2. Related Work

Sports-betting prediction has evolved into a mature interdisciplinary domain spanning statistical modelling, machine learning, and the study of market microstructure. Since bookmaker prices reflect large information sets and strategic adjustments, empirical evaluation must consider not only classification accuracy but also probability calibration, execution realism, and economic usefulness. Recent contributions converge on the view that predictive lift acquires value only when paired with robust calibration, transparent decision rules, and realistic odds assumptions. Within this broader landscape, prior work can be organised into three complementary strands: calibration-aware forecasting, discriminative modelling using structured features, and market-aware economic evaluation.

A first strand emphasises probability calibration as a determinant of betting profitability. Walsh and Joshi [

3], building on critiques of accuracy-only evaluation [

5], compare accuracy-based versus calibration-based model-selection pipelines across NBA seasons 2014–2019. Their models—logistic regression, random forests, SVMs, and multilayer perceptrons—are trained on pre-game box-score features and are evaluated against Westgate closing moneylines. Calibration-selected pipelines consistently achieve higher ROI under both fixed-stake and fractional-Kelly sizing, showing that probability reliability affects economic outcomes even when classification metrics are comparable. However, this work does not incorporate spatial representation learning, sequential models, or explicit uncertainty quantification, and does not examine how calibrated probabilities interact with real-world execution constraints.

A second strand investigates discriminative performance using structured team and player statistics. Wang [

6] evaluates logistic regression, SVMs, random forests, and feed-forward neural networks on more than 25,000 NBA games (2004–2020), using leakage-controlled shooting efficiency, turnover, rebounding, and assist features. Random forests and deep networks achieve the strongest accuracy and AUC, confirming that these structured metrics carry predictive signal. Yet the study does not assess calibration or simulate betting performance, leaving unclear whether discriminative lift survives bookmaker pricing or translates into value.

Adam, Pantatosakis, and Tsagris [

7] extend this line of research to within-game prediction using half-time features for 3540 NBA games (2020–2023). Ten algorithms (CART, kNN, SVMs, neural networks, naïve Bayes, GBM, XGBoost, and logistic regression) are compared using repeated cross-validation [

8,

9] and greedy ensembling [

5]. Ensembles reach AUCs above 0.90 within season but decline to 0.78–0.80 across seasons, highlighting temporal drift. Their analysis includes SHAP and ALE interpretability but does not address pre-game probability calibration, predictive uncertainty, or betting outcomes. Although neural networks are used, they function as standard discriminative classifiers rather than as spatial or sequential representation learners.

A third strand examines market realism, odds dynamics, and the feasibility of executing profitable strategies. Zimmermann [

4] compares naïve Bayes, neural networks, random forests, and a Pomeroy-style model across NBA, NCAA, and NFL games from 2015 to 2018 using least-favourable prices from Vegas Insider. Despite comparable accuracy across models, realised profits vary substantially by sport: The NFL and NCAA show occasional exploitable inefficiencies, whereas NBA markets appear considerably tighter. This work underscores that profitability requires both calibrated signals and market-aware decision rules, and that accuracy alone is insufficient in markets with limited inefficiency. However, the study does not incorporate uncertainty quantification, probability calibration, or bankroll-optimising decision layers.

Across these strands, three insights recur. First, calibration materially affects ROI, whereas accuracy alone provides an incomplete measure of decision usefulness. Second, market realism shapes outcomes: Adverse price selection, liquidity constraints, and season–boundary drift all influence realised profitability. Third, existing models—whether discriminative (Wang [

6]) or within-game (Adam et al. [

7])—do not integrate spatial embeddings, sequential uncertainty estimation, and financially coherent decision rules within a single pre-game forecasting pipeline.

Despite substantial progress, no prior work jointly integrates (i) high-resolution pre-game spatial embeddings derived from shot chart heatmaps, (ii) recurrent neural architectures with Monte Carlo dropout for calibrated uncertainty over sequential form indicators, and (iii) an explicit, market-aware decision layer based on expected-value thresholds and fractional-Kelly staking evaluated under strict chronological splits.

The present study fills this gap by combining structured statistics, PCA-refined spatial embeddings, and market-derived features with a Bayesian RNN whose predictive distributions feed directly into a transparent bankroll simulation. This unified design links representation learning, uncertainty quantification, and decision-theoretic wagering within a single coherent framework, enabling a clearer assessment of when—and under which market conditions—probabilistic lift translates into economic value.

Table 1 summarizes the strengths and limitations of the ost relevant articles.

4. Models and Experiments

We assemble an integrated dataset linking official game statistics, spatial shot information, and betting-market data so as to capture both on-court performance and the off-court expectations embedded in odds. Game-level statistics are scraped from Basketball Reference for seasons 2010–2024 via a Playwright + BeautifulSoup pipeline that iterates monthly schedules and retrieves box-score pages to local HTML with retries and backoff. Parsed tables are converted with pandas into structured records combining line scores, team box-score aggregates, and advanced efficiency indicators. For each game, we merge home and away features so that each team appears once with opponent-adjusted attributes.

Spatial shot charts are rasterized into 2D heatmaps on a fixed grid and are passed through a convolutional encoder with three convolution pool blocks, adaptive average pooling, and a final dense layer. The encoder outputs a 128-dimensional embedding that captures court space usage, shot density, and spatial diversity (e.g., perimeter versus paint frequency, corner threes versus above-the-break usage). As raw, 128-dimensional embeddings are high-dimensional and noisy, we apply principal component analysis (PCA) fitted strictly on the training set: Embeddings from seasons 2010–2018 are stacked into a matrix, PCA is fitted, and the transformation is then frozen. PCA reduces the representation to principal components, which retain 92.7% of the variance and empirically improve calibration and stability relative to unreduced embeddings. Retaining components increases explained variance to 96.1% but does not materially improve validation log-loss or AUC. In the final model, the PCA-reduced embedding is concatenated with box-score and market-derived features before being fed to the recurrent module.

To quantify the contribution of PCA, we compare three variants: (i) raw 128-dimensional embeddings, (ii) PCA-20 (92.7% variance explained), and (iii) PCA-30 (96.1% variance explained). PCA-20 achieves the best calibration and lowest validation log-loss, while PCA-30 yields only marginal AUC gains at the cost of worse calibration. Raw embeddings are computationally heavier and produce higher variance across validation seasons, consistent with overparameterisation relative to the available sequence length. Overall, the CNN encoder plus PCA-refined embeddings provide spatial and stylistic information in a compact representation that integrates cleanly into the forecasting pipeline.

For each team we compute rolling performance indicators over the last five completed games, using exclusively past information to avoid lookahead bias. For a match between teams A and B played on date t, the window for team A is the set of its five most recent games strictly preceding t; likewise for team B. All rolling statistics (shooting percentages, rebounds, assists, turnovers, pace, and efficiency measures) are therefore lagged features. The construction is symmetric: Both teams receive their own five-game aggregates, and the model is fed the pair aligned on the match date. If a team has fewer than five previous games (season start), the observation is excluded from sequence models that require at least five time steps to preserve consistent temporal structure. For use in tabular baselines, these rolling windows are summarised into scalar indicators such as team_rolling_win_rate_5 (mean of the binary outcome won over the last five games) and team_rolling_pts_5 (mean points scored), both computed with a one-step temporal shift so that only games strictly preceding t are used.

Moneylines, spreads, and totals are collected from a public Kaggle dataset (uploaded by Christopher Treasure as NBA odds data; visited 29 August 2025;

https://www.kaggle.com/datasets/christophertreasure/nba-odds-data) and, where missing, from major outlets (CBS Sports, Action Network, FoxSports, USAToday). American-odds moneylines are converted to decimal odds

and implied probabilities

and

We compute the overround

which measures the bookmaker margin. For a team-centric representation, we define

and

and include the scalar features

implied_prob_team (

),

spread,

total, and

overround (

) in the input vector. These quantities summarise market assessments of relative strength, expected scoring level, and bookmaker edge, and they are crucial for value-based betting decisions.

We augment team records with pace, projected possessions, point differential, and game totals, and compute rolling five-game averages as described above to capture short-term form. Headline-based sentiment scores (ESPN/Yahoo via Google News) were evaluated but showed weak association with outcomes and odds movements; they are excluded from the final feature set. The resulting panel links (i) parsed box scores, (ii) PCA-20 shot-location embeddings, and (iii) market-adjusted probabilities into a unified pre-game feature vector for each team game.

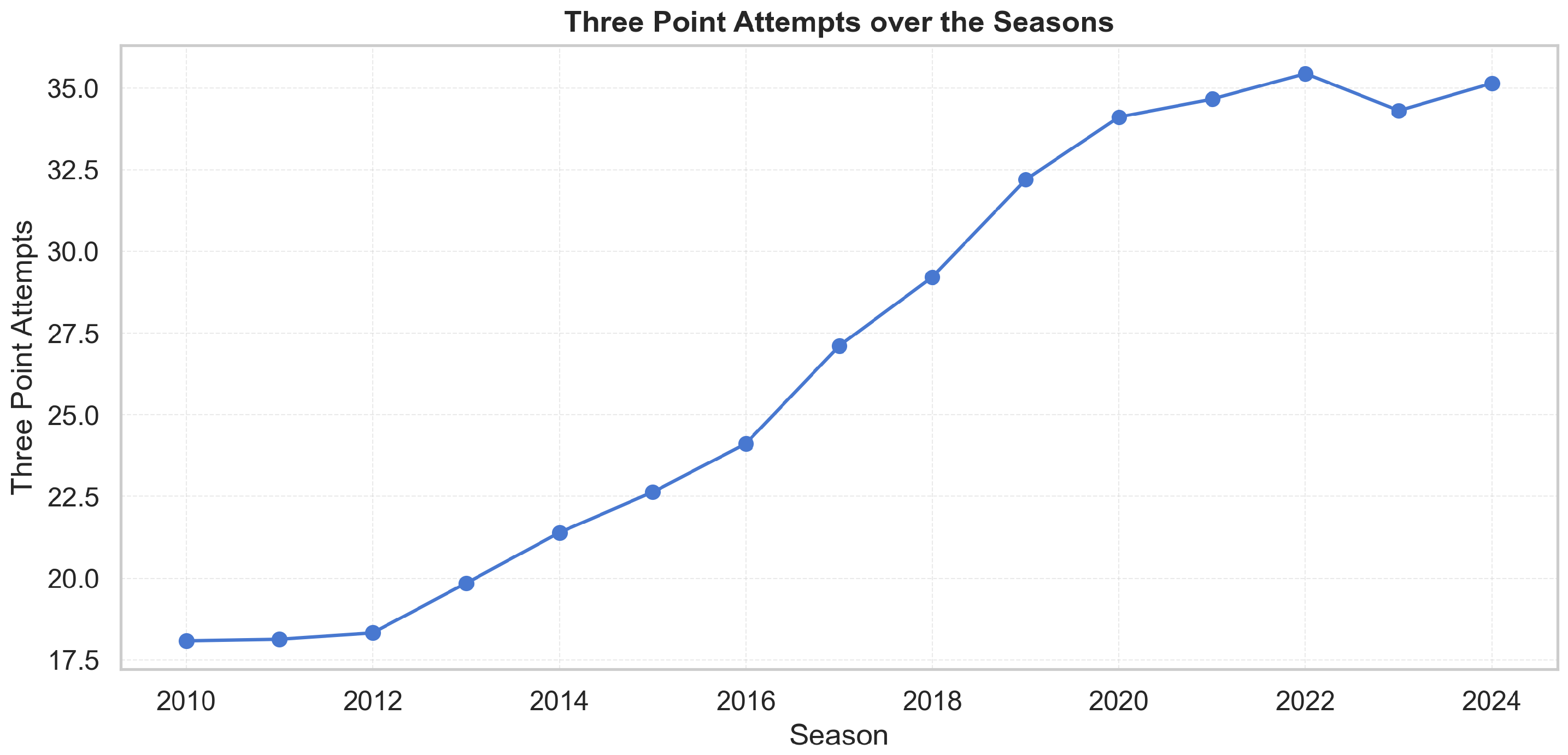

League style evolves markedly over 2010–2024. Three-point attempts roughly double and display a sustained upward drift (

Figure 2), while average points per game increase in parallel (

Figure 3).

Figure 4 and

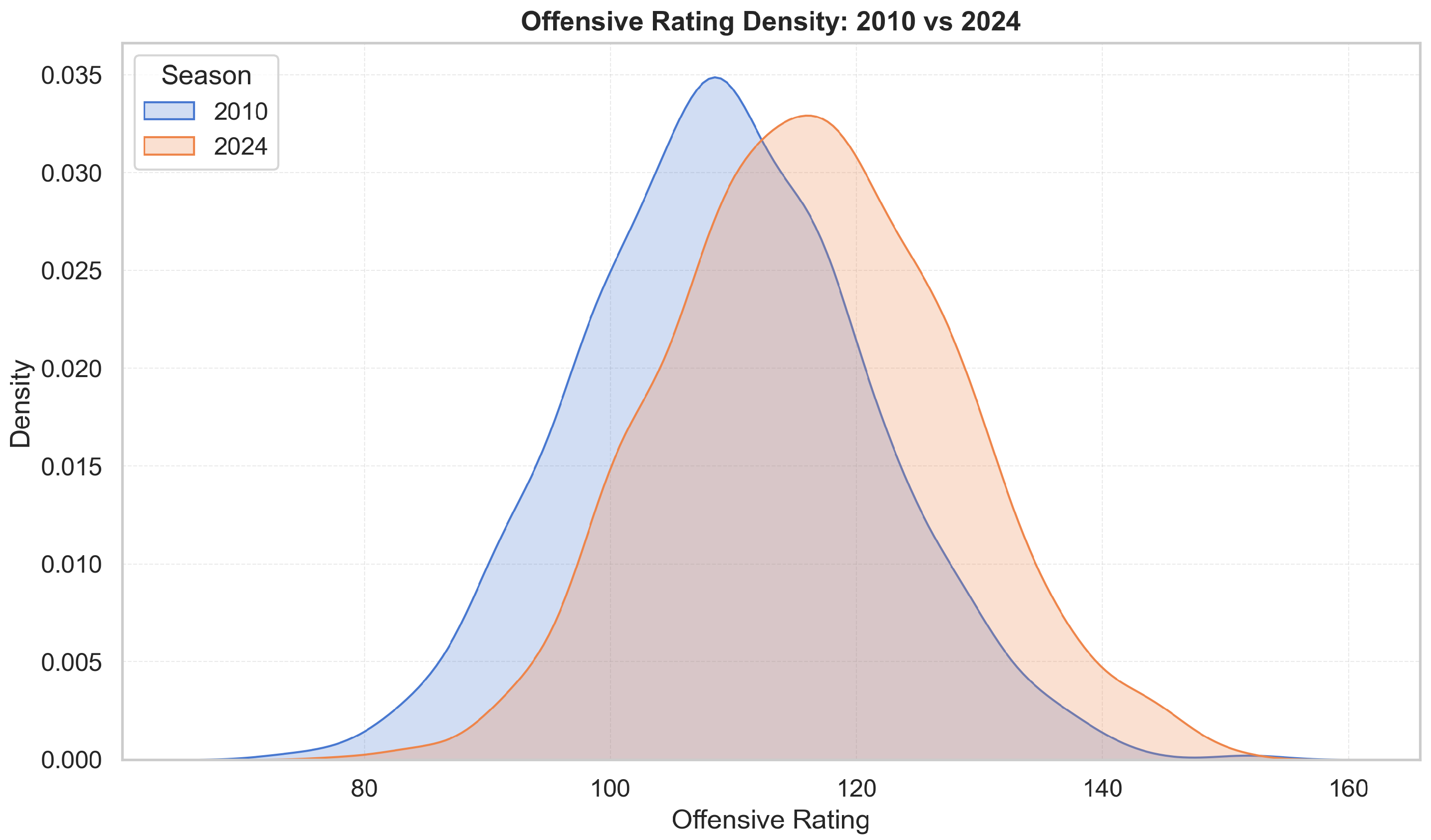

Figure 5 highlight deeper structural change. In

Figure 4, the offensive-rating distribution (points scored per 100 possessions) shifts rightwards and becomes more concentrated over time, indicating higher median scoring efficiency and reduced dispersion, consistent with league-wide adoption of pace-and-space offences, increased three-point volume, and rule changes favouring perimeter freedom of movement. The right tail thickens after 2018, reflecting historically elite offences.

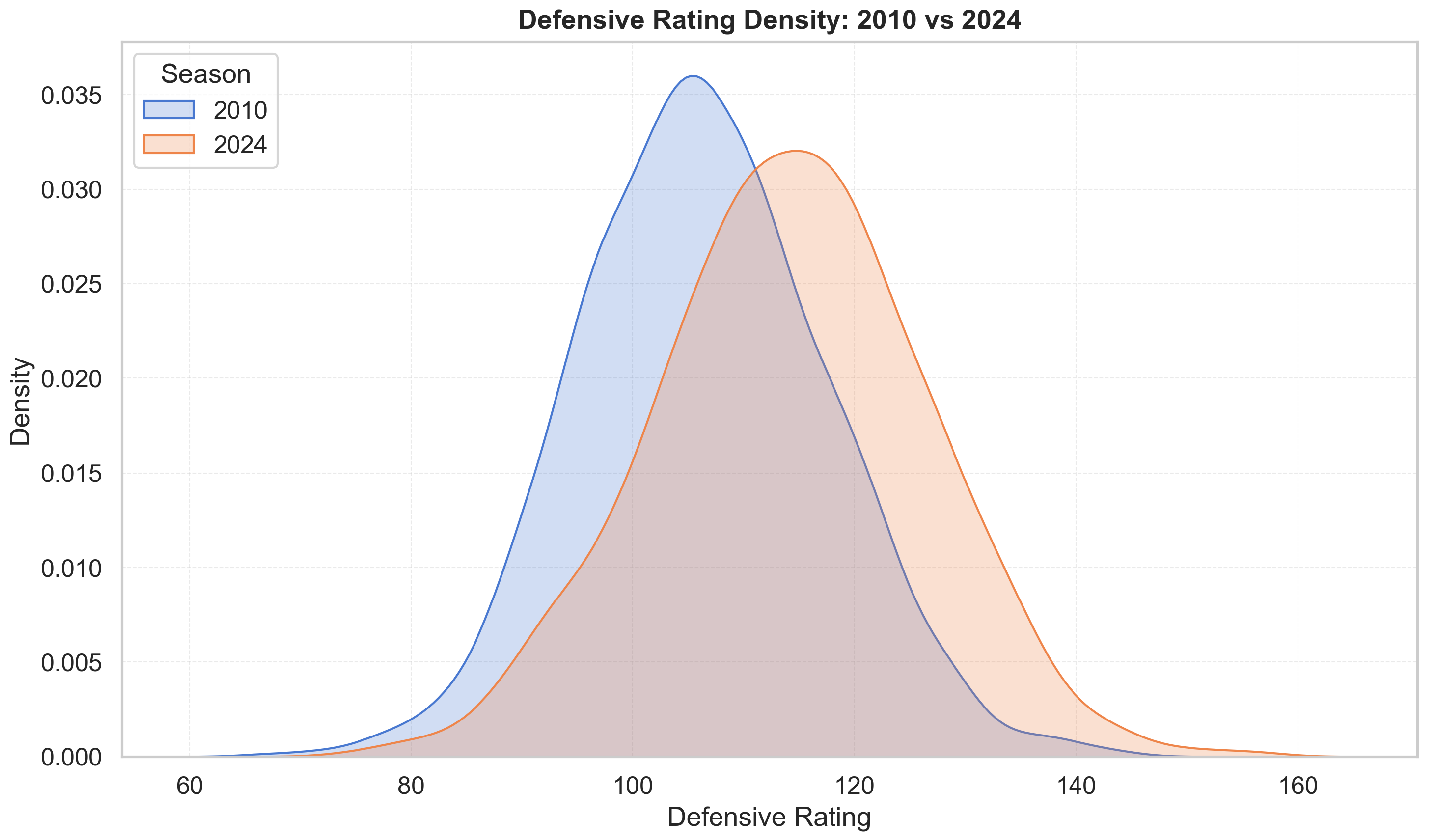

Figure 5 shows an analogous rightward shift in defensive ratings (points allowed per 100 possessions). The increase in defensive ratings reflects offensive inflation rather than uniformly weaker defence: It becomes harder to maintain low ratings when league scoring rises. The widening of the distribution suggests greater volatility in defensive outcomes, as teams face a more diverse mix of offensive styles. Taken together, the two figures show a joint upward drift in both offensive and defensive efficiency, indicating that the modern NBA environment is fundamentally different from earlier seasons. This motivates era controls and standardization. Accordingly, all raw counts are expressed per 100 possessions to remove pace effects, and season-fixed effects (or

z-normalization within season) are used to ensure comparability across years.

We initially framed outcome prediction as regression (team points) using sequences of prior games processed by an LSTM; although this captured scoring dynamics, RMSE remained too large for reliable winner inference. We therefore adopted binary classification for win/loss using the same sequential inputs (rolling statistics and PCA-reduced embeddings) over the last five games. To preserve causality, data are split chronologically: training on seasons ≤ 2022, validation on 2023, and testing on 2024. The main win model is an LSTM-based architecture with Monte Carlo (MC) dropout at inference, providing calibrated probabilities and uncertainty estimates that are crucial for principled betting decisions. We extend modelling to spread (cover/no-cover) and totals (over/under) using the same feature space. Targets are defined by comparing observed outcomes to bookmaker lines from each team’s perspective. To measure the value of temporal context, we compare recurrent models to feed-forward MLPs under identical features and splits. Evaluation emphasises discrimination (accuracy, ROC–AUC), probabilistic quality (Brier score, log-loss), and confusion matrices to monitor class balance and calibration.

Economic value is assessed using a fractional-Kelly staking rule [

20]. For decimal odds

o and win probability

p (with

), the full Kelly fraction is

To control risk, we use 0.3-Kelly, enforce a minimum expected-value threshold (), and impose a per-bet limit of EUR 100, with odds capped at 10.0. MC-dropout yields a distribution of predicted probabilities; wagers are placed only when both Kelly and criteria hold, filtering for edge and confidence. Bankroll simulations start at EUR 100 and proceed sequentially through the 2024 schedule; we record the full equity curve, number of bets, hit rate, and standard risk diagnostics (e.g., maximum drawdown). The same staking protocol is reused for all comparative baselines.

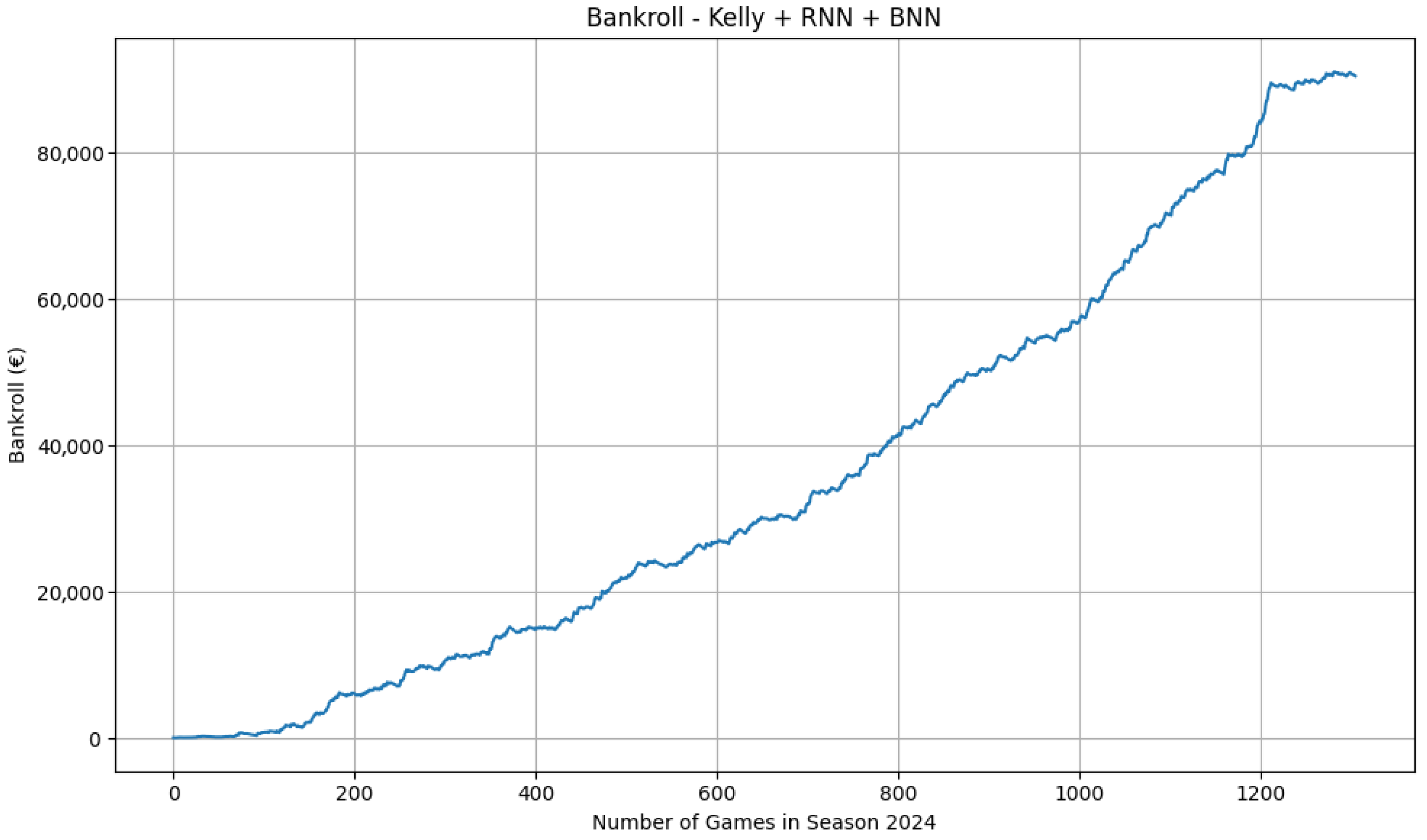

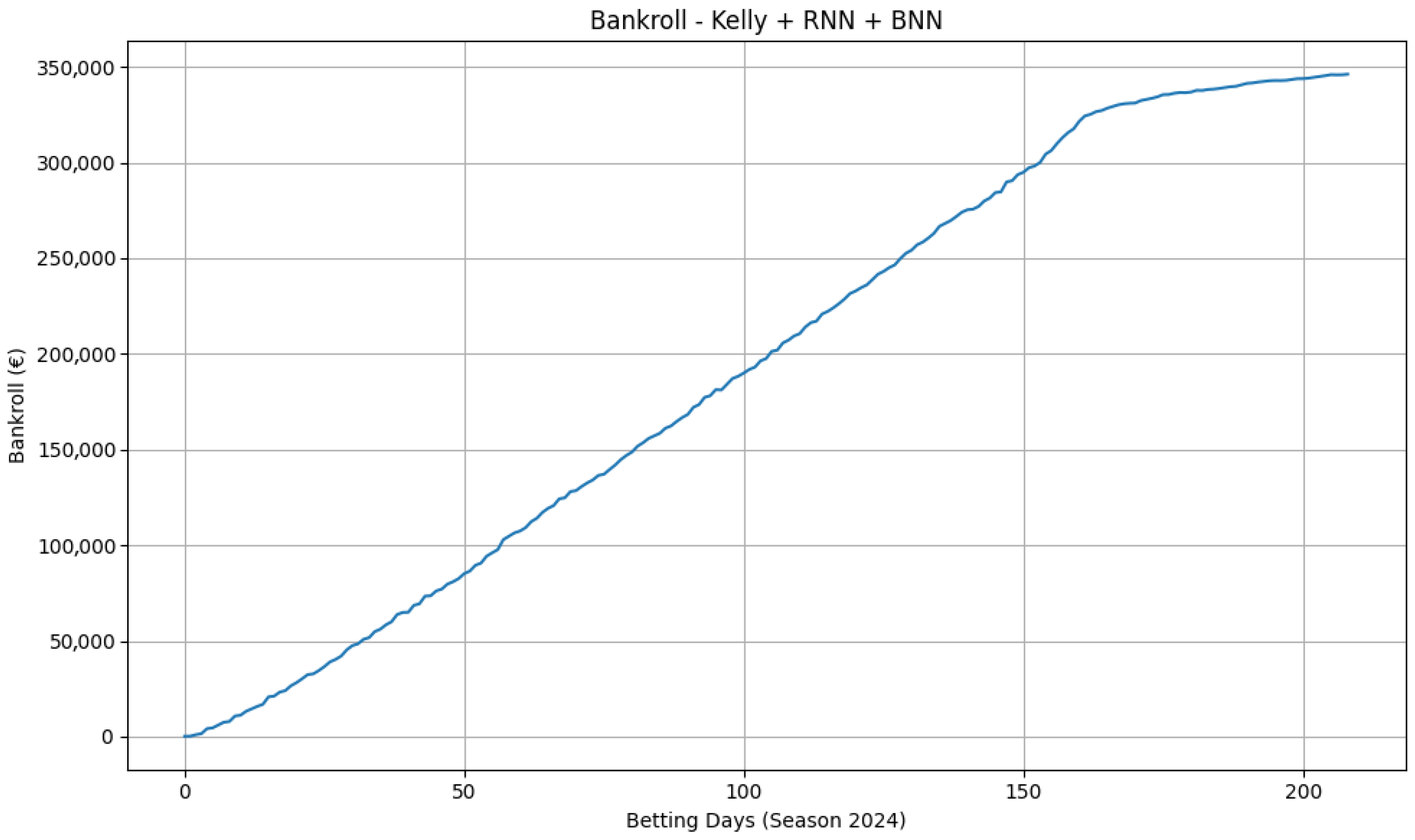

Uncertainty-aware win models (LSTM + MC-dropout) produce a steadily increasing equity curve on NBA moneylines (

Figure 6).

Periods of faster growth alternate with plateaus and shallow drawdowns, consistent with (i) time-varying edge, (ii) the selection filter reducing action during low-confidence windows, and (iii) the interaction between the Kelly fraction and the per-bet cap. Spread models are neutral to mildly negative, and totals deliver only marginal gains, aligning with the view that those markets are more efficient.

Table 3 compares several mainstream baselines on the 2024 test season under the same chronological split and staking rules. The market-implied probabilities and the logistic regression baseline exhibit reasonable calibration but do not generate profit, with final bankrolls of EUR 100 and EUR 80.34 respectively. Logistic regression attains the best Brier score and log-loss among tabular baselines (0.199 and 0.583), but its value-based filter yields a modest number of bets and a negative ROI. XGBoost offers slightly worse probabilistic scores (Brier 0.202, log-loss 0.589) but higher AUC (0.754, not shown in the table) and, critically, the best economic performance among tabular models, with a final bankroll of EUR 143.76 (ROI

) over 36 bets (hit rate 0.389). This illustrates that small differences in probability quality can interact non-linearly with the staking and EV thresholds, producing different economic outcomes. The GRU sequence model ingests a longer form history (last ten games per team) and achieves lower accuracy (0.604) and weaker probabilistic metrics than the tabular baselines. Its calibration is poor, and it issues many low-value bets, leading to aggressive overbetting: 1047 wagers, hit rate 0.284, and complete bankroll loss (ROI

). Finally, a CNN trained on shot location heatmaps and the same tabular features does not outperform simpler tabular baselines (accuracy 0.53, log-loss 0.694, AUC 0.462), suggesting that in the present configuration, deep spatial representation alone is insufficient to extract an edge over the market.

Figure 6 reports the bankroll trajectory obtained using our main model, which grows substantially over time (final bankroll

). To verify that this growth does not arise from compounding artefacts, unrealistic odds, or the staking mechanism itself, we evaluate two baseline systems under the same betting conditions used in the main experiment (fractional Kelly 0.3, EV

, EUR 100 stake cap, odds cap 10.0), starting from the same initial capital of EUR 100. When replacing our model probabilities with the probabilities implied by the decimal odds (

), the strategy places virtually no bets and the bankroll remains equal to the initial €100 (ROI

). A sensitivity analysis over 48 combinations of Kelly multiplier, EV threshold, stake cap, and odds cap yields final bankroll values consistently equal to EUR 100, and a block bootstrap produces a degenerate distribution with median EUR 100 and 2.5–97.5 percentiles [EUR 100, EUR 100]. This confirms that the staking engine alone cannot generate significant growth: Without a predictive edge, the bankroll does not rise to the levels observed in

Figure 6.

We trained the no-leakage logistic regression baseline on a reduced pre-game feature set (home indicator, implied probability, spread, total, overround, rolling win rate over five games, and rolling points over five games). On the 2024 test set, the baseline achieves accuracy 0.688, Brier score 0.199, and log-loss 0.583. When fed into the same staking engine, it produces a final bankroll of EUR 80.34, with a bootstrap median of EUR 80.34, a 95% interval of [EUR 54.31, EUR 122.22], and 87.8% of runs ending in a loss. Thus, a simple statistical baseline—despite reasonable predictive performance—fails to produce positive bankroll growth and remains far below the successful trajectory in

Figure 6.

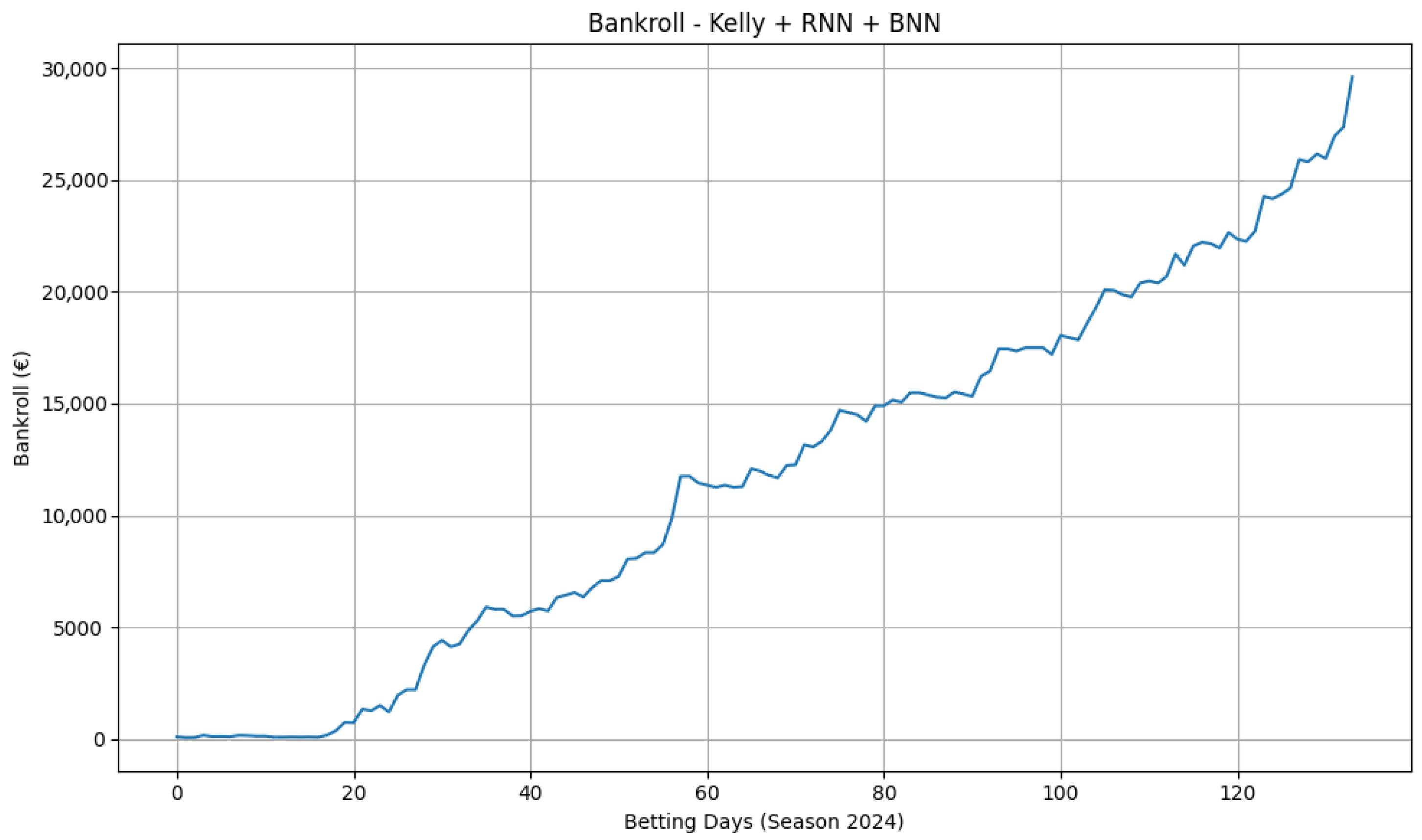

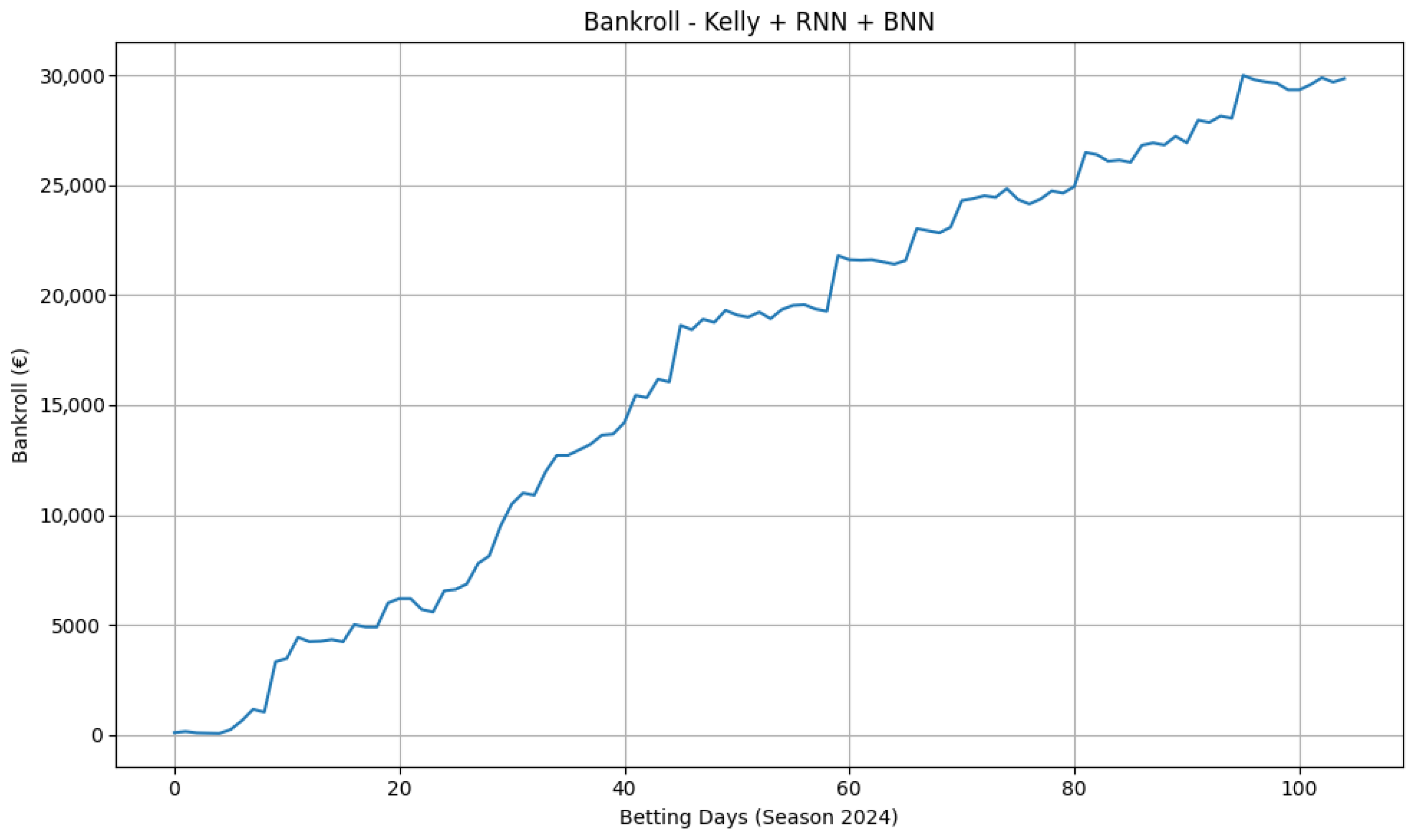

A player-level, three-class model paired with synthetic odds (

Figure 7) shows smoother compounding and larger absolute growth, indicating that thinner, less liquid markets can contain more exploitable signal. These results, however, depend on constructed odds and should be interpreted as an illustration of the pipeline’s behaviour under alternative pricing scenarios rather than as direct evidence of real-world profitability. To assess portability, we re-ran the moneyline pipeline on Serie A and Premier League seasons. The equity curves in

Figure 8 and

Figure 9 display consistent upward trends with manageable drawdowns, suggesting that the combination of calibrated probabilities and conservative staking generalises beyond basketball. For all bankroll figures, the same evaluation protocol applies (chronological processing, 0.3-Kelly,

, stake cap EUR 100, start EUR 100).

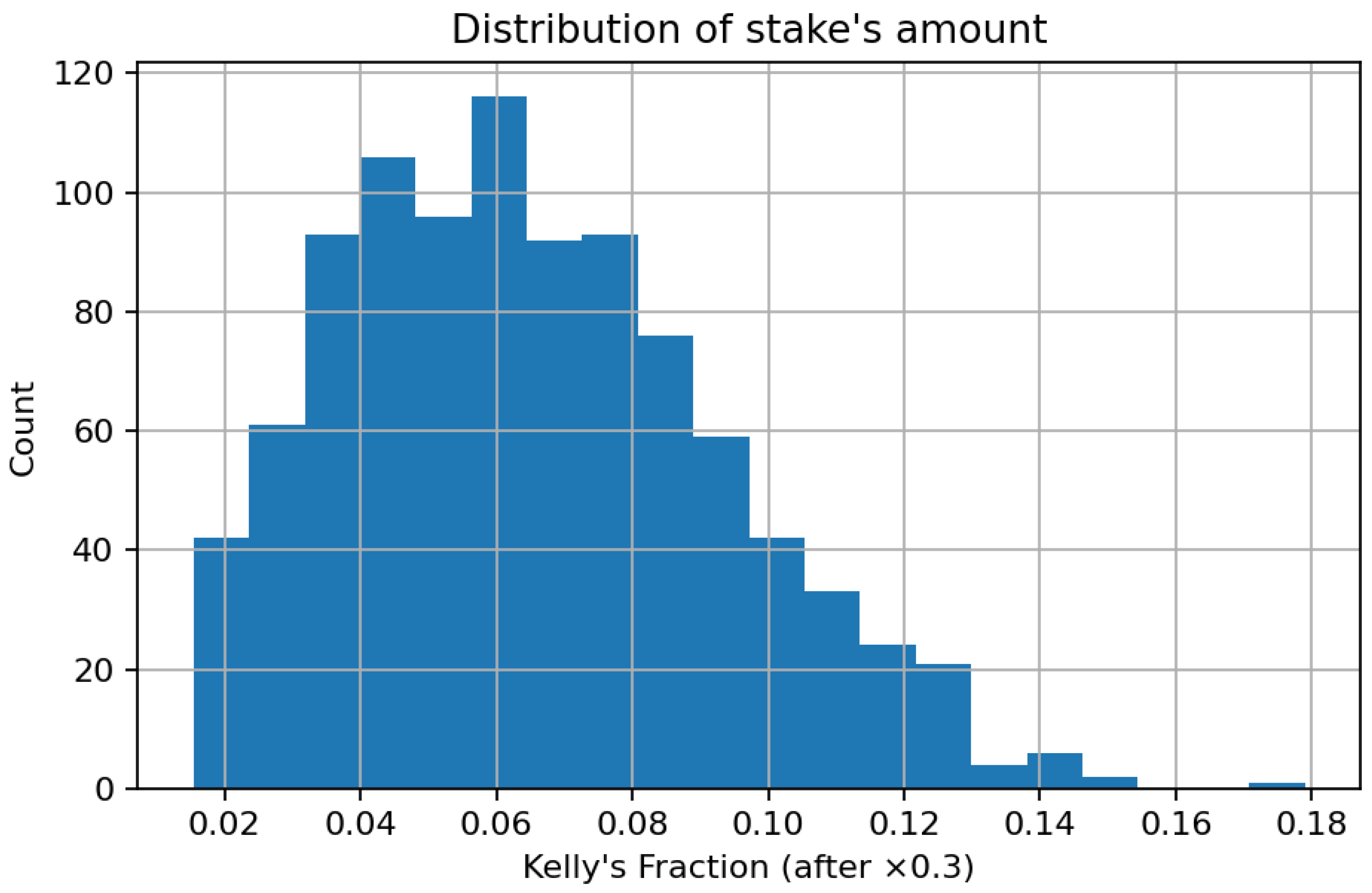

The histogram in

Figure 10 illustrates the empirical distribution of bet sizes represented as fractions of the bankroll following the use of the 0.3 × Kelly multiplier. The density has a pronounced right skewness, with the bulk of bets concentrated within the range [0.03, 0.09] of total capital, and a minimal fraction surpassing 0.12.

This trend illustrates that the implemented fractional-Kelly strategy effectively enforces risk discipline by allocating small chunks of money to the majority of positions while allowing for gradual increases in higher-confidence forecasts. The significant concentration in small fractions suggests a cautious exposure strategy that reduces the risk of catastrophic losses and fosters long-term capital preservation. From a portfolio-theoretic standpoint, the resultant stake distribution conforms to the notion of log-utility maximization under uncertainty, wherein growth is attained through numerous low-variance allocations rather than seldom substantial wagers. The histogram validates the internal consistency between the theoretical Kelly framework and its empirical application in this study, affirming that capital is allocated in proportion to anticipated informational advantage while preserving sensible leverage.

The scatter plot in

Figure 11 illustrates the functional relationship between the staked capital fraction and the model-derived expected edge, denoted as

A distinct positive monotonic correlation is evident: Greater estimated edges result in proportionately larger bet sizes, in accordance with the normative guidelines of the Kelly criterion. At near-zero or marginal thresholds, the allocation approaches minimal fractions (<0.04), demonstrating the self-regularizing nature of the technique in low-signal environments. Conversely, when the predicted value escalates, the staking function climbs gradually and asymptotically approaches its maximum limit of around 0.15–0.18, dictated by the fractional-Kelly coefficient. This relationship offers quantitative validation that the staking mechanism is consistently aligned with model-based probability evaluations, converting probabilistic advantages into capital exposure in a continuous and risk-conscious manner. The observed variability around the regression envelope indicates both market discretization in chances and the estimate noise intrinsic to probabilistic forecasts. The data substantiates the assertion that the adopted allocation policy maintains theoretical optimality while providing practical resilience against overconfidence and sampling variability.

The histogram in

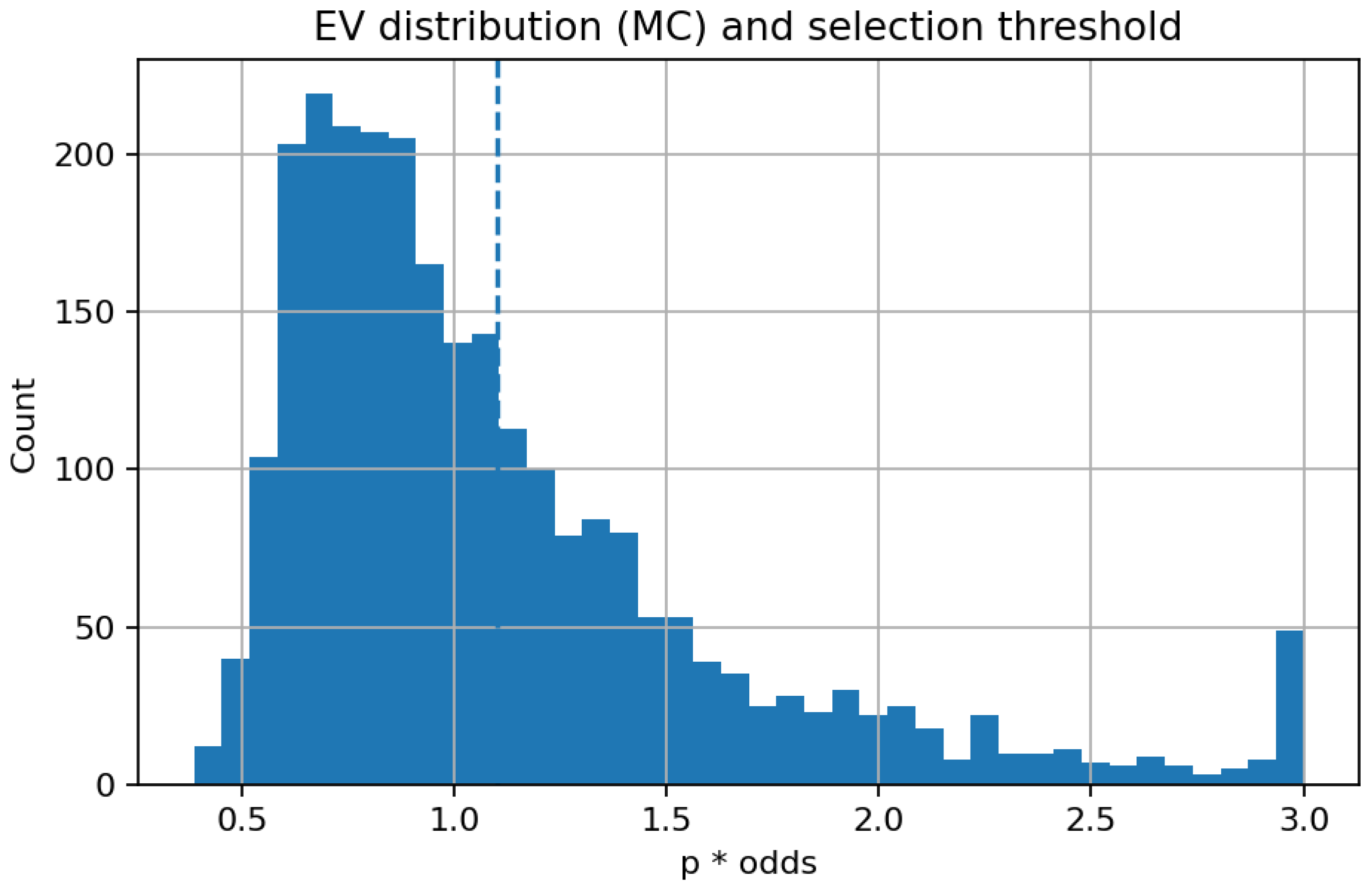

Figure 12 illustrates the empirical distribution of the model’s EV, calculated using Monte Carlo–Dropout probabilities.

The mass of the distribution is centred around one, indicating the efficacy of the betting market, where the majority of price–probability combinations produce an expected return near zero. The dashed vertical line indicates the operational threshold at EV = 1.10, which represents the lower limit for bet selection in the Kelly-based simulation. Observations over this threshold indicate instances where the model recognizes positive expected value prospects, factoring in market chances. The rapid decrease in frequency past the threshold signifies that such opportunities are statistically scarce, aligning with theoretical predictions for competitive marketplaces. The elongated right tail, despite its low population, underscores the existence of infrequent high-value forecasts that generate the majority of potential profit. This distribution thus offers empirical validation for the implemented EV filter, which adeptly balances coverage and quality by omitting the dense cluster of near-fair bets while preserving the limited collection of wagers with significant positive expectation.

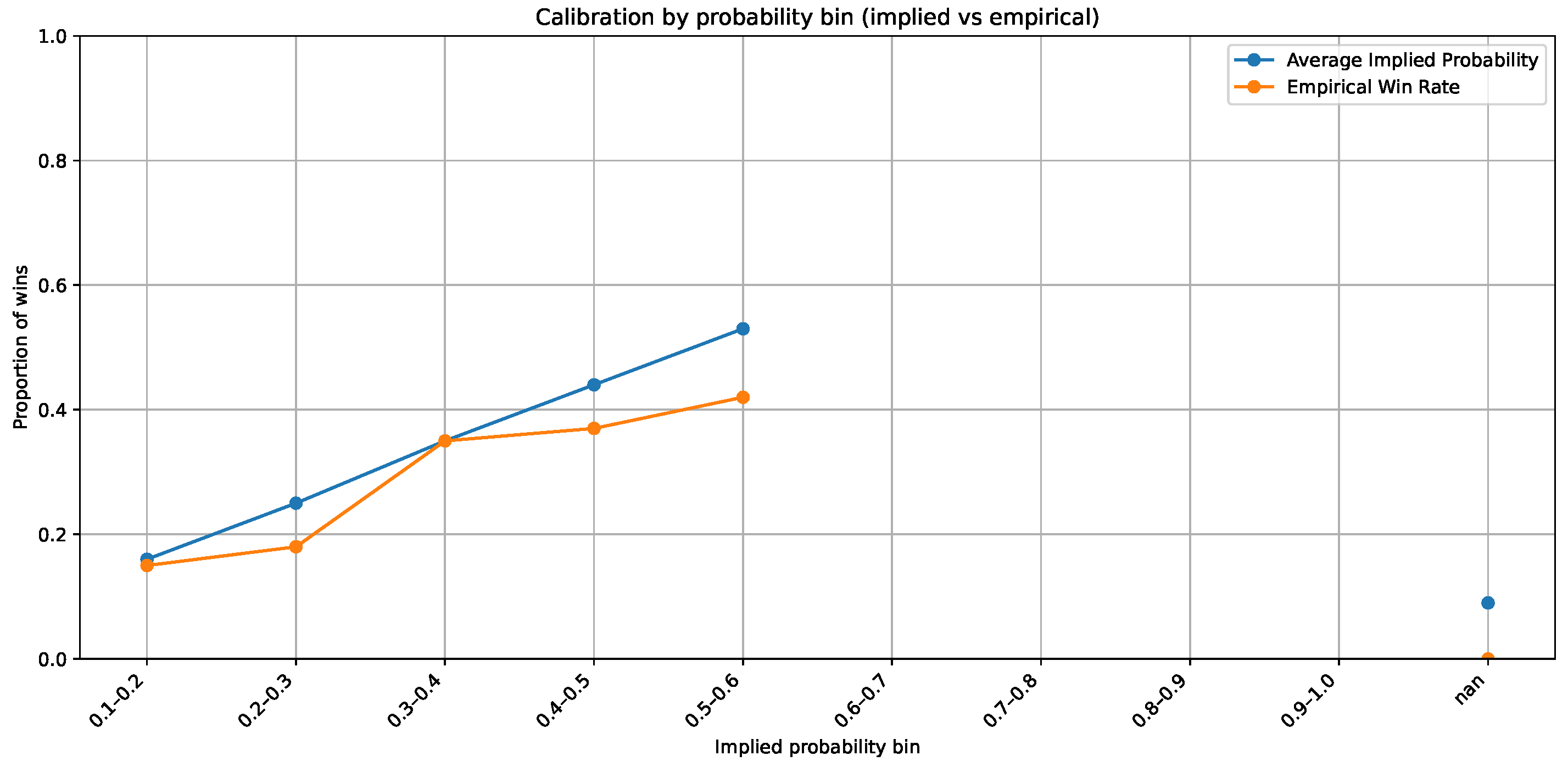

The juxtaposition of market-implied probability and empirical outcome frequencies indicates a significant divergence from ideal calibration. In the majority of probability bins, the empirical win rate consistently falls short of the bookmaker-implied level, signifying a systematic overestimation of favourites and a commensurate underestimation of underdogs. This asymmetry indicates a continual behavioural and structural bias in betting markets, aligning with previous findings of risk-averse pricing and the influence of public mood. The existence of such miscalibration indicates that market odds do not serve as entirely effective estimators of actual outcome probabilities. Thus, a precisely defined predictive model possesses both theoretical and practical validity: It may yield unbiased probability estimates and enhance expected-value evaluation. The Bayesian recurrent neural architecture employed herein aims to accurately capture these deviations via calibrated probabilistic inference. In

Figure 13, the disparity between suggested and empirical probability offers empirical support for model development, indicating that insights not entirely reflected in bookmaker odds can be derived from previous performance data. This statistic validates the primary assertion of the study, that machine learning-based probability modelling is a credible and potentially beneficial adjunct to market pricing processes.

For the logistic baseline, the merged dataset is partitioned into three non-overlapping subsets by season: (i) All seasons up to 2022 are used for training, (ii) season 2023 is reserved for model selection, and (iii) season 2024 is held out for final evaluation. The code enforces that date ranges do not overlap and that no game identifier appears in more than one split. To ensure that the logistic baseline has access exclusively to pre-game information, the feature vector excludes all post-game statistics. The only inputs retained are: (a) the home indicator, (b) market-implied probabilities (derived from published bookmaker odds), (c) closing spread and total, (d) the bookmaker overround, and (e) two past-only form features computed using a shifted rolling window (win rate and average points over the previous five games). Since these aggregates are computed with a one-step temporal shift, they incorporate only matches strictly preceding the game being predicted. Missing values are handled by an imputer fitted solely on the training data. On top of this pre-game feature set we train a family of logistic regression models with different regularisation strengths. Model selection is performed exclusively on the 2023 validation season using probabilistic metrics (log-loss and Brier score), not financial outcomes. The selected specification is the logistic model with

, which achieves a validation log-loss of 0.6266. The frozen model is then applied to the 2024 test season, generating the probabilities used in the bankroll simulator under the same staking rules as in the main experiment. Under these strictly non-leaky conditions, the logistic baseline behaves as expected for a simple statistical model, with final bankroll, ROI, and hit rate as reported in

Table 4. The main predictive architecture in the full experiment consumes a concatenation of: (i) the team and opponent box-score vector, (ii) the PCA-20 shot-location embedding, (iii) market-based features (implied probability, spread, total, overround), and (iv) short-term form indicators (rolling win rate, rolling points, home flag). In the no-leakage logistic baseline we restrict ourselves to the reduced, transparent subset listed above, which directly matches the feature engineering implemented in our public code. This explicit design makes it clear which sources of information enter the model, their dimensionality, the preprocessing steps applied, and the rationale for their inclusion.

We also conduct an expanding-window, cross-season evaluation of the no-leakage logistic model to assess temporal robustness. For each test season from 2012 to 2024, all earlier seasons are used for training, the immediately preceding season is used for validation, and the current season is used exclusively for testing, thus preserving chronological order and preventing information leakage. As summarised in

Table 5, the model exhibits stable probabilistic performance across seasons (mean accuracy

, Brier score

, log-loss

, AUC

), and its betting performance remains close to break-even (mean final bankroll EUR 92.99, mean ROI

with standard deviation

). This indicates that the behaviour observed on the 2024 test season is representative of the model’s typical out-of-sample performance rather than being driven by a single favourable split.

The betting simulation is carried out under a set of idealised execution assumptions that follow common practice in the sports-analytics literature. In particular, we assume that all wagers are filled at the quoted decimal odds with no slippage, no liquidity constraints, and no partial execution, and that stakes can always be placed at the amounts dictated by the Kelly criterion (subject to the imposed cap). These conditions abstract away market frictions such as real-time price drift, bookmaker stake limits, and odds movement between bet identification and order placement. The simulation therefore represents an upper bound on achievable returns; its purpose is to provide a consistent and noise-free comparison between models under identical conditions. Relative differences between models are thus meaningful, whereas absolute profitability should be interpreted with caution.

To ensure that the model is not trivially reproducing bookmaker probabilities and to separate the contribution of different information sources, we conduct a structured ablation analysis (

Table 6) isolating non-market features, market features, and their combination. The non-market model uses only team-level and performance-derived features (rolling indicators and contextual variables), achieving strong discriminative performance (AUC

) despite containing no market quantities. A market-only model is constructed in two forms: (i) an isotonic-regression calibration of the implied probabilities from closing moneylines, representing a best-possible probabilistic forecaster using only market information, and (ii) a logistic model trained exclusively on market features (spread, total, overround, and implied probability). Both market-only variants achieve reasonable calibration (Brier

) but substantially lower discrimination (AUC

) than the non-market model. When market information is added to the non-market feature set, the resulting fused model achieves the strongest overall performance (AUC

, log-loss

, Brier

). These results indicate that market and non-market information carry complementary predictive content, and that the fused model improves upon both components rather than collapsing to the bookmaker-implied probabilities. This substantially weakens any concern that the model’s performance is driven by trivial circularity between inputs and the odds used for value-based decision rules.

5. Discussion

The exploratory analysis confirms that the NBA environment over 2010–2024 is not stationary. Three-point volume roughly doubles (

Figure 2), and average points per game increase in parallel (

Figure 3). The rightward shift of the offensive rating density in 2024 relative to 2010 (

Figure 4), together with a similar shift in defensive ratings (

Figure 5), is consistent with higher pace and improved perimeter efficiency. In this context, per-100-possession standardisation and recent form windows (rolling last five games) are appropriate choices: They remove mechanical pace effects and allow the model to adapt to short-horizon changes in shot mix, tactical emphasis, and team health. The shot location embeddings likely contribute precisely because spatial tendencies (paint vs. perimeter, corner vs. above-the-break) evolved materially over the sample.

On NBA moneylines, the equity curve of the main uncertainty-aware win model (LSTM with MC-dropout) rises smoothly with intermittent plateaus and modest drawdowns (

Figure 6). This pattern is consistent with calibrated sequential probabilities, filtered through the

rule and fractional-Kelly staking, being converted into economic value. Two mechanisms plausibly contribute: (i) The recurrent input captures short-term momentum and roster shocks that are not always fully reflected in market prices; (ii) Monte Carlo dropout reduces overconfident selections, so fewer but higher-quality bets pass the decision threshold. Plateaus correspond to periods in which the uncertainty filter or the

threshold suppress action (e.g., tighter pricing, larger vig), while shallow drawdowns reflect natural variance under a conservative 0.3-Kelly policy.

The scale of the final bankroll in moneyline simulations may appear surprisingly large relative to the EUR 100 starting capital and the EUR 100 per-bet cap. This outcome does not arise from unconstrained compounding, but from the interaction between the selection filter and odds structure. Since wagers are placed only when the expected value exceeds 1.1, the resulting portfolio is skewed toward higher-odds events, frequently in the 5.0–10.0 range. Even with a maximum stake of EUR 100, a single correct prediction in such conditions produces EUR 400–900 in profit, several times the return from a typical even-odds wager. Over more than one thousand bets with a hit rate near 60%, this concentration on infrequent but high-multiplier opportunities can plausibly compound into the observed capital growth. The figures therefore reflect selective wagering, calibrated probabilities, and high-odds pricing, rather than a relaxation of bankroll or staking constraints.

By contrast, the mixed or neutral results on spread and totals are consistent with those markets being more efficiently priced. Point spreads already encode a large fraction of team strength and situational information; the residual variance around the number is heavily influenced by noise (e.g., late-game fouling, end-game variance). Totals are additionally exposed to pace volatility and correlation structures (e.g., endgame possessions) that are difficult to forecast precisely from team-level aggregates alone. In such settings, the incremental predictive lift from the sequential model does not reliably exceed transaction costs and selection filters, so bankroll growth is flat to mildly negative.

Applying the same pipeline to football moneylines (Serie A and Premier League) yields upward-sloping equity curves with manageable drawdowns (

Figure 8 and

Figure 9). This suggests that the core ingredients—recent form sequences, opponent-adjusted features, and an uncertainty-aware decision rule—capture aspects of team strength that are not fully arbitraged even in mature markets. At the same time, the growth is stepwise rather than exponential, indicating that the selection filter is active (fewer but higher-edge opportunities) and that returns concentrate in specific subperiods (e.g., injury clusters, congested schedules).

The smoother growth observed with player-level classification under synthetic odds (

Figure 7) points to richer, more idiosyncratic signal at finer granularity. Player performance is more volatile and information diffuses unevenly across sources, so a sequential model that conditions on recent usage and efficiency can identify edges more readily than at the team level. The main caveat is that pricing assumptions at player level are delicate; the results should therefore be interpreted as an illustration of how the pipeline behaves under alternative pricing regimes, not as direct evidence of real-world profitability. Nonetheless, they are coherent with the idea that thinner, less liquid markets may admit higher signal-to-noise ratios.

Across all bankroll figures, the decision layer shapes the trajectory as much as the classifier. Fractional-Kelly dampens volatility; the rule trades frequency for quality; and the per-bet cap limits extreme compounding. The resulting profiles—steady climbs punctuated by plateaus and shallow setbacks—are what one expects from a conservative staking policy applied to a model whose advantage is modest but persistent. Cross-market differences (moneyline vs. spreads/totals) manifest primarily as differences in slope (average edge) rather than as qualitatively different risk profiles, because the staking constraints are held fixed.

Figure 10,

Figure 11,

Figure 12 and

Figure 13 provide additional insight into the internal dynamics of the decision pipeline. The histogram of stake fractions in

Figure 10 confirms that the 0.3-Kelly policy enforces risk discipline: Most wagers concentrate on small slices of capital (typically within the first decile of the bankroll), with only a thin right tail. This shape is consistent with log-utility growth under uncertainty: many small exposures, occasional larger ones when the estimated edge is higher, and overall variance kept in check by the fractional multiplier and the per-bet cap.

Figure 11 shows the scatter plot of stake size against model-estimated edge,

. As the edge increases, the stake fraction rises smoothly toward the ceiling induced by the fractional-Kelly coefficient and the stake cap. The visible dispersion around the trend line reflects both the discretisation of market odds and estimation noise in probabilistic forecasts, but the global pattern confirms that capital allocation is aligned with model confidence.

The expected-value distribution in

Figure 12 is tightly massed around 1, illustrating that most price–probability pairs are close to fair and that markets are largely efficient. The operative threshold at

deliberately trades frequency for quality: It removes the dense cluster of near-fair bets while preserving the sparse right tail of high-EV opportunities. This scarcity explains the stepwise equity profiles: plateaus when the filter suppresses action, punctuated by upward moves when rare, high-EV bets satisfy the selection rule.

Figure 13 compares market-implied and empirical calibration. The calibration curves display a systematic gap, with favourites tending to be overpriced (empirical win rates below implied) and underdogs underpriced. This structural miscalibration motivates a decision layer driven by calibrated model probabilities: When the model’s estimates exceed market-implied levels by a margin that survives the EV and Kelly filters, the pipeline identifies genuine value rather than amplifying noise. Taken together,

Figure 10,

Figure 11,

Figure 12 and

Figure 13 help explain why the moneyline (and synthetic player–prop) bankroll trajectories exhibit steady growth under the stated protocol, while spreads and totals remain neutral: Risk is mechanically constrained, and excess return arises primarily from rare high-EV opportunities associated with bookmaker miscalibration.

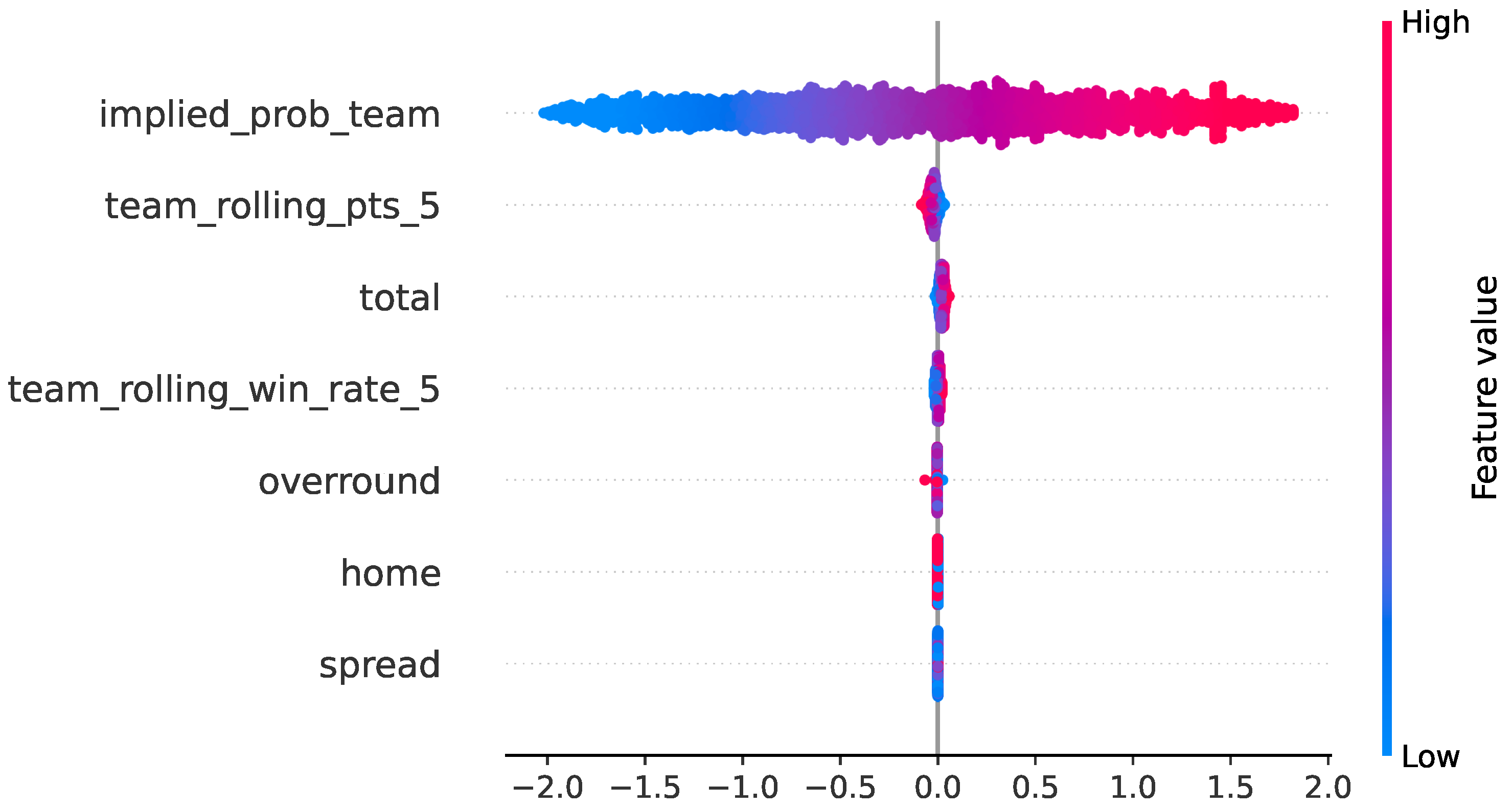

To clarify how classical probabilistic baselines use the available predictors, we computed

SHAP values for the no-leakage logistic baseline on the 2024 test season, using the same chronological train–validation–test split and the pre-game feature set described in

Section 4. The resulting global feature-importance ranking shows that the model relies predominantly on the market-implied probability for the team (mean

), with smaller contributions from recent form (rolling points:

; rolling win rate:

) and from pre-game betting information (total:

; overround:

). Home advantage (

) and spread (

) play only minor roles. The summary and bar plots in

Figure 14 and

Figure 15 show that the baseline behaves coherently with domain knowledge: Predictions are driven primarily by market expectations and simple form indicators, and no spurious or post-game features influence the output. This also explains why the logistic baseline, despite being well calibrated, fails to generate positive bankroll growth: It effectively reweights existing market information rather than uncovering independent signal.

To assess whether the main conclusions depend on specific hyperparameter settings, we conducted a sensitivity and robustness analysis for the main moneyline model, covering decision thresholds, staking rules, temporal structure, and feature composition. The betting layer is evaluated over a grid of expected-value thresholds , Kelly multipliers , bet size caps EUR , and maximum odds filters . For each configuration we compute ROI, number of bets, and hit rate. The resulting surface is smooth across EV and Kelly parameters: Aggressive settings increase variance, but the model ranking and overall profitability pattern remain stable. Performance does not hinge on a narrow, finely tuned parameter choice.

We also vary the temporal window used to build past form features for the main model, testing sequences of lengths 3, 5, 7, and 10 games. Predictive metrics change gradually with sequence length, and the ranking of model variants is preserved. An ablation without shot-chart embeddings shows a consistent decrease in discrimination and calibration, confirming that spatial shooting patterns provide complementary information beyond team-level statistics.

Finally, a rolling cross-season evaluation of the no-leakage logistic baseline (

Table 5) trains on seasons up to

, validates on

, and tests on

t. Across test seasons 2012–2024, the logistic model achieves stable accuracy, Brier score, and log-loss, with mean AUC

and betting performance clustered around break-even (mean final bankroll 92.99 EUR, mean ROI

). This confirms that the baseline’s behaviour on the 2024 test season is representative of its typical out-of-sample performance, and strengthens the comparison between the logistic baseline and the main uncertainty-aware pipeline.

Table 7 complements the bankroll analysis by reporting pure predictive and calibration metrics for the main baseline models on the 2024 test season. Logistic regression and XGBoost exhibit very similar behaviour: Both achieve accuracy around 0.68, Brier scores of about 0.20, and log-loss near 0.58, with AUC between 0.75 and 0.76 and low calibration errors (ECE

, MCE

). The GRU sequence model is clearly inferior on all metrics, with higher Brier score and log-loss, lower AUC (0.65), and larger calibration errors. Overall, these results show that classical probabilistic baselines (logistic regression and boosted trees) are both competitive and well calibrated, while more complex sequence modelling does not automatically translate into better predictive or calibration performance. The added value of the proposed uncertainty-aware pipeline thus lies not in pointwise accuracy alone, but in its combination of calibrated probabilities, richer feature representations, and a disciplined decision layer that jointly drive long-run economic outcomes.