Digital Technology Deployment and Improved Corporate Performance: Evidence from the Manufacturing Sector in China

Abstract

1. Introduction

2. Literature Review

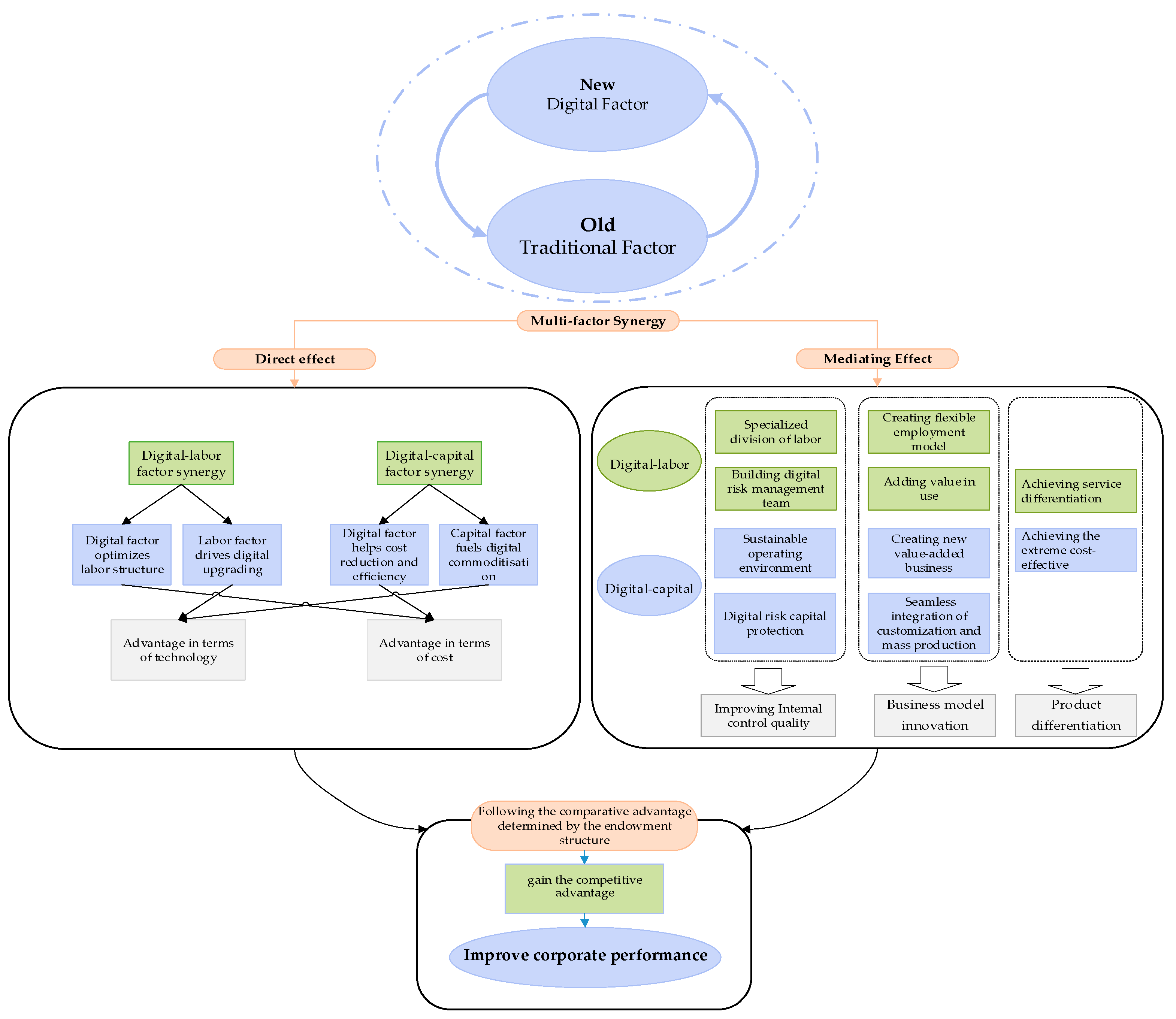

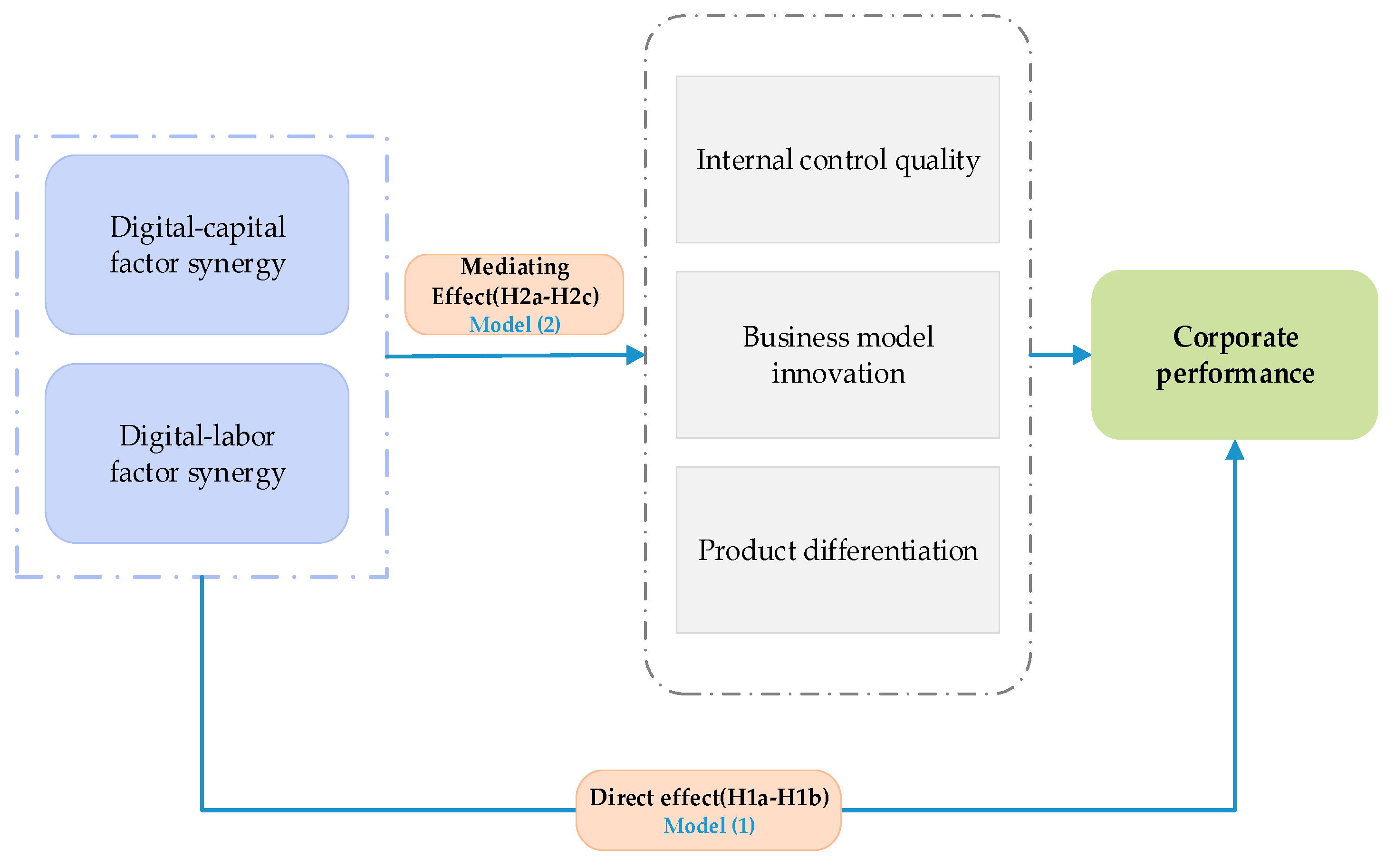

2.1. Multi-Factor Synergy and Corporate Performance

2.2. Synergistic Pathways for Increasing Corporate Performance

3. Data and Methods

3.1. Data and Sources

3.2. Variables

3.3. Methods

4. Empirical Results

4.1. Descriptive Statistics

4.2. Benchmark Result

4.3. Robustness Test

4.4. Mechanism Test

4.5. Heterogeneity Test

5. Discussion

5.1. Findings

5.2. Contributions

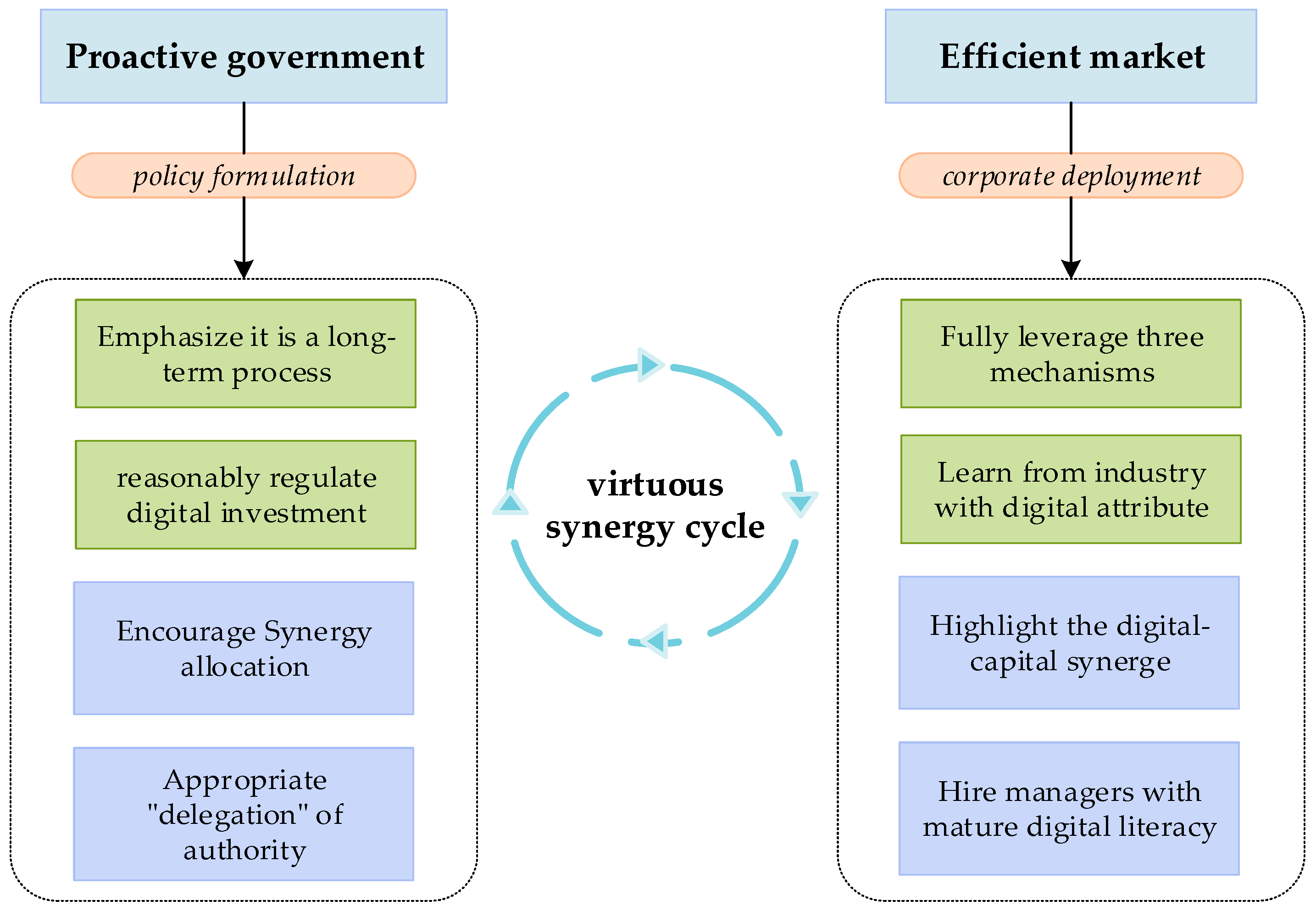

6. Conclusions, Policy Implications, and Limitations

6.1. Conclusions

6.2. Practical Implications

6.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Zhou, Y.; Li, X.; Wu, Z.; Wu, J.; Li, H. Green Bonds and Intelligent Manufacturing: Evidence from Listed Firms in China. Econ. Lett. 2025, 247, 112150. [Google Scholar] [CrossRef]

- Gao, Y.; Rong, J. Research on the Upgrading of China’s Manufacturing under the Value-Added Capability and Correlation Effect of Global Value Chain. Afr. Asian Stud. 2024, 23, 122–159. [Google Scholar] [CrossRef]

- Kpegba, S.A.; Oppong, C.; Atchulo, A.S. Urban Entrepreneurship, Public Management and Sustainability Nexus: Evidence from Developing Countries. Sustain. Dev. 2023, 32, 520–528. [Google Scholar] [CrossRef]

- Lai, G.; Meng, B. An analysis of China’s medium-level technology status. Bull. Chin. Acad. Sci. 2023, 38, 1593–1606. [Google Scholar]

- Yang, J.; Ying, L.; Gao, M. The Influence of Intelligent Manufacturing on Financial Performance and Innovation Performance: The Case of China. Enterp. Inf. Syst. 2020, 14, 812–832. [Google Scholar] [CrossRef]

- Wang, G.; Feng, X.; Tian, L.G.; Tu, Y. Environmental Regulation, Green Technology Innovation and Enterprise Performance. Financ. Res. Lett. 2024, 68, 105983. [Google Scholar] [CrossRef]

- Fu, Y. Enterprises’ Internationalization, R&D Investment and Enterprise Performance. Financ. Res. Lett. 2024, 67, 105721. [Google Scholar] [CrossRef]

- Zhao, C.; Zhou, P. Does Dialect Diversity Affect Enterprise Performance? Evidence from China. Emerg. Mark. Financ Trade 2024, 61, 516–528. [Google Scholar] [CrossRef]

- Gao, D.; Yan, Z.; Zhou, X.; Mo, X. Smarter and Prosperous: Digital Transformation and Enterprise Performance. Systems 2023, 11, 329. [Google Scholar] [CrossRef]

- Zhen, W.; Tang, P. Substantive Digital Innovation or Symbolic Digital Innovation: Which Type of Digital Innovation Is More Conducive to Corporate ESG Performance? Int. Rev. Econ. Financ. 2024, 93, 1212–1228. [Google Scholar]

- Li, H.; Zhang, Y.; Li, Y. The impact of the digital economy on the total factor productivity of manufacturing firms: Empirical evidence from China. Technol. Forecast. Soc. Change 2024, 207, 123604. [Google Scholar] [CrossRef]

- Porter, M.E.; Heppelmann, J.E. How smart, connected products are transforming competition. Harv. Bus. Rev. 2014, 92, 64–88. [Google Scholar]

- Lin, J.Y.; Liu, Z.; Zhang, B. Endowment, Technology Choice, and Industrial Upgrading. Struct. Change Econ. Dyn. 2023, 65, 364–381. [Google Scholar] [CrossRef]

- Knudsen, E.S.; Lien, L.B.; Timmermans, B.; Belik, I.; Pandey, S. Stability in Turbulent Times? The Effect of Digitalization on the Sustainability of Competitive Advantage. J. Bus. Res. 2021, 128, 360–369. [Google Scholar] [CrossRef]

- Zhang, Y.Q.; Lu, Y.; Li, L.Y. The impact of big data applications on the market value of Chinese firms—Evidence from textual analyses of Chinese listed companies’ annual reports. Econ. Res. J. 2021, 56, 42–59. [Google Scholar]

- Li, P.; Zhao, X. The impact of digital transformation on corporate supply chain management: Evidence from listed companies. Finance Res. Lett. 2024, 60, 104890. [Google Scholar] [CrossRef]

- Acemoglu, D.; Restrepo, P. Automation and New Tasks: How Technology Displaces and Reinstates Labor. J. Econ. Perspect. 2019, 33, 3–30. [Google Scholar] [CrossRef]

- Yu, K.; Shi, Y.; Feng, J. The Influence of Robot Applications on Rural Labor Transfer. Humanit. Soc. Sci. Commun. 2024, 11, 1–18. [Google Scholar] [CrossRef]

- Koch, M.; Manuylov, I. Measuring the Technological Bias of Robot Adoption and Its Implications for the Aggregate Labor Share. Res. Policy 2023, 52, 104848. [Google Scholar] [CrossRef]

- Moriuchi, E.; Murdy, S. The Role of Robots in the Service Industry: Factors Affecting Human-Robot Interactions. Int. J. Hosp. Manag. 2024, 118, 103682. [Google Scholar] [CrossRef]

- Wang, S.; Wang, Y.; Li, C. AI-Driven Capital-Skill Complementarity: Implications for Skill Premiums and Labor Mobility. Financ. Res. Lett. 2024, 68, 106044. [Google Scholar] [CrossRef]

- Chierici, R.; Tortora, D.; Del Giudice, M.; Quacquarelli, B. Strengthening Digital Collaboration to Enhance Social Innovation Capital: An Analysis of Italian Small Innovative Enterprises. J. Intellect. Cap. 2020, 22, 610–632. [Google Scholar] [CrossRef]

- Ameye, N.; Bughin, J.; van Zeebroeck, N. From Experimentation to Scaling: What Shapes the Funnel of AI Adoption? Econ. Innov. New Technol. 2024, 1, 1–15. [Google Scholar] [CrossRef]

- Liu, Z.; Yao, Y.X.; Zhang, G.S.; Kuang, H.S. Corporate digitalization, specialized knowledge and organizational empowerment. China Ind. Econ. 2020, 37, 156–174. [Google Scholar]

- Usai, A.; Fiano, F.; Petruzzelli, A.M.; Paoloni, P.; Briamonte, M.F.; Orlando, B. Unveiling the impact of the adoption of digital technologies on firms’ innovation performance. J. Bus. Res. 2021, 133, 327–336. [Google Scholar] [CrossRef]

- Kazantsev, N.; Islam, N.; Zwiegelaar, J.; Brown, A.; Maull, R. Data Sharing for Business Model Innovation in Platform Ecosystems: From Private Data to Public Good. Technol. Forecast. Soc. Change 2023, 192, 122515. [Google Scholar] [CrossRef]

- Chatterjee, S.; Chaudhuri, R.; Vrontis, D.; Mahto, R. Bright and Dark Sides of Adopting a Platform-Based Sharing Economy Business Model. RD Manag. 2023, 54, 1145–1165. [Google Scholar] [CrossRef]

- Abbas, A.E.; Agahari, W.; Van de Ven, M.; Zuiderwijk, A.; de Reuver, M. Business data sharing through data marketplaces: A systematic literature review. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 3321–3339. [Google Scholar] [CrossRef]

- Obradovits, M.; Plaickner, P. Price-Directed Search, Product Differentiation and Competition. Rev. Ind. Organ. 2023, 63, 317–348. [Google Scholar] [CrossRef]

- Kokkodis, M.; Adamopoulos, P.; Ransbotham, S. Reputation Spillover from Agencies on Online Platforms: Evidence from the Entertainment Industry. MIS Q. 2023, 47, 733–770. [Google Scholar] [CrossRef]

- Durmusoglu, S.S.; Kawakami, T. Information technology tool use frequency in new product development: The effect of stage-specific use frequency on performance. Ind. Mark. Manag. 2021, 93, 250–258. [Google Scholar] [CrossRef]

- Yang, D.; Chen, C.; Yang, P. Digitization, Dual Innovation, and Enterprise Performance. Stat. Decis. 2023, 39, 167–172. [Google Scholar]

- Lee, C.-C.; Wang, C. Financial development, technological innovation and energy security: Evidence from Chinese provincial experience. Energy Econ. 2022, 112, 106161. [Google Scholar] [CrossRef]

- Ni, J.J.; Guo, M.N. How the application of industrial robots affects the quality of internal control in enterprises. Res. Econ. Manag. 2023, 44, 19–37. [Google Scholar]

- Chen, J.; Huang, S.; Liu, Y.H. From Empowerment to Enable—Enterprise Operation Management in Digital Environment. J. Manag. World 2020, 36, 117–128+222. [Google Scholar]

- Li, J.; Sun, Z.; Zhou, J.; Sow, Y.; Cui, X.; Chen, H.; Shen, Q. The Impact of the Digital Economy on Carbon Emissions from Cultivated Land Use. Land 2023, 12, 665. [Google Scholar] [CrossRef]

- GB/T 4754-2017; Industrial Classification for National Economic Activities. Standardization Administration of China: Beijing, China, 2017.

- Cheng, X.S.; Wang, X.Q. Technology mergers and acquisitions and re-innovation—Evidence from Chinese listed companies. China Ind. Econ. 2023, 4, 156–173. [Google Scholar]

- He, X.; Xia, M.; Li, X.; Lin, H.; Xie, Z. How Innovation Ecosystem Synergy Degree Influences Technology Innovation Performance—Evidence from China’s High-Tech Industry. Systems 2022, 10, 124. [Google Scholar] [CrossRef]

- Hwang, Y.K. The synergy effect through combination of the digital economy and transition to renewable energy on green economic growth: Empirical study of 18 Latin American and caribbean countries. J. Clean. Prod. 2023, 418, 138146. [Google Scholar] [CrossRef]

- Yang, Z.B.; Dong, Y.S.; Yang, L.Q. Digitalization, service-oriented and performance in the manufacturing firms—A study based on moderated mediation model. Enterp. Econ. 2021, 40, 35–43. [Google Scholar]

- Zheng, H.; Zhang, L.; Zhao, X. Solitary or starry? Path options of the total factor productivity improvement in the aquatic seed industry from the configuration perspective. Mar. Dev. 2023, 1, 11. [Google Scholar] [CrossRef]

- Zhang, J. Digital Finance, Technological Innovation and Corporate Competitiveness—Evidence from Chinese A-share Listed Firms. South China Financ. 2023, 1, 23–36. [Google Scholar]

- Zhao, F.Y.; Pang, B.; Fang, J.M. Research on multi-factor synergy of enterprises and innovation performance under the perspective of IT capability. Bus. Rev. 2018, 30, 70–80. [Google Scholar]

- Miao, Z.; Zhao, G. Configurational paths to the green transformation of Chinese manufacturing enterprises: A TOE framework based on the fsQCA and NCA approaches. Sci. Rep. 2023, 13, 19181. [Google Scholar] [CrossRef] [PubMed]

| Variable Attribute | Variable Name | Symbol | Measure Method |

|---|---|---|---|

| Dependent variable | Corporate performance | Per | Operating income |

| Explanatory variables | Digital factor | D | The book value of intangible assets linked to digital utilization |

| Capital factor | K | The total assets | |

| Labor factor | L | The number of employees | |

| Digital–capital factor synergy | The cross-multiplication term of the digital factor and the capital factor | ||

| Digital–labor factor synergy | The cross-multiplication term of the digital factor and the labor factor | ||

| Intermediary variables | Internal control quality | ICI | The internal control index from the DIB database |

| Business model innovation | BMI | Ratio of word frequencies associated with BMI in the enterprise to word frequencies in the industry | |

| Product differentiation | PD | Corporate selling expenses | |

| Control variables | The current ratio | Flow | Ratio of current assets to current liabilities |

| Enterprise value | BTM | Ratio of book-to-market | |

| The shareholding ratio | Own1 | Percentage of total shares held by the biggest shareholder | |

| Own10 | Percentage of total shares held by the top ten shareholders | ||

| The ratio of intangible assets | Inta | Intangible assets divided by total assets | |

| Cash holdings | Cash | Cash and trading financial assets | |

| The proportion of independent board members | Inde | Divide the number of independent directors by the total number of board members | |

| Bi-power unison | Dual | Dual = 1 if the chairman and chief executive officer are the same person; otherwise, Dual = 0 | |

| Instrumental variables | Relief amplitude | iv1 | Standard deviation of geographic elevation |

| Digital policy shock | iv2 | Frequency of digital-economy-related policies in government reports | |

| Industry average | iv3 | Industry average of multi-factor synergies, excluding the enterprise itself | |

| Variables in the robustness test | Replacing Per | Per1 | Ratio of enterprise revenue to the total revenue of the industry |

| Replacing K | K1 | Net value of fixed assets | |

| Replacing L | L1 | Wage of enterprise employees |

| Variable Attributes | Variable | N | Mean | Sd. | Min | Max |

|---|---|---|---|---|---|---|

| Dependent variable | Corporate performance (Per) | 13,961 | 21.522 | 1.362 | 18.362 | 25.63 |

| Explanatory variables | Digital–capital synergy () | 13,961 | 15.835 | 1.862 | 10.669 | 21.038 |

| Digital–labor synergy () | 13,961 | 19.967 | 53.589 | 0.008 | 447.399 | |

| Control variables | The current ratio (Flow) | 13,961 | 2.364 | 2.105 | 0.284 | 13.836 |

| Enterprise value (BTM) | 13,961 | 32.164 | 13.814 | 8.16 | 73.19 | |

| The shareholding ratio of the biggest shareholder (Own1) | 13,961 | 56.797 | 14.37 | 23.1 | 90.62 | |

| The shareholding ratio of top ten shareholders (Own10) | 13,961 | 0.045 | 0.039 | 0 | 0.323 | |

| The ratio of intangible assets (Inta) | 13,961 | 0.187 | 0.124 | 0.014 | 0.66 | |

| Cash holdings (Cash) | 13,961 | 3.101 | 0.501 | 2 | 5 | |

| The proportion of independent board members (Inde) | 13,961 | 4.917 | 7.39 | 0 | 28.068 | |

| Bi-power unison (Dual) | 13,961 | 21.522 | 1.362 | 18.362 | 25.63 |

| Variable | Per | |||||

|---|---|---|---|---|---|---|

| H1a | H1b | |||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

| 0.3028 *** | 0.2812 *** | 0.1901 *** | ||||

| (0.0143) | (0.0128) | (0.0142) | ||||

| 0.0076 *** | 0.0056 *** | 0.0030 *** | ||||

| (0.0005) | (0.0006) | (0.0005) | ||||

| Flow | −0.1285 *** | −0.0595 *** | −0.0531 *** | −0.1586 *** | −0.0943 *** | −0.0641 *** |

| (0.0112) | (0.0071) | (0.0069) | (0.0112) | (0.0080) | (0.0071) | |

| BTM | 0.0114 *** | −0.0038 * | −0.0015 | 0.0122 *** | −0.0102 *** | −0.0025 |

| (0.0020) | (0.0019) | (0.0019) | (0.0020) | (0.0023) | (0.0020) | |

| Own1 | 0.0000 | 0.0005 | 0.0053 *** | 0.0007 | −0.0024 | 0.0067 *** |

| (0.0017) | (0.0016) | (0.0016) | (0.0017) | (0.0018) | (0.0018) | |

| Own10 | −2.2922 *** | −2.3630 *** | −2.0103 *** | −3.1153 *** | −2.6526 *** | −1.9554 *** |

| (0.4631) | (0.3996) | (0.3947) | (0.4722) | (0.5112) | (0.4490) | |

| Inta | 0.3475 ** | 0.2130 ** | 0.0371 | 0.4873 *** | 0.5048 *** | 0.0545 |

| (0.1739) | (0.0869) | (0.0899) | (0.1840) | (0.0954) | (0.0901) | |

| Cash | 0.3807 *** | 0.0498 ** | 0.0755 *** | 0.4226 *** | 0.0662 ** | 0.1004 *** |

| (0.0401) | (0.0232) | (0.0227) | (0.0437) | (0.0261) | (0.0237) | |

| Inde | 0.0115 *** | 0.0016 | 0.0015 | 0.0132 *** | 0.0026 | 0.0018 |

| (0.0025) | (0.0018) | (0.0017) | (0.0027) | (0.0020) | (0.0018) | |

| Dual | −0.1285 *** | −0.0595 *** | −0.0531 *** | −0.1586 *** | −0.0943 *** | −0.0641 *** |

| (0.0112) | (0.0071) | (0.0069) | (0.0112) | (0.0080) | (0.0071) | |

| Individual fixed | No | Yes | Yes | No | Yes | Yes |

| year fixed | Yes | No | Yes | Yes | No | Yes |

| N | 13,750 | 13,645 | 13,645 | 13,749 | 13,644 | 13,644 |

| R2 | 0.493 | 0.906 | 0.911 | 0.440 | 0.883 | 0.905 |

| Variable | Per1 | Per | ||||

| H1a | H1b | H1a | H1b | H1a | H1b | |

| Replace the dependent variable | Replace the explanatory variables | Enhance the fixed effect | ||||

| (1) | (2) | (3) | ||||

| 0.0008 ** | 0.1959 *** | |||||

| (0.0004) | (0.0165) | |||||

| 0.00002 *** | 0.0029 *** | |||||

| (0.0000) | (0.0005) | |||||

| 0.00007 *** | ||||||

| (0.0000) | ||||||

| 0.00001 *** | ||||||

| (0.0000) | ||||||

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual fixed | Yes | Yes | Yes | Yes | Yes | Yes |

| year fixed | Yes | Yes | Yes | Yes | Year # City | Year # City |

| N | 13,645 | 13,645 | 13,645 | 13,645 | 12,544 | 12,543 |

| R2 | 0.820 | 0.819 | 0.919 | 0.9183 | 0.939 | 0.934 |

| Variable | Per | |||||

| H1a | H1b | |||||

| Instrumental variable test | ||||||

| (4) | ||||||

| iv1 | iv2 | iv3 | iv1 | iv2 | iv3 | |

| 0.3549 *** | 0.3959 *** | 0.1592 *** | ||||

| (0.0130) | (0.0108) | (0.0206) | ||||

| 0.0048 *** | 0.0053 *** | 0.0051 *** | ||||

| (0.0022) | (0.0002) | (0.0006) | ||||

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual fixed | Yes | Yes | Yes | Yes | Yes | Yes |

| year fixed | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 10,889 | 10,897 | 10,800 | 10,886 | 10,894 | 10,797 |

| R2 | 0.998 | 0.998 | 0.998 | 0.997 | 0.997 | 0.997 |

| Anderson LM | 1988.919 *** (0.000) | 2955.724 *** (0.000) | 860.933 *** (0.000) | 4606.928 *** (0.000) | 9262.296 *** (0.000) | 819.777 *** (0.000) |

| Cragg–Donald Wald F | 2429.141 | 4048.765 | 933.863 | 7973.071 | 6200 | 885.572 |

| Variable | ICI | BMI | PD | |||

|---|---|---|---|---|---|---|

| H2a | H2b | H2c | ||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

| 12.0371 *** | 0.8239 *** | 0.1978 *** | ||||

| (2.7203) | (0.3172) | (0.0183) | ||||

| 0.1120 *** | 0.0338 *** | 0.0037 *** | ||||

| (0.0582) | (0.0126) | (0.0005) | ||||

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes |

| Individual fixed | Yes | Yes | Yes | Yes | Yes | Yes |

| Year fixed | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 13,645 | 13,644 | 13,645 | 13,644 | 13,607 | 13,606 |

| R2 | 0.489 | 0.487 | 0.636 | 0.637 | 0.905 | 0.901 |

| Variable | State-Owned | Non-State-Owned | State-Owned | Non-State-Owned |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| 0.1593 *** | 0.1992 *** | |||

| (0.0269) | (0.0165) | |||

| 0.0023 *** | 0.0035 *** | |||

| (0.0008) | (0.0006) | |||

| Control variables | Yes | Yes | Yes | Yes |

| Individual fixed | Yes | Yes | Yes | Yes |

| Year fixed | Yes | Yes | Yes | Yes |

| N | 3662 | 9929 | 3662 | 9929 |

| R2 | 0.944 | 0.912 | 0.941 | 0.906 |

| Fisher’s permutation test (p-value) | 0.041 | 0.011 | ||

| Variable | With the Digital Attribute | Without the Digital Attribute | With the Digital Attribute | Without the Digital Attribute |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| 0.2958 *** | 0.1787 *** | |||

| (0.0481) | (0.0146) | |||

| 0.0041 *** | 0.0025 *** | |||

| (0.0008) | (0.0005) | |||

| Control variables | Yes | Yes | Yes | Yes |

| Individual fixed | Yes | Yes | Yes | Yes |

| Year fixed | Yes | Yes | Yes | Yes |

| N | 1375 | 12,254 | 1375 | 12,254 |

| R2 | 0.942 | 0.925 | 0.936 | 0.920 |

| Fisher’s permutation test (p-value) | 0.000 | 0.004 | ||

| Variable | With the Political Connection | Without the Political Connection | With the Political Connection | Without the Political Connection |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| 0.1632 *** | 0.1939 *** | |||

| (0.0233) | (0.0176) | |||

| 0.0024 *** | 0.0028 *** | |||

| (0.0007) | (0.0006) | |||

| Control variables | Yes | Yes | Yes | Yes |

| Individual fixed | Yes | Yes | Yes | Yes |

| year fixed | Yes | Yes | Yes | Yes |

| N | 3630 | 9805 | 3630 | 9805 |

| R2 | 0.952 | 0.927 | 0.949 | 0.922 |

| Fisher’s permutation test (p-value) | 0.023 | 0.091 | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cheng, L.; Ma, R.; Chen, X.; Esposito, L. Digital Technology Deployment and Improved Corporate Performance: Evidence from the Manufacturing Sector in China. Information 2025, 16, 781. https://doi.org/10.3390/info16090781

Cheng L, Ma R, Chen X, Esposito L. Digital Technology Deployment and Improved Corporate Performance: Evidence from the Manufacturing Sector in China. Information. 2025; 16(9):781. https://doi.org/10.3390/info16090781

Chicago/Turabian StyleCheng, Liwen, Rui Ma, Xihui Chen, and Luca Esposito. 2025. "Digital Technology Deployment and Improved Corporate Performance: Evidence from the Manufacturing Sector in China" Information 16, no. 9: 781. https://doi.org/10.3390/info16090781

APA StyleCheng, L., Ma, R., Chen, X., & Esposito, L. (2025). Digital Technology Deployment and Improved Corporate Performance: Evidence from the Manufacturing Sector in China. Information, 16(9), 781. https://doi.org/10.3390/info16090781