1. Introduction

Driven by the rapid growth of cross-border e-commerce and the accelerated evolution of internet-enabled logistics, this business model—integrating traditional foreign trade with the internet—has demonstrated strong growth resilience and transformative potential. According to the 2023 China E-Commerce Market Data Report released by the China e-Business Research Center, China’s cross-border e-commerce market rose 7.32% year-on-year to RMB 16.85 trillion, from RMB 15.7 trillion in 2022, and has become a new driver of the country’s foreign trade growth (China e-Business Research Center, 2024) [

1].

This rapid expansion has placed higher demands on cross-border logistics. However, in many markets, the sector remains at an early stage, characterized by fragmented service capacity, low market concentration, elevated operating costs, and frictions in border procedures—constraints that have become key bottlenecks to scaling cross-border e-commerce (Wang et al., 2021) [

2]. In response, firms increasingly establish supply chain collaborative alliances with domestic and overseas partners and build global logistics operating systems to extend network coverage and accelerate international growth (Hua and Wu, 2024) [

3]. Such alliances are developing steadily in China, with several transnational, enterprise-led cases (e.g., Cainiao Network and Russian Post; JD and Yamato International Logistics). By integrating regional logistics resources worldwide to leverage complementary strengths and meet diverse cross-border e-commerce logistics needs, these alliances have achieved initial success.

The success of a logistics alliance hinges on partner selection, as it demands that partners align on strategic objectives, demonstrate complementary needs and capabilities, and maintain a cooperative orientation (Mamédio et al., 2019) [

4]. However, cross-border logistics enterprises often exhibit significant disparities in strategic objectives, service capabilities, and resource endowments due to national and regional heterogeneity. This heterogeneity not only intensifies information asymmetry during partner selection—prompting many firms to rely merely on preliminary reputation assessments—but also shapes each member’s contribution to the alliance and its strategic standing (Chen et al., 2022) [

5]. In response, priority-based collaboration models have become prevalent in alliance formation:

Resource-sharing (e.g., JD and Amazon Global Store; SF Express International), in which “strong-strong” collaboration aims to optimize resource utilization.

Resource-complementary (e.g., Amazon China; Deppon Logistics; Siqi International Freight Forwarding), in which tripartite cooperation delivers one-stop global e-commerce supply chain services.

Resource-integration (e.g., Alibaba Cainiao Logistics Ecosystem; Amazon FBA Ecosystem), which builds interconnected resource systems to support global logistics fulfillment.

With their high resource integration efficiency and strategic synergy, these models are often prioritized by enterprises seeking long-term cooperative stability (Martin et al., 2018) [

6].

Even with these priority-based collaboration models, the sustainability of cross-border e-commerce logistics alliances remains constrained by two interrelated challenges—rooted precisely in the aforementioned heterogeneity and strategic disparities. First, regional and institutional heterogeneity (a core driver of partner selection difficulties) further manifests in divergent strategic objectives, persistent information asymmetry, and unclear cooperation priorities, ultimately leading to inefficient resource allocation between leading logistics partners and smaller service providers. Second, the absence of a scientific and transparent profit allocation mechanism further exacerbates this instability: many alliances depend on ad hoc negotiations instead of objective evaluations, failing to reflect members’ actual contributions or their strategic significance across different priority models (e.g., a member’s role in resource-sharing versus resource-integration) (Dai et al., 2022) [

7]. These issues are further amplified by cross-border uncertainties—including cultural gaps, regulatory shifts, exchange rate volatility, and even data discontinuities or cooperation disruptions (Zha et al., 2022; Liu and Li, 2020) [

8,

9]—plunging many alliances into a recurring “formation–conflict–dissolution” cycle(Xie and Yin, 2019; Vaez-Alaei et al., 2022) [

10,

11].

However, existing research has not yet adequately addressed these practical challenges. Most profit-allocation models in the cooperative logistics literature treat alliances as homogeneous entities and overlook the hierarchical nature of cooperation. In practice, different alliance structures—ranging from loosely coordinated resource-sharing partnerships to deeply integrated logistics ecosystems—exhibit varying strategic priorities and levels of interdependence. Yet existing approaches rarely capture how these priority hierarchies influence profit distribution, resulting in incentive misalignment and constraining the practical implementability of cooperative schemes. Furthermore, current frameworks often lack sufficient consideration of cross-border operational realities—such as institutional heterogeneity, information asymmetry, and environmental uncertainty—which critically shape alliance behavior and stability in practice.

To bridge these gaps, this study develops a Priority-Based Multi-Objective Linear Programming (P-MOLP) framework that integrates Group Decision-Making (GDM) for quantifying member contributions with hierarchical priority structuring and lexicographic optimization for tiered profit allocation. This hybrid approach enables the model to simultaneously capture contribution heterogeneity and cooperation hierarchies, ensuring both fairness and managerial interpretability within a controllable optimization process. Beyond its methodological innovation, the study contributes to alliance theory by introducing a hierarchical priority perspective that links member-contribution heterogeneity with alliance governance and stability. The numerical results demonstrate that priority-driven optimization enhances both fairness and stability in cross-border logistics alliances, offering actionable guidance for alliance managers to design transparent, incentive-aligned profit-allocation schemes and for policymakers to promote resilient and sustainable cross-border logistics ecosystems.

The remainder of the paper is organized as follows.

Section 2 reviews the related literature and identifies the research gap.

Section 3 examines the vertical integration of cross-border e-commerce logistics supply chains (industry background).

Section 4 develops the contribution-evaluation index system.

Section 5 presents the group decision-making (GDM) procedure for assessing member contributions.

Section 6 formulates the priority-based multiobjective linear programming (P-MOLP) allocation model and analyzes its properties.

Section 7 reports numerical results and comparative analyses.

Section 8 discusses managerial implications, outlines limitations and avenues for future research, and concludes.

2. Literature Review

Research on profit distribution among logistics alliance members has attracted substantial scholarly attention, particularly within the broader domain of supply chain cooperation. Mainstream approaches include contract coordination mechanisms, cooperative-game–based allocation rules such as the Shapley value (and its weighted or modified variants), and multi-objective optimization frameworks.

Early studies focused on classical cooperative-game solutions. Wang et al. (2018) [

12] operationalized members’ core capabilities as resource-input levels via a scoring scheme and applied the Shapley value, the nucleolus, and the core method to achieve reasonable profit allocation in supply chain alliances. Yu et al. (2018) [

13] proposed a multi-factor improved Shapley value to address profit distribution in e-commerce logistics alliances under warehouse-overstock conditions. From a supply chain perspective, Li and Zhao (2019) [

14] analyzed the coordinated development of cross-border e-commerce and cross-border logistics, emphasizing the need for a sound profit-allocation mechanism and institutional safeguards to enhance trust and collaboration. Considering a closed-loop supply chain (CLSC), Zheng et al. (2019) [

15] studied optimal/equilibrium decisions and profits under five non-cooperative and cooperative game models, and introduced a variable-weighted Shapley value to coordinate the CLSC. Yan et al. (2021) [

16] developed a four-party, incomplete-cooperation Stackelberg model for cross-border e-commerce supply chain members and reallocated profits using the Shapley value and a total cooperative-profit-increment sharing mechanism across different cooperation modes. From a value co-creation angle, Wan et al. (2022) [

17] used a Stackelberg framework to model both a traditional e-commerce supply chain and one enhanced with buyer online comment technology (BOCR). They derived optimal decisions and profits under decentralized and centralized structures and proposed investment conditions, cost-sharing, and profit-sharing contracts to achieve coordination. Dai et al. (2022) [

7] found that communication structure matters and proposed a two-stage allocation—vertical-projection + (improved Shapley/A-T), then a fuzzy quality adjustment. Mou (2024) [

18] examined a supply chain composed of a cross-border import e-commerce firm and a third-party integrated overseas-warehouse logistics provider, studying the profit-impact mechanism and the optimization of value-added logistics service levels. Zhu and Liu (2023) [

19] analyzed how cost-sharing mechanisms shape key decisions regarding logistics service workload in live-streaming e-commerce logistics service supply chains (LSE-LSSCs), and designed coordination contracts for service-effort levels using game-theoretic methods. Finally, Meng et al. (2023) [

20] argued that ignoring cooperation constraints and heterogeneous enterprise priorities undermines fairness and rationality in supply chain profit distribution, calling for a revised Shapley-type rule with alliance-condition constraints to preserve cooperative stability.

More recent research expands from single-method cooperative games to multi-criteria a fairness-oriented, and stability-aware mechanisms. Wang, Chen, and Yu (2024) [

21] designed a multi-weight H-Shapley value model for express logistics sharing centers, capturing multidimensional contributions (resources, efficiency, risk). Dai et al. (2024) [

22] proposed a Rule–Utilitarian Core (RUC) mechanism that finds near-core allocations for e-retailer alliances. Zhang et al. (2023) [

23] applied Nash bargaining to multi-energy microgrid coalitions, designing a profit-sharing mechanism that reflects members’ marginal economic and environmental contributions. Liu, Huang, and Feng (2024) [

24] integrated Shapley risk quantification with Nash bargaining. From the stability and mechanism-design perspective, Saygın, Tekin and Kuyzu (2025) [

25] examined cost allocation in collaborative hub networks, comparing Shapley-value and core-based methods, and revealed the inherent tension between fairness and coalition stability when the core is empty. Ni, Feng, and Gou (2023) [

26] analyzed fairness concerns in Nash bargaining under push–pull supply chains, showing that moderate fairness preferences enhance overall stability. Marousi et al. (2024) [

27] proposed a Nash-bargaining-based optimization for industrial gas supply chains, prioritizing fairness before profit maximization. In parallel, research on multi-objective and priority-based optimization has emerged. Yang and Liu (2025) [

28] introduced a fairness-oriented multi-objective mixed-integer model for sustainable supply chain planning under uncertainty, embedding fairness as an explicit optimization goal. Amin-Tahmasbi et al. (2023) [

29] developed a multi-objective integrated optimization model for facility location and order allocation in two-level supply chains, jointly minimizing cost and improving responsiveness. Masruroh et al. (2024) [

30] introduced priority-based multi-objective evolutionary algorithms for green-supply chain network design under disruption risk, explicitly assigning hierarchical importance to cost, emissions, and reliability objectives. Collectively, these studies demonstrate a clear transition from static fairness-based allocation models toward multi-objective, lexicographic, and decision-maker–aware optimization frameworks.

Nevertheless, research on cross-border e-commerce logistics supply chain alliances remains limited. No existing study explicitly incorporates internal cooperation structures (e.g., priority-based coalition forms) into profit allocation design, even though these structures materially influence alliance stability and incentive compatibility (Meng et al., 2023; Wang and Zhu, 2023; Ding and Jian, 2024; Asghari et al., 2022) [

20,

31,

32,

33]. Moreover, existing methods exhibit several shortcomings:

First, to quantify member contributions, the existing literature primarily employs a spectrum of evaluation techniques, ranging from subjective methods—such as AHP, its numerous extensions, and rating-based scoring approaches—to objective methods like TOPSIS, as well as integrated subjective–objective frameworks that seek to combine the advantages of both perspectives. (Dai et al., 2022; Wang et al., 2018; Yu et al., 2018) [

7,

12,

13]. These methods are operable and can yield contribution levels determined by a single expert; however, the contribution index system is a multi-factor decision problem, and evaluations by a single expert often fail to capture this complexity, leading to a nontrivial risk of deviation from reality. Moreover, hybrid evaluation approaches typically require objective metrics, but for cross-border logistics supply chains, such information is expensive or hard to acquire, which restricts their practical use.

Second, within baseline allocation methods, non-cooperative game models chiefly address profit coordination under decentralized decision-making (Wan et al., 2022; Mou, 2024; Zhu and Liu, 2023,Marousi et al., 2024) [

17,

18,

19,

27] and are ill-suited to allocating the total profit of an alliance (grand coalition). Although scholars have used the Shapley value and core-based models to study alliance allocation (Wang et al., 2018; Zheng et al., 2019; Yan et al., 2021; Dai et al., 2024; Saygın et al., 2024) [

12,

15,

16,

22,

25], these frameworks commonly assume equal member status and do not account for heterogeneous contribution and strategic importance—assumptions misaligned with practice. Even improved (weighted) Shapley approaches (Yu et al., 2018; Wang et al., 2024) [

13,

21] may produce individually irrational allocations when expert judgments are extreme. Further, Shapley-type models have limited scope when coalition values are missing for “ineffective” coalitions—common in cross-border settings where members may opt not to cooperate or cooperation may be interrupted by changes in the trade environment—thus leaving payoff characteristics unavailable (Hu, 2018) [

34].

Third, although recent studies have developed multi-objective and fairness-oriented optimization frameworks (Marousi et al., 2024; Yang and Liu, 2025; Amin-Tahmasbi et al., 2023; Masruroh et al., 2024) [

27,

28,

29,

30], these approaches are not yet systematically integrated. They often address cost, efficiency, and fairness objectives in isolation and rarely incorporate expert-based decision inputs, hierarchical cooperation priorities, and coalition stability considerations within a unified allocation framework, which limits their explanatory depth and managerial applicability.

A comparison of these differences with relevant literature is presented in

Table 1.

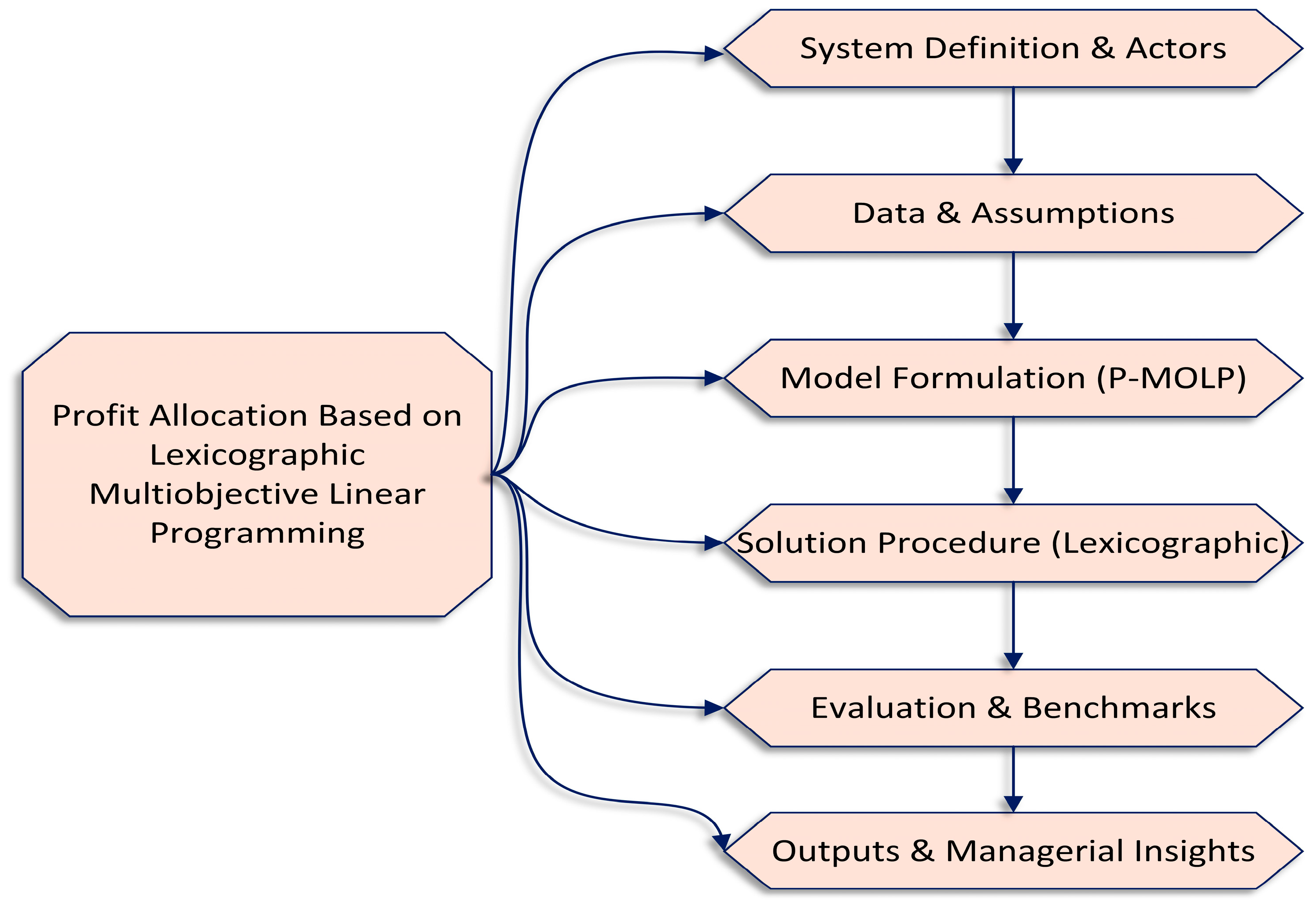

To close these gaps, we propose a linear-programming framework that explicitly integrates cooperation priorities with member contributions (

Figure 1). First, we build a contribution-evaluation index and obtain member weights via group decision-making (GDM). We then rank the candidate cooperation structures by priority based on these weights. We then adopt a priority-based multiobjective linear program in which tiered optimization satisfies high-priority goals first and refines lower-priority ones. The resulting profit-allocation model—Priority-Based Multiobjective Linear Programming (P-MOLP)—enforces individual rationality and budget balance.

Our contributions are threefold:

- (1)

We have developed a unified priority-based multiobjective linear programming (P-MOLP) allocation method that integrates GDM-based contribution evaluation with explicit cooperative priority control in an optimization scheme.

- (2)

We state and prove the key properties of the proposed allocation method—feasibility and boundedness, existence of tiered optima, individual rationality and budget balance, priority-order preservation (monotonicity), and an ε-core approximation.

- (3)

We conduct a comparative evaluation against an ordinary goal programming benchmark and cooperative-game baselines (Shapley, weighted-Shapley, least-core), showing that P-MOLP yields clearer differentiation across cooperation structures and is practically implementable—meeting IR and budget-balance requirements and allowing managers to tune outcomes via priority weights.

This synthesis closes the review and motivates the framework developed in the following sections.

6. Construction of the Multiobjective Linear-Programming Model for Profit Allocation

6.1. P-MOLP Model Formulation

Assume that, in the cooperation process of a cross-border e-commerce logistics supply chain alliance, there are members, with the player set . Let be the characteristic function on coalitions; in particular, . Denote the cooperative game by . For an allocation vector , if it satisfies individual rationality and group efficiency , then is called a rational allocation. Let be the partition of singletons, and let be the family of all coalitions on . Define , i.e., the set of all proper non-singleton coalitions. Then . Since different coalition forms may play different strategic roles, members may choose different cooperation orders, which leads to priority differences among coalitions.

Using goal programming ideas, we introduce priority levels

and, within each level, a coalition-specific priority weight

. We partition

into

disjoint priority classes

such that

,

,

, and denote by

the number of coalitions in class

. The

coalition of level

is written

. Let the total payoff obtained by the members of coalition

be

. In goal programming, the deviation between the allocated sum and the target is captured by the positive and negative deviation variables

and

. The basic balance for each coalition thus reads

To ensure the stability of the grand-coalition cooperation, we prefer the members’ payoffs in the grand coalition to be no less than those attainable in any sub-coalition they belong to; hence, we penalize the negative deviations and make them as small as possible. Taking into account the overall priority level

and the within-level weight

of each coalition, the objective becomes

Given the contribution levels determined earlier, let the members be ordered

in descending contribution. To respect fairness (“more work, more reward”), define each member’s increment relative to standing alone as

, and impose monotonicity

. Combining the above, the priority-based multiobjective linear-programming model (P-MOLP) is:

Here enforces individual rationality, and enforces group efficiency. The constraint means that, in a single allocation round, a member’s payoff in the grand coalition cannot be both higher and lower than the payoff it would obtain in its sub-coalition ; hence, only one of the deviation variables may be nonzero.

With the above linear programming model, profit allocation is carried out by using the priority factors to encode the ordering across different coalition forms, while the within-level weights capture the relative importance of coalitions inside the same priority level. The objective is a weighted sum of deviations; the larger a weight, the more strongly the corresponding deviation is forced to zero, so higher-priority targets are satisfied first.

In particular:

- (i)

If all coalitions are placed in one priority level (), the within-level weights compare their importance and model (5) reduces to Equation (6).

- (ii)

If there are no within-level weights but a clear priority ranking among coalition forms, model (5) reduces to Equation (7).

- (iii)

If there is no priority structure at all, the problem degenerates to a standard coalition profit-allocation problem, and model (5) reduces to Equation (8).

Here denotes the priority weight of the coalition structure at level ; and are its positive and negative deviation variables, respectively.

The determination of the priority factors

and the within-level weights

(applied to the positive/negative deviation terms as needed) is based on the GDM–AHP procedure in

Section 5, which yields the member weight vector

, where

denotes the intrinsic contribution weight of member

The coalition family

contains

proper coalitions. Drawing on resource-dependence theory (Pfeffer and Salancik, 1978) [

38] and the additivity axiom of cooperative games (Shapley, 1953) [

39], members’ inputs into core resources can be treated as linearly additive. Hence, the importance of a coalition—i.e., its priority weight—is computed by linearly summing the contribution weights of the members contained in that coalition:

After determining

, we analyze coalition structures using the hierarchical clustering procedure described in

Section 5. As a widely used tool for data classification and structure identification, hierarchical clustering has been applied to layered design of supply chain alliances, object grouping, and managerial decision-making; its dendrogram offers an intuitive view of multi-level structures (Shokouhyar et al., 2024; Daie and Li, 2016; Wang et al., 2005; Zhang and Wang, 2011) [

40,

41,

42,

43]. In implementation, we cluster coalition forms according to the similarity of their importance, thereby achieving automatic grouping and ranking. This yields the hierarchical partition and the corresponding priority levels

and factors

, providing the theoretical and data foundations for constructing the multi-level profit-allocation model.

6.2. Solution Procedure for the P-MOLP Model

“To ensure lexicographic priority and preserve fairness among coalition levels, the P-MOLP model is solved tier by tier using a sequential linear-programming procedure.”

- (i)

Inputs:

Member set ; feasible coalition family .

Coalition value function for all .

Baselines (for IR links ).

Tier partition .

Tier weights > 0 (normalized within each tier is recommended).

- (ii)

Decision variables

Allocations , gains .

Deviations for all

- (iii)

Common constraints (kept in every tier)

(C1) Budget balance: .

(C2) Coalition equations: .

(C3) IR link: .

(C4) Priority order (strict by a gap): , a small positive constant is used exclusively to enforce the strict priority order among the variables.

(C5) Nonnegativity: .

Tier-p objective: , .

Step 0 (Set up)

Create an LP model with variables () and constraints (C1)–(C5).

Set δ (locking tolerance) and ε (priority gap).

Step 1 (Tier 1)

Set objective: minimize Solve the LP. Record .

Lock 1: add .

Step 2 (Tiers 2…)

For each = 2…:

1. Objective: minimize .

2. Keep all common constraints (C1)–(C5) plus the previously added locks.

3. Solve LP; record .

4. Add lock: .

Step 3 (Output)

- (v)

Final Output:

Allocation vector ;

Increment vector and deviation terms ;

Optimal objective values for each tier .

7. Case Study

Drawing on the literature on the composition of cross-border e-commerce logistics supply chain alliances (Hua and Wu, 2024; Xie and Yin, 2019; Zhang et al., 2024) [

2,

9,

44] and on representative practices at firms such as JD Global, Amazon China, Deppon Logistics, and FedEx, we select the logistics supply chain alliance of a leading cross-border e-commerce platform as the focal case. Based on interviews with the platform’s cross-border logistics manager, the core members of the alliance are categorized as: platform operator

, domestic carrier

, freight forwarder

, and international carrier

. After computing the alliance’s total payoff, we first quantify the contribution of each member via a group decision-making (GDM) evaluation, and then build a multi-priority goal programming model to study profit allocation and test fairness and implementability.

7.2. Multiobjective Linear-Programming Model for Profit Allocation with Cooperation Priorities

Based on enterprise interviews, each alliance member

can either operate independently or form coalitions. The feasible coalition structures and their net payoffs are shown in

Table 4. The payoff data are designed to reflect typical operational characteristics of cross-border e-commerce logistics alliances. Each singleton value

represents the member’s standalone profit capacity determined by its role, cost structure, and control over resources. The platform (

) achieves the highest payoff due to its dominance in transaction aggregation; the international carrier (

) follows, reflecting its cross-border transport capability; while the domestic carrier (

) and freight forwarder (

) earn lower independent profits consistent with their supporting positions in the chain.

Coalition payoffs incorporate scale and coordination synergies—such as information sharing, route optimization, and joint customs handling—ensuring that all non-singleton coalitions satisfy . This construction captures cooperative value enhancement and maintains numerical realism, satisfying the fundamental superadditivity condition at the singleton level and providing a consistent empirical basis for subsequent allocation analysis.

Using the IAHP–based group decision results in

Section 7.1.2, we linearly summed the comprehensive weights of members that appear in each coalition to obtain the coalition importance (priority coefficient,

) for every feasible coalition

. The results are shown in

Table 5.

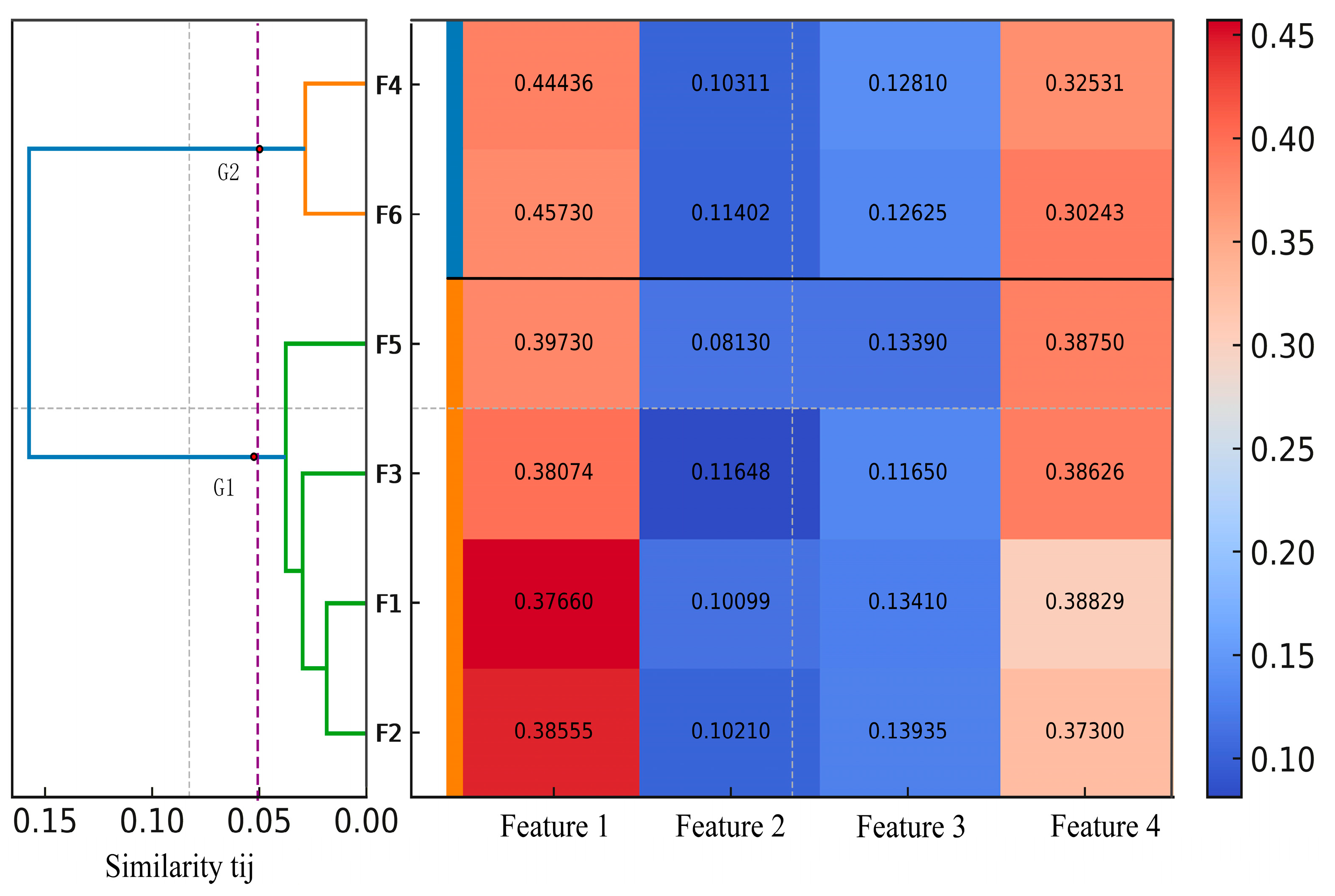

Using hierarchical clustering, we analyze the importance of alliance cooperation structures; the results are shown in

Figure 3. The

x-axis shows the pairwise similarity

between coalition structures, and the

y-axis reports the importance level of the coalition structures.

To quantitatively identify the most representative tier configuration, the clustering results were examined across a sequence of threshold intervals.

Table 6 summarizes how different threshold values affect the number of tiers and the resulting coalition grouping patterns, while

Table 7 further characterizes their structural properties.

First, let us examine how different threshold intervals influence the formation of tiers, coalition groupings, and their structural characteristics. Through this comparison, we observe that the clustering configuration evolves systematically with the similarity threshold: as the threshold increases, alliances gradually merge from fine-grained to coarse structures.

Within this process, the configuration around emerges as particularly representative—showing both statistical stability and managerial interpretability. The hierarchical clustering reveals a stable five-tier structure within , where alliances in the same tier share homogeneous importance patterns, while those across tiers differ substantially.

Correspondingly, these tiers align well with the practical typology of cross-border logistics alliances:

P1 (,): Strategic core alliances (resource-integration type);

P2 (): High-value bilateral cooperation (resource-complementary)

P3 (,): Potential tri-party partnerships (emerging complementary);

P4 (,,,): Operational-level collaborations (resource-sharing);

P5 (): Peripheral cooperation (transactional sharing).

This hierarchy captures both quantitative differentiation and managerial logic, illustrating how varying cooperation depths—from resource sharing to full integration—naturally translate into ordered priority tiers. In summary, the five-tier structure within achieves an optimal balance between statistical stability and managerial explicability.

Using the minimization model in (5) together with the coalition-revenue data in

Table 4, we build the following linear program for profit allocation:

We solve the model using a preemptive (lexicographic) goal-programming procedure implemented in LINGO 17. At the computed optimum, all negative-deviation variables are driven to zero (i.e.,

), while the solver reports the corresponding positive deviations

; the optimal objective value is

.

Accordingly, the optimal profit allocation for the four members of the cross-border e-commerce logistics supply chain alliance is:

- (1)

platform : 49.0

- (2)

domestic logistics firm : 16.0

- (3)

freight forwarder : 19.0

- (4)

international logistics firm : 40.0

To give readers a more intuitive comparison, the payoff vectors produced by different profit-allocation methods are listed in

Table 8, and the corresponding computational procedures are provided in

Appendix B.

7.3. Comparative Analysis of Results

From

Table 8, the P-MOLP allocation (which incorporates alliance priorities and weight coefficients) assigns larger payoffs to members

and

, and smaller payoffs to

and

. This reflects that, when operating independently,

and

earn higher revenues and have higher composite contributions (comprehensive weights) within the alliance, whereas

and

contribute less overall. The allocations are therefore consistent with actual operations and satisfy the “more contribution, more reward” principle. As shown in

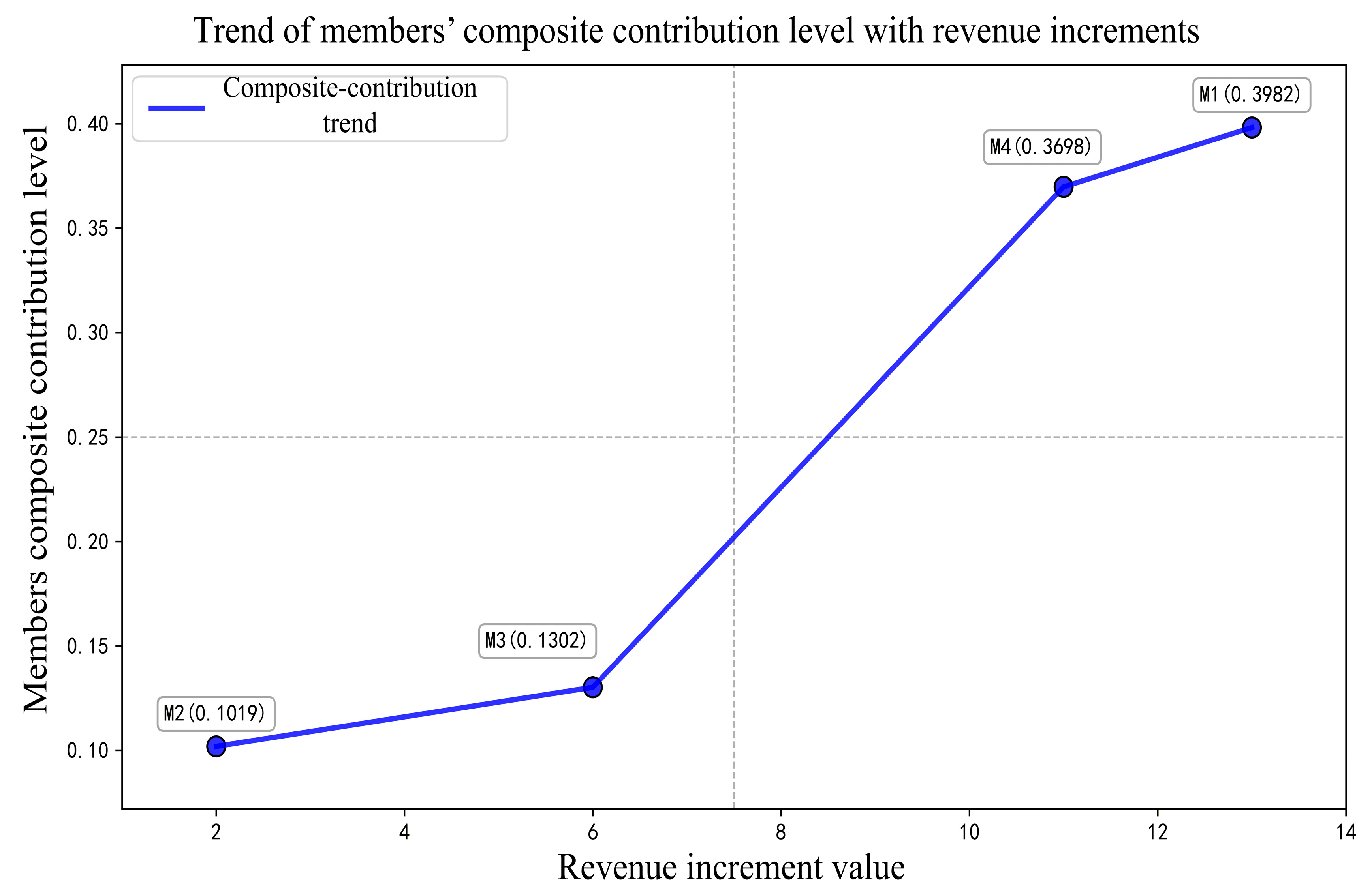

Figure 4, the increase in members’ benefits after forming the grand alliance follows:

which matches the ranking of their composite contributions, indicating that the allocation results are fairer.

Comparing P-MOLP with the ordinary goal programming model (which does not account for cooperation priority or weight coefficients) shows that P-MOLP yields clearer differentiation. Because and have higher comprehensive contributions and more central roles, the coalition structures they join are of higher priority and thus deliver higher benefits; the opposite holds for and .

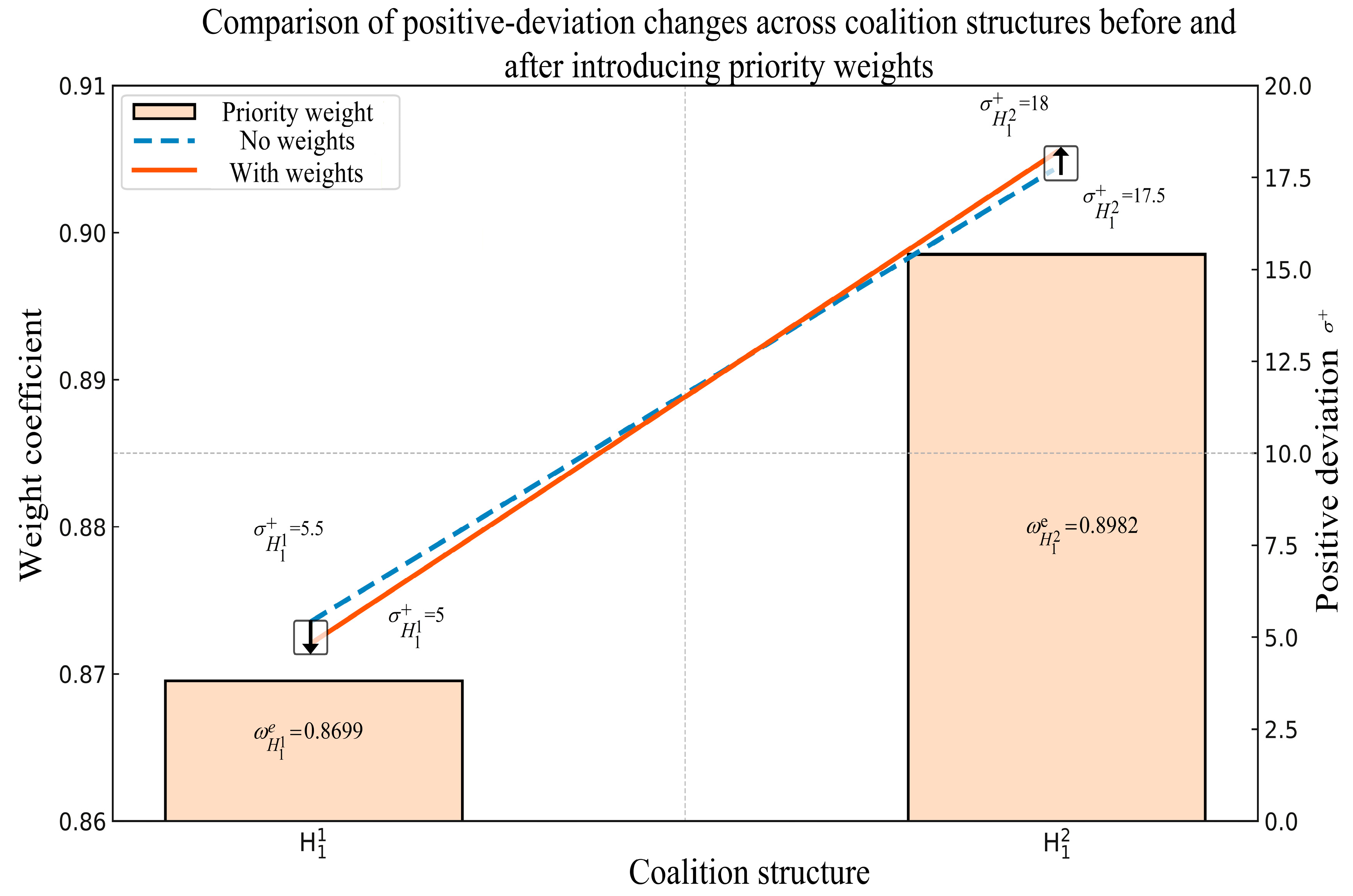

We also compare two P-MOLP variants—with and without weight coefficients. As illustrated in

Figure 5, some bias appears in the allocation results, especially at the first-priority level. After introducing weight coefficients, the positive deviation variables change from

Since the importance weight of is 0.8699, and that of is 0.8982, is more important; accordingly, the positive deviation allocated to the more important structure increases while that for the less important structure decreases. This shift indicates that introducing weight coefficients enhances the separation of allocation outcomes across coalition structures, improving both the reasonableness and sensitivity of the scheme.

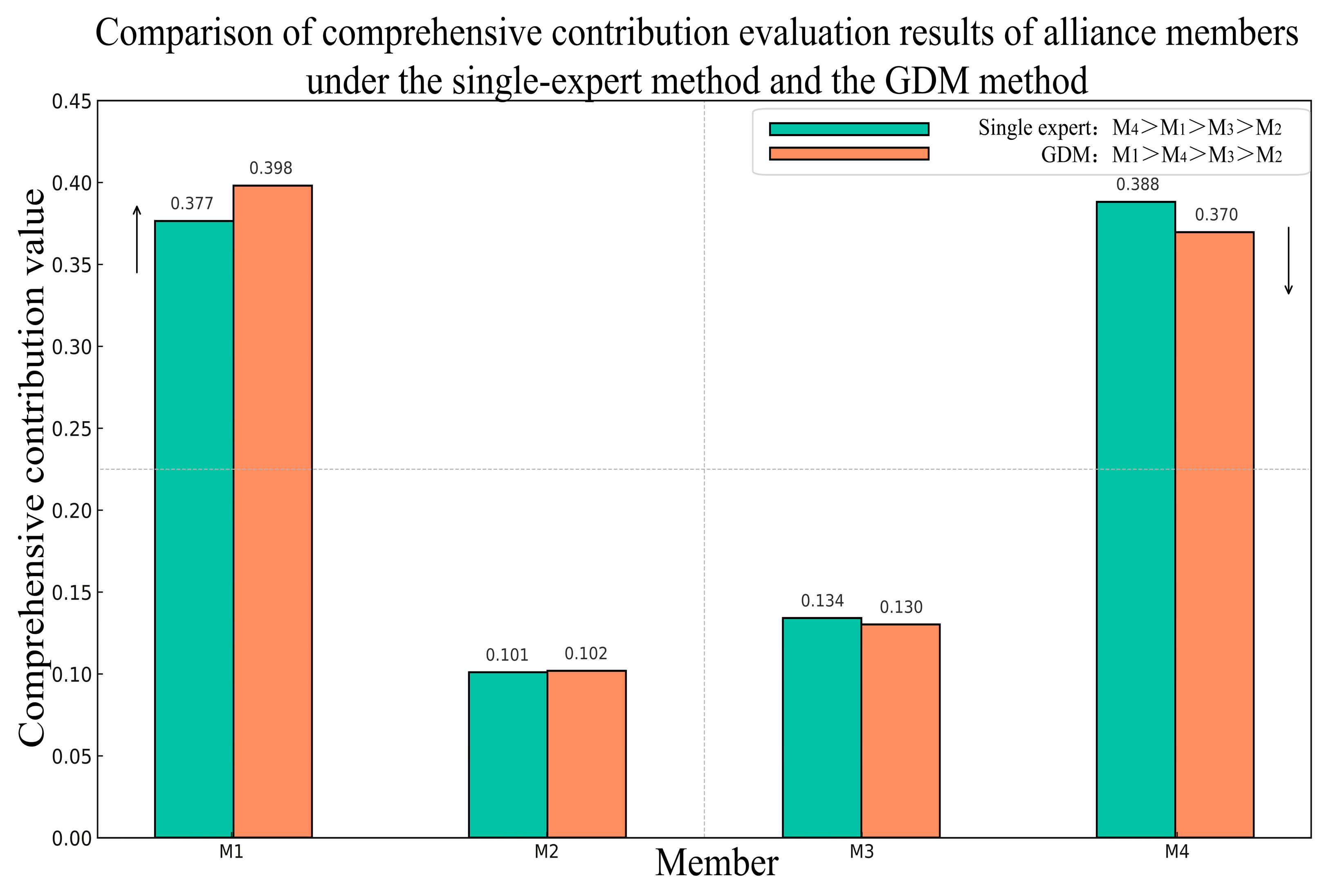

Combining the single-expert and group decision-making (GDM) schemes, we compare the composite contribution weights of members. As shown in

Figure 6, under GDM, the weight of

exceeds that of

; under the single-expert IAHP, however, the ranking is reversed. Even small differences in these weights can change the ordering of priority weights, which in turn produces sizable differences in the final profit-allocation outcomes. Hence, determining composite contribution weights via the GDM-based IAHP—by pooling the judgments of multiple experts—yields a more comprehensive decision and better reflects alliance reality.

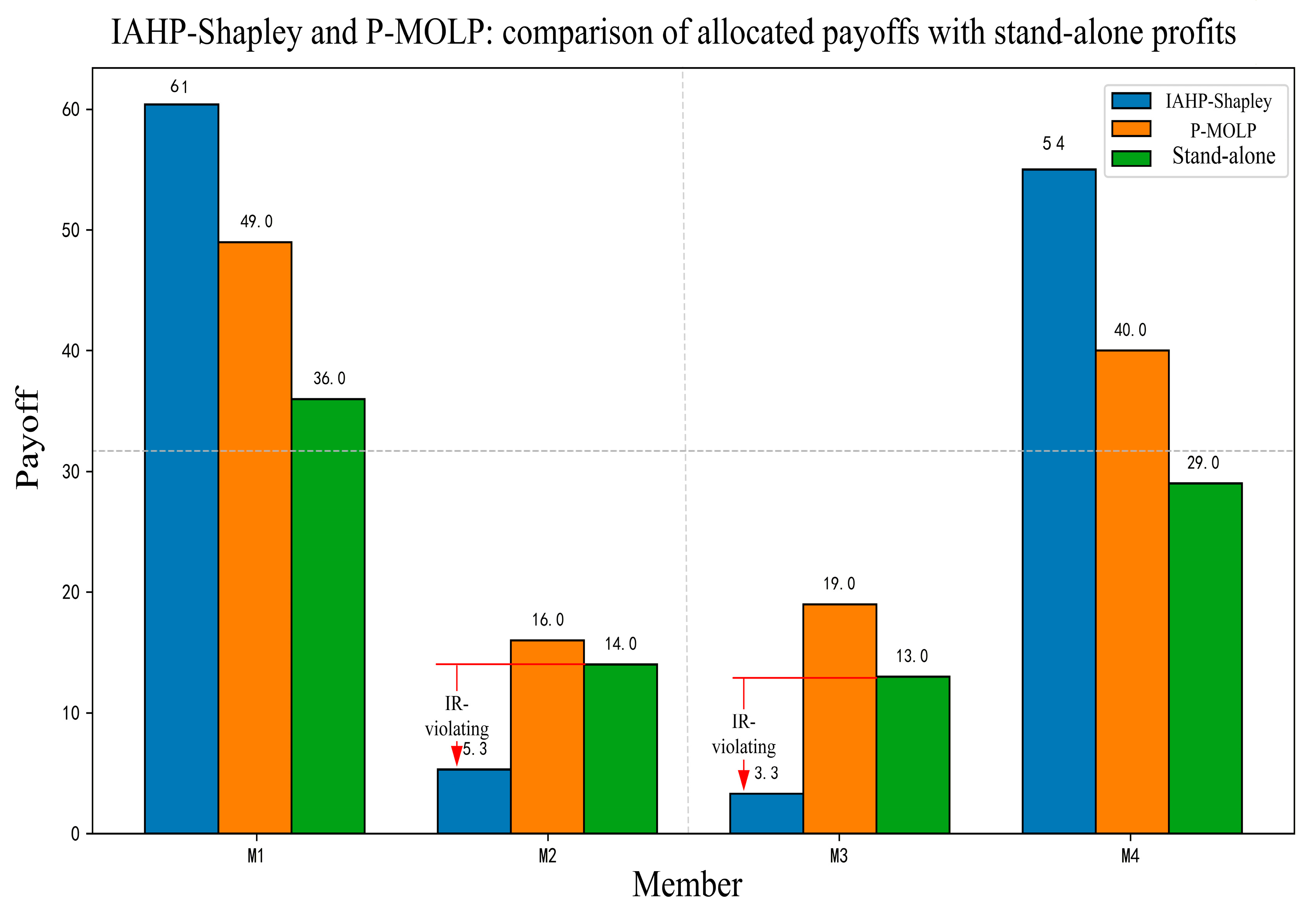

Comparing the P-MOLP with the Shapley allocation shows that, because the Shapley scheme assumes equal status among members and ignores cooperation-priority structures, its results do not sufficiently differentiate coalition patterns. Given that member has a higher overall contribution than , the increase in ’s allocated payoff under P-MOLP is larger than that of ; the plain Shapley allocation cannot reflect such differences in comprehensive contribution.

Moreover, many studies propose “modified-Shapley” variants (Yu et al., 2018; Zhang, 2018; Ma et al., 2020; Fang et al., 2020; Liu et al., 2021; Wang et al., 2023) [

13,

45,

46,

47,

48,

49]. Using IAHP-Shapley as an example,

Figure 7 shows that the payoffs allocated to

and

within the alliance are lower than their stand-alone profits, violating individual rationality. The reason is the strong subjectivity in expert judgments, which can drive some weights to extremes and lead to overly large corrections. Only when the coalition’s total profit is sufficiently high will all members’ final payoffs satisfy individual rationality. Hence, such methods can be limited in practice, whereas the proposed P-MOLP, by enforcing individual-rationality constraints, avoids this problem effectively.

Meanwhile, Shapley-value–type methods average over all possible coalition structures. In practice, however, capability heterogeneity among members and differences in culture, region, and economic policies in cross-border logistics often make some coalitions infeasible or cause cooperation to be interrupted. In such cases, those methods fail to produce valid allocations. The proposed priority-based multiobjective linear programming model addresses this issue: when a coalition is infeasible, the corresponding constraints can be deactivated during optimization, so the rest of the model proceeds without being affected.

Finally, we compare with the core approach. The core yields allocations that satisfy both collective and individual rationality and therefore have some practical value, but its solutions are generally non-unique. More importantly, it does not consider cooperation-priority structures or differences in member contributions, so it inherits the same limitations as the Shapley family. By contrast, the proposed P-MOLP, built on individual- and group-rationality constraints, admits ε-core stability under general conditions (see Proposition 6) and remains effective even when the core is empty. It also accounts for member importance and contribution levels, conforms to the “more work, more reward” principle, and delivers solutions with broader applicability and better realism.

8. Discussion, Implications, and Conclusion

8.2. Limitations and Future Research

This study has several limitations that also point to meaningful directions for future research.

First, when solving the multi-priority optimization model, the sensitivity of allocations to intra-tier priority weights gradually weakens at lower priority levels. This is not a modeling flaw but an inherent feature of lexicographic optimization: once upper-tier objectives are fully satisfied, lower-tier weights can only adjust within a highly restricted feasible region. Such dominance of hierarchical priorities reflects a balanced managerial logic in strongly tiered systems—such as cross-border e-commerce logistics alliances—where strategic stability provides the foundation for sustainable cooperation, and fairness refinements operate as complementary mechanisms that fine-tune equilibrium outcomes. Nevertheless, this strict hierarchy inevitably limits the influence of intra-tier weights. Future research may therefore introduce tolerance-based or relaxed lexicographic formulations to enhance the responsiveness of lower-tier objectives while maintaining upper-tier priority consistency.

Second, although the current framework estimates member contributions and filters infeasible coalition structures through static constraints, it still adopts a static perspective on cooperation. In reality, alliance formation is dynamic and adaptive, influenced by shifting policies, evolving trust, partner reputation, and cross-border institutional frictions. To capture this complexity, a Dynamic P-MOLP framework can be developed to couple static profit allocation with coalition evolution. Specifically, such an extension would:

- (1)

Assign each feasible coalition a time-dependent formation probability , evolving through Bayesian learning, Markov transitions, or replicator dynamics;

- (2)

represents the cooperation network as a weighted graph , where edge weights denote cooperative intensity, allowing network measures (e.g., edge density, clustering, modularity) to inform optimization constraints;

- (3)

Re-solve the allocation problem iteratively as the network evolves, yielding a time-dependent allocation trajectory that converges to a dynamic equilibrium.

This dynamic coupling scheme is computationally tractable for small- and medium-scale coalition systems and significantly enhances the robustness and realism of P-MOLP. It provides a theoretical foundation for linking static fairness optimization with dynamic coalition evolution, enabling the integrated analysis of alliance stability, fairness, and cooperative intensity under uncertainty—offering a promising and practically relevant direction for future research on cross-border e-commerce logistics systems.

Third, the framework assumes that alliance members provide accurate and unbiased information regarding their contributions, including resource inputs, service capacities, and exposure to operational risks. In practice, however, some members may unintentionally or strategically misreport such information—for instance, by emphasizing their pivotal roles or underestimating costs—to improve their perceived importance in allocation outcomes. These reporting deviations may affect the fairness and credibility of P-MOLP results. To address this issue, future research should consider incorporating incentive-compatible mechanisms that align reported contributions with verifiable performance indicators (e.g., order-fulfillment efficiency or cost-reduction rates) and draw on mechanism design theory to promote truthful reporting as the equilibrium behavior among participants.

Fourth, the framework does not explicitly account for transaction costs incurred during implementation, such as those associated with organizing expert panels for GDM evaluation, negotiating cooperation priorities and incentive schemes, or monitoring compliance with allocation results. These administrative and coordination costs can be non-negligible—especially in cross-border contexts characterized by regulatory diversity, cultural distance, and geographical dispersion. Future studies could quantify such costs empirically (e.g., through surveys of cross-border logistics alliances) and incorporate them into the optimization process, either as penalty components within the objective function or as constraints on the feasible allocation budget.

Collectively, addressing these limitations would enhance the robustness of the framework and broaden its applicability to dynamic, information-asymmetric, and transaction-cost-sensitive alliance environments. By integrating mechanisms that discourage strategic manipulation, incorporating dynamic coalition evolution, and accounting for transaction costs, future extensions of the P-MOLP framework can more faithfully capture the behavioral and institutional complexities of cross-border e-commerce logistics alliances, thereby reinforcing its theoretical rigor and managerial relevance.