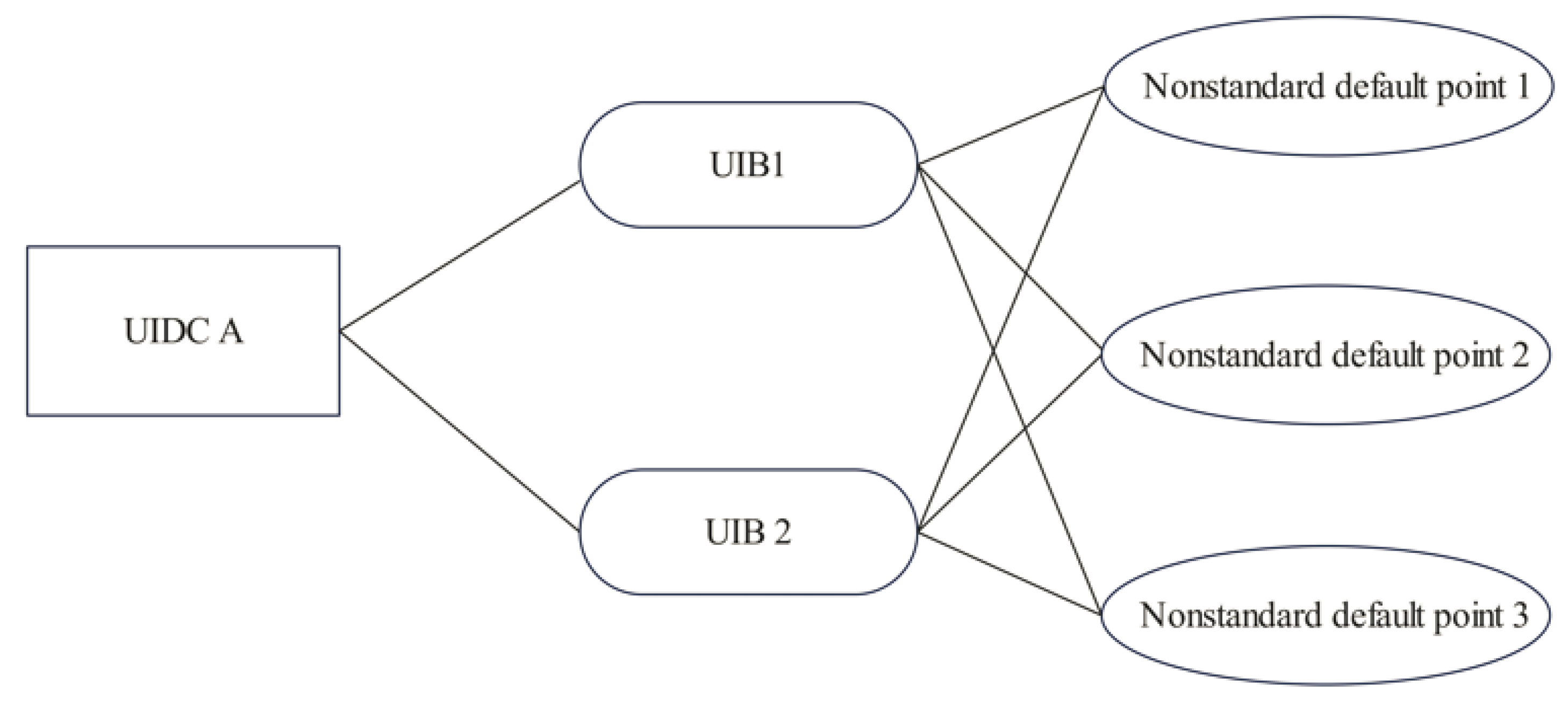

2.1. UIBs

2.2. Nonstandard Financing

2.3. The Event Studies

2.4. Hypotheses

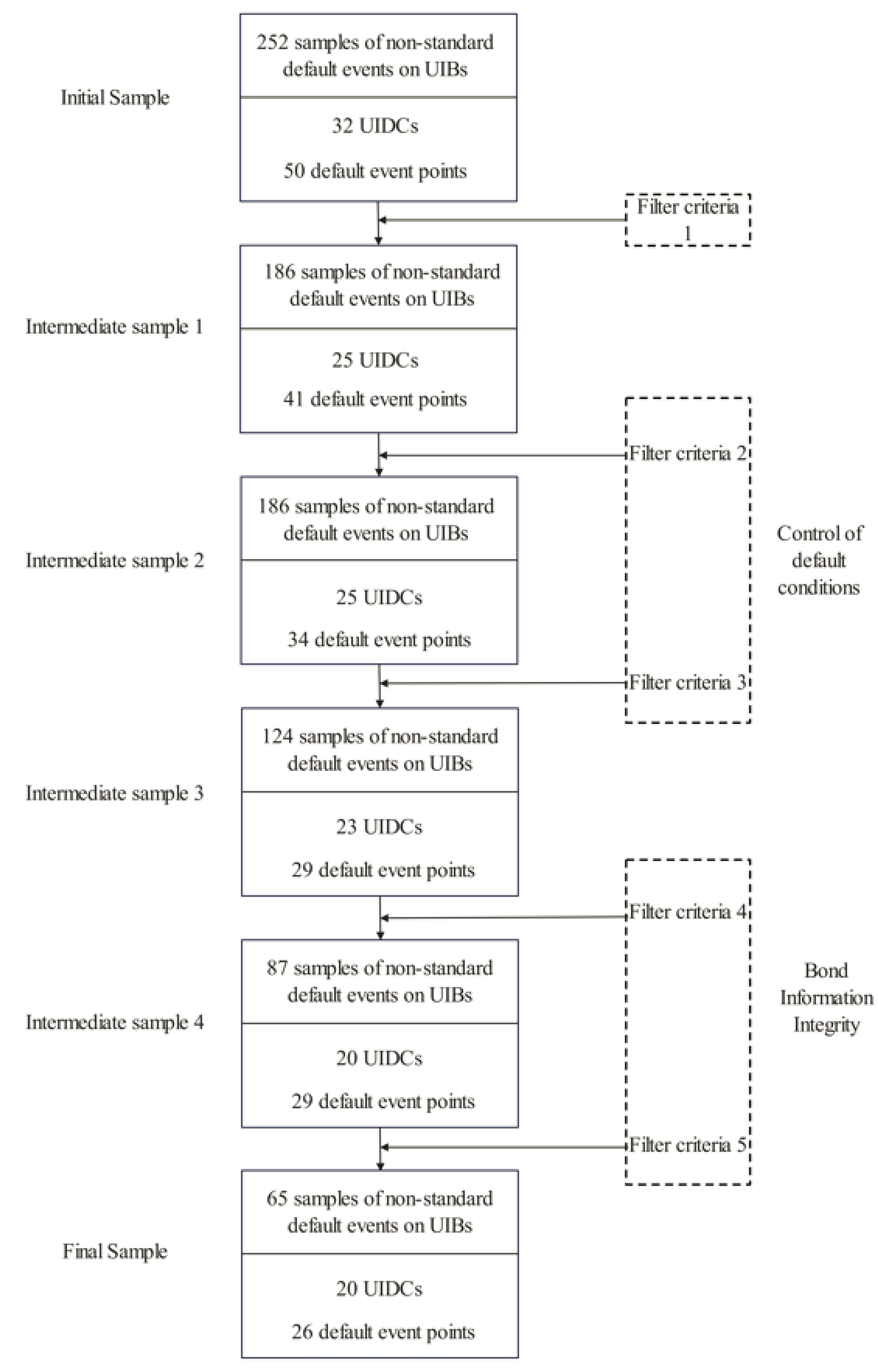

3. Data Source

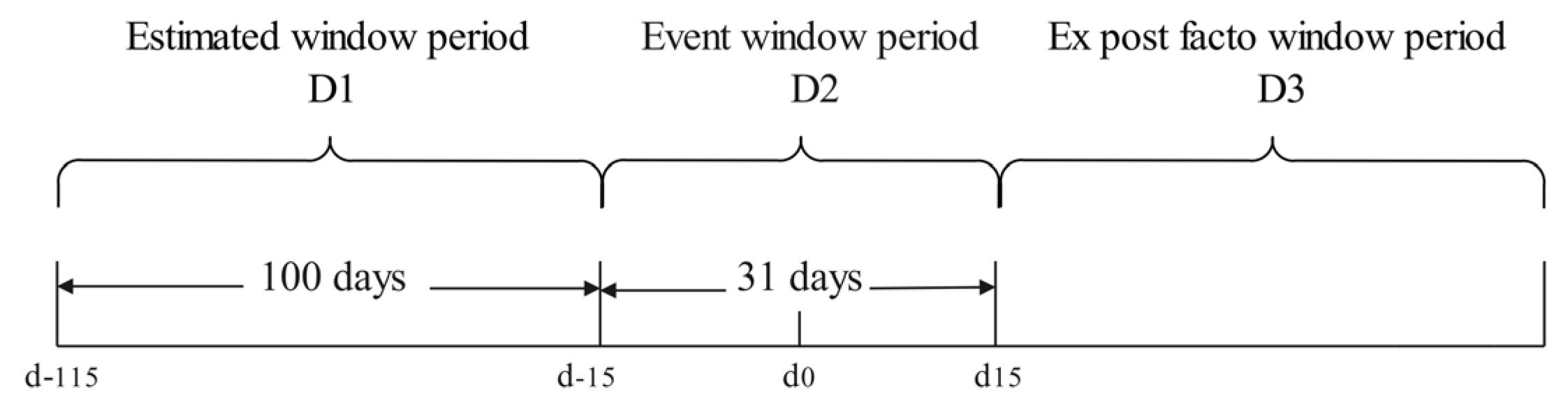

4. Research Methodology

5. Quantitative Analyses and Results

5.1. Quantitative Analyses

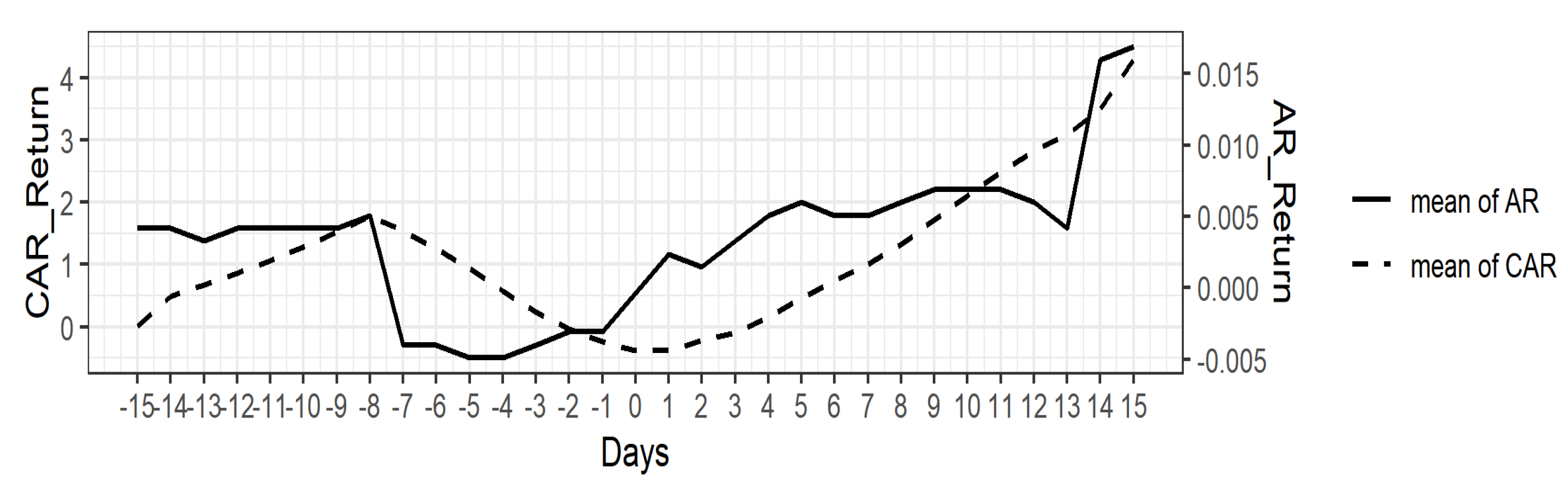

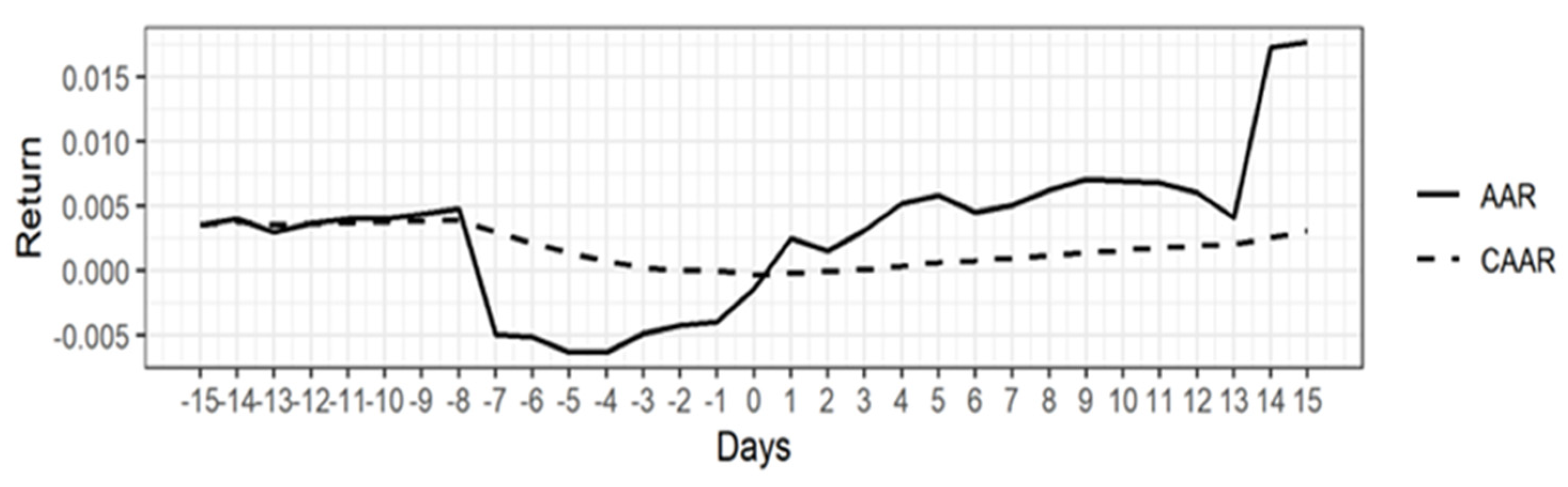

5.2. Results Regarding the Risk Transmission of Nonstandard Default Events

5.3. Results Regarding the Effectiveness of the UIB Market

6. Implications

7. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A. Summary of 50 Nonstandard Default Events of 32 UIDCs

| No. | Name of UIDC | Name of UIB | Date of Default | |

| 1 | Xiangtan Jiuhua Economic Construction Investment Co. | 17 Xiangtan Jiuhua MTN002, 17 Jiuhua 01, 16 Jiuhua Shuangchuang Bond, 19 Xiangtan Jiuhua MTN001, 19 Xiang Jiuhua, 17 Xiangtan Jiuhua PPN002, PR Shuangchuang Bond, 17 Xiangtan Jiuhua MTN001 | 1 January 2021 1 September 2020 20 June 2019 | |

| 2 | Zunyi City, Xuzhou District, Urban Construction Investment Management (Group) Co. | 17 Zunyi Bo Investment Bond 02, 17 Bo Investment Bond 01, PR Bo Investment Bond 02, 17 Zunyi Bo Investment Bond 01 | 1 January 2021 1 October 2020 1 September 2020 | |

| 3 | Anshun City Urban Construction Investment Co. | 18 Anshun 01, PR Anduan Bond, 18 Anshun 02, 17 Anshun Special Bond, 21 Anshun 01, 19 Anshun 02 | 1 December 2020 | |

| 4 | Puding County Puxin Urban Construction Investment Co. | No information on UIB | 1 December 2020 | |

| 5 | Zunyi Peace Investment and Construction Co. | 20Zunhe02, 20Zunhe01 | 1 October 2020 1 January 2020 | |

| 6 | Jilin Province Transportation Investment Group Co. | No information on UIB | 28 September 2020 | |

| 7 | Anshun City Transportation Construction Investment Co. | PR Anjiaotou, 17 Anshun Jiaotou Bond | 3 September 2020 2 August 2019 | |

| 8 | Guizhou Liupanshui Climbing Development Investment Trading Co. | PR Pantou Bond, 17 Pantou Special Bon, 21 Pantou Bond | 1 August 2020 1 March 2020 1 November 2019 | |

| 9 | Ruzhou Xinyuan Investment Co. | 16 Ruzhou Xinyuan Bond, PR Ruzhou Investment | 1 July 2020 | |

| 10 | Anshun City State-owned Assets Management Co. | 16 Anshun State Capital Bond, PR Anshun Bond | 1 July 2020 | |

| 11 | Guizhou Zhongshan Development and Investment Co. | PR Zhong Shan Kai, 19 Zhong Stop 01, 17 Zhong Stop Bond 01, 19 Zhong Stop Bond 01 | 1 May 2020 | |

| 12 | Hunan Zhaoshan Economic Construction Investment Co. | 17 Zhaotou 02, 18 Zhaoshan Economy PPN001, 17 Zhaotou 01, 19 Zhaoshan Economy PPN001, 17 Zhaoshan Economy PPN001 | 1 April 2020 | |

| 13 | Qiannan State Capital Operation Co. | 17 Qiannan Bond 01, 17 Qiannan Bond 02, PR Qiannan 01, PR Qiannan 02 | 1 April 2020 | |

| 14 | Zunyi City Investment (Group) Co. | 19 Zun Investment Bond 01, 19 Zun Investment Bond 02, 21 Zun Investment Bond 03, 19 Zun Investment Bond 03, 20 Zun Investment Bond 04, 21 Zun Investment Bond 04, 20 Zun Investment Bond 02, 20 Zun Investment Bond 01, 2Zun Investment Bond 101 | 1 April 2020 | |

| 15 | Guizhou Donghu New City Construction Investment Co. | 18 Donghu Pipeline Corridor Bond, 15 Qian Donghu Construction and Investment Bond, 18 Donghu Bond, 15 Qian Donghu Construction and Investment Bond, 21 Donghu Bond | 1 March 2020 | |

| 16 | Guizhou Xinpu Economic Development Investment Co. | 19 Xinpu 01, 20 Xinpu 02, 19 Xinpu 03, 19 Xinpu 05, 19 Xinpu 02, 20 Xinpu 01 | 1 March 2020 1 February 2020 | |

| 17 | Zunyi Road and Bridge Construction (Group) Co. | 22 Zunqiao 02, 19 Zunqiao 01, 21 Zunqiao 08, 21 Zunqiao 05, 21 Zunyidaoqiao PPN001, 21 Zunqiao 02, 21 Zunqiao 04, 21 Zunqiao 13, 15 Zunyidaoqiao Investment, 20 Zunqiao 04, 21 Zunqiao 09, 21 Zunqiao 03, 21 Zunqiao 07, 21 Zunqiao 03, 19 Zunqiao 02, 20 Zunqiao 02, 19 Zunqiao 03, 21 Zunqiao 11, 20 Zunqiao 01, 21 Zunqiao 12, PR Zundaoqiao, 22 Zunqiao 01, 21 Zunqiao 01, 21 Zunqiao 10, 20 Zunqiao 03, 19 Zunqiao 01, 21 Zunqiao D4, 21 Zunqiao 06 | 16 January 2020 10 January 2020 1 January 2020 | |

| 18 | Zunyi Huichuan District Urban Construction Investment Management Co. | 19 Huichuan 02, 18 Huichuan 01 | 2 January 2020 1 January 2020 1 September 2019 | |

| 19 | Zunyi Honghuagang City Construction Investment Management Co. | 17 Honghuagang Parking Lot Bond 01, PR Zunhong City, 17 Honghuagang, 16 Zunhong Urban Investment Bond | 1 February 2020 29 July 2019 | |

| 20 | Zhongshan District, Liupanshui City, Industry and Information Technology Bureau | No information on UIB | 1 March 2020 1 November 2019 | |

| 21 | Zunyi Honghuagang state-owned assets investment and management limited liability company | 19 Zunhong 02, 17 Zunhong Bond, 19 Zunhong 01 | 1 February 2020 | |

| 22 | Hancheng City Investment (Group) Co. | 20 Hancheng 01, 16 Hancheng Urban Investment Bond, 20 Hancheng 04, 20 Hancheng 03, 19 Hancheng 01, PR Hancheng Investment, 19 Hancheng 02, 20 Hancheng 02 | 10 December 2019 30 November 2018 | |

| 23 | Zunyi Economic and Technological Development Zone Investment and Construction Co. | 20 Zunjing 01, 21 Zunjing 01, 17 Zunjing Development Project Bond, 19 Zunjing 02, 19 Zunjing 03, PR Zunjing Development, 20 Zunjing 02, 19 Zunjing 01, PR Zunjing Bond, 16 Zunjing Development Bond | 1 December 2019 1 September 2019 | |

| 24 | Guizhou Daxing High-tech Development and Investment Co. | No information on UIB | 1 November 2019 | |

| 25 | Liupanshui Zhongshan District Urban Construction Investment Co. | 21 Jongsan 01 | 1 March 2020 1 November 2019 | |

| 26 | Alashan League infrastructure construction investment and operation | No information on UIB | 12 February 2019 | |

| 27 | Guizhou Kaili Kaiyuan Urban Investment Development Co. | 17Kaiyuan Special Bond 02, 17Kaiyuan Special Bond 01, PRKaiyuan 02, PRKaiyuan 01 | 10 February 2019 | |

| 28 | Huhehaote Economic and Technological Development Zone Investment and Development | No information on UIB | 1 September 2018 | |

| 29 | Qian southeast development investment (group) limited liability company | No information on UIB | 10 July 2018 | |

| 30 | Inner Mongolia horqin city construction investment group | No information on UIB | 8 June 2018 | |

| 31 | Tongliao City Investment Group Co. | 17 Tongliao Urban Investment PPN001 | 8 June 2018 | |

| 32 | Tianjin Municipal Construction Group Co. | No information on UIB | 27 April 2018 | |

| Data source: Enterprise Alerting Link. | ||||

Appendix B. Summary of 26 Nonstandard Default Events of 20 UIDCs

| NO. | Name of UIDC | Name of UIB | Date of Default |

| 1 | Xiangtan Jiuhua Economic Construction Investment Co. | 17 Xiangtan Jiuhua MTN002, 16 Jiuhua Shuangchuang Bond, 19 Xiangtan Jiuhua MTN001, 17 Xiangtan Jiuhua MTN001 | 1 January 2021 20 June 2019 |

| 2 | Zunyi City, Xuzhou District, Urban Construction Investment Management (Group) Co. | 17Zunyi Bo Invsetment Bond 02, PR Bo Investment 02, 17 Zunyi Bo Investment 01 | 1 January 2021 |

| 3 | Anshun City Urban Construction Investment Co. | PR Antoine Investment Bond, 17 Anshun Special Bond | 1 December 2020 |

| 4 | Zunyi Peace Investment and Construction Co. | 20Zunhe01 | 1 October 2020 1 January 2020 |

| 5 | Anshun City Transportation Construction Investment Co. | PR Anjiaotou, 17 Anshun Jiaotou Bond | 3 September 2020 2 August 2019 |

| 6 | Guizhou Liupanshui Climbing Development Investment Trading Co. | PR Pantou Bond, 17 Pantou Special Bond | 1 August 2020 1 November 2019 |

| 7 | Ruzhou Xinyuan Investment Co. | 16 Ruzhou Xinyuan Bond, PR Ruzhou Investment | 1 July 2020 |

| 8 | Anshun City State-owned Assets Management Co. | 16 Anshun State Capital Bond, PR Anshun Bond | 1 July 2020 |

| 9 | Guizhou Zhongshan Development and Investment Co. | PR Zhong Shan Kai, 19 Zhong Stop 01, 17 Zhong Stop Debt 01, 19 Zhong Stop Debt 01 | 1 May 2020 |

| 10 | Hunan Zhaoshan Economic Construction Investment Co. | 17Zhao Investment 02, 17Zhao Investment 01 | 1 April 2020 |

| 11 | Qiannan State Capital Operation Co. | 17 Qiannan Bond 01, 17 Qiannan Bond 02, PR Qiannan 01, PR Qiannan 02 | 1 April 2020 |

| 12 | Zunyi City Investment (Group) Co. | 19 Zun Investment 01, 19 Zun Investment 02, 19 Zun Investment 03 | 1 April 2020 |

| 13 | Guizhou Donghu New City Construction Investment Co. | 18 Donghu Pipeline Corridor Bond, 15 Qian Donghu Construction Investment Bond | 1 March 2020 |

| 14 | Guizhou Xinpu Economic Development Investment Co. | 19 xinpu 01, 19 xinpu 03, 19 xinpu 05, 19 xinpu 02 | 1 March 2020 |

| 15 | Zunyi Road and Bridge Construction (Group) Co. | 15 Zunyidaoqiao Bond, PR Zundaoqiao, 19 Daoqiao 01 | 1 February 2020 |

| 16 | Zunyi Honghuagang City Construction Investment Management Co. | 17 Honghuagang Parking Lot Bond 01, 16 Zunhong Urban Investment Bond | 1 February 2020 29 July 2019 |

| 17 | Zunyi Honghuagang state-owned assets investment and management limited liability company | 17 Zunhong Bond | 1 February 2020 |

| 18 | Hancheng City Investment (Group) Co. | 16 Hancheng Urban Investment Bond, PR Hancheng Investment | 30 November 2018 10 December 2019 |

| 19 | Zunyi Economic and Technological Development Zone Investment and Construction Co. | 17ZunJingKai Project Bond, PRZunJingKai, 16ZunJingKai Bond | 1 September 2019 |

| 20 | Guizhou Kaili Kaiyuan Urban Investment Development Co. | 17Kaiyuan Special Bond 02 17 Kaiyuan Special Bond 01 PR Kaiyuan 02 PR Kaiyuan01 | 10 February 2019 |

Appendix C. Fitted Slope and Intercept for All Bonds

| No. | Slope | Intercept | p−Value | Fit a Regression Function |

| 1 | −0.55 | −4.31 | 2.01 × 10−10 ** | y = −4.31 − 0.55x |

| 2 | 1.96 | 3.92 | 1.97 × 10−10 ** | y = 3.92 + 1.96x |

| 3 | −0.03 | −2.65 | 1.44 × 10−12 ** | y = −2.65 + 0.03x |

| 4 | −0.02 | −2.75 | 5.39 × 10−12 ** | y = −2.75−0.02x |

| 5 | 12.21 | 33.86 | 1.64 × 10−15 ** | y = 33.86 + 12.21x |

| 6 | 0.01 | −2.60 | 1.33 × 10−23 ** | y = −2.60 + 0.01x |

| 7 | −0.03 | −3.08 | 1.67 × 10−37 ** | y = −3.08 − 0.03x |

| 8 | 0.00 | − 2.99 | 4.39 × 10−7 ** | y = −2.99 + 0.00 |

| 9 | −0.01 | −3.02 | 1.76 × 10−10 ** | y = −3.02−0.01x |

| 10 | 1.25 | 1.13 | 1.73 × 10−1 | y = 1.13 + 1.25x |

| 11 | −0.46 | −3.90 | 5.09 × 10−3 ** | y = −3.90 − 0.46x |

| 12 | 0.03 | −2.44 | 8.93 × 10−25 ** | y = −2.44 + 0.03x |

| 13 | 0.18 | −1.99 | 7.66 × 10−07 ** | y = −1.99 + 0.18x |

| 14 | 3.01 | 6.71 | 8.52 × 10−4 ** | y = 6.71 + 3.01x |

| 15 | 2.30 | 4.49 | 7.55 × 10−15 ** | y = 4.49 + 2.30x |

| 16 | −0.01 | −2.64 | 1.81 × 10−31 ** | y = −2.64 − 0.01x |

| 17 | 0.00 | −2.60 | 2.64× 10−2 ** | y = −2.60 + 0.00 |

| 18 | 0.00 | −2.61 | 1.69 × 10−5 ** | y = −2.61 + 0.00 |

| 19 | 0.22 | −1.61 | 1.50 × 10−41 ** | y = −1.61 + 0.22x |

| 20 | −0.16 | −3.01 | 1.78 × 10−1 | y = −3.01 − 0.16x |

| 21 | 0.02 | −2.57 | 4.00 × 10−14 ** | y = −2.57 + 0.02x |

| 22 | −0.11 | −2.94 | 3.88 × 10−1 ** | y = −2.94 − 0.11x |

| 23 | 0.01 | −2.60 | 3.89 × 10−2 * | y = −2.60 + 0.01x |

| 24 | −0.07 | −2.77 | 2.66 × 10−1 | y = −2.77 − 0.07x |

| 25 | 0.19 | −2.00 | 2.31 × 10−13 ** | y = −2.00 + 0.19x |

| 26 | 0.00 | −3.13 | 9.73 × 10−5 ** | y = −3.13 + 0.00 |

| 27 | −0.56 | −4.30 | 2.94 × 10−9 ** | y = −4.30−0.56x |

| 28 | −0.01 | −3.13 | 7.32 × 10−7 ** | y = −3.13 − 0.01x |

| 29 | 0.01 | −2.72 | 5.10 × 10−25 ** | y = −2.72 + 0.01x |

| 30 | −0.01 | −2.56 | 3.40 × 10−50 ** | y = −2.56 − 0.01x |

| 31 | 0.01 | −2.71 | 1.13 × 10−47 ** | y = −2.71 + 0.01x |

| 32 | 0.33 | −1.66 | 3.90 × 10−7 ** | y = −1.66 + 0.33x |

| 33 | 0.01 | −2.59 | 5.50 × 10−16 ** | y = −2.59 + 0.01x |

| 34 | 0.01 | −2.58 | 3.14 × 10−9 ** | y = −2.58 + 0.01x |

| 35 | −0.28 | −3.22 | 1.99 × 10−6 ** | y = −3.22 − 0.28x |

| 36 | −0.03 | −2.72 | 1.77 × 10−47 ** | y = −2.72 − 0.03x |

| 37 | −0.01 | −2.70 | 7.73 × 10−33 ** | y = −2.70 − 0.01x |

| 38 | 0.00 | −2.66 | 6.69 × 10−3 ** | y = −2.66 + 0.00 |

| 39 | −0.01 | −2.65 | 1.90 × 10−43 ** | y = −2.65 − 0.01x |

| 40 | 0.01 | −2.57 | 1.18 × 10−16 ** | y = −2.57 + 0.01x |

| 41 | 0.01 | −2.57 | 8.38 × 10−17 ** | y = −2.57 + 0.01x |

| 42 | 0.10 | −2.34 | 3.31 × 10−12 ** | y = −2.34 + 0.10x |

| 43 | 1.46 | 1.99 | 7.28 × 10−9 ** | y = 1.99 + 1.46x |

| 44 | 0.00 | −2.59 | 4.45 × 10−1 | y = −2.59 + 0.00 |

| 45 | 0.02 | −2.52 | 3.06 × 10−31 ** | y = −2.52 + 0.02x |

| 46 | 0.02 | −2.52 | 2.96 × 10−17 ** | y = −2.52 + 0.02x |

| 47 | 0.01 | −2.58 | 1.14 × 10−1 | y = −2.58 + 0.01x |

| 48 | −0.01 | −2.64 | 1.51 × 10−1 | y = −2.64 − 0.01x |

| 49 | 0.14 | −2.14 | 7.25 × 10−1 | y = −2.14 + 0.14x |

| 50 | −0.44 | −3.96 | 2.78 × 10−6 ** | y = −3.96 − 0.44x |

| 51 | 0.01 | −2.96 | 3.74 × 10−1 | y = −2.96 + 0.01x |

| 52 | −0.01 | −3.02 | 2.01 × 10−2 * | y = −3.02 − 0.01x |

| 53 | 2.54 | 5.16 | 2.26 × 10−2 * | y = 5.16 + 2.54x |

| 54 | 0.35 | −1.47 | 1.54 × 10−3 ** | y = −1.47 + 0.35x |

| 55 | −1.82 | −8.49 | 2.97 × 10−2 * | y = −8.49 − 1.82x |

| 56 | 0.71 | −1.05 | 4.84 × 10−3 ** | y = −1.05 + 0.71x |

| 57 | 3.88 | 9.55 | 6.57 × 10−4 ** | y = 9.55 + 3.88x |

| 58 | −0.13 | −3.14 | 1.36 × 10−1 | y = −3.14−0.13x |

| 59 | −0.79 | −4.93 | 3.78 × 10−10 ** | y = −4.93 − 0.79x |

| 60 | −0.01 | −3.09 | 5.46 × 10−4 ** | y = −3.09 − 0.01x |

| 61 | −0.01 | −3.09 | 3.11 × 10−13 ** | y = −3.09 − 0.01x |

| 62 | 0.07 | −2.39 | 7.23 × 10−4 ** | y = −2.39 + 0.07x |

| 63 | −0.02 | −2.67 | 5.04 × 10−34 ** | y = −2.67 − 0.02x |

| 64 | 0.02 | −2.98 | 2.82 × 10−18 ** | y = −2.98 + 0.02x |

| 65 | −0.30 | −3.54 | 6.98 × 10−24 ** | y = −3.54 − 0.30x |

| Note: * is significant at the 0.05 level, ** is significant at the 0.01 level. | ||||

References

- Wu, F. The state acts through the market: ‘State entrepreneurialism beyond’ varieties of urban entrepreneurialism. Dialogues Hum. Geogr. 2020, 10, 326–329. [Google Scholar] [CrossRef]

- Li, J.; Chiu, L.R. Urban-investment-and-development-corporations, new-town-development and China’s local state restructuring–the case of Songjiang new town, Shanghai. Urban Geogr. 2018, 39, 687–705. [Google Scholar] [CrossRef]

- Jiang, Y.; Waley, P. Shenhong: The anatomy of an urban investment and development company in the context of China’s state corporatist urbanism. J. Contemp. China 2018, 27, 596–610. [Google Scholar] [CrossRef]

- Wu, H.; Yang, J.; Yang, Q. The pressure of economic growth and the issuance of Urban Investment Bonds: Based on panel data from 2005 to 2011 in China. J. Asian Econ. 2021, 76, 101341. [Google Scholar] [CrossRef]

- Wu, Y.; Zhao, H. Risk Measurement of Local Government Debt Based on Complex Networks: Taking China’s Urban Investment Bonds as an Example. Wirel. Commun. Mob. Comput. 2022, 2022, 2–11. [Google Scholar] [CrossRef]

- Ambrose, B.W.; Deng, Y.; Wu, J. Understanding the Risk of China’s Local Government Debts and Its Linkage with Property Markets. In SSRN Working Paper; SSRN: New York, NY, USA, 2015; p. 2557031. [Google Scholar]

- Ansar, A.; Flyvbjerg, B.; Budzier, A.; Lunn, D. Does infrastructure investment lead to economic growth or economic fragility? Evidence from China. Oxf. Rev. Econ. Policy 2016, 32, 360–390. [Google Scholar] [CrossRef] [Green Version]

- Liu, C. The Analysis of China Quasi-Municipal Bonds’ Issuing Spread. Mod. Econ. 2018, 9, 1009–1022. [Google Scholar]

- Pan, J.; Yu, Y.; Wang, L.; Jing, X. Monetary policy, differences among issuing agencies, and the pricing of local government bonds. China J. Account. Stud. 2019, 7, 524–541. [Google Scholar] [CrossRef]

- Liao, P. Interaction between non-standard debt and wealth management products in China. J. Appl. Financ. Bank. 2020, 10, 149–166. [Google Scholar]

- Liu, L.B.; Li, B.T.; Wang, B. Non-standard assets, Credit conversion and Shadow banking risk. Econ. Res. J. 2022, 57, 70–86. (In Chinese) [Google Scholar]

- Li, X.; Feng, G.; Hao, S. Market-Oriented Transformation and Development of Local Government Financing Platforms in China: Exploratory Research Based on Multiple Cases. Systems 2022, 10, 65. [Google Scholar] [CrossRef]

- Carpenter, S.; Demiralp, S.; Eisenschmidt, J. The effectiveness of non-standard monetary policy in addressing liquidity risk during the financial crisis: The experiences of the Federal Reserve and the European Central Bank. J. Econ. Dyn. Control. 2014, 43, 107–129. [Google Scholar] [CrossRef]

- Huang, Z.; Du, X. Holding the market under the stimulus plan: Local government financing vehicles’ land purchasing behavior in China. China Econ. Rev. 2018, 50, 85–100. [Google Scholar] [CrossRef]

- Wu, F. Land financialisation and the financing of urban development in China. Land Use Policy 2022, 112, 104412. [Google Scholar] [CrossRef]

- Chen, S.; Wang, L. Will political connections be accounted for in the interest rates of Chinese urban development investment bonds? Emerg. Mark. Financ. Trade 2015, 51, 108–129. [Google Scholar] [CrossRef]

- Bai, C.-E.; Hsieh, C.-T.; Song, Z. (Michael) The Long Shadow of a Fiscal Expansion. SSRN Electron. J. 2016.

- Choi, J.; Lu, L.; Park, H. The financial value of the within-government political network: Evidence from Chinese municipal corporate bonds. Financ. Res. Lett. 2021, 47, 102552. [Google Scholar] [CrossRef]

- Chen, Z.; He, Z.; Liu, C. The financing of local government in China: Stimulus loan wanes and shadow banking waxes. J. Financ. Econ. 2020, 137, 42–71. [Google Scholar] [CrossRef]

- Yu, M.; Jia, J.; Wang, S. Local officials’ promotion incentives and issuance of urban investment bonds. Res. Int. Bus. Financ. 2022, 63, 101791. [Google Scholar] [CrossRef]

- Zedan, K.; Daas, G.; Awwad, Y. Municipal bonds as a tool for financing capital investment in local government units in Palestine. Invest. Manag. Financ. Innov. 2020, 17, 213–248. [Google Scholar] [CrossRef] [Green Version]

- Huang, D.; Chan, R.C.K. On ‘Land Finance’ in urban China: Theory and practice. Habitat Int. 2018, 75, 96–104. [Google Scholar] [CrossRef]

- Walker, T.; Zhang, X.; Zhang, A.; Wang, Y. Fact-or-fiction: Implicit-government-guarantees in China’s corporate bond market. J. Int. Money Financ. 2021, 116, 102414. [Google Scholar] [CrossRef]

- Bo, L.; Mear, F.C.J.; Huang, J. New development: China’s debt transparency and the case of urban construction investment bonds. Public Money Manag. 2017, 37, 225–230. [Google Scholar] [CrossRef]

- Tiron, T.; Ștefănescu, C.; Dan, A. The Determinants of the Municipal Bonds Market in Romania. Transylv. Rev. Adm. Sci. 2021, 17, 175–192. [Google Scholar]

- Zhang, J.; Li, L.; Yu, T.; Gu, J.; Wen, H. Land assets, urban investment bonds, and local governments’ debt risk, China. Int. J. Strateg. Prop. Manag. 2021, 25, 65–75. [Google Scholar] [CrossRef]

- Qian, N. Anti-corruption effects on the credit risk of local financing vehicles and the pricing of Chengtou bonds: Evidence from a quasi-natural experiment in China. Financ. Res. Lett. 2018, 26, 162–168. [Google Scholar] [CrossRef]

- Zhao, Y.; Li, Y.; Feng, C.; Gong, C.; Tan, H. Early Warning of Systemic Financial Risk of Local Government Implicit Debt Based on BP Neural Network Model. Systems 2022, 10, 207. [Google Scholar] [CrossRef]

- Hu, Y.; Yang, Y.; Han, P. Credit enhancement and bond rating: An empirical study of the bonds issued by local government financing platforms. China Financ. Rev. Int. 2017, 7, 114–130. [Google Scholar] [CrossRef]

- Xu, J.; Mao, J.; Guan, X. Local government hidden debt re-understanding-based on the precise definition of financing platform companies and the perspective of financial potentials. Manag. World 2020, 36, 37–59. [Google Scholar]

- Poniatowicz, M.; Wyszkowska, D.; Piekarska, E. Controversies-Over-Non Convention -al Instruments of Financing Budget Needs of Local Government Units. Optim. Stud. Ekon. 2017, 5, 99–116. [Google Scholar]

- Allen, F.; Qian, M.; Xie, J. Understanding informal financing. J. Financ. Intermed. 2019, 39, 19–33. [Google Scholar] [CrossRef]

- Li, J.; Tochen, R.; Dong, Y.; Ren, Z. Debt-Driven-Property-Boom, Land-Based-Financing and Trends of Housing Financialization: Evidence from China. Land 2022, 11, 1967. [Google Scholar] [CrossRef]

- Ahmed, K.; Bebenroth, R.; Hennart, J.F. Formal institutional uncertainty and equity sought on foreign market entry: Does industry matter? Rev. Int. Bus. Strategy 2020, 30, 421–440. [Google Scholar] [CrossRef]

- Harrison, R.; Scheela, W.; Lai, P.C.; Vivekarajah, S. Beyond institutional voids and the middle-income trap: The emerging business angel market in Malaysia. Asia Pac. J. Manag. 2018, 35, 965–991. [Google Scholar] [CrossRef] [Green Version]

- Hałaburda, D.A. Niestandardowe instrumenty finansowania jednostek samorządu terytoerialnego. Ekon. Probl. Usług 2017, 129, 131–142. [Google Scholar] [CrossRef]

- Mohamed, S. The Impact of Unconventional Financing on Bank of Algeria Independence. Econ. Manag. Res. J. 2021, 15, 107–124. [Google Scholar]

- Howell, A. Ethnic entrepreneurship, initial financing, and business performance in China. Small Bus. Econ. 2019, 52, 697–712. [Google Scholar] [CrossRef]

- Manzilati, A.; Prestianawati, S.A.A. Informal financing or debt traps: Are the UN sustainable development goals being met in emerging economies? Rev. Int. Bus. Strategy 2021, 32, 132–145. [Google Scholar] [CrossRef]

- Mpofu, O.; Sibindi, A.B. Informal Finance: A Boon or Bane for African SMEs? J. Risk Financ. Manag. 2022, 15, 270. [Google Scholar] [CrossRef]

- Dolley, J.C. Characteristics and procedure of common stock split-ups. Harv. Bus. Rev. 1933, 11, 316–326. [Google Scholar]

- Brown, B. An Empirical Evaluation of Accounting Income Numbers. J. Account. Res. 1968, 6, 159–178. [Google Scholar]

- Fama, E. The Behavior of Stock Market Prices. J. Bus. 1965, 38, 34–105. [Google Scholar] [CrossRef] [Green Version]

- Kamien, M.I.; Schwartz, N.L. Market structure, elasticity of demand and incentive to invent. J. Law Econ. 1970, 13, 241–252. [Google Scholar] [CrossRef]

- Albuquerque, J.M.; Filipe, J.A.; Jorge, N.P.M.; Silva, C. The study of events approach applied to the impact of mergers and acquisitions on the performance of consulting engineering companies. Mathematics 2021, 9, 130. [Google Scholar] [CrossRef]

- Mandelker, G. Risk and return: The case of merging firms. J. Financ. Econ. 1974, 1, 303–335. [Google Scholar] [CrossRef]

- Brown, S.J.; Warner, J.B. Measuring security price performance. J. Financ. Econ. 1980, 8, 205–258. [Google Scholar] [CrossRef]

- Brown, S.J.; Warner, J.B. Using daily stock returns. J. Financ. Econ. 1985, 14, 3–31. [Google Scholar] [CrossRef]

- Fatehi, K.; Gupta, M. Political instability and capital flight: An application of event study methodology. Int. Exec. 1992, 34, 441–461. [Google Scholar] [CrossRef]

- Park, N.K. A guide to using event study methods in multi-country settings. Strateg. Manag. J. 2004, 25, 655–668. [Google Scholar] [CrossRef]

- Barr, D.G.; Campbell, J.Y. Inflation, real interest rates, and the bond market: A study of UK nominal and index-linked government bond prices. J. Monet. Econ. 1997, 39, 361–383. [Google Scholar] [CrossRef]

- Agarwal, S.; Zhang, J. FinTech, lending and payment innovation: A review. Asia-Pac. J. Financ. Stud. 2020, 49, 353–367. [Google Scholar] [CrossRef]

- Hannan, T.H.; Wolken, J.D. Returns to bidders and targets in the acquisition process: Evidence from the banking industry. J. Financ. Serv. Res. 1989, 3, 5–16. [Google Scholar] [CrossRef]

- Xianping, Y.; Dagang, K. Event Study Method and Its Application to Financial Economic Study. Stat. Res. 2006, 10, 31–35. [Google Scholar]

- Kothari, S.P.; Jerold, B.W. Econometrics of event studies. In Handbook of Empirical Corporate Finance; Elsevier: Amsterdam, The Netherlands, 2007; pp. 3–36. [Google Scholar]

- Hu, H.; Li, Y.; Tian, M.; Cai, X. Evolutionary-game-of-small-and-edium-sized-enterpri-ses’ accounts-receivable pledge financing in the supply chain. Systems 2022, 10, 21. [Google Scholar] [CrossRef]

- MacKinlay, A.C. Event studies in economics and finance. J. Econ. Lit. 1997, 35, 13–39. [Google Scholar]

- Brenner, M. The sensitivity of the efficient market hypothesis to alternative specifications of the market model. J. Financ. 1979, 34, 915–929. [Google Scholar] [CrossRef]

- Klein, A.; Rosenfeld, J. The influence of market conditions on event-study residuals. J. Financ. Quant. Anal. 1987, 22, 345–351. [Google Scholar] [CrossRef]

- Kothari, S.P.; Warner, J.B. Handbook of Empirical Corporate Finance. Econometrics of Event Studies; North-Holland: Amsterdam, The Netherlands, 2007; pp. 3–36. [Google Scholar]

- Maruyama, H.; Tabata, T.; Hosoda, T. A Study on the Effect of Resizing Tick Size on Stock Prices Using the Event Study Method. Inf. Eng. Express 2021, 7, 37–48. [Google Scholar] [CrossRef]

- Hiranto, P. Event Study: How Disaster and Celebration Affect the Stock Market? In SSRN Working Paper; SSRN: New York, NY, USA, 2019; p. 3323999. [Google Scholar]

- Pallant, J. SPSS Survival Manual: A Step by Step Guide to Data Analysis Using IBM SPSS; Routledge: London, UK, 2020. [Google Scholar]

- Liang, Y.; Shi, K.; Wang, L.; Xu, J. Local government debt and firm leverage: Evidence from China. Asian Econ. Policy Rev. 2017, 12, 210–232. [Google Scholar] [CrossRef]

| Time Point | Mean | SD | t-Value | p-Value |

|---|---|---|---|---|

| −15 | 0.004 | 0.11 | 0.241 | 0.81 |

| −14 | 0.481 | 0.232 | 15.41 | 0.000 ** |

| −13 | 0.677 | 0.234 | 21.485 | 0.000 ** |

| −12 | 0.855 | 0.228 | 27.751 | 0.000 ** |

| −11 | 1.066 | 0.226 | 35 | 0.000 ** |

| −10 | 1.283 | 0.222 | 42.866 | 0.000 ** |

| −9 | 1.521 | 0.222 | 50.807 | 0.000 ** |

| −8 | 1.777 | 0.22 | 59.882 | 0.000 ** |

| −7 | 1.538 | 0.16 | 71.255 | 0.000 ** |

| −6 | 1.246 | 0.156 | 59.232 | 0.000 ** |

| −5 | 0.94 | 0.162 | 43.001 | 0.000 ** |

| −4 | 0.574 | 0.154 | 27.676 | 0.000 ** |

| −3 | 0.244 | 0.136 | 13.342 | 0.000 ** |

| −2 | −0.032 | 0.126 | −1.914 | 0.061 |

| −1 | −0.231 | 0.127 | −13.455 | 0.000 ** |

| 0 | −0.386 | 0.089 | −32.276 | 0.000 ** |

| 1 | −0.381 | 0.067 | −42.089 | 0.000 ** |

| 2 | −0.222 | 0.081 | −20.3 | 0.000 ** |

| 3 | −0.088 | 0.087 | −7.511 | 0.000 ** |

| 4 | 0.153 | 0.096 | 11.893 | 0.000 ** |

| 5 | 0.457 | 0.098 | 34.524 | 0.000 ** |

| 6 | 0.739 | 0.092 | 59.529 | 0.000 ** |

| 7 | 1 | 0.093 | 79.773 | 0.000 ** |

| 8 | 1.318 | 0.102 | 96.285 | 0.000 ** |

| 9 | 1.711 | 0.114 | 111.581 | 0.000 ** |

| 10 | 2.107 | 0.113 | 138.746 | 0.000 ** |

| 11 | 2.484 | 0.112 | 164.387 | 0.000 ** |

| 12 | 2.833 | 0.108 | 195.342 | 0.000 ** |

| 13 | 3.085 | 0.109 | 210.152 | 0.000 ** |

| 14 | 3.485 | 0.324 | 79.878 | 0.000 ** |

| 15 | 4.304 | 0.261 | 122.186 | 0.000 ** |

| Mean | SD | t | Cohen’s d | p-Value |

|---|---|---|---|---|

| 0.002 | 0.001 | 6.939 | 1.267 | 0.000 ** |

| Mean | SD | t | Cohen’s d | p-Value |

|---|---|---|---|---|

| 0.002 | 0.002 | 5.522 | 1.381 | 0.000 ** |

| NO. | Hypothesis | Result |

|---|---|---|

| The nonstandard default events of UIDCs will have a significant impact on the UIB market. | Accepted | |

| The UIB market is a fully efficient market. | Rejected |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yan, X.; Li, Y.; Ming, M.; Chong, H.-Y. Impact of Nonstandard Default Risk of the Urban Investment and Development Companies on the Urban Investment Bond Market. Systems 2023, 11, 68. https://doi.org/10.3390/systems11020068

Yan X, Li Y, Ming M, Chong H-Y. Impact of Nonstandard Default Risk of the Urban Investment and Development Companies on the Urban Investment Bond Market. Systems. 2023; 11(2):68. https://doi.org/10.3390/systems11020068

Chicago/Turabian StyleYan, Xue, Yuke Li, Meng Ming, and Heap-Yih Chong. 2023. "Impact of Nonstandard Default Risk of the Urban Investment and Development Companies on the Urban Investment Bond Market" Systems 11, no. 2: 68. https://doi.org/10.3390/systems11020068