Mapping Blockchain Applications in FinTech: A Systematic Review of Eleven Key Domains

Abstract

1. Introduction

- I

- What are the main blockchain applications in the FinTech sector?

- II

- How are these applications used in FinTech fields?

- III

- What are the potential challenges and limitations of blockchain in FinTech?

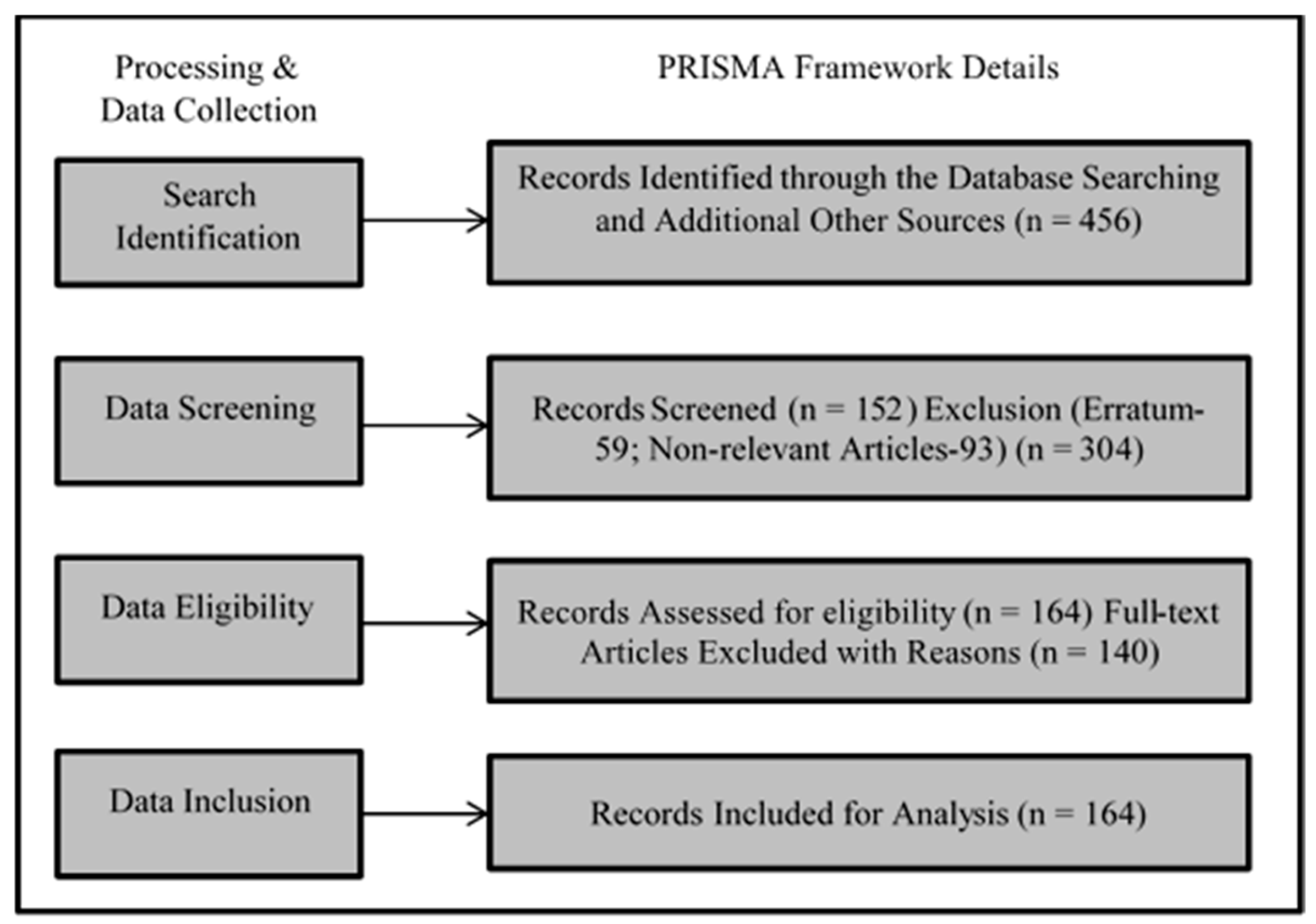

2. Materials and Methods

3. Blockchain Working Procedure

3.1. Authentication

3.2. Authorization

4. Importance of Blockchain Technology

5. Blockchain Application in FinTech

5.1. Blockchain Applications in Banking and Payments

5.2. Lending and Credit

5.2.1. Decentralized Peer-to-Peer (P2P) Lending

5.2.2. Blockchain-Based Credit Scoring

5.2.3. Automated Loan Underwriting

5.3. Investment and Wealth Management

5.3.1. Tokenized Securities

5.3.2. Decentralized Hedge Funds

5.3.3. Blockchain Robo-Advisors

5.3.4. Fractional Ownership of High-Value Assets

5.3.5. Decentralized Autonomous Organizations (DAOs) for Investment

5.4. Stock Trading and Asset Management

5.4.1. Blockchain-Based Stock Exchanges

5.4.2. Automated Market Makers (AMMs) for Trading

5.4.3. Decentralized Derivatives and Margin Trading

5.5. Insurance and Risk Management

5.5.1. Blockchain-Based Insurance Policies

5.5.2. Parametric Insurance

5.5.3. Trade Credit Insurance

5.6. Regulatory Technology and Compliance

5.6.1. AML/KYC on Blockchain

5.6.2. Real-Time Auditing and Financial Reporting

5.6.3. Taxation and Automated Tax Filing

5.6.4. Regulatory Reporting and Compliance Automation

5.7. Trade Finance and Supply Chain Finance

5.7.1. Blockchain-Based Trade Settlements

5.7.2. Supply Chain Finance

5.7.3. Real-Time Asset Tracking for Trade Finance

5.8. Digital Identity and Fraud Prevention

5.8.1. Blockchain-Based Digital Identity for Financial Services

5.8.2. Fraud Prevention and Cybersecurity in FinTech

5.8.3. Decentralized Identity Verification

5.9. Crowdfunding and Alternative Financing

5.9.1. Security Token Offerings (STOs)

5.9.2. Initial Coin Offerings (ICOs) for FinTech Startups

5.9.3. Blockchain-Based Crowd-Sourced Investment

5.10. Financial Inclusion and Micropayments

5.10.1. Blockchain-Based Micropayments

5.10.2. Microfinances for the Unbanked

5.10.3. Blockchain-Based Cross-Border Mobile Money

5.11. Smart Contracts and Automation in FinTech

5.11.1. Automated Smart Contract Escrow Services

5.11.2. Financial Data Sharing with Smart Contracts

5.11.3. Automated Loan Repayments

6. Challenges and Limitations of Blockchain in FinTech

6.1. Energy Consumption

6.2. Scalability

6.3. Legal Jurisdiction and Enforceability

6.4. Standardization and Interoperability

6.5. Privacy and Security

6.6. Talent Acquisition

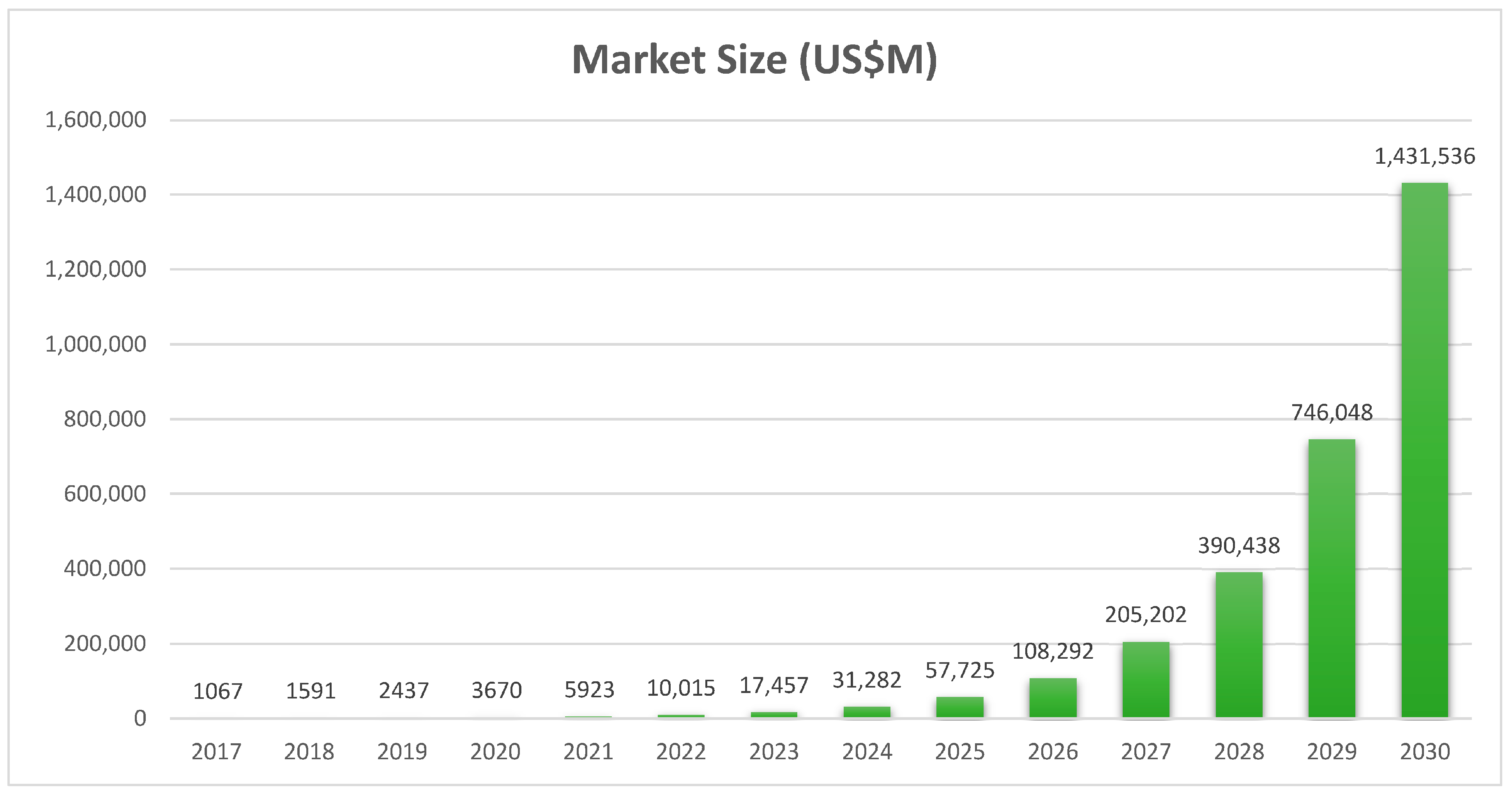

6.7. Evaluating the Reliability of Market Forecasts

7. Conclusions

8. Implications

- What effects do differences in national regulatory frameworks have on blockchain-based financial services’ scalability and compliance?

- In real-time transaction contexts, which architectural approaches facilitate the most seamless integration of blockchain networks with legacy financial systems?

- Which consensus techniques are best suited to reducing security flaws in financial companies authorized blockchain applications?

Funding

Data Availability Statement

Conflicts of Interest

References

- Javaid, M.; Haleem, A.; Singh, R.P.; Suman, R.; Khan, S. A review of Blockchain Technology applications for financial services. BenchCouncil Trans. Benchmarks Stand. Eval. 2022, 2, 100073. [Google Scholar] [CrossRef]

- Islam, H.; Rahman, J.; Tanchangya, T.; Islam, M.A. Impact of firms’ size, leverage, and net profit margin on firms’ profitability in the manufacturing sector of Bangladesh: An empirical analysis using GMM estimation. J. Ekon. 2023, 5, 1–9. [Google Scholar] [CrossRef]

- Mkrtchyan, G.; Treiblmaier, H. Business Implications and Theoretical Integration of the Markets in Crypto-Assets (MiCA) Regulation. FinTech 2025, 4, 11. [Google Scholar] [CrossRef]

- Manta, O.; Vasile, V.; Rusu, E. Banking Transformation Through FinTech and the Integration of Artificial Intelligence in Payments. FinTech 2025, 4, 13. [Google Scholar] [CrossRef]

- Siddiqi, K.O.; Rahman, J.; Tanchangya, T.; Rahman, H.; Esquivias, M.A.; Rahman, M.H. Investigating the factors influencing customer loyalty and the mediating effect of customer satisfaction in online food delivery services: Empirical evidence from an emerging market. Cogent Bus. Manag. 2024, 11, 2431188. [Google Scholar] [CrossRef]

- Raihan, A.; Atasoy, F.G.; Coskun, M.B.; Tanchangya, T.; Rahman, J.; Ridwan, M.; Sarker, T.; Elkassabgi, A.; Atasoy, M.; Yer, H. Fintech adoption and sustainable deployment of natural resources: Evidence from mineral management in Brazil. Resour. Policy 2024, 99, 105411. [Google Scholar] [CrossRef]

- Raihan, A.; Rahman, J.; Tanchangya, T.; Ridwan, M.; Bari, A.M. Influences of economy, energy, finance, and natural resources on carbon emissions in Bangladesh. Carbon Res. 2024, 3, 71. [Google Scholar] [CrossRef]

- Tanchangya, T.; Islam, N.; Naher, K.; Mia, M.R.; Chowdhury, S.; Sarker, S.R.; Rashid, F. Financial technology-enabled sustainable finance for small-and medium-sized enterprises. Environ. Innov. Manag. 2025, 1, 2550006. [Google Scholar] [CrossRef]

- Rahman, J.; Rahman, H.; Islam, N.; Tanchangya, T.; Ridwan, M.; Ali, M. Regulatory Landscape of Blockchain Assets: Analyzing the Drivers of NFT and Cryptocurrency Regulation. BenchCouncil Trans. Benchmarks Stand. Eval. 2025, 5, 100214. [Google Scholar] [CrossRef]

- Warokka, A.; Setiawan, A.; Aqmar, A.Z. Key Factors Influencing Fintech Development in ASEAN-4 Countries: A Mediation Analysis. FinTech 2025, 4, 17. [Google Scholar] [CrossRef]

- Tripathi, J.S.; Rengifo, E.W. FinTech, Fractional Trading, and Order Book Dynamics: A Study of US Equities Markets. FinTech 2025, 4, 16. [Google Scholar] [CrossRef]

- Rahman, M.H.; Tanchangya, T.; Rahman, J.; Aktar, M.A.; Majumder, S.C. Corporate social responsibility and green financing behavior in Bangladesh: Towards sustainable tourism. Innov. Green Dev. 2024, 3, 100133. [Google Scholar] [CrossRef]

- Varma, J.R. Blockchain in finance. Vikalpa 2019, 44, 1–11. [Google Scholar] [CrossRef]

- Al Mamun, M.A.; Tanchangya, T.; Rahman, M.A.; Hasan, M.M.; Islam, N.; Yeamin, B. Measuring the Influence of FinTech Innovation Towards Consumers’ Attitude: Moderating Role of Perceived Usefulness. Sustain. Futures 2025, 10, 100885. [Google Scholar] [CrossRef]

- Tanchangya, T.; Tafsirun, U.; Islam, M.S.; Islam, N.; Chakma, J.; Esquivias, M.A. Role of financial technology in small-scale natural Resource management through sustainable financing in Venezuela. Soc. Sci. Humanit. Open 2025, 11, 101636. [Google Scholar] [CrossRef]

- Tanchangya, T.; Rahman, J.; Waaje, A.; Roshid, M.M.; Islam, N. Impact of Fossil Fuels, Renewable Energy Consumption, and Economy on Carbon Emissions in Switzerland. Environ. Innov. Manag. 2025, 1, 2550012. [Google Scholar] [CrossRef]

- Cosares, S.; Kalish, K.; Maciura, T.; Spieler, A.C. Blockchain applications in finance. In The Emerald Handbook of Blockchain for Business; Emerald Publishing Limited: Leeds, UK, 2021; pp. 275–291. [Google Scholar]

- Abou Jaoude, J.; Saade, R.G. Blockchain applications–usage in different domains. IEEE Access 2019, 7, 45360–45381. [Google Scholar] [CrossRef]

- Guo, Y.; Liang, C. Blockchain application and outlook in the banking industry. Financ. Innov. 2016, 2, 24. [Google Scholar] [CrossRef]

- Rahman, J.; Raihan, A.; Tanchangya, T.; Ridwan, M. Optimizing the digital marketing landscape: A comprehensive exploration of artificial intelligence (AI) technologies, applications, advantages, and challenges. Front. Financ. 2024, 2, 6549. [Google Scholar] [CrossRef]

- Zhang, L.; Xie, Y.; Zheng, Y.; Xue, W.; Zheng, X.; Xu, X. The challenges and countermeasures of blockchain in finance and economics. Syst. Res. Behav. Sci. 2020, 37, 691–698. [Google Scholar] [CrossRef]

- Shah, T.; Jani, S. Applications of Blockchain Technology in Banking & Finance. Bachelor’s Thesis, Parul CUniversity, Vadodara, India, 2018. [Google Scholar]

- Agarwal, N.; Wongthongtham, P.; Khairwal, N.; Coutinho, K. Blockchain application to financial market clearing and settlement systems. J. Risk Financ. Manag. 2023, 16, 452. [Google Scholar] [CrossRef]

- Tüzün, O.; Ekinci, R. Blockchain Applications in Finance. In Exploring Blockchain Applications; CRC Press: Boca Raton, FL, USA, 2024; pp. 162–183. [Google Scholar]

- Tanchangya, T.; Raihan, A.; Rahman, J.; Ridwan, M. A review of deep learning applications for sustainable water resource management. Glob. Sustain. Res. 2024, 3, 48–73. [Google Scholar] [CrossRef]

- Villanueva, N.E. Blockchain Technology Application: Challenges, Limitations and issues. J. Comput. Innov. Eng. Appl. 2021, 5, 8–14. [Google Scholar]

- Salimitari, M.; Chatterjee, M.; Fallah, Y.P. A survey on consensus methods in blockchain for resource-constrained IoT networks. Internet Things 2020, 11, 100212. [Google Scholar] [CrossRef]

- Morkunas, V.J.; Paschen, J.; Boon, E. How blockchain technologies impact your business model. Bus. Horizons. 2019, 62, 295–306. [Google Scholar] [CrossRef]

- Gupta, N. A deep dive into security and privacy issues of blockchain technologies. In Handbook of Research on Blockchain Technology; Academic Press: Cambridge, MA, USA, 2020; pp. 95–112. [Google Scholar] [CrossRef]

- Islam, N.; Tanchangya, T.; Naher, K.; Tafsirun, U.; Mia, M.R.; Sarker, S.R.; Rashid, F. Revolutionizing supply chains: The role of emerging technologies in digital transformation. Financ. Risk Manag. Rev. 2025, 11, 72–102. [Google Scholar] [CrossRef]

- Raihan, A.; Ridwan, M.; Zimon, G.; Rahman, J.; Tanchangya, T.; Bari, A.M.; Atasoy, F.G.; Chowdhury, A.I.; Akter, R. Dynamic effects of foreign direct investment, globalization, economic growth, and energy consumption on carbon emissions in Mexico: An ARDL approach. Innov. Green Dev. 2025, 4, 100207. [Google Scholar] [CrossRef]

- Wang, D.; Zhao, J.; Wang, Y. A survey on Privacy Protection of Blockchain: The Technology and Application. IEEE Access 2020, 8, 108766–108781. [Google Scholar] [CrossRef]

- Jena, R.K. Examining the factors affecting the adoption of blockchain technology in the banking sector: An extended UTAUT model. Int. J. Financ. Stud. 2022, 10, 90. [Google Scholar] [CrossRef]

- Kajla, T.; Sood, K.; Gupta, S.; Raj, S.; Singh, H. Identification and prioritization of the factors influencing blockchain adoption in the banking sector: Integrating fuzzy AHP with TOE framework. Int. J. Qual. Reliab. Manag. 2024, 41, 2004–2026. [Google Scholar] [CrossRef]

- Lu, Y.H.; Yeh, C.C.; Kuo, Y.M. Exploring the critical factors affecting the adoption of blockchain: Taiwan’s banking industry. Financ. Innov. 2024, 10, 23. [Google Scholar] [CrossRef]

- Mishra, R.; Singh, R.K.; Kumar, S.; Mangla, S.K.; Kumar, V. Critical success factors of Blockchain technology adoption for sustainable and resilient operations in the banking industry during an uncertain business environment. Electron. Commer. Res. 2025, 25, 595–629. [Google Scholar] [CrossRef]

- Malik, S.; Chadhar, M.; Chetty, M.; Vatanasakdakul, S. Adoption of blockchain technology: Exploring the factors affecting organizational decision. Hum. Behav. Emerg. Technol. 2022, 2022, 7320526. [Google Scholar] [CrossRef]

- Taherdoost, H. A critical review of blockchain acceptance models—Blockchain technology adoption frameworks and applications. Computers 2022, 11, 24. [Google Scholar] [CrossRef]

- Al Shamsi, M.; Al-Emran, M.; Shaalan, K. A systematic review on blockchain adoption. Appl. Sci. 2022, 12, 4245. [Google Scholar] [CrossRef]

- Pal, A.; Tiwari, C.K.; Behl, A. Blockchain technology in financial services: A comprehensive review of the literature. J. Glob. Oper. Strateg. Sourc. 2021, 14, 61–80. [Google Scholar] [CrossRef]

- Basdekidou, V.; Papapanagos, H. Blockchain technology adoption for disrupting FinTech functionalities: A systematic literature review for corporate management, supply chain, banking industry, and stock markets. Digital 2024, 4, 762–780. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ 2021, 372, 71. [Google Scholar] [CrossRef]

- Risius, M.; Spohrer, K. A blockchain research framework: What we (don’t) know, where we go from here, and how we will get there. Bus. Inf. Syst. Eng. 2017, 59, 385–409. [Google Scholar] [CrossRef]

- Frizzo-Barker, J.; Chow-White, P.A.; Adams, P.R.; Mentanko, J.; Ha, D.; Green, S. Blockchain as a disruptive technology for business: A systematic review. Int. J. Inf. Manag. 2020, 51, 102029. [Google Scholar] [CrossRef]

- Blei, D.M.; Ng, A.Y.; Jordan, M.I. Latent dirichlet allocation. J. Mach. Learn. Res. 2003, 3, 993–1022. [Google Scholar]

- Namasudra, S.; Deka, G.C.; Johri, P.; Hosseinpour, M.; Gandomi, A.H. The revolution of blockchain: State-of-the-art and research challenges. Arch. Comput. Methods Eng. 2021, 28, 1497–1515. [Google Scholar] [CrossRef]

- Viriyasitavat, W.; Hoonsopon, D. Blockchain characteristics and consensus in modern business processes. J. Ind. Inf. Integr. 2019, 13, 32–39. [Google Scholar] [CrossRef]

- Gupta, S.; Sadoghi, M. Blockchain transaction processing. arXiv 2021, arXiv:2107.11592. [Google Scholar] [CrossRef]

- Prybila, C.; Schulte, S.; Hochreiner, C.; Weber, I. Runtime verification for business processes utilizing the Bitcoin blockchain. Future Gener. Comput. Syst. 2020, 107, 816–831. [Google Scholar] [CrossRef]

- Bhuiyan, M.R.I.; Akter, M.S. Assessing the potential usages of blockchain to transform Smart Bangladesh: A PRISMA based systematic review. J. Inf. Syst. Inform. 2024, 6, 245–269. [Google Scholar] [CrossRef]

- Khan, A.A.; Laghari, A.A.; Shaikh, Z.A.; Dacko-Pikiewicz, Z.; Kot, S. Internet of Things (IoT) security with blockchain technology: A state-of-the-art review. IEEE Access 2022, 10, 122679–122695. [Google Scholar] [CrossRef]

- Pinna, A.; Ibba, S. A blockchain-based decentralized system for proper handling of temporary employment contracts. In Intelligent Computing, Proceedings of the 2018 Computing Conference, London, UK, 10–12 July 2018; Springer International Publishing: Cham, Switzerland, 2019; Volume 2, pp. 1231–1243. [Google Scholar]

- Berg, C.; Davidson, S.; Potts, J. Proof of Work as a Three-Sided Market. Front. Blockchain 2020, 3, 2. [Google Scholar] [CrossRef]

- Chauhan, A.; Malviya, O.P.; Verma, M.; Mor, T.S. Blockchain and scalability. In Proceedings of the 2018 IEEE International Conference on Software Quality, Reliability and Security Companion (QRS-C), Lisbon, Portugal, 16–20 July 2018; IEEE: New York, NY, USA, 2018; pp. 122–128. [Google Scholar]

- Guggenmos, F.; Lockl, J.; Rieger, A.; Wenninger, A.; Fridgen, G. How to develop a GDPR-compliant blockchain solution for cross-organizational workflow management: Evidence from the German asylum procedure. In Proceedings of the 53rd Hawaii International Conference on System Sciences, Maui, HI, USA, 7–10 January 2020. [Google Scholar]

- Bhardwaj, S.; Kaushik, M. Blockchain—Technology to drive the future. In Smart Computing and Informatics, Proceedings of the First International Conference on SCI 2016, Visakhapatnam, India, 3–4 March 2017; Springer: Singapore, 2018; Volume 2, pp. 263–271. [Google Scholar]

- Arner, D.W.; Barberis, J.; Buckley, R.P. FinTech, RegTech and the reconceptualization of financial regulation. Northwestern J. Int. Law Bus. 2017, 37, 371–413. [Google Scholar]

- Agi, M.A.; Jha, A.K. Blockchain technology in the supply chain: An integrated theoretical perspective of organizational adoption. Int. J. Prod. Econ. 2022, 247, 108458. [Google Scholar] [CrossRef]

- Makridakis, S.; Christodoulou, K. Blockchain: Current challenges and future prospects/applications. Future Internet 2019, 11, 258. [Google Scholar] [CrossRef]

- Grand View Research. Global Blockchain Technology Market Size & Outlook. 2023. Available online: https://www.grandviewresearch.com/horizon/outlook/blockchain-technology-market-size/global#:~:text=Global%20Blockchain%20Technology%20Market%20Size,87.7%25%20from%202023%20to%202030 (accessed on 29 June 2025).

- Zhang, L.; Wen, H. A Study of Financial Engineering Security Issues Based on Block Cryptography. In Proceedings of the 2023 3rd International Conference on Public Management and Intelligent Society (PMIS 2023), Shanghai, China, 10–12 March 2023; Atlantis Press: Amsterdam, The Netherlands, 2023; pp. 375–381. [Google Scholar] [CrossRef]

- Hariyani, D.; Hariyani, P.; Mishra, S.; Sharma, M.K. A literature review on transformative impacts of blockchain technology on manufacturing management and industrial engineering practices. Green Technol. Sustain. 2025, 3, 100169. [Google Scholar] [CrossRef]

- Li, J.; Xu, F. Regulatory challenges and economic impact of CBDCs. Fintech Innov. 2023, 7, 175–190. [Google Scholar] [CrossRef]

- Fernandes, P.; Patel, R. Central bank digital currencies: Implications for global finance. Int. J. Digit. Bank. 2024, 9, 135–152. [Google Scholar] [CrossRef]

- Singh, A.; Zhao, L. The evolution of CBDCs and their role in digital economies. J. Bank. Paym. 2023, 8, 95–112. [Google Scholar] [CrossRef]

- Li, J.; Xu, F. Regulatory challenges and financial stability in stablecoin adoption. Fintech Innov. 2023, 7, 145–162. [Google Scholar] [CrossRef]

- Singh, A.; Zhao, L. The evolution of blockchain in global remittance markets. J. Bank. Paym. 2023, 8, 78–95. [Google Scholar] [CrossRef]

- Li, J.; Xu, F. Regulatory challenges in blockchain-driven cross-border transactions. Fintech Innov. 2023, 7, 165–180. [Google Scholar] [CrossRef]

- Smith, J. Bitwage: Revolutionizing global payroll with blockchain. Int. J. Payr. Compens. 2025, 10, 89–102. [Google Scholar] [CrossRef]

- Johnson, D.; Lee, A. Regulatory considerations for blockchain-based payroll. J. Financ. Technol. 2024, 8, 134–146. [Google Scholar] [CrossRef]

- Brown, T. Blockchain payroll systems: Enhancing efficiency and trust in employee compensation. J. Fintech Innov. 2025, 12, 55–68. [Google Scholar] [CrossRef]

- Manda, S.K.; Yamijala, S. Peer-to-Peer Lending using Blockchain. Int. J. Innov. Technol. Explor. Eng. 2019, 8, 329–332. [Google Scholar] [CrossRef]

- Singh, A.; Mali, P.V.; Thakare, S.; Bhattacharjee, S. Peer-to-Peer Lending using Blockchain. Int. J. Comput. Appl. 2019, 178, 1–5. [Google Scholar] [CrossRef]

- Mirdala, R. Is blockchain a cure for peer-to-peer lending? Ann. Oper. Res. 2022, 321, 693–716. [Google Scholar] [CrossRef]

- Zhou, F.; Wang, J.; Zhao, Y. BACS: Blockchain and AutoML-based technology for efficient credit scoring classification. Ann. Oper. Res. 2022, 345, 703–723. [Google Scholar] [CrossRef]

- Hassija, V.; Bansal, G.; Chamola, V.; Kumar, N.; Guizani, M. Secure lending: Blockchain and prospect theory-based decentralized credit scoring model. IEEE Consum. Electron. Mag. 2020, 9, 15–21. [Google Scholar] [CrossRef]

- Iyer, S.R.; Kumar, R.R. A privacy-preserving decentralized credit scoring method based on multi-party computation. Decis. Support Syst. 2022, 153, 113666. [Google Scholar] [CrossRef]

- Wamba, S.F.; Queiroz, M.M.; Trinchera, L. Dynamics between blockchain adoption determinants and supply chain performance: Lessons from early adopters of the technology. Inf. Manag. 2020, 57, 103365. [Google Scholar] [CrossRef]

- Chen, Y.; Bellavitis, C.; Fronczuk, A.; Wang, Y. Blockchain disruption and decentralized finance: The rise of decentralized business models. Technol. Forecast. Soc. Change 2021, 166, 120600. [Google Scholar] [CrossRef]

- Casino, F.; Dasaklis, T.K.; Patsakis, C. A systematic literature review of blockchain-based applications: Current status, classification and open issues. Telemat. Inform. 2019, 36, 55–81. [Google Scholar] [CrossRef]

- Xu, X.; Weber, I.; Staples, M. Architecture for Blockchain Applications; Springer: Berlin/Heidelberg, Germany, 2019. [Google Scholar] [CrossRef]

- Klages-Mundt, A.; Gupta, A.; Swan, M. Asset tokenization in financial markets: Balancing efficiency and fractional ownership. J. Financ. Digit. Assets 2023, 1, 45–67. [Google Scholar]

- Dehnavi, M.K.; Khani Dehnavi, M.; Amiri, H.A. Real estate security token offerings and the secondary market. J. Prop. Invest. Financ. 2023, 42, 614–620. [Google Scholar] [CrossRef]

- Wang, S.; Ouyang, L.; Yuan, Y.; Ni, X.; Han, X.; Wang, F.Y. Blockchain-enabled smart contracts: Architecture, applications, and future trends. IEEE Trans. Syst. Man Cybern. Syst. 2021, 51, 226–236. [Google Scholar] [CrossRef]

- Zheng, Z.; Xie, S.; Dai, H.; Chen, X.; Wang, H. An overview of blockchain technology: Architecture, consensus, and future trends. Proc. IEEE 2020, 108, 2046–2069. [Google Scholar] [CrossRef]

- Werner, S.M.; Perez, D.; Gudgeon, L.; Klages-Mundt, A.; Harz, D.; Knottenbelt, W.J. SoK: Decentralized finance (DeFi). In Proceedings of the 2021 IEEE Symposium on Security and Privacy (SP), San Francisco, CA, USA, 24–27 May 2021; IEEE: New York, NY, USA, 2021; pp. 164–183. [Google Scholar] [CrossRef]

- Auer, R.; Bohme, R. The Technology of Retail Central Bank Digital Currency. J. Econ. Perspect. 2023, 37, 49–72. [Google Scholar] [CrossRef]

- Feichtinger, R.; Fritsch, R.; Vonlanthen, Y.; Wattenhofer, R. The hidden shortcomings of DAOs: An empirical study of on-chain governance. Proc. ACM Program. Lang. 2023, 7, 1224–1252. [Google Scholar] [CrossRef]

- Ma, W.; Liu, Y.; Xie, X.; Li, Y. A comprehensive survey of security and privacy challenges in decentralized finance. IEEE Trans. Dependable Secur. Comput. 2023, 19, 172–190. [Google Scholar] [CrossRef]

- Li, Z. The application of blockchain and robo-advisors in wealth management: A literature review. Adv. Econ. Manag. Political Sci. 2023, 7, 397–406. [Google Scholar] [CrossRef]

- Joshi, S.; Choudhury, A. Tokenization of real estate assets using blockchain: A framework to enhance liquidity, accessibility, and security. Geoforum 2024, 159, 104193. [Google Scholar] [CrossRef]

- Swinkels, L. Empirical evidence on the ownership and liquidity of real estate tokens. Financ. Innov. 2023, 9, 27. [Google Scholar] [CrossRef]

- Harjoto, M.A.; Laksmana, I.; Lee, R. A review of DAO governance: Recent literature and emerging trends. J. Corp. Financ. 2025, 91, 102734. [Google Scholar] [CrossRef]

- Esposito, M.; Tse, T.; Goh, D. Decentralizing governance: Exploring the dynamics and challenges of digital commons and DAOs. Front. Blockchain 2025, 8, 1538227. [Google Scholar] [CrossRef]

- Ma, J.; Jiang, M.; Luo, X.; Hu, Y.; Zhou, Y.; Wang, Q.; Zhang, F. Demystifying the DAO governance process: An empirical analysis of proposal vulnerabilities. arXiv 2024. [Google Scholar] [CrossRef]

- Santana, C.; Albareda, L. Blockchain and the emergence of decentralized autonomous organizations (DAOs): An integrative model and research agenda. Technol. Forecast. Soc. Change 2022, 182, 121806. [Google Scholar] [CrossRef]

- Liu, Y.; Xie, X.; Hu, Y.; Zhou, Y.; Wang, Q.; Zhang, F. Applying blockchain for primary financial market: A survey. IET Blockchain 2021, 2, 115–128. [Google Scholar] [CrossRef]

- Cucculelli, M.; Recanatini, M. Distributed ledger technology systems in securities post-trading services: Evidence from European global systemic banks. Eur. J. Financ. 2021, 28, 195–218. [Google Scholar] [CrossRef]

- Wu, H.; Yao, Q.; Liu, Z.; Huang, B.; Zhuang, Y.; Tang, H.; Liu, E. Blockchain for finance: A survey. arXiv 2024. [Google Scholar] [CrossRef]

- Xu, J.; Paruch, C.; Cousaert, S.; Feng, J. SoK: Decentralized exchanges (DEX) with automated market maker (AMM) protocols. ACM Comput. Surv. 2023, 55, 8. [Google Scholar] [CrossRef]

- Cartea, Á.; Drissi, F.; Monga, M. Predictable losses of liquidity provision in constant function market makers. Appl. Math. Financ. 2023, 30, 69–93. [Google Scholar] [CrossRef]

- Fukasawa, A.; Lambert, G.; Fritz, L. Impermanent loss and loss-versus-rebalancing II. arXiv 2025. [Google Scholar] [CrossRef]

- Adams, A.; Moallemi, C.C.; Reynolds, S.; Robinson, D. am-AMM: An auction-managed automated market maker. arXiv 2024. [Google Scholar] [CrossRef]

- Yan, C.Y.; Keol, S.; Co, X.; Leung, N. Better market maker algorithm to save impermanent loss with high liquidity retention. arXiv 2025. [Google Scholar] [CrossRef]

- Hoque, M.M.; Kummer, T.F.; Yigitbasioglu, O. How can blockchain-based lending platforms support microcredit activities in developing countries? An empirical validation of its opportunities and challenges. Technol. Forecast. Soc. Change 2024, 203, 123400. [Google Scholar] [CrossRef]

- Jia, R. Assessing the potential of decentralised finance and blockchain technology in insurance. Geneva Assoc. 2013, 19, 2023-08. [Google Scholar]

- Shetty, A.S.; Shetty, A.D.; Pai, R.Y.; Rao, R.R.; Bhandary, R.; Nayak, S.; Dsouza, K.J. Blockchain application in insurance services: A systematic review of the evidence. SAGE Open 2022, 12, 21582440221079877. [Google Scholar] [CrossRef]

- Filippi, P.; Voisin, B. Blockchain and contract theory: Modeling smart contracts using insurance markets. Manag. Financ. 2020, 46, 1873–1887. [Google Scholar] [CrossRef]

- Cousaert, S.; Vadgama, N.; Xu, J. Token based insurance solutions on blockchain. J. Risk Financ. 2021, 22, 456–478. [Google Scholar] [CrossRef]

- Lopez, O.; Thomas, M. Parametric insurance for extreme risks: The challenge of properly covering severe claims. arXiv 2023. [Google Scholar] [CrossRef]

- Maier, M.J.; Scherer, M. Expectiles as basis risk optimal payment schemes in parametric insurance. arXiv 2025. [Google Scholar] [CrossRef]

- Smith, J.; Zhao, L. Political and credit risk in trade finance: The role of insurance mechanisms. Glob. Financ. J. 2023, 54, 100790. [Google Scholar] [CrossRef]

- Kumar, R.; Singh, A.; Verma, P. Trade credit insurance and firm performance: Evidence from global markets. J. Financ. Risk Manag. 2024, 15, 32–48. [Google Scholar] [CrossRef]

- Lee, S.; Park, J. Analyzing the trade-offs in trade credit insurance adoption: Costs versus risk mitigation. Int. J. Insur. Stud. 2023, 8, 101–115. [Google Scholar] [CrossRef]

- Axelsen, H.; Jensen, J.R.; Ross, O. DLT compliance reporting. arXiv 2022. [Google Scholar] [CrossRef]

- Cryptoworth Blog. How Digital Assets Will Be Monitored by 2030. Cryptoworth. 10 March 2025. Available online: https://blog.cryptoworth.com/how-digital-assets-will-be-monitored-by-2030 (accessed on 29 June 2025).

- Financial Action Task Force Updated Guidance for a Risk-Based Approach to Virtual Assets Virtual Asset Service Providers, F.A.T.F. October 2021. Available online: https://www.fatf-gafi.org/en/publications/Fatfrecommendations/Guidance-rba-virtual-assets-2021.html (accessed on 29 June 2025).

- Oduro, D.A.; Okoli, C.; Serifat, O.A. RegTech and blockchain integration in AML compliance: Financial and operational impacts. Asian J. Adv. Res. Rep. 2025, 19, 263–277. [Google Scholar] [CrossRef]

- Hannan, M.A.; Shahriar, M.A.; Ferdous, M.S.; Chowdhury, M.J.M.; Chowdhury, N.; Rahman, M.S. A systematic literature review of blockchain based electronic know your customer systems. Computing 2023, 105, 2089–2118. [Google Scholar] [CrossRef]

- Karadag, B.; Zaim, A.H.; Akbulut, A. (2023). Blockchain based KYC model for credit allocation in banking. IEEE Access 2023, 12, 80176–80182. [Google Scholar] [CrossRef]

- Agarwal, R.; Gupta, M.; Kumar, S. Blockchain adoption in auditing: Real time assurance and financial reporting. J. Emerg. Technol. Account. 2022, 19, 45–63. [Google Scholar] [CrossRef]

- Dai, J.; Vasarhelyi, M.A. Toward blockchain based accounting and assurance. J. Inf. Syst. 2017, 31, 5–21. [Google Scholar] [CrossRef]

- Kanaparthi, V. Exploring the impact of blockchain AI and machine learning on financial reporting efficiency. J. Account. Financ. 2024, 12, 101–118. [Google Scholar] [CrossRef]

- Ridwan, R.; Riswandi, D.; Mulyani, F.S. The implementation of blockchain in taxation efficiency transparency and reducing tax avoidance. In Proceedings of the 8th Global Conference on Business, Management, and Entrepreneurship (GCBME 2023), Bandung, Indonesia, 8 August 2023; pp. 234–243. [Google Scholar] [CrossRef]

- Akdeniz, D.Y. Blockchain in taxation. J. Account. Financ. 2021, 21, 140–155. [Google Scholar] [CrossRef]

- Zhang, Y.; Ma, Z.; Meng, J. Auditing in the blockchain a literature review. Front. Blockchain 2025, 8, 1549729. [Google Scholar] [CrossRef]

- Assiri, H.; Humayun, M. Optimizing internal control systems through blockchain based financial reporting: Opportunities and risks. J. Emerg. Technol. Account. 2024, 3, 213–222. [Google Scholar] [CrossRef]

- Roszkowska, E. Blockchain for internal controls in financial accounting. Res. Account. Innov. 2021, 1, 862–868. [Google Scholar] [CrossRef]

- Thurner, T. Supply chain finance and blockchain technology the case of reverse securitisation. Foresight 2018, 20, 447–448. [Google Scholar] [CrossRef]

- Chang, S.E.; Chen, Y.-C.; Wu, T.-C. Blockchain and supply chain finance in global trade: A critical synthesis of the state of the art, challenges and opportunities. Int. J. Prod. Res. 2019, 58, 2082–2099. [Google Scholar] [CrossRef]

- Ioannou, I.; Demirel, P. Blockchain and supply chain finance a critical literature review at the intersection of operations finance and law. J. Bank. Financ. Technol. 2022, 6, 83–107. [Google Scholar] [CrossRef]

- Liu, X.; Yang, Z. Security Token Offerings versus loan guarantees for risk averse entrepreneurs under asymmetric information. Financ. Res. Lett. 2023, 57, 104171. [Google Scholar] [CrossRef]

- Pal, R.; Bhandari, R.; Kumar, A. Supply chain finance what are the challenges in the adoption of blockchain technology. J. Digit. Econ. 2022, 1, 153–165. [Google Scholar] [CrossRef]

- Schlatt, V.; Sedlmeir, J.; Feulner, S.; Urbach, N. Designing a framework for digital know your customer processes built on blockchain based self sovereign identity. Inf. Manag. 2022, 59, 103553. [Google Scholar] [CrossRef]

- Ahmed, K.A.M.; Saraya, S.F.; Wanis, J.F.; Ali-Eldin, A.M.T. A blockchain self sovereign identity for open banking secured by the customer’s banking cards. Future Internet 2023, 15, 208. [Google Scholar] [CrossRef]

- Pava-Díaz, R.A.; Gil-Ruiz, J.; López-Sarmiento, D.A. Self sovereign identity on the blockchain contextual analysis and quantification of SSI principles implementation. Front. Blockchain 2024, 7, 1443362. [Google Scholar] [CrossRef]

- Hassan, M.U.; Rehmani, M.H.; Chen, J. Anomaly detection in blockchain networks: A comprehensive survey. Future Gener. Comput. Syst. 2021, 124, 422–444. [Google Scholar] [CrossRef]

- Osterrieder, J.; Chan, S.; Chu, J. Enhancing security in blockchain networks: Anomalies, frauds, and advanced detection techniques. arXiv 2024. [Google Scholar] [CrossRef]

- Kreppmeier, J.; Laschinger, R. Signaling in the market for security tokens. J. Bus. Econ. 2023, 93, 1515–1552. [Google Scholar] [CrossRef]

- Howell, S.T.; Niessner, M.; Yermack, D. Initial Coin Offerings Financing growth with cryptocurrency token sales. J. Financ. Econ. 2018, 128, 1–29. [Google Scholar] [CrossRef]

- Drobetz, W.; Merli, M.; Tiu, C. ICOs Technology or Financing dream Empirical evidence on token sales. J. Corp. Financ. 2019, 57, 101258. [Google Scholar] [CrossRef]

- Szwajdler, P. Regulatory dynamics in Initial Coin Offering markets. Eur. Bus. Organ. Law Rev. 2022, 23, 671–709. [Google Scholar] [CrossRef]

- Fisch, C.; Momtaz, P.P. Investment motives and performance of Initial Coin Offerings. J. Bank. Financ. 2020, 122, 105–112. [Google Scholar] [CrossRef]

- Bargoni, D.; Di Pietro, G.; Quaranta, S. Blockchain and crowdfunding at the intersection of innovation, investment, and trust. Electron. Commer. Res. 2022, 24, 239–273. [Google Scholar] [CrossRef]

- Zhu, H.; Zhou, Z. Analysis and outlook of applications of blockchain technology to equity crowdfunding in China. Financ. Innov. 2016, 2, 29. [Google Scholar] [CrossRef]

- Lee, J. Regulatory challenges for blockchain based crowdfunding platforms. J. Digit. Econ. 2024, 2, 45–61. [Google Scholar] [CrossRef]

- Wan, Z.-G.; Deng, R.H.; Lee, D.; Li, Y. MicroBTC efficient flexible and fair micropayment for Bitcoin using hash chains. J. Comput. Sci. Technol. 2019, 34, 403–415. [Google Scholar] [CrossRef]

- Amiruddin, A. Micropayments interoperability with blockchain and off chain data store to improve transaction throughputs. In Science and Technologies for Smart Cities; Springer: Cham, Switzerland, 2022; pp. 384–399. [Google Scholar] [CrossRef]

- Dutta, A.K. Role of blockchain in financial inclusion through microfinance. Manag. Account. J. 2021, 56, 50–51. [Google Scholar] [CrossRef]

- Hoque, M.M. Microfinance Challenges and the Potential Benefits of Blockchain Technology and Mobile Money. Master’s thesis, Queensland University of Technology, Brisbane City, Australia, 2022. [Google Scholar] [CrossRef]

- Keele, S. Guidelines for Performing Systematic Literature Reviews in Software Engineering (Vol. 5). Technical Report, Version 2.3 EBSE Technical Report. 2007. Available online: https://legacyfileshare.elsevier.com/promis_misc/525444systematicreviewsguide.pdf (accessed on 29 June 2025).

- Qiu, T.; Zhang, R.; Gao, Y. Ripple vs SWIFT transforming cross border remittance using blockchain technology. Procedia Comput. Sci. 2019, 147, 428–434. [Google Scholar] [CrossRef]

- Taherdoost, H. Smart contracts in blockchain technology: A critical review. Information 2023, 14, 117. [Google Scholar] [CrossRef]

- Hu, Y.; Liyanage, M.; Mansoor, A.; Thilakarathna, K.; Jourjon, G.; Seneviratne, A. An overview of blockchain smart contract execution mechanism. J. Ind. Inf. Integr. 2023, 41, 100674. [Google Scholar] [CrossRef]

- Zheng, Z.; Xie, S.; Dai, H.; Chen, X.; Chen, W.; Weng, J.; Imran, M. An overview on smart contracts: Challenges, advances and platforms. arXiv 2019. [Google Scholar] [CrossRef]

- Camargo, A.M. Integrating blockchain into global finance: A case study of SWIFT’s strategic collaboration with Chainlink. Rev. Gestão E Secr. 2023, 14, 1942–1961. [Google Scholar] [CrossRef]

- Chang, V.; Baudier, P.; Zhang, H.; Xu, Q.; Zhang, J.; Arami, M. How Blockchain can impact financial services–The overview, challenges and recommendations from expert interviewees. Technol. Forecast. Soc. Change 2020, 158, 120166. [Google Scholar] [CrossRef]

- Sedlmeir, J.; Buhl, H.U.; Fridgen, G.; Keller, R. The energy consumption of blockchain Technology: Beyond myth. Bus. Inf. Syst. Eng. 2020, 62, 599–608. [Google Scholar] [CrossRef]

- Staples, M.; Chen, S.; Falamaki, S.; Ponomarev, A.; Rimba, P.; Tran, A.B.; Weber, I.; Xu, X.; Zhu, J. Risks and Opportunities for Systems Using Blockchain and Smart Contracts. Data61 (CSIRO), Sydney 2017 June 6. Available online: https://publications.csiro.au/rpr/pub?pid=csiro:EP175103 (accessed on 29 June 2025).

- Yuan, Y.; Wang, F.Y.; Rong, C.; Stavrou, A.; Zhang, J.; Tang, Q.; Baldimtsi, F.; Yang, L.T.; Wu, D.; Wang, S.; et al. Guest editorial Special issue on Blockchain and Economic Knowledge Automation. IEEE Trans. Syst. Man Cybern. Syst. 2019, 50, 2–8. [Google Scholar] [CrossRef]

- Gatteschi, V.; Lamberti, F.; Demartini, C. Technology of Smart Contracts; Cambridge University Press eBooks: Cambridge, UK, 2019; pp. 37–58. [Google Scholar]

- Ferreira, A. Regulating smart contracts: Legal revolution or simply evolution? Telecommun. Policy 2020, 45, 102081. [Google Scholar] [CrossRef]

- Alam, S.; Shuaib, M.; Khan, W.Z.; Garg, S.; Kaddoum, G.; Hossain, M.S.; Bin Zikria, Y. Blockchain-based Initiatives: Current state and challenges. Comput. Networks 2021, 198, 108395. [Google Scholar] [CrossRef]

- Zhang, Q.; Cheng, L.; Boutaba, R. Smart contract vulnerabilities and countermeasures in financial FinTech applications. J. Syst. Softw. 2020, 169, 110123. [Google Scholar] [CrossRef]

- Onteddu, A.R.; Venkata, S.S.M.G.N.; Ying, D.; Kundavaram, R.R. Integrating Blockchain Technology in FinTech Database Systems: A security and performance analysis. Asian Account. Audit. Adv. 2020, 11, 129–142. [Google Scholar]

- Nelaturu, K.; Du, H.; Le, D.P. A review of Blockchain in Fintech: Taxonomy, challenges, and future directions. Cryptography 2022, 6, 18. [Google Scholar] [CrossRef]

- Mishra, L.; Kaushik, V. Application of blockchain in dealing with sustainability issues and challenges of financial sector. J. Sustain. Financ. Investig. 2021, 13, 1318–1333. [Google Scholar] [CrossRef]

- Monrat, A.A.; Schelen, O.; Andersson, K. A survey of blockchain from the perspectives of applications, challenges, and opportunities. IEEE Access 2019, 7, 117134–117151. [Google Scholar] [CrossRef]

- GVR Blockchain Technology Market Size, Share & Trends Analysis Report by Type (Public Cloud, Private Cloud), by Offering (Platform, Services), by Component, by Application, by Enterprise Size, by End-use, by Region, and Segment Forecasts, 2025–2030. 2023. Available online: https://www.grandviewresearch.com/industry-analysis/blockchain-technology-market (accessed on 29 June 2025).

| Application Area | Subdomains |

|---|---|

| Banking and Payments | Cross-border transactions, central bank digital currencies (CBDCs), decentralized payment networks, stablecoins, and blockchain-based payroll systems. |

| Lending and Credit | Automated loan underwriting, blockchain-based credit scoring, and peer-to-peer (P2P) lending platforms. |

| Investment and Wealth Management | Decentralized autonomous organizations (DAOs), blockchain robo-advisors, fractional ownership, decentralized hedge funds and tokenized securities. |

| Financial Inclusion and Micropayments | Blockchain micropayments, microlending to unbanked, and cross-border mobile money systems. |

| Crowdfunding and Alternative Financing | Security token offerings (STOs), initial coin offerings (ICOs), and blockchain-based crowd-sourced investment platforms. |

| Digital Identity and Fraud Prevention | Blockchain-based digital identity, decentralized identity authentication, and cybersecurity. |

| Trade Finance and Supply Chain Finance | Blockchain-enabled trade settlement, supply chain finance, and real-time tracking of assets. |

| Regulatory Technology and Compliance | AML/KYC systems, real-time auditing, automated tax filing, compliance automation. |

| Insurance and Risk Management | Blockchain-insured policies, parametric insurance, and trade credit insurance. |

| Stock Trading and Asset Management | Automated market makers (AMMs) for trading, decentralized derivatives, and stock exchanges on blockchain. |

| Smart Contracts and Automation | Automated smart contract escrow services, financial data sharing, and automatic loan repayment. |

| Applications | Definition | Description |

|---|---|---|

| Cross-border transactions and remittances | Cross-border transactions involve the transfer of money, goods, or services between individuals or businesses located in different countries. Remittances are a type of cross-border transaction where people, usually migrant workers, send money back to their home country to support family or relatives. Both play a key role in global trade and economic support, especially for developing nations. | Blockchain technology is revolutionizing cross-border transactions and remittances by making them more affordable, faster, and transparent. By using decentralized networks, blockchain eliminates the need for traditional intermediaries, which significantly lowers costs and speeds up transaction times [1,2,3,4,5,61]. Companies like Ripple and Stellar are at the forefront of this transformation, offering real-time, low-cost transfers that make sending money across borders easier and more efficient [10,11,12]. Furthermore, the introduction of stablecoins and central bank digital currencies (CBDCs) has added an extra layer of stability and security to these transactions, making cross-border payments more reliable and accessible. Despite these advancements, challenges such as regulatory hurdles and cybersecurity risks still need to be addressed before blockchain-based cross-border payments can be adopted on a global scale [13,17,18,19,61,62,63]. |

| Central bank digital currencies (CBDCs) | Central bank digital currencies (CBDCs) are digital forms of a country’s official currency issued and regulated by the central bank. Unlike cryptocurrencies, CBDCs are centralized, legal tender backed by the government, aiming to provide a secure, efficient, and low-cost alternative to cash. They can be used for everyday transactions, help improve payment systems, and promote financial inclusion while maintaining monetary stability. | Central bank digital currencies (CBDCs) are digital versions of a country’s official currency, issued and regulated by central banks. They are designed to improve payment efficiency, promote financial inclusion, and enhance the effectiveness of monetary policies [13,17,18,19]. Unlike cryptocurrencies, which are decentralized, CBDCs are government-backed, ensuring they are stable and subject to regulatory oversight. Countries like China with its Digital Yuan and the European Union with the Digital Euro are leading the way in CBDC development, aiming to modernize their financial systems and reduce dependence on physical cash [6,20,21,22]. However, there are still significant challenges to overcome, such as concerns around cybersecurity, privacy, and the potential disruption of traditional commercial banking systems, which could slow down the global adoption of CBDCs [63,64,65,66]. |

| Stablecoins | Stablecoins are a type of cryptocurrency designed to maintain a stable value by being pegged to a reserve asset, such as a fiat currency like the US dollar, a commodity like gold, or a basket of assets. They aim to combine the benefits of digital currencies—like fast and low-cost transactions—with the price stability of traditional money. Stablecoins are commonly used for trading, payments, and remittances within the crypto ecosystem. | Stablecoins are a type of cryptocurrency designed to reduce the volatility that often plagues traditional cryptocurrencies by tying their value to stable assets like fiat currencies, commodities, or a mix of financial instruments [23,24,25,26]. There are four main types of stablecoins: fiat-collateralized, commodity-backed, crypto-collateralized, and algorithmic. Fiat-backed stablecoins, like USDT and USDC, hold reserves in traditional currencies to maintain stability, while commodity-backed stablecoins, such as Tether Gold (XAUt), are backed by physical assets like gold [67]. Crypto-collateralized stablecoins, like MakerDAO’s DAI, use digital assets as collateral, often requiring more collateral than the value of the stablecoin issued. Algorithmic stablecoins, on the other hand, rely on smart contracts to control the supply of tokens and keep their value stable. Despite their increasing popularity, stablecoins still face significant regulatory scrutiny, particularly around issues of financial stability and compliance, which could slow down their global adoption [68]. |

| Blockchain-based payroll | Blockchain-based payroll is a system that uses blockchain technology to manage and process employee payments. It enables secure, transparent, and automated salary transfers, often using cryptocurrencies or stablecoins. This method reduces transaction costs, ensures faster cross-border payments, and minimizes errors through smart contracts. It is especially useful for global teams, freelancers, and remote workers who need efficient and timely compensation. | Blockchain-based payroll systems are transforming the way employees are compensated by making the process more secure, transparent, and efficient. By eliminating intermediaries and using smart contracts to automate payments, these systems ensure that employees are paid accurately and on time, while also cutting down on administrative costs and minimizing errors [1,27,28,29]. For instance, platforms like Bitwage use blockchain to offer global payroll solutions, giving employees the option to receive their wages in either cryptocurrency or traditional fiat currency [69]. Additionally, the immutable nature of blockchain’s ledger builds trust and helps ensure compliance by providing verifiable records of all payroll transactions, which is essential for meeting regulatory requirements [70]. However, despite the many benefits, there are still challenges to overcome, such as navigating regulatory frameworks, understanding tax implications, and encouraging employee adoption of these systems [71]. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tanchangya, T.; Sarker, T.; Rahman, J.; Islam, M.S.; Islam, N.; Siddiqi, K.O. Mapping Blockchain Applications in FinTech: A Systematic Review of Eleven Key Domains. Information 2025, 16, 769. https://doi.org/10.3390/info16090769

Tanchangya T, Sarker T, Rahman J, Islam MS, Islam N, Siddiqi KO. Mapping Blockchain Applications in FinTech: A Systematic Review of Eleven Key Domains. Information. 2025; 16(9):769. https://doi.org/10.3390/info16090769

Chicago/Turabian StyleTanchangya, Tipon, Tapan Sarker, Junaid Rahman, Md Shafiul Islam, Naimul Islam, and Kazi Omar Siddiqi. 2025. "Mapping Blockchain Applications in FinTech: A Systematic Review of Eleven Key Domains" Information 16, no. 9: 769. https://doi.org/10.3390/info16090769

APA StyleTanchangya, T., Sarker, T., Rahman, J., Islam, M. S., Islam, N., & Siddiqi, K. O. (2025). Mapping Blockchain Applications in FinTech: A Systematic Review of Eleven Key Domains. Information, 16(9), 769. https://doi.org/10.3390/info16090769