Drivers Influencing the Adoption Intention towards Mobile Fintech Services: A Study on the Emerging Bangladesh Market

Abstract

:1. Introduction

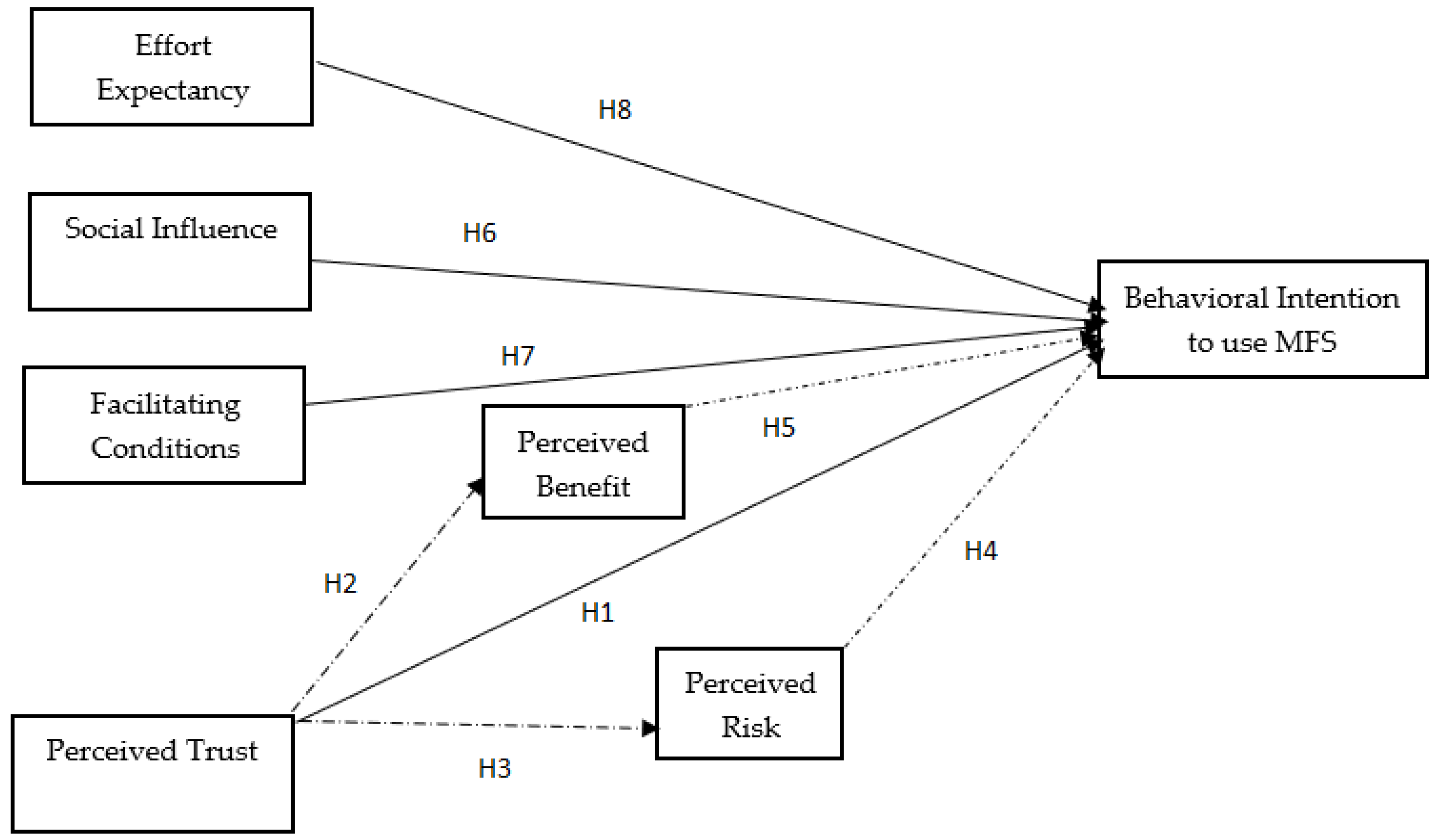

2. Literature Review

2.1. Behavioral Intention

2.2. Perceived Trust

2.3. Perceived Risk

2.4. Perceived Benefit

2.5. Social Influence

2.6. Facilitating Conditions

2.7. Effort Expectancy

3. Methodology

3.1. Data Collection

3.2. Data Analysis

4. Findings and Analysis

4.1. Measurement Model

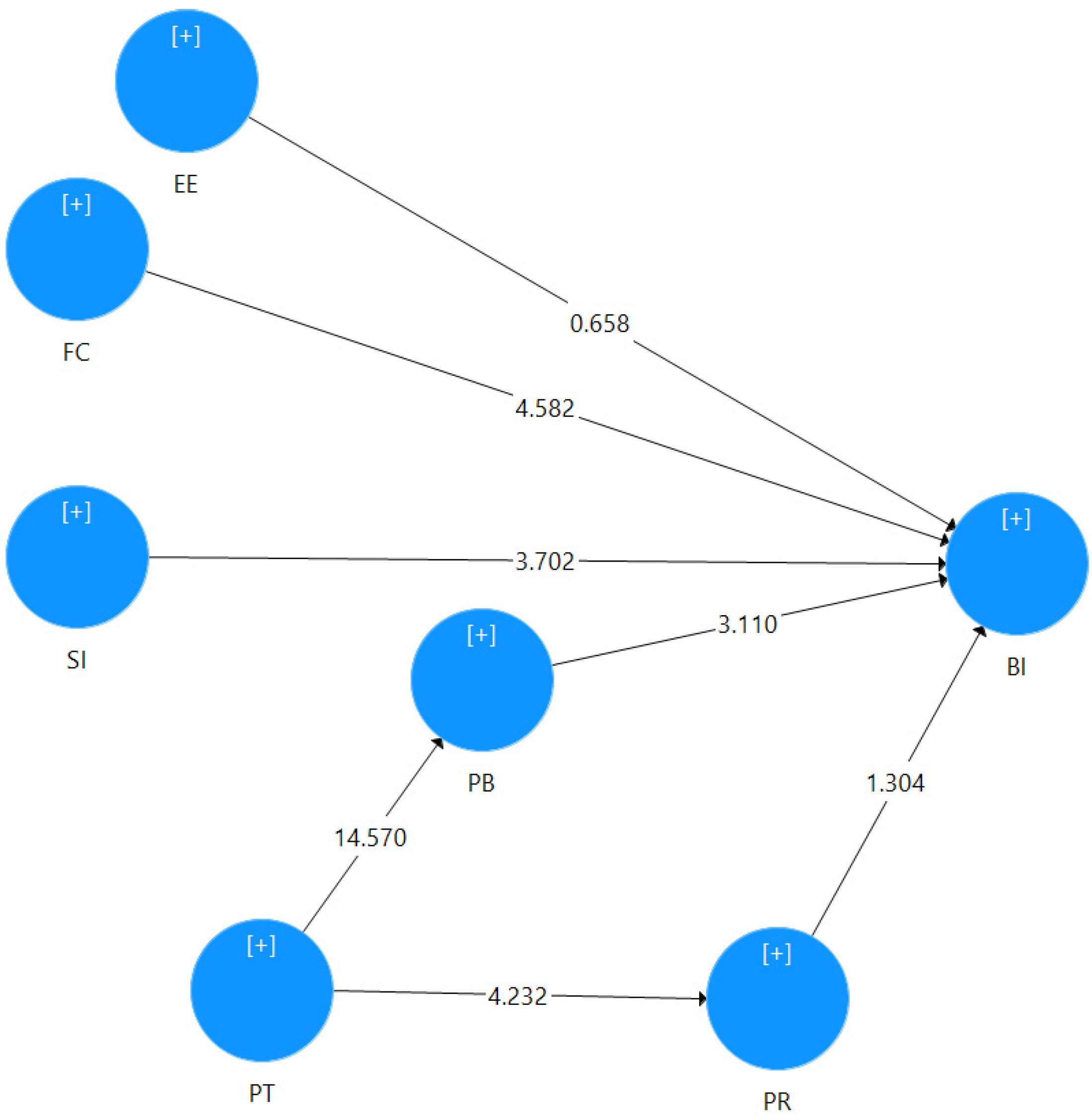

4.2. Structural Model Assessment

4.3. Post Hoc Analysis

4.4. Discussion

5. Conclusions

5.1. Theoretical Contribution

5.2. Managerial Implications

5.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variables | Measurement Constructs |

|---|---|

| Behavioral Intention to adapt MFS (BI) | BI1: I intend to adopt mobile fintech service in the future. BI2: I predict that I will frequently use mobile fintech service in the future BI3: I will strongly recommend others to use mobile fintech service. |

| Perceived Benefit (PB) | PB1: Using Mobile Fintech Services has many advantages PB2: I can easily and quickly use Mobile Fintech Services. PB3: Using Mobile Fintech Services is useful for me. |

| Perceived Trust (PT) | PT1: I trust MFS systems to be reliable. PT2: I trust MFS systems to be secure. PT3: I believe MFS systems are trustworthy |

| Perceived Risk (PR) | PR1: Using Mobile Fintech Services is associated with a high level of risk. PR2: Overall, I think that there is little benefit to using Mobile Fintech Services compared to traditional financial services. |

| Social Influence (SI) | SI1: People who are important to me think that I should use Mobile Fintech Services. SI2: People who influence my behavior think that I should use Mobile Fintech Services. SI3: People whose opinions I value prefer that I use Mobile Fintech Services. |

| Effort Expectancy (EE) | EE1: It is easy for me to understand the operation of Mobile Fintech Services EE2: I find conducting transactions through Mobile Fintech Services is convenient for me EE3: I find easy to conduct transactions through Mobile Fintech Services |

| Facilitating Conditions (FC) | FC1: I have necessary resources to use Mobile Fintech Services FC2: I have the necessary knowledge to use Mobile Fintech Services FC3: Mobile Fintech Services is compatible with other system that I use |

References

- Bangladesh Bank. Bangladesh Mobile Financial Services (MFS) Regulations, 2018. Bangladesh Bank. Available online: https://www.bb.org.bd/openpdf.php (accessed on 12 April 2022).

- Bangladesh Bank. Bangladesh Mobile Financial Services (MFS) Regulations. 2022. Available online: https://www.bb.org.bd/mediaroom/circulars/psd/feb152022psd04e.pdf (accessed on 12 April 2022).

- World Bank Group. Open Knowledge Repository. 2014. Available online: https://openknowledge.worldbank.org/handle/10986/20262?show=full (accessed on 12 April 2022).

- Bangladesh Bank. Mobile Financial Services (MFS) Comparative Summary Statement of March 2021 and April 2021. Available online: https://www.bb.org.bd/fnansys/paymentsys/mfsdata.php (accessed on 12 April 2022).

- Anik, S.A.M.; Khan, M.H.; Miah, R.H.; Kabir, F.; Alam, K. Customer Attitude towards Mobile Fintech Services: An Empirical Study on Dhaka City, Bangladesh. Int. J. Bus. Manag. Econ. Res. 2021, 12, 1918–1928. [Google Scholar]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User Acceptance of Information Technology: Toward a Unified View. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef] [Green Version]

- Venkatesh, V.; Thong, J.Y.L.; Xu, X. Consumer Acceptance and Use of Information Technology: Extending the Unified Theory of Acceptance and Use of Technology. MIS Q. 2012, 36, 157–178. [Google Scholar] [CrossRef] [Green Version]

- Rahman, M.A.; Qi, X.; Jinnah, M.S. Factors affecting the adoption of HRIS by the Bangladeshi banking and financial sector. Cogent Bus. Manag. 2016, 3, 1262107. [Google Scholar] [CrossRef]

- Davis, F.D. A Technology Acceptance Model for Empirically Testing New End-User Information Systems: Theory and Results. Doctoral Dissertation, Massachusetts Institute of Technology, Cambridge, MA, USA, 1985. [Google Scholar]

- Davis, F.D. A Technology Acceptance Model for Empirically Testing New End-User Information Systems. Doctoral Dissertation, Massachusetts Institute of Technology, Cambridge, MA, USA, 1986. [Google Scholar]

- Kabir, H.; Huda, S.S.M.S.; Faruq, O. Mobile financial services in the context of Bangladesh. Copernic. J. Finance Account. 2021, 9, 83–98. [Google Scholar] [CrossRef]

- Kim, D.J.; Ferrin, D.L.; Rao, H.R. A trust-based consumer decision-making model in electronic commerce: The role of trust, perceived risk, and their antecedents. Decis. Support Syst. 2008, 44, 544–564. [Google Scholar] [CrossRef]

- Chin, A.G.; Harris, M.A.; Brookshire, R. An Empirical Investigation of Intent to Adopt Mobile Payment Systems Using a Trust-based Extended Valence Framework. Inf. Syst. Front. 2020, 24, 329–347. [Google Scholar] [CrossRef]

- Dwivedi, Y.K.; Rana, N.P.; Jeyaraj, A.; Clement, M.; Williams, M.D. Re-examining the Unified Theory of Acceptance and Use of Technology (UTAUT): Towards a Revised Theoretical Model. Inf. Syst. Front. 2019, 21, 719–734. [Google Scholar] [CrossRef] [Green Version]

- Dorfleitner, G.; Hornuf, L.; Schmitt, M.; Weber, M. Definition of FinTech and Description of the FinTech Industry. In FinTech in Germany; Springer: Cham, Germany, 2017; pp. 5–10. [Google Scholar] [CrossRef]

- Putritama, A. The Mobile Payment Fintech Continuance Usage Intention in Indonesia. J. Econ. 2019, 15, 243–258. [Google Scholar] [CrossRef]

- Kim, M. The Impacts of Financial Reforms on Households’ Savings Behavior. Int. J. IT-Based Soc. Welf. Promot. Manag. 2018, 5, 7–12. [Google Scholar] [CrossRef]

- Yu, S. A Study on Developed Security Check Items for Assessing Mobile Financial Service Security. Master’s Thesis, Chung-Ang University, Seoul, Korea, 2017. [Google Scholar]

- EY Global Financial Services. Global FinTech Adoption Index 2019. Available online: https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/banking-and-capital-markets/ey-global-fintech-adoption-index.pdf (accessed on 20 April 2022).

- Hasan, R.; Ashfaq, M.; Shao, L. Evaluating Drivers of Fintech Adoption in the Netherlands. Glob. Bus. Rev. 2021, 1–14. [Google Scholar] [CrossRef]

- Ali, M.; Raza, S.A.; Khamis, B.; Puah, C.H.; Amin, H. How perceived risk, benefit and trust determine user Fintech adoption: A new dimension for Islamic finance. Foresight 2021, 23, 403–420. [Google Scholar] [CrossRef]

- Setiawan, B.; Nugraha, D.P.; Irawan, A.; Nathan, R.J.; Zoltan, Z. User Innovativeness and Fintech Adoption in Indonesia. J. Open Innov. Technol. Mark. Complex. 2021, 7, 188. [Google Scholar] [CrossRef]

- Vasenska, I.; Dimitrov, P.; Koyundzhiyska-Davidkova, B.; Krastev, V.; Durana, P.; Poulaki, I. Financial Transactions Using FINTECH during the COVID-19 Crisis in Bulgaria. Risks 2021, 9, 48. [Google Scholar] [CrossRef]

- Chauhan, S.; Jaiswal, M. Determinants of acceptance of ERP software training in business schools: Empirical investigation using UTAUT model. Int. J. Manag. Educ. 2016, 14, 248–262. [Google Scholar] [CrossRef]

- Khalilzadeh, J.; Ozturk, A.B.; Bilgihan, A. Security-related factors in extended UTAUT model for NFC based mobile payment in the restaurant industry. Comput. Hum. Behav. 2017, 70, 460–474. [Google Scholar] [CrossRef]

- Hoque, R.; Sorwar, G. Understanding factors influencing the adoption of mHealth by the elderly: An extension of the UTAUT model. Int. J. Med. Inform. 2017, 101, 75–84. [Google Scholar] [CrossRef]

- Cimperman, M.; Brenčič, M.M.; Trkman, P. Analyzing older users’ home telehealth services acceptance behavior—applying an Extended UTAUT model. Int. J. Med. Inform. 2016, 90, 22–31. [Google Scholar] [CrossRef] [Green Version]

- Bagozzi, R.P. The Legacy of the Technology Acceptance Model and a Proposal for a Paradigm Shift. J. Assoc. Inf. Syst. 2007, 8, 244–254. [Google Scholar] [CrossRef]

- Alshare, K.A.; AlOmari, M.K.; Lane, P.L.; Freeze, R.D. Development and determinants of end-user intention: Usage of expert systems. J. Syst. Inf. Technol. 2019, 21, 166–185. [Google Scholar] [CrossRef]

- Raihan, T.; Rachmawati, I. Analyzing Factors Influencing Continuance Intention Of E-wallet Adoption Using Utaut 2 Model (a Case Study Of Dana In Indonesia). Eproceedings Manag. 2019, 6, 3717. [Google Scholar]

- Yohanes, K.; Junius, K.; Saputra, Y.; Sari, R.; Lisanti, Y.; Luhukay, D. Unified Theory of Acceptance and Use of Technology (UTAUT) model perspective to enhance user acceptance of fintech application. In Proceedings of the 2020 International Conference on Information Management and Technology (ICIMTech), Bandung, Indonesia, 13–14 August 2019; pp. 643–648. [Google Scholar] [CrossRef]

- Najib, M.; Ermawati, W.; Fahma, F.; Endri, E.; Suhartanto, D. FinTech in the Small Food Business and Its Relation with Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 88. [Google Scholar] [CrossRef]

- Ahmed, R.R.; Štreimikienė, D.; Štreimikis, J. The extended utaut model and learning management system during COVID-19: Evidence from Pls-sem and conditional process modeling. J. Bus. Econ. Manag. 2021, 23, 82–104. [Google Scholar] [CrossRef]

- Dowdy, A.E.A. Public Librarians’ Adoption of Technology in Two Southeastern States. Doctoral Dissertation, Walden University, Minneapolis, MN, USA, 2020. [Google Scholar]

- Kim, D.J.; Ferrin, D.L.; Rao, H.R. Trust and Satisfaction, Two Stepping Stones for Successful E-Commerce Relationships: A Longitudinal Exploration. Inf. Syst. Res. 2009, 20, 237–257. [Google Scholar] [CrossRef] [Green Version]

- Azizah, N.; Handayani, P.W.; Azzahro, F. Factors Influencing Continuance Usage of Mobile Wallets in Indonesia. Int. Conf. Inf. Manag. Technol. (ICIMTech) 2018, 92–97. [Google Scholar] [CrossRef]

- Cui, Y.; Mou, J.; Cohen, J.; Liu, Y. Understanding information system success model and valence framework in sellers’ acceptance of cross-border e-commerce: A sequential multi-method approach. Electron. Commer. Res. 2019, 19, 885–914. [Google Scholar] [CrossRef]

- Mou, J.; Cohen, J.; Dou, Y.; Zhang, B. International buyers’ repurchase intentions in a Chinese cross-border e-commerce platform. Internet Res. 2019, 30, 403–437. [Google Scholar] [CrossRef]

- Fishbein, M.; Ajzen, I. Belief, Attitude, Intention, and Behavior: An Introduction to Theory and Research; Addison-Wesley: Reading, MA, USA, 1975; p. 39. [Google Scholar]

- Warshaw, P.R.; Davis, F.D. Disentangling behavioral intention and behavioral expectation. J. Exp. Soc. Psychol. 1985, 21, 213–228. [Google Scholar] [CrossRef]

- Li, H.; Schein, D.; Ravi, S.P.; Song, W.; Gu, Y. Factors influencing residents’ perceptions, attitudes and behavioral intention toward festivals and special events: A pre-event perspective. J. Bus. Econ. Manag. 2018, 19, 288–306. [Google Scholar] [CrossRef] [Green Version]

- Silva, J.; Pinho, J.C.; Soares, A.; Sá, E. Antecedents of online purchase intention and behaviour: Uncovering unobserved heterogeneity. J. Bus. Econ. Manag. 2019, 20, 131–148. [Google Scholar] [CrossRef] [Green Version]

- Bisdikian, C.; Gibson, C.; Chakraborty, S.; Srivastava, M.B.; Sensoy, M.; Norman, T.J. Inference management, trust and obfuscation principles for quality of information in emerging pervasive environments. Pervasive Mob. Comput. 2014, 11, 168–187. [Google Scholar] [CrossRef]

- Wang, S.W.; Ngamsiriudom, W.; Hsieh, C.-H. Trust disposition, trust antecedents, trust, and behavioral intention. Serv. Ind. J. 2015, 35, 555–572. [Google Scholar] [CrossRef]

- Yang, Q.; Pang, C.; Liu, L.; Yen, D.C.; Tarn, J.M. Exploring consumer perceived risk and trust for online payments: An empirical study in China’s younger generation. Comput. Hum. Behav. 2015, 50, 9–24. [Google Scholar] [CrossRef]

- Chin, A.G.; Harris, M.A.; Brookshire, R. A bidirectional perspective of trust and risk in determining factors that influence mobile app installation. Int. J. Inf. Manag. 2018, 39, 49–59. [Google Scholar] [CrossRef]

- Al-Saedi, K.; Al-Emran, M. A Systematic Review of Mobile Payment Studies from the Lens of the UTAUT Model. Recent Adv. Technol. Accept. Models Theor. 2021, 79–106. [Google Scholar] [CrossRef]

- Kaur, S.; Arora, S. Role of perceived risk in online banking and its impact on behavioral intention: Trust as a moderator. J. Asia Bus. Stud. 2020, 15, 1–30. [Google Scholar] [CrossRef]

- Madan, K.; Yadav, R. Behavioural intention to adopt mobile wallet: A developing country perspective. J. Indian Bus. Res. 2016, 8, 227–244. [Google Scholar] [CrossRef]

- Saprikis, V.; Avlogiaris, G. Factors That Determine the Adoption Intention of Direct Mobile Purchases through Social Media Apps. Information 2021, 12, 449. [Google Scholar] [CrossRef]

- Makanyeza, C. Determinants of consumers’ intention to adopt mobile banking services in Zimbabwe. Int. J. Bank Mark. 2017, 35, 997–1017. [Google Scholar] [CrossRef]

- Singh, S.; Srivastava, R. Predicting the intention to use mobile banking in India. Int. J. Bank Mark. 2018, 36, 357–378. [Google Scholar] [CrossRef]

- Utaminingsih, K.T.; Alianto, H. The Influence of UTAUT Model Factors on the Intension of Millennials Generation in Using Mobile Wallets in Jakarta. In Proceedings of the 2020 International Conference on Information Management and Technology (ICIMTech), Bandung, Indonesia, 13–14 August 2019; pp. 488–492. [Google Scholar] [CrossRef]

- Islam, S.; Karia, N.; Khaleel, M.; Fauzi, F.B.A.; Soliman, M.M.; Khalid, J.; Bhuiyan, Y.A.; Al Mamun, A. Intention to adopt mobile banking in Bangladesh: An empirical study of emerging economy. Int. J. Bus. Inf. Syst. 2019, 31, 136. [Google Scholar] [CrossRef]

- Blaise, R.; Halloran, M.; Muchnick, M. Mobile Commerce Competitive Advantage: A Quantitative Study of Variables that Predict M-Commerce Purchase Intentions. J. Internet Commer. 2018, 17, 96–114. [Google Scholar] [CrossRef]

- Chang, C.-M.; Liu, L.-W.; Huang, H.-C.; Hsieh, H.-H. Factors Influencing Online Hotel Booking: Extending UTAUT2 with Age, Gender, and Experience as Moderators. Information 2019, 10, 281. [Google Scholar] [CrossRef] [Green Version]

- Sobti, N. Impact of demonetization on diffusion of mobile payment service in India: Antecedents of behavioral intention and adoption using extended UTAUT model. J. Adv. Manag. Res. 2019, 16, 472–497. [Google Scholar] [CrossRef]

- Saprikis, V.; Avlogiaris, G.; Katarachia, A. A Comparative Study of Users versus Non-Users’ Behavioral Intention towards M-Banking Apps’ Adoption. Information 2022, 13, 30. [Google Scholar] [CrossRef]

- Rosnidah, I.; Muna, A.; Musyaffi, A.M.; Siregar, N.F. Critical factor of mobile payment acceptance in millen-nial generation: Study on the UTAUT model. In International Symposium on Social Sciences, Education, and Humanities (ISSEH 2018); Atlantis Press: Cirebon, Indonesia, 2019. [Google Scholar] [CrossRef] [Green Version]

- Sair, S.A.; Danish, R.Q. Effect of performance expectancy and effort expectancy on the mobile commerce adoption intention through personal innovativeness among Pakistani consumers. Pak. J. Commer. Soc. Sci. (PJCSS) 2018, 12, 501–520. [Google Scholar]

- Al Nawayseh, M.K. FinTech in COVID-19 and Beyond: What Factors Are Affecting Customers’ Choice of FinTech Applications? J. Open Innov. Technol. Mark. Complex. 2020, 6, 153. [Google Scholar] [CrossRef]

- Chen, W.-C.; Chen, C.-W.; Chen, W.-K. Drivers of Mobile Payment Acceptance in China: An Empirical Investigation. Information 2019, 10, 384. [Google Scholar] [CrossRef] [Green Version]

- Chen, J.V.; Chotimapruek, W.; Ha, Q.-A.; Widjaja, A.E. Investigating Female Customer’s Impulse Buying in Facebook B2C Social Commerce: An Experimental Study. Contemp. Manag. Res. 2021, 17, 65–96. [Google Scholar] [CrossRef]

- Barclay, D.; Higgins, C.; Thompson, R. The partial least squares (PLS) approach to causal modeling: Personal computer adoption and use as an illustration. Technol. Stud. 1995, 2, 285–309. [Google Scholar]

- Karim, W.; Chowdhury, M.A.M.; Al Masud, A. Arifuzzaman Analysis of Factors Influencing Impulse Buying Behavior towards e-Tailing Sites: An application of S-O-R model. Contemp. Manag. Res. 2021, 17, 97–126. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Thiele, K.O. Mirror, mirror on the wall: A comparative evaluation of composite-based structural equation modeling methods. J. Acad. Mark. Sci. 2017, 45, 616–632. [Google Scholar] [CrossRef]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2019, 31, 2–24. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A new criterion for assessing discriminant validity in variance-based structural equation modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef] [Green Version]

- Kemp, S. Digital 2022: Bangladesh. Datareportal. Available online: https://datareportal.com/reports/digital-2022-bangladesh#:~:text=There%20were%2052.58%20million%20internet,percent)%20between%202021%20and%202022 (accessed on 9 July 2022).

- Hu, Z.; Ding, S.; Li, S.; Chen, L.; Yang, S. Adoption Intention of Fintech Services for Bank Users: An Empirical Examination with an Extended Technology Acceptance Model. Symmetry 2019, 11, 340. [Google Scholar] [CrossRef] [Green Version]

- Jenkins, P.; Ophoff, J. Factors influencing the intention to adopt NFC mobile payments-A South African perspective. In CONF-IRM 2016 Proceedings; Association for Information Systems (AIS): Capetown, South Africa, 2016; p. 45. [Google Scholar]

- Jun, J.; Cho, I.; Park, H. Factors influencing continued use of mobile easy payment service: An empirical investigation. Total Qual. Manag. Bus. Excel. 2018, 29, 1043–1057. [Google Scholar] [CrossRef]

- Khan, I.U.; Hameed, Z.; Khan, S.U. Understanding Online Banking Adoption in a Developing Country: UTAUT2 with cultural moderators. J. Glob. Inf. Manag. 2017, 25, 43–65. [Google Scholar] [CrossRef] [Green Version]

- Widodo, M.; Irawan, M.I.; Sukmono, R.A. Extending UTAUT2 to Explore Digital Wallet Adoption in Indonesia. In Proceedings of the 2019 International Conference on Information and Communications Technology (ICOIACT), Yogyakarta, Indonesia, 24–25 July 2019; pp. 878–883. [Google Scholar] [CrossRef]

- Tak, P.; Panwar, S. Using UTAUT 2 model to predict mobile app based shopping: Evidences from India. J. Indian Bus. Res. 2017, 9, 248–264. [Google Scholar] [CrossRef]

- Liu, Z.; Ben, S.; Zhang, R. Factors affecting consumers’ mobile payment behavior: A meta-analysis. Electron. Commer. Res. 2019, 19, 575–601. [Google Scholar] [CrossRef]

| Demographic Variable | Frequency | Percentage |

|---|---|---|

| Gender | ||

| Male | 129 | 59.17 |

| Female | 89 | 40.83 |

| Total | 218 | 100.0 |

| Age | ||

| 18–24 | 85 | 38.99 |

| 25–34 | 100 | 45.87 |

| 35–44 | 29 | 13.31 |

| 45 and above | 4 | 1.83 |

| Total | 218 | 100.0 |

| Academic Qualification | ||

| Secondary | 0 | 0 |

| Higher Secondary | 18 | 8.26 |

| Graduate | 120 | 55.04 |

| Postgraduate | 80 | 36.70 |

| Total | 218 | 100.0 |

| Ownership of MFS Account | ||

| Yes | 198 | 90.82 |

| No | 20 | 9.18 |

| Total | 218 | 100.0 |

| Usage of MFS | ||

| Never | 8 | 3.70 |

| Sometimes | 105 | 48.15 |

| Frequently | 85 | 38.98 |

| Always | 20 | 9.18 |

| Total | 218 | 100.0 |

| BI | EE | FC | PB | PR | PT | SI | |

|---|---|---|---|---|---|---|---|

| BI1 | 0.851 | ||||||

| BI2 | 0.890 | ||||||

| BI3 | 0.865 | ||||||

| EE1 | 0.848 | ||||||

| EE2 | 0.848 | ||||||

| EE3 | 0.798 | ||||||

| FC1 | 0.759 | ||||||

| FC2 | 0.850 | ||||||

| FC3 | 0.790 | ||||||

| PB1 | 0.857 | ||||||

| PB2 | 0.813 | ||||||

| PB3 | 0.763 | ||||||

| PR2 | 0.791 | ||||||

| PR3 | 0.948 | ||||||

| PT1 | 0.880 | ||||||

| PT2 | 0.861 | ||||||

| PT3 | 0.905 | ||||||

| SI1 | 0.892 | ||||||

| SI2 | 0.906 | ||||||

| SI3 | 0.845 |

| Cronbach’s Alpha | Composite Reliability | Average Variance Extracted (AVE) | |

|---|---|---|---|

| BI | 0.838 | 0.903 | 0.755 |

| EE | 0.776 | 0.870 | 0.691 |

| FC | 0.721 | 0.842 | 0.641 |

| PB | 0.740 | 0.853 | 0.659 |

| PR | 0.714 | 0.864 | 0.762 |

| PT | 0.858 | 0.913 | 0.778 |

| SI | 0.856 | 0.913 | 0.777 |

| BI | EE | FC | PB | PR | PT | SI | |

|---|---|---|---|---|---|---|---|

| BI | 0.869 | ||||||

| EE | 0.634 | 0.831 | |||||

| FC | 0.738 | 0.760 | 0.800 | ||||

| PB | 0.713 | 0.744 | 0.782 | 0.812 | |||

| PR | 0.291 | 0.182 | 0.291 | 0.259 | 0.873 | ||

| PT | 0.660 | 0.543 | 0.745 | 0.610 | 0.282 | 0.882 | |

| SI | 0.565 | 0.443 | 0.500 | 0.541 | 0.242 | 0.485 | 0.881 |

| BI | EE | FC | PB | PR | PT | SI | |

|---|---|---|---|---|---|---|---|

| BI | |||||||

| EE | 0.786 | ||||||

| FC | 0.937 | 1.018 | |||||

| PB | 0.905 | 0.979 | 1.069 | ||||

| PR | 0.348 | 0.231 | 0.379 | 0.322 | |||

| PT | 0.774 | 0.661 | 0.932 | 0.760 | 0.331 | ||

| SI | 0.664 | 0.541 | 0.622 | 0.681 | 0.278 | 0.562 |

| VIF | |

|---|---|

| BI1 | 1.872 |

| BI2 | 2.256 |

| BI3 | 1.910 |

| EE1 | 1.782 |

| EE2 | 1.758 |

| EE3 | 1.425 |

| FC1 | 1.427 |

| FC2 | 1.531 |

| FC3 | 1.346 |

| PB1 | 1.699 |

| PB2 | 1.524 |

| PB3 | 1.357 |

| PR2 | 1.444 |

| PR3 | 1.444 |

| PT1 | 2.007 |

| PT2 | 2.131 |

| PT3 | 2.458 |

| SI1 | 2.306 |

| SI2 | 2.717 |

| SI3 | 1.859 |

| R Square | R Square Adjusted | |

|---|---|---|

| BI | 0.626 | 0.618 |

| PB | 0.372 | 0.369 |

| PR | 0.079 | 0.075 |

| Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) | p Values | |

|---|---|---|---|---|---|

| EE -> BI | 0.061 | 0.060 | 0.086 | 0.713 | 0.476 |

| FC -> BI | 0.385 | 0.387 | 0.076 | 5.027 | 0.000 |

| PB -> BI | 0.244 | 0.245 | 0.077 | 3.158 | 0.002 |

| PR -> BI | 0.056 | 0.055 | 0.042 | 1.326 | 0.185 |

| PT -> PB | 0.610 | 0.610 | 0.040 | 15.434 | 0.000 |

| PT -> PR | 0.282 | 0.286 | 0.066 | 4.239 | 0.000 |

| SI -> BI | 0.200 | 0.202 | 0.051 | 3.898 | 0.000 |

| Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T Statistics (|O/STDEV|) | p Values | |

|---|---|---|---|---|---|

| PT -> PB -> BI | 0.149 | 0.149 | 0.049 | 3.054 | 0.002 |

| PT -> PR -> BI | 0.016 | 0.016 | 0.013 | 1.187 | 0.236 |

| Hypothesis | Results | |

|---|---|---|

| H1 | Trust has a positive influence on behavioral intention | Supported |

| H2 | Trust has a positive influence on perceived benefit | Supported |

| H3 | Trust has a positive influence on perceived risk | Supported |

| H4 | The perceived risk has a negative influence on behavioral intention | Not Supported |

| H5 | The perceived benefit has a positive influence on behavioral intention | Supported |

| H6 | Social influence has a positive influence on behavioral intention | Supported |

| H7 | The facilitating conditions have a positive influence on behavioral intention | Supported |

| H8 | Effort expectancy has a positive influence on behavioral intention | Not supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hassan, M.S.; Islam, M.A.; Sobhani, F.A.; Nasir, H.; Mahmud, I.; Zahra, F.T. Drivers Influencing the Adoption Intention towards Mobile Fintech Services: A Study on the Emerging Bangladesh Market. Information 2022, 13, 349. https://doi.org/10.3390/info13070349

Hassan MS, Islam MA, Sobhani FA, Nasir H, Mahmud I, Zahra FT. Drivers Influencing the Adoption Intention towards Mobile Fintech Services: A Study on the Emerging Bangladesh Market. Information. 2022; 13(7):349. https://doi.org/10.3390/info13070349

Chicago/Turabian StyleHassan, Md. Sharif, Md. Aminul Islam, Farid Ahammad Sobhani, Hussen Nasir, Imroz Mahmud, and Fatema Tuz Zahra. 2022. "Drivers Influencing the Adoption Intention towards Mobile Fintech Services: A Study on the Emerging Bangladesh Market" Information 13, no. 7: 349. https://doi.org/10.3390/info13070349

APA StyleHassan, M. S., Islam, M. A., Sobhani, F. A., Nasir, H., Mahmud, I., & Zahra, F. T. (2022). Drivers Influencing the Adoption Intention towards Mobile Fintech Services: A Study on the Emerging Bangladesh Market. Information, 13(7), 349. https://doi.org/10.3390/info13070349