Tokenized Markets Using Blockchain Technology: Exploring Recent Developments and Opportunities

Abstract

1. Introduction

2. Basic Concepts and Conceptual Schemas

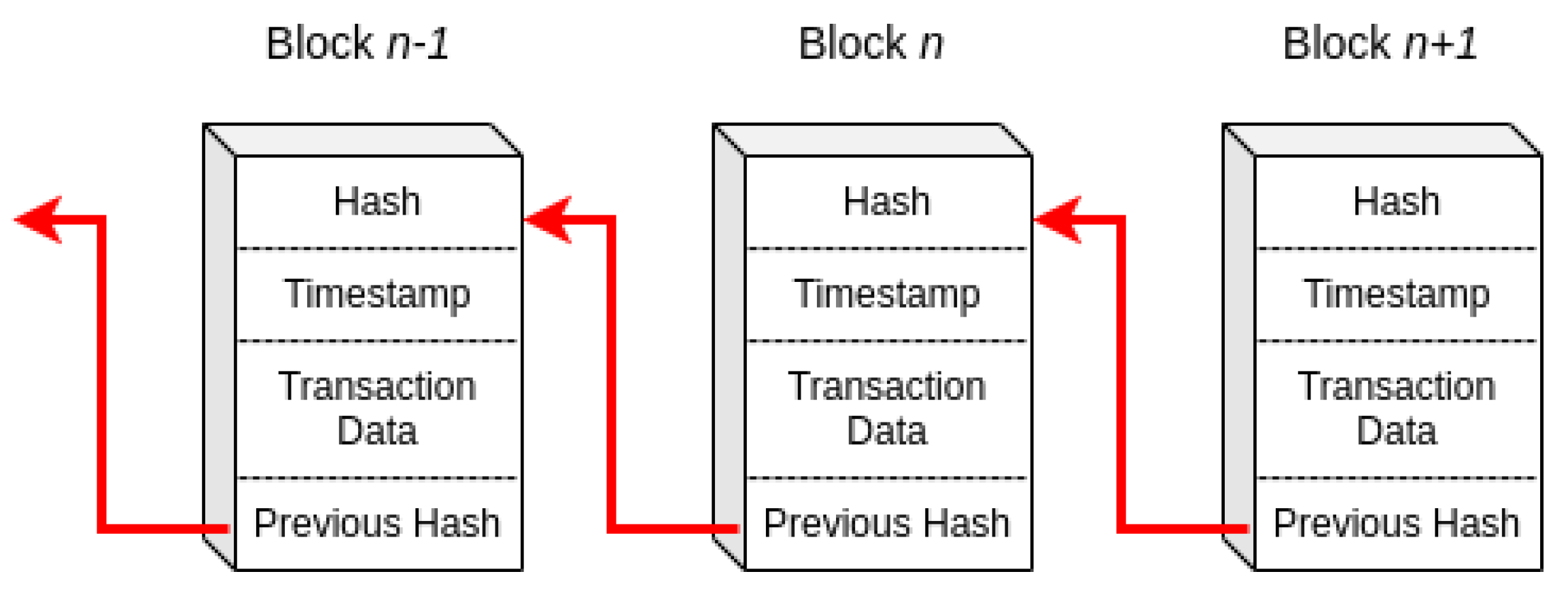

2.1. Blockchain

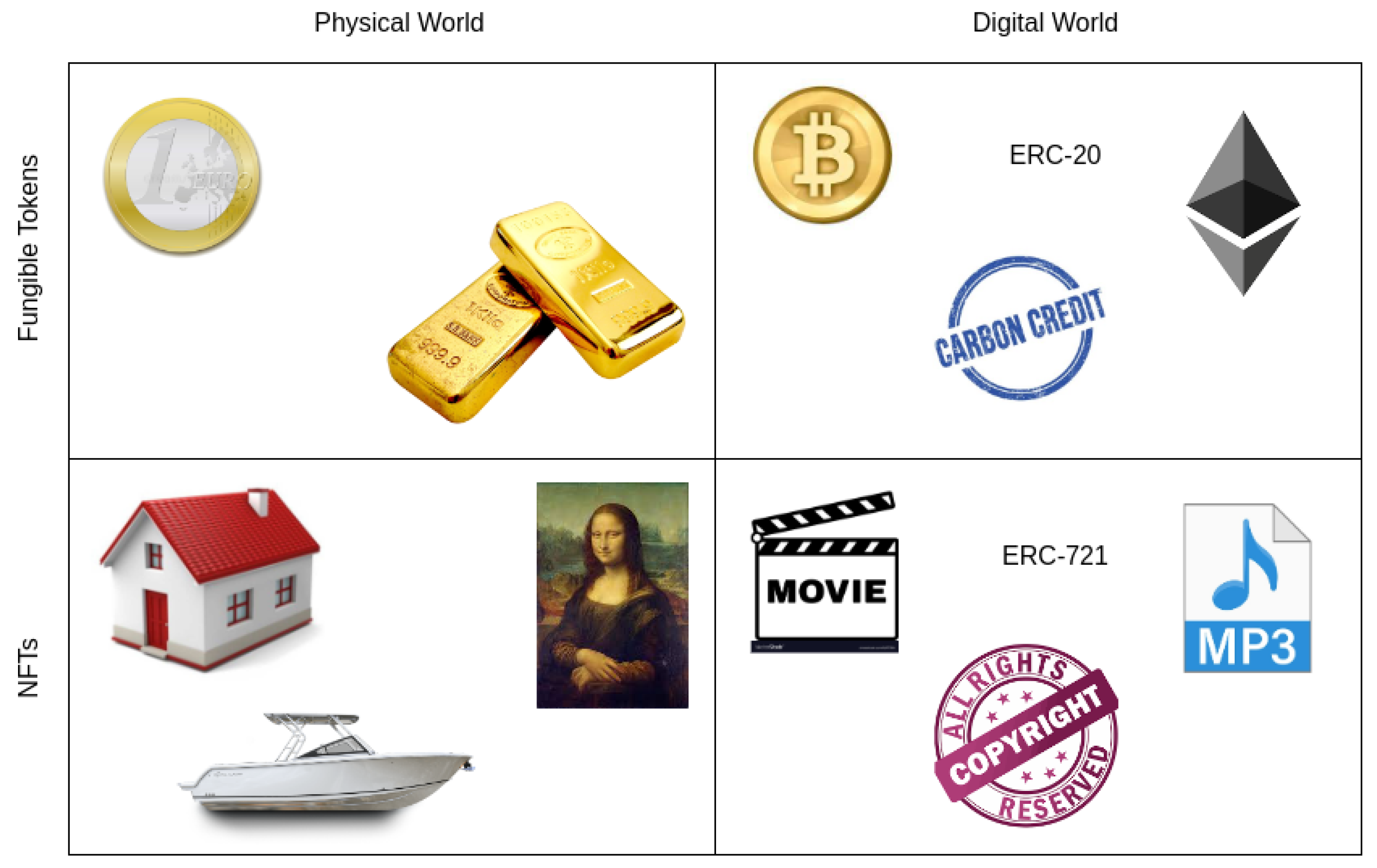

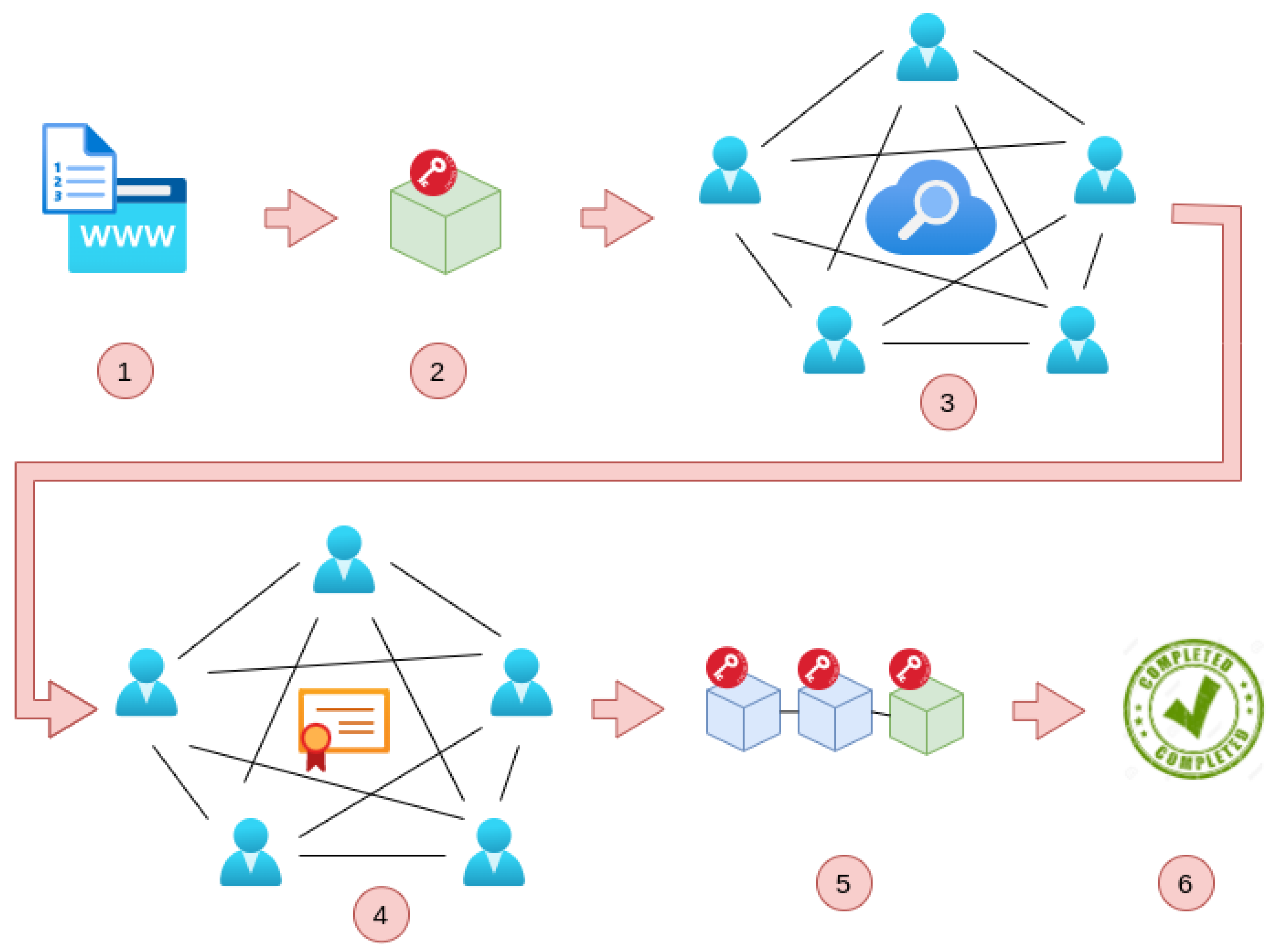

2.2. Smart Contracts and Tokenization

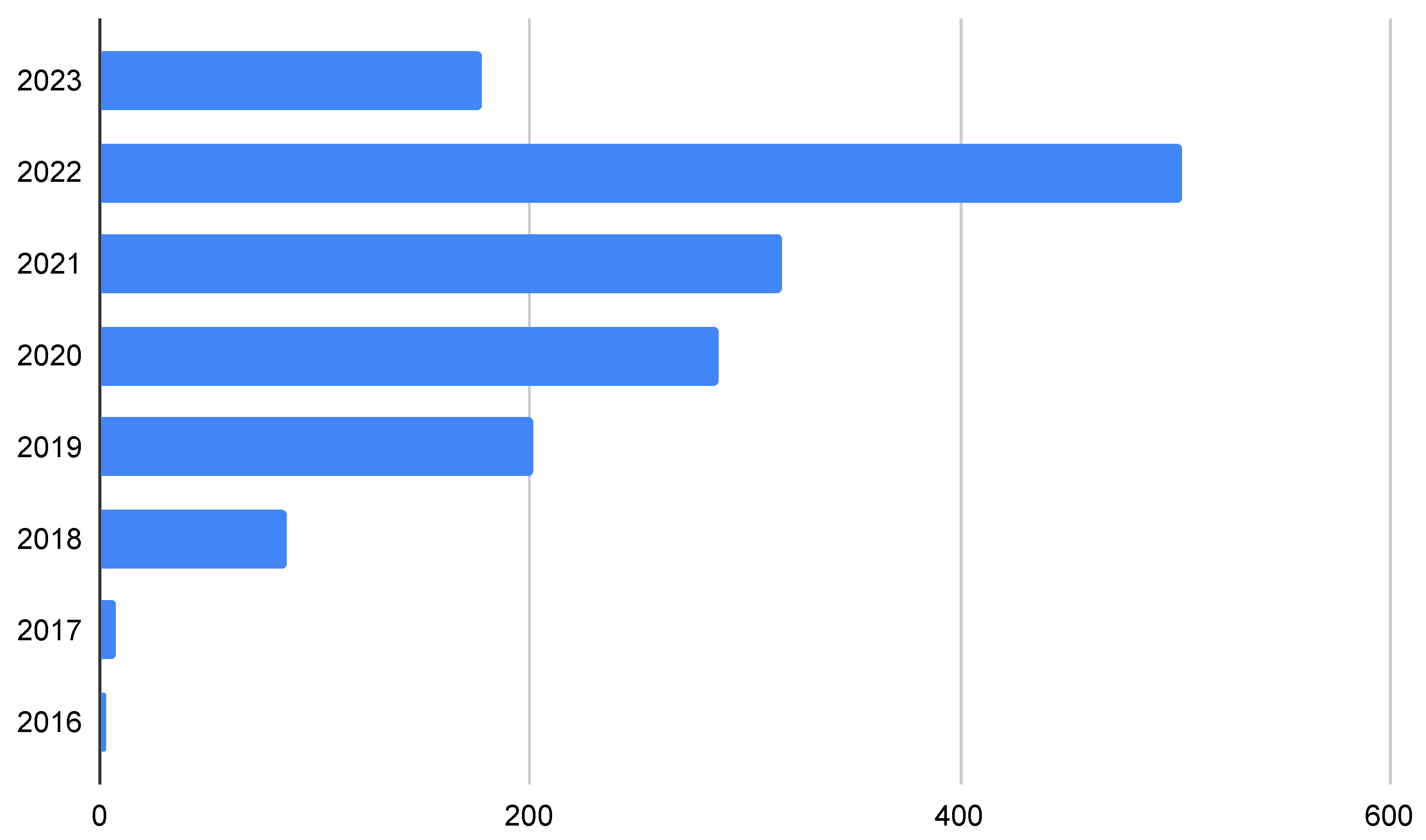

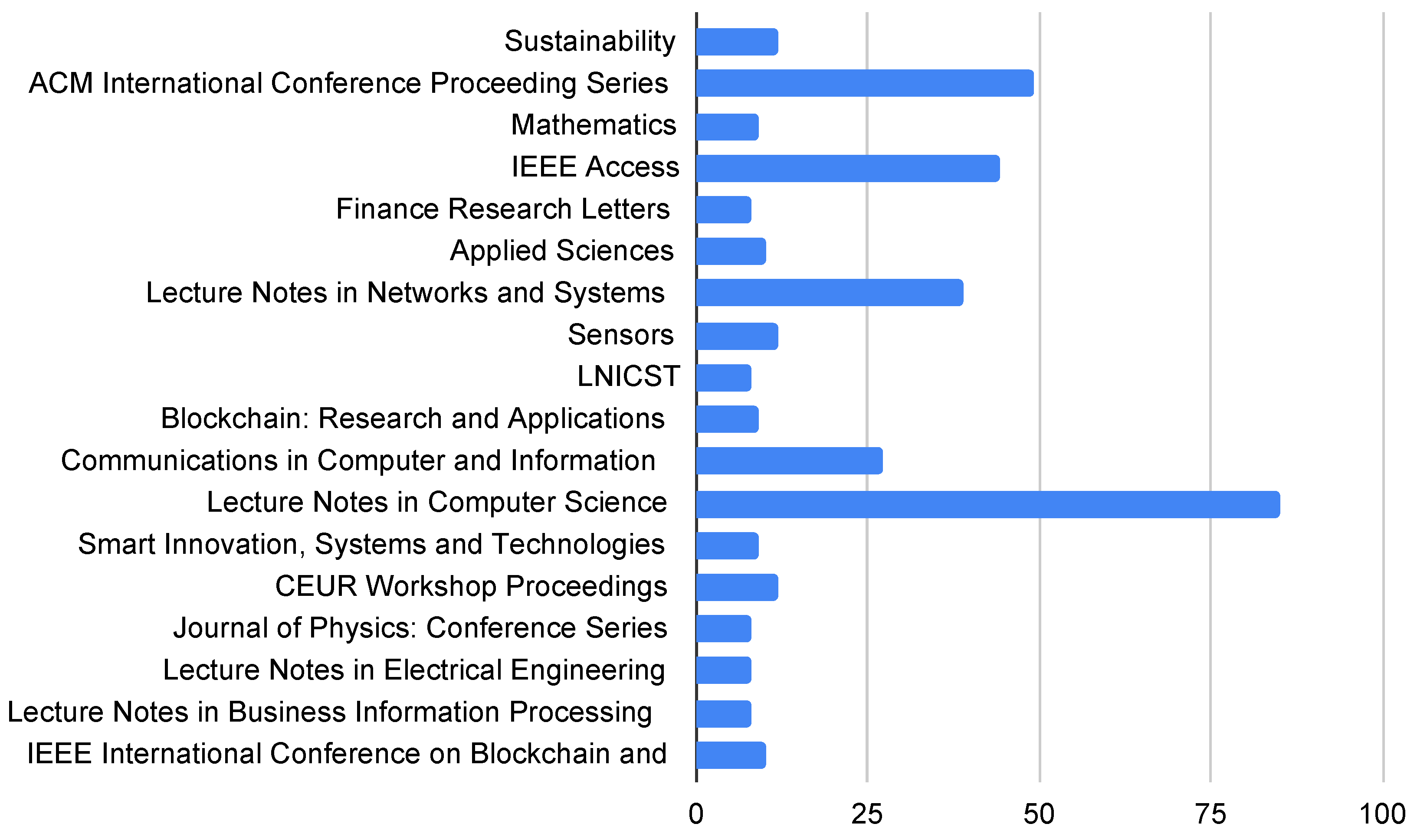

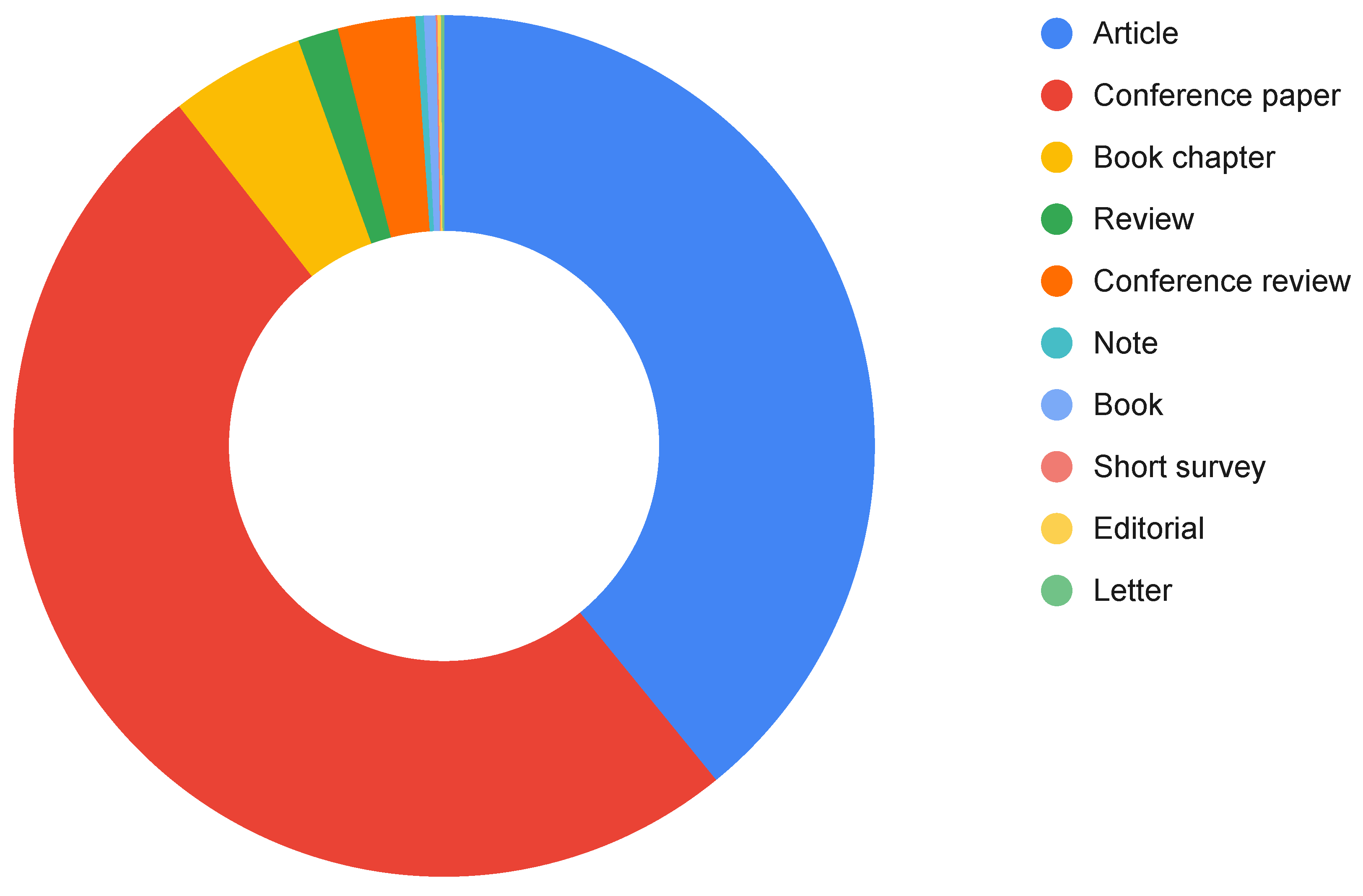

3. Review Methodology

- What are the benefits and drawbacks of tokenized platforms for exchanging digital assets? Semantic fields: Design, token, digital assets.

- What are the key factors of a distributed data management infrastructure? Semantic fields: Data management, distributed systems, infrastructure.

- What are the best practices associated with the implementation of tokenized platforms? Semantic fields: Implementation, tokenization, best practices.

- What are the tools for fighting cyber threats? Semantic fields: Machine learning, cyber-threat detection, cybersecurity tools.

- What are the main trends and challenges associated with tokenized markets? Semantic fields: Market trends, tokenization, challenges.

4. Design of Tokenized Platforms for Exchange of Digital Assets

- Bitbond (https://www.bitbond.com/, accessed on 2 May 2023): A peer-to-peer lending platform that uses blockchain technology to facilitate cross-border lending. It allows borrowers to access loans from investors globally using digital currencies such as Bitcoin.

- TrustToken (https://www.trusttoken.com/, accessed on 2 May 2023): A platform that enables the creation of asset-backed tokens. These tokens are backed by real-world assets, such as currencies or commodities, and can be traded on various exchanges.

- Harbor (https://goharbor.io/, accessed on 2 May 2023): A platform that streamlines the process of investing in private securities by using blockchain technology. It allows issuers to digitize their securities and investors to access and trade these securities in a secure and compliant manner.

- Polymath (https://polymath.network/, accessed on 2 May 2023): A platform that enables the creation of security tokens, which are digital tokens that represent ownership of a traditional security, such as stocks or bonds. It provides tools for issuers to create, issue, and manage security tokens in compliance with relevant regulations.

- Securitize (https://securitize.io/, accessed on 2 May 2023): A platform that specializes in the issuance and management of security tokens. It enables issuers to create and manage compliant security tokens and provides investors with a transparent and secure platform to buy and sell these tokens.

5. Distributed Data Management Infrastructure

6. Implementing Tokenized Platforms: Best Practices

7. AI Tools for Cyber-Threat Detection

8. Case Study: Axie Infinity and Solbeatz—Leveraging Blockchain Technology for Tokenized Markets

9. Trends and Challenges of Tokenized Markets

- Real estate: Tokenized real estate allows for fractional ownership of property, increasing liquidity for an otherwise non-liquid asset. By buying and selling tokens representing a share of the property, investors can bypass intermediaries such as brokers and reduce transaction costs.

- Commodities: Tokenized commodities enable investors to trade fractions of assets such as gold, silver, and oil, providing easier exposure to these assets without the need for physical ownership.

- Currencies: Tokenized currencies represent fiat currencies in digital form and can be used for cross-border payments, reducing the time and costs associated with traditional currency exchanges.

- Loyalty programs: Loyalty programs can use blockchain to offer more flexible and valuable rewards, such as those offered by Loyyal (https://loyyal.com/, accessed on 2 May 2023). Tokens allow customers to use their points across multiple programs and earn rewards beyond just purchases.

- Identity verification: Civic’s blockchain platform (https://www.civic.com/, accessed on 2 May 2023) allows individuals to securely prove their identity without sharing sensitive information with third parties. This has the potential to revolutionize industries such as finance, healthcare, and government.

- Digital gold: Platforms such as Rush Gold (https://rush.gold/, accessed on 2 May 2023) use blockchain to enable users to invest in digital gold, offering a secure and transparent way to invest in this traditional store of value and hedge against inflation.

10. Conclusions and Future Work

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Di Pierro, M. What is the blockchain? Comput. Sci. Eng. 2017, 19, 92–95. [Google Scholar] [CrossRef]

- Zheng, Z.; Xie, S.; Dai, H.N.; Chen, X.; Wang, H. Blockchain challenges and opportunities: A survey. Int. J. Web Grid Serv. 2018, 14, 352–375. [Google Scholar] [CrossRef]

- Monrat, A.A.; Schelén, O.; Andersson, K. A survey of blockchain from the perspectives of applications, challenges, and opportunities. IEEE Access 2019, 7, 117134–117151. [Google Scholar] [CrossRef]

- Steinmetz, F.; Von Meduna, M.; Ante, L.; Fiedler, I. Ownership, uses and perceptions of cryptocurrency: Results from a population survey. Technol. Forecast. Soc. Chang. 2021, 173, 121073. [Google Scholar] [CrossRef]

- Sazandrishvili, G. Asset tokenization in plain English. J. Corp. Account. Financ. 2020, 31, 68–73. [Google Scholar] [CrossRef]

- Bala, R. Tokenization of Assets. In Handbook on Blockchain; Springer: Berlin/Heidelberg, Germany, 2022; pp. 577–602. [Google Scholar]

- Zheng, M.; Sandner, P. Asset Tokenization of Real Estate in Europe. In Blockchains and the Token Economy: Theory and Practice; Springer: Berlin/Heidelberg, Germany, 2022; pp. 179–211. [Google Scholar]

- Garcia-Teruel, R.M.; Simón-Moreno, H. The digital tokenization of property rights. A comparative perspective. Comput. Law Secur. Rev. 2021, 41, 105543. [Google Scholar] [CrossRef]

- Moher, D.; Liberati, A.; Tetzlaff, J.; Altman, D.G.; Group, P. Reprint—Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. Phys. Ther. 2009, 89, 873–880. [Google Scholar] [CrossRef]

- Lee, D.D.; Seung, H.S. Learning the parts of objects by non-negative matrix factorization. Nature 1999, 401, 788–791. [Google Scholar] [CrossRef]

- Heines, R.; Dick, C.; Pohle, C.; Jung, R. The Tokenization of Everything: Towards a Framework for Understanding the Potentials of Tokenized Assets. In Proceedings of the PACIS, Virtual, 12–14 July 2021; p. 40. [Google Scholar]

- Freni, P.; Ferro, E.; Moncada, R. Tokenomics and blockchain tokens: A design-oriented morphological framework. Blockchain Res. Appl. 2022, 3, 100069. [Google Scholar] [CrossRef]

- Guggenberger, T.; Schellinger, B.; von Wachter, V.; Urbach, N. Kickstarting blockchain: Designing blockchain-based tokens for equity crowdfunding. Electron. Commer. Res. 2023, 1–35. [Google Scholar] [CrossRef]

- Warren, J.; Marz, N. Big Data: Principles and Best Practices of Scalable Realtime Data Systems; Simon and Schuster: New York, NY, USA, 2015. [Google Scholar]

- Van Steen, M.; Tanenbaum, A.S. Distributed Systems; Maarten van Steen: Leiden, The Netherlands, 2017. [Google Scholar]

- Moysiadis, V.; Sarigiannidis, P.; Moscholios, I. Towards distributed data management in fog computing. Wirel. Commun. Mob. Comput. 2018, 2018, 7597686. [Google Scholar] [CrossRef]

- Ahmed, N.; Barczak, A.L.; Susnjak, T.; Rashid, M.A. A comprehensive performance analysis of Apache Hadoop and Apache Spark for large scale data sets using HiBench. J. Big Data 2020, 7, 110. [Google Scholar] [CrossRef]

- Scerri, S.; Tuikka, T.; de Vallejo, I.L.; Curry, E. Common European Data Spaces: Challenges and Opportunities. Data Spaces Des. Deploy. Future Dir. 2022, 337–357. [Google Scholar] [CrossRef]

- European Commission. Towards a Common European Data Space; European Commission: Brussels, Belgium, 2018. [Google Scholar]

- Khan, N.; Kchouri, B.; Yatoo, N.A.; Kräussl, Z.; Patel, A.; State, R. Tokenization of sukuk: Ethereum case study. Glob. Financ. J. 2022, 51, 100539. [Google Scholar] [CrossRef]

- Tian, Y.; Minchin, R.; Chung, K.; Woo, J.; Adriaens, P. Towards Inclusive and Sustainable Infrastructure Development through Blockchain-enabled Asset Tokenization: An Exploratory Case Study. IOP Conf. Ser. Mater. Sci. Eng. 2022, 1218, 012040. [Google Scholar]

- Zarifis, A.; Cheng, X. The business models of NFTs and fan tokens and how they build trust. J. Electron. Bus. Digit. Econ. 2022; ahead-of-print. [Google Scholar] [CrossRef]

- Calandra, D.; Secinaro, S.; Massaro, M.; Dal Mas, F.; Bagnoli, C. The link between sustainable business models and Blockchain: A multiple case study approach. Bus. Strategy Environ. 2022, 32, 1403–1417. [Google Scholar] [CrossRef]

- Benedetti, H.; Rodríguez-Garnica, G. Tokenized Assets and Securities. In The Emerald Handbook on Cryptoassets: Investment Opportunities and Challenges; Emerald Publishing Limited: Bingley, UK, 2023; pp. 107–121. [Google Scholar]

- Kopp, A.; Orlovskyi, D. Towards the Tokenization of Business Process Models using the Blockchain Technology and Smart Contracts. CMIS 2022, 3137, 274–287. [Google Scholar]

- Buldas, A.; Draheim, D.; Gault, M.; Laanoja, R.; Nagumo, T.; Saarepera, M.; Shah, S.A.; Simm, J.; Steiner, J.; Tammet, T.; et al. An ultra-scalable blockchain platform for universal asset tokenization: Design and implementation. IEEE Access 2022, 10, 77284–77322. [Google Scholar] [CrossRef]

- Mazzei, D.; Baldi, G.; Fantoni, G.; Montelisciani, G.; Pitasi, A.; Ricci, L.; Rizzello, L. A Blockchain Tokenizer for Industrial IOT trustless applications. Future Gener. Comput. Syst. 2020, 105, 432–445. [Google Scholar] [CrossRef]

- Hubballi, N.; Suryanarayanan, V. False alarm minimization techniques in signature-based intrusion detection systems: A survey. Comput. Commun. 2014, 49, 1–17. [Google Scholar] [CrossRef]

- Buczak, A.L.; Guven, E. A survey of data mining and machine learning methods for cyber security intrusion detection. IEEE Commun. Surv. Tutor. 2015, 18, 1153–1176. [Google Scholar] [CrossRef]

- Shaukat, K.; Luo, S.; Chen, S.; Liu, D. Cyber threat detection using machine learning techniques: A performance evaluation perspective. In Proceedings of the 2020 International Conference on Cyber Warfare and Security (ICCWS), Norfolk, VA, USA, 12–13 March 2020; pp. 1–6. [Google Scholar]

- Apruzzese, G.; Colajanni, M.; Ferretti, L.; Guido, A.; Marchetti, M. On the effectiveness of machine and deep learning for cyber security. In Proceedings of the 2018 10th International Conference on Cyber Conflict (CyCon), Tallinn, Estonia, 29 May–1 June 2018; pp. 371–390. [Google Scholar]

- Miller, S.T.; Busby-Earle, C. Multi-perspective machine learning a classifier ensemble method for intrusion detection. In Proceedings of the 2017 International Conference on Machine Learning and Soft Computing, Ho Chi Minh City, Vietnam, 13–16 January 2017; pp. 7–12. [Google Scholar]

- Narudin, F.A.; Feizollah, A.; Anuar, N.B.; Gani, A. Evaluation of machine learning classifiers for mobile malware detection. Soft Comput. 2016, 20, 343–357. [Google Scholar] [CrossRef]

- Gauthama Raman, M.; Somu, N.; Jagarapu, S.; Manghnani, T.; Selvam, T.; Krithivasan, K.; Shankar Sriram, V. An efficient intrusion detection technique based on support vector machine and improved binary gravitational search algorithm. Artif. Intell. Rev. 2020, 53, 3255–3286. [Google Scholar] [CrossRef]

- Ghanem, K.; Aparicio-Navarro, F.J.; Kyriakopoulos, K.G.; Lambotharan, S.; Chambers, J.A. Support vector machine for network intrusion and cyber-attack detection. In Proceedings of the 2017 Sensor Signal Processing for Defence Conference (SSPD), London, UK, 6–7 December 2017; pp. 1–5. [Google Scholar]

- Li, Y.; Xia, J.; Zhang, S.; Yan, J.; Ai, X.; Dai, K. An efficient intrusion detection system based on support vector machines and gradually feature removal method. Expert Syst. Appl. 2012, 39, 424–430. [Google Scholar] [CrossRef]

- GuangJun, L.; Nazir, S.; Khan, H.U.; Haq, A.U. Spam detection approach for secure mobile message communication using machine learning algorithms. Secur. Commun. Netw. 2020, 2020, 8873639. [Google Scholar] [CrossRef]

- Lin, W.C.; Ke, S.W.; Tsai, C.F. CANN: An intrusion detection system based on combining cluster centers and nearest neighbors. Knowl.-Based Syst. 2015, 78, 13–21. [Google Scholar] [CrossRef]

- Meng, W.; Li, W.; Kwok, L.F. Design of intelligent KNN-based alarm filter using knowledge-based alert verification in intrusion detection. Secur. Commun. Netw. 2015, 8, 3883–3895. [Google Scholar] [CrossRef]

- Shapoorifard, H.; Shamsinejad, P. Intrusion detection using a novel hybrid method incorporating an improved KNN. Int. J. Comput. Appl. 2017, 173, 5–9. [Google Scholar] [CrossRef]

- Kaloudi, N.; Li, J. The ai-based cyber threat landscape: A survey. ACM Comput. Surv. (CSUR) 2020, 53, 1–34. [Google Scholar] [CrossRef]

- Martínez Torres, J.; Iglesias Comesaña, C.; García-Nieto, P.J. Machine learning techniques applied to cybersecurity. Int. J. Mach. Learn. Cybern. 2019, 10, 2823–2836. [Google Scholar] [CrossRef]

- Sarker, I.H.; Kayes, A.; Badsha, S.; Alqahtani, H.; Watters, P.; Ng, A. Cybersecurity data science: An overview from machine learning perspective. J. Big Data 2020, 7, 41. [Google Scholar] [CrossRef]

- Delic, A.J.; Delfabbro, P.H. Profiling the Potential Risks and Benefits of Emerging “Play to Earn” Games: A Qualitative Analysis of Players’ Experiences with Axie Infinity. Int. J. Ment. Health Addict. 2022, 1–14. [Google Scholar] [CrossRef]

- Li, Y.; Ma, X.; Li, Y.; Li, R.; Liu, H. How does platform’s fintech level affect its word of mouth from the perspective of user psychology? Front. Psychol. 2023, 14, 1085587. [Google Scholar] [CrossRef]

| Tokenized Platform | Compliance | Contract Standards | Consensus | User Experience |

|---|---|---|---|---|

| Bitbond | ✓ | ✓ | PoS | ✓ |

| TrustToken | ✓ | ✓ | PoS | ✓ |

| Harbor | ✓ | ✓ | PoS | ✓ |

| Polymath | ✓ | ✓ | PoS | ✓ |

| Securitize | ✓ | ✓ | PoS | ✓ |

| Aspect | Axie Infinity | Solbeatz |

|---|---|---|

| Founding Year | 2018 | 2022 |

| Industry | Gaming | Music |

| Technology | Blockchain | Blockchain |

| Tokenization | Game creatures (Axies), SLP, AXS | Music and associated rights |

| Use Cases | Play-to-earn gaming, NFT marketplace | Tokenized music marketplace |

| Economic Model | In-game cryptocurrency rewards | Music rights transactions |

| User Community | Global community of players | Global community of artists and audience |

| Main Features | Collectible digital creatures, battles, marketplace | Tokenized music |

| Primary Focus | Gaming and play-to-earn model | Music industry disruption |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Juan, A.A.; Perez-Bernabeu, E.; Li, Y.; Martin, X.A.; Ammouriova, M.; Barrios, B.B. Tokenized Markets Using Blockchain Technology: Exploring Recent Developments and Opportunities. Information 2023, 14, 347. https://doi.org/10.3390/info14060347

Juan AA, Perez-Bernabeu E, Li Y, Martin XA, Ammouriova M, Barrios BB. Tokenized Markets Using Blockchain Technology: Exploring Recent Developments and Opportunities. Information. 2023; 14(6):347. https://doi.org/10.3390/info14060347

Chicago/Turabian StyleJuan, Angel A., Elena Perez-Bernabeu, Yuda Li, Xabier A. Martin, Majsa Ammouriova, and Barry B. Barrios. 2023. "Tokenized Markets Using Blockchain Technology: Exploring Recent Developments and Opportunities" Information 14, no. 6: 347. https://doi.org/10.3390/info14060347

APA StyleJuan, A. A., Perez-Bernabeu, E., Li, Y., Martin, X. A., Ammouriova, M., & Barrios, B. B. (2023). Tokenized Markets Using Blockchain Technology: Exploring Recent Developments and Opportunities. Information, 14(6), 347. https://doi.org/10.3390/info14060347