Vertical Integration Decision Making in Information Technology Management

Abstract

:1. Introduction

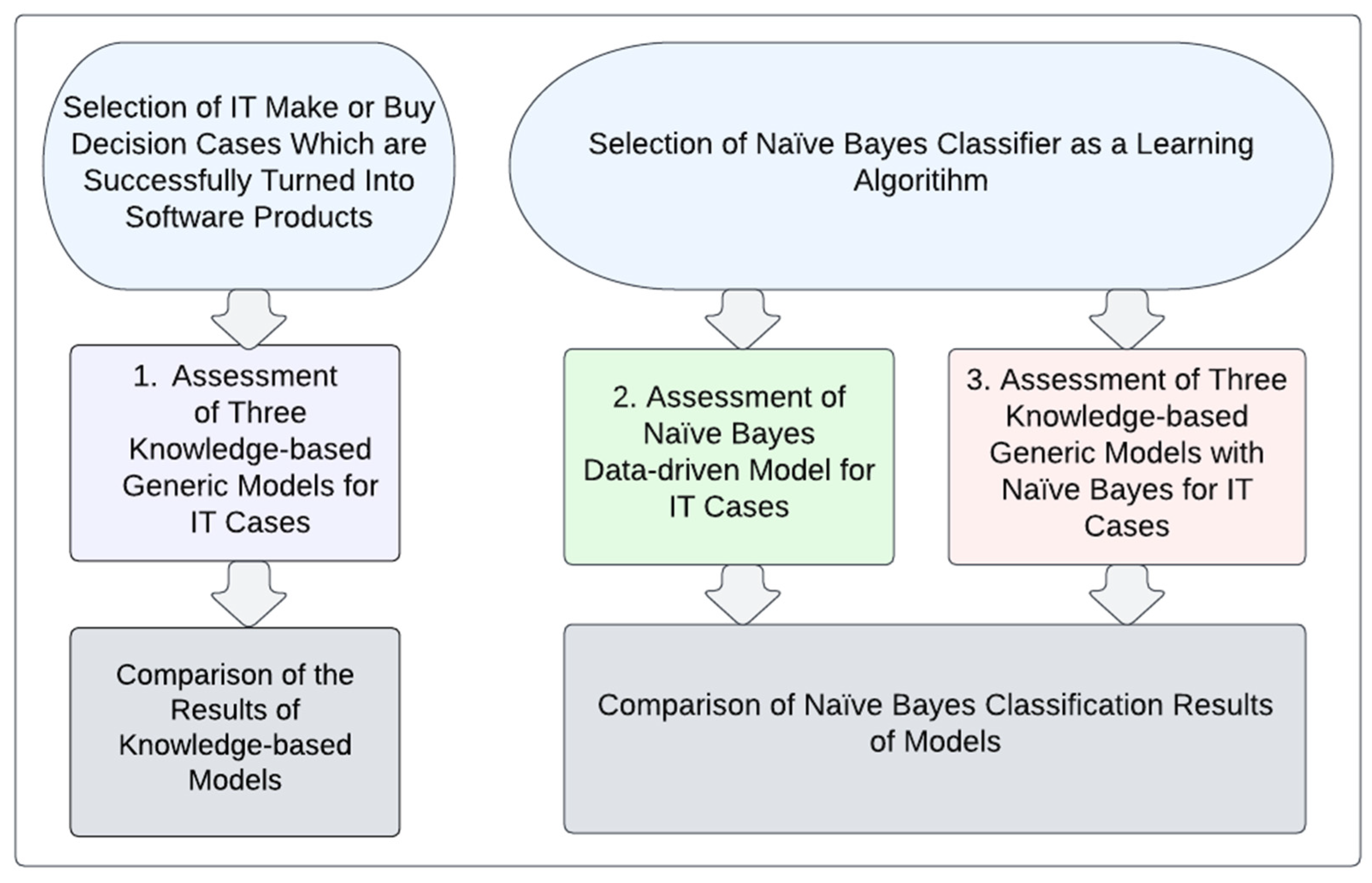

2. Methodology

- 4 Web-based software (SW) development (1 make and 3 buy decision)

- 6 Web-based SW together with mobile application development (2 make and 4 buy decision)

- 2 Web service development (2 make decision)

- 1 Web service development and its integration to third party (make decision).

- 2 ERP development (1 make and 1 buy decision)

- 2 CRM development (1 make and 1 buy decision)

- 2 Chatbot (1 make and 1 buy decision)

- 1 Robotic process automation (RPA) platform development (make decision)

- 1 Working-hours registration platform development (make decision).

2.1. Knowledge-Based Models in Vertical-Integration Decisions

- Maturity process technology across industries: What is the maturity level of this software in comparison with other industries? (Answer options: a—emerging/embryonic; b—growth; c—mature)

- Your process technology relative to competitors: What is the (superiority) status of this software compared to competitors? (Answer options: a—weak; b—tenable; c—superior)

- Significance of process technology for competitive advantage: What is the importance of this software in terms of competitive advantage? (Answer options: a—low today; b—high today; c—high in the future)

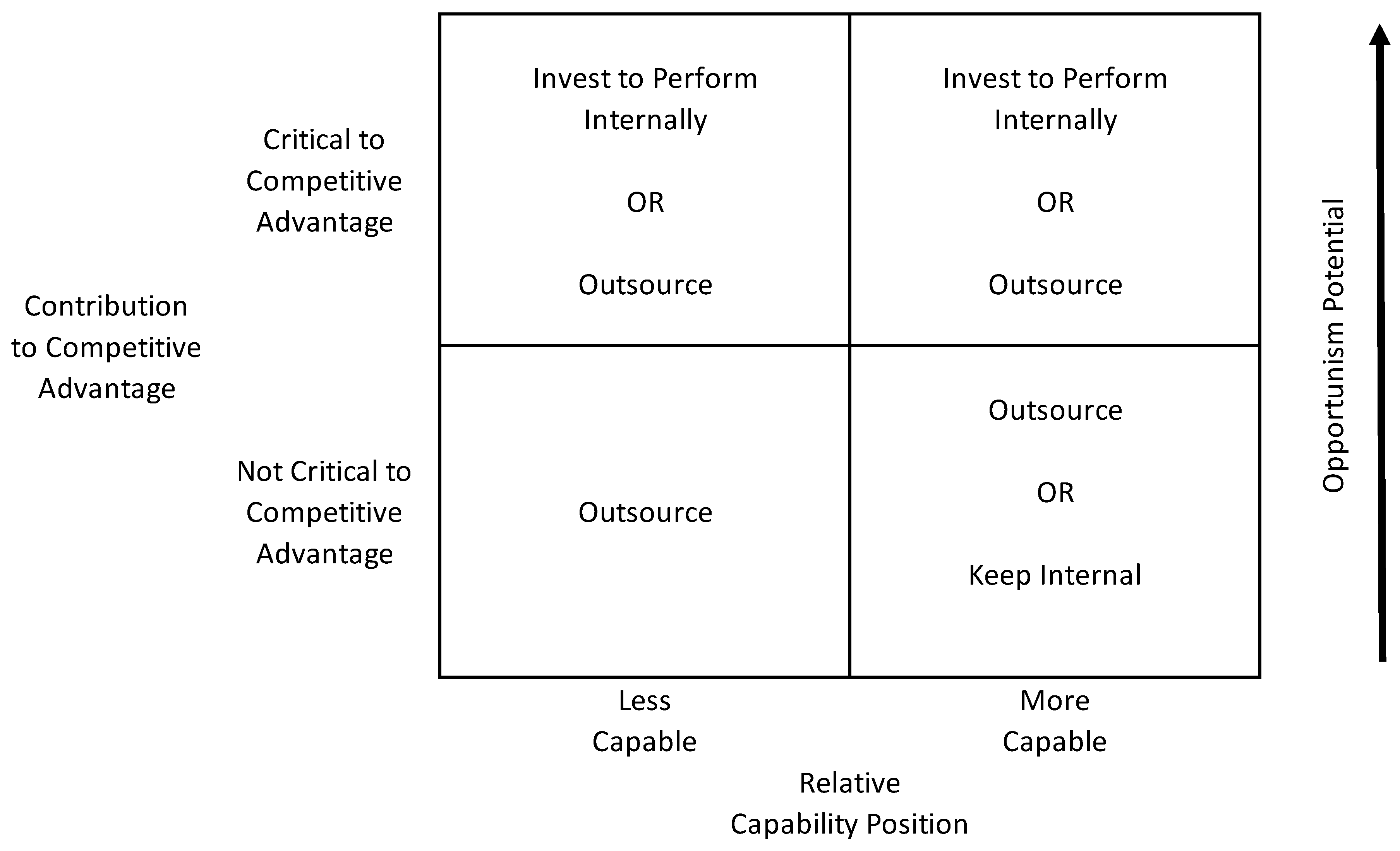

- Contribution to Competitive Advantage: What is the contribution of this software to competitive advantage? (Answer options: a—not critical; b—critical)

- Relative Capability Position: What are the capabilities of the company to develop this software in comparison with other companies? (Answer options: a—less capable; b—more capable)

- Opportunism Potential: What is the opportunism potential created by this software? (Answer options: a—low; b—middle; c—high)

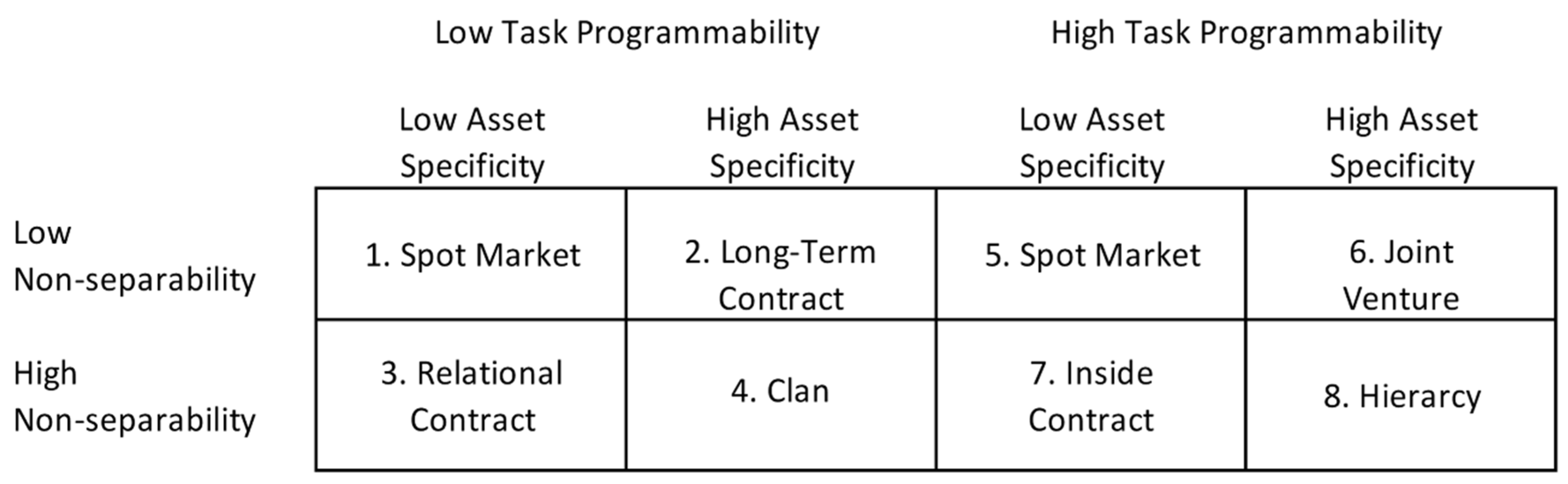

- Non-separability: Is this software (product/output) sufficient to measure the developer’s success? (Answer options: a—low; b—high)

- Task-programmability: Is effort/input sufficient to measure the success of the software? (Answer options: a—low; b—high)

- Asset Specificity: Can assets (internal and external) to develop this software be used for other purposes? (Answer options: a—low; b—high)

2.2. Naïve Bayes Classifier

- Determine significant factors and factor levels;

- Establish the training set;

- Indicate each instance in the training set in vector form ;

- Compute for each and each class by using the relative frequency of among the training instances belonging to ;

- Determine ;

- Based on the conditional independence assumption, calculate

- For each class, compute ;

- Select the class with the highest ;

- Assess the accuracy.

2.3. Data-Driven Vertical-Integration Model for IT

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Quinn, J.B.; Hilmer, F.G. Strategic Outsourcing. Mckinsey Q. 1995, 1, 48–70. [Google Scholar]

- Harrigan, K.R. Formulating Vertical Integration Strategies. Acad. Manag. Rev. 1984, 9, 638–652. [Google Scholar] [CrossRef] [Green Version]

- Besanko, D.; Dranove, D.; Shanley, M.; Schaefer, S. Economics of Strategy, 6th ed.; John Wiley: Hoboken, NJ, USA, 2013. [Google Scholar]

- Venkatesan, R. Strategic Sourcing: To Make or Not to Make. Harv. Bus. Rev. 1992, 70, 97–107. [Google Scholar]

- McIvor, R.T.; Humphreys, P.K.; McAleer, W.E. A Strategic Model for the Formulation of an Effective Make or Buy Decision. Manag. Decis. 1997, 35, 169–178. [Google Scholar] [CrossRef]

- Humphreys, P.K.; Lo, V.H.Y.; McIvor, R.T. A Decision Support Framework for Strategic Purchasing. J. Mater. Process. Technol. 2000, 107, 353–362. [Google Scholar] [CrossRef]

- Humphreys, P.; McIvor, R.; Huang, G. An Expert System for Evaluating the Make or Buy Decision. Comput. Ind. Eng. 2002, 42, 567–585. [Google Scholar] [CrossRef]

- Mahoney, J.T. The Choice of Organizational Form: Vertical Financial Ownership Versus Other Methods of Vertical Integration. Strateg. Manag. J. 1990, 13, 559–584. [Google Scholar] [CrossRef] [Green Version]

- Welch, J.A.; Nayak, P.R. Strategic Sourcing: A Progressive Approach to the Make-or-Buy Decision. Acad. Manag. Exec. 1992, 6, 23–31. [Google Scholar] [CrossRef]

- Canez, L.E.; Platts, K.W.; Probert, D.R. Developing a Framework for Make-or-buy Decisions. Int. J. Oper. Prod. Manag. 2000, 20, 1313–1330. [Google Scholar] [CrossRef]

- McIvor, R. A Practical Framework for Understanding the Outsourcing Process. Supply Chain. Manag. Int. J. 2000, 5, 22–36. [Google Scholar] [CrossRef]

- Coase, R.H. The nature of the firm. Economica 1937, 4, 386–405. [Google Scholar] [CrossRef]

- Williamson, O.E. Markets and Hierarchies; Free Press: New York, NY, USA, 1975. [Google Scholar]

- Buchowicz, B.S. A Process Model of Make-vs.-Buy Decision-Making; The Case of Manufacturing Software. IEEE Trans. Eng. Manag. 1991, 38, 24–32. [Google Scholar] [CrossRef]

- Rand, T. A framework for managing software make or buy. Manag. Sci. Inf. Syst. 1993, 2, 273–282. [Google Scholar] [CrossRef]

- Cortellessa, V.; Marinelli, F.; Potena, P. An optimization framework for build-or-buy decisions in software architecture. Comput. Oper. Res. 2008, 35, 3090–3106. [Google Scholar] [CrossRef]

- Kramer, T.; Heinzl, A.; Spohrer, K. Should this software component be developed inside or outside our firm? A design science perspective on the sourcing of application systems. In New Studies in Global IT and Business Service Outsourcing. 5th Global Sourcing Workshop Courchevel, France; Springer: Berlin/Heidelberg, Germany, 2011; pp. 115–132. [Google Scholar]

- Montgomery, R.; Ogden, J.; Boehmke, B. A quantified Kraljic Portfolio Matrix: Using decision analysis for strategic purchasing. J. Purch. Supply Manag. 2017, 24, 192–203. [Google Scholar] [CrossRef]

- Gelderman, C.; Weele, A. Purchasing Portfolio Models: A Critique and Update. J. Supply Chain Manag. 2005, 41, 19–28. [Google Scholar] [CrossRef]

- Lasi, H.; Kemper, H. Industry 4.0. Bus. Inf. Syst. Eng. 2014, 6, 239–242. [Google Scholar] [CrossRef]

- Rand, T. The key role of applications software make-or-buy decisions. J. Strateg. Inf. Syst. 1992, 1, 215–223. [Google Scholar] [CrossRef]

- Jones, C. Build, buy, or outsource? Softw. Product. Res. 1994, 27, 77–78. [Google Scholar] [CrossRef]

- Daneshgar, F.; Low, G.C.; Worasinchai, L. An investigation of ‘build vs. buy’ decision for software acquisition by small to medium enterprises. Inf. Softw. Technol. 2013, 55, 1741–1750. [Google Scholar] [CrossRef]

- Shahzad, B.; Abdullatif, A.M.; Ikram, N.; Mashkoor, A. Build Software or Buy: A Study on Developing Large Scale Software. IEEE Access 2017, 5, 24262–24274. [Google Scholar] [CrossRef]

- Sena, M.; Sena, J. Make or Buy: A Comparative Assessment of Organizations that Develop Software Internally Versus those that Purchase Software. J. Inf. Syst. Appl. Res. (JISAR) 2011, 4, 38–51. [Google Scholar]

- Borg, M.; Chatzipetrou, P.; Wnuk, K.; Alégroth, E.; Gorschek, T.; Papatheocharous, E.; Ali Shah, S.M.; Axelsson, J. Selecting Component Sourcing Options: A Survey of Software Engineering’s Broader Make-or-Buy Decisions. Inf. Softw. Technol. 2019, 112, 18–34. [Google Scholar] [CrossRef]

- Researchgate. Available online: https://www.researchgate.net/publication/228412936_Automated_support_for_make-or-buy_decisions_in_component_based_software_systems (accessed on 26 December 2021).

- Jha, P.C.; Bali, V.; Narula, S.; Kalra, M. Optimal component selection based on cohesion & coupling for component based software system under build-or-buy scheme. J. Comput. Sci. 2014, 5, 233–242. [Google Scholar]

- Jha, P.C.; Kaur, R.; Bali, S.; Madan, S. Optimal component selection Approach for Fault-Tolerant Software System Under CRB Incorporating Build-or-Buy Decision. Int. J. Reliab. 2013, 20, 1350024. [Google Scholar] [CrossRef]

- Bali, S.; Jha, P.C.; Kumar, U.D.; Pham, H. Fuzzy multi-objective build-or-buy approach for component selection of fault tolerant software system under consensus recovery block scheme with mandatory redundancy in critical modules. Int. J. Artif. Intell. Soft Comput. 2014, 4, 98–119. [Google Scholar] [CrossRef]

- Kalantari, S.; Motameni, H.; Akbari, E.; Rabbani, M. Optimal components selection based on fuzzy-intra coupling density for component-based software systems under build-or-buy scheme. Complex Intell. Syst. 2021, 7, 3111–3134. [Google Scholar] [CrossRef]

- Yang, C.; Huang, J. A decision model for IS outsourcing. Int. J. Inf. Manag. 2000, 20, 225–239. [Google Scholar] [CrossRef] [Green Version]

- Wang, J.; Yang, D. Using a hybrid multi-criteria decision aid method for information systems outsourcing. Comput. Oper. Res. 2006, 34, 3691–3700. [Google Scholar] [CrossRef]

- Yang, D.; Kim, S.; Min, J. Developing a decision model for business process outsourcing. Comput. Oper. Res. 2006, 34, 3496–3778. [Google Scholar] [CrossRef]

- Gorgun, M.; Polat, S.; Asan, U. A Learning Based Vertical Integration Decision Model. In International Conference on Intelligent and Fuzzy Systems; Springer: Cham, Switzerland, 2021. [Google Scholar]

- McIvor, R. What is the right outsourcing strategy for your process? Eur. Manag. J. 2008, 26, 24–34. [Google Scholar] [CrossRef]

- Zhang, X.; Li, M.; Zhang, Y.; Ning, J. Cost-sensitive Naïve Bayes Classification of Uncertain Data. J. Comput. 2014, 9, 1897–1903. [Google Scholar] [CrossRef]

- Ren, J.; Lee, S.D.; Chen, X.; Kao, B.; Cheng, R.; Cheung, D. Naive Bayes Classification of Uncertain Data. In Proceedings of the 2009 Ninth IEEE International Conference on Data Mining, Miami Beach, FL, USA, 6–9 December 2009. [Google Scholar]

- Maia, M.; Plastino, A.; Freitas, A. An Ensemble of Naive Bayes Classifiers for Uncertain Categorical Data. In Proceedings of the 2021 IEEE International Conference on Data Mining (ICDM), Auckland, New Zealand, 7–10 December 2021. [Google Scholar]

- Badampudi, D.; Wohlin, C.; Petersen, K. Software Component Decision-Making: In- house, OSS, COTS or Outsourcing- A Systematic Literature Review. J. Syst. Softw. 2016, 121, 105–124. [Google Scholar] [CrossRef]

- Witten, I.H.; Frank, E.; Hall, M.A.; Pal, C.J. Practical machine learning tools and techniques. Morgan Kaufmann 2005, 2, 578. [Google Scholar]

- Hamine, V.; Helman, P.A. Theoretical and Experimental Evaluation of Augmented Bayesian Classifiers. In American Association for Artificial Intelligence; The University of New Mexico: Albuquerque, NM, USA, 2006. [Google Scholar]

- Stern, M.; Beck, J.; Woolf, B.P. Naïve Bayes Classifiers for User Modeling; Center for Knowledge Communication, Computer Science Department, University of Massachusetts: Amherst, MA, USA, 1999. [Google Scholar]

- Kubat, M. Probabilities: Bayesian Classifiers. In An Introduction to Machine Learning; Springer: Cham, Switzerland, 2017; pp. 19–41. [Google Scholar]

- Weka Homepage. Available online: https://www.cs.waikato.ac.nz/ml/weka/index.html (accessed on 1 November 2021).

| Studies in the Literature | Generic/Function Specific | Methodology | Application Area |

|---|---|---|---|

| Harrigan (1984), [2] Mahoney (1990), [8] Venkatesan (1992), [4] Welch and Nayak (1992), [9] Humphreys et al. (2000), [6] McIvor (2000), [11] Humphreys et al. (2002), [7] McIvor (2008), [36] | Generic | Knowledge-Based Model | - |

| McIvor et al. (1997), [5] Canez et al. (2000), [11] | Manufacturing | ||

| Gelderman and Weele (2005), [19] Montgomery et al. (2017), [18] | Optimization Model | - | |

| Buchowicz (1991), [14] Rand (1993), [15] | Function Specific | Knowledge-Based Model -Multistage Decision | IT-Software |

| Cortellessa et al.(2008), [16] Jha et al. (2013), [29] Jha at al. (2014), [28] | Optimization Model | ||

| Daneshgar et al. (2013), [23] Shahzad et al. (2017), [24] | Interviewing | ||

| Sena et al. (2011), [25] Borg et al. (2019), [26] | Survey | ||

| Bali et al. (2014), [30] Kalantari et al. (2021), [31] | Optimization Model-Fuzzy Approach | ||

| Yang and Huang (2000), [32] Wang and Jang (2006), [33] Yang et al. (2006), [34] | Multicriteria Decision-making Model |

| Factor Name | Definition | Factor Levels |

|---|---|---|

| Time (T) | Time spent on development, testing and integration in total. | Less than 90 days, 90–270 days, More than 270 days. |

| Cost (C) | Any project-related expenses. | Less than average, Average, More than average. |

| Effort (E) | Effort for development and/or decision making and application. | Less than 2 man-months, 2–6 man-months, More than 6 man-months. |

| Quality (Q) | Expectations for quality. | Low, Middle, High. |

| Market Trend (Mt) | The product’s availability in the marketplace. | Growing, Fixed, Shrinking, Specific product (No trend). |

| Availability of Source Code (Sc) | Defining source code availability. | Open, Licensed, N/A. |

| Technical Support (Ts) | Support, bug fixes and feature updates are all required. | Low, Average, High. |

| License (L) | Fees and obligations for license. | Yes, No. |

| Integration (I) | Simplicity of combining process. | Simple, Hard. |

| Complexity of Requirements (Rco) | Defines product requirement complexity. | Complex, Uncomplex. |

| Certainty of Requirements (Rce) | Defines product requirement certainty. | Certain, Uncertain. |

| System Maintenance (M) | Easiness level for maintenance. | Easy, Middle, Difficult. |

| Number of Recommendations Consistent with the Company’s Make-or-Buy Decisions | Accuracy Rate | |

|---|---|---|

| Model 1: Process Technology | 14 | 67% |

| Model 2: Competitiveness, Capability and Opportunism | 16 | 76% |

| Model 3: Task Programmability, Separability and Asset Specificity | 12 | 57% |

| Classified as Insourcing | Classified as Outsourcing | |

|---|---|---|

| Insourcing (a) | 10 | 1 |

| Outsourcing (b) | 2 | 8 |

| Evaluation Metric | Insourcing Class | Outsourcing Class | Weighted Average |

|---|---|---|---|

| TP Rate | 0.909 | 0.800 | 0.857 |

| FP Rate | 0.200 | 0.091 | 0.148 |

| Precision | 0.833 | 0.889 | 0.860 |

| Recall | 0.909 | 0.800 | 0.857 |

| F-Measure | 0.870 | 0.842 | 0.856 |

| Model 1: Process Technology | Model 2: Competitiveness, Capability and Opportunism | Model 3: Task Programmability, Separability and Asset Specificity | Data-Driven Model | |

|---|---|---|---|---|

| Accuracy | 67% | 62% | 48% | 86% |

| Factors Considered in Models | Decision Factors Suggested by IT Experts | ||

|---|---|---|---|

| Knowledge-Based Models | Data-Driven IT Model | ||

| Model 1 | Maturity process technology across industries | Time | Business Know-How |

| Your process technology relative to competitors | Cost of Product and Maintenance | Core-Supportive Business Activity | |

| Significance of process tech. for competitive advantage | Effort | Technical Competence | |

| Model 2 | Contribution to Competitive Advantage | Quality | Capacity Availability |

| Relative Capability Position | Market Trend | ||

| Opportunism Potential | Availability of Source code | ||

| Model 3 | Nonseparability | Technical Support | |

| Task programmability | License | ||

| Asset Specificity | Integration | ||

| Complexity of Requirements | |||

| Certainty of Requirements | |||

| System Maintenance | |||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gorgun, M.G.; Polat, S.; Asan, U. Vertical Integration Decision Making in Information Technology Management. Information 2022, 13, 341. https://doi.org/10.3390/info13070341

Gorgun MG, Polat S, Asan U. Vertical Integration Decision Making in Information Technology Management. Information. 2022; 13(7):341. https://doi.org/10.3390/info13070341

Chicago/Turabian StyleGorgun, Menekse Gizem, Seckin Polat, and Umut Asan. 2022. "Vertical Integration Decision Making in Information Technology Management" Information 13, no. 7: 341. https://doi.org/10.3390/info13070341

APA StyleGorgun, M. G., Polat, S., & Asan, U. (2022). Vertical Integration Decision Making in Information Technology Management. Information, 13(7), 341. https://doi.org/10.3390/info13070341