A Novel Large-Scale Stochastic Pushback Design Merged with a Minimum Cut Algorithm for Open Pit Mine Production Scheduling

Abstract

:1. Introduction

2. Literature Survey

Stochastic Mine Planning under Uncertainties

3. Proposed Methodology

3.1. Stochastic Pushback Design Formulation

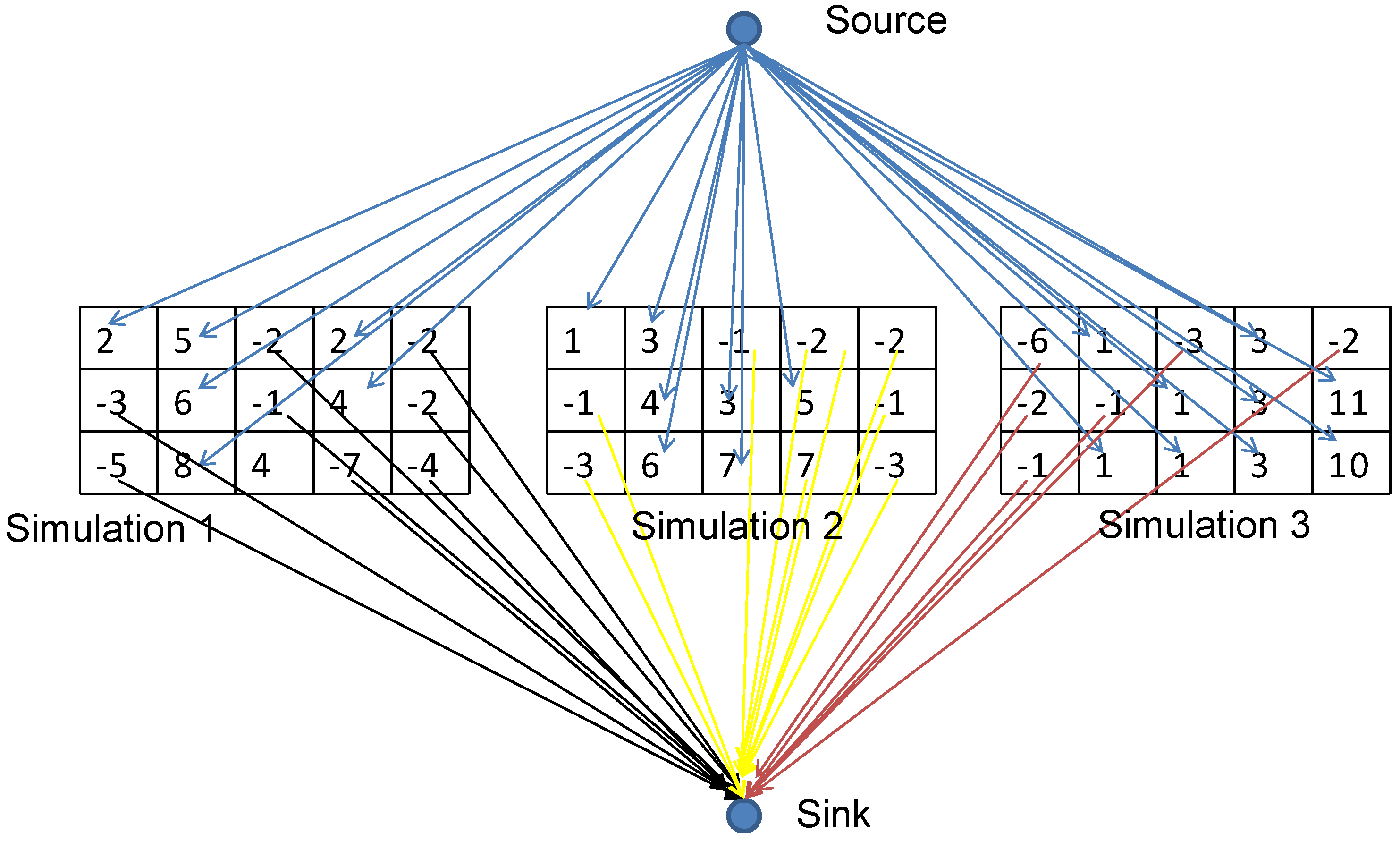

3.1.1. Stochastic Graph Closure with Multiple Scenarios

- 1.

- Set a parameter such that 0 < < 1.

- 2.

- Start = 0.

- 3.

- Assign best productionks = 0 at λ = 0 for all resource limitations and scenario .

- 4.

- Increase λ by a small value ∆λ, i.e.,

- 5.

- Solve .

- 6.

- If () from a solution of ,Update λ value by ;best productionks.

- 7.

- Go to step 5.

- 8.

- End.

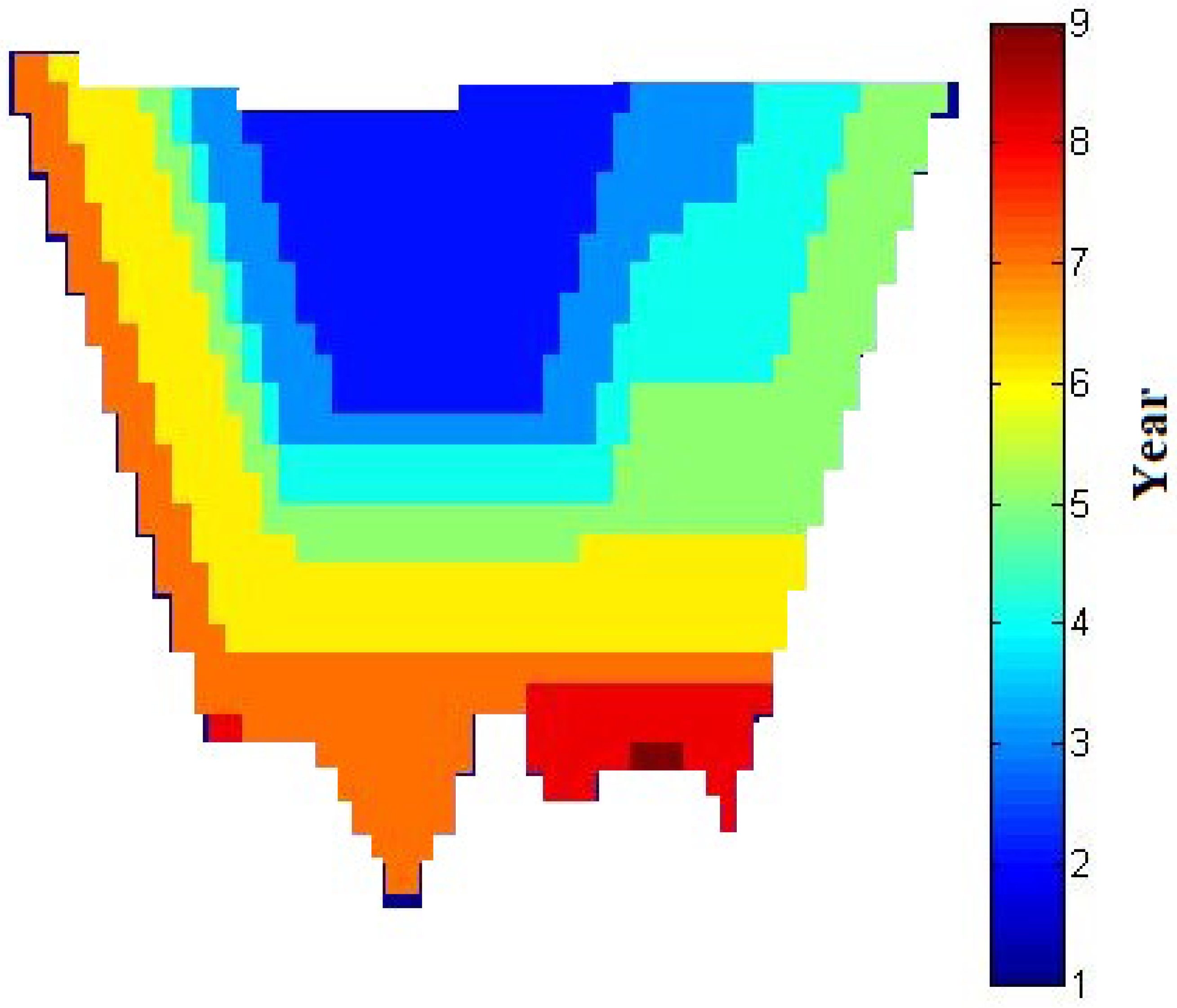

4. Results and Discussion

5. Conclusions and Future Scope

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Lerchs, H.; Grossmann, I.F. Optimum Design of Open Pit Mines. Canad. Inst. Mining Bull. 1965, 58, 47–54. [Google Scholar]

- Whittle, J.A. Decade of open-pit mine planning and optimization—The craft of turning algorithms into packages. In Proceedings of the APCOM ‘99 (Golden: Colorado School of Mines), Golden, CO, USA, 20–22 October 1999; pp. 15–24. [Google Scholar]

- Bongarcon, F.D.M.; Guibal, D. Parameterization of Optimal Designs of an Open Pit Beginning of a New Phase of Research. AIME Trans. 1983, 274, 1801–1805. [Google Scholar]

- Picard, J.C. Maximal closure of a graph and applications to combinatorial problems. Manag. Sci. 1976, 22, 1268–1272. [Google Scholar] [CrossRef]

- Hochbaum, D.S.; Chan, A. Performance analysis and best implementations of old and new algorithms for the open-pit mining problem. Oper. Res. 2000, 48, 894–914. [Google Scholar] [CrossRef]

- Goldberg, A.V. The Partial Augment–Relabel Algorithm for the Maximum Flow Problem. In Proceedings of the 16th Annual European Symposium Algorithms, Karlsruhe, Germany, 15–17 September 2008; pp. 466–477. [Google Scholar]

- Hochbaum, D.S. A new-old algorithm for minimum cut in closure graphs. Networks 2001, 34, 171–193. [Google Scholar] [CrossRef]

- Dimitrakopoulos, R.; Farrelly, C.T.; Godoy, M. Moving forward from traditional optimization: Grade uncertainty and risk effects in open pit design. Trans. Instn. Min. Metall. (Sec. A Min. Technol.) 2002, 111, A82–A88. [Google Scholar] [CrossRef]

- Dimitrakopoulos, R.; Abdel-Sabour, S.A. Evaluating mine plans under uncertainty: Can the real options make a difference? Res. Policy 2007, 32, 116–125. [Google Scholar] [CrossRef]

- Ramazan, S.; Dimitrakopoulos, R. Stochastic optimization of long-term production scheduling for open pit mines with a new integer programming formulation. In, Orebody modelling and strategic mine planning: Uncertainty and risk management models. AusIMM Spectr. Ser. 2007, 14, 385–392. [Google Scholar]

- Ramazan, S.; Dimitrakopoulos, R. Production Scheduling with Uncertain Supply: A New Solution to the Open Pit Mining Problem. Opt. Eng. 2013, 14, 361–380. [Google Scholar] [CrossRef]

- Albor, F.; Dimitrakopoulos, R. Algorithmic Approach to Pushback Design Based on Stochastic Programming: Method, Application, and Comparisons. IMM Trans. Sect. A Min. Technol. 2010, 119, 88–101. [Google Scholar]

- Godoy, M.; Dimitrakopoulos, R. Managing risk and waste mining in long-term production scheduling of open-pit mines. SME Trans. 2004, 316, 43–50. [Google Scholar]

- Leite, A.; Dimitrakopoulos, R. A stochastic optimization model for open pit mine planning: Application and risk analysis at a copper deposit. IMM Trans. Min. Technol. 2007, 116, 109–118. [Google Scholar] [CrossRef]

- Meagher, C.; Sabour, S.; Dimitrakopoulos, R. Pushback design of open pit optimization under geological and market uncertainties. Int. Symp. Orebody Modeling Strateg. Mine Plan. Old New Dimens. A Chang. World Perth Aust. 2009, 17, 291–298. [Google Scholar]

- Goldberg, A.V.; Tarjan, R.E. A new approach to the maximum flow problem. J. ACM 1998, 35, 921–940. [Google Scholar] [CrossRef]

- Asad, M.W.A.; Dimitrakopoulos, R. Implementing a parametric maximum flow algorithm for optimal open pit mine design under uncertain supply and demand. J. Oper. Res. Soc. 2013, 64, 185–197. [Google Scholar] [CrossRef]

- Schwartz, E.S. The stochastic behavior of commodity prices: Implications for valuation and hedging. J. Financ. 1997, 52, 923–973. [Google Scholar] [CrossRef]

- Azadeh, A.; Moghaddam, M.; Khahzad, M.; Ebrahimipour, V. A flexible neural network-fuzzy mathematical programming algorithm for improvement of oil price estimation and forecasting. Comput. Ind. Eng. 2012, 62, 421–430. [Google Scholar] [CrossRef]

- Godoy, M. The Effective Management of Geological Risk. Ph.D. Thesis, University of Queensland, St Lucia, Australia, 2003. [Google Scholar]

- Goovaerts, P. Geostatistics for Natural Resources Evaluation; Applied Geostatistics Series; Oxford University Press: New York, NY, USA, 1997. [Google Scholar]

- Remy, N.; Boucher, A.; WU, P. Applied Geostatistics with Sgems—A User’s Guide; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar]

- Dimitrakopoulos, R.; Ramazan, S. Uncertainty-based production scheduling in open pit mining. SME Trans. 2004, 316, 106–116. [Google Scholar]

- Dimitrakopoulos, R.G.; Grieco, N. Stope design and geological uncertainty: Quantification of risk in conventional designs and a probabilistic alternative. J. Min. Sci. 2009, 45, 152–163. [Google Scholar] [CrossRef]

- Ramazan, S.; Dimitrakopoulos, R. Stochastic Optimisation of Long-Term Production Scheduling for Open Pit Mines with a New Integer Programming Formulation. Adv. Appl. Strateg. Mine Plan. 2018. [Google Scholar] [CrossRef]

- Goodfellow, R.; Dimitrakopoulos, R.G. Simultaneous Stochastic Optimization of Mining Complexes and Mineral Value Chains. Math. Geosci. 2017, 49, 341–360. [Google Scholar] [CrossRef] [PubMed]

- Chatterjee, S.; Dimitrakopoulos, R. Production scheduling under uncertainty of an open-pit mine using Lagrangian relaxation and branch-and-cut algorithm. Int. J. Min. Reclam. Environ. 2020, 34, 343–361. [Google Scholar] [CrossRef]

- Joshi, D.; Paithankar, A.; Chatterjee, S.; Equeenuddin, S.M. Integrated Parametric Graph Closure, and Branch-and-Cut Algorithm for Open Pit Mine Scheduling under Uncertainty. Mining 2022, 2, 32–51. [Google Scholar] [CrossRef]

- Moreno, E.; Emery, X.; Goycoolea, M.; Morales, N.; Gonzalo, N. A two-stage stochastic model for open pit mine planning under geological uncertainty. In Proceedings of the 38th International Symposium on the Application of Computers and Operations Research in the Mineral Industry (APCOM 2017), Golden, CO, USA, 9–11 August 2017. [Google Scholar]

- Koushavand, B.; Askari-Nasab, H.; Deutsch, C.V. A linear programming model for long-term mine planning in the presence of grade uncertainty and a stockpile. Int. J. Min. Sci. Technol. 2014, 24, 451–459. [Google Scholar] [CrossRef]

- Joshi, D.; Satpathy, S.K. Production scheduling of open pit mine using sequential branch-and-cut and longest path algorithm: An application from an African copper mine. J. Eur. Syst. Autom. 2020, 53, 629–636. [Google Scholar] [CrossRef]

- Tachefine, B.; Soumis, F. Maximal Closure on a Graph with Resource Constraints. Com. Oper. Res. 1997, 24, 981–990. [Google Scholar] [CrossRef]

- Seymour, F. Pit limit parameterization from modified 3D Lerchs-Grossmann Algorithm. SME Trans. 1995, 298, 1860–1864. [Google Scholar]

- Coburn, T.C. Geostatistics for Natural Resources Evaluation. Technometrics 2000, 42, 437–438. [Google Scholar] [CrossRef]

- Deutsch, C.V.; Journel, A.G. GSLIB: Geostatistical Software Library and User’s Guide; Oxford University Press: New York, NY, USA, 1998. [Google Scholar]

- Hustrulid, W.A.; Kuchta, M. Open Pit Mine Planning and Design, Two Volume Set, 2nd ed.; Taylor & Francis: Leiden, The Netherlands, 2006. [Google Scholar]

- ILOG. CPLEX 12.5 User’s Manual; IBM: Armonk, NY, USA, 2012. [Google Scholar]

| Statistics | Sample No. | Mean (%) | Variance (%2) | Coefficient of Variation | Skewness | Kurtosis |

|---|---|---|---|---|---|---|

| Iron | 1456 | 63.85 | 64.52 | 12.58 | −2.74 | 8.39 |

| Description | Value |

|---|---|

| Slope angle (degree) | 45° |

| Block dimensions (m × m × m) | 20 × 20 × 10 |

| Recovery (%) | 0.9 |

| Cutoff grade of iron (%) | 55.26 |

| Discount cash flow (%) | 0.10 |

| Iron selling price (USD/ton) | 40 |

| Iron ore selling cost (USD/ton) | 3.6 |

| Iron ore processing cost (USD/ton) | 12 |

| Iron ore mining cost (USD/ton) | 3 |

| Year (T) | No. of Blocks (N) | No. of Blocks Extracted per Year | Solution Time in Seconds (t) | Gap (%) | No. of Scenarios (s) |

|---|---|---|---|---|---|

| 1 | 16,532 | 876 | 157.12 | 0.01 | 1 |

| 2 | 15,656 | 1815 | 37.19 | 0.00 | 1 |

| 3 | 13,841 | 1620 | 151.04 | 0.00 | 1 |

| 4 | 12,221 | 1919 | 263.66 | 0.01 | 1 |

| 5 | 10,302 | 2172 | 129.85 | 0.00 | 1 |

| 6 | 8130 | 2142 | 62.79 | 0.01 | 1 |

| 7 | 5988 | 1867 | 8.94 | 0.00 | 1 |

| 8 | 4121 | 1586 | 9.28 | 0.00 | 1 |

| 9 | 2535 | 1268 | 2.79 | 0.00 | 1 |

| 10 | 1267 | 1267 | 0.36 | 0.00 | 1 |

| Total | 823.02 s |

| Year | Ore (Mt) | Waste (Mt) | Metal (Kt) | NPV (USD 1 Million) |

| 1 | 7,170,000 | 2,850,000 | 50,000 | 101,000,000 |

| 2 | 8,000,000 | 12,800,000 | 40,400 | 56,900,000 |

| 3 | 8,000,000 | 10,500,000 | 36,700 | 43,900,000 |

| 4 | 8,000,000 | 14,000,000 | 36,900 | 38,800,000 |

| 5 | 8,000,000 | 16,900,000 | 38,800 | 38,100,000 |

| 6 | 8,000,000 | 16,500,000 | 39,600 | 36,200,000 |

| 7 | 8,000,000 | 13,400,000 | 38,300 | 31,800,000 |

| 8 | 8,000,000 | 10,100,000 | 35,900 | 26,100,000 |

| 9 | 8,000,000 | 6,510,000 | 32,200 | 19,600,000 |

| 10 | 7,700,000 | 6,800,000 | 27,500 | 12,700,000 |

| Total | 7.88 × 107 | 1.10 × 108 | 3.76 × 105 | 4.05 × 108 |

| Year (T) | No. of Blocks (N) | No. of Blocks Extracted per Year | Solution Time in Seconds (t) | Gap (%) | No. of the Scenarios (s) |

|---|---|---|---|---|---|

| 1 | 16,532 | 917 | 351.49 | 0.23 | 20 |

| 2 | 15,615 | 1925 | 577.38 | 0.58 | 20 |

| 3 | 13,690 | 1616 | 233.55 | 1.46 | 20 |

| 4 | 12,074 | 1867 | 1309.13 | 2.79 | 20 |

| 5 | 10,207 | 2112 | 589.09 | 2.76 | 20 |

| 6 | 8095 | 2185 | 111.98 | 2.43 | 20 |

| 7 | 5910 | 2167 | 22.36 | 0.05 | 20 |

| 8 | 3743 | 1750 | 15.37 | 1.77 | 20 |

| 9 | 1993 | 1464 | 3.46 | 0.88 | 20 |

| 10 | 529 | Left | No solution or infeasible sol. | ||

| Total | 3213.81 s |

| Year | Ore (Mt) | Waste (Mt) | Metal (Kt) | NPV (USD 1 Million) |

|---|---|---|---|---|

| 1 | 7,114,500 | 33,755,00 | 49,160 | 98,380,000 |

| 2 | 7,738,000 | 14,280,000 | 41,705 | 61,000,000 |

| 3 | 7,816,000 | 10,670,000 | 38,840 | 49,795,000 |

| 4 | 7,709,000 | 13,650,000 | 37,660 | 41,975,000 |

| 5 | 7,755,500 | 16,425,000 | 39,345 | 40,275,000 |

| 6 | 7,643,000 | 17,355,000 | 40,355 | 38,535,000 |

| 7 | 7,776,500 | 17,020,000 | 41,575 | 36,690,000 |

| 8 | 7,717,500 | 12,305,000 | 37,295 | 28,465,000 |

| 9 | 7,629,000 | 9,117,500 | 32,530 | 20,465,000 |

| Sum | 6.89 × 107 | 1.14 × 108 | 3.58 × 105 | 4.16 × 108 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Joshi, D.; Chithaluru, P.; Singh, A.; Yadav, A.; Elkamchouchi, D.H.; Pérez-Oleaga, C.M.; Anand, D. A Novel Large-Scale Stochastic Pushback Design Merged with a Minimum Cut Algorithm for Open Pit Mine Production Scheduling. Systems 2022, 10, 159. https://doi.org/10.3390/systems10050159

Joshi D, Chithaluru P, Singh A, Yadav A, Elkamchouchi DH, Pérez-Oleaga CM, Anand D. A Novel Large-Scale Stochastic Pushback Design Merged with a Minimum Cut Algorithm for Open Pit Mine Production Scheduling. Systems. 2022; 10(5):159. https://doi.org/10.3390/systems10050159

Chicago/Turabian StyleJoshi, Devendra, Premkumar Chithaluru, Aman Singh, Arvind Yadav, Dalia H. Elkamchouchi, Cristina Mazas Pérez-Oleaga, and Divya Anand. 2022. "A Novel Large-Scale Stochastic Pushback Design Merged with a Minimum Cut Algorithm for Open Pit Mine Production Scheduling" Systems 10, no. 5: 159. https://doi.org/10.3390/systems10050159

APA StyleJoshi, D., Chithaluru, P., Singh, A., Yadav, A., Elkamchouchi, D. H., Pérez-Oleaga, C. M., & Anand, D. (2022). A Novel Large-Scale Stochastic Pushback Design Merged with a Minimum Cut Algorithm for Open Pit Mine Production Scheduling. Systems, 10(5), 159. https://doi.org/10.3390/systems10050159